Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Orexigen Therapeutics, Inc. | d280254d8k.htm |

Exhibit 99.1 |

2

Forward-Looking Statements

Forward-Looking Statements

This presentation contains forward-looking statements about Orexigen Therapeutics, Inc.

Words such as "believes," "anticipates," "plans,"

"expects,"

"indicates,"

"will,"

"intends,"

"potential,"

"suggests,"

"assuming,"

"designed,“

“probability”

and

similar

expressions

are

intended

to

identify

forward-looking

statements.

These

statements

are

based

on

the

Company's

current

beliefs

and

expectations.

These forward-looking statements include statements regarding: a clear and feasible path

forward for Contrave ®; the protocol for, and the timing and feasibility of, the

Contrave cardiovascular outcomes trial (CVOT); the initiation of enrollment for the CVOT in

second quarter of 2012; the expected rate of enrollment of the CVOT; the probability of success

of the CVOT; the potential for, and timing of, resubmission and approval of an NDA based

on interim results of the CVOT; the prospects for ultimate approval of an NDA for

Contrave; the potential to maintain the Company’s existing North American collaboration with Takeda Pharmaceuticals; estimates

of

the

potential

market

for

Contrave;

and

the

sufficiency

of

the

Company’s

existing

cash

to

fund

the

Company’s

operations

through

potential approval of Contrave in 2014. The inclusion of forward-looking statements should

not be regarded as a representation by Orexigen that any of its plans will be achieved.

Actual results may differ from those set forth in this presentation due to the risk and

uncertainties inherent in Orexigen’s business, including, without limitation: the

uncertainty of the FDA approval process, including requirements for additional clinical

and non-clinical studies or other commitments prior to the submission and approval of an NDA for

Contrave; Orexigen's ability to demonstrate that the risk of major adverse cardiovascular

events in overweight and obese subjects treated with Contrave does not adversely affect

the product candidate’s benefit-risk profile; the potential for FDA’s planned 2012

public

advisory

committee

meeting

on

obesity

drug

development

to

result

in

additional

NDA

approval

requirements

for

Contrave

as

well as post-approval commitments; Orexigen’s dependence on Takeda Pharmaceuticals for

aspects of the development and commercialization of Contrave; reliance on third parties

to manufacture and supply Contrave and assist with the conduct of the CVOT; the

potential for adverse safety findings relating to Contrave; intense competition in the obesity marketplace and the potential

for new products to emerge that provide different or better therapeutic alternatives for

obesity and weight loss compared to Contrave; and other risks described in the Company's

filings with the SEC. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof, and Orexigen undertakes

no obligation to revise or update this presentation to reflect events or circumstances

after the date hereof. Further information regarding these and other risks is included

under

the

heading

"Risk

Factors"

in

Orexigen’s

Quarterly

Report

on

Form

10-Q,

which

was

filed

with

the

SEC

on

November

10,

2011

and

is

available

from

the

SEC's

website

(www.sec.gov)

and

on

the

Company’s

website

(www.orexigen.com)

under

the

heading

"Investor Relations”. All forward-looking statements are qualified in their

entirety by this cautionary statement. This caution is made under the safe harbor

provisions of Section 21E of the Private Securities Litigation Reform Act of 1995. |

3

Large, growing market

Unmet need, limited

competition

Differentiated product

profile

Skilled partner with heavy

resourcing

Keys to Commercial Success

Keys to Commercial Success

Orexigen: Poised to Deliver

Orexigen: Poised to Deliver

Clear path to approval

High probability of

technical success

Keys to Regulatory Success

Keys to Regulatory Success |

|

5

Regulatory Direction is Clear

Regulatory Direction is Clear

Complete NDA already reviewed by FDA

–

Efficacy threshold has been met

–

General safety & tolerability profile established

–

Positive Ad-Com

A single approval deficiency of theoretical CV risk was identified in CRL

Clarity on the requirement to satisfactorily address the CRL was

obtained through a formal dispute resolution process

–

Approval obtainable based on acceptable interim analysis

–

Key trial elements and risk exclusion criteria were defined and not subject

to change based on upcoming obesity Advisory Committee

Subsequent protocol discussions with FDA maintained alignment and

clarity on path to approval |

6

Key Elements for CVOT Trial

Key Elements for CVOT Trial

Primary endpoint ITT analysis of MACE (CV death, MI, stroke)

Exclude a doubling of MACE at interim to obtain approval

Exclude a 40% increase in MACE at final to remain on market

Real-world test of Contrave-

long term exposure to study drug is only

in those experiencing benefit from therapy

–

Patients with limited weight loss or increased blood pressure discontinue

study drug at Week 16, but remain in ITT analysis

Enroll patient population targeting a background MACE rate of 1.5%

per year |

7

Large But Streamlined Trial

Large But Streamlined Trial

Sole focus to address the single approval

deficiency in CRL

Excluding low CV risk requires large

sample size, but limited information per

subject

–

No ongoing labs

–

Infrequent visits

–

Minimal data collection

Cost per patient lower than traditional

clinical development programs

World-class advisors assembled to steer

the study

Total cost of

Contrave CVOT to

interim analysis

and approval is

estimated at

~$100M

*

*based on Orexigen current estimates (01/09/12) |

8

CV Outcomes Study Design

CV Outcomes Study Design

Contrave32 + Weight Management Program

Placebo + Weight Management Program

Wk

208

Wk

182

Wk

130

Wk

104

Wk

78

Wk

52

Wk

26

Wk

16

Wk

156

Wk

8

Wk

2

Day

1

Wk

-2

Evaluation of appropriateness of treatment

Lead-in

Treatment Period |

9

Timeline Assumptions that Lead to a Potential

2014 Approval

Timeline Assumptions that Lead to a Potential

2014 Approval

Development Milestone

Estimated Time

First Patient Visit

Late Q2 2012

Enroll Trial and Accrue 87 CV Events for Interim

Analysis

18-20 months

Time to Prepare Resubmission

3-4 months

Regulatory Review (Type II)

6 months

Potential Approval

H2 2014 |

10

Probability of Success of CVOT is High

Probability of Success of CVOT is High

Hurdle for approval is not based on demonstrating CV benefit, but

instead requires excluding a doubling of CV risk in non-inferiority

design

Bupropion well characterized in >50M patients over >25 years

–

Large patient registries and AERS have not identified evidence of

increased CV events

Risk Engine modeling of 1-year Contrave Phase 3 data predicts

reduced

10-year CV risk compared to placebo

Trial focus on responders to drug therapy allows real-world test

–

Long term exposure to study drug is only in those experiencing benefit

from therapy |

11

-

40

-

30

-

20

-

10

0

10

20

30

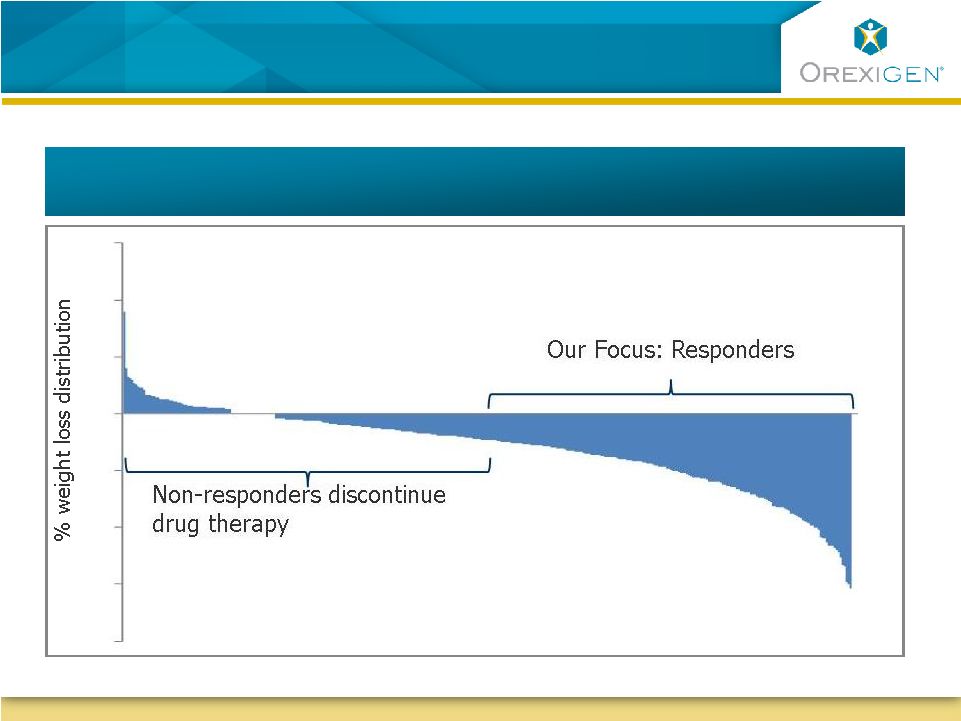

Our Focus is on Responders to Contrave Therapy

Our Focus is on Responders to Contrave Therapy

Illustrative : Typical distribution of weight loss response to obesity therapy

|

12

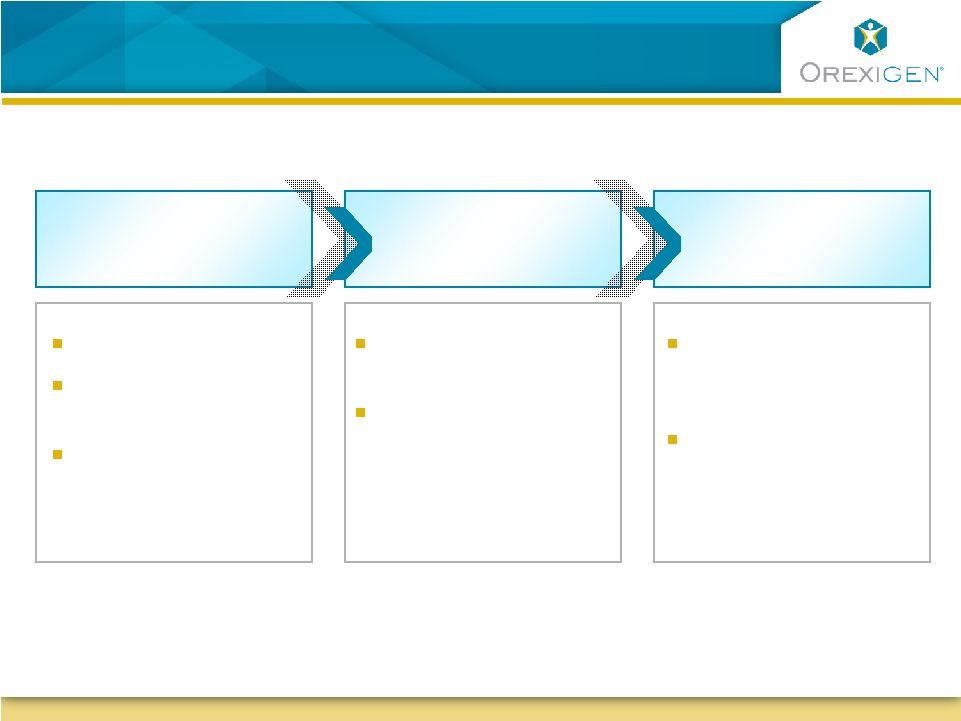

Proposed Treatment Algorithm Identifies Early

Responders for Continued Long-term Therapy

Proposed Treatment Algorithm Identifies Early

Responders for Continued Long-term Therapy

Appropriate BMI

Motivated to Adhere

to Lifestyle Change

Inadequate

Response to Diet &

Exercise

Select Responders

for Continued

Treatment

Reinforce Adherence

to Appropriate Use

Evaluate Adherence

to Appropriate Use

Assess Weight & BP

Response to

Therapy

Screening

16-Week

Therapeutic Trial

Long-Term

Therapy |

13

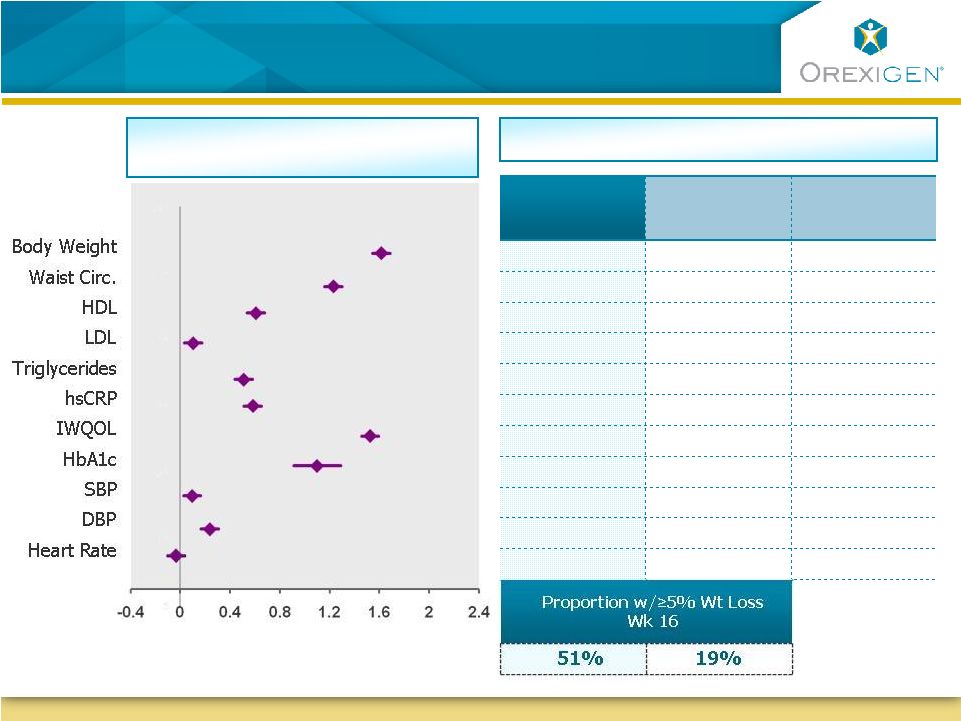

Contrave Responders Achieve Improvements Across

Multiple Cardiometabolic Parameters

Contrave Responders Achieve Improvements Across

Multiple Cardiometabolic Parameters

Improvement

(Standardized Mean Change from Baseline)

Contrave32 Standardized Mean

Change from Baseline at 1 Year

Change from Baseline at 1 Year

Contrave

Contrave

Responder

Responder

N=1038

N=1038

Placebo

Responder

N=254

All Placebo

N=1319

-11.3%

-8.6%

-2.4%

-9.5 cm

-7.2 cm

-3.5 cm

5.2 mg/dL

2.9 mg/dL

0.0 mg/dL

-2.5 mg/dL

1.7 mg/dL

0.0 mg/dL

-16.0%

-9.2%

-2.8%

-38.9%

-36.2%

-14.5%

14.7

12.3

8.3

-1.0%

-0.6%

-0.1%

-0.9 mm Hg

-2.8 mm Hg

-1.6 mm Hg

-1.6 mm Hg

-2.6 mm Hg

-1.3 mm Hg

0.2 bpm

-2.3 bpm

-0.2 bpm |

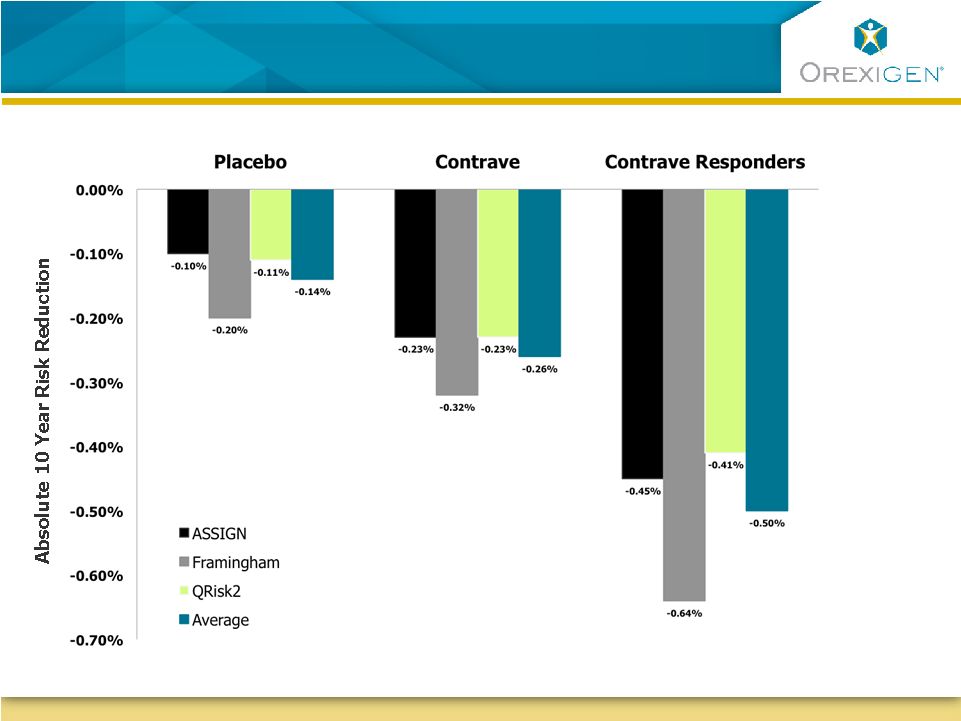

14

Risk Engine Modeling Suggests Long-term CVD Risk

Reduction on Contrave

Risk Engine Modeling Suggests Long-term CVD Risk

Reduction on Contrave |

|

16

Contrave Poised for Commercial Success

Contrave Poised for Commercial Success

Market Size / Market Growth

Market Size / Market Growth

Unmet Need / Limited Competition

Unmet Need / Limited Competition

Differentiated Product Profile

Differentiated Product Profile

Blockbuster Building Blocks

Blockbuster Building Blocks

Heavy Resourcing

Heavy Resourcing |

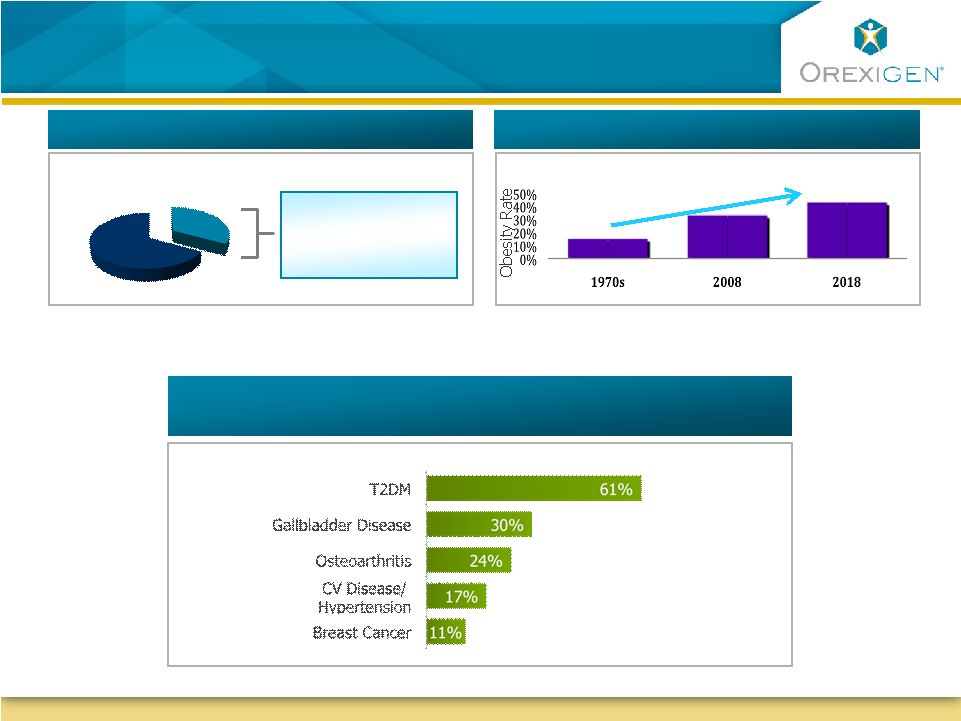

17

103M

US Obesity Rate Growth

Blockbuster Market Growth

Blockbuster Market Growth

Serious Disease Attributable to Obesity

Serious Disease Attributable to Obesity

Obesity: A Large Untapped Market in Need of

Solutions

Obesity: A Large Untapped Market in Need of

Solutions

Source: Wolf, AM, et al. Obes. Res. 1998; 6(2) 97-106

Source: CDC (2010)

Blockbuster Market Size

Blockbuster Market Size

Source: CDC (2009)

US Population

~ 1 in 3 People

in the US

are Obese |

18

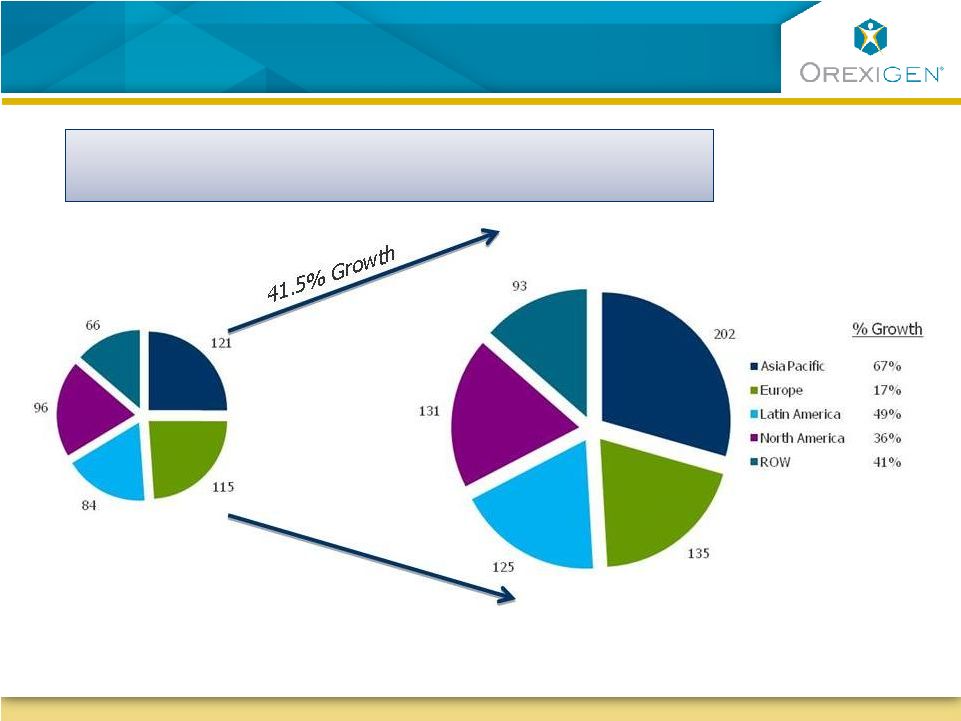

Obesity Epidemic is Projected to Grow Globally

Obesity Epidemic is Projected to Grow Globally

n= ~484M people

n= ~484M people

n= ~685M people

n= ~685M people

2010

2010

Source: EuroMonitor, 2010; Timely Data Resources 2010

Source: EuroMonitor, 2010; Timely Data Resources 2010

2020

2020 |

19

Significant Unmet Need in the Market

Significant Unmet Need in the Market

Treatment Options Needed

Treatment Options Needed

T2DM, driven by obesity, is an epidemic

–

1 in 3 adults in the U.S. May have diabetes by 2050 (CDC)

–

Associated with premature death & physical/psychosocial consequences

Weight loss of 5-10% confers significant benefits

Lifestyle change is critical, but weight loss difficult to

achieve/maintain

Large gaps in current treatment paradigm

Majority of Obese are Untreated in an Environment of Limited Treatment Options

BMI

Distribution

of US Pop:

Morbidly Obese

Obese

Overweight

~ 113K People

Treated w/ Surgery

~ 2 Million People

Treated w/ Rxs

Source: Walters Kluwer 2009; Am. J. Surg. 2010

Significant Unmet Need –

Limited Competition |

20

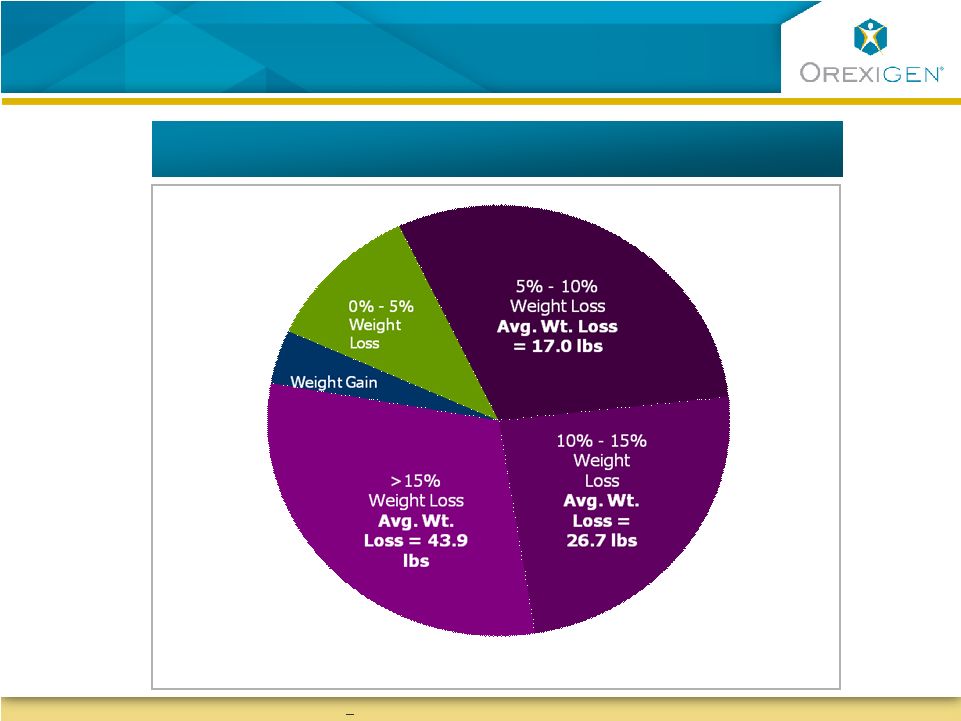

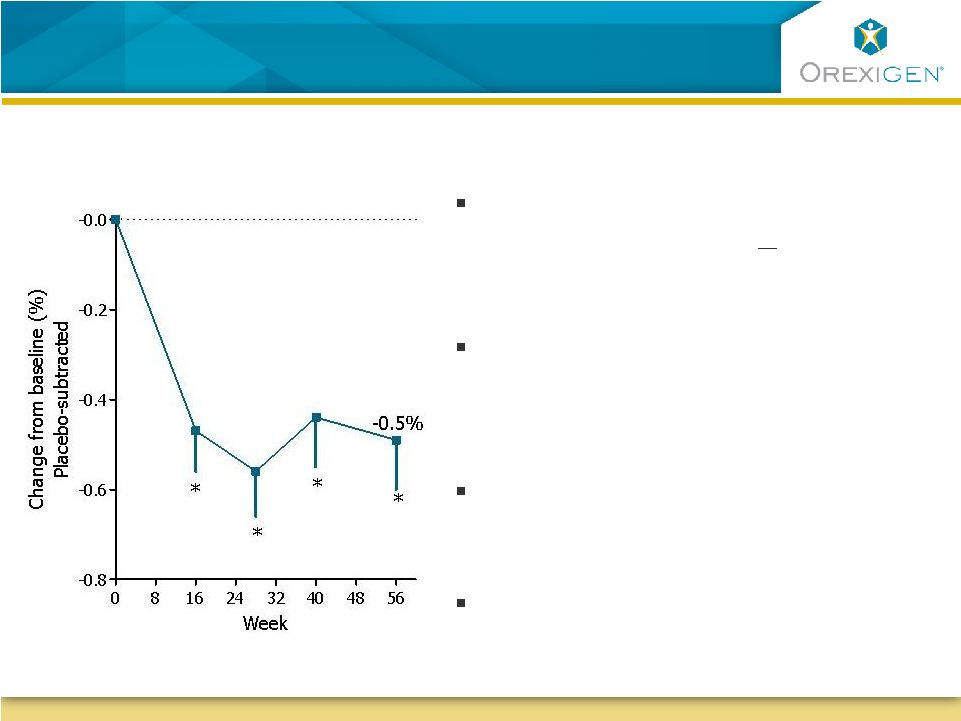

Contrave Responders Achieved Significant Weight

Loss

Contrave Responders Achieved Significant Weight

Loss

Responders Maintained Meaningful Weight Loss

Responders Maintained Meaningful Weight Loss

Represents one year data for responders (patients with

>5% weight loss at week 16 per recommended treatment protocol)

|

21

Contrave is Uniquely Positioned for Significant

Segments of the Obese Population

Contrave is Uniquely Positioned for Significant

Segments of the Obese Population

Has diabetes and/or

dyslipidemia

Reports having

uncontrollable food

cravings

Is depressed or has

depressive symptoms

Is female, many of

child bearing age

A Typical

Obese Patient:

Sources: Orexigen quantitative market research 2009; IMS NDTI audit data, 6 months ending

3/09 63%

50%

72%

62% |

22

Patients With Diabetes On Contrave Achieve

Improvements In Glycemic Control with Weight Loss

Patients With Diabetes On Contrave Achieve

Improvements In Glycemic Control with Weight Loss

HbA1c, change from baseline

ITT-LOCF (Mean baseline A1C = 8.0%)

Half the Contrave patients who

completed therapy lost >5% body

weight

Half the Contrave patients who

completed therapy achieved ADA

HbA1c guideline of <7%

As little as 5% weight loss has been

shown to reduce mortality risk by 25%

1

Patients on Contrave experienced a

reduction in rescue medications

1

Source: Diabetes Care, Vol 23, No.10 Oct (2000) |

23

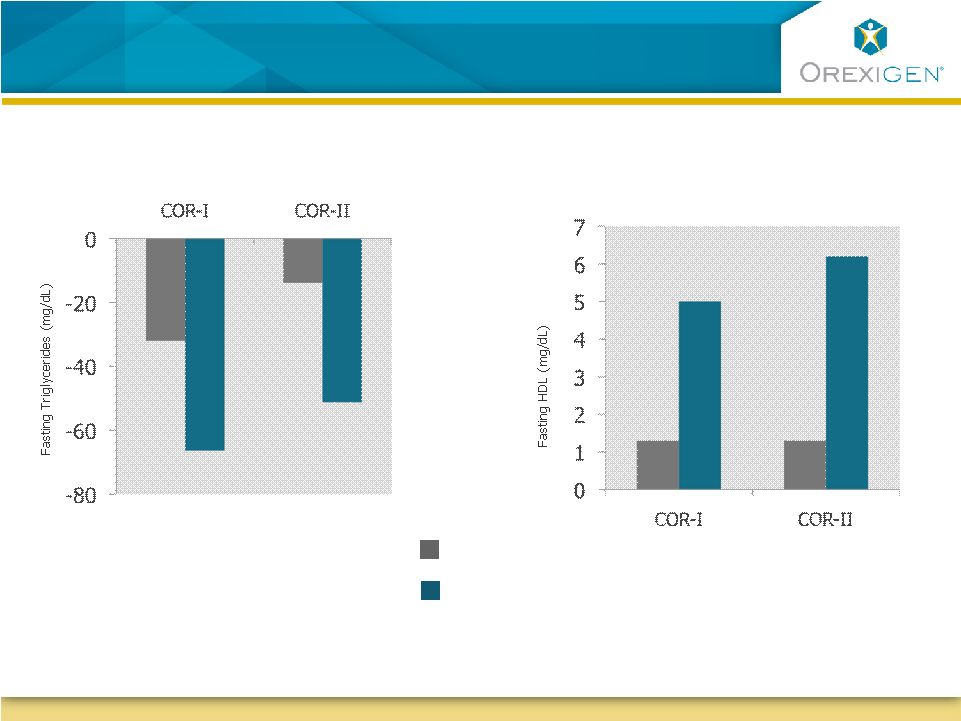

Patients with Dyslipidemia Experienced Clinically

Significant Improvement in Lipid Profiles

Patients with Dyslipidemia Experienced Clinically

Significant Improvement in Lipid Profiles

Triglycerides

HDL Cholesterol

Placebo

Contrave32

P < 0.05

P < 0.05

P < 0.05

P < 0.05

Data is for completers in high-risk subgroups. High risk is defined by ATPIII Guidelines;

Baseline 200-222mg/dl for TGs, 40-41 mg/dl for HDL

N=82

N=87

N=69

N=135

N=122

N=121

N=117

N=184 |

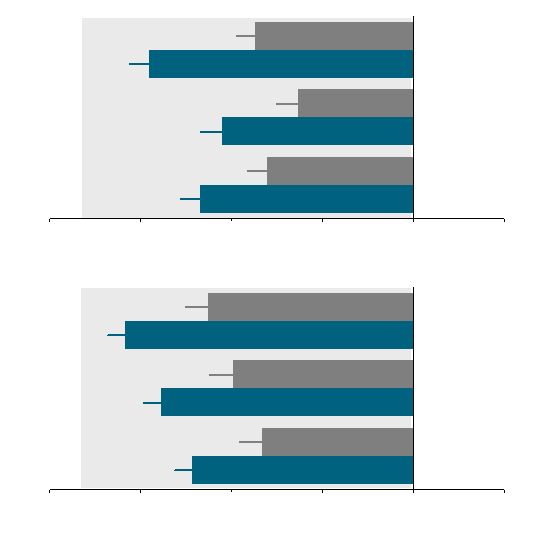

24

Contrave Patients Experienced Statistically Significant

Improvements in Eating Control

Contrave Patients Experienced Statistically Significant

Improvements in Eating Control

-20

-15

-10

-5

0

5

*

*

*

Change from baseline (mm)

-20

-15

-10

-5

0

5

*

*

*

Change from baseline (mm)

Less

More

Placebo (N=511)

Contrave32 (N=471)

How difficult has it been to control your eating?

How often have you eaten in response to food cravings?

How difficult has it been to resist any food cravings?

COR-I

Placebo (N=456)

Contrave32 (N=702)

COR-II

How difficult has it been to control your eating?

How often have you had food cravings?

How difficult has it been to resist any food cravings?

*P<0.05 vs. Placebo; ITT-LOCF; results were measured based on

measurements using 100mm VAS scale Less

More |

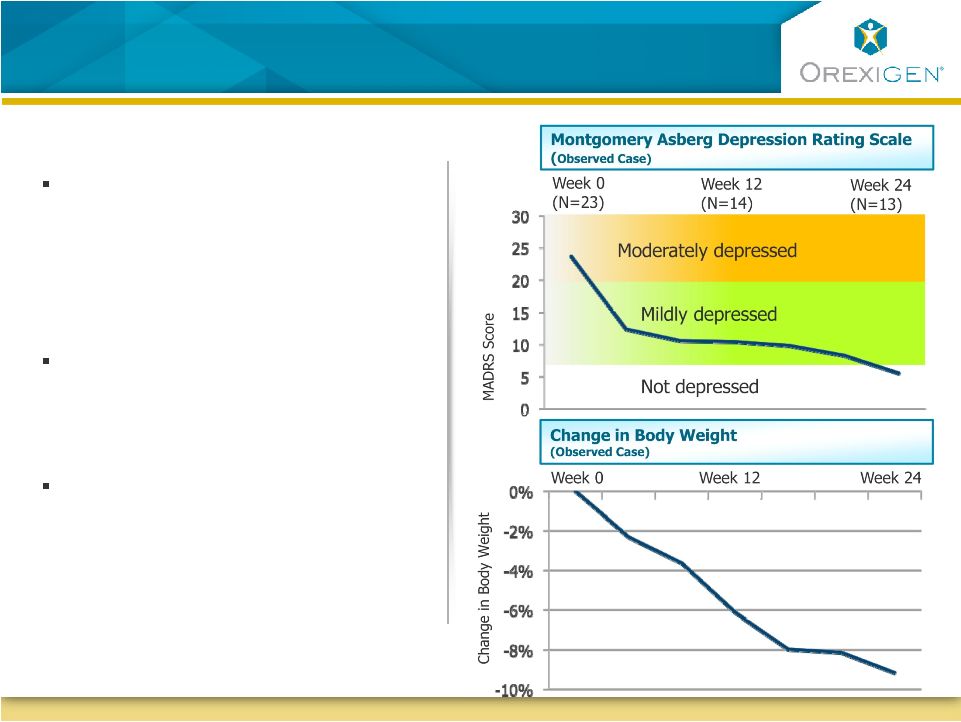

25

Contrave Has Shown Significant Weight Loss And

Improvement In Depressive Symptoms Within 24 Weeks

Contrave Has Shown Significant Weight Loss And

Improvement In Depressive Symptoms Within 24 Weeks

In a 24-week Phase 2 open-label

trial of obese depressed patients,

Contrave significantly

improved measures of

depression

At the same time,

patients who

completed the trial lost over

9% of their body weight

In addition, in a Control of Eating

Questionnaire, patients reported

decreases in hunger and cravings,

and less difficulty resisting cravings

Trial included 25 obese patients that met DSM-IV criteria for

major depression. |

26

Contrave May Be The Logical Treatment Choice for

Women

Contrave May Be The Logical Treatment Choice for

Women

Source: Orexigen market research; IMS

Health, National Disease and Therapeutic Index, Obesity (2010) 18:

347-353

Women seek obesity therapy more than

men

Research has indicated that women tend

to crave food more than men, and

younger women tend to crave more than

older women (Pelchat, 1997)

Female gender is one of the few factors

that has been consistently associated with

an increased risk of depression among

obese individuals (Ma, 2010)

Majority of obesity Rx today go to women

under 60 years of age

Majority of the obesity Rxs today go

to women of child-bearing age

0

500

1,000

1,500

2,000

2,500

3,000

0-19

20-39

40-59

60-64

65+

Female

Male

Age (years) |

27

Contrave is Uniquely Positioned for Significant

Segments of the Obese Population

Contrave is Uniquely Positioned for Significant

Segments of the Obese Population

Has diabetes and/or

dyslipidemia

Reports having

uncontrollable food

cravings

Is depressed or has

depressive symptoms

Is female, many of

child bearing age

62%

63%

72%

50%

A Typical

Obese Patient: |

28

SCALE

Top 15 Pharma

Significant U.S. Presence

Primary Care Focus

COMMITMENT

TO OBESITY

Partnership

with Amylin

Stated

Strategy

DOMAIN

EXPERIENCE

Leader in

Cardiometabolic

Care

Excellence in

Life Cycle

Management

SUCCESSFUL

BRAND BUILDER

Actos ~$3B in U.S.

Sales in 2009

Prevacid ~$3B in U.S.

Sales in 2009

Heavy Resourcing: Takeda is an Ideal Partner

Heavy Resourcing: Takeda is an Ideal Partner |

29

Attractive Value Proposition

Attractive Value Proposition

Focused, experienced and capable team

World-class clinical advisory board to steer the study

Large capable partner in Takeda responsible for North American

commercialization

Significant revenue potential projected from lead product, Contrave

Retained ROW rights for future catalysts and upside

Sufficient cash to fund operations (~$145m) through potential

approval in 2014 |

30 |