Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - INTELEPEER INC | a2204812zex-23_2.htm |

Use these links to rapidly review the document

Table of Contents

INTELEPEER, INC. INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on January 11, 2012

Registration No. 333-174080

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Amendment No. 6

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IntelePeer, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

7372 (Primary Standard Industrial Classification Code Number) |

68-0556257 (I.R.S. Employer Identification Number) |

2855 Campus Drive, Suite 200

San Mateo, CA 94403

(650) 525-9200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Frank Fawzi

Chairman, President and Chief Executive Officer

IntelePeer, Inc.

2855 Campus Drive, Suite 200

San Mateo, CA 94403

(650) 525-9200

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

| Copies to: | ||

Peter M. Astiz, Esq. Bradley J. Gersich, Esq. DLA Piper LLP (US) 2000 University Avenue East Palo Alto, CA 94303 (650) 833-2000 |

Christopher J. Austin, Esq. Anthony J. McCusker, Esq. Bradley C. Weber, Esq. Goodwin Procter LLP 135 Commonwealth Drive Menlo Park, CA 94025 (650) 752-3100 |

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount To Be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, $0.0001 par value per share |

8,625,000 | $11.00 | $94,875,000 | $10,873 | ||||

|

||||||||

- (1)

- Includes

1,125,000 shares that the underwriters have the option to purchase to cover over-allotments, if any.

- (2)

- Estimated

solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as

amended.

- (3)

- Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), shall determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 11, 2012

Preliminary Prospectus

7,500,000 Shares

Common Stock

This is the initial public offering of shares of common stock of IntelePeer, Inc. Prior to this offering, there has been no public market for our common stock. We are offering 7,500,000 shares of our common stock. The initial public offering price of our common stock is expected to be between $9.00 and $11.00 per share.

We have applied for listing of our common stock on the Nasdaq Global Market under the symbol "PEER."

Investing in our common stock involves a high degree of risk. Please read "Risk Factors" beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Initial public offering price |

$ | $ | |||||

Underwriting discounts and commissions |

$ | $ | |||||

Proceeds to IntelePeer, before expenses |

$ | $ | |||||

The underwriters have an option to purchase a maximum of 1,125,000 additional shares of common stock from us at the public offering price, less underwriting discounts and commissions, to cover over-allotments of shares, if any. The underwriters can exercise this option at any time within 30 days from the date of this prospectus.

Certain entities associated with VantagePoint Capital Partners, Kennet II L.P. and IVS Fund II K/S, each of which is an existing stockholder of IntelePeer, as well as certain officers and existing stockholders of IntelePeer, have indicated an interest in purchasing shares of common stock with an aggregate price of up to $7,000,000 in this offering at the initial public offering price. Because these indications of interest are not binding agreements or commitments to purchase, these existing stockholders may elect not to purchase shares in this offering or the underwriters may elect not to sell any shares in this offering to such stockholders. The underwriters will receive the same discount from shares of our common stock purchased by such stockholders as they will from other shares of our common stock sold to the public in this offering.

If the existing stockholders elect to purchase shares of IntelePeer's common stock with an aggregate price of approximately $7,000,000 in this offering as described above, assuming no exercise by the underwriters of their over-allotment option, the executive officers, directors and 5% or greater stockholders of IntelePeer will beneficially own, in the aggregate, approximately 69.5% of the outstanding capital stock of IntelePeer upon completion of this offering. If these existing stockholders do not elect to purchase shares in this offering or the underwriters elect not to sell any shares in this offering to such stockholders, then the executive officers, directors and 5% or greater stockholders of IntelePeer will beneficially own, in the aggregate, approximately 67.8% of the outstanding capital stock of IntelePeer upon completion of this offering.

The underwriters expect to deliver the shares of common stock to purchasers on , 2012.

| J.P. Morgan | Deutsche Bank Securities | Barclays Capital |

| RBC Capital Markets | William Blair & Company |

, 2012

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock. Our business, financial condition, results of operations, and prospects may have changed since that date.

Until , 2012, U.S. federal securities laws may require all dealers that effect transactions in our common stock, whether or not participating in this offering, to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

This prospectus summary highlights information contained elsewhere in this prospectus. It does not contain all of the information that may be important to your investment decision. Before making an investment decision, you should carefully read and consider this entire prospectus, including our financial statements and the related notes included elsewhere in this prospectus and the information set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Unless otherwise indicated, the terms "IntelePeer," "we," "us" and "our" refer to IntelePeer, Inc. and its subsidiary.

Business Overview

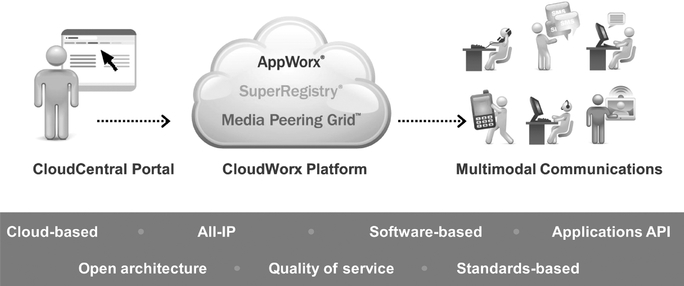

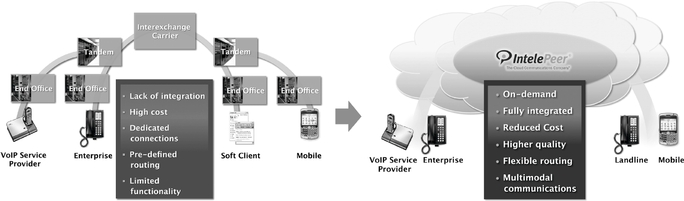

We are a provider of on-demand, cloud-based communications services to service providers and enterprises. Our customers can leverage our proprietary Communications-as-a-Service, or CaaS, platform, which we refer to as our CloudWorx CaaS Platform, to deliver multimodal communications services, including voice, unified communications, video and other rich-media applications, to communications devices with reduced cost and improved quality compared to existing alternatives. Our CloudWorx CaaS Platform allows customers to rapidly and easily transition from legacy network infrastructures to our flexible, software-based, multimodal, IP-based solutions. Our service provider customers include wireless and wireline carriers, as well as cable and voice over IP, or VoIP, providers. Our enterprise customers include businesses seeking integrated multimodal communications solutions.

The global telecommunications industry is undergoing a shift to next-generation IP-based communication technologies from legacy telephone networks. This transition is being driven by the widespread availability of broadband Internet connectivity and the emergence of cloud-based infrastructures and on-demand service delivery models, such as Software-as-a-Service, or SaaS. Cloud-based infrastructures or services refer to services that are delivered from remote servers at shared data centers over the Internet to clients or their customers, in contrast to services delivered using servers and computers controlled and operated by the client on its internal networks at its owned or leased facilities. We believe these trends, along with the inability of legacy infrastructures to support user demand for next-generation multimodal communications services, have created an opportunity and a need for a flexible and high-quality cloud-based communications platform.

Our on-demand CloudWorx CaaS Platform is fast to implement, easy to administer through our self-service web-based CloudCentral Portal and highly scalable. It is based on a sophisticated and integrated multi-layer approach, which includes:

- •

- our software-based Media Peering Grid service, providing any-to-any connection capabilities and

allowing service providers and enterprises to cost-effectively interconnect and transport communications traffic, at a rate of more than 23 billion minutes annually;

- •

- our SuperRegistry directory, currently containing more than 450 million telephone numbers and end-point identifying

addresses for wireless, wireline and other communications devices, enabling intelligent routing of communications traffic over our Media Peering Grid service; and

- •

- our AppWorx open and secure communications application development environment, which allows our customers and partners to build and offer a growing set of multimodal communications applications, which they can use to generate additional revenue or enhanced productivity.

These three layers are fully integrated, allowing simplified delivery of enhanced voice and rich-media services connecting through the industry-standard Session Initiation Protocol, or SIP, to IP devices and enabling connectivity to traditional non-IP communication devices, such as legacy telephones. Our software-based platform scales easily without requiring significant additional capital expenditures to

1

create and implement new services for new and existing customers and provides significant benefits versus traditional neutral and direct interconnection arrangements.

Our CloudWorx CaaS Platform is used by service provider customers, such as Sprint Nextel Corp. and Qwest Communications, and enterprise customers, as well as our channel partners delivering communications services to enterprises using equipment and software supplied by technology partners such as Microsoft, Cisco, Avaya and Siemens.

We believe that our cloud-based architecture, the scale of our proprietary, multi-layer, fully-integrated CloudWorx CaaS Platform, and the network effects arising out of the breadth of our relationships with service provider customers, enterprise customers and channel partners, provide us with a significant competitive advantage.

Our revenue is derived principally from the delivery of communications services over our CloudWorx CaaS Platform. Substantially all of our revenue to date has been derived from the transmission of voice traffic and related value-added services. Service provider and enterprise customers direct communications traffic to us, which we route through our peering partners so that the traffic can be delivered to the ultimate recipient of the communication, which is the end-point device. We typically charge our customers based upon minutes of use for traffic delivered through our platform.

Our customer contracts generally are non-exclusive and have neither volume nor time period commitments. Our top two customers, in the aggregate, represented 45 percent of our revenue during 2010 and our top two customers, in aggregate, represented 33 percent of our revenue in the nine months ended September 30, 2011. In 2010 and the nine months ended September 30, 2011, 2.7 percent and 4.9 percent of our revenue, respectively, was generated from enterprise customers.

For the nine months ended September 30, 2010 and 2011 our revenue was $80.4 million and $106.2 million, respectively, representing year over year growth of 32 percent, and our net loss was $7.8 million and $9.6 million, respectively. For 2008, 2009 and 2010 our total revenue was $43.4 million, $76.2 million and $111.5 million, representing year-over-year organic growth rates of 57 percent, 76 percent and 46 percent, respectively. For the same periods, our net loss was $5.1 million, $3.3 million and $11.6 million, respectively.

Industry Overview

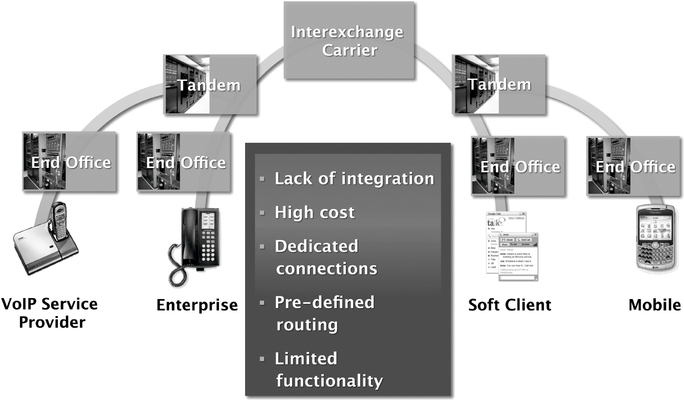

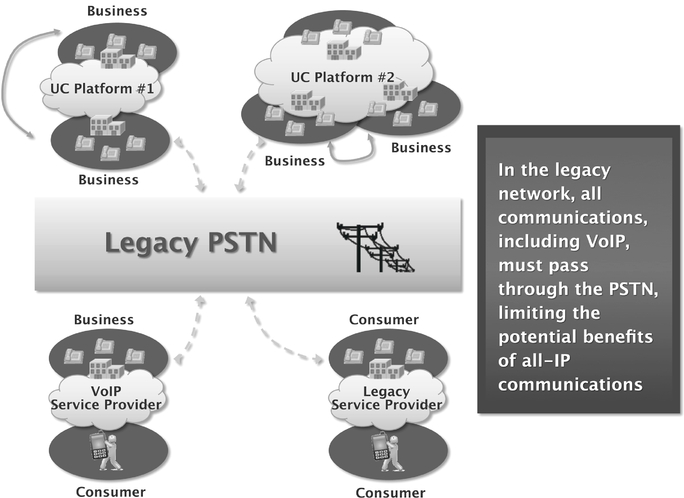

Despite significant developments in communications technology, the basic public telephone system, which is known as the Public Switched Telephone Network, or PSTN, continues to rely on legacy networks using many of the same techniques that have been used for decades to connect one voice caller to another. The legacy PSTN structure requires coordination across service providers and creates significant costs, including transit charges and other payments to intermediate service providers. In addition, the transit of communications across multiple service providers can degrade voice quality and reduce reliability. This structure also lacks flexibility to support multimodal communications and creates obstacles to the introduction of new forms of communications services and applications.

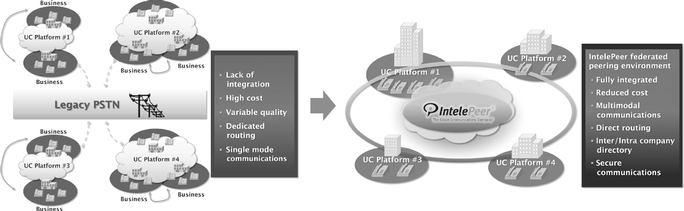

The growth of next-generation communications services, driven by the increasing availability of broadband Internet connections, has led to the development of the SIP standard protocol to provide a uniform standard for controlling multimodal communications sessions among IP networks, unified communications systems and end-user communications devices. Infrastructure investments in, and widespread availability of, broadband Internet connections have led to an increase in the adoption of unified communications systems, offering more advanced features such as VoIP, email, instant messaging, collaboration and video conferencing as well as the ability to combine different forms of multimodal communications such as voice and video. SIP-based communications enable substantial cost savings, operating flexibility and advanced features relative to traditional telephony.

2

However, due to the lack of an end-to-end SIP-based communications platform, the legacy PSTN has had to serve as a bridge for traffic between and among VoIP and other SIP networks as well as for connections to non-IP-based networks and end point devices, thus losing the advantages of SIP. This legacy PSTN infrastructure has become increasingly difficult to support as service providers balance the need to upgrade networks and introduce new communications services, with the goal of reducing operating costs and capital expenditures. Traditional approaches are severely limited by their inadequate support for software-based communications and rich media applications, higher capital and operating costs, reliance on multiple regional and local physical facilities, inefficient routing, lack of dynamic network capacity allocation and the absence of a centralized directory for multimodal communications.

Some service providers that exchange significant volumes of traffic have used SIP to directly interconnect with other service providers. These direct connect approaches require unique solutions for each individual partner, which are complex to implement and costly to manage because of the large number of direct interconnects required and the inefficiency of managing multiple partner relationships. In addition, existing neutral interconnect solution providers offering peering services use a series of hardware switches that rely on legacy protocols and a hierarchical architecture that must be deployed in every local market where communication services are to be provided. These neutral interconnect solutions require high initial capital expenditures and significant ongoing maintenance. Moreover, these solutions still rely upon the PSTN hierarchical architecture and are not capable of providing large scale multimodal communications solutions.

By migrating to IP networks, service providers can leverage the flexibility of a software and cloud-based platform to increase the variety of communications services delivered to customers as hosted offerings. Further, customers recognize that, in addition to the many service improvements, adoption of SIP as a protocol for controlling multimedia communication sessions, such as voice and video over IP, provides the potential to drive down telecommunications costs as IP-based networks are more efficient and cost-effective than those that rely on legacy PSTN infrastructure. According to IDC, the total U.S. telecommunications services market is expected to reach $326.5 billion by 2014.(1) Additionally, Infonetics Research has forecasted that the worldwide market for VoIP services could reach $74.5 billion by 2015 while the U.S. market for VoIP services could reach $25.5 billion by the same period.(2) Connecting IP-based networks to each other or the PSTN, which is referred to as SIP trunking, represents one of the fastest growing segments within the VoIP services market, and is forecasted to increase at a compound annual growth rate of 52 percent from $599 million in 2010 to $4.8 billion in 2015 worldwide and at 49 percent from $342 million in 2010 to $2.5 billion in 2015 in the U.S.(2) In addition to the migration of communications traffic from the PSTN to IP networks, a number of other trends in the industry are driving the growth in demand for a new cloud-based communications service platform including the proliferation of broadband connectivity, emergence of cloud-based service architectures, the proliferation of SIP/IP-based devices, increased demand for multimodal and unified communications.

- (1)

- IDC, "U.S. Telecommunications Services 2010-2014 Forecast," IDC #223323, July 2010.

- (2)

- Infonetics Research, "VoIP and UC Services and Subscribers Biannual Worldwide and Regional Market Share, Size, and Forecasts," March 28, 2011.

Our Competitive Strengths

Our solutions address the needs of service providers and enterprises while maintaining capital and operating efficiency. We believe the following strengths differentiate us and position us for continued growth:

- •

- Cloud-based services architecture. Our solutions are delivered on demand through a cloud-based architecture that can serve customers anytime and anywhere. This flexible and scalable architecture also enables us to customize our services to match each new customer's needs,

3

- •

- Fully-managed, IP-based Media Peering Grid

service. Our proprietary software-based, fully-managed, distributed Media Peering Grid service provides carrier-grade,

high-quality voice and connectivity that can be relied on as a primary communications network. Our flexible Media Peering Grid software supports both legacy and VoIP network

interoperability and enables our customers to efficiently and cost-effectively transition their communications infrastructures from the legacy PSTN to an IP network incrementally and on

demand, thus reducing expenses associated with legacy architecture as well as call delivery tolls and circuit expenses.

- •

- Extensive, secure, multimodal SuperRegistry directory. The

scale and multimodal nature of our directory give us the ability to complete a call to any connected end-point device, regardless of whether it is a PSTN-based handset or a

SIP-connected device. Using our proprietary intelligent routing software, and the telephone numbers and end-point identifying addresses in our SuperRegistry directory, we are able to

determine the interface type necessary to complete the connection and route traffic more efficiently from end-to-end, through our Media Peering Grid service. Furthermore, our SuperRegistry directory

enables our enterprise customers to achieve rich media, all-IP unified communications across disparate communications technologies with other enterprises and IP connected devices.

- •

- AppWorx open application development environment. Our

AppWorx open application development environment provides software developers and channel partners with access to powerful tools for rapid development and integration of new communications services.

These applications and new services can be accessed from anywhere, deployed quickly over our platform and easily integrated into existing web services or software applications. Our AppWorx development

environment enables our customers to develop and use these applications to provide additional functionality and new and differentiated services to their end-users, which our customers can

use to develop a stronger relationship with their end-customers.

- •

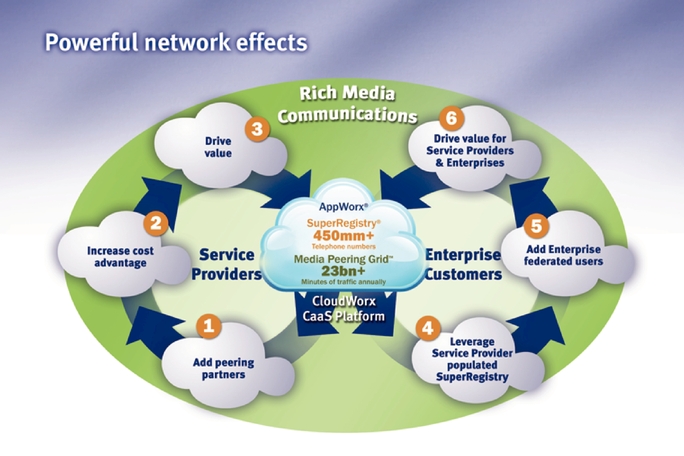

- Powerful network effects. We benefit from strong network

effects driven by the large volume of numbers in our SuperRegistry directory. As our service provider peering partnerships and enterprise customer base grow, the benefits each existing customer

realizes by using our platform increase, resulting in reduced costs for our customers and increased traffic through our platform. New features and partnerships broaden our value proposition,

attracting more customers, peering partners and channel partners. The scale of our business and depth of our relationships not only attract new customers but also serve as barriers to entry for

potential competitors.

- •

- Fully integrated communications platform. Our multi-layer platform, which integrates transport, peering, registry services and application programming interfaces, or APIs, offers our customers a one-stop, flexible and full-featured solution for developing and extending their communications services as compared to alternatives that focus on local market, hardware-based solutions. Our fully integrated platform also enables us to be flexible and to easily add and deploy new IP-enabled communications and collaboration services as our customers' needs evolve.

thereby eliminating the challenges often associated with the adoption and implementation of fixed, one-size-fits-all solutions.

Our Strategy

Our objective is to continue to leverage our CloudWorx CaaS Platform to establish a position as a leading provider of communications solutions for service providers and enterprises. We intend to accomplish this by pursuing the following strategies:

- •

- Establish the technology leadership of our CloudWorx CaaS Platform. We intend to continue to invest in our platform through internal development or by acquiring complementary technology. These activities are expected to broaden our support for new collaboration and communications

4

- •

- Extend the reach and breadth of our peering

partnerships. We plan to add additional telephone numbers and end-point identifying addresses to our SuperRegistry directory

from new and expanded relationships with service providers and enterprise customers. As we add additional direct peering partners, we expect to increase our communications traffic and revenue without

needing to utilize the legacy PSTN, which we expect will reduce our traffic delivery costs.

- •

- Grow our relationships with existing customers. Our sales

team works closely with our customers to understand their challenges and industry trends, determine the services that we can provide to better serve their needs as well as to identify areas of focus

for our ongoing research and development activities. These relationships allow our support team to respond more quickly and effectively to customer needs and our development team to provide customized

solutions for our customers. We intend to continue to leverage the work of our sales team to identify and deliver additional services to expand our relationships.

- •

- Expand our customer base and technology partnerships. We

intend to expand our base of enterprise customers by deepening our existing technology partnerships, developing new technology partnerships and expanding our network of channel partners. We also

intend to focus on expanding our service provider customer base by leveraging our CloudWorx CaaS Platform, investing in our direct sales force and educating service providers on the potential

opportunity to reduce or eliminate capital expenditures and reduce operating costs by leveraging our platform.

- •

- Broaden our international presence. We plan to extend our geographic reach and coverage by expanding our peering partner network and SuperRegistry directory globally through the addition of international service providers, peering partners and global enterprise customers.

features, enhance the capabilities of our SuperRegistry directory, and expand our AppWorx application development environment to drive broader adoption among new customers and developer communities.

Risks

Investing in our common stock involves significant risks. You should carefully consider the risks in "Risk Factors" before making a decision to invest in our common stock. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our common stock would likely decline, and you may lose all or a part of your investment. Below is a summary of some of the principal risks we face.

- •

- Our recent growth rates may not be indicative of our future growth;

- •

- We have a history of losses and may not achieve profitability in the future;

- •

- Our revenue is concentrated in a limited number of customers, and our contracts do not include any fixed commitments to

use our services;

- •

- We face significant competition from both established and new service providers and we may not compete successfully;

- •

- We operate in a dynamic legal and regulatory environment where changes in laws and regulations could adversely impact our business. In particular, the Federal Communications Commission, or FCC, recently released an order that comprehensively reforms the system by which service providers compensate each other for the origination and termination of telecommunications and Voice-over-Internet Protocol traffic which could result in a decrease in the revenue which we can generate from communications traffic or otherwise adversely impact our results of operations; and

5

- •

- We are subject to federal and state regulation, and we may be subject to enforcement and other adverse proceedings that may have a material adverse effect on our reputation or our future results of operations.

Recent Developments

Our financial data for the three months and year ended December 31, 2011 presented below are preliminary, based upon our estimates and are subject to completion of our financial closing procedures. These estimates have been prepared by and are the responsibility of management. Our independent registered public accounting firm has not audited or reviewed our preliminary financial data, and does not express an opinion or any other form of assurance with respect to the preliminary financial data. The below summary of financial data is not a comprehensive statement of our financial results for the three months and year ended December 31, 2011 and our actual results may differ materially from these estimates due to the completion of our financial closing procedures, final adjustments and other developments that may arise between now and the time the financial results are finalized.

Revenue for the three months ended December 31, 2011 is expected to be between $38.0 million and $39.0 million, compared to $31.1 million for the three months ended December 31, 2010. The increase is due to revenue from new customers and increased revenue from existing customers.

Revenue for the year ended December 31, 2011 is expected to be between $144.2 million and $145.2 million, compared to $111.5 million for the year ended December 31, 2010. The increase is due to revenue from new customers and increased revenue from existing customers. Revenue from Sprint and Qwest is expected to represent approximately 21 percent and 11 percent of our revenue in 2011, respectively, compared to 29 percent and 16 percent of our revenue in 2010.

Loss from operations for the three months ended December 31, 2011 is expected to be between $0.4 million and $0.8 million compared to income from operations of $0.1 million for the three months ended December 31, 2010.

Loss from operations for the year ended December 31, 2011 is expected to be between $5.4 million and $5.8 million compared to a loss from operations of $0.5 million for the year ended December 31, 2010. The estimated increase in loss from operations is primarily due to a $4.1 million increase in stock compensation expense to $4.7 million in 2011 compared to $0.6 million in 2010. Stock compensation expense in 2011 includes a charge of $3.5 million related to the issuance of fully vested options to certain long-time employees whose nonstatutory options had expired.

Depreciation and amortization expense is expected to be an expense of $5.4 million for the year ended December 31, 2011 compared to an expense of $3.7 million for the year ended December 31, 2010. The increase was primarily due to an increase in costs related to the equipment that hosts our CloudWorx CaaS Platform as we added more capacity to address the increase in minutes of use and expansion of our customer base.

The change in fair value of warrant liabilities is expected to be a non-cash income of $0.2 million for the three months ended December 31, 2011 compared to an expense of $3.2 million for the three months ended December 31, 2010. The change was primarily due to a decrease in the number of shares underlying the warrants.

The change in fair value of warrant liabilities is expected to be a non-cash expense of $2.4 million for the year ended December 31, 2011 compared to a non-cash expense of $8.5 million for the year ended December 31, 2010. The change was primarily due to the increase in the fair value of the stock underlying the warrants, partially offset by a decrease in the number of warrants.

6

Our cash and cash equivalents and our total indebtedness as of December 31, 2011 is estimated to have been $7.9 million and $26.3 million respectively, compared to $9.2 million and $18.7 million, respectively, as of December 31, 2010.

Corporate Information

We were incorporated in June 2003 under the laws of the State of Washington as Voex, Inc. We were reincorporated under the laws of the State of Delaware in October 2006. We changed our name to IntelePeer, Inc. in September 2007. Our principal executive offices are located at 2855 Campus Drive, Suite 200, San Mateo, California 94403, and our telephone number is (650) 525-9200. We maintain a corporate website at www.intelepeer.com. The information on, or accessible through, our website does not constitute a part of, and is not incorporated into, this prospectus.

Our trademarks include IntelePeer®, our company name and logo, AppWorx®, CloudWorx™, CoreCloud™, CloudCentral™, IntelePeer AppWorx®, Media Peering Grid™ and SuperRegistry®. All other trademarks or service marks appearing in this prospectus are trademarks or service marks of their respective owners.

7

| Common stock offered by us | 7,500,000 shares (8,625,000 shares if the underwriters exercise their over-allotment option in full). | |

Common stock to be outstanding after this offering |

34,399,597 shares |

|

Over-allotment option |

The underwriters have an option to purchase a maximum of 1,125,000 additional shares of common stock from us at the public offering price, less underwriting discounts and commissions, to cover over-allotments of shares, if any. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

|

Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $64.3 million, assuming an initial public offering price of $10.00 per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We currently intend to use approximately $25.5 million of the net proceeds from this offering to repay loans outstanding under our existing equipment purchase facilities and any accrued but unpaid interest thereon and other related fees. We currently intend to use the remainder of the net proceeds from this offering for working capital and general corporate purposes. |

|

See "Use of Proceeds" for additional information. |

||

Risk factors |

See "Risk Factors" immediately following this prospectus summary to read about factors you should consider before investing in our common stock. |

|

Proposed market symbol |

We have applied for listing of our common stock on the Nasdaq Global Market under the symbol "PEER." |

|

Proposed purchase by certain current stockholders |

Certain entities associated with VantagePoint Capital Partners, Kennet II L.P. and IVS Fund II K/S, each of which is an existing stockholder of IntelePeer, as well as certain officers and existing stockholders of IntelePeer, have indicated an interest in purchasing shares of common stock with an aggregate price of up to $7,000,000 in this offering at the initial public offering price. Because these indications of interest are not binding agreements or commitments to purchase, these existing stockholders may elect not to purchase shares in this offering or the underwriters may elect not to sell any shares in this offering to such stockholders. The underwriters will receive the same discount from shares of our common stock purchased by such stockholders as they will from other shares of our common stock sold to the public in this offering. Any shares purchased by such stockholders will be subject to lock-up restrictions described in the section entitled "Shares Eligible for Future Sale." |

8

The number of shares of our common stock expected to be outstanding after completion of this offering is based on 26,899,597 shares outstanding as of December 31, 2011, and excludes:

- •

- 7,748,387 shares of common stock issuable upon the exercise of options outstanding as of December 31, 2011 at a

weighted average exercise price of $1.82 per share;

- •

- 1,037,601 shares of common stock reserved for issuance upon the exercise of warrants outstanding as of December 31,

2011 at a weighted average exercise price of $1.68; and

- •

- 1,589,099 shares of common stock reserved for issuance under our equity incentive plan as of December 31, 2011.

Unless otherwise indicated, this prospectus reflects and assumes the following:

- •

- the conversion of all then-outstanding shares of our convertible preferred stock into an aggregate of

21,569,923 shares of common stock upon the closing of this offering;

- •

- the conversion of all then-outstanding warrants to purchase shares of convertible preferred stock, which

warrants by their express terms do not terminate if not exercised prior to this offering, into warrants to purchase an identical number of shares of common stock upon the closing of this offering;

- •

- the exercise in full of all then-outstanding warrants to purchase shares of convertible preferred stock and

common stock prior to the closing of this offering pursuant to conditional notices of exercise received for warrants which by their express terms terminate if not exercised prior to this offering;

- •

- a 1.5-to-1 reverse stock split of our outstanding stock effected on August 9, 2011 and a 1.33333333-to-1 reverse

stock split effected on September 29, 2011, which together had the effect of an approximately 2-to-1 reverse stock split for securities outstanding prior to August 9, 2011; and

- •

- no exercise by the underwriters of their over-allotment option.

9

The following table summarizes our financial data for the periods presented. We have derived the summary statement of operations data for the years ended December 31, 2008, 2009 and 2010 from our audited financial statements included elsewhere in this prospectus. We have derived the summary statement of operations data for the nine months ended September 30, 2010 and 2011 and the balance sheet data as of September 30, 2011 from our unaudited financial statements included elsewhere in this prospectus. The unaudited financial statements have been prepared on the same basis as the annual audited financial statements, and, in the opinion of management reflect all adjustments necessary for the fair presentation of the financial information set forth in those statements. Our historical results are not necessarily indicative of the results that may be expected in the future. The following summary financial data should be read in conjunction with "Selected Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and related notes included elsewhere in this prospectus.

| |

Year Ended December 31, | Nine Months Ended September 30, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||

| |

(in thousands, except share and per share data) |

|||||||||||||||||

| |

|

|

|

(unaudited) |

(unaudited) |

|||||||||||||

Statement of Operations Data: |

||||||||||||||||||

Revenue |

$ | 43,352 | $ | 76,194 | $ | 111,549 | $ | 80,445 | $ | 106,234 | ||||||||

Operating expenses: |

||||||||||||||||||

Peering partner compensation |

29,824 | 50,232 | 79,108 | 56,890 | 74,927 | |||||||||||||

Infrastructure costs |

2,987 | 5,265 | 6,348 | 4,546 | 5,691 | |||||||||||||

Operations(1) |

3,353 | 4,673 | 5,578 | 4,181 | 5,610 | |||||||||||||

Research and development(1) |

2,447 | 3,567 | 4,069 | 3,042 | 4,688 | |||||||||||||

Sales and marketing(1) |

4,741 | 6,367 | 7,693 | 5,636 | 10,411 | |||||||||||||

General and administrative(1) |

2,177 | 4,568 | 5,547 | 4,177 | 5,927 | |||||||||||||

Depreciation and amortization |

1,852 | 2,373 | 3,719 | 2,627 | 3,960 | |||||||||||||

Total operating expenses |

47,381 | 77,045 | 112,062 | 81,099 | 111,214 | |||||||||||||

Loss from operations |

(4,029 | ) | (851 | ) | (513 | ) | (654 | ) | (4,980 | ) | ||||||||

Interest expense, net |

(1,274 | ) | (1,488 | ) | (2,614 | ) | (1,842 | ) | (2,072 | ) | ||||||||

Change in fair value of warrant liabilities |

163 | (1,004 | ) | (8,492 | ) | (5,260 | ) | (2,590 | ) | |||||||||

Net loss |

$ | (5,140 | ) | $ | (3,343 | ) | $ | (11,619 | ) | $ | (7,756 | ) | $ | (9,642 | ) | |||

Net loss per share of common stock, basic and diluted(2) |

$ | (1.17 | ) | $ | (0.76 | ) | $ | (2.65 | ) | $ | (1.77 | ) | $ | (1.98 | ) | |||

Shares used in computing net loss per share of common stock, basic and diluted(2) |

4,378,964 | 4,378,964 | 4,381,308 | 4,378,964 | 4,864,178 | |||||||||||||

Pro forma net loss per share of common stock, basic and diluted (unaudited)(2) |

$ | (0.15 | ) | $ | (0.27 | ) | ||||||||||||

Shares used in computing pro forma net loss per share of common stock, basic and diluted (unaudited)(2) |

25,225,094 | 26,289,604 | ||||||||||||||||

10

| |

As of September 30, 2011 (unaudited) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma(3) | Pro Forma as Adjusted(4) |

|||||||

| |

(in thousands) |

|||||||||

Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 5,093 | $ | 5,093 | $ | 43,805 | ||||

Working capital (deficit) |

(14,219 | ) | (14,219 | ) | 42,019 | |||||

Total assets |

61,794 | 61,794 | 100,506 | |||||||

Total indebtedness(5) |

26,074 | 26,074 | 443 | |||||||

Warrant liabilities |

7,996 | 1,617 | 1,617 | |||||||

Redeemable convertible preferred stock |

40,386 | — | — | |||||||

Total stockholders' equity (deficit) |

(36,439 | ) | 10,326 | 74,669 | ||||||

- (1)

- The following table presents stock-based compensation expense included in each expense category (in thousands):

| |

Year Ended December 31, |

Nine Months Ended September 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||

| |

|

|

|

(unaudited) |

||||||||||||

Operations |

$ | 27 | $ | 31 | $ | 144 | $ | 100 | $ | 192 | ||||||

Research and development |

16 | 49 | 81 | 56 | 725 | |||||||||||

Sales and marketing |

185 | 111 | 153 | 99 | 3,056 | |||||||||||

General and administrative |

91 | 106 | 186 | 138 | 244 | |||||||||||

Total stock-based compensation |

$ | 319 | $ | 297 | $ | 564 | $ | 393 | $ | 4,217 | ||||||

- (2)

- Please

see Notes 1 and 12 to our audited financial statements included elsewhere in this prospectus for an explanation of the calculations of our

basic and diluted net loss per share of common stock and pro forma net loss per share of common stock.

- (3)

- The

pro forma column in the balance sheet data table above reflects (i) the conversion of all outstanding shares of our convertible preferred stock

into 21,569,923 shares of common stock immediately upon the completion of this offering and (ii) the resulting reclassification of the convertible preferred stock warrant liability to

additional paid-in capital.

- (4)

- The

pro forma as adjusted column in the balance sheet data table above reflects (i) the conversion of all outstanding shares of our convertible

preferred stock into 21,569,923 shares of common stock immediately upon the completion of this offering, (ii) the resulting reclassification of the convertible preferred stock warrant liability

to additional paid-in capital and (iii) the receipt of the net proceeds from the sale of 7,500,000 shares of common stock offered by us in this offering at an assumed initial public

offering price of $10.00 per share (the midpoint of the estimated price range set forth on the cover page of this prospectus), after deducting underwriting discounts and commissions and estimated

offering expenses payable by us. A $1.00 increase (decrease) in the assumed initial public offering price of $10.00 per share would increase (decrease) our cash and cash equivalents, working capital,

total assets and total stockholders' equity by $7.0 million, assuming the number of shares offered by us remains the same as set forth on the cover page of this prospectus and after deducting

estimated underwriting discounts and commissions and estimated offering expenses payable by us.

- (5)

- Total indebtedness includes $20.1 million in equipment financing obligations, $5.5 million of obligations under our revolving accounts receivable loan facility, and $0.4 million payable under our capital lease obligation. See Notes 4 and 10 to our audited financial statements included elsewhere in this prospectus.

11

Investing in our common stock involves a high degree of risk. You should carefully consider all the risks described below before making a decision to invest in our common stock. Our business could be harmed by any of these risks at any time. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Relating to Our Business

We have experienced rapid growth in recent periods and our recent growth rates may not be indicative of our future growth. If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service and customer satisfaction or adequately address competitive challenges.

Our revenue has increased substantially since our inception, but we may not be able to sustain revenue growth consistent with recent history, or at all. We believe growth of our revenue depends on a number of factors, including our ability to:

- •

- Price our services effectively so that we are able to attract and retain customers without compromising our profitability;

- •

- Attract new customers, increase our existing customers' use of our services and provide our customers with excellent

customer support;

- •

- Continue to increase the number of telephone numbers and end-point identifying addresses in our SuperRegistry

directory;

- •

- Develop new communications applications to increase our customers' use of our services;

- •

- Efficiently and accurately capture cost and revenue data for the more than 1.9 billion minutes of traffic delivered

per month over our platform;

- •

- Introduce our services to new markets outside of the United States; and

- •

- Increase awareness of our brand on a global basis.

We cannot assure you that we will be able to successfully accomplish any of these tasks.

Additionally, we currently plan to expand our business significantly to satisfy the anticipated demand for our services. To manage this growth, we must improve operational and financial systems, procedures and controls, and expand, train and manage our employee base. We must maintain and expand relationships with current customers, peering partners and other third parties, while attracting new customers, peering partners and channel partners. If we cannot manage our growth effectively, we may be unable to take advantage of market opportunities, execute our business strategies or respond to competitive pressures.

We have a history of losses and may not achieve or maintain profitability in the future.

We had net losses of $3.3 million, $11.6 million and $9.6 million in the years ended December 31, 2009 and 2010 and the nine months ended September 30, 2011, respectively. We cannot predict if we will attain profitability in the near future or at all. We expect to continue to make significant expenditures to develop and expand our business. In addition, as a public company, we will incur additional legal, accounting and other expenses that we did not incur as a private company. These increased expenditures will make it more difficult to achieve future profitability. We may incur significant losses in the future for a number of reasons, including the other risks described in this prospectus, and unforeseen expenses, difficulties, complications and delays and other unknown events. Accordingly, we may not be able to achieve or maintain profitability. We will need to generate significant revenue to achieve profitability, and we cannot assure any prospective investor that we will

12

be able to do so. Likewise, we cannot assure you of our ability to sustain or increase such profitability on a quarterly or annual basis in the future.

Our revenue is concentrated in a relatively limited number of customers, and our contracts do not include any fixed commitment to use our services. The termination of these contracts by our customers, or a decrease in traffic from those customers, could materially and adversely impact our results of operations and financial condition.

Our top two customers for the nine months ended September 30, 2011, Sprint and Qwest, represented 21 percent and 12 percent of our revenue for the period, respectively. Our top two customers in 2010, Sprint and Qwest, represented 29 percent and 16 percent of our revenue for the period, respectively. In general, our customer contracts are non-exclusive and have neither volume nor time period commitments. Any customer is able to discontinue the use of all or a portion of our services at any time. If one or more customers were to reduce their demand for our services, our revenue could decline. If we lose one or more of our top customers, or, if one or more of these major customers significantly decreases its use of our services, our business will be materially and adversely affected. From time to time, we have experienced material reductions in revenue from key customers. For example, our revenue from one of our top customers decreased from $35.3 million in 2009 to $18.2 million in 2010. Revenue from another top customer decreased from $2.9 million in 2008 to $0.2 million in 2009. There can be no assurance that we will not have similar substantial decreases in customer revenue in the future, or that the growth in our other customers will make up for any such decreases. As a result, our future revenue is difficult to forecast. Because our expense levels are based on our expectations as to future revenue and to a large extent are fixed in the short term, we might be unable to adjust spending in time to compensate for any shortfall in revenue. Accordingly, any significant shortfall of revenue in relation to our expectations will harm our operating results.

Our pricing and billing systems are complex and errors could adversely affect our revenue and profits.

We currently route more than 1.9 billion minutes of traffic each month and operate in a dynamic market, which makes our pricing and billing efforts complex to develop and challenging to implement. To be profitable, we must have accurate and complete information about the costs associated with connecting data and voice transmissions over our platform, and properly incorporate such information into our pricing model. Our pricing model must also reflect accurate and current information about the market for our services, including the pricing of competitive alternatives for our services, as well as reliable forecasts of traffic volume. We may determine pricing for our services based on data that is outdated or otherwise flawed. Even if we have complete and accurate market information, we may not set prices to optimize both revenue and profitability. If we price our services too high, the amount of traffic that may be routed through our platform may decrease and accordingly our revenue may decline. If we price our services too low, our margins may be adversely affected, which will reduce our ability to achieve and maintain profitability.

Additionally, we rely heavily on a single third party to provide us with key software and services for our billing. If that third party ceases to provide those services to us for any reason, or fails to perform billing services accurately and completely, we may not be able to deliver accurate invoices promptly. Delays in invoicing can lead to delays in revenue recognition, and inaccuracies in our billing could result in lost revenue. If we fail to adapt quickly and effectively to changes affecting our costs, pricing and billing, our profitability and cash flow will be adversely affected.

13

Commercial disputes and collection issues are common in our industry and any disputes with our peering partners or our customers could result in increased expenses or an inability to collect revenue for services provided and any collection problems could result in delays or failures to collect revenue.

Our direct and indirect peering arrangements are based on commercial agreements with a variety of parties. Disputes concerning payment for services rendered can occur for numerous reasons given the complexities of the regulatory environment and the number of parties involved in handling communications traffic. From time to time, we may dispute an invoice for the amount of traffic that we delivered to our peering partners or the rates that should have been applied to that traffic. Dispute resolution generally requires a review of call detail records and negotiations with our peering partners. If we subsequently determine that the disputed amounts will be settled for an amount in excess of the amount which we originally accrued, we will recognize the difference as an increase in peering partner compensation which would adversely impact our results of operations. For example, for the year ended December 31, 2010, we determined that certain disputed amounts could result in an additional charge of $1.1 million, which resulted in us recognizing this amount as additional peering partner compensation.

We are also subject to potential billing disputes with customers. Additionally, some customers have failed to pay for services because their financial condition limits their ability to satisfy their obligations. For example, in 2007, a customer that represented 1.6 percent of our revenue defaulted on its obligation of $163,000 and declared bankruptcy. Delays in receiving payments, or our inability to collect payments pursuant to such agreements, can adversely impact our business.

Our financial position, revenue, operating results and profitability may vary significantly from quarter to quarter, which could cause the price of our common stock to decline significantly.

As our business continues to grow, we believe that our quarterly operating results may be subject to significant fluctuation due to various factors, many of which are beyond our control. Factors that may affect our quarterly operating results in the future include the risk factors discussed in this Risk Factors section, and in particular the following:

- •

- changes in the amount of voice traffic which major customers route through our CloudWorx CaaS Platform;

- •

- our failure to properly anticipate changes in the price our customers are willing to pay, or the costs we must pay, to

deliver certain traffic;

- •

- the timing, capacity and breadth of direct peering established to support our customers;

- •

- decisions by our service provider customers to establish direct connection arrangements with other major service providers

rather than route traffic through our CloudWorx CaaS Platform;

- •

- fluctuations based upon seasonality or the weighted average number of business days in a particular quarter;

- •

- traffic outages or other failures of our platform; and

- •

- variability of operating expenses as a percentage of revenue.

Accordingly, it is difficult for us to accurately forecast our results of operations on a quarterly basis. If we fail to meet expectations of investors or analysts, our stock price may fall rapidly and without notice. Furthermore, the fluctuation of our quarterly operating results may render period-to-period comparisons of our operating results less meaningful and you should not rely upon them as an indication of our future performance.

14

We have a limited operating history and a relatively new business in an emerging and rapidly evolving market, making it difficult to evaluate our business and future prospects, thereby increasing the risk of your investment.

The revenue and income potential of our business and market is unproven, and our limited operating history with our current business model makes an evaluation of our business and prospects difficult. We were incorporated in June 2003 and since inception have been generating revenue from service provider customers. We first began offering applications to enterprise customers in 2008. In 2010 and the nine months ended September 30, 2011, 2.7 and 4.9 percent of our revenue, respectively, was generated from enterprise customers.

Our ability to grow our business will depend significantly on an increase in the adoption of new technologies, which may not occur or may not occur as quickly as we anticipate. Our CloudWorx CaaS Platform has the ability to deliver multimodal communications services, including voice, video, unified communications and other rich-media applications. If the market for these multimodal and unified communications capabilities does not develop, or develop as fast as we expect, our revenue may not grow.

We also seek to expand our business through growth in markets outside of the United States. We have no experience in providing services to, or in navigating the regulatory landscape of, those markets. If we fail to execute our business plan and attract new customers from outside of the United States, we may be unable to grow our revenue or offset declines in revenue in the United States.

Additionally, current or future competitors may develop and offer competing products or services that are, or are perceived to be, superior to our services in some respect. Our services may not be sufficiently competitive with those new products or services and, as a result, our revenue may decrease.

Decreasing telecommunications rates may diminish or eliminate our competitive pricing advantage.

The market for communications services is highly competitive and is characterized by decreasing rates for services. Even as traffic volumes have increased due to the increasing penetration of broadband Internet access services and consumer demand for content over such services, the rates that service providers pay each other has decreased over time. International and domestic telecommunications rates have decreased significantly over the last few years in most of the markets in which we operate, and we anticipate these rates will continue to decline in all of the markets in which we do business or expect to do business. If we are unable to reduce our operating expenses and adjust the rates we charge for our services, the decreasing market rates for the exchange of traffic may diminish or eliminate our competitive pricing position. Continued rate decreases may require us to lower our rates to remain competitive and could reduce or possibly eliminate any gross profit from our services.

If we fail to accurately forecast our revenue or the commitments we must make to satisfy demand for our services, our results of operations and financial condition could be adversely affected.

We must continue to invest in our business such that we have sufficient infrastructure and support to transport increasing numbers of minutes through our Media Peering Grid service. Our investment in our infrastructure depends largely on our forecasts of demand for our services, which is based on historical growth in the use of our services. If communications traffic declines or does not grow as fast as it has historically grown, our revenue may be less than we forecast, and we may have incurred infrastructure costs in excess of what was required to facilitate the delivery of communications traffic through our platform. If demand for our services exceeds our forecasts, our infrastructure may not be prepared for such an increase in demand and we may not be able to capitalize fully on the growth opportunity and increase our revenue in an optimal manner. In either case, the results of operations and our financial condition could be adversely affected.

15

We may lose customers if we experience system failures that significantly disrupt the availability and quality of the services that we provide.

Our operations are dependent upon our ability to prevent system interruption. We have experienced system failures from time to time, including loss of power in a commercially hosted facility, software bugs that prevented calls from routing normally and fiber cuts that denied access to a site from our backbone. In the past, these system failures caused periods of low quality service lasting from 10 to 180 minutes and total site unavailability of 10 to 60 minutes. Although we have endeavored to mitigate the potential impact of failures through our distributed platform and redundant operations, there is no guarantee that we will not have system failures in the future, including those that are materially worse in scope or duration. Any interruption in the ability of our customers to use our services reduces our current revenue, could harm our future revenue, and could subject us to additional regulatory scrutiny. Such interruptions could also undermine customer confidence in the reliability of our services and cause us to lose customers or make it more difficult to attract new ones.

Our business also requires us to protect our infrastructure against damage from human error, fire, earthquakes, floods, power loss, sabotage, intentional acts of vandalism, terrorism and similar events. Despite any precautions we may take, the occurrence of a natural disaster, power outage or other unanticipated problems could result in lengthy interruptions in the availability of our services. We do not carry business interruption insurance sufficient to compensate us for losses that may result from interruptions in the availability of our services as a result of system failures.

Our offerings are dependent upon third-party facilities, equipment and services, and interruptions or delays in service from our third-party facility providers could impair our ability to deliver our services to our customers, resulting in customer dissatisfaction, damage to our reputation, loss of customers, limited growth and reduction in revenue.

We rely on third parties' facilities and equipment to operate our business as our customers' traffic traverses a variety of facilities controlled by third parties. We principally buy equipment and software to build and update our system infrastructure from one supplier. If our third-party service providers fail to maintain facilities properly, if our equipment fails to perform as expected or if the providers of facilities or equipment fail to respond quickly to problems, our customers may experience service interruptions. Such service interruptions may affect the perceived reliability of our service which could damage our brand and reputation adversely affecting our growth. Additionally, we rely on a single supplier to provide us with key billing and related services. If that supplier stops providing those services to us for any reason, we could experience disruption in our ability to quickly capture the information we need to promptly generate invoices for our services. These delays in invoicing could materially delay our receipt of revenue from our customers.

Our IP telephony offering relies, in some instances, on third parties to originate and deliver all calls placed and received by such customers.

In offering IP telephony services, we rely on the infrastructure of the third-party network service providers who are our peering partners to provide telephone numbers, PSTN call termination and origination services and local number portability. In relying on such third parties, we are able to offer our services over a greater geographic area and can compete with other providers of such services in a broader marketplace. But in relying on such third parties, we have less control over the quality and reliability of our service. Moreover, if any of these third-party service providers cease operations or otherwise terminate services on which we depend, we could suffer customer loss or increased costs for our services, which could have a material adverse impact on us and our reputation.

16

We face significant competition from both established and new service providers, as well as from our customers, and if we do not compete successfully, we could lose market share, experience reduced revenue or suffer losses.

The services we provide are also offered by others and in the future may be offered by an increasing number of parties. Currently, we face competition from legacy telecommunications service providers as well as emerging providers of voice peering services. Our competitors include traditional telecommunications carriers and other providers of specialized communications services.

There are few substantial barriers to pursuing business from our customers, and we expect to face additional competition from new market entrants in the future. Many of our current and potential competitors have substantially greater financial, technical and marketing resources, larger customer bases, greater name recognition and more established relationships in the industry than we have. As a result, certain of our competitors may be able to develop and expand their network infrastructures and service offerings more quickly, adapt to new or emerging technologies and changes in customer requirements more quickly, take advantage of acquisitions and other opportunities more readily, devote greater resources to the marketing and sale of their services and adopt more aggressive pricing and incentive policies than we can. Those service providers may attract communications traffic that is currently utilizing our CloudWorx CaaS Platform.

Moreover, some of the potentially biggest users of our peering services, like incumbent local exchange carriers, competitive local exchange carriers and wireless and cable companies, may enter into direct peering arrangements between and among themselves and with other service providers. Such direct connections may result in lower traffic volumes for us and negatively impact our business.

Our ability to compete effectively will depend on a number of factors, including without limitation:

- •

- our ability to offer cost-effective and high-quality services consistently and without delay;

- •

- our ability to respond quickly and effectively to market demand for new services;

- •

- our ability to adopt or adapt to changing regulatory standards and industry practices;

- •

- the number and nature of our competitors and competitiveness of their services; and

- •

- the entrance of new competitors into our markets.

Many of these factors are outside of our control. For these reasons, we may not be able to compete successfully against our current or future competitors.

Consolidation in the telecommunications industry could lead to an unexpected and significant reduction in revenue.

The telecommunications industry has historically been marked by significant consolidation. If two service providers that are currently connecting traffic through our platform become part of a single entity and network infrastructure, those parties may no longer need to route telecommunications traffic through our platform, which will adversely affect the revenue we generate from such traffic.

If we fail to adapt and respond effectively to rapidly changing technology, evolving industry standards and changing customer needs, our services may become less competitive or obsolete, and we could lose customers or market share.

Our future success will depend in part on our ability to modify or enhance our services to meet customer needs, to add functionality and to address technological advancements. The telecommunications industry is characterized by rapid technological change and new service offerings, which could make our service offerings obsolete or too costly or inefficient on a relative basis. We must adapt to this rapidly changing market by continually improving the features, functionality, reliability and

17

responsiveness of our services, and by developing new features, services and applications to meet changing customer needs or developing industry standards. We cannot assure you that we will be able to adapt to these challenges or respond successfully or in a cost effective way. Failure to do so would adversely affect our ability to compete and retain customers or market share. In addition, our innovations may not achieve the market penetration or price levels necessary for profitability.

The market for next generation communications services may not develop as we anticipate.

The market for multimodal communications and unified communications services is at an early stage of development, and the market for these services may not achieve high levels of demand. Our success depends on the willingness of enterprises to adopt these next generation communications services. If demand for these services does not develop as we expect, it may adversely affect our revenue growth from enterprise customers.

Our sales channels may not be effective in selling our communications services to enterprise customers.

Currently, we rely on sales channels to acquire enterprise customers. If our sales channel partners are not effective in generating demand from enterprise customers for our services, we may have to evaluate alternative customer acquisition models, including introducing a direct sales model for attracting and retaining enterprise customers. As a result, our operating costs may be significantly increased, which may adversely affect our ability to achieve or maintain profitability.

Our CloudWorx CaaS Platform could subject us to litigation and other disputes from third parties.

Our CloudWorx CaaS Platform relies on multiple service providers to deliver communications traffic. We enter into contractual or other arrangements with the service provider from which we receive traffic and with the peering partner to which we deliver communications traffic. However, we do not have written contractual arrangements with all of the parties that participate in the origination, transit or termination of traffic through our platform. Our partners provide us assurances that they are in compliance with applicable laws and regulations. While our contracts address compensation issues, they also recognize that the market is subject to regulatory uncertainty and changes in law. We may be subject to litigation or other disputes as a result of our indirect peering business. We may not have recourse through contractual indemnification. Our inability to seek recourse either from those with which we enter into written contracts or third parties may adversely impact our business.

We could be subject to litigation that could adversely affect our business or operations.

We are currently the defendant in one lawsuit, and a second lawsuit has been threatened against us. These current or potential lawsuits allege various failures by our management, and could distract attention from our operation of our business. These matters are described in "Business—Legal Proceedings."

We may be vulnerable to security breaches, which could disrupt our operations and have a material adverse effect on our financial performance and operating results.

A party who is able to compromise the security of our facilities could misappropriate either our proprietary information or the personal information of our customers, or cause interruptions or malfunctions in our operations. We may be required to expend significant capital and financial resources to protect against such threats or to alleviate problems caused by breaches in security. As techniques used to breach security change frequently, and are generally not recognized until launched against a target, we may not be able to implement security measures in a timely manner or, if and when implemented, these measures could be circumvented. Any breaches that may occur could expose us to increased risk of lawsuits, loss of existing or potential customers, harm to our reputation and

18

increases in our security costs, which could have a material adverse effect on our financial performance and operating results.

If our security measures are breached and unauthorized access is obtained to a customer's stored data or any consumer data that we may store from time to time or if data is lost due to hardware failures or errors, our services may be perceived as not being secure, customers may curtail or stop using our services and we may incur significant legal and financial exposure and liabilities.

Certain of our services involve the storage and transmission of customers' proprietary information, including certain consumer data. Security breaches related to this information could expose us to a risk of loss of this information, forfeiture or other enforcement actions by federal or state regulatory agencies or state attorneys general, litigation and possible liability, as well as damage our relationships with our customers. Our security measures may be breached as a result of third-party action, employee error, malfeasance or otherwise, during transfer of data to additional data centers or at any time, and, as a result, someone may obtain unauthorized access to our data or our customers' data. For example, in October 2011, as a result of employee error, two customers inadvertently received access to data regarding call transmissions unrelated to those customers.

As a result of a security breach, our reputation could be damaged, our business may suffer and we could incur significant liability. Additionally, third parties may attempt to fraudulently induce employees or customers into disclosing sensitive information such as user names, passwords or other information in order to gain access to our data or our customers' data, which could result in significant legal and financial exposure and a loss of confidence in the security of our service, which would harm our future business prospects. Furthermore, our ability to collect and report data may be interrupted by a number of factors, including our inability to access the Internet, the failure of our platform, security breaches or variability in user traffic on customer websites. In addition, computer viruses may harm our systems causing us to lose data, and the transmission of computer viruses could expose us to litigation. Because the techniques used to obtain unauthorized access, or to sabotage systems, change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures could be harmed and we could lose sales and customers. Our errors and omissions insurance may be inadequate or may not be available in the future on acceptable terms, or at all. In addition, our policy may not cover any claim against us for loss of data or other indirect or consequential damages and defending a suit, regardless of its merit, could be costly and divert management's attention.

The loss of key members of our senior management team could prevent us from executing our business strategy and could have a material adverse effect on our business. Additionally, the failure to attract and retain qualified personnel could prevent us from executing our business strategy.