Attached files

| file | filename |

|---|---|

| 8-K - KAMAN CORPORATION FORM 8-K - KAMAN Corp | form8-k.htm |

Kaman Corporation (NASDAQ-GS: KAMN)

Kaman Corporation (NASDAQ-GS: KAMN)

Investor Presentation

January 10, 2012

2

Investment Summary

§ Significant long-term organic growth opportunities in Aerospace

and Industrial Distribution

and Industrial Distribution

§ High margin Aerospace business benefiting from increasing

commercial aircraft build rates

commercial aircraft build rates

§ Stable defense platforms with incremental revenue coming from

new programs (e.g. A-10, AH-1Z, F-35)

new programs (e.g. A-10, AH-1Z, F-35)

§ Industrial Distribution business growing organically, gaining scale

via acquisitions, and adding complementary product lines

via acquisitions, and adding complementary product lines

§ Investing in new product development, new product applications,

acquisitions and technology for long-term growth

acquisitions and technology for long-term growth

§ Strong balance sheet to drive growth and strategic initiatives

§ Experienced management team

3

Distribution

63%

Aerospace

37%

2010 Sales

§ Kaman Corporation is a diversified company that conducts

business in the aerospace and industrial distribution markets

business in the aerospace and industrial distribution markets

§ The Company has two segments

– Industrial Distribution

• Third largest distributor in the power transmission/motion

control/fluid power market

control/fluid power market

• Offers over four million SKUs to over 50K customers

via 230 locations

– Aerospace

• Manufacturer and subcontractor in the global commercial

and military aerospace and defense market

and military aerospace and defense market

• Diverse customer base of government divisions and blue

chip customers

chip customers

§ Publicly listed on NASDAQ with a market capitalization of

$733 million as of December 31, 2011

$733 million as of December 31, 2011

§ 2011 Expected sales of $1.5 billion(2); 4,800 Employees

Corporate Overview

(1) Operating profit after depreciation and before interest and corporate charges

(2) Based on 11/2/2011 Outlook

Distribution

31%

Aerospace

69%

2010 Segment

Operating Income (1)

4

|

|

Nine Months

YTD

10/01/2010

|

Nine Months

YTD

09/30/2011

|

Change

|

|

Sales

|

$ 953

|

$ 1,119

|

+ 17.4%

|

|

Earnings per share

|

$ 0.79(1)

|

$ 1.41(2)

|

+ 78.5%

|

|

Free cash flow

|

$ 12.6

|

$ (3.9)

|

- 131.0%

|

|

Market capitalization

|

$ 670

|

$ 734

|

+ 9.6%

|

|

Price per share

|

$ 25.83

|

$ 27.85

|

+ 7.8%

|

(In millions except per share amounts)

(1) Adjusted - excludes look back interest benefit of $6.6 million pretax ($0.17 per share per share, net of tax)

and an aerospace contract settlement of $2.0 million pretax ($.05 per share, net of tax).

(2) Adjusted - excludes $2.4 million pretax ($0.07 per share, net of tax) benefit associated with the death

of a former executive

Key Metrics

5

AEROSPACE

2011 Sales $560 Million (11/2/2011 Outlook)

6

Aerospace

OBJECTIVE:

§ $1 billion in sales by 2014 / margins in the “high teens”

STRATEGY:

§ DEPTH - Size/financial strength to address larger, integrated work

packages from primes/OEM’s and Tier 1’s

packages from primes/OEM’s and Tier 1’s

§ DIVERSITY - Balance portfolio thru increased commercial content

§ DIFFERENTIATION - Continue to move from build-to-print to design-

and-build for higher margins and more defensible positions

and-build for higher margins and more defensible positions

§ DEVELOPMENT - Increased, focused investments in our people and

infrastructure to increase capabilities and support improved

performance

infrastructure to increase capabilities and support improved

performance

7

Aerospace Business Drivers

§ Continued outsourcing trend by OEMs and Super Tier 1s to increase

flexibility and lower costs

flexibility and lower costs

§ High margin specialty bearing and aerostructure businesses

positioned to capitalize from significant ramp in commercial build

rates at Boeing and Airbus

positioned to capitalize from significant ramp in commercial build

rates at Boeing and Airbus

§ Defense platforms provide exposure to key vertical lift and reset

programs

programs

§ Legacy prime contractor capabilities provide attractive outsourcing

alternatives to today’s helicopter and fixed wing aircraft OEMs

alternatives to today’s helicopter and fixed wing aircraft OEMs

8

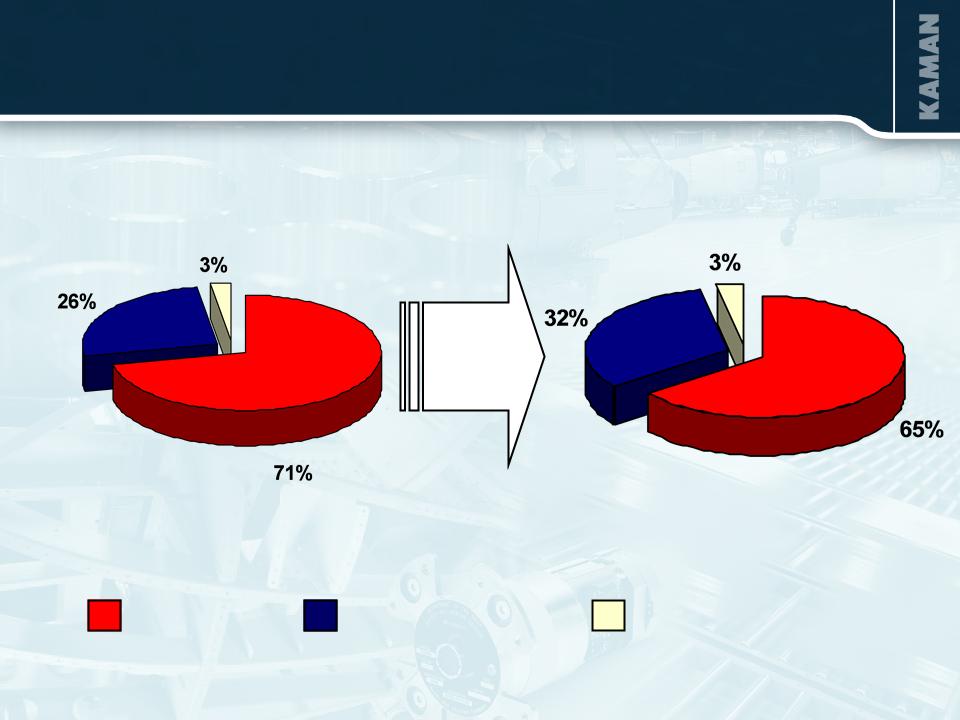

Defense

Commercial

Business/Regional

2010

$487M

2011 Expected(1)

$560M

+≈15%

Aerospace Sales

(1) Based on 11/2/2011 Outlook

9

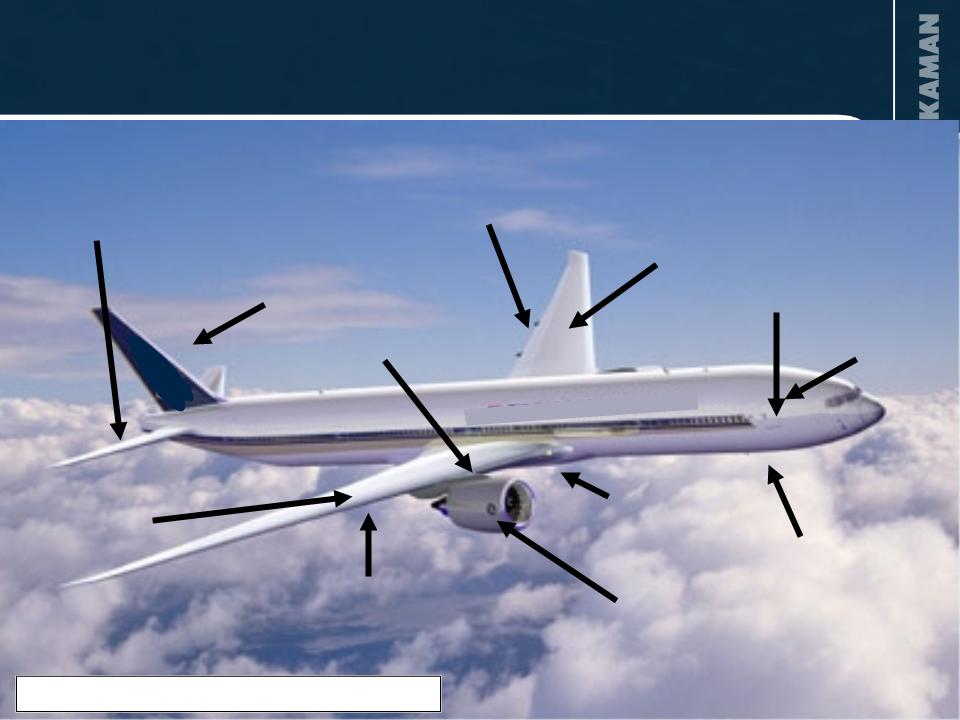

Fixed trailing edge

Fuel tank access doors

Top covers

Red denotes bearing products

Nose landing gear

Rudder

Main landing gear

Flaps

Horizontal stabilizer

Door assemblies

Engine/thrust reverser

Aircraft Programs/Capabilities

Flight controls

Doors

10

Manufacture of cockpit

Blade erosion coating

Manufacture and assembly

of tail rotor pylon

of tail rotor pylon

Manufacture, sub assembly

and joining of fuselage

and joining of fuselage

Blade manufacture,

repair and overhaul

repair and overhaul

Driveline couplings

Bushings

Flight control bearings

Aircraft Programs/Capabilities

Red denotes bearing products

11

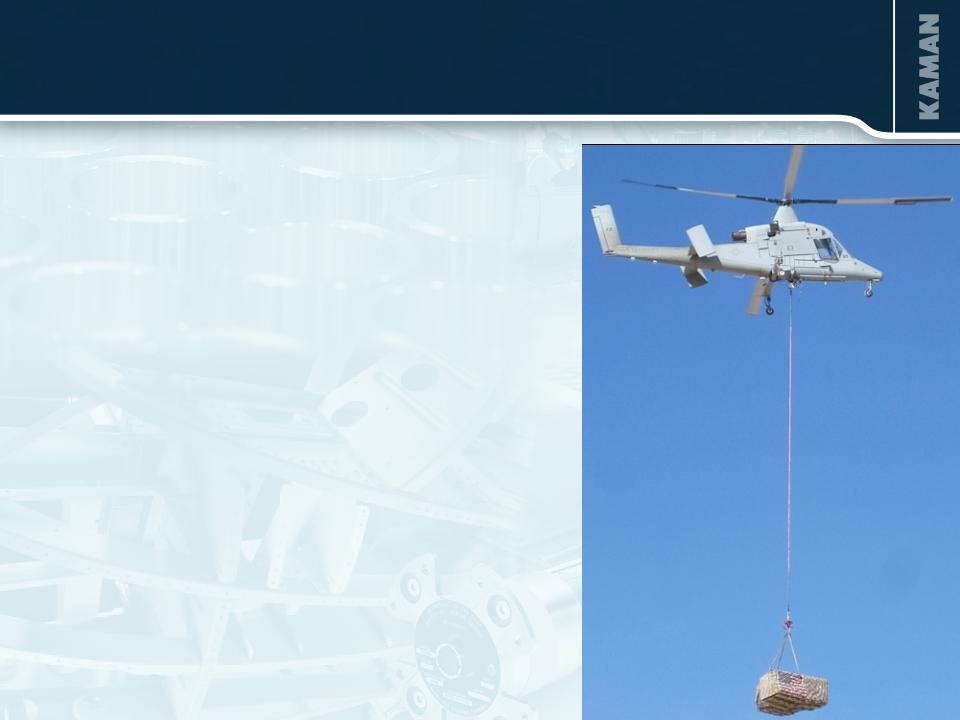

§ Teamed with Lockheed Martin to develop

an unmanned military version of the

Kaman K-MAX commercial helicopter

an unmanned military version of the

Kaman K-MAX commercial helicopter

§ Lockheed Martin / Kaman team working

under a $45.8 million contract for the

evaluation of unmanned aircraft systems

by the USMC

under a $45.8 million contract for the

evaluation of unmanned aircraft systems

by the USMC

- Two aircraft delivered under this

program to the USMC

program to the USMC

- Successfully completed a five-day

Quick Reaction Assessment (QRA) in

August 2011

Quick Reaction Assessment (QRA) in

August 2011

- USMC aircraft are currently

performing unmanned cargo resupply

missions in Afghanistan

performing unmanned cargo resupply

missions in Afghanistan

§ Lockheed Martin awarded $47 million

Army contract for unmanned K-MAX

development

Army contract for unmanned K-MAX

development

Unmanned K-MAX®

12

Aerospace - Budget Impact on Defense

Programs

Programs

§ Defense business is comprised of programs largely unaffected by

proposed budget cuts

proposed budget cuts

– UH-60 BLACK HAWK - relatively stable demand

– Joint Programmable Fuze - backlog into 2013, foreign demand, continued

sole source

sole source

– F-35 (Joint Strike Fighter) - incremental business at any production level

– A-10 - reset, new business (approximately $20M per year)

– AH-1Z - new business (up to $10M per year)

– C-17 - firm backlog into 2013, potential for additional foreign orders

13

|

|

Projected Deliveries

|

||||

|

|

2011

|

|

2014

|

|

% Increase

|

|

Boeing 777

|

75

|

|

100

|

|

+ 33%

|

|

Boeing 747

|

15

|

|

24

|

|

+ 60%

|

|

Boeing 737

|

376

|

|

484

|

|

+ 29%

|

|

Boeing 787

|

11

|

|

117

|

|

+ 964%

|

|

Airbus A320

|

409

|

|

454

|

|

+ 11%

|

|

Airbus A380

|

24

|

|

28

|

|

+ 17%

|

|

Airbus A350

|

0

|

|

21

|

|

-

|

Source: Jefferies Estimates

Positioned to Benefit from Ramp in

Commercial Production

Commercial Production

14

Other Growth Programs

§ A-10 re-wing

§ F-35 (Joint Strike Fighter)

§ Bell Helicopter

– AH-1Z

– Commercial

§ Learjet 85

15

16

Acquisition of Vermont Composites

§ Acquired November 4, 2011

§ A leader in the design and manufacture of composite

aerostructures and advanced composite medical equipment

aerostructures and advanced composite medical equipment

§ Major platforms:

- V-22 Osprey

- P-8 Poseidon

- C-130 Hercules

- MH-60 BLACK HAWK

- Various UAV’s

§ Expected 2011 annual sales of $32 million

§ 230 employees in Bennington, VT

17

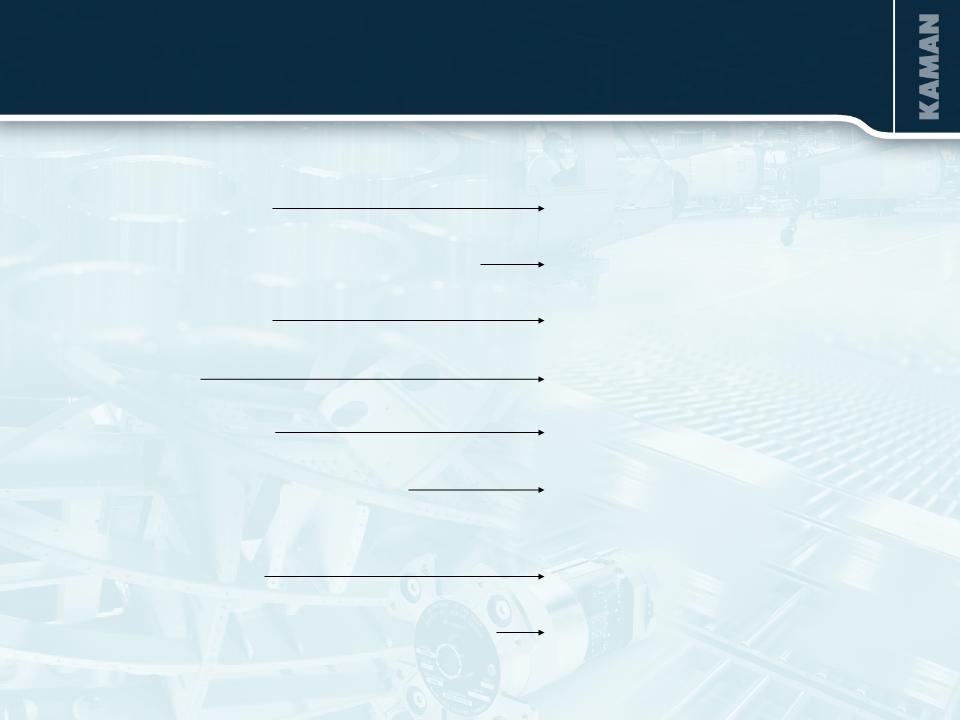

NOW

FUTURE/VISION

(1) Based on 11/2/2011 Outlook

Aerospace Strategic Transition

$560 Million sales(1) $1 Billion sales

15.3% to 15.5% Operating margin(1) “High Teens” operating margin

60% Build-to-print 70% Design-and-build

65% Defense 50% Defense/50% Commercial

Tier II/III Supplier Super Tier II

Small, independent businesses Integrated, coordinated,

synergistic business

synergistic business

Primarily domestic Multi-national

Competing on cost and manufacturing Competing on design-and-build

capability

manufacturing capability, and

Intellectual Property

manufacturing capability, and

Intellectual Property

18

INDUSTRIAL DISTRIBUTION

2011 Sales $950 Million (11/2/2011 Outlook)

19

§ Third largest industrial distribution firm serving the $23 billion power

transmission / motion control market.

transmission / motion control market.

§ 230 locations and 5 distribution centers

§ Major product categories:

– Bearings

– Mechanical and electrical power transmission

– Fluid Power

– Motion control

– Automation

– Material handling

§ Metrics:

– $470,000 sales per employee (2010)

– 2,100 employees (approximately one third outside sales)

– 4.0 million SKUs offered

– 50,000+ customers

Industrial Distribution Overview

20

Industrial Distribution

OBJECTIVE:

§ $1.5 billion in sales - 7% operating profit margin by 2014

STRATEGY:

§ SCALE/GROWTH - Broaden product offering organically and through

acquisitions. Expand geographic footprint to enhance position in the

national accounts market

acquisitions. Expand geographic footprint to enhance position in the

national accounts market

§ PRODUCTIVITY - Recognize benefits from organizational realignment

and implement multi-faceted technology investments

and implement multi-faceted technology investments

§ PROFITABILITY - Recognize sales and cost synergies from the eight

acquisitions completed in 2010 and 2011. Enhance margins through new

higher margin product lines, a focus on pricing management and

leverage increased purchasing scale

acquisitions completed in 2010 and 2011. Enhance margins through new

higher margin product lines, a focus on pricing management and

leverage increased purchasing scale

21

Acquisition of Catching FluidPower, Inc.

§ Acquired December 15, 2011

§ Distributor of a wide variety of product technologies including:

hydraulic and pneumatic pumps, motors, valves, cylinders,

manifolds, precision automation, instrumentation, hose and

fittings, connectors, filtration products, seals and all other

necessary fluid power components

hydraulic and pneumatic pumps, motors, valves, cylinders,

manifolds, precision automation, instrumentation, hose and

fittings, connectors, filtration products, seals and all other

necessary fluid power components

§ Six locations in Illinois and Indiana

22

|

Product

Category |

Bearings & Mechanical Power

Transmission (BPT)

|

Motion & Automation

Control |

Fluid Power and Control

|

|

% of 2011 Sales

(approximate)

|

72%

|

16%

|

12%

|

|

Business Unit

|

Kaman Industrial Technologies

(National) |

Minarik (National)

|

Kaman Industrial Technologies

(National) Catching (Regional)

INRUMEC (Regional) |

|

Acquisitions

since 2008 |

•Industrial Supply Corp.

•Allied Bearings Supply

•Plains Bearing

•Fawick de Mexico

|

•Minarik

•Automation Technology

•Target Electronic Supply

|

•Catching FluidPower

•INRUMEC

|

|

Major Suppliers

|

|

|

Major Product Categories

23

Executing Strategy and Building Network

(10/14/11)

(9/2/11)

(4/15/11)

24

§ Total 2011 sales are expected to be up approximately 15% to a

record $950 million(1) over the prior year

record $950 million(1) over the prior year

§ Organic growth in 2011 was broad based

– 10 of top 10 product categories were up year-over-year

– 9 of top 10 end markets were up year-over-year

– 9 of top 10 states were up year-over-year (1 was down 1%)

§ Eight acquisitions completed in 2010 and 2011, accelerating the top

line and building scale (added approximately $208 million in sales on

a run rate basis)

line and building scale (added approximately $208 million in sales on

a run rate basis)

§ 2010 acquisitions have been twice as accretive as expected

Growth Continues

Q311 Operating profit margin was 5.0%,

the seventh consecutive quarter of year-over-year improvement

(1) Based on 11/2/2011 Outlook

25

Acquisition of Target Electronic Supply, Inc.

§ Acquired September 2, 2011

§ Expected 2012 sales of about $20 million

§ A leader in the motion control systems market in New England with

branches in MA, CT and NH

branches in MA, CT and NH

§ Adds motion control systems capabilities complementing Kaman’s

power transmission and Minarik’s automation offerings in New

England

power transmission and Minarik’s automation offerings in New

England

§ Adds additional scale to drive cost efficiencies and increase

leverage

leverage

26

Industrial Distribution Opportunities

§ Broaden product offering organically and through acquisition to win

additional business from existing customers and gain market share

additional business from existing customers and gain market share

§ Enhance margins through new higher margin product lines, a focus

on pricing management and leverage from higher sales

on pricing management and leverage from higher sales

§ Expand higher margin fluid power business via Parker national

reseller agreement

reseller agreement

§ Recognize sales and cost synergies from the eight acquisitions

completed in 2010 and 2011

completed in 2010 and 2011

§ Expand geographic footprint through additional acquisitions to

enhance Kaman’s position in the competition for national accounts

enhance Kaman’s position in the competition for national accounts

§ Improve productivity through technology investments to enhance

return on sales

return on sales

27

Kaman Investment Merits

§ A Leading Market Position in Both Business Segments

§ Continued Focus on Profit Optimization, Increasing Cash

Flows and Strengthening Competitive Position

Flows and Strengthening Competitive Position

§ Strong Liquidity and Conservative Financial Profile

- Investment Grade Rating (BBB-/Stable)

§ Disciplined and Focused Acquisition Strategy

§ Experienced Management Team

28

APPENDIX

29

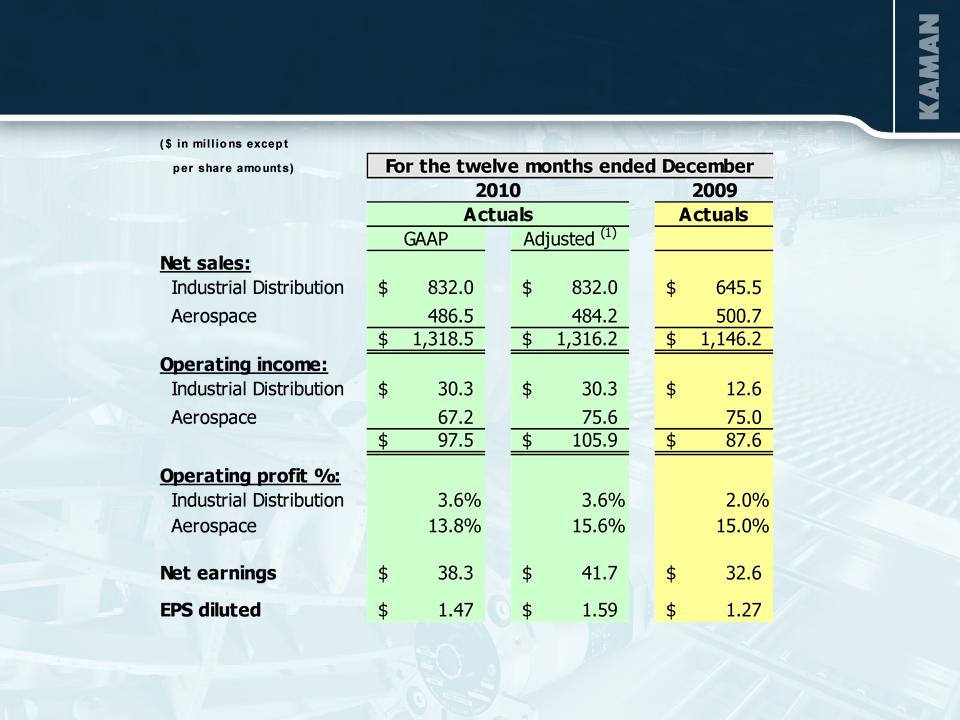

FINANCIAL SUMMARY

37%

2010 Sales $1.32 Billion

30

(1)

(2)

(3)

(3)

(1) Excludes a sales adjustment of $2.3 million related to a contract pricing settlement

(2) Excludes a $2.0 million pretax adjustment related to a contract pricing settlement

(3) Excludes the adjustment in note (2), which was $0.05 per share, net of tax; and a look back

interest benefit of $6.6 million pretax ($0.17 per share, net of tax)

Financial Highlights - Q3

31

(1) Excludes a sales adjustment of $2.3 million related to a contract pricing settlement

(2) Excludes a $2.0 million pretax adjustment related to a contract pricing settlement

(3) Excludes the adjustment in note (2), which was $0.05, net of tax; and a look back interest

benefit of $6.6 million pretax ($0.17 per share, net of tax)

(4) Excludes $2.4 million pretax ($0.07 per share, net of tax) benefit associated with the death of a former executive

(1)

(2)

(3)

(3)

(4)

(4)

Financial Highlights - Nine Months YTD

32

(1)Adjusted - excludes $6.4 million goodwill impairment, $2.0 million aerospace contract settlement and

$6.6 look-back interest benefit

Financial Highlights - Full Year 2010

33

|

(In Millions)

|

As of 9/30/2011

|

As of 12/31/10

|

As of 12/31/09

|

|

Cash and Cash Equivalents

|

$ 15.2

|

$ 32.2

|

$ 18.0

|

|

Notes Payable and Long-term Debt

|

$ 149.7

|

$ 148.4

|

$ 63.6

|

|

Shareholders’ Equity

|

$ 399.4

|

$ 362.7

|

$ 312.9

|

|

Debt as % of Total Capitalization

|

27.3%

|

29.0%

|

16.9%

|

|

Capital Expenditures

|

$ 19.41

|

$ 21.5

|

$ 13.6

|

|

Depreciation & Amortization

|

$ 16.61

|

$ 20.5

|

$ 16.1

|

1 For the nine months ended 9/30/2011

Balance Sheet and Capital Factors

34

Forward Looking Statement

This presentation contains forward-looking information relating to the Company's business and prospects, including the Aerospace and

Industrial Distribution businesses, operating cash flow, and other matters that involve a number of uncertainties that may cause actual results

to differ materially from expectations. Those uncertainties include, but are not limited to: 1) the successful conclusion of competitions for

government programs and thereafter contract negotiations with government authorities, both foreign and domestic; 2) political conditions in

countries where the Company does or intends to do business; 3) standard government contract provisions permitting renegotiation of terms

and termination for the convenience of the government; 4) satisfactory conclusion to government inquiries or investigations regarding

government programs; 5) domestic and foreign economic and competitive conditions in markets served by the Company, particularly the

defense, commercial aviation and industrial production markets; 6) risks associated with successful implementation and ramp up of significant

new programs; 7) potential difficulties associated with variable acceptance test results, given sensitive production materials and extreme test

parameters; 8) management's success in increasing the volume of profitable work at the Wichita facility; 9) successful resale of the SH-2G(I)

aircraft, equipment and spare parts; 10) receipt and successful execution of production orders for the JPF U.S. government contract, including

the exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection with goodwill

impairment evaluations; 11) satisfactory resolution of (i) the Company's litigation relating to the FMU-143 program and (ii) the Wichita

subpoena matter; 12) continued support of the existing K-MAX® helicopter fleet, including sale of existing K-MAX® spare parts inventory; 13)

cost estimates associated with environmental remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K.

facilities; 14) profitable integration of acquired businesses into the Company's operations; 15) changes in supplier sales or vendor incentive

policies; 16) the effects of price increases or decreases; 17) the effects of pension regulations, pension plan assumptions and future

contributions; 18) future levels of indebtedness and capital expenditures; 19) continued availability of raw materials and other commodities in

adequate supplies and the effect of increased costs for such items; 20) the effects of currency exchange rates and foreign competition on

future operations; 21) changes in laws and regulations, taxes, interest rates, inflation rates and general business conditions; 22) future

repurchases and/or issuances of common stock; and 23) other risks and uncertainties set forth in the Company's annual, quarterly and

current reports, proxy statements and other filings with the SEC. Any forward-looking information provided in this presentation should be

considered with these factors in mind. The Company assumes no obligation to update any forward-looking statements contained in this

presentation.

Industrial Distribution businesses, operating cash flow, and other matters that involve a number of uncertainties that may cause actual results

to differ materially from expectations. Those uncertainties include, but are not limited to: 1) the successful conclusion of competitions for

government programs and thereafter contract negotiations with government authorities, both foreign and domestic; 2) political conditions in

countries where the Company does or intends to do business; 3) standard government contract provisions permitting renegotiation of terms

and termination for the convenience of the government; 4) satisfactory conclusion to government inquiries or investigations regarding

government programs; 5) domestic and foreign economic and competitive conditions in markets served by the Company, particularly the

defense, commercial aviation and industrial production markets; 6) risks associated with successful implementation and ramp up of significant

new programs; 7) potential difficulties associated with variable acceptance test results, given sensitive production materials and extreme test

parameters; 8) management's success in increasing the volume of profitable work at the Wichita facility; 9) successful resale of the SH-2G(I)

aircraft, equipment and spare parts; 10) receipt and successful execution of production orders for the JPF U.S. government contract, including

the exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection with goodwill

impairment evaluations; 11) satisfactory resolution of (i) the Company's litigation relating to the FMU-143 program and (ii) the Wichita

subpoena matter; 12) continued support of the existing K-MAX® helicopter fleet, including sale of existing K-MAX® spare parts inventory; 13)

cost estimates associated with environmental remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K.

facilities; 14) profitable integration of acquired businesses into the Company's operations; 15) changes in supplier sales or vendor incentive

policies; 16) the effects of price increases or decreases; 17) the effects of pension regulations, pension plan assumptions and future

contributions; 18) future levels of indebtedness and capital expenditures; 19) continued availability of raw materials and other commodities in

adequate supplies and the effect of increased costs for such items; 20) the effects of currency exchange rates and foreign competition on

future operations; 21) changes in laws and regulations, taxes, interest rates, inflation rates and general business conditions; 22) future

repurchases and/or issuances of common stock; and 23) other risks and uncertainties set forth in the Company's annual, quarterly and

current reports, proxy statements and other filings with the SEC. Any forward-looking information provided in this presentation should be

considered with these factors in mind. The Company assumes no obligation to update any forward-looking statements contained in this

presentation.

Contact: Eric Remington

V.P., Investor Relations

(860) 243-6334

Eric.Remington@kaman.com