Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BLACKBAUD INC | d284115d8k.htm |

| EX-2.4 - EX-2.4 - BLACKBAUD INC | d284115dex24.htm |

| EX-99.2 - EX-99.2 - BLACKBAUD INC | d284115dex992.htm |

| EX-99.1 - EX-99.1 - BLACKBAUD INC | d284115dex991.htm |

| EX-10.52 - EX-10.52 - BLACKBAUD INC | d284115dex1052.htm |

January

17,

2012

Blackbaud

Announces

Agreement

to

Acquire

Convio

Accelerates

Multi-Channel

Supporter Engagement

Exhibit 99.3 |

Forward-Looking Statements

This

presentation

contains

“forward-looking

statements”

relating

to

the

acquisition

of

Convio

by

Blackbaud

and

the

companies’

potential

combined

business.

Those

forward-looking

statements

are

based

on

current

expectations

and

involve

inherent risks and uncertainties, including factors that could delay, divert or

change any of them, and actual outcomes and results

could

differ

materially.

Among

other

risks,

there

can

be

no

guarantee

that

the

acquisition

will

be

completed,

or

if

it

is

completed,

that

it

will

close

within

the

anticipated

time

period

or

that

the

expected

benefits

of

the

acquisition

and

combined

business

will

be

realized.

These

forward-looking

statements

should

be

evaluated

together

with

the

risk

factors

and

uncertainties that affect Blackbaud’s and Convio’s businesses,

particularly those identified in their Annual Reports on Form 10-K

and

other

filings

with

the

U.S.

Securities

and

Exchange

Commission,

or

SEC.

Except

as

might

be

required

by

law,

neither

company

undertakes

any

obligation

to

publicly

update

any

forward-looking

statement,

whether

as

a

result

of

new

information, future events or otherwise.

Additional Information

The tender offer for Convio stock has not yet commenced, and this presentation is

neither an offer to purchase nor a solicitation

of

an

offer

to

sell

securities.

At

the

time

the

tender

offer

is

commenced,

Blackbaud’s

wholly

owned

subsidiary

Caribou

Acquisition

Corporation

will

file

with

the

SEC

a

tender

offer

statement

on

Schedule

TO.

Investors

and

Convio

stockholders should read the tender offer statement (including an offer to

purchase, letter of transmittal and related tender offer documents) and the

related solicitation/recommendation statement on Schedule 14D-9 that will be filed by Convio with

the

SEC,

because

they

will

contain

important

information.

These

documents

will

be

available

at

no

charge

on

the

SEC’s

website

at

www.sec.gov.

In

addition,

a

copy

of

the

offer

to

purchase,

letter

of

transmittal

and

other

related

tender

offer

documents

may

be

obtained

free

of

charge

from

Blackbaud

at

www.blackbaud.com

or

its

Office

of

the

[Investor

Relations],

2000 Daniel Island Drive, Charleston, SC 29492.

Convio will make available to all its stockholders a copy of the tender offer

statement

and

the

solicitation/recommendation

statement

free

of

charge

at

www.convio.com

or

you

can

get

one

by

contacting

Convio

[Investor

Relations]

at

11501

Domain

Drive,

Suite

200,

Austin,

TX

78758,

phone

888-528-9501.

In addition to the offer to purchase, the related letter of transmittal and other

offer documents, as well as the solicitation/recommendation statement,

Blackbaud and Convio file annual, quarterly and special reports, proxy

statements and

other

information

with

the

SEC.

You

may

read

and

copy

any

of

these

reports,

statements

or

other

information

in

the

EDGAR

database

at

the

SEC

website,

www.sec.gov,

or

at

the

SEC

public

reference

room

at

100

F

Street,

N.E.,

Washington, D.C. 20549.

Please call the SEC at 1-800-SEC-0330 for further information on the

public reference room. 2 |

3

•

Leading supplier of software and

services to the non profit sector

•

Founded 1981

•

IPO 2004

•

25,000+ nonprofit customers

in 60 countries

•

2,200+ employees worldwide

•

12 global offices

•

Headquarters in Charleston, SC

•

TTM revenue ended 9/30/11:

-

~$363 million

•

TTM EBITDA ended 9/30/11

(1)

:

-

~$85 million

WHO IS BLACKBAUD?

Blackbaud’s Purpose

To power the business of philanthropy from

____________________

(1)

Non-GAAP , unaudited

fundraising through outcomes |

4

ACQUISITION STRATEGIC RATIONALE

Highly complementary solutions

•

Convio’s SaaS-based capabilities for large events, advocacy and federated

organizations complement our current solutions •

Enables us to offer a comprehensive set of multi-channel supporter engagement

solutions to nonprofit organizations Enhances ability to deliver value to

customers •

Brings significant domain expertise, innovation and thought leadership, especially in

online, advocacy and social •

Valuable experience in effectively scaling a SaaS business

Significant cross-sell opportunity

•

Convio has over 1,500 customers, many that are new to Blackbaud’s 25,000+ customer

base •

Integration

of

specific

Blackbaud

and

Convio

offerings

will

provide

seamless

solutions

Accelerates Blackbaud’s SaaS expansion

•

Significant addition to our growing subscription and transactional revenue base

•

Combined

pro

forma

subscription

and

usage

revenue

annualized

run

rate

of

~$170

million

&

total

recurring

revenue

run

rate of

~$300 million (Quarter ended 9/30/11, non-GAAP,

unaudited) Attractive financial impact

•

Transaction is expected to be accretive to non-GAAP EPS in 2012 and beyond

|

KEY

TRANSACTION TERMS Transaction

Purchase Price

Timing

Financing

•

On January 16, 2012, Blackbaud entered into a definitive merger agreement to acquire

Convio •

The acquisition is structured as a cash tender offer

•

All Convio directors and officers and certain of its affiliates (representing over 30%

of the outstanding shares in total) have agreed to tender all of their

respective shares subject to tender and support agreements

•

Blackbaud

will

acquire

all

outstanding

shares

of

common

stock

of

Convio

for

$16.00

per

share

in

cash, or an enterprise value of approximately $275 million (based on fully diluted

shares and net of approximately

$50

million

of

cash

and

debt

(1)

)

•

The

per

share

price

represents

a

premium

of

49%

over

Convio’s

January

13

closing

price

•

The

acquisition

is

expected

to

close

during

the

first

quarter

of

2012

•

The consummation of the tender offer is subject to various conditions, including a

minimum tender of at least a majority of outstanding Convio shares on a fully

diluted basis, the expiration or termination of the waiting period under the

Hart Scott Rodino Antitrust Improvements Act and other customary conditions.

The board of directors of both companies have unanimously approved the transaction

•

The transaction will be financed through a combination of existing cash and

newly-issued syndicated debt

(1)

Net cash balance of $50 million based on Convio’s public filings as of

[September 30, 2011]. 5

th |

6

____________________

(1)

Source: CNVO Public filings.

(2)

Excludes stock-based compensation and acquisition-related transaction

costs. (3)

See the non-GAAP disclosure and reconciliation at the end of this presentation. CONVIO OVERVIEW

Headquarters

Key Offices

3 Party Hosting

Facility

Austin, TX

Sacramento, CA

San Francisco, CA

Overland Park, KS

Lincoln, NE

Washington DC

Convio at a Glance

(1)

Convio provides on-demand constituent engagement

solutions that enable non-profit organizations to raise funds,

advocate for change and cultivate relationships with

donors, activists, volunteers, alumni and other constituents

Serves more than 1,500 nonprofits of all sizes, including 29

of the top 50 US charities

Convio was founded in 1999 and is headquartered in

Austin, TX

Convio went public in April 2010

YoY Growth: 100%

32% 11% 11%

14%

Adjusted EBITDA Margin

Adjusted EBITDA

Revenue

(1)

Adjusted EBITDA

(1)

(2) (3)

$43.1

$57.0

$63.1

$69.7

$52.8

$60.0

6

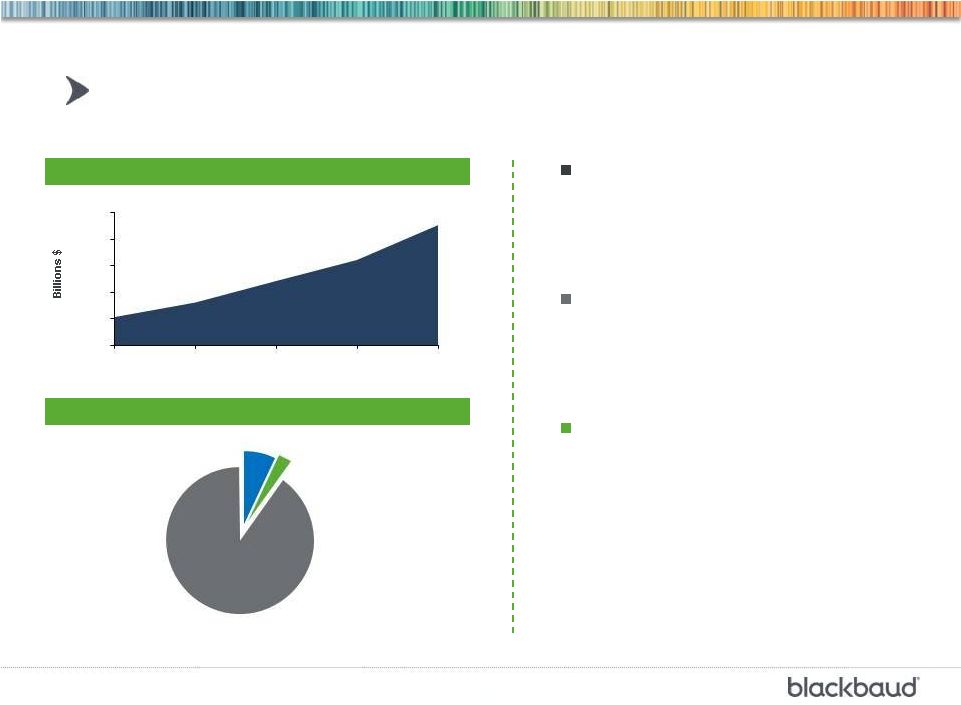

rd |

Other

Blackbaud

Convio

____________________

(1)

Sourced from various industry and internal sources. Represents estimate of

2010 market size. Online

Giving

Rapidly

Growing

(1)

$19.0

$1.5

$0.6

Significant

Opportunity

in

Online

Fundraising

($bn)

(1)

New fundraising and communication

channels

are expanding, not

replacing traditional channels

Online fundraising and advocacy are

important and growing components

of the

Nonprofit supporters engage across

multiple channels

and expect cross-

channel consistency

WELL POSITIONED IN LARGE AND GROWING SEGMENT

$0

$5

$10

$15

$20

$25

2006

2007

2008

2009

2010

total supporter journey

7 |

APPENDIX

8 |

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(in thousands)

Blackbaud

Convio

Pro Forma Combined Total

GAAP revenue

363,165

$

76,933

$

440,098

$

Reconcilation of net income to adjusted EBITDA:

GAAP net income

34,817

$

2,441

$

37,258

$

Non-GAAP adjustments:

Add: Interest expense (income), net

(106)

(89)

(195)

Add: Income tax expense

17,562

214

17,776

Add: Depreciation expense

9,058

2,274

11,332

Add: Amortization of intangibles from business

combinations and capitalized software costs

7,336

1,675

9,011

Add: Stock-based compensation expense

14,732

2,815

17,547

Add: Acquisition-related expenses

2,054

702

2,756

Less: Gain on sale of assets

(550)

-

(550)

Total Non-GAAP adjustments

50,086

7,591

57,677

Non-GAAP adjusted EBITDA

84,903

$

10,032

$

94,935

$

GAAP cash flow from operating activities

74,764

$

8,234

$

82,998

$

Non-GAAP adjustments:

Less: Capital expenditures

(13,160)

(3,295)

(16,455)

Free cash flow

61,604

$

4,939

$

66,543

$

Twelve months ended September 30, 2011

Blackbaud, Inc.

Reconciliation of GAAP to Non-GAAP financial measures

(Unaudited)

Confidential

9 |