Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Valaris Ltd | d269752d8k.htm |

Exhibit 99.1

Exceeding Expectations Fleet Status Report15 December 2011Last week Ensco had two naming ceremonies for its newest ultra-deepwater rigs – ENSCO DS-6 in South Korea and ENSCO 8505 in Singapore. Ensco continues to have the world’s youngest ultra-deepwater fleet. ENSCO 8505

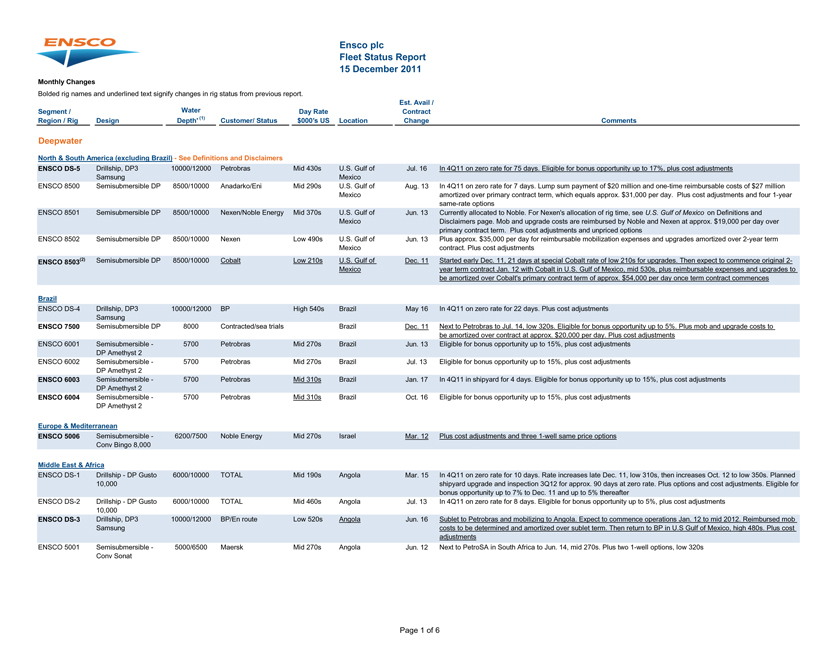

ENSCO DS-6Ensco plc Fleet Status Report15 December 2011Monthly Changes Bolded rig names and underlined text signify changes in rig status from previous report. Segment / Water Day Rate Contract Region / Rig Design Depth’ (1) Customer/ Status $000’s US Location Change Comments Deepwater North & South America (excluding Brazil)—See Definitions and Disclaimers ENSCO DS-5 Drillship, DP3 10000/12000 Petrobras Mid 430s U.S. Gulf of Jul. 16 In 4Q11 on zero rate for 75 days. Eligible for bonus opportunity up to 17%, plus cost adjustments Samsung Mexico ENSCO 8500 Semisubmersible DP 8500/10000 Anadarko/Eni Mid 290s U.S. Gulf of Aug. 13 In 4Q11 on zero rate for 7 days. Lump sum payment of $20 million and one-time reimbursable costs of $27 million Mexico amortized over primary contract term, which equals approx. $31,000 per day. Plus cost adjustments and four 1-year same-rate options ENSCO 8501 Semisubmersible DP 8500/10000 Nexen /Noble Energy Mid 370s U.S. Gulf of Jun. 13 Currently allocated to Noble. For Nexen’s allocation of rig time, see U.S. Gulf of Mexico on Definitions and Mexico Disclaimers page. Mob and upgrade costs are reimbursed by Noble and Nexen at approx. $19,000 per day over primary contract term. Plus cost adjustments and unpriced options ENSCO 8502 Semisubmersible DP 8500/10000 Nexen Low 490s U.S. Gulf of Jun. 13 Plus approx. $35,000 per day for reimbursable mobilization expenses and upgrades amortized over 2-year term Mexico contract. Plus cost adjustments ENSCO 8503(2) Semisubmersible DP 8500/10000 Cobalt Low 210s U.S. Gulf of Dec. 11 Started early Dec. 11, 21 days at special Cobalt rate of low 210s for upgrades. Then expect to commence original 2-Mexico year term contract Jan. 12 with Cobalt in U.S. Gulf of Mexico, mid 530s, plus reimbursable expenses and upgrades to be amortized over Cobalt’s primary contract term of approx. $54,000 per day once term contract commencesBrazilENSCO DS-4 Drillship, DP3 10000/12000 BP High 540s Brazil May 16 In 4Q11 on zero rate for 22 days. Plus cost adjustments SamsungENSCO 7500 Semisubmersible DP 8000 Contracted/sea trials Brazil Dec. 11 Next to Petrobras to Jul. 14, low 320s. Eligible for bonus opportunity up to 5%. Plus mob and upgrade costs to be amortized over contract at approx. $20,000 per day. Plus cost adjustments ENSCO 6001 Semisubmersible—5700 Petrobras Mid 270s Brazil Jun. 13 Eligible for bonus opportunity up to 15%, plus cost adjustments DP Amethyst 2 ENSCO 6002 Semisubmersible—5700 Petrobras Mid 270s Brazil Jul. 13 Eligible for bonus opportunity up to 15%, plus cost adjustments DP Amethyst 2 ENSCO 6003 Semisubmersible—5700 Petrobras Mid 310s Brazil Jan. 17 In 4Q11 in shipyard for 4 days. Eligible for bonus opportunity up to 15%, plus cost adjustments DP Amethyst 2 ENSCO 6004 Semisubmersible—5700 Petrobras Mid 310s Brazil Oct. 16 Eligible for bonus opportunity up to 15%, plus cost adjustments DP Amethyst 2Europe & MediterraneanENSCO 5006 Semisubmersible—6200/7500 Noble Energy Mid 270s Israel Mar. 12 Plus cost adjustments and three 1-well same price options Conv Bingo 8,000Middle East & AfricaENSCO DS-1 Drillship—DP Gusto 6000/10000 TOTAL Mid 190s Angola Mar. 15 In 4Q11 on zero rate for 10 days. Rate increases late Dec. 11, low 310s, then increases Oct. 12 to low 350s. Planned 10,000 shipyard upgrade and inspection 3Q12 for approx. 90 days at zero rate. Plus options and cost adjustments. Eligible for bonus opportunity up to 7% to Dec. 11 and up to 5% thereafter ENSCO DS-2 Drillship—DP Gusto 6000/10000 TOTAL Mid 460s Angola Jul. 13 In 4Q11 on zero rate for 8 days. Eligible for bonus opportunity up to 5%, plus cost adjustments 10,000 ENSCO DS-3 Drillship, DP3 10000/12000 BP/En route Low 520s Angola Jun. 16 Sublet to Petrobras and mobilizing to Angola. Expect to commence operations Jan. 12 to mid 2012. Reimbursed mob Samsung costs to be determined and amortized over sublet term. Then return to BP in U.S Gulf of Mexico, high 480s. Plus cost adjustments ENSCO 5001 Semisubmersible—5000/6500 Maersk Mid 270s Angola Jun. 12 Next to PetroSA in South Africa to Jun.14, mid 270s. Plus two 1-well options, low 320s Conv Sonat Page 1 of 6

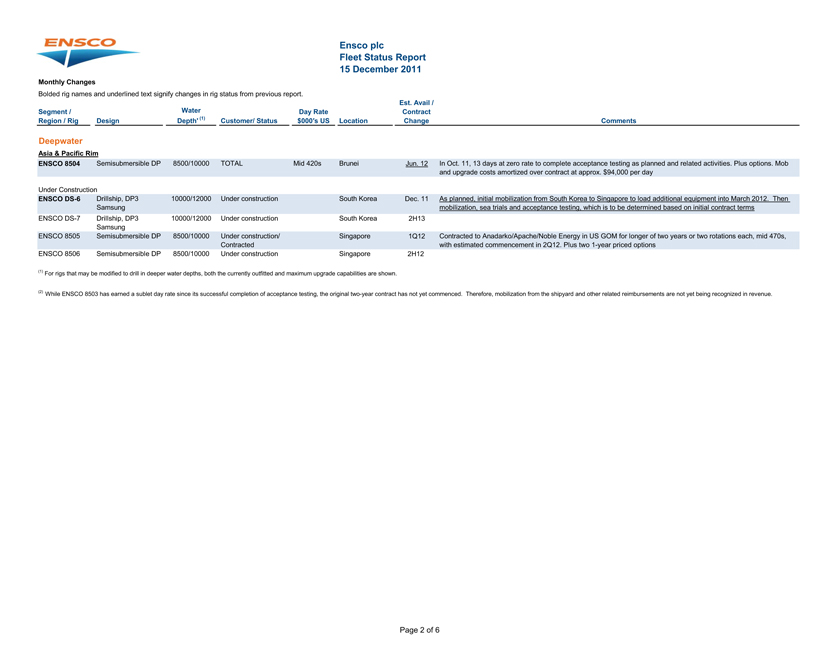

Ensco plcFleet Status Report15 December 2011Monthly ChangesBolded rig names and underlined text signify changes in rig status from previous report.Est. Avail / Segment / Water Day Rate Contract Region / Rig Design Depth’ (1) Customer/ Status $000’s USLocation Change CommentsDeepwater Asia & Pacific RimENSCO 8504 Semisubmersible DP 8500/10000 TOTAL Mid 420s Brunei Jun. 12 In Oct. 11, 13 days at zero rate to complete acceptance testing as planned and related activities. Plus options. Mob and upgrade costs amortized over contract at approx. $94,000 per dayUnder Construction ENSCO DS-6 Drillship, DP3 10000/12000 Under construction South Korea Dec. 11 As planned, initial mobilization from South Korea to Singapore to load additional equipment through March 2012. Samsung Then mobilization, sea trials and acceptance testing, which is to be determined based on initial contract terms ENSCO DS-7 Drillship, DP3 10000/12000 Under construction South Korea 2H13 Samsung ENSCO 8505 Semisubmersible DP 8500/10000 Under construction/ Singapore 1Q12 Contracted to Anadarko/Apache/Noble Energy in US GOM for longer of two years or two rotations each, mid 470s, Contracted with estimated commencement in 2Q12. Plus two 1-year priced options ENSCO 8506 Semisubmersible DP 8500/10000 Under construction Singapore 2H12 (1) For rigs that may be modified to drill in deeper water depths, both the currently outfitted and maximum upgrade capabilities are shown.(2) While ENSCO 8503 has earned a sublet day rate since its successful completion of acceptance testing, the original two-year contract has not yet commenced. Therefore, mobilization from the shipyard and other related reimbursements are not yet being recognized in revenue. Page 2 of 6

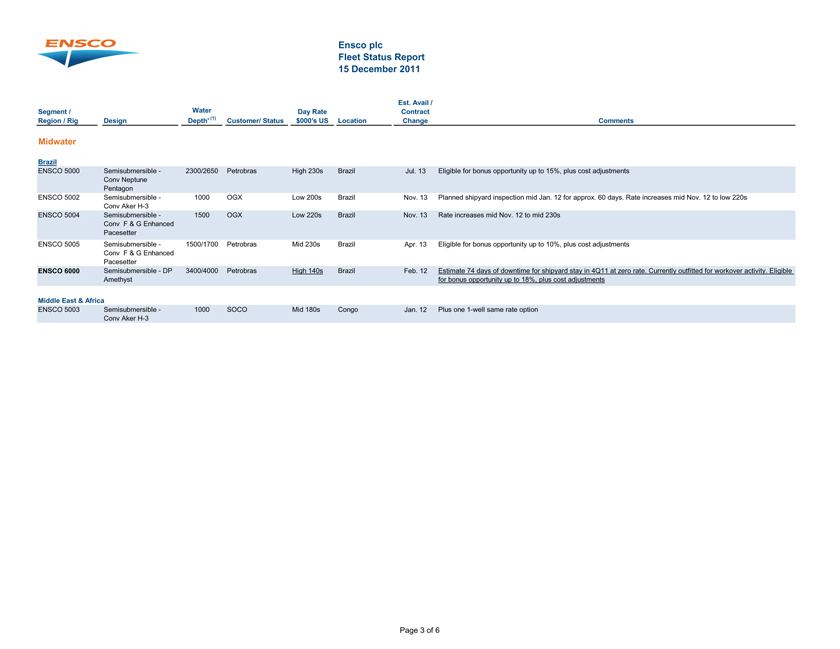

Ensco plcFleet Status Report15 December 2011Est. Avail / Segment / Water Day Rate Contract Region / Rig Design Depth’ (1) Customer/ Status $000’s USLocation Change CommentsMidwaterBrazilENSCO 5000 Semisubmersible—2300/2650 Petrobras High 230s Brazil Jul. 13 Eligible for bonus opportunity up to 15%, plus cost adjustments Conv Neptune PentagonENSCO 5002 Semisubmersible—1000 OGX Low 200s Brazil Nov. 13 Planned shipyard inspection mid Jan. 12 for approx. 60 days. Rate increases mid Nov. 12 to low 220s Conv Aker H-3 ENSCO 5004 Semisubmersible—1500 OGX Low 220s Brazil Nov. 13 Rate increases mid Nov. 12 to mid 230s Conv F & G Enhanced Pacesetter ENSCO 5005 Semisubmersible—1500/1700 Petrobras Mid 230s Brazil Apr. 13 Eligible for bonus opportunity up to 10%, plus cost adjustments Conv F & G Enhanced PacesetterENSCO 6000 Semisubmersible—DP 3400/4000 Petrobras High 140s Brazil Feb. 12 Estimate 74 days of downtime for shipyard stay in 4Q11 at zero rate. Currently outfitted for workover activity. Eligible Amethyst for bonus opportunity up to 18%, plus cost adjustmentsMiddle East & AfricaENSCO 5003 Semisubmersible—1000 SOCO Mid 180s Congo Jan. 12 Plus one 1-well same rate option Conv Aker H-3Page 3 of 6

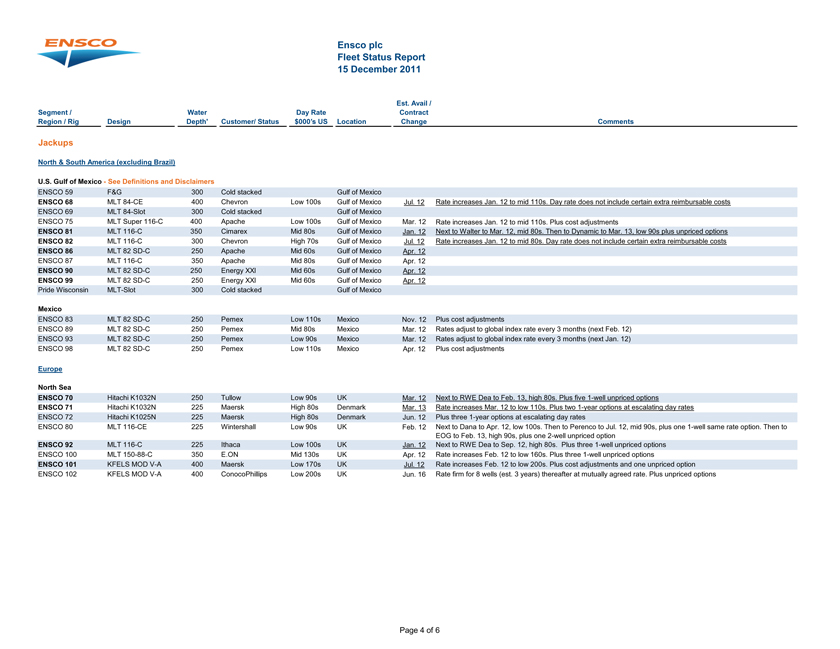

Ensco plcFleet Status Report15 December 2011Est. Avail / Segment / Water Day Rate Contract Region / Rig Design Depth’ Customer/ Status $000’s USLocation Change CommentsJackupsNorth & South America (excluding Brazil)U.S. Gulf of Mexico—See Definitions and Disclaimers ENSCO 59 F&G 300 Cold stacked Gulf of MexicoENSCO 68 MLT 84-CE 400 Chevron Low 100s Gulf of Mexico Jul. 12 Rate increases Jan. 12 to mid 110s. Day rate does not include certain extra reimbursable costs ENSCO 69 MLT 84-Slot 300 Cold stacked Gulf of Mexico ENSCO 75 MLT Super 116-C 400 Apache Low 100s Gulf of Mexico Mar. 12 Rate increases Jan. 12 to mid 110s. Plus cost adjustments ENSCO 81 MLT 116-C 350 Cimarex Mid 80s Gulf of Mexico Jan. 12 Next to Walter to Mar. 12, mid 80s. Then to Dynamic to Mar. 13, low 90s plus unpriced options ENSCO 82 MLT 116-C 300 Chevron High 70s Gulf of Mexico Jul. 12 Rate increases Jan. 12 to mid 80s. Day rate does not include certain extra reimbursable costs ENSCO 86 MLT 82 SD-C 250 Apache Mid 60s Gulf of Mexico Apr. 12 ENSCO 87 MLT 116-C 350 Apache Mid 80s Gulf of Mexico Apr. 12 ENSCO 90 MLT 82 SD-C 250 Energy XXI Mid 60s Gulf of Mexico Apr. 12 ENSCO 99 MLT 82 SD-C 250 Energy XXI Mid 60s Gulf of Mexico Apr. 12 Pride Wisconsin MLT-Slot 300 Cold stacked Gulf of MexicoMexicoENSCO 83 MLT 82 SD-C 250 Pemex Low 110s Mexico Nov. 12 Plus cost adjustmentsENSCO 89 MLT 82 SD-C 250 Pemex Mid 80s Mexico Mar. 12 Rates adjust to global index rate every 3 months (next Feb. 12) ENSCO 93 MLT 82 SD-C 250 Pemex Low 90s Mexico Mar. 12 Rates adjust to global index rate every 3 months (next Jan. 12) ENSCO 98 MLT 82 SD-C 250 Pemex Low 110s Mexico Apr. 12 Plus cost adjustmentsEuropeNorth SeaENSCO 70 Hitachi K1032N 250 Tullow Low 90s UK Mar. 12 Next to RWE Dea to Feb. 13, high 80s. Plus five 1-well unpriced optionsENSCO 71 Hitachi K1032N 225 Maersk High 80s Denmark Mar. 13 Rate increases Mar. 12 to low 110s. Plus two 1-year options at escalating day rates ENSCO 72 Hitachi K1025N 225 Maersk High 80s Denmark Jun. 12 Plus three 1-year options at escalating day ratesENSCO 80 MLT 116-CE 225 Wintershall Low 90s UK Feb. 12 Next to Dana to Apr. 12, low 100s. Then to Perenco to Jul. 12, mid 90s, plus one 1-well same rate option. Then to EOG to Feb. 13, high 90s, plus one 2-well unpriced option ENSCO 92 MLT 116-C 225 Ithaca Low 100s UK Jan. 12 Next to RWE Dea to Sep. 12, high 80s. Plus three 1-well unpriced options ENSCO 100 MLT 150-88-C 350 E.ON Mid 130s UK Apr. 12 Rate increases Feb. 12 to low 160s. Plus three 1-well unpriced options ENSCO 101 KFELS MOD V-A 400 Maersk Low 170s UK Jul. 12 Rate increases Feb. 12 to low 200s. Plus cost adjustments and one unpriced option ENSCO 102 KFELS MOD V-A 400 ConocoPhillips Low 200s UK Jun. 16 Rate firm for 8 wells (est. 3 years) thereafter at mutually agreed rate. Plus unpriced options Page 4 of 6

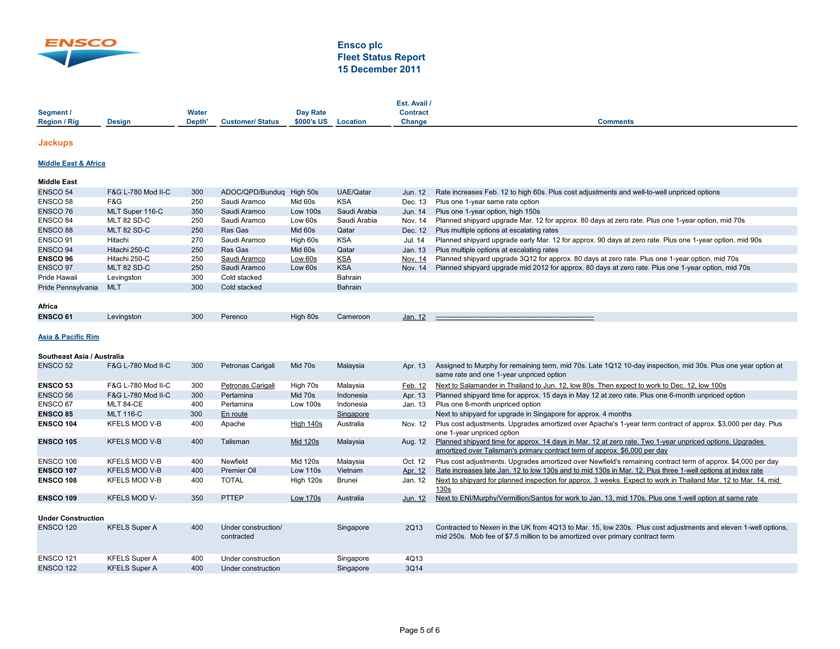

Ensco plcFleet Status Report15 December 2011Est. Avail / Segment / Water Day Rate Contract Region / Rig Design Depth’ Customer/ Status $000’s USLocation Change CommentsJackupsMiddle East & AfricaMiddle EastENSCO 54 F&G L-780 Mod II-C 300 ADOC/QPD/Bunduq High 50s UAE/Qatar Jun. 12 Rate increases Feb. 12 to high 60s. Plus cost adjustments and well-to-well unpriced options ENSCO 58 F&G 250 Saudi Aramco Mid 60s KSA Dec. 13 Plus one 1-year same rate option ENSCO 76 MLT Super 116-C 350 Saudi Aramco Low 100s Saudi Arabia Jun. 14 Plus one 1-year option, high 150sENSCO 84 MLT 82 SD-C 250 Saudi Aramco Low 60s Saudi Arabia Nov. 14 Planned shipyard upgrade Mar. 12 for approx. 80 days at zero rate. Plus one 1-year option, mid 70s ENSCO 88 MLT 82 SD-C 250 Ras Gas Mid 60s Qatar Dec. 12 Plus multiple options at escalating rates ENSCO 91 Hitachi 270 Saudi Aramco High 60s KSA Jul. 14 Planned shipyard upgrade early Mar. 12 for approx. 90 days at zero rate. Plus one 1-year option, mid 90s ENSCO 94 Hitachi 250-C 250 Ras Gas Mid 60s Qatar Jan. 13 Plus multiple options at escalating rates ENSCO 96 Hitachi 250-C 250 Saudi Aramco Low 60s KSA Nov. 14 Planned shipyard upgrade 3Q12 for approx. 80 days at zero rate. Plus one 1-year option, mid 70s ENSCO 97 MLT 82 SD-C 250 Saudi Aramco Low 60s KSA Nov. 14 Planned shipyard upgrade mid 2012 for approx. 80 days at zero rate. Plus one 1-year option, mid 70s Pride Hawaii Levingston 300 Cold stacked Bahrain Pride Pennsylvania MLT 300 Cold stacked BahrainAfricaENSCO 61 Levingston 300 Perenco High 80s Cameroon Jan. 12 Asia & Pacific RimSoutheast Asia / AustraliaENSCO 52 F&G L-780 Mod II-C 300 Petronas Carigali Mid 70s Malaysia Apr. 13 Assigned to Murphy for remaining term, mid 70s. Late 1Q12 10-day inspection, mid 30s. Plus one year option at same rate and one 1-year unpriced option ENSCO 53 F&G L-780 Mod II-C 300 Petronas Carigali High 70s Malaysia Feb. 12 Next to Salamander in Thailand to Jun. 12, low 80s. Then expect to work to Dec. 12, low 100s ENSCO 56 F&G L-780 Mod II-C 300 Pertamina Mid 70s Indonesia Apr. 13 Planned shipyard time for approx. 15 days in May 12 at zero rate. Plus one 6-month unpriced option ENSCO 67 MLT 84-CE 400 Pertamina Low 100s Indonesia Jan. 13 Plus one 8-month unpriced option ENSCO 85 MLT 116-C 300 En route Singapore Next to shipyard for upgrade in Singapore for approx. 4 months ENSCO 104 KFELS MOD V-B 400 Apache High 140s Australia Nov. 12 Plus cost adjustments. Upgrades amortized over Apache’s 1-year term contract of approx. $3,000 per day. Plus one 1-year unpriced option ENSCO 105 KFELS MOD V-B 400 Talisman Mid 120s Malaysia Aug. 12 Planned shipyard time for approx. 14 days in Mar. 12 at zero rate. Two 1-year unpriced options. Upgrades amortized over Talisman’s primary contract term of approx. $6,000 per day ENSCO 106 KFELS MOD V-B 400 Newfield Mid 120s Malaysia Oct. 12 Plus cost adjustments. Upgrades amortized over Newfield’s remaining contract term of approx. $4,000 per day ENSCO 107 KFELS MOD V-B 400 Premier Oil Low 110s Vietnam Apr. 12 Rate increases late Jan. 12 to low 130s and to mid 130s in Mar. 12. Plus three 1-well options at index rate ENSCO 108 KFELS MOD V-B 400 TOTAL High 120s Brunei Jan. 12 Next to shipyard for planned inspection for approx. 3 weeks. Expect to work in Thailand Mar. 12 to Mar. 14, mid 130s ENSCO 109 KFELS MOD V- 350 PTTEP Low 170s Australia Jun. 12 Next to ENI/Murphy/Vermillion/Santos for work to Jan. 13, mid 170s. Plus one 1-well option at same rate Super BUnder Construction ENSCO 120 KFELS Super A 400 Under construction/ Singapore 2Q13 Contracted to Nexen in the UK from 4Q13 to Mar. 15, low 230s. Plus cost adjustments and eleven 1-well options, contracted mid 250s. Mob fee of $7.5 million to be amortized over primary contract termENSCO 121 KFELS Super A 400 Under construction Singapore 4Q13 ENSCO 122 KFELS Super A 400 Under construction Singapore 3Q14 Page 5 of 6

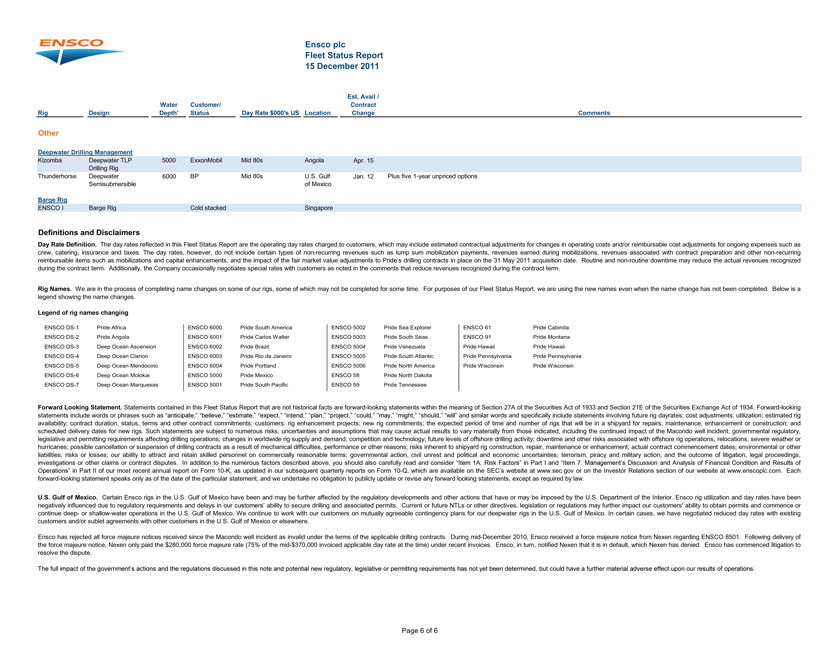

Ensco plcFleet Status Report15 December 2011Water Customer/ Contract Rig Design Depth’ Status Day Rate $000’s Location US Change CommentsOtherDeepwater Drilling ManagementKizomba Deepwater TLP 5000 ExxonMobil Mid 80s Angola Apr. 15 Drilling RigThunderhorse Deepwater 6000 BP Mid 80s U.S. Gulf Jan. 12 Plus five 1-year unpriced options Semisubmersible of MexicoBarge RigENSCO I Barge Rig Cold stacked Singapore Definitions and DisclaimersDay Rate Definition. The day rates reflected in this Fleet Status Report are the operating day rates charged to customers, which may include estimated contractual adjustments for changes in operating costs and/or reimbursable cost adjustments for ongoing expenses such as crew, catering, insurance and taxes. The day rates, however, do not include certain types of non-recurring revenues such as lump sum mobilization payments, revenues earned during mobilizations, revenues associated with contract preparation and other non-recurring reimbursable items such as mobilizations and capital enhancements, and the impact of the fair market value adjustments to Pride’sdrilling contracts in place on the 31 May 2011 acquisition date. Routine and non-routine downtime may reduce the actual revenues recognized during the contract term. Additionally, the Company occasionally negotiates special rates with customers as noted in the comments that reduce revenues recognized during the contract term.Rig Names. We are in the process of completing name changes on some of our rigs, some of which may not be completed for some time. For purposes of our Fleet Status Report, we are using the new names even when the name change has not been completed. Below is a legend showing the name changes.Legend of rig names changingENSCO DS-1 Pride Africa ENSCO 6000 Pride South America ENSCO 5002 Pride Sea Explorer ENSCO 61 Pride Cabinda ENSCO DS-2 Pride Angola ENSCO 6001 Pride Carlos Walter ENSCO 5003 Pride South Seas ENSCO 91 Pride Montana ENSCO DS-3 Deep Ocean Ascension ENSCO 6002 Pride Brazil ENSCO 5004 Pride Venezuela Pride Hawaii Pride Hawaii ENSCO DS-4 Deep Ocean Clarion ENSCO 6003 Pride Rio de Janeiro ENSCO 5005 Pride South Atlantic Pride Pennsylvania Pride Pennsylvania ENSCO DS-5 Deep Ocean Mendocino ENSCO 6004 Pride Portland ENSCO 5006 Pride North America Pride Wisconsin Pride Wisconsin ENSCO DS-6 Deep Ocean Molokai ENSCO 5000 Pride Mexico ENSCO 58 Pride North Dakota ENSCO DS-7 Deep Ocean Marquesas ENSCO 5001 Pride South Pacific ENSCO 59 Pride Tennessee Forward Looking Statement. Statements contained in this Fleet Status Report that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include words or phrases such as“anticipate,”“believe,”“estimate,”“expect,”“intend,”“plan,”“project,”“could,”“may,”“might,”“should,”“will”and similar words and specifically include statements involving future rig dayrates; cost adjustments; utilization; estimated rig availability; contract duration, status, terms and other contract commitments; customers; rig enhancement projects; new rig commitments; the expected period of time and number of rigs that will be in a shipyard for repairs, maintenance, enhancement or construction; and scheduled delivery dates for new rigs. Such statements are subject to numerous risks, uncertainties and assumptions that may cause actual results to vary materially from those indicated, including the continued impact of the Macondo well incident; governmental regulatory, legislative and permitting requirements affecting drilling operations; changes in worldwide rig supply and demand, competition and technology; future levels of offshore drilling activity; downtime and other risks associated with offshore rig operations, relocations, severe weather or hurricanes; possible cancellation or suspension of drilling contracts as a result of mechanical difficulties, performance or other reasons; risks inherent to shipyard rig construction, repair, maintenance or enhancement; actual contract commencement dates; environmental or other liabilities, risks or losses; our ability to attract and retain skilled personnel on commercially reasonable terms; governmental action, civil unrest and political and economic uncertainties; terrorism, piracy and military action; and the outcome of litigation, legal proceedings, investigations or other claims or contract disputes. In addition to the numerous factors described above, you should also carefully read and consider “Item1A. Risk Factors”in Part I and “Item7. Management’sDiscussion and Analysis of Financial Condition and Results of Operations”in Part II of our most recent annual report on Form 10-K, as updated in our subsequent quarterly reports on Form 10-Q, which are available on the SEC’swebsite at www.sec.gov or on the Investor Relations section of our website at www.enscoplc.com. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward looking statements, except as required by law. U.S. Gulf of Mexico. Certain Ensco rigs in the U.S. Gulf of Mexico have been and may be further affected by the regulatory developments and other actions that have or may be imposed by the U.S. Department of the Interior. Ensco rig utilization and day rates have been negatively influenced due to regulatory requirements and delays in our customers’ability to secure drilling and associated permits. Current or future NTLs or other directives, legislation or regulations may further impact our customers’ ability to obtain permits and commence or continue deep- or shallow-water operations in the U.S. Gulf of Mexico. We continue to work with our customers on mutually agreeable contingency plans for our deepwater rigs in the U.S. Gulf of Mexico. In certain cases, we have negotiated reduced day rates with existing customers and/or sublet agreements with other customers in the U.S. Gulf of Mexico or elsewhere. Ensco has rejected all force majeure notices received since the Macondo well incident as invalid under the terms of the applicable drilling contracts. During mid-December 2010, Ensco received a force majeure notice from Nexen regarding ENSCO 8501. Following delivery of the force majeure notice, Nexen only paid the $280,000 force majeure rate (75% of the mid-$370,000 invoiced applicable day rate at the time) under recent invoices. Ensco, in turn, notified Nexen that it is in default, which Nexen has denied. Ensco has commenced litigation to resolve the dispute. The full impact of the government’s actions and the regulations discussed in this note and potential new regulatory, Page 6 of 6