Attached files

| file | filename |

|---|---|

| EX-99.1 - TRANSCRIPT OF CONFERENCE CALL - MOSAIC CO | d280778dex991.htm |

| 8-K - FORM 8-K - MOSAIC CO | d280778d8k.htm |

The Mosaic Company

Jim Prokopanko, President and Chief Executive Officer

Laura Gagnon, Vice President Investor Relations

Earnings

Conference

Call

–

2

nd

Quarter

Fiscal

2012

Thursday, January 5, 2012 |

This presentation contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about future financial and operating results. Such statements are based upon the

current beliefs and expectations of The Mosaic Company’s management and are

subject to significant risks and uncertainties. These risks and

uncertainties include but are not limited to the predictability and volatility of, and customer expectations about, agriculture,

fertilizer,

raw

material,

energy

and

transportation

markets

that

are

subject

to

competitive

and

other

pressures

and

economic

and

credit

market conditions; the level of inventories in the distribution channels for crop

nutrients; changes in foreign currency and exchange rates; international

trade risks; changes in government policy; changes in environmental and other governmental regulation, including

greenhouse gas regulation, implementation of the U.S. Environmental Protection

Agency’s numeric water quality standards for the discharge of

nutrients into Florida lakes and streams or possible efforts to reduce the flow of excess nutrients into the Gulf of Mexico;

further developments in the lawsuit involving the federal wetlands permit for the

extension of the Company’s South Fort Meade, Florida, mine into Hardee

County, including orders, rulings, injunctions or other actions by the court or actions by the plaintiffs, the

Army

Corps

of

Engineers

or

others

in

relation

to

the

lawsuit,

or

any

actions

the

Company

may

identify

and

implement

in

an

effort

to

mitigate the effects of the lawsuit; other difficulties or delays in receiving, or

increased costs of, necessary governmental permits or approvals; the

effectiveness of the Company’s processes for managing its strategic priorities; adverse weather conditions affecting

operations in Central Florida or the Gulf Coast of the United States, including

potential hurricanes or excess rainfall; actual costs of various items

differing from management’s current estimates, including, among others, asset retirement, environmental remediation,

reclamation or other environmental regulation, or Canadian resources taxes and

royalties; accidents and other disruptions involving Mosaic’s

operations, including brine inflows at its Esterhazy, Saskatchewan potash mine and other potential mine fires, floods,

explosions, seismic events or releases of hazardous or volatile chemicals, as well

as other risks and uncertainties reported from time to time in The Mosaic

Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set

forth in the forward-looking statements.

Safe Harbor Statement

2 |

Another Quarter of Strong Results

Revenue

$3.0 billion

+13%

Net Earnings

$624 million

+37%

EPS

$1.40

+37%

3

(1)

Excluding net gain of $570.1 million, or $1.27 per share, from sale of Fosfertil

in Q2 FY11. (1)

(1) |

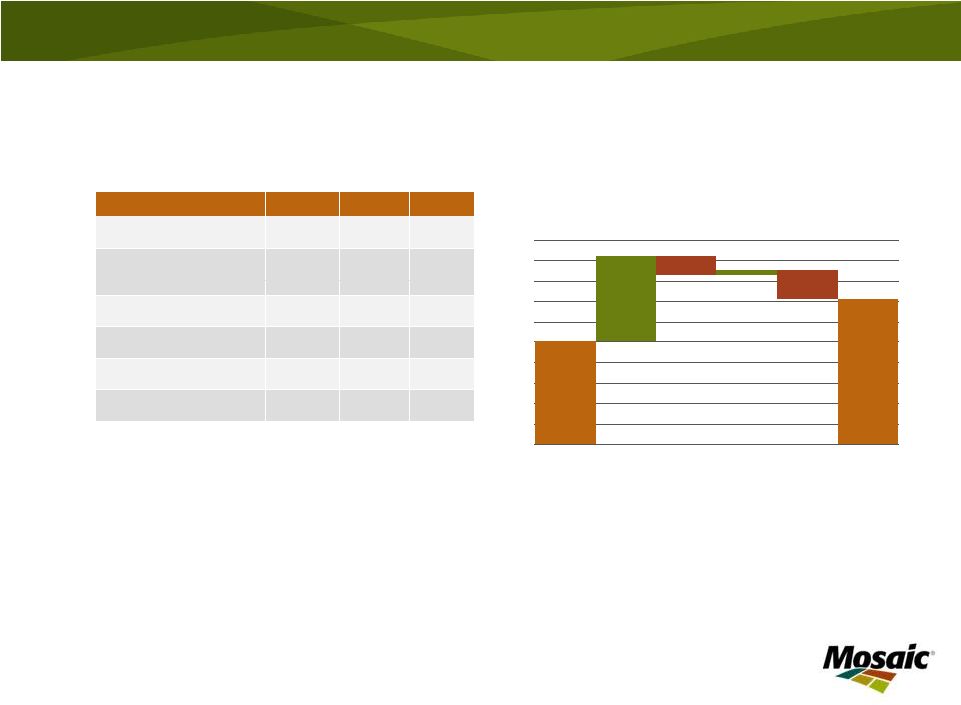

Potash Segment Highlights

4

In millions, except MOP price

Q2 FY12

Q1 FY12

Q2 FY11

Net sales

$839

$873

$699

Gross Margin

$394

$444

$285

% of net sales

47%

51%

41%

Operating earnings

$358

$402

$252

Sales volumes

1.8

1.8

1.8

Production volume

1.8

1.9

1.7

Avg MOP selling price

$440

$446

$331

Second quarter year over year highlights:

•

Operating earnings up 42% due to increased selling prices and higher operating

rates •

Operating rate of 78% vs. 74% a year ago

•

Average selling price driven by international mix

0

50

100

150

200

250

300

350

400

450

500

Q2 FY11 OE

Sales

price

Sales volumes

Resource

taxes

Other

Q2 FY12 OE

OPERATING EARNINGS BRIDGE

$ IN MILLIONS |

Potash Expansion on Track

Over 60% capacity increase expected by 2019

5

10

12

14

16

18

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

FISCAL YEAR

CUMULATIVE PEAKING CAPACITY ADDITIONS

MILLION TONNES

EXISTING

TOLLING

IN PROGRESS

FUTURE |

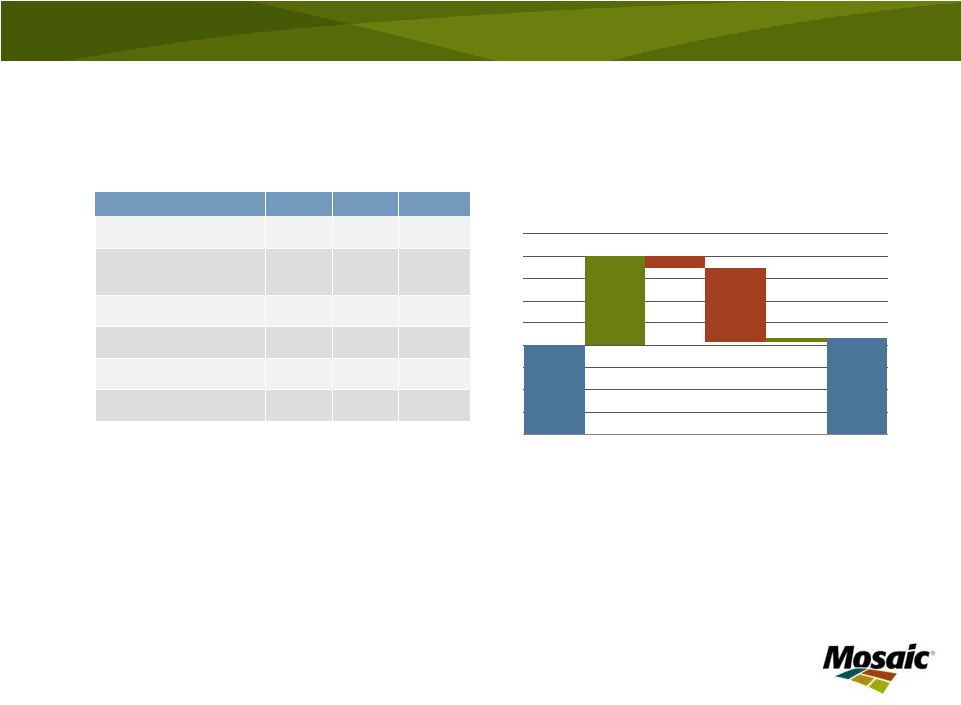

Phosphates Segment Highlights

6

In millions, except DAP price

Q2 FY12

Q1 FY12

Q2 FY11

Net sales

$2,179

$2,220

$1,974

Gross Margin

$476

$410

$476

% of net sales

22%

18%

24%

Operating earnings

$432

$333

$402

Sales volumes

3.2

3.2

3.7

NA production volume

(a)

2.1

2.2

2.1

Avg DAP selling price

$611

$576

$461

(a)

Includes crop nutrient dry concentrates and animal feed ingredients

Second quarter year over year highlights:

•

Operating

earnings

up

7%

due

to

higher

selling

prices,

partially

offset

by

higher

raw

material

costs

and

lower

volumes

•

Finished product operating rate of 86% down slightly from 88% a year ago

•

Sequential improvement in gross margins to 22% reflect price offsetting higher raw

material costs •

Faustina fully operational by November

0

100

200

300

400

500

600

700

800

900

Q2 FY11

OE

Sales

price

Sales

volumes

Raw

materials

Other

Q2 FY12

OE

OPERATING EARNINGS BRIDGE

$ IN MILLIONS |

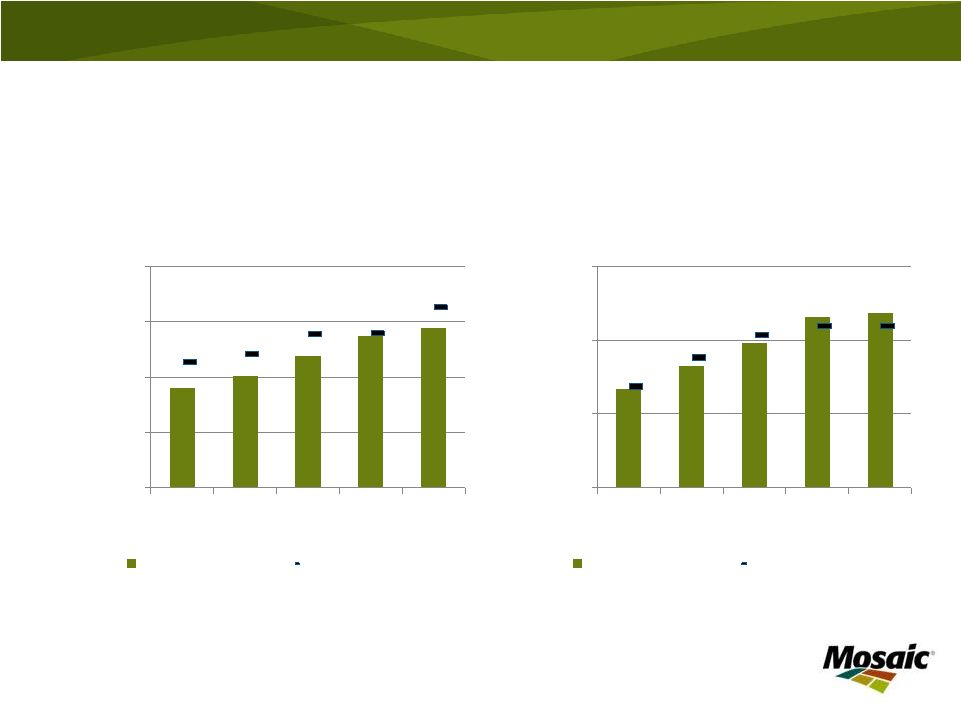

Phosphate Raw Material Costs

7

Ammonia

$/tonne

Sulfur Costs

$/long ton

Realized costs of raw materials in COGS lag spot prices by approximately 3 months.

Realized ammonia costs, in most periods shown, include a benefit of our

manufacture of ammonia at Faustina. In addition, sulfur realized prices include

storage,

conversion

and

transformation

costs

of

$10

-

$15

/

ton.

$0

$200

$400

$600

$800

2Q

2011

3Q

2011

4Q

2011

1Q

2012

2Q

2012

Realized in COGS

Ave Purchase Price

$0

$100

$200

$300

2Q

2011

3Q

2011

4Q

2011

1Q

2012

2Q

2012

Realized in COGS

Ave Purchase Price |

Phosphate Rock Sourcing

8

Rock Mix used in U.S. Operations

$-

$25

$50

$75

$100

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

US mined rock

Purchased Miski Mayo rock

Other purchased rock |

9

Affordability has improved due to higher grain

prices and lower crop nutrient costs

0.00

0.25

0.50

0.75

1.00

1.25

1.50

1.75

2.00

2.25

2.50

2.75

00

01

02

03

04

05

06

07

08

09

10

11

Crop Nutrient Price Index/Crop Price Index Ratio

Ratio

Average |

Markets are signaling to farmers to keep

the foot on the gas and not the brake

10

3.50

4.00

4.50

5.00

5.50

6.00

6.50

7.00

7.50

8.00

O

N

D

J

F

M

A

M

J

J

US$ BU

New Crop Corn Prices

Daily Close of the New Crop Option October 1 to June 30

2008

2009

2010

2011

2012

Source: CBOT |

Near term market forecast

The issue is timing, not tonnes

11

0

1

2

3

4

5

6

7

8

Jun-Nov

Dec-May

NORTH AMERICAN MOP SHIPMENTS

MILLION TONS

0

1

2

3

4

5

6

7

8

Jun-Nov

Dec-May

NORTH AMERICAN PHOSPHATE SHIPMENTS

MILLION TONS

5 yr range

2011/12F

5 yr average |

Category

Guidance

Potash

Q3

Sales

volume

1.2

–

1.5

million

tonnes

Q3

MOP

selling

price

$430

–

$460

per

tonne

Q3 Operating rate above 80%

Phosphates

Q3

Sales

volume

2.2

–

2.6

million

tonnes

Q3 DAP selling price $530 -

$560 per tonne

Q3

Operating

rate

range

of

70%

-

80%

Capital Expenditures

$1.6

-

$1.9

billion

Canadian Resource Taxes and Royalties

$420

–

$470

million

SG&A

$400

–

$430

million

Effective Tax Rate

Upper 20 percent range

Financial Guidance –

Fiscal 2012

12 |

Record Phosphate Shipments

In both 2011 and 2012

13

Phosphate shipments are expected to climb to record levels driven by high

agricultural commodity prices and profitable farm economics

Source: Fertecon, IFA and Mosaic estimates

52

47

58

60

62-64

30

40

50

60

70

00

01

02

03

04

05

06

07

08

09

10

11F

12F

CALENDAR YEAR

WORLD PHOSPHATE SHIPMENTS

MILLION TONNES DAP/MAP/TSP |

Record Potash Demand

In both 2011 and 2012

14

Source: Fertecon, IFA and Mosaic estimates

Muriate

of

Potash

shipments

also

are

expected

to

climb

to

record

levels

driven

by

high agricultural commodity prices and profitable farm economics

51

31

53

56

57-59

25

35

45

55

65

00

01

02

03

04

05

06

07

08

09

10

11F

12F

CALENDAR YEAR

WORLD POTASH SHIPMENTS

MILLION TONNES KCl |

The Mosaic Company

Thank you |

Earnings

Sensitivity

to

Key

Drivers

(a)

Change

Estimated Change in

Pre-Tax Earnings

($ in millions)

Estimated

Change in Annual

EPS

MOP Price ($/tonne)

$50

$354

$0.59

Potash Volume (000 tonnes)

500

$160

$0.27

DAP Price ($/tonne)

$50

$416

$0.69

Phosphates Volume (000 tonnes)

500

$111

$0.18

Sulfur ($/lt)

$25

$175

$0.29

Ammonia ($/tonne)

$25

$78

$0.13

Natural Gas ($/mmbtu)

$1.00

$36

$0.06

(a)

These factors do not change in isolation; actual results could vary from the above

estimates 16 |

Three Months Ended

November

30, ,

2011 –

2010 . (in millions, except per share amounts)

2011

2010

Change

Percent

Net earnings attributable to Mosaic

$623.6

$1,025.6

$(402.0)

(39%)

After-tax gain from sale of Fosfertil

-

$(570.1)

$570.1

-

Adjusted net earnings attributable to Mosaic

$623.6

$455.5

$168.1

37%

Diluted net earnings per share attributable to Mosaic

$1.40

$1.02

$0.38

37%

Diluted weighted average number of shares outstanding

444.7

447.3

17

Adjusted Net Earnings Attributable to Mosaic

The Company has presented above adjusted net earnings attributable to Mosaic which

is a non-GAAP financial measure. Generally, a non-GAAP

financial measure is a supplemental numerical measure of a company's performance,

financial position or cash flows that either excludes or includes amounts

that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with

U.S. generally accepted accounting principles ("GAAP"). Adjusted net

earnings attributable to Mosaic is not a measure of financial performance

under GAAP. Because not all companies use identical calculations, investors

should consider that Mosaic’s calculation may not be comparable to

other similarly titled measures presented by other companies.

Adjusted net earnings attributable to Mosaic provides a metric that the Company

believes is helpful to investors in evaluating the Company’s

performance as it excludes the one-time gain from the sale of Mosaic’s

equity investment in Fosfertil. Adjusted net earnings attributable to Mosaic

should not be considered as a substitute for, or superior to, measures of financial

performance prepared in accordance with GAAP. |