Attached files

| file | filename |

|---|---|

| 8-K - JOINT FORM 8-K - KANSAS CITY POWER & LIGHT CO | f8kirdeck12-7_11.htm |

December 2011 Investor Presentation

Great Plains Energy

Investor Presentation

December 2011

Exhibit 99.1

December 2011 Investor Presentation

2

Statements made in this presentation that are not based on historical facts are forward-looking, may involve risks and

uncertainties, and are intended to be as of the date when made. Forward-looking statements include, but are not limited to,

the outcome of regulatory proceedings, cost estimates of capital projects and other matters affecting future operations. In

connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great Plains Energy and

KCP&L are providing a number of important factors that could cause actual results to differ materially from the provided

forward-looking information. These important factors include: future economic conditions in regional, national and

international markets and their effects on sales, prices and costs, including but not limited to possible further deterioration in

economic conditions and the timing and extent of economic recovery; prices and availability of electricity in regional and

national wholesale markets; market perception of the energy industry, Great Plains Energy and KCP&L; changes in business

strategy, operations or development plans; effects of current or proposed state and federal legislative and regulatory actions

or developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry;

decisions of regulators regarding rates the companies can charge for electricity; adverse changes in applicable laws,

regulations, rules, principles or practices governing tax, accounting and environmental matters including, but not limited to,

air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates

and credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension plan

assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk

management policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of

terrorist acts, including but not limited to cyber terrorism; ability to carry out marketing and sales plans; weather conditions

including, but not limited to, weather-related damage and their effects on sales, prices and costs; cost, availability, quality

and deliverability of fuel; the inherent uncertainties in estimating the effects of weather, economic conditions and other

factors on customer consumption and financial results; ability to achieve generation goals and the occurrence and duration

of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of additional

generation, transmission, distribution or other projects; the inherent risks associated with the ownership and operation of a

nuclear facility including, but not limited to, environmental, health, safety, regulatory and financial risks; workforce risks,

including, but not limited to, increased costs of retirement, health care and other benefits; and other risks and uncertainties.

uncertainties, and are intended to be as of the date when made. Forward-looking statements include, but are not limited to,

the outcome of regulatory proceedings, cost estimates of capital projects and other matters affecting future operations. In

connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great Plains Energy and

KCP&L are providing a number of important factors that could cause actual results to differ materially from the provided

forward-looking information. These important factors include: future economic conditions in regional, national and

international markets and their effects on sales, prices and costs, including but not limited to possible further deterioration in

economic conditions and the timing and extent of economic recovery; prices and availability of electricity in regional and

national wholesale markets; market perception of the energy industry, Great Plains Energy and KCP&L; changes in business

strategy, operations or development plans; effects of current or proposed state and federal legislative and regulatory actions

or developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry;

decisions of regulators regarding rates the companies can charge for electricity; adverse changes in applicable laws,

regulations, rules, principles or practices governing tax, accounting and environmental matters including, but not limited to,

air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates

and credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension plan

assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk

management policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of

terrorist acts, including but not limited to cyber terrorism; ability to carry out marketing and sales plans; weather conditions

including, but not limited to, weather-related damage and their effects on sales, prices and costs; cost, availability, quality

and deliverability of fuel; the inherent uncertainties in estimating the effects of weather, economic conditions and other

factors on customer consumption and financial results; ability to achieve generation goals and the occurrence and duration

of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of additional

generation, transmission, distribution or other projects; the inherent risks associated with the ownership and operation of a

nuclear facility including, but not limited to, environmental, health, safety, regulatory and financial risks; workforce risks,

including, but not limited to, increased costs of retirement, health care and other benefits; and other risks and uncertainties.

This list of factors is not all-inclusive because it is not possible to predict all factors. Other risk factors are detailed from time

to time in Great Plains Energy’s and KCP&L’s quarterly reports on Form 10-Q and annual report on Form 10-K filed with the

Securities and Exchange Commission. Each forward-looking statement speaks only as of the date of the particular

statement. Great Plains Energy and KCP&L undertake no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or otherwise.

to time in Great Plains Energy’s and KCP&L’s quarterly reports on Form 10-Q and annual report on Form 10-K filed with the

Securities and Exchange Commission. Each forward-looking statement speaks only as of the date of the particular

statement. Great Plains Energy and KCP&L undertake no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or otherwise.

Forward-Looking Statement

December 2011 Investor Presentation

3

Overview

December 2011 Investor Presentation

4

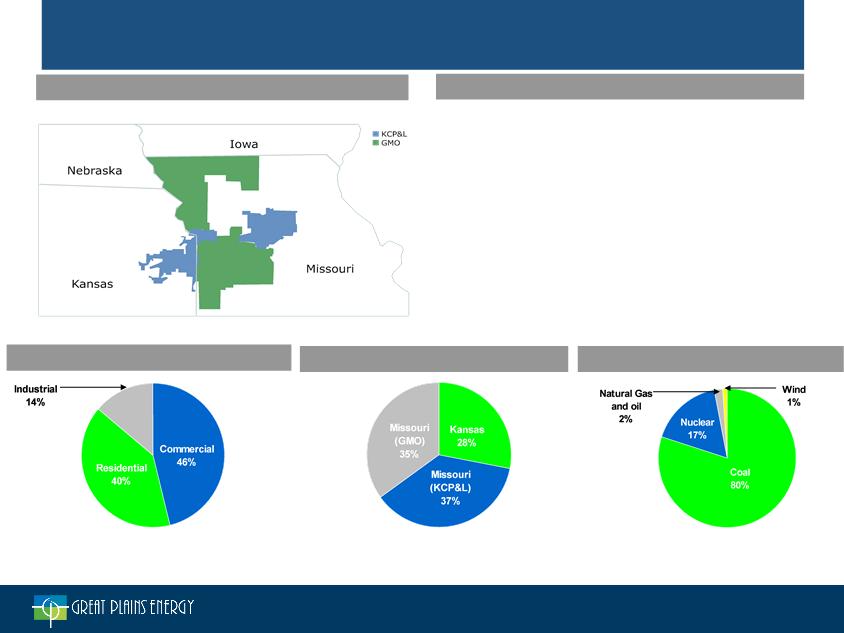

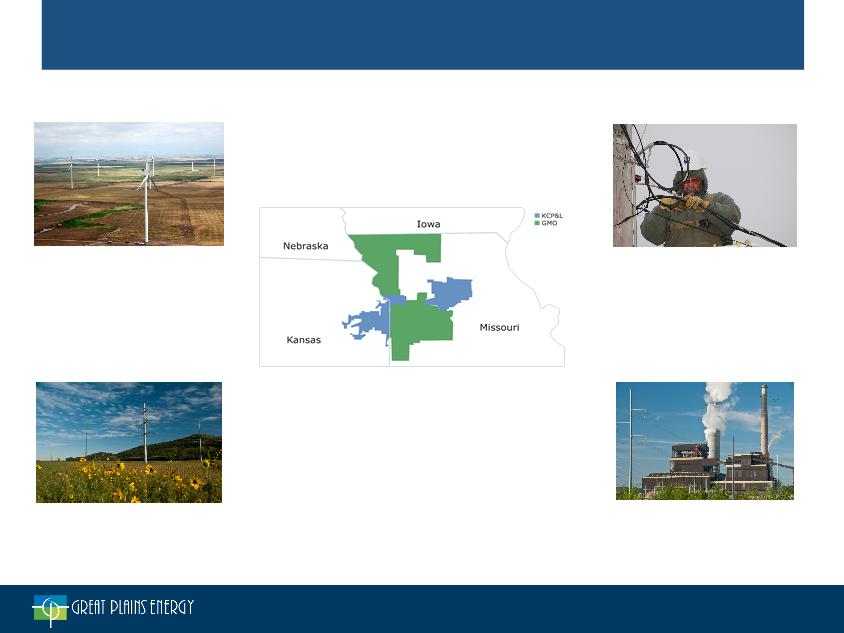

• Solid Midwest electric utility operating under the KCP&L brand

• Transformational events in 2008 to focus business model on fully

regulated utility operations

regulated utility operations

– Sale of Strategic Energy

– Acquisition of Aquila (now KCP&L Greater Missouri Operations

Company, or “GMO”)

Company, or “GMO”)

• Company attributes

– ~824,000 customers / 3,000 employees

– ~6,600 MW of primarily low-cost coal baseload generation

– 5-year projected synergies post-GMO acquisition of ~$757M

– ~$8.8bn in assets at 2010YE

– ~$5.6bn in rate base

Service Territories: KCP&L and GMO

Business Highlights

2010 Retail MWh Sold by Customer Type

2010 Retail MWh Sales by Jurisdiction

2010 MWh Generated by Fuel Type

Total: ~ 23,806 MWhs*

Total: ~ 23,806 MWhs*

Total: ~ 26,679 MWhs*

Solid Vertically-Integrated Midwest Utility

* In thousands

December 2011 Investor Presentation

5

5

2005 - 2,382

2010 - 3,188

INCREASE = 34%

2005 - 500,000

2010 - 823,200

INCREASE = 65%

2005 - 14,400

2010 - 25,600

2010 - 25,600

INCREASE = 78%

2005 - 2,788 MW

2010 - 4,345 MW

INCREASE = 56%

2005 - $2.12 Billion

2010 - $5.59 Billion

INCREASE = 164%

GXP’s Transformation: 2005 - Present

Rate Base

Utility Employees

Customers

T&D Route-Miles

Base Load Generation

December 2011 Investor Presentation

6

|

Leading Industries

(Employees in 000’s)

|

|

|

State & Local Government

|

124.8

|

|

Full and Limited-Service Restaurants

|

63.3

|

|

General Medical & Surgical Hospitals / Offices of

Physicians |

46.7

|

|

Federal Government

|

29.1

|

|

Employment Services

|

20.6

|

|

Depository Credit Intermediation

|

16.3

|

|

Grocery Stores

|

16.2

|

|

Department Stores

|

15.5

|

|

Computer Systems Design and Related Srvcs

|

15.2

|

|

Management of Companies and Enterprises

|

15.2

|

KC Metropolitan Area Economy - Snapshot

|

Top 10 Employers

(# of Employees)

|

|

|

HCA Midwest Health System

|

8,127

|

|

Wal-Mart Stores, Inc.

|

7,400

|

|

Sprint Corporation

|

7,300

|

|

St. Luke’s Health System

|

6,622

|

|

McDonald’s USA LLC

|

5,700

|

|

Cerner Corporation

|

4,980

|

|

Children’s Mercy Hospital & Clinics

|

4,812

|

|

DST Systems, Inc.

|

4,425

|

|

Truman Medical Center

|

4,081

|

|

University of Kansas Hospital

|

3,880

|

• The Kansas City metro area economy is represented by a diverse set of

industries, supported by a sizeable presence in the governmental sector

industries, supported by a sizeable presence in the governmental sector

Strengths

• Diversified economy

• Stability from governmental sector

• Well-developed transportation &

distribution network

distribution network

• Central national location

• Low cost of living/business

Weaknesses

• Increased competition from other

Midwest business centers

Midwest business centers

• High dependence on Sprint Nextel

and telecom

and telecom

• Suburban sprawl

• Low employment growth

Opportunities

• New Ford product lines create local

jobs

jobs

• Google ultra-high speed fiber

network supports tech economy

network supports tech economy

• Kansas wind power attracts clean-

energy firms

energy firms

Source: The Kansas City Business Journal, BLS and Moody’s Analytics

Source for Listed Attributes: Moody’s Analytics

December 2011 Investor Presentation

7

Recent Developments and

September 30, 2011 Year-to-Date

Operating & Financial Update

December 2011 Investor Presentation

8

• KCC order stated that the decision to retrofit LaCygne 1 and 2 was

reasonable, reliable, efficient and prudent and the cost estimate is

reasonable

reasonable, reliable, efficient and prudent and the cost estimate is

reasonable

• Total project cost estimate, excluding AFUDC and property tax, of $1.23

billion; KCP&L’s total share is $615 million and Kansas jurisdictional share is

$281 million

billion; KCP&L’s total share is $615 million and Kansas jurisdictional share is

$281 million

• Requested environmental rider denied

LaCygne Environmental Retrofit

Kansas Predetermination

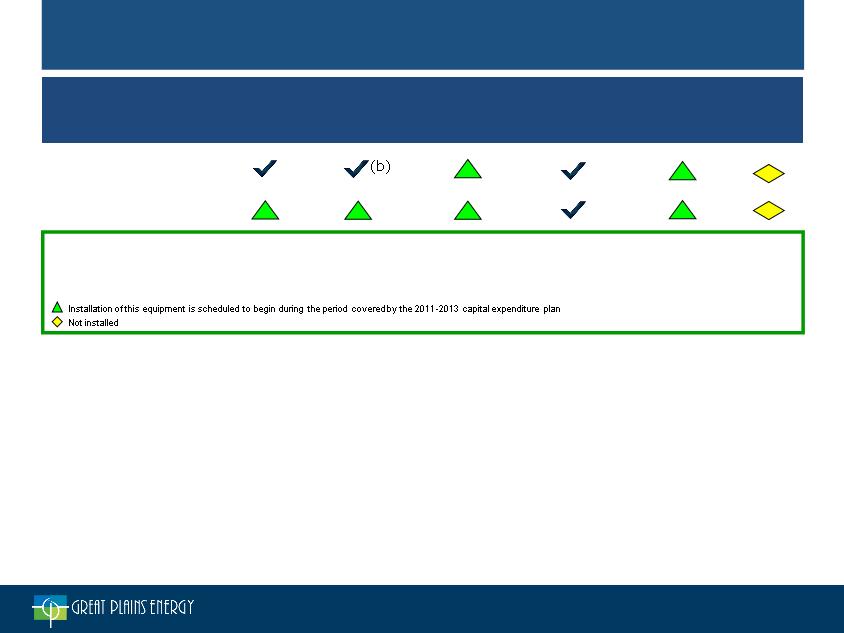

|

Coal Unit

|

MW

|

SCR

|

Scrubber

|

Baghouse

|

Other

Particulate

Control

|

Mercury

Controls |

Cooling

Tower |

|

LaCygne 1

|

368(a)

|

|

|

|

|

|

|

|

LaCygne 2

|

341(a)

|

|

|

|

|

|

|

(a) KCP&L’s share of jointly-owned facility

(b) LaCygne 1 currently has a scrubber installed; however, 2011-13 capital expenditure plan includes the installation of a new scrubber on the unit

(c) Existing scrubber removes particulate matter but will be replaced by the baghouse

(d) Existing precipitator will be replaced by the baghouse

ü Installed

(c)

(d)

December 2011 Investor Presentation

9

• Air permits have been obtained

• Entered into a firm fixed Engineering, Procurement and Construction Services

(EPC) contract

(EPC) contract

• Construction of new duel flue chimney expected to begin 1Q 2012

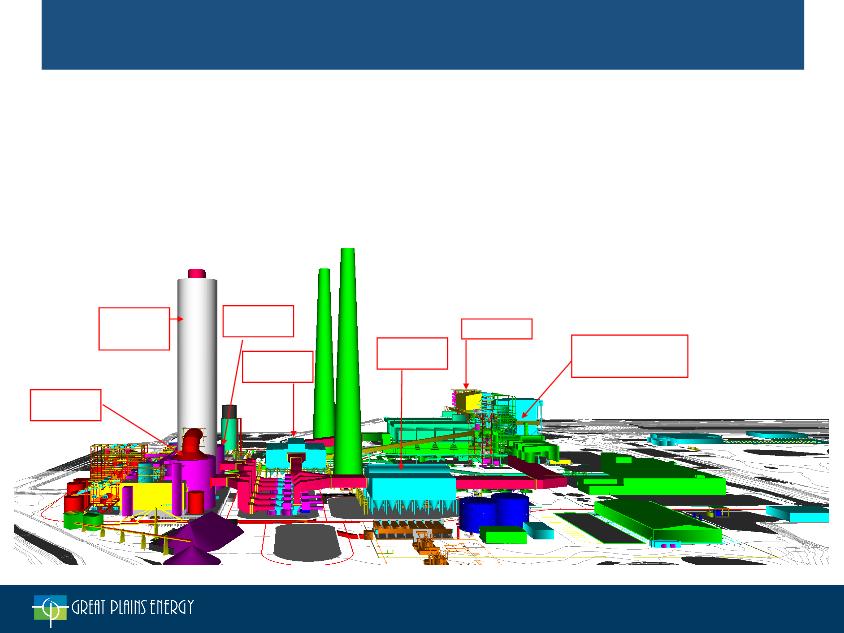

LaCygne Environmental Retrofit

Construction Update

Construction Update

New Duel

Flue

Chimney

Flue

Chimney

Unit 1 Wet

Scrubber

Scrubber

Unit 2 Wet

Scrubber

Scrubber

Unit 1

Baghouse

Baghouse

Unit 2 SCR

Low NOx Burners

and Overfire Air

System

and Overfire Air

System

Unit 2

Baghouse

Baghouse

Artist’s rendering of the LaCygne Generating Station Environmental Retrofit Project. Actual scale and location may vary.

December 2011 Investor Presentation

10

Collaboration

Agreement with

Sierra Club

Agreement with

Sierra Club

Renewable

Portfolio

Standards - KS

and MO

Portfolio

Standards - KS

and MO

Future Renewable

Requirements

Requirements

• 2007 Agreement

• KCP&L pledged to add 100 MW of wind (beyond

initial 100.5 MW at Spearville) by end of 2010

and 300 MW by end of 2012, subject to

regulatory approval

initial 100.5 MW at Spearville) by end of 2010

and 300 MW by end of 2012, subject to

regulatory approval

• 48 MW built in 2010 and 52 MW of RECs

purchased for 2010 applied to 2010

commitment; 48 MW and recent 131 MW PPA

apply toward 2012 commitment

purchased for 2010 applied to 2010

commitment; 48 MW and recent 131 MW PPA

apply toward 2012 commitment

• In November 2011, entered into PPAs for 200

MW of wind; applies towards 2012 commitment

MW of wind; applies towards 2012 commitment

• RPS requirements are different in each state

– Missouri requirements based upon retail

energy sales and include solar needs

energy sales and include solar needs

– Kansas requirements based upon retail

peak load

peak load

Drivers of Future Renewable Energy Needs

December 2011 Investor Presentation

11

|

Analyst Day Presentation

|

|

• RFP for 220 MW of wind

projects being evaluated — Likely structure is a PPA

— Would consider using equity

to finance asset growth if expected to be EPS accretive within 12-24 months of issuance |

|

|

|

|

Renewable Investment and

Financing Considerations

|

Update to Plan

|

|

• Negotiated two wind contracts in 4Q 2011

for in-service by the end of 2012 — KCP&L - 100 MW PPA

— GMO - 100 MW PPA

|

|

• May consider future ownership

― Would consider using equity to finance asset

growth if expected to be EPS accretive within 12-24 months |

December 2011 Investor Presentation

12

|

Overview

of Rule

|

|

• Final rule signed in July

2011 |

|

• Regulates SO2 and NOx

|

|

• Allows limited air quality-

assured allowance trading |

|

• Includes Kansas and

Missouri |

|

• Uncertainty of rule

pending judicial and administrative consideration |

|

Potential Impact to

Great Plains Energy |

|

• Increased capital costs

from additional emissions control equipment* |

|

• Purchase allowances, if

available |

|

• Off-systems sales

margin threshold |

|

• Increased costs to

customers |

|

|

|

|

|

Achieving

Compliance

|

|

• Install emissions control

equipment |

|

• Purchase allowances, if

available |

|

• Change in plant

processes |

|

|

|

|

|

|

*Potential costs included in approximate $1 billion for environmental compliance as noted in 3Q 2011 10-Q

Cross-State Air Pollution Rule (CSAPR)

December 2011 Investor Presentation

13

Regulatory Update

• Missouri

― On December 1, KCP&L and GMO gave notice to the

Missouri Public Service Commission (MPSC) of their intent

to file rate cases

Missouri Public Service Commission (MPSC) of their intent

to file rate cases

• Rate cases anticipated to be filed in 1Q 2012

― On December 1, KCP&L and GMO filed with the MPSC a

notice of intent to file a merger case

notice of intent to file a merger case

• This filing preserves the ability to file a merger case

concurrently with the anticipated rate cases

concurrently with the anticipated rate cases

― KCP&L and GMO anticipate making a filing under the

Missouri Energy Efficiency Investment Act (MEEIA) by year

end

Missouri Energy Efficiency Investment Act (MEEIA) by year

end

• Kansas

― KCP&L anticipates filing for a property tax rider by year

end with an effective date in February 2012

end with an effective date in February 2012

December 2011 Investor Presentation

14

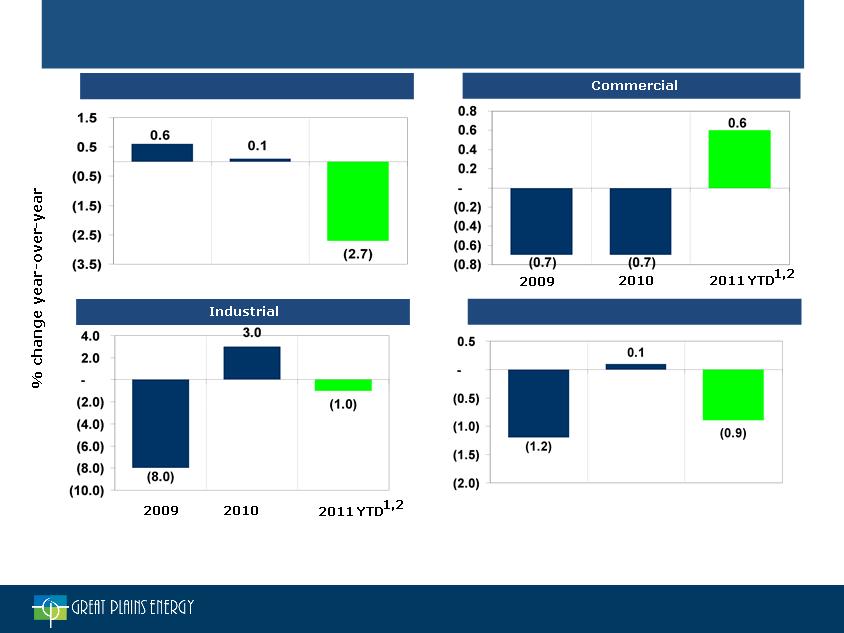

Weather-Normalized Year-over-Year

Retail MWh Sales

Retail MWh Sales

1 Drivers contributing to the portion of the YTD decline that occurred in 1Q11 may have included a) switching to natural gas heat; b) conversion to more

efficient heat pumps; c) conservation among KCP&L KS customers on an all-electric rate triggered by a substantial rate increase for this rate class in

KCP&L’s 2010 KS rate case; and d) continued challenges in the local economy

efficient heat pumps; c) conservation among KCP&L KS customers on an all-electric rate triggered by a substantial rate increase for this rate class in

KCP&L’s 2010 KS rate case; and d) continued challenges in the local economy

2 As of September 30

2009

2009

2010

2010

Residential

Total Customer Class

2011 YTD1,2

2011 YTD1,2

December 2011 Investor Presentation

15

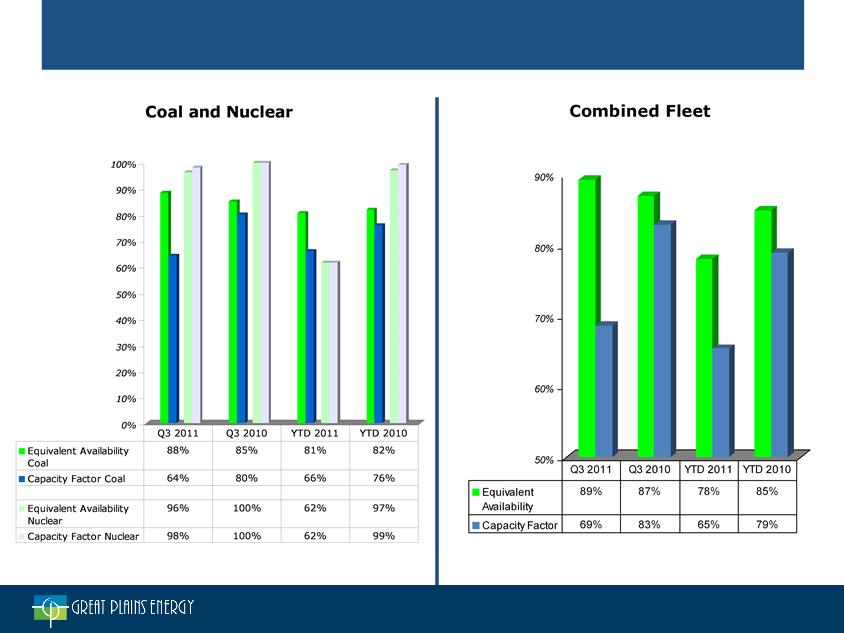

Plant Performance

1 As of September 30

1

1

1

1

December 2011 Investor Presentation

16

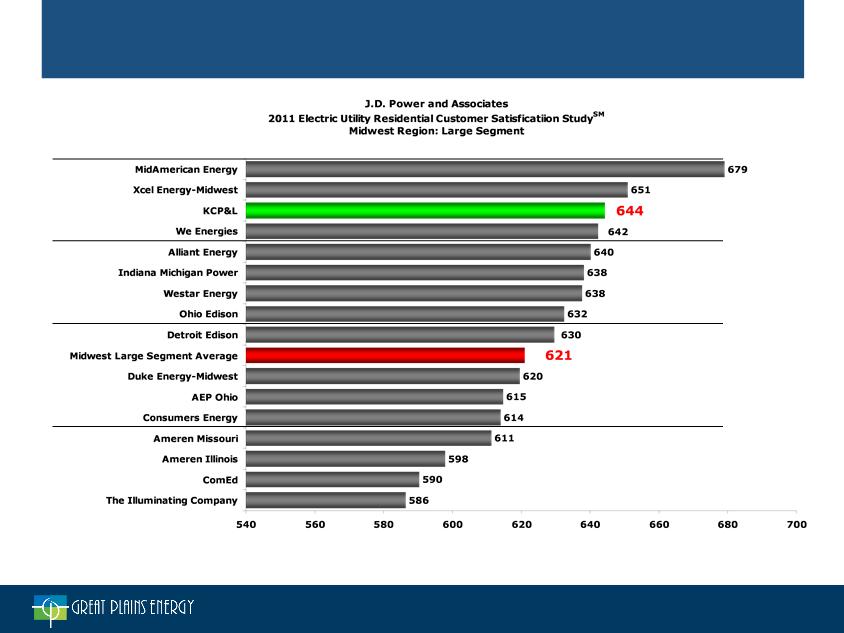

Source: J.D. Power and Associates 2011 Electric Utility Residential Customer Satisfaction StudySM

Tier 1

Tier 2

Tier 3

Tier 4

Customer Satisfaction

December 2011 Investor Presentation

17

2011 Quarterly and Year-to-Date September 30 EPS

Reconciliation Versus 2010

Reconciliation Versus 2010

|

|

Special

Factors |

WN Demand

|

Weather

|

Lag

|

Other

|

Total

|

|

1Q 2011

|

($0.07)

|

($0.04)

|

$0.01

|

($0.04)

|

-

|

($0.14)

|

|

2Q 2011

|

($0.06)

|

($0.01)

|

($0.03)

|

($0.02)

|

($0.04)

|

($0.16)

|

|

3Q 2011

|

($0.09)

|

$0.05

|

($0.03)

|

($0.03)

|

$0.05

|

($0.05)

|

|

Year To

Date |

($0.22)

|

$0.01

|

($0.04)

|

($0.09)

|

$0.01

|

($0.33)

|

|

|

2010 EPS

|

2011 EPS

|

Change in EPS

|

|

1Q

|

$0.15

|

$0.01

|

($0.14)

|

|

2Q

|

$0.47

|

$0.31

|

($0.16)

|

|

3Q

|

$0.96

|

$0.91

|

($0.05)

|

|

Year To

Date |

$1.57

|

$1.24

|

($0.33)

|

Contributors to Lower 2011 EPS Compared to 2010

Note: Numbers may not add due to the effect of dilutive shares on EPS

December 2011 Investor Presentation

18

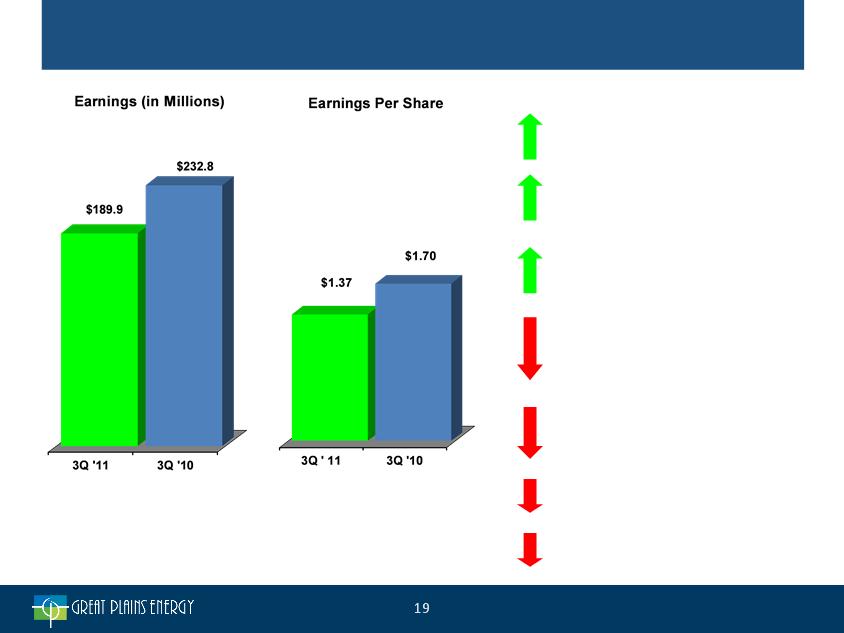

• Common stock outstanding for the year to date averaged 138.5 million shares, about 1 percent

higher than the same period in 2010

higher than the same period in 2010

|

|

Earnings (in Millions)

|

|

Earnings per Share

|

||

|

|

2011

|

2010

|

|

2011

|

2010

|

|

Electric Utility

|

$ 189.9

|

$ 232.8

|

|

$ 1.37

|

$ 1.70

|

|

Other

|

(17.6)

|

(16.1)

|

|

(0.13)

|

(0.12)

|

|

Net income

|

172.3

|

216.7

|

|

1.24

|

1.58

|

|

Less: Net income attributable to noncontrolling

interest |

-

|

(0.1)

|

|

-

|

-

|

|

Net income attributable to Great Plains Energy

|

172.3

|

216.6

|

|

1.24

|

1.58

|

|

Preferred dividends

|

(1.2)

|

(1.2)

|

|

-

|

(0.01)

|

|

Earnings available for common shareholders

|

$ 171.1

|

$ 215.4

|

|

$ 1.24

|

$ 1.57

|

Great Plains Energy Consolidated Earnings

and Earnings Per Share - Year-to-Date September 30

(Unaudited)

and Earnings Per Share - Year-to-Date September 30

(Unaudited)

December 2011 Investor Presentation

Electric Utility Year-to-Date Results

Decreased depreciation and amortization

• Lower regulatory amortization

• Lower depreciation rates established in recent

rate cases

rate cases

Decreased income tax expense

• Lower pre-tax income

Increased other operating expenses

• O&M and property taxes related to Iatan 2

• Disallowances and other costs resulting

from MO rate case orders

• Pension expense

• Flood related expenses

Decreased non-operating income and expenses

• Lower AFUDC equity

Charges related to organizational realignment

and voluntary separation program

and voluntary separation program

Key Earnings Drivers

$42.6M Pre-tax

$15.6M

$50.8M Pre-tax

Increased gross margin*

• New retail rates partially offset by an

extended Wolf Creek refueling outage, coal

conservation activities and higher coal

transportation costs

extended Wolf Creek refueling outage, coal

conservation activities and higher coal

transportation costs

$22.4M Pre-tax

$12.7M Pre-tax

$2.2M Pre-tax

*Gross margin is a non-GAAP measure that is defined and reconciled

to GAAP operating revenues in Appendix

to GAAP operating revenues in Appendix

Increased interest expense

• Lower AFUDC debt

• Lower carrying costs

$17.4M Pre-tax

December 2011 Investor Presentation

20

Special Factors Impacting

Year-to-Date Results and 2011 Guidance

Year-to-Date Results and 2011 Guidance

|

|

1Q

|

2Q

|

3Q

|

Total

|

|

Disallowances and other

accounting effects from Missouri rate case orders |

($0.03)

|

|

|

($0.03)

|

|

Organizational realignment and

voluntary separation program |

($0.04)

|

($0.01)

|

|

($0.05)

|

|

Wolf Creek extended outage

and replacement power |

|

($0.05)

|

|

($0.05)

|

|

Coal conservation and flooding

related expenses |

|

|

($0.09)

|

($0.09) (a)

|

|

Total

|

($0.07)

|

($0.06)

|

($0.09)

|

($0.22)

|

(a) Coal conservation ended mid-October and 4Q impact expected to be insignificant

(All Amounts Per-Share)

December 2011 Investor Presentation

21

|

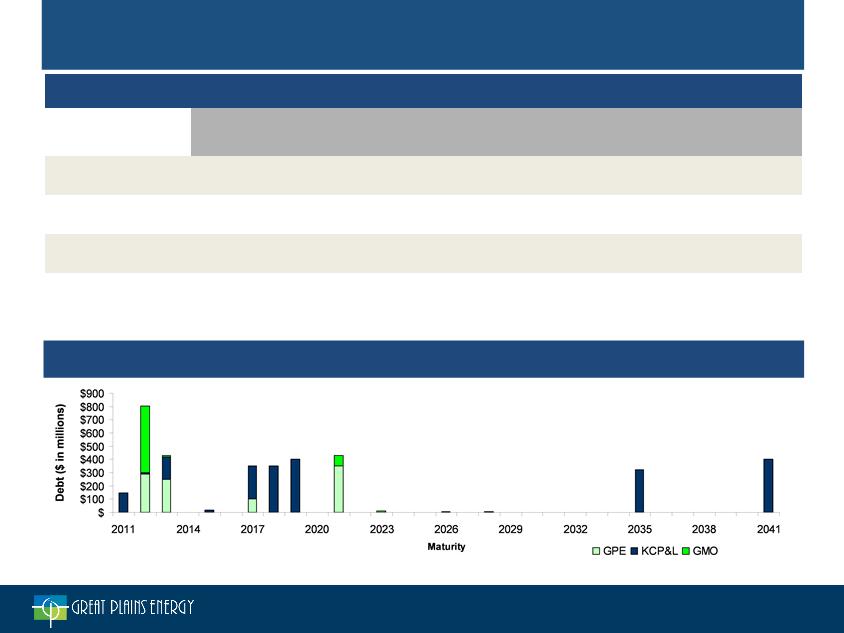

Great Plains Energy Debt

|

||||||||

|

($ in Millions)

|

KCP&L

|

GMO (1)

|

GPE

|

Consolidated

|

||||

|

|

Amount

|

Rate (2)

|

Amount

|

Rate (2)

|

Amount

|

Rate (2)

|

Amount

|

Rate (2)

|

|

Short-term debt

|

$ 105.5

|

1.07%

|

$ 0.0

|

0.0%

|

$ 28.0

|

3.00%

|

$ 133.5

|

1.47%

|

|

Long-term debt (3)

|

2,064.5

|

6.04%

|

650.2

|

10.96%

|

986.8

|

6.61%

|

3,701.5

|

7.03%

|

|

Total

|

$2,170.0

|

5.80%

|

$650.2

|

10.96%

|

$1,014.8

|

6.51%

|

$3,835.0

|

6.83%

|

|

Secured debt = $749 (20%), Unsecured debt = $3,086 (80%)

(1) GPE guarantees substantially all of GMO’s debt

(2) Weighted Average Rates - excludes premium / discounts and fair market value adjustments; includes full Equity Units coupon (12%) for GPE

(3) Includes current maturities of long-term debt

|

||||||||

Long-Term Debt Maturities (4)

Debt Profile as of September 30, 2011

(4) 2013 reflects mode maturity for $167.6 million of KCP&L tax-exempt bonds subject to remarketing prior to final maturity date

(5) $150 million of KCP&L long-term debt matured November 15, 2011

(5)

December 2011 Investor Presentation

22

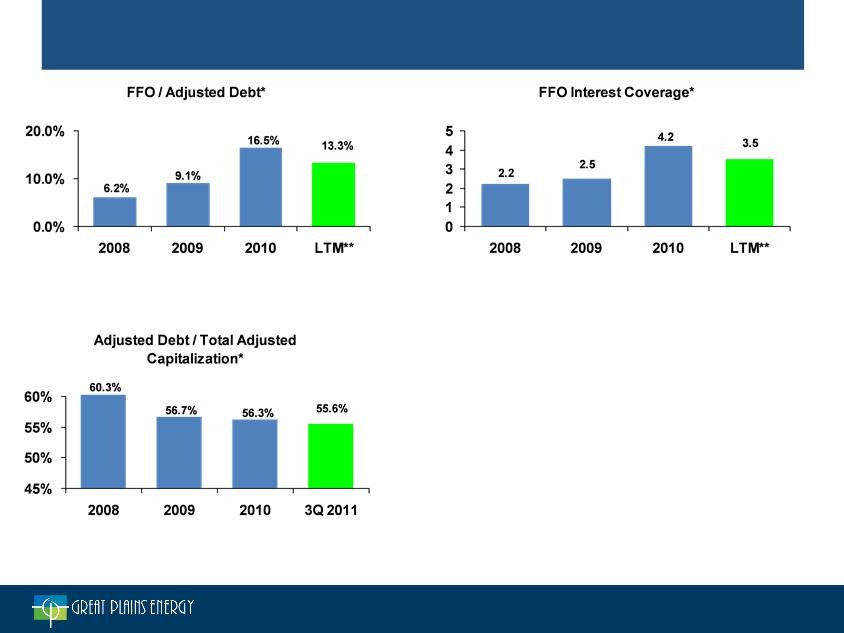

* All ratios calculated using Standard and Poor’s methodology. Ratios are non-GAAP measures that are defined and reconciled to GAAP in Appendix

** Last twelve months as of September 30, 2011

Credit Profile for Great Plains Energy

|

Current Credit Ratings

|

||

|

|

Moody’s

|

Standard & Poor’s

|

|

Great Plains Energy

Outlook

Corporate Credit Rating

Preferred Stock

Senior Unsecured Debt

|

Stable

-

Ba2

Baa3

|

Stable

BBB

BB+

BBB-

|

|

KCP&L

Outlook

Senior Secured Debt

Senior Unsecured Debt

Commercial Paper

|

Stable

A3

Baa2

P-2

|

Stable

BBB+

BBB

A-2

|

|

GMO

Outlook

Senior Unsecured Debt

Commercial Paper

|

Stable

Baa3

P-3

|

Stable

BBB

A-2

|

December 2011 Investor Presentation

23

Operations and Regulatory Strategy

December 2011 Investor Presentation

24

Environmental

1. Estimated cost of compliance with

current / proposed legislation =

approximately $1 billion:

current / proposed legislation =

approximately $1 billion:

• LaCygne

– Unit 1 (368 MW*) - scrubber

and baghouse - 2015

and baghouse - 2015

– Unit 2 (341 MW*) - full Air

Quality Control System

(“AQCS”) - 2015

Quality Control System

(“AQCS”) - 2015

• Montrose 3 (176 MW) - full AQCS -

2016 (approx.)

2016 (approx.)

• Sibley 3 (364 MW) - scrubber and

baghouse - 2016

baghouse - 2016

2. Other retrofits less likely and therefore

not included in estimated cost of

compliance:

not included in estimated cost of

compliance:

• Montrose 1 and 2 (total capacity 334

MW)

MW)

• Sibley 1 and 2 (total capacity 102

MW)

MW)

• Lake Road 4 and 6 (99 MW)

*KCP&L’s share of jointly-owned facility

Iatan 2 cooling tower fans. The use of a cooling tower for condenser cooling is an

integral part of Iatan’s environmentally friendly zero liquid discharge operation.

integral part of Iatan’s environmentally friendly zero liquid discharge operation.

December 2011 Investor Presentation

25

Renewable Energy and Energy Efficiency

1. Future renewable requirements

driven by the following:

driven by the following:

• Renewable Portfolio Standards

(“RPS”) in Missouri and Kansas

(“RPS”) in Missouri and Kansas

• 2007 Collaboration Agreement

with Sierra Club

with Sierra Club

2. Flexibility regarding acquisition of

future renewable resources:

future renewable resources:

• Through Purchased Power

Agreements (“PPAs”) and

purchases of Renewable Energy

Credits (“RECs”); or

Agreements (“PPAs”) and

purchases of Renewable Energy

Credits (“RECs”); or

• Adding to rate base if supported

by credit profile and available

equity and debt financing

by credit profile and available

equity and debt financing

3. Energy efficiency expected to be a

key component of future resource

portfolio:

key component of future resource

portfolio:

• Aggressive pursuit planned with

appropriate regulatory recovery

appropriate regulatory recovery

Spearville 2 Wind Energy Facility in Western Kansas

December 2011 Investor Presentation

26

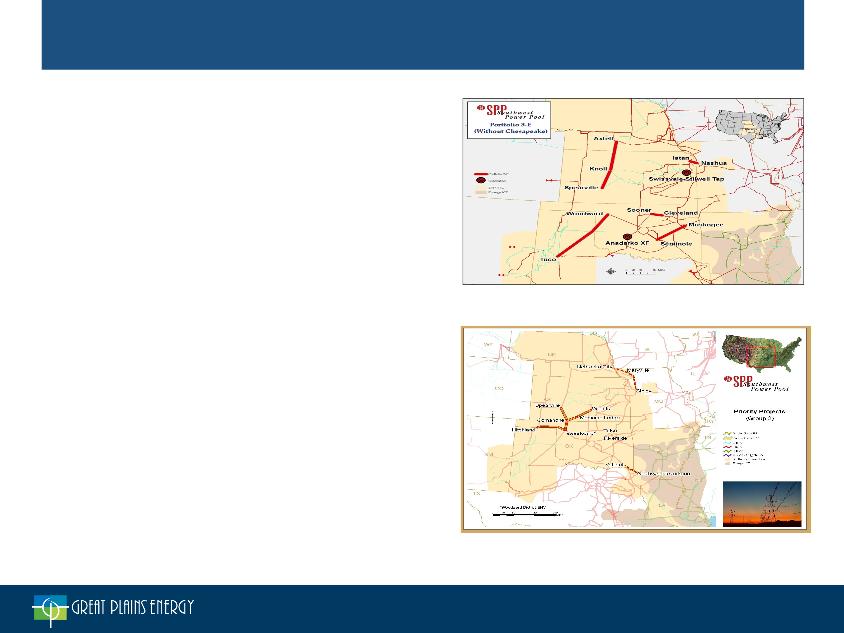

Transmission

1. Two significant projects are

currently in GXP’s plans:

currently in GXP’s plans:

• Iatan-Nashua 345kV line -

Projected $54M total cost and

2015 in-service date

Projected $54M total cost and

2015 in-service date

• Sibley-Maryville-Nebraska City

345kV line - Projected $380M

total cost and 2017 in-service

date

345kV line - Projected $380M

total cost and 2017 in-service

date

2. Increasingly competitive

environment requires consideration

of strategic options

environment requires consideration

of strategic options

3. Flexibility is important - opportunity

to pursue projects unilaterally but

also preserve capital if needed

through partnership

to pursue projects unilaterally but

also preserve capital if needed

through partnership

Iatan-Nashua 345kV, 30 miles, $54M

Expected in-service: 2015

Sibley-Maryville-Nebraska City 345kV,

170 miles, projected cost ~$380M

170 miles, projected cost ~$380M

December 2011 Investor Presentation

27

Plant Operations

1. No additional baseload

generation expected for

several years

generation expected for

several years

2. Targeting modest

improvements in existing

fleet performance in the

coming years

improvements in existing

fleet performance in the

coming years

3. No changes currently

planned regarding nuclear’s

role in the portfolio

planned regarding nuclear’s

role in the portfolio

Iatan 2, 850-megawatt coal fired power

plant recognized as power plant of the year

by Power Magazine

plant recognized as power plant of the year

by Power Magazine

December 2011 Investor Presentation

28

Regulatory

• Our rates continue to compare well regionally and nationally

• Over the last five years, the Company has received fair and

constructive treatment in both Kansas and Missouri, allowing

for recovery of our CEP capital additions

constructive treatment in both Kansas and Missouri, allowing

for recovery of our CEP capital additions

• We continue to aggressively pursue strategies to improve our

operating cost structure and are evaluating the best

combination of rate cases and riders/trackers to reduce

regulatory lag while minimizing the impact on customers

operating cost structure and are evaluating the best

combination of rate cases and riders/trackers to reduce

regulatory lag while minimizing the impact on customers

December 2011 Investor Presentation

29

2011 - 2012

Earnings Guidance

December 2011 Investor Presentation

30

Focused on Delivering Value to Shareholders

Earnings Growth

Expected Through Reduced Regulatory Lag, Disciplined Cost

Management and Long-Term Rate Base Growth

Management and Long-Term Rate Base Growth

Competitive Dividend

Goal to Maintain Competitive Dividend While Strengthening Key Credit

Metrics; Objective to Grow Dividend In Line With Payout Ratio

Targets

Metrics; Objective to Grow Dividend In Line With Payout Ratio

Targets

Objective: Improved Total Shareholder Returns

December 2011 Investor Presentation

31

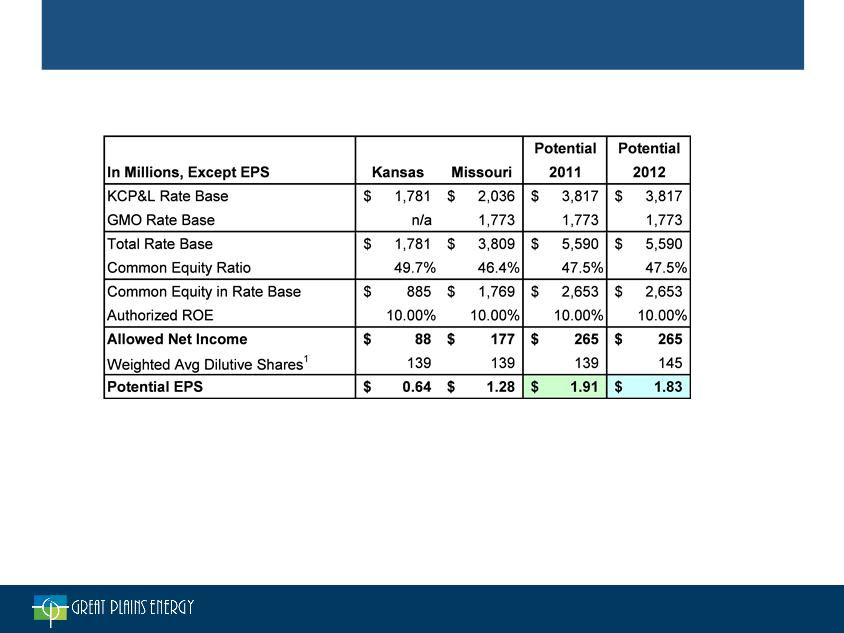

Potential Earnings from Regulated Operations

Based on Recent Rate Case Outcomes

Based on Recent Rate Case Outcomes

12012 includes conversion to 17.1M shares of GXP common stock in June

December 2011 Investor Presentation

32

2011 and 2012 EPS Guidance Range

• Increased 2011 guidance to $1.22 - $1.32 from $1.10 - $1.25

– Drivers:

• 3Q weather warmer than normal

• 3Q increase in weather-normalized demand

• Actual 2011 capital expenditures estimated to be $50 million less

than projected

than projected

• Reaffirming 2012 guidance of $1.35 - $1.55

• Reaffirming 2013 target of 50 basis points of lag in regulated

operations

operations

December 2011 Investor Presentation

33

• Strong emphasis on improving credit metrics

– Objective is visibility to sustainable FFO / Adjusted Debt* of 16%+

beginning in 2012

beginning in 2012

• Dividend is reviewed quarterly in context of this objective as well as a

belief that a sustainable and increasing dividend is a key driver of TSR

and therefore a desirable goal

belief that a sustainable and increasing dividend is a key driver of TSR

and therefore a desirable goal

• Target payout ratio remains 50-70%

Dividend Strategy Considerations

Competitive Dividend

Goal to Maintain Competitive Dividend While Strengthening Key Credit

Metrics; Objective to Grow Dividend In Line With Payout Ratio

Targets

Metrics; Objective to Grow Dividend In Line With Payout Ratio

Targets

• Company’s objective is to create shareholder value through

– Increased earnings from reduced lag, disciplined cost management and long

-term asset growth

-term asset growth

– A competitive dividend that complements this growth platform

*FFO / Adjusted Debt is a non-GAAP measure that is defined in the Appendix

December 2011 Investor Presentation

34

• Proven track record of constructive regulatory treatment

• Credibility with regulators in terms of planning and execution of large, complex projects

• Competitive retail rates on a regional and national level supportive of potential future

investment

investment

Diligent

Regulatory

Approach

Regulatory

Approach

• Target significant reduction in regulatory lag

• Seek to deliver earnings growth and increasing and sustainable cash dividends as a key

component of TSR

component of TSR

• Improvement in / stability of key credit metrics is a priority

Focused on

Shareholder

Value Creation

Shareholder

Value Creation

Excellent

Relationships

with Key

Stakeholders

Relationships

with Key

Stakeholders

• Customers - Tier 1 customer satisfaction

• Suppliers - strategic supplier alliances focused on long-term supply chain value

• Employees - strong relations between management and labor (3 IBEW locals)

• Communities - Leadership, volunteerism and high engagement in the areas we serve

• Environmental - additional ~$1 billion of “High Likelihood” capital projects planned to

comply with existing / proposed environmental rules

comply with existing / proposed environmental rules

• Transmission - additional $0.4 billion of capital additions planned

• Renewables - driven by Collaboration Agreement and MO/KS RPS; potential capital

additions

additions

• Other Growth Opportunities - selective future initiatives that will leverage our core

strengths

strengths

Attractive

Platform for

Long-Term

Growth

Platform for

Long-Term

Growth

GXP - Platform for Shareholder Value

December 2011 Investor Presentation

35

Great Plains Energy

Investor Presentation

December 2011

December 2011 Investor Presentation

36

Appendix

December 2011 Investor Presentation

37

Gross margin is a financial measure that is not calculated in accordance with generally accepted accounting

principles (GAAP). Gross margin, as used by Great Plains Energy, is defined as operating revenues less fuel,

purchased power and transmission of electricity by others. The Company’s expense for fuel, purchased

power and transmission of electricity by others, offset by wholesale sales margin, is subject to recovery

through cost adjustment mechanisms, except for KCP&L’s Missouri retail operations. As a result, operating

revenues increase or decrease in relation to a significant portion of these expenses. Management believes

that gross margin provides a more meaningful basis for evaluating the Electric Utility segment’s operations

across periods than operating revenues because gross margin excludes the revenue effect of fluctuations in

these expenses. Gross margin is used internally to measure performance against budget and in reports for

management and the Board of Directors. The Company’s definition of gross margin may differ from similar

terms used by other companies. A reconciliation to GAAP operating revenues is provided in the table above.

principles (GAAP). Gross margin, as used by Great Plains Energy, is defined as operating revenues less fuel,

purchased power and transmission of electricity by others. The Company’s expense for fuel, purchased

power and transmission of electricity by others, offset by wholesale sales margin, is subject to recovery

through cost adjustment mechanisms, except for KCP&L’s Missouri retail operations. As a result, operating

revenues increase or decrease in relation to a significant portion of these expenses. Management believes

that gross margin provides a more meaningful basis for evaluating the Electric Utility segment’s operations

across periods than operating revenues because gross margin excludes the revenue effect of fluctuations in

these expenses. Gross margin is used internally to measure performance against budget and in reports for

management and the Board of Directors. The Company’s definition of gross margin may differ from similar

terms used by other companies. A reconciliation to GAAP operating revenues is provided in the table above.

Great Plains Energy Reconciliation of

Gross Margin to Operating Revenues

(Unaudited)

Gross Margin to Operating Revenues

(Unaudited)

|

(millions)

|

Three Months Ended

September 30 |

Year to Date

September 30

|

||

|

|

2011

|

2010

|

2011

|

2010

|

|

Operating revenues

|

$773.7

|

$ 728.8

|

$1,831.7

|

$ 1,787.7

|

|

Fuel

|

(146.5)

|

(127.3)

|

(365.8)

|

(333.2)

|

|

Purchase power

|

(68.1)

|

(68.0)

|

(178.4)

|

(171.4)

|

|

Transmission of electricity by others

|

(8.6)

|

(8.1)

|

(23.1)

|

(20.9)

|

|

Gross margin

|

$550.5

|

$ 525.4

|

$1,264.4

|

$ 1,262.2

|

December 2011 Investor Presentation

38

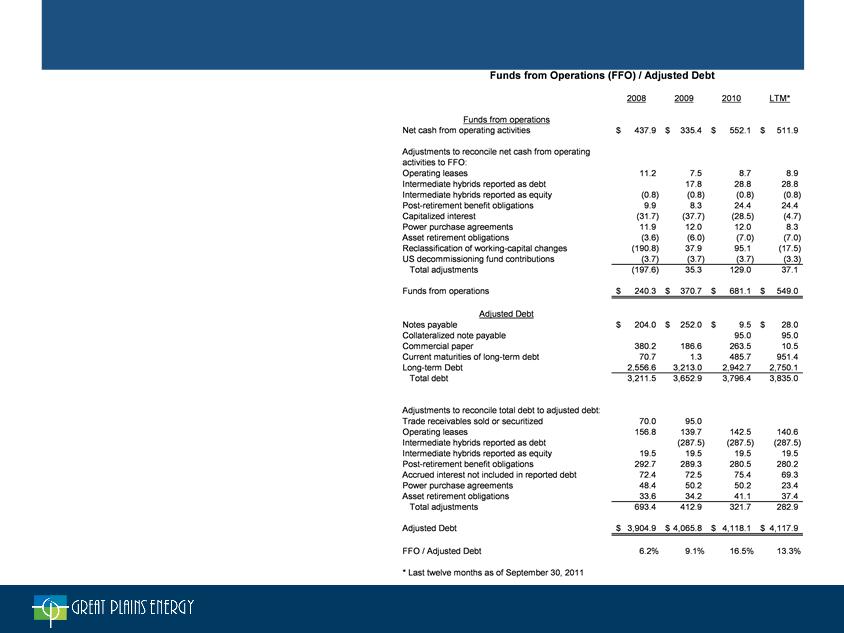

Credit Metric Reconciliation to GAAP

Funds from operations (FFO) to adjusted debt is a

financial measure that is not calculated in

accordance with generally accepted accounting

principles (GAAP). FFO to adjusted debt, as used

by Great Plains Energy, is defined in accordance

with Standard & Poor’s methodology used for

calculating FFO to debt. The numerator of the ratio

is defined as net cash from operating activities

(GAAP) plus non-GAAP adjustments related to

operating leases, hybrid securities, post-retirement

benefit obligations, capitalized interest, power

purchase agreements, asset retirement obligations,

changes in working capital and decommissioning

fund contributions. The denominator of the ratio is

defined as the sum of debt balances (GAAP) plus

non-GAAP adjustments related to some of the same

items adjusted for in the numerator and other

adjustments related to securitized receivables and

accrued interest. Management believes that FFO to

adjusted debt provides a meaningful way to better

understand the Company’s credit profile. FFO to

adjusted debt is used internally to help evaluate the

possibility of a change in the Company’s credit

rating.

financial measure that is not calculated in

accordance with generally accepted accounting

principles (GAAP). FFO to adjusted debt, as used

by Great Plains Energy, is defined in accordance

with Standard & Poor’s methodology used for

calculating FFO to debt. The numerator of the ratio

is defined as net cash from operating activities

(GAAP) plus non-GAAP adjustments related to

operating leases, hybrid securities, post-retirement

benefit obligations, capitalized interest, power

purchase agreements, asset retirement obligations,

changes in working capital and decommissioning

fund contributions. The denominator of the ratio is

defined as the sum of debt balances (GAAP) plus

non-GAAP adjustments related to some of the same

items adjusted for in the numerator and other

adjustments related to securitized receivables and

accrued interest. Management believes that FFO to

adjusted debt provides a meaningful way to better

understand the Company’s credit profile. FFO to

adjusted debt is used internally to help evaluate the

possibility of a change in the Company’s credit

rating.

December 2011 Investor Presentation

39

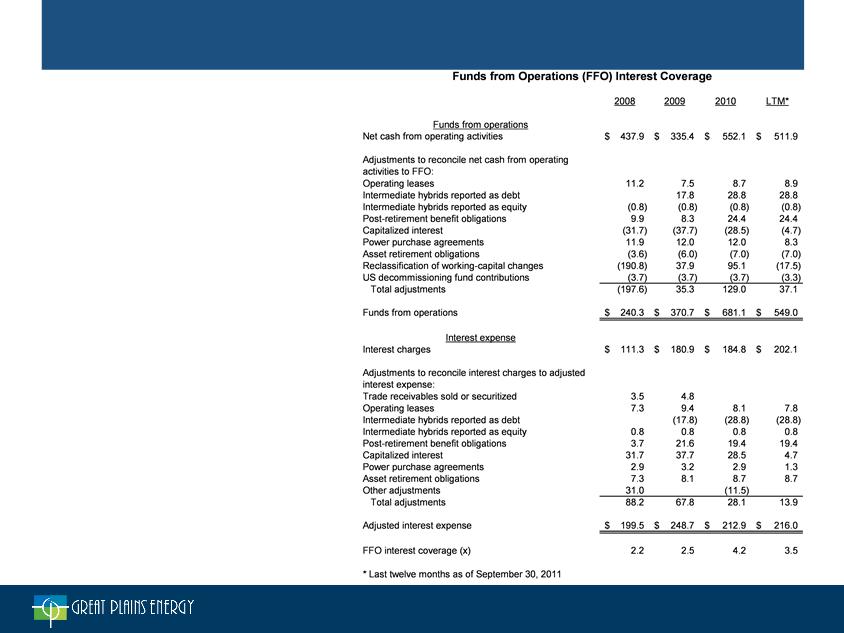

Credit Metric Reconciliation to GAAP

Funds from operations (FFO) interest coverage

ratio is a financial measure that is not calculated in

accordance with generally accepted accounting

principles (GAAP). FFO interest coverage, as

used by Great Plains Energy, is defined in

accordance with Standard & Poor’s methodology

used for calculating FFO interest coverage. The

numerator of the ratio is defined as net cash from

operating activities (GAAP) plus non-GAAP

adjustments related to operating leases, hybrid

securities, post-retirement benefit obligations,

capitalized interest, power purchase agreements,

asset retirement obligations, changes in working

capital and decommissioning fund contributions

plus adjusted interest expense (non-GAAP). The

denominator of the ratio, adjusted interest

expense, is defined as interest charges (GAAP)

plus non-GAAP adjustments related to some of

the same items adjusted for in the numerator and

other adjustments needed to match Standard &

Poor’s calculation. Management believes that

FFO interest coverage provides a meaningful way

to better understand the Company’s credit profile.

FFO interest coverage is used internally to help

evaluate the possibility of a change in the

Company’s credit rating.

ratio is a financial measure that is not calculated in

accordance with generally accepted accounting

principles (GAAP). FFO interest coverage, as

used by Great Plains Energy, is defined in

accordance with Standard & Poor’s methodology

used for calculating FFO interest coverage. The

numerator of the ratio is defined as net cash from

operating activities (GAAP) plus non-GAAP

adjustments related to operating leases, hybrid

securities, post-retirement benefit obligations,

capitalized interest, power purchase agreements,

asset retirement obligations, changes in working

capital and decommissioning fund contributions

plus adjusted interest expense (non-GAAP). The

denominator of the ratio, adjusted interest

expense, is defined as interest charges (GAAP)

plus non-GAAP adjustments related to some of

the same items adjusted for in the numerator and

other adjustments needed to match Standard &

Poor’s calculation. Management believes that

FFO interest coverage provides a meaningful way

to better understand the Company’s credit profile.

FFO interest coverage is used internally to help

evaluate the possibility of a change in the

Company’s credit rating.

December 2011 Investor Presentation

40

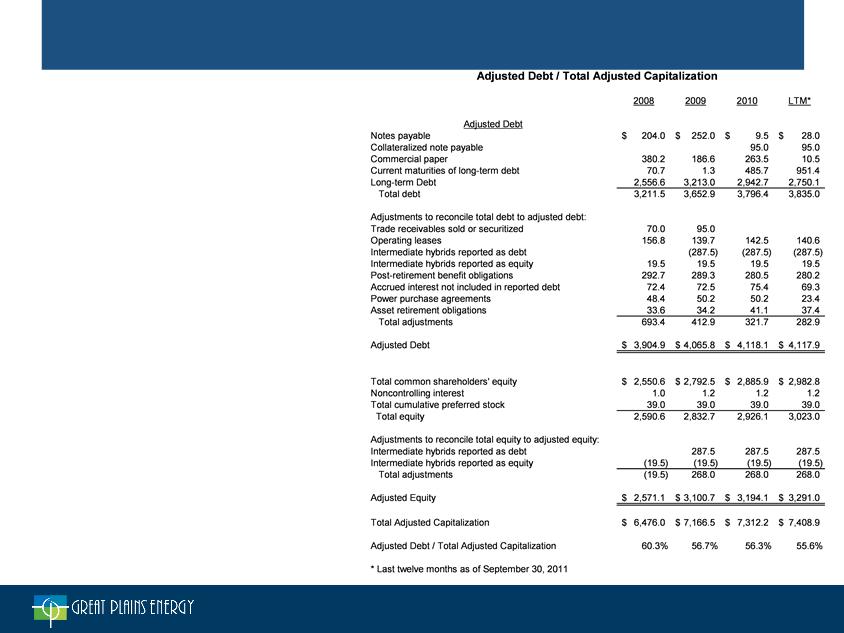

Credit Metric Reconciliation to GAAP

Adjusted debt to total adjusted capitalization is

a financial measure that is not calculated in

accordance with generally accepted accounting

principles (GAAP). Adjusted debt to total

adjusted capitalization, as used by Great Plains

Energy, is defined in accordance with Standard

& Poor’s methodology used for calculating the

ratio of debt to debt and equity. The numerator

of the ratio, adjusted debt, is defined as the

sum of debt balances (GAAP) plus non-GAAP

adjustments related to securitized receivables,

operating leases, hybrid securities, post-

retirement benefit obligations, accrued interest,

power purchase agreements and asset

retirement obligations. The denominator of the

ratio, total adjusted capitalization, is defined as

the sum of equity balances (GAAP) plus non-

GAAP adjustments related to hybrid securities

plus the non-GAAP adjusted debt as defined for

the numerator. Management believes that

adjusted debt to total adjusted capitalization

provides a meaningful way to better understand

the Company’s credit profile. Adjusted debt to

total adjusted capitalization is used internally to

help evaluate the possibility of a change in the

Company’s credit rating.

a financial measure that is not calculated in

accordance with generally accepted accounting

principles (GAAP). Adjusted debt to total

adjusted capitalization, as used by Great Plains

Energy, is defined in accordance with Standard

& Poor’s methodology used for calculating the

ratio of debt to debt and equity. The numerator

of the ratio, adjusted debt, is defined as the

sum of debt balances (GAAP) plus non-GAAP

adjustments related to securitized receivables,

operating leases, hybrid securities, post-

retirement benefit obligations, accrued interest,

power purchase agreements and asset

retirement obligations. The denominator of the

ratio, total adjusted capitalization, is defined as

the sum of equity balances (GAAP) plus non-

GAAP adjustments related to hybrid securities

plus the non-GAAP adjusted debt as defined for

the numerator. Management believes that

adjusted debt to total adjusted capitalization

provides a meaningful way to better understand

the Company’s credit profile. Adjusted debt to

total adjusted capitalization is used internally to

help evaluate the possibility of a change in the

Company’s credit rating.

`