Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InvenTrust Properties Corp. | a11-32424_18k.htm |

| EX-10.1 - EX-10.1 - InvenTrust Properties Corp. | a11-32424_1ex10d1.htm |

| EX-99.2 - EX-99.2 - InvenTrust Properties Corp. | a11-32424_1ex99d2.htm |

Exhibit 99.1

December 29, 2011

Dear Stockholder:

For the last few months we have been discussing the current economic and real estate market conditions. For now the “new normal” includes increased stock market volatility, a European debt crisis abroad, and political gridlock here at home. But even in this environment, Inland American is still generating positive results.

Inland American’s year-over-year results, as of September 30th, show our lodging and multi-family revenues growing at double-digit rates, our net operating income is up in each of our asset classes except office, which is flat, our cash flow from operations is up 12%, and our new property acquisitions continue to enhance our portfolio. With our improved performance, we are comfortable with the sustainability of our distribution rate. Since 2006, the REIT has distributed over $1.8 billion, which translates to about $3.45 per share, to our stockholders — a fact we are proud of.

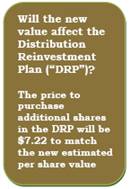

Today, despite our improved performance, Inland American announced our new estimated value per share of $7.22, which will first be shown in your January account statement. As stockholders as well, we want to reassure you that this new estimated value only represents a snapshot in time and the dollar amount of your monthly distribution will not change. Said another way, the dollar amount of your next distribution check you receive from Inland American will be the same.

Inland American is in the business of acquiring and managing a diverse portfolio of in-demand, high-quality commercial real estate. Over the years, the value of these assets might go up or down as global and local economic conditions change. But as the tenants of these assets continue to pay their rents at the same or increasing rates, we will continue to derive the same or greater income from these assets regardless of the fluctuation of the asset values.

Our improved performance and positive outlook did convince Inland American’s Board of Directors to approve an expansion of our Share Repurchase Program (“SRP”). For 2012, the Board has allocated $100 million in total funding to repurchase shares in the following circumstances — death/estate ($40 million), disability, long-term care ($60 million). This letter serves as our notice to our stockholders of the amendment of the SRP, and complete details of the SRP are available in the Form 8-K that we filed with the SEC on December 29, 2011.

|

|

In another piece of news, Inland American has negotiated a fee reduction with our property managers. Inland American has a strong tradition of reducing or limiting expenses to manage our almost 1,000 properties. We recognize the dollars we save on the expense side go right to the bottom-line of the REIT. As a partner with the Board in this investment vehicle we hope this is another action that will show our stockholders that their actual net income, we believe, will increase.

How was the value calculated and did the NAV method influence the lower value? You might find it interesting that there are no specific requirements or guidelines on how to estimate the value of a non-traded REIT’s shares, and there is a wide range of methodologies used in our industry. For 2011, Inland American decided to use an approach based on Net Asset Value (“NAV”) — or aggregating the value of our real estate assets, subtracting the fair value of our liabilities, and dividing the total by the number of our common shares outstanding. The NAV method does not take into account a premium for the size of our portfolio or the intrinsic value of the entire REIT if listed on a national securities exchange. We believe this unrecognized value can be meaningful, but we are a conservative company and the NAV methodology matches the current direction of the industry. We also believe this method will be easier for our stockholders and the investment community to understand. | |

|

|

| |

|

It is important to remember that different parties or different valuation methodologies may produce a different estimated value than the one presented here today. Also, the new estimated per share value does not represent the amount that our shares may trade on a national securities exchange, if listed, or the amount stockholders may obtain if they tried to sell their shares today, or if we liquidated our assets and distributed the proceeds to our stockholders. | ||

|

|

| |

|

As part of estimating the per share value, we engaged Real Global Advisors, an independent third party. Real Global Advisors reviewed our underlying cash flow forecasts, existing lease agreements and other financial assumptions. They also examined the final estimate of our per share value. Our Business Manager then presented Real Globe’s report and recommended the estimated per share value of our stock to our Board. After considering all information provided and with the Board’s extensive knowledge of our assets, our Board unanimously accepted the new estimated value, consistent with the Business Manager’s recommendation. We intend to update this estimated share value at least once every 12 months until the REIT is listed on a public exchange or there is a liquidation of our assets. | ||

|

|

In closing, Inland American is focused on maintaining our positive momentum. We are continuously evaluating our options for liquidity across all of our asset classes and we work closely with investment banking firms to understand the market cycles. Looking at it another way, we believe it is a “paid-to-wait” strategy until the markets improve. We hope you can appreciate how our diversified portfolio of assets and conservative investment philosophy has supported our distributions during these uncertain economic times. We also hope our remarks regarding your monthly distribution and our new estimated per share value give you a better understanding of the health of this REIT and the positive direction in which we believe it is headed. On behalf of the Board and all of the management at Inland American, we would like to thank you for your continued confidence in our company.

|

Sincerely,

|

INLAND AMERICAN REAL ESTATE TRUST, INC. |

|

|

|

|

|

|

|

|

|

|

|

Robert D. Parks |

|

Brenda Gail Gujral |

|

Chairman of the Board |

|

President |

cc: Trustee

Broker Dealer

Financial Advisor

The statements and certain other information contained in this letter, which can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “continue,” “remains,” “intend,” “aim,” “towards,” “should,” “prospects,” “could,” “future,” “potential,” “believes,” “plans,” “likely,” “anticipate,” “position,” “probable,” “committed,” “achieve,” and “focused,” or the negative thereof or other variations thereon or comparable terminology, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbors created thereby. These statements should be considered as subject to the many risks and uncertainties that exist in the Company’s operations and business environment. Such risks and uncertainties could cause actual results to differ materially from those projected. These uncertainties include, but are not limited to, economic conditions, market demand and pricing, competitive and cost factors, and other risk factors.