Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Dehaier Medical Systems Ltd | v244865_8k.htm |

Dehaier Medical Systems Limited NASDAQ : DHRM January, 2012

Forward Looking Statements This presentation contains forward - looking statements as defined by the Private Securities Litigation Reform Act of 1995 . Forward - looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts . These statements are subject to uncertainties and risks including, but not limited to, product and service demand and acceptance, changes in technology, economic conditions, the impact of competition and pricing, government regulation, and other risks contained in reports filed by the company with the Securities and Exchange Commission . In particular, forward - looking statements include the following : our discussions of planned growth strategies, projected revenue growth and product mixes, expectations about governmental infrastructure spending, performance and opportunities in our new business initiatives, receipt of foreign governmental approvals for current and future products, the continuation of favorable market conditions in future periods . All such forward - looking statements, whether made by or on behalf of the company, are expressly qualified by the cautionary statements and any other cautionary statements which may accompany the forward - looking statements . In addition, the company disclaims any obligation to update any forward - looking statements to reflect events or circumstances after the date hereof .

• Introduction • History • Management Company Overview • Product Categories and Market Business Overview • Financial Highlights Financial Results • Growth Strategy • New Business Initiatives Growth Plan

About Us A leading China - based manufacturer and distributor of professional medical equipment as well as homecare medical products. » Founded in 2003, completed IPO and NASDAQ listing in 2010 » Headquartered in Beijing Science Park » R&D and Sales center in Beijing, over 20 marketing offices across China Who We Are » To be a leading manufacturer and provider of medical equipment in China » To become the largest and most reliable provider of respiratory and oxygen homecare medical products and services in China » To develop a leading position in the emerging market of home oxygen therapy service (“HOTS”) in China Our Vision Company Overview

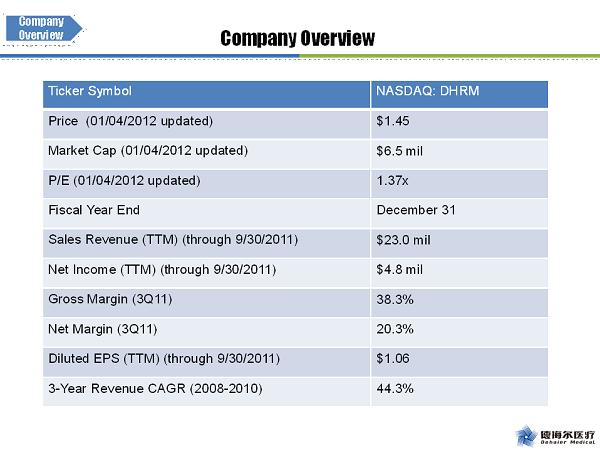

Company Overview Company Overview Ticker Symbol NASDAQ: DHRM Price (01/04/2012 updated) $1.45 Market Cap (01/04/2012 updated) $6.5 mil P/E (01/04/2012 updated) 1.37x Fiscal Year End December 31 Sales Revenue (TTM) (through 9/30/2011) $23.0 mil Net Income (TTM) (through 9/30/2011) $4.8 mil Gross Margin (3Q11) 38.3% Net Margin (3Q11) 20.3% Diluted EPS (TTM) (through 9/30/2011) $1.06 3 - Year Revenue CAGR (2008 - 2010) 44.3%

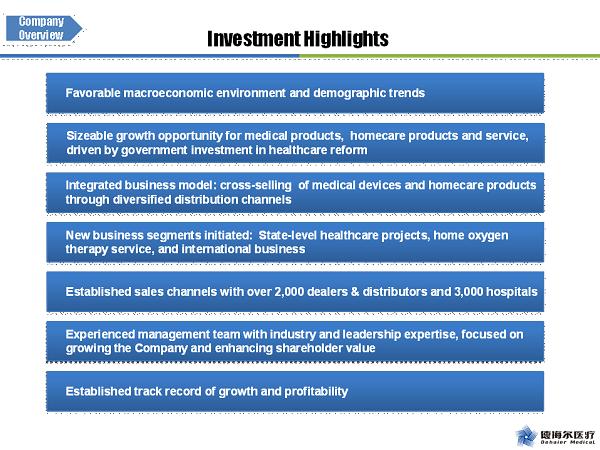

Favorable macroeconomic environment and demographic trends Sizeable growth opportunity for medical products, homecare products and service, driven by government investment in healthcare reform Integrated business model: cross - selling of medical devices and homecare products through diversified distribution channels New business segments initiated: State - level healthcare projects, home oxygen therapy service, and international business Experienced management team with industry and leadership expertise, focused on growing the Company and enhancing shareholder value Established track record of growth and profitability Investment Highlights Company Overview Established sales channels with over 2,000 dealers & distributors and 3,000 hospitals

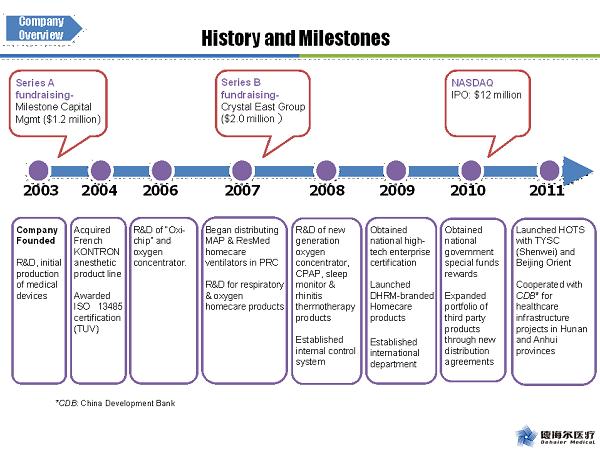

Company Founded R&D, initial production of medical devices Acquired French KONTRON anesthetic product line Awarded ISO 13485 certification (TUV) R&D of “Oxi - chip” and oxygen concentrator. Began distributing MAP & ResMed homecare ventilators in PRC R&D for respiratory & oxygen homecare products R&D of new generation oxygen concentrator, CPAP, sleep monitor & rhinitis thermotherapy products Established internal control system 获得国家高新 技术企业认证 开始销售德海 尔自产家庭医 疗产品 启动国际市场 的开发及销售 Obtained national government special funds rewards Expanded portfolio of third party products through new distribution agreements History and Milestones NASDAQ IPO: $12 million 2003 2004 2006 Series B fundraising - Crystal East Group ($2.0 million ) Series A fundraising - Milestone Capital Mgmt ($1.2 million ) 2007 2008 2009 2010 Launched HOTS with TYSC (Shenwei) and Beijing Orient Cooperated with CDB * for healthcare infrastructure projects in Hunan and Anhui provinces 2011 Obtained national high - tech enterprise certification Launched DHRM - branded Homecare products Established international department Company Overview * CDB : China Development Bank

Fei Dong Chief Operating Officer Administration & Coordination Assessments & Evaluation Marketing & Sales M&S Management Weibing Yang Vice President Internal Control Financial Management Yanying Qi Chief Financial Officer Ping Chen CEO & President Seasoned Management Team Ping Chen, CEO & President . 20 years experience in medical device R&D and distribution . Founded Beijing Dehaier Medical Technology Co . in 2003 . Previously CEO of Beijing Chengcheng Medical Electronic Equipment Co . , Chief Engineer at the No . 2 Academy, Ministry of Aeronautics and Astronautics, Head of the Civilian Products . Bachelor’s degree from National University of Defense Technology . Master’s degree in Ministry of Aeronautics and Astronautics . Weibing Yang, Vice President of Sales and Marketing . Previously Sales Director in Beijing Dehaier Medical Technology Company . Product manager for AMTRONIX, sales manager for Planmeca Medical Equipment . Doctor in the Beijing Ship Hospital . Graduate of the Medical School at Soochow University . Yanying (Aileen) Qi, Chief Financial Officer . Previously served as senior financial manager at Dehaier for over years . Prior to joining Dehaier, Ms . Qi also served as financial manager of Singapore Shoubiao Company . Ms . Qi earned dual degrees in accounting and finance at Renmin University of China . Fei Dong, Chief Operating Officer . More than 20 years of experience in the healthcare industry . Previously sales manager, after - sales manager, assistant to CEO and public affairs director at Dehaier . Academic background in finance . More than 10 years of career with the company and familiar with all its business details . Company Overview

• Introduction • History • Management Company Overview • Product Categories and Markets Business Overview • Achievement Highlights Financial Results • Growth Strategy • New Business Initiatives Growth Plan

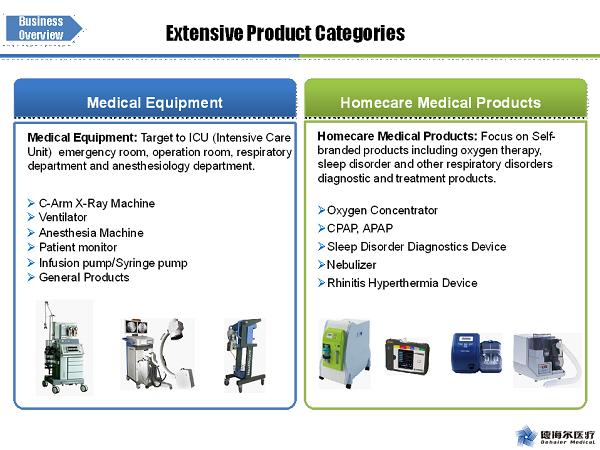

Medical Equipment Homecare Medical Products Extensive Product Categories Business Overview Homecare Medical Products: Focus on Self - branded products including oxygen therapy, sleep disorder and other respiratory disorders diagnostic and treatment products. » Oxygen Concentrator » CPAP, APAP » Sleep Disorder Diagnostics Device » Nebulizer » Rhinitis Hyperthermia Device Medical Equipment: Target to ICU (Intensive Care Unit) emergency room, operation room, respiratory department and anesthesiology department. » C - Arm X - Ray Machine » Ventilator » Anesthesia Machine » Patient monitor » Infusion pump / Syringe pump » General Products

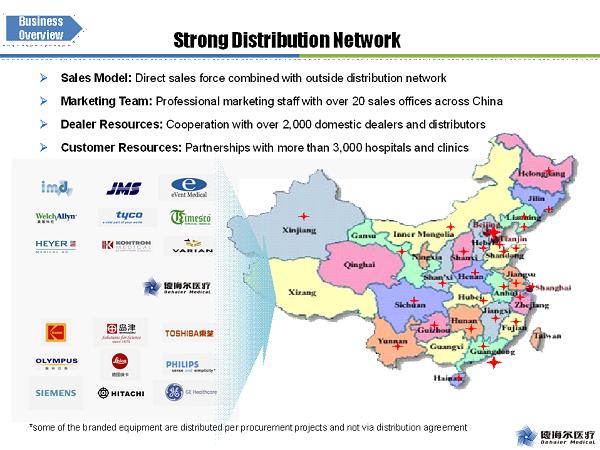

Strong Distribution Network » Sales Model: Direct sales force combined with outside distribution network » Marketing Team: Professional marketing staff with over 20 sales offices across China » Dealer Resources: Cooperation with over 2,000 domestic dealers and distributors » Customer Resources: Partnerships with more than 3,000 hospitals and clinics Business Overview *some of the branded equipment are distributed per procurement projects and not via distribution agreement

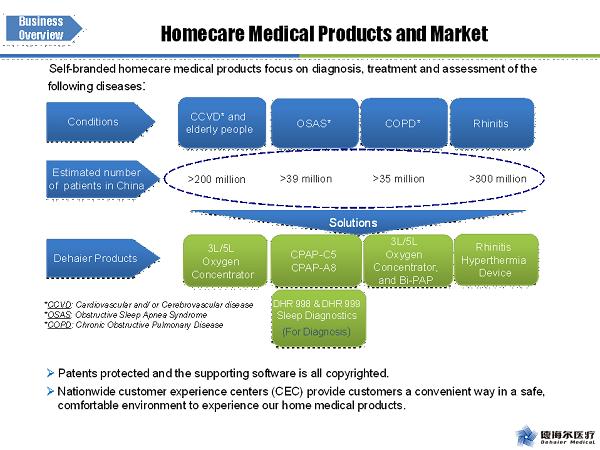

Homecare Medical Products and Market Self - branded homecare medical products focus on diagnosis, treatment and assessment of the following diseases : Solutions CCVD* and elderly people OSAS* COPD* Rhinitis 3L/5L Oxygen Concentrator CPAP - C5 CPAP - A8 3L/5L Oxygen Concentrator, and Bi - PAP Rhinitis Hyperthermia Device DHR 998 & DHR 999 Sleep Diagnostics (For Diagnosis ) Conditions Estimated number of patients in China Dehaier Products >200 million >39 million >35 million >300 million » Patents protected and the supporting software is all copyrighted. » Nationwide customer experience centers (CEC) provide customers a convenient way in a safe, comfortable environment to experience our home medical products. Business Overview * CCVD : Cardiovascular and/ or Cerebrovascular disease * OSAS : Obstructive Sleep Apnea Syndrome * COPD : Chronic Obstructive Pulmonary Disease

• Introduction • History • Management Company Overview • Product Categories and Markets Business Overview • Financial Highlights Financial Results • Growth Strategy • New Business Initiatives Growth Plan

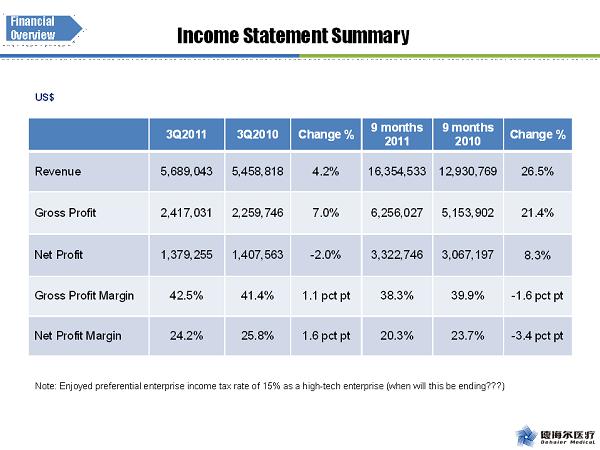

Income Statement Summary US$ Note: Enjoyed preferential enterprise income tax rate of 15% as a high - tech enterprise (when will this be ending???) Financial Overview 3Q2011 3Q2010 Change % 9 months 2011 9 months 2010 Change % Revenue 5,689,043 5,458,818 4.2% 16,354,533 12,930,769 26.5% Gross Profit 2,417,031 2,259,746 7.0% 6,256,027 5,153,902 21.4% Net Profit 1,379,255 1,407,563 - 2.0% 3,322,746 3,067,197 8.3% Gross Profit Margin 42.5% 41.4% 1.1 pct pt 38.3% 39.9% - 1.6 pct pt Net Profit Margin 24.2% 25.8% 1.6 pct pt 20.3% 23.7% - 3.4 pct pt

2.3 3.5 4.9 7.6 2.3 2.4 35.2% 37.0% 39.3% 38.9% 41.4% 42.5% 30.0% 32.0% 34.0% 36.0% 38.0% 40.0% 42.0% 0 2 4 6 8 07 08 09 10 3Q10 3Q11 Gross Profit Gross Margin Gross Profit and Gross Profit Margin Net Profit Financial Operation Results Quick View Financial Overview US$ Million Sales Revenue 0.8 0.9 2.7 4.5 1.41 1.38 07 08 09 10 3Q10 3Q11

• Introduction • History • Management Company Overview • Product Categories and Markets Business Overview • Financial Highlights Financial Results • Growth Strategy • New Business Initiatives Growth Plan

Growth Strategy Expand existing relationships of third party distributed products Pursuit new distribution partners Build international business for self - branded medical products Expand and strengthen our team for State - level Contracted Business Actively participate in government healthcare projects Increase investment in R&D, marketing for self - branded products Diversify sales through shifting focus to homecare medical segment Become a leading respiratory and oxygen product manufacturer Expand coverage for home oxygen therapy service Utilize the service platform to engage in value - added business Obtain FDA and CE approval for home medical products Establish worldwide distribution network for homecare medical products Growth Plan Medical Equipment Sales Homecare Medical Product and Service International Business

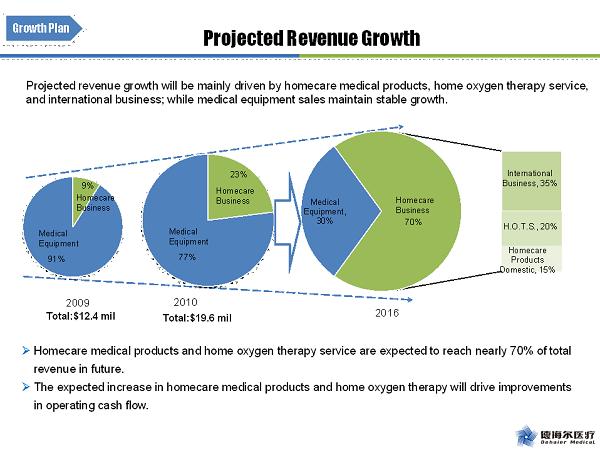

» Homecare medical products and home oxygen therapy service are expected to reach nearly 70% of total revenue in future. » The expected increase in homecare medical products and home oxygen therapy will drive improvements in operating cash flow. 2009 2010 2016 Total:$12.4 mil Total:$19.6 mil Growth Plan 9% 91 % Projected revenue growth will be mainly driven by homecare medical products, home oxygen therapy service, and international business; while medical equipment sales maintain stable growth. Medical Equipment, 30% International Business, 35% H.O.T.S., 20% Homecare Products Domestic, 15% Homecare Business Medical Equipment Projected Revenue Growth Homecare Business Medical Equipment 23% 77% Homecare Business 70%

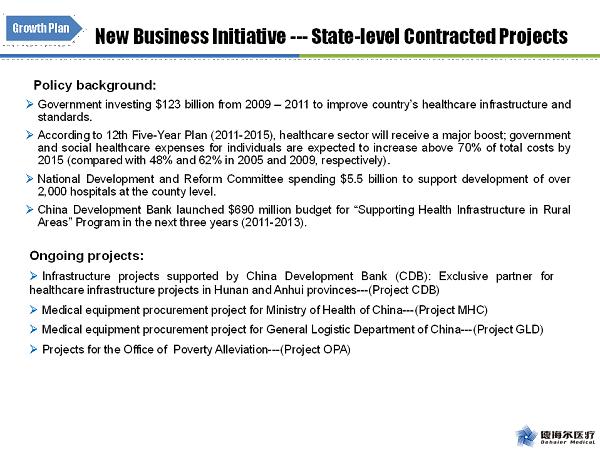

New Business Initiative --- State - level Contracted Projects Ongoing projects: » Infrastructure projects supported by China Development Bank (CDB) : Exclusive partner for healthcare infrastructure projects in Hunan and Anhui provinces --- (Project CDB) » Medical equipment procurement project for Ministry of Health of China --- (Project MHC) » Medical equipment procurement project for General Logistic Department of China --- (Project GLD) » Projects for the Office of Poverty Alleviation --- (Project OPA) Policy background: » Government investing $ 123 billion from 2009 – 2011 to improve country’s healthcare infrastructure and standards . » According to 12 th Five - Year Plan ( 2011 - 2015 ), healthcare sector will receive a major boost ; government and social healthcare expenses for individuals are expected to increase above 70 % of total costs by 2015 (compared with 48 % and 62 % in 2005 and 2009 , respectively) . » National Development and Reform Committee spending $ 5 . 5 billion to support development of over 2 , 000 hospitals at the county level . » China Development Bank launched $ 690 million budget for “Supporting Health Infrastructure in Rural Areas” Program in the next three years ( 2011 - 2013 ) . Growth Plan

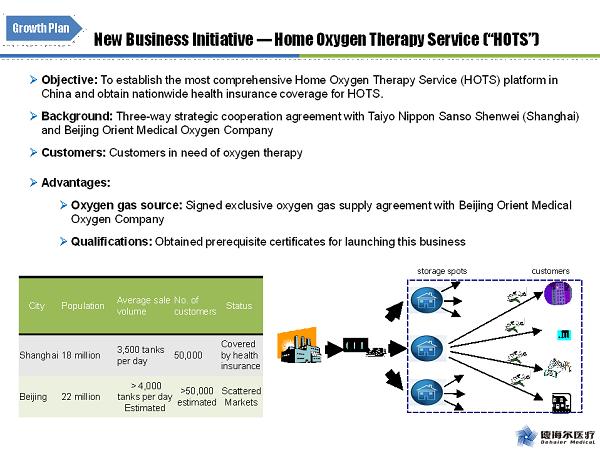

New Business Initiative --- Home Oxygen Therapy Service (“HOTS”) » Objective: To establish the most comprehensive Home Oxygen Therapy Service (HOTS) platform in China and obtain nationwide health insurance coverage for HOTS. » Background: Three - way strategic cooperation agreement with Taiyo Nippon Sanso Shenwei (Shanghai) and Beijing Orient Medical Oxygen Company » Customers: Customers in need of oxygen therapy storage spots customers » Advantages: » Oxygen gas source: Signed exclusive oxygen gas supply agreement with Beijing Orient Medical Oxygen Company » Qualifications : O btained prerequisite certificates for launching this business City Population Average sale volume No. of customers Status Shanghai 18 million 3,500 tanks per day 50,000 Covered by health insurance Beijing 22 million > 4,000 tanks per day Estimated >50,000 estimated Scattered Markets Growth Plan

» Entered home oxygen therapy service in Beijing in 2 Q 2011 » Target to duplicate this business model in other cities » Cross selling opportunities from existing sales channels and customer databases » Building a B 2 C e - commerce platform to integrate home medical devices, home care products, and home oxygen therapy service as well as other value - added services . Tanked oxygen gas delivery Home medical devices ( CPAP etc. ) Supplies, home care products Other value - added services B2C Platform Beijing Launched Tianjin Middle 2013 Chengdu Late 2013 Guangzhou - Wuhan Middle 2014 Xi’an - Zhengzhou After 2014 Home oxygen therapy service marketing plan Customized delivery solution to meet with customers’ needs, with options of several sizes of tanks Combined home medical product mix: Dehaier self - branded and third party brand products Traditional Chinese Medical (TCM) delivery, and other customized services Respiratory masks, water tanks, disposables etc. Growth Plan New Business Initiative --- “HOTS”

» Received CE certification for 2 products and 8 more in process of application » Reached to more than 20 countries worldwide » Cooperated with several renowned US and European companies on international marketing » Established several distribution agreements for our homecare medical products in Europe » Build up brand awareness through constantly participating in international exhibitions New Business Initiative --- International Business x Florida International Medical Expo x Arab Health International Exhibition x International Home Care Expo, USA x International Medical Trade Fair, Dusseldorf, Germany International exhibitions attended: Growth Plan

Thank you ! DHRM January 2012 Please Contact: investors@dehaier.com.cn