Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JPMORGAN CHASE & CO | jpmc4q11form8k.htm |

January 13, 2012 F I N A N C I A L R E S U L T S 4Q11

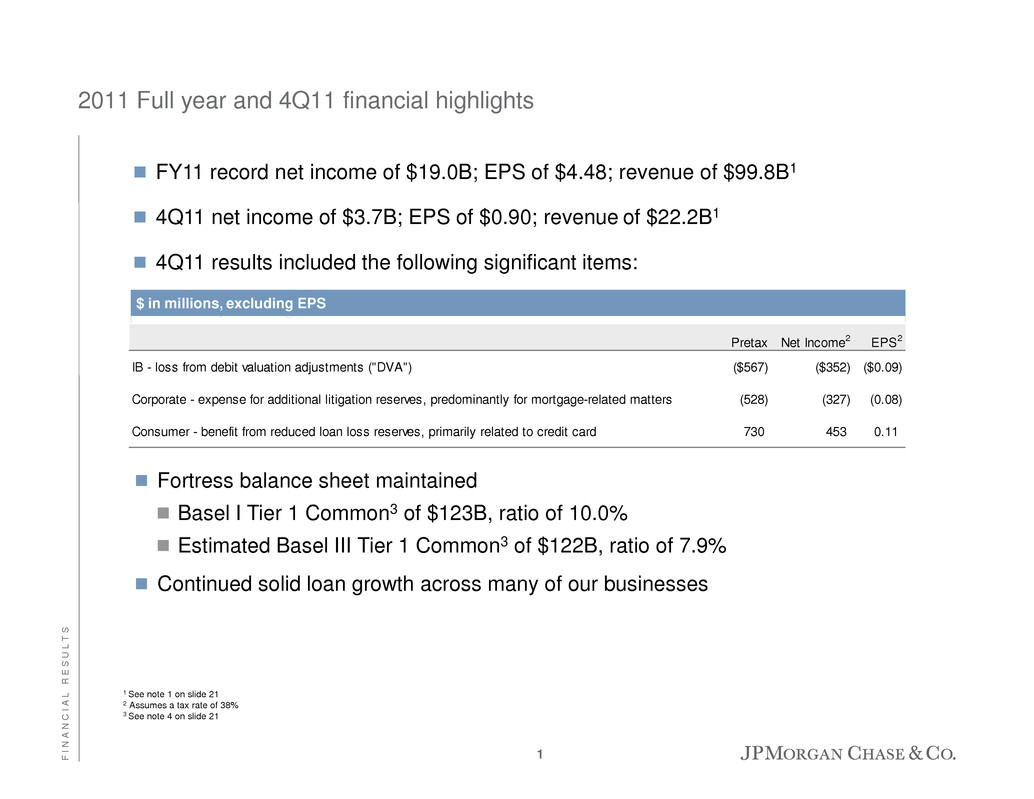

2011 Full year and 4Q11 financial highlights 1 See note 1 on slide 21 2 Assumes a tax rate of 38% 3 See note 4 on slide 21 FY11 record net income of $19.0B; EPS of $4.48; revenue of $99.8B1 4Q11 net income of $3.7B; EPS of $0.90; revenue of $22.2B1 4Q11 results included the following significant items: $ in millions, excluding EPS Fortress balance sheet maintained Basel I Tier 1 Common3 of $123B, ratio of 10.0% Estimated Basel III Tier 1 Common3 of $122B, ratio of 7.9% Continued solid loan growth across many of our businesses Pretax Net Income2 EPS2 IB - loss from debit valuation adjustments ("DVA") ($567) ($352) ($0.09) Corporate - expense for additional litigation reserves, predominantly for mortgage-related matters (528) (327) (0.08) Consumer - benefit from reduced loan loss reserves, primarily related to credit card 730 453 0.11 1 F I N A N C I A L R E S U L T S

2011 Full year managed results1 $ in millions, excluding EPS 1 See note 1 on slide 21 2 Actual numbers for all periods, not over/under 3 See note 4 on slide 21 FY2011 FY2010 FY2010 Revenue (FTE)1 $99,767 $104,842 ($5,075) Credit Costs 7,574 16,639 (9,065) Expense 62,911 61,196 1,715 Reported Net Income $18,976 $17,370 $1,606 Net Income Applicable to Common Stock $17,568 $15,764 $1,804 Reported EPS $4.48 $3.96 $0.52 ROE2 11% 10% ROTCE2,3 15% 15% $ O/(U) 2 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 Revenue (FTE)1 $22,198 ($2,170) ($4,524) Credit Costs 2,184 (227) (859) Expense 14,540 (994) (1,503) Reported Net Income $3,728 ($534) ($1,103) Net Income Applicable to Common Stock $3,425 ($511) ($987) Reported EPS $0.90 ($0.12) ($0.22) ROE2 8% 9% 11% ROTCE2,3 11% 13% 16% $ O/(U) 4Q11 Financial results1 1 See note 1 on slide 21 2 Actual numbers for all periods, not over/under 3 See note 4 on slide 21 $ millions, excluding EPS 3 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 Revenue $4,358 ($2,011) ($1,855) Investment Banking Fees 1,119 80 (714) Fixed Income Markets 2,491 (837) (384) Equity Markets 779 (645) (349) Credit Portfolio (31) (609) (408) Credit Costs 272 218 543 Expense 2,969 (830) (1,232) Net Income $726 ($910) ($775) Key Statistics ($B)2 Overhead Ratio 68% 60% 68% Comp/Revenue 27% 29% 30% EOP Loans $71.1 $60.5 $56.9 Allowance for Loan Losses $1.4 $1.3 $1.9 Nonaccrual loans $1.2 $1.4 $3.6 Net Charge-off Rate3 1.26% (1.16%) (0.17%) ALL / Loans3 2.11% 2.30% 3.51% ROE4 7% 16% 15% VAR ($mm)5 $75.0 $70.0 $78.0 EOP Equity $40.0 $40.0 $40.0 $ O/(U) Investment Bank1 $ in millions Net income of $726mm on revenue of $4.4B DVA loss of $567mm pretax ROE of 7%; 11% ex-DVA IB fees of $1.1B down 39% YoY on lower industry- wide volumes Continue to rank #1 in Global IB Fees for full year Fixed Income Markets revenue of $2.5B Excluding DVA, down 6% QoQ and 9% YoY Continued solid client revenue Equity Markets revenue of $779mm Excluding DVA, down 23% QoQ and 26% YoY Decrease primarily driven by lower market volumes Credit Portfolio loss of $31mm due to DVA losses of $405mm, offset by NII and fees on retained loans, and net CVA gains Credit cost of $272mm driven by net charge-offs of $199mm and an increase in allowance for loan losses due to portfolio activity Expense of $3.0B down 29% YoY, driven by both lower compensation and noncompensation expense 1 See note 1 on slide 21 2 Actual numbers for all periods, not over/under 3 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off rate 4 Calculated based on average equity of $40B 5 Average Trading and Credit Portfolio VAR at 95% confidence level 4 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 Retail Financial Services Net Interest Income $3,958 ($104) ($298) Noninterest Revenue 2,437 (1,036) (1,006) Revenue 6,395 (1,140) (1,304) Expense 4,722 157 251 Pre-Provision Pretax $1,673 ($1,297) ($1,555) Credit Costs 779 (248) (1,639) Net Income $533 ($628) $74 EOP Equity ($B)2 $25.0 $25.0 $24.6 ROE2,3 8% 18% 7% Memo: RFS Net Income Excl. Real Estate Portfolios $544 ($684) ($738) ROE Excl. Real Estate Portfolios 2,4 15% 34% 34% $ O/(U) Retail Financial Services1 $ in millions 1 See note 1 on slide 21 2 Actual numbers for all periods, not over/under 3 Calculated based on average equity; average equity for 4Q11, 3Q11 and 4Q10 was $25.0B, $25.0B and $24.6B, respectively 4 Calculated based on average equity; average equity for 4Q11, 3Q11 and 4Q10 was $14.5B, $14.5B and $14.9B, respectively Net income of $533mm, compared with $459mm in the prior year Revenue of $6.4B, down 17% YoY and 15% QoQ Credit costs of $779mm continue to reflect elevated losses in the mortgage and home equity portfolios, and include a net reduction of $230mm in the allowance for loan losses Expense of $4.7B, up 6% YoY driven by investments in sales force, new branch builds and higher mortgage production costs 5 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 Net Interest Income $2,714 ($16) $21 Noninterest Income 1,603 (349) (113) Revenue $4,317 ($365) ($92) Expense 2,848 6 172 Pre-Provision Pretax $1,469 ($371) ($264) Credit Costs 132 6 63 Net Income $802 ($221) ($150) Key Drivers1 ($ in billions) Average Total Deposits $367.9 $362.2 $342.8 Deposit Margin 2.76% 2.82% 2.96% Checking Accounts (mm) 26.6 26.5 27.3 # of Branches 5,508 5,396 5,268 Business Banking Originations $1.4 $1.4 $1.4 Client Investment Assets $137.9 $132.3 $133.1 # of Active Mobile Customers (mm) 8.4 7.2 5.3 $ O/(U) Retail Financial Services Consumer & Business Banking $ in millions Key drivers Financial performance 1 Actual numbers for all periods, not over/under Consumer & Business Banking net income of $802mm, down 16% YoY Net revenue of $4.3B, down 2% YoY driven by lower debit card revenue reflecting the impact of the Durbin Amendment, partially offset by increased deposit-related fees Expense up 6% YoY due to investments in sales force and new branch builds Credit costs of $132mm up 91% YoY driven by the absence of a reduction to the allowance for loan losses in the current quarter Average total deposits of $367.9B up 7% YoY and 2% QoQ Checking accounts down 2% YoY and flat QoQ Business Banking originations down 3% YoY and 4% QoQ Client investment assets up 4% YoY and 4% QoQ 6 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 Production Production-related Revenue excl. Repurchase Losses $1,069 ($234) ($269) Production Expense 518 22 82 Income excl. repurchase losses $551 ($256) ($351) Repurchase Losses (390) (76) (41) Income/(loss) before income tax expense/(benefit) $161 ($332) ($392) Servicing Servicing-related Revenue $1,122 ($32) ($115) MSR Asset Amoritization (406) 51 149 Servicing Expense 925 59 (33) Income/(loss), excl. MSR risk management ($209) ($40) $67 MSR Risk Management (377) (393) (667) Income/(loss) before income tax expense/(benefit) ($586) ($433) ($600) Net income/(loss) ($258) ($463) ($588) Key Drivers1 ($ in billions) Mortgage Loan Originations $38.6 $36.8 $50.8 Retail Channel Originations $23.1 $22.4 $22.9 Mortgage Application Volume $52.6 $58.1 $57.7 3rd Party Mtg Loans Svc'd (EOP) $902.2 $924.5 $967.5 Headcount2 49,189 46,374 39,440 $ O/(U) Retail Financial Services Mortgage Production and Servicing $ in millions Financial performance Key drivers 1 Actual numbers for all periods, not over/under 2 Headcount for total Mortgage Banking Mortgage Production and Servicing net loss of $258mm, compared with net income of $330mm in the prior year Production-related revenue excluding repurchase losses of $1.1B down 20% YoY reflecting narrower margins and lower volumes Repurchase losses of $390mm, up 12% YoY Net servicing-related revenue, after MSR asset amortization, of $716mm up 5% YoY Servicing expense down $33mm YoY; prior year included $374mm related to foreclosure-related matters MSR risk management loss of $377mm driven by an $832mm decrease in the fair value of the MSR asset, partially offset by $460mm of gains on the associated derivative hedges Mortgage originations of $38.6B up 5% QoQ and down 24% YoY Retail channel originations (branch and direct to consumer) up 3% QoQ and 1% YoY 7 F I N A N C I A L R E S U L T S

Retail Financial Services Real Estate Portfolios $ in millions 4Q11 3Q11 4Q10 Revenue $1,060 ($91) ($269) Expense 432 69 19 Pre-Provision Pretax $628 ($160) ($288) Net Charge-Offs 876 (23) (913) Change in Allowance (230) (230) (778) Credit Costs 646 (253) (1,691) Net Income ($11) $56 $812 Memo: ALL/ EOP Loans 1,2 6.58% 7.12% 6.47% Key Drivers1 ($ in billions) Average Home Equity Loans Owned3 $102.0 $104.9 $114.9 Average Mortgage Loans Owned3 $98.2 $101.1 $111.4 $ O/(U) Net loss of $11mm compared with net loss of $823mm in the prior year Total net revenue of $1.1B down 20% YoY driven by a decline in net interest income due to portfolio runoff Expense up 5% YoY Credit costs of $646mm down 72% YoY reflecting lower PCI impairment as well as lower net charge-offs 1 Actual numbers for all periods, not over/under 2 Excludes the impact of purchased credit-impaired loans acquired as part of the WaMu transaction. An allowance for loan losses of $5.7B, $4.9B and $4.9B was recorded for these loans as of 4Q11, 3Q11 and 4Q10, respectively 3 Includes purchased credit-impaired loans acquired as part of the WaMu transaction 8 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 EOP NCI owned portfolio ($B) Home Equity $77.8 $80.3 $88.4 Prime Mortgage, including option ARMs2 61.2 60.2 64.0 Subprime Mortgage and other 10.4 10.8 12.1 Net charge-offs ($mm) Home Equity $579 $581 $792 Prime Mortgage, including option ARMs3 152 174 570 Subprime Mortgage and other 146 146 439 Total4 $877 $901 $1,801 Net charge-off rate Home Equity 2.90% 2.82% 3.48% Prime Mortgage, including option ARMs 1.00% 1.14% 3.51% Subprime Mortgage and other 5.46% 5.27% 13.75% Nonaccrual loans ($mm) Home Equity $1,287 $1,290 $1,263 Prime Mortgage, including option ARMs3 3,404 3,597 4,255 Subprime Mortgage and other 1,785 1,936 2,217 Mortgage Banking Portfolios update Key statistics1 Delinquency trends improved marginally in 4Q11 Net charge-offs for home equity and prime mortgage, including option ARMs improved slightly compared to 3Q11, but remain at elevated levels Reduction in allowance for loan losses of $230mm comprised of Reduction in allowance for loan losses of $1.0B for non-credit impaired portfolio due to lower estimated losses, primarily for home equity and subprime mortgage Impairment of $770mm for increase in estimated lifetime losses of PCI portfolio Mortgage Banking loss guidance Expect total quarterly net charge-offs of $900mm+/- 1 Excludes 4Q11 EOP home equity, prime mortgage, subprime mortgage and option ARMs purchased credit- impaired loans of $22.7B, $15.2B, $4.9B and $22.7B respectively, acquired as part of the WaMu transaction 2 Ending balances include all noncredit-impaired prime mortgage balances held by Retail Financial Services, including $15.6B, $13.6B and $12.9B for 4Q11, 3Q11 and 4Q10, respectively, of loans insured by U.S. government agencies. These loans are included in Mortgage Production and Servicing 3 Net charge-offs and nonaccrual loans exclude loans insured by U.S. government agencies 4 Net charge-offs for 4Q10 included a one-time adjustment of $632mm 9 F I N A N C I A L R E S U L T S

Net income of $1.1B compared with $1.5B in the prior year The decrease was driven by a $1.7B lower reduction in the allowance compared with the prior year, predominantly offset by lower net charge-offs Revenue of $4.8B down 5% YoY and up 1% QoQ Credit costs of $1.1B reflect lower net charge-offs and a reduction of $500mm to the allowance for loan losses, reflecting lower estimated losses Prior year includes a reduction of $2.2B to the allowance for loan losses Net charge-offs are down 45% YoY and 5% QoQ Expense of $2.0B up 8% YoY, due to higher marketing expense and the inclusion of the Commercial Card business 4Q11 3Q11 4Q10 Card Services & Auto Revenue $4,814 $39 ($258) Credit Costs 1,060 (204) 351 Expense 2,025 (90) 158 Net Income $1,051 $202 ($497) ROE2,3 26% 21% 33% EOP Equity ($B)3 $16.0 $16.0 $18.4 Card Services — Key Drivers Excl. WaMu and Commercial Card3 ($ in billions) Avg Outstandings $116.0 $113.5 $121.5 Sales volume $91.0 $84.8 $83.2 New Accts Opened (mm) 2.2 2.0 3.4 Net Revenue Rate 11.64% 11.68% 11.78% Net Charge-off Rate4 3.93% 4.34% 7.08% 30+ Day Delinquency Rate4 2.54% 2.64% 3.66% Merchant Services — Key Drivers3 (billions) Bank card volume $152.6 $138.1 $127.2 # of total transactions 6.8 6.1 5.6 Auto — Key Drivers3 ($ in billions) Avg Outstanding - Auto $46.9 $46.5 $48.3 Avg Outstandings - Student $13.5 $13.9 $14.6 Auto Originations $4.9 $5.9 $4.8 $ O/(U) Card Services & Auto1 1 See note 1 on slide 21 2 Calculated based on average equity; 4Q11, 3Q11 and 4Q10 average equity was $16.0B, $16.0B and $18.4B, respectively 3 Actual numbers for all periods, not over/under. Statistics include loans held for sale 4 See note 5 on slide 21 $ in millions Card Services & Auto Key drivers Card Services Average outstandings (excluding the WaMu and Commercial Card portfolios) of $116.0B down 4% YoY and up 2% QoQ EOP outstandings (excluding WaMu and Commercial Card portfolios) of $120.0B down 3% YoY and up 5% QoQ Sales volume (excluding the WaMu and Commercial Card portfolios) of $91.0B up 9% YoY and 7% QoQ Net charge-off rate (excluding the WaMu and Commercial Card portfolios) of 3.93% down from 7.08% in 4Q10 and 4.34% in 3Q11 Auto Average auto outstandings down 3% YoY and up 1% QoQ Auto loan originations up 2% YoY and down 17% QoQ 10 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 Revenue $1,687 $99 $76 Middle Market Banking 810 19 29 Corporate Client Banking 326 20 24 Commercial Term Lending 299 2 (2) Real Estate Banking 115 11 (2) Other 137 47 27 Credit Costs 40 (27) (112) Expense 579 6 21 Net Income $643 $72 $113 Key Statistics ($B)2 Average Loans & Leases $109.9 $105.3 $98.4 EOP Loans & Leases $112.0 $107.4 $98.9 Average Liability Balances3 $199.1 $180.3 $147.5 Allowance for Loan Losses $2.6 $2.7 $2.6 Nonaccrual Loans $1.1 $1.4 $2.0 Net Charge-Off Rate4 0.36% 0.06% 1.16% ALL / Loans4 2.34% 2.50% 2.61% ROE5 32% 28% 26% Overhead Ratio 34% 36% 35% EOP Equity $8.0 $8.0 $8.0 $ O/(U) Commercial Banking1 $ in millions 1 See note 1 on slide 21 2 Actual numbers for all periods, not over/under 3 Includes deposits and deposits swept to on-balance sheet liabilities 4 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off rate 5 Calculated based on average equity of $8B Net income of $643mm, up 21% YoY Record revenue of $1.7B, up 5% YoY EOP loan balances up 13% YoY and 4% QoQ 6th consecutive quarter of increased loan balances Middle Market loans up 17% YoY; 7th consecutive quarter of increased loan balances Record average liability balances of $199.1B, up 35% YoY Credit costs of $40mm Net charge-offs of $99mm down $187mm YoY and up $82mm QoQ Nonaccrual loans down 47% YoY Expense up 4% YoY; overhead ratio of 34% 11 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 Revenue $2,022 $114 $109 Treasury Services 1,051 82 98 Worldwide Securities Services 971 32 11 Expense 1,563 93 93 Credit Allocation Income/(Expense)1 (60) (69) (30) Net Income $250 ($55) ($7) Key statistics2 Average Liability Balances ($B)3 $364.2 $341.1 $256.7 Assets under Custody ($T) $16.9 $16.3 $16.1 EOP Trade Loans ($B) $36.7 $30.1 $21.2 Pretax Margin 19% 24% 21% ROE4 14% 17% 16% TSS Firmwide Revenue $2,691 $2,548 $2,637 TS Firmwide Revenue $1,720 $1,609 $1,677 TSS Firmwide Average Liab Bal ($B)3 $563.3 $521.4 $404.2 EOP Equity ($B) $7.0 $7.0 $6.5 $ O/(U) Treasury & Securities Services $ in millions 1 Effective 1/1/11, IB and TSS share the economics related to the Firm’s GCB clients. Included within this allocation are net revenue, provision for credit losses as well as expense 2 Actual numbers for all periods, not over/under 3 Includes deposits and deposits swept to on-balance sheet liabilities 4 Calculated based on average equity; 4Q11, 3Q11, and 4Q10 average equity was $7.0B, $7.0B, and $6.5B respectively Net income of $250mm down 3% YoY and 18% QoQ QoQ decrease driven by higher GCB credit allocation expense and higher provision for credit losses Revenue of $2.0B up 6% YoY and up 9% excluding the impact of the Commercial Card business TS revenue of $1.1B up 10% YoY WSS revenue of $971mm up 1% YoY Liability balances up 42% YoY, driven primarily by lower rates on other alternative investments and the low interest rate environment Assets under custody of $16.9T up 5% YoY Trade loans of $36.7B up 73% YoY Expense up 6% YoY driven by expenses related to exiting unprofitable business partially offset by the transfer of the Commercial Card business to Card 12 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 Revenue $2,284 ($32) ($329) Private Banking 1,212 (86) (164) Institutional 558 80 (117) Retail 514 (26) (48) Credit Costs 24 (2) 1 Expense 1,752 (44) (25) Net Income $302 ($83) ($205) Key Statistics ($B)1 Assets under Management $1,336 $1,254 $1,298 Assets under Supervision $1,921 $1,806 $1,840 Average Loans $54.7 $52.7 $42.3 EOP Loans $57.6 $54.2 $44.1 Average Deposits $121.5 $111.1 $89.3 Pretax Margin 22% 21% 31% ROE2 18% 24% 31% EOP Equity $6.5 $6.5 $6.5 $ O/(U) Asset Management 1 Actual numbers for all periods, not over/under 2 Calculated based on average equity of $6.5B $ in millions Net income of $302mm down 40% YoY Revenue of $2.3B down 13% YoY primarily due to lower performance fees and lower loan- related revenue Assets under management of $1.3T up 3% YoY; Assets under supervision of $1.9T up 4% YoY AUM net inflows for the quarter of $58B included inflows of $53B to liquidity products and $5B to long-term products Good global investment performance 78% of mutual fund AUM ranked in the first or second quartiles over past 5 years; 72% over 3 years and 48% over 1 year Expense down 1% YoY largely resulting from lower performance-based compensation predominantly offset by higher headcount- related expense 13 F I N A N C I A L R E S U L T S

Corporate/Private Equity1 Net Income ($ in millions) 1 See note 1 on slide 21 4Q11 3Q11 4Q10 Private Equity ($89) $258 ($267) Corporate 312 610 461 Net Income $223 $868 $194 $ O/(U) Private Equity Private Equity net revenue of negative $113mm Private Equity portfolio of $7.7B (5.7% of stockholders’ equity less goodwill) Corporate Noninterest expense includes an increase of $528mm (pretax) for additional litigation reserves, predominantly for mortgage-related matters 14 F I N A N C I A L R E S U L T S

4Q11 3Q11 4Q10 Basel I Tier 1 Common Capital1,2 $123 $120 $115 Basel III Tier 1 Common Capital1,2,3 (Estimate) $122 $119 $112 Basel I Risk-Weighted Assets1 $1,224 $1,218 $1,175 Basel III Risk-Weighted Assets1,2,3 (Estimate) $1,546 $1,549 $1,610 Total Assets $2,266 $2,289 $2,118 Basel I Tier 1 Common Ratio1,2 10.0% 9.9% 9.8% Basel III Tier 1 Common Ratio1,2,3 (Estimate) 7.9% 7.7% 7.0% Fortress balance sheet 1 Estimated for 4Q11 2 See note 3 on slide 21 3 Represents the Firm’s best estimate, based on its current understanding of proposed rules 4 See note 2 on slide 21 5 The Global Liquidity Reserve represents cash on deposit at central banks, and the cash proceeds expected to be received in connection with secured financing of highly liquid, unencumbered securities (such as sovereigns, FDIC and government guaranteed, agency and agency MBS). In addition, the Global Liquidity Reserve includes the Firm’s borrowing capacity at the Federal Reserve Bank discount window and various other central banks and from various Federal Home Loan Banks, which capacity is maintained by the Firm having pledged collateral to all such banks. These amounts represent preliminary estimates which may be revised in the Firm’s 10-K for the year ending December 31, 2011 6 Common stock repurchases also include repurchases of warrants to purchase common stock. Reflects repurchases through December 31, 2011, on a trade-date basis Note: Firmwide Level 3 assets are estimated to be 5% of total Firm assets at December 31, 2011 $ in billions Firmwide total credit reserves of $28.3B; loan loss coverage ratio of 3.35%4 Global liquidity reserve of $379B5 Repurchased $950mm of common stock6 in 4Q11 and $9B6 in full year 2011 15 F I N A N C I A L R E S U L T S

Outlook Consumer & Business Banking – 2012 outlook Spread compression, given low interest rates, will negatively impact net income by $400mm+/- Durbin Amendment will reduce net income by $600mm +/- on an annualized basis Mortgage Banking Estimate realized repurchase losses of $350mm+/- per quarter Expect total quarterly net charge-offs of $900mm+/- Real Estate Portfolios – Expect balances to further decline 10-15% in 2012, reducing annual net interest income by $500mm+/- Retail Financial Services Corporate / Private Equity In 2012, Corporate quarterly net income, excluding Private Equity, and excluding significant nonrecurring items and litigation expense, could be $200mm +/- Will depend on decisions related to repositioning of the investment securities portfolio Card Services Credit losses: Credit Card (excl. Commercial Card portfolios) credit losses for 1Q12 of 4.50% +/- Net charge-off rate (%) 4Q11 Chase Credit Card1 3.93% WaMu Credit Card 8.56% Combined Credit Card1 4.33% 16 F I N A N C I A L R E S U L T S 1 Excludes Commercial Card

Agenda Page 17 Appendix 17 F I N A N C I A L R E S U L T S

Consumer credit — delinquency trends (Excl. purchased credit-impaired loans and WaMu and Commercial Card portfolios) Note: Delinquencies prior to September 2008 are heritage Chase Prime Mortgage excludes loans held-for-sale, Asset Management and U.S. Government-Insured loans 1 See note 5 on slide 21 2 “Payment holiday” in 2Q09 impacted 30+ day and 30-89 day delinquency trends in 3Q09 Credit Card delinquency trend1,2 ($ in millions) $1,200 $2,600 $4,000 $5,400 $6,800 $8,200 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 30+ day delinquencies 30-89 day delinquencies Prime Mortgage delinquency trend ($ in millions) Home Equity delinquency trend ($ in millions) Subprime Mortgage delinquency trend ($ in millions) $0 $1,000 $2,000 $3,000 $4,000 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 $0 $1,300 $2,600 $3,900 $5,200 $6,500 Jun-08 8 09 09 Jun-10 Dec-10 Jun-11 Dec-11 30 – 150 day delinquencies 150+ day delinquencies $0 $1,000 $2,000 $3,000 $4,000 $5,000 Jun-08 Dec-08 9 ec-09 Jun-1 Dec-1 Jun-11 Dec-11 30 – 150 day delinquencies 150+ day delinquencies 30 – 150 day delinquencies 18 A P P E N D I X

17,564 17,050 16,179 15,503 14,841 13,441 11,928 11,005 9,993 31,602 38,186 35,836 34,161 32,266 29,750 28,520 28,350 27,609 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 0% 100% 200% 300% 400% 500% Coverage ratios are strong Loan Loss Reserve Nonperforming Loans Loan Loss Reserve/Total Loans1 Loan Loss Reserve/NPLs1 Peer comparison $27.6B of loan loss reserves in 4Q11, down ~$4.7B from $32.3B one year ago reflecting improved portfolio credit quality; loan loss coverage ratio of 3.35%1 $7.5B (pretax) addition in allowance for loan losses related to the consolidation of credit card receivables in 1Q10 1 See note 2 on slide 21 2 Peer average reflects equivalent metrics for key competitors. Peers are defined as C, BAC and WFC $ in millions 4Q11 3Q11 JPM 1 JPM 1 Peer Avg. 2 Consumer LLR/Total Loans 4.69% 5.16% 4.69% LLR/NPLs 237% 244% 194% Wholesale LLR/Total Loans 1.55% 1.68% 1.65% LLR/NPLs 180% 143% 71% Firmwide LLR/Total Loans 3.35% 3.74% 3.61% LLR/NPLs 223% 216% 153% 19 A P P E N D I X

IB League Tables Rank Share Rank Share Rank Share Based on fees: Global IB fees1 1 8.1% 1 7.6% 1 9.0% Based on volumes: Global Debt, Equity & Equity-related 1 6.8% 1 7.2% 1 8.8% US Debt, Equity & Equity-related 1 11.1% 1 11.1% 1 14.8% Global Equity & Equity-related2 3 6.8% 3 7.3% 1 11.6% US Equity & Equity-related 1 12.5% 2 13.1% 2 15.5% Global Long-term Debt3 1 6.7% 2 7.2% 1 8.4% US Long-term Debt3 1 11.2% 2 10.9% 1 14.2% Global M&A Announced4 2 18.6% 4 15.9% 3 23.7% US M&A Announced4,5 2 27.5% 3 21.9% 2 35.6% Global Loan Syndications 1 11.0% 2 8.5% 1 8.1% US Loan Syndications 1 21.4% 2 19.1% 1 21.8% FY11 FY09FY10 League table results For FY11, JPM ranked: #1 in Global IB fees #1 in Global Debt, Equity & Equity-related #3 in Global Equity & Equity-related #1 in Global Long-term Debt #2 in Global M&A Announced #1 in Global Loan Syndications Source: Dealogic 1 Global IB fees exclude money market, short term debt and shelf deals 2 Equity & Equity-related include rights offerings and Chinese A-Shares 3 Long-term Debt tables include investment grade, high yield, ABS, MBS, covered bonds, supranational, sovereign and agency issuance; exclude money market, short term debt and U.S. municipal securities 4 Global announced M&A is based upon value at announcement, with full credit to each advisor/equal if joint; all other rankings are based upon proceeds. Because of joint assignments, M&A market share of all participants will add up to more than 100%. Rankings reflect the removal of any withdrawn transactions 5 US M&A represents any US involvement ranking 20 A P P E N D I X FY11 Rank Share FY10 Share Rank

Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews the Firm’s results and the results of the lines of business on a “managed” basis, which is a non-GAAP financial measure. The Firm’s definition of managed basis starts with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm (and each of the business segments) on a FTE basis. Accordingly, revenue from tax-exempt securities and investments that receive tax credits is presented in the managed results on a basis comparable to taxable securities and investments. This non-GAAP financial measure allows management to assess the comparability of revenue arising from both taxable and tax- exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. 2. The ratio of the allowance for loan losses to end-of-period loans excludes the following: loans accounted for at fair value and loans held-for-sale; purchased credit-impaired (“PCI”) loans; and the allowance for loan losses related to PCI loans. Additionally, Real Estate Portfolios net charge-offs exclude the impact of PCI loans. The allowance for loan losses related to the purchased credit-impaired portfolio totaled $5.7 billion, $4.9 billion and $4.9 billion at December 31, 2011, September 30, 2011, and December 31, 2010, respectively. 3. The Basel I Tier 1 common ratio is Tier 1 common divided by risk-weighted assets. Tier 1 common is defined as Tier 1 capital less elements of Tier 1 capital not in the form of common equity, such as perpetual preferred stock, noncontrolling interests in subsidiaries and trust preferred capital debt securities. Tier 1 common, a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of the Firm’s capital with the capital of other financial services companies. The Firm uses Tier 1 common along with other capital measures to assess and monitor its capital position. On December 16, 2010, the Basel Committee issued the final version of the Basel Capital Accord, commonly referred to as “Basel III.” The Firm’s estimate of its Tier 1 common ratio under Basel III is a non-GAAP financial measure and reflects the Firm’s current understanding of the Basel III rules and the application of such rules to its businesses as currently conducted. The Firm’s estimates of its Basel III Tier 1 common ratio will evolve over time as the Firm’s businesses change, and as a result of further rule-making on Basel III implementation by U.S. federal banking agencies. Management considers this estimate as a key measure to assess the Firm’s capital position in conjunction with its capital ratios under Basel I requirements, in order to enable management, investors and analysts to compare the Firm’s capital under the Basel III capital standards with similar estimates provided by other financial services companies. 4. Tangible common equity (“TCE”), a non-GAAP financial measure, represents common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. ROTCE, a non-GAAP financial ratio, measures the Firm’s earnings as a percentage of TCE. In management’s view, these measures are meaningful to the Firm, as well as analysts and investors in assessing the Firm’s use of equity, and in facilitating comparisons with competitors. 5. In Card Services, supplemental information is provided for Chase, excluding Washington Mutual and Commercial Card portfolios, to provide more meaningful measures that enable comparability with prior periods. The net charge-off rate and 30+ delinquency rate presented include loans held-for-sale. Additional notes on financial measures 6. Treasury & Securities Services firmwide metrics include certain TSS product revenue and liability balances reported in other lines of business related to customers who are also customers of those other lines of business. In order to capture the firmwide impact of TSS products and revenue, management reviews firmwide metrics such as liability balances, revenue and overhead ratios in assessing financial performance for TSS. Firmwide metrics are necessary, in management’s view, in order to understand the aggregate TSS business. 7. Pretax margin represents income before income tax expense divided by total net revenue, which is, in management’s view, a comprehensive measure of pretax performance derived by measuring earnings after all costs are taken into consideration. It is, therefore, another basis that management uses to evaluate the performance of TSS and AM against the performance of their respective competitors. 8. Headcount-related expense includes salary and benefits (excluding performance-based incentives), and other noncompensation costs related to employees. Notes on non-GAAP & other financial measures 21 A P P E N D I X

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2010 (as revised by a Current Report on Form 8-K dated November 4, 2011), and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2011 (as revised by a Current Report on Form 8-K dated November 4, 2011), June 30, 2011 (as revised by a Current Report on Form 8-K dated November 4, 2011), and September 30, 2011, which have been filed with the Securities and Exchange Commission and are available on JPMorgan Chase & Co.’s website (www.jpmorganchase.com) and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the respective dates of the referenced forward-looking statements. 22 A P P E N D I X