Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RTI INTERNATIONAL METALS INC | d280252d8k.htm |

| EX-99.2 - PRESS RELEASE DATED JANUARY 10, 2012 - RTI INTERNATIONAL METALS INC | d280252dex992.htm |

RTI

International Metals to Acquire Remmele Engineering INVESTOR

PRESENTATION JANUARY 10, 2012

Exhibit 99.1 |

Safe

Harbor The

information

in

this

presentation,

including

accompanying

oral

comments,

includes

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995,

and

is

subject

to

the

safe

harbor

created

by

that

Act.

These

statements,

which

represent

the

Company’s

expectations

or

beliefs

concerning

various

future

events,

include

statements

concerning

future

revenues,

EBITDA,

synergies,

strategy,

earnings

and

liquidity

associated

with

continued

growth

in

various

market

segments,

cost

reductions

expected

from

various

initiatives,

our

contemplated

acquisition

and

other

events.

Because

such

forward-looking

statements

involve

risks

and

uncertainties,

there

are

important

factors

that

could

cause

actual

results

to

differ

materially

from

those

expressed

or

implied

by

such

forward-looking

statements.

These

factors

include,

but

are

not

limited

to,

the

impact

of

global

events

on

the

commercial

aerospace

industry,

ultimate

titanium

content

per

copy

and

actual

aircraft

build

rates

for

new

commercial

and

military

aircraft

programs,

global

economic

conditions,

the

competitive

nature

of

the

markets

for

specialty

metals,

availability

and

pricing

of

raw

materials,

the

successful

completion

of

our

capital

expansion

projects,

the

ability

to

successfully

acquire

and

integrate

Remmele

Engineering

and

other

acquisitions;

and

other

risks

and

uncertainties

included

in

the

Company’s

filings

with

the

Securities

and

Exchange

Commission.

Actual

results

can

differ

materially

from

those

forecasted

or

expected.

For

additional

information

about

factors

that

could

cause

actual

results

to

differ

materially

from

those

described

in

the

forward-looking

statements,

please

see

the

documents

that

the

Company

has

filed

or

furnished

with

the

Securities

Exchange

Commission,

including

its

quarterly

reports

on

Form

10-Q,

its

most

recent

annual

report

on

Form

10-K,

its

current

reports

on

Form

8-K

and

its

proxy

statement.

All

subsequent

forward-looking

statements

attributable

to

RTI

or

any

person

acting

on

its

behalf

are

expressly

qualified

in

their

entirety

by

the

cautionary

statements

contained

or

referred

to

in

this

section.

RTI

is

not

under

any

obligation

to,

and

expressly

disclaims

any

obligation

to,

update

or

alter

any

forward-looking

statements

whether

as

a

result

of

such

changes,

new

information,

subsequent

events

or

otherwise.

2 |

Agenda

Key Transaction Terms

Remmele Engineering Overview

Strategic & Financial Rationale

Full Year 2011 Update

Combined Company Benefits

Q&A

3 |

Key

Transaction Terms 4

RTI is acquiring Remmele Engineering, a privately held company, in a transaction

currently valued at $182.5 million, with approximately $164.5 million in

cash and the assumption of $18.0 million in debt

Purchase price is approximately ~8.3x 2011 EBITDA

Purchase price is approximately ~7.4x 2012 EBITDA*

The transaction will be financed from existing cash reserves

If the transaction would have closed December 31, 2011, RTI’s cash, cash

equivalents and highly liquid investments would have totaled approximately

$165 million Expected to be immediately accretive to RTI’s EPS, before

the inclusion of the benefit from the anticipated cost or revenue synergies

Remmele Engineering’s key senior leadership will remain with and

continue to lead the organization

Transaction currently expected to close during 1Q 2012, subject to customary

closing conditions, including receipt of applicable regulatory

approvals *2012 EBITDA RTI management estimate

STRUCTURE

FINANCING

FINANCIAL BENEFITS

LEADERSHIP

CONDITIONS/TIMING |

Remmele Engineering Overview

Attractive financial profile with strong margins

o

2011 Sales -

$125.9 million*

•

Aerospace & Defense ($74.9 million)

•

Medical ($51.0 million)

Long-term, blue-chip, customer relationships

Well established contract manufacturer for medical device makers

Highly experienced management team with significant bench strength

Opportunity

for

strategic

capital

investments

to

increase

growth

potential

*Estimated, Unaudited

5

2011 A&D Sales by End Market

2011 Medical Sales by End Market

Well-respected manufacturer of machined products serving the aerospace &

defense and medical device segments

Minimally

Invasive

Surgery

47%

Spine

22%

Vascular

6%

Urology

11%

Other

5%

Drug

Infusion

9%

Military

15%

Radar

29%

Space

7%

Comm'l

Aero

49% |

Strategic & Financial Rationale Overview

6

•

Accelerates RTI’s downstream strategy in the aerospace and defense

sector •

Enhances ability to adapt to future needs of customers

•

Provides entry into attractive new end markets

•

Transforms profile of Fabrication Segment

Acquisition is consistent with the objectives RTI has set out when capital raising

– to be in a position to take advantage of growth opportunities

|

Accelerates RTI’s downstream strategy in the

aerospace and defense sector

Expands RTI’s precision machining and collaborative engineering

capabilities in the A&D market

o

Remmele Engineering -

$70 million current backlog, $200 million LTAs over seven years

Highly respected supplier of finished engineered products to aerostructures, radar

and space markets

Improves scale and capabilities of manufacturing base, providing

opportunities to bid

on additional contracts

Acquisition repositions RTI to adapt to evolving defense landscape

A&D –

Key growth drivers:

o

Increase in commercial air travel

o

Industry need to reduce operating / fuel costs through more efficient

aircraft 7

RTI expects to leverage Remmele Engineering’s collaborative engineering

processes and resources across the RTI enterprise, bringing tremendous

benefits to its aerospace and defense customers |

Enhances ability to adapt to future needs of customers

Remmele

Engineering

has

long

standing

relationships

with

many

of

RTI’s

key

A&D

customers,

such as Boeing and Lockheed Martin; adding RTI’s manufacturing expertise and

investment will help Remmele Engineering accelerate the combined

opportunities to provide advanced solutions for these customers

A&D customers increasingly looking for US-based partners that can provide

a more complete offering of titanium products and services alongside

best-in-class engineering design Remmele Engineering will provide

RTI with an advanced manufacturing platform with a demonstrated record of

collaborative engineering and customer partnering o

Original Equipment Manufacturers (OEMs) increasingly depend on US-based

contract manufacturers as a way to decrease manufacturing costs and improve

production capabilities o

Contract

manufacturers

are

a

cost

effective

solution

for

OEMs

to

manufacture

products

that

require

highly specialized capabilities or supplementary production capacity

8 |

Provides entry into attractive new end markets

Remmele Engineering’s strong position in

medical engineering and precision machining

of titanium provides access to fast-growing

medical device market

Medical segment provides steady returns and

real diversification

Technical capabilities required for medical

are different than those needed in A&D

Remmele Engineering’s Top Medical Device

sub-segments include:

o

Minimally invasive surgery

o

Spine

o

Urology

9

Medical device industry poised for growth at annual

rate of ~6% from 2011-2016*

Key drivers include:

o

Aging US population, number of physician visits,

increasing rate of obesity

o

Greater need for cost-efficient solutions to address

pressures faced by medical industry, specifically with

regard to Medicare and Medicaid funding

o

New medical devices / new treatments

o

Regulatory considerations

*

Source: IBIS World

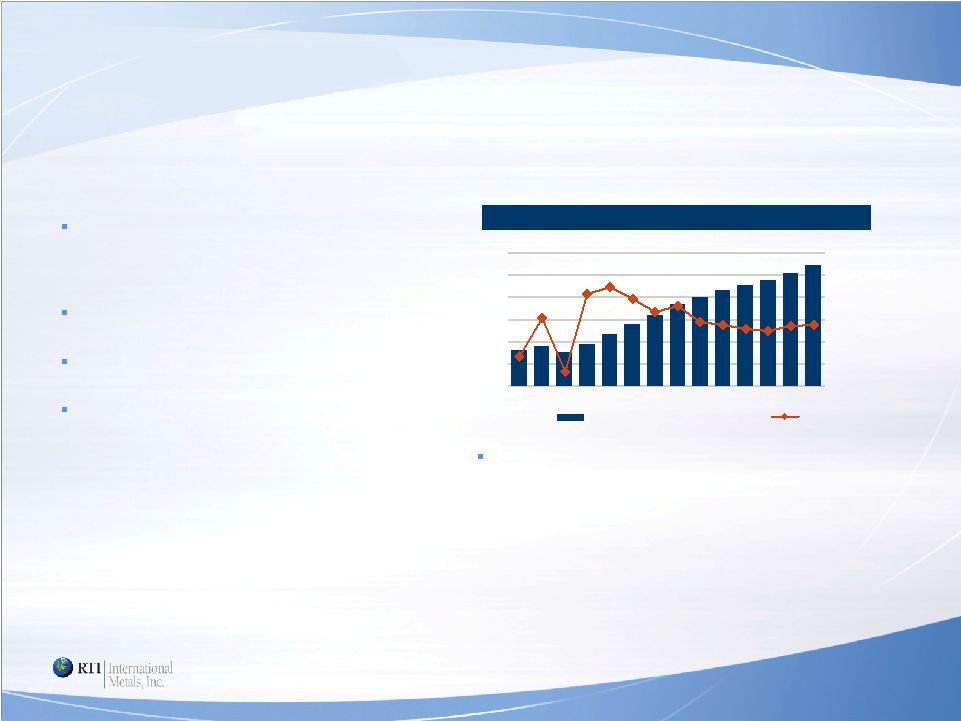

24

27

23

28

35

42

48

60

65

68

71

76

82

55

-7%

9%

7%

6%

5%

7%

8%

16%

-14%

25%

22%

13%

19%

11%

0

15

30

45

60

75

90

'03

'04

'05

'06

'07

'08

'09

'10

'11

'12

'13

'14

'15

'16

$, bn

-20%

-10%

0%

10%

20%

30%

40%

% Growth

Revenue

% Growth

Medical Device (OEMs) Growth Trends

(1) |

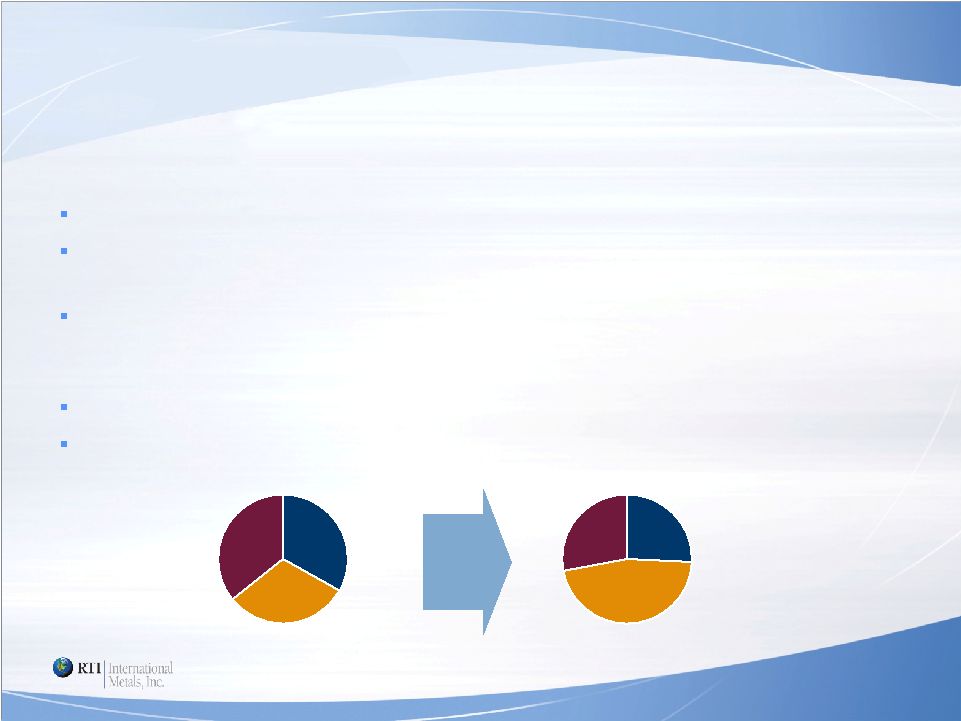

Transforms profile of Fabrication Segment

Machining operations will fill out a capability need for RTI Fabrication

Remmele Engineering’s fabrication capabilities include: precision machining,

integrated assembly, program management and engineering support

Remmele Engineering’s capabilities complement RTI’s current capabilities

such as advance forming, precision production, hot forming, superplastic

forming, and thermal-mechanical hot working

Fabrication segment growth will increase opportunities and reduces cyclical

volatility Improves sustainable operating profile

10

Fabrication

31%

Titanium

Distribution

Fabrication

46%

Titanium

Distribution

RTI Sales Today

Pro-forma Sales |

Full

Year 2011 Update 11

Estimated Mill Product Volume

~14.6 million pounds

2011 Net Sales

$520-$535 million

Cash and Liquid Securities at End of Year

~$330 million |

Combined Company Benefits

Enhances leadership position as an integrated, value-add titanium manufacturer

in the A&D segment

Transaction

builds

on

RTI’s

core

strength

in

titanium

manufacturing

and

is

expected

to

enhance

our

engineering

and

precision

machining

capabilities

o

Combination will offer superior engineering support and capabilities

o

Medical engineering processes and expertise can be used to enhance what RTI does

currently on the

aerospace side

Fulfills

the

demand

from

customers

looking

to

identify

strategic

partners

in

the

supply

chain

Strong cultural alignment: Both companies share a commitment to excellent customer

service and best-in-class manufacturing

Transaction expected to be immediately accretive and will leave ample liquidity to

pursue further growth opportunities

12 |

Q&A

13 |