Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF ERNST & YOUNG LLP - Cantor Entertainment Technology, Inc. | d252726dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on December 22, 2011.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Cantor Entertainment Technology, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7990 | |||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2575 S. Highland Drive

Las Vegas, NV 89109

(702) 677-3800

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Stephen M. Merkel

Executive Vice President, Chief Legal Officer,

General Counsel and Secretary

Cantor Entertainment Technology, Inc.

499 Park Avenue

New York, New York 10022

(212) 610-2200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Christopher T. Jensen

George G. Yearsich

Morgan, Lewis & Bockius LLP

101 Park Avenue

New York, New York 10178-0002

(212) 309-6000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee | ||

| Class A common stock, $0.01 par value per share |

$100,000,000 | $11,460 | ||

|

| ||||

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion.

Preliminary Prospectus dated December 22, 2011.

PROSPECTUS

Cantor Entertainment Technology, Inc.

Shares

Class A Common Stock

This is the initial public offering of Class A common stock of Cantor Entertainment Technology, Inc., which we refer to as “Cantor Entertainment Technology.” We are selling shares of our Class A common stock. Except as required by law, shares of our Class A common stock do not have voting rights.

We expect the initial public offering price to be between $ and $ per share. Currently, no public market exists for our Class A common stock. We intend to apply to list our Class A common stock on the Nasdaq Global Market under the symbol “CETI.”

Investing in our Class A common stock involves risks that are described in the “Risk Factors” section beginning on page 17.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

The underwriters may also purchase up to an additional shares of Class A common stock from Cantor Entertainment Technology at the initial public offering price less the underwriting discount.

Neither the U.S. Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Neither the Nevada Gaming Commission, the Nevada State Gaming Control Board, nor any other gaming authority has passed upon the accuracy or adequacy of this prospectus or the investment merits of the securities offered hereby. Any representation to the contrary is unlawful.

The shares of our Class A common stock will be ready for delivery on or about , 2012.

| Cantor Fitzgerald & Co. |

The date of this prospectus is , 2012.

Table of Contents

| Page | ||||

| 1 | ||||

| 17 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 52 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

53 | |||

| 73 | ||||

| 76 | ||||

| 101 | ||||

| 113 | ||||

| 114 | ||||

| 135 | ||||

| 140 | ||||

| Certain U.S. Federal Tax Considerations for Non-U.S. Holders of Class A Common Stock |

142 | |||

| 145 | ||||

| 150 | ||||

| 150 | ||||

| 150 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus. Neither we nor the underwriters have authorized anyone to provide information different from or in addition to that contained in this prospectus. If anyone provides you with different or additional information, you should not rely on it. We and the underwriters are offering to sell, and seeking offers to buy, shares of Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of our Class A common stock.

Logos and other trademarks, tradenames and service marks of Cantor Fitzgerald, L.P. and its subsidiaries mentioned in this prospectus are currently the property of, and are used with the permission of, Cantor Fitzgerald, L.P. and its subsidiaries. The logos, trademarks, tradenames and service marks discussed in this paragraph may have registrations pending or in effect in one or more of the countries or jurisdictions in which Cantor Fitzgerald, L.P. or any of its subsidiaries does business.

i

Table of Contents

DEFINED TERMS

Unless we otherwise indicate or unless the context requires otherwise, any reference in this prospectus to:

“APSUs” means certain working partner units of Cantor Entertainment Technology Holdings to be issued to certain persons in connection with acquisition of assets or businesses from such persons.

“AREUs” means certain working partner units of Cantor Entertainment Technology Holdings to be issued to certain persons in connection with acquisition of assets or businesses from such persons.

“Bonus Plan” means the Cantor Entertainment Technology Incentive Bonus Compensation Plan.

“Cantor” means Cantor Fitzgerald, L.P. and its subsidiaries other than Cantor Entertainment Technology.

“Cantor Entertainment Technology” means Cantor Entertainment Technology, Inc. and its consolidated subsidiaries.

“Cantor Entertainment Technology Global” means Cantor Entertainment Technology Global, L.P., which will hold the non-U.S. businesses of Cantor Entertainment Technology.

“Cantor Entertainment Technology Holdings” means Cantor Entertainment Technology Holdings, L.P.

“Cantor G&W (Nevada)” means Cantor G&W (Nevada), L.P., our only operating subsidiary as of September 30, 2011.

“Cantor Entertainment Technology U.S.” means Cantor Entertainment Technology U.S., L.P., which will hold the U.S. businesses of Cantor Entertainment Technology.

“Cantor Note” means that certain promissory note dated as of December 8, 2004, as amended, by and between Cantor Entertainment Technology and Cantor.

“Cantor units” refers to exchangeable limited partnership units of Cantor Entertainment Technology Holdings to be held by Cantor.

“CFGM” means CF Group Management, Inc., the managing general partner of Cantor.

“Class A common stock” means Cantor Entertainment Technology Class A non-voting common stock, par value $0.01 per share.

“Class B common stock” means Cantor Entertainment Technology Class B common stock, par value $0.01 per share.

“common stock” means Class A common stock and Class B common stock, collectively.

“contribution” means that certain transaction by which Cantor will contribute, convey, transfer, assign and deliver and/or license to Cantor Entertainment Technology all of the right, title and interest of Cantor in, or license for, gaming, wagering or lottery use, certain intellectual property and other assets, including patents and pending patents, software and other technology assets, copyrights and copyright registrations.

“Deferral Plan” means Cantor Entertainment Technology’s 401(k) defined contribution plan.

“founding partner units” means limited partnership units of Cantor Entertainment Technology Holdings to be held by founding partners.

“founding partners” means Lee Amaitis, Stephen M. Merkel and the Trust controlled by our Chairman of the Board, Howard W. Lutnick.

ii

Table of Contents

“founding/working partners” means founding partners and/or working partners of Cantor Entertainment Technology Holdings.

“founding/working partner units” means limited partnership units of Cantor Entertainment Technology Holdings to be held by founding/working partners.

“GAAP” means accounting principles generally accepted in the United States of America.

“limited partners” means holders of limited partnership units.

“limited partnership units” means Cantor units, founding partner units and working partner units, collectively.

“Long-Term Incentive Plan” means the Cantor Entertainment Technology Long-Term Incentive Plan.

“mobile gaming” means wagering on casino-style games on mobile devices.

“mobile gaming wagering” or “mobile wagering” means placing sports bets on mobile devices.

“Participation Plan” means the Cantor Entertainment Technology Holdings, L.P. Participation Plan.

“PSUs” means certain working partner units of Cantor Entertainment Technology Holdings to be held by certain employees of Cantor Entertainment Technology and other persons who provide services to Cantor Entertainment Technology.

“REUs” means certain working partner units of Cantor Entertainment Technology Holdings to be held by certain employees of Cantor Entertainment Technology and other persons.

“Trust” means The Howard W. Lutnick Family Trust.

“working partners” means holders of working partner units.

“working partner units” means limited partnership units of Cantor Entertainment Technology Holdings, other than founding partner units and Cantor units, to be held by working partners.

MARKET AND INDUSTRY DATA

Market and industry data used in this prospectus have been obtained through our research, surveys and studies conducted by third parties and industry and general publications. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus.

iii

Table of Contents

This summary highlights certain information contained elsewhere in this prospectus. Because this is a summary, it may not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, especially the risks of investing in our Class A common stock discussed under “Risk Factors” beginning on page 17.

This prospectus describes the licenses and other assets that Cantor Fitzgerald, L.P., a Delaware limited partnership, expects to contribute to Cantor Entertainment Technology, Inc., a Delaware corporation, and its subsidiaries in connection with this offering as if such contribution were complete and the licenses and other assets contributed were included in our business for all purposes for all periods described. A list of terms specific to our organization and the contribution is set forth above in the section entitled “Defined Terms.”

Unless the context otherwise requires, the terms “we, “us,” “our,” “our company,” and “Cantor Entertainment Technology” refer to Cantor Entertainment Technology, Inc. and its consolidated subsidiaries. Prior to our formation, all of our operations were performed by Cantor G&W (Nevada), L.P., which is currently an indirect subsidiary of ours, and its respective subsidiaries.

Our Business

We are a leading technology company that provides, through our subsidiary Cantor G&W (Nevada), software, services, data and content to the gaming industry and additional entertainment channels worldwide. We are a market leader in comprehensive account-based and over-the-counter race and sports book solutions and mobile gaming technology for casino-style gaming and race and sports wagering for the global gaming market. Our technology infrastructure platform allows us to provide scalable services at minimal incremental operating costs. Due to the significant historical capital investment in our technology platform and our leadership position within the industry, we believe substantial barriers to entry and brand equity have been created. We provide innovative wagering solutions, creative content, and superior products and services. We are a premier operator of mobile gaming and mobile wagering systems that provide patrons the ability to play a full suite of casino games and place race and sports wagers, including In-Running™ (our in-game wagering product), from mobile devices in many areas of the casino resort. We currently operate race and sports books and mobile gaming in six locations in the State of Nevada and have announced the addition of a seventh race and sports book that we will begin operating in early 2012. We also operate a sports line making service, as well as a slot route in Nevada which places and operates slot machines in approved locations, such as bars and taverns which are typically restricted to 15 machines per location and an unlimited amount for licensed non-restricted locations. We have marketed our product offerings to other gaming jurisdictions where mobile gaming is permitted, such as Native American casinos and other gaming venues throughout the world. In June 2011, mobile gaming wagering in casino hotel rooms was legalized in Nevada, and regulations implementing such wagering have been adopted by the Nevada Gaming Commission. As a result, we intend to expand the service area of our mobile gaming system to include hotel rooms. In addition, until recently, Nevada gaming regulations required that any wagers placed through our mobile gaming system be done using our proprietary mobile hardware. However, on October 26, 2011 as a result of recent regulatory changes, we launched a sports wagering application on Android® devices, including through an application downloadable on a patron’s personal device enabling the patron to place sports wagers through his or her wagering account anywhere within Nevada. We also have iOS and Windows-based sports applications in process. Our mobile wagering technology also enables casino properties to leverage our products for marketing and promotional efforts. Our cloud-based software automates and executes mobility for entertainment options that previously were inefficient to manage or distribute and could not be consumed wherever and whenever the customer wanted them.

We were the first to be licensed by the Nevada Gaming Commission to manufacture, distribute and operate a mobile gaming system in the State of Nevada. Our mobile gaming system was licensed in 2006 and approved by the Nevada Gaming Commission on November 20, 2008. We believe that our mobile gaming system is the

1

Table of Contents

only one approved in Nevada to date. We provide our casino partners with a complete mobile gaming solution, including a proprietary wireless gaming system, full back-office infrastructure and a portfolio of casino games. We design, finance, install and operate our mobile platform and share a portion of our mobile gaming revenues with our casino partners. Our software can be integrated into our casino partners’ software platforms for the purpose of expanded concierge type services, food and beverage orders, restaurant or show reservations and tailored marketing materials based upon a player’s location and profile. Our licenses as an operator, manufacturer and distributor of mobile gaming systems in Nevada allow us the opportunity and ability to expand into additional properties.

We are a leading race and sports book operator in the State of Nevada. A race and sports book is a gambling establishment that sets odds and point spreads and accepts wagers on the outcome of horse races and sporting events, such as football, basketball, baseball, and hockey games. A unique aspect of the race and sports books that we operate is our ability to process In-Running™ wagers after a race or sporting event has begun. In-Running™ is wagering on an event where the odds change dynamically based upon changes that occur within the sporting event and where the player can wager multiple times on events during the course of the event. We pay fixed rent and/or a share in wagering handle or profits from race and sports wagering with our casino partners. Importantly, we believe that our technology increases the traditional gaming offerings and opens up new revenue generating opportunities for our casino partners.

We are the exclusive mobile gaming and race and sports book operator at the following six Las Vegas resorts: the M Resort, which we refer to as the “M Resort,” The Cosmopolitan of Las Vegas, which we refer to as the “Cosmopolitan of Las Vegas,” The Tropicana Las Vegas, which we refer to as the “Tropicana Las Vegas,” the Hard Rock Hotel & Casino Las Vegas, which we refer to as the “Hard Rock Hotel & Casino,” The Venetian Resort Hotel Casino, which we refer to as “The Venetian,” and The Palazzo Resort Hotel Casino, which we refer to as the “The Palazzo.” The Palazzo and The Venetian are a single licensee for Nevada Gaming Control Board purposes. Accordingly, we have five licenses to operate race and sports books and mobile gaming in six properties. In addition, beginning in 2012, we expect to become the exclusive mobile gaming and race and sports book operator at the Palms Casino Resort, which we refer to as the “Palms Casino Resort.”

Our international operations include a financial fixed odds betting product, which we refer to as “FFO.” FFO is a proprietary betting product that allows a customer to bet online or otherwise remotely on short-term movements in the financial markets, including stock indices, commodities (such as gold and oil), and foreign exchange. We currently offer FFO as a white label product to licensed bookmakers, as opposed to offering FFO directly to end customers under our own brand. Our white label bookmakers include Ladbrokes in the United Kingdom and 32 Red, PartyGaming and Victor Chandler in Gibraltar. Ladbrokes is the United Kingdom’s largest land-based bookmaking operator, and our FFO product is featured on the Ladbrokes website. We plan to market the FFO product to other licensed bookmakers in jurisdictions where this form of wagering is permitted.

In addition to the businesses described above, we also provide other services and products to businesses in the gaming industry, such as licensing our proprietary intellectual property, providing market information (odds and sports lines) to licensed sports books and lotteries for license fees, providing sports news and data within casinos and operating numerous slot machine locations.

We are an affiliate of Cantor Fitzgerald, L.P., which we refer to as “Cantor,” a leading provider of financial brokerage, technology and execution services to institutions operating in the global financial markets. For more than 65 years, Cantor has been at the forefront of financial and technological innovation in the financial services industry, developing new markets and providing superior service to its more than 5,000 institutional customers around the world. Cantor is a leader in technological innovation, including developing the world’s first electronic marketplace for U.S. Government Securities, the world’s first full-time electronic exchange for trading U.S.

2

Table of Contents

Treasury futures, and one of the first wireless bond trading platforms. Cantor provides us with expertise in electronic data processing and the experience of our officers and senior employees with such systems. We have already created advanced mobile gaming technologies by leveraging such expertise and expect to develop additional technological innovations in the future by adapting to the gaming industry technology that Cantor has successfully implemented, including technology to electronically process in real-time massive numbers of transactions and provide real-time electronic dissemination of data. Throughout its long history of serving financial marketplaces, Cantor has continually enhanced the ability of its electronic trading systems to lower costs for users, as well as increase volumes and velocity of transactions overall. We foresee over time similar benefits accruing to the gaming industry through the use of our technology.

We generate revenue in five principal ways:

| • | Race and sports book; |

| • | Mobile gaming; |

| • | Sports and odds subscriptions; |

| • | Fixed financial odds; and |

| • | Slot route. |

3

Table of Contents

Our Competitive Strengths

We believe that our competitive strengths include the following:

First Mover Status

We were the first company licensed as a manufacturer, distributor and operator of a mobile gaming system by the State of Nevada, and we were the first, and we believe we are the only, company to have a mobile gaming system approved by the Nevada Gaming Commission. We remain the sole active operator of mobile gaming in Nevada. Our “first mover” status in mobile gaming in Nevada has provided us with valuable feedback about our product and services that has enabled us to develop enhancements that increase the marketability and success of our entertainment solutions and mobile gaming system.

Appeal and Advantages of Mobile Gaming

We believe that we have a competitive advantage over traditional fixed-based game providers, as we can rapidly roll out new games on our mobile gaming system with lower capital and operating expenditures. We believe this will be a significant advantage in an environment when casino operators are increasingly pressed to reduce their capital expenditures. In addition to cost advantages, mobile gaming has the natural advantage of providing the player freedom to gamble in all approved areas of the resort property rather than just the casino, while at the same time offering the casino owner the opportunity to generate gaming revenues off the casino floor.

We are Technological and Gaming Innovators

We currently own patents for a number of innovative technologies that we have developed, including our technology for In-RunningTM betting. In 2009, we became the only company to launch such In-Running™ betting in the State of Nevada. We also have a broad array of gaming technology intellectual property, gaming content, and a database of statistics, odds and lines from which we continue to develop new proprietary products and services.

Our affiliate, Cantor, is a leading innovator in the financial market place and is known globally for its superior financial technology and real-time, secure execution of financial transactions. We currently license more than 250 U.S. and foreign patents and patent applications for such technologies from Cantor. On or prior to the closing of this offering, Cantor will contribute most of these patents to us and license others to us. We expect to leverage Cantor’s expertise in electronic data processing by adapting technology for processing in real-time massive numbers of transactions and dissemination of data for use in the gaming industry. For example, using our unique technology and account-based wagering systems, our race and sports book patrons can place numerous bets on different outcomes throughout a sporting event. In the same way that prices in the financial markets are constantly updated, our lines and spreads change continuously as the action in a game evolves.

Throughout its long history of serving financial marketplaces, Cantor has continually enhanced the ability of its electronic trading systems to lower costs for users, as well as increase volumes and velocity of transactions overall. We foresee over time similar benefits accruing to the gaming industry through the use of our technology.

We are passionate about the way in which technology can enhance and transform gaming, and are continuously updating our products and technology to enable casinos to offer their customers a unique experience.

4

Table of Contents

Proven and Scalable Technology

We designed our mobile gaming system to be intuitive and user friendly. In addition, our mobile gaming system has proven its scalability to easily handle new operator partners. We believe that our technological capabilities allow us to more rapidly implement and integrate our suite of gaming products and services. Our mobile wagering technology also enables casino properties to leverage our products for marketing and promotional efforts.

We have an Experienced Senior Management Team

Members of our senior management team are currently or have been in the past senior executives of Cantor and its affiliates, and have significant collective experience gained from decades of developing secure financial transactions based on superior technology, and working in the highly regulated financial services industry. Our senior management team has applied this same rigor and experience to the development of our businesses. We believe that bringing our senior management’s proven capabilities from the financial services industry to the gaming industry to deliver real-time data and information, in a transaction-intensive environment, and to provide rapid and secure settlement of such transactions are key differentiating factors, and ones which will have growing importance to casinos in making their business decisions. We intend to use our senior management’s extensive knowledge of building electronic marketplaces and developing value-added financial products and services, which dramatically increased transaction volumes and revenues in the financial industry, in the development and expansion of our products and services. We have complemented the expertise of our senior management team by hiring seasoned gaming executives. The gaming experience they possess includes significant operational experience, relationships, as well as strategic guidance. We believe that our experienced senior management team gives us a competitive advantage in executing our business strategy.

Award Winning Race and Sports Book and Premier Industry Recognition

We believe the quality of our race and sports books is demonstrated by such factors as size, design, ambiance, the breadth and superior nature of amenities offered, and the innovative technology at the heart of the sports trading experience offered to our customers. For example, in 2010 and 2011, ESPN Insider named the M Resort race and sports book the “Best Sports Book For Watching March Madness.” We were awarded first place in the “Best Productivity-Enhancement Technology” category at the tenth annual Gaming & Technology Awards at the 2011 Global Gaming Expo (G2E), and “Best Table Game Product or Innovation” by Global Gaming Business magazine in 2009. We are committed to maintaining and expanding market leading, state-of-the-art properties through capital spending programs designed to continually expand and enhance our gaming options and facilities in order to offer our patrons a superior overall gaming experience.

Reflecting our eminent position in the marketplace, our President and CEO, Lee M. Amaitis, frequently is an invited speaker at industry events, including G2E, International Masters of Gaming Law, US Online Gaming Law Conference, and International Association of Gaming Advisors.

Our breakthrough technology and advanced trading account-based wagering system environments have been profiled by leading national print, broadcast and online media, including The Wall Street Journal, The New York Times, Fortune, Associated Press, Wired magazine, Bloomberg BusinessWeek, Wall Street & Technology, CNN, CNBC, Fox Business Network, CBS, ABC, ESPN, and Bloomberg TV. Las Vegas market coverage of our operations as a top destination for sports enthusiasts has included the Las Vegas Review Journal, Las Vegas Sun, Las Vegas Business Press, Vegas Magazine, Vegas News, University of Nevada-Las Vegas Podcast, Vegas Seven, Fox 5, Channel 8, and XTRA 910 radio, as well as press in other major markets, including the Los Angeles Times, Philadelphia Inquirer, and Pittsburgh Tribune. The quality of our product and service offerings has been recognized with significant industry press coverage, including Yahoo.sports, Global Gaming Business, Gaming Today, Casino Enterprise Management, iGaming Business, and covers.com.

5

Table of Contents

Our Business Strategy

Our goal is to be the global leader in mobile gaming systems with real-time wagering capabilities and to provide exciting traditional casino games, innovative casino-style games and dynamic race and sports book offerings. We intend to achieve this goal by employing the following strategies:

Continue to Develop and Introduce Innovative New Products

We have a history of developing and introducing innovative gaming products and services. We plan to use our expertise in financial markets, gaming and technology to continue to develop and introduce innovative new products and content primarily through mobile devices. After the contribution from Cantor discussed under “—Our Organizational Structure—The Contribution and Related Transactions,” we will own more than 500 U.S. and foreign patents and patent applications relating to gaming and race and sports wagering. In addition to the launch of our Android®-compatible mobile sports wagering application on October 26, 2011, which enables customers to place sports wagers on all Android® devices, including mobile phones and tablets, throughout Nevada, we are also seeking approval to offer an Android®-compatible mobile gaming application, which will enable customers to similarly place mobile gaming wagers on all Android® devices while at the casino property. We are also developing mobile gaming and sports wagering applications for iOS and a mobile gaming application for iOS. We also plan to launch other products for commercially available personal mobile devices and even through the internet, differentiating in each market the technological model permitted by applicable laws and regulations.

We have popularized or introduced newer modes of race and sports betting, such as In Running™ and Inside Wagers, which offer reduced commission spot markets for wagering on sporting events. We believe, based on the growth of the overall market, that there is a significant market for In-Running™ betting on sports in the State of Nevada as well as internationally.

On the mobile gaming side, we intend to continue to introduce new proprietary games, including games known as Slottery™, Red/Black™ , Kill the Number™ and Five-Wheel™, and features that enable additional bets during traditional casino games, which we refer to as “extra odds,” which yields an increased volume turnover.

Generate Increased Mobile Gaming Revenues

We plan to expand our mobile gaming system to other casinos. In June 2011, mobile gaming wagering in casino hotel rooms was legalized in the State of Nevada, and regulations implementing such wagering have been adopted by the Nevada Gaming Commission. With our current footprint, we expect to add approximately 15,000 hotel rooms to our mobile gaming revenue opportunities as a result of these regulatory developments.

Continue to Apply Leading-Edge Technology to Improve the Gaming Experience

We seek to be the leader in developing state-of-the-art technology enhancements to improve the overall gaming experience for players. For example, our intuitive and easy-to-use touch-based gaming system capitalizes on the general population’s familiarity with mobile phones, tablets and personal media products and provides a seamless transition to our account-based mobile gaming and sports wagering applications.

Promote the Advantages of our Products and Services

We continue to demonstrate the value of our gaming products and services to casinos which may be experiencing slowing revenue growth due to current economic conditions or otherwise, and which may have capital expenditure and operating cost limitations. For example, we believe that our system can increase overall wagering volume by: (1) dramatically expanding the playable area of a resort and a player’s potential wagering time, and (2) employing innovative games and services, such as In-Running™, that can significantly increase the number of wagers by a player. We also aim to be the leading developer and supplier of unique gaming content delivered through innovative mediums.

6

Table of Contents

We offer a compelling value proposition to the casino by providing comprehensive gaming solutions that either the casino can operate or we can operate for them. Furthermore, we intend to use our capabilities gained from operating race and sports books and an odds-making service to develop advanced wagering methodologies, which are made possible with electronic gaming, enhancing both wagering revenues and the leadership of our technology, platform and delivery systems. We believe this integrated approach will foster more rapid adoption of our gaming products as it delivers value to both the casino and the player.

Expand in Attractive Markets

We have initially focused our marketing efforts on casinos located in Nevada; however, we believe that we are well-positioned to enter into and successfully compete in new markets where mobile gaming or race and sports wagering may sometime be permitted, such as non-Nevada casinos in the United States, including those located on Native American reservations and outside the United States. Our goal is to become the comprehensive mobile gaming and wagering services solution provider to traditional as well as non-traditional gaming operations on a global basis.

Acquisitions and Strategic Alliances

We have been active in acquiring companies that possess unique content and services. We intend to continue to explore opportunities to acquire companies, intellectual property and products that will enhance our overall position in the gaming industry.

7

Table of Contents

Our Organizational Structure

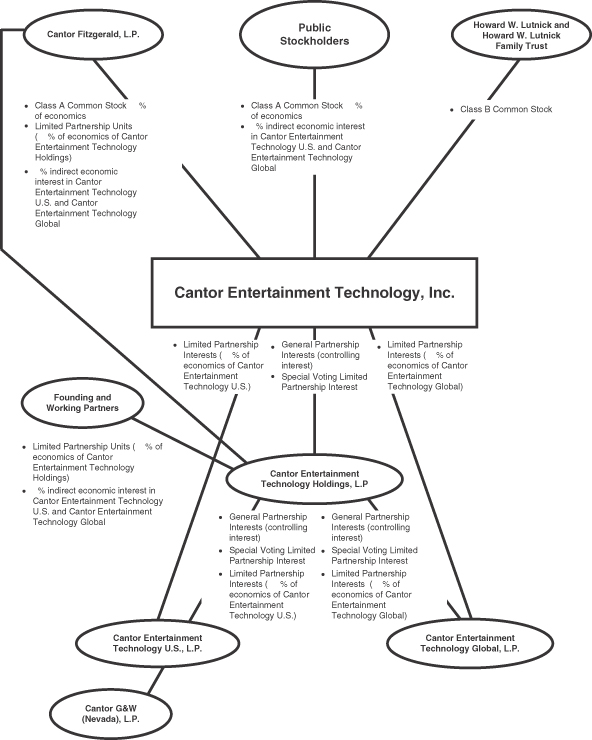

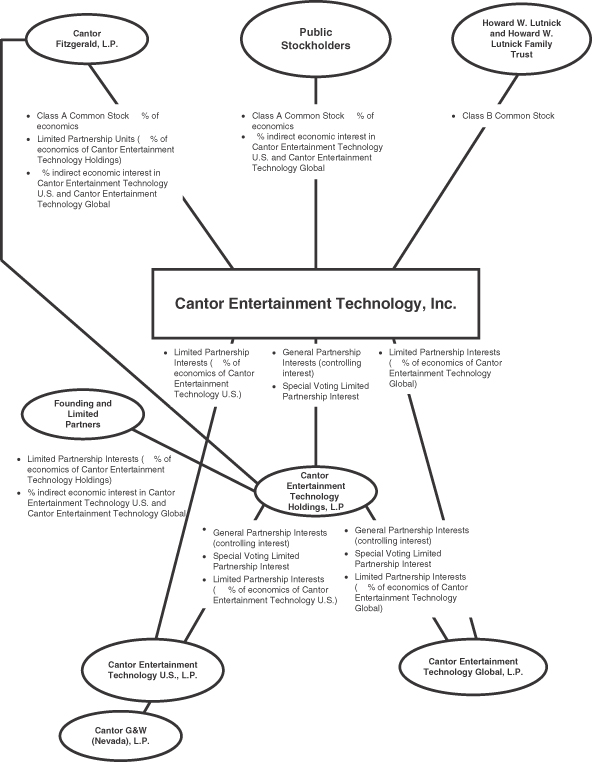

We expect to enter into a contribution agreement and related transactions, which will result in the organizational structure described below.

The Contribution and Related Transactions

In connection with this offering, we expect to enter into a contribution agreement with Cantor, pursuant to which Cantor will contribute certain licenses and other assets to us and our subsidiaries in exchange for shares of our Class A common stock and Cantor Entertainment Technology Holdings exchangeable limited partnership units, which will be exchangeable with us for shares of our Class A common stock on a one-for-one basis (subject to customary anti-dilution adjustments) immediately upon the closing of this offering. See “Certain Relationships and Related Transactions—Contribution Agreement” for a description of the licenses and assets to be contributed to us. In addition, in connection with this offering, we and Cantor Entertainment Technology Holdings expect to issue the following equity interests: and shares of Class B common stock to The Howard W. Lutnick Family Trust, which we refer to as the “Trust,” and our Chairman of the Board, Howard W. Lutnick, respectively, and , and Cantor Entertainment Technology Holdings founding partner units to the Trust and our President, Chief Executive Officer and Director, Lee M. Amaitis and our Executive Vice President, Chief Legal Officer, General Counsel, Secretary and Director, Stephen M. Merkel, respectively. The Trust and Messrs. Lutnick, Amaitis and Merkel will exchange their current ownership interests in our company for the foregoing shares of Class B common stock or Cantor Entertainment Technology Holdings founding partner units.

Our Organizational Structure Post-Offering

Upon the closing of this offering, we expect to be structured as a holding company and our business will be operated through two operating partnerships, Cantor Entertainment Technology U.S., which will hold our U.S. businesses, and Cantor Entertainment Technology Global, which will hold our non-U.S. businesses.

The limited partnership interests of Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global will be held by us and Cantor Entertainment Technology Holdings and the limited partnership units of Cantor Entertainment Technology Holdings will be held by Cantor, the founding partners and the working partners. We will hold the Cantor Entertainment Technology Holdings general partnership interest and the Cantor Entertainment Technology Holdings special voting limited partnership interest, which will entitle us to remove and appoint the general partner of Cantor Entertainment Technology Holdings, and serve as the general partner of Cantor Entertainment Technology Holdings, which will entitle us to control Cantor Entertainment Technology Holdings. Cantor Entertainment Technology Holdings, in turn, will hold the Cantor Entertainment Technology U.S. general partnership interest and the Cantor Entertainment Technology U.S. special voting limited partnership interest, which will entitle the holder thereof to remove and appoint the general partner of Cantor Entertainment Technology U.S., and the Cantor Entertainment Technology Global general partnership interest and the Cantor Entertainment Technology Global special voting limited partnership interest, which will entitle the holder thereof to remove and appoint the general partner of Cantor Entertainment Technology Global, and serve as the general partner of Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global, all of which will entitle Cantor Entertainment Technology Holdings (and thereby us) to control each of Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global. Cantor Entertainment Technology Holdings will hold its Cantor Entertainment Technology Global general partnership interest through a company incorporated in the Cayman Islands, Cantor Entertainment Technology Global Holdings GP Limited.

8

Table of Contents

Upon the closing of this offering, there will be several types of economic interests in us, Cantor Entertainment Technology Holdings, Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global and they are as follows:

Cantor Entertainment Technology, Inc.

| • | Cantor Entertainment Technology, Inc. Class A non-voting common stock ( shares of which will be issued and outstanding upon the closing of this offering, including shares held by Cantor, an entity controlled by our Chairman of the Board, Howard W. Lutnick). |

| • | Cantor Entertainment Technology, Inc. Class B voting common stock (100 shares of which will be issued and outstanding upon the closing of this offering), which will be held exclusively by the Trust (95 shares) and Mr. Lutnick (5 shares). Each share of our Class A common stock is equivalent to a share of our Class B common stock for purposes of economic rights; however, shares of Class B common stock will be our only voting securities. |

| • | RSUs (of which will be issued and outstanding upon the completion of this offering). |

Cantor Entertainment Technology Holdings:

| • | Cantor Entertainment Technology Holdings exchangeable limited partnership interests, which we refer to as “Cantor units,” ( of which will be issued and outstanding upon the closing of this offering), which will be held by Cantor, and which will be immediately exchangeable with us for our Class A common stock generally on a one-for-one basis (subject to customary anti-dilution adjustments) upon the closing of this offering. |

| • | Cantor Entertainment Technology Holdings founding partner units ( of which will be issued and outstanding upon the closing of this offering), which will be limited partnership units held by founding partners, and of which % held by each founding partner will be immediately exchangeable with us for our Class A common stock generally on a one-for-one basis (subject to customary anti-dilution adjustments) upon the closing of this offering, and the remaining % held by each founding partner will not be exchangeable with us unless Cantor determines that such units can be exchanged by such founding partners with us for our Class A common stock, generally on a one-for-one basis (subject to customary anti-dilution adjustments), on terms and conditions to be determined by Cantor, provided that the terms and conditions of such exchange cannot in any way diminish or adversely affect our rights or the rights of our subsidiaries (it being understood that our obligation to deliver shares of our Class A common stock upon exchange will not be deemed to diminish or adversely affect our rights or the rights of our subsidiaries). Cantor will be the only holder of the Cantor units as of the closing of this offering. To the extent there are any additional holders of Cantor units in the future, any such consent of Cantor will be determined by the holders of a majority in interest of the Cantor units. Cantor expects to permit such exchanges from time to time. Once a Cantor Entertainment Technology Holdings founding partner unit becomes exchangeable, such founding partner unit is automatically exchanged for our Class A common stock upon termination or bankruptcy of the holder of such interest or upon redemption by Cantor Entertainment Technology Holdings, generally on a one-for-one basis (subject to customary anti-dilution adjustments). |

| • | Cantor Entertainment Technology Holdings working partner units ( of which will be issued and outstanding upon the closing of this offering), and will not be exchangeable with us unless otherwise determined by us with the written consent of Cantor in accordance with the terms of the Cantor Entertainment Technology Holdings limited partnership agreement. Once a Cantor Entertainment Technology working partner unit becomes exchangeable, such unit is automatically exchanged for Class A common stock upon termination or bankruptcy of the holder of such unit or upon redemption by Cantor |

9

Table of Contents

| Entertainment Technology Holdings, generally on a one-for-one basis (subject to customary anti-dilution provisions). Additional Cantor Entertainment Technology Holdings working partner units will be issued in the future from time to time to certain of our employees and other persons. |

Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global:

| • | Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global limited partnership interests which will be issued and outstanding upon the closing of this offering ( and , respectively, of which will be held by us and and , respectively, of which will be held by Cantor Entertainment Technology Holdings). There will be a one-for-one exchange ratio between Cantor Entertainment Technology Holdings limited partnership units and our Class A common stock, which reflects that one Cantor Entertainment Technology Holdings limited partnership unit and one share of our Class A common stock are expected to represent an equivalent indirect economic interest in the income stream of Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global. As a result of Cantor Entertainment Technology Holdings’ ownership of Cantor Entertainment Technology U.S. limited partnership interests and Cantor Entertainment Technology Global limited partnership interests, Cantor, the founding partners and the working partners indirectly will have interests in Cantor Entertainment Technology U.S. limited partnership interests and Cantor Entertainment Technology Global limited partnership interests. |

As a result of our expected ownership of the general partnership interest in Cantor Entertainment Technology Holdings and Cantor Entertainment Technology Holdings’ general partnership interest in each of Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global, we expect to consolidate Cantor Entertainment Technology U.S.’s and Cantor Entertainment Technology Global’s results for financial reporting purposes.

Upon each exchange of a Cantor Entertainment Technology Holdings limited partnership unit, we will deliver shares of our Class A common stock in exchange for the underlying unit (on a one-for-one basis). Cantor Entertainment Technology Holdings will then redeem the Cantor Entertainment Technology Holdings units so acquired and deliver to us a like number of Cantor Entertainment Technology U.S. limited partnership interests and Cantor Entertainment Technology Global limited partnership interests underlying such Cantor Entertainment Technology Holdings units. As a result, with each exchange of a Cantor Entertainment Technology Holdings limited partnership unit, our direct interest in Cantor Entertainment Technology U.S. limited partnership interests and Cantor Entertainment Technology Global limited partnership interests will proportionately increase. The profit and loss of Cantor Entertainment Technology U.S., Cantor Entertainment Technology Global and Cantor Entertainment Technology Holdings, as the case may be, will be allocated based on the total number of Cantor Entertainment Technology U.S. interests, Cantor Entertainment Technology Global interests and Cantor Entertainment Technology Holdings units.

10

Table of Contents

The following diagram illustrates our expected ownership structure immediately after the completion of this offering. The following diagram does not reflect our various subsidiaries or those of Cantor Entertainment Technology U.S., Cantor Entertainment Technology Global, Cantor Entertainment Technology Holdings or Cantor, or the results of any exchange of Cantor Entertainment Technology Holdings limited partnership units:

11

Table of Contents

Risks That We Face

You should carefully consider the risks described under “Risk Factors” and elsewhere in this prospectus. These risks could materially and adversely impact our business, results of operations and financial condition, which could cause the trading price of our Class A common stock to decline and result in a partial or total loss of your investment.

Executive Offices

Our principal executive offices are located at 2575 S. Highland Drive, Las Vegas, NV 89109. Our telephone number is (702) 677-3800. Our corporate website address is www.cantorgaming.com and our email address is info@cantorgaming.com. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this prospectus.

12

Table of Contents

This Offering

| Class A common stock offered by Cantor Entertainment Technology |

shares |

| Class A common stock to be outstanding after this offering |

shares(1) |

| Class B common stock to be outstanding after this offering |

100 shares |

| Total common stock to be outstanding after this offering |

shares |

| Use of Proceeds |

We estimate that we will receive net proceeds from this offering of approximately $ million ($ million if the underwriters exercise in full their option to purchase additional shares) after deducting the estimated underwriting discounts and commissions and estimated offering expenses, assuming the shares of our Class A common stock are offered at $ per share, which represents the mid-point of the range set forth on the cover page of this prospectus. |

| We intend to use a portion of the net proceeds to us from this offering to repay $ million of the aggregate principal amount of and accrued interest on the Cantor Note. The remaining $ outstanding under the Cantor Note will be converted to a term note payable over a -year period bearing interest at a rate of % per annum. |

| We intend to contribute all of the remaining net proceeds to us from this offering to Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global in exchange for Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global limited partnership interests. |

| Cantor Entertainment Technology U.S. and Cantor Entertainment Technology Global intend to use the net proceeds they receive from us for various purposes, including general partnership purposes, as well as potential strategic alliances, acquisitions, joint ventures or capital investments. In addition, from time to time, we have evaluated and we expect to continue to evaluate and potentially pursue possible strategic alliances, acquisitions, joint ventures or capital investments. |

| Voting Rights |

Except as required by law, shares of our Class A common stock do not have voting rights. Shares of our Class B common stock have voting rights, thereby entitling holders of our Class B common stock to 100% of our voting power in the aggregate immediately after this offering. Our Class B common stock is exclusively held by our Chairman of the Board, Howard W. Lutnick, and the Trust controlled by Mr. Lutnick. See “Description of Capital Stock.” |

13

Table of Contents

| Economic Rights |

Pursuant to our Amended and Restated Certificate of Incorporation, shares of our Class A common stock and Class B common stock are entitled to equal economic rights. |

| Dividend Policy |

We have not paid any dividends on our common stock to date. The payment of dividends in the future will be contingent upon the terms of our indebtedness, and our revenues and earnings, if any, capital requirements and general financial condition. It is the present intention of our Board of Directors to retain all earnings, if any, for use in our business operations and, accordingly, our Board of Directors does not anticipate paying any dividends in the foreseeable future. See “Dividend Policy.” |

| Risk Factors |

You should carefully read and consider the information set forth under “Risk Factors” beginning on page 17 and all other information set forth in this prospectus before investing in our Class A common stock. |

| Listing |

We intend to apply to list our Class A common stock on the Nasdaq Global Market under the symbol “CETI.” |

| (1) | Includes shares of our Class A common stock to be sold pursuant to this offering, but excludes (i) 100 shares of our Class A common stock issuable upon conversion of shares of outstanding Class B common stock, (ii) shares of our Class A common stock issuable upon exchange of Cantor Entertainment Technology Holdings exchangeable limited partnership units and (iii) shares of our Class A common stock reserved for issuance in connection with our Long-Term Incentive Plan, of which will have been granted or be subject to awards immediately following this offering. |

Unless we specifically state otherwise, all information in this prospectus assumes that our Class A common stock will be sold at $ per share, which is the mid-point of the range set forth on the cover of this prospectus.

Unless otherwise indicated, the information contained in this prospectus assumes that the underwriters’ option to purchase up to additional shares is not exercised.

14

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

Set forth below is summary historical consolidated financial data and unaudited pro forma consolidated financial data as of and for the periods presented for our operating company, Cantor G&W (Nevada), L.P.

The summary historical consolidated financial data have been prepared in accordance with accounting principles generally accepted in the United States, which we refer to as “U.S. GAAP”. The consolidated statement of operations data for fiscal years ended December 31, 2010, 2009 and 2008 and historical balance sheet data as of December 31, 2010 and 2009, have been derived from, and should be read in conjunction with, the audited consolidated financial statements appearing elsewhere in this prospectus. The unaudited historical financial data for the nine months ended September 30, 2011 and 2010 have been derived from the unaudited condensed consolidated financial statements appearing elsewhere in this prospectus, which have been prepared on a basis consistent with the annual audited consolidated financial statements. In the opinion of management, such unaudited financial data reflect all adjustments necessary for a fair presentation of the results for such periods. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

The unaudited pro forma consolidated statements of operations data for the year ended December 31, 2010 and the nine months ended September 30, 2011 were derived by applying pro forma adjustments to our operating company’s consolidated statements of operations data for the year ended December 31, 2010 and the nine months ended September 30, 2011. The unaudited pro forma consolidated statement of operations data for the year ended December 31, 2010 and the nine months ended September 30, 2011 present our operating company’s results of operations and financial position assuming that the contribution of the licenses and other assets by Cantor had been completed as of January 1, 2010 with respect to the unaudited pro forma consolidated statement of operations data and at September 30, 2011 and December 31, 2010 with respect to the unaudited pro forma consolidated balance sheet data.

The following information is only a summary and should be read in conjunction with the audited and unaudited consolidated financial statements and the related notes appearing elsewhere in this prospectus, the financial information included in this prospectus in the sections entitled “Selected Consolidated Financial Data,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the section entitled “Risk Factors.”

The summary pro forma financial data are included for informational purposes only and should not be considered indicative of actual results that would have been achieved had these events actually been consummated on the dates indicated and do not purport to indicate results of operations as of any future date or for any future period. Please refer to “Unaudited Pro Forma Consolidated Financial Information” included in this prospectus for more information regarding the pro forma adjustments.

15

Table of Contents

| (Unaudited) | (Audited) | (Unaudited) | ||||||||||||||||||||

| Nine Months Ended September 30, |

For the Years Ended December 31, |

|||||||||||||||||||||

| (Amounts in thousands, except per share data) | 2011 | 2010 | 2010 | 2009 | 2008 | Pro Forma | ||||||||||||||||

| STATEMENT OF OPERATIONS DATA |

||||||||||||||||||||||

| Operating revenues: |

||||||||||||||||||||||

| Race and sports book |

$ | 7,275 | $ | 3,541 | $ | 4,359 | $ | 612 | $ | — | ||||||||||||

| Mobile gaming |

1,348 | 55 | 5 | 161 | — | |||||||||||||||||

| Sports and odds subscriptions |

414 | 526 | 697 | 839 | 215 | |||||||||||||||||

| Financial fixed odds |

387 | 409 | 460 | — | — | |||||||||||||||||

| Slot route |

396 | 375 | 493 | 455 | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Total revenues |

9,820 | 4,906 | 6,014 | 2,067 | 215 | |||||||||||||||||

| Less: Promotional allowances |

(2,072 | ) | (224 | ) | (225 | ) | (554 | ) | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Net revenues |

7,748 | 4,682 | 5,789 | 1,513 | 215 | |||||||||||||||||

| Operating costs and expenses: |

||||||||||||||||||||||

| Costs of revenues |

13,652 | 8,585 | 13,871 | 7,242 | — | |||||||||||||||||

| Selling, general and administrative |

7,155 | 6,234 | 7,956 | 7,537 | 9,930 | |||||||||||||||||

| Depreciation and amortization |

3,562 | 3,113 | 4,384 | 2,918 | 543 | |||||||||||||||||

| Loss on disposal of assets |

— | — | 1,809 | 1,726 | 135 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Total operating costs and expenses |

24,369 | 17,932 | 28,020 | 19,423 | 10,608 | |||||||||||||||||

| Operating loss |

(16,621 | ) | (13,250 | ) | (22,231 | ) | (17,910 | ) | (10,393 | ) | ||||||||||||

| Other expenses: |

||||||||||||||||||||||

| Interest expense |

5,612 | 3,740 | 5,213 | 3,608 | 1,483 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Consolidated net loss |

(22,233 | ) | (16,990 | ) | (27,444 | ) | (21,518 | ) | (11,876 | ) | ||||||||||||

| Less: Net loss attributable to non-controlling interest in subsidiaries |

(29 | ) | (123 | ) | (147 | ) | (150 | ) | — | |||||||||||||

| Net loss attributable to Cantor G&W (Nevada), L.P. |

$ | (22,204 | ) | $ | (16,867 | ) | $ | (27,297 | ) | $ | (21,368 | ) | $ | (11,876 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| BALANCE SHEET DATA (for period ended) |

||||||||||||||||||||||

| Cash and cash equivalents |

19,302 | 15,656 | 16,012 | 11,177 | 43 | |||||||||||||||||

| Fixed assets and leasehold improvements, net |

34,579 | 22,075 | 26,602 | 20,056 | 13,215 | |||||||||||||||||

| Other assets |

12,512 | 4,526 | 4,290 | 3,685 | 2,997 | |||||||||||||||||

| Total assets |

66,393 | 42,257 | 46,904 | 34,918 | 16,255 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Total liabilities |

162,962 | 106,137 | 121,240 | 81,810 | 41,628 | |||||||||||||||||

| Total liabilities and partners’ deficit |

$ | 66,393 | $ | 42,257 | $ | 46,904 | $ | 34,918 | $ | 16,255 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

16

Table of Contents

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding whether to invest in our Class A common stock. If any of the events highlighted in the following risks actually occurs, our business, results of operations and financial condition would likely suffer. In such an event, the trading price of our Class A common stock would likely decline, and you could lose part or all of your investment in our Class A common stock.

Risks Related to Our Business

Our Class A common stock has no voting rights. Upon the closing of this offering, our Chairman of the Board will control 100% of our voting stock and all actions requiring the vote or consent of our stockholders, which may have an adverse effect on the trading price of our Class A common stock and may discourage a takeover.

Upon the closing of this offering, our Chairman of the Board, Howard W. Lutnick, directly or through the Trust controlled by him, will own all of our only class of voting securities, our Class B common stock. Accordingly, Mr. Lutnick will control the election of all members of our Board of Directors and all other actions requiring a vote of our stockholders. Holders of shares of Class A common stock will not have the right to vote for the election of directors or for any other action requiring a vote of stockholders, except in certain limited circumstances prescribed by applicable law. No assurances can be given that Mr. Lutnick and the Trust controlled by him will exercise their control of us in the same manner that a majority of holders of shares of Class A common stock would if they were entitled to vote on actions currently reserved exclusively for holders of shares of Class B common stock. In addition, the control of a majority of our voting stock by Mr. Lutnick and the Trust controlled by him will make it impossible for a third party to acquire voting control of us without Mr. Lutnick’s consent. This differential in voting rights between the Class A common stock and Class B common stock could adversely affect the market price for our Class A common stock.

We have a limited operating history on which to evaluate our business.

We have only a limited operating history, particularly outside the United States, upon which you can evaluate our prospects and future performance. Our business model is unproven, and the lack of meaningful historical financial data makes it difficult to evaluate our prospects. To the extent that we are able to implement our business strategy, our business could be subject to all of the problems that typically affect a business with a limited operating history, such as unanticipated expenses, capital shortfalls, delays in product development, possible cost overruns and regulatory and competitive uncertainties. Additional risks include our failure or inability to:

| • | provide products and services to our customers that are reliable and cost-effective; |

| • | increase awareness of our brand; |

| • | respond to technological developments or product and service offerings by competitors; and |

| • | respond to opportunities presented by changes in law and regulation. |

We may not be able to implement our business strategy successfully, or at all.

We have a history of cumulative net losses and we may continue to incur cumulative net losses and generate negative cash flow from operations in the future.

Since our inception, we have incurred substantial costs to develop our technology and infrastructure. As a result, from our inception through September 30, 2011, we have sustained a cumulative net loss of $96,243 on a consolidated basis. We may continue to incur losses and generate negative cash flow from operations in the future as we continue to develop our business and products and services and expand our brand recognition and customer base through increased marketing efforts.

17

Table of Contents

Our failure to retain and extend our existing contracts with our casino partners and to win new casino partners could have a material adverse effect upon our business, results of operations and financial condition.

We have entered into contracts to operate mobile gaming and race and sports books with our casino partners, including with the operating companies of the resorts known as The Venetian, The Palazzo, the M Resort, the Cosmopolitan of Las Vegas, the Tropicana Las Vegas, the Hard Rock Hotel & Casino and the Palms Casino Resort. While our contracts provide that we are the exclusive operator of mobile gaming and race and sports book wagering, they do not preclude the resorts from offering other forms of traditional or electronic gaming. Upon the expiration of its contracts with us, a gaming establishment may award a new mobile gaming or race and sports book contract through a competitive procurement process in which we may be unsuccessful in winning a new contract or be forced to pay higher rent or greater handle or profit participations to the gaming establishment in order to renew our contract, or may choose to operate such services itself. In addition, some of our contracts permit gaming establishments to terminate certain contracts at any time for our failure to perform and for other specified reasons, which termination, under certain circumstances, may result in our obligation to pay liquidated damages approximating the amount of our investment. The termination or failure to renew or extend one or more contracts, or the renewal or extension of one or more of our contracts on materially altered terms, could have a material adverse effect upon our business, results of operations and financial condition.

If we do not expand the use of our mobile gaming system, or if casino patrons do not use our mobile gaming system, our revenues and profitability will be adversely affected.

Mobile gaming is relatively new. The success of our business strategy depends, in part, on our ability to maintain and expand the number of our casino partners and casino patrons that use our mobile gaming system. We cannot assure you that we will be able to maintain and expand the number of our casino partners and casino patrons that use our mobile gaming system.

Our lack of revenue diversification may adversely affect our operating results and place us at a competitive disadvantage.

We have derived almost all of our total revenues to date from our race and sports book business. If we fail to diversify our product and service offerings, our operating results and future profitability will continue to depend primarily on our race and sports book business. Any event that reduces the amount of revenues that we receive from this business, including the loss of one or more of our significant casino partners, could cause our revenues to decline significantly and our business, results of operations and financial condition would suffer.

In addition, our dependence on revenues derived from our race and sports book business may place us at a competitive disadvantage. Some of our competitors in the gaming industry benefit from a more diversified product and service offering. As a result, lower gaming volume may impact our operating results and future profitability more significantly than our competitors.

Due to our current concentration of race and sports wagering among a small group of players, a loss of one or more of our significant players could harm our business, results of operations and financial condition.

A significant portion of our race and sports wagers is attributable to the play of a limited number of players. The loss or a reduction in the play of some or all of these customers could harm our business, results of operations and financial condition. In addition, unlike many race and sports books that place a cap on the amount of a wager (anywhere from $1,000 to $10,000) on a given event, we generally permit players to place large wagers. We believe that permitting our players to place large wagers on sporting events will increase volume; however, it also exposes us to potential losses, particularly if we are unable to effectively balance such wagers. Such losses may have a negative impact on cash flow and earnings in a particular quarter.

18

Table of Contents

Our success in the race and sports book business depends on our ability to continue to attract patrons, manage our risk and volatility and make capital investments in expansion of our operations and development of new technologies.

Our success in the race and sports book business depends on our ability to continue to attract patrons, including frequent bettors and bettors who make large wagers. drive volume through marketing, diversify the methods by which patrons may place wagers, offer competitive, unique and diversified wagering products, and manage risk and volatility. Our race and sports book revenues are based on hold percentage, meaning the ratio of the amount we win from patrons and the amount wagered. If we do not successfully manage our risk, including balancing wagers received on a specific event, which we are not always able to do, we could experience large losses, resulting in a low hold percentage. Without a sufficiently high volume of wagers, we will not earn sufficient revenues, even if we achieve an optimum hold percentage.

Moreover, we have traditionally made large capital investments to design and construct new or improved race and sports books at our casino partners. In some cases, we have the potential to recover some or all of that investment from mobile gaming revenues, but not from race and sports operations. If mobile gaming is unsuccessful, we are unlikely to recover that investment. The expansion of our race and sports product to other casino partners is likely also to require capital investment.

Our success in mobile gaming depends on our ability to develop technologies and products that appeal to players.

Our success in mobile gaming depends on continually developing and successfully marketing new technologies and games with strong and sustained player appeal. Our ability to do so depends on the preferences of gaming establishment players who play casino-style games and slots. The success in mobile gaming of our business strategy will depend to a large extent on broad market acceptance of our mobile gaming system among casinos and their players. Although we believe that a significant market exists for mobile gaming, the acceptance of our mobile gaming system by casinos and their players will depend on our ability to demonstrate the economic and other benefits of our products to casinos and their players becoming comfortable with using our mobile gaming system and account-based gaming and sports wagering systems, the attractiveness of the casino-style games that players can play using our mobile gaming system, the ease of use, the reliability of the hardware and software within our mobile gaming system, and the continued approval of our technology by gaming regulators.

A new game or updated mobile gaming system will be accepted by casino operators only if we can show that it is likely to produce more revenues and net wins to the casino operator than our competitors’ products. Some of our agreements include certain performance criteria such that, if not met, they may be terminated before the end of their stated term by our casino partners. If our current or future products do not achieve significant market acceptance, we may not recover our development, regulatory approval, installation or promotion costs at casino sites.

To increase awareness of our gaming products and services and brand, we may need to incur significant marketing expenses.

To successfully execute our business strategy, we must build awareness and understanding of our gaming products and services and brand. In order to build this awareness, our marketing efforts must succeed and we must provide high-quality products and services. These efforts may require us to incur significant expenses. We cannot assure you that our marketing efforts will be successful or that the allocation of funds to these marketing efforts will be the most effective use of those funds.

19

Table of Contents

We expect to spend substantial amounts on research and development, but these efforts may fail or lead to operational problems that could negatively impact our operations.

In order to compete effectively in an era of technological changes, we must continually enhance our existing products and services and develop, introduce and market new products and services. As a result, we expect, as needed, to continue to make a significant investment in the development of products and services, including, for example, new games, unique wagering types and enhanced player experience and payment procedures. Our development of products and services is dependent on factors such as assessing market trends and demands and obtaining requisite governmental approvals. Although we are pursuing and will continue to pursue development opportunities, we may fail to develop any new products or services or enhancements to existing products or services. Our ability to develop enhancements and improvements or new products or services may be limited by the intellectual property rights of our competitors or others. Even if new products or services are developed, these products or services may not prove to be commercially viable, or we may not be able to obtain the various gaming licenses and approvals necessary to distribute these products or provide these services to our customers. We may experience operational problems with such products after commercial introduction that could delay or defeat the ability of such products to generate revenues or operating profits. Future operational problems could increase our costs, delay our plans or adversely affect our reputation or our sales of other products, which, in turn, could materially adversely affect our prospects. We cannot predict which of the many possible future products will meet evolving industry standards and casino or player demands.

Our failure to properly manage our growth effectively could have a material adverse effect upon our business, results of operations and financial condition.

In order to execute our business strategy, we must grow significantly. This growth could place significant strain on our existing management team and other personnel, management systems and resources. For example, the deployment and installation of cabling, network and server infrastructure and other technology related to our mobile gaming and race and sports book operations, as well as the redesign or reconstruction of new race and sports book facilities, require significant design, production planning and quality assurance efforts. In particular, we will be required to seamlessly integrate our wireless infrastructure throughout various areas of large-scale casinos and resorts in order to create a secure and reliable mobile network with no perceived disruption to casino or resort function. These plans may strain our technology development and project management capabilities and resources. Significant growth will also require us to improve our financial, accounting and operational systems and controls. Expansion into new geographic areas would further strain our limited operational and marketing resources. We cannot assure you that we will properly manage our growth effectively, and failure to do so may have a material adverse effect upon our business, results of operations and financial condition.

Changes in technology may make our technology and products less profitable or obsolete and cause significant losses.

Future technological advances in the gaming market may result in the availability of new products or increase the efficiency of existing products. We may not be able to adapt to such technological changes. If a technology becomes available that is more cost-effective or creates a superior product, we may be unable to access such technology or its use may involve substantial capital expenditures that we may be unable to finance. Existing, proposed or as yet undeveloped technologies may render our technologies and products less viable, less profitable or obsolete. We may not have available the financial and other resources to compete effectively against companies possessing such technologies. If we were to fail to develop our product and service offerings to take advantage of technological developments, we may fall behind our competitors, and our business, results of operations and financial condition could suffer.

Our expansion opportunities to other states and jurisdictions are limited by law and regulation.

Mobile gaming and sports wagering, and to a lesser extent wagering on horse racing, are not currently permitted by law or regulation in many jurisdictions outside of Nevada. Such limitations could adversely affect our ability to expand our business model into other states or jurisdictions.

20

Table of Contents