Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - China Electronics Holdings, Inc. | v244456_ex23-1.htm |

As filed with the Securities and Exchange Commission on January 6, 2012

Registration No. 333-169968

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CHINA ELECTRONICS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

0273

|

98-0550385

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

Building 3, Binhe District, Longhe East Road, Lu’an City

Anhui Province, PRC 237000

011-86-564-3224888

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Hailong Liu

President and Chief Executive Officer

Building 3, Binhe District, Longhe East Road, Lu’an City

Anhui Province, PRC 237000

011-86-564-3224888

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

China Financial Services, Inc.

87 Dennis Street

Garden City Park, NY 11040

(212) 240-0707

Approximate date of commencement of proposed sale to public: as soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o __________

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o _________

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o __________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be

registered

|

Amount to be

registered (1)

|

Proposed maximum

offering price per

unit

|

Proposed

maximum

aggregate offering

price

|

Amount of

registration fee

(5)

|

||||||||||||

|

Common Stock, par value $.0001 per share

|

2,468,059 | |||||||||||||||

|

Common Stock, par value $.0001 per share, underlying Series A Warrants

|

183,999 | (2) | ||||||||||||||

|

Common Stock, par value $.0001 per share, underlying Series B Warrants

|

183,999 | (3) | ||||||||||||||

|

Common Stock, par value $.0001 per share, underlying Series E Warrants

|

585,453 | (4) | ||||||||||||||

|

Total

|

3,421,510 | |||||||||||||||

|

|

(1)

|

Pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended, there are also registered hereunder such indeterminate number of additional shares as may be issued to the selling stockholders to prevent dilution resulting from stock splits, stock dividends or similar transactions.

|

|

|

(2)

|

Consists of shares of Common Stock underlying three year Series A warrants to purchase an aggregate of 183,999 shares of Common Stock with an exercise price of $2.19 per share.

|

|

|

(3)

|

Consists of shares of Common Stock underlying three year Series B warrants to purchase an aggregate of 183,999 shares of Common Stock with an exercise price of $2.63 per share.

|

|

|

(4)

|

Consists of shares of Common Stock underlying five year Series E warrants to purchase an aggregate of 585,453 shares of Common Stock with an exercise price of $0.25 per share.

|

|

|

(5)

|

$1,711 was previously paid.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

3,421,510 Shares of Common Stock

CHINA ELECTRONICS HOLDINGS, INC.

Common Stock

PROSPECTUS

__________, 2011

1

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 30, 2011

PRELIMINARY PROSPECTUS

3,421,510 Shares

China Electronics Holdings, Inc.

Common Stock

This prospectus relates to the resale by the Selling Stockholders of up to 3,421,510 shares of our Common Stock, $.0001 par value (“Common Stock”), including an aggregate of 495,588 shares issued to 5 Selling Stockholders pursuant to or in connection with a Share Exchange Agreement dated as of July 9, 2010 (the “Share Exchange Agreement”), an aggregate of 953,451 shares of common stock issuable to 5 Selling Stockholders upon exercise of warrants to purchase our Common Stock issued pursuant to the Share Exchange Agreement, an aggregate of 1,122,641 shares of our Common Stock issued to 106 Selling Stockholders in a series of private placements (individually, a “Private Placement” and collectively the “Private Placements”) pursuant to Subscription Agreements dated between July 9, 2010 and August 17, 2010 (the “Purchase Agreement”), and an aggregate of 849,830 shares of our Common Stock issued to 4 Selling Stockholders pursuant to the Share Exchange Agreement.

All of such shares may be sold by the Selling Stockholders. It is anticipated that the Selling Stockholders will sell these shares of Common Stock from time to time in one or more transactions, in negotiated transactions or otherwise, at prevailing market prices or at prices otherwise negotiated (see “Plan of Distribution”). We will not receive any proceeds from the sales by the Selling Stockholders. Under the terms of the warrants, cashless exercise is permitted in certain circumstances. We will not receive any proceeds from any cashless exercise of the warrants, but will receive the exercise price of warrants exercised on a cash basis. If all of the warrants covered by this prospectus are exercised for cash, the Company would receive aggregate gross proceeds of $1,033,238. We will pay all of the registration expenses incurred in connection with this offering, but the Selling Stockholders will pay any selling commissions, brokerage fees and related expenses.

There is a limited market for our Common Stock. The shares are being offered by the Selling Stockholders in anticipation of the continued development of a secondary trading market in our Common Stock. We cannot give you any assurance that an active trading market for our Common Stock will develop, or if an active market does develop, that it will continue.

Our Common Stock is quoted on OTCQB and trades under the symbol CEHD.QB. On May 6, 2011, the closing sale price of our Common Stock was $1.70 per share.

Investing in our Common Stock involves risks. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ______, 2011

2

TABLE OF CONTENTS

|

Page

|

|

|

|

|

|

Prospectus Summary

|

4

|

|

Risk Factors

|

8

|

|

Cautionary Note Regarding Forward-Looking Statements

|

15

|

|

Use of Proceeds

|

16

|

|

Market for Common Equity and Related Stockholder Matters

|

17

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

18

|

|

Organizational History of the Company and its Subsidiaries

|

31

|

|

Business

|

32

|

|

Description of Property

|

39

|

|

Directors, Executive Officers, Promoters and Control Persons

|

39

|

|

Transactions With Related Persons, Promoters And Control Persons; Corporate Governance

|

41

|

|

Legal Proceedings

|

41

|

|

Security Ownership of Certain Beneficial Owners and Management

|

41

|

|

Selling Stockholders

|

43

|

|

Description of Securities

|

52

|

|

Shares Eligible for Future Sale

|

55

|

|

Material United States Federal Income Tax Considerations

|

55

|

|

Material PRC Income Tax Considerations

|

58

|

|

Plan of Distribution

|

60

|

|

Legal Matters

|

61

|

|

Experts

|

61

|

|

Changes in and Disagreements With Accountants

|

62

|

|

Where You Can Find More Information

|

62

|

|

Index to Financial Statements

|

F-1

|

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to offer or sell these securities. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy these securities in any jurisdiction in which such offer or solicitation may not be legally made. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us or the underwriter, and neither we nor the underwriter accept any liability in relation thereto.

We obtained statistical data, market data and other industry data and forecasts used throughout, or incorporated by reference in, this prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. While we believe that the statistical data, industry data and forecasts and market research are reliable, we have not independently verified the data. We have not sought the consent of the sources to refer to their reports appearing or incorporated by reference in this prospectus.

3

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the “Risk Factors” section and our consolidated financial statements and the related notes appearing at the end of this prospectus, before making an investment decision. Unless the context otherwise requires, the "Company", "we," "us," and "our," refer collectively to (i) China Electronics Holdings, Inc., a Nevada corporation (“China Electronics”), (ii) China Electronic Holdings, Inc., a Delaware corporation (“CEH Delaware”), and (iii) Lu’an Guoying Electronic Sales Co., Ltd., a wholly foreign enterprise (“WOFE”), under the laws of the People’s Republic of China (“Guoying”).

Overview

We are a significant retailer of consumer electronics and appliances in certain rural markets in the People’s Republic of China (the “PRC” or “China”). Our retail stores operate under the Guoying brand name. Such stores include locations that are owned and operated by us as well as locations that we exclusively franchise pursuant to cooperation agreements that franchisees sign with us. Both our Company-owned stores and our exclusive franchise stores only sell merchandise that we provide to them as their exclusive wholesaler, and such merchandise includes Guoying branded products as well as products from major wholesalers such as Sony, Samsung and LG. In addition to our Company-owned stores and our exclusive franchise stores, we provide Guoying branded merchandise as a wholesaler or distributor to other stores to which we are a non-exclusive wholesaler of consumer electronics and appliances.

As of September 30, 2011:

|

|

|

We were the exclusive wholesaler to 561 exclusive franchise stores operating under the Guoying brand name;

|

|

|

|

We provided Guoying branded merchandise as well as merchandise from well known companies including Sony, Samsung and LG to 716 non-exclusive stores; and

|

|

|

|

We owned 2 stores both of which operate in Lu’An City, Anhui Province, that operate under the Guoying brand name and to which we are the exclusive wholesaler and distributor.

|

As of September 30, 2011, we provided merchandise to 1,279 stores located in Anhui, Henan and Hubei provinces.

We are the world-wide exclusive distributor for Guoying branded merchandise, which currently includes refrigerators and in the future will include consumer LED products. We are also a wholesaler in the Lu’an area for products under the brand names, Sony, LG, Samsung, Tsinghua Tongfang, Haier, Shanghai Shangling, Chigo, Huayang and Huangming. Guoying is a general sales agency of Sino-Japan Sanyo electronic products, such as Sanyo televisions, air conditioners, washing machines and micro-wave ovens. Currently, our products are supplied to us by large distributors, including the brand names Sony, Samsung, LG, Tsinghua Tongfang, Haier. Guoying has partnered with Huangming and Huayang, the two largest manufacturers of solar thermal products in China, to be their exclusive retail outlet in Lu’an. Some of their energy efficient, “green” products include solar thermal water heaters, solar panels (photovoltaic) and energy saving glass.

In the periods ended September 30, 2011 and 2010, we generated net revenues of approximately $87.61 million and approximately $89.36 million, respectively, and net income attributable to us of approximately $16.22 million and approximately $15.09 million, respectively. In the periods ended September 30, 2011 and 2010, we generated net revenues derived from sales to our exclusive franchise business of approximately $36.92 million and approximately $47.29 million respectively, representing 42.1% and 52.9% of our total net revenues; net revenues derived from sales to our non-exclusive stores of approximately $42.64 million and approximately $35.37 million, representing 48.7% and 39.6%, respectively, of our total revenues; and net revenues derived from sales by our company-owned stores of approximately $8.05 million and approximately $6.70 million, representing 9.2% and 7.5%, respectively, of our total revenues.

According to the 2010 PRC Census, more than 50% of China’s population resides in rural areas of China and rural purchasers are the largest consumer group in China. After many years of economic reforms, the average income of people living in China’s rural areas has gradually increased, and according to the National Bureau of Statistics of China, the per capita net income of rural residents increased 10.9% in 2010. Based on this increase in average income, we believe that such area has significant growth potential, and it does not appear that many of the urban chains have expanded into the rural communities.

4

First, according to information published by China Economic News dated December 9, 2010, the central government has increased the income of the rural population by reducing the amount of taxes paid by farmers. As a result of this increase in income, such people have more disposable income for discretionary spending.

Second, the Chinese government has initiated a rural home appliance and electronics rebate program, called the “Rural Consumer Electronics” plan. This plan (a) provides that the maximum sales price of electronics is fixed at a price which is usually equal to the market price of the same products in urban areas and (b) grants rural consumers a 13% rebate from the government on their purchases of electronics.

Third, the current consumer electronics and appliances markets in big PRC cities like Beijing, Shanghai, and Shenzhen are already saturated by electronics stores, which results in limited margins. While we have some competitors in the rural markets, we believe that the retail chains that exist in larger cities have not established any significant name recognition in the rural markets. Therefore, we believe that such stores’ success in larger cities will not necessarily result in success in the rural areas where we operate. We believe that significant opportunity remains due to the increased per capita income of rural residents.

Our Competitive Strengths

We believe that the following strengths differentiate us from our competitors and enable us to maintain a leading position as a rural retailer and wholesale distributor of electronics and consumer appliances in China:

|

|

|

We are a wholesaler in the Lu’an area for products under the brand name Sony, LG, Samsung, Tsinghua Tongfang, Haier, Shanghai Shangling;

|

|

|

|

We are a rural based business and we understand the preferences of a rural customers; and

|

|

|

|

We are the exclusive retail seller in the Lu’an area for Huangming and Huayang, each are well-regarded PRC companies that manufacture solar-powered products for consumer usage.

|

Our Strategy

Our goal is to become the dominant rural retailer and wholesale distributor of electronics and consumer appliances in China. The principal components of the business strategy we plan to implement to attain our goals include the following:

|

|

|

Develop New Exclusive Franchise Stores;

|

|

|

|

Develop New Company-Owned Stores;

|

|

|

|

Develop New Non-Exclusive Stores;

|

|

|

|

Be the Exclusive Rural Distributor for Well-Known Electronic and Consumer Appliance Manufactures; and

|

|

|

|

Develop an LED Wholesale and Manufacturing Business.

|

We anticipate funding our growth strategy primarily from our working capital and below is a summary of approximately how much we anticipate spending in order to achieve our growth strategies:

|

Growth Strategies

|

Approximate

Expenditures

|

Timing

|

|||

|

Develop new exclusive franchise stores

|

$

|

0.6 million

|

Ongoing

|

||

|

Develop new company-owned stores

|

$

|

3.4 million

|

Ongoing

|

||

|

Develop new non-exclusive stores

|

$

|

1.7 million

|

Ongoing

|

||

|

Develop additional OEM contracts

|

$

|

2.8 million

|

Ongoing

|

||

|

Develop LED manufacturing and wholesale business

|

$

|

8 million

|

Construction completed by 06/30/12

Commence manufacturing by 7/31/2012

|

||

5

Risks and Challenges

We believe that the following are some of the major risks and uncertainties that may materially and adversely affect our business, financial condition, results of operations and prospects:

|

|

|

Poor performance or sales by our exclusive franchise stores or non-exclusive stores;

|

|

|

|

Our dependence on a limited number of suppliers for our wholesale business;

|

|

|

|

Our ability to manage the growth and expansion of our operations;

|

|

|

|

Demand for electronics and consumer appliances in China may not continue to grow;

|

|

|

|

Our ability to develop new exclusive franchise stores; and

|

|

|

|

Adverse changes in the Chinese economy.

|

See “Risk Factors” beginning on page 8 and other information contained in this prospectus for a detailed discussion of these risks and uncertainties.

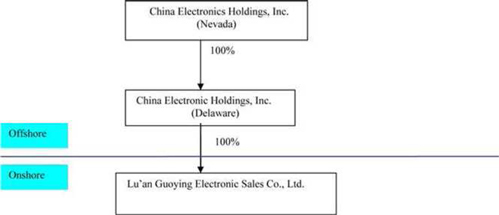

Our Corporate Structure

Our current structure is set forth in the diagram below:

Company Information

Our principal executive offices are located at Building G-08, Guangcai Market, Foziling West Road, Lu’an City, Anhui Province, PRC 237001, and our telephone number is 011-86-564-3224888.

THE OFFERING

Between three months and 2 ½ years prior to the consummation of the Share Exchange Agreement, dated as of July 9, 2010 (the “Share Exchange Agreement”), CEH Delaware sold shares of common stock and warrants to investors in transactions pursuant to Section 4(2) of the Securities Act of 1933 and Rule 506 of Regulation D promulgated thereunder. On July 15, 2010 we consummated the Share Exchange Agreement with certain Selling Stockholders. Pursuant to the Share Exchange Agreement, on July 15, 2010, 10 former stockholders of our subsidiary, CEH Delaware, transferred to us 100% of the outstanding shares of common stock and preferred stock of CEH Delaware and 100% of the warrants to purchase common stock of CEH Delaware held by them, in exchange for an aggregate of 13,785,902 newly issued shares of our Common Stock (including 13,665,902 shares of common stock issued pursuant to the Share Exchange Agreement dated July 22, 2010, and 120,000 shares of common stock issued to consultants related to their professional services) and warrants to purchase an aggregate of 1,628,572 shares of our Common Stock. CEH Delaware’s outstanding Series A warrants were exchanged on a one-for-one basis for Series A warrants of the Company to purchase an aggregate of 314,285 shares of Common Stock, with an exercise price of $2.19 per share. CEH Delaware’s outstanding Series B warrants were exchanged on a one-for-one basis for Series B warrants of the Company to purchase an aggregate of 314,285 shares of Common Stock, with an exercise price of $2.63 per share. CEH Delaware’s outstanding $1.00 warrants were exchanged on a one-for-one basis for Series E warrants of the Company to purchase an aggregate of 1,000,000 shares of Common Stock, with an exercise price of $0.25 per share. Pursuant to the terms of the Series A, B and E warrants, the Company is required to register as many shares as permitted of Common Stock issuable upon the exercise of the warrants.

6

On July 15, 2010 we also consummated a Private Placement made pursuant to a Subscription Agreement dated as of July 9, 2010 (the “Purchase Agreement”) with certain of the Selling Stockholders, pursuant to which we sold units (the “Units”) to such Selling Stockholders. Each Unit consists of four shares of our Common Stock, a warrant to purchase one share of Common Stock at an exercise price of $3.70 per share (a “Series C Warrant”) and a warrant to purchase one share of Common Stock at an exercise price of $4.75 per share (a “Series D Warrant”). Additional Private Placements were consummated on July 26, 2010 and August 17, 2010. The aggregate gross proceeds from the sale of the Units was $5,251,548 and in such Private Placements, an aggregate of (a) 1,989,211 shares of our Common Stock, (b) Series C Warrants to purchase an aggregate of 499,403 shares of our Common Stock and (c) Series D Warrants to purchase an aggregate of 499,403 shares of our Common Stock was sold. Pursuant to Section 9(d) of the Purchase Agreement, the Company is required to register all of the shares of Common Stock and shares of Common Stock underlying the warrants that were issued in the Private Placement. Under Section 8 of the warrants issued by the Company, as many shares as permitted of Common Stock issuable upon exercise of the warrants are required to be registered pursuant to Section 9(d) of the Purchase Agreement.

The below table sets forth gross proceeds paid to the Company in the Private Placements, fees paid by the Company in connection with the Private Placements and the resulting net proceeds to the Company:

|

Gross Proceeds

|

Fees

|

Net Proceeds

|

||||||||

| $ | 5,251,548 | $ | 525,155 | (1) | $ | 4,726,393 | ||||

(1) Represents an aggregate of success fees paid to Hunter Wise Securities, LLC and American Capital Partners, LLC in connection with the offering. As additional consideration, Hunter Wise Securities, LLC received a Series F warrant to purchase 31,429 shares of Common Stock at an exercise price of $1.75 per share, a Series F warrant to purchase 94,329 shares of Common Stock at an exercise price of $2.64 per share and 180,000 shares of Common Stock. American Capital Partners, LLC received a Series F warrant to purchase 104,592 shares of Common Stock at an exercise price of $2.64 per share.

This prospectus relates to the resale of the 3,421,510 shares of our Common Stock issued to the Selling Stockholders and issuable to the Selling Stockholders upon exercise of all of the warrants referred to in the preceding paragraphs.

|

Issuer

|

China Electronics Holdings, Inc.

|

|

|

Common Stock outstanding prior to the Offering

|

16,775,113 shares

|

|

|

Common Stock offered by the Selling Stockholders

|

3,421,510 shares

|

|

|

Total shares of Common Stock to be outstanding after the Offering assuming exercise of the Series A, B and E warrants registered on this Registration Statement

|

17,728,564 shares

|

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of the shares of Common Stock.

|

|

|

Our OTCQB Trading Symbol

|

CEHD.QB

|

|

|

Risk Factors

|

You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our Common Stock.

|

The number of shares of our Common Stock that will be outstanding after this offering is based on 16,775,113 shares of our Common Stock outstanding as of December 31, 2011, and gives effect to the issuance of an aggregate of 953,451 shares of Common Stock to the Selling Stockholders upon exercise of the Series A, B and E warrants to purchase our Common Stock. The number of shares of our Common Stock that will be outstanding after this offering does not include 130,286 shares of our Common Stock that are currently issuable upon exercise of our Series A warrants, 130,286 shares of our Common Stock that are currently issuable upon exercise of our Series B warrants, 499,403 shares of our Common Stock that are currently issuable upon exercise of our Series C warrants, 499,403 shares of our Common Stock that are currently issuable upon exercise of our Series D warrants, 414,547 shares of our Common Stock that are currently issuable upon exercise of our Series E warrants, 230,350 shares of Common Stock that are currently issuable upon exercise of our Series F warrants and 50,000 shares of Common Stock that are currently issuable upon exercise of our Series G warrants. We are not required to register the shares of Common Stock issuable upon exercise of our Series F and Series G warrants at this time and we cannot estimate when or whether we will be required to register such shares.

7

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our sales revenues are derived primarily from our exclusive franchise stores and non-exclusive stores, and should any of them perform poorly or cease purchasing wholesale merchandise from us, our sales results, revenues, net income, reputation and competitive position would suffer.

We sell most of our products through exclusive franchise stores and non-exclusive stores. Though our sales persons visit the stores regularly, third party store managers make decisions about order quantities and are responsible for the daily operations of the stores. If factors either in or out of a store manager’s control cause harm to a store’s business, the store’s income could decrease, which would negatively impact our sales. If an exclusive franchise store bearing our brand name performs poorly or is run improperly by such third party store managers, our reputation could be adversely affected. Additionally, if a large number of exclusive franchise stores and non-exclusive franchise stores choose to cease purchasing products from us, we could experience a material decrease in revenues and net income. There is no termination provision in, or expiration of the term of, the exclusive franchise agreements.

We depend heavily on large suppliers and if any of our largest suppliers cease to provide products to us, our business could be adversely affected.

All of the products purchased by the Company during the fiscal year ended December 31, 2010 were provided by twelve vendors, with three major vendors, Shandong Huangming, Jiangsu Huayang Solar Power Sales Co. and Ynagzhou Huiyin Co.,Ltd. accounting for 43.5%, 16.5% and 12.6% of our total purchases, respectively. All of the products purchased by the Company during the fiscal year ended December 31, 2009 were provided by seven vendors, with three major vendors, Shandong Huangming, Hier Hefei Ririshun Sales Co., and Jiangshu Huayang Solar Power Sales Co. accounting for 52.2%, 26.2% and 14.9% of our total purchases, respectively. If any of these vendors cease doing business with us, we will experience significant reductions in our sales and income.

We may not be able to effectively control and manage our growth, and a failure to do so could adversely affect our operations and financial condition.

We also plan to expand our company-owned stores and develop manufacturing capabilities for our new LED business. Planned expenditures for the stores and manufacturing capabilities are $8-10 million. Even if we are able to secure the funds necessary to implement our growth strategies (of which there can be no assurance), we will face management, resource and other challenges in expanding our current facilities, integrating acquired assets or businesses with our own, and managing expanding product offerings. Failure to effectively deal with increased demands on our resources could interrupt or adversely affect our operations and cause production backlogs, longer product development time frames and administrative inefficiencies. Other challenges involved with expansion, acquisitions and operation include:

|

|

|

unanticipated costs;

|

|

|

|

the diversion of management’s attention for unanticipated business concerns;

|

|

|

|

potential adverse effects on existing business relationships with suppliers and customers;

|

|

|

|

obtaining sufficient working capital to support expansion;

|

|

|

|

expanding our product offerings and maintaining the high quality of our products;

|

|

|

|

maintaining adequate control of our expenses and accounting systems;

|

8

|

|

|

successfully integrating any future acquisitions;

|

|

|

|

anticipating and adapting to changing conditions in the electronics retail industry, whether from changes in government regulations, mergers and acquisitions involving our competitors, technological developments or other economic, competitive or market dynamics; and

|

|

|

|

outsourcing the manufacture and production of our refrigerators to OEM manufacturers may not give us sufficient control over the quality of those products.

|

Even if we do experience increased sales due to expansion, there may be a lag between the time when the expenses associated with an expansion or acquisition are incurred and the time when we recognize such benefits, which would affect our earnings.

We may not be able to hire and retain qualified personnel to support our growth and if we are unable to do so, our ability to implement our business objectives could be limited. Difficulties with hiring, employee training and other labor issues could disrupt our operations.

Our operations depend on the work of our sales persons and other employees. We may not be able to retain those employees, successfully hire and train new employees or integrate new employees into the Company. Any such difficulties would reduce our operating efficiency and increase our costs of operations, and could harm our overall financial condition.

Our operations also depend in significant part upon the continued contributions of our key technical and senior management personnel, including Mr. Hailong Liu, and upon our ability to attract and retain additional qualified management, technical, marketing and sales and support personnel for our operations. If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them within a reasonable time, which could result in disruption of our business and an adverse effect on our financial condition and results of operations. None of our senior management personnel have signed employment agreements. Significant turnover in our senior management could significantly deplete the institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the technical, marketing and sales aspects of our business, which could be harmed by turnover in the future. Competition for senior management and personnel is intense, the pool of qualified candidates is very limited, and we may not be able to retain the services of our senior executives or senior personnel, or attract and retain high-quality senior executives or senior personnel in the future. This failure could limit our future growth and reduce the value of our common stock.

The consumer electronics and appliances retail industry in the PRC is competitive and, unless we are able to compete effectively with competitor retailers, our profits could suffer.

The consumer electronics and appliances retail industry in the PRC has become highly and increasingly competitive. Large national retailers such as Suning Appliance and Guomei Appliance have expanded, and local and regional competition has increased. Some of these companies have substantially greater financial, marketing, personnel and other resources than we do.

Our competitors could adapt more quickly to evolving consumer preferences or market trends, have greater success in their marketing efforts, control supply costs and operating expenses more effectively, or do a better job in formulating and executing expansion plans. Increased competition may also lead to price wars, counterfeit products or negative brand advertising, all of which may adversely affect our market share and profit margins. Existing or new competitors could receive contracts for which we compete due to events and factors beyond our control, and expansion of large retailers into new locations may limit the locations into which we may profitably expand. To the extent that our competitors are able to take advantage of any of these factors, our competitive position and operating results may suffer.

Because we face intense competition, we must anticipate and quickly respond to changing consumer demands more effectively than our competitors. In order to succeed in implementing our business plan, we must achieve and maintain favorable recognition of our private label brands (i.e. our Guoying branded products, company-owned stores and exclusive franchise stores operating under our brand name), effectively market our products to consumers, competitively price our products, and maintain and enhance a perception of value for consumers. We must also source and distribute our merchandise efficiently. Failure to accomplish these objectives could impair our ability to compete with larger retailers and could adversely affect our growth and profitability.

We do not maintain product liability insurance or business interruption insurance, and our property and equipment insurance does not cover the full value of our property and equipment.

We currently do not carry any product liability or other similar insurance or business interruption insurance. If product liability litigation becomes more commonplace in the PRC, we could be exposed to additional liability. Moreover, we may have increased product liability exposure as we expand our sales into international markets, like the United States, where product liability claims are more prevalent.

9

We may be required from time to time to recall products entirely or from specific markets or batches. We do not maintain recall insurance. Additionally, our property and equipment insurance does not cover the full value of our property and equipment. In the event we do experience product liability claims or a product recall, or suffer from a natural or other unexpected disaster, business or government litigation, or any uncovered risks of operation, our financial condition and business operations could be materially adversely affected.

As all of our operations and personnel are in the PRC, we may have difficulty establishing adequate western style management, legal and financial controls.

The PRC has not adopted a Western style of management and financial reporting concepts and practices. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result, we may experience difficulty in establishing accounting and financial controls, collecting financial data, budgeting, managing our funds and preparing financial statements, books and records and instituting business practices that meet Western standards.

We currently do not have accounting personnel that have adequate knowledge of U.S. generally accepted accounting principles. Our lack of familiarity with Western practices generally and Section 404 specifically may unduly divert management’s time and resources, which could have a material adverse effect on our operating results. As a result of our lack of U.S. GAAP trained personnel and our lack of familiarity with U.S. GAAP, our internal control over financial reporting may be deficient. If material weaknesses in our internal controls over financial reporting are identified, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price and/or subject us to sanctions or investigation by regulatory authorities.

RISKS RELATED TO DOING BUSINESS IN CHINA

The Company faces the risk that changes in the policies of the PRC government could have a significant impact upon the business that the Company may be able to conduct in the PRC and the profitability of such business .

The PRC economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy, but there can be no assurance that this will be the case. A change in policies by the PRC government could adversely affect the Company’s interests due to factors such as changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. There can be no assurance that the government will continue to pursue economic reform policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC political, economic and social life.

The PRC laws and regulations governing the Company’s business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may have a material and adverse effect on the Company’s business.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing the Company’s business, or the enforcement and performance of the Company’s arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. The Company and any future subsidiaries are considered foreign persons or foreign funded enterprises under PRC laws, and as a result, the Company is required to comply with PRC laws and regulations. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty.

The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. The Company cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on the Company’s businesses.

New labor laws in the PRC may adversely affect our results of operations.

On January 1, 2008, the PRC government promulgated the Labor Contract Law of the PRC, or the New Labor Contract Law. The New Labor Contract Law imposes greater liabilities on employers and significantly impacts the cost of an employer’s decision to reduce its workforce. Further, it requires certain terminations to be based upon seniority and not merit. In the event we decide to significantly change or decrease our workforce, the New Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost effective manner, thus materially and adversely affecting our financial condition and results of operations.

10

A slowdown or other adverse developments in the PRC economy may materially and adversely affect the Company’s customers, demand for the Company’s products and the Company’s business.

All of the Company’s operations are conducted in the PRC and all of its revenue is generated from sales in the PRC and we cannot assure you that our historic growth will continue. In addition, the PRC government exercises significant control over PRC economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Efforts by the PRC government to slow the pace of growth of the PRC economy could result in reduced demand for our products. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the PRC may materially reduce the demand for our products and materially and adversely affect our business.

Inflation in the PRC could negatively affect our profitability and growth.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, reduce demand, materially increase our costs, and harm the market for our products and our Company.

Governmental control of currency conversion may affect the value of an investment in the Company and may limit our ability to receive and use our revenues effectively.

At the present time, the Renminbi, the currency of the PRC, is not a freely convertible currency. We receive all of our revenue in Renminbi, which may need to be converted to other currencies, primarily U.S. dollars, in order to be remitted outside of the PRC. The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. Any future restrictions on currency exchanges may limit our ability to use revenue generated in Renminbi to fund any future business activities outside China or to make dividend or other payments in U.S. dollars.

Effective July 1, 1996, foreign currency “current account” transactions by foreign investment enterprises are no longer subject to the approval of State Administration of Foreign Exchange (“SAFE,” formerly, “State Administration of Exchange Control”), but need only a ministerial review, according to the Administration of the Settlement, Sale and Payment of Foreign Exchange Provisions promulgated in 1996 (the “FX regulations”). “Current account” items include international commercial transactions, which occur on a regular basis, such as those relating to trade and provision of services. Distributions to joint venture parties also are considered “current account transactions.” Non-current account items, including direct investments and loans, known as “capital account” items, remain subject to SAFE approval and companies are required to open and maintain separate foreign exchange accounts for capital account items. There are other significant restrictions on the convertibility of Renminbi, including that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. Under current regulations, we can obtain foreign currency in exchange for Renminbi from swap centers authorized by the government. While we do not anticipate problems in obtaining foreign currency to satisfy our requirements, we cannot be certain that foreign currency shortages or changes in currency exchange laws and regulations by the PRC government will not restrict us from freely converting Renminbi in a timely manner.

The fluctuation of the Renminbi may materially and adversely affect investments in the Company and the value of our securities.

As the Company relies principally on revenues earned in the PRC, any significant revaluation of the Renminbi may materially and adversely affect the Company’s cash flows, revenues and financial condition, and the price of our common stock may be harmed. The value of the Renminbi depends to a large extent on PRC government policies and the PRC’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of Renminbi to the U.S. dollar had generally been stable and the Renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the PRC government changed its policy of pegging the value of Renminbi to the U.S. dollar. Under the new policy, Renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. It is possible that the PRC government could adopt a more flexible currency policy, which could result in more significant fluctuation of Renminbi against the U.S. dollar. We can offer no assurance that Chinese Renminbi will be stable against the U.S. dollar or any other foreign currency.

For example, to the extent that the Company needs to convert U.S. dollars it receives from an offering of its securities into Renminbi for the Company’s operations, appreciation of the Renminbi against the U.S. dollar could have a material adverse effect on the Company’s business, financial condition and results of operations. Conversely, if the Company decides to convert its Renminbi into U.S. dollars for the purpose of making payments for dividends on its common stock or for other business purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar equivalent of the Renminbi that the Company converts would be reduced. In addition, the depreciation of significant U.S. dollar denominated assets could result in a charge to the Company’s income statement and a reduction in the value of these assets.

11

The application of Chinese regulations relating to the overseas listing of Chinese domestic companies is uncertain, and we may be subject to penalties for failing to request approval of the Chinese authorities prior to listing our shares in the U.S.

On August 8, 2006, six Chinese government agencies, namely, the Ministry of Commerce, or MOFCOM, the State Administration for Industry and Commerce, or SAIC, the China Securities Regulatory Commission, or CSRC, the State Administration of Foreign Exchange, or SAFE, the State Assets Supervision and Administration Commission, or SASAC, and the State Administration for Taxation, or SAT, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, which we refer to as the “New M&A Rules”, which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore “special purpose vehicles,” that are (1) formed for the purpose of overseas listing of the equity interests of Chinese companies via acquisition and (2) are controlled directly or indirectly by Chinese companies and/or Chinese individuals, to obtain the approval of the CSRC prior to the listing and trading of their securities on overseas stock exchanges. The Company has not sought any approvals under the New M&A Rules.

There are substantial uncertainties regarding the interpretation, application and enforcement of the New M&A Rules and CSRC has yet to promulgate any written provisions or formally declare or state whether the overseas listing of a China-related company structured similar to ours is subject to the approval of CSRC. Any violation of these rules could result in fines and other penalties on our operations in China, restrictions or limitations on remitting dividends outside of China, and other forms of sanctions that may cause a material and adverse effect to our business, operations and financial conditions.

The new mergers and acquisitions regulations also established additional procedures and requirements that are expected to make merger and acquisition activities by foreign investors more time-consuming and complex, including requirements in some instances that the Ministry of Commerce be notified in advance of any change-of-control transaction in which a foreign investor takes control of a Chinese domestic enterprise that owns well-known trademarks or China’s traditional brands. We may grow our business in part by acquiring other businesses. Complying with the requirements of the new mergers and acquisitions regulations in completing this type of transactions could be time-consuming, and any required approval processes, including CSRC approval, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders or our PRC subsidiary to penalties, limit our ability to distribute capital to our PRC subsidiary, limit our Chinese subsidiary’s ability to distribute funds to us, or otherwise adversely affect us.

The PRC State Administration of Foreign Exchange (“SAFE”) issued a public notice in October 2005, or the SAFE Circular No. 75, requiring PRC residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the SAFE Circular No. 75 as special purpose vehicles, or SPVs. PRC residents who are shareholders of SPVs established before November 1, 2005 were required to register with the local SAFE branch before June 30, 2006. Further, PRC residents are required to file amendments to their registrations with the local SAFE branch if their SPVs undergo a material event involving changes in capital, such as changes in share capital, mergers and acquisitions, share transfers or exchanges, spin-off transactions or long-term equity or debt investments.

Our current shareholders and/or beneficial owners may fall within the ambit of the SAFE notice and be required to register with the local SAFE branch as required under the SAFE notice. If so required, and if such shareholders and/or beneficial owners fail to timely register their SAFE registrations pursuant to the SAFE notice, or if future shareholders and/or beneficial owners of our company who are PRC residents fail to comply with the registration procedures set forth in the SAFE notice, this may subject such shareholders, beneficial owners and/or our PRC subsidiary to fines and legal sanctions and may also limit our ability to contribute additional capital to our PRC subsidiary, limit our PRC subsidiary’s ability to distribute dividends to our company, or otherwise adversely affect our business. To date, our current shareholders and beneficial owners have not made any filings with the applicable SAFE branch.

We face uncertainty from the Circular on Strengthening the Administration of Enterprise Income Tax on Non-resident Enterprises' Share Transfer, or Circular 698, released in December 2009 by China's State Administration of Taxation, or the SAT, effective as of January 1, 2010.

Pursuant to the Circular 698, where a foreign investor transfers the equity interests of a Chinese resident enterprise indirectly via disposing of the equity interests of an overseas holding company, which we refer to as an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the foreign investor shall report such Indirect Transfer to the competent tax authority of the Chinese resident enterprise. The Chinese tax authority will examine the true nature of the Indirect Transfer, and if the tax authority considers that the foreign investor has adopted an abusive arrangement in order to avoid Chinese tax, they will disregard the existence of the overseas holding company and re-characterize the Indirect Transfer and as a result, gains derived from such Indirect Transfer may be subject to Chinese withholding tax at the rate of up to 10%. Circular 698 also provides that, where a non-Chinese resident enterprise transfers its equity interests in a Chinese resident enterprise to its related parties at a price lower than the fair market value, the competent tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

12

Since Circular 698 became effective on January 1, 2010, we cannot assure you that our reorganization will not be subject to examination by Chinese tax authorities or that any direct or indirect transfer of our equity interests in our Chinese subsidiary via our overseas holding companies will not be subject to a withholding tax of 10%.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could harm our business.

Although we are currently not subject to these regulations, we anticipate that we will be subject to the United States Foreign Corrupt Practices Act, or FCPA, and other laws that prohibit U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our Company, even though these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove ineffective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could adversely impact our business, operating results and financial condition.

Because the Company’s principal assets are located outside of the United States and the Company’s officers and directors reside outside of the United States, it may be difficult for investors to enforce their rights in the U.S. based on U.S. federal securities laws against the Company and the Company’s officers and directors or to enforce U.S. court judgments against the Company or them in the PRC.

The Company is located in the PRC and substantially all of its assets are located outside of the United States. The PRC does not have a treaty with United States providing for the reciprocal recognition and enforcement of judgments of courts. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the United States federal securities laws against us in the courts of either the United States or the PRC and, even if civil judgments are obtained in courts of the United States, to enforce such judgments in PRC courts. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement against us or our officers and directors of criminal penalties, under the United States federal securities laws or otherwise.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations governing the validity and legality of call options which are held by our Chairman and others and there can be no assurance that the call options are not in breach of such laws and regulations.

Under a call option agreement with our Chairman Hailong Liu, Sherry Li, the holder of 11,556,288 shares of our Common Stock, has granted to Mr. Liu an option to purchase all of her shares over the course of two years in installments upon achievement of certain performance milestones by the Company. While we believe that this arrangement is not governed by PRC laws and regulations, there are substantial uncertainties regarding the interpretation and application of current or future PRC laws and regulations, including regulations governing the validity and legality of call options. Accordingly, we cannot assure you that PRC government authorities will not determine that the call option agreement is subject to PRC laws and regulations. If the call option agreement is deemed to be governed by PRC laws and regulations, our Chairman may be required to register with the local SAFE branch for his overseas direct investment in the Company. Failure to make such SAFE registration may subject our Chairman to fines and legal sanctions, and may also limit his ability to receive dividends from our PRC subsidiary and remit his proceeds from their overseas investment into the PRC as a result of foreign exchange control under PRC laws and regulations.

The cessation of tax exemptions and deductions by the Chinese government may affect our profitability.

On March 16, 2007, the National People’s Congress of China enacted a new tax law, or the New Tax Law, whereby both foreign investment enterprises, or FIEs, and domestic companies will be subject to a uniform income tax rate of 25%. On November 28 2007, the State Council of China promulgated the Implementation Rules of the New Tax Law, the “Implementation Rules”. Both the New Tax Law and the Implementation Rules have become effective on January 1, 2008. Both the New Tax Law and the Implementation Rules provide that companies not entitled to tax exemption or relevant preferential tax treatment shall be subject to 17% value added tax. The Company recognizes its revenues net of value-added taxes (“VAT”). The Company is subject to VAT which is levied at a fixed annual amount. Currently, the Company is charged at a fixed annual amount of approximately $1,200 to cover all types of taxes including income taxes and VATs. This is approved by the PRC tax department. In the future, if the relevant tax authorities determine that the Company is not eligible for preferential treatment of VAT, loss of such preferential treatment may materially and adversely affect our profits, business and financial performance.

13

RISKS RELATED TO OUR COMMON STOCK

Our common stock is quoted on the OTCQB which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the OTCQB. The OTCQB is a significantly more limited market than the New York Stock Exchange or NASDAQ. The quotation of our shares on the OTCQB may result in a less liquid market for our common stock, could depress the trading price of our common stock, could cause high volatility and price fluctuations, and could have a long-term adverse impact on our ability to raise capital in the future.

There is a limited trading market for our common stock.

There is currently a limited trading market on the OTCQB for our common stock, and there can be no assurance that a less limited trading market will develop or be sustained.

Certain of our existing stockholders will control the outcome of matters requiring stockholder approval, and their interests may not be aligned with the interests of our other stockholders.

Sherry Li is our majority stockholder, holding 11,556,288 shares of our Common Stock (approximately 68.9 % of the outstanding shares of Common Stock as of August 1, 2011. As more particularly described in footnote (3) and (4) to the table contained in “Security Ownership of Certain Beneficial Owners and Management,” Ms. Li has entered into a voting trust agreement with, and granted options to, our Chairman, Hailong Liu, to vote or purchase all 11,556,288 of her shares. As a result, Mr. Liu will have the ability to control the election of our directors and the outcome of corporate actions requiring stockholder approval, such as changes to our articles of incorporation and by-laws and a merger or a sale of our company or a sale of all or substantially all of our assets. This concentration of voting power and control could have a significant effect in delaying, deferring or preventing an action that might otherwise be beneficial to our other stockholders and be disadvantageous to our stockholders with interests different from those of our officers, directors and affiliates. Additionally, this significant concentration of share ownership may adversely affect the trading price for our Common Stock because investors often perceive disadvantages in owning stock in companies with controlling stockholders.

The elimination of monetary liability of the Company’s directors and officers under Nevada law and the existence of indemnification rights of the Company’s directors, officers and employees may result in substantial expenditures by the Company and may discourage lawsuits against the Company’s directors and officers.

Under Nevada law, a corporation may indemnify its directors, officers, employees and agents under certain circumstances, including indemnification of such persons against liability under the Securities Act of 1933, as amended (the “Securities Act”). In addition, a corporation may purchase or maintain insurance on behalf of its directors, officers, employees or agents for any liability incurred by him in such capacity, whether or not the corporation has the authority to indemnify such person. We do not currently maintain such insurance.

These provisions may eliminate the rights of the Company and its stockholders (through stockholder’s derivative suits on behalf of the Company) to recover monetary damages against a director, officer, employee or agent for breach of fiduciary duty. Insofar as indemnification for liabilities arising under the Securities Act may be provided for directors, officers, employees, agents or persons controlling an issuer pursuant to the foregoing provisions, the opinion of the Commission is that such indemnification is against public policy as expressed in the Securities Act, and is therefore unenforceable.

Shares eligible for future sale may adversely affect the market price of our common stock, as the future sale of a substantial amount of outstanding stock in the public marketplace could reduce the price of our common stock.

As of December 30, 2011, there were issued and outstanding (i) 16,775,113 shares of our Common Stock, and (ii) immediately exercisable warrants to purchase an aggregate of 2,903,528 shares of our Common Stock. We currently have obligation to register the resale of an aggregate of 2,623,178 shares of our Common Stock, including shares issuable upon exercise of warrants. Future sales of substantial amounts of our Common Stock in the trading market could adversely affect the market price of our Common Stock.

Our holding company structure may limit the payment of dividends.

We have no direct business operations, other than ownership of our subsidiaries. While we have no current intention of paying dividends, should we decide to do so in the future, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries may be subject to restrictions on their ability to make distributions to us, including restrictions resulting from restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars.

14

The Wholly-Foreign Owned Enterprise Law (1986), as amended, the Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended and the Company Law of China (2006) contain the principal regulations governing dividend distributions by wholly foreign-owned enterprises. Under these regulations, wholly foreign-owned enterprises may pay dividends only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. Our subsidiary in China is also required to set aside a certain amount of its accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The Chinese government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of China. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the profits of our subsidiary in China.

Furthermore, if our subsidiary in China incur debt in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If we are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our common stock. In addition, under current PRC law, we must retain a reserve equal to 10 percent of net income after taxes each year, with the total amount of the reserve not to exceed 50 percent of registered capital. Accordingly, this reserve will not be available to be distributed as dividends to our shareholders.

Provisions in our Articles of Incorporation could prevent or delay stockholders’ attempts to replace or remove current management or otherwise adversely affect the rights of the holders of our Common Stock.

Under our Articles of Incorporation, our Board of Directors is authorized to issue “blank check” preferred stock, with any designations, rights and preferences they may determine. Any shares of preferred stock that are issued are likely to have priority over our common stock with respect to dividend or liquidation rights. If issued, preferred stock could be used under certain circumstances as a method of discouraging, delaying or preventing a change in control, which could have discourage bids to acquire us and thereby prevent shareholders from receiving the maximum value for their shares. Though we have no present intention to issue any additional shares of preferred stock, there can be no assurance that preferred stock will not be issued at some time in the future.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains certain forward-looking statements (as such term is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934). The statements herein which are not historical reflect our current expectations and projections about the Company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to us and our management and our interpretation of what we believe to be significant factors affecting our business, including many assumptions about future events. Such forward-looking statements include statements regarding, among other things:

|

|

|

our ability to produce, market and generate sales of our private label products;

|

|

|

|

our ability to market and generate sales of the products that we sell as a wholesaler;

|

|

|

|

our ability to develop, acquire and/or introduce new products;

|

|

|

|

our projected future sales, profitability and other financial metrics;

|

|

|

|

our future financing plans;

|

|

|

|

our plans for expansion of our stores and manufacturing facilities;

|

|

|

|

our anticipated needs for working capital;

|

|

|

|

the anticipated trends in our industry;

|

15

|

|

|

our ability to expand our sales and marketing capability;

|

|

|

|

acquisitions of other companies or assets that we might undertake in the future;

|

|

|

|

our operations in China and the regulatory, economic and political conditions in China;

|

|

|

|

our ability as a U.S. company to operate our business in China through our subsidiary, Guoying; and

|

|

|

|

competition existing today or that will likely arise in the future.

|

Forward-looking statements are generally identifiable by use of the words “may,” “should,” “will,” “plan,” “could,” “target,” “contemplate,” “predict,” “potential,” “continue,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,” or “project” or the negative of these words or other variations on these or similar words. Actual results, performance, liquidity, financial condition and results of operations, prospects and opportunities could differ materially from those expressed in, or implied by, forward-looking statements as a result of various risks, uncertainties and other factors, including the ability to raise sufficient capital to continue the Company’s operations. These statements may be found under the sections of this prospectus entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations ” and “Business,” as well as elsewhere in this prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this prospectus will in fact occur.

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

The forward-looking statements in this prospectus represent our views as of the date of this prospectus. Such statements are presented only as a guide about future possibilities and do not represent assured events, and we anticipate that subsequent events and developments will cause our views to change. You should, therefore, not rely on these forward-looking statements as representing our views as of any date after the date of this prospectus.

This prospectus also contains estimates and other statistical data prepared by independent parties and by us relating to market size and growth and other data about our industry. These estimates and data involve a number of assumptions and limitations, and potential investors are cautioned not to give undue weight to these estimates and data. We have not independently verified the statistical and other industry data generated by independent parties and contained in this prospectus. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk.

Potential investors should not make an investment decision based solely on our projections, estimates or expectations.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the shares of Common Stock. To the extent the warrants are exercised for cash, if they are exercised at all, the Company will receive the exercise price for those warrants. Under the terms of the warrants, cashless exercise is permitted in certain circumstances. The Company intends to use any proceeds received from the exercise of warrants for working capital and other general corporate purposes. The Company cannot make assurances that any of the warrants will ever be exercised for cash or at all. If all of the warrants covered by this prospectus are exercised for cash, the Company would receive aggregate gross proceeds of $1,033,238.

16

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Our Common Stock is quoted on the OTCQB under the symbol “CEHD.QB.” There were no reported quotations for our Common Stock during calendar year 2009.

The following table sets forth the high and low sales prices, without retail mark-up, mark-down or commission, of our Common Stock during each calendar quarter in the fiscal year ending December 31, 2010 and the four quarters of the fiscal year ending December 31, 2011,and may not represent actual transactions.

|

Fiscal Year 2010

|

High

|

Low

|

||||||

|

First quarter

|

$ | 2.00 | $ | 2.00 | ||||

|

Second quarter

|

$ | — | $ | — | ||||

|

Third quarter

|

$ | 3.60 | $ | 2.00 | ||||

|

Fourth quarter

|

$ | 6.40 | $ | 2.85 | ||||

|

Fiscal Year 2011

|

||||||||

|

First quarter

|

$ | 4.95 | $ | 1.46 | ||||

|

Second quarter

|

$ | 2.75 | $ | 0.6 | ||||

|

Third quarter

|

$ | 1.32 | $ | 0.25 | ||||

|

Fourth quarter

|

$ | 0.51 | $ | 0.17 | ||||