Attached files

| file | filename |

|---|---|

| EX-23 - CONSENT OF INDEPENDENT REGISTER PUBLIC FIRM - L & L ENERGY, INC. | consentofindependentregister.htm |

|

As filed with the Securities and Exchange Commission on December 8, 2011 Registration No. 333-164229 |

|

|

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

AMENDMENT NO. 5

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

______________________

L & L ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada (State or other jurisdiction of incorporation or organization) |

1220 |

91-2103949 (I.R.S. Employer Identification No.) |

130 Andover Park East

Suite 200

Seattle, WA 98188

(206) 264-8065

(Address, Including zip code, and telephone number, including area code, of registrant’s principal executive offices)

______________________

Dickson V. Lee, Chief Executive Officer

L & L Energy, Inc.

130 Andover Park East

Suite 200

Seattle, WA 98188

(206) 264-8065

(Name, address, including zip code, and telephone number, including area code, of agent for service)

______________________

Copies of all communications, including communications sent to agent for service, shall be sent to:

|

D. Roger Glenn, Esq. Glenn & Glenn LLP 124 Main Street, Suite 8 New Paltz, NY12561 (845) 256-8396 |

______________________

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. T

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer £ |

|

Accelerated filer T |

|

|

Non-accelerated filer £ (Do not check if a smaller reporting company) |

|

Smaller reporting company £ |

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

|

|

|

The information in this prospectus is not complete and may be changed. The selling security holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

SUBJECT TO COMPLETION, DATED DECEMBER 8, 2011

Preliminary Prospectus

4,206,773 shares

L & L ENERGY, INC.

Common Stock

________________________

This prospectus covers the resale by selling security holders named starting on page 44, of up to 4,206,773 shares of our common stock, $0.001 par value per share (the “Common Stock”), which includes:

· 1,371,021 shares of common stock issued in conjunction with our private placement financing completed on October 8, 2009 (the “October Financing”);

· 932,295 shares of common stock underlying the warrants issued in conjunction with the October Financing;

· 835,389 shares of common stock issued in conjunction with our private placement financing completed on November 6, 2009 (the “November Financing”);

· 568,068 shares of common stock underlying the warrants issued in conjunction with the November Financing;

· 250,000 shares of common stock underlying the warrants issued in conjunction with our private placement financing completed on May 6, 2009 (the “May Financing”); and

· 250,000 shares of common stock issued upon the exercise of warrants issued in the May Financing.

These securities will be offered for sale from time to time by the selling security holders identified in this prospectus in accordance with the terms described in the section of this prospectus entitled “Plan of Distribution.” We will not receive any of the proceeds from the sale of the common stock by the selling security holders.

Our common stock is listed on the Nasdaq Stock Market and is traded under the symbol “LLEN”. The last reported per share sales price for our common stock was $2.96 on, November 31, 2011.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is [leave blank until declared effective]

|

TABLE OF CONTENTS

PROSPECTUS SUMMARY |

1 |

|

RISK FACTORS |

3 |

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

12 |

|

USE OF PROCEEDS |

12 |

|

SELECTED FINANCIAL DATA |

12 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

14 |

|

DESCRIPTION OF BUSINESS |

35 |

|

DESCRIPTION OF PROPERTY |

51 |

|

MANAGEMENT |

51 |

|

COMPENSATION OF EXECUTIVE OFFICERS |

54 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

59 |

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS |

60 |

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

62 |

|

DESCRIPTION OF SECURITIES TO BE REGISTERED |

62 |

|

SELLING SECURITY HOLDERS |

65 |

|

PLAN OF DISTRIBUTION |

67 |

|

LEGAL PROCEEDINGS |

67 |

|

LEGAL MATTERS |

67 |

|

EXPERTS |

68 |

|

ADDITIONAL INFORMATION |

68 |

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS |

F-1 |

You should rely only on the information contained in this prospectus. Neither we, the selling stockholders nor the underwriters, if any, have authorized anyone to provide you with information different from that contained in this prospectus. We and the selling security holders are offering to sell, and seeking offers to buy, common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

Market data and other statistical information used throughout this prospectus are based upon independent industry publications, government publications and other published information from third-party sources that we believe are reliable. None of the publications, reports or other published industry sources referred to in this prospectus were commissioned by us or prepared at our request and, except as we deemed necessary, we have not sought or obtained the consent from any of these sources to include their data in this prospectus.

PROSPECTUS SUMMARY

This summary contains basic information about us and this offering. The reader should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained in this prospectus, including statements under “Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. We note that our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

References to “we,” “our,” “us,” the “Company,” or “L&L” refer to L & L Energy, Inc., a Nevada corporation, and its consolidated subsidiaries.

Our Business

L & L Energy, Inc. is an energy company engaged in the government-mandated consolidation and expansion of the fragmented coal industry in Southwestern China.

We are an American company headquartered in Seattle, Washington and incorporated in the State of Nevada. We were founded in 1995, have been an SEC public reporting company since 2001, began trading on the Over-the-Counter Bulletin Board in 2008, and started trading on the NASDAQ Global Market in 2010 under “LLEN”. Many of our board of directors, officers, and management are U.S. citizens and bilingual.

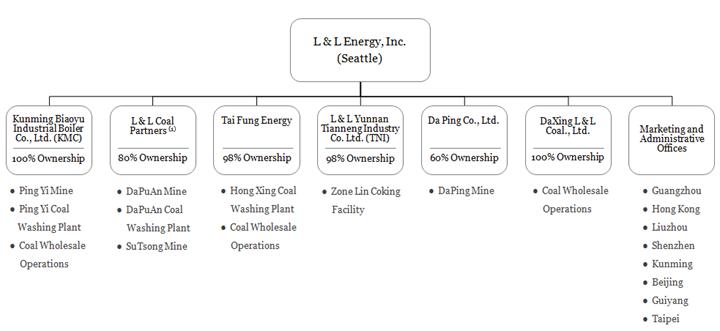

We are in the business of producing, processing, and selling coal in the People’s Republic of China. Our vertically integrated and diversified operations include four coal mines, three coal washing plants, coal wholesale and distribution networks, and one coking facility. We conduct our business though wholly-owned subsidiaries or majority interests in other entities. As of July 31, 2011, the Company has the following subsidiaries or majority interests in Guizhou and Yunnan Provinces in Southwestern China:

Kunming Biaoyu Industrial Boiler Co., Ltd (“KMC”) which owns/controls coal wholesale operations, the Ping Yi Coal Mine (“PYC”), and the Ping Yi coal washing facility, both in Pan County in Guizhou Province;

L&L Coal Partners (also known as “2 Mines” or “LLC”) which owns/controls two coal mining operations DaPuAn Mine and SuTsong Mine and DaPuAn Mine’s coal washing facility, all located in Shizong County in Yunnan Province;

L&L Yunnan Tianneng Industry Co., Ltd. (“TNI) which owns/controls ZoneLin Coal Coking Factory (“ZoneLine”) located in LuoPing County in Yunnan Province;

Yunnan L&L Tai Fung (“Tai Fung”) which owns/controls SeZone County Hong Xing Coal Washing Factory (“Hong Xing”) and coal wholesale and distribution operations located in Shizong County; and

DaPing Co., Ltd “DaPing”) which owns/controls DaPing Coal Mine located in Pan County in Guizhou Province.

DaXing L & L Coal Co., Ltd. (“DaXing”) which owns/ controls our coal wholesale operation located in Pan County in Guizhou Province.

Our China Operations Center is located in Kunming City, Yunnan Province. In addition, we have sales and administrative offices throughout China. Our customers are mainly State Owned Enterprises that mostly produce electricity or steel.

The Offering

We are registering 4,206,773 shares of our common stock for sale by the selling security holders identified in the section of this prospectus entitled “Selling Security Holders.” As required by the Securities Purchase Agreements that we executed as part of the October Financing and the November Financing, we are registering for resale the following: (i) 2,206,410 shares of Common Stock issued to investors in the October and November Financing; (ii) 1,323,849 shares of Common Stock underlying the Warrants issued to the investors in the October Financing and the November Financing; (iii) 109,682 shares of Common stock underlying the warrant issued to the placement agent with an exercise price of $6.11 per share and five year term in connection with the October Financing; and (iv) 66,832 shares of Common Stock underlying the warrant with an exercise price of $6.11 per share and a five year term issued to the placement agent in connection with the November Financing. Information regarding our Common Stock is included in the section of this prospectus entitled “Description of Securities.”

1

The shares of common stock offered under this prospectus may be sold by the selling security holders on the public market, in negotiated transactions with a broker-dealer or market maker as principal or agent, or in privately negotiated transactions not involving a broker or dealer. Information regarding the shares of common stock offered under this prospectus, and the times and manner in which they may be offered and sold is provided in the sections of this prospectus entitled “Plan of Distribution.” We will not receive any of the proceeds from those sales. The registration of the shares of common stock offered under this prospectus does not necessarily mean that any of these shares will ultimately be offered or sold by the selling security holders.

General Information

Our principal executive offices are located at 130 Andover Park East, Suite 200, Seattle, Washington 98188 and our telephone number there is (206) 264-8065.

2

RISK FACTORS

The reader should carefully consider the risks described below together with all of the other information included in this prospectus. The statements contained in or incorporated into this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and an investor in our securities may lose all or part of their investment.

RISKS RELATING TO THE COMPANY AND OUR BUSINESS

Our business and results of operations depend on the volatile People’s Republic of China domestic coal markets.

Substantially all of our coal business is conducted in the People’s Republic of China (“PRC” or “China”), and as a result, our business and operating results depend on the domestic supply and demand for coal and coal products in China. The domestic coal markets are cyclical and have historically experienced pricing volatility, which reflects, among other factors, the conditions of the PRC and global economies and demand fluctuations in key industries that have high coal consumption, such as the power generation and steel industries. Difficult economic conditions in recent periods have resulted in lower coal prices, which in turn negatively affect our operational and financial performance. For example, after reaching record high levels in 2008, the price of domestic coal in China fell in 2009 due to weakening demand as a result of the global economic downturn. The domestic and international coal markets are affected by supply and demand. The demand for coal is primarily affected by the global economy and the performance of power generation, chemical, metallurgy and construction materials industries. The availability and prices of alternative sources of energy, such as natural gas, oil, hydropower, solar and nuclear power also affect the demand for coal. The supply of coal, on the other hand, is primarily affected by the geographical location of coal reserves, the transportation capacity of coal transportation railways, the volume of domestic and international coal supplies and the type, quality and price of competitors’ coal. A significant rise in global coal supply or a reduction in coal demand may have an adverse effect on coal prices, which in turn, may reduce our profitability and adversely affect our business and results of operations.

Our mining operations are inherently subject to changing conditions that could adversely affect our profitability.

Our coal operations are inherently subject to changing conditions that can adversely affect our levels of production and production costs for varying lengths of time and can result in decreases in profitability. We are exposed to commodity price risk related to the purchase of diesel fuel, wood, explosives and steel. In addition, weather and natural disasters (such as earthquakes, landslides, flooding, and other similar occurrences), unexpected maintenance problems, key equipment failures, fires, variations in thickness of the layer, or seam, of coal, amounts of overburden, rock and other natural materials, variations in rock and other natural materials and variations in geological conditions can be expected in the future to have, a significant impact on our operating results. Prolonged disruption of production at the mine would result in a decrease in our revenues and profitability, which could be material. Other factors affecting the production and sale of our coal and coke that could result in decreases in our profitability include:

- sustained high pricing environment for raw materials, including, among other things, diesel fuel, explosives and steel;

- changes in the laws and/or regulations that we are subject to, including permitting, safety, labor and environmental requirements;

- labor shortages; and

- changes in the coal markets and general economic conditions.

Our results of operations depend on our ability to acquire new coal mines and other coal-related businesses.

The recoverable coal reserves in mines decline as coal is extracted from them. In addition, the coal related business in China is heavily regulated by the PRC government, which, among other things, imposes limits on the amount of coal that may be extracted. As a result, our ability to significantly increase our production capacity at existing mines is limited, and our ability to increase our coal production will depend on acquiring new mines. Our existing mines are the DaPuAn, SuTsong, Ping Yi and Da Ping coal mines.

Our ability to acquire new coal mines and to expand production capacity in China and to procure related licenses and permits is subject to approval of the PRC government (including local governments.) Delays in securing or failure to secure relevant PRC government approvals, licenses or permits, as well as any adverse change in government policies, may hinder our expansion plans, which may materially and adversely affect our profitability and growth prospects. We cannot assure you that our future acquisitions, expansions, or investments will be successful.

Furthermore, we cannot assure you that we will be able to identify suitable acquisition targets or acquire these targets on competitive terms and in a timely manner. We may not be able to successfully develop new coal mines or expand our existing ones in accordance with our development plans or at all. We may also fail to acquire or develop additional coal washing and coking facilities in the future. Failure to successfully acquire suitable targets on competitive terms, develop new coal mines or expand our existing coal mines and other coal related operations could have an adverse effect on our competitiveness and growth prospects. Further, the benefits of an acquisition may take considerable time and other resources to develop and we cannot assure investors that any particular acquisition or joint venture will produce the intended benefits. Moreover, the identification and completion of these transactions may require us to expend significant management time and effort and other resources.

3

If we fail to obtain additional financing we will be unable to execute our business plan.

As we continue to expand our business, we require capital infusions from the capital market. Under our current business strategy, our ability to grow will depend on the availability of additional funds, suitable acquisition targets at an acceptable cost, and working capital. Our ability to compete effectively, to reach agreements with acquisition targets on commercially reasonable terms, to secure critical financing and to attract professional managers is critical to our success. We will require additional funds to complete recent acquisitions, as well as to make future acquisitions, continue improving our current coal mines and other coal processing facilities, and to obtain regulatory approvals for our operations. We intend to seek additional funds through public or private equity or debt financing, strategic transactions and/or from other sources. However, there are no assurances that future funding will be available on favorable terms or at all. If additional funding is not obtained, we will need to reduce, defer or cancel development programs, planned initiatives or overhead expenditures, to the extent necessary. The failure to fund our capital requirements would have a material adverse effect on our business, financial condition and results of operations.

Coal reserve estimates may not be indicative of reserves that we actually recover.

The coal reserves disclosed for the mines from which we have the right to extract coal are the estimated quantities (based on applicable reporting regulations) that under present and anticipated conditions have the potential to be economically mined and processed. However, the amount of coal that we may extract from a given mine is limited by the mining rights granted to us by local governmental authorities. In addition, there are numerous uncertainties inherent in estimating quantities of coal reserves and in projecting potential future rates of coal production including many factors beyond our control. Reserve engineering is a subjective process of estimating underground deposits of reserves that cannot be measured in an exact manner and the accuracy of any reserve estimate is a function of the quality of available data and engineering and geological interpretation and judgment. Estimates of different engineers may vary (e.g., in coal grade and reserve quantity) and results of our mining/drilling and production subsequent to the date of an estimate may justify revision of estimates. Reserve estimates may require revision based on actual production experience and other factors. In addition, several factors including the market price of coal, reduced recovery rates or increased production costs due to inflation or other factors may render certain estimated proved and probable coal reserves uneconomical to exploit and may ultimately result in a restatement of reserves. This may have a material adverse effect on our business, operating results, cash flows and financial condition.

U.S.-listed companies with substantial business operations in China have recently become subject to increased scrutiny, criticism and negative publicity.

Since 2010, a number of U.S. publicly-listed companies with substantial operations in China have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the United States Securities and Exchange Commission (“SEC”) resulting in loss of share value. Much of the scrutiny and negative publicity has centered around accounting weaknesses, inadequate corporate governance and, in some cases, allegations of fraud. As a result of such scrutiny and negative publicity, the stock prices of most U.S. public companies with operations in China have sharply decreased in recent months.

Our industry is heavily regulated and we may not be able to remain in compliance with all such regulations and we may be required to incur substantial costs in complying with such regulation.

We are subject to extensive regulation by China’s Mining Ministry and by other provincial, county and local authorities in jurisdictions in which our products are processed or sold, regarding the processing, storage, and distribution of our product. Our processing facilities are subject to periodic inspection by national, province, county and local authorities. We may not be able to comply with current laws and regulations, or any future laws and regulations. To the extent that new regulations are adopted, we will be required to adjust our activities in order to comply with such regulations. We may be required to incur substantial costs in order to comply. Our failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material and adverse effect on our business, operations and finances. Changes in applicable laws and regulations may also have a negative impact on our sales.

Government regulation of our operations imposes additional costs on us, and future regulations could increase those costs or limit our ability to mine, crush, clean, process and sell coal. China’s central, provincial and local authorities regulate the coal mining industry with respect to matters such as employee health and safety, permitting and licensing requirements, air quality standards, water pollution, plant and wildlife protection, reclamation and restoration of mining properties after mining is completed, the discharge of materials into the environment, surface subsidence from underground mining and the effects that mining has on groundwater quality and availability. We are required to prepare and present to China’s central, provincial and local authorities data pertaining to the effect or impact that any proposed processing of coal may have upon the environment. The costs, liabilities and requirements associated with these regulations may be costly and time-consuming and may delay commencement, expansion or continuation of our coal processing operations. The possibility exists that new legislation and/or regulations and orders may be adopted that may materially and adversely affect our operations, our cost structure and/or our customers’ ability to use coal. New legislation or administrative regulations (or judicial interpretations of existing laws and regulations), including proposals related to the protection of the environment that would further regulate and tax the coal industry, may also require us and our customers to change operations significantly or incur increased costs. Certain sales agreements contain provisions that allow a purchaser to terminate its contract if legislation is passed that either restricts the use or type of coal permissible at the purchaser’s plant or results in specified increases in the cost of coal or its use. These factors and legislation, if enacted, could have a material adverse effect on our financial condition and results of operations.

4

As a producer of coal products in China, we are subject to significant, extensive and increasingly stringent environmental protection laws, governmental regulations on coal standards and safety requirements. These laws and regulations, among other things:

· impose fees for the discharge of waste substances and pollutants;

· require the establishment of reserves for reclamation and rehabilitation;

· impose fines for serious environmental offenses; and

· authorize the PRC government, at its discretion, to close any facility that it determines has failed to comply with environmental regulations, operating standards, and suspend any coal operations that cause excessive environmental damage.

Some of our operations are based on traditional, old coal extraction and processing techniques, which are popular in China, and which produce waste water, gas emissions and solid waste materials. The PRC government has tightened enforcement of applicable laws and regulations and adopted more stringent environmental and operational standards. We believe that our coal mining, washing and coking operations comply in all material respects with existing Chinese environmental and safety standards. However, some of our mines were recently subject to what we believe county-wide shut downs and safety inspection of coal mines by the local governments and it remains unclear when or if operations will be resumed to their full production level. If we are unable to resume operations to full production level in a timely manner, our results of operations will be harmed.

In addition, our budgeted amount for environmental and safety regulatory compliance may not be sufficient, and we may need to allocate additional funds for this purpose. If we fail to comply with current or future environmental and safety laws and regulations, we may be required to pay penalties or fines or take corrective actions, any of which may have a material adverse effect on our business operations and financial condition. China is a signatory to the 1992 United Nations Framework Convention on Climate Change and the 1997 Kyoto Protocol, which are intended to limit greenhouse gas emissions. On March 14, 2011, the PRC government approved the Twelfth Five-Year Plan for National Economic and Social Development, which sets goals to decrease the amount of energy consumed per unit of GDP by 16% from 2010 levels, cap energy use at 4 billion tons of coal equivalents by 2015 and reduce the carbon emissions by 17% from 2010 levels by 2015. Efforts to reduce energy consumption, use low-carbon coal, and control greenhouse gas emissions could materially reduce coal consumption, which would adversely affect our revenue and our business.

We depend on key persons and the loss of any key person could adversely affect our operations.

The future success of our investments in China is dependent on our management team, including Mr. Dickson V. Lee, our Chairman and Chief Executive Officer, and our professional team and advisors. If one or more of our key personnel are unable or unwilling to continue in their present positions, we may not be able to easily replace them, and we may incur additional expenses to recruit and train new personnel. The loss of our key personnel could severely disrupt our business and its financial condition and results of operations could be materially and adversely affected. Furthermore, since the industries we invest in are characterized by high demand and intense competition for talent, we may need to offer higher compensation and other benefits in order to attract and retain key personnel in the future. We cannot assure investors that we will be able to attract or retain the key personnel needed to achieve our business objectives. While Mr. Dickson V. Lee is covered by a one-year term accident insurance policy in China, which is paid for by the Company, we currently do not maintain “key person” life insurance coverage for any of our officers.

5

Our business is highly competitive and increased competition could reduce our sales, earnings and profitability.

The coal business is highly competitive in China and we face substantial competition in connection with the marketing and sale of our products. Some of our competitors are well established, have greater financial, marketing, personnel and other resources, have been in business for longer periods of time than we have, and have products that have gained wide customer acceptance in the marketplace. The greater financial resources of our competitors will permit them to implement extensive marketing and promotional programs. We could fail to expand our market share, and could fail to maintain our current share. Increased competition could also result in overcapacity in the Chinese coal industry in general. The coal industry in China has experienced overcapacity in the past. During the mid-1970s and early 1980s, a growing coal market and increased demand for coal in China attracted new investors to the coal industry, spurred the development of new mines and resulted in added production capacity throughout the industry, all of which led to increased competition and lower coal prices. Similarly, an increase in future coal prices could encourage the development of expanded capacity by new or existing coal processors. Any overcapacity could reduce coal prices in the future and our profitability would be impaired.

We operate coal mines and related facilities that may be affected by water, gas, fire or structural problems and earthquakes. As a result, we, like other companies operating coal mines, have experienced accidents that have caused property damage and personal injuries. Although we continuously review our existing operational standards, including insurance coverage and have implemented safety measures, fire training at our mining operations and provided on-the-job training for our employees and workers, there can be no assurance that industry-related accidents, earthquakes or other disasters will not occur in the future. The insurance industry in China is still in its development stage, and Chinese insurance companies offer only limited business insurance products. We currently only have work-related injury insurance for our employees at the DaPuAn, SuTsong, Ping Yi and Da Ping mines and limited accident insurance for staff and miners working in China. Any uninsured losses and liabilities incurred by us could have a material adverse effect on our financial condition and results of operations.

Disruptions to the Chinese railway transportation system and the other limited modes of transportation by which we deliver our products may adversely affect our ability to sell our coal products.

A substantial portion of the coal products we sell is transported to our customers by the Chinese national railway system. As the railway system has limited transportation capacity and cannot fully satisfy coal transportation requirements, discrepancies between capacity and demand for transportation exist in certain areas of the PRC. No assurance can be given that we will continue to be allocated adequate railway transport capacity or acquire adequate rail cars, or that we will not experience any material delay in transporting our coal as a result of insufficient railway transport capacity or rail cars.

Some of our business operations depend on a single transportation carrier or a single mode of transportation to deliver our coal products. Disruption of any of these transportation services due to weather-related problems, flooding, drought, accidents, mechanical difficulties, strikes, lockouts, bottlenecks, and other events could temporarily impair our ability to supply coal to our customers. Our transportation providers may face difficulties in the future that may impair our ability to supply coal to our customers, resulting in decreased revenues.

Our continued operation of coal mines is dependent on our ability to obtain and maintain mining licenses and other PRC government approvals for our mining operations.

Unlike land in the United States, much of which is owned by private individuals, the land and underlying minerals in China belongs to the PRC government and is only leased to lessees such as us on a long-term basis, ranging from 40 to 70 years. Further, coal reserves are owned by the PRC government, which issues mining licenses and exclusive mining rights for a particular mine to a mining operator on a long term basis (normally 50 years). This license allows the mining operators to operate and extract coal from the mine. Thus, coal mining licenses are the exclusive evidence of approval of a coal mine’s mining rights by the PRC government. The government charges all mining operators an upfront fee plus a surcharge ranging from 2%-3% of the value of the coal excavated from the ground. There can be no assurances that we will be able to obtain additional mining licenses (including licenses to expand our production capacity at our existing mines) and rights for additional mines or to maintain such licenses for our existing operations. The loss or failure to obtain or maintain these licenses in full force and effect will have a material adverse impact on our ability to conduct our business and on our financial condition.

Furthermore, the coal industry in China is heavily regulated by the government for safety and operational reasons. Several licenses and permits are required in order to operate a coal mine. These licenses and permits, once issued, are reviewed typically once a year. Failure to comply with such regulations could result in fines or temporary or permanent shutdowns of our mining operations, which would adversely impact our business and results of operations.

6

Risks inherent to mining could increase the cost of operating our business.

Our coal mining operations are subject to conditions beyond our control that can delay coal deliveries or increase the cost of mining at particular mines for varying lengths of time. These conditions include weather and natural disasters, unexpected maintenance problems, key equipment failures, variations in coal seam thickness, variations in the amount of rock and soil overlying the coal deposit, variations in rock and other natural materials and variations in geologic conditions.

As with all underground coal mining companies, our operations are affected by mining conditions such as a deterioration in the quality or thickness of faults and/or coal seams, pressure in mine openings, presence of gas and/or water inflow and propensity for spontaneous combustion, as well as operational risks associated with industrial or engineering activity, such as mechanical breakdowns. Although we have conducted geological investigations to evaluate such mining conditions and adapt our mining plans to address them, there can be no assurance that the occurrence of any adverse mining conditions would not result in an increase in our costs of production, a reduction of our coal output or the temporary suspension of our operations.

Underground mining is also subject to certain risks such as methane outbursts and accidents caused by roof weakness and ground-falls. There can be no assurance that the occurrence of such events or conditions would not have a material adverse impact on our business and results of operations.

We have not maintained sufficient documentation of our internal control over financial reporting for the year ended April 30, 2010 and 2011, and have identified material weaknesses in our system of internal controls relating to the same.

We are subject to reporting obligations under the U.S. securities laws. The SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, adopted rules requiring every public company to include a management report on such company’s internal controls over financial reporting in its Annual Report, which contains management’s assessment of the effectiveness of our internal controls over financial reporting. Our management conducted an assessment of the effectiveness of our internal control over financial reporting as of April 30, 2010 and 2011 concluded that we did not maintain effective controls over the process of ensuring timely preparation of our financial reporting as of and for the fiscal years ended April 30, 2010 and 2011. In addition, the Company has completed the documentation supporting our assessment to our auditor Kabani & Co. Inc. As a result, Kabani & Co. Inc. has given an opinion that identified material weaknesses in our system of internal controls relating to the same periods. During the last two fiscal years, we have taken several steps to improve our internal control procedures, including adding additional internal and external resources. Until we are able to ensure the effectiveness of our internal controls, any material weaknesses may materially adversely affect our ability to report accurately our financial condition and results of operations in a timely and reliable manner. Our reporting obligations as a public company will place a significant strain on our management, operational and financial resources and systems for the foreseeable future. Effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent fraud. As a result, our failure to achieve and maintain effective internal controls over financial reporting could result in the loss of investor confidence in the reliability of our financial statements, which in turn could harm our business and negatively impact the trading price of our stock. Furthermore, we anticipate that we will incur considerable costs and use significant management time and other resources in an effort to comply with Section 404 and other requirements of the Sarbanes-Oxley Act. We also expect these developments will make it more difficult and more expensive for us to attract and retain additional members to the board of directors (both independent and non-independent), and additional executives.

RISKS RELATED TO DOING BUSINESS IN CHINA

Our Chinese operations pose certain risks because of the evolving state of the Chinese economy and Chinese political, legislative and regulatory systems. Changes in the interpretations of existing laws and the enactment of new laws may negatively impact our business and results of operation.

Although our principal executive office is located in Seattle, Washington, all of our current coal business operations are conducted in China. Accordingly, our results of operations, financial condition and prospects are subject to economic, political and legal developments in China. China’s economy differs from the economies of most developed countries in many respects, including its levels of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Doing business in China involves various risks including internal and international political risks, evolving national economic policies, governmental policy on coal industry, as well as financial accounting standards, expropriation and the potential for a reversal in economic conditions. Since the late 1970s, the Chinese government has been reforming its economic system. These policies and measures may from time to time be modified or revised. While the Chinese economy has experienced significant growth in the past 20 years, growth has been uneven across different regions and among various economic sectors of China. Furthermore, while the Chinese government has implemented various measures to encourage economic development and guide the allocation of resources, some of these measures may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. Also, since early 2004, the Chinese government has implemented certain measures to control the pace of economic growth including certain levels of price controls on raw coking coal. Such controls could cause our margins to be decreased. In addition, such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition. Adverse changes in economic policies of the Chinese government or in the laws and regulations, if any, could have a material and adverse effect on the overall economic growth of China, and could adversely affect our business operations.

7

There are substantial uncertainties regarding the application of Chinese laws, especially with respect to existing and future foreign investments in China. Despite China having its own securities laws and regulators, the Chinese legal system is in a developmental stage and has historically not enforced its Chinese securities law as rigidly as their U.S. counterparts. The interpretation and application of existing Chinese laws, regulations and policies, and the stated positions of the Chinese authorities may change and possible new laws, regulations or policies will impact our business and operations. Because of the evolving nature of the law, it will be difficult for us to manage and plan for changes that may arise. China’s judiciary is relatively inexperienced in enforcing corporate and commercial law, resulting in significant uncertainty as to the outcome of any litigation in China. Consequently, there is a risk that should a dispute arise between the Company and any party with whom the Company has entered into a material agreement in China, the Company may be unable to enforce such agreements under the Chinese legal system. Chinese law will govern almost all of the Company's acquisition agreements, many of which may also require the approval of Chinese government agencies. Thus, the Company cannot assure investors that the target business will be able to enforce any of the Company’s material agreements or that remedies will be available outside China.

Our business is and will continue to be subject to central, provincial, local and municipal regulation and licensing in China. Compliance with such regulations and licensing can be expected to be a time-consuming, expensive process. Compliance with foreign country laws and regulations affecting foreign investment, business operations, currency exchange, repatriation of profits and taxation will increase the risk of investing in our securities.

On April 15, 2011, the Guizhou province of China, in which the Company operates two of its four coal mines, issued a provincial-level notice/order (the “Guizhou Consolidation Policy”) that set forth the following key requirements, among others—by the end of 2013: (i) the total number of coal-mine related business enterprises in the Guizhou province (“Guizhou Coal Enterprise”) shall be limited to no more than 200; (ii) each Guizhou Coal Enterprise in Gui Yang City of Guizhou province shall reach at least the capacity to produce One Million (1,000,000) tons of coal per year; (iii) each Guizhou Coal Enterprise in Liu Pan Shu City of Guizhou province shall reach at least the capacity to produce Two Million (2,000,000) tons of coal per year; (iv) for certain coal mines, the mechanization level for coal-mine development and coal mining shall reach, respectively, 70% and 45% (by the end of 2015, 80% and 55% respectively.) While the Guizhou Consolidation Policy has opened the door for the Company to acquire/consolidate additional smaller coal mines in the Guizhou province at faster speed and at attractive prices, the Company is also aware that the Company’s current coal-production capacity and mechanization level have not met the requirements set forth in the Guizhou Consolidation Policy, but we intend to work diligently to meet the requirements in the policy by the end of 2013.

Restrictions on Chinese currency may limit our ability to obtain operating capital and could restrict our ability to move funds out of China.

The Chinese currency, the Renminbi (RMB), is not a freely convertible currency, which could limit our ability to obtain sufficient foreign currency to support our business operations and could impair the ability of our Chinese subsidiaries to pay dividends or other distributions to us. We rely on the Chinese government’s foreign currency conversion policies, which may change at any time, in regard to our currency exchange needs. We currently receive all of our revenues in Renminbi, which is not freely convertible into other foreign currencies. In China, the government has control over Renminbi reserves through, among other things, direct regulation of the conversion of Renminbi into other foreign currencies and restrictions on foreign imports. Although foreign currencies which are required for “current account” transactions can be bought freely at authorized Chinese banks, the proper procedural requirements prescribed by Chinese law must be met. Current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from the Chinese State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies. At the same time, Chinese companies are also required to sell their foreign exchange earnings to authorized Chinese banks and the purchase of foreign currencies for capital account transactions still requires prior approval of the Chinese government. This type of heavy regulation by the Chinese government of foreign currency exchange restricts certain of our business operations and a change in any of these government policies, or any other, could further negatively impact our operations.

Our ownership structure is subject to regulatory controls by the PRC government, including approvals and timely payments in connection with our acquisitions. Failure to obtain such approvals or to timely remit required payments may cause the unwinding of our acquisitions.

On October 21, 2005, the PRC State Administration of Foreign Exchange (“SAFE”) issued a circular (“Circular 75”), effective November 1, 2005, which repealed Circular 11 and Circular 29, which previously required Chinese residents to seek approval from SAFE before establishing any control of a foreign company or transfer of China-based assets or equity for the shares of the foreign company. SAFE also issued a news release about the issuance of Circular 75 to make it clear that China’s national policies encourage the efforts by Chinese private companies and high technology companies to obtain offshore financing. Circular 75 confirmed that the uses of offshore special purpose vehicles (“SPV”) as holding companies for PRC investments are permitted as long as proper foreign exchange registrations are made with SAFE. As China continues to develop its legal system, additional legal, administrative, and regulatory rules and regulations may be enacted, and we may become subject to the additional rules and regulation applicable to the our Chinese subsidiaries.

8

Our Chinese subsidiaries, Kunming Biaoyu Industrial Boiler Co., Ltd. (“KMC”) and L&L Yunnan Tianneng Industry Co. Ltd. (“TNI”), have been registered as American subsidiaries, and all required capital contributions have been made into them. We own our equity ownership interest in the DaPuAn and SuTsong Mines through a nominee who is a Chinese citizen that holds our equity ownership in trust for our benefit under an agency agreement executed in April 2008, and we refer to the operations as “L & L Coal Partners” Because this equity will be held by a nominee, no SAFE approval is necessary for it. We believe that Circular 75 and other related Circulars or regulations may likely be further clarified by SAFE, in writing or through oral comments by officials from SAFE, or through implementation by SAFE in connection with actual transactions. However, if we fail to obtain the required PRC government approvals for our acquisitions or fail to remit all of the required payments for acquisitions, such acquisitions may be deemed void or unwound. Should this occur, we may seek to acquire the equity interest of our subsidiaries through other means, although no assurance can be given that we will be able to do so, nor can we assure that we will be successful if we do.

We may have to incur unanticipated costs because of the unpredictability of the Chinese legal system.

The Chinese legal system has many uncertainties. The Chinese legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value. Since 1979, Chinese legislation and regulations have enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system and recently-enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their nonbinding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the Chinese legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

It will be difficult for any shareholder to commence a legal action against our executives. Most of our assets are located in China.

Because our directors and officer(s) reside both within and outside of the United States, it may be difficult for an investor to enforce his or her rights against them or to enforce United States court judgments against them if they live outside the United States. Most of our assets are located outside of the United States in China. Additionally, we plan to continue acquiring other energy-related entities in China in the future. It may therefore be difficult for investors in the United States to enforce their legal rights, to effect service of process upon us or our directors or officers, or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties on us or our directors and officers under federal securities laws. Moreover, China currently does not have treaties with the United States or many other countries providing for the reciprocal recognition and enforcement of judgments of courts.

We are subject to currency fluctuations from our Chinese operations and fluctuations in the exchange rate may negatively affect our expenses and results of operations, as well as the value of our assets and liabilities.

Effective July 21, 2005, The People’s Bank of China announced that the Renminbi (RMB) exchange rate regime changed from a fixed rate of exchange based upon the U.S. dollar to a managed floating exchange rate regime based upon market supply and demand of a basket of currencies. On July 26, 2005, the exchange rate against the Renminbi was adjusted to 8.11 Renminbi per U.S. dollar from 8.28 Renminbi per U.S. dollar, which represents an adjustment of approximately two percent. As of July 22, 2011, the Renminbi appreciated to approximately RMB 6.45 per U.S. Dollar. It is expected that the revaluation of the Renminbi and the exchange rate of the Renminbi may continue to change in the future. Fluctuations in the exchange rate between the RMB and the United States dollar could adversely affect our operating results. Results of our business operations are translated at average exchange rates into United States Dollars for purposes of reporting results. As a result, fluctuations in exchange rates may adversely affect our expenses and results of operations as well as the value of our assets and liabilities. Fluctuations may adversely affect the comparability of period-to-period results. We do not use hedging techniques to eliminate the effects of currency fluctuations. Thus, exchange rate fluctuations could have a material adverse impact on our operating results and stock prices.

New governmental regulation relating to greenhouse gas emissions may subject us to significant new costs and restrictions on our operations.

Climate change is receiving increasing attention worldwide. Many scientists, legislators and others attribute climate change to increased levels of greenhouse gases, including carbon dioxide, which has led to significant legislative and regulatory efforts to limit greenhouse gas emissions. There are bills pending in Congress that would regulate greenhouse gas emissions. While US regulations are not applicable in China, China has agreed to reduce greenhouse gas emissions per unit of GDP which may reduce the rate of growth in coal consumption in China. Additionally as China begins to implement more stringent environmental and safety regulations our mining and operational costs may increase.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with us, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC. We can make no assurance, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

9

RISKS RELATED TO OUR COMMON STOCK

The market price of our stock may be volatile.

The market price of our stock may be volatile and subject to wide fluctuations in response to factors including the following:

- actual or anticipated fluctuations in our quarterly operating results;

- changes in financial estimates by securities research analysts;

- conditions in coal energy markets;

- changes in the economic performance or market valuations of other coal energy companies;

- announcements by us or our competitors of new products, acquisitions, strategic partnerships, joint ventures or capital commitments;

- addition or departure of key personnel;

- fluctuations of exchange rates between RMB and the U.S. dollar; and

- general economic or political conditions in China.

In addition, the securities market has from time to time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our stock.

Our corporate actions are substantially influenced by our principal stockholders and affiliated entities.

Members of our management and their affiliated entities own or have the beneficial ownership right to approximately 30% of our outstanding common shares, representing approximately 30% of our voting power. These stockholders, acting individually or as a group, could exert substantial influence over matters such as approving mergers or other business combination transactions. In addition, because of the percentage of ownership and voting concentration in these principal stockholders and their affiliated entities, elections of our board of directors will generally be within the control of these stockholders and their affiliated entities. While all of our stockholders are entitled to vote on matters submitted to our stockholders for approval, the concentration of shares and voting control presently lies with these principal stockholders and their affiliated entities. As such, it would be difficult for stockholders to propose and have approved proposals not supported by management. There can be no assurances that matters voted upon by our officers and directors in their capacity as stockholders will be viewed favorably by all stockholders of the company.

10

We have the right to issue additional common stock and preferred stock without the consent of our stockholders. If we issue additional shares in the future, this may result in dilution to our existing stockholders and could decrease the value of your shares.

Our articles of incorporation, as amended, authorize the issuance of 120,000,000 shares of common stock and 2,500,000 shares of preferred stock. Our board of directors has the authority to issue additional shares up to the authorized capital stated in the articles of incorporation. Our board of directors may choose to issue some or all of such shares to acquire one or more businesses or to provide additional financing in the future. The issuance of any such shares may result in a reduction of the book value or market price of the outstanding shares of our common stock. If we do issue any such additional shares, such issuance also will cause a reduction in the proportionate ownership and voting power of all other stockholders. Further, any such issuance may result in a change of control of our company.

Our business strategy calls for strategic acquisitions of additional coal mines and other coal-related businesses. It is anticipated that future acquisitions will require cash and issuances of our capital stock, including our common stock, warrants, preferred shares or convertible bonds in the future. To the extent we are required to pay cash for any acquisition, we anticipate that we would be required to obtain additional equity and/or debt financing from either the public sector, or private financing. Equity financing would result in dilution for our stockholders. Stock issuances and equity financing, if obtained, may not be on terms favorable to us, and could result in dilution to our stockholders at the time(s) of these stock issuances and equity financings.

Our authorized preferred stock constitutes what is commonly referred to as “blank check” preferred stock. This type of preferred stock allows our board of directors to divide the preferred stock into series, to designate each series, to fix and determine separately for each series any one or more relative rights and preferences and to issue shares of any series without further stockholder approval. This authorized preferred stock allows our board of directors to hinder or discourage an attempt to gain control of us by a merger, tender offer at a control premium price, proxy contest or otherwise. Consequently, the preferred stock could entrench our management. In addition, the market price of our common stock could be materially and adversely affected by the existence of the preferred stock.

Certain SEC rules and FINRA sales practices may limit a stockholder’s ability to buy and sell and our stock, which could adversely affect the price of our common stock.

The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. If the trading price of our common stock falls below $5.00 per share, the open-market trading of our common stock is subject to the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Stockholders should have no expectation of any dividends.

The holders of our common stock are entitled to receive dividends only when, as and if declared by the board of directors out of funds legally available therefore. To date, we have not declared nor paid any cash dividends. Our board of directors does not intend to declare any dividends in the foreseeable future, but instead intends to retain all earnings, if any, for use in our business operations.

11

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained or incorporated by reference in this prospectus or in any prospectus supplement, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” and similar expressions to identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to various risks, uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our forward-looking statements: changing local, regional and global economic conditions and demand for coal and other fuels, availability of qualified workers, risks incident to operating coal mines and related businesses in China, ability to distribute our products as and where needed, our ability to obtain financing and to consummate acquisition, disposition or other transactions and the effect of such transactions on our business, regulatory constraints including environmental, worker safety, employee benefit and other regulatory matters, and other risks described from time to time in periodic and current reports that we file with the Securities and Exchange Commission (“SEC”).

Consequently, all of the forward-looking statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results or developments that we anticipate will be realized or, even if realized, that they will have the expected consequences to or effects on us and our subsidiaries or our businesses or operations. We undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events, or other such factors that affect the subject of these statements, except where we are expressly required to do so by law.

USE OF PROCEEDS

We will not receive any proceeds from the sale of Common Stock by the selling security holders. However, we may receive up to $8,518,532 upon exercise of the Warrants with exercise prices of $5.62 per share for the Warrants issued to accredited investors, and $6.11 per share for the warrants issued to the placement agents in the October Financing and November Financing, the underlying shares of which are included in the registration statement of which this prospectus is a part. From August 2008 to January 2011, we received $6,835,500 from T Squared for the exercise of 4,248,800 warrants. Such funds will be used for general corporate purposes, including working capital requirements. All proceeds from the sale of such securities offered by the selling security holders under this prospectus will be for the account of the selling security holders, as described below in the sections entitled “Selling Security Holders” and “Plan of Distribution.” With the exception of any brokerage fees and commissions which are the obligation of the selling security holders, we are responsible for the fees, costs and expenses of this offering.

12

SELECTED FINANCIAL DATA

The summary financial data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus. We derived the selected financial data for the fiscal years ended April 30, 2011, 2010, and 2009 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the unaudited consolidated income statement data for the three months ended July 31, 2011 and 2010 and the consolidated balance sheet data as of July 31, 2011 from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on a basis consistent with the audited consolidated financial statements appearing elsewhere in this prospectus and, in the opinion of management, include all adjustments, consisting only of normal recurring adjustments, necessary for fair presentation of such data. Certain reclassifications have been made to the 2010 and 2009 consolidated financial statements to conform to the 2011 consolidated financial statement presentation. These reclassifications had no effect on net loss or cash flows as previously reported. Our historical results are not necessarily indicative of results to be expected for any future periods.

|

Three Months Ended |

Fiscal Year Ended | ||||||||

|

July 31, |

April 30, | ||||||||

|

(unaudited) |

|||||||||

|

2011 |

2010 |

2011 |

2010 |

2009 | |||||

|

Income Statement Data: |

|||||||||

|

Revenues |

$36,633,306 |

$55,329,939 |

$223,851,105 |

$109,217,838 |

$40,938,128 | ||||

|

Cost of Revenues |

28,443,975 |

36,724,263 |

154,064,768 |

57,036,887 |

17,946,206 | ||||

|

Gross Profit |

8,189,331 |

18,605,676 |

69,786,337 |

52,180,951 |

22,991,922 | ||||

|

Total Operating Expenses |

3,951,049 |

4,006,281 |

20,793,551 |

9,855,351 |

3,996,795 | ||||

|

Income from Operations |

4,238,282 |

14,599,395 |

48,992,786 |

42,325,600 |

18,995,127 | ||||

|

Total Other Income (Expense) |

(569,213) |

(83,383) |

925,235 |

301,626 |

(265,356) | ||||

|

Income Before Income Taxes, Discontinued Operations, Net of Tax, and Non-Controlling Interests |

3,669,069 |

14,516,012 |

49,918,021 |

42,627,226 |

18,729,771 | ||||

|

Income Tax Provision |

585,867 |

2,183,300 |

7,517,533 |

4,531,088 |

1,219,457 | ||||

|

Income from Discontinued Operations, Net of Tax |

3,083,202 |

12,332,712 |

- |

834,181 |

145,220 | ||||

|

Net Income Attributable to Non-Controlling Interests |

697,314 |

1,394,198 |

5,620,679 |

7,040,555 |

7,315,330 | ||||

|

Gain (Loss) on Disposal |

- |

- |

- |

1,017,928 |

(382,961) | ||||

|

Net Income |

$3,083,202 |

$12,332,712 |

$36,779,809 |

$32,907,692 |

$9,957,243 | ||||

|

Earnings per share: |

|||||||||

|

Basic |

$0.08 |

$0.38 |

$1.24 |

$1.35 |

$0.46 | ||||

|

Diluted |

$0.08 |

$0.36 |

$1.21 |

$1.28 |

$0.46 | ||||

|

Weighted average shares outstanding: |

|||||||||

|

Basic |

31,355,781 |

29,037,451 |

29,764,705 |

24,375,508 |

21,492,215 | ||||

|

Diluted |

31,704,978 |

30,407,090 |

30,422,393 |

25,748,036 |

21,822,215 | ||||

|

As of July 31, |

|

As of April 30, | |||||

|

(unaudited) |

|

||||||

|

2011 |

|

2011 |

2010 |

|

2009 | ||

|

Balance Sheet Data: |

|

|

| ||||

|

Cash and Cash Equivalents |

$6,097,089 |

|

$4,914,425 |

$7,327,369 |

|

$5,098,711 | |

|

Working Capital |

6,174,262 |

|

8,195,750 |

31,416,055 |

|

20,496,386 | |

|

Total Assets |

231,218,656 |

|

227,352,325 |

128,604,524 |

|

54,275,375 | |

|

Total Liabilities |

58,000,787 |

|

61,375,571 |

38,344,991 |

|

19,110,409 | |

|

Non Controlling Interest |

30,467,590 |

|

29,530,133 |

12,594,293 |

|

12,731,987 | |

|

Total Stockholders’ Equity |

$142,750,279 |

|

$136,446,621 |

$77,665,240 |

|

$22,432,979 | |

13

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition of the Company for the fiscal years ended April 30, 2011, 2010, 2009 and the three months ended July 31, 2011 and 2010 should be read in conjunction with the Selected Financial Data, the Company’s financial statements, and the notes to those financial statements that are included elsewhere in this prospectus. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors, Cautionary Notice Regarding Forward-Looking Statements and Business sections in this prospectus. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

Overview