Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Edgen Murray II, L.P. | d275539d8k.htm |

| EX-99.2 - PRESS RELEASE OF EDGEN GROUP INC. DATED DECEMBER 29, 2011 - Edgen Murray II, L.P. | d275539dex992.htm |

Exhibit 99.1

SPECIAL NOTE REGARDING INDUSTRY AND MARKET DATA

This exhibit contains estimates regarding market data which are based on our internal estimates, independent industry publications, reports by market research firms and/or other published independent sources. In each case, we believe those estimates are reasonable and reliable but have not independently verified the accuracy of any such third party information. However, market data is subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market data.

1

SUMMARY

Unless we state otherwise, “the Company,” “we,” “us,” “our” and similar terms, refer to Edgen Group Inc. and, where appropriate, its direct and indirect wholly-owned subsidiaries, and assume and give effect to the Reorganization, including the integration of Edgen Murray II, L.P., or EM II LP, and Bourland & Leverich Holdings, LLC, or B&L, into our operations. Unless otherwise noted, when we present historical financial information in this prospectus, such financial information represents the consolidated financial statements of our predecessor, EM II LP and its consolidated subsidiaries, as well as their predecessors, Bourland & Leverich Holding Company, or B&L Predecessor and its consolidated subsidiaries, as well as their predecessors, as applicable. When we present financial information on a pro forma basis, such financial information assumes and gives effect to the Reorganization, among other things.

Our Company

We are a leading global distributor of specialty products to the energy sector, including highly engineered steel pipe, valves, quenched and tempered and high yield heavy plate and related components. We primarily serve customers that operate in the upstream (conventional and unconventional exploration, drilling and production of oil and natural gas in both onshore and offshore environments), midstream (gathering, processing, fractionation, transportation and storage of oil and natural gas) and downstream (refining and petrochemical applications) end-markets for oil and natural gas. We also serve power generation, civil construction and mining applications, which have a similar need for our technical expertise in specialized steel and specialty products. Our customers in all of these end-markets increasingly demand our products in the build-out and maintenance of infrastructure that is required when the extraction, handling and treatment of energy resources becomes more complex and technically challenging. We source and distribute premium quality, highly engineered and mission critical steel components from our global network of more than 800 suppliers. We have sales and distribution operations in 14 countries serving over 1,800 customers who rely on our supplier relationships, procurement ability, stocking and logistical support for the timely provision of our products around the world. For the nine months ended September 30, 2011, we achieved pro forma sales of $1.2 billion, pro forma net loss of $3.6 million and pro forma earnings before interest, taxes, depreciation and amortization, or EBITDA, of $91.0 million.

2

Our Market

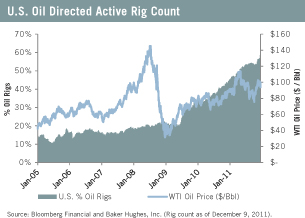

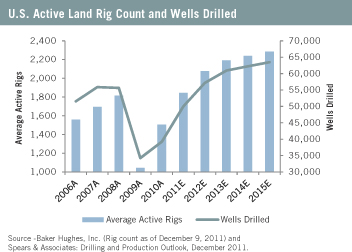

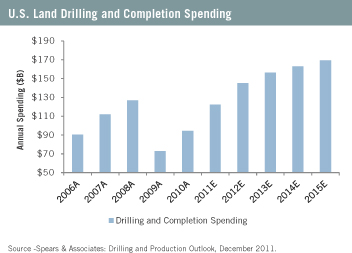

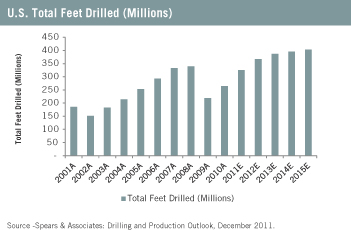

Our business is driven largely by global demand for energy, in particular by the levels of upstream, midstream and downstream oil and natural gas related activity, with over 90% of our pro forma sales derived from customers operating within the energy sector. As demand increases for energy, our customers typically increase their capital spending on infrastructure, which results in increased demand for our specialty products. Recently, capital expenditures in our end-markets have substantially increased, driven in large part by significant drilling activity in unconventional resource developments, new onshore and offshore drilling rig construction, maintenance and expansion of oil and natural gas gathering and transmission networks and continued investment in maintenance and construction of downstream facilities, including refineries. We believe the following factors in particular will continue to support spending in the end-markets we serve, and, in turn, drive demand for our specialized steel products:

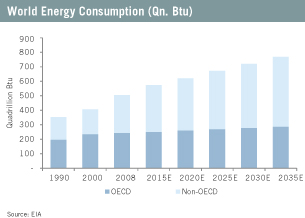

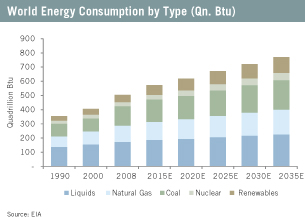

| n | Increasing global demand for energy. It is anticipated that global energy consumption will continue to increase and that additional oil and natural gas production will be required to meet this demand. Growth in global energy consumption is being driven, in part, by the continued development and industrialization of countries not part of the Organisation for Economic Co-operation and Development, or OECD. As a supplier of specialized products to companies across the global energy supply chain, we expect to benefit from these demand trends. |

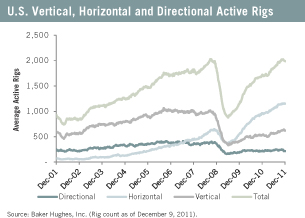

| n | Continued requirement for additional oil and natural gas drilling activity. The oil and natural gas industry is investing significantly in the development of previously underexploited resources of oil and natural gas to meet existing, and anticipated growth in, global demand for energy. In particular, the development of onshore unconventional resources, such as the U.S. shales, Canadian oil sands and Australian coalbed methane, or CBM, and global deepwater drilling activity in areas such as West Africa and offshore Brazil, have led to significant additional drilling activity. We believe that such activity will support increased demand for our products and services. |

| n | Continued investment in oil and natural gas gathering and transmission capacity. Many of the world’s oil and natural gas-producing regions experiencing growth in drilling activity lack sufficient pipeline, processing, fractionation, treatment or storage infrastructure. We expect that as production from new oil and natural gas developments increases, additional investments in oil and natural gas gathering and transmission capacity will be required. At the same time, many existing transmission networks are aging, necessitating increased maintenance and repair. We believe that we will benefit from increased demand for many of the specialized components that are needed for the construction and maintenance of these transmission systems. |

| n | Continued and expected increases in downstream refining activity. The continued industrialization of emerging economies such as those of China and India, as well as the recovery of the global economy, is expected to result in increased demand for refined petroleum and petrochemical products. This increased demand should in turn result in increasing downstream activity and investment, particularly in the refining sector. Because these refineries require the use of products that are designed to withstand extreme temperatures and pressures and corrosive conditions, we expect to benefit from anticipated future demand from this end-market for our specialized steel products. |

| n | Growing global investment in power generation capacity. Substantial new electricity generation capacity will be required as developing economies experience rapid population growth and industrialization. Additionally, many developed economies continue to enact regulations that promote cleaner sources of energy and the retirement or refurbishment of older power generation capacity. This increased regulation tends to drive the construction of new power generation sources or capital expenditures to refurbish older power generation sources. We believe that the increased global demand for electricity and the focus on developing cleaner sources of energy will drive demand for our specialty products. |

| n | Increased focus on environmental and safety standards. Many of our key markets have been subject to increased regulation relating to environmental and safety issues. As a result, owners and operators of oil and natural gas extraction, processing and transmission infrastructure are facing stricter environmental and safety regulation as they manage and build infrastructure. Future environmental and safety compliance could require the use of more specialized products and higher rates of maintenance, repair and replacement to ensure the integrity of our customers’ facilities. We believe that such laws and regulations will drive |

3

| greater spending on maintenance, repair and operations, or MRO, by our customers and increased demand for our specialty products. Similarly, we believe heightened regulations, safety requirements and technical specifications in the civil construction and mining sectors will lead to higher project spending on products we distribute to these end-markets. |

Our Business

We believe we are an essential link between our customers and suppliers. Our customers often operate in remote geographical locations and severe environments that require materials capable of meeting exacting standards for temperature, pressure, corrosion and abrasion. We deliver value to our customers around the world by providing:

| n | Access to a broad range of high quality products from multiple supplier sources; |

| n | Coordination and quality control of logistics, staged delivery, fabrication and additional services; |

| n | Understanding of supplier pricing, capacity and deliveries; |

| n | Ability to bundle specialized offerings across multiple suppliers to create complete material packages; |

| n | On-hand inventory of specialty products to reduce our customers’ need to maintain large stocks of replacement products; and |

| n | Capitalization necessary to manage multi-million dollar supply orders. |

Many of the products we distribute require specialized production to exacting technical and quality standards. We have established global supply channels with a premier network of suppliers to address our customers’ demands. As our suppliers increasingly focus on their core production competencies rather than on sales, marketing and logistics, we are able to deliver numerous benefits, including:

| n | Aggressive marketing of our suppliers’ product offerings; |

| n | Deep knowledge of customer spending plans and material requirements; |

| n | Aggregation of numerous orders to create the critical volume required to make the production of a specific product economically viable; |

| n | Expertise and market knowledge to facilitate the development and sale of new products; and |

| n | Delivery of value-added services to end users, including coordination of logistics, fabrication and additional services. |

We have observed a trend by our customers and suppliers toward increased reliance on distributors as both groups seek to find new ways to reduce costs while maintaining product quality and service levels. Furthermore, we believe that the proliferation of new technologies within the upstream, midstream and downstream end-markets of the energy industry and the increased specialization of products needed to build and implement these technologies will continue to drive demand for our products and services. We believe we are well suited to continue to benefit from these trends of specialization by suppliers and improved internal efficiencies implemented by end users.

Our customers include engineering, procurement and construction firms, equipment fabricators, multi-national and national integrated oil and natural gas companies, independent oil and natural gas exploration and production companies, onshore and offshore drilling contractors, oil and natural gas transmission and distribution companies, petrochemical companies, mining companies, oil sands developers, hydrocarbon, nuclear and renewable power generation companies, public utilities, civil construction contractors and municipal and transportation authorities. Our sales to these customers generally fall into the following three categories:

| n | Project. Project orders relate to our customers’ capital expenditures for various planned projects across the upstream, midstream and downstream end-markets of the energy sector, such as transmission infrastructure build-out and rig construction and refurbishment. For these orders, we serve as a |

4

| provider of global inventory logistics, delivering high quality, technically specific products in accordance with our customers’ project timelines. For many customers, we stage material and manage simultaneous product deliveries to multiple site locations. These orders tend to involve larger volumes that are delivered over longer timeframes and can lead to future MRO business. In addition, projects are often divided into different phases, and the initial project orders can also lead to subsequent project orders. Project orders constituted 35% of our pro forma sales for the nine months ended September 30, 2011. |

| n | Drilling Program. Drilling program orders relate to the delivery of surface casing and production tubulars for the onshore upstream market and require close consultation with our customers with regard to product specifications and delivery timing. Similar to our role in Project orders, we serve as an inventory logistics provider for our customers, delivering products in accordance with their drilling plans, often for multiple drilling rigs or site locations. We generally leverage our technical expertise to act as a liaison between customers and suppliers as they design new products that meet specific technical requirements. Drilling program orders constituted 46% of our pro forma sales for the nine months ended September 30, 2011. |

| n | Maintenance, Repair and Operations Order Fulfillment. MRO orders typically relate to the replacement of existing products that have reached their service limits or are being replaced due to regulatory requirements. Replacement orders are influenced by both product design and regulatory requirements. These orders tend to be consistent in nature and can be driven by customer relationships developed by fulfillment of Project orders. Often, the fulfillment of these MRO orders is critical to our customers’ ongoing operations, and the prompt receipt of the required component is of significant value to them. We maintain an inventory of specialty products in order to provide timely delivery of these products from our stocking locations around the world. Fulfillment of MRO orders constituted 19% of our pro forma sales for the nine months ended September 30, 2011. |

Our Operating Segments

After the Reorganization and the offering, we will deliver our specialty products through two operating segments:

Energy and Infrastructure Products, or E&I. The E&I Segment serves customers in the Americas, Europe/Middle East/Africa, or EMEA, and Asia Pacific, or APAC, regions, distributing highly engineered pipe, plate, valves and related components to upstream, midstream, downstream and select power generation, civil construction and mining customers across more than 35 global locations. This operating segment provides project and MRO order fulfillment capabilities from stocking locations throughout the world. For the nine months ended September 30, 2011, our E&I Segment represented 54% of our pro forma sales and 49% of our pro forma EBITDA. Our E&I Segment is branded under the “Edgen Murray” name.

Oil Country Tubular Goods, or OCTG. The OCTG Segment is a leading provider of premium oil country tubular goods to the upstream conventional and unconventional onshore drilling markets in the U.S. We deliver products through nine customer sales and service locations, including our Pampa, Texas operating center, and over 50 third-party owned distribution facilities. For the nine months ended September 30, 2011, our OCTG Segment represented 46% of our pro forma sales and 51% of our pro forma EBITDA. Our OCTG Segment is branded under the “Bourland & Leverich” name.

Our Competitive Strengths

We consider the following to be our principal competitive strengths:

Broad Scale with Global Distribution Capabilities. As one of the largest global purchasers of specialty steel products for the energy infrastructure market, we use our scale to aggregate demand for the benefit of both our customers and our suppliers. We are able to secure volume pricing and production priority from our suppliers, often for specialty products for which no individual customer has enough demand to justify a timely production

5

run, and thereby meet the specific product and delivery needs of our customers. In addition, we locate our global distribution facilities in close proximity to the major upstream, midstream and downstream energy end-markets we serve, including in the U.S., U.K., Singapore and Dubai. The benefits of our global presence include the ability to serve as a single global source of supply for our customers and participation in infrastructure investment activities in multiple regions around the world, increasing our growth opportunities and reducing our relative exposure to any one geographic market.

Diversified and Stable Customer Base. We have a diversified customer base of over 1,800 active customers in more than 50 countries with operations in the upstream, midstream and downstream energy end-markets, as well as in power generation, civil construction and mining. Our top ten customers, with each of whom we have had a relationship for more than nine years, accounted for 35% of our pro forma sales for the nine months ended September 30, 2011, yet no single customer represented more than 9% of our pro forma sales over the same period. We believe this diversification affords us a measure of protection in the event of a downturn in any specific region or market, or from the loss of individual customers. In addition, we tend to receive a base level of MRO sales from our large, longstanding customers, which provides additional stability to our sales during periods of limited infrastructure expansion.

Strategic and Longstanding Supplier Relationships. We have longstanding, strong relationships with leading suppliers across all of our product lines. While we are able to source almost all of our products from multiple suppliers, our scale allows us to be one of the largest, if not the largest, customer to each of our key suppliers. As a large customer, we provide our suppliers with a stable and significant source of demand. In addition, our market knowledge and insight into our customers’ capital expenditure plans enable us to aggregate multiple orders of a specialty product into volumes appropriate for a production run. We believe that these differentiating factors enhance our ability to obtain product allocations, timely delivery and competitive pricing on our orders from our suppliers. We believe that obtaining these same benefits from suppliers would be difficult for others, including our customers.

Focus on Premium Products. Our product portfolio is composed primarily of premium quality, specialty steel products and components. These types of products often are available from only a select number of suppliers, have limited production schedules and require technical expertise to sell. Our emphasis on the procurement and distribution of highly engineered products that in many cases are not widely available is the foundation of our ability to deliver value to our customers.

Sophisticated Material Sourcing and Logistical Expertise. Many of our customers rely on us to source products for them, as they lack the supplier relationships, resources, volume and/or logistical capabilities to complete procurement and delivery independently or on a cost-effective basis. We believe our professionals have the expertise necessary to manage the coordinated delivery of purchased product to multiple, often remote operating sites according to specific schedules. They also have the knowledge, experience, training and technical expertise in their products to provide valuable advisory support to our customers regarding selection of the most appropriate product to meet their specific needs.

Capitalization and Cash Flow to Maintain Necessary Inventory Levels. Our size affords us the ability to maintain inventory levels necessary to meet the unexpected MRO needs of our customers in the geographies in which they operate. Such requests are often less price sensitive than longer lead-time Project and Drilling program orders. Our scale and wherewithal to support large projects also enable us to participate in Project order proposals otherwise inaccessible to smaller competitors. Many of our regional competitors have comparatively smaller balance sheets and resources and have limited cash flow, which limits their capacity to carry the appropriate inventory levels to meet certain customers’ needs.

Asset-Light Business Model. We maintain an asset-light business model to maximize our profitability and operational flexibility. Our model results in high operating leverage, as evidenced by our $2.3 million in pro forma sales per employee for the year ended December 31, 2010. Our OCTG Segment operates one facility

6

while leveraging the storage and transportation capabilities of over 50 trusted third party service providers to serve customers in the U.S. Our E&I Segment serves over 1,500 global customers through 24 distribution facilities strategically located throughout the world. We often enter new geographic areas of energy infrastructure development in conjunction with service to existing clients and working with third party service providers. In doing so, we are able to efficiently and quickly introduce our specialty products and technical expertise into new regions of high demand with minimal capital investment.

Experienced and Incentivized Management Team. Our senior managers have significant industry experience, averaging over 25 years, across upstream, midstream and downstream energy end-markets in the diverse geographies we serve and in the manufacture of the products we distribute. The compensation of our senior managers is tied to financial performance measures, which we believe aligns their interests with those of our stockholders. Following completion of the offering and as a result of the Reorganization, our management and employees would own approximately % of our Class A common stock in the aggregate, assuming all such persons exchange their limited partnership units in EM II LP for shares of our Class A common stock.

Our Business Strategies

Our goal is to be the leading distributor of specialty steel products to the global energy sector. We intend to achieve this goal through the following strategies:

Expand Business with Existing Customers. We strive to introduce our customers to the entirety of our product portfolio on a global basis. Our experienced and knowledgeable sales force is trained to capture additional share of our customers’ overall spending on specialty steel products. Opportunities to expand business with our customers include capitalizing on new product sales and cross-selling opportunities across all of a customer’s operations in different end-markets and geographies, further penetration of existing customers’ Projects, Drilling programs and MRO supply requirements and leveraging our platform to address our customers’ global needs.

We believe our proven ability to deliver our specialized products to address complex customer needs in a timely fashion differentiates us from our competitors and facilitates our ability to drive additional business with our current customer base.

Grow Business in Select New and Existing Markets. We intend to exploit opportunities for profit and margin expansion within our existing core markets, as well as in new geographies and end-markets. We expect to capitalize on the increasing demand for energy by leveraging our suite of capabilities and reputation as a market leader to drive new customer acquisitions. We plan to achieve this goal in part by selectively enhancing our presence in geographies where significant investments in energy infrastructure are being made. Notably, we believe our specialty product offering positions us well to take advantage of the development of previously underexploited unconventional onshore and deepwater offshore resources. We also plan to expand our presence in new end-markets outside of oil and natural gas that are characterized by difficult operating environments and have similar demand for our technical expertise and highly engineered specialty products.

We also plan to selectively expand our global footprint through our asset-light model in order to maximize our ability to meet evolving customer needs. We believe our platform is highly flexible, as we are able to rapidly address areas of new demand through the addition of satellite offices, representative offices and third party stocking facilities. These means of expansion require minimal capital investment, while enabling us to deliver our full suite of capabilities. We use our asset-light profile to quickly adjust our geographic priorities according to changes in secular demand trends in our target markets.

Continue to Pursue Strategic Acquisitions and Investments. We intend to continue to grow our business through selective acquisitions, joint ventures and other strategic investments. Our proven ability to identify and integrate significant and bolt-on opportunities has been a critical factor in the creation of the existing Edgen

7

Group. Between 2005 and 2009, we executed five acquisitions for a total consideration of approximately $360.0 million. These acquisitions, coupled with the consolidation of B&L which will occur in connection with the Reorganization, have facilitated the growth of Edgen Group from predecessor sales of $322.3 million for the year ended 2005 to pro forma sales of $1.2 billion for the nine months ended September 30, 2011. We apply a strict set of evaluation criteria to ensure that all investments are consistent with our strategic priorities. We anticipate that our investments will expand our product offering, customer base, supplier relationships, and in certain instances, our end-market exposure.

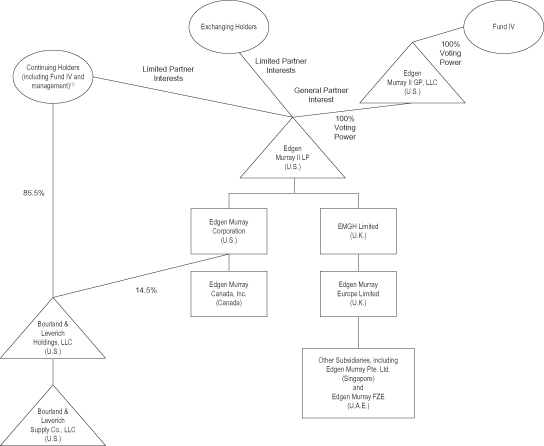

Formation of Edgen Group and the Reorganization

Edgen Group was incorporated in December 2011 in Delaware and is the issuer in the offering. In connection with the completion of the offering:

| n | Edgen Group will become our new parent holding company and will be controlled by Edgen Holdings LLC, or Edgen Holdings, which will control us through its ownership of all of the Class B common stock of Edgen Group. Edgen Holdings, in turn, will be controlled by affiliates of JCP. |

| n | Approximately % of the partnership interests of EM II LP will be owned by JCP and other existing investors in EM II LP, which we refer to collectively as the Continuing Holders, and % will be owned by Edgen Group. The general partner of EM II LP will become Edgen GP LLC, or New GP, a newly formed limited liability company wholly-owned by Edgen Group. |

| n | The Continuing Holders will have a right, which we refer to as the Exchange Right, to exchange their limited partnership units in EM II LP and the shares of Class B common stock of Edgen Group held by Edgen Holdings for cash or, if Edgen Group so elects, Class A common stock of Edgen Group and, in both cases, payments under a tax receivable agreement. |

| n | B&L will become wholly owned by EM II LP. |

| n | EMGH Limited will become a subsidiary of Edgen Murray Corporation, or EMC. |

The holders of limited partnership units of EM II LP will incur U.S. federal, state and local income taxes on their proportionate share of any taxable income of EM II LP. Net profits and net losses of EM II LP will generally be allocated to its limited partners pro rata in accordance with the percentages of their unit ownership. The limited partnership agreement of EM II LP will provide for cash distributions to the holders of limited partnership units of EM II LP if we determine that the taxable income of EM II LP will give rise to taxable income for its limited partners. In accordance with the limited partnership agreement of EM II LP, we intend to cause EM II LP to make cash distributions to the limited partners of EM II LP, including Edgen Group, for purposes of funding their tax obligations in respect of the income of EM II LP that is allocated to them. Generally, these tax distributions will be computed based on our estimate of the taxable income of EM II LP allocable to such limited partner multiplied by an assumed tax rate equal to the highest effective marginal combined U.S. federal, state and local income tax rate prescribed for an individual or corporate resident in New York, New York (taking into account the nondeductibility of certain expenses and the character of our income).

8

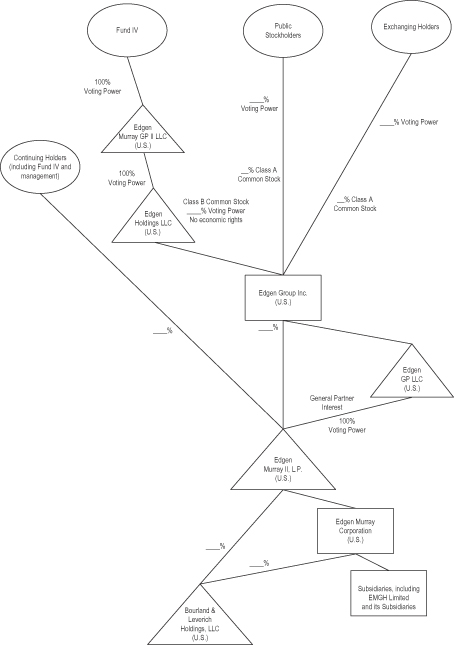

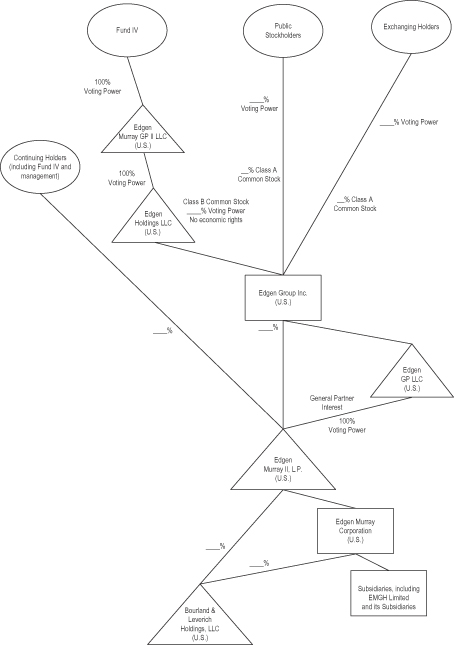

The following diagram illustrates our summary organizational structure after the completion of the Reorganization and the offering:

Summary Organizational Structure

9

Use of Proceeds

We intend to use the net proceeds of the offering to purchase additional limited partnership interests in EM II LP which will be used to repay certain amounts outstanding under B&L’s term loan and revolving credit facility and a note payable issued to the former owner of B&L Predecessor and to redeem a portion of EMC’s senior secured notes.

10

RISK FACTORS

Any of the following risks could materially and adversely affect our business, financial condition or results of operations.

Risks relating to our business

Volatility in the global energy infrastructure market, and, in particular, a significant decline in oil and natural gas prices and refining margins, has in the past reduced, and could in the future reduce, the demand for our products, which could cause our sales and margins to decrease.

Proceeds from the sale of products to the global energy infrastructure market constitute a significant portion of our sales. As a result, we depend upon the global energy infrastructure market, and in particular the oil and natural gas industry, and upon the ability and willingness of industry participants to make capital expenditures to explore for, develop and produce, transport, process and refine oil and natural gas. The industry’s willingness to make these expenditures depends largely upon the availability of attractive drilling prospects, regulatory requirements and limitations, the prevailing view of future oil and natural gas prices, refinery margins and general economic conditions. As we experienced in 2009, 2010 and continuing into 2011, volatile oil and natural gas prices can lead to variable capital expenditures and infrastructure project spending by industry participants, which in turn can affect the demand for our products. Further sustained decreases in capital expenditures in the oil and natural gas industry could have a material adverse effect on our business, financial condition and results of operations. Many factors affect the supply of and demand for oil and natural gas and refined products, thereby affecting our sales and margins, including:

| n | the level of U.S. and worldwide oil and natural gas production; |

| n | the level of U.S. and worldwide supplies of, and demand for, oil, natural gas and refined products; |

| n | the discovery rates of new oil and natural gas resources; |

| n | the expected cost of delivery of oil, natural gas and refined products; |

| n | the availability of attractive oil and natural gas fields for production, which may be affected by governmental action or environmental policy, which may restrict exploration and development prospects; |

| n | U.S. and worldwide refinery utilization rates; |

| n | the amount of capital available for development and maintenance of infrastructure related to oil, gas and refined products; |

| n | changes in the cost or availability of transportation infrastructure and pipeline capacity; |

| n | levels of oil and natural gas exploration activity; |

| n | national, governmental and other political requirements, including the ability of the Organization of the Petroleum Exporting Countries to set and maintain production levels and pricing; |

| n | the impact of political instability, terrorist activities, piracy or armed hostilities involving one or more oil and natural gas producing nations; |

| n | pricing and other actions taken by competitors that impact the market; |

| n | the failure by industry participants to implement planned capital projects successfully or to realize the benefits expected for those projects; |

| n | the cost of, and relative political momentum in respect of, developing alternative energy sources; |

| n | U.S. and non-U.S. governmental laws and regulations, especially anti-bribery law enforcement in underdeveloped nations, environmental and safety laws and regulations (including mandated changes in fuel consumption and specifications), trade laws, commodities and derivatives trading regulations and tax policies; |

| n | technological advances in the oil and natural gas industry; |

| n | natural disasters, including hurricanes, tsunamis, earthquakes and other weather-related events; and |

| n | the overall global economic environment. |

11

Oil and natural gas prices and processing and refining margins have been and are expected to remain volatile. This volatility may cause our customers to change their strategies and capital expenditure levels. We are experiencing, have experienced in the past and may experience in the future, significant fluctuations in our business, financial condition and results of operations, based on these changes. In particular, such continued volatility in the oil, natural gas and refined products margins and markets more generally could materially and adversely affect our business, consolidated financial condition, results of operations and liquidity.

The prices we pay and charge for steel products, and the availability of steel products generally, may fluctuate due to a number of factors beyond our control, which could materially and adversely affect the value of our inventory, business, financial condition, results of operations and liquidity.

We purchase large quantities of steel products from our suppliers for distribution to our customers. The steel industry as a whole is cyclical and at times pricing and availability of these products change depending on many factors outside of our control, such as general global economic conditions, competition, consolidation of steel producers, cost and availability of raw materials necessary to produce steel (such as iron ore, coking coal and steel scrap), production levels, labor costs, freight and shipping costs, natural disasters, political instability, import duties, tariffs and other trade restrictions, currency fluctuations and surcharges imposed by our suppliers.

We seek to maintain our profit margins by attempting to increase the prices we charge for our products in response to increases in the prices we pay for them. However, demand for our products, the actions of our competitors, our contracts with certain of our customers and other factors largely out of our control will influence whether, and to what extent, we can pass any such steel cost increases and surcharges on to our customers. We may be unable to pass increased supply costs on to our customers because a portion of our sales are derived from stocking program arrangements, contracts and MRO arrangements which provide certain customers time limited price protection, which may obligate us to sell products at a set price for a specific period or because of general competitive conditions. If we are unable to pass on higher costs and surcharges to our customers, or if we are unable to do so in a timely manner, our business, financial condition, results of operations and liquidity could be materially and adversely affected.

Alternatively, if the price of steel decreases significantly or if demand for our products decreases because of increased customer, manufacturer or distributor inventory levels of specialty steel pipe, pipe components, high yield structural steel products and valves, we may be required to reduce the prices we charge for our products to remain competitive. These factors may affect our gross profit and cash flow and may also require us to write-down the value of inventory on hand that we purchased prior to the steel price decreases, which could materially and adversely affect our business, financial condition, results of operations and liquidity. For example, on a pro forma basis, we had inventory write-downs of $0.3 million and $61.7 million for the years ended December 31, 2010 and 2009, respectively, related to selling prices falling below the average cost of inventory in some of the markets we serve, including the U.S. and the Middle East. Although neither our predecessor nor B&L had any inventory write-downs during the nine months ended September 30, 2011, there can be no assurances such write-downs will not occur in the future.

Our business could also be negatively impacted by the importation of lower-cost specialty steel products into the U.S. market. An increase in the level of imported lower-cost products could adversely affect our business to the extent that we then have higher-cost products in inventory or if prices and margins are driven down by increased supplies of such products. These events could also have a material adverse effect on our profit margins and results of operations. These risks may be heightened if recently imposed tariffs on certain imported competing products and OCTG are reduced, eliminated or allowed to expire.

In addition, the domestic metals production industry has experienced consolidation in recent years. Further consolidation could result in a decrease in the number of our major suppliers or a decrease in the number of alternative supply sources available to us, which could make it more likely that termination of one or more of our relationships with major suppliers would result in a material adverse effect on our business, financial condition, results of operations or cash flows. Consolidation could also result in price increases for the products that we purchase. Such price increases could have a material adverse effect on our business, financial condition, results of operations or cash flows if we were not able to pass these price increases on to our customers.

12

We may experience unexpected supply shortages.

We distribute products from a wide variety of vendors and suppliers. In the future we may have difficulty obtaining the products we need from suppliers and manufacturers as a result of unexpected demand or production difficulties. Also, products may not be available to us in quantities sufficient to meet customer demand. Failure to fulfill customer orders in a timely manner could have an adverse effect on our relationships with these customers. Our inability to obtain products from suppliers and manufacturers in sufficient quantities to meet demand could have a material adverse effect on our business, results of operations and financial condition.

We maintain an inventory of products for which we do not have firm customer orders. As a result, if prices or sales volumes decline, our profit margins and results of operations could be adversely affected.

Our profitability, margins and cash flows may be negatively affected if we are unable to sell our inventory in a timely manner. Because we maintain substantial inventories of specialty steel products for which we do not have firm customer orders, there is a risk that we will be unable to sell our existing inventory at the volumes and prices we expect. For example, the value of our inventory could decline if the prices we are able to charge our customers decline. In that case, we may experience reduced margins or losses as we dispose of higher-cost products at reduced market prices. For instance, during the fiscal year ended December 31, 2009, our predecessor incurred losses of $12.7 million due to strategic inventory liquidation (at prices below cost) of inventory related primarily to products for the North American midstream oil and natural gas market. Although neither our predecessor nor B&L incurred significant losses related to inventory liquidation during the nine months ended September 30, 2011, there can be no assurance that such losses will not occur in the future.

Our ten largest customers account for a substantial portion of our sales and profits, and the loss of these customers could result in materially decreased sales and profits.

Our ten largest customers accounted for approximately 35% of our pro forma sales for the nine months ended September 30, 2011. We may lose a customer for any number of reasons, including as a result of a merger or acquisition, the selection of another provider of specialty steel products, business failure or bankruptcy of the customer, or dissatisfaction with our performance. Consistent with industry practice, we do not have long-term contracts with most of our major customers. Our customers with whom we do not have long-term contracts have the ability to terminate their relationships with us at any time. Moreover, to the extent we have long-term

contracts with our major customers, these contracts generally may be discontinued with 30 days notice by either party, are not exclusive and do not require minimum levels of purchases. Loss of these customers could adversely affect our business, results of operations and cash flow.

Our business is sensitive to economic downturns and adverse credit market conditions, which could adversely affect our business, financial condition, results of operations and liquidity.

Aspects of our business, including demand for and availability of our products, are dependent on, among other things, the state of the global economy and adverse conditions in the global credit markets. Our business has been affected in the past and may be affected in the future by the following:

| n | our customers may reduce or eliminate capital expenditures as a result of reduced demand from their customers; |

| n | our customers may not be able to obtain sufficient funding at a reasonable cost or at all as a result of tightening credit markets, which may result in delayed or cancelled projects or maintenance expenditures; |

| n | our customers may not be able to pay us in a timely manner, or at all, as a result of declines in their cash flows or available credit; |

| n | we may experience supply shortages for certain products if our suppliers reduce production as a result of reduced demand for their products or as a result of limitations on their ability to access credit for their operations; |

| n | we may experience tighter credit terms from our suppliers, which could increase our working capital needs and potentially reduce our liquidity; and |

| n | the value of our inventory could decline if the sales prices we are able to charge our customers decline. |

As a result of these and other effects, economic downturns such as the one we recently experienced have, and could in the future, materially and adversely affect our business, financial condition, results of operations and liquidity.

13

In addition, market disruptions, such as the recent global economic recession, could adversely affect the creditworthiness of lenders under our debt facilities. Any reduced credit availability under our revolving credit facilities could require us to seek other forms of liquidity through financing in the future and the availability of such financing will depend on market conditions prevailing at that time.

We rely on our suppliers to meet the required specifications for the products we purchase from them, and we may have unreimbursed losses arising from our suppliers’ failure to meet such specifications.

We rely on our suppliers to provide mill certifications that attest to the specifications and physical and chemical properties of the steel products that we purchase from them for resale. We generally do not undertake independent testing of any such steel but rely on our customers or assigned third-party inspection services to notify us of any products that do not conform to the specifications certified by the mill or equipment fabricators. We may be subject to customer claims and other damages if products purchased from our suppliers are deemed to not meet customer specifications. These damages could exceed any amounts that we are able to recover from our suppliers or under our insurance policies. Failure to provide products that meet our customer’s specifications would adversely affect our relationship with such customer, which could negatively impact our business and results of operations.

Loss of key suppliers could decrease our sales volumes and overall profitability.

For the nine months ended September 30, 2011, our ten largest suppliers accounted for approximately 66% of our pro forma purchases and our single largest supplier accounted for approximately 26% of our pro forma purchases. Consistent with industry practice, we do not have long-term contracts with most of our suppliers. Therefore, most of our suppliers have the ability to terminate their relationships with us or reduce their planned allocations of product to us at any time. The loss of any of these suppliers due to merger or acquisition, business failure, bankruptcy or other reason could put us at a competitive disadvantage by decreasing the availability or increasing the prices, or both, of products we distribute, which in turn could result in a decrease in our sales volumes and overall profitability.

Loss of third-party transportation providers upon which we depend, failure of such third-party transportation providers to deliver high quality service or conditions negatively affecting the transportation industry could increase our costs and disrupt our operations.

We depend upon third-party transportation providers for delivery of products to our customers. Shortages of transportation vessels, transportation disruptions or other adverse conditions in the transportation industry due to shortages of truck drivers, strikes, slowdowns, piracy, terrorism, disruptions in rail service, closures of shipping routes, unavailability of ports and port service for other reasons, increases in fuel prices and adverse weather conditions could increase our costs and disrupt our operations and our ability to deliver products to our customers on a timely basis. We cannot predict whether or to what extent any of these factors would affect our costs or otherwise harm our business. In addition, the failure of our third-party transportation providers to provide high quality customer service when delivering product to our customers would adversely affect our reputation and our relationship with our customers and could negatively impact our business and results of operations.

Significant competition from a number of companies could reduce our market share and have an adverse effect on our selling prices, sales volumes and results of operations.

We operate in a highly competitive industry and compete against a number of other market participants, some of which have significantly greater financial, technological and marketing resources than we do. We compete primarily on the basis of pricing, availability of specialty products and customer service. We may be unable to compete successfully with respect to these or other competitive factors. If we fail to compete effectively, we could lose market share to our competitors. Moreover, our competitors’ actions could have an adverse effect on our selling prices and sales volume. To compete for customers, we may elect to lower selling prices or offer increased services at a higher cost to us, each of which could reduce our sales, margins and earnings. There can be no assurance that we will be able to compete successfully in the future, and our failure to do so could adversely affect our business, results of operations and financial condition.

Loss of key management or sales and customer service personnel could harm our business.

Our future success depends to a significant extent on the skills, experience and efforts of management. While we have not experienced problems in the past attracting and retaining members of our management team, the loss of any or all of these individuals could materially and adversely affect our business. We do not carry key-man life

14

insurance on any member of management other than a policy inherited by us for our Chief Operating Officer, Craig S. Kiefer. We must continue to develop and retain a core group of individuals if we are to realize our goal of continued expansion and growth. We cannot assure you that we will be able to do so in the future.

Because of the specialized nature of our products and services, generally only highly qualified and trained sales and customer service personnel have the necessary skills to market our products and provide product support to our customers. Such employees develop relationships with our customers that could be damaged or lost if these employees are not retained. We face intense competition for the hiring of these professionals. Any failure on our part to hire, train and retain a sufficient number of qualified sales and customer service personnel could materially and adversely affect our business. In particular, our efforts to continue expansion internationally will be dependent on our ability to continue to hire and train a skilled and knowledgeable sales force to attract customers in these markets. In addition, a significant increase in the wages paid by competing employers could result in a reduction of our skilled labor force, increases in the wage rates that we must pay, or both. The actual occurrence of any of these events could appreciably increase our cost structure and, as a result, materially impair our growth potential and our results of operations.

The development of alternatives to steel product distributors in the supply chain in the industries in which we operate could cause a decrease in our sales and results of operations and limit our ability to grow our business.

If our customers were to acquire or develop the capability and desire to purchase products directly from our suppliers in a competitive fashion, it would likely reduce our sales volume and overall profitability. Our suppliers also could expand their own local sales forces, marketing capabilities and inventory stocking capabilities and sell more products directly to our customers. Likewise, customers could purchase from our suppliers directly in situations where large orders are being placed and where inventory and logistics support planning are not necessary in connection with the delivery of the products. These and other actions that remove us from, limit our role in, or reduce the value that our services provide in the distribution chain could materially and adversely affect our business, financial condition and results of operations.

Our customers that are pursuing unconventional or offshore oil and natural gas resources, or that are using new drilling and extraction technologies, such as horizontal drilling and hydraulic fracturing, could face regulatory, political and economic challenges that may result in increased costs and additional operating restrictions or delays as well as adversely affect our business and operating results.

The pursuit of unconventional oil and natural gas resources, the expansion of offshore drilling and exploration, as well as new drilling and extraction technologies, including hydraulic fracturing and horizontal drilling, have received significant regulatory and political focus. Hydraulic fracturing is an essential technology for the development and production of unconventional oil and natural gas resources. The hydraulic fracturing process in the U.S. is typically subject to state and local regulation, and has been exempt from federal regulation since 2005 pursuant to the federal Safe Drinking Water Act (except when the fracturing fluids or propping agents contain diesel fuels). Public concerns have been raised regarding the potential impact of hydraulic fracturing on drinking water. Two companion bills, known collectively as the Fracturing Responsibility and Awareness of Chemicals Act, or FRAC Act, have been introduced before the U.S. Congress that would repeal the Safe Drinking Water Act exemption and otherwise restrict hydraulic fracturing. If enacted, the FRAC Act could result in additional regulatory burdens such as permitting, construction, financial assurance, monitoring, recordkeeping and plugging and abandonment requirements. The FRAC Act also proposes requiring the disclosure of chemical constituents used in the hydraulic fracturing process to state or federal regulatory authorities, who would then make such information publicly available. Several states have enacted similar chemical disclosure regulations. The availability of this information could make it easier for third parties to initiate legal proceedings based on allegations that specific chemicals used in the hydraulic fracturing process could adversely affect groundwater.

The United States Environmental Protection Agency, or the EPA, is conducting a comprehensive study of the potential environmental impacts of hydraulic fracturing activities, and a committee of the House of Representatives is also conducting an investigation of hydraulic fracturing practices. In August and November 2011, the United States Department of Energy Shale Gas Subcommittee, or DOE, issued two reports on measures that can be taken to reduce the potential environmental impacts of shale gas production. The results of the DOE and EPA studies and House investigation could lead to restrictions on hydraulic fracturing. The EPA is currently working on new interpretive guidance for Safe Drinking Water Act permits that would be required with respect to the oil and natural

15

gas wells that use fracturing fluids or propping agents containing diesel fuels. The EPA has proposed regulations under the federal Clean Air Act in July 2011 regarding certain criteria and hazardous air pollutant emissions from the hydraulic fracturing of oil and natural gas wells and, in October 2011, announced its intention to propose regulations by 2014 under the federal Clean Water Act to regulate wastewater discharges from hydraulic fracturing and other gas production. In addition, various state and local governments, as well as the United States Department of Interior and certain river basin commissions have taken steps to increase regulatory oversight of hydraulic fracturing through additional permit requirements, operational restrictions, disclosure obligations and temporary or permanent bans on hydraulic fracturing in certain local jurisdictions or in environmentally sensitive areas such as watersheds. Any future federal, state or local laws or regulations imposing reporting obligations on, or otherwise limiting, the hydraulic fracturing process could make it more difficult to complete oil and natural gas wells in certain formations. Any decrease in drilling activity resulting from the increased regulatory restrictions and costs associated with hydraulic fracturing, or any permanent, temporary or regional prohibition of the uses of this technology, could adversely affect demand for our products and our results of operations.

In addition to regulatory challenges facing hydraulic fracturing, the process of extracting hydrocarbons from shale formations requires access to water, chemicals and proppants. If any of these necessary components of the fracturing process is in short supply in a particular operating area or in general, the pace of drilling could be slowed, which could reduce demand for the products we distribute.

Another source of oil and natural gas resources facing increased regulation is offshore drilling and exploration. The April 2010 Deepwater Horizon accident in the Gulf of Mexico and its aftermath resulted in increased public scrutiny, including a moratorium on offshore drilling in the U.S. While the moratorium has been lifted, there has been a delay in resuming operations related to drilling offshore in areas impacted by the moratorium and we cannot assure you that operations related to drilling offshore in such areas will reach the same levels that existed prior to the moratorium or that a future moratorium may not arise. In addition, this event has resulted in new and proposed legislation and regulation in the U.S. of the offshore oil and natural gas industry, which may result in substantial increases in costs or delays in drilling or other operations in U.S. waters, oil and natural gas projects potentially becoming less economically viable and reduced demand for our products and services. Other countries in which we operate may also consider moratoriums or increase regulation with respect to offshore drilling. If future moratoriums or increased regulations on offshore drilling or contracting services operations arose in the U.S. or other countries, our customers could be required to cease their offshore drilling activities or face higher operating costs in those areas. These events and any other regulatory and political challenges with respect to unconventional oil and natural gas resources and new drilling and extraction technologies could reduce demand for our products and services and materially and adversely affect our business and operating results.

Changes in the payment terms we receive from our suppliers could have a material adverse effect on our liquidity.

The payment terms we receive from our suppliers are dependent on several factors, including, but not limited to, our payment history with the supplier, the supplier’s credit granting policies, contractual provisions, our credit profile, industry conditions, global economic conditions, our recent operating results, financial position and cash flows and the supplier’s ability to obtain credit insurance on amounts that we owe them. Adverse changes in any of these factors, certain of which may not be wholly in our control, may induce our suppliers to shorten the payment terms of their invoices. For example, as a result of the worldwide economic recession and its impact on steel demand and prices, some of our suppliers have experienced a reduction in trade credit insurance available to them for sales to foreign accounts. This reduction in trade credit insurance has resulted in certain suppliers reducing the available credit they grant to us and/or requiring other forms of credit support, including letters of credit and payment guarantees under the revolving credit facility available to EMC and certain of EM II LP’s non-U.S. subsidiaries, which we refer to as the EM revolving credit facility. Providing this credit support decreases availability under this revolving credit facility. Since we incur costs for trade finance instruments under our revolving credit facilities, this trend has increased our borrowing costs, although not significantly. Given the large amounts and volume of our purchases from suppliers, a change in payment terms may have a material adverse effect on our liquidity and our ability to make payments to our suppliers, and consequently may have a material adverse effect on our business, results of operations and financial condition.

16

We are a holding company with no revenue generating operations of our own. We depend on the performance of our subsidiaries and their ability to make distributions to us.

We are a holding company with no business operations, sources of income or assets of our own other than our ownership interests in our subsidiaries. Because all of our operations are conducted by our subsidiaries, our cash flow and our ability to repay debt that we currently have and that we may incur after the offering and our ability to pay dividends to our stockholders are dependent upon cash dividends and distributions or other transfers from our subsidiaries. Payment of dividends, distributions, loans or advances by our subsidiaries to us are subject to restrictions imposed by our revolving credit agreements and the indenture governing EMC’s senior secured notes. Our revolving credit agreements also limit our ability to allocate cash flow or resources among certain subsidiaries. In addition, payments or distributions from our subsidiaries could be subject to restrictions on dividends or repatriation of earnings, monetary transfer restrictions and foreign currency exchange regulations in the jurisdictions in which our subsidiaries operate. In particular, EMGH Limited, our principal U.K. subsidiary, may under English law only pay dividends out of distributable profits.

Our subsidiaries are separate and distinct legal entities. Any right that we have to receive any assets of or distributions from any of our subsidiaries upon the bankruptcy, dissolution, liquidation or reorganization of any such subsidiary, or to realize proceeds from the sale of their assets, will be junior to the claims of that subsidiary’s creditors, including trade creditors and holders of debt issued by that subsidiary.

Risks generally associated with acquisitions, including identifying and integrating future acquisitions, could adversely affect our growth strategy.

A key element of our growth strategy has been, and is expected to be, the pursuit of acquisitions of other businesses that either expand or complement our global platform. However, we cannot assure you that we will be able to consummate future acquisitions because of uncertainty in respect of competition for such acquisitions or, availability of financial resources or regulatory approval, amongst other reasons. Additionally, we cannot assure you that we will be able to identify additional acquisitions or that we would realize any anticipated benefits from such acquisitions. Integrating businesses involves a number of risks, including the possibility that management may be distracted from regular business concerns by the need to integrate operations, unforeseen difficulties in integrating operations and systems, problems concerning assimilating and retaining the employees of the acquired business, accounting issues that arise in connection with the acquisition, including amortization of acquired assets, challenges in retaining customers, assumption of known or unknown material liabilities or regulatory non-compliance issues and potentially adverse short-term effects on cash flow or operating results. Acquired businesses may require a greater amount of capital, infrastructure or other spending than we anticipate. In addition, we may incur debt to finance future acquisitions, which could increase our leverage. Further, we may face additional risks to the extent that we make acquisitions of international companies or involving international operations, including, among other things, compliance with foreign regulatory requirements, political risks, difficulties in enforcement of third-party contractual obligations and integration of international operations with our domestic operations. We cannot assure you that we will be successful in consummating future acquisitions on favorable terms, if at all. If we are unable to successfully complete and integrate strategic acquisitions in a timely manner, our growth strategy could be adversely impacted.

Our global operations, in particular those in emerging markets, are subject to various risks which could have a material adverse effect on our business, results of operations and financial condition.

Our business is subject to certain risks associated with doing business globally, particularly in emerging markets. Our sales outside of North America represented approximately 20% of our pro forma sales for the nine months ended September 30, 2011. One of our growth strategies is to pursue opportunities for our business in a variety of geographies outside the U.S., which could be adversely affected by the risks set forth below. Our operations are subject to risks associated with the political, regulatory and economic conditions of the countries in which we operate, such as:

| n | the burden of complying with multiple and possibly conflicting laws and any unexpected changes in regulatory requirements, including those disrupting purchasing and distribution capabilities; |

| n | foreign currency exchange controls, import and export restrictions and tariffs, including restrictions promulgated by the Office of Foreign Assets Control of the U.S. Department of the Treasury, and other trade protection regulations and measures; |

17

| n | political risks, including risks of loss due to civil disturbances, acts of terrorism, acts of war, piracy, guerilla activities and insurrection; |

| n | unstable economic, financial and market conditions and increased expenses as a result of inflation, or higher interest rates; |

| n | difficulties in enforcement of third-party contractual obligations and collecting receivables through foreign legal systems; |

| n | foreign governmental regulations that favor or require the awarding of contracts to local contractors or by regulations requiring foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction; |

| n | difficulty in staffing and managing international operations and the application of foreign labor regulations; |

| n | workforce uncertainty in countries where labor unrest is more common than in the U.S.; |

| n | differing local product preferences and product requirements; |

| n | fluctuations in currency exchange rates to the extent that our assets or liabilities are denominated in a currency other than the functional currency of the country where we operate; |

| n | potentially adverse tax consequences from changes in tax laws, requirements relating to withholding taxes on remittances and other payments by subsidiaries and restrictions on our ability to repatriate dividends from our subsidiaries; |

| n | exposure to liabilities under anti-corruption and anti-money laundering laws and regulations, including the U.S. Foreign Corrupt Practices Act, or FCPA, the U.K. Bribery Act 2010 and similar laws and regulations in other jurisdictions; and |

| n | enhanced costs associated with complying with increasing governmental regulation of anti-corruption and anti-money laundering. |

Any one of these factors could materially adversely affect our sales of products or services to global customers or harm our reputation, which could materially adversely affect our business, results of operations and financial condition.

Exchange rate fluctuations could adversely affect our results of operations and financial position.

In the ordinary course of our business, we enter into purchase and sales commitments that are denominated in currencies that differ from the functional currency used by our operating subsidiaries. Currency exchange rate fluctuations can create volatility in our consolidated financial position, results of operations and/or cash flows. Although we may enter into foreign exchange agreements with financial institutions in order to reduce our exposure to fluctuations in currency exchange rates, these transactions, if entered into, will not eliminate that risk entirely. To the extent that we are unable to match sales received in foreign currencies with expenses paid in the same currency, exchange rate fluctuations could have a negative impact on our consolidated financial position, results of operations and/or cash flows. Additionally, because our consolidated financial results are reported in U.S. dollars, if we generate net sales or earnings within entities whose functional currency is not the U.S. dollar, the translation of such amounts into U.S. dollars can result in an increase or decrease in the amount of our net sales or earnings. With respect to our potential exposure to foreign currency fluctuations and devaluations, for the nine months ended September 30, 2011, approximately 22% of our pro forma sales originated from subsidiaries outside of the U.S. in currencies including, among others, the pound sterling, euro and U.S. dollar. As a result, a material decrease in the value of these currencies relative to the U.S. dollar may have a negative impact on our reported sales, net income and cash flows. Any currency controls implemented by local monetary authorities in countries where we currently operate could adversely affect our business, financial condition and results of operations.

Due to the global nature of our business, we could be adversely affected by violations of the FCPA, similar anti-bribery laws in other jurisdictions in which we operate, and various international trade and export laws.

The global nature of our business creates various domestic and local regulatory challenges. FCPA, and similar anti-bribery laws in other jurisdictions generally prohibit U.S.-based companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. The U.K. Bribery Act 2010 prohibits certain entities from making improper payments to governmental officials and to commercial entities. Our policies mandate compliance with these anti-bribery laws. We operate in many parts of the world that experience corruption by government officials to some degree and, in certain circumstances, compliance with anti-bribery laws may conflict with local customs and practices. Our global operations require us to import and export to and from myriad countries, which geographically stretches our compliance obligations. To help ensure compliance, our anti-

18

bribery policy and training on a global basis provide our employees with procedures, guidelines and information about anti-bribery obligations and compliance. Further, we require our partners, subcontractors, agents and others who work for us or on our behalf to comply with anti-bribery laws. We also have procedures and controls in place designed to ensure internal and external compliance. However, such anti-bribery policy, training, internal controls and procedures will not always protect us from reckless, criminal, or unintentional acts committed by our employees, agents or other persons associated with us. If we are found to be in violation of the FCPA, the U.K. Bribery Act 2010 or other anti-bribery laws (either due to acts or inadvertence of our employees, or due to the acts or inadvertence of others), we could suffer criminal or civil penalties or other sanctions, which could have a material adverse effect on our business.

Hurricanes or other adverse weather events could negatively affect our local economies or disrupt our operations, which could have an adverse effect on our business or results of operations.

Our geographic market areas in the southeastern U.S. and APAC are susceptible to tropical storms, or, in more severe cases, hurricanes and typhoons, respectively. Such weather events can disrupt our operations or those of our customers or suppliers, result in damage to our properties and negatively affect the local economies in which we operate. Additionally, we may experience communication disruptions with our customers, suppliers and employees. In 2008 and 2005, Hurricanes Gustav, Ike, Katrina and Rita struck the Gulf Coast of Louisiana, Mississippi, Alabama and Texas and caused extensive and catastrophic physical damage to those market areas. As a result of Hurricanes Katrina and Rita, our Louisiana and Texas locations sustained minor physical damage and were closed for a number of days to secure our employees. Our sales order backlog and shipments experienced a temporary decline immediately following the hurricanes.

We cannot predict whether, or to what extent, damage caused by future hurricanes and tropical storms will affect our operations or the economies in those market areas. Such weather events could result in a disruption of our purchasing and distribution capabilities, an interruption of our business that exceeds our insurance coverage, our inability to collect from customers, the inability of our suppliers to provide product, the inability of third-party transportation providers to deliver product and increased operating costs. Our business or results of operations may be adversely affected by these and other negative effects of hurricanes or other adverse weather events.

We rely on our information technology systems to manage numerous aspects of our business and customer and supplier relationships, and a disruption of these systems could adversely affect our business, financial condition and results of operations.

We depend on our information technology, or IT, systems to manage numerous aspects of our business transactions and provide analytical information to management. Our IT systems allow us to efficiently purchase products from our suppliers, provide procurement and logistics services, ship products to our customers on a timely basis, maintain cost-effective operations and provide superior service to our customers. Our IT systems are an essential component of our business and growth strategies, and a disruption to our IT systems could significantly limit our ability to manage and operate our business efficiently. These systems are vulnerable to, among other things, damage and interruption from power loss, including as a result of natural disasters, computer system and network failures, loss of telecommunications services, operator negligence, loss of data, security breaches and computer viruses. Any such disruption could adversely affect our competitive position and thereby our business, financial condition and results of operations.

Our operations and those of our customers are subject to environmental laws and regulations. Liabilities or claims with respect to environmental matters could materially and adversely affect our business.

Our operations and those of our customers are subject to extensive and frequently changing federal, state, local and foreign laws and regulations relating to the protection of human health and the environment, including those limiting the discharge and release of pollutants into the environment and those regulating the transport, use, treatment, storage, disposal and remediation of, and exposure to, hazardous materials, substances and wastes. Failure to comply with environmental laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of fines and penalties, imposition of remedial requirements and the issuance of orders enjoining future operations or imposing additional compliance requirements on such operations. In addition, certain environmental laws can impose strict, joint and several liability without regard to fault on responsible parties, including past and present owners and operators of sites, related to cleaning up sites at which hazardous wastes or materials were disposed or released even if the disposals or releases were in compliance with applicable law at the time of those actions.

19

Our customers operate primarily in the upstream, midstream and downstream end-markets for oil and natural gas, each of which is highly regulated due to high level of perceived environmental risk. Liability under environmental laws and regulations could result in cancellation of or reduction in future oil and natural gas related activity. Future events, such as the discovery of currently unknown contamination or other matters, spills caused by future pipeline ruptures, changes in existing environmental laws and regulations or their interpretation and more vigorous enforcement policies by regulatory agencies, may give rise to additional expenditures or liabilities for our operations or those of our customers, which could impair our operations and adversely affect our business and results of operations.

In addition, various current and likely future federal, state, local and foreign laws and regulations could regulate climate change and the emission of greenhouse gases, particularly carbon dioxide and methane. Future climate change regulation could reduce demand for the use of fossil fuels, which could adversely impact the operations of our customers. We cannot predict the impact that such regulation may have, or that climate change may otherwise have, on our business.

Increased regulatory focus on worker safety and health, including pipeline safety, could subject us and our customers to significant liabilities and compliance expenditures.

Companies undertaking oil and natural gas extraction, processing and transmission infrastructure across the upstream, midstream and downstream end-markets are facing increasingly strict safety requirements as they manage and build infrastructure. As a result, our operations and those of our customers are subject to increasingly strict federal, state, local and foreign laws and regulations governing worker safety and employee health, including pipeline safety and exposure to hazardous materials. Future environmental and safety compliance could require the use of more specialized products and higher rates of maintenance, repair and replacement to ensure the integrity of our customers’ facilities. The Pipeline Inspection, Protection, Enforcement and Safety Act has established a regulatory framework that mandates comprehensive testing and replacement programs for transmission lines across the U.S. Pipeline safety is subject to state regulation as well as by the Pipeline and Hazardous Materials Safety Administration of the United States Department of Transportation, which, among other things, regulates natural gas and hazardous liquid pipelines. The Pipeline Safety, Regulatory Certainty and Job Creation Act of 2011 bill that would further enhance federal regulation of pipeline safety passed Congress by unanimous consent in December 2011. From time to time, administrative or judicial proceedings or investigations may be brought by private parties or government agencies, or stricter enforcement could arise, with respect to pipeline safety and employee health matters. Such proceedings or investigations, stricter enforcement or increased regulation of pipeline safety could result in fines or costs or a disruption of our operations and those of our customers, all of which could adversely affect our business and results of operations.

We could be subject to personal injury, property damage, product liability, warranty, environmental and other claims involving allegedly defective products that we distribute.