Attached files

| file | filename |

|---|---|

| 8-K - CHINA FUND INC | v244267_8k.htm |

|

THE CHINA FUND, INC. (CHN)

MONTHLY INSIGHT

|

|

AT NOVEMBER 30, 2011

|

IN BRIEF

|

|

|

Net asset value per share

|

US$26.90

|

|

Market price

|

US$25.32

|

|

Premium/(discount)

|

(5.87%)

|

|

Fund size

|

US$612.9m

|

Source: State Street Bank and Trust Company.

|

At November 30, 2011

|

US$ return

|

|||||||

|

China Fund

|

MSCI Golden

|

|||||||

|

NAV

|

Dragon*

|

|||||||

|

%

|

%

|

|||||||

|

One month

|

(7.2 | ) | (8.5 | ) | ||||

|

Year to date

|

(23.8 | ) | (20.4 | ) | ||||

|

One year

|

(18.4 | ) | (17.7 | ) | ||||

|

Three years % pa

|

22.4 | 17.5 | ||||||

Past performance is not a guide to future returns.

Source: State Street Bank and Trust Company.

NAV performance. *Source for index data: MSCI.

As of November 9, 2011, the Fund has entered into an Interim Investment Advisory and Management Agreement with Martin Currie Inc. and on November 10, 2011, Martin Currie Inc. entered into an Interim Sub-Advisory Agreement with APS Asset Management Pte Ltd. to manage the Fund’s portfolio until new permanent management arrangements can be put in place. APS Asset Management Pte Ltd. is a Singapore based investment management firm that specializes in Asia Pacific equity investments with a particular focus on China and Greater China. APS has a team of ten analysts based across Beijing, Shanghai and Shenzhen. The interim arrangements will remain in place for a maximum of 150 days. The Board is also considering potential managers, including Martin Currie Inc. and APS Asset Management Pte Ltd., to take over the management of the Fund’s portfolio at the end of the term of the Interim Agreements. The selection of any such manager by the Board will be subject to stockholder approval.

FUND MANAGERS (interim)

|

|

||

|

Wong Kok Hoi

|

James Liu

|

MANAGER’S COMMENTARY

Under sustained pressure from stubbornly negative global newsflow and sluggish Chinese economic indicators, equity markets in the Greater China region plummeted in November. Although sentiment improved slightly towards the end of the month, the late gains were wholly insufficient to offset the losses made earlier in the month. Hong Kong and Taiwanese stocks were hit particularly hard, as capital fled markets regarded as risky. The Chinese A-share market lost 5.5%. Overall, the MSCI Golden Dragon index fell 8.5%. Although the Fund could not avoid this downturn, it did manage to outperform its benchmark by 1.3 percentage points.

On the domestic front, the main development was November’s HSBC purchasing managers’ index, which came in at 47.7. This indicates a sharp deterioration in business conditions. After October’s reading of 51, this was the biggest monthly fall since August 2008 and the lowest figure since March 2009.

With reduced export orders from the United States and Europe, as well as a very tight credit environment, many of China’s small and medium-sized enterprises are experiencing the toughest conditions they have ever faced. Factories have been cautious about expanding, and consumers are much less ready to open their wallets for discretionary items. Feedback from manufacturers of factory-automation equipment shows that new orders have been slowing since the third quarter. Meanwhile, China’s department-store operators have been reporting decelerating same-store sales growth since September.

The government’s unprecedented tightening measures in the property market are also working. More cities are reporting shrinking transaction volumes and lower house prices compared with a year ago. Now that inflation appears to have peaked, there is mounting speculation that the authorities will adjust their policy stance, given the increasing concerns about China’s economic growth and the uncertain global environment.

Indeed, in November, the People’s Bank of China announced a 50-basis-point cut in the required-reserve ratio for the country’s commercial banks. This will take effect from December 5, 2011. The earlier-than-expected move is the clearest signal so far that there will be a change in monetary policy.

Meanwhile, Taiwan’s heavily export-oriented economy looks set to remain volatile, given the uncertainties in the export market. The third-quarter GDP growth rate dropped to 3.2%, far below the 5.57% posted in the first half of the year. Economists are becoming more conservative in their estimates for growth next year.

Among the main contributors to the Fund’s outperformance in November were China Medical System Holdings, VanceInfo Technologies and Ports Design. China Medical System Holdings outperformed after the company announced that it was testing its new liver-cancer drug at 26 hospitals in China. VanceInfo Technology’s shares enjoyed a recovery after the firm revised up its fourth-quarter guidance by 7%. The main factor in fashion retailer Port Design’s outperformance was the good visitor numbers announced by the Hong Kong Tourism Board for October.

Negatives included Far Eastern Department Stores, which fell on weaker consumption data from Taiwan. The company’s anniversary sales promotions generated only 2% sales growth, with year-to-date revenue up just 4%. On the mainland, another significant detractor from returns was Huiyin Household Appliances, which declined on worries about the expiry of the government’s old-for-new subsidy program at the end of the year. Huiyin’s competitors have also reported weaker sales, leading to concerns about a shrinking appetite for electrical products. Finally, Shandong Weigao Group Medical Polymer, which makes medical consumables, weakened after disappointing the market’s high expectations in its third-quarter results.

Source: Martin Currie Inc. and APS Asset Management Pte Ltd.

MONTHLY INSIGHT

INVESTMENT STRATEGY

During November we bought a new position in Citic Securities. This is China’s largest investment bank as measured by assets, equity, revenue and net profit. It has pioneered many capital-market services in China, including index futures, stock borrowing and financing. We expect the company to benefit from the ongoing development of the Chinese capital market. Also, at 1.4 times price/book, the valuation has fallen close to historical lows.

We also added ZTE Corp, China’s second-largest manufacturer of telecom equipment. The company has underperformed recently after announcing a disappointing set of third-quarter results. Because of an aggressive pricing strategy in overseas markets, gross margin shrank by 3.5%, year-on-year, to 30.3%. As a result, net profit declined by 21.5%, year-on-year. But we believe that the firm is sacrificing short-term profitability for long-term benefits by increasing its market share. There should be a good chance of a turnaround in the fourth quarter. The stock trades at 13 times 2012 P/E.

Another new holding is UFIDA Software, which provides management software and e-business services on the Chinese mainland. Its market share in China was 22% in 2010 – more than the combined market share of its two closest competitors. China’s IT-solutions industry is still in its infancy and offers significant growth potential. We expect UFIDA to maintain its leading position and grow at 30% per annum over the next few years. It trades at 21.7 times 2012 P/E.

Finally, we sold out of China Railways Construction, the largest mainland construction firm by market cap and construction revenue. We expect the company’s new orders to slow or decline, both domestically and internationally. At home, railway construction appears to have peaked in the last two years; abroad, we expect the turmoil in the Middle East and Africa (the firm’s two largest overseas markets) to affect business there. The company also faces receivable and contract-default risks in its international orders.

Source: APS Asset Management Pte Ltd.

FUND DETAILS

|

Market cap

|

US$576.8m

|

|

Shares outstanding

|

22,781,762

|

|

Exchange listed

|

NYSE

|

|

Listing date

|

July 10, 1992

|

|

Listing and direct investment manager

|

Martin Currie Inc

|

Source: State Street Bank and Trust Company.

|

ASSET ALLOCATION

|

Source: State Street Bank and Trust Company

|

INDUSTRY ALLOCATION

|

|

The China Fund, Inc %

|

MSCI Golden Dragon %

|

|||

|

Healthcare

|

23.8

|

0.4

|

||

|

Consumer discretionary

|

16.4

|

6.9

|

||

|

Financials

|

14.7

|

33.4

|

||

|

Consumer staples

|

12.5

|

3.6

|

||

|

Information technology

|

13.9

|

19.1

|

||

|

Industrials

|

3.2

|

6.7

|

||

|

Utilities

|

3.8

|

4.6

|

||

|

Telecommunications

|

5.0

|

8.8

|

||

|

Materials

|

1.5

|

7.0

|

||

|

Energy

|

0.4

|

9.6

|

||

|

Other assets & liabilities

|

4.8

|

—

|

Source: State Street Bank and Trust Company. Source for index data: MSCI

|

PERFORMANCE

|

(US$ RETURNS)

|

|||

|

NAV %

|

Market price %

|

|||

|

One month

|

(7.2)

|

(2.2)

|

||

|

Year to date

|

(23.8)

|

(22.1)

|

||

|

Three years % pa

|

22.4

|

25.1

|

Past performance is not a guide to future returns.

Three year returns are annualized.

Source: State Street Bank and Trust Company

Martin Currie Ltd and Heartland Capital Management Ltd (‘HCML’) established MC China Ltd (‘MCCL’), as a joint venture company, to provide investment consultancy services to the range of China investment products managed by Marin Currie and its affiliates. HCML seconded Shifeng Ke to Martin Currie Inc. and its affiliates, on a full time basis. Effective November 9, 2011, Martin Currie’s interest in MCCL terminated and Shifeng Ke ceased to be the lead manager of the Fund. At that time, Martin Currie Inc entered into an interim investment advisory agreement with the Fund and also entered into an interim sub-advisory agreement with APS Asset Management Pte Ltd for management of the Fund’s portfolio.

The Fund announced that its Board of Directors has commenced a process to review investment manager alternatives for the Fund.

For further information please go to www.chinafundinc.com.

15 LARGEST HOLDINGS (50.8%)

|

Fund %

|

|||||

|

China Medical System Holdings

|

Healthcare

|

10.5 | |||

|

Hand Enterprise Solutions

|

Information technology

|

5.5 | |||

|

Ping An Insurance

|

Financials

|

3.5 | |||

|

FamilyMart

|

Consumer discretionary

|

3.2 | |||

|

Wumart Stores

|

Consumer discretionary

|

2.9 | |||

|

ENN Energy

|

Utilities

|

2.9 | |||

|

China Bright

|

Healthcare

|

2.7 | |||

|

Zong Su Foods

|

Consumer staples

|

2.6 | |||

|

China Mobile

|

Telecommunications

|

2.6 | |||

|

Ruentex Development Co

|

Financials

|

2.5 | |||

|

Shandong Weigao Group

|

Healthcare

|

2.5 | |||

|

Far Eastern Department Stores

|

Consumer discretionary

|

2.4 | |||

|

Uni-President Enterprises Corp.

|

Consumer staples

|

2.4 | |||

|

Sinopharm Group

|

Healthcare

|

2.3 | |||

|

Huiyin Household Appliances

|

Consumer discretionary

|

2.3 | |||

|

DIRECT INVESTMENTS (5.3%)

|

|||||

|

Fund %

|

|||||

|

China Bright

|

Healthcare

|

2.7 | |||

|

Zong Su Foods

|

Consumer staples

|

2.6 | |||

|

China Silicon

|

Information technology

|

0.0 | |||

|

Hand Enterprise Solutions (preferred)

|

Information technology

|

0.0 | |||

Source: State Street Bank and Trust Company.

|

FUND PERFORMANCE (BASED ON NET ASSET VALUE)

|

(US$ returns)

|

| One month |

Three months

|

Calendar year

|

One year

|

Three years

|

Five years

|

Since launch

|

||||||||||||||||||||||

|

%

|

%

|

to date %

|

%

|

% pa

|

% pa

|

% pa

|

||||||||||||||||||||||

|

The China Fund, Inc.

|

(7.2 | ) | (12.8 | ) | (23.8 | ) | (18.4 | ) | 22.4 | 11.9 | 10.8 | |||||||||||||||||

|

MSCI Golden Dragon

|

(8.5 | ) | (12.7 | ) | (20.4 | ) | (17.7 | ) | 17.5 | 2.5 | n/a | |||||||||||||||||

|

Hang Seng Chinese Enterprise

|

(9.7 | ) | (13.0 | ) | (25.1 | ) | (25.9 | ) | 9.6 | 2.2 | n/a | |||||||||||||||||

|

Shanghai Stock Exchange 180

|

(7.1 | ) | (10.5 | ) | (15.8 | ) | (15.0 | ) | 12.0 | 10.5 | n/a | |||||||||||||||||

Past performance is not a guide to future returns. Source: State Street Bank and Trust Company. Launch date July 10, 1992. Three, five year and since launch returns are all annualized. Source for index data: MSCI for the MSCI Golden Dragon and Copyright 2011 Bloomberg LP for the Hang Seng China Enterprise and the Shanghai Stock Exchange 180. For a full description of each index please see the index descriptions section.

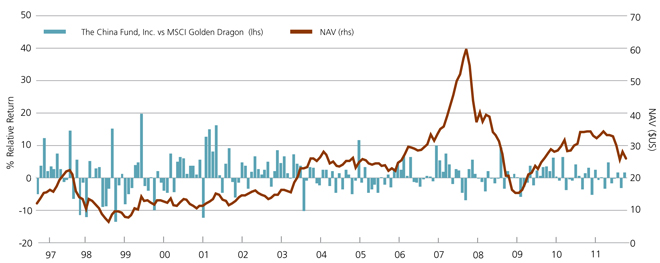

PERFORMANCE IN PERSPECTIVE

Past performance is not a guide to future returns.

Source: Martin Currie Inc as at November 30, 2011.

MONTHLY INSIGHT

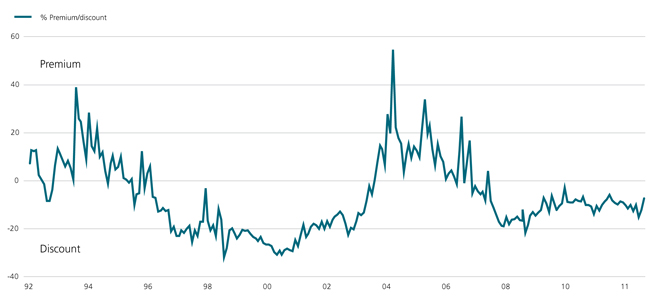

THE CHINA FUND INC. PREMIUM/DISCOUNT

Past performance is not a guide to future returns.

Source: Martin Currie Inc as at November 30, 2011.

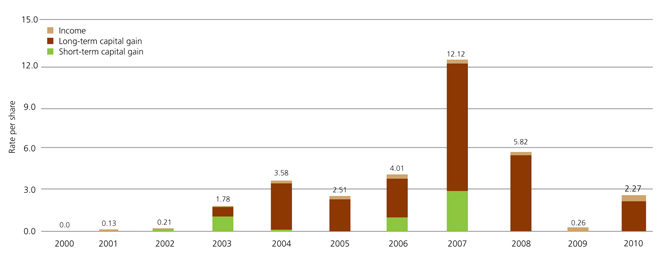

10 YEAR DIVIDEND HISTORY CHART

|

2000

|

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

||||||||||||||||||||||||||||||||||

|

Total

|

0.00 | 0.13 | 0.21 | 1.78 | 3.58 | 2.51 | 4.01 | 12.12 | 5.82 | 0.26 | 2.27 | |||||||||||||||||||||||||||||||||

|

Income

|

0.00 | 0.13 | 0.06 | 0.07 | 0.20 | 0.22 | 0.30 | 0.28 | 0.48 | 0.26 | 0.37 | |||||||||||||||||||||||||||||||||

|

Long-term capital

|

0.00 | 0.00 | 0.00 | 0.67 | 3.27 | 2.29 | 2.73 | 9.00 | 5.34 | 0.00 | 1.90 | |||||||||||||||||||||||||||||||||

|

Short-term capital

|

0.00 | 0.00 | 0.15 | 1.04 | 0.11 | 0.00 | 0.98 | 2.84 | 0.00 | 0.00 | 0.00 | |||||||||||||||||||||||||||||||||

Past performance is not a guide to future returns.

Source: State Street Bank and Trust Company.

|

Sector

|

Company (BBG ticker)

|

Price

|

Holding

|

Value US$

|

% of portfolio

|

|

|

HONG KONG H

|

23.0

|

|||||

|

China Medical System Holdings

|

867 HK

|

HK$5.5

|

90,442,200

|

$64,342,274

|

10.5

|

|

|

Wumart Stores

|

1025 HK

|

HK$16.0

|

8,632,750

|

$17,902,528

|

2.9

|

|

|

Shandong Weigao Group Medical Polymer

|

1066 HK

|

HK$6.5

|

18,352,000

|

$15,393,279

|

2.5

|

|

|

Sinopharm Group

|

1099 HK

|

HK$18.4

|

6,056,800

|

$14,196,843

|

2.3

|

|

|

Citic Securities

|

6030 HK

|

HK$12.7

|

6,688,500

|

$10,927,797

|

1.8

|

|

|

ZTE Corp.

|

763 HK

|

HK$22.7

|

2,250,826

|

$6,587,544

|

1.1

|

|

|

Asian Citrus Holdings

|

73 HK

|

HK$4.9

|

9,120,000

|

$5,795,914

|

1.0

|

|

|

Fook Woo

|

923 HK

|

HK$1.4

|

25,314,000

|

$4,461,506

|

0.7

|

|

|

Shandong Chenming Paper Holdings

|

1812 HK

|

HK$4.0

|

2,736,522

|

$1,394,101

|

0.2

|

|

|

TAIWAN

|

19.3

|

|||||

|

FamilyMart

|

5903 TT

|

NT$129.0

|

4,501,652

|

$19,144,599

|

3.2

|

|

|

Ruentex Development Co

|

9945 TT

|

NT$30.4

|

15,636,301

|

$15,645,064

|

2.5

|

|

|

Far Eastern Department Stores

|

2903 TT

|

NT$37.7

|

11,922,460

|

$14,798,425

|

2.4

|

|

|

Uni-President Enterprises Corp.

|

1216 TT

|

NT$41.2

|

10,625,335

|

$14,431,932

|

2.4

|

|

|

Chinatrust Financial

|

2891 TT

|

NT$16.6

|

18,788,646

|

$10,251,281

|

1.7

|

|

|

Yuanta Financial Holdings

|

2885 TT

|

NT$14.8

|

19,305,680

|

$9,387,755

|

1.5

|

|

|

China Metal Products

|

1532 TT

|

NT$20.2

|

12,420,374

|

$8,250,768

|

1.3

|

|

|

KGI Securities

|

6008 TT

|

NT$11.7

|

17,321,078

|

$6,652,509

|

1.1

|

|

|

Test-Rite International

|

2908 TT

|

NT$20.2

|

8,457,000

|

$5,631,866

|

0.9

|

|

|

Fubon Financial Holdings

|

2881 TT

|

NT$30.4

|

5,454,608

|

$5,466,656

|

0.9

|

|

|

W T Microelectronics

|

3036 TT

|

NT$37.1

|

3,889,000

|

$4,756,599

|

0.8

|

|

|

Taiwan Life 4percent Conv Bond*

|

n/a

|

NT$57.6

|

200,000,000

|

$3,798,767

|

0.6

|

|

|

HONG KONG

|

18.2

|

|||||

|

Enn Energy

|

2688 HK

|

HK$27.3

|

5,084,000

|

$17,855,349

|

2.9

|

|

|

China Mobile

|

941 HK

|

HK$74.3

|

1,636,500

|

$15,663,510

|

2.6

|

|

|

Huiyin Household Appliances

|

1280 HK

|

HK$0.7

|

160,413,750

|

$13,826,637

|

2.3

|

|

|

Ajisen China Holdings

|

538 HK

|

HK$9.6

|

6,945,000

|

$8,586,097

|

1.4

|

|

|

Ports Design

|

589 HK

|

HK$13.8

|

4,549,500

|

$8,123,689

|

1.3

|

|

|

Natural Beauty Bio-Technology

|

157 HK

|

HK$1.1

|

47,710,000

|

$6,812,909

|

1.1

|

|

|

Far East Horizon

|

3360 HK

|

HK$6.4

|

7,898,000

|

$6,482,432

|

1.1

|

|

|

Shangri-La Asia

|

69 HK

|

HK$14.0

|

3,316,683

|

$5,973,545

|

1.0

|

|

|

China Water Affairs

|

855 HK

|

HK$2.2

|

19,976,000

|

$5,730,778

|

0.9

|

|

|

Tencent Holdings

|

700 HK

|

HK$145.2

|

291,000

|

$5,424,523

|

0.9

|

|

|

China Shineway Pharmaceutical Group

|

2877 HK

|

HK$10.8

|

3,041,000

|

$4,186,011

|

0.7

|

|

|

Golden Meditech Co

|

801 HK

|

HK$0.9

|

35,040,000

|

$4,057,016

|

0.6

|

|

|

China Innovationpay Group

|

8083 HK

|

HK$0.2

|

146,000,000

|

$4,000,669

|

0.6

|

|

|

Chaoda Modern Agriculture (Holdings)

|

682 HK

|

HK$0.8

|

26,651,357

|

$2,828,612

|

0.5

|

|

|

Shenzhen International Holdings

|

152 HK

|

HK$0.5

|

33,137,500

|

$1,982,316

|

0.3

|

|

|

FUJI Food & Catering Services

|

1175 HK

|

HK$0.0

|

5,462,000

|

$0

|

0.0

|

|

|

EQUITY LINKED SECURITIES (‘A’ SHARES)

|

15.1

|

|||||

|

Ping An Insurance

|

n/a

|

US$5.5

|

3,870,559

|

$21,394,898

|

3.5

|

|

|

Wuliangye Yibin

|

n/a

|

US$5.9

|

2,334,507

|

$13,732,929

|

2.2

|

|

|

ZTE Corp

|

n/a

|

US$2.7

|

4,099,499

|

$11,163,099

|

1.8

|

|

|

Ufida Software

|

n/a

|

US$3.1

|

3,130,788

|

$9,663,926

|

1.6

|

|

|

Jiangsu Yuyue Medical Equipment

|

n/a

|

US$3.8

|

2,364,500

|

$9,040,767

|

1.5

|

|

|

China United Network Communications

|

n/a

|

US$0.8

|

9,809,037

|

$8,073,093

|

1.3

|

|

|

Suning Appliance

|

n/a

|

US$1.4

|

4,607,872

|

$6,552,394

|

1.1

|

|

|

Shanghai Yuyuan Tourist

|

n/a

|

US$1.5

|

4,293,036

|

$6,312,794

|

1.0

|

|

|

Qinghai Salt Lake Potash

|

n/a

|

US$6.2

|

814,450

|

$5,081,614

|

0.8

|

|

|

Shanghai Qiangsheng

|

n/a

|

US$0.8

|

1,843,000

|

$1,505,280

|

0.3

|

|

|

USA

|

6.2

|

|||||

|

WuXi PharmaTech Cayman

|

WX US

|

US$12.0

|

883,490

|

$10,601,880

|

1.7

|

|

|

Hollysys Automation Technologies

|

HOLI US

|

US$8.9

|

925,700

|

$8,192,445

|

1.3

|

|

|

Mindray Medical International

|

MR US

|

US$27.0

|

291,700

|

$7,870,066

|

1.3

|

|

|

VanceInfo Technologies

|

VIT US

|

US$11.1

|

474,800

|

$5,256,036

|

0.9

|

|

|

China New Borun Corp.

|

BORN US

|

US$3.2

|

1,202,859

|

$3,825,091

|

0.6

|

|

|

Far East Energy

|

FEEC US

|

US$0.2

|

10,303,847

|

$2,442,012

|

0.4

|

|

MONTHLY INSIGHT

|

Sector

|

Company (BBG ticker)

|

Price

|

Holding

|

Value US$

|

% of portfolio

|

|

|

CHINA ‘A’ SHARE

|

5.5

|

|||||

|

Hand Enterprise Solutions

|

300170 CH

|

Rmb19.3

|

11,238,137

|

$34,019,725

|

5.5

|

|

|

DIRECT

|

5.3

|

|||||

|

China Bright

|

n/a

|

HK$8.7

|

14,665,617

|

$16,489,669

|

2.7

|

|

|

Zong Su Foods

|

n/a

|

US$5,977.0

|

2,677

|

$16,000,429

|

2.6

|

|

|

China Silicon Corp.

|

n/a

|

US$0.0

|

2,329,281

|

$0

|

0.0

|

|

|

Hand Enterprise Solutions (preferred)

|

n/a

|

US$0.0

|

500,000

|

$0

|

0.0

|

|

|

SINGAPORE

|

2.6

|

|||||

|

China Fishery Group

|

CFG SP

|

SG$0.9

|

13,594,872

|

$9,167,464

|

1.5

|

|

|

Hsu Fu Chi International

|

HFCI SP

|

SG$4.2

|

1,049,084

|

$3,418,570

|

0.6

|

|

|

CDW Holding

|

CDW SP

|

SG$0.1

|

47,602,000

|

$3,191,403

|

0.5

|

|

|

OTHER ASSETS & LIABILITIES

|

$29,143,640

|

4.8

|

INDEX DESCRIPTIONS

MSCI Golden Dragon Index

The MSCI Golden Dragon is a free float-adjusted market capitalization index that is designed to measure equity market performance in the China region. As of May 2005 the MSCI Golden Dragon Index consisted of the following country indices: China, Hong Kong and Taiwan.

Hang Seng China Enterprise Index

The Hang Seng China Enterprise Index is a capitalization-weighted index comprised of state-owned Chinese companies (H-shares) listed on the Hong Kong Stock Exchange and included in Hans Seng Mainland China index.

Shanghai Stock Exchange 180 Index

The Shanghai Stock Exchange 180 ‘A’ Share Index is a capitalization-weighted index. The index tracks the daily price performance of the 180 most representative ‘A’ share stocks listed on the Shanghai Stock Exchange.

OBJECTIVE

The investment objective of the Fund is to achieve long term capital appreciation. The Fund seeks to achieve its objective through investment in the equity securities of companies and other entities with significant assets, investments, production activities, trading or other business interests in China or which derive a significant part of their revenue from China.

The Fund has an operating policy that the Fund will invest at least 80% of its assets in China companies. For this purpose, ‘China companies’ are (i) companies for which the principal securities trading market is in China; (ii) companies for which the principal securities trading market is outside of China or in companies organized outside of China, that in both cases derive at least 50% of their revenues from goods or services sold or produced, or have a least 50% of their assets in China; or (iii) companies organized in China. Under the policy, China will mean the People’s Republic of China, including Hong Kong, and Taiwan. The Fund will provide its stockholders with at least 60 days’ prior notice of any change to this policy.

CONTACTS

The China Fund, Inc.

c/o State Street Bank and Trust Company

2 Avenue de Lafayette

PO Box 5049

Boston, MA 02206-5049

Tel: (1) 888 CHN-CALL (246 2255)

www.chinafundinc.com

IMPORTANT INFORMATION

This document is issued and approved by Martin Currie Inc (MC Inc), as investment adviser of The China Fund Inc (the Fund). MC Inc is authorised and regulated by the Financial Services Authority (FSA) and incorporated under limited liability in New York, USA. Registered in Scotland (No BR2575), registered address Saltire Court, 20 Castle Terrace, Edinburgh, EH1 2ES. Information herein is believed to be reliable but has not been verified by MC Inc. MC Inc makes no representation or warranty and does not accept any responsibility in relation to such information or for opinion or conclusion which the reader may draw from the newsletter.

The Fund is classified as a 'non-diversified' investment company under the US Investment Company Act of 1940 as amended. It meets the criteria of a closed ended US fund and its shares are listed on the New York Stock Exchange. MC Inc has been appointed investment adviser to the Fund.

Investors are advised that they will not generally benefit from the rules and regulations of the United Kingdom Financial Services and Markets Act 2000 and the FSA for the protection of investors, nor benefit from the United Kingdom Financial Services Compensation Scheme, nor have access to the Financial Services Ombudsman in the event of a dispute. Investors will also have no rights of cancellation under the FSA's Conduct of Business Sourcebook of the United Kingdom.

This newsletter does not constitute an offer of shares. MC Inc, its ultimate and intermediate holding companies, subsidiaries, affiliates, clients, directors or staff may, at any time, have a position in the market referred to herein, and may buy or sell securities, currencies, or any other financial instruments in such markets. The information or opinion expressed in this newsletter should not be construed to be a recommendation to buy or sell the securities, commodities, currencies or financial instruments referred to herein.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account's portfolio at the time you receive this report or that securities sold have not been repurchased.

It should not be assumed that any of the securities transactions or holdings discussed here were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

Investing in the Fund involves certain considerations in addition to the risks normally associated with making investments in securities. The value of the shares issued by the Fund, and the income from them, may go down as well as up and there can be no assurance that upon sale, or otherwise, investors will receive back the amount originally invested. There can be no assurance that you will receive comparable performance returns, or that investments will reflect the performance of the stock examples contained in this document. Movements in foreign exchange rates may have a separate effect, unfavorable as well as favorable, on the gain or loss otherwise experienced on an investment. Past performance is not a guide to future returns. Accordingly, the Fund is only suitable for investment by investors who are able and willing to withstand the total loss of their investment. In particular, prospective investors should consider the following risks:

|

–

|

The companies quoted on Greater Chinese stock exchanges are exposed to the risks of political, social and religious instability, expropriation of assets or nationalisation, rapid rates of inflation, high interest rates, currency depreciation and fluctuations and changes in taxation, which may affect income and the value of investments.

|

|

–

|

At present, the securities market and the regulatory framework for the securities industry in China is at an early stage of development. The China Securities Regulatory Commission (CSRC) is responsible for supervising the national securities markets and producing relevant regulations. The Investment Regulations, under which the Fund invests in the People's Republic of China (PRC) and which regulate repatriation and currency conversion, are new. The Investment Regulations give CSRC and State Administration of Foreign Exchange (SAFE) wide discretions and there is no precedent or certainty as to how these discretions might be exercised, either now or in the future. The Fund may, from time to time, obtain access to the securities markets in China via Access Products. Such products carry additional risk and may be less liquid than the underlying securities which they represent.

|

|

–

|

During the past 15 years, the PRC government has been reforming the economic and political systems of the PRC, and these reforms are expected to continue, as evidenced by the recently announced changes. The Fund's operations and financial results could be adversely affected by adjustments in the PRC's state plans, political, economic and social conditions, changes in the policies of the PRC government such as changes in laws and regulations (or the interpretation thereof), measures which may be introduced to control inflation, changes in the rate or method of taxation, imposition of additional restrictions on currency conversion and the imposition of additional import restrictions.

|

|

–

|

PRC's disclosure and regulatory standards are in many respects less stringent than standards in certain Organisation for Economic Co-operation and Development (OECD) countries, and there may be less publicly available or less reliable information about PRC companies than is regularly published by or about companies from OECD countries.

|

|

–

|

The Shanghai Stock Exchange and Shenzhen Stock Exchange have lower trading volumes than most OECD exchanges and the market capitalisations of listed companies are small compared to those on more developed exchanges in developed markets. The listed equity securities of many companies in the PRC are accordingly materially less liquid, subject to greater dealing spreads and experience materially greater volatility than those of OECD countries. These factors could negatively affect the Fund's NAV.

|

|

–

|

The Fund invests primarily in securities denominated in other currencies but its NAV will be quoted in US dollars. Accordingly, a change in the value of such securities against US dollars will result in a corresponding change in the US dollar NAV.

|

|

–

|

The marketability of quoted shares may be limited due to foreign investment restrictions, wide dealing spreads, exchange controls, foreign ownership restrictions, the restricted opening of stock exchanges and a narrow range of investors. Trading volume may be lower than on more developed stockmarkets, and equities are less liquid. Volatility of prices can also be greater than in more developed stockmarkets. The infrastructure for clearing, settlement and registration on the primary and secondary markets may be underdeveloped. Under certain circumstances, there may be delays in settling transactions in some of the markets.

|

Martin Currie Inc registered in Scotland (no BR2575)

Registered office: Saltire Court, 20 Castle Terrace, Edinburgh EH1 2ES

Tel: 44 (0) 131 229 5252 Fax: 44 (0) 131 228 5959 www.martincurrie.com

North American office: 1350 Avenue of the Americas, Suite 3010, New York, NY

10019, USA Tel: (1) 212 258 1900 Fax: (1) 212 258 1919

Authorised and regulated by the Financial Services Authority and incorporated with

limited liability in New York, USA. Registered with the SEC as an investment adviser.

Please note: calls to the above numbers may be recorded.