Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Expedia Group, Inc. | d266730d8k.htm |

INVESTOR

PRESENTATION

December 2011

Exhibit 99.1 |

2

Safe Harbor

Forward-Looking

Statements.

This

presentation

contains

"forward-looking

statements"

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

statements

are

not

guarantees

of

future

performance.

These

forward-looking

statements

are

based

on

management’s

expectations

as

of

December

9,

2011

and

assumptions

which

are

inherently

subject

to

uncertainties,

risks

and

changes

in

circumstances

that

are

difficult

to

predict.

The

use

of

words

such

as

intends

and

expects,

among

others,

generally

identify

forward-looking

statements.

However,

these

words

are

not

the

exclusive

means

of

identifying

such

statements.

In

addition,

any

statements

that

refer

to

expectations,

projections

or

other

characterizations

of

future

events

or

circumstances

are

forward-

looking

statements

and

may

include

statements

relating

to

future

revenues,

expenses,

margins,

profitability,

net

income

/

(loss),

earnings

per

share

and

other

measures

of

results

of

operations

and

the

prospects

for

future

growth

of

Expedia,

Inc.’s

business.

Actual

results

and

the

timing

and

outcome

of

events

may

differ

materially

from

those

expressed

or

implied

in

the

forward-looking

statements

for

a

variety

of

reasons,

including,

among

others:

declines

or

disruptions

in

the

travel

industry;

changes

in

our

relationships

and

contractual

agreements

with

travel

suppliers

or

supplier

intermediaries;

risks

relating

to

the

announced

spin-off

of

our

TripAdvisor

business;

increases

in

the

costs

of

maintaining

and

enhancing

our

brand

awareness;

changes

in

search

engine

algorithms

and

dynamics,

or

search

engine

disintermediation;

our

inability

to

adapt

to

technological

developments

or

to

maintain

our

existing

technologies;

our

ability

to

expand

successfully

in

international

markets;

changes

in

senior

management;

volatility

in

our

stock

price;

changing

laws,

rules

and

regulations

and

legal

uncertainties

relating

to

our

business;

unfavorable

new,

or

adverse

application

of

existing,

tax

laws,

rules

or

regulations;

adverse

outcomes

in

legal

proceedings

to

which

we

are

party;

provisions

in

certain

credit

card

processing

agreements

that

could

adversely

impact

our

liquidity

and

financial

positions;

fluctuations

in

our

effective

tax

rate;

our

inability

to

access

the

capital

markets

when

necessary;

risks

related

to

our

long

term

indebtedness;

fluctuations

in

foreign

exchange

rates;

risks

related

to

the

failure

of

counterparties

to

perform

on

financial

obligations;

potential

liabilities

resulting

from

our

processing,

storage,

use

and

disclosure

of

personal

data;

the

integration

of

current

and

acquired

businesses;

the

risk

that

our

intellectual

property

is

not

protected

from

copying

or

use

by

others,

including

competitors;

and

other

risks

detailed

in

our

public

filings

with

the

SEC,

including

our

annual

report

on

Form

10-K

for

the

year

ended

December

31,

2010

and

quarterly

report

on

Form

10-Q

for

the

quarter

ended

September

30,

2011.

Except

as

required

by

law,

we

undertake

no

obligation

to

update

any

forward-looking

or

other

statements

in

this

presentation,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

Non-GAAP

Measures.

Reconciliations

to

GAAP

measures

of

non-GAAP

measures

included

in

this

presentation

are

included

in

the

Appendices.

These

measures

are

intended

to

supplement,

not

substitute

for,

GAAP

comparable

measures.

Investors

are

urged

to

consider

carefully

the

comparable

GAAP

measures

and

reconciliations.

Industry

/

Market

Data.

Industry

and

market

data

used

in

this

presentation

have

been

obtained

from

industry

publications

and

sources

as

well

as

from

research

reports

prepared

for

other

purposes.

We

have

not

independently

verified

the

data

obtained

from

these

sources

and

cannot

assure

you

of

the

data’s

accuracy

or

completeness.

Trademarks

&

Logos.

Trademarks

and

logos

are

the

property

of

their

respective

owners.

©

2011 Expedia, Inc. All rights reserved. CST: 2029030-50

|

3

Basis of Presentation

The

operating

results

for

Expedia,

Inc.

within

this

presentation

exclude

segment

results

for

the

TripAdvisor

Media

Group

(“TripAdvisor”)

unless

otherwise

noted.

Expedia

allocates

certain

expenses,

such

as

stock-based

compensation

and

amortization

of

intangible

assets,

to

its

corporate

segment

while

depreciation

is

included

on

a

segment

basis.

The

adjusted

earnings

per

share

figures

presented

within

are

based

on

historical

results,

after

giving

effect

to

discontinued

operations

results

of

TripAdvisor

for

the

respective

periods

presented.

Subsequent

to

the

transaction

closing

on

or

about

December

20,

2011,

Expedia

expects

to

file

on

Form

8-K

pro

forma

results

for

new

Expedia,

Inc.

for

the

years

ended

2008,

2009,

2010

as

well

as

the

nine

months

ended

September

30,

2011

that

will

reflect

results

from

discontinued

operations

with

respect

to

TripAdvisor.

Our

management

believes

that

the

assumptions

underlying

the

financial

statements

are

reasonable.

However,

this

financial

information

does

not

necessarily

reflect

the

future

financial

position,

results

of

operations

and

cash

flows

of

Expedia

or

TripAdvisor,

nor

does

it

reflect

what

the

historical

financial

position,

results

of

operations

and

cash

flows

of

Expedia

or

TripAdvisor

would

have

been

had

we

been

a

stand-alone

company

during

the

periods

presented. |

4

Transaction Summary

IS SPINNING OFF

the Portfolio of Travel Media and Content

Sites within the TripAdvisor

®

Media Group

0.6 Billion

$

324 Million

$

1

TTM = Trailing Twelve Months

2

See Appendix A for Non-GAAP to GAAP Reconciliation

3

Adjusted EBITDA is calculated as operating income plus: stock-based compensation

expense, including compensation expense related to certain subsidiary equity plans; acquisition-related

impacts

including

amortization

of

intangible

assets

and

goodwill

and

intangible

asset

impairment,

and

gains

(losses)

recognized

on

changes

in

the

value

of

contingent

consideration

arrangements; certain infrequently occurring items, including restructuring; charges

incurred, if any, for monies that may be required to be paid in advance of litigation in certain occupancy tax

proceedings; gains (losses) realized on revenue hedging activities that are included

in other, net; and depreciation TTM

1

3Q 2011 REVENUES

3.4 Billion

$

TTM 3Q 2011ADJUSTED EBITDA

2,3

683 Million

$ |

5

Investment Highlights

Global Leader in ~$1 Trillion

Global Leader in ~$1 Trillion

Market with

Market with

Strong Offline-to-Online Trends

Strong Offline-to-Online Trends

Significant Growth Opportunities Across Geographies

Significant Growth Opportunities Across Geographies

Rapid Expansion in Highly Fragmented Hotel Industry

Rapid Expansion in Highly Fragmented Hotel Industry

Technology Platform Investment and

Technology Platform Investment and

Innovation Driving Higher Conversion

Innovation Driving Higher Conversion

Success in New Distribution Channels, e.g. Mobile

Success in New Distribution Channels, e.g. Mobile

A Growth

Company

Powerful Free Cash Flow Generation

Powerful Free Cash Flow Generation |

6

The Largest Online Travel Company in

the World

Mutually

Beneficial

Supply

Agreements

Value to

Travelers

Scale Enables

Virtuous Circle

Diverse Demand:

Geography AND Travel Type

1

comScore Worldwide Average Monthly UV data, January 2011-October 2011

SUPPLY

SUPPLY

Massive

Depth and

Breadth of

~145,000 Hotels in

200+

Countries

300+

Airlines

2.6 Million

Packages

Unmatched

Volume and

Diversity of

Global Travel

DEMAND

DEMAND

60 Million

Unique Visitors

1

Travelers in

~70 Countries

Corporate and

Leisure Travel;

Online and Offline |

15

Sites in 39 Countries

A Leader in Global

Corporate Travel

Established Brands with Global Reach

76 Sites in

67 Countries

A Leading Hotel

Specialist Globally

26 Sites in

26 Countries

#1

Online Travel Agency

10,000 Affiliates in

33 Countries

“Expedia Inside”

Private Label Solutions

Trusted Brands

Trusted Brands |

8

Business Mix Transformation

Positions Us for Growth

Revenue

5 Years Ago

Revenue

Today

Note: 5 Years Ago = 2005 Revenues; Today = TTM ending September 30, 2011

Revenues |

9

Expedia Well-Positioned to Capture

Significant Global Growth Opportunity

Sources: PhoCusWright estimates and Expedia data

Note: EXPE share of travel market defined by TTM gross bookings as of September 30,

2011. APAC data includes gross bookings from AirAsia joint venture |

10

Asia –

Investing for Growth

Key Assets

Key Assets

14 Sites in

13 Asian Countries —

5 Launched

Since 2009

Powers Important

Asian Brands, e.g.

JALAN: One of Asia’s

Leading Travel Sites

64% Ownership in

#2 Chinese Online

Travel Agency

Partnership with Asia’s

Leading Low Cost

Carrier

+

1

Includes Gross Bookings for AirAsia joint venture that launched July 1, 2011 and were

not consolidated in Expedia’s 3Q 2011 results |

11

Expedia

Expedia

®

Has Scale in Hotels …

Has Scale in Hotels …

Global Team

Working to Sign

Up New Hotels

Number of Hotels3

Rapidly Expanding in

Fragmented Hotel Market

1

Other includes Advertising, Destination Services, Insurance, Cruise, Agency Packages,

and Other 2

Smith Travel Research and Expedia data

3

Hotel

data

for

TripAdvisor,

Priceline,

Orbitz

and

Ctrip.com

from

Companywebsites

…

…

And Significant Room for

And Significant Room for

Additional Growth

Additional Growth

Hotels

Hotels

72%

72%

$3.4B

TTM 3Q 2011

Revenues

~145k Hotels in

200+ Countries

Single Largest

Booker of

Rooms in US

…

But Still Only

~5% Share2 |

12

UNIFIED

Customer

Operations

Technology

UNIFIED

Transactional

Infrastructure:

Financials / Order Management / Inventory Management

Technology Investment

Positions Us for Growth

10,000

Affiliates

CUSTOMIZED

Front-End

Technology

for

Rapid

Innovation

and Powerful Analytics …

Improving Conversion |

13

Technology Investment

Positions Us for Growth

1

Hotels.com Gross Bookings growth does not include Venere

|

14

Fast Paced Innovation from

Fast Paced Innovation from

Technology Investment

Technology Investment

Simplifying the Customer

Simplifying the Customer

Experience to Drive Conversion:

Experience to Drive Conversion:

An Example

An Example

Investing in Technology at

24

3-4

New Technology Releases Annually

Pre-Investment

New Platform

Capability

…

and Driving Toward Even Faster Releases

…

…

Increases Conversion Rates

Increases Conversion Rates

Pre-Platform

Migration

Post-Platform

Migration

+~20%

Number of Pages to Booking

Pre-Investment

~6

Pages

1

Page

New Platform

Capability |

15

Opening Up Significant

Opening Up Significant

Opportunity in Travel

Opportunity in Travel

Industry Leading Mobile, Social and Deal

Initiatives Drive Traffic and Revenue

50-70%

of Mobile Bookings

of Mobile Bookings

Completed within

Completed within

One Day

of Travel / Stay

of Travel / Stay

in App Development

Leading Travel

App Developer

in App Success

#1 Free iPhone

Travel Apps in

40+ Countries

1

in Deals

…

…

Expedia

Expedia

Leads the Way

Leads the Way

The World Is

The World Is

Changing …

Changing …

PC-Connected

Users

24 x 7

Mobile Users

Unique Supply Deal and

Unique Supply Deal and

Value Proposition to

Value Proposition to

Customers:

Customers:

40-50% Off

Just for Mobile

Just for Mobile

1

Source: AppAnnie |

16

Expedia’s Significant Competitive Moats

SCALE and BREADTH

SCALE and BREADTH

Global Scale Across Multiple Travel Brands and Product Offerings

Global Scale Across Multiple Travel Brands and Product Offerings

DIVERSE DEMAND

DIVERSE DEMAND

Multiple Sources

Multiple Sources

Leisure

Leisure

Corporate

Corporate

Call Centers

Call Centers

Traditional Travel Agency

Traditional Travel Agency

Online

Online

SUPPLY

SUPPLY

Global Travel Supply Footprint and

Global Travel Supply Footprint and

Deeper Supplier Relationships

Deeper Supplier Relationships

TECHNOLOGY PLATFORM

TECHNOLOGY PLATFORM

Investment in Technology to

Investment in Technology to

Drive Conversion and Bookings

Drive Conversion and Bookings |

17

Experienced Leadership Team

with Deep Industry Knowledge

Dara

Dara

Khosrowshahi

Khosrowshahi

Chief Executive Officer

and President

6 Years at Expedia

Mark

Mark

Okerstrom

Okerstrom

Chief Financial Officer

5 Years at Expedia

Barry

Barry

Diller

Diller

Senior Executive

16 Years at

IAC/Expedia |

18

FINANCIALS |

19

Large User Base With Multiple Growth Vectors

Large User Base With Multiple Growth Vectors

Key Financial Highlights

High Quality Diversified Revenue Streams

High Quality Diversified Revenue Streams

Consistent, Robust Cash Flow Generation and Strong EPS Growth

Consistent, Robust Cash Flow Generation and Strong EPS Growth

Strong Balance Sheet Allows Ample Value-Add Opportunities

Strong Balance Sheet Allows Ample Value-Add Opportunities

Investing Now to Support Future Growth |

20

Investing to Drive Accelerating Growth

ADJUSTED EBITDA¹

ADJUSTED EPS GROWTH

2,3,4

$ Millions

’07-’10 CAGR: 2.8%

TTM 3Q11 Y-o-Y Growth: 2.2%

’07-’10 CAGR: 2.8%

TTM 3Q11 Y-o-Y Growth: 2.2%

’07-’10 CAGR: 6.4%

TTM 3Q11 Y-o-Y Growth: 8.2%

’07-’10 CAGR: 6.4%

TTM 3Q11 Y-o-Y Growth: 8.2%

2

See Appendix B for Non-GAAP to GAAP Reconciliation

3

Adj. EPS does not take into account the reverse stock split expected to occur

immediately prior to the contemplated TripAdvisor spin transaction

4

Adj. EPS is EPS for Expedia, Inc. considering TripAdvisor on a discontinued

operations basis REVENUE

$ Billions

’07-’10 CAGR :

6.1%

TTM 3Q11 Y-o-Y Growth: 15.5%

’07-’10 CAGR :

6.1%

TTM 3Q11 Y-o-Y Growth: 15.5%

1

See Appendix A for Non-GAAP to GAAP Reconciliation

GROSS BOOKINGS

World’s Largest Travel Company

World’s Largest Travel Company

$ Billions |

21

High Quality, Diversified Revenue

Weighted Towards Growth

1

Other Leisure includes Classic Vacations, Expedia Local Expert and

CruiseShipCenters 2

Hotels.com includes Venere |

22

The Three Stages of Expedia Growth

STAGE 1

2010

STAGE 2

2011-2012

STAGE 3

2013

Revenue Growth

Modest:

6.1% Growth¹

Accelerating

Continuing

Line Item Trajectory

(% of Revenues)

Cost of Revenue

22.5%

Flat as

% of Revenue

Declining

as

%

of

Revenue

Selling and Marketing

40.3%

Increasing as

% of Revenue

Flat to Slightly

Increasing as

% of Revenue

Technology

and Content

9.8%

Increasing as

% of Revenue

Flat or Declining

as

%

of

Revenue

G&A

8.5%

Declining

as

% of Revenue

Declining

as

%

of Revenue

Adjusted

EBITDA Margin²

22.3%

Slightly Decreasing as

% of Revenue

Increasing as

% of Revenue

1

Represents 2007 –

2010 CAGR

2

See Appendix A for Non-GAAP to GAAP Reconciliation |

23

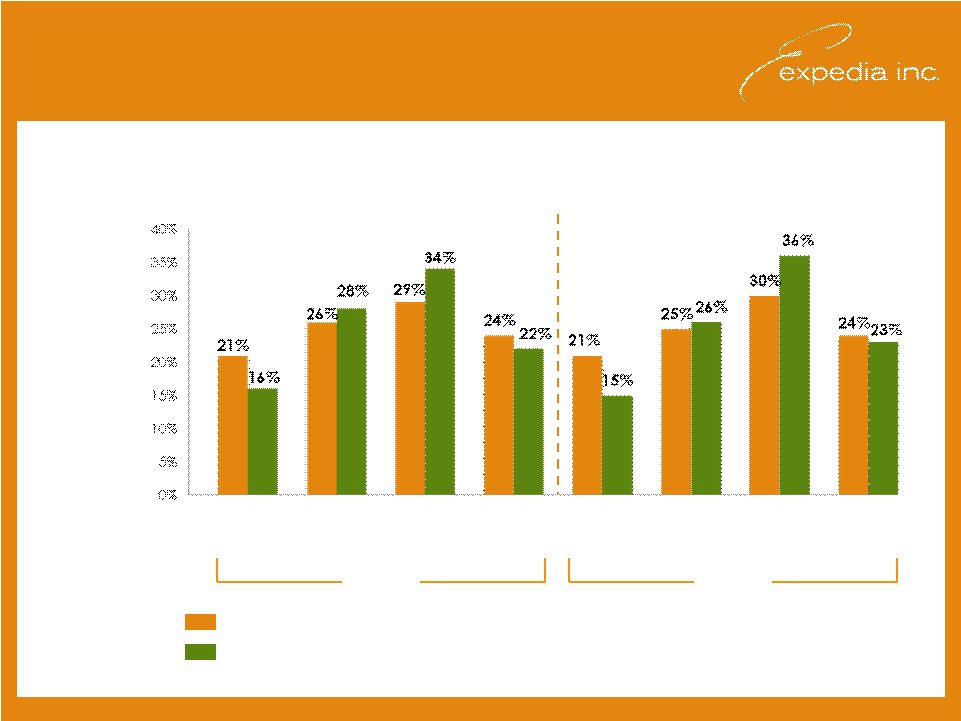

Understanding Expedia’s Seasonality

QUARTERLY REVENUE AND ADJUSTED EBITDA CONTRIBUTION

Quarterly Adjusted EBITDA % of Total Annual Adjusted EBITDA

Quarterly Revenue % of Total Annual Revenue

2009

Quarterly Adj.

EBITDA Margin:

Quarter as %

of Total Year

1Q

18%

2Q

26%

3Q

28%

4Q

23%

1Q

15%

2Q

23%

3Q

28%

4Q

21%

2010 |

24

$ Millions

2008

2009

2010

TTM 3Q11

Capex

$142

$78

$136

$195

Capex (% of Revenue)

5.2%

2.8%

4.5%

5.7%

Share Repurchases

$ –

$ –

$489

$306

Dividend Payment

–

–

79

77

Acquisitions & Other

Investments¹ 342

12

98

88

2

Cash Interest Paid³

54

79

78

124

Consistent, Robust Cash Flow

Available to Drive Equity Returns

Note:

Share

repurchases

and

dividend

payments

reflect

consolidated

Expedia

amounts;

Free

cash

flow

defined

as

net

cash

provided

by

operating

activities

less

capital

expenditures

1

Includes

certain

investment

activity

included

in

sales

and

maturities

of

investments

as

well

as

sales

(purchases)

of

interest

in

controlled

subsidiaries,

net,

as

recorded

on

Expedia’s

cash

flow

statement

2

Acquisitions are as of TTM ending 9/30/2011. Includes $22mm of acquisitions as well as

additional investments in majority-owned subsidiaries and the AirAsia joint venture

3

Includes interest on 8.5% Notes

CONSISTENT AND

STRONG FREE CASH

FLOW DRIVERS:

Strong Adjusted EBITDA

Generation

Working Capital Benefit from

Growing Merchant Hotel

Business

Declining Cash Taxes

Annual Free

Annual Free

Cash Flow

Cash Flow

Between

Between

$300M and

$300M and

$600M

$600M

DRIVES |

25

Expedia Pro Forma Capitalization

$ Millions

AS OF 9/30/2011

PF 9/30/2011

Cash, Cash Equivalents & Short Term Investments1

$2,006

$1,842

Revolving Credit Facility2

–

–

5.950% Notes Due 20203

749

749

7.456% Notes Due 2018

500

500

8.500% Notes Due 2016

4

396

–

Total Debt

$1,645

$1,249

Net Debt

$(361)

$(593)

TTM Adjusted EBITDA

5

683

683

Total Debt / TTM Adjusted EBITDA

2.4x

1.8x

Net Debt / TTM Adjusted EBITDA

(0.5)x

(0.9)x

Source: Company financial reports and estimates. Some numbers may not add due to

rounding 1

Excludes restricted cash

2

Total

size

of

revolving

credit

facility

closed

in

February

2010

is

$750mm;

available

capacity

reduced

by

$20mm

in

outstanding

letters

of

credit

as

of

September

30,

2011

3

The 5.950% Notes were issued at 99.893% of par resulting in a discount, which is being

amortized over their life 4

The 8.5% Notes were issued at 98.572% resulting in a discount, which is being

amortized over their life 5

TTM ending 9/30/11Adjusted EBITDA excludes segment results for TripAdvisor

|

26

Summary

Global Leader in ~$1 Trillion Market with

Global Leader in ~$1 Trillion Market with

Strong Offline-to-Online Trends

Strong Offline-to-Online Trends

Significant Growth Opportunities Across Geographies

Significant Growth Opportunities Across Geographies

Rapid Expansion in Highly Fragmented Hotel Industry

Rapid Expansion in Highly Fragmented Hotel Industry

Technology Platform Investment and

Technology Platform Investment and

Innovation Driving Higher Conversion

Innovation Driving Higher Conversion

Success in New Distribution Channels, e.g. Mobile

Success in New Distribution Channels, e.g. Mobile

A Growth

Company

Powerful Free Cash Flow Generation

Powerful Free Cash Flow Generation |

27

APPENDICES |

28

$ Millions

2007

2008

2009

2010

TTM ENDING

9/30/2011

Trip

Adv.

Expe.

Inc. ²

Total

Trip

Adv.

Expe.

Inc. ²

Total

Trip

Adv.

Expe.

Inc. ²

Total

Trip

Adv.

Expe.

Inc. ²

Total

Trip

Adv.

Expe.

Inc. ²

Total

Adjusted EBITDA

$623

$619

$659

$677

$324

$683

$1,007

Depreciation

57

72

93

105

17

126

143

OIBA¹

$104

$565

$669

$150

$548

$698

$196

$566

$761

$260

$571

$831

$307

$557

$864

Amortization of Intangible Assets

-

-

(78)

-

-

(69)

-

-

(38)

-

-

(37)

-

-

(35)

Impairment of Goodwill

-

-

-

-

-

(2,762)

-

-

-

-

-

-

-

-

-

Impairment of Intangible and

Other Long-Lived Assets

-

-

-

-

-

(234)

-

-

-

-

-

-

-

-

-

Legal Reserves and Occupancy

Tax Assessments

-

-

-

-

-

-

-

-

(68)

-

-

(6)

-

-

(7)

Stock-Based Compensation

-

-

(63)

-

-

(61)

-

-

(62)

-

-

(60)

-

-

(59)

Restructuring Charges

-

-

-

-

-

-

-

-

(34)

-

-

-

-

-

-

Realized Loss on Revenue Hedges

-

-

-

-

-

-

-

-

11

-

-

4

-

-

17

Spin-off Costs

-

-

-

-

-

-

-

-

-

-

-

-

-

-

(7)

Operating Income / (Loss)

$-

$-

$529

$-

$-

$(2,429)

$-

$-

$571

$-

$-

$732

$-

$-

$774

Other Expense, Net

-

-

(32)

-

-

(86)

-

-

(113)

-

-

(111)

-

-

(118)

Income before Income Taxes

$-

$-

$497

$-

$-

$(2,515)

$-

$-

$458

$-

$-

$621

$-

$-

$656

Provision for Income Taxes

-

-

(203)

-

-

(6)

-

-

(154)

-

-

(195)

-

-

(181)

Net Income

$-

$-

$294

$-

$-

$(2,521)

$-

$-

$304

$-

$-

$426

$-

$-

$475

Net Income Attributable to

Noncontrolling Interests

-

-

2

-

-

3

-

-

(4)

-

-

(4)

-

-

(2)

Net Income Attributable to

Expedia, Inc.

$-

$-

$296

$-

$-

$(2,518)

$-

$-

$300

$-

$-

$422

$-

$-

$473

Non-GAAP / GAAP Reconciliation

Appendix A: Adjusted EBITDA

1

Note: Numbers may not sum due to rounding

1

As previously reported in Expedia, Inc.'s annual and quarterly reports filed with the

Securities and Exchange Commission for the periods reflected above

2

Represents the remaining segments -

Leisure, Egencia and Corporate, as reported under the Expedia, Inc. consolidated

financial statements |

29

$ Thousands

2007

2008

2009

2010

TTM ENDING

9/30/2011

Net Income / (Loss) from Continuing Operations

$241,968

$(2,340,174)

$214,406

$302,251

$323,575

Stock-Based Compensation

59,948

55,731

55,756

52,507

50,728

Amortization of Intangibles

68,367

58,275

23,875

22,514

23,148

Restructuring Charges

-

-

34,168

-

-

Noncontrolling Investment Basis Adjustment

-

-

5,158

-

-

Legal Reserves and Occupancy Tax Assessments

-

-

67,658

5,542

7,334

Foreign Currency Loss on U.S. Dollar Cash Balances Held by

eLong

-

8,586

128

2,711

2,723

Impairment of Goodwill

8,642

2,480,470

-

-

-

Impairment of Intangibles

-

233,900

-

-

-

Federal Excise Tax Refunds

(12,058)

-

-

-

-

(Gain) / Loss on Derivative Instruments Assumed at Spin-Off

5,748

(4,600)

38

-

-

Amort. of Intangible Assets as Part of Equity Method Investments

2,324

2,593

458

-

-

Unrealized (Gain) / Loss on Revenue Hedges

-

-

(1,033)

4,898

(13,654)

Noncontrolling Interests

(4,515)

(3,837)

(1,343)

(2,877)

(3,243)

Provision for Income Taxes

(38,774)

(196,092)

(86,521)

(26,541)

(20,259)

Adjusted Net Income from Continuing Operations

$331,650

$294,852

$312,748

$361,005

370,352

GAAP Diluted Weighted Average Shares Outstanding

314,233

286,167

292,141

288,028

278,541

Additional Restricted Stock Units

6,237

13,771

6,367

3,777

2,748

Adjusted Diluted Weighted Average Shares Outstanding

320,470

299,938

298,508

291,805

281,289

Adjusted Earnings from Continued Operations Per Share

$1.03

$0.98

$1.05

$1.24

$1.32

Non-GAAP / GAAP Reconciliation

Appendix B: Adjusted EPS Reconciliation

Note: Numbers may not sum due to rounding |

30

$ Thousands

2010

TTM ENDING

9/30/11

Cost of Revenue

$685

$752

Stock-Based Compensation

(2)

(3)

Cost of Revenue ex. Stock-Based Compensation

$683

$749

Selling and Marketing

$1,235

$1,444

Stock-Based Compensation

(14)

(14)

Selling and Marketing ex. Stock-Based Compensation

$1,221

$1,430

Technology and Content

$311

$360

Stock-Based Compensation

(14)

(15)

Technology and Content ex. Stock-Based Compensation

$296

$345

G&A

$287

$328

Stock-Based Compensation

(29)

(28)

G&A ex. Stock-Based Compensation

$258

$300

Non-GAAP / GAAP Reconciliation

Appendix C: Non-GAAP Expense Items

Non-GAAP Cost of Revenue, Selling and Marketing, Technology and Content and

General and Administrative Expenses Excluding Stock-Based Compensation

Note: Numbers may not sum due to rounding |