Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Aquilex Holdings LLC | d273078d8k.htm |

Exhibit 99.1

Exhibit 99.1

October 2011

Selected pages for the bondholders

Executive summary

Executive summary

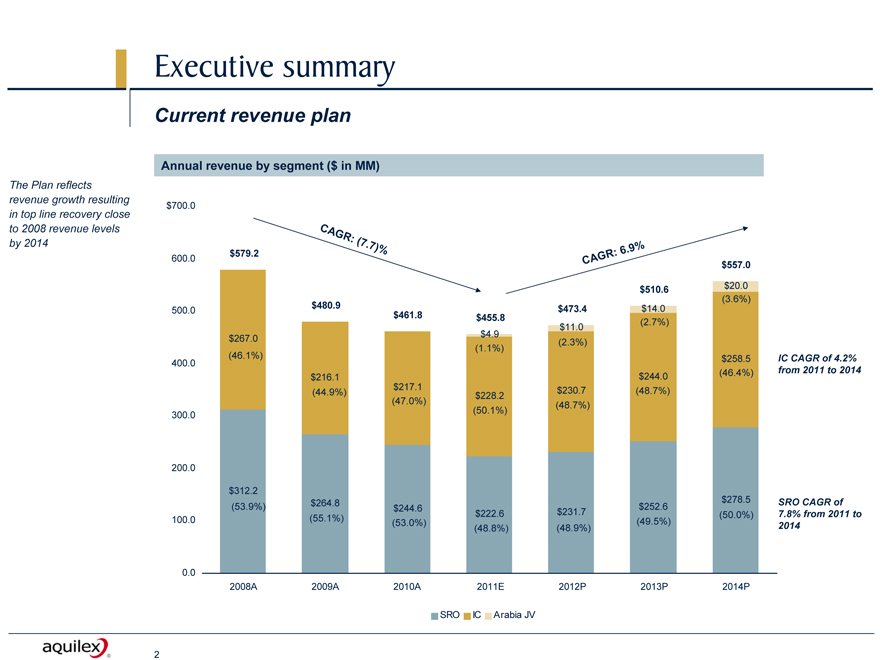

Current revenue plan

Annual revenue by segment ($ in MM)

The Plan reflects revenue growth resulting in top line recovery close to 2008 revenue levels by 2014

Annual revenue by segment ($ in MM)

$700.0

CAGR: (7.7)%

600.0 $579.2 CAGR:6.9%

$557.0

$510.6 $20.0

$480.9 (3.6%)

500.0 $473.4 $14.0

$461.8 $455.8 (2.7%)

$11.0

$4.9

$267.0 (2.3%)

(1.1%)

(46.1%) $258.5 IC CAGR of 4.2%

400.0

$216.1 $244.0 (46.4%) from 2011 to 2014

(44.9%) $217.1 $230.7 (48.7%)

$228.2

(47.0%) (48.7%)

300.0 (50.1%)

200.0

$312.2

$264.8 $278.5 SRO CAGR of

(53.9%) $244.6 $252.6

$222.6 $231.7 (50.0%) 7.8% from 2011 to

100.0 (55.1%) (53.0%) (48.8%) (48.9%) (49.5%) 2014

0.0

2008A 2009A 2010A 2011E 2012P 2013P 2014P

SRO IC Arabia JV

2

Executive summary

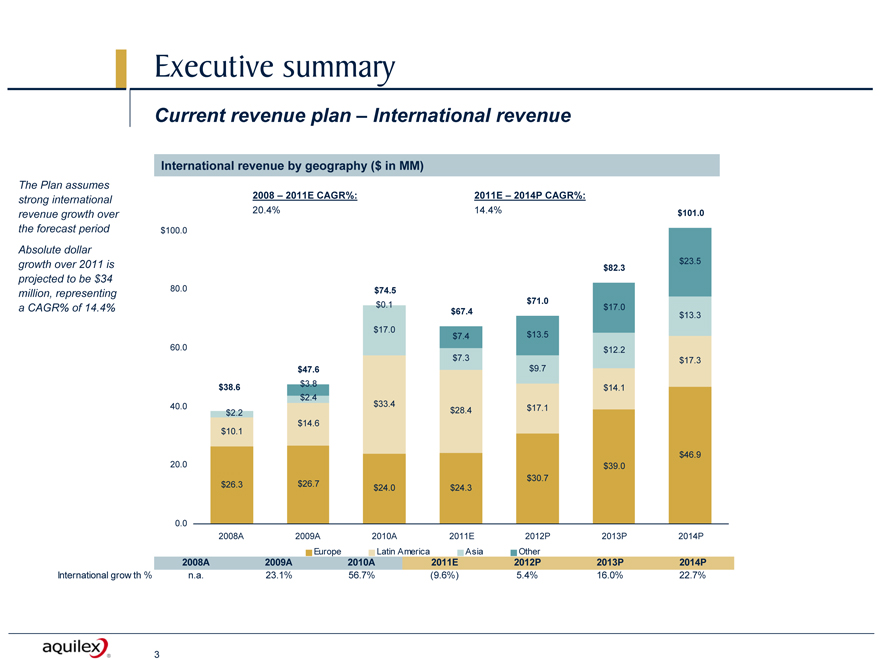

Current revenue plan – International revenue

International revenue by geography ($ in MM)

The Plan assumes strong international revenue growth over the forecast period Absolute dollar growth over 2011 is projected to be $34 million, representing a CAGR% of 14.4%

2008 – 2011E CAGR%: 2011E – 2014P CAGR%:

20.4% 14.4% $101.0

$100.0

$23.5

$82.3

80.0 $74.5

$0.1 $71.0 $17.0

$67.4 $13.3

$17.0 $7.4 $13.5

60.0 $12.2

$7.3 $17.3

$47.6 $9.7

$38.6 $3.8 $14.1

$2.4

40.0 $2.2 $33.4 $28.4 $17.1

$14.6

$10.1

$46.9

20.0 $39.0

$30.7

$26.3 $26.7 $24.0 $24.3

0.0

2008A 2009A 2010A 2011E 2012P 2013P 2014P

Europe Latin America Asia Other

2008A 2009A 2010A 2011E 2012P 2013P 2014P

n.a. 23.1% 56.7% (9.6%) 5.4% 16.0% 22.7%

International growth %

| 3 |

|

Executive summary

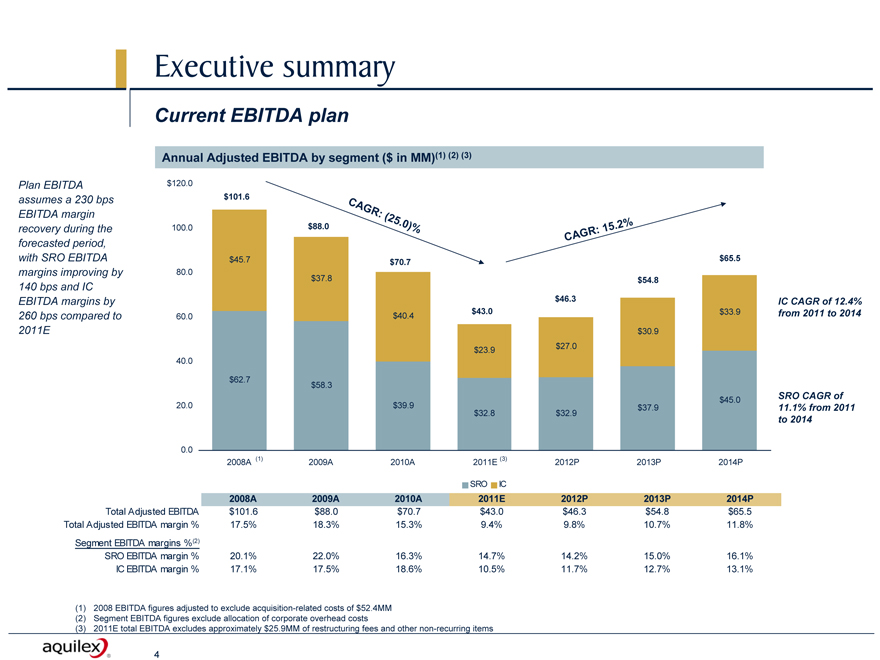

Current EBITDA plan

Annual Adjusted EBITDA by segment ($ in MM)(1) (2) (3)

Plan EBITDA assumes a 230 bps EBITDA margin recovery during the forecasted period, with SRO EBITDA margins improving by 140 bps and IC EBITDA margins by 260 bps compared to 2011E

$120.0

$101.6

CAGR: (25.0)%

100.0 $88.0 CAGR: 15.2%

$45.7 $70.7 $65.5

80.0

$37.8 $54.8

$46.3

60.0 $40.4 $43.0 $33.9

$30.9

$23.9 $27.0

40.0

$62.7 $58.3

$45.0

20.0 $39.9 $37.9

$32.8 $32.9

0.0

2008A (1) 2009A 2010A 2011E (3) 2012P 2013P 2014P

IC CAGR of 12.4% from 2011 to 2014

SRO CAGR of 11.1% from 2011 to 2014

SRO IC

2008A 2009A 2010A 2011E 2012P 2013P 2014P

Total Adjusted EBITDA $101.6 $88.0 $70.7 $43.0 $46.3 $54.8 $65.5

Total Adjusted EBITDA margin % 17.5% 18.3% 15.3% 9.4% 9.8% 10.7% 11.8%

Segment EBITDA margins %(2)

SRO EBITDA margin % 20.1% 22.0% 16.3% 14.7% 14.2% 15.0% 16.1%

IC EBITDA margin % 17.1% 17.5% 18.6% 10.5% 11.7% 12.7% 13.1%

(1) 2008 EBITDA figures adjusted to exclude acquisition-related costs of $52.4MM (2) Segment EBITDA figures exclude allocation of corporate overhead costs

| (3) |

|

2011E total EBITDA excludes approximately $25.9MM of restructuring fees and other non-recurring items |

| 4 |

|

Executive summary

Gross margin plan

Gross margins by segment ($ in MM)(1)

SRO gross margins are projected to increase slightly from the 2010A levels

IC gross margins are expected to decline to approximately 30% (approximately 640bps) in 2011E and slowly recover by approximately 250 bps by 2014

$250.0 40.0%

35.0%

200.0

30.0%

150.0 25.0%

$94.3

$78.2 20.0%

$83.9

100.0 $79.0 $78.2

$68.4 $72.3 15.0%

10.0%

50.0 $96.7 $87.0

$73.0

$62.1 $56.4 $57.9 $64.3 5.0%

0.0 0.0%

2008A 2009A 2010A 2011E 2012P 2013P 2014P

SRO % of SRO sales IC % of IC sales

2008A 2009A 2010A 2011E 2012P 2013P 2014P

Consolidated gross margin $191.1 $165.2 $141.1 $126.1 $132.8 $146.1 $162.9

| (1) |

|

Gross margin information excludes Aquilex Arabia JV |

| 5 |

|

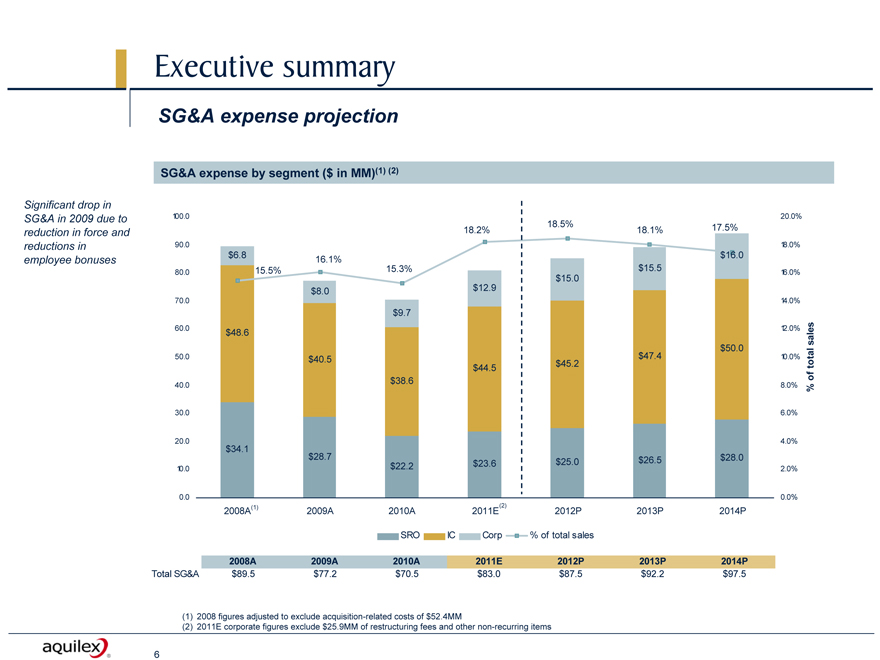

Executive summary

SG&A expense projection

SG&A expense by segment ($ in MM)(1) (2)

Significant drop in SG&A in 2009 due to reduction in force and reductions in employee bonuses

100.0 20.0%

18.2% 18.5% 18.1% 17.5%

90.0 18.0%

$6.8 $16.0

16.1%

80.0 15.5% 15.3% $15.5 16.0%

$15.0

$8.0 $12.9

70.0 14.0%

$9.7

60.0 $48.6 12.0% sales

$50.0

$47.4

50.0 $40.5 $45.2 10.0% total

$44.5

$38.6 of

40.0 8.0% %

30.0 6.0%

20.0 4.0%

$34.1

$28.7 $22.2 $23.6 $25.0 $26.5 $28.0

10.0 2.0%

0.0 0.0%

2008A(1) 2009A 2010A 2011E(2) 2012P 2013P 2014P

SRO IC Corp % of total sales

2008A 2009A 2010A 2011E 2012P 2013P 2014P

Total SG&A $89.5 $77.2 $70.5 $83.0 $87.5 $92.2 $97.5

| (1) |

|

2008 figures adjusted to exclude acquisition-related costs of $52.4MM |

| (2) |

|

2011E corporate figures exclude $25.9MM of restructuring fees and other non-recurring items |

| 6 |

|

Executive summary

Capex plan

Capex ($ in MM)

25.0 20.0 15.0 10.0 5.0 0.0

$24.0

$18.3 5.1%

$17.0 $18.0

$15.8

$14.3 $14.1

3.2%

3.2%

3.3%

3.5%

3.0% 3.0%

2008A 2009A 2010A 2011E 2012P 2013P 2014P

6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0%

% of Sales

Capex % of total sales

| 7 |

|

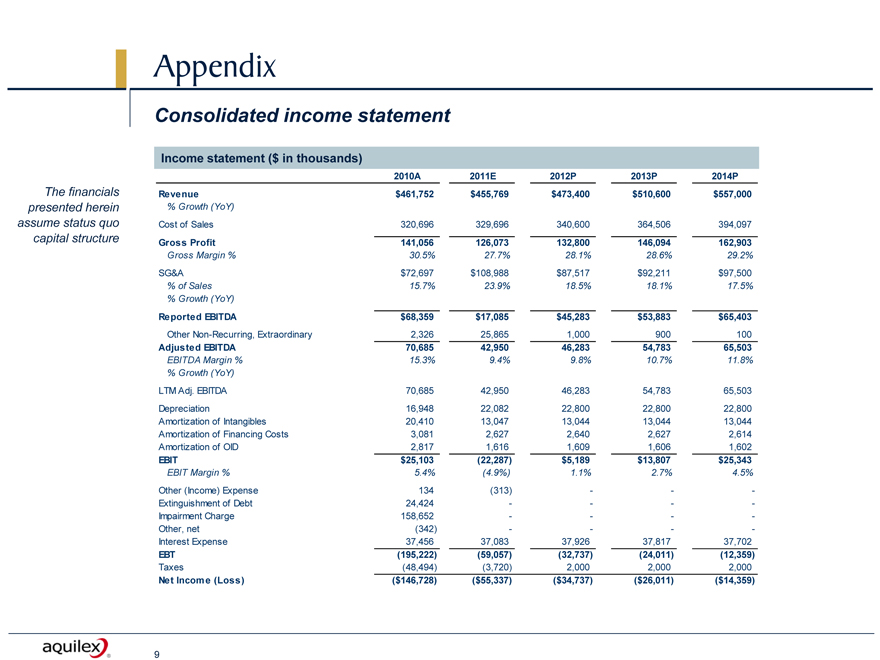

Appendix

Appendix

Consolidated income statement

The financials presented herein assume status quo capital structure

Income statement ($ in thousands)

2010A 2011E 2012P 2013P 2014P

Revenue $461,752 $455,769 $473,400 $510,600 $557,000

% Growth (YoY)

Cost of Sales 320,696 329,696 340,600 364,506 394,097

Gross Profit 141,056 126,073 132,800 146,094 162,903

Gross Margin % 30.5% 27.7% 28.1% 28.6% 29.2%

SG&A $72,697 $108,988 $87,517 $92,211 $97,500

% of Sales 15.7% 23.9% 18.5% 18.1% 17.5%

% Growth (YoY)

Reported EBITDA $68,359 $17,085 $45,283 $53,883 $65,403

Other Non-Recurring, Extraordinary 2,326 25,865 1,000 900 100

Adjusted EBITDA 70,685 42,950 46,283 54,783 65,503

EBITDA Margin % 15.3% 9.4% 9.8% 10.7% 11.8%

% Growth (YoY)

LTM Adj. EBITDA 70,685 42,950 46,283 54,783 65,503

Depreciation 16,948 22,082 22,800 22,800 22,800

Amortization of Intangibles 20,410 13,047 13,044 13,044 13,044

Amortization of Financing Costs 3,081 2,627 2,640 2,627 2,614

Amortization of OID 2,817 1,616 1,609 1,606 1,602

EBIT $25,103 (22,287) $5,189 $13,807 $25,343

EBIT Margin % 5.4% (4.9%) 1.1% 2.7% 4.5%

Other (Income) Expense 134 (313) - - -

Extinguishment of Debt 24,424 - - -

Impairment Charge 158,652 - - -

Other, net (342) - - -

Interest Expense 37,456 37,083 37,926 37,817 37,702

EBT (195,222) (59,057) (32,737) (24,011) (12,359)

Taxes (48,494) (3,720) 2,000 2,000 2,000

Net Income (Loss) ($146,728) ($55,337) ($34,737) ($26,011) ($14,359)

9

450276

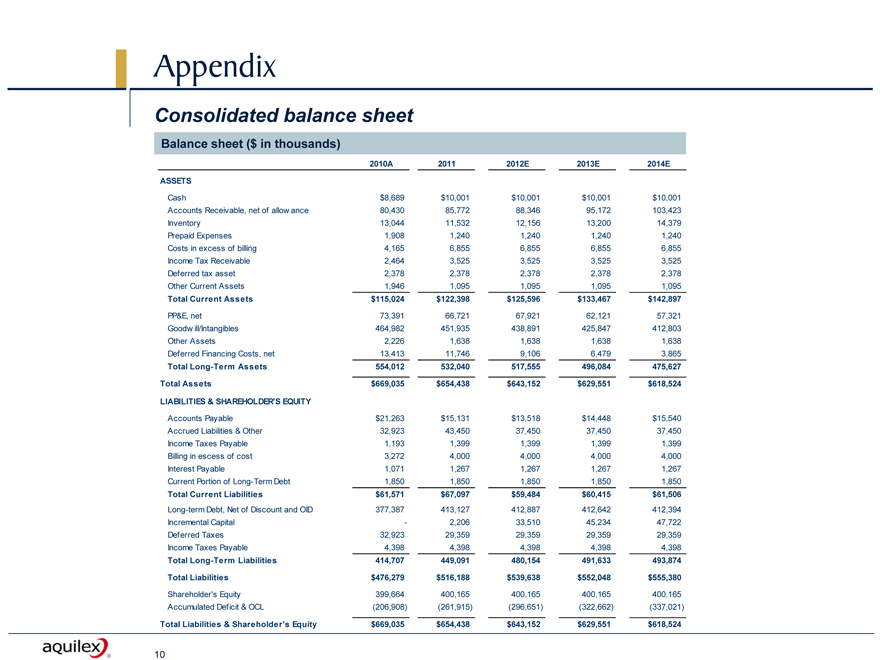

Appendix

Consolidated balance sheet

Balance sheet ($ in thousands)

2010A 2011 2012E 2013E 2014E

ASSETS

Cash $8,689 $10,001 $10,001 $10,001 $10,001

Accounts Receivable, net of allowance 80,430 85,772 88,346 95,172 103,423

Inventory 13,044 11,532 12,156 13,200 14,379

Prepaid Expenses 1,908 1,240 1,240 1,240 1,240

Costs in excess of billing 4,165 6,855 6,855 6,855 6,855

Income Tax Receivable 2,464 3,525 3,525 3,525 3,525

Deferred tax asset 2,378 2,378 2,378 2,378 2,378

Other Current Assets 1,946 1,095 1,095 1,095 1,095

Total Current Assets $115,024 $122,398 $125,596 $133,467 $142,897

PP&E, net 73,391 66,721 67,921 62,121 57,321

Goodwill/Intangibles 464,982 451,935 438,891 425,847 412,803

Other Assets 2,226 1,638 1,638 1,638 1,638

Deferred Financing Costs, net 13,413 11,746 9,106 6,479 3,865

Total Long-Term Assets 554,012 532,040 517,555 496,084 475,627

Total Assets $669,035 $654,438 $643,152 $629,551 $618,524

LIABILITIES & SHAREHOLDER’S EQUITY

Accounts Payable $21,263 $15,131 $13,518 $14,448 $15,540

Accrued Liabilities & Other 32,923 43,450 37,450 37,450 37,450

Income Taxes Payable 1,193 1,399 1,399 1,399 1,399

Billing in escess of cost 3,272 4,000 4,000 4,000 4,000

Interest Payable 1,071 1,267 1,267 1,267 1,267

Current Portion of Long-Term Debt 1,850 1,850 1,850 1,850 1,850

Total Current Liabilities $61,571 $67,097 $59,484 $60,415 $61,506

Long-term Debt, Net of Discount and OID 377,387 413,127 412,887 412,642 412,394

Incremental Capital — 2,206 33,510 45,234 47,722

Deferred Taxes 32,923 29,359 29,359 29,359 29,359

Income Taxes Payable 4,398 4,398 4,398 4,398 4,398

Total Long-Term Liabilities 414,707 449,091 480,154 491,633 493,874

Total Liabilities $476,279 $516,188 $539,638 $552,048 $555,380

Shareholder’s Equity 399,664 400,165 400,165 400,165 400,165

Accumulated Deficit & OCL (206,908) (261,915) (296,651) (322,662) (337,021)

Total Liabilities & Shareholder’s Equity $669,035 $654,438 $643,152 $629,551 $618,524

10

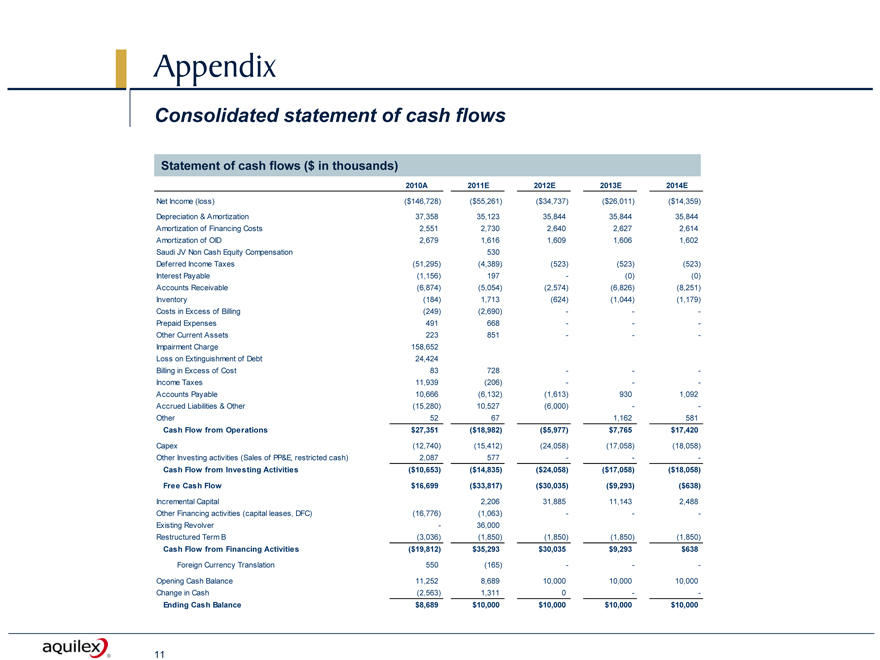

Appendix

Consolidated statement of cash flows

Statement of cash flows ($ in thousands)

2010A 2011E 2012E 2013E 2014E

Net Income (loss) ($146,728) ($55,261) ($34,737) ($26,011) ($14,359)

Depreciation & Amortization 37,358 35,123 35,844 35,844 35,844

Amortization of Financing Costs 2,551 2,730 2,640 2,627 2,614

Amortization of OID 2,679 1,616 1,609 1,606 1,602

Saudi JV Non Cash Equity Compensation 530

Deferred Income Taxes (51,295) (4,389) (523) (523) (523)

Interest Payable (1,156) 197 - (0) (0)

Accounts Receivable (6,874) (5,054) (2,574) (6,826) (8,251)

Inventory (184) 1,713 (624) (1,044) (1,179)

Costs in Excess of Billing (249) (2,690) - - -

Prepaid Expenses 491 668 - - -

Other Current Assets 223 851 - - -

Impairment Charge 158,652

Loss on Extinguishment of Debt 24,424

Billing in Excess of Cost 83 728 - - -

Income Taxes 11,939 (206) - - -

Accounts Payable 10,666 (6,132) (1,613) 930 1,092

Accrued Liabilities & Other (15,280) 10,527 (6,000) - - -

Other 52 67 1,162 581

Cash Flow from Operations $27,351 ($18,982) ($5,977) $7,765 $17,420

Capex (12,740) (15,412) (24,058) (17,058) (18,058)

Other Investing activities (Sales of PP&E, restricted cash) 2,087 577 - - -

Cash Flow from Investing Activities ($10,653) ($14,835) ($24,058) ($17,058) ($18,058)

Free Cash Flow $16,699 ($33,817) ($30,035) ($9,293) ($638)

Incremental Capital 2,206 31,885 11,143 2,488

Other Financing activities (capital leases, DFC) (16,776) (1,063) - - -

Existing Revolver - 36,000

Restructured Term B (3,036) (1,850) (1,850) (1,850) (1,850)

Cash Flow from Financing Activities ($19,812) $35,293 $30,035 $9,293 $638

Foreign Currency Translation 550 (165) - - -

Opening Cash Balance 11,252 8,689 10,000 10,000 10,000

Change in Cash (2,563) 1,311 0 - - -

Ending Cash Balance $8,689 $10,000 $10,000 $10,000 $10,000

11