Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ventas, Inc. | a11-32316_18k.htm |

| EX-2.1 - EX-2.1 - Ventas, Inc. | a11-32316_1ex2d1.htm |

| EX-99.1 - EX-99.1 - Ventas, Inc. | a11-32316_1ex99d1.htm |

| EX-99.3 - EX-99.3 - Ventas, Inc. | a11-32316_1ex99d3.htm |

Exhibit 99.2

|

|

Acquisition of Cogdell Spencer December 2011 |

|

|

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, among others, statements of expectations, beliefs, future plans and strategies, anticipated results from operations and developments and other matters that are not historical facts. The forward-looking statements are based on management’s beliefs as well as on a number of assumptions concerning future events. Readers of these materials are cautioned not to put undue reliance on these forward-looking statements, which are not a guarantee of performance and are subject to a number of uncertainties and other factors that could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements. The most important factors that could prevent the Company from achieving its stated goals include, but are not limited to: (a) the ability and willingness of the Company’s tenants, operators, borrowers, managers and other third parties to meet and/or perform the obligations under their various contractual arrangements with the Company, including, in some cases, their obligations to indemnify, defend and hold the Company harmless from and against various claims, litigation and liabilities; (b) the ability of the Company’s tenants, operators, borrowers and managers to maintain the financial strength and liquidity necessary to satisfy their respective obligations and liabilities to third parties, including without limitation obligations under their existing credit facilities and other indebtedness; (c) the Company’s success in implementing its business strategy and the Company's ability to identify, underwrite, finance, consummate and integrate diversifying acquisitions or investments; (d) the extent of future or pending healthcare reform and regulation, including cost containment measures and changes in reimbursement policies, procedures and rates; (e) the ability of the Company’s operators and managers, as applicable, to deliver high quality services, to attract and retain qualified personnel and to attract residents and patients; (f) the Company’s ability and willingness to maintain its qualification as a REIT due to economic, market, legal, tax or other considerations; (g) risks associated with the Company’s senior living operating portfolio, such as factors causing volatility in the Company’s operating income and earnings generated by its properties, including without limitation national and regional economic conditions, costs of materials, energy, labor and services, employee benefit costs, insurance costs and professional and general liability claims, and timely delivery of accurate property-level financial results for those properties; and (h) the other factors set forth in the Company‘s periodic filings with the Securities and Exchange Commission. |

|

|

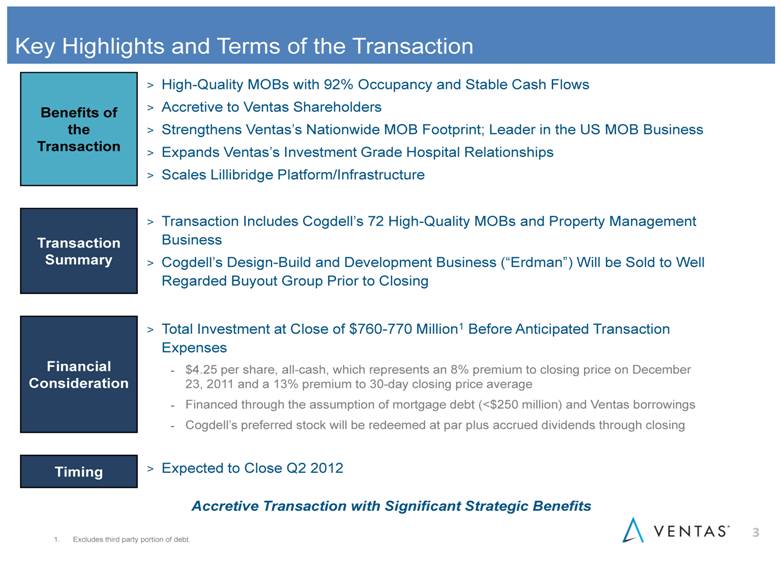

Key Highlights and Terms of the Transaction Total Investment at Close of $760-770 Million1 Before Anticipated Transaction Expenses $4.25 per share, all-cash, which represents an 8% premium to closing price on December 23, 2011 and a 13% premium to 30-day closing price average Financed through the assumption of mortgage debt (<$250 million) and Ventas borrowings Cogdell’s preferred stock will be redeemed at par plus accrued dividends through closing Timing Financial Consideration Expected to Close Q2 2012 Transaction Includes Cogdell’s 72 High-Quality MOBs and Property Management Business Cogdell’s Design-Build and Development Business (“Erdman”) Will be Sold to Well Regarded Buyout Group Prior to Closing Transaction Summary High-Quality MOBs with 92% Occupancy and Stable Cash Flows Accretive to Ventas Shareholders Strengthens Ventas’s Nationwide MOB Footprint; Leader in the US MOB Business Expands Ventas’s Investment Grade Hospital Relationships Scales Lillibridge Platform/Infrastructure Benefits of the Transaction Accretive Transaction with Significant Strategic Benefits Excludes third party portion of debt. |

|

|

Cogdell: High-Quality, On-Campus MOB Portfolio Overview 44 Third Party MOBs Comprising 2 Million Square Feet Primarily hospital-owned Provides additional potential pipeline Acquired Property Management 72 High-Quality MOBs Comprising 4.2 Million Square Feet 68 stable, 2 in lease-up, 2 in development Located in 15 states Strong stabilized occupancy of 92% 88% of square footage is on-campus or hospital anchored 40% leased directly to hospital systems 13 investment grade hospitals in the portfolio, including Bon Secours Health System (A-) and Carolinas HealthCare System (AA-) Diversified tenant base, no single tenant/operator >7% of property NOI Acquired Assets |

|

|

Cogdell: High-Quality, On-Campus MOB Portfolio Overview Property Summary (as of September 30, 2011) Number of Properties Net Rentable Square Feet Owned-Stabilized 68 3,834,767 Owned – Fill-up 2 113,627 In-Process Development 2 256,000 Unconsolidated 3 213,789 Managed for Third Parties 44 1,989,919 Total 119 6,408,102 Wholly Owned Joint Venture Managed for Third Parties |

|

|

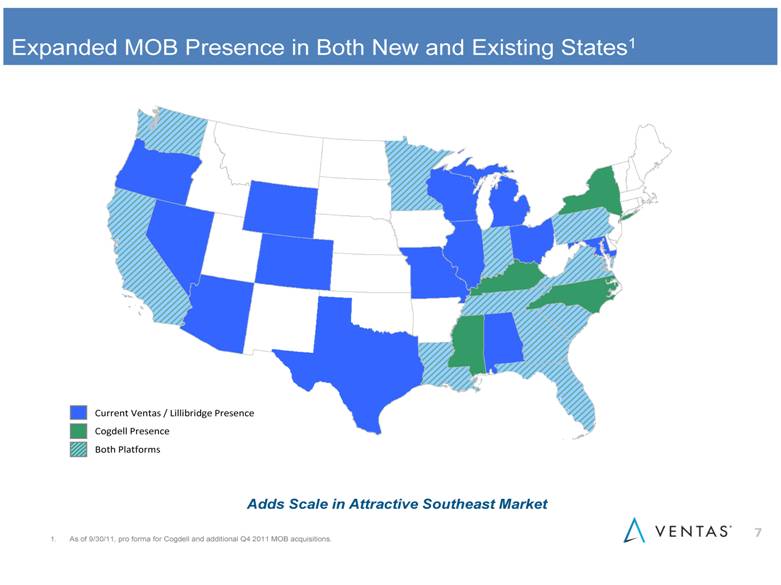

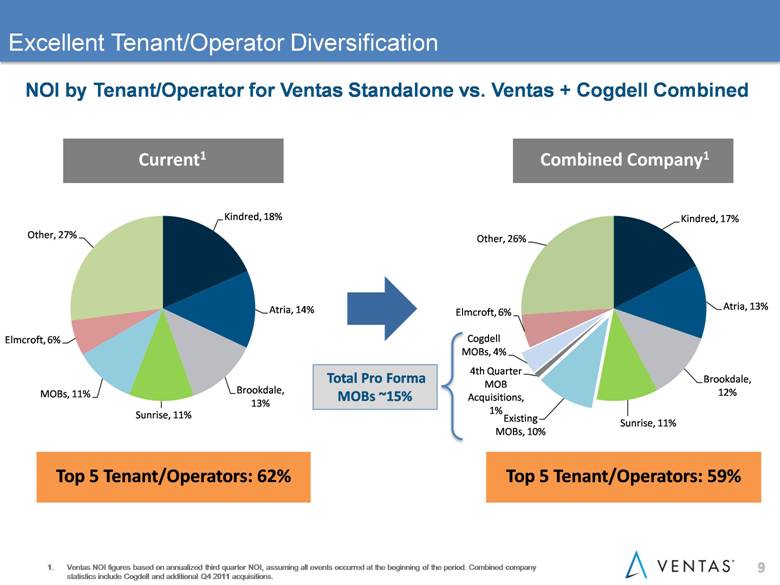

Benefits of the Transaction Immediately Accretive to Normalized FFO / Share by 3-5¢ Low- to Mid- 7% Property NOI Cap Rate3; > $200 per Square Foot3 Balance Sheet and Liquidity Remain Strong Pro Forma Net Debt / EBITDA ~5x Sufficient Liquidity to Fund Transaction Diversifies Enterprise, Scales Lillibridge Platform and Expands Leading Hospital Relationships Accretive and Continued Strong Balance Sheet Top 5 Tenant/Operators Improves to 59% from 62% Develops 12 New Investment Grade Hospital Relationships, Including Carolinas HealthCare System (AA-) Synergies Expected Due to Lillibridge/Ventas Existing Infrastructure High Quality, 92% Occupied MOBs1 with Strong Hospital Affiliations Increases Ventas’s MOBs from 11% to 15% of NOI2 Adds MOBs in 4 New States; Augments Ventas Portfolio in 11 States Increases Owned/Managed MOBs (Portfolio) From 14 Million to >20 Million Square Feet; Scales the Lillibridge Platform Strategic Acquisition of High-Quality MOBs 68 stabilized MOBs. Includes $168 million of MOBs acquired in Q4 2011. Includes anticipated transaction costs. Accretive & Diversifying Transaction Enhances Shareholder Value |

|

|

Expanded MOB Presence in Both New and Existing States1 As of 9/30/11, pro forma for Cogdell and additional Q4 2011 MOB acquisitions. Cogdell Presence Both Platforms Current Ventas / Lillibridge Presence Adds Scale in Attractive Southeast Market Current Ventas / Lillibridge Presence NHP / PMB Platform Presence Both Platforms |

|

|

Building on Strategic Plan to Grow MOB Portfolio Growth in the Ventas MOB Platform High-Quality MOB Investments Closed in Q4 2011 – $168 Million, Average Yield 7.3% Grows portfolio to 300+ stable cash flowing MOBs Leading MOB business in the US Fully integrated owner, property manager, developer and advisor Scalable infrastructure >20 million square feet owned and managed Expanded investment grade hospital relationship network Over 60 relationships Channels for future growth Lillibridge Pacific Medical Buildings – exclusive development arrangement Potential pipeline through Cogdell and other property management relationships Lillibridge MOB Platform – Acquisitions of Stabilized Assets MOB portfolio – 10 MOBs in Arizona 2 MOBs in Texas Pacific Medical Buildings – Investment Through Exclusive Pipeline Arrangement (NHP) On-campus MOB development in Castro Valley, CA ($27.5 Million) – Fully preleased by AA- System “Doing What We Say” – Expanding Ventas’s MOB Portfolio “We continue to believe that MOBs present a compelling long-term investment thesis We expect that this area will continue to be a focus for us.” – Ventas Q1 2010 Earnings Call |

|

|

Excellent Tenant/Operator Diversification NOI by Tenant/Operator for Ventas Standalone vs. Ventas + Cogdell Combined Current1 Ventas NOI figures based on annualized third quarter NOI, assuming all events occurred at the beginning of the period. Combined company statistics include Cogdell and additional Q4 2011 acquisitions. Combined Company1 Total Pro Forma MOBs ~15% |

|

|

Industry Leading Diversified NOI NOI by Asset Class For Ventas Standalone vs. Ventas + Cogdell Combined Current1 Combined Company1 Ventas NOI figures based on annualized third quarter NOI, assuming all events occurred at the beginning of the period. Combined company statistics include Cogdell and additional Q4 2011 acquisitions. Total Pro Forma MOBs ~15% Increases Stable Cash-Flowing MOBs |

|

|

Low Medical Office Building Supply and Increasing Demand Favorable Outlook Source: Green Street Advisors. December 2011. Source: Marcus and Millichap. “Medical office buildings enjoy a stable, needs-based demand” – Green Street Advisors, December 2011 Superior MOB Supply and Demand Fundamentals Increasing Demand for MOBs/Outpatient Settings MOB Supply1,2 MOBs Should Continue to Provide Reliable and Growing Cash Flows |

|

|

The Acquisition of Cogdell Spencer: Accretive to Ventas Shareholders and Represents Attractive Valuation All-Cash Transaction Provides Premium to Cogdell Shareholders Separation of MOBs from Design-Build and Development Business Creates Certainty MOB stable cash flows in REIT Design-build and development business in private entrepreneurial company Ventas becomes the Leading, Fully Integrated MOB Business in the US Improves Top 5 Tenant/Operator Diversification Improves Asset Class, Tenant/Operator and Geographic Diversification MOBs provide stable cash flows due to favorable supply-demand characteristics Adds New Investment Grade Hospital Relationships Maintains Strong Balance Sheet – 5x Net Debt / EBITDA Provides for Additional Growth Opportunities |

|

|

Additional Information about the Proposed Transaction and Where to Find It This document does not constitute the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, Cogdell expects to prepare and file with the Securities and Exchange Commission (the “SEC”) a proxy statement with respect to Ventas’s proposed acquisition of Cogdell. Investors are urged to read Cogdell’s proxy statement (including all amendments and supplements thereto) and other relevant documents filed with the SEC if and when they become available because they will contain important information about the proposed transaction. Investors may obtain copies of Cogdell’s proxy statement and other relevant documents filed by Ventas and Cogdell with the SEC (if and when they become available) through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Ventas with the SEC are also available free of charge on Ventas’s website at www.ventasreit.com, and copies of the documents filed by Cogdell with the SEC are available free of charge on Cogdell’s website at www.cogdell.com. Ventas, Cogdell and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Cogdell’s shareholders in respect of the proposed transaction. Information regarding Ventas’s directors and executive officers can be found in Ventas’s definitive proxy statement filed with the SEC on March 28, 2011. Information regarding Cogdell’s directors and executive officers can be found in Cogdell’s definitive proxy statement filed with the SEC on March 25, 2011. Additional information regarding the interests of such potential participants will be included in Cogdell’s proxy statement and other relevant documents filed with the SEC in connection with the proposed transaction if and when they become available. These documents are available free of charge on the SEC’s website and from Ventas or Cogdell, as applicable, using the sources indicated above. |

|

|

December 2011 |