Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TripAdvisor, Inc. | d282766d8k.htm |

Supplemental

Financial Information (NASDAQ: TRIP)

Exhibit 99.1 |

Introduction

As

previously

disclosed,

following

the

close

of

trading

on

the

Nasdaq

Stock

Market

on

December

20, 2011, Expedia, Inc. (“Expedia”), a Delaware corporation, completed the

spin-off (the “Spin-Off”) of TripAdvisor, Inc., a Delaware

corporation (“TripAdvisor”) to Expedia stockholders. TripAdvisor

consists of the domestic and international operations previously associated

with Expedia’s TripAdvisor Media Group and is now a separately traded public

company, trading under the symbol “TRIP”

on The Nasdaq Global Select Market.

The supplemental historical financial information that follows presents certain

historical financial metrics

for

TripAdvisor

as

a

standalone

public

company

for

the

fiscal

years

ended

2008,

2009,

2010 and the interim periods of 2010 and 2011 through September 30, 2011.

Information contained in this document should be read in conjunction with, and

as a supplement to, the information contained in the Registration Statement on

Form S-4 (File No. 333-175828-1), as was declared effective by the

Securities and Exchange Commission (“SEC”) on November 1, 2011,

including, but not limited to “Management’s Discussion and Analysis of

Results of Operations and Financial Condition”, “Risk

Factors” and the financial statements and notes thereto.

TripAdvisor makes reference to non-GAAP financial measures, and includes

information regarding such measures, in the supplemental historical financial

information. Reconciliations to GAAP measures of non-GAAP measures

set forth in this presentation are included in the Appendices.

These measures are intended to supplement, not substitute for, comparable

GAAP measures.

Investors are urged to consider carefully the comparable GAAP measures

and reconciliations.

Trademarks and logos are the property of their respective owners.

©

2012 TripAdvisor, Inc. All rights reserved.

1 |

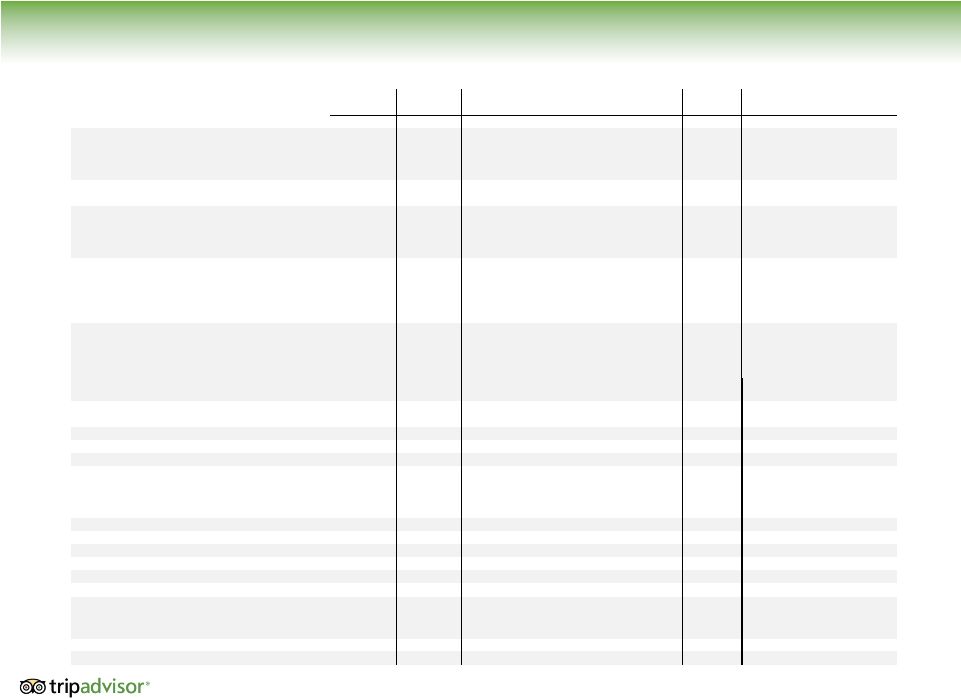

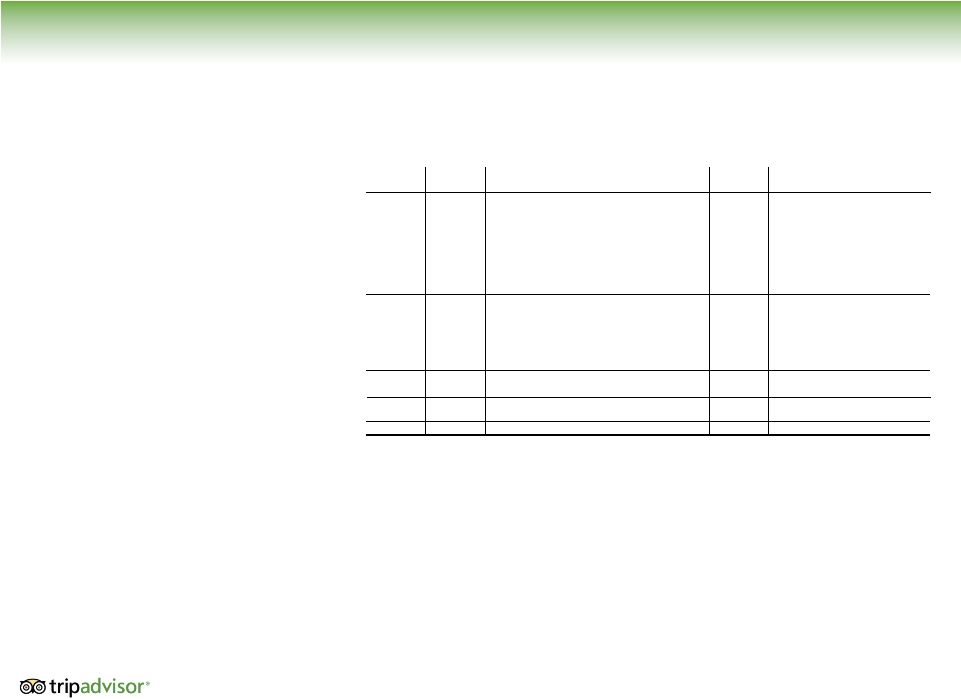

Historical

Financial Information – TripAdvisor Standalone

(in thousands)

FY 2008

FY 2009

Q1

Q2

Q3

Q4

FY 2010

Q1

Q2

Q3

Revenue

200,578

$

212,375

$

71,501

$

82,422

$

89,761

$

69,841

$

313,525

$

95,278

$

110,043

$

120,384

$

Related-party revenue from Expedia

97,668

139,714

42,081

42,987

49,558

36,484

171,110

53,944

59,199

60,417

Total Revenue

298,246

352,089

113,582

125,409

139,319

106,325

484,635

149,222

169,242

180,801

year-over-year growth

18%

38%

31%

35%

30%

GAAP Cost of Revenue

2,414

4,569

1,547

1,735

2,056

2,007

7,345

2,231

2,735

3,227

% of total revenue

1%

1%

1%

1%

1%

2%

2%

1%

2%

2%

GAAP Selling and marketing

98,291

105,679

30,921

31,392

42,446

35,711

140,470

44,195

52,685

60,349

Stock based compensation

1,669

1,885

655

434

506

506

2,101

805

589

568

Non-GAAP Selling and marketing

96,622

103,794

30,266

30,958

41,940

35,205

138,369

43,390

52,096

59,781

% of total revenue

32%

29%

27%

25%

30%

33%

29%

29%

31%

33%

GAAP Technology and content

30,240

37,074

11,572

13,015

13,535

15,545

53,667

16,379

17,058

18,406

Depreciation

4,193

7,743

2,134

2,446

2,737

3,034

10,351

3,290

3,679

3,658

Stock based compensation

2,784

2,276

777

601

641

642

2,661

888

639

750

Non-GAAP Technology and content

23,263

27,055

8,661

9,968

10,157

11,869

40,655

12,201

12,740

13,998

% of total revenue

8%

8%

8%

8%

7%

11%

8%

8%

8%

8%

GAAP General and adminstrative

22,937

15,873

4,732

8,851

10,130

10,631

34,344

9,006

8,779

10,166

Related-party

shared

services

fee

(1)

8,320

6,910

1,975

1,975

1,975

1,975

7,900

1,980

1,980

1,980

Depreciation

829

1,587

455

643

688

734

2,520

812

835

972

Stock based compensation

1,107

1,744

735

519

583

584

2,421

781

740

719

Non-GAAP General and adminstrative

29,321

19,452

5,517

9,664

10,834

11,288

37,303

9,393

9,184

10,455

% of total revenue

10%

6%

5%

8%

8%

11%

8%

6%

5%

6%

Amortization of Intangibles

11,161

13,806

3,378

2,864

2,577

5,790

14,609

2,117

1,132

2,394

% of total revenue

4%

4%

3%

2%

2%

5%

3%

1%

1%

1%

Other operating expense (Spin-off costs)

-

-

-

-

-

-

-

-

1,054

2,211

Total costs and expenses

173,363

183,911

54,125

59,832

72,719

71,659

258,335

75,908

85,423

98,733

GAAP Operating income

124,883

168,178

59,457

65,577

66,600

34,666

226,300

73,314

83,819

82,068

Other income (expense):

Related-party interest income (expense), net

(4,035)

(978)

(78)

(70)

(56)

(37)

(241)

98

217

212

Other, net

(1,738)

(660)

(1,315)

(1,359)

1,634

(604)

(1,644)

965

457

(2,802)

Total other income (expense), net

(5,773)

(1,638)

(1,393)

(1,429)

1,578

(641)

(1,885)

1,063

674

(2,590)

Income before income taxes

119,110

166,540

58,064

64,148

68,178

34,025

224,415

74,377

84,493

79,478

Provision for income taxes

46,788

64,325

20,650

24,073

25,239

15,499

85,461

27,006

30,383

25,185

GAAP Net income

72,322

102,215

37,414

40,075

42,939

18,526

138,954

47,371

54,110

54,293

GAAP Net (income) loss attributable to noncontrolling interests

49

212

(41)

(13)

(27)

(97)

(178)

(93)

(46)

21

GAAP Net income attributable to TripAdvisor, Inc

72,371

102,427

37,373

40,062

42,912

18,429

138,776

47,278

54,064

54,314

OIBA

(2)

141,604

187,889

65,002

69,995

70,907

42,188

248,092

77,905

87,973

88,709

Adjusted EBITDA

(3)

146,626

197,219

67,591

73,084

74,332

45,956

260,963

82,007

92,487

93,339

% of total revenue

49%

56%

60%

58%

53%

43%

54%

55%

55%

52%

year-over-year growth

35%

32%

21%

27%

26%

Cash flow from operations

110,726

125,738

46,566

44,232

57,395

48,722

196,915

53,316

60,555

77,854

Capital

Expenditures

(4)

17,871

13,873

4,053

5,532

4,398

4,830

18,813

4,993

5,431

5,604

2011

2010

33%

39%

44%

35%

2 |

(1)

General and Administrative expense includes related-party shared services fee previously

reported as a separate line item in our combined statement of operations on our Form

S-4 filed on November 1, 2011. (2)

Our primary operating metric prior to the Spin-Off for evaluating operating performance

was Operating Income Before Amortization (“OIBA”), as reported on our Form

S-4 filed on November 1, 2011. OIBA is defined as Operating income plus: (1)

amortization of intangible assets and any related impairment; (2) stock-based compensation expense; and (3)

non-recurring expenses incurred to effect the Spin-Off during the nine months ended

September 30, 2011. This

operating metric is no longer being used by our management to measure operating performance

and is only being shown above to illustrate the financial impact as we convert to a

new operating metric post Spin-Off. (3)

Adjusted EBITDA is defined as operating income plus: (1) depreciation of property and

equipment, including internal use software and website development; (2)

amortization of intangible assets; (3) stock-based compensation; and (4)

non-recurring expenses incurred to effect the Spin-Off during the nine months ended

September 30, 2011. (4)

Includes internal-use software and website development.

3 |

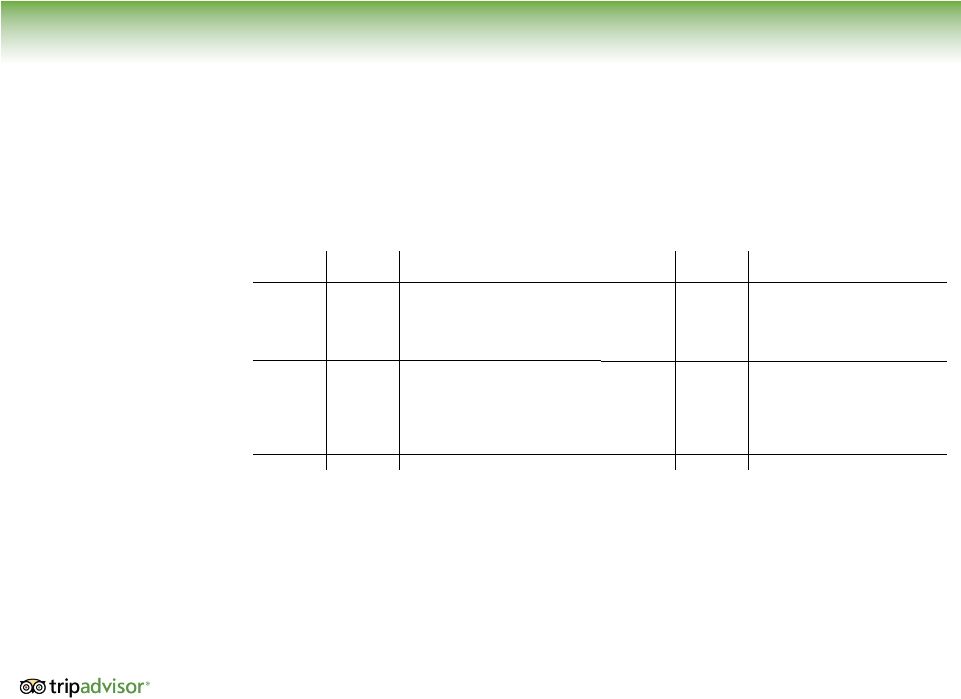

Revenue

Information 4

2010

(in millions)

FY 2008

FY 2009

Q1

Q2

Q3

Q4

FY 2010

Q1

Q2

Q3

Revenue by geographic region

United States

245

$

247

$

75

$

80

$

80

$

63

$

298

$

85

$

94

$

97

$

United Kingdom

23

42

16

16

23

15

70

$

25

27

28

All other countries

30

63

23

29

37

28

117

$

39

48

56

Total Revenue

298

$

352

$

114

$

125

$

140

$

106

$

485

$

149

$

169

$

181

$

Revenue by product

Click-based advertising

258

$

302

$

88

$

100

$

115

$

81

$

384

120

$

134

$

146

$

Display-based advertising

39

49

16

19

19

18

72

19

23

21

Subscription and other

1

1

10

6

6

7

29

10

12

14

Total Revenue

298

$

352

$

114

$

125

$

140

$

106

$

485

$

149

$

169

$

181

$

2010

2011 |

APPENDIX

5 |

Appendix A:

Non-GAAP / GAAP Reconciliations Definitions of Non-GAAP Measures

TripAdvisor,

Inc.

reports

Adjusted

EBITDA,

which

is

a

supplemental

measure

to

GAAP

and

is

defined

by

the

SEC

as

a

non-GAAP

financial

measure.

This

measure

is

the

primary

metric

by

which

management

evaluates

the

performance

of

the

business

and

on

which

internal

budgets

are

based.

Management

believes

that

investors

should

have

access

to

the

same

set

of

tools

that

management

uses

to

analyze

our

results.

This

non-GAAP

measure

should

be

considered

in

addition

to

results

prepared

in

accordance

with

GAAP,

but

should

not

be

considered

a

substitute

for

or

superior

to

GAAP.

We

endeavor

to

compensate

for

the

limitation

of

the

non-GAAP

measures

presented

by

also

providing

the

most

directly

comparable

GAAP

measures

and

descriptions

of

the

reconciling

items

and

adjustments

to

derive

the

non-GAAP

measures.

Our

primary

non-GAAP

financial

measure

used

by

management

prior

to

the

Spin-Off

for

evaluating

operating

performance

was

Operating

Income

Before

Amortization

(“OIBA”),

as

reported

on

our

Form

S-4

filed

on

November

1,

2011.

Amortization

of

intangible

assets

and

any

related

impairment,

as

well

as

stock-

based

compensation

expense

and

other

items

were

excluded

from

OIBA.

This

non-GAAP

financial

measure

is

no

longer

being

used

by

our

management

to

measure

operating

performance

and

is

only

being

shown

to

illustrate

the

financial

impact

as

we

convert

to

a

new

operating

metric

post

Spin-Off.

Adjusted

EBITDA

is

defined

as

operating

income

plus:

(1)

depreciation

of

property

and

equipment,

including

internal

use

software

and

website

development;

(2)

amortization

of

intangible

assets;

(3)

stock-based

compensation;

and

(4)

non-recurring

expenses

incurred

to

effect

the

Spin-Off

during

the

nine

months

ended

September

30,

2011.

The

above

items

are

excluded

from

our

Adjusted

EBITDA

measure

because

these

items

are

noncash

in

nature,

or

because

the

amount

and

timing

of

these

items

is

either unpredictable,

or not

driven

by

core

operating

results

and

renders

comparisons

with

prior

periods and

competitors

less

meaningful.

We

believe

Adjusted

EBITDA

is

a

useful

measure

for

analysts

and

investors

to

evaluate

our

future on-going

performance

as

this

measure

allows

a

more

meaningful

comparison

of

our

projected

cash

earnings

and

performance with

our

historical

results

from

prior

periods

and

to

the

results

of

our

competitors.

Moreover,

our

management

uses

this

measure internally

to

evaluate

the

performance

of

our

business

as

a

whole.

In

addition,

we

believe

that

by

excluding

certain

items,

such

as stock-based

compensation

and

non-recurring

expenses,

Adjusted

EBITDA

corresponds

more

closely

to

the

cash

operating

income generated

from

our

business

and

allows

investors

to

gain

an

understanding

of

the

factors

and

trends

affecting

the

ongoing

cash earnings

capabilities

of

our

business,

from

which

capital

investments

are

made

and

debt

is

serviced.

Adjusted

EBITDA

has

certain limitations

in

that

it

does

not

take

into

account

the

impact

of

certain

expenses

to

our

consolidated

statements

of

operations.

We endeavor

to

compensate

for

the

limitation

of

the

non-GAAP

measures

presented

by

also

providing

the

comparable

GAAP measure,

GAAP

financial

statements,

and

descriptions

of

the

reconciling

items

and

adjustments,

to

derive

the

non-GAAP

measure. However,

Adjusted

EBITDA

should

be

considered

in

addition

to

results

prepared

in

accordance

with

GAAP,

but

should

not

be considered

as

a

substitute

for,

or

superior

to,

GAAP

measures.

We

present

a

reconciliation

of

this

non-

GAAP

financial

measure

to GAAP below

6 |

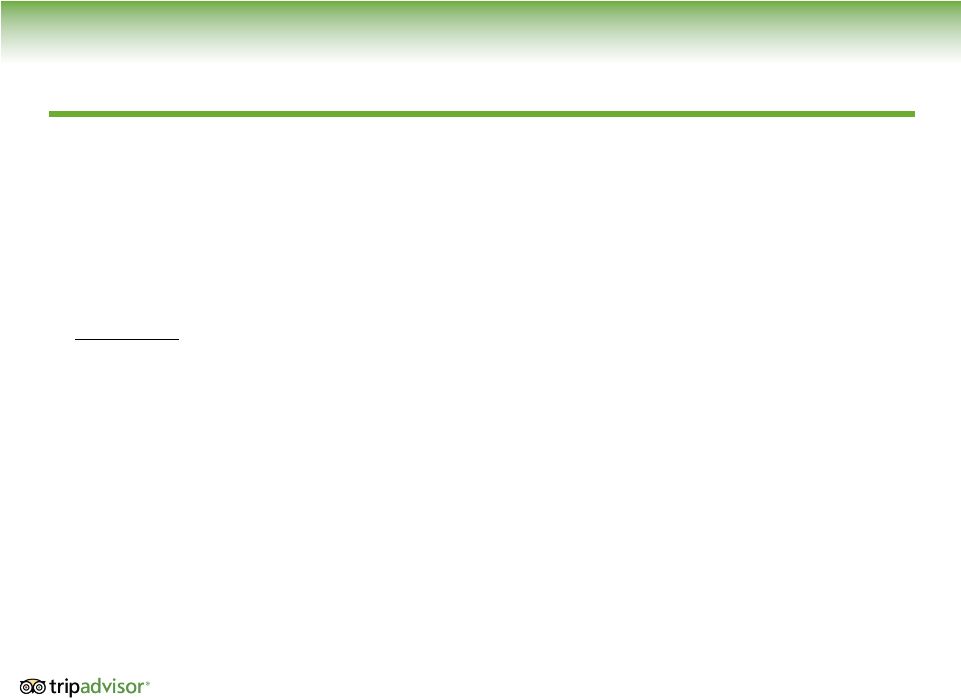

Appendix B:

Adjusted EBITDA and OIBA Reconciliation (in thousands)

FY 2008

FY 2009

Q1

Q2

Q3

Q4

FY 2010

Q1

Q2

Q3

Adjusted EBITDA(1)

146,626

$

197,219

$

67,591

$

73,084

$

74,332

$

45,956

$

260,963

$

82,007

$

92,487

$

93,339

$

Depreciation (2)

5,022

9,330

2,589

3,089

3,425

3,768

12,871

4,102

4,514

4,630

OIBA (3)

141,604

$

187,889

$

65,002

$

69,995

$

70,907

$

42,188

$

248,092

$

77,905

$

87,973

$

88,709

$

Amortization of intangible assets

11,161

13,806

3,378

2,864

2,577

5,790

14,609

2,117

1,132

2,394

Stock-based compensation

5,560

5,905

2,167

1,554

1,730

1,732

7,183

2,474

1,968

2,036

Spin-off costs

-

-

-

-

-

-

-

-

1,054

2,211

GAAP Operating Income

124,883

$

168,178

$

59,457

$

65,577

$

66,600

$

34,666

$

226,300

$

73,314

$

83,819

$

82,068

$

Related-party interest income (expense), net

(4,035)

(978)

(78)

(70)

(56)

(37)

(241)

98

217

212

Other, net

(1,738)

(660)

(1,315)

(1,359)

1,634

(604)

(1,644)

965

457

(2,802)

Income before income taxes

119,110

166,540

58,064

64,148

68,178

34,025

224,415

74,377

84,493

79,478

Provision for income taxes

46,788

64,325

20,650

24,073

25,239

15,499

85,461

27,006

30,383

25,185

GAAP Net income

72,322

102,215

37,414

40,075

42,939

18,526

138,954

47,371

54,110

54,293

GAAP Net (income) loss attributable to noncontrolling interest

49

212

(41)

(13)

(27)

(97)

(178)

(93)

(46)

21

GAAP Net income attributable to TripAdvisor, Inc.

72,371

$

102,427

$

37,373

$

40,062

$

42,912

$

18,429

$

138,776

$

47,278

$

54,064

$

54,314

$

(1) Adjusted EBITDA is defined as operating income plus: (1) depreciation of property and

equipment, including internal use software and website development; (2) amortization of

intangible assets; (3) stock-based compensation; and (4) non-recurring expenses

incurred to effect the Spin-Off during the nine months ended September 30, 2011. (2)

Includes internal use software and website development. (3) Our primary operating metric

prior to the Spin-Off for evaluating operating performance was Operating Income Before Amortization (“OIBA”), as reported on our Form S-4 filed on November 1, 2011.

OIBA is defined as Operating income plus: (1) amortization of intangible assets and any related

impairment; (2) stock-based compensation expense; and (3) non-recurring expenses incurred to effect

the Spin-Off during the nine months ended September 30, 2011. This operating metric is no

longer being used by our management to measure operating performance and is only being shown above to

illustrate the financial impact as we convert to a new operating metric post Spin-Off.

2010

2011

7 |