Attached files

| file | filename |

|---|---|

| 8-K - SUN HEALTHCARE GROUP INC | form8k.htm |

EXHIBIT 99.1

J.P. Morgan Healthcare Conference

San Francisco, CA

January 10, 2012

1

Statements made in this presentation that are not historical facts are "forward-looking" statements (as defined in the Private

Securities Litigation Reform Act of 1995) that involve risks and uncertainties and are subject to change at any time. These

forward-looking statements may include, but are not limited to, statements containing words such as "anticipate," "believe,"

"plan," "estimate,” "expect,” "hope,” "intend,” "may” and similar expressions. Forward-looking statements in this presentation

also include all statements regarding the estimated impact of the CMS Rule, planned capital expenditures, expected

financial position, results of operations, cash flows, liquidity, business strategy, growth opportunities, plans and objectives of

management for future operations, the impact of reductions in reimbursements and other changes in government

reimbursement programs and the timing and impact of the proposed restructuring transactions. Factors that could cause

actual results to differ are identified in the public filings made by Sun with the Securities and Exchange Commission and

include changes in Medicare and Medicaid reimbursements and Sun’s ability to mitigate such changes; the impact that

healthcare reform legislation will have on Sun’s business; Sun’s ability to maintain the occupancy rates and payor mix at

Sun’s healthcare centers; potential liability for losses not covered by, or in excess of, Sun’s insurance; the effects of

government regulations and investigations; the significant amount of Sun’s indebtedness, covenants in Sun’s debt

agreements that may restrict Sun’s activities and Sun’s ability to make acquisitions, incur more indebtedness; the impact of

the current economic downturn on Sun’s business; the ability of Sun to collect its accounts receivable on a timely basis;

increasing labor costs and the shortage of qualified healthcare personnel; and Sun’s ability to receive increases in

reimbursement rates from government payors to cover increased costs. More information on factors that could affect Sun’s

business and financial results are included in Sun’s public filings made with the Securities and Exchange Commission,

including Sun’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, copies of which are available on Sun’s

web site, www.sunh.com. There may be additional risks of which Sun is presently unaware or that Sun currently deems

immaterial.

Securities Litigation Reform Act of 1995) that involve risks and uncertainties and are subject to change at any time. These

forward-looking statements may include, but are not limited to, statements containing words such as "anticipate," "believe,"

"plan," "estimate,” "expect,” "hope,” "intend,” "may” and similar expressions. Forward-looking statements in this presentation

also include all statements regarding the estimated impact of the CMS Rule, planned capital expenditures, expected

financial position, results of operations, cash flows, liquidity, business strategy, growth opportunities, plans and objectives of

management for future operations, the impact of reductions in reimbursements and other changes in government

reimbursement programs and the timing and impact of the proposed restructuring transactions. Factors that could cause

actual results to differ are identified in the public filings made by Sun with the Securities and Exchange Commission and

include changes in Medicare and Medicaid reimbursements and Sun’s ability to mitigate such changes; the impact that

healthcare reform legislation will have on Sun’s business; Sun’s ability to maintain the occupancy rates and payor mix at

Sun’s healthcare centers; potential liability for losses not covered by, or in excess of, Sun’s insurance; the effects of

government regulations and investigations; the significant amount of Sun’s indebtedness, covenants in Sun’s debt

agreements that may restrict Sun’s activities and Sun’s ability to make acquisitions, incur more indebtedness; the impact of

the current economic downturn on Sun’s business; the ability of Sun to collect its accounts receivable on a timely basis;

increasing labor costs and the shortage of qualified healthcare personnel; and Sun’s ability to receive increases in

reimbursement rates from government payors to cover increased costs. More information on factors that could affect Sun’s

business and financial results are included in Sun’s public filings made with the Securities and Exchange Commission,

including Sun’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, copies of which are available on Sun’s

web site, www.sunh.com. There may be additional risks of which Sun is presently unaware or that Sun currently deems

immaterial.

The forward-looking statements involve known and unknown risks, uncertainties and other factors that are, in some cases,

beyond Sun’s control. Sun cautions that any forward-looking statements made by Sun are not guarantees of future

performance. Sun disclaims any obligation to update any such factors or to announce publicly the results of any revisions to

any of the forward-looking statements to reflect future events or developments.

beyond Sun’s control. Sun cautions that any forward-looking statements made by Sun are not guarantees of future

performance. Sun disclaims any obligation to update any such factors or to announce publicly the results of any revisions to

any of the forward-looking statements to reflect future events or developments.

References to “Sun” refer to Sun Healthcare Group, Inc. and its subsidiaries

Forward-Looking Statements

2

References are made in this presentation to EBITDA, EBITDA margin, EBITDAR and EBITDAR margin, which are non-

GAAP financial measures.

GAAP financial measures.

EBITDA is defined as net income before loss (gain) on discontinued operations, interest expense (net of interest income),

income tax expense (benefit) and depreciation and amortization. EBITDA margin is EBITDA as a percentage of revenue.

EBITDAR is EBITDA before rent expense and EBITDAR margin is EBITDAR as a percentage of revenue. Sun believes

that EBITDA, EBITDA margin, EBITDAR and EBITDAR margin provide useful information regarding Sun’s operational

performance because these financial measures enhance the overall understanding of the financial performance and

prospects for the future of Sun’s core business activities, provide consistency in Sun’s financial reporting and provide a

basis for the comparison of results of core business operations between current, past and future periods. These

measures are also some of the primary indicators Sun uses for planning and forecasting in future periods, including

trending and analyzing the core operating performance of its business from period to period without the effect of GAAP

expenses, revenues and gains that are unrelated to day-to-day performance.

income tax expense (benefit) and depreciation and amortization. EBITDA margin is EBITDA as a percentage of revenue.

EBITDAR is EBITDA before rent expense and EBITDAR margin is EBITDAR as a percentage of revenue. Sun believes

that EBITDA, EBITDA margin, EBITDAR and EBITDAR margin provide useful information regarding Sun’s operational

performance because these financial measures enhance the overall understanding of the financial performance and

prospects for the future of Sun’s core business activities, provide consistency in Sun’s financial reporting and provide a

basis for the comparison of results of core business operations between current, past and future periods. These

measures are also some of the primary indicators Sun uses for planning and forecasting in future periods, including

trending and analyzing the core operating performance of its business from period to period without the effect of GAAP

expenses, revenues and gains that are unrelated to day-to-day performance.

Non-GAAP Financial Measures

3

Investment Considerations

Weather challenges

and adapt to change

and adapt to change

Experienced

management team

management team

National platform

with four

complementary

business

with four

complementary

business

lines

Focus on high-acuity,

clinically

clinically

complex

patients

4

Proven Track Record

(1)

(2)

Focused on admitting patients in nine new RUG

categories

categories

Exceeded the average acuity projected by CMS

Increased average Medicare rates by $9.85 in 2006

Achieved synergies ahead of schedule at high-end

of $12 to $15 million range

of $12 to $15 million range

Achieved targeted cost savings of $10 million

Successfully implemented new assessment tool (MDS

3.0) and clinical protocols

3.0) and clinical protocols

Reduced concurrent utilization to <5% to minimize

impact of change in concurrent therapy

impact of change in concurrent therapy

Continued to grow Medicare rate via acuity shift beyond

market basket increase

market basket increase

Medicare Forecast

Medicare Forecast

Error Correction

Error Correction

RUGs IV & MDS 3.0

RUGs IV & MDS 3.0

Harborside Acquisition

Harborside Acquisition

RUGs III Refinement

RUGs III Refinement

2006

2006

2007

2007

2009

2009

2010

2010

Event

Event

Year

Year

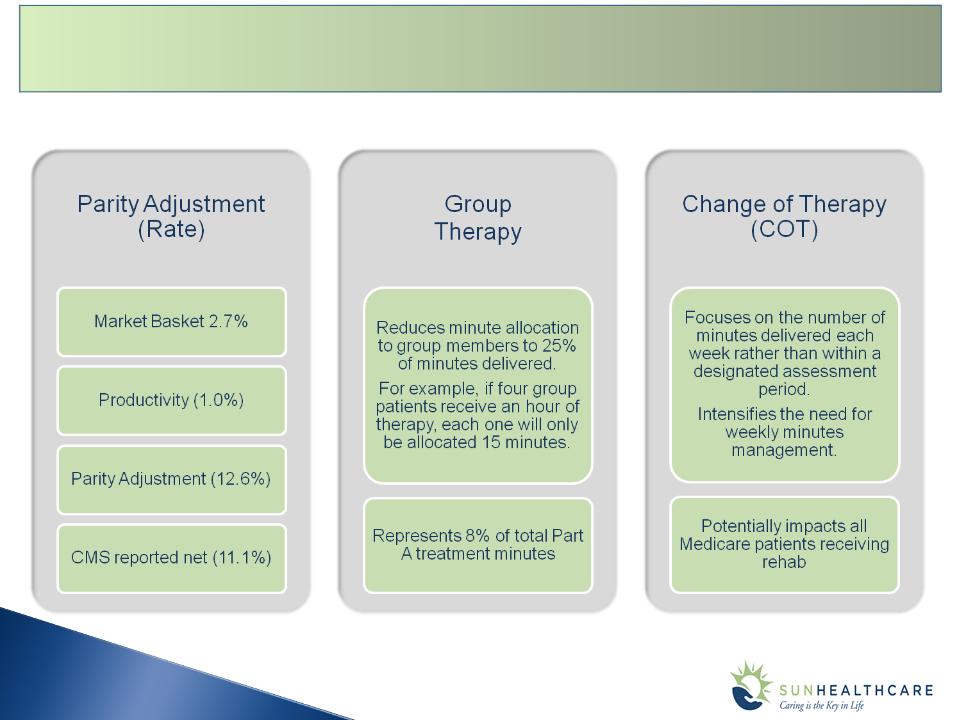

CMS Final Rule - 3 Components

5

Annual Update For Fiscal Year 10/1/11 to 9/30/12 (Released July 29, 2011)

6

Mitigation Approach to CMS Final Rule

Estimated Impact of

Final Rule

to 2012 EBITDAR:

$40 to $45 million

7

Net Revenue by Line of Business

Sun Healthcare Today

8

Complementary Lines of Business

Skilled Nursing Services

Rehabilitation Therapy Services

Hospice Services

9

Key Strategic Initiatives

Focus on delivering quality care services to medically-complex,

high-acuity patients.

Specialize and differentiate our clinical product on a

market-by-market basis to gain market share.

Seek partnerships, not just relationships (hospitals,

physicians, managed care providers, etc.).

Continue modernizing the portfolio to include

discrete environments for both long-term and short stay

patients.

Continue upgrading our technology systems.

Continue hospice and SNF growth that

strengthens or creates market density in priority

markets.

10

Examples of Strategic Initiatives In Action

Expansion of Product

and Service Offering

and Service Offering

• Expand clinical capabilities

to improve ability to capture

more clinically complex

patients

to improve ability to capture

more clinically complex

patients

• Augment existing rehab

capability with focus on

cardiac, pulmonary and

infectious disease

capability with focus on

cardiac, pulmonary and

infectious disease

Long-term Asset

Modernization

Modernization

• Upgrade, fully renovate or

replace centers:

replace centers:

Focus on privacy;

Enhance amenities; and

Designate unique space

for short and longer-

term customers

for short and longer-

term customers

Grow Short-Term

Specialty Unit Capacity

Specialty Unit Capacity

• Build-out Rehab Recovery

Suite (RRS) capacity within

targeted urban markets:

Suite (RRS) capacity within

targeted urban markets:

Distinct and separate

units;

units;

Enhanced product; and

Dedicated concierge

service

service

Ø 2,185 designated RRS

beds in 80% of urban

centers

beds in 80% of urban

centers

Ø Centers with RRS units run

600 bps higher skilled mix

than those without

600 bps higher skilled mix

than those without

OUTCOME

OUTCOME

OUTCOME

11

Track Record of Operational Growth

Acquired Harborside in April 2007

+33%

+120bps

9.3%

margin

margin

22.8%

margin

margin

+670bps

12.0%

margin

margin

13.5%

margin

margin

2012 Guidance

12

2012 Guidance Parameters

13

No acquisitions contemplated

Excludes the results of operations of assets that Sun expects to

transition to held for sale in 2012, which generated revenues of

approximately $49 million and an EBITDA loss of approximately

$4.6 million in 2011

transition to held for sale in 2012, which generated revenues of

approximately $49 million and an EBITDA loss of approximately

$4.6 million in 2011

Organic consolidated revenue growth would be 4.1% primarily

based on:

based on:

§ Organic growth opportunities in volume, acuity and a moderate

Medicare market basket increase in Q4 2012; and

Medicare market basket increase in Q4 2012; and

§ Medicaid rates, net of provider taxes, which are expected to be

flat in 2012

flat in 2012

Revenue and EBITDA will be impacted by the CMS Final Rule

offset by mitigation activities

offset by mitigation activities

An increase in center lease costs of 2.7%

Capital expenditures in the range of $35 to $40 million

2012 interest expense of approximately $17.5 million reflecting an

average debt balance of $87 million plus a $75 million funded letter

of credit balance at a blended interest rate of approximately 11%

which includes $2.9 million of non-cash amortization of financing

costs

average debt balance of $87 million plus a $75 million funded letter

of credit balance at a blended interest rate of approximately 11%

which includes $2.9 million of non-cash amortization of financing

costs

Effective tax rate of 39% and 2012 cash income taxes paid between

$4 million and $6 million as a result of net operating loss

carryforwards

$4 million and $6 million as a result of net operating loss

carryforwards

Guidance Parameters:

14

Capital Structure & Bank Covenants (1)

(1) In December 2011, Sun amended its Credit Facility and made a voluntary debt pay-down of $50 million and increased its interest

rate by 1.25% in return for greater flexibility to financial covenants

(2) Based upon 2012 guidance

(3) $60 million of capacity of which $0.4 million issued for letters of credit

(4) Assumes add-back to EBITDA for non-cash stock compensation in 2012 of approximately $6 million

(5) Excludes non-cash interest expense of $2.9 million in 2012 related to amortization of financing costs

incurred in connection with our Credit Facility

15

Capital Investment

2011 is an estimate and 2012 is based on guidance

$20 funded to-date

$8 under construction in 2012

$22 available for additional projects

2012 Cash Flows

16

*Based upon 2012 Guidance

17

Investment Highlights

18