Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OSH 1 LIQUIDATING Corp | d277710d8k.htm |

| EX-4.1 - SECOND AMENDED AND RESTATED STOCKHOLDERS' AGREEMENT - OSH 1 LIQUIDATING Corp | d277710dex41.htm |

| EX-3.1 - AMENDED AND RESTATED CERTIFICATE OF INCORPORATION - OSH 1 LIQUIDATING Corp | d277710dex31.htm |

| EX-3.2 - AMENDED AND RESTATED BYLAWS - OSH 1 LIQUIDATING Corp | d277710dex32.htm |

| EX-4.2 - CERTIFICATE OF DESIGNATION OF SERIES A PREFERRED STOCK - OSH 1 LIQUIDATING Corp | d277710dex42.htm |

Orchard

Presentation January 2012 NASDAQ: OSH

January 2012

Exhibit 99.1 |

Orchard

Presentation January 2012 2

This presentation (including information incorporated or deemed incorporated by reference

herein) contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are those involving future events and future results that are

based on current expectations, estimates, forecasts, and projects as well as the

current beliefs and assumptions of our management. Words such as “outlook”,

“believes”, “expects”, “appears”, “may”, “will”, “should”, “intend”, “target”, “projects”,

“estimates”, “plans”, “forecast”, “is likely to”,

“anticipates”, or the negative thereof or comparable terminology, are

intended to identify such forward looking statements. Any statement that is not a historical

fact, including estimates, projections, future trends and the outcome of events that

have not yet occurred, is a forward-looking statement. Forward-looking

statements are only predictions and are subject to risks, uncertainties and assumptions that are

difficult to predict. Therefore actual results may differ materially and adversely from those

expressed in any forward-looking statements. Factors that might cause or contribute

to such differences include, but are not limited to,

those

discussed

under

the

section

entitled

“Risk

Factors”

in

our

reports

filed

with

the

Securities

and

Exchange

Commission. Many of such factors relate to events and circumstances that are beyond our

control. You should not place

undue

reliance

on

forward-looking

statements.

Forward-looking

statements

speak

only

as

of

the

date

they

are

made.

The Company undertakes no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events, or otherwise.

Safe Harbor Statement |

Orchard

Presentation January 2012 3

•

Strong brand heritage and 80 year history

•

Uniquely positioned between big boxes and small independent hardware stores

•

Differentiated operating model focuses on high margin categories

•

A new, experienced management team is in place and focused on five

key priorities:

•

Project a consistent and compelling brand identity

•

Drive sales through merchandising and marketing initiatives

•

Improve operational efficiencies

•

Align resources and talent

•

Strengthen the Company’s financial position

•

2012 plans call for up to 3 new stores, renovations of up to 6 existing stores and

continued positive comps; Approximately 15% of Orchard stores are expected

to be in our new format by the end of fiscal 2012

About Orchard |

Orchard

Presentation January 2012 4

Strong Brand Heritage –

Serving Customers for 80 Years

80

YEARS |

Orchard

Presentation January 2012 5

Orchard History

1931

Founded as a

Farmer’s Purchasing

Cooperative

1979

W.R. Grace

acquires Orchard

1986

Wickes acquires

Orchard from

W.R. Grace

1989

Freeman Spogli

acquires Orchard

from Wickes

34 stores

1993

Orchard IPO

43 stores

1996

Sears acquires

Orchard

65 stores

2005

Ares acquires 20%

stake

85 stores

2009/10

Opened new stores

and launched

e-commerce

89 stores

2011

New management team, transition to stand-

alone public company, new store prototype

87 stores |

Orchard

Presentation January 2012 6

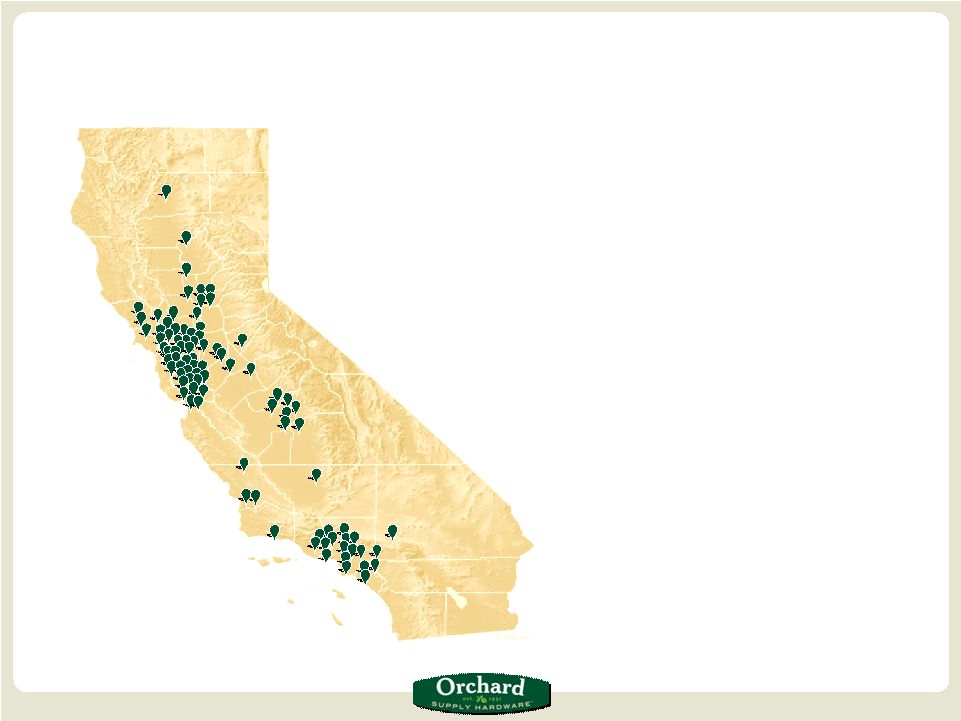

Orchard geographic footprint (as of January 5, 2012)

87

locations in California

63

leased; 16 Company-owned

64

in Northern California

23

in Southern California

42,000 –

75,000 gross sq.

ft. 45,000

SKUs

1

Distribution Center (458,000

square feet in Tracy, CA) |

Orchard

Presentation January 2012 7

Service

•

Knowledgeable and experienced associates

•

Genuine customer hospitality

•

Engaging shopping environment

Selection

•

Extensive selection of national brands

•

Large assortment in recurring maintenance & repair items

•

High in-stock levels

•

Unique assortments tailored to customer segments and geographic location

Convenience

•

Prime locations in densely populated areas

•

Easy in-and-out

•

Easy-to-shop format

•

Efficient checkout and customer pick-up across all channels

Orchard has a Powerful Operating Model |

Orchard

Presentation January 2012 8

Our Operating Model Is Aligned with Industry Forces

•

Meeting the need for smaller, personalized

spaces to shop

•

Combining global market savvy and sourcing

with local market delivery and know how

•

Leveraging the retail evolution –

going back

to specialty retailing’s roots and getting

closer to the customer |

Orchard

Presentation January 2012 9

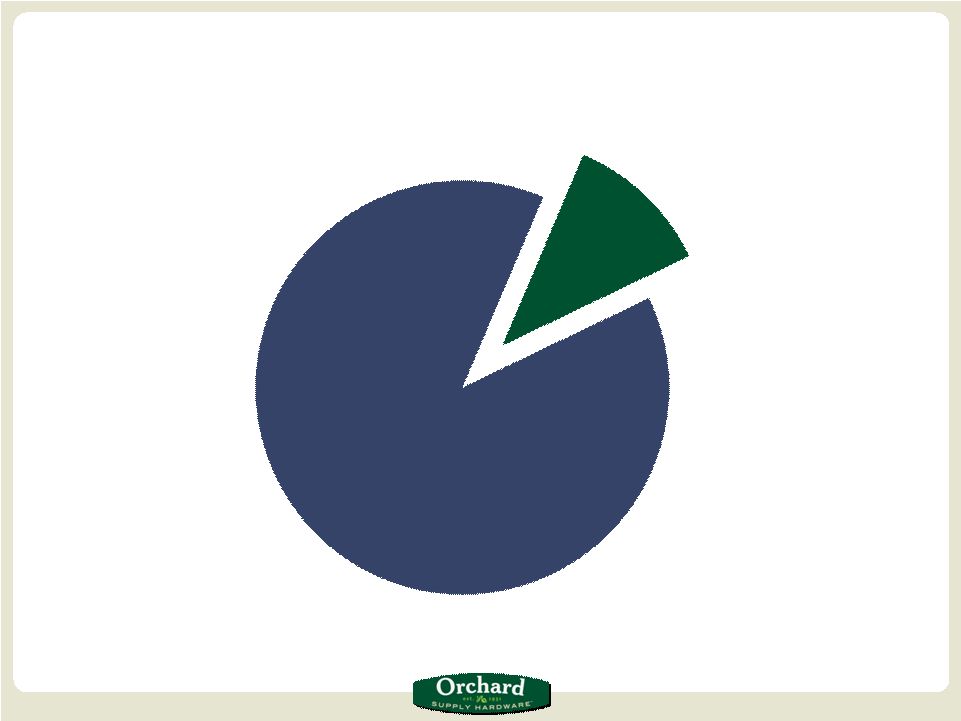

Orchard Competes in a $36 Billion Home Improvement Market

Total Home

Improvement Market

$277B

CA Home

Improvement

Market

$36B

Source: HIRI and California GDP data |

Orchard

Presentation January 2012 10

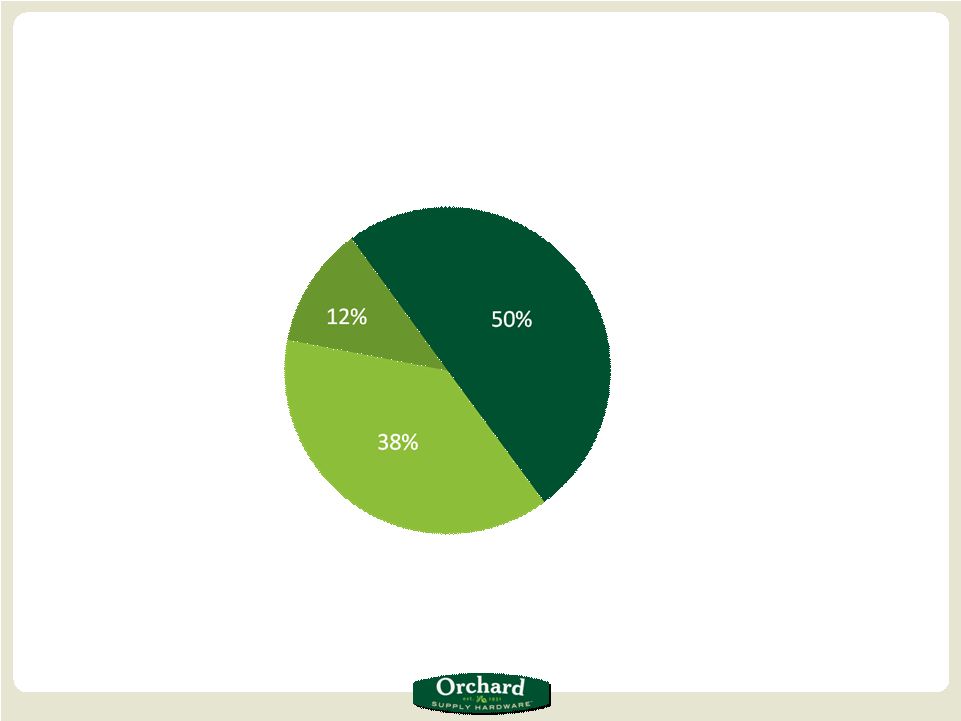

% of Fiscal 2010 Revenue

Repair and Maintenance

•

Hardware

•

Plumbing

•

Electrical & industrial

•

Hand & power tools

In Home

•

Paint & home décor

•

Housewares & seasonal

Lawn & Garden

We are Focused on High Margin Categories

*Lumber and building materials do not represent a significant portion of revenue

|

Orchard

Presentation January 2012 11

A New High Performance Management Team is in Place

Home Improvement and Retail Expertise

Hire Date

Years in Retail

Prior Experience

Mark Baker

Chief Executive Officer,

President and Director

March 2011

31 years

Chris Newman

Executive Vice President,

Chief Financial Officer

October 2011

12 years

Steven L. Mahurin

Executive Vice President,

Merchandising

May 2011

30 years

Mark A. Bussard

Senior Vice President,

Operations

June 2011

22 years

Thomas J. Carey

Senior Vice President,

Chief Marketing Officer

July 2007

17 years

David I. Bogage

Senior Vice President,

Human Resources

April 2011

17 years

Stephen W. Olsen

Senior Vice President, Supply Chain,

IT and Chief Strategy Officer

June 2010

15 years

Michael Fox

Senior Vice President,

General Counsel

October 2011

6 years

Scotty’s Home

Improvement Centers

Knox Hardware

And Lumber

Golf & Tennis

Pro Shop, Inc.

Meridian Point

Properties |

Orchard

Presentation January 2012 12

1.

Project a consistent and

compelling brand identity

2.

Drive sales through

merchandising and marketing

initiatives

3.

Improve operational efficiencies

4.

Align resources and talent

5.

Strengthen the Company’s

financial position

We’re Focused on Five Key Priorities |

Orchard

Presentation January 2012 13

•

Differentiated through service

•

Rationalized and localized

assortments

•

Provides solutions

•

Neighborhood convenience

•

High repeat shopping in

garden category drives traffic

•

Quick in-and-out

•

Key home improvement

do-it-yourself category

Emphasizing High Impact Categories

Repair & Maintenance

Backyard

Paint |

Orchard

Presentation January 2012 14

Old Brand

New Brand (logo, colors, look/feel)

New Brand Identity |

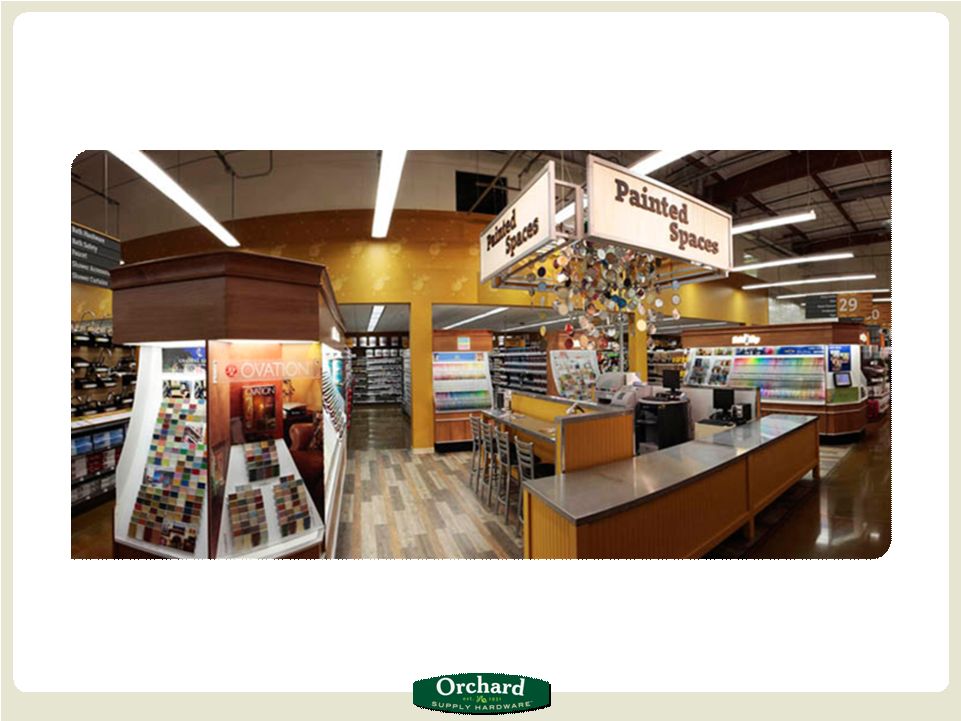

Orchard

Presentation January 2012 15

New Paint Area |

Orchard

Presentation January 2012 16

Old Paint Area |

Orchard

Presentation January 2012 17

New Nursery and Garden Center |

Orchard

Presentation January 2012 18

Old Nursery and Garden Center |

Orchard

Presentation January 2012 19

New Tools Area |

Orchard

Presentation January 2012 20

Old Tools Area |

Orchard

Presentation January 2012 21

New Workbench Area |

Orchard

Presentation January 2012 22

Sales will be Driven by New Merchandising and

Marketing Strategies

•

Implementing product line reviews

designed to strengthen product

assortments and drive margin growth

•

Further improving inventory in-stock

levels

•

Emphasizing three key categories:

repair & maintenance, backyard and

paint |

Orchard

Presentation January 2012 23

We’re Reaching New and Existing Customers to

Drive Traffic and Conversion

1.

Targeting New Customers

•

Radio program & local television throughout California

•

Unique campaign with “cult”

following; fun, quirky and informative

•

Digital media –

reaching a younger audience

•

Mobile billboards –

vendor partnerships advertise Orchard/brands on trucks

across the state

2.

Driving Increased Purchasing Among Existing Customers

•

New Loyalty Program

•

Print programs emphasize project help and “how-to”

•

Strategic shift away from being promotionally-based to being advice-oriented

|

Orchard

Presentation January 2012 24 |

Orchard

Presentation January 2012 25

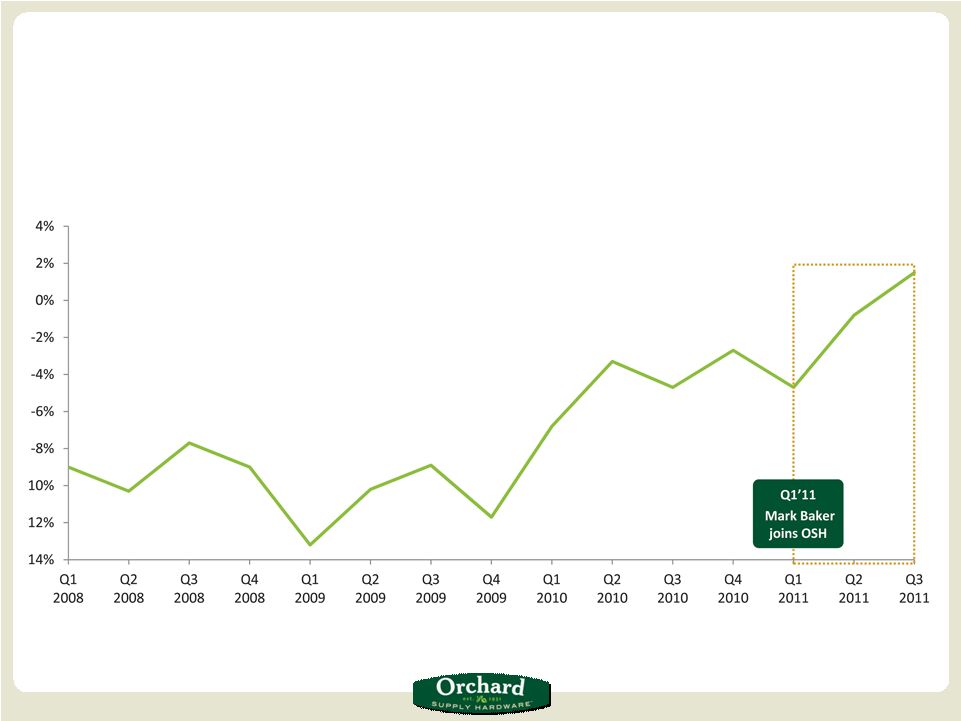

New Strategies Are Generating Positive

Comparable Store Sales Momentum

Comparable Store Sales* Growth by Quarter

*Comparable store sales are calculated using sales of stores open at least twelve months and

exclude e-commerce. |

Orchard

Presentation January 2012 26

Key Accomplishments:

•

Improved inventory in-stock levels

•

Enhanced customer service and store support

•

New floor zone coverage

•

2-way radios

•

Increased effectiveness of promotional dollars

•

Better managed store and regional leadership

•

Increased average ticket

•

Developed new, productive

store format

•

Reinforced sales and service culture

Operational Efficiency is Improving |

Orchard

Presentation January 2012 27

•

Reorganized regional leadership team

•

Moved from 8 districts to 4 regions

•

Home improvement and specialty retail experience

includes Home Depot, Whole Foods, Office Depot,

Safeway, Gander Mountain and Macy’s

•

Set higher expectations for store management

•

New playbook of standards across the store network

•

Migrating from operations to sales and service focus for store

teams

We are Aligning and Better Managing

Resources and Talent |

Orchard

Presentation January 2012 28

•

Took actions to deleverage the Company through recent

sale-leaseback transactions on 5 properties

•

Generated gross proceeds of $57.8 million

•

Paid down Real Estate Term Loan by $21.6 million

•

Paid down Senior Secured Term Loan by $34.4 million

•

Renegotiated Financing Arrangements in December 2011

•

Goal of enhancing operating flexibility and extending term

•

Reduced total outstanding debt, including capital leases

The Company Lowered its Debt

Source: Form 8-K filed on December 29, 2011 |

Orchard

Presentation January 2012 29

Fiscal 2012 Growth Plans

•

Roll-out new, store format

•

Open up to 3 new stores

•

Remodel up to 6 locations

•

Approximately 15% of fleet in new format by end of fiscal 2012

•

Continue to drive comp store sales through new merchandising and

marketing initiatives

•

Leverage e-commerce platform (launched November 2010) |