Attached files

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K/A

Amendment No. 1

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended August 27, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-17276

FSI INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

| MINNESOTA | 41-1223238 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

3455 LYMAN BOULEVARD, CHASKA, MINNESOTA 55318-3052

(Address of principal executive offices and Zip Code)

Registrant’s telephone number, including area code: (952) 448-5440

Securities registered pursuant to Section 12(b) of the Securities Exchange Act:

Title of each class

Common Stock, no par value

Name of Exchange on which registered:

NASDAQ Global Market

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate by a check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes ¨ No þ

Indicate by a check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ¨ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by a checkmark whether the Registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large accelerated filer | ¨ | Accelerated filer | þ | |||||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||||

Indicate by a check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act of 1934). Yes ¨ No þ

The aggregate market value of the voting common stock held by non-affiliates of the Registrant, based on the closing price on February 25, 2011, the last business day of the Registrant’s most recently completed second fiscal quarter, as reported on the NASDAQ Global Market, was approximately $152,763,000. Shares of common stock held by each officer and director have been excluded from this computation in that such persons may be deemed to be affiliates. This amount is provided only for purposes of this report on Form 10-K and does not represent an admission by the Registrant or any such person as to the status of such person.

As of October 28, 2011, the Registrant had issued and outstanding 38,861,000 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for the Annual Meeting of Shareholders to be held on January 18, 2012 and to be filed within 120 days after the Registrant’s fiscal year ended August 27, 2011, are incorporated by reference into Part III of this Form 10-K Report. (The Audit and Finance Committee Report and the Compensation Committee Report of the Registrant’s proxy statement are expressly not incorporated by reference herein.)

EXPLANATORY NOTE

The Registrant filed with the Securities and Exchange Commission (“SEC”) an Annual Report on Form 10-K for the year ended August 27, 2011 (“Form 10-K”) on November 4, 2011. This Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) amends the Form 10-K solely for the purpose to amend and restate Item 5 of Part II of the Form 10-K to add the Performance Graph. In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, Amendment No.1 has been signed on behalf of the Registrant by a duly authorized representative and new certifications by the Registrant’s principal executive officer and principal financial officer are included as exhibits to this Amendment No. 1 under Part IV, Item 15 hereof.

Amendment No. 1 does not modify or update other disclosures presented in the Form 10-K. This Amendment No. 1 does not reflect events occurring after the filing of the Form 10-K or modify or update those disclosures. Accordingly, this Amendment No. 1 should be read in conjunction with the Form 10-K and the Registrant’s other filings with the SEC.

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock is traded on the NASDAQ Global MarketSM under the symbol “FSII”. The following table sets forth the highest and lowest daily sale prices, as reported by the NASDAQ Global Market for the fiscal periods indicated:

| 2011 | 2010 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| Fiscal Quarter |

||||||||||||||||

| First |

$ | 3.38 | $ | 2.22 | $ | 2.40 | $ | 0.83 | ||||||||

| Second |

4.82 | 3.25 | 3.47 | 1.13 | ||||||||||||

| Third |

5.41 | 3.20 | 4.56 | 2.31 | ||||||||||||

| Fourth |

4.76 | 2.11 | 5.17 | 2.65 | ||||||||||||

There were approximately 435 record holders of our common stock on October 31, 2011.

We have never declared or paid cash dividends on our common stock. We currently intend to retain all earnings for use in our business and do not anticipate paying dividends in the foreseeable future.* Any future determination as to payment of dividends will depend upon our financial condition and results of operations and such other factors as are deemed relevant by our board of directors.

2

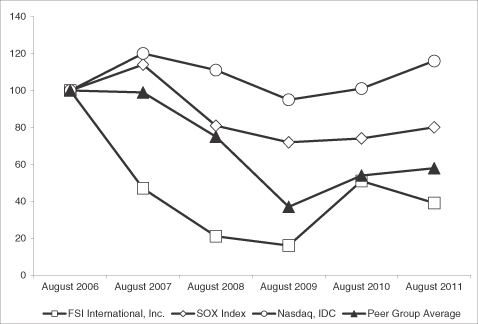

Performance Graph

The following graph compares the annual change in the cumulative total shareholder return on our common stock from August 25, 2006 through August 27, 2011 with the cumulative total return on the NASDAQ, IDC, the Philadelphia Stock Exchange Semiconductor Sector (“SOX”) Index and a peer group of companies selected by FSI. The comparison assumes $100 was invested in FSI common stock and in each of the foregoing indices and assumes that dividends were reinvested when and as paid. We have not declared dividends on our common stock. The selected peer group consists of Mattson Technology, Inc., Ultratech, Inc., Axcelis Technology, Inc. and Rudolph Technologies, Inc. You should not consider shareholder return over the indicated period to be indicative of future shareholder returns.

| 8/26/2006 | 8/25/2007 | 8/30/2008 | 8/29/2009 | 8/28/2010 | 8/27/2011 | |||||||||||||||||||

| FSI |

$ | 100 | $ | 47 | $ | 21 | $ | 16 | $ | 51 | $ | 39 | ||||||||||||

| Nasdaq |

100 | 120 | 111 | 95 | 101 | 116 | ||||||||||||||||||

| SOX |

100 | 114 | 81 | 72 | 74 | 80 | ||||||||||||||||||

| Peer Group |

100 | 99 | 75 | 37 | 54 | 58 | ||||||||||||||||||

PART IV

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

(a)(3) Exhibits

| 31.1 | Certification by Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. (filed herewith) | |

| 31.2 | Certification by Principal Financial and Accounting Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. (filed herewith) | |

| 32.1 | Certification of Chief Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. (filed herewith) | |

3

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FSI INTERNATIONAL, INC. | ||

| By: | /s/ Donald S. Mitchell | |

| Donald S. Mitchell, Chairman and Chief Executive Officer (Principal Executive Officer) | ||

Dated: December 6, 2011

| By: | /s/ Patricia M. Hollister | |||

| Patricia M. Hollister, Chief Financial Officer (Principal Financial and Accounting Officer) | ||||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons, constituting a majority of the Board of Directors, on behalf of the Registrant and in the capacities and on the dates indicated.

James A. Bernards, Director*

Terrence W. Glarner, Director*

Donald S. Mitchell, Director*

David V. Smith, Director*

Stan Yarbro, Director*

| *By: | /s/ Patricia M. Hollister | |

| Patricia M. Hollister, Attorney-in-fact | ||

Dated: December 6, 2011

4

INDEX TO EXHIBITS

| Exhibit |

Description |

Method of Filing | ||

| 31.1 | Certification by Principal Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act. | Filed herewith | ||

| 31.2 | Certification by Principal Financial and Accounting Officer Pursuant to Section 302 of the Sarbanes-Oxley Act. | Filed herewith | ||

| 32.1 | Certification of Chief Executive Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | Filed herewith |

5