Attached files

| file | filename |

|---|---|

| EX-10.1 - iLOAN INC | v244023_ex10-1.htm |

| EX-23.1 - iLOAN INC | v244023_ex23-1.htm |

| EX-10.2 - iLOAN INC | v244023_ex10-2.htm |

As filed with the Securities and Exchange Commission on December 27, 2011

An Exhibit List can be found on page II-2.

Registration No. 333-178099

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

I LOAN INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

6163

|

99-0370158

|

||

|

(State or other jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

incorporation or organization)

|

Classification Code)

|

Identification No.)

|

5 HaRimon St.

Kiryat Yearim, Israel

90838

Tel: (866) 365-8141

(Address and telephone number of Registrant's principal executive offices)

Vcorp Services, LLC

25 Robert Pitt Drive, Suite 204

Monsey, New York10952

Toll Free: 1.888.528-2677 ext. 112

Tel. 845.425.0077

Fax 845.818.3588

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all Correspondence to:

Law Offices of Jonathan D. Strum

5638 Utah Avenue NW

Washington DC 20015

Ph: (202) 362-9027

Fax: (202) 362-9037

Email: jdstrum@jdstrumlaw.com

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Calculation of Registration Fee

|

Title of Class of

Securities to be

Registered

|

Amount to be

Registered(¹)

|

Proposed

Maximum

Offering Price

Per Share

|

Proposed

Maximum

Aggregate

Offering Price(²)

|

Amount of

Registration Fee

|

||||||||||||

|

Common Stock, $0.0001 per share

|

1,000,000

|

$

|

0.10

|

$

|

100,000

|

$

|

11.60

|

|||||||||

|

Total

|

1,000,000

|

$

|

0.10

|

$

|

100,000

|

$

|

11.60

|

|||||||||

|

(¹)

|

In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

|

|

(²)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED DECEMBER 27, 2011

ILOAN INC.

1,000,000 Shares of Common Stock

This prospectus relates to our initial public offering of 1,000,000 new shares of our common stock at an offering price of $0.10 per share. The offering will commence promptly after the date of this prospectus and close no later than 180 days after the date of this prospectus. However, we may extend the offering for up to 90 days following the 180-day offering period. We will pay all expenses incurred in this offering. The common stock is being offered by us on a no-minimum basis. Since there are no minimum purchase requirements, we may not receive any proceeds or we may receive only minimal proceeds from this offering. To the extent that we receive funds in this offering, they will be immediately available for our use since we have no arrangements to place funds in escrow, trust or similar account.

The offering is a self-underwritten offering; there will be no underwriter involved in the sale of these securities. We are offering our shares of common stock on a best efforts basis. This means there is no guarantee that we will be able to sell all or any of the shares being offered. We intend to offer the securities through our Officers and Directors, who will not be paid any commission or any other form of compensation for such sales.

OUR BUSINESS IS SUBJECT TO MANY RISKS AND AN INVESTMENT IN OUR COMMON STOCK WILL ALSO INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FACTORS DESCRIBED UNDER THE HEADING "RISK FACTORS" BEGINNING ON PAGE 8 BEFORE INVESTING IN OUR COMMON STOCK.

Prior to this offering, there has been no public market for our common stock and we have not applied for listing or quotation on any public market. We have arbitrarily determined the offering price of $0.10 per share offered hereby. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. After the effective date of the registration statement, we intend to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our stock. There is no assurance that an active trading market for our shares will develop, or, if developed, that it will be sustained.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be amended. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

2

|

Page

No.

|

||

|

Part I

|

||

|

Summary Information

|

6

|

|

|

Summary Financial Data

|

7

|

|

|

Risk Factors

|

8

|

|

|

Cautionary Statement Regarding Forward-Looking Statements

|

14

|

|

|

Use of Proceeds

|

14

|

|

|

Determination of Offering Price

|

15

|

|

|

Dilution

|

15

|

|

|

Plan of Distribution

|

16

|

|

|

Legal Proceedings

|

19

|

|

|

Directors, Executive Officers, Promoters and Control Persons

|

19

|

|

|

Security Ownership of Certain Beneficial Owners and Management

|

20

|

|

|

Description of Securities

|

21

|

|

|

Interests of Named Experts and Counsel

|

23

|

|

|

Disclosure of SEC Position on Indemnification for Securities Act Liabilities

|

24

|

|

|

Description of Business

|

24

|

|

|

Where You Can Get More Information

|

32

|

|

|

Description of Property

|

32

|

|

|

Management’s Discussion and Analysis or Plan of Operation

|

32

|

|

|

Critical Accounting Policies

|

38

|

|

|

Certain Relationships and Related Transactions

|

38

|

|

|

Market for Common Equity and related Stockholder Matters

|

39

|

|

|

Executive Compensation

|

39

|

|

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

40

|

|

|

Index to Financial Statements

|

F-1

|

3

You may rely only on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any time after its date.

4

Until (90 days after the effective date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

5

This summary highlights certain information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including our financial statements and related notes, and especially the risks described under "Risk Factors" beginning on page 8. All references to "we," "us," "our," "I Loan," "Company," ”Registrant” or similar terms used in this prospectus refer to I Loan Inc.

Corporate Background

We were incorporated in Delaware on August 2, 2011. We are a development stage company that has not generated any revenues to date. We plan to earn our revenues through providing lead services to potential lenders. We intend for our services to be provided free of charge for the potential borrower and will be based solely on fees paid to us by the lenders who ultimately provide the loans.

We have commenced limited operations by reviewing several types of content management systems to ascertain which is best suited for our platform and by conducting market research of the banks in Russia and their online marketing practices and activities required to complete this offering. We initially intend to provide our customers with online consumer loan comparison and lead services to borrowers and lenders in Russia via our websites. This will be the initial business experience of our current President who is a student in Israel. Mrs. Yafe has no prior experience in these markets. For a detailed explanation see Risk Factors below and the Business Section.

Our principal offices are currently located at 5 HaRimon St. Kiryat Yearim Israel 90838. Our telephone number is (866) 365-8141. We have secured a domain name but do not currently have an operating website. Our fiscal year end is December 31.

Our auditors have issued an audit opinion which includes a statement describing their doubts about whether we will continue as a going concern since we have not established any source of revenues to covering our operating costs and only have limited cash receipts to cover our expenses. In addition, our financial status creates substantial doubt whether we will continue as a going concern.

The Offering

|

Shares being offered

|

Up to 1,000,000 shares of our common stock.

|

|

|

Offering price

|

$0.10 per share of common stock.

|

|

|

Terms of the offering

|

The offering will commence when the Securities and Exchange Commission declares this prospectus effective. The offering will terminate upon the earlier of the sale of all the 1,000,000 shares of common stock being offered or 180 days unless it is extended for an additional 90 days.

|

|

|

Number of shares outstanding before the offering

|

1,600,000

|

|

|

Number of shares outstanding after the offering if all the shares are sold

|

2,600,000

|

|

|

Our executive Officers and Directors currently hold 100% of our shares, and, as a result, they will exercise control over our direction. After the offering, our Officers and Directors will hold approximately 61.54% if we are successful at selling all the shares offered.

|

||

|

Market for the common stock

|

There is no public market for our common stock. After the effective date of the registration statement, we intend to have a market maker file an application on our behalf with FINRA to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our stock. There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale.

|

|

|

Use of proceeds

|

If we are successful at selling all the shares we are offering, our gross proceeds from this offering will be approximately $100,000. We intend to use these proceeds to execute our business plan.

|

6

SUMMARY FINANCIAL DATA

The following summary financial information for the period from August 2, 2011 (date of inception) through October 31, 2011, includes statement of operations and balance sheet data from our audited financial statements. The information contained in this table should be read in conjunction with "Management's Discussion and Analysis of Financial Condition or Plan of Operation" and the financial statements and accompanying notes included in this prospectus.

|

For the

Period

from

inception

(August 2,

2011)

through

October 31,

2011

|

||||

|

Total Revenues

|

$

|

-

|

||

|

Income (Loss) from Operations

|

-

|

|||

|

Other Income (Expense)

|

-

|

|||

|

Net Income (Loss)

|

-

|

|||

|

Basic Earnings (Loss) per Share

|

-

|

|||

|

Diluted Earnings (Loss) per Share

|

-

|

|||

|

As of

October

30, 2011

|

||||

|

Total Assets

|

$

|

4,500

|

||

|

Total Current Liabilities

|

4,500

|

|||

|

Shareholders’ Deficit

|

-

|

|||

|

Total liabilities and shareholders’ deficit

|

4,500

|

|||

7

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following factors and other information in this prospectus before deciding to invest in us. If any of the following risks actually occurs, our business, financial condition, results of operations and prospects for growth would likely suffer. As a result, you could lose all or part of your investment.

Risks Relating to Our Lack of Operating History

|

1.

|

Our business is at an early stage of development and we may not develop an online consumer loan comparison and lead service for borrowers and lender platform that can be commercialized.

|

The success of our business is dependent on our ability to develop successfully our online loan service platform. Our ability to achieve this goal is unproven, and the lack of operating history makes it difficult to validate our business plan. In addition, the success of our business plan is dependent upon acceptance of our platform by potential borrowers and lenders of consumer loans in several geographical locations. Should the target markets not be as responsive as we anticipate, we will not have in place alternate services or products that we can offer to ensure our continuing as a going concern .

Management believes that a net investment of $40,000 will be sufficient to enable us to complete development of our online consumer loan lender platform, commence sales, and continue our planned activities for approximately 12 months after the offering. We also expect to continue to incur operating losses in future periods. These losses will occur because we do not yet have any revenues to offset the expenses associated with the development and marketing of our online platform. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations.

|

2.

|

We have a history of operating losses and we may not achieve future revenues or operating profits.

|

We anticipate generating losses until we are able to generate revenues. We do not anticipate generating revenues before the second half of 2012. Therefore, we may be unable to continue operations in the future as a going concern. No adjustment has been made in the accompanying financial statements to the amounts and classification of assets and liabilities which could result should we be unable to continue as a going concern. If we cannot continue as a viable entity, our stockholders may lose some or all of their investment in us.

|

3.

|

We have a going concern opinion from our auditors indicating the possibility that we may not be able to continue to operate .

|

Our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. As a result, we may not be able to obtain additional necessary funding. There can be no assurance that we will ever achieve any revenues or profitability. The revenue and income potential of our proposed business and operations are unproven, and the lack of operating history makes it difficult to evaluate the future prospects of our business.

|

4.

|

We have a limited operating history on which investors may evaluate our operations and prospects for profitable operations.

|

We were incorporated on August 2, 2011. We currently have no agreements with online borrowers or lenders of consumer loans in our target markets nor any revenues. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

|

5.

|

If we are unable to obtain funding for development of our platform, we will have to delay development of our platform and/or change our line of business, which could result in the loss of your total investment.

|

We currently have not completed development of our proposed platform and we have no revenues. We will not be able to execute our business plan unless and until we are successful in raising funds in this offering. We anticipate that we will require the net proceeds we hope to raise from the sale of shares offered under this offering in an amount of $60,000 to commence operations and continue our planned activities during the next twelve months. In the event we do not sell at least 80% of the shares offered, we will have to defer working towards the achievement of the remaining milestones until after we are able to raise additional working capital Since there are no refunds on the shares sold in this offering, if any, you may be investing in a company that will not have the funds necessary to commence operations or develop its intended platform which could result in loss of your total investment.

8

|

6.

|

Our business plan may be unsuccessful.

|

The success of our business plan is dependent on our ability to develop successfully our online consumer loan platform and to secure borrowers and lenders in our target markets to use our platform. Our ability to develop an online platform for this market is unproven, and the lack of operating history makes it difficult to validate our business plan. In addition, the success of our business plan is dependent upon acceptance of our platform by the consumer lending market. Should the target market not be as responsive as we anticipate, we will not have in place alternate services or products that we can offer to ensure our continuing as a going concern .

|

7.

|

Our Officers have no experience in operating an online consumer lending platform.

|

Since our Officers and Directors have no experience in operating an online consumer lending platform, they may make inexperienced or uninformed decisions regarding the development of platform for this market, the operation of our business, or the marketing of our platform, which could harm our business and result in our having to suspend or cease operations, which could cause investors to lose their entire investment.

Risks Relating to Our Business

|

8.

|

Our executive Officers and Directors have significant voting power and may take actions that may be different than actions sought by our other stockholders.

|

If we are successful in selling all 1,000,000 shares being offered in this prospectus, our Officers and Directors will own approximately 61.54% of the outstanding shares of our common stock.

These stockholders will be able to exercise significant influence over all matters requiring stockholder approval. This influence over our affairs might be adverse to the interest of our other stockholders. In addition, this concentration of ownership could delay or prevent a change in control and might have an adverse effect on the market price of our common stock.

|

9.

|

Our Officers and Directors are located outside of the United States and our assets may also be held from time to time outside of the United States.

|

Since all of our Officers and Directors are located outside of the United States, any attempt to enforce liabilities upon such individuals under the U.S. securities and bankruptcy laws may be difficult.

Our assets may also be held from time to time outside of the United States. Since our Directors and executive Officers are foreign citizens and do not reside in the United States, it may be difficult for courts in the United States to obtain jurisdiction over our foreign assets or persons, and as a result, it may be difficult or impossible for you to enforce judgments rendered against us or our Directors or executive Officers in United States courts. Thus, investing in us may pose a greater risk because should any situation arise in the future in which you would have a cause of action against these persons or against us, you may face potential difficulties in bringing lawsuits or, if successful, in collecting judgments against these persons or against the Company.

|

10

|

We may not be able to raise the required capital to conduct our operations and develop and commercialize our product.

|

We were incorporated on August 2, 2011. We currently have not completed development of our online consumer loan comparison platform and we have no agreements with potential clients, nor any revenues. Although we have begun development and initial planning for the marketing of our online consumer loan platform, we may not be able to execute our business plan unless and until we are successful in raising funds in this offering. We anticipate that we will require the gross proceeds we hope to raise from the sale of shares offered under this offering in an amount of $100,000 to commence operations and continue our planned activities during the next twelve months. If the securities being offered under this prospectus are not fully subscribed for or if we do not generate any revenues during our first year of operations, we may require additional financing in order to establish profitable operations. Such additional financing, if required, may not be forthcoming. Even if additional financing is available, it may not be available on terms we find favorable. Failure to secure any needed additional financing may have a serious effect on our company's ability to survive. At this time, there are no anticipated additional sources of funds in place.

9

If we continue to suffer losses, investors may not receive any return on their investment and may lose their entire investment. Our prospects must be considered speculative in light of the risks, expenses, and difficulties frequently encountered by companies in their early stages of development, particularly in light of the uncertainties relating to the new, competitive and rapidly evolving markets in which we anticipate we will operate. To attempt to address these risks, we must, among other things, further develop our technology and product, successfully implement our development, marketing and commercialization strategies, respond to competitive developments, and attract, retain, and motivate qualified personnel. A substantial risk is involved in investing in us because, as an early stage company we have fewer resources than an established company, our management may be more likely to make mistakes at such an early stage, and we may be more vulnerable operationally and financially to any mistakes that may be made as well as to external factors beyond our control.

We expect to continue to incur operating losses in future periods. These losses will occur because we do not yet have any revenues to offset the expenses associated with the development and promotion of our platform. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations.

|

11.

|

Our Directors and sole officers own 100% of the outstanding shares of our common stock, and will be able to influence control of the company or decision making as management of the Company.

|

Mrs. Yafe and Mr. Petuhovs are our sole Directors and officers. Our Directors presently own 100% of our outstanding common stock. If all of the 1,000,000 shares of our common stock being offered hereby are sold, the shares held by our Directors will constitute approximately 62% of our outstanding common stock. After sale of all stock, the current Directors will still have a majority control and will still have a majority of the voting power for all business decisions. Because Mrs. Yafe and Mr. Petuhovs are our only two officers there is no other independent check on their activities, other than our auditors.

|

Our lack of business diversification could result in the loss of your investment if revenues from our primary product decrease.

|

Currently, our business is focused on the development and marketing of an online consumer loan borrowing platform. We do not have any other lines of business or other sources of revenue if we are unable to successfully implement our business plan. Our lack of business diversification could cause you to lose all or some of your investment if we are unable to generate revenues by the operation of the platform since we do not have any other lines of business or alternative revenue sources.

|

13.

|

We need to retain key personnel to support our activities and ongoing operations, and a loss of certain key personnel could significantly hinder our ability to move forward with our business plan.

|

The development, promotion, and operation of our online consumer loan platform will continue to place a significant strain on our limited personnel, management, and other resources. Our future success depends upon the continued services of our executive Officers and other needed key employees and contractors who have critical industry experience and relationships that we will rely on to implement our business plan. The loss of the services of any of our Officers or the lack of availability of other skilled personnel would negatively impact our ability to market and sell our products, which could adversely affect our financial results and impair our growth.

|

14

|

Since our Officers and Directors may work or consult for other companies, their other activities could slow down our operations.

|

Our Officers and Directors are not required to work exclusively for us and do not devote all of their time to our operations. Presently, our Officers and Directors allocate only a portion of their time to the operation of our business. Since our Officers and Directors are currently employed full-time elsewhere, they are each able to commit to us only up to 5-10 hours a week. Therefore, it is possible that their pursuit of other activities may slow our operations and reduce our financial results because of the slow-down in operations.

|

We are a small company with limited resources compared to some of our current and potential competitors and we may not be able to compete effectively and increase market share.

|

Most of our current and potential competitors have longer operating histories, significantly greater resources, and name recognition, and a larger base of customers than we have. As a result, these competitors have greater credibility with our potential lenders and borrowers of consumer loans in our target markets. They also may be able to devote greater resources to the development, promotion, and sale of their products and services than we can to ours.

|

16.

|

Our results of operations and business prospects and are subject to the economic and political environment in Russia and a change in our ability to provide leads to potential banks and lenders in Russia our business will likely fail.

|

Our results of operations and business prospects and are subject to the economic and political environment in Russia. Russia has experienced and is continuing to experience political instability in the aftermath of the December 2011 elections. If Russia's federal or local governments adopt new restrictions, such as those relating to conducting a lead producing service for providing consumer loans in Russia, an internet based business in Russia, taxation, or impose stricter regulations or interpretations of existing regulations, our intended business could be limited and our operating results and financial position could be harmed and our investors could lose all or some of their potential investment in us.

10

Risks Relating to Technology and Intellectual Property

|

17.

|

We need to complete development of our online consumer loan platform.

|

We have not yet completed the development of our online consumer loan platform. We intend to rely both on employees and on third party independent contractors for software development. These third party developers may not dedicate sufficient resources or give sufficient priority to developing our required resources. There is no history upon which to base any assumption as to the likelihood that we will prove successful in selecting qualified software development contractor s. We can provide investors with no assurance that our online consumer loan platform will be developed according to the specifications that we require. If we are unsuccessful in addressing the risks associated with software development, our business will most likely fail.

|

18.

|

We may lose clients if we experience system failures that significantly disrupt the availability and quality of our online consumer loan platform.

|

The operation of our online consumer loan platform will depend on our ability to avoid and mitigate any interruptions in service or reduced capacity for borrowers or lenders. Interruptions in service or performance problems, for whatever reason, could undermine confidence in our platform and cause us to lose licensees or make it more difficult to attract new ones.

|

19.

|

If a third party asserts that we infringe upon its proprietary rights, we could be required to redesign our product, pay significant royalties, or enter into license agreements.

|

Although presently we are not aware of any such claims, a third party may assert that our consumer loan platform violates its intellectual property rights. As the number of online consumer loan platforms in our market increases, we believe that infringement claims will become more common. Any claims against us, regardless of their merit, could:

|

•

|

Be expensive and time-consuming to defend;

|

|

•

|

Result in negative publicity;

|

|

•

|

Force us to stop operating our platform;

|

|

•

|

Divert management’s attention and our other resources; or

|

|

•

|

Require us to enter into royalty or licensing agreements in order to obtain the right to operate our platform, which right may not be available on terms acceptable to us, if at all.

|

In addition, we believe that any successful challenge to our use of a trademark or domain name could substantially diminish our ability to conduct business in a particular market or jurisdiction and thus could decrease our revenues and/or result in losses to our business.

|

20.

|

We face risks related to compliance with corporate governance laws and financial reporting standards.

|

The Sarbanes-Oxley Act of 2002, as well as related new rules and regulations implemented by the Securities and Exchange Commission and the Public Company Accounting Oversight Board, require changes in the corporate governance practices and financial reporting standards for public companies. These new laws, rules and regulations, including compliance with Section 404 of the Sarbanes-Oxley Act of 2002 relating to internal control over financial reporting, referred to as Section 404, have materially increased the legal and financial compliance costs of small companies and have made some activities more time-consuming and more burdensome.

11

|

21.

|

We may not have effective internal controls.

|

In connection with Section 404 of the Sarbanes-Oxley Act of 2002, we need to assess the adequacy of our internal control, remedy any weaknesses that may be identified, validate that controls are functioning as documented and implement a continuous reporting and improvement process for internal controls. We may discover deficiencies that require us to improve our procedures, processes and systems in order to ensure that our internal controls are adequate and effective and that we are in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act. If the deficiencies are not adequately addressed, or if we are unable to complete all of our testing and any remediation in time for compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the SEC rules under it, we would be unable to conclude that our internal controls over financial reporting are designed and operating effectively, which could adversely affect investor confidence in our internal controls over financial reporting.

Risks Relating to this Offering

|

22.

|

The shares are being offered directly by us without any minimum number of shares necessary to be sold. Accordingly, there is no guarantee that we will be successful at raising sufficient funds from the proceeds of this offering to execute our business plan.

|

There is no assurance that we will be successful in raising the maximum amount of this offering. This is especially true in light of the fact that no underwriter is being utilized, and that we are not experienced in the sale of securities. If we only raise a portion of the offering, we will be limited in our ability to achieve our objectives, and there will be a greater likelihood that investors will lose their entire investment because of the lack of sufficient funding. In addition, given our expected offering expenses, we must sell at least 20% of the securities being offered to avoid losing money in this offering.

|

23.

|

NASD sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

|

In addition to the "penny stock" rules described below, the NASD has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder's ability to resell shares of our common stock.

|

24.

|

There is no public market for the securities and even if a market is created, the market price of our common stock will be subject to volatility.

|

Prior to this offering, there has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop after this offering, or, if developed, be sustained. We anticipate that, upon completion of this offering, our common stock will be eligible for quotation on the OTC Bulletin Board. However, quotation of our common stock on the OTC Bulletin Board is dependent on our finding a market maker willing to file an application for quotation on our behalf. We do not currently have a market maker and there is no guarantee that we will find a market maker willing to file an application for quotation or that any such application will be successful. If, for any reason, our securities are not eligible for initial or continued quotation on the OTC Bulletin Board, or we do not find a market maker willing to file an application for quotation, or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities.

12

|

25.

|

The price of our shares in this offering was arbitrarily determined by us and may not reflect the actual market price for the securities.

|

The initial public offering price of the common stock was determined by us arbitrarily. The price is not based on our financial condition and prospects, market prices of similar securities of comparable publicly traded companies, certain financial and operating information of companies engaged in similar activities to ours, or general conditions of the securities market. The price may not be indicative of the market price, if any, for the common stock in the trading market after this offering. The market price of the securities offered herein, if any, may decline below the initial public offering price. The stock market has experienced extreme price and volume fluctuations. In the past, securities class action litigation has often been instituted against various companies following periods of volatility in the market price of their securities. If instituted against us, regardless of the outcome, such litigation would result in substantial costs and a diversion of management's attention and resources, which would increase our operating expenses and affect our financial condition and business operations.

|

State securities laws may limit secondary trading, which may restrict the states in which you may sell the shares offered by this prospectus.

|

If you purchase shares of our common stock sold in this offering, you may not be able to resell the shares in any state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. We currently do not intend to register or qualify our stock in any state. Because the shares of our common stock registered hereunder have not been registered for resale under the blue sky laws of any state, and we have no current plans to register or qualify our shares in any state, the holders of such shares and persons who desire to purchase such shares in any trading market that might develop in the future should be aware that there may be significant state blue sky restrictions upon the ability of investors to purchase and sell such shares. In this regard, each state's statutes and regulations must be reviewed before engaging in any securities sales activities in a state to determine what is permitted, or not permitted, in a particular state. Furthermore, even in those states that do not require registration or qualification for the resale of registered securities, such states may require the filing of notices or place additional conditions on the availability of exemptions. Accordingly, since many states continue to restrict the resale of securities that have not been qualified for resale, investors should consider any potential secondary market for our securities to be a limited one.

|

27.

|

Our stock is a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations, which may limit a stockholder's ability to buy and sell our stock.

|

You should note that our stock is a penny stock. Pursuant to Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rule 15g-9 and Rule 3a(51)-(1), "penny stock" is defined to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers prior to a transaction in a penny stock not otherwise exempt from those rules. Under Rule 15g-1 and Regulation D, the term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

13

|

28.

|

We have not paid dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

|

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant.

|

We have not yet engaged the services of a transfer agent which may affect our stockholders’ ability to transfer their shares in the Company.

|

We have not yet engaged the services of a transfer agent, and until a transfer agent is retained, we will act as our own transfer agent. The absence of a professional transfer agent may result in delays in the recordation of share transfers and the issuance of new stock certificates, which has the potential to disrupt the orderly transfer of stock from one stockholder to another.

Some discussions in this prospectus may contain forward-looking statements that involve risks and uncertainties. These statements relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this prospectus. Forward-looking statements are often identified by words like: "believe," "expect," "estimate," "anticipate," "intend," "project" and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as "may," "will," "should," "plans," "predicts," "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled Risk Factors beginning on page 8, that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the Business section beginning on page 29, the Management's Discussion and Analysis or Plan of Operation section beginning on page 34, and as well as those discussed elsewhere in this prospectus.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with accounting principles generally accepted in the United States.

We estimate that the net proceeds to us from the sale of our shares in this offering will be approximately $80,500, after deducting the estimated expenses of this offering. Regardless of the number of shares sold, we expect to incur offering expenses estimated at approximately $19,500 for legal, accounting, printing, and other costs in connection with this offering. We may not be successful in selling any or all of the securities offered hereby. Because there is no minimum offering amount required as a condition to closing in this offering, we may sell less than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us.

We expect to use any proceeds received from the offering for general corporate purposes, including working capital needs set forth in our plan of operation as described below in Management’s Discussion and Analysis or Plan of Operation. Our Officers and Directors will not receive any compensation for their efforts in selling our shares. Our management will have broad discretion in the application of the net proceeds of this offering. In addition to changing allocations because of the amount of proceeds received, we may change the use of proceeds because of changes in our business plan. Investors will be relying on the judgment of our management regarding the application of the proceeds of any sale of the securities. We may invest the net proceeds received from this offering temporarily until we use them for general corporate purposes.

14

We do not intend to use the proceeds to acquire assets or finance the acquisition of other businesses. At present, no material changes are contemplated. Should there be any material changes in the projected use of proceeds in connection with this offering, we will issue an amended prospectus reflecting the new uses.

DETERMINATION OF THE OFFERING PRICE

There has been no public market for our common shares. The price of the shares we are offering was arbitrarily determined at $0.10 per share. Because we have no significant operating history and have not generated any revenues to date, the price of our common stock is not based on past earnings, nor is the price of our common stock indicative of the current market value of the assets owned by us. No valuation or appraisal has been prepared for our business and potential business expansion. The offering price should not be regarded as an indicator of the future market price of the securities, which is likely to fluctuate.

DILUTION

Purchasers of our securities in this offering will experience immediate and substantial dilution in the net tangible book value of their common stock from the initial public offering price.

The historical net tangible book value as of October 31, 2011, was negative $4,500 or negative $0.0028 per share. Historical net tangible book value per share of common stock is equal to our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of October 31, 2011, as adjusted to give effect to the receipt of net proceeds from the sale of 1,000,000 shares of common stock for $80,500, which represents net proceeds after deducting estimated offering expenses of $19,500. This represents an immediate increase of $0.0320per share to existing stockholders and an immediate and substantial dilution of $0.0708 per share, or approximately 70.77%, to new investors purchasing our securities in this offering. Dilution in pro forma net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the pro forma net tangible book value per share of our common stock immediately following this offering.

The following table sets forth as of October 31, 2011, the number of shares of common stock purchased from us and the total consideration paid by our existing stockholders and by new investors in this offering if new investors purchase all of the shares being offered in this offering, before deducting offering expenses payable by us, assuming a purchase price in this offering of $0.10 per share of common stock.

Since we are making this offering without any minimum requirement, there is no guarantee that we will be successful at selling any of the securities being offered in this prospectus. Accordingly, the actual amount of proceeds we will raise in this offering, if any, may differ.

|

Assuming 10% of shares sold in the offering

|

Shares

|

|||||||||||

|

Number

|

Percent

|

Amount

|

||||||||||

|

Existing Stockholders

|

1,600,000

|

94

|

%

|

$

|

24,000

|

|||||||

|

New Investors

|

100,000

|

6

|

%

|

$

|

10,000

|

|||||||

|

Total

|

1,700,000

|

100

|

%

|

$

|

34,000

|

|||||||

|

Assuming 25% of shares sold in the offering

|

Shares

|

|||||||||||

|

Number

|

Percent

|

Amount

|

||||||||||

|

Existing Stockholders

|

1,600,000

|

87

|

%

|

$

|

24,000

|

|||||||

|

New Investors

|

250,000

|

13

|

%

|

$

|

25,000

|

|||||||

|

Total

|

1,850,000

|

100

|

%

|

$

|

49,000

|

|||||||

15

|

Assuming 50% of shares sold in the offering

|

Shares

|

|||||||||||

|

Number

|

Percent

|

Amount

|

||||||||||

|

Existing Stockholders

|

1,600,000

|

76

|

%

|

$

|

24,000

|

|||||||

|

New Investors

|

500,000

|

24

|

%

|

$

|

50,000

|

|||||||

|

Total

|

2,100,000

|

100

|

%

|

$

|

74,000

|

|||||||

|

Assuming 75% of shares sold in the offering

|

Shares

|

|||||||||||

|

Number

|

Percent

|

Amount

|

||||||||||

|

Existing Stockholders

|

1,600,000

|

68

|

%

|

$

|

24,000

|

|||||||

|

New Investors

|

750,000

|

32

|

%

|

$

|

75,000

|

|||||||

|

Total

|

2,350,000

|

100

|

%

|

$

|

99,000

|

|||||||

|

Assuming 100% of shares sold in the offering

|

Shares

|

|||||||||||

|

Number

|

Percent

|

Amount

|

||||||||||

|

Existing Stockholders

|

1,600,000

|

62

|

%

|

$

|

24,000

|

|||||||

|

New Investors

|

1,000,000

|

38

|

%

|

$

|

100,000

|

|||||||

|

Total

|

2,600,000

|

100

|

%

|

$

|

124,000

|

|||||||

PLAN OF DISTRIBUTION

There Is No Current Market for Our Shares of Common Stock

There has been no market for our securities. We cannot give you any assurance that the shares you purchase will ever have a market or that if a market for our shares ever develops, that you will be able to sell your shares. In addition, even if a public market for our shares develops, there is no assurance that a secondary public market will be sustained.

16

Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the FINRA for our common stock to be eligible for trading on the Over the Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application. Further, even assuming we do locate such a market maker, it could take several months before the market maker’s listing application for our shares is approved. Our shares of common stock will be offered at a fixed price of $0.10 per share until our shares are quoted on the OTC Bulletin Board, and thereafter will be sold at prevailing market prices or privately negotiated prices.

The OTC Bulletin Board is maintained by FINRA. The securities traded on the Bulletin Board are not listed or traded on the floor of an organized national or regional stock exchange. Instead, these securities transactions are conducted through a telephone and computer network connecting dealers in stocks. Over-the-counter stocks are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

Even if our shares are quoted on the OTC Bulletin Board, a purchaser of our shares may not be able to resell the shares. Broker-dealers may be discouraged from effecting transactions in our shares because they will be considered penny stocks and will be subject to the penny stock rules. Pursuant to Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rule 15g-9 and Rule 3a(51)-(1), "penny stock" is defined to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers prior to a transaction in a penny stock not otherwise exempt from those rules. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock. The compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction.

The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market, assuming one develops.

The Offering will be Sold by Our Officers and Directors

We are offering up to a total of 1,000,000 shares of common stock. The offering price is $0.10 per share. The offering will be for a period of 180 days from the effective date and may be extended for an additional 90 days if we choose to do so. In our sole discretion, we have the right to terminate the offering at any time, even before we have sold the 1,000,000 shares. There are no specific events which might trigger our decision to terminate the offering.

We have not established a minimum amount of proceeds that we must receive in the offering before any proceeds may be accepted. We cannot assure you that all or any of the shares offered under this prospectus will be sold. No one has committed to purchase any of the shares offered. Therefore, we may sell only a nominal amount of shares and receive minimal proceeds from the offering. We reserve the right to withdraw or cancel this offering and to accept or reject any subscription in whole or in part, for any reason or for no reason. Subscriptions will be accepted or rejected promptly. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions.

17

Any accepted subscriptions will be made on a rolling basis. Once accepted, the funds will be deposited into an account maintained by us and be immediately available to us. Subscription funds will not be placed into escrow, trust, or any other similar arrangement. There are no investor protections for the return of subscription funds once accepted. Once we receive the purchase price for the shares, we will be able to use the funds. Certificates for shares purchased will be issued and distributed by our transfer agent promptly after a subscription is accepted and "good funds" are received in our account.

If it turns out that we have not raised enough money to effectuate our business plan, we will try to raise additional funds from a second public offering, a private placement, or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and are not successful in raising additional funds, we will have to suspend or cease operations.

We will sell the shares in this offering through our Officers and Directors. The Officers and Directors engaged in the sale of the securities will receive no commission from the sale of the shares nor will they register as a broker-dealer pursuant to Section 15 of the Securities Exchange Act of 1934 in reliance upon Rule 3(a)4-1. Rule 3(a)4-1 sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer's securities and not be deemed to be a broker-dealer. Our Officers and Directors satisfy the requirements of Rule 3(a)4-1 in that:

|

1.

|

None of such persons is subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Act, at the time of his participation; and

|

|

|

2.

|

None of such persons is compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and

|

|

|

3.

|

None of such persons is, at the time of his participation, an associated person of a broker-dealer; and

|

|

|

4.

|

All of such persons meet the conditions of Paragraph (a)(4)(ii) of Rule 3(a)4-1 of the Exchange Act in that they (A) primarily perform, or are intended primarily to perform at the end of the offering, substantial duties for or on behalf of the issuer otherwise than in connection with transactions in securities; and (B) are not a broker or dealer, or an associated person of a broker or dealer, within the preceding twelve (12) months; and (C) do not participate in selling and offering of securities for any issuer more than once every twelve (12) months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii).

|

As long as we satisfy all of these conditions, we are comfortable that we will be able to satisfy the requirements of Rule 3(a)4-1 of the Exchange Act notwithstanding that a portion of the proceeds from this offering may be used to pay the salaries, if any, of our Officers.

As our Officers and Directors will sell the shares being offered pursuant to this offering, Regulation M prohibits the Registrant and its Officers and Directors from certain types of trading activities during the time of distribution of our securities. Specifically, Regulation M prohibits our Officers and Directors from bidding for or purchasing any common stock or attempting to induce any other person to purchase any common stock, until the distribution of our securities pursuant to this offering has ended.

We have no intention of inviting broker-dealer participation in this offering.

Offering Period and Expiration Date

This offering will commence on the effective date of this prospectus, as determined by the Securities and Exchange Commission and continue for a period of 180 days. We may extend the offering for an additional 90 days unless the offering is completed or otherwise terminated by us.

Procedures for Subscribing

We intend to sell the shares in this offering through our Officers and Directors. Once the registration statement is effective, our Officers and Directors will contact individuals and corporations with whom they have an existing or past pre-existing business or personal relationship and will attempt to sell them the shares. Upon being declared publicly reporting, we intend to explore other legal means of promoting the sale of shares of our common stock. If you decide to subscribe for any shares in this offering, you must deliver a check or certified funds for acceptance or rejection. There are no minimum share purchase requirements for individual investors. All checks for subscriptions must be made payable to "I LOAN INC".

18

Upon receipt, all funds provided as subscriptions will be immediately deposited into our account and be available for our use to further the development and business of the Company.

Right to Reject Subscriptions

We maintain the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours of our having received them.

LEGAL PROCEEDINGS

We know of no existing or pending legal proceedings against us, nor are we involved as a plaintiff in any proceeding or pending litigation. There are no proceedings in which any of our Directors, Officers or any of their respective affiliates, or any beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Our Directors hold office until the next annual general meeting of the stockholders or until their successors are elected and qualified. Our Officers are appointed by our Board of Directors and hold office until the earlier of their death, retirement, resignation, or removal.

|

Name

|

Age

|

Position

|

||

|

Rivka Ruth Yafe

|

20

|

Director, President and Treasurer

|

||

|

Sergejs Petuhovs

|

38

|

Director and Secretary

|

From October 2011 until present Mrs. Rivka Ruth Yafe, Our Chief Executive and Financial Officer, has been employed at Matrix Ltd. in Jerusalem, Israel. Mrs. Yafe is working in the software engineering department as a computer programmer and writing code for software applications in the following computer languages: wps, html, asp, java and sql. Between 2008-2010, Mrs. Yafe was a student at Maalot College with a focus in computer programming in Jerusam, Israel. At Maalot College Mrs. Yafe completed her coursework and is currently working on her final dissertation which is required in order to receive her technical degree in software engineering. Mrs. Yaffe’s dissertation is based on internet marketing and programming. In addition, Mrs. Yafe is enrolled at the Michlelet Bait Vagen College in Jerusalem, a fully accredited academic institution from which she anticipates to receive her Bachelors of Science in computer sciences in 2013.

Mrs. Yafe is a skilled computer programmer and is able to write software applications in the following computer languages : wps, html, asp, java and sql.

Her employment at Maalot is part time and is a paid position. She possesses the internet and web based knowledge in order to ensure that the company’s technical and internet strategy are successful.

Mr. Sergejs Petuhovs

Mr. Sergejs Petuhovs is currently employed as an installation engineer at Sintek in London, England where he is employed full time, paid position as a electronic installation engineer. He has been in this position since January 2011. His job requires a hands on presence as he is responsible for installing, maintaining and repairing electronic equipment in customers homes. This position is a paid, full time position. From February 2009 to November 2010 Mr. Petuhoys was employed at A-ml as installation engineer in Riga, Latvia. There he was responsible for repairing and installing large scale air conditioning systems in commercial premises. This position was a paid, full time position. From September 2005 to December 2008 Mr. Petuhovs was the sales manager at Autoexpo in Riga, Latvia where he was responsible for organizing the yearly auto expos. Mr. Petuhovs position required oversight over ten sales personal whose job was to sell vehicles to people who visited the auto expo in subsequent months after the exposition. This position was a paid, full time position. From 2002-2005 Mr. Sergejs Petuhovs was employed as an engineer at BaltOst Geo a geological prospecting and research company. This position was a paid, full time position. In this position, Mr. Petuhovs assisted with drilling/sampling/and recording the prospecting that was taking place on several job sites. In 1996 Mr. Petuhovs was awarded a technical degree from Rigas Aviacijas University in Electrical Equipment and Systems.

Mr. Petuhovs posseses the language skills, negotiation skills, and sales skills to assist the company in its Russian language operations.

Committees of the Board of Directors

We do not presently have a separately constituted audit committee, compensation committee, nominating committee, executive committee or any other committees of our Board of Directors. As such, our entire Board of Directors acts as our audit committee.

Audit Committee Financial Expert

Our Board of Directors does not currently have any member who qualifies as an audit committee financial expert. We believe that the cost related to retaining such a financial expert at this time is prohibitive. Further, because we are in the start-up stage of our business operations, we believe the services of an audit committee financial expert are not warranted at this time.

19

Involvement in Legal Proceedings

None of our Directors, nominee for Directors, or Officers has appeared as a party during the past ten years in any legal proceedings that may bear on his ability or integrity to serve as a Director or officer of the Company.

Board Leadership Structure

The Company has chosen to combine the principal executive officer and Board chairman positions. The Company believes that this Board leadership structure is the most appropriate for the Company for the following reasons. First, the Company is a development stage company and at this early stage it is more efficient to have the leadership of the Board in the same hands as the principal executive officer of the Company. The challenges faced by the Company at this stage – obtaining financing and performing research and development activities – are most efficiently dealt with by having one person intimately familiar with both the operational aspects as well as the strategic aspects of the Company’s business. Second, Ms. Yafe is uniquely suited to fulfill both positions of responsibility because she possesses technical and other experience with start-up companies.

Code of Ethics

We do not currently have a Code of Ethics applicable to our principal executive, financial and accounting Officers; however, the Company plans to implement such a code in the second quarter of 2012.

Potential Conflict of Interest

Since we do not have an audit or compensation committee comprised of independent Directors, the functions that would have been performed by such committees are performed by our Board of Directors. Thus, there is a potential conflict of interest in that our Directors have the authority to determine issues concerning management compensation, in essence their own, and audit issues that may affect management decisions. We are not aware of any other conflicts of interest with any of our executives or Directors.

Board’s Role in Risk Oversight

The Board assesses on an ongoing basis the risks faced by the Company. These risks include financial, technological, competitive, and operational risks. The Board dedicates time at each of its meetings to review and consider the relevant risks faced by the Company at that time. In addition, since the Company does not have an Audit Committee, the Board is also responsible for the assessment and oversight of the Company’s financial risk exposures.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of December 27 , 2011, certain information with respect to the beneficial ownership of our common stock by each stockholder known by us to be the beneficial owner of more than 5% of our common stock and by each of our current Directors and executive Officers. Each person has sole voting and investment power with respect to the shares of common stock, except as otherwise indicated. Information relating to beneficial ownership of common stock by our principal stockholders and management is based upon information furnished by each person using "beneficial ownership" concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the disposition of the shares. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest.

20

The percentages below are calculated based on 1,600,000 shares of our common stock issued and outstanding as of December 27, 2011 . We do not have any outstanding options, warrants or other securities exercisable for or convertible into shares of our common stock.

|

Title of Class

|

Name and Address

of Beneficial

Owner (²)

|

Position

|

Amount and

Nature

of Beneficial

Ownership

|

Percentage of

Class(¹)

|

||||||

|

|

||||||||||

|

Common Stock

|

Rivka Ruth Yafe

|

President, Treasurer and Director

|

1,000,000

|

62.50

|

%

|

|||||

|

Common Stock

|

Sergejs Petuhovs

|

Secretary and Director

|

600,000

|

37.50

|

%

|

|||||

|

All Directors and Officers as a Group (2 people)

|

|

1,600,000

|

100

|

%

|

||||||

|

(¹)

|

Based on 1,600,000 shares of our common stock outstanding.

|

|

(²)

|

The address for Ms.Yafe is 5 HaRimon St.

Kiryat Yearim Israel 90838.

|

|

The address for Mr. Petuhovs is A.Peglava 55-21 Riga Latvia.

|

We are unaware of any contract or other arrangement the operation of which may at a subsequent date result in a change in control of our Company.

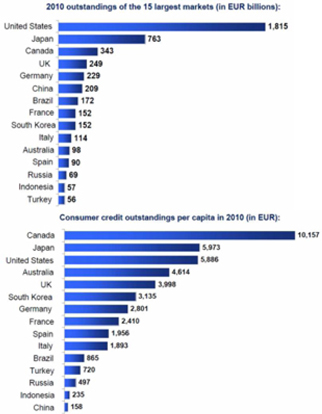

Future Sales by Existing Stockholders