Attached files

| file | filename |

|---|---|

| 8-K - IHS Inc. | q4-11earningsrelease.htm |

| EX-99.1 - EARNINGS RELEASE - IHS Inc. | exh991q411.htm |

Supplemental Materials for Q4 and FY 2011 Earnings Conference Call January 6, 2012 1

Copyright © 2012 IHS Inc. Agenda • Objectives of comprehensive pension plan review • Impacted groups of participants • Action steps • Impacts • Settlement • Change in investment strategy • Change in accounting policy • Funding • 2011 financial statements • Quarterly profit spread 2

Copyright © 2012 IHS Inc. Objectives of comprehensive review of US pension plan • Objectives: • Continue providing market-competitive benefits • Reduce complexity • Decrease volatility • Identified steps impact settlement, investment, accounting, and funding • Many plan sponsors have employed similar steps to better manage their pension programs 3

Copyright © 2012 IHS Inc. Actions taken impact three groups of participants • Three groups of plan participants—retirees, former colleagues who are not yet receiving benefits and active colleagues • Retirees and former colleagues (collectively, “inactives”) represented approximately 80% of total plan participants and approximately 75% of total US pension liability at 1/1/11 4

Copyright © 2012 IHS Inc. Actions • Settle obligations for inactives: • Purchased annuities (for retirees) • Expect to offer buyouts (for former colleagues who aren’t yet receiving benefits) • Changed investment strategy to reduce volatility; better matches assets and obligations going forward • Changed pension and OPEB accounting policy to preferred accelerated method of recognition • Funded current deficit and 2012 service costs for eligible active colleagues 5

Copyright © 2012 IHS Inc. Impact of settlement actions: retirees • Purchased annuities to settle retiree pension obligations through a third-party insurer which has assumed those pension obligations from IHS • Annuity purchase was funded out of current pension assets • Annuitization was completed in November 2011 and is reflected in our year-end financial statements • Accounting impacts: • Net projected benefit obligation (PBO) and pension plan assets were both reduced by over $100 million at year end • Will recognize and disclose the settlement expense as a separate component of pension expense in the 2011 financial statement footnotes 6

Copyright © 2012 IHS Inc. Impact of settlement actions: former colleagues not yet receiving benefits • We expect to offer buyouts to settle former colleague pension obligations • Buyouts are optional; those who decline will remain in the plan • Buyouts expected to be offered in fiscal 2012 • Acceptance rate is expected to be approximately 70% • Accounting impacts: • For all accepted buyouts in 2012, net PBO and pension plan assets will be reduced in 2012 • Will recognize and disclose the settlement expense as a separate component of pension expense in the 2012 financial statement footnotes (below the line; will not impact Adjusted EBITDA) 7

Copyright © 2012 IHS Inc. Impact of changing investment strategy • Previously, pension assets were primarily invested in equities • Pension assets now primarily invested in fixed-income securities • De-risks our pension asset portfolio • Better matches assets and obligations • Reduces volatility 8

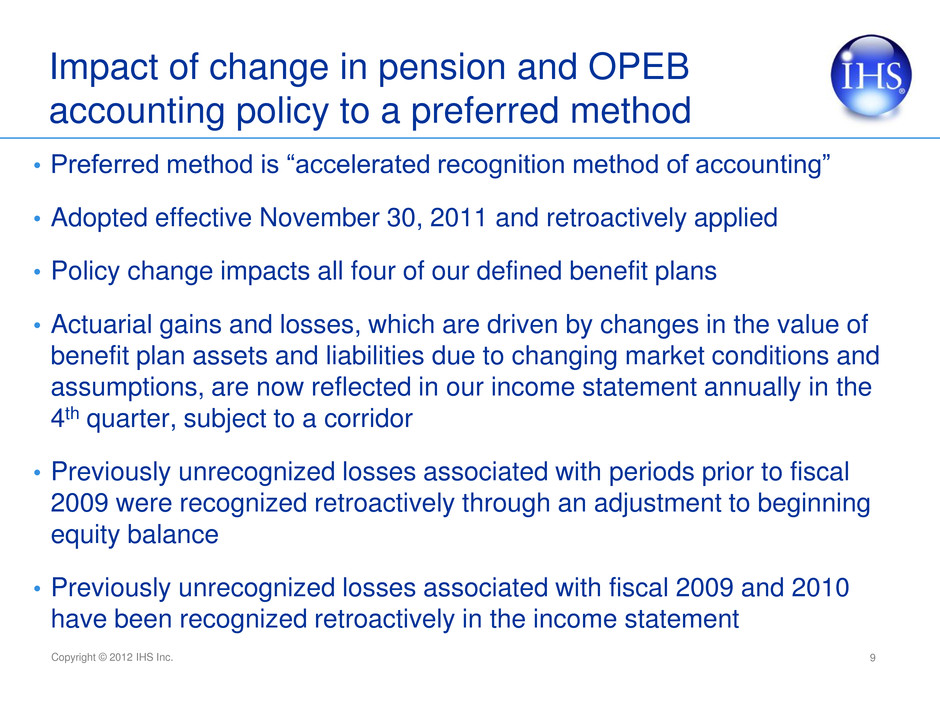

Copyright © 2012 IHS Inc. Impact of change in pension and OPEB accounting policy to a preferred method • Preferred method is “accelerated recognition method of accounting” • Adopted effective November 30, 2011 and retroactively applied • Policy change impacts all four of our defined benefit plans • Actuarial gains and losses, which are driven by changes in the value of benefit plan assets and liabilities due to changing market conditions and assumptions, are now reflected in our income statement annually in the 4th quarter, subject to a corridor • Previously unrecognized losses associated with periods prior to fiscal 2009 were recognized retroactively through an adjustment to beginning equity balance • Previously unrecognized losses associated with fiscal 2009 and 2010 have been recognized retroactively in the income statement 9

Copyright © 2012 IHS Inc. Impact of pension funding change • Eliminates the current deficit in our US pension plan • Funded approximately $65 million in early fiscal 2012 • Approximately $57 million of which is a one-time deficit funding and fees and costs associated with the settlement of retiree pension obligations through third-party annuitization; no impact to 2012 Adjusted EBITDA calculation • Approximately $8 million relates to 2012 pension and, consistent with guidance previously provided, impacts 2012 Adjusted EBITDA ratably through the year 10

Copyright © 2012 IHS Inc. Impact of steps taken – “before” and “after” as reflected in 2011 financials Income Statement (for year ended 11/30/11): Pension & Postretirement Expense $11.0 $45.0 US GAAP Net Income $(6.8) $(27.9) US GAAP Diluted EPS $(0.10) $(0.42) Adjusted EBITDA $(0.6) $(0.3) 11 ($ in millions, except diluted earnings per share) Estimated financial statement amounts before steps taken Actual financial statement amounts after steps taken Balance Sheet Components (as of 11/30/11): Net Benefit Obligation $292.0 $188.1 Net Asset/(Liability) $(50.0) $(68.7) Pre-Tax Accumulated Other Comprehensive Loss (Net Actuarial Loss) $128.0 $8.9

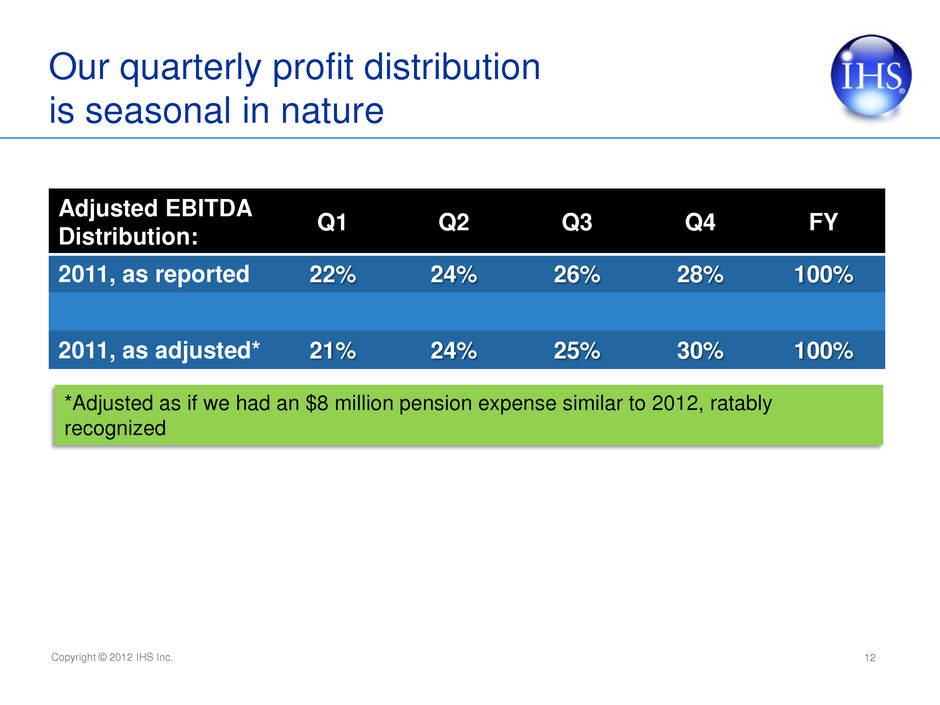

Copyright © 2012 IHS Inc. Our quarterly profit distribution is seasonal in nature 12 Adjusted EBITDA Distribution: Q1 Q2 Q3 Q4 FY 2011, as reported 22% 24% 26% 28% 100% 2011, as adjusted* 21% 24% 25% 30% 100% *Adjusted as if we had an $8 million pension expense similar to 2012, ratably recognized