Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JPMORGAN CHASE & CO | d267019d8k.htm |

December 7, 2011

Jamie Dimon, Chairman and Chief Executive Officer

Goldman Sachs U.S. Financial Services Conference

Exhibit 99.1 |

Industry landscape

If you view the business from the point of

view of the customer, i.e., consumers, Middle

Market, investors and corporations

They will still need financial products

Expect to see significant growth in

customer needs over the next 10 years

Opportunity to gain share in many underlying

areas

Small business

Emerging markets

Multinational corporations

Asset Management / Private Banking

New technology will create new products

Mobile payments

Regulatory changes other than capital

Durbin Amendment

Derivatives reform

Volcker

Capital

G-SIB capital surcharge

Mortgage-related issues

Litigation

Put-back exposure

European exposures

Low interest rate environment

Future profitability of investment banking

Economy and loan growth

1

There are several issues affecting banks….

…but there are still significant growth opportunities

|

We start with a good

hand Excellent client-facing franchises that continue to grow and strengthen

Unparalleled client relationships in 120+ countries

Strong products and technology

Each standalone business has a top 1, 2 or 3 position

Solid organic growth opportunities across LOBs

Never stopped investing in new products, branches and bankers

Continued focus on cross-sell

Significant earnings power, strong margins and strong risk management

Significant excess capital

Basel

I

Tier

I

Common

of

$120B,

ratio

of

9.9%

as

of

3Q11

Estimated

Basel

III

Tier

I

Common ratio

of

7.7%

as

of

3Q11

Ability

to

achieve

Basel

III

Tier

I

Common

ratio

of

9%+

by

end

of

2012 –

will

depend

on

interpretation

of

rules

and

decisions

on

usage

of

excess

capital

Firmwide

total

credit

reserves

of

$29B,

loan

loss

coverage

ratio

of

3.74%

of total loans as of 3Q11

Benefits

from

diversification

–

funding,

capital,

lower

volatility

1

See note 3 on slide 43

2

See note 2 on slide 43

We will spend a considerable amount of time in 2012 navigating at a very detailed level

through an increasingly complex environment

2

1

1

1

2

incremental

pretax

income

of

$500mm

-

$1B

Excellent client

facing

franchises

Solid growth

opportunities

Battleship

balance sheet |

Quick overview of some growth opportunities

Branch build

Chase Private Client

Business Banking

Retail branch cross-sell

Card products

Commercial Banking expansion and cross-sell

Asset Management client advisors

Global Corporate Bank

Industry regulatory issues

Volcker Rule

G-SIB –

unintended consequences

Pro-cyclicality of regulation

Regulation skewed against U.S. banks

##

##

##

##

Agenda

Key investor topics

European exposures

Firmwide expense management

Credit –

Wholesale and Retail

Mortgage related issues

–

Private label securitizations

Future of investment banking

Capital

–

Basel III estimates

–

LOB capital

–

Performance targets

–

Comments on capital

4Q11 outlook and future comments

3 |

Opportunities for growth

Branch build

Chase Private Client

Business Banking

Retail branch cross-sell

Card products

Commercial Banking expansion and cross-sell

Asset Management client advisors

Global Corporate Bank

Investment Bank emerging markets expansion

Commodities

International Prime Brokerage

Commercial Banking international expansion

Treasury & Securities Services client penetration and

expanded product capabilities

Asset Management market share gains in investment

products

4

Opportunities

we will review

Opportunities we will

not review |

Update on growth

initiatives Intend to build 175 +/-

branches in 2012 (down from 300+/-

mentioned at

Investor Day)

Branches are a primary reason customers select a bank

95%+ of checking accounts are opened in a branch

Branches

are

invaluable

to

the

overall

franchise

(e.g.,

Mortgage

Banking,

Card,

Middle

Market

and Private Bank)

Economics of branches are changing

Durbin and regulatory costs have made some branches less attractive

On average, we still expect branches to break even on a contribution basis in ~3 years

We continue to build the majority of our branches in CA and FL

We will also continue to build branches to meet our responsibilities under the Community

Reinvestment Act (“CRA”)

5

Branch formats will vary by demographics, customer needs and behavior – branch configurations

could change (e.g., technology could change formats, some branches could be smaller) Branches are

invaluable to the overall franchise (e.g., Mortgage Banking, Card, Middle Market and

Private Bank) |

Update on growth initiatives

Update on the economics of the retail banking model

Durbin Amendment will reduce Consumer and Business Banking’s annualized

revenue by $1B in 2012

Some changes to products and services have already been made to mitigate the

impact of Durbin Changed banker and branch manager compensation

Stopped issuing new debit rewards cards

Stopped the ability for almost all existing debit cards to earn new rewards going

forward Eliminated debit usage as a way for new customers to have monthly

checking account fee waived

We

have

great

products

and

services

that

cost

over

$350

a

year

per

checking

account

–

including

debit cards, call centers, ATMs, on-line banking and bill pay, branches, and

fraud protection on debit transactions

We

do

not

expect

to

recoup

all

our

losses

from

Durbin

and

NSF/OD

right

away

Adjusting our business model to address the needs of each individual market

segment Redesigning products to forge and build on strong customer

relationships and provide customer value while generating a fair

return We believe that there will be some pressure in the short term, but in

the long-run it will continue to be a profitable business because our

underlying business drivers remain strong 6 |

4K

12K

20K+

70K+

2010

3Q11

2011F

2012 target

16

139

250+

750+

2010

3Q11

2011F

2012 target

Opened 250+ CPC locations in 2011

Expansion into New York, Chicago, South

Florida, Los Angeles and San Francisco

400 private client bankers and 130 private

client advisors

Progress to date

On track for 20,000+ clients in the program by

year-end

~40% of CPC clients invest with Chase

Each 1% wallet penetration with our affluent

clients represents $40B in new balances

Plan to add 500+ additional CPC locations in

2012

Expansion: California, Texas, Florida, Arizona

and Washington

Deepening presence in Tri-state, Midwest,

Los Angeles and San Francisco

Adding 600 Private Client Bankers and 200

Private Client Advisors

Recent progress

Update on growth initiatives

Chase Private Client (CPC)

# of CPC locations

# of Chase Private Clients

7

Becoming a significant provider to 10-20% of current affluent clients would result in

incremental pretax income of $500mm -

$1B |

Update on growth

initiatives Business Banking

Expansion markets (hWaMu footprint -

$ in billions)

Business Banking loan originations ($ in billions)

Expansion in the hWaMu footprint is a ~$1B revenue

growth opportunity. As of 3Q 2011:

Average deposit balances per WaMu branch are

~40% of a Chase branch

Average loan balances per WaMu branch are ~25% of

a Chase branch

Business bankers of 882, up from 180 in 2008 (up

390%)

Initiatives to capture expansion market opportunity

include:

Growing dedicated business bankers (200+ per year)

Delivering full suite of small business products and

innovative solutions

$5.4

$5.7

$7.3

$9.3

$1.2

$1.1

$1.0

$1.5

2008

2009

2010

3Q11YTD

Deposit balances ADB

Lending balances ADB

Higher demand, growth in bankers (up ~400 each

year) and return to normalized underwriting criteria are

driving higher lending volumes

Projected loan originations up ~25% YoY from higher

quality applications / higher pull-through rates

#1 SBA lender by loan units

Expansion in the hWaMu footprint is a ~$1B revenue growth opportunity

8

$4.2

$2.3

$5.9

$4.7

$1.3

2008

2009

2010

2011

Verified income

Stated income

Annualized

1

2

1

Annualized based on 3Q11YTD

2

Expansion markets

includes CA, FL, OR, NV, GA & WA. Loan and Deposit ADBs for expansion markets are estimated for

2008 and 2009 |

14.7

11.0

6.0

2.0

2008

2009

2010

2011

Annualized

WaMu

Update on growth initiatives

Retail branch cross-sell

6.8

7.4

7.8

8.4

14-16

h-WAMU

Combined

Chase

h-Chase

Chase top region

Avg. U.S.

financial services

consumer

3.2

5.0

5.8

6.3

2008

2009

2010

2011

Annualized

WaMu

513

556

522

373

2008

2009

2010

2011

Annualized

WaMu

Mortgage

sales

($B)

Investment sales ($B)

Credit cards –

Retail Banking (000’s)

WaMu cross-sell and growth drivers

1

Represents cross sell activity from the WaMu branches acquired in September 2008

2

Annualized figures. 2008 annualized based on 4Q08 and 2011 annualized based on 3Q11YTD

3

Excludes time deposits

We are best-in-class in our ability to cross sell

Cross-sell for Combined Chase has

improved to 7.4 products and services per

household in 3Q11 vs. 6.5 in 1Q10

Sales force has increased significantly in the

CA/FL markets since the WaMu acquisition

(4Q08)

Added ~4,800 bankers and advisors;

currently at ~8,000

2

Avg. checking and saving balances ($B)

2

2

2

2

2

77

77

80

89

2008

2009

2010

3Q 2011

WaMu

9

Retail

bank

household

cross-sell

–

as

of

3Q11

3

1 |

Update on growth initiatives

Card products

We invested heavily in new products and services through the cycle and shifted our

portfolio mix towards more rewards-engaged customers with a lower risk

profile Our business continues to gain momentum

Sales

volume

1

has

increased

from

$285B

in

2008

to

$322B

in

2011

2

Market

share

3

gains

have

been

considerable,

increasing

from

16.67%

in

2008

to

19.35%

in

3Q11

Outstandings

1

bottomed

in

1Q11

and

are

expected

to

be

$115B

-

$120B

by

year-end

We are gaining traction with our high quality new products

Sapphire:

1.8mm

open

accounts

4

at

3Q11,

since

its

introduction

in

3Q09

Ink:

1.5mm

open

accounts

4

at

3Q11,

since

its

introduction

in

4Q09

Freedom:

14.5mm

open

accounts

4

at

3Q11;

incremental

8.6mm

open

accounts

4

since

the

product was re-launched in 2Q10

Market

share

of

new

accounts

opened

increased

300

bps

YoY

in

3Q11

5

1

Excludes WaMu, Commercial Card and

Kohl’s

2

2011 Sales volume is annualized based on 3Q11YTD

3

General Purpose Credit Card (GPCC) market share; excludes WaMu and Commercial card.

Estimates based on SEC filings and internal data 4

Includes new accounts as well as migrations from legacy products

5

Based on Equifax Inc. bankcard data; excludes private label and authorized user

trades 10 |

Update on growth initiatives

Commercial Banking expansion

Expansion markets

Opportunity

Progress

1

Middle Market only, does not include other CB LOB efforts in expansion states

Long-term CB pretax income opportunity of $650-800mm

Continue to add between 175-200 new clients a year

New markets we are adding:

Seattle

Portland

San Francisco

Los Angeles

Orange County

Sacramento

More than 300 in-market dedicated resources Firmwide

Over $2.2B in loans as of 3Q11; more than double year-

end 2010

Over $1.8B in liability balances as of 3Q11; up from $1B

at year end 2010

Breakeven in 2Q11; now fully self-funded

Expect to completely pay-back all investment cost in 2012

(third year into effort)

San Diego

Atlanta

Orlando

Tampa

Miami

Progress

Opportunity

Out-of-footprint markets

Out-of-footprint markets we are covering:

Minneapolis

St. Louis

Nashville

Bowling Green

Birmingham

Over 1,400 prospects

Over 40 Commercial Bankers covering these markets

Actively building out coverage teams across markets

Knoxville

Charlotte

Richmond

Washington D.C.

Tyson’s Corner

Pittsburgh

Philadelphia

Boston

11

1

1

1 |

Update on growth

initiatives Commercial Banking cross-sell

Non-lending revenue –

CB reported ($ in billions)

1

Includes Commercial Card

2

2011 annualized based on 3Q11 actuals and adjusting for seasonality

3

Total revenue and lending excludes CTL

4

Average products per relationship excludes CTL

8.4

8.1

7.4

7.2

7.0

2007

2008

2009

2010

3Q11 YTD

Product sales to CB customers include TS,

IB, AM, and Commercial Card

Average

products

per

relationship

4

Product

revenue

%

of

Total

revenue

3

6%

8%

9%

10%

17%

35%

35%

35%

29%

23%

18%

28%

56%

66%

67%

62%

59%

59%

57%

6%

16%

0%

20%

40%

60%

80%

100%

2005

2006

2007

2008

2009

2010

2011

Treasury Services

IB & Other

Lending

Annualized

2

Great clients and outstanding franchises

Strong business and credit performance

2005

2006

2007

2008

2009

2010

2011

Treasury Services

IB & Other

$2.3

$2.5

$2.7

$3.0

$3.1

$3.3

$3.1

Annualized

3

12

2

1 |

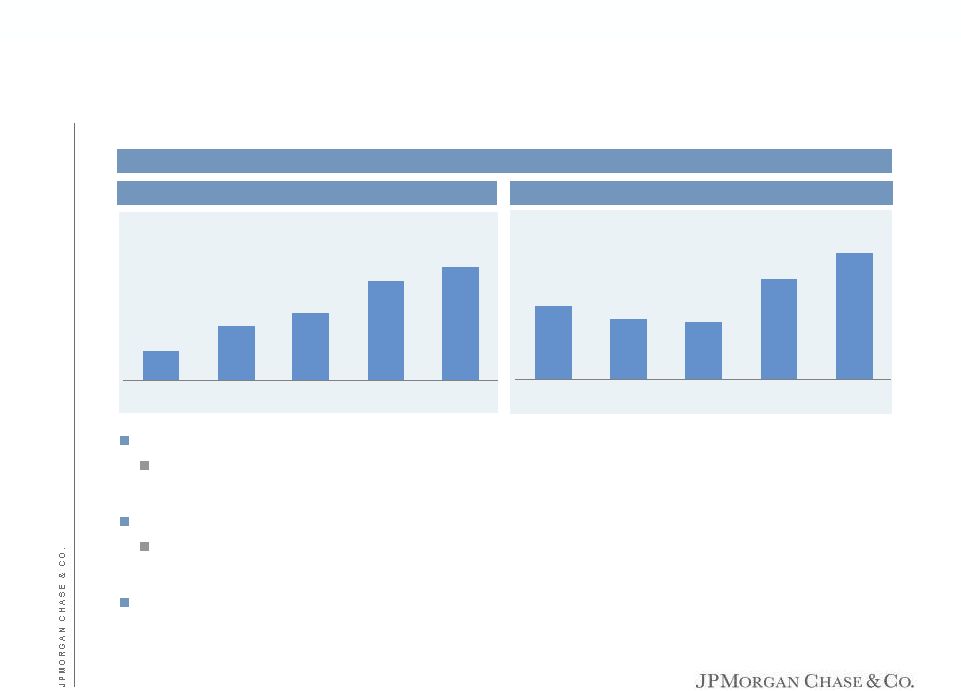

Private

Banking

–

Client

advisors

(#)

Update on growth initiatives

AM –

client advisors

Talent

Global

Investment

Management

–

Sales

headcount

(#)

676

647

638

741

2007

2008

2009

2010

3Q11

802

Client facing headcount growth has continued in 2011, despite challenging

markets 6%

growth

in

total

Private

Banking

client

advisors

and

8%

growth

in

Global

Investment

Management

sales

force in 2011

1

International expansion is a priority and growing more rapidly

International growth of 20%+ in Private Banking client advisors and 13%+ in Global

Investment Management sales force in 2011

1

The

profit

contribution

from

bankers

hired

in

2009

–

2011

is

projected

to

turn

positive

in

2013

1

Represents 3Q11 growth from year-end 2010

1,868

2,164

2,310

2,696

2007

2008

2009

2010

3Q11

13

2,864 |

Update on growth initiatives

Global Corporate Bank (GCB)

GCB

will

provide

an

additional

~$1B

of

annual

pretax

income

in

5

years

~3,500

clients

–

mostly

pre-existing

relationships

and

large

international

clients

Continuing to add bankers; on track for 2011 target with ~260 bankers

2011

banker

coverage

78%

international

Overall 3Q11YTD international revenue growth of 17% YoY

International revenues with Corporate clients 3Q11YTD up 17% YoY

LatAm (+33%), APAC (+19%), US Outbound (+39%)

Rates

&

FX

(+27%),

commodities

(+24%),

cash

and

liquidity

(+19%)

and

trade

(+13%)

Approximately

40%

of

incremental

revenues

related

to

new

clients,

new

products,

or

new

countries

14

– |

20

markets

prioritized

–

partner

bank

solutions

to

extend

network

Holistic effort looking at target client needs, TSS and IB product capabilities and local

infrastructure including local treasury, balance sheet and operations; Completing local

currency capabilities including deposit-taking, clearing and lending Long-term

plan

for

building

Sub-Saharan

Africa

–

starting

from

South

Africa

and

Nigeria

Update on growth initiatives

GCB priority countries and branch builds

15

2011 Branches

2011/2012 Rep Offices

2012/2013 Branches

Panama City

Legend

Colombia

Chile

Argentina

South Africa

Ghana (1Q12)

Turkey

Nigeria

Saudi Arabia

Kenya (1Q12)

Qatar

Russia

Harbin, China

Suzhou, China

Sri Lanka (4Q11)

Sufficient capabilities based

on client requirements

Major additional

investments 2011-

2013 |

Growth initiatives

Industry regulatory issues

Agenda

Key investor topics

4Q11 outlook and future comments

Appendix

16 |

The

industry and markets transformed significantly before Dodd Frank and Basel

requirements – this should be recognized in policy making

More capital

Less leverage

More liquidity

Bad actors are gone

Most off-balance sheet vehicles like SIVs are gone

CDO and CLO markets have virtually closed and are more conservative

More conservative asset-backed commercial paper market

More conservative money market funds

More conservative repo and tri-party market

Less exotic derivatives

Less leveraged loans

Back to excellent mortgage underwriting, since 2008

Alt-A

and

subprime

mortgage

–

virtually

gone

Increased focus on risk by Boards of Directors, Risk

Committees and regulators

Better compensation practices

17

Post-crisis landscape –

Industry is stronger for it

Industry

Markets

Housing

These are substantial changes – may need to be codified

|

Basel III

There has been significant regulation, much of which we have supported…

Dodd

Frank

Support

Concerns/comments

Support more capital – up to 10-11% Basel I capital

requirement

G-SIB methodology and magnitude are an issue

LCR – support stronger liquidity

Calibration, and significant economic effects from giving no

credit to certain liquid assets

Basel III RWA consistency

Being worked on

Volcker ban on proprietary trading

Rules should not stifle market-making/ALM/liquidity

management

Higher capital/liquidity

Should not disadvantage U.S. banks

Derivatives reform

End user margin/extraterritoriality

Push-out

Position limits

Industry, not taxpayer replenishing FDIC fund

Methodology to calculate should not penalize any

organizations; exorbitantly expensive for short-term assets

Mortgage reform (skin in the game) – completely fine with

concept

Rules should be finalized as soon as possible to help market

Believe mortgage markets should be regulated

Consumer Financial Protection Bureau

Support same rule writer for all actors; concerned about

overlap and inefficiency

Resolution authority

Need to finalize rules so that they are believable, executable

by regulators and provide comfort to taxpayers that they

won’t pay – we believe this is achievable

Financial Stability Oversight Council

Needs more teeth

Regulatory topics reviewed

in the presentation

18

Regulation commentary

|

…but

this

is

not

the

optimal

way

to

run

a

robust

financial

system

–

oversight

needs

to

be simple, transparent, coordinated and consistent

This chart assumes these activities are conducted in a systemically important bank holding company

(BHC) 1

The Council, through Office of Financial Research, may request reports from systemically important BHCs

2

FDIC may conduct exams of systemically important BHCs for purposes of implementing its authority for

orderly liquidations, but may not examine those in generally sound condition

3

The Dodd-Frank Act expanded the FDIC’s authority when liquidating a financial institution to

include the bank holding company, not just entities that house FDIC-insured deposits

Dotted line indicates authority to request

information, but no examination authority.

19

Note: Green lines from SEC and CFTC represent enhanced

authority over existing relationships

|

Metric description (% weight)

Global Systemically Important Bank (G-SIB) capital surcharge

Overview of proposed methodology

“G-SIBiness”

is measured relative to 73 other banks, making it difficult to determine where a

bank scores under the metrics

Criteria (each 20% of score)

Total assets (100%)

Based on total grossed-up nominal asset

exposure

OTC derivatives notional –

gross notional not

centrally cleared (33%)

Level 3 assets (33%)

Trading book and AFS securities (33%)

Assets under custody (33%)

Market share in major global payments

systems (33%)

Market share in debt / equity / loans

underwriting (33%)

Lending to financial counterparties (33%)

Borrowing from financial counterparties

(33%)

Wholesale funding ratio –

i.e., non-retail

deposit funding (33%)

Cross-border / cross-currency:

Lending (50%)

Deposit taking (50%)

Issues with methodology

Double counts with all other categories

Ignores diversification benefits

Wholesale funding ratio –

inaccurate

measure of a bank’s systemic risk

Inconsistent with Basel / LCR, ignores

benefit of operational wholesale deposits

No credit for secured or long-term

funding

Derivatives risk is driven more by collateral,

counterparty quality, net exposure, etc. than

notional value

Penalizes appropriate in-country funding of

assets, gives no credit for risk or tenor of

asset

Underwriting and custody businesses are

severable and substitutable

20

Size

Interconnectedness

Substitutability

Complexity

Cross

jurisdictional

activity |

Regulation…Things to be careful about…

Reduction in interbank business

Surcharge can distort markets

Discourages asset diversification

Complex and compliance heavy

Potential limits on liquidity to clients

Could reduce ALM activity

May encourage balance sheet shrinkage in

downturn

Reserving-related DTA recognition limited in

Basel III

OCI impact

Credit spreads under Basel III increase RWA

in

adverse

economic

environments

(e.g.,

CVA)

Dodd Frank

Volcker Rule –

only impacts U.S.

Extraterritoriality of margin rules

Collins Amendment eliminates tax-efficient Tier 1 capital

Basel III capital

High MSR capital charges in Basel III

Accounting differences more punitive for OCI for U.S.

banks

Liquidity Coverage Ratio

U.S.-specific liquid asset classes given less credit or

excluded (e.g., Agency MBS)

G-SIB capital charge

Limited credit for U.S. resolution authority

High U.S. market share businesses penalized (e.g.,

underwriting and custody)

Could exacerbate cross-border Basel III inconsistencies

Pro-cyclicality of regulation in adverse environments

Potential unintended consequences of G-SIB

Volcker Rule

Regulation skewed against U.S. banks

21 |

Growth initiatives

Industry regulatory issues

Agenda

Key investor topics

4Q11 outlook and future comments

Appendix

22 |

Lending exposure

includes both funded loans and undrawn commitments Lending exposure ~72% to corporates

Trading exposure ~ 35% to sovereigns

Includes $1.2B of debt and equity securities

Predominantly client-driven derivatives MTM of $13.9B, offset by collateral of $6.3B (95%+ held

in cash) Credit derivatives counterparties primarily outside Euro 5 and are

investment-grade or well-supported by collateral arrangements Mark-to-market of

large counterparty gross long and short positions largely offset and all collateralized daily ~

80% of portfolio hedges are on sovereign exposure Substantially all hedges are with

investment-grade counterparties outside the Euro 5 and are collateralized

Non-sovereign

net

exposure

–

76%

to

corporate

clients

and

remaining

24%

to

the

banking

sector

Exposure

to

top

5

banks

of

$1.4B

in

Italy

and

$1.2B

in

Spain.

Greece,

Portugal

and

Ireland

is

minimal

–

not

bigger

than

$0.5B;

26%

of

total

country exposure

European exposure

Our Euro 5 net exposure –

Risk view

As of November 17, 2011 ($ in billions)

23

Exposure¹

Securities & Trading

Lending

AFS

Trading

Total

Derivative

Collateral

Portfolio

Hedging

Net

exposure

Spain

$3.6

$2.6

$4.7

$10.9

($2.5)

($0.7)

$7.7

Sovereign

-

2.3

(0.3)

2.0

-

(0.3)

1.7

Non-Sovereign

3.6

0.3

5.0

8.9

(2.5)

(0.4)

6.0

Italy

3.2

0.2

8.4

11.8

(2.5)

(3.2)

6.1

Sovereign

-

-

6.0

6.0

(1.0)

(2.7)

2.3

Non-Sovereign

3.2

0.2

2.4

5.8

(1.5)

(0.5)

3.8

Other (Ireland, Portugal and

Greece)

1.5

1.0

2.0

4.5

(1.3)

(1.1)

2.1

Sovereign

-

1.0

(0.1)

0.9

-

(1.0)

(0.1)

Non-Sovereign

1.5

-

2.1

3.6

(1.3)

(0.1)

2.2

Total Firmwide Exposure

$8.3

$3.8

$15.1

$27.2

($6.3)

($5.0)

$15.9

AFS securities exposure – 89% government guaranteed

1

Exposure is a risk management view. Lending is net of liquid collateral. Trading includes

net inventory, derivative netting under legally enforceable trading agreements and net CDS underlying exposure from market-making flows and under

collateralized securities financing counterparty exposure

|

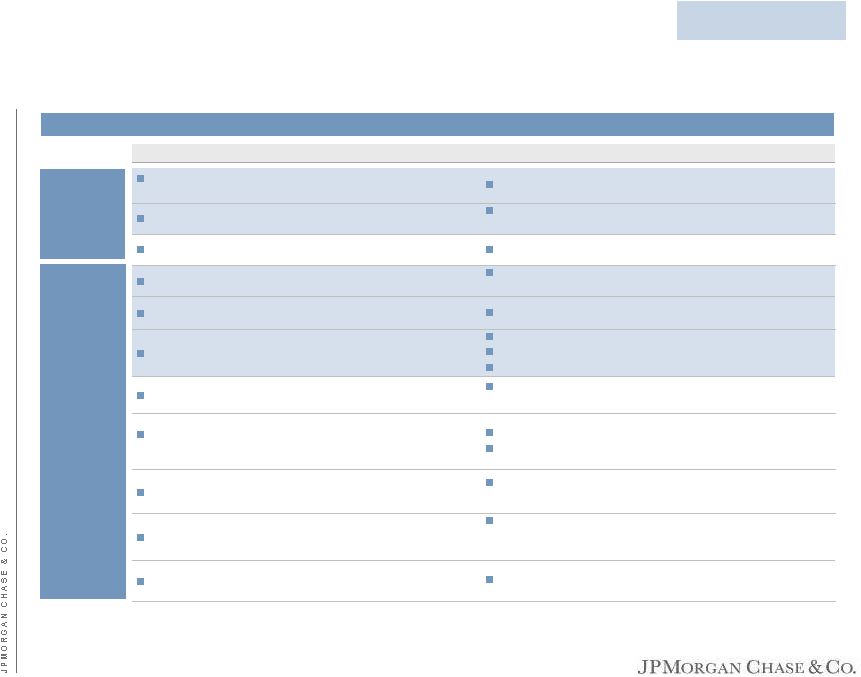

18.4

2.4

6.8

4.7

3.7

9.4

58%

0

10

20

30

40

50

60

2010

2011 Estimated

0%

10%

20%

30%

40%

50%

60%

70%

Firmwide expense has been trending higher

Comp.

Marketing

Professional & outside services

Managed basis firmwide overhead ratio

Headcount

239,831

$45.4

~$49.0

256,663

2

Tech. & comms.

Occupancy

Other expense

Firmwide noninterest expense, excluding

Investment Bank compensation, Corporate

litigation expense, and foreclosure-related

matters, has trended higher from 2010 to 2011,

including:

$900mm of higher mortgage servicing

expense

$600mm of additional FDIC assessments

$550mm of higher credit card marketing

expense

$450mm of additional expense associated

with the expansion of the commodities

business

Expect 2012 firmwide expense to remain

relatively flat compared with 2011 despite

continued investments

24

1

Excludes Investment Bank compensation expense, Corporate litigation expense, and

foreclosure-related matters. Investment Bank compensation expense totaled $9.7B in FY2010, $3.3B in 1Q11, $2.6B in

2Q11,

and

$1.9B

in

3Q11.

Corporate

litigation

expense

totaled

$5.7B

in

FY2010,

$400mm

in

1Q11,

$1.3B

in

2Q11,

and

$1.0B

in

3Q11.

Foreclosure-related

matters

totaled

$350mm

in

FY2010,

$650mm

in

1Q11 and $1.0B in 2Q11.

2

For FY2011, 4Q11 estimated expense assumed to equal 3Q11 actual expense. Headcount

at September 30, 2011. |

Credit –

Wholesale and Retail

Net charge-off (%)

Expect

reserve

levels

to

adjust

to

normalized

levels

of

~$15B

as

underlying

credit

improves and certain portfolios run off

5.12%

3.74%

5.64%

3.83%

4.10%

4.46%

5.34%

5.51%

5.28%

$0

$7

$14

$21

$28

$35

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

LLR - Wholesale

LLR - Consumer

LLR/Total loans

$ in billions

$30.6

$31.6

$38.2

$35.8

$34.2

$32.3

$29.8

$28.5

$28.4

2

1

See note 5 on page 43

2

See note 2 on page 43

25

3Q11 YTD

Through-the-cycle

expectations

Investment Bank

(0.09)%

0.70%

Commercial Banking

0.12%

0.50%

Credit Card (ex. WaMu and ComCard)

5.28%

4.50%

Home Equity (ex. PCI)

3.01%

0.25%

Prime Mortgage (excl. Option ARMs)

1.20%

0.10%

1 |

Private label securitization –

Litigation will be a long and tough process for plaintiffs

Original

balances

in

litigation

for

Chase

(excl.

WaMu)

1

of

$54.9B

2

Claims made for both securities litigation and repurchase

Substantial impediments to repurchase claims:

Quorum requirements

Trustees generally require indemnification and advancement of litigation

costs Trustees face uncertain legal landscape which make action

difficult Claims

are

fact

intensive,

requiring

loan-by-loan

analysis

–

there

is

no

repurchase

absent

proof

that

an

underwriting

breach

“materially

and

adversely”

affected

value

of

loan

–

Likely to be more difficult than GSE repurchase experience

Securities litigation claimants also face significant hurdles:

Disclosures were clear; risks were plainly set forth

Investors

were

sophisticated

–

they

understood

and

accepted

the

risks

Damages

difficult

to

prove

–

losses

in

value

resulted

from

economic

decline;

many

securities

current

and

paying

Numerous legal and technical defenses

In either case, claimants are potentially facing years of litigation

We

have

built

significant

litigation

reserves

3

There is significant overlap between repurchase and securities exposure: We do not

intend to pay twice for the same exposure

1

The Firm believes that WaMu bank-related repurchase liabilities are the

responsibility of the FDIC (the FDIC disagrees) and any securities liabilities reside with the WaMu subsidiaries

2

Excludes class action deals with standing defects, deals where the Firm was sued

solely as an underwriter, monoline claims and trustee claims 3

Median analyst estimate of exposure across the entire private label securitization

portfolio, including balances not in litigation, is $6.5B. Analyst estimates range from $3B to $18.3B. Certain

analysts

include

estimates

for

private

label

litigation

in

their

private

label

repurchase

exposure

estimates.

Certain

analysts

exclude

WaMu

related

liabilities

from

JPM

repurchase

estimates

26 |

1

World Economic Forum Report in collaboration with McKinsey and Company

27

Investment Bank –

Thoughts on future |

Demystifying the markets

Primary and secondary volumes continue to rise; trading spreads are decreasing

Source: SIFMA, Federal Reserve Bank of New York, MSRB, FINRA, Thomson

Reuters, and Bloomberg 6.7

2.1

1996

1998

2000

2002

2004

2006

2008

2010

0.9

0.3

1996

1998

2000

2002

2004

2006

2008

2010

214

79

1992

1998

2004

2010

0.2

3.5

1992

1998

2004

2010

Gross U.S. long-term debt issuance

($ in trillions)

Avg. daily volumes –

debt

instruments ($ in trillions)

Gross U.S. equity issuance

($ in billions)

U.S. equity trading volumes

(billions of shares / day)

Primary issuance

Secondary trading

Trading spreads & commissions

Over the past 20 years,

Fixed Income spreads

and Institutional Equity

commissions have

decreased significantly

28 |

Demystifying the markets

J.P. Morgan IB Markets: A world-class franchise

JPM IB Markets revenue ($B) and ranking

1

Based on public disclosure of top 10 IB competitors

2

As of 3Q11YTD compared with 2007

8

9

6

2

18

15

2

3

4

4

4

5

4

13

17

10

6

12

10

22

20

2005

2006

2007

2008

2009

2010

2011

YTD

Fixed Income (incl. Commodities)

Equities

Commentary

Fixed Income revenue nearly doubled since

2005

Flight to quality –

9% market share to ~15%

Franchise expansion (Bear, Sempra)

Equities revenue steady amidst margin

compression and lower volumes

Gained leading Prime Services franchise

Market share gains in both high-touch and

low-touch businesses

Electronic build-out underway

–

Increasing revenue to $500mm+ by 2015

(+200%)

Strong debt and equity capital markets platform

complements secondary market trading

#5

#5

#3

#1

Fixed Income¹

#7

#4

#1

#8

#8

#5

#5

Equities¹

#8

#5

#5

2011 YTD Issuance

Volume

($B)

Market

share

Rank

Syn. Loans

$402

11%

#1

Bonds

366

7%

#1

Debt underwriting

768

9%

#1

ECM

41

7%

#3

Source: Dealogic. 2011 YTD through November

29

2 |

Demystifying the markets

A diverse revenue base

IB Markets revenues: Typical quarter (%)

Treasuries, agencies, interest rate swaps, futures, options

Municipal debt instruments and derivatives

Mortgage and asset backed securities

Corporate bonds, loans, and associated derivatives

Spot/forward foreign exchange swaps, forwards, futures, options

Structured derivatives

Cash and electronic execution services

Financing, execution and clearing

Swaps, options, convertibles

Corporate derivatives (margin financing), structured notes

Physical commodities and swaps, forwards, futures, and options

Description

Non G-10 Rates, Credit and FX trading

100%

100%

100%

Rates

Securitized

Products

Emerging

Markets

Credit

Trading

Commodities

FX

Structured

Cash

Derivatives

Prime

Services

Structured

Structured

Flow

Structured

70%

Fixed

Income

30%

Equities

Flow

30 |

Demystifying the markets

Sales & Trading at JPM

2,500+ sales professionals

Sales professionals build & maintain client relationships

Matches our products to their needs

Provide the link between clients, traders and our research teams

2,000+ trading professionals

Traders execute transactions and develop customized solutions for clients

Manage risk, liquidity and exposure

20 global trading centers, 110+ global trading desks

13,000+ professionals

13,000+ Finance, Risk, Technology, and Operations professionals support our

IB Markets businesses

$3 billion+ Technology and Operations spend per year

800+ research analysts

Research covers Equities, Fixed Income, Commodities, Emerging Markets, and

Economics and Market Strategy

Provides information to the markets and original trade ideas to clients

Produces research that explains the financial markets in depth

$400 million+ Research spend per year

~16,000 investor clients

~10,000 financials

~

6,000

corporates

31

Investor clients

Sales and Trading

Research

Control, Technology,

and Operations |

Demystifying the markets

Typical trades (high volume, flow driven business)

Swaps (e.g., Interest Rate Swap)

30,000

FX Spot

4,000,000

Retail Mortgage Backed Securities

25,000

Emerging Market Trading (Rates, FX, Credit)

175,000

Credit Derivatives (e.g., Index Credit Derivative)

200,000

Structured Credit Derivatives

400

Energy Trading

50,000

F&O and OTC clearing

200mm lots

Structured Equity Derivatives

800

Cash Equities (N.A.)

8 billion shares

Flow Derivatives

8,000

High

High

High

High

High

High

Low

High

High

High

Low

Major trading products

Quantity per quarter

(# of trades)

Volumes

Prime Brokerage

$200bn balance

10mm trades

High

Financing

100,000

High

Loan Trading

10,000

High

Note: Quantity estimated based on typical quarter

32 |

Use

derivatives

94%

Don't use

derivatives

6%

Derivatives usage by Global Fortune 500

Demystifying the markets

Over 90% of the Global Fortune 500 use derivatives

Derivatives usage by industry for Global Fortune 500

Source: ISDA 2009 Survey

Derivatives usage by product for Global Fortune 500

Derivatives usage in top 10 countries (% of

companies)¹ Source: ISDA 2009 Survey

1

Number in column indicates total number of companies that use derivatives

98%

97%

95%

92%

92%

92%

91%

88%

Financial

Basic

materials

Tech.

Industrial

goods

Health

care

Utilities

Consumer

goods

Services

Total usage across

all industries: 94%

88%

83%

49%

29%

20%

FX

Interest rate

Commodity

Equity

Credit

Source: ISDA 2009 Survey

Source: ISDA 2009 Survey

33

100%

100%

100%

100%

100%

97%

92%

87%

62%

100%

Japan

France

Britain

Canada

Switz.

Netherlands

Germ.

US

S.Kor.

China

64

39

34

14

14

13

36

140

13

18 |

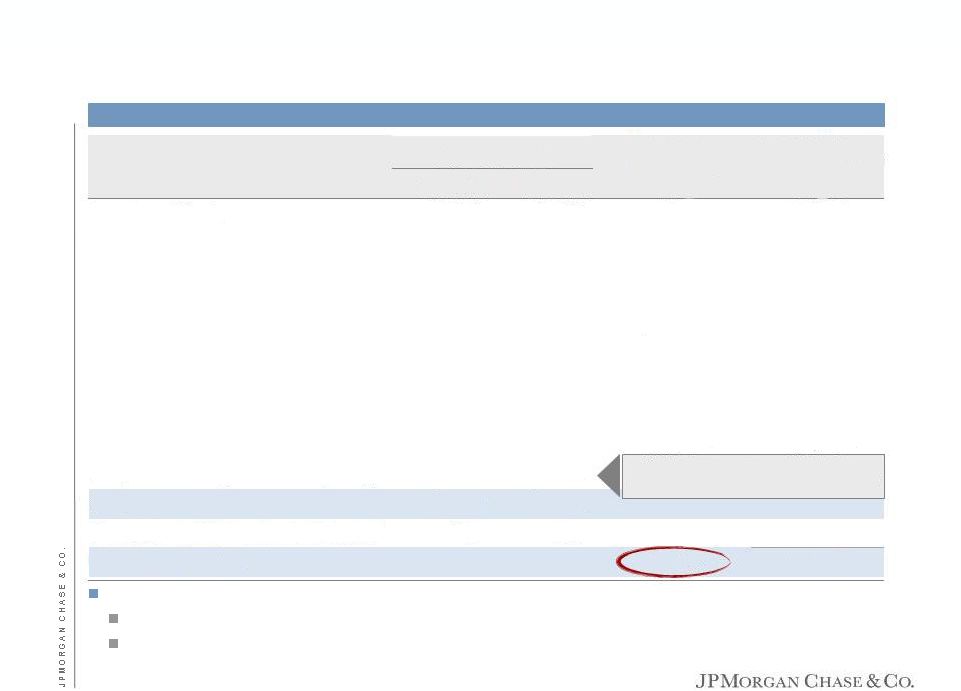

Basel III –

RWA and capital estimates

Basel I 3Q11

Basel III 3Q11

Basel III 4Q12

RWA ($ in trillions)

Capital ($ in billions)

$1.5

Adjustments to RWA from 3Q11 Basel I to Basel III

(+$330B):

Market risk impact (+$130B)

Risk weight 50/50 deductions at 1250% (+$90B)

CVA (+$90B)

250% risk weight applied to MSR, DTA, and

Investments in Unconsolidated Financial

Institutions (+$35B)

Other (-$15B)

3Q11 to 4Q12 reduction in Basel III RWA

(-$140B):

Data / Model enhancements (-$60B)

Legacy portfolio runoff through 2014 (-$90B)

LOB Growth (+$10B)

Basel I 3Q11

Basel III 3Q11

Basel III 4Q12

Adjustments to Capital from 3Q11 Basel I to Basel III:

Deduct net pension asset (-$3B)

Adjustments related to AFS Securities and

pension-related components of accumulated other

comprehensive income (+$2B)

Analyst estimate of ~$10B net capital generation

through 2012

Net Income (+$22B)

Dividends (-$5B)

Other (-$7B)

$120

$119

$1.4

$129

9.9%

7.7%

9.2%

Tier 1 Common Ratio

$1.2

1

Analyst projections represent the average of 8 analysts; regulatory changes are

assumed to be incorporated in the analyst projections. JPM does not endorse these projections

1

34

1 |

Common equity and performance targets

Common equity and target ROEs ($ in billions)

1

TSS

and

AM

pre-tax

margin

targets

remain

unchanged

at

35%

+/-

through

the

cycle

²

IRR of 20% +/-

³

Reflects

goodwill

and

intangibles

held

at

corporate

and

capital

not

allocated

to

LOBs.

1/1/2012

reflects

3Q11

total

common

equity

for

illustrative

purposes

4

See note 3 on slide 43

Significant earnings upside if the Firm reaches its performance targets

Net income at performance targets expected to be $24B +/-

Current capital and mitigation will get businesses to these targets

$500-$1,000mm +/-

annual net income;

earnings and capital will vary through the cycle

4

35

1/1/2011

1/1/2012

Investment Bank

$40.0

$40.0

17% +/-

9.5% +/-

Retail Financial Services

25.0

26.5

30% +/-

8.5% +/-

Mortgage Banking

15.5

17.0

15% +/-

8.5% +/-

Consumer & Business Banking

9.5

9.5

30% +/-

8.5% +/-

Card Services & Auto

16.0

16.5

20% +/-

8.5% +/-

Commercial Banking

8.0

9.5

20% +

8.5% +/-

Treasury & Securities Services

¹

7.0

9.0

25% +/-

9.0% +/-

Asset Management

¹

6.5

7.0

35% +/-

8.5% +/-

Private Equity

3.5

5.0

20% +/-²

9.5% +/-

Corporate Other (CIO/Treasury/Corp)

13.0

15.5

Subtotal

$119.0

$129.0

Corp. Goodwill & Unallocated Capital³

49.5

45.5

Future State

Total Firm ROTCE

16 +/-

9.5% +/-

Common equity

Through-the-

cycle target

ROE

Current Basel III

Tier 1 Common

Target |

If our Board makes the decision, we can get to a Basel III Tier I Common

ratio of 9.5% by the end of 2012

We currently believe we will achieve a Basel III Tier I Common ratio of 9%+

by

the

end

of

2012

because

the

market

will

demand

higher

capital

ratios

than before (race to the top)

Still enables healthy stock buybacks and modest dividend increase

Dependent on earnings

These are Board-level decisions and we will ultimately need to finish the

regulatory approval process

Comments on capital

Severe stress scenario

Unemployment of 13%

Home price decline of 20% from current level

Severe global market shock, including specific European stresses

Results

under

the

Fed

stress

scenario

will

be

evaluated

relative

to

a

Basel I

Tier 1 Common threshold of 5%

Do not expect this to be an issue for the Firm

36

Federal Reserve

Comprehensive

Capital Analysis

and Review

Capital comments |

Growth initiatives

Industry regulatory issues

Agenda

Key investor topics

4Q11 outlook and future comments

Appendix

37 |

4Q11 outlook and future comments

Investment Bank

Credit Card (excl. WaMu and Commercial Card)

credit losses could be modestly better than 4.34%

reported in 3Q11

Private Equity

Expect modest loss this quarter

Corporate

Corporate net income slightly better than the zero

guidance given at 3Q11

Total revenue (excl. DVA) essentially flat

Card Services & Auto

Corporate / Private Equity

Ability to repurchase an additional $950mm of equity

which we may or may not use

Represents a reallocation of previously approved

capacity for distribution of the Firm’s capital

pursuant to the Federal Reserve’s 2011

Comprehensive Capital Analysis and Review

(“CCAR”)

Firm

Lower markets; lower performance fees

Mortgage Banking (excl. Real Estate Portfolios)

Production revenue expected to be down from

3Q11, driven by lower spreads and volumes

Realized repurchase losses likely to be slightly

higher

–

timing

issue

MSR risk management could be down $100mm+

from 3Q11

Consumer

&

Business

Banking

–

2012

outlook

Spread compression, given low interest rates, will

negatively impact net income by $400mm+/-

Retail Financial Services

Credit and litigation reserve actions

Redemption of $10B +/-

outstanding Trust Preferred

securities once we make a determination that a

regulatory capital event has occurred

Remaining securities viewed as attractive long

term financing

To be determined

38

Asset Management |

Tremendously focused on strategy to skillfully navigate through the

environment in 2012, including regulation

1

See note 3 on slide 43

2

See note 2 on slide 43

Solid growth

opportunities

Excellent client-facing franchises that continue to grow and strengthen

Unparalleled client relationships in 120+ countries

Strong products and technology

Each standalone business has a top 1, 2 or 3 position

Excellent client

facing

franchises

Battleship

balance sheet

Solid organic growth opportunities across LOBs

Never stopped investing in new products, branches and bankers

Continued focus on cross-sell

Significant earnings power, strong margins and strong risk management

Significant excess capital

Basel

I

Tier

I

Common

1

of

$120B,

ratio

of

9.9%

as

of

3Q11

Estimated

Basel

III

Tier

I

Common

1

ratio

of

7.7%

as

of

3Q11

Ability

to

achieve

Basel

III

Tier

I

Common

1

ratio

of

9%+

by

end

of

2012 –

will

depend

on

interpretation

of

rules

and

decisions

on

usage

of

excess

capital

Firmwide

total

credit

reserves

of

$29B,

loan

loss

coverage

ratio

of

3.74%

2

of total loans as of 3Q11

39

Benefits from diversification – funding, capital, lower volatility |

Growth initiatives

Industry regulatory issues

Agenda

Key investor topics

4Q11 outlook and future comments

Appendix

40 |

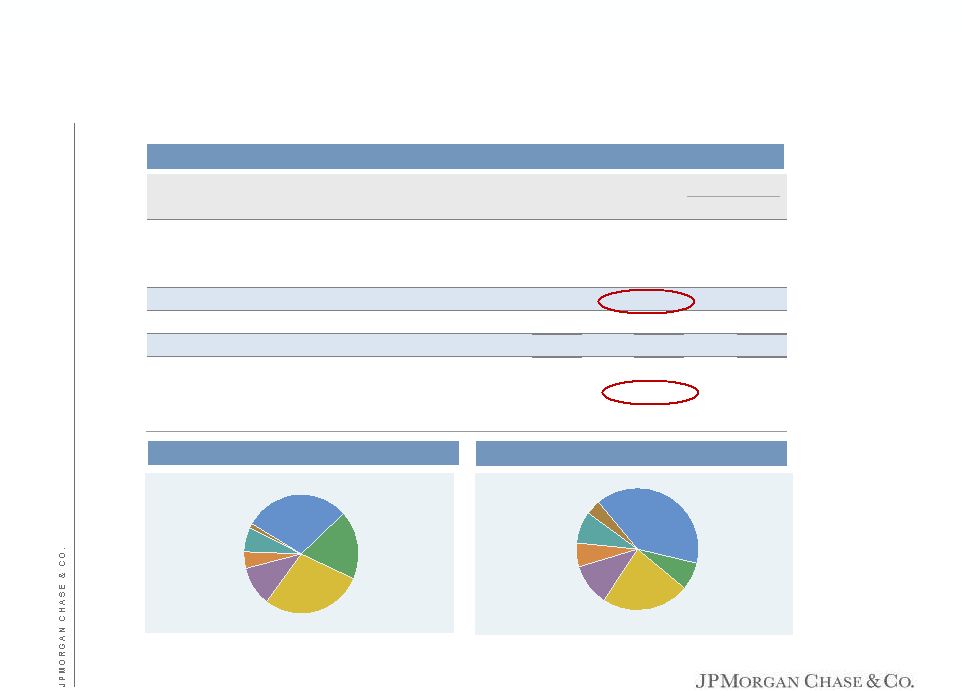

CB 10%

Card 28%

TSS 5%

IB 30%

RFS 19%

Corp/PE

1%

AM 7%

CB 11%

Card 23%

TSS 6%

IB 40%

RFS 8%

Corp/PE

4%

AM 8%

Net income –

3Q11YTD

JPMorgan Chase overview

Performance summary

1

See note 1 on slide 43

2

See note 4 on slide 43

Total = $15.2B

Total = $29.2B

$ in millions, excluding EPS

Pretax pre-provision profit –

3Q11YTD

41

$O/(U)

3Q10YTD

3Q11YTD

3Q10YTD

Revenue (FTE)

1

$78,120

$77,569

($551)

Credit Costs

13,596

5,390

(8,206)

Expense

45,153

48,371

3,218

Reported Net Income

$12,539

$15,248

$2,709

Net Income Applicable to Common Stock

$11,353

$14,141

$2,788

Reported EPS

$2.84

$3.57

$0.73

ROE

2

10%

11%

ROTCE

2

15%

16%

Tier 1 Common

$110,842

$120,234 |

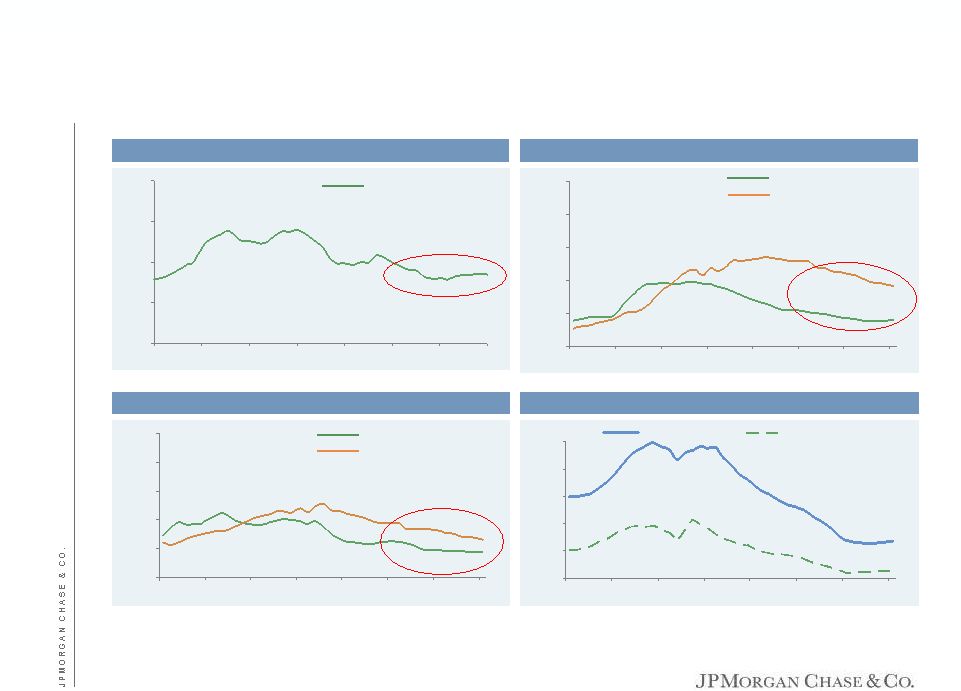

Consumer credit

— delinquency trends

(Excl. purchased credit-impaired loans and WaMu and Commercial Card portfolios)

Credit Card delinquency trend

1,2

($ in millions)

Prime Mortgage delinquency trend ($ in millions)

Home Equity delinquency trend ($ in millions)

Subprime Mortgage delinquency trend ($ in millions)

$0

$1,000

$2,000

$3,000

$4,000

May-08

Nov-08

May-09

Nov-09

May-10

Nov-10

May-11

Nov-11

$0

$1,300

$2,600

$3,900

$5,200

$6,500

May-08

Nov-08

May-09

Nov-09

May-10

Nov-10

May-11

Nov-11

30 –

150 day delinquencies

150+ day delinquencies

$0

$1,000

$2,000

$3,000

$4,000

$5,000

May-08

Nov-08

May-09

Nov-09

May-10

Nov-10

May-11

Nov-11

30 –

150 day delinquencies

150+ day delinquencies

$1,200

$2,600

$4,000

$5,400

$6,800

$8,200

May-08

Nov-08

May-09

Nov-09

May-10

Nov-10

May-11

Nov-11

30+ day delinquencies

30-89 day delinquencies

30 –

150 day delinquencies

42

Note: Delinquencies prior to September 2008 are heritage Chase

Prime Mortgage excludes loans held-for-sale, Asset Management and U.S. Government-Insured

loans 1

See note 5 on slide 43

2

“Payment holiday” in 2Q09 impacted 30+ day and 30-89 day delinquency trends in

3Q09 |

Notes on non-GAAP & other financial measures

43

Notes on non-GAAP financial measures 1.

In addition to analyzing the Firm’s results on a reported basis, management reviews the

Firm’s results and the results of the lines of business on a “managed” basis, which is a non-GAAP

financial measure. The Firm’s definition of managed basis starts with the reported U.S. GAAP

results and includes certain reclassifications to present total net revenue for the Firm (and each of

the business segments) on a FTE basis. Accordingly, revenue from tax-exempt securities and

investments that receive tax credits is presented in the managed results on a basis comparable to

taxable securities and investments. This non-GAAP financial measure allows management to assess

the comparability of revenue arising from both taxable and tax-exempt sources. The

corresponding income tax impact related to tax-exempt items is recorded within income tax expense.

These adjustments have no impact on net income as reported by the Firm as a whole or by the

lines of business. 2.

The ratio of the allowance for loan losses to end-of-period loans excludes the following:

loans accounted for at fair value and loans held-for-sale; purchased credit-impaired (“PCI”) loans; and the

allowance for loan losses related to PCI loans. Additionally, Real Estate Portfolios net

charge-offs exclude the impact of PCI loans. The allowance for loan losses related to the purchased credit-

impaired portfolio totaled $4.9 billion, $4.9 billion and $2.8 billion at September 30, 2011,

June 30, 2011, and September 30, 2010, respectively. 3.

The Basel I Tier 1 common ratio is Tier 1 common divided by risk-weighted assets. Tier 1 common is

defined as Tier 1 capital less elements of Tier 1 capital not in the form of common equity,

such as perpetual preferred stock, noncontrolling interests in subsidiaries and trust preferred

capital debt securities. Tier 1 common, a non-GAAP financial measure, is used by banking

regulators, investors and analysts to assess and compare the quality and composition of the

Firm’s capital with the capital of other financial services companies. The Firm uses Tier 1 common

along with other capital measures to assess and monitor its capital position. On December 16, 2010,

the Basel Committee issued the final version of the Basel Capital Accord, commonly referred to

as “Basel III.” The Firm’s estimate of its Tier 1 common ratio under Basel III is a non-GAAP financial measure and reflects the Firm’s current understanding of the Basel III rules and the

application of such rules to its businesses as currently conducted. The Firm’s estimates of its

Basel III Tier 1 common ratio will evolve over time as the Firm’s businesses change, and as a result

of further rule-making on Basel III implementation by U.S. federal banking agencies. Management

considers this estimate as a key measure to assess the Firm’s capital position in conjunction

with its capital ratios under Basel I requirements, in order to enable management, investors and

analysts to compare the Firm’s capital under the Basel III capital standards with similar estimates

provided by other financial services companies.

4.

Tangible common equity (“TCE”), a non-GAAP financial measure, represents common

stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable

intangible assets (other than MSRs), net of related deferred tax liabilities. ROTCE, a non-GAAP

financial ratio, measures the Firm’s earnings as a percentage of TCE. In management’s view,

these measures are meaningful to the Firm, as well as analysts and investors in assessing the

Firm’s use of equity, and in facilitating comparisons with competitors.

5.

In Card Services, supplemental information is provided for Chase, excluding Washington Mutual and

Commercial Card portfolios, to provide more meaningful measures that enable comparability with

prior periods. The net charge-off rate and 30+ delinquency rate presented include loans held-for-sale.

Additional notes on financial measures 6.

Pretax margin represents income before income tax expense divided by total net revenue, which

is, in management’s view, a comprehensive measure of pretax performance derived by

measuring earnings after all costs are taken into consideration. It is, therefore, another basis that

management uses to evaluate the performance of TSS and AM against the performance of their

respective competitors.

|

Forward-looking statements

This presentation contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Such statements

are based upon the current beliefs and expectations of JPMorgan Chase &

Co.’s management and are subject to significant risks and

uncertainties. Actual results may differ from those set forth in the forward-looking

statements. Factors that could cause JPMorgan Chase & Co.’s actual

results to differ materially from those described in the

forward-looking statements can be found in JPMorgan Chase & Co.’s

Annual Report on Form 10-K for the year ended December 31, 2010 (as revised by

a Current Report on Form 8-K dated November 4, 2011), and Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2011 (as revised

by a Current Report on Form 8-K dated November 4, 2011), June 30, 2011

(as revised by a Current Report on Form 8-K dated November 4, 2011),

and September 30, 2011, which have been filed with the Securities and Exchange

Commission and are

available

on

JPMorgan

Chase

&

Co.’s

website

(www.jpmorganchase.com)

and

on

the

Securities

and

Exchange

Commission’s

website

(www.sec.gov).

JPMorgan

Chase

&

Co.

does

not

undertake to update the forward-looking statements to reflect the impact of

circumstances or events that may arise after the respective dates of the

referenced forward-looking statements. 44 |