Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BPZ RESOURCES, INC. | a12-2180_18k.htm |

| EX-99.1 - EX-99.1 - BPZ RESOURCES, INC. | a12-2180_1ex99d1.htm |

Exhibit 99.2

|

|

Pritchard Capital Conference Energize San Francisco, CA January 2012 |

|

|

1 Forward Looking Statements www.bpzenergy.com NYSE & BVL: BPZ This Presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.These forward looking statements are based on our current expectations about our company, our properties, our estimates of required capital expenditures and our industry. You can identify these forward-looking statements when you see us using words such as "expect”, "will", "anticipate," "indicate," "estimate," "believes," "plans" and other similar expressions. These forward-looking statements involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward looking statements. Such uncertainties include the success of our project financing efforts, accuracy of well test results, well refurbishment efforts, successful production of indicated reserves, satisfaction of well test period requirements, successful installation of required permanent processing facilities, receipt of all required permits, results of seismic date acquisition efforts, and the successful management of our capital expenditures, the successful completion of a new drilling platform for the Corvina Field, and other normal business risks. We undertake no obligation to publicly update any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. We caution you not to place undue reliance on those statements. The U.S. Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only “reserves” that a company anticipates to be economically producible by application of development projects to known accumulations, and there exists or is a reasonable expectation there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project. We are prohibited from disclosing estimates of oil and gas resources that do not constitute such “reserves” in our SEC filings. We may use certain terms in this presentation such as “contingent” and “prospective” resources which imply the existence of quantities of resources which the SEC guidelines strictly prohibit U.S. publicly registered companies from including in reported reserves in their filings with the SEC. With respect to possible and probable reserves we are required to disclose the relative uncertainty of such classifications of reserves when they are included in our SEC filings, and investors are urged to consider closely the disclosure in our SEC filings, available from us at 580 Westlake Park Blvd., Suite 525, Houston, Texas 77079; Telephone: (281) 556-6200. These filings can also be obtained from the SEC via the internet at www.sec.gov. The definitions of Contingent and Prospective Resources have been excerpted from the Petroleum Resources Management System approved by the Society of Petroleum Engineers (SPE) Board of Directors, March 2007. Proved, Probable and Possible Reserves are denoted by P1, P2 and P3, respectively. Prospective resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. Prospective resources have both an associated chance of discovery and a chance of development. Prospective resources are further subdivided in accordance with the level of certainty associated with recoverable estimates assuming their discovery and development and may be sub-classified based on project maturity. Contingent resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations, but the applied project(s) are not yet considered mature enough for commercial development due to one or more contingencies. Contingent Resources may include, for example, projects for which there are currently no viable markets, or where commercial recovery is dependent on technology under development, or where evaluation of the accumulation is insufficient to clearly assess commerciality. Contingent Resources are further categorized in accordance with the level of certainty associated with the estimates and may be sub classified based on project maturity and/or characterized by their economic status. The volume and parameters associated with low, best and high estimates scenarios of contingent resources are referred to as 1C, 2C and 3C, respectively. The Company is aware that certain information concerning its operations and production is available from time to time from Perupetro, an instrumentality of the Peruvian government, and the Ministry of Energy and Mines (“MEM”), a ministry of the government of Peru. This information is available from the websites of Perupetro and MEM and may be available from other official sources of which the Company is unaware. This information is published by Perupetro and MEM outside the control of the Company and may be published in a format different from the format used by the Company to disclose such information, in compliance with SEC and other U.S. regulatory requirements. The Company provides such information in the format required, and at the times required, by the SEC and as determined to be both material and relevant by management of the Company. The Company urges interested investors and third parties to review the Company’s filing with the SEC before making an investment decision. Information obtained from other sources may not comply with the requirements of the SEC or management of the Company. Nothing herein shall be deemed to constitute an offer to sell, or the solicitation of an offer to buy, any securities of the Company. Any securities issued in connection with the transactions described herein will not be registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. |

|

|

2 BPZ Energy in Peru www.bpzenergy.com NYSE & BVL: BPZ Focus Oil & Gas Four Blocks 100% working interests Acreage 2.2 million acres Current Production Corvina & Albacora* Oil Fields Offshore Exploration Multiple Plays *Albacora production achieved during testing |

|

|

3 More About Us www.bpzenergy.com NYSE & BVL: BPZ NYSE & BVL Ticker BPZ Market Capitalization (1) $ 350 MM Shares Outstanding 116 MM Proved Oil Reserves (2) 39 MMBO Est. 2011 Avg. Daily Production 3,775 BOPD Nine-Month 2011: Revenues $ 112 MM Operating Income $ 16 MM EBITDAX (3) $ 53 MM Share Ownership: Insider 12% Institutional 72% Notes: (1) Approximate as of 1/3/12. (2) As of 12/31/10 based on Netherland, Sewell & Associates (NSAI) report. (3) EBITDAX is a non-GAAP measure. The Appendix slide to this presentation contains a reconciliation of EBITDAX to the Company’s net income (loss), which is the most directly comparable financial measure calculated in accordance with Generally Accepted Accounting Principles (GAAP) in the United States of America. |

|

|

4 2011 Building Blocks www.bpzenergy.com NYSE & BVL: BPZ Launched the partnering process on Block Z-1 Received 3-D seismic approval for Block Z-1 Signed new CX-15 platform contracts and began work Conducted seismic surveys & interpreted data on Blocks XXII and XXIII Drilled first onshore exploration well in Block XIX Completed workovers at Corvina and Albacora Implemented gas cap reinjection at Corvina Conducted interference testing at Albacora Placed reinjection equipment on Albacora Initiated artificial lift programs in both fields Finished the Caleta Cruz dock extension Obtained $115 MM of new financings Listed shares on Bolsa de Valores Lima |

|

|

5 2012 Key Initiatives www.bpzenergy.com NYSE & BVL: BPZ Achieving commerciality at Albacora oil field Optimizing oil production via artificial lift Developing 22MMBO of Corvina PUDs from new CX-15 platform Exploring onshore and offshore Unlocking asset value 1. 2. 3. 4. 5. |

|

|

6 Achieving Commerciality at Albacora www.bpzenergy.com NYSE & BVL: BPZ Steps to Commerciality Equipment placed on platform Installation underway Commission gas reinjection equipment |

|

|

Optimizing Production 7 www.bpzenergy.com NYSE & BVL: BPZ Corvina Field Workovers completed Gas cap reinjection program underway Continue to implement artificial lift program Albacora Field A-14XD well again producing oil naturally Permit received to open and test A-12F Continue to implement artificial lift program |

|

|

Tapping into Corvina’s 22 MMBO of PUDs 8 www.bpzenergy.com NYSE & BVL: BPZ The New CX-15 Platform Contracts for fabrication signed and work underway Transport and install new platform Commence CX-15 drilling campaign First oil production expected by fourth quarter 2012 |

|

|

The New CX-15 Platform 9 www.bpzenergy.com NYSE & BVL: BPZ First Buoyant Tower in Peru 24 slots Production and reinjection equipment included CX-15 and CX-11 platforms connected via 4 subsea pipelines Design Capacity Product Rate Oil 12,200 bpd Gas 12.8 mmscfd Produced Water 3,500 bpd mmscfd - million standard cubic feet per day, bpd - barrels per day |

|

|

Exploring Offshore Block Z-1... Overview 3-D seismic EIA granted Seismic boat selected Complete approved 1,500 sq. km. 3-D seismic survey Process and interpret 3-D seismic data Prepare future exploration campaign 10 www.bpzenergy.com NYSE & BVL: BPZ |

|

|

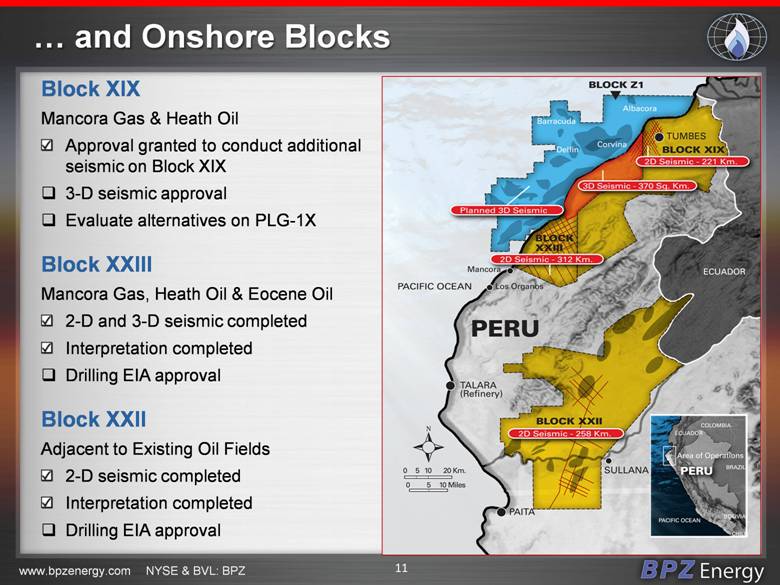

... and Onshore Blocks 11 Block XIX Mancora Gas & Heath Oil Approval granted to conduct additional seismic on Block XIX 3-D seismic approval Evaluate alternatives on PLG-1X Block XXIII Mancora Gas, Heath Oil & Eocene Oil 2-D and 3-D seismic completed Interpretation completed Drilling EIA approval Block XXII Adjacent to Existing Oil Fields 2-D seismic completed Interpretation completed Drilling EIA approval www.bpzenergy.com NYSE & BVL: BPZ |

|

|

Corporate & Social Responsibility 12 www.bpzenergy.com NYSE & BVL: BPZ Investing with Social Inclusion CHILDHOOD EDUCATION CULTURE HEALTH ENVIRONMENTAL |

|

|

Unlocking Further Value 13 www.bpzenergy.com NYSE & BVL: BPZ Finishing Block Z-1 Partnering Process Opening of Block Z-1 data room Ongoing JV process for Block Z-1 Execute JV agreement for Block Z-1 Further Gas to Power Plant Optionality Starting Blocks XIX and XXIII Partnering Process 2D and 3D Block XXIII seismic interpretation completed Open data room in 1Q 2012 Execute JV Agreement |

|

|

2012 Capital & Exploratory Expenditures 14 www.bpzenergy.com NYSE & BVL: BPZ Capital Expenditures Projects & Engineering $ 42 MM Corvina (1) $ 30 MM Albacora $ 6 MM Other projects $ 6 MM Corvina CX-15 Developmental Drilling $ 32 MM Other $ 6 MM TOTAL $ 80 MM Exploratory Expenditures (GG&E) (2) Block Z-1 Seismic Survey $ 22 MM Blocks XIX, XXIII and XXII $ 3 MM TOTAL $ 25 MM Notes: (1) Includes remaining $27 MM of total $60 MM investment for CX-15 platform, (2) GG&E -geological, geophysical and engineering expenses |

|

|

15 www.bpzenergy.com NYSE & BVL: BPZ Field Commerciality Production Optimization 2011-12 Corvina Produce Block Z-1 PUDs Online Since 2011-12 Dec.2010 Workovers Exploration Completed 2012 Î Albacora Build & Install Unlock Value Equipment Corvina Corvina CX-15 2012 Î Being Gas Cap Platform Block Z-1 Installed Reinjection 2012 Î 3-DSeismic CX-15 Partnering ArtificialLift Developmental Map&Rank Program Drilling Onshore and Increase Offshore Production & Albacora Prospects Cash Flow Drilling Campaign Drill Best Lower Costs Review Prospects Catalysts for Growth |

|

|

Conclusion Manolo Zúñiga President & CEO 16 The BPZ team will be recognized for excellence in exploring, developing and producing oil and gas in the Americas. For additional information please contact: A. Pierre Dubois Investor Relations & Corporate Communications BPZ Energy 580 Westlake Park Blvd., Suite 525 Houston, Texas 77079 (281) 752-1240 pierre_dubois@bpzenergy.com www.bpzenergy.com NYSE & BVL: BPZ |

|

|

Appendix – GAAP Reconciliation 17 Reconciliation of non-GAAP measure The table below represents a reconciliation of EBITDAX to the Company’s net income (loss), which is the most directly comparable financial measure calculated in accordance with generally accepted accounting principles in the United States of America. Earnings before interest, income taxes, depletion, depreciation and amortization, exploration expense and certain non-cash charges (“EBITDAX”) is a non-GAAP financial measure, as it excludes amounts or is subject to adjustments that effectively exclude amounts, included in the most directly comparable measure calculated and presented in accordance with GAAP in financial statements. “GAAP” refers to generally accepted accounting principles in the United States of America. Non-GAAP financial measures disclosed by management are provided as additional information to investors in order to provide them with an alternative method for assessing the Company’s financial condition and operating results. These measures are not in accordance with, or a substitute for, GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. Pursuant to the requirements of Regulation G, whenever the Company refers to a non-GAAP financial measure, it also presents the most directly comparable financial measure presented in accordance with GAAP, along with a reconciliation of the differences between the non-GAAP financial measure and such comparable GAAP financial measure. Management believes that EBITDAX may provide additional helpful information with respect to the Company’s performance or ability to meet its debt service and working capital requirements. www.bpzenergy.com NYSE & BVL: BPZ 2011 2010 2011 2010 (in thousands) (in thousands) Net income (loss) 5,705 $ (43,659) $ (2,096) $ (49,695) $ Interest expense 5,600 2,821 14,240 8,510 Income tax expense (benefit) 1,075 (9,132) 5,191 (6,964) Depreciation, depletion and amortization expense 8,534 6,659 27,811 24,193 Geological, geophysical and engineering expense 571 6,113 8,290 7,016 Dry hole costs - 32,059 - 32,059 Other expense - 12,738 - 12,738 Gain (loss) on derivatives (4,622) - 1 - EBITDAX (a) 16,863 $ 7,599 $ 53,437 $ 27,857 $ Three Months Ended September 30, Nine Months Ended September 30, |