Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Yunhong CTI Ltd. | v245277_8k.htm |

CTI Industries Corporation NASDAQ Capital Market: CTIB

Forward - Looking Statements This presentation may contain “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward - looking statements involve risk and uncertainties, and investors are cautioned that outcomes and results may vary from those projected due to factors beyond the company’s control. These include economic, competitive, governmental, technological and other factors discussed in the company’s filings with the SEC on forms 10 - K and 10 - Q.

CTI Industries Value - Added Design, Engineering and Production for FLEXIBLE FILM PRODUCTS Pouches Foil Balloons Latex Balloons Product Development Printed and Laminated Films

Strong Technology Base • Products Incorporate Patent Rights and Proprietary Features • CTI Holds 27 Patents, with several pending, covering pouch, film and novelty products • Vacuum Pouches – 13 patents on pouch closures and film methods

Presence in Consumer and Commercial Markets • Significant and growing business in household storage products • Leading position worldwide in novelty film products – foil and latex balloons • Value added producer of laminated and printed films for packaging applications • Develop and produce specialty film products

Long - Term Growth Revenues CAGR 8.9%

PROFITABLE SIXTEEN CONSECUTIVE QUARTERS

POSITIONED FOR GROWTH • Major Brand License and Product Introduction • International Growth • Market Development • Margin Expansion

Pouches

ZipVac ® • Food and household storage system developed by CTI • Patented zipper closure, film and valve • Rechargeable pump • Use in refrigerator, freezer, or countertop • Protects food 5X longer

Insert picture of product Ziploc ® Zippered Vacuum Bags • Jointly developed • Produced for S.C. Johnson & Son, Inc. • Marketed under Ziploc ® brand • Now in hundreds of retail stores

ZipVac ® Universal Vacuum Sealer Bags and Rolls • Works with all food - sealing machines • Uses CTI film technology • “Industrial strength”

ZIPLOC ® BRAND LICENSE December 2011 License from SC Johnson & Son, Inc. To Manufacture and Sell Vacuum Sealing Machines and Pouches under the Ziploc ® Brand

ZipLoc ® Brand Product Introduction Vacuum Sealing Machines Pouches and Rolls

Store Displays

Novelty Balloons

Foil Balloons • Leading producer of foil balloons for over 30 years • Marketed throughout U.S., Latin America, and Europe • Sold in thousands of retail outlets

Proprietary Shapes

Latex Balloons • Manufactured in Guadalajara, Mexico • Marketed in U.S., Canada, Mexico, and Europe

Laminated and Printed Films

Packaging and Specialty Film Products • Commercial, industrial and medical uses • Laminated and coated films • Up to 8 - color printing – environmentally friendly

Internal Product Development • Over 500 novelty balloon graphic designs – New designs each year – New balloon shapes • ZipVac vacuum storage system – a unique, effective food storage system – Patented zipper seal features – Patented valve – Patented embossed film • Patient Transfer Bags

Production Facilities • Principal plant and offices in suburban Chicago (Lake Barrington) – Production of pouches, foil balloons and specialty film products • Plant and offices in Guadalajara, Mexico – Production of latex balloons

Distribution Facilities • Chicago – principal warehouse and distribution; sales and customer service • Mexico – warehouse, sales, customer service for Mexico and Latin America • U.K. – warehouse, sales and customer service for U.K. • Frankfurt, Germany – warehouse, sales and customer service for Europe

Supplier to Major Companies • S.C. Johnson & Son, Inc. • Rapak (D.S. Smith) • Dollar Tree Stores • Wal - Mart (U.S., Mexico and UK) • Menards • Food Lion • K Mart • Stryker Medical • Academy

Other Distribution Ch annels • Independent balloon distributors (U.S., Canada, Mexico, Europe, and Australia) • Retailers – Balloon Products – Pouch Products • Direct sales company • Industrial companies – films and custom film products • Independent sales reps – pouch products

Market Size • Zippered Pouches – $4.2 billion* • Vacuum Sealing Machines and Pouches – Est $250 million • Foil Balloons - Est. $250 million (world ) • Latex Balloons – Est. $500 million (Americas and Europe) • Flexible Packaging Films – $6.2 billion** * Parker, P.M. (2006). The 2007 - 2012 World Outlook for Polyethylene Household Food Storage, Sandwich, and Freezer Bags and Pouches. Icon Group International, Inc. ** U.S. Census Bureau. (2002). Plastic Packaging Film and Sheet (Including Laminated) Manufacturing: 2002. U.S. Department of Commerce.

Growth Initiatives • ZipLoc Brand License and Product Line Introduction • Novelty Balloons – Europe and Latin America – Major retail chain programs • Margin Expansion

Financial Review

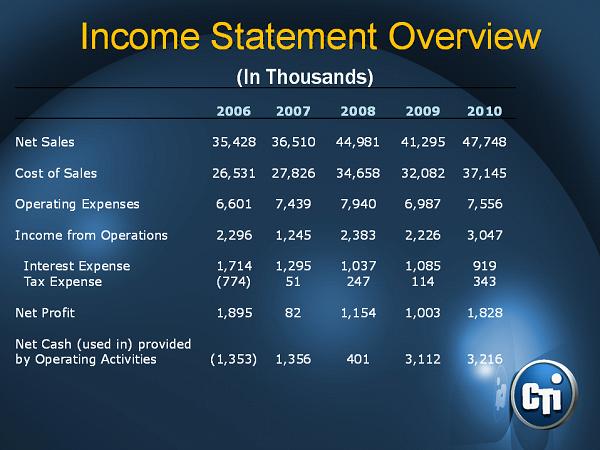

Income Statement Overview (In Thousands) 2006 2007 2008 2009 2010 Net Sales 35,428 36,510 44,981 41,295 47,748 Cost of Sales 26,531 27,826 34,658 32,082 37,145 Operating Expenses 6,601 7,439 7,940 6,987 7,556 Income from Operations 2,296 1,245 2,383 2,226 3,047 Interest Expense 1,714 1,295 1,037 1,085 919 Tax Expense (774) 51 247 114 343 Net Profit 1,895 82 1,154 1,003 1,828 Net Cash (used in) provided by Operating Activities (1,353) 1,356 401 3,112 3,216

Income Statement Ratios (As a Percentage of Sales) 2006 2007 2008 2009 2010 Cost of Sales 74.89% 76.21% 77.05% 77.69% 77.79% Operating Expenses 18.63% 20.38% 17.65% 16.92% 15.82% Income from Operations 6.48% 3.41% 5.30% 5.39% 6.38% Net Profit 5.35% 0.22% 2.57% 2.43% 3.83% Gross Margin 25.11% 23.79% 22.95% 22.31% 22.21%

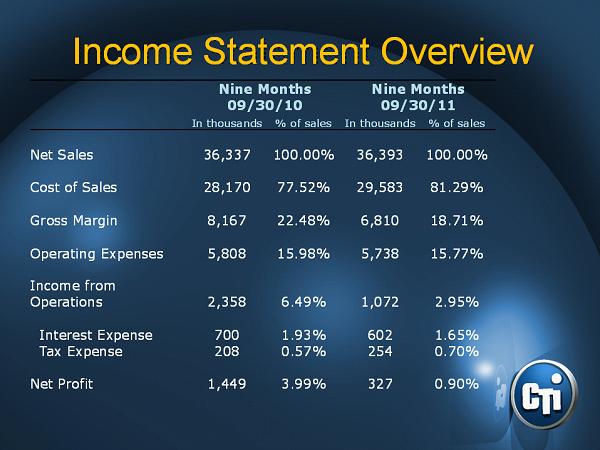

Income Statement Overview Nine Months Nine Months 09/30/10 09/30/11 In thousands % of sales In thousands % of sales Net Sales 36,337 100.00% 36,393 100.00% Cost of Sales 28,170 77.52% 29,583 81.29% Gross Margin 8,167 22.48% 6,810 18.71% Operating Expenses 5,808 15.98% 5,738 15.77% Income from Operations 2,358 6.49% 1,072 2.95% Interest Expense 700 1.93% 602 1.65% Tax Expense 208 0.57% 254 0.70% Net Profit 1,449 3.99% 327 0.90%

Margin Improvement • Latex Cost – Increased by over 100% 2009 to early 2011 – Recent decrease of 35% from early 2011 levels • New products – higher margins • Pricing improvements • Materials development and production overhead improvements

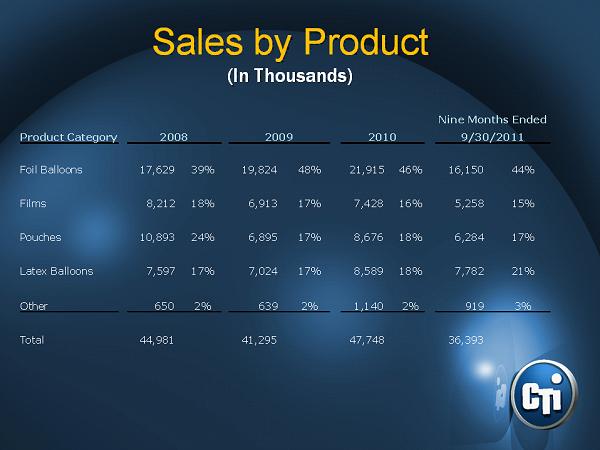

Sales by Product (In Thousands) Nine Months Ended Product Category 2008 2009 2010 9/30/2011 Foil Balloons 17,629 39% 19,824 48% 21,915 46% 16,150 44% Films 8,212 18% 6,913 17% 7,428 16% 5,258 15% Pouches 10,893 24% 6,895 17% 8,676 18% 6,284 17% Latex Balloons 7,597 17% 7,024 17% 8,589 18% 7,782 21% Other 650 2% 639 2% 1,140 2% 919 3% Total 44,981 41,295 47,748 36,393

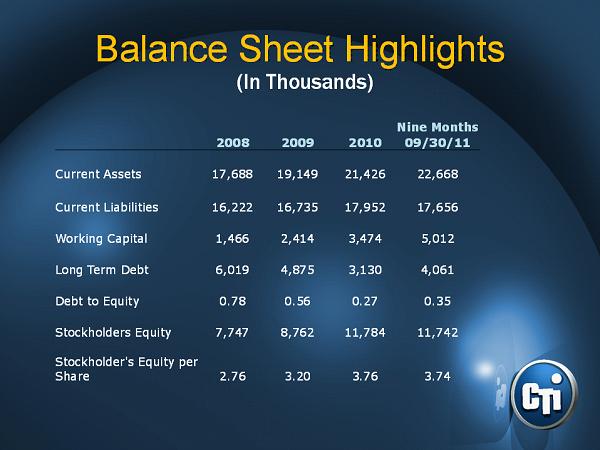

Balance Sheet Highlights (In Thousands) Nine Months 2008 2009 2010 09/30/11 Current Assets 17,688 19,149 21,426 22,668 Current Liabilities 16,222 16,735 17,952 17,656 Working Capital 1,466 2,414 3,474 5,012 Long Term Debt 6,019 4,875 3,130 4,061 Debt to Equity 0.78 0.56 0.27 0.35 Stockholders Equity 7,747 8,762 11,784 11,742 Stockholder's Equity per Share 2.76 3.20 3.76 3.74