Attached files

| file | filename |

|---|---|

| EX-4.4 - EXHIBIT 4.4 - PHOENIX ENERGY RESOURCE CORP | exhibit4-4.htm |

| EX-32.1 - EXHIBIT 32.1 - PHOENIX ENERGY RESOURCE CORP | exhibit32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - PHOENIX ENERGY RESOURCE CORP | exhibit31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - PHOENIX ENERGY RESOURCE CORP | exhibit32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - PHOENIX ENERGY RESOURCE CORP | exhibit31-2.htm |

| EX-10.27 - EXHIBIT 10.27 - PHOENIX ENERGY RESOURCE CORP | exhibit10-27.htm |

| EX-10.28 - EXHIBIT 10.28 - PHOENIX ENERGY RESOURCE CORP | exhibit10-28.htm |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM 10−K/A |

| (Amendment No. 1) |

(Mark One)

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File No. 000-52843

SILVAN INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 20-5408832 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Jun Yue Hua Ting, Building A

3rd Floor, Unit

-1

#58 Xin Hua Road

Guiyang, Guizhou 550002

People’s Republic of China

(Address of principal

executive offices)

(+86) 851-552-0951

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] | Smaller reporting company [ X ] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [ X ]

As of June 30, 2010 (the last business day of the registrant’s most recently completed second fiscal quarter), there were 2,090,000 shares of the registrant’s common stock issued and outstanding, of which 756,644 were held by non-affiliates of the registrant. The aggregate market value could not be determined because we only had nominal trading volume as of June 30, 2010.

There were a total of 30,000,000 shares of the registrant’s common stock outstanding as of April 12, 2011, of which 9,400,000, were held by non-affiliates of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K (this "Amendment") hereby amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2010, previously filed with the Securities and Exchange Commission (the "Commission’) on April 12, 2011 (the "Original Filing"). This Amendment is being filed in response to comments by the staff of Commission in connection with its review of the Original Filing.

This Amendment does not reflect events occurring after the filing of the Original Filing or modify or update those disclosures, including the exhibits to the Original Filing affected by subsequent events.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), this Amendment contains new certifications pursuant to Rules 13a-14 and 15d-14 under the Exchange Act and Section 302 of the Sarbanes-Oxley Act of 2002.

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A, “Risk Factors” included herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except where the context otherwise requires and for the purposes of this report only:

-

the “Company,” “we,” “us,” and “our” refer to the combined business of CNFI and its subsidiaries, Bingwu Forestry, Aosen Forestry and Silvan Flooring;

-

“CNFI” refers to China Forestry Industry Group, Inc., a Nevada corporation;

-

“Bingwu Forestry” refers to China Bingwu Forestry Group Limited, a Hong Kong company;

-

“Aosen Forestry” refers to Qian Xi Nan Aosen Forestry Company, Limited, a PRC company;

-

“Silvan Flooring” refers to Qian Xi Nan Silvan Flooring Company, Limited, a PRC company;

-

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China;

-

“PRC,” “China,” and “Chinese,” refer to the People's Republic of China;

-

“SEC” refers to the Securities and Exchange Commission;

-

“Exchange Act” refers the Securities Exchange Act of 1934, as amended;

-

“Securities Act” refers to the Securities Act of 1933, as amended;

-

“Renminbi” and “RMB” refer to the legal currency of China; and

-

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States.

PART I

ITEM 1. BUSINESS

Business Overview

Through our wholly-owned PRC operating subsidiaries, Aosen Forestry and Silvan Flooring, we produce and sell floor materials and related products to residential and commercial customers in China. Our product lines include laminate flooring and fiber floor boards that are manufactured in a variety of colors, dimensions and designs.

1

The primary raw material used in our products is wood, which we currently procure from third party suppliers. We expect that commencing in late 2015 or early 2016 we will be able to procure approximately 20% of our wood from our 2,250 hectares (approximately, 22.5 km2) of fir forest in Guizhou Province.

Our manufacturing facility in Qianxinan, Guizhou Province has an annual production capacity of six million square meters of laminate flooring and 75,000 cubic meters of industrial fiber boards. We are constructing two new manufacturing facilities next to our current facility to expand our laminate flooring production line and industrial fiber board production line. We expect this expansion will increase our overall capacity to 200,000 cubic meters of fiber boards and 12 million square meters of laminate floor. We are in the process of obtaining the land use rights for this new facility and, based on our current production schedule, we expect it to be completed by late-2012.

We market and sell our products through five branch offices and approximately several hundred specialty retail flooring stores, concentrated mostly in southwestern China. We also sell some of our products through eight retail stores which we refer to as “flagship” stores because they are generally larger and better equipped with samples, promotional material and product inventory, as compared to regular retail stores, and as a result, they are better promote our image and the quality of our products. We are also seeking commercial arrangements for the sale of our products through home supply stores, such as our recent agreement to sell our products at Red Star Macalline Furniture Mall’s Guiyang store. Red Star Macalline Furniture Mall is a large home products supply store chain in China, similar to Home Depot and Lowe’s in the U.S., with over 30 malls and stores across China. We believe that home supply stores are an important channel for the sale of building/home renovation materials and we plan to increase our efforts to work with more home supply stores in the future.

Our principal executive offices are located at Jun Yue Hua Ting, Building A, 3rd Floor, Unit -1, #58 Xin Hua Road, Guiyang, Guizhou 550002, People’s Republic of China. The telephone number at our principal executive office is +86 851-552-0951.

Our Corporate History and Background

We were organized under the laws of the State of Nevada on June 3, 2005, as Exotacar, Inc. On June 25, 2008, we changed our business focus to the development of energy resources, and changed our name to Phoenix Energy Resource Corporation. From June 25, 2008 through to the date of our reverse acquisition, discussed below, we were a shell company with minimal operations. On January 7, 2011, we changed our name to “China Forestry Industry Group, Inc.” to more accurately reflect our new business operations following the reverse acquisition.

Reverse Acquisition of Bingwu Forestry

On November 1, 2010, we completed a reverse acquisition transaction with Bingwu Forestry, and Ms. Ren Ping Tu, its sole shareholder and the wife of Mr. Yulu Bai, the founder of Bingwu Forestry’s PRC subsidiary, pursuant to which we acquired 100% of the issued and outstanding capital stock of Bingwu Forestry in exchange for 20,500,000 shares of our common stock, which constituted 68.33% of our issued and outstanding capital stock on a fully-diluted basis, as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Bingwu Forestry became our wholly-owned subsidiary and Ms. Tu became our controlling stockholder. For accounting purposes, the reverse acquisition transaction with Bingwu Forestry was treated as a reverse acquisition, with Bingwu Forestry as the acquirer and CNFI as the acquired party.

Upon closing of the reverse acquisition, on November 1, 2010, Mr. Rene Soullier, our sole director and officer, submitted a resignation letter, pursuant to which he resigned from all offices that he held, effective immediately, and from his position as our director that became effective on November 28, 2010, the tenth day following our mailing of an information statement complying with the requirements of Section 14f-1 of the Exchange Act, or the Information Statement, to our stockholders. On the same date, our board of directors increased its size from one to three members and appointed Messrs. Yulu Bai, Yudong Ji and Yi Zeng to fill the vacancies created by such increase and by Mr. Soullier’s resignation. Mr. Bai’s appointment became effective upon the closing of the reverse acquisition on November 1, 2010, while the remaining appointments became effective on November 28, 2010. In addition, our board of directors appointed Mr. Bai to serve as our Chief Executive Officer, Mr. Jiyong He to serve as our Chief Financial Officer, Mr. Fangping Peng to serve as our Chief Operating Officer and Mr. Dongsheng Tan to serve as our Chief Marketing Officer, effective immediately.

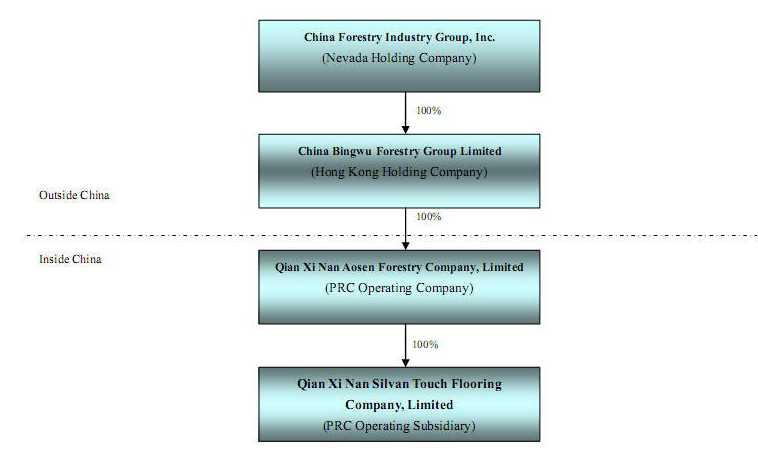

As a result of the reverse acquisition, our business operations consist of the business and operations of Bingwu Forestry and its PRC subsidiaries. Bingwu Forestry serves as a holding company that owns 100% of Aosen Forestry, which in turn owns 100% of Silvan Flooring.

2

Background and History of Bingwu Forestry and Aosen Forestry

Bingwu Forestry was incorporated in Hong Kong as a private limited company on April 9, 2010 by Ms. Ren Ping Tu, Mr. Bai’s wife and a Canadian citizen. As a PRC citizen, Mr. Bai would have been prohibited under PRC law from incorporating Bingwu Forestry in Hong Kong, acquiring Aosen Forestry and establishing Bingwu Forestry as a foreign holding company over Aosen Forestry. Mr. Bai has the right to acquire control of Bingwu Forestry after one year, pursuant to an option agreement discussed below. Bingwu Forestry has no active business operations or assets other than its 100% ownership of Aosen Forestry.

Aosen Forestry was established in the PRC on November 22, 2004, for the primary purpose of engaging in the manufacturing and sale of fiber boards. On May 18, 2010, pursuant to a restructuring plan intended to ensure compliance with regulatory requirements of the PRC, the original shareholders of Aosen Forestry, including our chairman and chief executive officer, Mr. Bai, entered into an equity transfer agreement, or the Equity Transfer Agreement, with Bingwu Forestry, pursuant to which the shareholders transferred all of their equity interests in Aosen Forestry to Bingwu Forestry for a purchase price of $2,488,471. As a result, Aosen Forestry became the 100% owner of Bingwu Forestry.

On May 17, 2010, Mr. Bai entered into an option agreement, or the Option Agreement, with Ms. Ren Ping Tu, pursuant to which Mr. Bai was granted an option to acquire Ms. Tu’s shares in Bingwu Forestry, including any shares delivered to Ms. Tu in exchange for her ordinary shares, in a future merger, reorganization, consolidation, sale or other disposition of the Bingwu Forestry’s securities, for an exercise price of $2,500,000. Mr. Bai may exercise this option, in whole but not in part, during the period commencing on the 365th day following of the date of the option agreement and ending on the second anniversary of the date thereof. After Mr. Bai exercises this option, he will acquire all of the shares of our common stock currently owned by Ms. Tu and therefore become our controlling stockholder. His acquisition of our equity interest is required to be registered with the competent administration of industry and commerce authorities, or AIC, in Beijing. Mr. Bai will also be required to make filings with the Beijing SAFE, to register the Company and its non-PRC subsidiaries to qualify them as SPVs, pursuant to Circular 75.

Establishment and Acquisition of Silvan Flooring

Silvan Flooring was established in the PRC on October 22, 2007, for the purpose of engaging in the manufacturing and sale of wood flooring, furniture and decorations. On October 22, 2007, Aosen Forestry established Silvan Flooring as a 55% majority-owned joint venture with Guizhou Silvan Touch Wooden Co., Limited, or GST, the 45% minority holder, which was 94.3% owned and controlled at the time by Mr. Yulu Bai, our Chief Executive Officer and Aosen Forestry’s General Manager at the time. On May 8, 2009, Aosen Forestry acquired GST’s minority interest in Silvan Flooring from GST and Silvan Flooring thereby became Aosen Forestry’s wholly-owned subsidiary. GST no longer holds any equity interest in Silvan Flooring. On May 28, 2010, Mr. Bai sold his entire ownership interest in GST and no longer holds any equity interest in GST.

In connection with the acquisition of Silvan Flooring, Silvan Flooring and GST entered into a trademark transfer agreement and a trademark licensing agreement, on November 18, 2009 and November 19, 2009, respectively. Pursuant to these two agreements, GST transferred its “Silvan Touch” trademark (registered trademark number 1182064) to Silvan Flooring which then licensed it back to GST to be used in connection with its distribution of our “Silvan Touch” products. There was no consideration paid in connection with the transfer and licensing. The assignment of the trademark has received government approval. As a result of the acquisition of 100% equity interests in Aosen Froestry by Bingwu Forestry on May 18, 2010, we own the “Silvan Trouch” trademark.

Assumption and Conversion of Outstanding Notes and Warrant

At the time of the reverse acquisition, Bingwu Forestry had two outstanding non-interest-bearing convertible notes in the aggregate principal amount of $4,800,000, convertible into an aggregate of 4,000,000 shares of the surviving company upon the consummation of a fundamental transaction, such as the reverse acquisition. These convertible notes were issued to PRC investors who provided Bingwu Forestry with valuable working capital during the period leading up to the reverse acquisition.

The first note, in the principal amount of $2,400,000, was issued to Horoy International Holding Limited, or Horoy, on July 23, 2010, and the second note, also in the principal amount of $2,400,000, was issued to Goldenbridge Investment Holdings Limited, or Goldenbridge, on September 7, 2010. Both notes were due and payable on or before November 15, 2010, and provided that, if at any time prior to their maturity date the Company is party to a reorganization or business combination transaction where the Company is not the surviving entity, the principal balance of such note would be immediately convertible into shares of common stock of the surviving entity at the option of the note holder at a rate of $1.20 per share. Neither the note holders, nor their beneficial owners, are affiliates of Bingwu Forestry or the Company.

3

We assumed these notes in connection with the reverse acquisition, and immediately thereafter, each of Horoy and Goldenbridge elected to convert their respective notes into an aggregate of 4,000,000 shares of our common stock.

Our Corporate Structure

All of our business operations are conducted through our PRC operating subsidiaries, Aosen Forestry and Silvan Flooring. The chart below presents our current corporate structure.

Our Industry

According to a PRC flooring industry publication entitled “China Wood Flooring Industry Status and Trends” (available at http://hi.baidu.com/xlove813/blog/item/03c675f0d81a6ac67931aadf.html), the size of China’s laminate flooring industry is estimated to be approximately $4.1 billion per year, with approximately 370 million square meters of wood flooring sold each year at an average sale price of $11 per square meter. We believe that the growth in our industry centers around an urbanization trend in China, where it is estimated that approximately 15 to 20 million people are migrating to urban areas each year. This migration has created approximately 500 million newly relocated urban dwellers and has increased demand for urban residential properties. We believe that many urban residential property owners will prefer laminate over more expensive hard wood due to cost concerns. Based on the “2010 China Wood Flooring Market Planning Report” published in April 2010 by 360BaoGao.com, laminate flooring accounted for 57% of wood-based flooring choices, with hardwood flooring and multilayer flooring accounting for most of the remaining market demand.

We believe that China lacks a significant supply of ancient forests to supply hardwood materials, and government policy has heavily restricted deforestation activities since 1998. Deforestation restrictions have been a part of the PRC government’s successive 7th, 8th, 9th, 10th and 11th 5-Year Plans since 1986, however, such policies were not strictly enforced until 1998, when the government determined that a main cause of the massive Yangtze flooding was deforestation around the upper Yangtze. During 2011, we plan to outsource the manufacturing of our hardwood flooring products and to sell such products through our sales network. We have no immediate plans to internally produce hardwood flooring products in order to mitigate raw material supply risk.

4

Our Growth Strategy

We believe that China's growing urban residential housing market creates a significant growth opportunity on which we intend to capitalize by utilizing the following strategies:

- Significantly expand our flagship stores and our sales network during the next two years;

- Enhance brand awareness through strategic marketing campaigns, initially focusing in southwestern China;

- Increase fiber board production capacity of our current facility from 75,000 cubic meters to 200,000 cubic meters and double our laminate floor production capacity to 12 million square meters in the next 18 months;

- Cultivate timberland resources in Guizhou province to provide sufficient raw material for our growth plans throughout the next five years; and

- Acquire forestry assets and leading regional flooring companies in key regions in China to establish a nation-wide presence.

Our Products

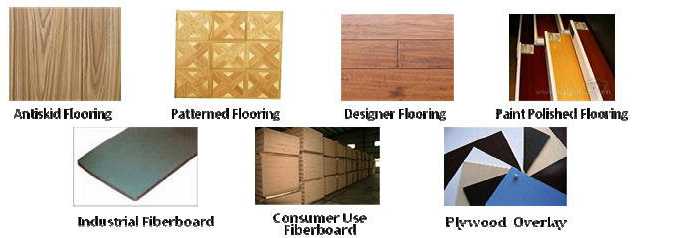

Laminate Flooring - We produce laminate flooring products in a variety of types, designs, and colors and often with antiskid, patterned, designer, and paint polished features. We sell those products to wholesalers, retailers and contractors. We also provide installation services.

Fiber Boards - We manufacture high density industrial fiber boards and plywood overlays which sell mainly to industrial customers. Our fiber board products come in a variety of wood and designs as shown below.

For the fiscal year ended December 31, 2010, 69.4% of our revenue was generated from the sale of laminated flooring products and 30.6% was generated from the sale of fiber boards.

We believe that consumers choose our products based on quality, service, convenience and brand recognition. Based on our internal research on consumers’ product selection behaviors and available information from publicly traded competitors such as PowerDekor Group Ltd., or PowerDekor, and Shengda Forestry (Group) Co., Ltd., or SDF, we believe that our “Silvan Touch” brand is one of the top flooring brands in Guizhou province and ranks among the widely recognized brands in Southwestern China.

We also intend to develop a business segment focused on other forest-based products such as wood furniture, decorative wood products, and environmentally-friendly wood cabins that are intended to be used within natural reserves as a premium alternative to traditional camping equipment.

5

Production

We produce flooring products at our manufacturing facility which is located in Qianxinan, Guizhou province and has annual production capacity of six million square meters of laminate flooring and 75,000 cubic meters of industrial fiber boards. We are constructing new manufacturing facility that we expect will increase our overall capacity to 200,000 cubic meters of fiber boards and 12 million square meters of laminate floor. We are in the process of obtaining the land use rights for this new facility and, based on our current production schedule, we expect it to be completed by late 2012.

Production of our fiber boards involves the following multistep process: raw material sourcing, wood chipping and waxing, hot abrasion and adhesives application, air drying, weight and density testing, molding, cooling, hot pressing, transporting to processing stations, cutting, pressing, polishing, trimming, quality examinations and delivery.

Production of our laminate flooring involves the following process: sourcing fiber board, raw material cutting and drying, glue application, hot pressing, cooling, transporting to processing stations, cutting, pressing, polishing, weathering, surface material selection and application, trimming, quality examinations and delivery.

We strive to maintain high product standards and enforce strict quality controls in our production facility. Our products are tested individually, segmented into different quality tiers and priced according to the tiers. We use a combination of ISO and China National Standards to manage our business. We have used the ISO-2001 system since January 2008 to manage our production flow and we recently upgraded to the ISO-2009 system for a number of production procedures. We conduct standard quality testing on all of our products prior to sales.

We hold several international product quality certifications, including: the European Union CE Certification, the International Production Standard Certification. In addition, we hold the ISO14001:2004 (International Environmental Management System), ISO10012:2003 (International Measurement Management System), ISO 9001:2000 (International Quality Management System) certifications. We are also a Standing Member of the National Forestry Industry Association, Flooring Committee, and of the Director of China Timber Distribution Association, Flooring Committee.

We strive to minimize waste of natural resources and use by-products, such as branches and other wood scraps, in our manufacturing operations. We also work continuously on improving energy efficiency in our production process. For example, we recently improved our thermal oil furnace to virtually eliminate dust and sulphur dioxide emission, and keep dust and sulphur dioxide emission below the GB13271-2001 emission standard requirements during abnormal operation conditions, which are operating conditions when the machinery does not operate fully as designed or when raw material quality does not fully satisfy requirements.

GB13271—2001 is China’s national "Boiler Gas Emission Standard" issued on November 12, 2001 by the Ministry of Environmental Protection and the General Administration of Quality Supervision, Inspection and Quarantine, and effective since January 1, 2002. This standard sets the maximum allowable emission limits of flue dust, flue gas blackness and SO2 of coal-fueled boilers with capacity <0.7MW(1t/h) and the maximum allowable emission limits of flue dust, flue gas blackness, SO2 and NOx of oil-burning and gas-burning boilers. We satisfy the requirements from requirements from section type II of GB13271—2001, which limits powder level <200 mg / cubic meter, SO2 level <900 mg / cubic meter. During abnormal operating conditions, our production system keeps the powder level <188 mg / cubic meter and SO2 level < 800 mg / cubic meter, both within the requirement of GB13271—2001.

Raw Materials and Suppliers

The major raw materials for our laminate flooring and fiber boards are hardwood lumber, branches, and other wood byproducts. We also purchase significant amounts of packaging materials, resins, stains, veneers and chemicals, and consume significant amounts of electricity, natural gas and water.

We currently purchase raw materials essential to our business from numerous suppliers, but in the future, we expect to utilize raw materials from our 2,250 hectares (approximately, 22.5 km2) of fir trees for which we hold land use rights. See “Properties” below for a description of our land use rights. We acquired a land use right over this piece of land with the fir trees that had already planted on it. We expect to start harvesting these trees in the fourth quarter of 2012. After harvesting these fir trees, we plan to cultivate eucalyptus trees on this piece of land. The general process for cultivating and harvesting the fir trees and eucalyptus trees includes planting, initial watering, general inspections, pest control, fertilization, protection against theft and vandals, and harvesting.

6

Pursuant to the joint management agreements discussed below, we intend to plant trees on a land of 43.2 km2 in 2011 for our future raw materials use. Our long-term goal is to ultimately develop and have access to raw materials from approximately 333.5 km2 of forestry land using this joint-management approach.

We procure most of our production chemicals, such as paraffin, formaldehyde and accelerant, from Guizhou Shuanghe Industrial & Trading Co., Ltd.

In general, adequate supplies of raw materials are available from numerous suppliers and we are not dependent on any single supplier. Availability can change based on environmental conditions, laws and regulations, shifts in demand, transportation disruption and other events that affect us and our suppliers which often are outside of our control.

Customers

We sell our flooring products primarily to private residential customers and various commercial, educational and government entities. Our residential sales are primarily through specialty stores and our flagship stores. Our commercial sales of industrial fiber boards and flooring products are usually through our direct sales force. We are also seeking commercial arrangements for the sale of our products through home supply stores, such as our recent agreement to sell our products at Red Star Macalline Furniture Mall’s Guiyang store. We believe that home supply stores are an important channel for the sale of building/home renovation materials and we plan to increase our efforts to work with more home supply stores in the future.

Below is a list of our top customers for the fiscal year ended December 31, 2010:

| Company | Region | % of total sales | |

| 1. | Guizhou Shuanghe Industrial & Trading Co., Ltd | Guizhou | 47.95% |

| 2. | Kunming Hing Hong Building Materials Co., Ltd | Kunming | 25.75% |

| 3. | GST | Guizhou | 4.02 |

| Total | 77.72% |

For the year ended December 31, 2010, sales revenues generated from Guizhou Shuanghe Industrial & Trading Co., Ltd, Kunming Hing Hong Building Materials Co., Ltd, and GST amounted to 77.72% of total sales revenues, and sales to Guizhou Shuanghe Industrial & Trading Co., Ltd., our largest single customer, amounted to 47.95% of total sales revenues during the period. We do not enter into long-term contracts with these customers and therefore cannot be certain that sales to these customers will continue. The loss of our largest customers would likely have a material negative impact on our sales revenues and business.

During the fiscal year ended December 31, 2009, 63.27% of our sales were to GST, a company formerly owned and controlled by Mr. Yulu Bai, our Chairman and Chief Executive Officer. GST procures industrial fiber boards from us for the production of laminate flooring. Through March 31, 2010, we sold approximately $1.5 million in fiber board products to GST, after which time GST ceased to produce laminate flooring and no longer procured flooring products directly from us. However, we continue to provide our flooring products via commercial arrangements with five stores controlled by GST and its affiliates. On September 29, 2009, Mr. Bai disposed of his interest in GST to a third party purchaser.

During the fiscal year ended December 31, 2010, only 4.02% of our sales were to GST, Guizhou Shuanghe Industrial & Trading Co., Ltd became our largest customer for the year ended December 31, 2010.

Competition

Competition in the flooring industry is based primarily on product quality, pricing, and perceived brand quality. Currently the flooring market is very fragmented with dozens of companies of various sizes. We believe that no single company in China holds more than 15% of the market share in the flooring industry. Competition tends to be regionally concentrated due to high transportation and distribution costs. Our primary competition comes from domestic companies such as PowerDekor, SDF, and Der International Flooring Ltd, or Der.

The quality of our products is similar to most of our competitors, however, some of our competitors charge higher prices due to a higher perceived brand value. Other competitors focus more heavily to consumers and are present in larger numbers of distribution outlets.

7

We believe that having our own regenerative source of raw materials will afford us a competitive advantage in terms of securing long-term raw materials, maintaining reasonable margins, and ensuring continued production. A key business risk in the wood-based flooring industry is the continued availability of reasonably priced raw materials without which flooring companies could experience business interruptions. As a result, we believe that our control of a significant portion of our own future raw material supply via our land use rights to forestry land is a key advantage in our future operations and growth. In addition, we will practice reforestation by planting of fast growing eucalyptus trees on our forest land to replenish raw material sources, which we expect will lead to constant forest regeneration. These rapid growth trees could be harvested 5 years after the initial planting by cutting the trunks and leaving the roots in place. The trees usually grow again from the roots and may be harvested within another 5 years. With this method we will be able to plant such trees at 10-year intervals and harvest twice during each 10-year period. Due to recent droughts in southwestern China, our original tree-planting schedule on our own regenerative forest land has been delayed to date, but we expect to commence planting during 2011. Barring any unforeseen difficulties with the growth rate of our crop, we expect to commence harvesting raw materials from this land by late 2015 or early 2016. We expect to procure approximately 20% of our raw materials needs during the first quarter of harvesting from our regenerative forest land.

We have entered into joint management agreements with 11 villages representing a total of 408 local farmers to look after and maintain the forest land covered under these agreements. All pieces of the land are located at Zhenfeng County, Guizhou Province. According to the agreements, which have a 30-year term, the villages continue to hold the land use rights and have the obligations to maintain the forest land, including planting, cultivation, pest control, fertilization and other maintenance activities. Under the joint management agreements, the first stage of cultivation of the land includes planting trees on a piece of land of 43.2 km2. Due to recent droughts in southwestern China, this cultivation has been delayed to date, but we expect to commence planting by the end of 2011, and to harvest trees from this land by early 2016. In exchange, we agree to provide the villages with technological guidance, as well as with the funding to purchase young trees and fertilizers as necessary for maintaining and reforesting the land, and to cover expenses related to harvesting, transportation, taxes and other costs of sale. In addition, we will receive 80% of the profits generated from the forest land and the villages will retain the remaining 20%. Either party may sue the other party for breach of contract if the other party fails to fulfill its obligations according to the agreements. The agreements are not required to be registered with any PRC governmental authority. Since we have not yet planted or harvested from this forest land, only minimal costs have been incurred by, and no revenues have resulted from, these agreements. To date we have only incurred approximately RMB 80,000 ($12,139.61) in such expenses, which we have currently recorded under General and administration expenses. We plan to record 100% of the revenue generated from the sale of raw materials procured from such land upon the sale of such raw materials. Expenses related to plantation, management and harvesting, and the 20% pro-rata share of the profits deliverable to our local partners pursuant to the agreements would be recorded as the cost of goods sold.

We believe that the quality of our product and service offerings and our access to regenerative forests distinguish us from many of our competitors and provide us with a competitive edge in the market for wood flooring. In addition, we ensure the highest level of service and customer satisfaction by providing customers with our own professionally trained installers instead of third-party contractors. We believe that our focus on quality and service also positions us to successfully bid on commercial, governmental, and residential projects.

Sales and Marketing

We market our products at five branch offices and eight flagship stores, and through approximately 504 contracted flooring specialty retail stores that are concentrated mostly in southwestern China. Of the stores, 266 are located in Guizhou province, 136 in Yunnan province, 75 in the Guangxi Zhuang Autonomous Region and 27 in Sichuan province. All of our branch offices have been registered with appropriated local government authorities. We plan to gradually expand our presence beyond southwest China and are working to develop the central China (Henan province) and northwestern China (Shaanxi province) markets. We are also evaluating the Southeast Asian, Australian, and North American markets for future expansion opportunities.

We are also in process of negotiating commercial arrangements with home supply stores to market our products. For instance, we have entered into an agreement to sell our products at Red Star Macalline Furniture Mall’s Guiyang store, a large home products supply store chain in China with over 30 malls and stores across China. Large home supply stores, similar to Home Depot and Lowe’s in the US, are an important channel for building/home renovation material sales. We plan to increase our efforts to work with more home supply stores in the future but cannot assure you that our negotiations will result in any revenue generating agreement.

8

Over 80% of our total flooring sales are made through distributors who are critical to our overall success. To encourage this trend, we have created a standardized approach to quickly recruit and train distributors on how to effectively sell our products. In addition, we provide ongoing training sessions to continuously develop our distributors’ capabilities to ensure long term success.

Furthermore, we have established a comprehensive reward system in which distributors can earn monetary incentives if they achieve and exceed sales targets. We also provide marketing funds to distributors to help generate consumer interest and promote brand awareness. All marketing activities are monitored regionally to optimize marketing fund allocation and avoid redundancy in coverage. Due to our targeted focus on distributor support, we believe that we have one of the lower distributor turnover ratios in the industry at 5% a year.

Research and Development

We do not have a research and development center or a dedicated research and development team. Approximately 20% of our employees are members of our technical staff, who focus on maintaining and improving the production procedures and on developing new products.

Intellectual Property

Aosen Forestry currently holds the following utility model patents from China’s state intellectual property office:

| Description | Patent Number | Authorization Date |

| An environment friendly base molding | ZL 2009 2 0314290.1 | August 4, 2010 |

| A type of laminate flooring | ZL 2009 2 0314294.X | August 4, 2010 |

| A type of anti-skid laminate flooring | ZL 2009 2 0314289.9 | August 4, 2010 |

In connection with the acquisition of Silvan Flooring, Aosen Forestry and GST entered into a licensing and distribution agreement, dated November 18, 2009, pursuant to which GST transferred its “Silvan Touch” trademark (registered trademark number 1182064) to Aosen Forestry which then licensed it back to GST to be used in connection with its distribution of our “Silvan Touch” products. The assignment of the trademark has received government approval.

We rely on trade secret protection and non-disclosure agreements to protect our proprietary information and know-how. Our management and key members of our technical staff have entered into non-disclosure agreements in which they acknowledge that all inventions, designs, trade secrets, works of authorship, developments and other processes generated by them on our behalf are our property, and assigning to us any ownership rights that they may claim in those works. It may be possible for third parties to obtain and use, without our consent, intellectual property that we own or are licensed to use. Unauthorized use of our intellectual property by third parties, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business. See Item 1A, “Risk factors—Risks Related to Our Business—Our inability to protect our intellectual property may prevent us from successfully marketing our products and competing effectively.”

Employees

As of December 31, 2010, we employed a total of 228 full-time employees. The following table sets forth the number of our employees by function.

| Function | Number of Employees |

| Management, Financial, and Administrative Office | 36 |

| Production | 60 |

| Sales and Marketing | 18 |

| Technical Staff | 45 |

| Security* | 36 |

| Cafeteria | 16 |

| Logistics | 14 |

| Housing Management | 3 |

| Total | 228 |

9

* We store certain amounts of raw materials, such as wood and wood byproducts, along with work-in-progress, in both indoor and outdoor warehouses. Such stored raw materials and work-in-progress require round-the-clock security to guard against hazards such as fire. We also provide round-the-clock security at our employee dormitories for the safety of our resident employees. The foregoing uses of security personnel are usual and customary in our industry in China.

We maintain a satisfactory working relationship with our employees, and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations. None of our employees is represented by a labor union.

We are required by Chinese law to make monthly contributions to a state pension plan organized by Chinese municipal and provincial governments to cover employees in China with various types of social insurance. We have purchased such social insurance for some of our employees and for those whom we have not purchased social insurance, the premium has been added into their salary so that they can purchase social insurance in their individual capacity at the location of their recorded residences. Failure to make such social security contribution is subject to a late payment fee equal to 2% of the unpaid amount each day and we may be subject to a fine of up to RMB 10,000. We believe that we are in material compliance with the relevant PRC laws.

Environmental Compliance

As we conduct our manufacturing activities in China, we are subject to the requirements of PRC environmental laws and regulations on air emission, waste water discharge, solid waste and noise. We aim to comply with environmental laws and regulations. The local environmental protection authority issued to us a “Pollutant Discharge Permit” and requested that the company conduct an annual audit of its compliance with the national standards. We are not subject to any admonitions, penalties, investigations or inquiries imposed by the environmental regulators, nor are we subject to any claims or legal proceedings to which we are named as defendant for violation of any environmental law or regulation. We do not have any reasonable basis to believe that there is any threatened claim, action or legal proceedings against us that would have a material adverse effect on our business, financial condition or results of operations.

PRC Government Regulations

General Regulation of Business

Because our primary operating subsidiaries are located in China, we are subject to China’s national and local laws. This section summarizes the major PRC regulations relating to our business. Among others, we are subject to regulations related to a foreign invested enterprise, or FIE, which refers to an enterprise whose equity interest is held by a non-PRC shareholder. There are three main PRC regulations governing FIEs in China: the Laws of China-Foreign Equity Joint Ventures, the Laws of China-Foreign Cooperative Joint Ventures and the Laws of Wholly Foreign Owned Enterprises. As Aosen Forestry is the wholly owned subsidiary of Bingwu Forestry, only the Laws of Wholly Foreign Owned Enterprises, or the WFOE Law, applies to our business. To comply with the WFOE Law, Aosen Forestry needs to (a) obtain an approval certificate from the local Ministry of Commerce, or MOFCOM, in addition to a business license, (b) make a capital contribution in accordance with the MOFCOM approved schedule, and (c) register with the PRC local foreign exchange bureau and open a foreign exchange account. It will also need to obtain approvals and make filings for transferring funds in and out of China. On June 18, 2010, Aosen Forestry obtained the “Certificate of Approval with Foreign, Taiwan, Hong Kong, and Macau Investment” issued by the Guizhou Province MOFCOM and a new business license was issued to Aosen Forestry on July 12, 2010. Aosen Forestry has a registered capital of RMB 100 million. The acquisition price of RMB 16,963,000 (approximately $2.48 million) was all paid. The company also opened a foreign exchange account with the approval of the PRC local foreign exchange bureau on August 4, 2010. We believe that we have been in compliance with these requirements.

Permits and Certificates

We operate in an industry with mature regulatory standards. In order to continue our operations, we are required to maintain the following manufacturing and operational licenses and certifications:

10

|

Permit/Certification |

Issuing Authority |

Subsidiary that |

Effective Date |

Expiration/Term |

|

|

|

maintain the |

|

|

|

|

license/certification |

|

|

|

|

National Industrial Product Production |

PRC State Administration for |

Aosen Forestry |

September 29, 2007 |

Expires on September 28, 2012 |

|

Permit |

Quality Supervision and Inspection and Quarantine |

Silvan Flooring |

September 8, 2010 |

Expires on September 7, 2015 |

|

Quality Management System Authentication Certificate (consistency with ISO9001:2000 and GB/T19001-2000) |

China Quality Authentication Center |

Aosen Forestry |

March 18, 2008 |

Expired on March 17, 2011 (renewal pending) |

|

Measurement Management System Authentication Certificate (consistency with GB/T19022-2003 and ISO10012-2003) |

Zhongqi Measurement System Authentication Center |

Aosen Forestry |

July 8, 2008 |

Expires on July 7, 2012 |

Environmental Regulations

The major environmental regulations applicable to us include the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Air Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution. We hold the following environmental licenses and certifications:

|

Permit/Certification |

Issuing Authority |

Subsidiary that maintain the license/certification |

Effective Date |

Expiration/Term |

|

Environment Management System Authentication Certificate |

China Quality Authentication Center (consistency with the standards of ISO14001:2004 and GB/T24001-2004) |

Aosen Forestry |

April 3, 2008 |

Expired on April 2, 2011, (renewal pending) |

|

Emission Certification |

Guizhou Dingxiao Economic Development District Environment Protection Agency (EPA) |

Aosen Forestry |

May 24, 2010 |

May 24, 2013 |

|

Radiation Safety Certification |

Environment Protection Agency (EPA) of Guizhou province |

Aosen Forestry |

January 8, 2007 |

January 8, 2012 |

Patent Protection in China

The PRC's intellectual property protection regime is consistent with those of other modern industrialized countries. The PRC has domestic laws for the protection of rights in copyrights, patents, trademarks and trade secrets. The PRC is also a signatory to most of the world's major intellectual property conventions, including:

- Convention establishing the World Intellectual Property Organization (WIPO Convention) (June 4, 1980);

- Paris Convention for the Protection of Industrial Property (March 19, 1985);

- Patent Cooperation Treaty (January 1, 1994); and

- The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPs) (November 11, 2001).

11

Patents in the PRC are governed by the China Patent Law and its Implementing Regulations, each of which went into effect in 1985. Amended versions of the China Patent Law and its Implementing Regulations came into effect in 2001 and 2003, respectively.

The PRC is signatory to the Paris Convention for the Protection of Industrial Property, in accordance with which any person who has duly filed an application for a patent in one signatory country shall enjoy, for the purposes of filing in the other countries, a right of priority during the period fixed in the convention (12 months for inventions and utility models, and 6 months for industrial designs).

Implementation of PRC intellectual property-related laws has historically been lacking, primarily because of ambiguities in PRC laws and difficulties in enforcement. Accordingly, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other developed countries. See Item 1A, “Risk Factors — Risks Related to Our Business —Our inability to protect our intellectual property may prevent us from successfully marketing our products and competing effectively.”

Taxation

On March 16, 2007, the National People's Congress of China passed a new Enterprise Income Tax Law, or EIT Law, and on November 28, 2007, the State Council of China passed its implementing rules, which took effect on January 1, 2008.

Before the implementation of the EIT Law, FIEs established in the PRC, unless granted preferential tax treatments by the PRC government, were generally subject to an earned income tax, or EIT, rate of 33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The EIT Law and its implementing rules impose a unified EIT of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions. Despite these changes, the EIT Law gives FIEs established before March 16, 2007, or Old FIEs, a five-year grandfather period during which they can continue to enjoy their existing preferential tax treatments. During this five-year grandfather period, the Old FIEs which enjoyed tax rates lower than 25% under the original EIT law will be subject to gradually increased EIT rates over a 5-year period until their tax rate reaches 25%. In addition, the Old FIEs that are eligible for other preferential tax treatments by the PRC government under the original EIT law are allowed to continue enjoying their preference until these preferential treatment periods expire. The discontinuation of any such special or preferential tax treatment or other incentives would have an adverse effect on any organization's business, fiscal condition and current operations in China.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization's global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see Item 1A, “Risk Factors – Risks Related to Doing Business in China – Under the New Enterprise Income Tax Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

In addition, the EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises' shareholder has a tax treaty with China that provides for a different withholding arrangement. Aosen Forestry and Silvan Flooring are considered FIEs and are directly held by our subsidiary in Hong Kong. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Bingwu Forestry by Aosen Forestry and Silvan Flooring, but this treatment will depend on our status as a nonresident enterprise.

Pursuant to the Provisional Regulation of China on Value Added Tax and its implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay value added tax, or VAT, at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Further, when exporting goods, the exporter is entitled to some or all of the refund of VAT that it has already paid or borne.

12

Foreign Currency Exchange

All of our sales revenue and expenses are denominated in RMB. Under the PRC foreign currency exchange regulations applicable to us, RMB is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Currently, our PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, employee salaries (even if employees are based outside of China), and payment for equipment purchases outside of China, without the approval of the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, by complying with certain procedural requirements. Conversion of RMB for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of SAFE. In particular, if our PRC operating subsidiaries borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including MOFCOM, or their respective local branches. These limitations could affect our PRC operating subsidiaries’ ability to obtain foreign exchange through debt or equity financing. In the event of a liquidation of our PRC subsidiaries, SAFE approval is required before the remaining proceeds can be expatriated from China.

Dividend Distributions

Substantially all of our sales are earned by our PRC subsidiaries. However, PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes, such as setting off the accumulated losses, enterprise expansion or increasing the registered capital and are not distributable as cash dividends.

During 2008 and 2009, we reinvested our available capital on the development of the Company and did not distribute any dividends to shareholders during this period. We plan to keep reinvesting any available capital in the Company for the foreseeable future. As a result, we did not allocate the required 10% of our after-tax profit to the statutory general reserve fund and did not hold shareholder meetings to distribute this fund. We may be ordered by the local government to fund the statutory general reserve fund by making up the balance from previous years and may be subject to a fine up to RMB 200,000. We plan to allocate the appropriate amount to the general statutory fund as soon as our working capital situation allows.

Circular 75

In October 2005, SAFE issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligation.

In the case of an SPV which was established, and which acquired a related domestic company or assets, before the implementation date of Circular 75, a retroactive SAFE registration was required to have been completed. Failure to comply with the requirements of Circular 75 may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

As we stated under Item 1A, “Risk factors—Risks Related to Doing Business in China—Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into PRC subsidiaries, limit our PRC subsidiary's ability to distribute profits to us or otherwise materially adversely affect us,” we have asked our stockholders, who are PRC residents as defined in Circular 75, to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiaries. However, many of the terms and provisions in Circular 75 remain unclear and implementation by central SAFE and local SAFE branches of Circular 75 have been inconsistent since their adoption. Therefore, we cannot predict how Circular 75 will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries' ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our PRC resident beneficial holders.

13

Mergers and Acquisitions

On August 8, 2006, six PRC regulatory agencies promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the 2006 M&A Rule, which became effective on September 8, 2006, and was amended in 2009. According to the 2006 M&A Rule, a “Round-trip Investment” is defined as having taken place when a PRC business that is owned by PRC individual(s) is sold to a non-PRC entity that is established or controlled, directly or indirectly, by those same PRC individual(s). Under the 2006 M&A Rules, any Round-trip Investment must be approved by MOFCOM and any indirect arrangement or series of arrangements which achieves the same end result without the approval of MOFCOM is a violation of PRC law.

On May 17, 2010, our Chairman and CEO, Mr. Yulu Bai, entered into an option agreement with Ms. Ren Ping Tu, pursuant to which Mr. Bai was granted an option to acquire 20,500,000 shares our common stock currently owned by Ms. Tu, for an exercise price of $2,500,000. Mr. Bai may exercise this option, in whole but not in part, during the period commencing on the 365th day following of the date of the option agreement and ending on the second anniversary of the date thereof. After Mr. Bai exercises this option, he will be our controlling stockholder. His acquisition of our equity interest is required to be registered with the competent administration of industry and commerce authorities, or AIC, in Beijing. Mr. Bai will also be required to make filings with the Beijing SAFE, to register the Company and its non-PRC subsidiaries to qualify them as SPVs, pursuant to Circular 75.

We were advised by our PRC counsel that our acquisition of Aosen Forestry does not constitute a Round-trip Investment. The opinion of our PRC counsel, however, was based on the express, but not detailed language of the 2006 PRC Provisions on the Acquisition of Domestic Enterprises by Foreign Investors, also known as Circular 10, which deal with round trip investments in Article 11. That Article requires that approvals from the national-level Ministry of Commerce be obtained in situations where a PRC person or company acquires, in the name of a foreign company established or controlled by it, a domestic PRC company with which it is connected. Article 11 also contains a general warning against “circumventing” this requirement by use of a foreign invested entity established in the PRC “or other means.”

In this case our PRC counsel was of the opinion that the explicit language of Article 11 was satisfied because Bingwu Forestry, the non-PRC “foreign company” in this situation, was established by Ms. Tu, an individual holding a Canadian passport and holding no equity or management position with Aosen Forestry. Bingwu Forestry was still wholly owned and controlled by Ms. Tu at the time of its acquisition of Aosen Forestry, our PRC operating entity. Our PRC counsel therefore was of the opinion that Bingwu Forestry was not established by a PRC person and not controlled by a PRC person at the time of the acquisition. It therefore was not necessary to reach the question of whether Ms. Tu was “connected with” Aosen Forestry; but if it had been, the conclusion of our PRC counsel was that she was not so “connected” for purposes of Article 11. As we have disclosed, Ms. Tu is the wife of Mr. Bai, a principal shareholder of Aosen Forestry at the time of its transfer to Bingwu Forestry. We appreciate that US authorities might view this relationship as giving Mr. Bai indirect ownership or control over his wife’s company. However, we have been advised that there is no administrative or judicial guidance in the PRC which would suggest this result. Nor is there any such guidance as to what the phrase “other means” in Article 11 is intended to encompass. Finally, as a general interpretive principle in China, what the law does not prohibit is taken to be permitted. For all these reasons, our PRC counsel concluded that the acquisition of Aosen Forestry by Bingwu Forestry was not captured by Article 11.

As we stated below under Item 1A, “Risk factors—Risks Related to Doing Business in China—Our business and financial performance may be materially adversely affected if the PRC regulatory authorities determine that our acquisition of Aosen Forestry constitutes a Round-trip Investment without MOFCOM approval,” although we have been advised by competent counsel that the acquisition of Aosen Forestry by Bingwu Forestry complied with the requirements of Circular 10, the law and the regulations in China are not well settled, and it is at least possible that the PRC authorities could reach a conclusion contrary to the one reached by our PRC counsel.

Insurance

We do not have any business liability, interruption or litigation insurance coverage for our operations in China. Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. Therefore, we are subject to business and product liability exposure. Item 1A, See “Risk Factors – Risks Related to Our Business – We have limited insurance coverage in China.”

14

ITEM 1A. RISK FACTORS.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

RISKS RELATED TO OUR BUSINESS

We depend upon commercial relationships with three major customers for a significant portion of our sales revenue, and we cannot be certain that sales to these customers will continue. If sales to these customers do not continue, then our sales may decline and our business may be negatively impacted.

We currently supply our wood flooring products to three major customers in the Chinese domestic market. For the year ended December 31, 2010, sales revenues generated from Guizhou Shuanghe Industrial & Trading Co., Ltd, Kunming Hing Hong Building Materials Co., Ltd, and GST amounted to 77.72% of total sales revenues, and sales to Guizhou Shuanghe Industrial & Trading Co., Ltd., our largest single customer, amounted to 47.95% of total sales revenues during the period. We do not enter into long-term contracts with these customers and therefore cannot be certain that sales to these customers will continue. The loss of our largest customers would likely have a material negative impact on our sales revenues and business.

In order to grow at the pace expected by management, we will require additional capital to support our long-term growth strategies. If we are unable to obtain additional capital in future years, we may be unable to proceed with our plans and we may be forced to curtail our operations.

Our working capital requirements and the cash flow provided by future operating activities, if any, will vary greatly from quarter to quarter, depending on the volume of business during the period and payment terms with our customers. We will require additional working capital to support our long-term growth strategies, which includes identifying suitable targets for horizontal or vertical mergers or acquisitions so as to enhance the overall productivity and benefit from economies of scale. However, due to the uncertainty arising out of domestic and global economic conditions and the ongoing tightening of domestic credit markets, we may not be able to generate adequate cash flows or obtain adequate levels of additional financing, whether through equity financing, debt financing or other sources. Even if we are able to obtain additional financing, it may not be on terms that are favorable to the Company. Furthermore, additional financings could result in significant dilution to our earnings per share or the issuance of securities with rights superior to our current outstanding securities, including registration rights. If we are unable to raise additional financing, we may be unable to implement our long-term growth strategies, develop or enhance our products and services, take advantage of future opportunities or respond to competitive pressures on a timely basis, if at all. In addition, a lack of additional financing could force us to substantially curtail operations.

Our business could be adversely affected by reduced levels of cash, whether from operations or from borrowings.

Historically, our principal sources of funds have been cash flows from operations and borrowings from banks and other institutions. Our commercial short term bank loans totaled $4,535,830 (RMB 29,900,000) as of December 31, 2010. Under our credit agreements with the banks, we are subject to typical commercial loan covenants, such as using the funds in a way set forth in the credit agreements, paying loan interests timely and not using company assets to provide guarantee to a third party without the creditor’s prior consent. Our operating and financial performance may generate less cash and result in our failing to comply with our credit agreement covenants. We were in compliance with these covenants during the 2010 fiscal year, however, our ability to remain compliant in the future will depend on our future financial performance and may be affected by events beyond our control. There can be no assurance that we will generate sufficient earnings and cash flow to remain in compliance with the credit agreement or that we will be able to obtain future amendments to the credit agreement to avoid a default. In the event of a default, there can be no assurance that we could negotiate a new credit agreement or that we could obtain a new credit agreement with satisfactory terms and conditions within a reasonable time period.

15

Our business and operations will suffer if end-customers prove to be not creditworthy.

In our industry, companies such as ours enter into large industrial commercial sub-contracts with prime contractors in addition to consumer retail sales. While our retail customers generally pay the entire amount at time of purchase but we sometimes do not receive full payment on a project from our industrial customers until they are paid by the end-customer. Consequently, we extend credit to some of our industrial customers while generally requiring no collateral. We perform ongoing credit evaluations of our customers' financial condition and generally have no difficulties in collecting our payments. However, if we encounter future problems collecting amounts due from our clients or if we experience delays in the collection of amounts due from our clients, our liquidity could be negatively affected. In order to reduce collection risks, we have turned down some opportunities that we believed carried unfavorable payment terms.

Environmental regulations impose substantial costs and limitations on our operations.

We are subject to various national and local environmental laws and regulations in China concerning issues such as air emissions, wastewater discharges, and solid waste management and disposal. These laws and regulations can restrict or limit our operations and expose us to liability and penalties for non-compliance. While we believe that our facilities are in material compliance with all applicable environmental laws and regulations, the risks of substantial unanticipated costs and liabilities related to compliance with these laws and regulations are an inherent part of our business. It is possible that future conditions may develop, arise or be discovered that create new environmental compliance or remediation liabilities and costs. While we believe that we can comply with existing environmental legislation and regulatory requirements and that the costs of compliance have been included within budgeted cost estimates, compliance may prove to be more limiting and costly than anticipated.

Our success relies on our management’s ability to understand the wood flooring industry. We may not be able to maintain or improve our competitive position in the wood flooring industries, and we expect this competition to continue to be intense.

We target the highly fragmented and competitive wood flooring market in China for our products and services. China’s wood flooring industries are large and established and rapidly evolving. As such, it is critical that our management is able to understand industry trends and make good strategic business decisions. If our management is unable to identify industry trends and act in response to such trends in a way that is beneficial to us, our business will suffer.

Our primary competition comes from domestic companies such as SDF and PowerDekor. These entities may be able to respond more quickly to changing market conditions by developing new products and services that meet customer requirements or are otherwise superior to our products and services, and may be able to more effectively market their products than we can because they have significantly greater financial, technical and marketing resources than we do. They may also be able to devote greater resources than we can to the development of their products. Increased competition could require us to reduce our prices, resulting in our receiving fewer customer orders and in our loss of market share. We cannot assure you that we will be able to distinguish ourselves in a competitive market. To the extent that we are unable to successfully compete against existing and future competitors, our business, operating results and financial condition could be materially adversely affected.

Future government regulations or other standards could have an adverse effect on our operations.

Our operations are subject to a variety of laws, regulations and licensing requirements of national and local authorities in the PRC. We are required to obtain licenses or permits from the PRC central government and from Guizhou province, where we operate, and to meet certain standards in the conduct of our business. The loss of such licenses, or the imposition of conditions to the granting or retention of such licenses, could have an adverse effect on us. In the event that these laws, regulations and/or licensing requirements change, we may be required to modify our operations or to utilize resources to maintain compliance with such rules and regulations. In addition, new regulations may be enacted that could have an adverse effect on us.

Our business and reputation as a provider of wood flooring products may be adversely affected by product defects or performance.

We believe that we offer high quality products that are reliable and competitively priced. If our products do not perform to specifications, we might be required to redesign or recall those products or pay substantial damages. Such an event could result in significant expenses, disrupt sales and affect our reputation and that of our products. In addition, product defects could result in substantial product liability. We do not have product liability insurance. If we face significant liability claims, our business, financial condition, and results of operations would be adversely affected.

16

If our suppliers fail to perform their contractual obligations, our ability to provide services and products to our customers, as well as our ability to obtain future business, may be harmed.

Many of our products include machines and raw materials procured from other companies upon which we rely to provide a portion of the products that we provide to our customers. There is a risk that we may have disputes with our suppliers, including disputes regarding the quality and timeliness of parts and raw materials provided by these suppliers. A failure by one or more of our suppliers to satisfy the agreed-upon contracts may materially and adversely impact our ability to perform our obligations to our customers, could expose us to liability, and could have a material adverse effect on our ability to compete for future contracts and orders.

Our expansion plans may not be successful.