Attached files

Exhibit 99.5

NORTHERN GRAPHITE CORPORATION

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2010

June 28, 2011

TABLE OF CONTENTS

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

1 | |

| MARKET AND INDUSTRY DATA |

1 | |

| GENERAL MATTERS |

1 | |

| CORPORATE STRUCTURE |

2 | |

| DESCRIPTION OF THE BUSINESS |

2 | |

| GENERAL DEVELOPMENT OF THE BUSINESS |

3 | |

| THE GRAPHITE INDUSTRY |

6 | |

| THE BISSETT CREEK PROJECT |

10 | |

| DIVIDENDS |

29 | |

| DESCRIPTION OF CAPITAL STRUCTURE |

29 | |

| PRICE RANGE AND TRADING VOLUME OF SHARES |

30 | |

| PRIOR SALES OF SHARES |

30 | |

| ESCROWED SECURITIES |

31 | |

| DIRECTORS AND OFFICERS |

32 | |

| PROMOTERS |

38 | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

38 | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

39 | |

| REGISTRAR AND TRANSFER AGENTS |

39 | |

| MATERIAL CONTRACTS |

39 | |

| INTERESTS OF EXPERTS |

39 | |

| RISK FACTORS |

39 | |

| ADDITIONAL INFORMATION |

44 | |

| SCHEDULE “A” – CHARTER OF THE AUDIT COMMITTEE |

45 | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Information Form contains “forward-looking statements” which reflect management’s expectations regarding the Corporation’s future growth, results of operations, performance and business prospects and opportunities. Such forward-looking statements may include, but are not limited to, statements with respect to the future financial or operating performance of the Corporation and its projects, the future price of graphite or other metal prices, the estimation of mineral resources, the timing and amount of estimated future production, costs of production, capital, operating and exploration expenditures, costs and timing of the development of new deposits, costs and timing of future exploration, requirements for additional capital, government regulation of mining operations, environmental risks, reclamation expenses, title disputes or claims, limitations of insurance coverage and the timing and possible outcome of regulatory matters. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others: general business, economic, competitive, political and social uncertainties; the actual results of current exploration activities; conclusions of economic evaluations; fluctuations in currency exchange rates; changes in project parameters as plans continue to be refined; changes in labor costs or other costs of production; future prices of graphite or other industrial mineral prices; possible variations of mineral grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labor disputes and other risks of the mining industry, including but not limited to environmental hazards, cave-ins, pit-wall failures, flooding, rock bursts and other acts of God or unfavorable operating conditions and losses; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; actual results of reclamation activities, and the factors discussed in the section entitled “Risk Factors” in this Annual Information Form. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this Annual Information Form and the Corporation disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

MARKET AND INDUSTRY DATA

This Annual Information Form includes market and industry data that has been obtained from third party sources, including industry publications, as well as industry data prepared by management on the basis of its knowledge of and experience in the industry in which the Corporation operates (including management’s estimates and assumptions relating to such industry based on that knowledge). Management’s knowledge of such industry has been developed through its experience and participation in such industry. Although management believes such information to be reliable, the Corporation has not independently verified any of the data from third party sources referred to in this Annual Information Form or ascertained the underlying economic assumptions relied upon by such sources. Furthermore, references in this Annual Information Form to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this Annual Information Form.

GENERAL MATTERS

Unless otherwise indicated, all amounts herein are stated in Canadian dollars ($). Unless otherwise specified, the information contained in this Annual Information Form is presented as at December 31, 2010.

CORPORATE STRUCTURE

Name and Incorporation

Northern Graphite Corporation (“Northern” or the “Corporation”) was incorporated on February 25, 2002 under the Business Corporations Act (Ontario) as “Industrial Minerals Canada Inc.” Pursuant to articles of amendment dated March 1, 2010, the Corporation changed its name to “Northern Graphite Corporation” and subdivided its then outstanding common shares. Pursuant to articles of amendment dated August 10, 2010, the Corporation amended its articles to remove certain private company restrictions and cumulative voting provisions.

The registered office of the Corporation is located at Suite 800, Wildeboer Dellelce Place, 365 Bay Street, Toronto, Ontario, M5H 2V1. The head office of the Corporation is located at Suite 201, 290 Picton Avenue, Ottawa, Ontario, K1Z 8P8.

Intercorporate Relationships

The Corporation has no subsidiaries.

DESCRIPTION OF THE BUSINESS

Northern is a mineral exploration and development company which holds a 100% interest in the Bissett Creek graphite project (the “Bissett Creek Project”). The Bissett Creek Project presently consists of Ontario mining lease number 106693, covering 564.6 hectares (the “Mining Lease”), which together with various unpatented mining claims, covers approximately 2,989 hectares (the “Mining Claims”), all contiguous to one another and located in the United Townships of Head, Clara and Maria, in the County of Renfrew, Province of Ontario. The Mining Lease was originally granted to a predecessor lessee by the Province of Ontario in 1993 with a twenty-one year term and annual rental payments payable to the Ontario Ministry of Northern Development, Mines and Forestry (the “MNDM”) in an amount prescribed by the Mining Act (Ontario). The Mining Claims principally consist of six unpatented mining claims numbered 1192304, 1192305, 1192306, 1192307, 4200145 and 4200146 covering approximately 624 hectares held by the Corporation since between 2006 and 2009. The Mining Claims also include another thirteen (13) unpatented mining claims recently staked by the Corporation covering approximately 1,800 hectares. The well explored area remains less than 100 hectares.

The principal business being carried on by the Corporation is the exploration and potential development of the Bissett Creek Project. The Corporation has no other properties or rights to acquire other properties. The Corporation is working towards the completion of a bankable feasibility study on the Bissett Creek Project, which is expected to be completed in November 2011, which will include metallurgical testing and a new resource estimate based on recent drilling, and through the environmental and mine permitting process for the Bissett Creek Project, which is expected to be completed during the first quarter of 2012. The Corporation intends to be in a position to make a construction decision on the Bissett Creek Project following these events, subject positive results of the feasibility study, the receipt of all required permits and regulatory approvals and the availability of financing. Northern owns sufficient ground rights for the development of the Bissett Creek Project. Operational permits and environmental authorization certificates are required for the mining of the open pit but it is expected that these approvals will be obtained normally when needed.

The Bissett Creek Project is subject to a royalty of $20 per tonne of graphite concentrate produced from the Bissett Creek Project and a 2.5% NSR on any other minerals or metals produced from the Bissett Creek Project, both of which are payable to the original prospectors who identified and staked the Bissett Creek Project. An annual advance royalty of $27,000 is payable in two equal instalments on March 15 and September 15 of each year, which will be credited against the royalty in respect of graphite concentrate produced from the Bissett Creek Project.

The Corporation has negotiated employment contracts with Gregory Bowes, Chief Executive Officer, and Stephen Thompson, Chief Financial Officer, that are effective as of May 1, 2011. Up until this date, the Corporation had no employees. Donald Baxter, President, provides his services as an independent contractor. In addition, the Corporation retains consultants to assist in its operations on an as-needed basis.

2

GENERAL DEVELOPMENT OF THE BUSINESS

History

Until March 1, 2010, the Corporation was a wholly-owned subsidiary of Industrial Minerals, Inc. (“Industrial Minerals”), a corporation incorporated under the laws of Delaware which is quoted on the over-the-counter bulletin board in the United States (OTC-BB: IDSM) and is a reporting issuer in the Province of British Columbia. Industrial Minerals acquired the Mining Lease and a number of associated mining claims in 2002 and assigned them to the Corporation in 2003. The original mining claims subsequently expired and the Corporation re-staked the unpatented mining claims numbered 1192304, 1192305, 1192306, 1192307, 4200145 and 4200146 forming part of the Mining Claims, which cover essentially the same area.

The Corporation filed a mine closure plan with the MNDM in 2004, the acceptance of which by the MNDM authorized Northern to proceed with the construction of a mine and processing plant on the Bissett Creek Project property. A small processing plant, based on a dry recovery process, was constructed and a very small amount of material was mined. However, the performance of the dry process was unsatisfactory, commercial operation was never achieved, and the Bissett Creek Project was put on a care and maintenance basis in 2005.

In May 2007, Industrial Minerals retained SGS Canada Inc., formerly and then named Systèmes Geostat International Inc. (“SGS”), to prepare a NI 43-101 compliant technical report on the Bissett Creek Project, including a preliminary assessment. Industrial Minerals received the completed technical report from SGS in December 2007 and intended at that time to proceed with additional exploration drilling, pilot plant testing and preparation of a feasibility study on the Bissett Creek Project. However, due to Industrial Minerals’ lack of financial resources this work was not accomplished and the report prepared by SGS was not filed with securities regulators.

In 2010 SGS updated their 2007 work and produced a technical report (the “Technical Report”) entitled “Technical Report Preliminary Economic Assessment on the Bissett Creek Graphite Property of Industrial Minerals, Inc. & Northern Graphite Corporation” dated July 16, 2010 and revised February 2, 2011. It was prepared by Gilbert Rousseau P.Eng and Claude Duplessis P.Eng of SGS, each of whom is an independent Qualified Person pursuant to National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Prospective investors should be aware that certain historical technical disclosure regarding the Bissett Creek Project by Industrial Minerals did not comply with NI 43-101 and should not be relied upon. Prospective investors should rely only on the information contained in this Annual Information Form and the Technical Report.

Between March 2007 and June 2008, Industrial Minerals experienced a number of changes in directors and management as it attempted to develop and execute a strategy for the exploration and development of the Bissett Creek Project. Eventually, these changes resulted in Gregory Bowes joining the Board of Industrial Minerals on June 23, 2008 as an independent director. Mr. Bowes was also made a director of the Corporation on July 9, 2008.

In October 2008, Industrial Minerals, under the direction of its newly reorganized management and Board of Directors, engaged RBC Capital Markets as financial advisor with respect to strategic options facing the company, including raising financing for the continued exploration and development of the Bissett Creek Project, the potential sale of Industrial Minerals or the Bissett Creek Project or an alternative merger or strategic transaction. Industrial Minerals was unable to secure financing or another transaction, particularly given the market and economic conditions which arose in the fall of 2008, and the agreement with RBC Capital Markets was terminated in June 2009.

Faced with the lack of prospects for the exploration and development of the Bissett Creek Project through Industrial Minerals, the management and Board of Directors of Industrial Minerals determined that the best prospects for the continued exploration and development of the Bissett Creek Project would be through the Corporation independently seeking its own financing and pursuing a going public transaction in Canada. Mr. Bowes was appointed as the President and Chief Executive Officer of the Corporation effective May 1, 2009 with the objective of executing upon this strategy.

3

On October 27, 2009, Northern entered into a letter of intent to effect a business combination with Rattlesnake Ventures Inc. (“RVI”) which would have constituted the Qualifying Transaction of RVI, a Capital Pool Company, and would have resulted in the Corporation becoming publicly listed on the TSXV. In conjunction with the proposed RVI transaction, the Corporation also signed an engagement letter with Research Capital Corporation to complete, on a best efforts basis, a financing for the Corporation consisting of up to $3,000,000 in subscription receipts at a price of $0.50 per subscription receipt and $3,000,000 in flow-through common shares at a price of $0.50 per share. Each subscription receipt was, subject to the satisfaction of certain conditions, convertible into one unit consisting of one common share and one half of one common share purchase warrant of the Corporation. These transactions were not completed and the agreements with RVI and Research Capital Corporation were subsequently terminated in February 2010.

In order to obtain working capital so that the Corporation could pay certain debts and continue to seek additional financing, the Corporation issued $600,000 in non-interest bearing senior secured convertible notes (the “Notes”) in November 2009 and January 2010. The Notes were automatically converted into units of the Corporation effective March 10, 2010 in accordance with their terms upon the Corporation having completed financings for proceeds of not less than $1,000,000 as described below, at a 30% discount to the financing price.

On March 1, 2010, the Corporation changed its name to “Northern Graphite Corporation” and subdivided its then outstanding common shares to result in Industrial Minerals owning 11,750,000 common shares.

In March 2010, the Corporation completed non-brokered private placements pursuant to which it issued an aggregate of 7,327,000 units at a price of $0.25 per unit for gross proceeds of $1,831,750, each unit consisting of one common share and one share purchase warrant exercisable to acquire one common share at an exercise price of $0.35 for a period of 18 months from the date upon which the Corporation or its successor becomes a reporting issuer in a jurisdiction of Canada which has been determined as October 7, 2012.

As a result of Northern having raised proceeds of more than $1,000,000 under the private placements, the Notes were converted effective March 10, 2010 into 3,428,571 units, each unit consisting of one common share and one share purchase warrant exercisable to acquire one common share at an exercise price of $0.245 for a period of 18 months from the date upon which the Corporation or its successor becomes a reporting issuer in a jurisdiction of Canada which has been determined as October 7, 2012.

In March 2010, the Corporation also issued 400,000 units, with the same terms as the units issued under the private placements, as part of debt settlement agreements with three creditors. The Corporation also issued 31,354 common shares in June 2010 to settle two additional claims.

The net proceeds from the issuance of the Notes and the private placements of the Corporation enabled Northern to complete a 2,900 meter drilling program and commence a pre-feasibility study, metallurgical testing and the environmental and mine permitting process for the Bissett Creek Project.

In the Technical Report, SGS updated the preliminary assessment it initially prepared in December 2007, and SGS was also engaged to complete the pre-feasibility study, which would include a new resource estimate based on recent drilling. The Corporation expected that the pre-feasibility study would be finished in the third quarter of 2011. As part of this process, SGS would complete a new set of metallurgical tests to confirm previous results and also to examine the potential to produce saleable by-products and value added graphite products for specialty markets.

In July 2010, the Corporation commenced a 2,500 metre drill program on the Bissett Creek Project with the objectives of upgrading Inferred Resources to Indicated Resources, confirming results of historical drilling, and expanding the resource to demonstrate the potential to significantly increase production in the future if warranted by graphite demand. On May 16, 2011, the Corporation announced the results of its 2010 drilling program on the Bissett Creek Project. A total of 51 holes were drilled, totalling 2,927 meters of drilling. All 51 holes intersected widespread graphite mineralization, with 50 of the 51 holes containing widths and grades similar to those within the current resource model. As a result, the deposit was significantly enlarged and remains open to the north and to the east.

4

The current resource estimate on the Bissett Creek Project is based on approximately 8,400m of drilling in 242 holes completed during the 1980s. Six confirmation holes were drilled in 2007 and the current program included 13 additional twin and infill holes to further confirm previous results and support the calculation of a proven and probable reserve in the pre-feasibility study. The drill program was also designed to upgrade the existing resource such that the pre-feasibility study can include a new resource estimate based on this more recent drilling and evaluate the economics of a 20 year operation based on Indicated Resources only.

The graphitic gneiss unit which hosts the Bissett Creek deposit outcrops at surface in a band that is approximately one kilometre wide and three kilometres in strike, and dips to the east at approximately 20 degrees. Drilling to date and the planned open pit from the Technical Report only cover the southern portion of the graphitic unit.

The Corporation has also engaged Knight Piesold Consulting to define and complete all environmental and engineering studies required to file a closure plan amendment for the Bissett Creek Project and to prepare and submit all permit applications required to initiate construction and mining. This process includes community and First Nations consulting.

During the course of the Corporation’s reorganization, on August 18, 2009, Industrial Minerals was advised by the British Columbia Securities Commission (the “BCSC”) that the BCSC had issued a cease trade order against it for failure to file a NI 43-101 compliant technical report in connection with the November 2007 announcement by Industrial Minerals of a Mineral Resource estimate and the results of a preliminary assessment for the Bissett Creek Project and subsequent similar disclosure. Industrial Minerals had been designated a reporting issuer in British Columbia by the BCSC pursuant to British Columbia Instrument 51-509 – Issuers Quoted in the U.S. Over-the-Counter Markets (“BCI 51-509”) on September 15, 2008. The technical report had been completed and Industrial Minerals’ disclosure was consistent with it, but the report was not filed with the BCSC due to the financial difficulties being experienced by Industrial Minerals. In October 2010, Industrial Minerals applied to revoke the cease trade order of the BCSC. On March 10, 2011, the BCSC issued a full revocation of the cease trade order. In connection with the revocation application, Industrial Minerals and the Corporation filed the revised version of the Technical Report dated February 2, 2011. Mr. Bowes, who has remained a director of Industrial Minerals, took over as Chief Executive Officer and Chief Financial Officer of Industrial Minerals on May 10, 2010 following the resignation of Robert Dinning from such offices. Industrial Minerals intends to eventually cease being a reporting issuer in British Columbia under BCI 51-509.

Recent Developments

On January 7, 2011 Industrial Minerals sold 2,000,000 common shares of Northern to Geologic Resource Partners LLC at a price of $0.50 per share, following which it owned 9,750,000 common shares representing 42.5% of the issued and outstanding shares of Northern, after the completion of the Corporation’s private placements, debt settlements and Notes conversion described above.

On February 1, 2011, Don Baxter was appointed as the President of the Corporation, while Mr. Bowes resigned as President but remains as Chief Executive Officer. Stephen Thompson was appointed as the Chief Financial Officer of the Corporation on the same date.

The Corporation recently expanded the size of the Bissett Creek Project by staking an additional twelve unpatented mining claims forming part of the Mining Claims, which cover approximately 1,800 hectares.

Industrial Minerals entered into an inter-corporate working capital loan facility with the Corporation to provide the Corporation with up to $600,000 in interim financing to continue work on the Bissett Creek Project pending completion of the IPO (the “Industrial Minerals Loan Facility”). Amounts outstanding under the Industrial Minerals Loan Facility bear interest at a rate of 7.5% per annum. Almost $600,000 was advanced to the Corporation under the facility which was repaid following the completion of the IPO (as hereinafter defined).

On April 18, 2011, the Corporation completed its initial public offering by which it issued an aggregate of 8,000,000 common shares at a price of $0.50 per share for gross proceeds of $4,000,000 pursuant to a final prospectus dated April 7, 2011 filed in the provinces of Ontario, Alberta and British Columbia (the “IPO”). The common shares of the Corporation commenced trading on the TSX Venture Exchange (the “TSX-V”) on April 20, 2011 under the symbol “NGC”. As a result of the IPO, Industrial Minerals’ ownership in Northern was further reduced to 31.5%. Industrial Minerals is examining a number of mechanisms for distributing all of the common shares that it owns to its shareholders on a pro rata basis.

5

On June 21, 2011, the Corporation announced that the pre-feasibility study underway on the Bissett Creek Project would be upgraded to a full bankable feasibility study scheduled for completion in November, 2011.

Trends

There are significant uncertainties regarding the prices of industrial minerals as well as other minerals and metals and in the availability of equity financing for the purposes of mineral exploration and development. For instance, the prices of industrial minerals, including graphite, have fluctuated widely in recent years and it is expected that wide fluctuations may continue. Management of the Corporation is not aware of any trend, commitment, event or uncertainty both presently known or reasonably expected by the Corporation to have a material adverse effect on the Corporation’s business, financial condition or results of operations other than the normal speculative nature of the natural resource industry and the risks disclosed in this Annual Information Form under the heading “Risk Factors”.

THE GRAPHITE INDUSTRY

The Graphite Industry

Graphite is one of only two naturally occurring polymers of carbon, the other being diamonds. Graphite consists of a two dimensional planar structure whereas diamonds have a three dimensional crystal structure. Graphite is formed by the metamorphism of organic, carbon rich materials which leads to the formation of either crystalline flake graphite, fine grained amorphous graphite, or crystalline vein or lump graphite. Graphite is a non-metal but has many properties of metals and is desirable for its thermal and electrical conductivity, resistance to acids and heat, chemical inertness, and lubricity.

Because of supply concerns relating to the fact that China produces 70% of the world’s graphite, and to potential demand growth from new applications such as lithium-ion batteries, the European Union announced that graphite is one of 14 “critical mineral raw materials” considered to be in supply risk. The United States government has also included graphite on a list of mineral resources whose loss could critically impact the public health, economic security and/or national and homeland security of the United States.

Uses

Graphite is primarily used in the steel industry where it is added to bricks which line furnaces (“refractories”) to provide strength and resistance to heat, used to line ladles and crucibles, and added to steel to increase carbon content. Graphite is also used extensively in the automobile industry in gaskets, brake linings and clutch materials. It has a myriad of other industrial uses including electric motors (carbon brushes), batteries, lubricants and pencils. The graphite commonly used in golf clubs and tennis rackets is synthetic graphite made from petroleum coke.

6

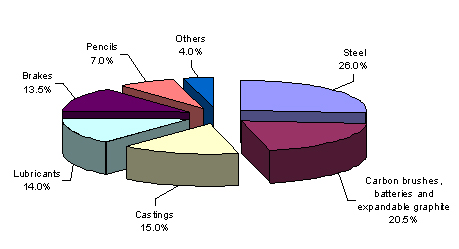

2009 World Consumption of Natural Graphite by end-use

Source: Industrial Minerals magazine

Imports and exports of natural graphite have been growing at 6% per year since 2001, largely driven by the ongoing modernization of China and India and other emerging economies and demand from traditional industrial applications. However, emerging applications including lithium-ion batteries, fuel cells and nuclear power have the potential to create significant incremental demand growth in the future.

Lithium-ion batteries are preferred over conventional nickel metal hydride batteries in most applications due to their greater energy density, power density, charge efficiency, and thermal stability parameters. In simple terms, lithium-ion batteries are smaller, lighter, more powerful and more efficient than conventional nickel metal hydride batteries, which makes them more desirable in most applications. Lithium-ion batteries have emerged as one of the markets with the greatest potential to increase natural graphite demand as graphite is the second largest input material for these batteries. It takes 20 to 30 times as much graphite, by weight, than lithium to make a lithium-ion battery.

Lithium-ion batteries are now used in the majority of portable electronic devices such as cell phones and laptops which caused demand for these batteries to grow by 65% from 2004-2008. The market for such portable devices, as well as the rate of penetration of lithium-ion batteries, are both expected to continue growing strongly. In addition, lithium-ion batteries are now beginning to be used in larger applications such as power tools and scooters.

However, the largest potential market for lithium-ion batteries, and therefore graphite, is expected to be increased production of hybrid electric vehicles (“HEV”) and electric vehicles (“EV”). It is estimated that there is over 2 to 3kgs of graphite in a HEV and 25-50kgs in an EV using lithium-ion batteries. Almost every major automotive producer currently has or is working on an HEV or EV. Examples include the Chevrolet Volt and the Nissan Leaf. Canaccord Capital Inc. estimates that the HEV and EV market will grow to 11 million units by 2015 and that by 2020 the market penetration rate of HEVs and EVs will reach 10-20%. According to Canaccord Capital Inc., this will increase incremental global lithium carbonate demand for battery applications by 286,000 tonnes. The natural flake graphite required to meet this demand is over 1.5 million tonnes, which is well above current annual worldwide production of natural flake graphite.

The spherical or potato shaped graphite used in lithium-ion batteries can only be made from flake graphite that can be economically purified to 99.95%C. Only 40% of the one million tonnes of graphite produced annually is flake and not all is suitable for lithium-ion battery applications. Synthetic graphite offers the only alternative to natural graphite for the manufacture of lithium-ion batteries. However, natural graphite is much less expensive as synthetic graphite is made from petroleum coke which is tied to the price of oil.

The United States Geological Survey has stated that fuel cells have the potential to consume as much graphite as all other uses combined. Fuel cells also require high purity flake graphite.

7

Production

World production of natural graphite was just over one million tonnes in 2008. Production of natural graphite is almost as large as the global nickel market, much larger than the markets for molybdenum or tungsten, and substantially larger than the markets for lithium or rare earth elements. Of all global production, 40% is accounted for by flake graphite, 1% by vein graphite and the remainder is low value, amorphous graphite. Graphite production has not increased substantially since 2001 due to a combination of low prices, a lack of investment and development, and weak demand in the first part of this decade.

| World Production of natural graphite by country (tonnes)

|

||||||||||||||||||||||||||||||||

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008(2) | |||||||||||||||||||||||||

| Europe |

||||||||||||||||||||||||||||||||

| Czech Rep. |

17,000 | 16,000 | 9,000 | 5,000 | 3,000 | 5,000 | 3,000 | 3,000 | ||||||||||||||||||||||||

| Russia |

16,500 | 12,100 | 9,500 | 13,600 | 14,000 | 11,100 | 9,900 | 9,000 | ||||||||||||||||||||||||

| Other |

15,265 | 13,083 | 5,001 | 9,600 | 12,179 | 9,060 | 3,060 | 3,060 | ||||||||||||||||||||||||

| Ukraine |

7,800 | 10,500 | 11,000 | 10,800 | 10,700 | 10,700 | 10,700 | 10,700 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 56,565 | 51,683 | 34,501 | 39,000 | 39,879 | 35,860 | 26,660 | 25,760 | |||||||||||||||||||||||||

| Africa |

||||||||||||||||||||||||||||||||

| Madagascar |

12,580 | 7,522 | 2,170 | 7,770 | 6,400 | 4,857 | 5,000 | 5,000 | ||||||||||||||||||||||||

| Zimbabwe |

11,837 | 9,700 | 6,280 | 10,267 | 4,298 | 6,588 | 6,600 | 6,600 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 24,417 | 17,222 | 8,450 | 18,037 | 10,698 | 11,445 | 11,600 | 11,600 | |||||||||||||||||||||||||

| N. America |

||||||||||||||||||||||||||||||||

| Canada |

20,984 | 15,039 | 12,500 | 15,000 | (2) | 17,000 | (2) | 15,000 | 15,000 | (2) | 16,000 | |||||||||||||||||||||

| Mexico |

21,442 | 14,065 | 8,730 | 14,769 | 12,357 | 11,773 | 9,900 | 7,229 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 42,426 | 29,104 | 21,230 | 29,769 | 29,357 | 26,773 | 24,900 | 23,229 | |||||||||||||||||||||||||

| S. America |

||||||||||||||||||||||||||||||||

| Brazil |

60,666 | 60,922 | 70,739 | 76,332 | 75,515 | 76,194 | 77,163 | 78,000 | ||||||||||||||||||||||||

| Asia |

||||||||||||||||||||||||||||||||

| China |

862,000 | 669,000 | 710,000 | 700,000 | 720,000 | 720,000 | 800,000 | 810,000 | ||||||||||||||||||||||||

| India |

15,872 | 15,909 | 13,081 | 16,223 | 18,848 | 18,658 | 17,327 | 17,000 | ||||||||||||||||||||||||

| N. Korea |

25,000 | 25,000 | 25,000 | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | ||||||||||||||||||||||||

| Other |

6,883 | 3,773 | 3,505 | 5,681 | 6,469 | 5,884 | 9,705 | 10,115 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 909,755 | 713,682 | 751,586 | 751,904 | 775,317 | 774,542 | 857,032 | 867,115 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL |

1,093,829 | 872,613 | 886,506 | 915,042 | 930,766 | 924,814 | 997,355 | 1,005,704 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Notes:

| (1) | Source: The Economics of Natural Graphite, Roskill Market Reports, 7th Edition, August, 2009. |

| (2) | Estimate. |

According to Roskill Market Reports, China produces 80% of the world’s graphite but only exports 40% of its production since it is also the world’s largest consumer of graphite. The largest component of global graphite trade is from China to Japan with considerable quantities of Chinese graphite also going to the United States, Europe, South Korea and Taiwan. The largest importers of natural graphite tend to be nations with developed steel industries. Japan is the world’s largest volume graphite importer and, despite being the dominant world supplier, China is also the world’s third largest importer of natural graphite, mostly from North Korea.

70% of Chinese production is low value amorphous graphite and flake graphite that tends to be smaller in flake size and lower in carbon content. The Chinese industry is characterized by a large number of small producers. The country is addressing poor labour and environmental standards and a lack of investment and professional mine planning by closing smaller operations and forcing others to consolidate to create a larger, more professional industry. Generally this process leads to the elimination of marginal producers and therefore lower supply and

8

higher process. In addition, China currently imposes a 20% export duty and a 17% value-added tax on graphite, and an export permit is required. Export permits are only granted to large producers and provide a means to control exports in the future. Chinese production is at similar levels to 2001. Given the lack of investment and mine planning, the closure of marginal operations, the “high grading” of mines during periods of low prices, the fact that mines are getting deeper and older, and a desire to do value added manufacturing domestically, the Corporation believes that Chinese production, and particularly exports, will likely decline in the future.

Like uranium, there is a posted price for graphite which provides a long term guideline but actual sales are negotiated between producers and consumers. Graphite is not sold under long term contracts and there is no futures market. Prices increase with flake size and carbon content with the +80 mesh, 94% carbon varieties being the premium product and well established producers with guaranteed consistency can generally charge more. Industrial Minerals magazine polls users every week and publishes a price range for the most popular grades.

Current Graphite Prices by Grade (US$/tonne – CIF Europe), June 2011

| Low | High | |||||||

| Synthetic graphite 99.95%C |

$ | 7,000 | $ | 20,000 | ||||

| Large flake (+80 mesh) 94-97%C |

$ | 2,500 | $ | 3,000 | ||||

| Large flake (+80 mesh) 90%C |

$ | 1,250 | $ | 1,450 | ||||

| Medium flake (+100 to -80 mesh) 94-97%C |

$ | 2,200 | $ | 2,500 | ||||

| Medium flake (+100 to -80 mesh) 90%C |

$ | 1,300 | $ | 1,450 | ||||

| Fine flake (-100 mesh) 94-97%C |

$ | 2,000 | $ | 2,400 | ||||

| Fine flake (-100 mesh) 90%C |

$ | 1,400 | $ | 1,800 | ||||

| Amorphous powder (80-85%C) |

$ | 600 | $ | 800 | ||||

Source: Industrial Minerals magazine

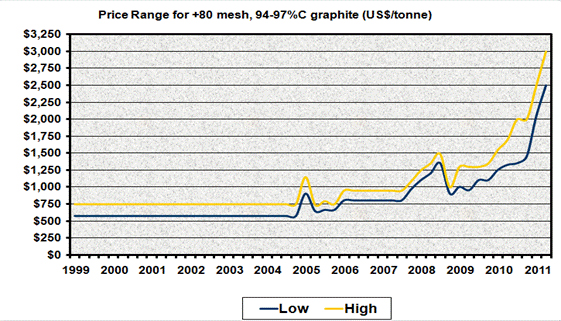

Graphite prices peaked in the $1,300/tonne range for the premium grade (large flake +80 mesh, 94-97%C) in the late 1980s and then declined sharply as Chinese producers dumped product on the market. Prices did not begin to recover until 2005 and are now in the US$2,500 to $3,000/tonne range for premium grade product as industrial demand remains strong and the effects of new demand from the lithium-ion battery market is beginning to be felt.

Graphite Price History

(US$/tonne, +80 mesh, 94-97%C)

Source: Industrial Minerals magazine

9

THE BISSETT CREEK PROJECT

The Bissett Creek Project is the subject of a technical report (the “Technical Report”) entitled “Technical Report Preliminary Economic Assessment on the Bissett Creek Graphite Property of Industrial Minerals, Inc. & Northern Graphite Corporation” dated July 16, 2010 and revised February 2, 2011, prepared by Gilbert Rousseau P.Eng and Claude Duplessis P.Eng of SGS, each of whom is an independent Qualified Person pursuant to National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The following is a description of the Bissett Creek Project based on the Technical Report, and in many cases is a direct extract of the disclosure contained in the Technical Report. Portions of the following information are based on assumptions, qualifications and procedures described in the Technical Report but which are not fully described herein. Reference should be made to the full text of the Technical Report, which is incorporated by reference herein. The Technical Report has been filed with certain Canadian securities regulatory authorities pursuant to NI 43-101 and is available for review under Northern’s SEDAR profile at www.sedar.com.

Shareholders and prospective investors should be aware that certain historical technical disclosure regarding the Bissett Creek Project by Industrial Minerals did not comply with NI 43-101 and should not be relied upon. Shareholders and prospective investors should rely only on the information contained in this Annual Information Form and the Technical Report.

Project Description and Location

The Corporation holds a 100% interest in the Bissett Creek Project, which contains large crystal graphite flakes in a graphitic gneiss deposit south of the Trans-Canada Highway (Highway 17) and 53 kilometres east of Mattawa, Ontario. The Bissett Creek Project is located in the United Townships of Head, Clara and Maria, in the County of Renfrew, Province of Ontario, approximately 300 km north-northeast of Toronto.

The Bissett Creek Project consists of the Mining Lease, being Ontario mining lease number 106693 issued in 1993 for 21 years covering 564.6 hectares, and the Mining Claims, initially comprised of a group of six unpatented mineral claims covering approximately 624 hectares at the time of preparation of the Technical Report, for a total property area of approximately 1,189 hectares, with the well explored area being less than 60 hectares. The Corporation recently expanded the size of the Bissett Creek Project by staking an additional twelve unpatented mining claims forming part of the Mining Claims, which cover approximately 1,800 hectares, with the result that the total property area now covers approximately 2,989 hectares, with the well explored area remaining less than 100 hectares. The Bissett Creek Project is centred on UTM coordinates 727170 E and 5112025N (NAD 83) on the topographic map (NTS 31L/01). Northern owns sufficient ground rights for the development of the Bissett Creek Project. Operational permits and environmental authorization certificates are required for the mining of the open pit but it is expected that these approvals will be obtained normally when needed.

10

Royalties on the Bissett Creek Project include an annual advance payment of $27,000 to the three original prospectors that discovered the property which will be credited against a royalty of $20 per ton of concentrate on net sales once the mine is operational, and a 2.5% NSR on any other minerals derived from the property payable to the same parties.

SGS was retained by Industrial Minerals in May 2007 to prepare a NI 43-101 compliant technical report on the Bissett Creek Project with a preliminary assessment in order to evaluate the economic potential of the Bissett Creek Project. This preliminary assessment was updated in the Technical Report and is preliminary in nature and includes Inferred Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. As well, there is no certainty that the results of this preliminary assessment will be realized by Northern.

The preliminary assessment in the Technical Report covers the scientific and financial aspects of the Bissett Creek Project, the technical aspect of the mining and the construction and operation of milling facilities capable of processing 870,000 tonnes per year of graphite bearing rock. Annual production should be in the range of 18,500 tonnes of graphitic flakes, spread more or less in the three following size ranges: 30% +35mesh, 40% -35 to +48 mesh and 30% -48 mesh. The pre-production scenario envisaged by Northern requires the stripping of the open pit, a tailings pond, a waste dump site, a polishing pond, a 2,500 tpd concentrator and the construction of a power line from Highway 17 to the mine site.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Accessibility

The property is accessible by the Trans-Canada Highway (Highway 17), approximately 53 km east of the town of Mattawa. The Trans-Canada Highway in this area connects the cities of North Bay and Ottawa. The Bissett Creek road intersects Highway 17 two km east of the village of Bissett Creek. Access from Highway 17 to the property is by way of a well maintained gravel forestry road on a distance of 13 km and then east on a winding road for a distance of 4 km.

Climate

The nearest town to the Bissett Creek Project with the most complete data on the climate is Petawawa, which hosts a military camp. In Ontario, the climate is generally continental, although modified by the Great Lakes to the south, and precipitation increases from NW to SE. Annual runoff is from 200 to 600 mm.

Local Resources

The local resources in terms of labour force, supplies and equipment are not sufficient. However, the area is well served by regional geological and mining service firms in North Bay, which is situated 110 km to the northwest. The nearest town, Mattawa, may also provide some workers for minor services, lodging and living support.

Buildings at the site installed in 2002 by Industrial Minerals provide shelter facilities for small groups, core logging, splitting facilities and some storage. All major services are available in North Bay, while minor ones may be available in Mattawa.

Infrastructure

The access road, the mobile house and stripping of the overburden in certain areas were completed by North Coast Industries Ltd. (“North Coast”), a previous optionee of the project, between 1987 and 1992. The dry process pilot plant building was completed by Industrial Minerals in 2005. All of these are kept in good condition. Presently there are not sufficient catering and sleeping facilities to accommodate more than two workers during a stay at the site. Sand and gravel are available within the Bissett Creek Project, if additional material should be required.

11

Presently, there is a no electrical power from Ontario Hydro at the site and electrical power at the site is provided by a small power generator. The Corporation contemplates bringing a power line from Highway 17 to the property in the near future.

In the past, the MNDM and Ontario government have encouraged natural resource development through the granting of permits, title security and financial incentives. Politically, the Ontario government and local Northern Ontario governments are very supportive of mining activities.

Physiography

The Bissett Creek Project is located in rolling hilly terrain. The elevation above sea level ranges from 270 to 320 metres. The property is covered by a mixed forest of conifers and hardwoods. Merchantable red and white pine occurs near the western margin of the property. Soil cover is variable. Rock exposures are found in road cuts and ridge crests. Soil cover is normally sandy, glaciofluvial deposits over ridge areas and glacial lake and stream sediments at lower elevations. Lower lying areas tend to be swampy and covered by moderately thick growth of stunted cedar and swamp grasses.

Recognized overburden depth on the property is variable, ranging from zero metres to ten metres thick in the swampy areas.

History

The Bissett Creek Project was first staked by Frank Tagliamonti and associates in 1980. The same year, Donegal Resources Ltd. optioned the Bissett Creek Project but limited work was performed prior to its decision to abandon the property.

In 1981, Hartford Resources Inc. (“Hartford”) optioned the Bissett Creek Project and staked an additional 24 claims. In 1984, Princeton Resources Corp. (“Princeton”) acquired a 100% interest in the Bissett Creek Project through the acquisition of Hartford. Hartford had held the claims since 1981 and had conducted some exploration work including line cutting, surveying, and trenching. During the latter part of 1984 through 1986, Princeton carried out a program of mapping, trenching, surveying, drilling, sampling, and testing with the result that 10 million tonnes of approximately 3% graphite were defined. Historical information is provided for informational purposes only. This resource estimate was not completed in accordance with NI 43-101 and therefore should not be relied upon. Subsequent work identified areas ranging from 3% to 6% graphite. In 1985, Princeton set up a base camp and constructed a batch testing plant.

In November 1986, North Coast entered into an option agreement with Princeton whereby North Coast would be awarded a 58% interest in the Bissett Creek Project upon the completion of a batch testing plant, bulk sampling and the production of graphite flake for end user tests. North Coast was awarded its 58% interest in the property in June of 1987 and subsequently acquired Princeton’s remaining 42% interest on February 6, 1989.

In 1986, North Coast hired KHD Canada Inc. (“KHD”) to review the test plant and make process recommendations. In 1987, the results of these recommendations indicated that the Bissett Creek graphite deposit could be concentrated into high grade and high value graphite flakes. A full feasibility study was undertaken and completed in 1989 which deemed the Bissett Creek Project to be viable with a potential +40% IRR. Kilborn Engineering Ltd., KHD, Bacon Donaldson and Associates Ltd. and Cominco Engineering Services Limited determined that the Bissett Creek Project had a minimum of 20 million tonnes of graphitic material grading higher than 3.18% C. Historical information is provided for informational purposes only. The feasibility study and resource estimate were not completed in accordance with NI 43-101 and therefore should not be relied upon. North Coast undertook extensive exploration and evaluation work on the Bissett Creek Project. Exploration work included detailed geologic mapping on a scale of 1:100, 700m of trenching and a total of 7,232m of drilling in 160 holes. Percussion drilling totalling 1,207m in 82 holes was also done. This drilling was carried out on a 64m x 46m grid spacing with infill drilling at 23m x 23m. In addition to the Princeton 3,630 tonne bulk sample, North Coast collected a number of smaller bulk samples for bench test work by KHD and a large 6,668 tonne bulk sample for pilot testing by EKOF Flotation GmbH (“EKOF”) and KHD.

12

World graphite prices underwent a significant decline in the late 1980’s as China aggressively entered the graphite market, and the Bissett Creek Project was put on hold. North Coast continued to maintain the leases up until 1997 but graphite prices did not recover sufficiently to warrant proceeding with a mine/mill development at Bissett Creek.

In 2002, Industrial Minerals, through the Corporation, took over the Bissett Creek Project and attempted to develop a dry process flow sheet for the recovery of the graphite flakes. A poorly engineered and flawed design resulted in very little product being produced and continuous or commercial operation was never achieved.

In April 2007, Industrial Minerals, through a new management group, proceeded to review the past documentation and determined that there was sufficient data to proceed with a preliminary assessment study. Graphite prices had recovered significantly as the future for graphite in some applications is increasing at double digit rates. SGS was contracted in May 2007 to produce a NI 43-101 compliant technical report on the Bissett Creek Project.

Industrial Minerals planned to install a one tonne per hour pilot plant on the property in the spring of 2008 and a full size 2,500 tonne per day commercial plant producing approximately 20,000 tonnes per year of high grade, high quality graphite flakes in 2010. Industrial Minerals also extended its claims by adding an additional 950 acres (380 hectares) in the spring of 2007 bringing the total property area to 3,250 acres (1,304 hectares). For various reasons, mainly financial, Industrial Minerals did not pursue the development of the Bissett Creek Project.

The Corporation changed its name from “Industrial Minerals Canada Inc.” to “Northern Graphite Corporation” in December 2009 and has to date operated as a subsidiary of Industrial Minerals.

Geological Setting

The Bissett Creek Project lies within the Ontario Gneiss Segment of the Grenville Structural Province of the Canadian Shield. This area is characterized by quartzofeldspathic gneisses which have undergone upper amphibolite facies grade of regional metamorphism with metamorphic temperatures estimated to have reached the 600 to 700 degrees Celsius range. The Ontario Gneiss Segment is distinguished from other areas of the same belt by having northwesterly dominant foliation and structural trends.

Mapping by S.B. Lumbers, 1976, of the Ontario Department of Mines, indicates that the property and surrounding area are underlain by Middle Precambrian metasedimentary rocks. These are coarse and medium grained, biotite-K-feldspar quartz-plagioclase gneisses which are high grade metamorphic equivalents of pure sandstone, arkose and argillite. These highly deformed and recrystallized rocks have been folded into northwest trending, northeast dipping recumbent folds which are refolded by large broad open folds. Greater than 10 % of the rocks are composed of remobilized quartz and feldspar migmatite.

The Bissett Creek Project is predominantly underlain by Middle Precambrian age meta-sedimentary rocks. These are divided into graphite gneiss, transitional graphitic gneiss, and barren gneiss for mapping purposes. The graphitic gneiss is a distinctive recessive weathering unit, commonly exposed along rock cuts, hill tops and occasional cliff faces. It is a calcareous, biotite-amphibole-quartzofelspathic gneiss (generally red-brown to pale yellow-brown weathering). Graphite, pyrite and pyrrhotite occur throughout. Graphite occurs in concentrations visually estimated to be from 1 to 10 %. Sulphides occur in concentrations from 1 to 5 %. In its unweathered state, the rock unit is pale to medium grey in colour.

This graphite gneiss has a moderate 5 to 20 degree dip to the east and the high grade layer dips 20 to 30 degrees to the south on the property. This unit is sandwiched between the upper barren non-calcareous gneiss, which forms the hanging wall of the deposit and a similar lower barren gneiss which forms the footwall. A total thickness of 75m of graphitic gneiss was intersected by drilling.

The barren gneiss is a pale to dark grey-green non-calcareous unit. Black biotite, dark green amphiboles and red garnets distinguish the units from the graphite bearing varieties.

13

An intermediate unit is present, typically a biotite-muscovite-garnet-quartzofeldspathic gneiss. Muscovite is the distinguishing mica variety and the garnets are mauve in color. This unit may contain variable amounts of graphite and occurs below and within the graphitic gneiss. Two intrusive units have been observed on surface; dykes and sills of coarse grained biotite-muscovite-quartz-feldspar pegmatites and a dark green lamprophyre.

The deposit may be classified as a sedimentary type origin. However metamorphism has transformed the original organic content of the mother sedimentary rock into graphitic carbon flakes. The actual appellation of the deposit is graphitic gneiss. The Bissett Creek Project main zone area is composed of sub-horizontal 5 to 10 degrees undulating layers. The actual well recognized higher grade layer is dipping 15 to 20 degrees to the south.

Exploration

In 1984, Princeton completed geological mapping, line cutting, surveying, trenching, sampling and diamond drilling. A total of 1,041 ft. (317 m) of BQ diameter core was drilled in 7 holes. Forty trench samples were taken along 5 new trenches. A 15 ton bulk sample was taken from a previously known surface high grade outcrop. A higher grade graphite horizon in the Northeast Zone was identified with a thickness of about 30 meters.

In 1985, Princeton completed geological grid mapping, a magnetic survey, diamond drilling and bulk sampling. A pilot test plant was constructed on site. 99 vertical BQ diamond drill holes were completed for a total footage drilled of 16,836 (3,131 m). Mineralization occurs in gently southeast dipping horizons within an envelope of lower grade graphitic gneiss. The higher grade sections occur in up to 3 horizons. In cross-section, true thicknesses range from 15 to 30 meters. Commonly, a second horizon with a thickness ranging from 3 to 6 meters occurs in the same section. The larger horizons are traceable over a 350 meter strike length. Grade and thickness decrease in the southwest, northeast and down dip directions.

In late 1986, North Coast optioned a 58% interest in the property and became the operator. As part of this agreement North Coast operated the pilot plant processing some 4,900 tons of ore and producing approx. 36 tons of graphite concentrate.

In 1987 North Coast completed geological mapping at 1”=100’ and outcrop sampling completed in the “NE”, “A”, “B”, and “C” zones. Trench sampling was also completed in 5 trenches (T-87-1 to 5). 67 percussion holes were drilled to 60’ where possible and the whole length was sampled in 10’ lengths, strictly for assay. A total of 976.9 ft. of N-DBGM diameter core was drilled in 6 holes. An additional 5,707 ft. of BQ diameter core was drilled in 34 holes. North Coast collected a number of smaller bulk samples for bench test work by KHD and a large 60 tonne bulk sample for pilot testing by EKOF and KHD. Further detailed exploration and evaluation consisted of ore reserve calculations, mine planning, estimates of associated capital and operating costs, extensive metallurgical evaluation, process design, environmental assessment, graphite flake quality evaluation, flake concentrate end user testing and market analysis. North Coast engaged KHD to review the pilot plant flow sheet and equipment, to make process recommendations, and to perform test work on samples and concentrate from the pilot plant. Based on the positive conclusions of the “Prefeasibility Study for the Bissett Creek Graphite Project” issued in December 1987 by KHD, a full feasibility study was completed by KHD in April 1989 for operation of a graphite beneficiation plant with mining facilities and necessary infrastructure. This work had determined that the property had a minimum of 20 million tons of graphitic material grading 3.18%. Historical information is presented for informational purposes only. The resource estimation was not completed in accordance with NI 43-101 and therefore should not be relied upon.

Exploration work indicated that the property, predominantly underlain by Middle Precambrian aged meta-sedimentary rocks, could be divided for mapping purposes into three subunits; 1aG, graphitic gneiss; 1aBT, transitional gneiss and 1aB, barren gneiss. The graphitic gneiss unit hosting the Bissett Creek deposit forms an irregular area with a north-south length of 2.1 km and east-west dimensions reach a maximum of 1.2 km. The graphitic gneiss exposures taper toward the north and south before being lost through structural displacement or erosion. It is a distinctive recessive weathering unit, sometimes calcareous, and generally red-brown to pale yellow-brown weathering biotite-amphibole-quartzo-feldspathic gneiss. Graphite, pyrite and pyrrhotite occur throughout. Graphite occurs in concentrations from 1 to 10% by volume and a flake size range of 1 to 6 mm in diameter. Pyrite and pyrrhotite occur in concentrations ranging from 1 to 5%. In the unweathered state, the rock unit is a pale to medium grey color. This distinct, well mineralized unit, occurs as a gently to moderately east

14

dipping unit, sandwiched between an underlying and overlying barren, non-calcareous gneiss (unit laB). The western edge of the graphitic gneiss is truncated by erosion. The eastern limit of graphite is determined by the overlying barren gneiss contact. A total thickness of at least 76 m has been demonstrated by drilling. Unit laG is uniformly mineralized by low grade flake graphite in the range of 1 to 2% and higher grades occur within and near the structural base of the unit. These bands range in thickness from 10 to 98 feet (3 to 30 meters). On a smaller scale, broad open folds are recognized and vertical faults have been recognized and inferred from drill core. These faults have easterly and east-northeasterly strikes and occur at intervals of 200 to 250 meters. Their effect has been to rotate uniformly dipping blocks around vertical axes. Displacement across the faults appears to be minor.

SGS’s geological and mining-metallurgical engineers visited the site on June 6 and 7, 2007 and the geological engineer visited again on August 6 and 7, 2007. In addition, the phase 1 independent drilling campaign was carried out and supervised by SGS personnel from the beginning to the end.

No additional work was done on the Bissett Creek Project between the summer and fall of 2007 leading up to the completion of a report by SGS in November 2007, and the completion of the Technical Report in July 2010 (subsequently revised in February 2011). Since the original completion of the Technical Report in July 2010 (and prior to its revision in February 2011), the Corporation started to implement the recommendations in the Technical Report and completed a 2,900m infill and exploration drilling program and initiated a metallurgical testing program, a pre-feasibility study and the environmental and permitting review process, all with the objective of positioning the Corporation to make a construction decision on the Bissett Creek Project in early 2012. A construction decision is contingent on the positive results of the pre-feasibility study and the availability of financing. There is no guarantee the results of the pre-feasibility study will be positive or will support a construction decision. In addition, there are risks associated with going into production without completing a full feasibility study in that the capital and operating costs estimates, the degree of engineering that has been applied to the various parameters and the extent of testing contained in a pre-feasibility study are not as formal, detailed and reliable as those contained in a feasibility study.

Mineralization

The Bissett Creek mineralization is relatively simple when looked at from a deposit scale, on local scale it is structurally complex with pegmatite and diabase dykes cutting through it.

The actual sub-horizontal graphitic gneiss was probably an impure greywacke including organic materials. It was metamorphosed under high pressure and temperature and the carbon has been transformed into crystal flakes. As they were formed from sedimentary origin, the graphite flakes are well distributed and occur in successions of low to high density within the graphitic gneiss rock. As in any sedimentary rock, the grade varies less laterally and more across the beds which may be compared to the metasediment graphitic gneiss layers. It is not possible to associate polarity to the gneiss. However, a higher grade layer within the 70m thick graphitic gneiss was observed at the base of the actual arrangement. This creates layers in the order of 20 meters thick which gently dip south in the western part of the deposit.

Graphite flakes occur disseminated in the gneiss and in variable concentration in the transitional gneiss. The graphite flakes are present as oval to sub rounded particles from 1 to 6 millimetres in diameter. The flake sizes measured in the core samples taken in 2007 show a general distribution that is not associated with the percentage of total graphitic carbon. This means the whole deposit can be considered of interest since large flakes are generally present no matter the percentage grade of the graphite. Below the top soil, for the first one to two meters in thickness, the rock is weathered and thus friable. At least the first meter of rock should allow very high recovery of large flakes with little communition.

Drilling

In 1984, Princeton completed a total of 1,041 ft. (317 m) of BQ diameter core drilling in 7 holes. 2 holes drill tested the South Zone, 1 hole tested the North Zone, and 4 holes were drilled in the Northeast Zone.

15

In 1985, Princeton completed 99 vertical BQ diamond drill holes for a total footage drilled of 16,836 (3,131 m). This total included about 30 shallow unnamed test holes which were drilled to outline surface sample sites. The shallow hole footage totaled 348 ft. (106m). The combined 1985-86 drilling totals 17,881 ft. (5450 m) in 106 holes. Ninety-three holes were drilled in the northeast zone. The majority were drilled at a 64 meter by 46 meter spacing. A detail grid spacing of 23 m by 23 m was used in one area and one fence of holes was drilled at a 10 m spacing to determine the continuity of the graphite horizons. Percussion drill sampling was carried out in 5 areas and 4,000 tons were mined from 3 sites. A total of 3.8 million tons of flake graphite bearing gneiss grading an average of 3.05% graphitic carbon was outlined by diamond drilling in the western and northeast zones. Historical information is presented for informational purposes only. The resource calculation was not completed in accordance with NI 43-101 and therefore should not be relied upon. A cutoff grade of 2.5% C(g) (graphitic carbon) was applied. Resource calculations were based on blocks measuring 70 x 70 x 10 meters. Close to 3 million of the 3.8 million tons are within 34 meters of the bedrock surface. This figure has not been evaluated in terms of mining feasibility and no mining dilution or stripping ratio had been calculated. Complete data on the relationship of graphitic carbon assays to full scale flotation was not available and further information was also needed to be gathered on the physical properties of the final product.

In 1987, North Coast drilled 67 percussion holes to 60’ where possible and the whole length was sampled in 10’ lengths, strictly for assay. A total of 976.9 ft. of N-DBGM diameter core was drilled in 6 holes. An additional 5,707 ft. of BQ diameter core was drilled in 34 holes.

158 of the 160 historical diamond drill holes were retained for the present resource calculation. Two historical diamond drill holes located north of the conceptual pit were not used. The percussion holes were excluded from the resource calculation because their methodology description was not thorough enough. None of the trench data or pit results was utilized in the present resource calculation.

In the summer of 2007, following SGS’s recommendation, Northern undertook an independent validation drilling program. The program permitted the development of independent assay results and has also provided material to carry out metallurgical testing and validation. Six vertical NQ size diamond drill holes were drilled in the eastern part of the deposit for a total of 246.43 meters (808.5 ft) around the location of pit # 1. The last drill hole (DDH-07-06) was drilled in an area of the Bissett Creek Project previously named the “pencil zone”. Drilling was done by George Downing Estate Drilling Ltd., from August 1 to August 9, 2007. The results obtained from these six holes were consistent with previous drilling done on the Bissett Creek Project.

SGS’s geological and mining-metallurgical engineers visited the site on June 6 and 7, 2007 and the geological engineer visited again on August 6 and 7, 2007. In addition, the phase 1 independent drilling campaign was carried out and supervised by SGS personnel from the beginning to the end.

No additional work was done on the Bissett Creek Project between the summer and fall of 2007 leading up to the completion of a report by SGS in November 2007, and the completion of the Technical Report in July 2010. Since the completion of the Technical Report, the Corporation has started to implement the recommendations in the Technical Report and has completed a 2,900m infill and exploration drilling program. Results of the program have been compiled and evaluated and QA/QC results verified.

Historical drilling has showed that graphite flakes appear to be evenly distributed throughout the main graphitic unit, regardless of grade. Minor pegmatite and lamprophyre dykes with no grade were also intersected. Higher grade sections of economic interest within the graphitic unit generally consist of an upper zone and a lower basal zone. In a significant majority of the holes both of these zones were present or they coalesced into one thicker zone. In a small number of holes economic mineralization only occurred in the basal zone. Rarely was just the upper zone present.

Potentially economic mineralization is often bounded by transitional mineralization that is treated as waste in the economic analysis but it is not far below cut off. As the grade is high enough to cover incremental milling costs, it will be stored in a low grade stockpile and processed at the end of the mine life.

The graphitic unit as well as the upper and basal zones shows very good correlation and consistency from drill hole to drill hole. As a result, there is a relatively high degree of confidence that the inferred resources can upgraded to a higher category with additional drilling. Furthermore, the deposit remains open north/south along strike and to the east. There are a number of obvious opportunities to increase the current resources around the pit and to the north, with additional drilling. Drill holes located to the north of the current conceptual pit, and which are not included in the resource calculation, intersected the same style and tenor of mineralization.

16

All 6 holes of the 2007 drill program intersected mineralized gneiss. There was no overburden at drill site locations. The graphitic gneiss foliation being sub horizontal, the vertical holes cut mineralized thicknesses from 30 meters up to 49 meters

Sampling and Analysis

The majority of samples taken during the 1980’s drilling programs were prepared on site. Early on, drill core and channel samples prepared for LECO analysis used a 4 to 5 kg sample split in 10 ft intervals on average for drill core and then crushed to one-half inch size. Later on, a detailed procedure was prepared for site sample preparation.

Historically, the carbon content determination of graphite was done using two methods: the double loss of ignition, (double LOI) approach; and a more specific LECO analysis. The double LOI method was and is still being accepted as an industry standard and this method was the basis for much of the original resource analysis done on Bissett Creek. A limited range of results were also tested using the LECO methodology. In both cases, the majority of samples were prepared and analyzed at the site facility. Regular checks were also conducted at SGS Lakefield Research in Lakefield, Ontario, and KHD’s facilities in West Germany.

QA/QC procedures with respect to historical data are not the same as those currently in force. However, extensive testing was done on site, check assays by well known labs were used and the results were reviewed and used at the time by a number of reputable engineering firms including Kilborn, Cominco, KHD, Bacon Donaldson and Pincock Allen & Holt. Furthermore, SGS had access to all the original assay sheets and the results of check sampling at SGS Lakefield. Also, SGS was able to reproduce similar grades and thicknesses to those intersected by historical holes. Therefore results are considered reliable for the purposes of the Technical Report. The observed ranges in values gave a certain level of confidence with respect to the use of historical data. In order to reflect the level of uncertainty in the use of historical results, no resources are categorized as measured.

During the 2007 drill campaign, every core box was photographed prior to splitting. Core from drill holes was first stored in boxes containing each 15 ft in length. After being logged and measured, the core was cut in two parts on its longitudinal direction with a rock saw. One half of the core was sampled for analysis in a laboratory and the other half of the core was stored back in core boxes. Each sample measured approximately 5 ft. A total of 162 samples have been retrieved and kept for analysis. The boxes were numbered and tagged for each drill holes. The boxes were left in a warehouse on site.

During the summer of 2007, in addition to the independent drill program, SGS carried out validation tests on the recovery of graphite and especially the large flakes. This was first done at CFP, a processing laboratory in Val d’Or, Quebec and then assays were done at the COREM facilities in Quebec City. The tests were done on graphitic gneiss rock samples taken from the pit #1 location and acquired during SGS’s first site visit in June 2007. A second battery of tests was also performed at Ortech, with assays at Activation Laboratories Ltd. in Ontario, to further validate the results. The samples came from parts of the witness core samples housed at the mine site.

These additional tests have allowed SGS to conclude that large flakes were present evenly in the various grades and locations drilled in 2007. The actual proven graphitic carbon recovery is in the 95% range. The actual flake size distribution before optimization showed approximately 30% in the +35 mesh size, 40% in the -35 to +48 mesh fraction and 30% in the – 48 mesh portion.

In 2007, SGS did not carry out an extensive QA/QC program during the independent drilling campaign. The main goal of the drilling was to confirm the graphitic gneiss mineralization grade and thickness. However, since samples from the deposit were prepared and assayed at different laboratories and the results were very similar, in SGS’s opinion, the results are considered reliable and reproducible.

In the 2010 definition drilling and exploration program on the Bissett Creek Project, a standard procedure of QA/QC was put in place and was followed with repeats and double lab controls. This included additional internal laboratory standards and controls, the inclusion of standards and a 5 to 10% re-assay in a second laboratory.

17

Security of Samples

Review of the sampling preparation, security and analytical procedures used on the Bissett Creek Project in the past were judged to be adequate, though SGS did not have access to the original assay certificates to verify the accuracy of the data. Historically, the carbon content determination of graphite was done using two methods: the double loss of ignition, (double LOI) approach; and a more specific LECO analysis.

The double LOI method was and is still being accepted as an industry standard and this method was the basis for much of the original resource analysis done on the Bissett Creek Project. A limited range of results were also tested using the LECO methodology. In both cases, the majority of samples were prepared and analyzed at the site facility. Regular checks were also conducted at SGS Lakefield Research in Lakefield, Ontario, and KHD’s facilities in West Germany.

For the 2007 campaign, sampling preparation, security and analytical procedures were judged to be adequate. The possibility of tampering is almost nil since the core was split bagged and sealed. The sample bags were under witness of SGS staff until being shipped to the laboratory for preparation and analysis.

Mineral Resource Estimate

In order to be able to properly estimate the Bissett Creek graphite resources, SGS carried out extensive computer modeling of the historical data on the Bissett Creek Project. It should be noted that even if the original data had been computerized in the late1980’s, it was not possible to retrieve it. Requests to SNC-Lavalin (which acquired Kilborn) confirmed that they only had hard copies of the Kilborn reports in their archives. Moreover, the data was done in imperial measures and had to be converted over to metric units. As a result, SGS had to manually enter all of the data to create its resource models.

This process started with computerization of the cross-sections done by the original driller, as well as data from the assay sheets retrieved from the archived records which were available on the Bissett Creek Project. Because of the tremendous amount of historical data in different coordinate systems, the work was tedious, and somewhat complicated by the graphitic carbon assay methods used at that time.

In 2007, SGS’s review of the original results of the two assay methods confirmed that the LOI results were designed more as a graphitic indicator, while the LECO methodology provides a more specific assessment of the graphitic carbon content. It is important to mention that the LOI method of analysis should not be used to measure graphite content since pyrite and calcite (carbonate) content which are present in the deposit may distort the appropriate % graphitic carbon values. 1,791 assays were compiled from the 1980’s drilling, 1,433 of which (80% of the historical dataset) had Double LOI and LECO assay values. Linear regression calculations from these data pairs lead to establishing the following predictive equation: predicted LECO = 0.665*LOI + 0.004. The linear regression was applied to the 358 samples (20% of the historical dataset) that were not assayed for LECO, allowing the results to be more effectively extrapolated across the deposit and compared to the 2007 drill program.

These efforts mean that SGS has carried out modern measurements of the graphitic carbon, which in turn have resulted in a more specific analysis of the graphitic carbon. In doing so, SGS was able to confirm that the LECO grades were consistently 66% of the original LOI grades established for the Bissett Creek Project. It also confirmed that the original LECO results were the more accurate assays of the Bissett Creek graphitic grades.

Within the historical data, only the diamond drill holes were used. In SGS’s opinion, the percussion holes did not have enough description on their methodology to ensure they were as reliable as the drill holes. Drill hole positions from maps were digitized in imperial and converted to metric units. Two conversions occur since they were first transformed into UTM based on a georeference satellite image. Another map from KHD with holes locations was digitized again and converted to the NAD 83 UTM system. Relative positions from one hole to another is maintained. However, SGS believes the exact hole locations in the new coordinate system to be within a 3 to 5 meter radius. The diamond drill hole database has a total of 164 usable holes, i.e. 6 new holes and 158 historical holes.

18