Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ZOGENIX, INC. | d279320d8k.htm |

®

ZOGENIX UPDATE

January 2012

NASDAQ: ZGNX

Exhibit 99.1 |

2

Forward Looking Statements

Zogenix cautions you that statements included in this presentation that are not a

description of historical facts are forward- looking statements. Words such

as “believes,” “anticipates,” “plans,” “expects,” “indicates,” “will,” “intends,” “potential,”

“suggests,” “assuming,” “designed” and similar

expressions are intended to identify forward looking statements. These

statements are based on Zogenix’s current beliefs and expectations. These

forward-looking statements include statements regarding: the ability to

successfully commercialize Sumavel DosePro and its continued sales growth; the progress and timing of

clinical trials for Zohydro and planned development of Relday; the potential for, and

timing of, an NDA submission for Zohydro and an IND submission for Relday; the

potential for Zohydro to be the first approved oral, single-entity extended release

formulation of hydrocodone; the expansion of Zogenix’s existing sales force; the

potential to broaden the application of the DosePro technology; and the

potential market penetration of Sumavel DosePro and Zohydro. The inclusion of forward-looking

statements should not be regarded as a representation by Zogenix that any of its

plans will be achieved. Actual results may differ from those set forth in this

presentation due to the risk and uncertainties inherent in Zogenix’s business, including, without

limitation: the market potential for migraine treatments, and Zogenix’s ability

to compete within that market; inadequate therapeutic efficacy or unexpected

adverse side effects relating to Sumavel DosePro that could adversely affect

commercialization, or that could result in recalls or product liability claims;

Zogenix’s dependence on its collaboration with Astellas Pharma US, Inc.

to promote Sumavel DosePro; the progress and timing of Zogenix’s clinical trials; the potential that earlier

clinical trials may not be predictive of future results; the potential for Zohydro to

receive regulatory approval on a timely basis or at all; the potential for

adverse safety findings relating to Zohydro to delay or prevent regulatory approval or commercialization;

the ability of Zogenix and its licensors to obtain, maintain and successfully enforce

adequate patent and other intellectual property protection of its products and

product candidates and the ability to operate its business without infringing the

intellectual property rights of others; the inherent risks of clinical development of

Relday and Zogenix's dependence on its collaboration with DURECT Corporation

to develop Relday; and other risks described in Zogenix’s filings with the SEC, including

the prospectus filed with the SEC on September 15, 2011. You are cautioned not to

place undue reliance on these forward- looking statements, which speak only

as of the date hereof, and Zogenix undertakes no obligation to revise or update this

presentation to reflect events or circumstances after the date hereof. All

forward-looking statements are qualified in their entirety by this

cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities

Litigation Reform Act of 1995.

This presentation also contains estimates, projections and other information

concerning our industry, our business, and the markets for Sumavel DosePro,

Zohydro, Relday and other drugs, as well as data regarding market research, estimates and

forecasts prepared by our management. Information that is based on estimates,

forecasts, projections, market research or similar methodologies is inherently

subject to uncertainties and actual events or circumstances may differ materially from events and

circumstances reflected in this information. In some cases, we do not refer to

the source from which this data is derived. |

Sources:

Wolters

Kluwer

Pharma

Solutions,

Source

®

PHAST

Institution/Retail

(12

months

ended

December

2010);

industry

sources

1

st

Needle-Free,

Commercial Product

Acute Migraines and

Cluster Headache

Commercializing and Developing Products for Treatment of

Central Nervous System (CNS) Disorders and Pain

$3.5B Market

Expanding Commercial Initiatives

with PCPs in 2012

$13B Market

US Market Unpartnered

$16B Market

Worldwide Market Rights

1

st

Oral, Single-Entity

Hydrocodone, 12-Hour

Extended Release for

Chronic Pain (no APAP)

1

st

Once-Monthly,

Needle-Free

Subcutaneous

Antipsychotic

Relday™

GROWING SALES

PREPARING NDA

IND STUDIES IN 2012

3 |

4

Goals Completed Since IPO

SUMAVEL DosePro

Continued US Script Growth

Direct-to-Patient Initiatives

Phase IV Data Publication

“Innovation”

Award from

Drug Delivery Partnerships

EU Approvals

Building on Track Record of

Successful Execution

Zohydro

Seeking First Licensee for Biologic

Relday

DosePro Technology

$31.5m financing

$60.0m Follow-on offering

Financing

Completed Enrollment of Phase 3

Efficacy Study 801

Announced Positive Phase 3

Efficacy Top–Line Results for Study

801

Last Patient Completion for Safety

Study 802

Pre-NDA Meeting with FDA

in

Q4 2011

Anticipate NDA Submission early in

Q2 2012

Completed Licensing Deal with

DURECT

Anticipate IND Submission in 1H

2012 |

5

1

st

Single Use, Needle-Free,

Commercial Product Marketed

for Treating Acute Migraine and

Cluster Headaches |

6

75%

of

Patients

Are Women

The

9th

Leading Cause

of Disability

in Women Globally

7th

Most Costly Disease

to US Employers

30 Million People in the U.S. Suffer Migraines**

Symptoms and Nature of Episodes Vary Widely

Disabling Headache Pain, 4-72 Hours in Duration

$25 B Annual Estimated Cost to Employers

63% Suffer

1 Attack per

Month

25% Have 1 Attack per

Week 48% Upon Morning Wakening (between 4 -9 am)

29% Reported Vomiting as a Symptom of Migraine Attacks

Treatment Depends on Type of Episode

Migraine Frequency, Severity, Speed of Onset, and Previous

Response to Medication Determine Treatment

25% Have

2 Active Prescriptions

Oral

Triptans

Often

Prescribed

as

1

st

Line

Therapy

Sources:

NHF(2010),

World

Health

Organization

(2000),

Goetzel

et

all,

JOEM

(2004),

International

Headache

Society

(www.ihs-headache.org), Thomson

Medstat (2006), Lipton et al, Neurology (2002), Fox and Davis, Headache (1998),

Lipton et al, Neurology (2001), Boston Healthcare Associates, Inc. (2007) |

7

SUMAVEL DosePro:

A Differentiated Migraine Therapy

COMPLETE

Pain Free

EFFECTIVE

Pain Relief

EASY TO USE

FAST

Pain Relief in as little as

Sources: SUMAVEL DosePro Prescribing Information

minutes

98%

Used SUMAVEL DosePro

During Migraine Attacks

on Their First Try at Home

of Patients Correctly |

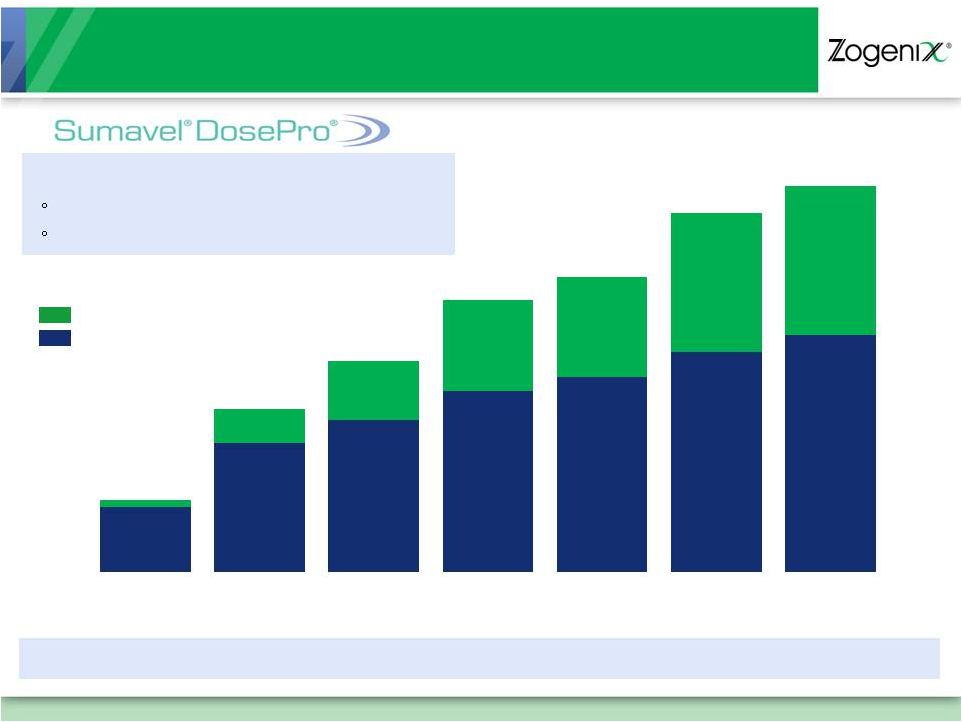

8

Growing Prescriptions Since Launch

$1.9M

Net Sales

$4.2M

Net Sales

$5.7M

Net Sales

$6.8M

Net Sales

$7.5M

Net Sales

$8.7M

Net Sales

Refill Prescriptions

New Prescriptions

*Revenue recognition methodology changed beginning Q3 2011

**Sources:

Wolters

Kluwer

Pharma

Solutions,Source®

PHAST

Prescription

Monthly,

January

2010

-

November

2011,and

Wolters

Kluwer

Pharma

Solutions,

Source®

LaunchTrac,

WE

10/7-WE

12/23

vs

WE 7/8-WE 9/23

$8.8M

Net Sales*

Q/Q Script Growth Rate

127% 29%

29%

8% 22%

6%*

3,207

6,332

7,443

8,872

9,568

10,806

11,549

327

1,674

2,907

4,487

4,910

6,822

7,109

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

~100,000 Total Prescriptions**

38% Refill Rate (3Q 2011)

Total Prescriptions up 15% in first 12 weeks of Q4 2011 vs. first 12 weeks of Q3

2011** January 2010 –

November 2011

8 |

9

Amended SUMAVEL DosePro Co-Promotion Agreement

Astellas agreement will end March 31, 2012

Beginning 2Q 2012, Zogenix will assume full responsibility for the

continued commercialization of the brand

–

Evaluating potential co-promotion partners who could complement the

Zogenix sales force efforts

–

Detailed transition plan to ensure uninterrupted access and service to

physicians within the Astellas segment

–

Astellas to receive tail payments which are estimated to be approximately $3.6

million in July 2013 and $2.1 million in July 2014*

Zogenix expects minimal impact on brand cash flow in 2012

–

Recent growth driven primarily by Zogenix sales force

–

Zogenix’s 95 reps can cover prescribers representing ~85% of the volume unit

demand by adding ~5 new doctors each to sales coverage

–

Lower expenses starting 2Q 2012 due to elimination of Astellas service fee

* These amounts are estimates and actuals will be based on the final sales results

for the 12 months ending March 31, 2012 |

10

SUMAVEL DosePro Growth Drivers

Sales Force Expansion

95 reps calling on neurologists, pain specialists

and high Rx PCPs beginning in 4Q 2011

Evaluating new co-promotion opportunities

to supplement Zogenix U.S. sales team

Migraine Toolbox Launch

Helps patients choose

most

appropriate therapy

Supports updated label on dosing 1 hour

before or after other sumatriptan forms

Supported by published Phase 4 data

Direct-To-Patient Initiatives

WebMD online and print campaign

Real Age e-mail series

Future Product Enhancements

Sound suppression for improved patient

experience

Anticipate sNDA submission of 4mg dose line

extension by end of 2012 |

11

Choosing the Right Tools for Specific Migraine Attacks

SUMAVEL DosePro Migraine

TOOLBOX

A comprehensive new patient starter

kit with relevant product information

for physician, patient and pharmacist,

including a free sample, $15 co-pay

card, carrying case, training material,

support resources, video access

and a migraine journal. |

12

SUMAVEL DosePro Phase IV Study:

Improves Treatment Satisfaction and Patient Confidence*

Improvement in Overall Treatment

Satisfaction versus oral triptans

(p=0.0007)

Substantial Improvement in

Confidence to treat repeated

attacks after using SUMAVEL DosePro

(65% confident/very confident vs.

41% at baseline)

Rapid and sustained pain relief and

freedom from pain

Tolerability of treatment same as

baseline therapy (mainly oral triptans)

* Cady, R. et al (2011) Headache

Study design: >200 patients who were less than very satisfied with current

triptan therapy treated >650 migraine attacks with Sumavel DosePro.

Pre-study triptan use was predominantly oral forms (99% patients) with

only 17% of patients reporting recent experience with injectable sumatriptan.

Pain

Relief

Pain

Free

24 hours

81.3%

72.3%

1 –

24 hour sustained

66.3%

35.4%

Pain Relief %

Pain Free % |

Oral,

Single-Entity (without acetaminophen),

Extended Release Hydrocodone

for Treating Chronic Pain

1

st

13 |

14

Effective 12-hour pain relief without acetaminophen

Single-Entity Hydrocodone,

Multiple Strengths (10-50 mg)

Uses Alkermes’

Proprietary

SODAS Delivery System to

Enhance Hydrocodone

Release Profile

Schedule II product

Allows clinicians to prescribe the RIGHT dose of hydrocodone

by simplifying conversion from IR to ER and

reducing the risk of accidental acetaminophen toxicity

1

st

1

st

Oral, extended-release, single-

entity hydrocodone

Consistent 12-hour pain relief

Improved convenience

and

Acetaminophen-free

hydrocodone product

Reduces risk of liver toxicity

Unrestricted therapeutic dosing

(hydrocodone bitartrate)

compliance |

15

Zohydro in the Marketplace

Large market characterized by dose escalation and opioid rotation

Hydrocodone

is

the

only

opioid

not

currently

available

in

ER

form

and

available

only

in

combination

with

APAP/NSAID;

FDA

advisory

committee

noted

single

hydrocodone would be logical substitute

FDA asked manufacturers to limit acetaminophen to 325 mg in combination products and

will

require

updated

labeling

information

warning

about

the

risk

of

severe

liver

injury

Drug

Sales (M)

IR TRx

Count (M)

ER TRx

Count (M)

% ER

ER Products

Sales

(M)

Oxycodone

$6,823

46.1

6.9

13%

OxyContin (including generics)

$3,645

Morphine

$1,172

1.8

5.6

76%

Avinza, Kadian,

Embeda,

MS Contin + Generic ERs

$1,127

Oxymorphone

$480

0.2

0.8

81%

Opana ER

$394

Hydromorphone

$170

2.5

0.02

1%

Exalgo

$18

Hydrocodone

$3,222

128.3

n/a

n/a

entity

formulation

of

Sources:

Wolters

Kluwer

Pharma

Solutions,

Source

®

PHAST

Institution/Retail,

12

months

ended

December

2010 |

16

Pivotal Phase 3 Efficacy Study (Study 801) Met Endpoints

Significant

difference

in

chronic

pain

relief

(lower

back)

vs.

placebo

(p=0.008)

based on average mean changes in daily pain intensity (Numeric Rating Scale)

Key secondary endpoints support Zohydro efficacy

–

Significantly higher proportion of patients experiencing improvement in pain

relief

from beginning to end of study

–

Significantly improved overall satisfaction (p<0.001)

Safe and generally well tolerated

–

Adverse event profile consistent with approved oral, extended release opioid

products 68

48

31

23

30% improvement

50% improvement

Zohydro

Placebo

p<0.001

p<0.001 |

17

Summary of Safety (Study 801)

Safe and generally well tolerated

–

Adverse event profile consistent with approved oral, extended release opioid

products Overall % of subjects experienced an AE

–

C/T Phase = 33.7%

–

Treatment Phase = 28.8%

Most Commonly reported Adverse Events ( 2%)

–

Constipation

–

Nausea

–

Somnolence

–

Vomiting

–

Diarrhea

–

Insomnia

–

Fatigue

–

Headache

–

Dizziness

–

Dry mouth

< 3% of patients withdrew due to an adverse event

AEs representative of those experienced with other opioid products

Zohydro Phase 3 Trial |

18

Zohydro NDA Submission Expected Early 2Q 2012

More than 1,000 Patients with Chronic Pain Treated with Zohydro

Phase 3 open label safety study (Study 802) completed; fulfills

database requirements for 505(b)(2) NDA

–

300 patients completed six months of exposure

–

100 patients completed 12 months of exposure

All NDA-required Phase 1 clinical trials and toxicology studies

completed

REMS program in preparation to meet ER opioid standards

CMC work with Alkermes on track to support NDA and

commercial scale production from established US manufacturing

facility

Completed Pre-NDA meeting Q4 2011; NDA filing anticipated

early Q2 2012 |

19

Zohydro Key Commercial Events and Goals

Expand Zogenix Sales Team from 95

Reps to ~ 250 Reps to Support Zohydro

Launch and SUMAVEL DosePro

2013

Develop Marketing Communications and Launch Campaign

2012

Physician Advisory Boards

Branding and Market Research

Payer/Pricing Research

APAP data dissemination

2011

95

250 |

20

Relday

(risperidone)

DosePro Needle-Free Delivery System

TM

Once-monthly risperidone

available as a needle-free

subcutaneous injection for

treatment of schizophrenia

1

st |

21

Relday Needle-Free SubQ Injection for Schizophrenia

Proprietary long-acting injection formulation

of risperidone (Durect’s SABER technology)

deliverable by DosePro

Potential Benefits

–

Consistent, sustained drug release over one

month per injection

–

High drug loading facilitates low injection

volume and subcutaneous dosing

–

Prefilled, easy-to-use delivery system, no

reconstitution required

–

No needle

Completed pre-IND

meeting;

505(b)(2) NDA strategy

World-wide marketing rights provide

potential partnering opportunities

2H 2011

IND Enabling Studies

Early 2012

Submit IND to FDA

Begin Human

Clinical Trials

Ex-US Partner with PK

Data -

before Phase 3

Potential to leverage DosePro manufacturing capacity

with volume and lower SUMAVEL DosePro COGs |

22

Relday Addresses Treatment Needs

Long-acting injections reduces the risk of noncompliance compared with

oral treatments

Growing US and EU market for long-acting injectable products -

exceeded $1.5 billion in 2010 (according to industry reports)

–

Risperdal Consta, 100 mg/month >$1000

Highly concentrated market with 13,000 prescribers of long-acting

injectable antipsychotics (US)

Relday is the only product in class that may satisfy all

criteria

highlighted in physician research conducted on our behalf

Attributes from

Physician Research

Risperdal

Consta

(risperidone)

Invega

Sustenna

(paliperidone)

Zyprexa

Relprevv

(olanzapine)

Relday

(risperidone)

1X Monthly

×

Subcutaneous

×

×

×

Needle-Free

×

×

×

Sources:

Goldine;

Wolters

Kluwer

Pharma

Solutions,

Source®

PHAST

Institution/Retail

(January

2010

–

December

2010),

BioStrategies

market

research

study |

23

DosePro Technology:

New CNS Applications and Out Licensing Opportunities

Validated Delivery Option for Additional Medications,

Including Biologics and Small Molecules

DosePro Technology Platform

Internal Development

Injectable CNS Drug

Product Candidates

(RELDAY + TBA Pre-Clinical)

Second Generation

Technology

(1mL device)

Broaden Application

for Biologics

Technology Out Licensing

Enhance, Differentiate

or Extend Injectable

Product Lifecycles

Prototypes of Second Generation DosePro |

24

Large Commercial Opportunities

*Includes Co-Pay Assistance ** Based on current pricing of branded ER

opioids †

Represents net revenue assuming market share equal to 1% of estimated TRx

1.28 Million TRx

$248 Million

†

122,000 TRx

$59 Million

†

48% of Episodes Upon Morning

Wakening (between 4 -9 am)

29% of Sufferers Reported Vomiting as a

Symptom of Migraine Attacks

30% of Patients Fail to Respond

to Oral or Nasal Triptans

Net Revenue/Dose: $69/Unit*

7 Units/TRx

Average TRx Value: $483 Net

1% Triptan TRx Share

128M TRx Hydrocodone only

(~30% for Chronic Use)

(excludes

78M TRx Other ER & IR Opioids) Net Revenue/Day: $7.75**

Average TRx: 25 Days

Average TRx Value: $194 Net

1% Hydrocodone TRx only Share

128 Million TRx per Year

12.2

Million

TRx

per

Year

Patient/

Market

Segments

Prescription

Values

Illustrative

Market Penetration

Sources:

Wolters

Kluwer

Pharma

Solutions,

Source

®

PHAST

Institution/Retail

(12

months

ended

December

2010) |

25

Financial Summary

P&L

9 months ended September 30, 2011

($ Millions)

Financial Highlights

($ Millions)

Revenue

$

29.8

Operating Expense

$

85.5

Loss From Operations

$

55.8

Other (Income)/Loss

$ 4.4

Net Loss

$

60.2

Cash Flow Used In

Operations

$ 64.2

**Sum total may not appear to add due to rounding

Market Capitalization

(January 6, 2012)

~$184m

Cash Balance

At 12/31/11 (unaudited)

$ 56.5m

Debt

At 12/31/11

$30M Royalty Financing

$25M Term Loan

$10M Working Capital Line

-

Balance $5.2M |

26

Continue U.S. Script Growth

Q1 2012 transition of Astellas

segment

Explore new co-promotion

opportunities

Sound Suppression

Improvements

4mg DosePro Line Extension

NDA

Submission

–

early

Q2

2012

Publish Pivotal Data

Explore partnership

Commercial Readiness

Expand Sales Force Upon

Approval

2

nd

Generation 1mL Device

3

rd

New CNS Product

File IND in 1H 2012

Initiate Phase 1 Study

Building on Track Record of

Successful Execution

Planned Goals

SUMAVEL DosePro

Relday

DosePro Technology

Zohydro |