Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PRESS RELEASE - CLECO POWER LLC | exhibit991.htm |

| 8-K - CLECO CORPORATION SEC FORM 8-K - CLECO POWER LLC | clecocorp8k_120611.htm |

CLECO CORPORATION

December 6-9, 2011

Exhibit 99.2

Forward-Looking Statements

2

This presentation contains forward-looking statements about future

results and circumstances, including, without limitation, statements

regarding future earnings, capital expenditures, project completion

dates, future dividends and total shareholder return, with respect to

which there are many risks and uncertainties. Although the company

believes that expectations reflected in such forward-looking

statements are based on reasonable assumptions, we can give no

assurances that these expectations will prove to be correct or that

other benefits anticipated in the forward-looking statements will be

achieved. For a discussion of risk factors and other factors that may

cause the company’s actual results to differ materially from those

contemplated in its forward-looking statements, please refer to the

company’s filings with the Securities and Exchange Commission,

including its 2010 Annual Report on Form 10-K and 2011 Quarterly

Reports on Form 10-Q.

results and circumstances, including, without limitation, statements

regarding future earnings, capital expenditures, project completion

dates, future dividends and total shareholder return, with respect to

which there are many risks and uncertainties. Although the company

believes that expectations reflected in such forward-looking

statements are based on reasonable assumptions, we can give no

assurances that these expectations will prove to be correct or that

other benefits anticipated in the forward-looking statements will be

achieved. For a discussion of risk factors and other factors that may

cause the company’s actual results to differ materially from those

contemplated in its forward-looking statements, please refer to the

company’s filings with the Securities and Exchange Commission,

including its 2010 Annual Report on Form 10-K and 2011 Quarterly

Reports on Form 10-Q.

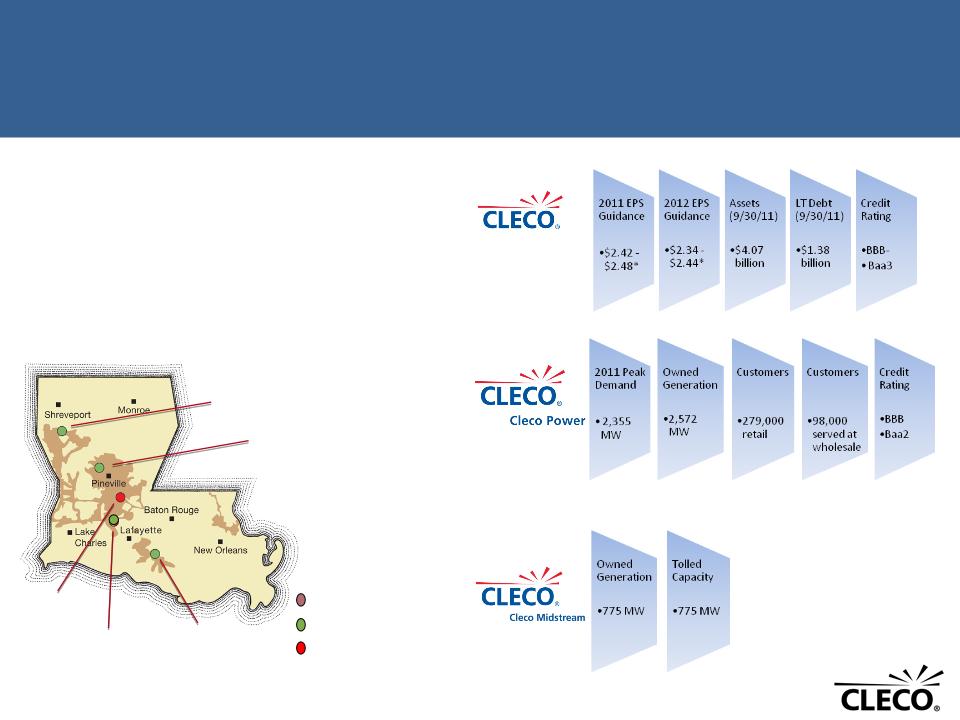

Who is Cleco?

Corporate structure/location

Corporate structure/location

3

SERVICE TERRITORY

REGULATED

GENERATION

GENERATION

WHOLESALE

GENERATION

GENERATION

Dolet Hills

Brame Energy Center

Nesbitt Unit 1

Rodemacher Unit 2

Madison Unit 3

Coughlin

Units 6 & 7

Acadia

Unit 1

Teche

Units 1 - 4

Retail Formula Rate Plan

Effective 2010 -2014

Target ROE of 10.7%; 51% Equity

Up to 11.3% ROE before customer sharing

11.7% maximum for retail

Riders to include large projects in rate base and rates

* Operational earnings

guidance as of 12/6/11.

guidance as of 12/6/11.

Who is Cleco?

Proven Management Team

Proven Management Team

4

Bruce Williamson - President & Chief Executive Officer

30 years in the energy/utility business, ½ year with Cleco

George Bausewine - Chief Operating Officer of Cleco Power

26 years with Cleco

Darren Olagues - Senior VP & Chief Financial Officer

17 years in the energy/utility business, 4 years with Cleco

Russell Davis - Senior VP of External Relations & Information Technology

29 years in the utility business, 12 years with Cleco

Jeff Hall - Senior VP of Governmental Affairs & Chief Diversity Officer

31 years with Cleco

Wade Hoefling - Senior VP and General Counsel

30 years in the energy/utility business, 5 years with Cleco

Judy Miller - Senior VP of Corporate Services & Internal Audit

27 years with Cleco

5

Who is Cleco?

Generation fleet: much of the hard work is behind us

Generation fleet: much of the hard work is behind us

|

Plant

|

MW

|

Original COD

|

Fuel

|

|

Madison 3

|

600

|

2010

|

Petcoke, Illinois basin coal, biomass capable

|

|

Acadia 1

|

580

|

2002

|

Natural Gas

|

|

Dolet Hills

|

650*

|

1986

|

Lignite

|

|

Rodemacher 2

|

523**

|

1982

|

Powder River Basin coal

|

|

Nesbitt 1

|

440

|

1975

|

Natural Gas

|

|

Teche 1/2/3/4

|

463

|

1953/56/71/2011

|

Natural Gas

|

* Cleco owns 325 MW or

50% of the 650-MW unit

50% of the 650-MW unit

** Cleco owns 157 MW or

30% of the 523-MW unit

30% of the 523-MW unit

|

Plant

|

MW

|

Heat Rate

|

COD

|

Fuel

|

|

Coughlin Unit 6

|

264

|

7360

|

2000

|

Natural Gas

|

|

Coughlin Unit 7

|

511

|

7400

|

2000

|

Natural Gas

|

Madison Unit 3

600-MW solid fuel circulating fluidized-bed unit

Placed in service Feb 2010 at cost of $1 billion

State-of-the-art environmental controls

Acadia Unit 1

580-MW CCGT

Acquired in Feb 2010

$304 million cost/$526 kW

• Last merchant combined-cycle plant in La.

• Ready to serve the growing needs of

regulated utilities, municipalities and

cooperatives

regulated utilities, municipalities and

cooperatives

RFP for 3 or 5 years

beginning May 2012

Up to 750 MWs

Long-Term RFP

Closely coordinated with winning

resources from

Phase I RFP

resources from

Phase I RFP

Up to 750 MWs

• RFP issued: Oct. 21, 2011

• Bids due: Nov. 17, 2011

• Anticipated winner notification: Dec. 21, 2011

• Anticipate issuing RFP in early 2012

• Bids will be compared to full

environmental retrofits at existing facilities

environmental retrofits at existing facilities

6

Phase I

Phase II

Who is Cleco?

Unique position in the face of changing environmental compliance

Unique position in the face of changing environmental compliance

Plans to address short- and long-term environmental

compliance needs up to 750 MW through RFPs

compliance needs up to 750 MW through RFPs

Coughlin -

• Coming off toll at 1/1/12 coincident with CSAPR effective date

• Increasing value as environmental regulations tighten

Value Driver

Ongoing reliability/cost containment investments

Ongoing reliability/cost containment investments

7

Acadiana Load Pocket Transmission Project

• Relieves constraints in south Louisiana service territory

• 90 miles of new transmission infrastructure

• Allows for more efficient dispatch of generation

• Estimated total cost of $250 million (Cleco estimate $125 million)

• Cleco has expended approximately $86 million through Sep 30, 2011

• Included in rate base and rates through the Formula Rate Plan

• 81% complete; final expected in service 2012

Advanced Metering Infrastructure Project

• Replaces all existing meters with electronic meters

• Provides better information for customers and company

• Enhanced outage detection and operational gains

• $73 million total estimated costs less $20 million D.O.E. grant

• Expected project completion - 2013

8

Value Driver

Commitment to shareholder value

Commitment to shareholder value

Feb 24,

2011

2011

Aug 3, 2011

Nov 2, 2011

May 2010

May 2011

Nov 2011

• Dividend has increased 38.9% since Feb 2010

• Commitment to produce total shareholder return of 8%-10% annually through 2014

• Long-term dividend payout target of 50%-60% of sustainable earnings

Earnings

Dividends

* Operational earnings guidance as of 12/6/11.

Dec 6, 2011

9

Value Driver

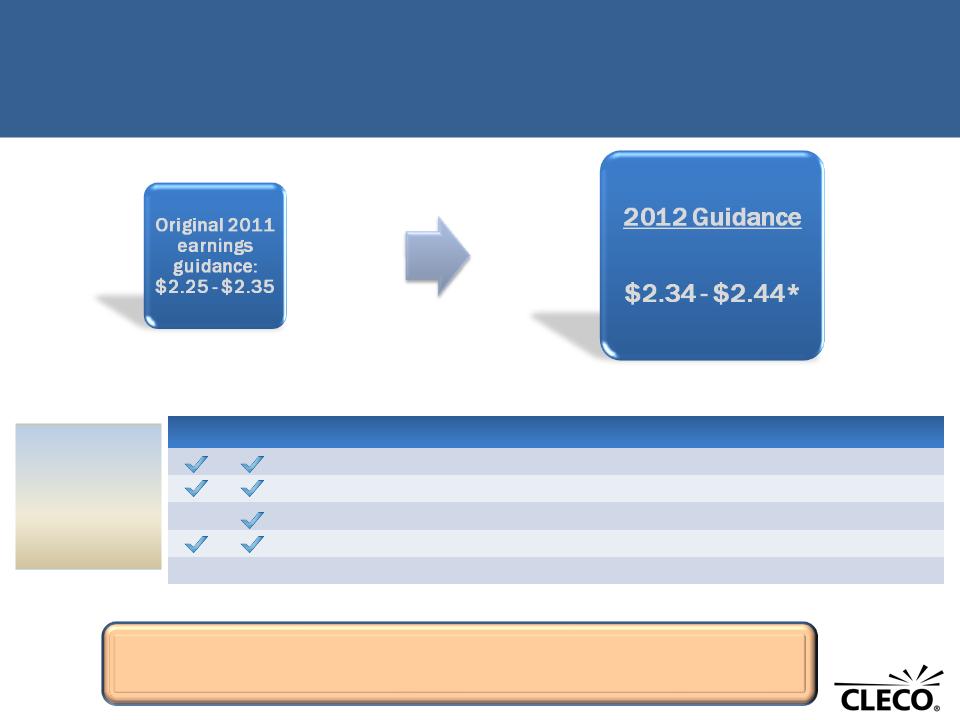

2012 - Earnings Guidance

2012 - Earnings Guidance

* Operational earnings guidance as of 12/6/11.

Initial 2011 guidance (assuming normal weather) was $2.25 - $2.35; Approx $0.14 of

revenue EPS, related to favorable weather, in 2011 earnings through Sep 30, 2011

revenue EPS, related to favorable weather, in 2011 earnings through Sep 30, 2011

|

2011

|

2012

|

Original Earnings Guidance Assumption

|

|

|

|

Normal weather

|

|

|

|

No earnings contribution from Midstream

|

|

NA

|

|

No impact included for Cleco Power intermediate-term RFP; results will be made public in late January 2012

|

|

|

|

Excludes adjustments related to life insurance policies

|

|

31.4%

|

29.9%

|

Effective tax rate

|

Initial guidance

for 2012 is on

average 4%

higher than

initial guidance

for 2011

for 2012 is on

average 4%

higher than

initial guidance

for 2011

Value Driver

2012 - Capital Expenditures (excluding AFUDC)

2012 - Capital Expenditures (excluding AFUDC)

10

|

($ millions)

|

2012

|

2012 - 2016

|

|

Routine/Maintenance

|

117.5

|

502.1

|

|

Rate Base Expansion

|

|

|

|

Discretionary

|

|

|

|

Acadiana Load Pocket

|

25.6

|

25.6

|

|

Automated Metering Infrastructure

|

34.1

|

45.4

|

|

Acadia Pipeline

|

8.1

|

8.1

|

|

Total Discretionary

|

67.8

|

79.1

|

|

Environmental

|

|

|

|

Utility MACT Rule Compliance

|

21.5

|

105.9

|

|

CSAPR Compliance

|

9.4

|

9.4

|

|

Total Environmental

|

30.9

|

115.3

|

|

Total Rate Base Expansion

|

98.7

|

194.4

|

|

Cleco Power Total

|

216.2

|

696.5

|

|

Midstream

|

5.2

|

24.2

|

|

Cleco Consolidated Total

|

221.4

|

720.7

|

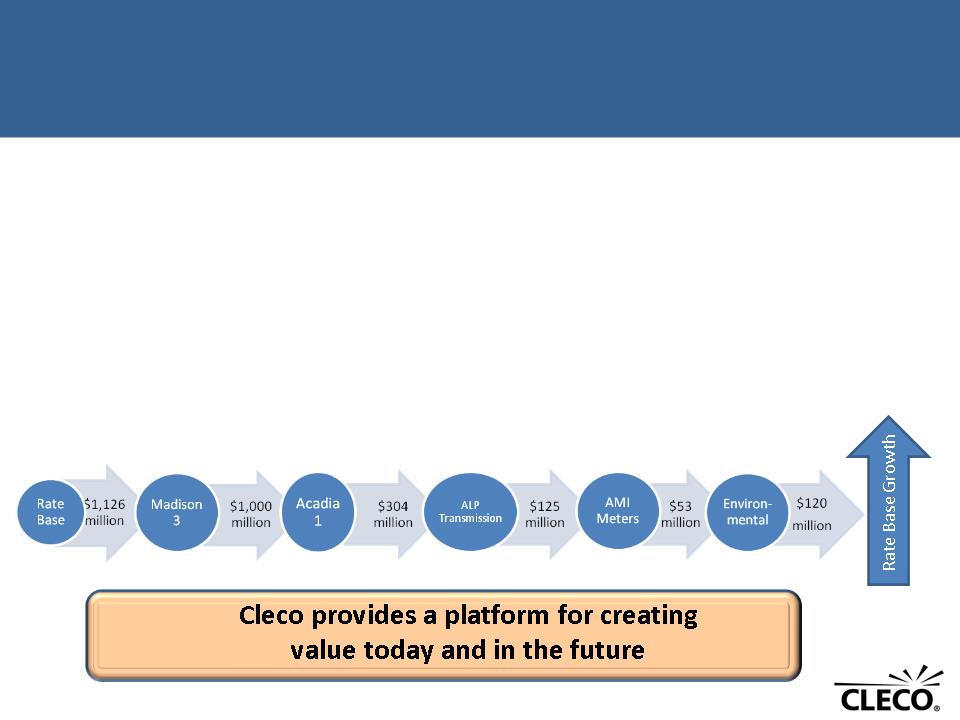

• Routine CAPEX runs approx $100 million per

year

year

• Acadiana Load Pocket transmission project is in

its final year of construction in 2012

its final year of construction in 2012

• AMI project is approx $53 million net of the

DOE grant of $20 million

DOE grant of $20 million

• Acadia Pipeline will interconnect the Acadia

Power Station with the Pine Prairie gas storage

site - approx $2 million will be expended in 2011

Power Station with the Pine Prairie gas storage

site - approx $2 million will be expended in 2011

• Utility MACT Rule Compliance expenditures

will be over a three-year period of 2012 - 2014

will be over a three-year period of 2012 - 2014

• CSAPR Compliance will have approx $5.2

million expended in 2011

million expended in 2011

Value Driver

Financial strength

Financial strength

11

2013

2012

•All debt at the holding company retired in 2011

• Revolving credit facilities increased $50 million to $550 million

• Interest rate lowered

• Term increased to 5 years

• Liquidity of $658 million at Sep 30, 2011 - Ability to fund

growth initiatives

growth initiatives

• Free Cash Flow1 = approx $70 million - $100 million after

payment of dividends

payment of dividends

2011 - 14

1 Free Cash Flow defined as Operating Cash Flow less Routine/Maintenance CAPEX less Dividends

Major CAPEX Rate Base Additions