Attached files

Table of Contents

As filed with the Securities and Exchange Commission on January 6, 2012

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Pacific Coast Oil Trust | Pacific Coast Energy Company LP | |

| (Exact Name of co-registrant as specified in its charter) | (Exact Name of co-registrant as specified in its charter) | |

| Delaware | Delaware | |

| (State or other jurisdiction of incorporation or organization) | (State or other jurisdiction of incorporation or organization) | |

| 1311 | 1311 | |

| (Primary Standard Industrial Classification Code Number) | (Primary Standard Industrial Classification Code Number) | |

| 80-6216242 | 20-1241171 | |

| (I.R.S. Employer Identification No.) | (I.R.S. Employer Identification No.) | |

| 919 Congress Avenue, Suite 500 Austin, Texas 78701 (512) 236-6599 |

515 South Flower Street, Suite 4800 Los Angeles, California 90071 (213) 225-5900 Attention: Gregory C. Brown | |

| (Address, including zip code, and telephone number, including area code, of co-registrant’s Principal Executive Offices) |

(Address, including zip code, and telephone number, including area code, of co-registrant’s Principal Executive Offices) | |

| The Bank of New York Mellon Trust Company, N.A., Trustee 919 Congress Avenue, Suite 500 Austin, Texas 78701 (512) 236-6599 Attention: Michael J. Ulrich (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Gregory C. Brown 515 South Flower Street, Suite 4800 Los Angeles, California 90071 (213) 225-5900 (Name, address, including zip code, and telephone number, including area code, of agent for service) | |

Copies to:

| Sean T. Wheeler Steven B. Stokdyk Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

Gerald M. Spedale Baker Botts L.L.P 910 Louisiana, Suite 3200 Houston, Texas 77002 (713) 229-1234 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ | |||||

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Fee | ||

| Units of Beneficial Interest in Pacific Coast Oil Trust |

$345,000,000 | $39,537 | ||

|

| ||||

|

| ||||

| (1) | Includes trust units issuable upon exercise of the underwriters’ option to purchase additional trust units. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o). |

The co-registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the co-registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these in any state where the offer or sale is not permitted.

Subject to Completion, dated January 6, 2012

PROSPECTUS

Trust Units

This is the initial public offering of units of beneficial interest in Pacific Coast Oil Trust, or the “trust.” Pacific Coast Energy Company LP, or “PCEC,” has formed the trust and, immediately prior to the closing of this offering, will convey, or cause to be conveyed, net profits interests in oil properties to the trust in exchange for trust units. PCEC is offering trust units to be sold in this offering and will receive all of the proceeds derived therefrom. After the offering, PCEC will own trust units, or trust units if the underwriters exercise their option to purchase additional trust units from PCEC. No public market currently exists for the trust units. PCEC is a privately held Delaware limited partnership engaged in the production and development of oil and natural gas from properties located onshore in California.

The trust intends to apply to list the trust units on the New York Stock Exchange under the symbol “ROYT.”

PCEC expects that the public offering price will be between $ and $ per trust unit.

The trust units. Trust units are equity securities of the trust and represent undivided beneficial interests in the trust assets. They do not represent any interest in PCEC.

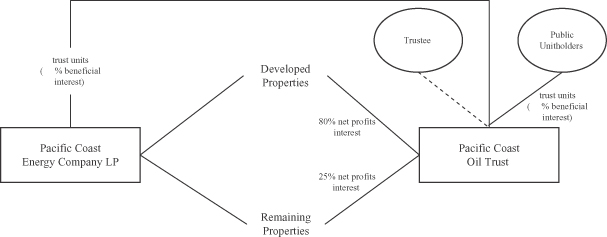

The trust. The trust will own net profits interests in properties held by PCEC in California, which we refer to as the Underlying Properties, as of the date of the conveyances of the net profits interests to the trust. The net profits interests will entitle the trust to receive 80% of the net profits from the sale of oil and natural gas production from proved developed reserves on the Underlying Properties as of September 30, 2011 and 25% of the net profits from the sale of oil and natural gas production from the remaining Underlying Properties. The conveyed interests are referred to as the “Net Profits Interests.”

The trust unitholders. As a trust unitholder, you will receive monthly cash distributions from the proceeds that the trust receives from PCEC pursuant to the Net Profits Interests. The trust’s ability to pay monthly cash distributions will depend on its receipt of net profits attributable to the Net Profits Interests, which net profits will depend on, among other things, volumes produced, wellhead prices, price differentials, production and development costs, potential reductions or suspensions of production, and the amount and timing of trust administrative expenses.

Investing in the trust units involves a high degree of risk. Please read “Risk Factors” beginning on page 16 of this prospectus.

| Per Trust Unit | Total | |||||||

| Price to the public |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to PCEC, before expenses |

$ | $ | ||||||

| (1) | Excludes a structuring fee of % of the gross proceeds of the offering payable to Barclays Capital Inc. by PCEC for the evaluation, analysis and structuring of the trust. |

PCEC has granted the underwriters an option to purchase up to an additional trust units from it on the same terms and conditions set forth above if the underwriters sell more than trust units in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Barclays Capital, on behalf of the underwriters, expects to deliver the trust units on or about , 2012.

Barclays Capital

Prospectus dated , 2012

Table of Contents

| 1 | ||||

| 16 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 48 | ||||

| 66 | ||||

| 70 | ||||

| 75 | ||||

| 78 | ||||

| 80 | ||||

| 87 | ||||

| 88 | ||||

| 89 | ||||

| 90 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 97 | ||||

| INDEX TO FINANCIAL STATEMENTS OF PACIFIC COAST OIL TRUST |

F-1 | |||

| PCEC -1 | ||||

| INDEX TO FINANCIAL STATEMENTS OF PACIFIC COAST ENERGY COMPANY LP |

PCEC F-1 | |||

| SUMMARY OF RESERVE REPORT OF PACIFIC COAST ENERGY COMPANY LP AS OF SEPTEMBER 30, 2011 |

ANNEX A-1 | |||

| SUMMARY OF RESERVE REPORT OF PACIFIC COAST ENERGY COMPANY LP AS OF DECEMBER 31, 2010 |

ANNEX B-1 | |||

| SUMMARY OF RESERVE REPORT OF PACIFIC COAST OIL TRUST AS OF SEPTEMBER 30, 2011 |

ANNEX C-1 |

Important Notice About Information in This Prospectus

PCEC and the trust have not, and the underwriters have not, authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell or a solicitation of an offer to buy the trust units in any jurisdiction where such offer and sale would be unlawful. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this document. The business, financial condition, results of operations and prospects of PCEC and the trust may have changed since such date.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. To understand this offering fully, you should read the entire prospectus carefully, including the risk factors, the summary reserve reports and the financial statements and notes to those statements. Unless otherwise indicated, all information in this prospectus assumes (a) an initial public offering price of $ per trust unit and (b) no exercise of the underwriters’ option to purchase additional trust units.

Unless otherwise indicated, as used in this prospectus, (i) “PCEC” refers to Pacific Coast Energy Company LP and its subsidiaries, including any predecessor entities of PCEC, (ii) the “Underlying Properties” refers to the Orcutt properties located onshore in the Santa Maria Basin and the East Coyote, Sawtelle and West Pico properties located onshore in the Los Angeles Basin held by PCEC and (iii) “proved developed reserves” refers to proved developed producing and proved developed non-producing reserves, as such terms are defined by the Securities and Exchange Commission, or the “SEC.”

References in this prospectus to future production from, or future reserves or revenues attributable to, PCEC’s East Coyote and Sawtelle properties assume that PCEC’s average working interest in such properties increases from approximately 5.0% to approximately 37.6% in April 2012 after certain payout milestones are achieved. We refer to this increase in PCEC’s interest as the East Coyote and Sawtelle Reversion. However, references in this prospectus to historical production, reserves or revenues do not give effect to the East Coyote and Sawtelle Reversion. Please read “Risk Factors—A delay in the East Coyote and Sawtelle Reversion will result in lower distributions to unitholders than those projected, which would continue until the reversion occurs.”

Netherland, Sewell & Associates, Inc., referred to in this prospectus as “Netherland Sewell,” an independent engineering firm, provided the estimates of proved oil and natural gas reserves as of December 31, 2010 and September 30, 2011 included in this prospectus. These estimates are contained in summaries prepared by Netherland Sewell of its reserve reports as of December 31, 2010 and September 30, 2011 for the Underlying Properties held by PCEC and the Net Profits Interests (as defined below) held by the trust. These summaries are located at the back of this prospectus in Annexes A, B and C and are collectively referred to in this prospectus as the “reserve reports.” You will find definitions for terms relating to the oil and natural gas business in “Glossary of Certain Oil and Natural Gas Terms.”

Pacific Coast Oil Trust

Pacific Coast Oil Trust is a Delaware statutory trust formed by PCEC in January 2012 to own net profits interests in the Underlying Properties. The net profits interests, which we refer to as the “Net Profits Interests,” will entitle the trust to receive:

| • | 80% of the net profits from the sale of oil and natural gas production from proved developed reserves on the Underlying Properties as of September 30, 2011, which we refer to as the “Developed Properties”; and |

| • | 25% of the net profits from the sale of oil and natural gas production from the remaining Underlying Properties, which we refer to as the “Remaining Properties.” |

Net profits payable to the trust will depend on production quantities, sales prices of oil and natural gas and costs to develop and produce the oil and natural gas. If at any time costs should exceed gross proceeds, neither the trust nor the trust unitholders would be liable for the excess costs. However, the trust would not receive any net profits until future net profits exceed the total of those excess costs, plus interest. The trust calculates the net profits from the Underlying Properties separately for the Developed Properties and the Remaining Properties. Any excess costs for either the Developed Properties or the Remaining Properties will not reduce net profits calculated for the other. Please read “Computation of Net Profits.”

1

Table of Contents

The trust will make monthly cash distributions of all of its monthly cash receipts, after deduction of fees and expenses for the administration of the trust, to holders of its trust units as of the applicable record date (generally the last business day of each calendar month) on or before the 10th business day after the record date. The Net Profits Interests will be entitled to a share of the profits from and after April 1, 2012 attributable to production from the Underlying Properties from and after April 1, 2012. The trust is not subject to any pre-set termination provisions based on a maximum volume of oil or natural gas to be produced or the passage of time.

The Underlying Properties are located in California in the Santa Maria and Los Angeles Basins. PCEC operated approximately 98% of the average daily production from the Underlying Properties for the month ended September 30, 2011. The Underlying Properties held approximately 33.3 MMBoe in proved reserves as of September 30, 2011, which were approximately 98% oil and 61% proved developed. The Underlying Properties produced approximately 3,391 Boe/d from 265 producing wells for the month ended September 30, 2011. The following table summarizes certain information regarding the proved reserves and production associated with the Underlying Properties as of and for the periods indicated. The reserve reports were prepared by Netherland Sewell in accordance with criteria established by the SEC. For information regarding proved reserves and production related to the Net Profits Interests, please read “The Underlying Properties.”

| Underlying Properties | ||||||||||||||||||||||||||

| Properties |

PCEC Operated | Average Daily Net Production for Month Ended September 30, 2011 (Boe/d) |

Producing Wells |

Proved Reserves as of September 30, 2011(1) |

R/P Ratio as of September 30, 2011(3) |

|||||||||||||||||||||

| Total (MBoe)(2) |

% Oil | % Proved Developed Reserves |

||||||||||||||||||||||||

| Orcutt, Conventional |

2004 – Present | 1,957 | 123 | 11,351 | 100 | % | 100 | % | 16.0 | |||||||||||||||||

| West Pico(4) |

1993 – Present | 721 | 39 | 3,758 | 85 | % | 66 | % | 16.2 | |||||||||||||||||

| Orcutt, Diatomite |

2005 – Present | 649 | 46 | 15,289 | 100 | % | 24 | % | 68.6 | |||||||||||||||||

| East Coyote |

1999 – Present | 23 | 46 | 1,636 | 100 | % | 100 | % | 200.8 | |||||||||||||||||

| Sawtelle |

1993 – Present | 41 | 11 | 1,247 | 98 | % | 100 | % | 78.7 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

3,391 | 265 | 33,281 | 98 | % | 61 | % | 28.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | In accordance with the rules and regulations promulgated by the SEC, the proved reserves presented above were determined using the twelve month unweighted arithmetic average of the first-day-of-the-month price for the period from October 1, 2010 through September 30, 2011, without giving effect to any hedge transactions, and were held constant for the life of the properties. This yielded a price for oil of $94.29 per Bbl and a price for natural gas of $4.16 per MMBtu. |

| (2) | Oil equivalents in the table are the sum of the Bbls of oil and the Boe of the stated Mcfs of natural gas, calculated on the basis that six Mcfs of natural gas are the energy equivalent of one Bbl of oil. |

| (3) | The R/P ratio, or the reserves-to-production ratio, is a measure of the number of years that a specified reserve base could support a fixed amount of production. This ratio is calculated by dividing total estimated proved reserves of the subject properties at the end of a period by annual total production for the prior twelve months. Because production rates naturally decline over time, the R/P ratio is not a useful estimate of how long properties should economically produce. |

| (4) | The West Pico property consists of the West Pico Unit and includes three wells owned by the Stocker JV (a joint venture between PCEC and Plains Exploration & Production Company, or “PXP”). |

Underlying Properties

The Underlying Properties are located onshore in California in the Santa Maria and Los Angeles Basins, both of which are characterized by long producing histories.

2

Table of Contents

The Santa Maria Basin is one of California’s largest and longest producing oil regions. The Santa Maria Basin has produced over one billion Bbls of oil since its discovery in 1901 and is characterized by oilfields with long production histories. PCEC produces oil and natural gas from its Orcutt properties in the Santa Maria Basin. Currently, a majority of production in the Orcutt oilfield is produced from formations utilizing conventional production methods. Beginning in the 1990s, companies in California began to focus on the development of the Diatomite formations, a typically shallow zone. The Orcutt Diatomite formation lies approximately 100 to 900 feet below the surface and is produced by utilizing cyclic steam injection. PCEC utilizes primarily water flooding to produce oil from its conventional Orcutt properties, and since 2005, has utilized cyclic steam injection to produce oil from the Diatomite formation in its Orcutt properties.

Similar to the Santa Maria Basin, the Los Angeles Basin is characterized by its mature oilfields with long production histories. The Los Angeles Basin has produced more than nine billion Bbls of oil since its discovery in 1892. Within the Los Angeles Basin, PCEC produces oil and natural gas from its conventional West Pico, East Coyote and Sawtelle properties.

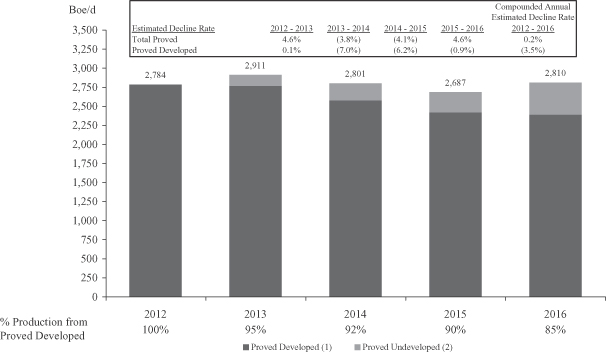

The following graph shows estimated average daily production and decline rates of total proved reserves attributable to 80% of proved developed reserves and 25% of proved undeveloped reserves based on the pricing and other assumptions set forth in the reserve report for the Underlying Properties. This graph presents the total proved volumes and decline rates as reflected in the reserve report broken down by two reserve categories (proved developed and proved undeveloped reserves) as of September 30, 2011. This graph does not reflect any probable or possible reserves.

| (1) | Represents 80% of sales volumes from the proved developed reserves as of September 30, 2011. |

| (2) | Represents 25% of sales volumes from the proved undeveloped reserves as of September 30, 2011. |

3

Table of Contents

Key Investment Considerations

The following are some key investment considerations related to the Underlying Properties, the Net Profits Interests and the trust units:

| • | Mature, primarily oil asset base with predictable production and long lived reserves. The Underlying Properties consist primarily of oil reserves and prospects in multiple geologic horizons in mature oilfields located onshore in California. As of September 30, 2011, proved reserves were comprised of approximately 98% oil. Long producing histories in the Santa Maria and Los Angeles Basins provide for well established production profiles and increased certainty of production estimates. |

| • | Substantial proved developed oil reserves. Proved developed reserves are generally considered the most valuable and lowest risk category of reserves. As of September 30, 2011, approximately 61% of the volumes of the proved reserves associated with the Underlying Properties and 84% of the volumes of the proved reserves associated with the trust were attributed to proved developed reserves. As of September 30, 2011, the Underlying Properties had a proved reserves to production ratio of 28.0 years and proved developed reserves to production ratio of 17.2 years. |

| • | Significant resource base and original oil in place with considerable development opportunities. PCEC believes that the Underlying Properties are likely to offer economic development opportunities in the future that are not reflected in existing proved reserves and could significantly increase future reserves and production. The fields within the Underlying Properties were estimated to hold approximately 1.6 billion Bbls of original oil in place, or “OOIP.” The Diatomite formation in PCEC’s Orcutt properties offers significant development opportunities for the Underlying Properties. PCEC expects to implement several projects starting in 2012 to increase production from the Underlying Properties. These projects include developing in the near term 38 wells in the Diatomite formation. Further projects may include permitting and drilling additional Diatomite wells in areas not currently developed. In addition to these projects, future increases in estimated oil recovery factors in the Santa Maria and Los Angeles Basins may significantly increase reserves and production. Such increases in recovery factors may occur through, among other means, technological advances, implementation of additional enhanced recovery techniques, infill drilling and production outperformance. |

| • | Significant percentage of operated properties. PCEC owned a majority working interest in, and operated approximately 98% of the average daily production from, the Underlying Properties for the month ended September 30, 2011. This high level of operational control allows PCEC to use its technical and operational expertise to manage overhead, production and drilling costs and capital expenditures and to control the timing and amount of discretionary expenditures for exploration, exploitation and development activities. PCEC is not under any obligation to drill in order to hold leases since 100% of the properties are already held by production or owned in fee. In addition, PCEC’s management team has managed the operations of the Underlying Properties for an average of twelve years. |

| • | High operating margins provide strong cash flow profile. The Underlying Properties have historically generated substantial operating margins. Lease operating expenses and property and other taxes related to the Underlying Properties averaged $33.06 per Boe for the nine months ended September 30, 2011. During the same period, the averaged realized sales price for oil and natural gas (excluding the effects of hedges) averaged $87.51 per Boe, providing an operating margin of $54.45 per Boe, or 62%. |

| • | Initial downside crude oil price protection with long-term direct exposure to oil prices. To mitigate the negative effects of a possible decline in oil prices on distributable income to the trust, PCEC intends to enter into commodity derivative contracts with respect to 50% to 70% of expected oil production for 2012 and 2013 from the proved developed reserves attributable to the Underlying Properties in the reserve report. These commodity derivative contracts may include a combination of puts, swaps, and collars to mitigate the risk of price declines to the trust, while still allowing the trust to benefit from increases in oil prices. |

4

Table of Contents

| • | Alignment of interests between PCEC and the trust unitholders. Immediately following the closing of this offering, PCEC will have an effective ownership of approximately % of the net profits attributable to the sale of oil and natural gas produced from the Underlying Properties, including its retained 20% net profits interest in the Developed Properties, its retained 75% net profits interest in the Remaining Properties and its ownership of approximately % of the trust units. By having a material, direct economic interest in the Underlying Properties, PCEC is incentivized to deploy capital on projects where it is likely to successfully increase production or reserves at attractive returns. PCEC expects to maintain a strong financial position, including a borrowing base credit facility, which will allow it and the trust to capitalize on future projects on the Underlying Properties. |

Formation Transactions

At or prior to the closing of this offering, the following transactions, which are referred to herein as the “Formation Transactions,” will occur:

| • | PCEC will convey, or cause to be conveyed, to the trust the Net Profits Interests effective as of April 1, 2012 in exchange for trust units in the aggregate, representing all of the outstanding trust units of the trust. |

| • | PCEC will sell trust units offered hereby, representing an % interest in the trust. PCEC will also make available during the 30-day option period up to trust units for the underwriters to purchase at the initial offering price to cover over-allotments. PCEC intends to use the proceeds of the offering as disclosed under “Use of Proceeds.” |

| • | PCEC and the trust will enter into an administrative services agreement that will define the services PCEC will provide to the trust on an ongoing basis as well as its compensation. Please read “The Trust.” |

Structure of the Trust

The following chart shows the relationship of PCEC, the trust and the public trust unitholders after the closing of this offering.

5

Table of Contents

Risk Factors

An investment in the trust units involves risks associated with fluctuations in commodity prices, the operation of the Underlying Properties, certain regulatory and legal matters, the structure of the trust and the tax characteristics of the trust units. Please read carefully the risks described under “Risk Factors” on page 16 of this prospectus.

| • | Prices of oil and natural gas fluctuate, and changes in prices could reduce proceeds to the trust and cash distributions to trust unitholders. |

| • | Estimates of future cash distributions to trust unitholders are based on assumptions that are inherently subjective. |

| • | Actual reserves and future production may be less than current estimates, which could reduce cash distributions by the trust and the value of the trust units. |

| • | A delay in the East Coyote and Sawtelle Reversion will result in lower distributions to unitholders than those projected, which would continue until the reversion occurs. |

| • | Developing oil and natural gas wells and producing oil and natural gas are costly and high-risk activities with many uncertainties that could adversely affect future production from the Underlying Properties. Any delays, reductions or cancellations in development and producing activities could decrease revenues that are available for distribution to trust unitholders. |

| • | The trust is passive in nature and neither the trust nor the trust unitholders will have any ability to influence PCEC or control the operations or development of the Underlying Properties. |

| • | Shortages of equipment, services and qualified personnel could increase costs of developing and operating the Underlying Properties and result in a reduction in the amount of cash available for distribution to the trust unitholders. |

| • | The trust units may lose value as a result of title deficiencies with respect to the Underlying Properties. |

| • | PCEC may transfer all or a portion of the Underlying Properties at any time without trust unitholder consent. |

| • | PCEC may be unable to successfully renegotiate its administrative services agreement with BreitBurn Management LLC, a wholly owned subsidiary of BreitBurn Energy Partners L.P., or “BBEP,” which failure would require PCEC to hire its own management and other employees. |

| • | The reserves attributable to the Underlying Properties are depleting assets and production from those reserves may diminish over time. Furthermore, the trust is precluded from acquiring other oil and natural gas properties or net profits interests to replace the depleting assets and production. Therefore, proceeds to the trust and cash distributions to trust unitholders may decrease over time. |

| • | A change in crude oil price differentials may adversely impact the cash distributions available to trust unitholders. |

| • | The amount of cash available for distribution by the trust will be reduced by the amount of any costs and expenses related to the Underlying Properties and other costs and expenses incurred by the trust. |

| • | The generation of profits for distribution by the trust depends in part on access to and operation of gathering, transportation and processing facilities. Any limitation in the availability of those facilities could interfere with sales of oil and natural gas production from the Underlying Properties. |

6

Table of Contents

| • | ConocoPhillips purchases a significant percentage of PCEC’s production, and a decision by ConocoPhillips to discontinue or reduce its purchases of PCEC’s production may adversely impact the cash distributions available to trust unitholders. |

| • | The trustee must, under certain circumstances, sell the Net Profits Interests and dissolve the trust prior to the expected termination of the trust. As a result, trust unitholders may not recover their investment. |

| • | PCEC may sell trust units in the public or private markets, and such sales could have an adverse impact on the trading price of the trust units. |

| • | There has been no public market for the trust units, and accordingly the value after this offering may differ from the price in the offering. |

| • | The trading price for the trust units may not reflect the value of the Net Profits Interests held by the trust, which would adversely affect the return on an investment in the units. |

| • | Conflicts of interest could arise between PCEC and its affiliates, on the one hand, and the trust and the trust unitholders, on the other hand, which could harm the business or financial results of the trust. |

| • | The trust is managed by a trustee who cannot be replaced except by a majority vote of the trust unitholders at a special meeting, which may make it difficult for trust unitholders to remove or replace the trustee. |

| • | Trust unitholders have limited ability to enforce provisions of the conveyances creating the Net Profits Interests, and PCEC’s liability to the trust is limited. |

| • | Courts outside of Delaware may not recognize the limited liability of the trust unitholders provided under Delaware law. |

| • | The operations of the Underlying Properties are subject to environmental laws and regulations that could adversely affect the cost, manner or feasibility of conducting operations on them or result in significant costs and liabilities, which could reduce the amount of cash available for distribution to trust unitholders. |

| • | The operations of the Underlying Properties are subject to complex federal, state, local and other laws and regulations that could adversely affect the cost, manner or feasibility of conducting operations on them or expose the operator to significant liabilities, which could reduce the amount of cash available for distribution to trust unitholders. |

| • | Climate change laws and regulations restricting emissions of “greenhouse gases” could result in increased operating costs and reduced demand for the oil and natural gas that PCEC produces while the physical effects of climate change could disrupt their production and cause it to incur significant costs in preparing for or responding to those effects. |

| • | Recent regulatory changes in California have and may continue to negatively impact PCEC’s production in its Diatomite properties. |

| • | The bankruptcy of PCEC or any third party operator could impede the operation of wells and the development of the proved undeveloped reserves. |

| • | Due to the trust’s lack of industry and geographic diversification, adverse developments in California could adversely impact the results of operations and cash flows of the Underlying Properties and reduce the amount of cash available for distributions to trust unitholders. |

7

Table of Contents

| • | The receipt of payments by PCEC based on any commodity derivative contract will depend upon the financial position of the commodity derivative contract counterparties. A default by any commodity derivative contract counterparties could reduce the amount of cash available for distribution to the trust unitholders. |

| • | The trust has not requested a ruling from the Internal Revenue Service, or the “IRS,” regarding the tax treatment of the trust. If the IRS were to determine (and be sustained in that determination) that the trust is not a “grantor trust” for federal income tax purposes, the trust could be subject to more complex and costly tax reporting requirements that could reduce the amount of cash available for distribution to trust unitholders. |

| • | Certain U.S. federal income tax preferences currently available with respect to oil and natural gas production may be eliminated as a result of future legislation. |

| • | You will be required to pay taxes on your share of the trust’s income even if you do not receive any cash distributions from the trust. |

| • | A portion of any tax gain on the disposition of the trust units could be taxed as ordinary income. |

| • | The trust will allocate its items of income, gain, loss and deduction between transferors and transferees of the trust units each month based upon the ownership of the trust units on the monthly record date, instead of on the basis of the date a particular trust unit is transferred. The IRS may challenge this treatment, which could change the allocation of items of income, gain, loss and deduction among the trust unitholders. |

| • | As a result of investing in trust units, you may become subject to state and local taxes and return filing requirements in California. |

Summary Historical, Unaudited and Pro Forma Financial, Operating and Reserve Data of PCEC

The summary historical audited financial data of PCEC as of December 31, 2010 and 2009 and for the two-year period ended December 31, 2010 and the period from August 26, 2008 to December 31, 2008 have been derived from PCEC’s audited financial statements. The summary historical audited financial data for the period from January 1, 2008 to August 25, 2008 has been derived from PCEC’s predecessor’s audited financial statements. The summary historical unaudited interim financial data of PCEC as of September 30, 2011 and 2010 and for the nine-month periods ended September 30, 2011 and 2010 have been derived from PCEC’s unaudited interim financial statements. The unaudited interim financial statements were prepared on a basis consistent with the audited statements and, in the opinion of PCEC’s management, include all adjustments (consisting only of normal recurring adjustments) necessary to state fairly the results of PCEC for the periods presented.

The summary unaudited pro forma financial data as of and for the nine months ended September 30, 2011 and for the year ended December 31, 2010 has been derived from the unaudited pro forma financial statements of PCEC included elsewhere in this prospectus. The pro forma data has been prepared as if the conveyances of the Net Profits Interests and the offer and sale of the trust units and application of the net proceeds therefrom had taken place (i) on September 30, 2011, in the case of the pro forma balance sheet information as of September 30, 2011, and (ii) as of January 1, 2010, in the case of the pro forma statements of earnings for the nine months ended September 30, 2011 and for the year ended December 31, 2010. The summary historical, unaudited and pro forma financial, operating and reserve data presented below should be read in conjunction with “Pacific Coast Energy Company LP—Selected Historical, Unaudited and Pro Forma Financial Data of PCEC,” “Information About Pacific Coast Energy Company LP—Management’s Discussion and Analysis of Financial Condition and Results of Operations of PCEC” and the accompanying financial statements and related notes of PCEC included elsewhere in this prospectus.

8

Table of Contents

Summary Historical, Unaudited and Pro Forma Financial Data of PCEC

| PCEC Pro Forma for the Offering (Including the Conveyances of the Net Profits Interests) |

PCEC | Predecessor | ||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2011 |

Year Ended December 31, 2010 |

Nine Months Ended September 30, |

Year Ended December 31, |

August 26 to December 31, 2008 |

January 1 to August 25, 2008 |

|||||||||||||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | |||||||||||||||||||||||||||||||

| (In thousands) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||||||||||||||||

| Total revenues and other income |

$ | 106,370 | $ | 62,805 | $ | 114,756 | $ | 61,737 | $ | 62,805 | $ | 6,478 | $ | 166,934 | $ | 61,472 | ||||||||||||||||||

| Net income (loss) |

$ | 59,677 | $ | (307 | ) | $ | 57,012 | $ | 1,697 | $ | (18,810 | ) | $ | (90,980 | ) | $ | 135,842 | $ | 25,063 | |||||||||||||||

| Total assets (at period end) |

$ | 484,047 | $ | 428,072 | $ | 406,795 | $ | 393,315 | $ | 398,245 | $ | 509,405 | $ | 221,675 | ||||||||||||||||||||

| Total debt(1) (at period end) |

$ | — | $ | 124,000 | $ | 135,000 | $ | 142,000 | $ | 133,000 | $ | 155,500 | $ | 13,500 | ||||||||||||||||||||

| Partners’ equity (at period end) |

$ | 447,953 | $ | 267,978 | $ | 244,999 | $ | 211,445 | $ | 230,742 | $ | 322,125 | $ | 171,726 | ||||||||||||||||||||

| (1) | As of September 30, 2011, PCEC had $94.0 million of borrowings under its senior secured credit agreement that is classified as short-term debt. |

Operating and Reserves Data of PCEC

The following table provides the oil and natural gas sales volumes, average sales prices, average costs per Boe and capital expenditures for PCEC for the nine months ended September 30, 2011 and 2010 and for the years ended December 31, 2010, 2009 and 2008 and reserves and production data for PCEC as of September 30, 2011 and December 31, 2010, 2009 and 2008.

| Nine Months

Ended September 30, |

Year Ended December 31, | |||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | Combined 2008 | ||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Operating Data: |

||||||||||||||||||||

| Sales volumes: |

||||||||||||||||||||

| Oil (MBbls) |

869 | 817 | 1,086 | 1,240 | 947 | |||||||||||||||

| Natural gas (MMcf) |

212 | 207 | 259 | 305 | 315 | |||||||||||||||

| Total sales (MBoe) |

905 | 851 | 1,129 | 1,291 | 999 | |||||||||||||||

| Average sales prices: |

||||||||||||||||||||

| Oil (per Bbl) |

$ | 90.14 | $ | 68.07 | $ | 69.99 | $ | 53.22 | $ | 86.57 | ||||||||||

| Natural gas (per Mcf) |

3.87 | 3.70 | 3.45 | 2.72 | 7.22 | |||||||||||||||

| Average costs per Boe: |

||||||||||||||||||||

| Lease operating expenses |

$ | 30.89 | $ | 28.90 | $ | 29.37 | $ | 27.02 | $ | 33.12 | ||||||||||

| Production and other taxes |

2.17 | 1.67 | 2.08 | 2.92 | 1.81 | |||||||||||||||

| Capital expenditures (in thousands): |

||||||||||||||||||||

| Property development costs |

$ | 20,576 | $ | 29,992 | $ | 44,000 | $ | 15,852 | $ | 28,291 | ||||||||||

| Proved reserves (at period end): |

||||||||||||||||||||

| Proved developed (MBoe) |

20,392 | 17,462 | 11,566 | 6,442 | ||||||||||||||||

| Proved undeveloped (MBoe) |

12,889 | 1,847 | 1,276 | 440 | ||||||||||||||||

| Total proved reserves (MBoe) |

33,281 | 19,309 | 12,842 | 6,882 | ||||||||||||||||

| Production (MBoe) |

905 | 851 | 1,129 | 1,291 | 999 | |||||||||||||||

9

Table of Contents

Unaudited Pro Forma Distributable Income of the Trust

The table below outlines the calculation of pro forma distributable income from the Net Profits Interests for the nine months ended September 30, 2011 and for the year ended December 31, 2010 based on the excess of revenues over direct operating expenses attributable to the Net Profits Interests for the nine months ended September 30, 2011 and for the year ended December 31, 2010 as if the contemplated Formation Transactions had occurred on January 1, 2010. The table below should be read in conjunction with the unaudited pro forma financial information of the trust included elsewhere in this prospectus. The pro forma amounts below do not purport to present distributable income of the trust had the Formation Transactions contemplated actually occurred on January 1, 2010. Distributable income of the trust will be calculated using a modified cash basis of accounting. Please refer to the unaudited pro forma financial information for the trust included elsewhere in this prospectus for more information. As a result, you should view the amount of unaudited pro forma distributable income only as a general indication of the amount of cash available for distribution by the trust for the nine months ended September 30, 2011 and for the year ended December 31, 2010.

| Nine Months Ended September 30, 2011 |

Year Ended December 31, 2010 |

|||||||

| (In thousands, except per unit data) | ||||||||

| (Unaudited) | (Unaudited) | |||||||

| Oil and gas revenues |

$ | 79,155 | $ | 76,898 | ||||

| Direct operating expenses |

28,906 | 34,260 | ||||||

|

|

|

|

|

|||||

| Excess of revenues over direct operating expenses |

$ | 50,249 | $ | 42,638 | ||||

| Less development expenses |

(20,576 | ) | (44,000 | ) | ||||

|

|

|

|

|

|||||

| Excess (deficiency) of revenues over direct operating expenses and development expenses |

$ | 29,673 | $ | (1,362 | ) | |||

| Times Net Profits Interests(1) |

80 | % | 80 | % | ||||

|

|

|

|

|

|||||

| Income (loss) from Net Profits Interests |

23,738 | (1,090 | ) | |||||

| Less PCEC operating and services fee |

(724 | ) | (903 | ) | ||||

| Reimbursement of excess costs from prior periods(2) |

(2,049 | ) | — | |||||

|

|

|

|

|

|||||

| Income (excess cost) from Net Profits Interests |

$ | 20,965 | $ | (1,993 | ) | |||

|

|

|

|

|

|||||

| Pro forma adjustments: |

||||||||

| Less trust general and administrative expenses |

(638 | ) | (850 | ) | ||||

|

|

|

|

|

|||||

| Cash available for distribution by the trust |

$ | 20,327 | $ | (2,843 | ) | |||

|

|

|

|

|

|||||

| Cash distribution per trust unit |

$ | $ | ||||||

|

|

|

|

|

|||||

| (1) | Includes no revenues or expenses attributable to the Remaining Properties. |

| (2) | The net profits relating to the Developed Properties was a negative amount for the year ended December 31, 2010. The trust is not liable to the owners of the Underlying Properties, PCEC or any other operator for such negative amounts. However, when the net profits relating to the Developed Properties or the Remaining Properties for any computation period is a negative amount, such negative amount plus accrued interest will be deducted from gross proceeds for the Developed Properties or Remaining Properties, as the case may be, in the following computation period for purposes of determining the net profits relating to such properties for the following computation period. Please read “Computation of Net Profits — Net Profits Interests.” |

10

Table of Contents

Summary Projected Cash Distributions

The following table presents a calculation of forecasted cash distributions to holders of trust units who own the trust units as of the record date for the distribution payable in June 2012 and continue to own trust units through the record date for the distribution payable in May 2013 and was prepared by PCEC based on the assumptions that are described below and in “Projected Cash Distributions—Significant Assumptions Used to Prepare the Projected Cash Distributions.” The trust expects to make its first distribution to unitholders in June 2012, which distribution will cover the proceeds attributable to the Net Profits Interests for April 2012.

PCEC does not as a matter of course make public projections as to future sales, earnings or other results. However, the management of PCEC has prepared the projected financial information set forth below to present the projected cash distributions to the holders of the trust units based on the estimates and hypothetical assumptions described below. The accompanying projected financial information was not prepared with a view toward complying with the published guidelines of the SEC or guidelines established by the American Institute of Certified Public Accountants with respect to projected financial information. More specifically, such information omits items that are not relevant to the trust. Neither PricewaterhouseCoopers LLP nor any other independent accountants have examined, compiled or performed any procedures with respect to the accompanying projected financial information and, accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto. The reports of PricewaterhouseCoopers LLP included in this prospectus relate to the trust, PCEC and PCEC’s predecessor historical financial information. They do not extend to the projected financial information and should not be read to do so.

In the view of PCEC’s management, the accompanying unaudited projected financial information was prepared on a reasonable basis and reflects the best currently available estimates and judgments of PCEC related to oil and natural gas production, operating expenses and development expenses, settlement of commodity derivative contracts and other general and administrative expenses based on:

| • | the oil and natural gas production estimates for the twelve months ending March 31, 2013 contained in the reserve reports; |

| • | estimated direct operating expenses and development expenses for the twelve months ending March 31, 2013 contained in the reserve reports; |

| • | projected payments made or received pursuant to the commodity derivative contracts for the twelve months ending March 31, 2013; |

| • | estimated trust general and administrative expenses of $850,000 for the twelve months ending March 31, 2013; and |

| • | an operating and services fee of approximately $1,027,000 for the Developed Properties payable to PCEC for the twelve months ending March 31, 2013. |

The projected financial information was based on the hypothetical assumption that prices for oil and natural gas remain constant at $103.00 per Bbl of oil (WTI) and $3.50 per MMBtu of natural gas (Henry Hub) during the twelve-month projection period. Actual prices paid for oil and natural gas expected to be produced from the Underlying Properties during the twelve months ending March 31, 2013 will likely differ from these hypothetical prices due to fluctuations in the prices generally experienced with respect to the production of oil and natural gas and variations in basis differentials. For the twelve months ending March 31, 2013, the monthly average forward NYMEX crude oil (WTI) price per Bbl was approximately $102.07 and the monthly average forward NYMEX natural gas (Henry Hub) price per MMBtu was approximately $3.45.

Please read “Projected Cash Distributions—Significant Assumptions Used to Prepare the Projected Cash Distributions,” “Risk Factors—Prices of oil and natural gas fluctuate, and changes in prices could reduce proceeds to the trust and cash distributions to trust unitholders” and “Risk Factors—A delay in the East Coyote and Sawtelle Reversion will result in lower distributions to unitholders than those projected, which would continue until the reversion occurs.”

11

Table of Contents

The projections and estimates and the hypothetical assumptions on which they are based are subject to significant uncertainties, many of which are beyond the control of PCEC or the trust. Actual cash distributions to trust unitholders, therefore, could vary significantly based upon events or conditions occurring that are different from the events or conditions assumed to occur for purposes of these projections. Cash distributions to trust unitholders will be particularly sensitive to fluctuations in oil and natural gas prices. Please read “Risk Factors—Prices of oil and natural gas fluctuate, and changes in prices could reduce proceeds to the trust and cash distributions to trust unitholders.” As a result of typical production declines for oil and natural gas properties, production estimates generally decrease from year to year, and the projected cash distributions shown in the table below are not necessarily indicative of distributions for future years. Please read “Projected Cash Distributions—Sensitivity of Projected Cash Distributions to Oil Production and Prices,” which shows projected effects on cash distributions from hypothetical changes in oil production and prices. Because payments to the trust will be generated by depleting assets and the trust has a finite life with the production from the Underlying Properties diminishing over time, a portion of each distribution will represent, in effect, a return of your original investment. Please read “Risk Factors—The reserves attributable to the Underlying Properties are depleting assets and production from those reserves may diminish over time. Furthermore, the trust is precluded from acquiring other oil and natural gas properties or net profits interests to replace the depleting assets and production. Therefore, proceeds to the trust and cash distributions to trust unitholders may decrease over time.”

The following table presents a calculation of forecasted cash distributions to holders of trust units for the twelve months ending May 31, 2013, which was prepared by PCEC based on the assumptions that are described in “Projected Cash Distributions—Significant Assumptions Used to Prepare the Projected Cash Distributions.” The following table represents amounts associated with the Developed Properties for the projection period but does not include amounts associated with the Remaining Properties because the costs and development expenses associated with such properties exceed revenues associated with such properties for the projection period.

| Projected Cash Distributions to Trust Unitholders |

Projections for the Twelve Months Ending May 31, 2013 |

|||

| (In thousands, except per unit data) |

||||

| Underlying Properties sales volumes, net to the trust(1): |

||||

| Oil (MBbl) |

995.3 | |||

| Natural gas (MMcf) |

189.6 | |||

|

|

|

|||

| Total sales (MBoe) |

1,026.9 | |||

| Daily production (Boe) |

2,813.3 | |||

| Commodity prices(2): |

||||

| Oil (per Bbl) |

$ | 103.00 | ||

| Natural gas (per MMBtu) |

$ | 3.50 | ||

| Assumed realized sales prices(3): |

||||

| Oil (per Bbl) |

$ | 97.31 | ||

| Natural gas (per Mcf) |

$ | 2.85 | ||

| Net profits, net to the trust: |

||||

| Gross profits(4): |

||||

| Oil sales |

$ | 96,853 | ||

| Natural gas sales |

540 | |||

|

|

|

|||

| Total |

$ | 97,393 | ||

| Costs, net to the trust(5): |

||||

| Direct operating expenses: |

||||

| Lease operating expenses |

$ | 29,204 | ||

| Production and other taxes |

3,200 | |||

| Development expenses(6) |

5,470 | |||

|

|

|

|||

| Total |

$ | 37,874 | ||

| Settlement of commodity derivative contracts, net to the trust(7) |

— | |||

| PCEC operating and services fee(8) |

(1,027 | ) | ||

|

|

|

|||

| Net profits to trust from Net Profits Interests |

$ | 58,492 | ||

| Trust general and administrative expenses(9) |

(850 | ) | ||

|

|

|

|||

| Cash available for distribution by the trust |

$ | 57,642 | ||

|

|

|

|||

| Cash distribution per trust unit (assumes units) |

$ | |||

|

|

|

|||

12

Table of Contents

| (1) | Sales volumes net to the trust include 80% of sales volumes from the Developed Properties contained in the reserve report for the Underlying Properties. |

| (2) | For a description of the effect of lower crude oil prices on projected cash distributions, please read “Projected Cash Distributions—Sensitivity of Projected Cash Distributions to Oil Production and Prices.” |

| (3) | Sales price net of forecasted gravity, quality, transportation, gathering and processing and marketing costs. For more information about the estimates and hypothetical assumptions made in preparing the table above, please read “Projected Cash Distributions—Significant Assumptions Used to Prepare the Projected Cash Distributions.” |

| (4) | Represents “gross profits” as described in “Computation of Net Profits.” |

| (5) | Costs net to the trust include 80% of costs from the Developed Properties contained in the reserve report for the Underlying Properties. |

| (6) | Total development expenses expected to be allocated to the Net Profits Interests for the twelve months ending May 31, 2013 are $12.5 million, of which $7.0 million relates to the Remaining Properties. |

| (7) | Reflects net cash impact of settlements of commodity derivative contracts relating to production. Please read “The Underlying Properties—Commodity Derivative Contracts.” |

| (8) | The PCEC operating and services fee relating to production from the Developed Properties will be charged monthly in an amount equal to $1.00 per Boe of production, which fee will change on an annual basis commencing on April 1, 2013, based on changes to the United States Consumer Price Index, or “CPI.” |

| (9) | Total general and administrative expenses of the trust on an annualized basis for the twelve months ending May 31, 2013 are expected to be $850,000 and will include the annual fees to the trustees, accounting fees, engineering fees, legal fees, printing costs and other expenses properly chargeable to the trust. |

Pacific Coast Energy Company LP

PCEC is a privately held Delaware limited partnership formed on June 15, 2004 as BreitBurn Energy Company, L.P. to engage in the production and development of oil and natural gas from properties located in California. As of December 31, 2010, PCEC held interests in approximately 265 gross (204 net) producing wells, and had proved reserves of approximately 33.3 MMBoe.

After giving pro forma effect to the conveyances of the Net Profits Interests to the trust, the offering of the trust units contemplated by this prospectus and the application of the net proceeds as described in “Use of Proceeds,” as of September 30, 2011, PCEC would have had total assets of $484.0 million and total liabilities of $36.1 million. For an explanation of the pro forma adjustments, please read “Financial Statements of Pacific Coast Energy Company LP—Unaudited Pro Forma Financial Statements—Introduction.”

The address of PCEC is 515 South Flower Street, Suite 4800, Los Angeles, California 90071, and its telephone number is (213) 225-5900.

13

Table of Contents

The Offering

| Trust units offered by PCEC |

trust units, or trust units if the underwriters exercise their option to purchase additional trust units in full |

| Trust units owned by PCEC after the offering |

trust units, or trust units if the underwriters exercise their option to purchase additional trust units in full |

| Trust units outstanding after the offering |

trust units |

| Use of proceeds |

PCEC is offering all of the trust units to be sold in this offering, including the trust units to be sold upon any exercise of the underwriters’ option to purchase additional trust units. The estimated net proceeds of this offering to be received by PCEC will be approximately $ million, after deducting underwriting discounts and commissions, structuring fees and expenses, and $ million if the underwriters exercise their option to purchase additional trust units in full. PCEC intends to use the net proceeds from this offering, including any proceeds from the exercise of the underwriters’ option to purchase additional trust units, to repay amounts outstanding under its senior secured credit agreement and second lien credit agreement, to make a distribution of approximately $ million to the equity owners of PCEC and for general corporate purposes. PCEC is deemed to be an underwriter with respect to the trust units offered hereby. Please read “Use of Proceeds.” |

| Proposed NYSE symbol |

“ROYT” |

| Monthly cash distributions |

The trust will pay monthly distributions to the holders of trust units as of the applicable record date (generally the last business day of each calendar month) on or before the 10th business day after the record date. The first distribution from the trust to the trust unitholders will be made on or about June 15, 2012 to trust unitholders owning trust units on or about May 31, 2012. |

| Actual cash distributions to the trust unitholders will fluctuate monthly based upon the quantity of oil and natural gas produced from the Underlying Properties, the prices received for oil and natural gas production, costs to develop and produce the oil and natural gas and other factors. Because payments to the trust will be generated by depleting assets with the production from the Underlying Properties diminishing over time, a portion of each distribution will represent, in effect, a return of your original investment. Oil and natural gas production from proved reserves attributable to the Underlying Properties may decline over time. Please read “Risk Factors.” |

14

Table of Contents

If at any time costs should exceed gross proceeds, neither the trust nor the trust unitholders would be liable for the excess costs. However, the trust would not receive any net profits until future net profits exceed the total of those excess costs, plus interest. The trust calculates the net profits from the Underlying Properties separately for the Developed Properties and the Remaining Properties. Any excess costs for either the Developed Properties or the Remaining Properties will not reduce net profits calculated for the other.

| Dissolution of the trust |

The trust will dissolve upon the earliest to occur of the following: (1) the trust, upon approval of the holders of at least 75% of the outstanding trust units, sells the Net Profits Interests, (2) the annual cash available for distribution to the trust is less than $2.0 million for each of any two consecutive years, (3) the holders of at least 75% of the outstanding trust units vote in favor of dissolution or (4) the trust is judicially dissolved. |

| Estimated ratio of taxable income to distributions |

PCEC estimates that a trust unitholder who owns the trust units purchased in this offering through the record date for distributions for the month ending December 31, 2014, will recognize, on a cumulative basis, an amount of federal taxable income for that period of approximately % of the cash distributed to such trust unitholder with respect to that period. Please read “United States Federal Income Tax Considerations—Direct Taxation of Trust Unitholders” for the basis of this estimate. |

| Summary of income tax consequences |

Trust unitholders will be taxed directly on the income from assets of the trust. PCEC and the trust intend to treat the Net Profits Interests, which will be granted to the trust on a perpetual basis, as mineral royalty interests that generate ordinary income subject to depletion for U.S. federal income tax purposes. Please read “United States Federal Income Tax Considerations.” |

15

Table of Contents

Prices of oil and natural gas fluctuate, and changes in prices could reduce proceeds to the trust and cash distributions to trust unitholders.

The trust’s reserves and monthly cash distributions are highly dependent upon the prices realized from the sale of oil and natural gas. Prices of oil and natural gas can fluctuate widely in response to a variety of factors that are beyond the control of the trust and PCEC. These factors include, among others:

| • | regional, domestic and foreign supply and perceptions of supply of oil and natural gas; |

| • | the level of demand and perceptions of demand for oil and natural gas; |

| • | political conditions or hostilities in oil and natural gas producing countries; |

| • | anticipated future prices of oil and natural gas and other commodities; |

| • | weather conditions and seasonal trends; |

| • | technological advances affecting energy consumption and energy supply; |

| • | U.S. and worldwide economic conditions; |

| • | the price and availability of alternative fuels; |

| • | the proximity, capacity, cost and availability of gathering and transportation facilities; |

| • | the volatility and uncertainty of regional pricing differentials; |

| • | governmental regulations and taxation; |

| • | energy conservation and environmental measures; |

| • | level and effect of trading in commodity futures markets, including by commodity price speculators; and |

| • | acts of force majeure. |

Crude oil prices declined from record high levels in early July 2008 of over $140 per Bbl to below $45 per Bbl in February 2009. In November 2011, crude oil prices ranged from $92.19 per Bbl to $102.59 per Bbl. Natural gas prices declined from over $13.57 per MMBtu in July 2008 to below $3.30 per MMBtu in October 2010. In November 2011, natural gas prices ranged from $2.84 per MMBtu to $3.55 per MMBtu.

Changes in the prices of oil and natural gas may reduce profits to which the trust is entitled and may ultimately reduce the amount of oil and natural gas that is economic to produce from the Underlying Properties. As a result, PCEC could determine during periods of low commodity prices to shut in or curtail production from wells on the Underlying Properties. In addition, PCEC or any third party operator could determine during periods of low commodity prices to plug and abandon marginal wells that otherwise may have been allowed to continue to produce for a longer period under conditions of higher prices. Specifically, PCEC or any third party operator may abandon any well or property if it reasonably believes that the well or property can no longer produce oil or natural gas in commercially paying quantities. This could result in termination of the Net Profits Interests relating to the abandoned well or property.

The Underlying Properties are sensitive to decreasing commodity prices. The commodity price sensitivity is due to a variety of factors that vary from well to well, including the costs associated with water handling and disposal, chemicals, surface equipment maintenance, downhole casing repairs and reservoir pressure maintenance activities that are necessary to maintain production. As a result, a decrease in commodity prices may cause the expenses of certain wells to exceed the well’s revenue. If this scenario were to occur, PCEC or any third party operator may decide to shut-in the well or plug and abandon the well. This scenario could reduce future cash distributions to trust unitholders. In addition, PCEC is also sensitive to increasing natural gas prices at its Orcutt properties, where it consumes natural gas in connection with its production of oil. Accordingly, at

16

Table of Contents

times when PCEC is a net buyer of natural gas, increases in the price of natural gas may reduce proceeds from production from PCEC’s Orcutt Diatomite properties and could reduce future cash distributions to trust unitholders.

PCEC intends to enter into commodity derivative contracts with respect to 50% to 70% of expected production of oil for 2012 and 2013 from the proved developed reserves attributable to the Underlying Properties in the reserve reports. The commodity derivative contracts are intended to reduce exposure of the revenues from oil production from the Underlying Properties to fluctuations in oil prices and to achieve more predictable cash flow. Some of the commodity derivative contracts could limit the benefit to the trust of any increase in oil prices through 2013. The trust will be required to bear its share of the hedge payments regardless of whether the corresponding quantities of oil are produced or sold. Furthermore, PCEC does not intend to enter into any commodity derivative contracts affecting the trust relating to oil volumes expected to be produced after 2013, and the terms of the conveyances of the Net Profits Interests will prohibit PCEC from entering into new hedging arrangements burdening the trust following the completion of this offering. As a result, the amount of the cash distributions will be subject to a greater fluctuation after 2013 due to changes in oil prices. For a discussion of the commodity derivative contracts, please read “The Underlying Properties—Commodity Derivative Contracts.”

Estimates of future cash distributions to trust unitholders are based on assumptions that are inherently subjective.

The projected cash distributions to trust unitholders for the twelve months ending May 31, 2013 contained elsewhere in this prospectus are based on PCEC’s calculations, and PCEC has not received an opinion or report on such calculations from any independent accountants or engineers. Such calculations are based on assumptions about drilling, production, crude oil and natural gas prices, hedging activities, development expenses, and other matters that are inherently uncertain and are subject to significant business, economic, financial, legal, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those estimated. In particular, these estimates have assumed that crude oil and natural gas production is sold in 2012 and 2013 based on assumed NYMEX prices of $103.00 per Bbl in the case of crude oil and $3.50 per MMBtu in the case of natural gas. However, actual sales prices may be significantly lower. Additionally, these estimates assume the Underlying Properties will achieve production volumes set forth in the reserve reports; however, actual production volumes may be significantly lower. If prices or production are lower than expected, the amount of cash available for distribution to trust unitholders would be reduced.

Actual reserves and future production may be less than current estimates, which could reduce cash distributions by the trust and the value of the trust units.

The value of the trust units and the amount of future cash distributions to the trust unitholders will depend upon, among other things, the accuracy of the reserves and future production estimated to be attributable to the trust’s interest in the Underlying Properties. Please read “The Underlying Properties—Reserve Reports” for a discussion of the method of allocating proved reserves to the Underlying Properties and the Net Profits Interests. It is not possible to measure underground accumulations of oil and natural gas in an exact way, and estimating reserves is inherently uncertain. Ultimately, actual production and revenues for the Underlying Properties could vary both positively and negatively and in material amounts from estimates. Furthermore, direct operating expenses and development expenses relating to the Underlying Properties could be substantially higher than current estimates. Petroleum engineers are required to make subjective estimates of underground accumulations of oil and natural gas based on factors and assumptions that include:

| • | historical production from the area compared with production rates from other producing areas; |

| • | oil and natural gas prices, production levels, Btu content, production expenses, transportation costs, severance and excise taxes and development expenses; and |

| • | the assumed effect of expected governmental regulation and future tax rates. |

17

Table of Contents

Changes in these assumptions and amounts of actual direct operating expenses and development expenses could materially decrease reserve estimates. In addition, the quantities of recovered reserves attributable to the Underlying Properties may decrease in the future as a result of future decreases in the price of oil or natural gas.

A delay in the East Coyote and Sawtelle Reversion will result in lower distributions to unitholders than those projected, which would continue until the reversion occurs.

The projected cash distributions to trust unitholders and the reserve reports each assume that PCEC’s working interests in the East Coyote and Sawtelle properties will increase in April 2012. PCEC currently holds an average working interest of approximately 5.0% in the East Coyote and Sawtelle properties. PCEC holds a reversionary interest in both of these fields, and its average working interest will increase to approximately 37.6% once certain payment milestones are achieved, which PCEC expects to occur in April 2012. At this time, PCEC’s share of production from its East Coyote and Sawtelle properties is 23 and 41 Boe/d, respectively, and would increase to 186 and 152 Boe/d, respectively, following the East Coyote and Sawtelle Reversion. Delays in the timing of the East Coyote and Sawtelle Reversion could be caused by, among other things, production issues and decreases in the price of oil and natural gas, and hence the timing of the reversion is beyond PCEC’s control.

Developing oil and natural gas wells and producing oil and natural gas are costly and high-risk activities with many uncertainties that could adversely affect future production from the Underlying Properties. Any delays, reductions or cancellations in development and producing activities could decrease revenues that are available for distribution to trust unitholders.

The process of developing oil and natural gas wells and producing oil and natural gas on the Underlying Properties is subject to numerous risks beyond the trust’s or PCEC’s control, including risks that could delay PCEC’s or other third party operators’ current drilling or production schedule and the risk that drilling will not result in commercially viable oil or natural gas production. PCEC is not obligated to undertake any development activities, and, as a result, any drilling or completion activities will be subject to the reasonable discretion of PCEC. The ability of PCEC or any third party operator to carry out operations or to finance planned development expenses could be materially and adversely affected by any factor that may curtail, delay, reduce or cancel development and production, including:

| • | delays imposed by or resulting from compliance with regulatory requirements, including permitting; |

| • | unusual or unexpected geological formations; |

| • | shortages of or delays in obtaining equipment and qualified personnel; |

| • | lack of available gathering facilities or delays in construction of gathering facilities; |

| • | lack of available capacity on interconnecting transmission pipelines; |

| • | equipment malfunctions, failures or accidents; |

| • | unexpected operational events and drilling conditions; |

| • | reductions in oil or natural gas prices; |

| • | market limitations for oil or natural gas; |

| • | pipe or cement failures; |

| • | casing collapses; |

| • | lost or damaged drilling and service tools; |

| • | loss of drilling fluid circulation; |

| • | uncontrollable flows of oil and natural gas, insert gas, water or drilling fluids; |

| • | fires and natural disasters; |

| • | environmental hazards, such as oil and natural gas leaks, pipeline ruptures and discharges of toxic gases; |

18

Table of Contents

| • | adverse weather conditions; and |

| • | oil or natural gas property title problems. |

In the event that planned operations, including drilling of development wells, are delayed or cancelled, or existing wells or development wells have lower than anticipated production due to one or more of the factors above or for any other reason, estimated future distributions to trust unitholders may be reduced. In the event PCEC or any third party operator incurs increased costs due to one or more of the above factors or for any other reason and is not able to recover such costs from insurance, the estimated future distributions to trust unitholders may be reduced.

The trust is passive in nature and neither the trust nor the trust unitholders will have any ability to influence PCEC or control the operations or development of the Underlying Properties.

The trust units are a passive investment that entitle the trust unitholder to only receive cash distributions from the Net Profits Interests and commodity derivative contracts being conveyed to the trust. Trust unitholders have no voting rights with respect to PCEC and, therefore, will have no managerial, contractual or other ability to influence PCEC’s activities or the operations of the Underlying Properties. PCEC operated approximately 98% of the average daily production from the Underlying Properties for the month ended September 30, 2011 and is generally responsible for making all decisions relating to drilling activities, sale of production, compliance with regulatory requirements and other matters that affect such properties. Accordingly, PCEC may take actions that are in its own interests that may be different from the interests of the trust.

Shortages of equipment, services and qualified personnel could increase costs of developing and operating the Underlying Properties and result in a reduction in the amount of cash available for distribution to the trust unitholders.

The demand for qualified and experienced personnel to conduct field operations, geologists, geophysicists, engineers and other professionals in the oil and natural gas industry can fluctuate significantly, often in correlation with oil and natural gas prices, causing periodic shortages. Historically, there have been shortages of drilling rigs and other equipment as demand for rigs and equipment has increased along with the number of wells being drilled. These factors also cause significant increases in costs for equipment, services and personnel. Higher oil and natural gas prices generally stimulate demand and result in increased prices for drilling rigs, crews and associated supplies, equipment and services. Shortages of field personnel and equipment or price increases could hinder the ability of PCEC or any third party operator to conduct the operations which it currently has planned for the Underlying Properties, which would reduce the amount of cash received by the trust and available for distribution to the trust unitholders.

The trust units may lose value as a result of title deficiencies with respect to the Underlying Properties.

The existence of a material title deficiency with respect to the Underlying Properties could reduce the value of a property or render it worthless, thus adversely affecting the Net Profits Interests and the distributions to trust unitholders. PCEC does not obtain title insurance covering mineral leaseholds, and PCEC’s failure to cure any title defects may cause PCEC to lose its rights to production from the Underlying Properties. In the event of any such material title problem, profits available for distribution to trust unitholders and the value of the trust units may be reduced.

PCEC may transfer all or a portion of the Underlying Properties at any time without trust unitholder consent.