Attached files

|

Exhibit 10.9 -

|

Commitment Letter

|

Execution Version

|

DEUTSCHE BANK TRUST COMPANY AMERICAS

60 Wall Street

New York, New York 10005

|

GOLDMAN SACHS LENDING

PARTNERS LLC

200 West Street

New York, New York 10282

|

December 2, 2011

CONFIDENTIAL

Lee Enterprises, Incorporated

215 North Harrison Street

Suite 600

Davenport, Iowa 52801

Attn: Carl G. Schmidt

Chief Financial Officer

Commitment Letter

Ladies and Gentlemen:

You have advised Deutsche Bank Trust Company Americas (“DBTCA”), Deutsche Bank Securities Inc. (“DBSI” and, together with DBTCA, “DB”) and Goldman Sachs Lending Partners LLC (“Goldman Sachs” and, together with DB, “we” or “us”) that Lee Enterprises, Incorporated (“Lee” or the “Borrower”) and its subsidiaries (other than Pulitzer Inc. and its subsidiaries) (collectively, the “Company Parties” or “you”) intend to effect a restructuring of their obligations under the Amended and Restated Credit Agreement, dated as of December 21, 2005 (as amended, supplemented or otherwise modified from time to time, the “Credit Agreement”), among the Borrower, the lenders party thereto from time to time, DBTCA, as administrative agent, DBSI and Suntrust Capital Markets, Inc., as Joint Lead Arrangers, DBSI, as Book Running Manager, Suntrust Bank, as Syndication Agent, and Bank of America, N.A., The Bank of New York and The Bank Of Tokyo-Mitsubishi, Ltd., Chicago Branch, as Co-Documentation Agents, as more fully set forth in the Support Agreement, dated as of August 11, 2011 (including the Term Sheet referred to therein and attached thereto, in each case as in effect on the date hereof and as hereafter may be amended, supplemented or otherwise modified from time to time with the prior consent of the Commitment Parties (as defined below), the “Lee Support Agreement”) among the Parties referred to therein. You further advised us that, pursuant to the Lee Support Agreement, such restructuring will be effectuated through a prepackaged plan of reorganization, with the Company Parties filing voluntary petitions (the date of such filing, the “Petition Date”) for relief under Chapter 11 of Title 11 of the United States Code, 11 U.S.C. §§ 101 et seq. (as amended, the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court” and the bankruptcy cases of the Company Parties, the “Bankruptcy Cases”).

In connection therewith, the Borrower has requested that DB and Goldman Sachs agree to structure, arrange and syndicate a superpriority priming debtor-in-possession revolving credit facility providing for borrowings in an aggregate principal amount of up to $40,000,000 under sections 364(c)(1), (2) and (3) and (d)(1) of the Bankruptcy Code (the “DIP Facility”), which may be converted, in

2

accordance with the terms hereof, into an exit revolving credit facility for the reorganized Borrower upon its emergence from chapter 11 for the reorganized Company Parties providing for borrowings in an aggregate principal amount of up to $40,000,000 (the “Exit Facility”, each of the DIP Facility and the Exit Facility, as applicable, the “Facility”) on terms substantially consistent with the indicative terms for the relevant Facility set forth in Exhibits A and B hereto, and in each case DBTCA will serve as administrative agent for the Facility. In addition, the Borrower has requested that DBTCA, Goldman Sachs and the other undersigned lenders commit to provide the Facility.

It is agreed that (a) DBSI and Goldman Sachs will act as joint bookrunners for the Facility (the “Joint Bookrunners”), (b) DBSI and Goldman Sachs will act as joint lead arrangers for the Facility (the “Joint Lead Arrangers”) and (c) DBTCA will act as administrative agent for the Facility. It is further agreed that DB will have “left” placement in any marketing materials or other documentation used in connection with the Facility. You agree that we may appoint additional financial institutions agreeable to you to act as named agents for the Facility. You agree that no additional bookrunners, joint bookrunners, agents, co-agents, arrangers or joint lead arrangers will be appointed, no additional titles will be awarded and no compensation (other than compensation expressly contemplated by the Lee Support Agreement, the term sheets attached hereto as Exhibits A and B (the “Term Sheets”) and the other Commitment Papers (as defined below)) will be paid in connection with the Facility unless you, DBSI and Goldman Sachs so agree.

Furthermore, each of the undersigned lenders (including each of DBTCA and Goldman Sachs, collectively, the “Commitment Parties”) is pleased to advise you of its several (and not joint) commitment to provide the portion of the Facility in the amounts set forth beneath such Commitment Party’s signature below, which commitments, collectively, constitute the entire amount of the Facility. It is understood that (x) participation in the Facility will be offered to a group of financial institutions identified by us in consultation with you (together with the Commitment Parties, the “Lenders”), in each case upon the terms and subject to the conditions set forth or referred to in this commitment letter (including the Term Sheets, this “Commitment Letter” and, together with one or more Fee Letters dated the date hereof and delivered herewith (collectively, the “Fee Letter”) and the letter entered into by you and us prior to the date hereof in respect of the transactions contemplated by the Lee Support Agreement, collectively, the “Commitment Papers”) and in the Term Sheets and (y) any such participation by Lenders (other than the Commitment Parties) would ratably reduce the commitments provided hereunder by the Commitment Parties.

The Joint Bookrunners reserve the right, prior to or after the execution of the definitive financing documentation for the Facility, to syndicate the Facility to additional prospective Lenders identified by us in consultation with you. In connection with any such syndication, you agree actively to assist the Joint Bookrunners prior to the closing of the Facility in completing a syndication that is satisfactory to the Joint Bookrunners and you. Such assistance shall include (a) your using commercially reasonable efforts to ensure that the Joint Bookrunners’ syndication efforts benefit materially from your existing banking relationships, (b) the hosting, with the Joint Bookrunners, of one or more meetings or conference calls with prospective Lenders, (c) direct contact between your senior management and advisors, on the one hand, and the senior management and advisors of prospective Lenders, on the other hand, (d) entry into confidentiality agreements with prospective Lenders that are in form and substance reasonably acceptable to you, and (e) assistance in the preparation of an information package (including a Confidential Information Memorandum) and other marketing materials to be used in connection with the syndication. At the request of the Joint Bookrunners, you agree to assist in the preparation of a version of the information package and presentation consisting exclusively of information and documentation that is either publicly available or not material with respect to the Borrower and any of their respective securities for purposes of United States federal and state securities laws.

3

The Joint Bookrunners will manage, in consultation with you, all aspects of the arrangement of the Facility and any further syndication thereof, including but not limited to decisions as to the selection of institutions to be approached and when they will be approached, when their commitments will be accepted, which institutions will participate, the allocations of the commitments among the Lenders and the amount and distribution of fees among the Lenders. To assist the Joint Bookrunners in their arrangement and syndication efforts, you agree promptly to prepare and provide to the Joint Bookrunners and the Commitment Parties all information reasonably requested by us with respect to the Borrower, including all financial information and projections (the “Projections”), as they may reasonably request in connection with the arrangement and syndication of the Facility. You hereby represent and covenant that (a) all information other than the Projections and information of a general economic nature (the “Information”) that has been or will be made available to the Joint Bookrunners or the Commitment Parties in writing by you or any of your legal or financial advisors is or will be, when furnished and taken as a whole, complete and correct in all material respects and does not or will not, when furnished and taken as a whole, contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements contained therein not materially misleading in light of the circumstances under which such statements are made and (b) the Projections that have been or will be made available to the Joint Bookrunners or the Commitment Parties by you or any of your representatives have been or will be prepared in good faith based upon reasonable assumptions. In arranging and syndicating the Facility, we will be entitled to use and rely upon the Information and the Projections without responsibility for independent verification thereof.

As consideration for the commitments of the Commitment Parties hereunder and the agreement of the Joint Bookrunners hereunder to perform the services described herein, you agree, jointly and severally, to pay or cause to be paid to DBTCA (for its account and for the account of the Joint Bookrunners and each of the Commitment Parties), in each case as further described in the Commitment Papers, the nonrefundable fees set forth in the Commitment Papers as and when provided in the applicable Commitment Papers, and subject to the terms and conditions set forth herein.

The commitments of the Commitment Parties hereunder and the agreement of the Joint Bookrunners to perform the services described herein are subject to: (a) neither of them having discovered or otherwise becoming aware of any information not previously disclosed to or known by us (including pursuant to public filings by the Borrower with the U.S. Securities and Exchange Commission prior to the date hereof) that they believe to be adverse and materially inconsistent with our understanding, based on information provided to them or their advisors (including pursuant to such public filings) prior to the date hereof, of the business, operations, assets, properties or financial condition of the Borrower and its subsidiaries, taken as a whole, or that could reasonably be expected to materially impair the syndication of the Facility; (b) there not having occurred any event, development, change or condition not previously disclosed to or known to us (including pursuant to public filings by the Borrower with the U.S. Securities and Exchange Commission prior to the date hereof) that has had or could be reasonably expected to have a material adverse effect on the business, operations, assets, property, or financial condition of the Borrower and its subsidiaries, taken as a whole, since June 26, 2011 other than those which customarily occur as a result of events leading up to and following the commencement of a proceeding under chapter 11 of the Bankruptcy Code; (c) each Commitment Party’s satisfaction that there is no competing offering, placement, arrangement or syndication (including renewals and refinancing thereof) of any debt securities or bank financing by the Borrower or its subsidiaries, except with respect to the New PD LLC Notes (as defined in the Lee Support Agreement), the Facility and the Amendment; (d) as a condition to our commitments with respect to the DIP Facility (i) the negotiation, execution and delivery of definitive financing documentation substantially consistent with the indicative terms for the DIP Facility set forth in Exhibit B hereto and the Lee Support Agreement and otherwise reasonably satisfactory to the Joint Bookrunners (including their counsel) and the Commitment Parties, (ii) each Commitment Party’s reasonable satisfaction with, and the approval by the Bankruptcy Court of, (A) all

4

aspects of the DIP Facility and the transactions contemplated thereby, including without limitation, the administrative expense priority of, and the senior priming and other liens on assets of the Company Parties to be granted to secure, the DIP Facility, the interim and final order and all definitive documentation in connection therewith consistent with the Term Sheet and the Lee Support Agreement, and (B) all actions to be taken, undertakings to be made and obligations to be incurred by the Company Parties and all liens or other securities to be granted by the Company Parties in connection with the DIP Facility (all such approvals to be evidenced by the entry of one or more orders of the Bankruptcy Court consistent with the Term Sheet and Lee Support Agreement and otherwise reasonably satisfactory in form and substance to Commitment Parties, which orders shall, among other things, approve the payment by the Company Parties of all of the fees that are provided for in, and the other terms of, this Commitment Letter and the Fee Letter); (e) as a condition to our commitments with respect to the Exit Facility, (i) the negotiation, execution and delivery of definitive financing documentation substantially consistent with the indicative terms of the Exit Facility set forth in Exhibit A hereto and the Lee Support Agreement and otherwise reasonably satisfactory to the Joint Bookrunners (including their counsel) and the Commitment Parties, (ii) the satisfaction of the applicable conditions set forth under the heading “Exit Conditions” in Exhibit B hereto, and (iii) there not having occurred a dismissal or conversion of the Bankruptcy Cases to proceedings under Chapter 7 of the Bankruptcy Code and no trustee under Chapter 11 of the Bankruptcy Code or examiner with enlarged powers relating to the operation of the businesses of the Company Parties having been appointed in any of the Bankruptcy Cases; and (f) your compliance with the terms of this Commitment Letter and the Fee Letter.

You agree, jointly and severally, (a) to indemnify and hold harmless each Joint Bookrunner and the Commitment Parties and their respective officers, directors, employees, affiliates, partners, advisors, agents and controlling persons (collectively, the “Indemnified Parties”) from and against any and all losses, claims, damages and liabilities to which any such Indemnified Party may become subject arising out of or in connection with this Commitment Letter, the Facility, the use of any proceeds thereof or any claim, litigation, investigation or proceeding relating to any of the foregoing (any of the foregoing, a “Proceeding”), regardless of whether any of such Indemnified Parties is a party thereto or whether a Proceeding is initiated by or on behalf of a third party or you or any of your equity holders, affiliates, creditors or any similar person, and to reimburse each Indemnified Party for any reasonable and documented legal or other expenses incurred in connection with investigating or defending any of the foregoing, provided that the foregoing indemnity will not, as to any Indemnified Party, apply to losses, claims, damages and liabilities to the extent they are found by a final, nonappealable judgment of a court of competent jurisdiction to arise from the willful misconduct or gross negligence of such Indemnified Party, and (b) to reimburse each of the Joint Bookrunners, the Commitment Parties and their respective affiliates from time to time for all reasonable out-of-pocket expenses and reasonable fees, charges and disbursements of Simpson Thacher & Bartlett LLP (in addition to outside local legal counsel) incurred in connection with the Facility and any related documentation (including the Commitment Papers and the definitive financing documentation with respect to the Facility). No Indemnified Party shall be liable for any damages arising from the use by others of information or other materials obtained through electronic, telecommunications or other information transmission systems, and neither the Borrower nor any Indemnified Party shall be liable for any special, indirect, punitive or consequential damages in connection with its activities related to this Commitment Letter or the Facility except to the extent such damages would otherwise be subject to indemnity hereunder.

It is understood and agreed that this Commitment Letter shall not constitute or give rise to any obligation on the part of the Joint Bookrunners, the Commitment Parties or any of their respective affiliates to provide any financing, except as expressly provided herein.

You acknowledge and agree that (a) no fiduciary, advisory or agency relationship between you, on the one hand, and the Joint Bookrunners or the Commitment Parties, on the other hand, is intended to

5

be or has been created in respect of the Facility or any of the transactions contemplated by this Commitment Letter, irrespective of whether any Joint Bookrunner or any Commitment Party has advised or is advising you on other matters, (b) the Joint Bookrunners and the Commitment Parties, on the one hand, and you, on the other hand, have an arms-length business relationship that does not directly or indirectly give rise to, nor do you rely on, any fiduciary or other implied duty on the part of the Joint Bookrunners or the Commitment Parties, (c) you are capable of evaluating and understanding, and you understand and accept, the terms, risks and conditions of the Facility and the other transactions contemplated by this Commitment Letter, and have sought independent legal advice from counsel of your choice with respect to the foregoing, (d) you have been advised that the Joint Bookrunners and the Commitment Parties are engaged in a broad range of transactions that may involve interests that differ from your interests and that neither the Joint Bookrunners nor the Commitment Parties have any obligation to disclose such interests and transactions to you by virtue of any fiduciary, advisory or agency relationship and (e) you waive, to the fullest extent permitted by law, any claims you may have against the Joint Bookrunners and the Commitment Parties for breach of fiduciary duty, alleged breach of fiduciary duty or other implied duty and agree that neither the Joint Bookrunners nor the Commitment Parties shall have any liability (whether direct or indirect) to you in respect of such a fiduciary or other implied duty claim or to any person asserting a fiduciary or other implied duty claim on behalf of or in right of you, including your stockholders, employees or creditors. Additionally, you acknowledge and agree that, as Joint Bookrunners, neither DBSI nor Goldman Sachs is advising you as to any legal, tax, investment, accounting or regulatory matters in any jurisdiction. You shall consult with your own advisors concerning such matters and shall be responsible for making your own independent investigation and appraisal of the Facility and the transactions contemplated hereby, and the Joint Bookrunners shall have no responsibility or liability to you with respect thereto. Goldman Sachs or its affiliates are, or may at any time be, a lender under the Credit Agreement (in such capacity, the “Existing Lender”). The Company Parties acknowledge and agree for themselves and their subsidiaries that the Existing Lender (a) will be acting for its own account as principal in connection with the existing facilities, (b) will be under no obligation or duty as a result of Goldman Sachs’ role in connection with the transactions contemplated by this Commitment Letter or otherwise to take any action or refrain from taking any action (including with respect to voting for or against any requested amendments), or exercising any rights or remedies, that the Existing Lender may be entitled to take or exercise in respect of the existing facilities and (c) may manage its exposure to the existing facilities without regard to Goldman Sachs’ role hereunder.

You acknowledge that the Joint Bookrunners, the Commitment Parties and their respective affiliates may be providing debt financing, equity capital or other services (including but not limited to financial advisory services) to other companies in respect of which you may have conflicting interests regarding the Facility or the transactions described herein and otherwise. None of the Joint Bookrunners, the Commitment Parties or any of their respective affiliates will use confidential information obtained from you by virtue of the transactions contemplated by this Commitment Letter or their other relationships with you in connection with the performance by the Joint Bookrunners, the Commitment Parties or any of their respective affiliates of services for other companies, and the Joint Bookrunners, the Commitment Parties or any of their respective affiliates will not furnish any such information to other companies. You also acknowledge that the Joint Bookrunners, the Commitment Parties or any of their respective affiliates have no obligation to use in connection with the Facility or transactions contemplated by this Commitment Letter, or to furnish to the Borrower or its subsidiaries or representatives, confidential information obtained by the Joint Bookrunners, the Commitment Parties or any of their respective affiliates from any other company or person.

This Commitment Letter shall not be assignable by you without the prior written consent of the Joint Bookrunners and the Commitment Parties (and any purported assignment without such consent shall be null and void). The Commitment Parties may, in consultation with you, assign their commitments

6

hereunder, in whole or in part, to other prospective Lenders, provided that such assignment shall not relieve the Commitment Parties of their obligations hereunder except to the extent such assignment is evidenced by (i) a joinder agreement reasonably satisfactory to the Joint Bookrunners and the Company Parties to which the assignee and you are parties or (ii) the definitive financing documentation. This Commitment Letter is intended to be solely for the benefit of the parties hereto (and the Indemnified Parties), is not intended to confer any benefits on, or create any rights in favor of, any person other than the parties hereto (and Indemnified Parties) and may not be amended or waived except by an instrument in writing signed by you, the Joint Bookrunners and the Commitment Parties. Any and all obligations of, and services to be provided by, the Joint Bookrunners or the Commitment Parties hereunder may be performed, and any and all rights of such person hereunder may be exercised, by or through their respective affiliates without affecting the obligations of such person hereunder. This Commitment Letter may be executed in any number of counterparts, each of which shall be an original and all of which, when taken together, shall constitute one agreement. Delivery of an executed signature page of this Commitment Letter by facsimile or other electronic transmission shall be effective as delivery of a manually executed counterpart hereof. The Commitment Papers (and the documents referenced therein) are the only agreements entered into among us with respect to the Facility and set forth the entire understanding of the parties with respect thereto. THIS COMMITMENT LETTER SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO THE CONFLICT OF LAW PRINCIPLES THEREOF.

EACH OF THE PARTIES HERETO IRREVOCABLY WAIVES THE RIGHT TO TRIAL BY JURY IN ANY ACTION, PROCEEDING, CLAIM OR COUNTERCLAIM BROUGHT BY OR ON BEHALF OF ANY PARTY RELATED TO OR ARISING OUT OF THIS COMMITMENT LETTER OR THE PERFORMANCE OF SERVICES HEREUNDER.

Each of the parties hereto hereby irrevocably and unconditionally (a) submits, for itself and its property, to the non-exclusive jurisdiction of any New York State court or federal court of the United States of America sitting in New York City, and any appellate court from any thereof (or, in the event the Bankruptcy Cases are commenced, the Bankruptcy Court, or any other court having jurisdiction over the Bankruptcy Cases from time to time), in any action or proceeding arising out of or relating to this Commitment Letter or the Fee Letter or the transactions contemplated hereby, or for recognition or enforcement of any judgment, and agrees that all claims in respect of any such action or proceeding may be heard and determined in New York State or (x) to the extent permitted by law, in such federal court or (y) if the Bankruptcy Cases are commenced, in the Bankruptcy Court or any other court having jurisdiction over the Bankruptcy Cases from time to time), (b) waives, to the fullest extent it may legally and effectively do so, any objection which it may now or hereafter have to the laying of venue of any suit, action or proceeding arising out of or relating to this Commitment Letter or the Fee Letter or the transactions contemplated hereby in any New York State or federal court and (c) waives, to the fullest extent permitted by law, the defense of an inconvenient forum to the maintenance of such action or proceeding in any such court.

This Commitment Letter is delivered to you on the understanding that this Commitment Letter and the Fee Letter, their terms and substance and any other information and work product provided by the Joint Bookrunners, the Commitment Parties or any of their respective affiliates, employees, officers, attorneys or other professional advisors in connection herewith or therewith shall be for your confidential use only and shall not be disclosed, directly or indirectly, by you to any other person other than to your controlling persons, directors, employees, officers, accountants, attorneys and professional advisors directly involved in the consideration of this matter, provided that nothing herein shall prevent you from disclosing such information (a) upon the order of any court or administrative agency, (b) upon demand of any regulatory agency or authority, (c) to the United States Trustee either prior to or following the commencement of the Bankruptcy Cases, or (d) otherwise as required by law. The restrictions contained

7

in the preceding sentence shall cease to apply (except in respect of the Fee Letter and its terms and substance) after this Commitment Letter has been accepted by you. The Joint Bookrunners and the Commitment Parties agree, and agree to cause their respective affiliates, employees, officers, attorneys and other professional advisors, to maintain all non-public information concerning the Borrower as confidential in accordance with the confidentiality provisions set forth in the Credit Agreement.

The compensation, reimbursement, indemnification, confidentiality, jurisdiction and waiver of jury trial provisions contained herein shall remain in full force and effect regardless of whether definitive financing documentation for the Facility shall be executed and delivered and notwithstanding the termination of this Commitment Letter, provided that this Commitment Letter shall in all other respects be superseded by the definitive financing documentation for the Facility upon the effectiveness thereof.

The Joint Bookrunners and the Commitment Parties hereby notifies you that pursuant to the requirements of the U.S.A. PATRIOT ACT (Title III of Pub. L. 107 56 (signed into law October 26, 2001)) (the “Patriot Act”), it and each of the Lenders may be required to obtain, verify and record information that identifies the Borrower and each guarantor of the Facility, which information may include the name and address of the Borrower, and other information that will allow the Joint Bookrunners, the Commitment Parties and each of the Lenders to identify the Borrower and such guarantors in accordance with the Patriot Act. This notice is given in accordance with the requirements of the Patriot Act and is effective for the Joint Bookrunners, the Commitment Parties and each of the Lenders.

If the foregoing correctly sets forth our agreement, please indicate your acceptance of the terms of this Commitment Letter and the Fee Letter by returning to us executed counterparts of this Commitment Letter and the Fee Letter not later than December 2, 2011. The commitment of the Commitment Parties hereunder and the agreement of the Joint Bookrunners hereunder to perform the services contemplated herein and the obligations of the Borrower hereunder and under the other Commitment Papers shall terminate (the “Termination Date”): (a) in the event that the closing of the Exit Facility does not occur on or before March 11, 2012; or (b) upon (i) automatic termination of either the Lee Support Agreement or the Pulitzer Support Agreement (as defined in the Lee Support Agreement and, together with the Lee Support Agreement referred to herein as the “Support Agreements”), (ii) termination of the (x) Lee Support Agreement by the Required Consenting Lenders (under and as defined therein) or the (y) Pulitzer Support Agreement by the Required Consenting Noteholders (under and as defined therein), or (iii) the occurrence of (x) a Termination Date under (and as defined in) the Lee Support Agreement) or (y) a Termination Date under (and as defined in) the Pulitzer Support Agreement; or (c) immediately following the closing of the Exit Facility. In addition, the Commitment Parties may by written notice to Lee terminate this Commitment Letter at any time (i) upon the occurrence and continuance of a Termination Event (x) under the Lee Support Agreement other than under subsections 2.1(c)(ii), 2.1(c)(v), 2.1(c)(xi) or 2.1(c)(xii) thereof or (y) under (and as defined in) the Pulitzer Support Agreement other than under subsections 2.1(vii), 2.1(x), 2.1(xvi) or 2.1(xvii) thereof, or (iii) upon the effectiveness of any amendment, supplement or other modification of, or waiver or forbearance under either Support Agreement (including, without limitation, the term sheets and other exhibits and annexes attached thereto) relating to the terms or conditions of the Facility, in each case (a) prior to the effectiveness of the DIP Facility and (b) without the prior consent of the Commitment Parties.

[Remainder of this page intentionally left blank]

We are pleased to have been given the opportunity to assist you in connection with this important financing.

|

Very truly yours,

|

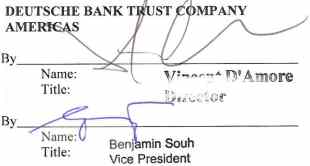

||

|

|

||

|

||

|

||

[COMMITMENT LETTER SIGNATURE PAGE]

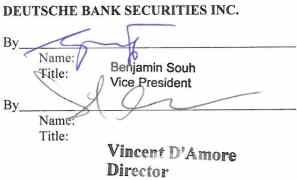

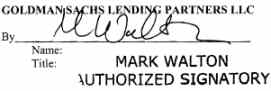

|

||

[COMMITMENT LETTER SIGNATURE PAGE]

|

The Bank of New York Mellon

|

||

|

||

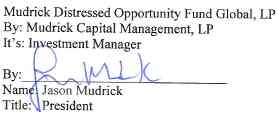

[COMMITMENT LETTER SIGNATURE PAGE]

|

|

||

|

||

[COMMITMENT LETTER SIGNATURE PAGE]

|

|

||

|

||

[COMMITMENT LETTER SIGNATURE PAGE]

|

|

||

|

||

[COMMITMENT LETTER SIGNATURE PAGE]

|

|

||

|

||

[COMMITMENT LETTER SIGNATURE PAGE]

|

||

[COMMITMENT LETTER SIGNATURE PAGE]

Accepted and agreed to as of the date first

written above by:

|

LEE ENTERPRISES, INCORPORATED

For itself and the Company Parties

|

|||

| By: |  |

||

| Name: | Carl G. Schmidt | ||

| Title: | Chief Financial Officer | ||

[COMMITMENT LETTER SIGNATURE PAGE]

A-1

Exhibit A

To Commitment Letter

SUMMARY OF INDICATIVE TERMS

FOR THE REVOLVING CREDIT FACILITY

The Borrower1 is party to the Credit Agreement. In accordance with the terms of the Commitment Letter and the Support Agreement, the Borrower intends to enter into either (i) an amendment to the Credit Agreement that is implemented out of court (the “Amendment”), pursuant to which certain lenders under the Credit Agreement shall agree to (a) extend the maturity date of certain of the Loans, (b) provide new revolving commitments in an aggregate principal amount of up to $40,000,000 and (c) the other amendments and modifications described below (the “Revolving Credit Facility”); or (ii) in the event the Loan Parties commence the Bankruptcy Cases, an exit revolving credit facility for the reorganized Loan Parties providing for borrowings in an aggregate principal amount of up to $40,000,000 on substantially the same terms as the Revolving Credit Facility (the “Exit Facility”). If the Loan Parties consummate their restructuring pursuant to a prepackaged plan of reorganization, all references to the Revolving Credit Facility herein shall mean the Exit Facility. The Revolving Credit Facility or the Exit Facility, as applicable, shall be provided to the Loan Parties under the First Lien Credit Facility referred to and defined below.

|

Borrower:

Guarantors:

|

Lee Enterprises, Incorporated (the “Borrower”).

Each Subsidiary Guarantor (the Borrower and the Subsidiary Guarantors, collectively, the “Loan Parties”) shall be required to provide an unconditional guaranty of all amounts owing under the First Lien Credit Facility (as defined below) (the “Guaranties”). Such Guaranties shall be in form and substance satisfactory to the Joint Lead Arrangers and shall also guarantee the Borrower’s and its subsidiaries’ obligations under interest rate swaps/foreign currency swaps or similar agreements or depository or cash management arrangements with a First Lien Lender or its affiliates (the “Other Secured Obligations”). All Guaranties shall be guarantees of payment and not of collection.

|

|

First Lien Agent and Collateral Agent:

|

Deutsche Bank Trust Company Americas (“DBTCA”) shall act as the sole administrative agent and sole collateral agent (in such capacities, the “First Lien Agent”) for the First Lien Lenders (as defined below).

|

|

Joint Lead

Arrangers

and Joint

Bookrunners:

|

Deutsche Bank Securities Inc. (“DBSI”) and Goldman Sachs Lending Partners LLC (“Goldman Sachs” and, together with DBSI, the “Joint Lead Arrangers”).

|

|

1

|

Capitalized terms used but not otherwise defined herein have the meanings ascribed to them in the Commitment Letter, the Support Agreement or the Credit Agreement, as applicable.

|

A-2

|

First Lien Lenders:

|

Certain of the lenders under the Borrower’s Credit Agreement (the “First Lien Lenders”).

|

|

Type, Amount and Maturity:

|

First Lien Term Loan Facility. Loans in an aggregate principal amount up to $689,510,000 (minus the aggregate principal amount of Non-Extended Loans (defined below), if any) under the Existing Credit Facility shall be amended and be outstanding (such loans, the “Extended Loans”) under the First Lien Credit Facility (as defined below).

The Extended Loans shall mature on December 31, 2015 (the “Extended Loan Maturity Date”). The principal amount of the Extended Loans will amortize in quarterly installments in an aggregate annual amount equal to (x) $10,000,000 during the first four fiscal quarters starting with the fiscal quarter ended closest to June 30, 2012, (y) $12,000,000 during the next four fiscal quarters thereafter, and (z) $13,500,000 thereafter. All such quarterly amortization payments shall be due and payable on the 15th day of the last month of the applicable fiscal quarter. Any remaining outstanding principal amount of the Extended Loans shall be paid in full on the Extended Loan Maturity Date.

If the Amendment is implemented, the Loans of Non-Consenting Lenders (the “Non-Extended Loans”) shall mature on April 28, 2012 (the “Non-Extended Loan Maturity Date”). Amortization shall be made on the Non-Extended Loans that were Term Loans as set forth in the Credit Agreement with the remaining balance of the principal amount of all Non-Extended Loans to be paid in full on the Non-Extended Loan Maturity Date. If the Loan Parties commence the Bankruptcy Cases and consummate their restructuring pursuant to a pre-packaged plan of reorganization, no Non-Extended Loans shall be deemed outstanding on the closing of the transactions contemplated by the restructuring and all such Loans shall be part of the First Lien Credit Facility.

Revolving Credit Facility. The existing Revolving Lender Commitments shall be terminated and a new “super-priority” revolving commitments of up to $40,000,000 (the “Revolving Credit Facility”, together with the facility under which the Extended Loans are issued, the “First Lien Credit Facility”), shall be provided under the First Lien Credit Facility. The Revolving Credit Facility shall be available for new loans or new letters of credit (the “Revolving Loans” and the “Letters of Credit”, respectively), subject to a sublimit to be agreed. The letters of credit outstanding under the Credit Agreement shall be deemed made or issued, as applicable, under the Revolving Credit Facility. The Revolving Credit Facility shall terminate on December 31, 2015 (the “Revolving Commitment Termination Date”).

|

A-3

|

Purpose:

|

The proceeds of loans under the Revolving Credit Facility will be used

(a) to provide working capital from time to time for the Borrower and its subsidiaries and (b) for other general corporate purposes.

|

|

Interest Rates and

Fees:

|

As set forth on Annex I hereto.

|

|

Security:

|

All amounts owing under the First Lien Credit Facility and (if applicable) the Other Secured Obligations (and all obligations under the Guaranties) will continue to be secured by a perfected first-priority security interest in all Lee Collateral subject to exceptions satisfactory to the Joint Lead Arrangers (the “First Priority Collateral”); provided, however, proceeds of the First Priority Collateral (and in the case of any distributions pursuant to bankruptcy, insolvency or similar proceedings, whether or not representing the proceeds of the First Priority Collateral), shall be applied in the following order among the first priority tranches: first, to (x) the repayment in full of the obligations (or cash collateralization of Letters of Credit outstanding) under the Revolving Credit Facility and (y) the payment of all obligations owing in respect of interest rate swap agreements (“Hedge Agreements”) to be entered into between the Borrower and the Joint Lead Arrangers, the Lenders or their respective affiliates (ratably among the holders of such obligations); second, to the repayment in full of the Extended Loans; and third, to the repayment in full of the Non-Extended Loans (if the Amendment is implemented).

All documentation evidencing the security required pursuant to the preceding paragraph shall be in form and substance satisfactory to the Joint Lead Arrangers (including the “waterfall” and related provisions providing for the “super-priority” status of the obligations under Revolving Credit Facility and the Hedge Agreements), and shall effectively create first-priority security interests in the property purported to be covered thereby, with such exceptions as are reasonably acceptable to the Joint Lead Arrangers.

|

|

Intercreditor

Matters:

|

The relative rights and priorities in the First Priority Collateral and in the collateral provided to secure the Borrower’s second lien term loan facility (the “Second Lien Term Loan Facility”), and among the First Lien Lenders and the lenders under Second Lien Term Loan Facility shall be set forth in an intercreditor agreement substantially in the form attached to the Support Agreement.

|

|

Mandatory

Prepayments:

|

Mandatory prepayments of the Extended Loans and the Revolving Loans shall be required from (a) 100% of the Net Sale Proceeds from asset sales by the Loan Parties (subject to certain ordinary course and reinvestment exceptions to be mutually agreed upon), (b) 100% of the Net Cash Proceeds from issuances of debt by the Loan Parties (with appropriate exceptions, including proceeds from the issuance of second lien debt or

|

A-4

|

subordinated debt that are to be utilized to reduce the outstanding balance of Second Lien Term Loans (defined below), plus related fees and expenses in connection with such refinancing, to be mutually agreed upon), (c) the Net Cash Proceeds from issuances of common equity by the Loan Parties (with appropriate exceptions to be mutually agreed upon), which shall be applied ratably to reduce the outstanding Extended Loans, Revolving Loans and, subject to the proviso below, the Second Lien Term Loans; provided that in the event the Borrower does not apply such Net Cash Proceeds to reduce the Second Lien Term Loans, such Net Cash Proceeds shall be applied ratably to reduce the outstanding Extended Loans and Revolving Loans; (d) the Net Cash Proceeds from issuances of preferred equity by the Loan Parties (with appropriate exceptions to be mutually agreed upon), the first $50,000,000 of which shall be applied ratably to reduce the outstanding Extended Loans and Revolving Loans and the balance of which may be applied to reduce the outstanding Second Lien Term Loans; provided that in the event the Borrower does not elect to apply the balance to reduce the Second Lien Term Loans, the balance shall be applied ratably to reduce the outstanding Extended Loans and Revolving Loans, and (e) 100% of the Net Cash Proceeds from insurance recovery and condemnation events of the Loan Parties (subject to certain reinvestment rights to be mutually agreed upon).

|

|

|

After the Borrower has accumulated $20,000,000 (including, at the option of the Borrower, any replenishments thereof) from 100% of excess cash flow of the Borrower and its subsidiaries (excluding the Pulitzer Entities) (the “Lee Reserve”), the Borrower shall be required to prepay 75% of excess cash flow of the Borrower and its subsidiaries (excluding the Pulitzer Entities) to be determined on a quarterly basis (with appropriate carry-forward credits for quarters lacking excess cash flow) to be applied, after (without duplication) deduction for the amount of the scheduled amortization payment for the applicable quarter, and actually applied to make such payment (the remaining amount after such deduction, the “Excess Cash Flow Payment Amount”), to prepay the Extended Loans and applied (A) to the extent the Excess Cash Flow Payment Amount is positive, to reduce the immediately succeeding amortization payment of the Extended Loans and (B) to the remaining amortization payments thereof in inverse order of maturity. Excess cash flow shall be defined substantially as set forth in the Credit Agreement (but excluding the Pulitzer Entities), provided, that the definition shall include certain dividend amounts and deduct certain permitted investment payments and the amount of carry-forward credits referenced above. For the avoidance of doubt, the Lee Reserve and any Cash accumulated therein shall be subject to the liens of the First Lien Agent pursuant a deposit account control agreement or other documents in form and substance satisfactory to the First Lien Agent.

|

A-5

|

Mandatory repayments of Non-Extended Loans, the Extended Loans and the Revolving Loans made pursuant to the immediately preceding paragraph above shall not reduce the commitments under the Revolving Credit Facility. In addition, if at any time the outstandings pursuant to the Revolving Credit Facility (including Letter of Credit outstandings) exceed the aggregate commitments with respect thereto, prepayments of Revolving Loans (and/or the cash collateralization of Letters of Credit) shall be required in an amount equal to such excess.

Notwithstanding the foregoing, if any Default or Event of Default exists under the First Lien Credit Facility at the time of any mandatory repayment of Extended Loans and Revolving Loans as required above, the Revolving Loans and Letters of Credit shall first be repaid and/or cash collateralized, as applicable, in full in the amount otherwise required to be applied to the Extended Loans (without any accompanying permanent reduction of the commitments under the Revolving Credit Facility in connection therewith), with any excess to be applied as otherwise required above (without regard to this sentence).

|

|

|

Voluntary

Prepayments and Reductions in

Commitments:

|

The Borrower may repay the Non-Extended Loans and the Extended Loans at any time without premium or penalty (other than breakage costs, if applicable). Such prepayments shall be applied to the Extended Loans or the Non-Extended Loans, as directed by the Borrower, and pro rata with respect to such reduced loans and commitments, as applicable; provided that if any Default or Event of Default exists under the First Lien Credit Facility at the time of the proposed prepayment of the Non-Extended Loans and the Extended Loans as required by the foregoing, then the Revolving Loans and Letters of Credit shall first be repaid and/or cash collateralized, as applicable, in full before any such prepayment of the Non-Extended Loans and the Extended Loans shall be made (without any accompanying permanent reduction of the commitments under the Revolving Credit Facility in connection therewith).

Voluntary reductions of the unutilized portion of the Revolving Credit Facility commitments will be permitted at any time, without premium or penalty, subject to reimbursement for all losses, expenses and liabilities of First Lien Lenders’ (other than lost profits) to the extent set forth in the Credit Agreement. Such reductions will be pro rata with respect to the such prepaid commitments.

|

|

Representations

and Warranties:

|

Representations and warranties of the type as in the Credit Agreement, with such additions and modifications as may be agreed upon, including without limitation, to take into account the Second Lien Term Loan Facility.

|

A-6

|

Conditions

Precedent

and

Implementation:

|

Conditions precedent of the type as set forth in the Credit Agreement, with such additions and modifications to provide for the transactions contemplated by the Support Agreement, including without limitation (a) to take into account the Second Lien Term Loan Facility and (b) the conditions set forth in “Closing Conditions and Implementation” in the Transaction Term Sheet.

|

|

Conditions

Precedent

to Each Borrowing

under Revolving

Credit Facility:

|

The making of each extension of credit under the Revolving Credit Facility, shall be conditioned upon the satisfaction of conditions substantially similar to those in Credit Agreement.

|

|

Affirmative and

Negative Covenants:

|

Covenants, other than financial covenants (described below), of the type as in the Credit Agreement, with such additions and modifications to provide for the transactions contemplated by the Support Agreement, as described on Annex II hereto and to permit (x) intercompany transactions between the Borrower and its subsidiaries in the ordinary course of business and consistent with historical practice and (y) other ordinary course investments consistent with historical practices, subject to caps to be agreed upon.

|

|

Financial Covenants:

|

A Lee-only interest coverage ratio and a Lee-only total leverage ratio with levels as set forth on Annex III attached hereto (in each case tested quarterly on an LTM basis), and a consolidated capital expenditure limitation with levels as set forth on Annex III attached hereto and otherwise determined in accordance with the Existing Credit Agreement (including, without limitation, capital expenditure carry over provisions). The leverage and interest coverage ratios will be based upon Consolidated EBITDA, consolidated indebtedness and consolidated interest expense, as applicable, in each case substantially as defined in the Existing Credit Agreement, but calculated to exclude the Pulitzer Entities using the substantially the same financial definitions (such excluded EBITDA being the “Excluded Pulitzer EBITDA”),2 except that (1) Consolidated EBITDA, Lee EBITDA and Excluded Pulitzer EBITDA (as applicable) and Consolidated Interest Expense, Lee Interest Expense and Pulitzer Interest Expense (as applicable) will be calculated to exclude (x) curtailment gains or losses relating to Pulitzer benefit

|

|

2

|

If such definitions or the exclusions above are modified in the documentation for the PD LLC Notes, the definitions and exclusions used in the financial covenants for the First Lien Credit Facility for the Pulitzer exclusion will be conformed to such modified definitions and the levels set forth in Annex III shall be adjusted to in a manner satisfactory to the Borrower and the First Lien Agent to achieve approximately the same variance from the Borrower’s projections as are applicable to the levels currently set forth on Annex III.

|

A-7

|

plans, (y) transaction expenses (beginning with the June 2011 quarter) and (z) bankruptcy-related professional fees and expenses payable by the Loan Parties or the Pulitzer Entities; (2) Excluded Pulitzer EBITDA will be calculated to further exclude all cash payments by the Pulitzer Entities for intercompany charges incurred by the Pulitzer Entities and owed or paid to Lee and its non-Pulitzer subsidiaries, for fees, overhead and administrative expenses which are incurred by Lee and its non-Pulitzer subsidiaries and allocated to the Pulitzer Entities in a manner consistent with past practices, in an aggregate amount not to exceed $20 million in any fiscal year; and (3) Lee EBITDA will be calculated to include an add back for all cash payments by the Pulitzer Entities for the intercompany charges described in clause (2) above. For purposes of the financial covenants, GAAP shall be as in effect as of September 2011.

|

|

|

Events of Default:

|

Events of default of the type as in the Credit Agreement, with such additions and modifications as may be agreed upon to provide for the transactions contemplated by the Support Agreement and including, without limitation, a change of control that occurs upon acquisition of more than 50% of the voting power of the Borrower. In addition, execution by the Borrower of the Support Agreement shall not constitute an Event of Default.

|

|

Waivers and

Amendments:

|

Customary and appropriate for financings of this type including without limitation, appropriate tranche voting for applications of repayments between the Revolving Loans and the Extended Loans and for any modifications to the “super-priority” status of the Revolving Credit Facility.

|

A-8

|

ANNEX I TO EXHIBIT A

|

|||||||||

|

Interest

Rates

|

|||||||||

|

Eurodollar

Loans

Applicable

Margin for

Revolving

Loans

|

Base Rate

Loans

Applicable

Margin for

Revolving

Loans

|

||||||||

|

5.50%3

|

4.50%

|

||||||||

|

Payable quarterly in arrears in cash.

|

|

|

Default Rate:

|

Upon the occurrence of any event of default, interest on the Obligations shall be payable in an amount equal to 2.00% per annum above (x) the rate otherwise applicable thereto or (y) the interest rate applicable to Base rate loans. Default interest shall be payable upon written demand.

|

|

Letter of Credit Fees:

|

5.50% per annum on the aggregate face amount of outstanding Letters of Credit.

|

|

Commitment Fees:

|

The Borrower shall pay to First Lien Lenders a commitment fee of 0.50% per annum on the average daily unused portion of the Revolving Credit Facility (disregarding swingline loans as a utilization thereof), and payable quarterly in arrears.

|

3 Subject to 1.25% Eurodollar floor.

A-9

ANNEX II TO EXHIBIT A

COVENANT EXCEPTIONS

|

1.

|

Permit a single joint venture transaction pursuant to which (x) the Borrower or one or more of its subsidiaries contributes, sells, leases or otherwise transfers assets (including without limitation, Capital Stock) to a joint venture or (y) a subsidiary of the Borrower issues Capital Stock to a person other than the Borrower or its subsidiaries for the purpose of forming a joint venture or similar arrangement; provided that immediately after giving effect to such transaction (a) the aggregate net book value of all such assets and Capital Stock contributed, sold, leased or otherwise transferred and all Capital Stock issued to persons other than the Borrower or a Subsidiary of the Borrower pursuant to such transactions subsequent to the closing date shall not exceed $35,000,000, (b) such joint venture is a subsidiary of the Borrower, (c) cash contributed to such joint venture shall not exceed $250,000 in the aggregate and (d) the equity interests of the Borrower and its subsidiaries in such joint venture shall be pledged to secure the Obligations.

|

|

2.

|

Permit the following:

|

|

a.

|

An additional Investments basket that, in the aggregate, does not exceed $2,000,000 in any fiscal year; provided that no such Investments may be used, directly or indirectly, to purchase, repurchase, redeem, defease or otherwise acquire or retire for value any (i) Additional Permitted Indebtedness, (ii) unsecured Indebtedness of the Borrower or a Subsidiary Guarantor, (iii) junior lien obligations of the Borrower or a Subsidiary Guarantor, including without limitation, the Second Lien Term Loans, or (iv) the Pulitzer Notes;

|

|

b.

|

Investments made in connection with the funding of contributions under any qualified or non-qualified pension, retirement or similar employee compensation plan, including, without limitation, split-dollar insurance policies in such amounts as may be required under applicable law and consistent with the Borrower’s past practices; provided that any such contributions by Lee and its subsidiaries (excluding the Pulitzer Entities) to the Pulitzer Entities shall not exceed $2,000,000 in any fiscal year;

|

|

c.

|

Investments in the Associated Press Digital Rights Agency or any successor thereto or any Affiliate thereof in an aggregate amount not to exceed $1,500,000 at any time outstanding;

|

|

d.

|

Payments to be made to satisfy certain obligations owed to The Herald Publishing Company, LLC as described in note 19 to the Borrower’s Annual Report on Form 10-K for the fiscal year ended September 26, 2010; provided that any such payments made by Lee and its subsidiaries (excluding the Pulitzer Entities) shall not exceed $3,500,000 in the aggregate; and

|

A-10

|

e.

|

Permit the incurrence of (i) additional second lien debt to repay existing second lien debt so long as (A) no default or event of default exists or is continuing, (B) pro forma compliance with the financial covenants, (C) the maturity date with respect thereto is beyond six months after the maturity date of any Obligations and, in no event, earlier than the second lien debt being repaid, (D) the terms thereof, taken as a whole, not being materially worse than the terms of the Second Lien Term Loan Facility, (E) such second lien debt is subject to the Intercreditor Agreement and (F) the Net Cash Proceeds thereof are applied in accordance with (and to the extent required by) "Mandatory Prepayments" above and (ii) Additional Permitted Indebtedness so long as the maturity date with respect thereto is beyond six months after the maturity date of any Obligations.

|

A-11

ANNEX III TO EXHIBIT A

FINANCIAL COVENANT LEVELS

Lee Enterprises, Inc.

|

Covenant Summary

|

||||||||||||||||||||||||

|

FY2012

|

FY2013

|

FY2014

|

FY2015

|

FY2016

|

||||||||||||||||||||

|

Calendar Year Period

|

1Q2012

|

2Q2012

|

3Q2012

|

4Q2012

|

1Q2013

|

2Q2013

|

3Q2013

|

4Q2013

|

1Q2014

|

2Q2014

|

3Q2014

|

4Q2014

|

1Q2015

|

2Q2015

|

3Q2015

|

4Q2015

|

||||||||

|

Fiscal Year Period

|

2Q2012E

|

3Q2012E

|

4Q2012E

|

FY2012E

|

1Q2013E

|

2Q2013E

|

3Q2013E

|

4Q2013E

|

FY2013E

|

1Q2013E

|

2Q2013E

|

3Q2013E

|

4Q2013E

|

FY2014E

|

1Q2014E

|

2Q2014E

|

3Q2014E

|

4Q2014E

|

FY2015E

|

1Q2015E

|

||||

|

($ in millions)

|

||||||||||||||||||||||||

|

Covenant Summary

|

||||||||||||||||||||||||

|

Leverage Covenant

|

10.00x

|

10.00x

|

10.00x

|

10.00x

|

10.00x

|

10.00x

|

9.90x

|

9.90x

|

9.90x

|

9.70x

|

9.60x

|

9.50x

|

9.50x

|

9.30x

|

9.20x

|

9.10x

|

||||||||

|

Coverage Covenant

|

1.50x

|

1.50x

|

1.25x

|

1.10x

|

1.08x

|

1.08x

|

1.08x

|

1.08x

|

1.08x

|

1.08x

|

1.08x

|

1.10x

|

1.10x

|

1.10x

|

1.10x

|

1.10x

|

||||||||

|

Annual Capex Limit

|

$20.0

|

$20.0

|

$20.0

|

$20.0

|

||||||||||||||||||||

B-1

|

|

Exhibit B

|

To Commitment Letter

SUMMARY OF INDICATIVE TERMS

$40 MILLION DEBTOR-IN-POSSESSION REVOLVING CREDIT FACILITY4

|

Borrower:

|

Lee Enterprises, Incorporated (the “Borrower”), as a debtor-in-possession in its Bankruptcy Case to be filed in the Bankruptcy Court (the date of commencement of such Bankruptcy Case, the “Petition Date”).

|

|

Guarantors:

|

Each “Subsidiary Guarantor” (the “Guarantors”; the Borrower and the Guarantors, collectively, the “Loan Parties”) under and as defined in the Amended and Restated Credit Agreement, dated as of December 21, 2005 (as amended, supplemented or otherwise modified as of the Petition Date, the “Existing Credit Agreement”). Such Guarantors shall also guarantee the Borrower’s and the Loan Parties’ obligations under interest rate swaps/foreign currency swaps or similar agreements or depository or cash management arrangements with a DIP Lender (as defined below) or its affiliates (the “Other Secured Obligations”). Prior to the Conversion Date (as defined below), each Subsidiary Guarantor will be a debtor-in-possession in the respective Bankruptcy Cases to be filed in the Bankruptcy Court.

|

|

Administrative

Agent and Collateral Agent:

|

Deutsche Bank Trust Company Americas (“DBTCA”) shall act as the sole administrative agent and sole collateral agent (in such capacities, the “Agent”) for the DIP Lenders.

|

|

Joint Lead Arrangers

and Joint

Bookrunners:

|

Deutsche Bank Securities Inc. (“DBSI”) and Goldman Sachs Lending Partners LLC (“Goldman Sachs” and, together with DBSI, the “Joint Lead Arrangers”).

|

|

DIP Lenders:

|

A syndicate of banks, financial institutions and other entities, including DBTCA, Goldman Sachs and certain lenders under the Existing Credit Agreement, arranged by the Joint Lead Arrangers (the “DIP Lenders”).

|

|

Type, Amount, Availability:

|

Superpriority DIP Facility. A superpriority senior secured revolving credit facility providing for borrowings in an aggregate principal amount of up to $40,000,000 (the “DIP Facility”). The DIP Facility shall be available (the “Commitment”) from the Closing Date until the Maturity Date (as defined below) for loans or letters of credit (the “Revolving Loans” and the “Letters of Credit”, respectively), subject to a sublimit to

|

|

4

|

Capitalized terms used but not otherwise defined herein have the meanings ascribed to them in the Commitment Letter or the Support Agreement, as applicable.

|

B-2

|

be agreed, and in an aggregate amount for Revolving Loans and Letters of Credit not to exceed an amount equal to $40,000,000, less the aggregate face amount of all letters of credit issued and outstanding under the Existing Credit Agreement.

|

|

|

Maturity Date:

|

The earlier of (i) the later of (A) the six-month anniversary of the Petition Date and (B) March 31, 2012 and (ii) the effective date (the “Effective Date”) of a Chapter 11 plan of reorganization that has been confirmed pursuant to an order entered by the Bankruptcy Court or any other court having jurisdiction over the Bankruptcy Cases in accordance with the terms of the Support Agreement (the “Plan of Reorganization”).

Subject to the timely satisfaction of the Exit Conditions (as defined below), the Borrower has the option to convert the DIP Facility from a debtor-in-possession financing to exit financing with the maturity date for the Revolving Credit Facility set forth in Exhibit A.

|

|

Purpose:

|

The proceeds of loans under the DIP Facility will be used (a) to provide working capital from time to time for the Loan Parties and (b) for other general corporate purposes consistent with the Budget (as defined below).

|

|

Interest Rates and

Fees:

|

Prior to Conversion Date, as set forth on Annex I to this Exhibit B. On and after the Conversion Date, as set forth for the Revolving Credit Facility on Annex I to Exhibit A.

|

|

Security Prior to Conversion Date:

|

Prior to the Conversion Date, all direct borrowings by the Borrower and other obligations of the Borrower under the DIP Facility (and all guaranties by the Guarantors) shall, subject to the Carve-Out (defined below), at all times:

(i) pursuant to Section 364(c)(1) of the Bankruptcy Code, be entitled to joint and several superpriority administrative expense claim status in the Bankruptcy Cases of the Loan Parties;

(ii) pursuant to Section 364(c)(2) of the Bankruptcy Code, be secured by a perfected first priority lien on all property of the Loan Parties’ respective estates in the Bankruptcy Cases that is not subject to valid, perfected and non-avoidable liens as of the commencement of the Bankruptcy Cases, provided, however, that such lien shall not encumber the claims and causes of action of the Loan Parties under sections 544, 545, 547, 548, 549 and 550 of the Bankruptcy Code (collectively, “Avoidance Actions”), but, upon entry of the Final Order (as defined below), such lien shall attach to any proceeds of successful Avoidance Actions;

(iii) pursuant to Section 364(c)(3) of the Bankruptcy

|

B-3

|

Code, be secured by a perfected junior lien on all property of the Loan Parties’ respective estates in the Bankruptcy Cases, that is subject to valid, perfected and non-avoidable liens in existence at the time of the commencement of the Bankruptcy Cases or to valid liens in existence at the time of such commencement that are perfected subsequent to such commencement as permitted by Section 546(b) of the Bankruptcy Code (other than property that is subject to the existing liens that secure obligations under the Existing Credit Agreement, which liens shall be primed by the liens to be granted to the Agent as described in clause (iv) below); and

(iv) pursuant to Section 364(d)(1) of the Bankruptcy Code, be secured by a perfected first priority, senior priming lien on all of the property of the Loan Parties’ respective estates in the Bankruptcy Cases that is subject to the existing liens that secure the obligations of the Loan Parties under or in connection with the Existing Credit Agreement (the liens thereunder, the “Primed Liens”), which shall be primed by and made subject and subordinate to the perfected first priority senior liens to be granted to the Agent, which senior priming liens in favor of the Agent shall also prime any liens granted after the commencement of the Bankruptcy Cases to provide adequate protection in respect of any of the Primed Liens but shall not prime liens, if any, to which the Primed Liens are subject at the time of the commencement of the Bankruptcy Cases;

(v) subject, in each case, only to (x) in the event of the occurrence and during the continuance of an event of default with respect to which the Agent provides notice to the Borrower thereof (a “Carve-Out Event”), the payment of allowed and unpaid professional fees and disbursements incurred by the Loan Parties and any statutory committees appointed in the Bankruptcy Cases (each a “Committee”) in an aggregate amount not in excess of $2,500,000, plus (y) all allowed and unpaid professional fees and disbursements incurred by the Loan Parties and any Committee prior to such Carve-Out Event and the payment of fees pursuant to 28 U.S.C. §1930 (the amounts described in clauses (x) and (y) collectively, the “Carve-Out”).

Notwithstanding the foregoing, at any time prior to the occurrence of a Carve-Out Event, the Loan Parties shall be permitted to pay all compensation and reimburse all expenses that are allowed and payable under 11 U.S.C. § 330 and § 331, as the same may be due and payable, and such payments shall not reduce the Carve-Out.

All of the liens described above shall be effective and perfected as of the Closing Date and without the necessity of the execution of mortgages, security agreements, pledge agreements, financing statements or other agreements.

|

B-4

|

Conditions to

Priming Prior to Conversion Date:

|

The lenders under the Existing Credit Agreement (the “Primed Parties”) whose liens are primed as described in clause (iv) of “Security Prior to Conversion Date” above, shall receive adequate protection of their interest in their prepetition collateral pursuant to Sections 361, 363(c)(2), 363(e) and 364(d)(1) of the Bankruptcy Code, in an amount equal to the aggregate diminution in value of the Primed Parties’ respective prepetition collateral including, without limitation, any such diminution resulting from the implementation of the DIP Facility and the priming of the Primed Parties’ liens on the prepetition collateral, the sale, lease or use by the Loan Parties (or other decline in value) of the prepetition collateral (including cash collateral), all of which adequate protection must be reasonably satisfactory to the Agent, including the following: (i) a superpriority claim as contemplated by Section 507(b) of the Bankruptcy Code in the Bankruptcy Cases of the Loan Parties, which superpriority claim shall be immediately junior to the claims under Section 364(c)(1) of the Bankruptcy Code held by the Agent and the DIP Lenders, (ii) a replacement lien on the Collateral, which adequate protection lien shall have a priority immediately junior to the priming and other liens to be granted in favor of the Agent, (iii) payment of cash interest at the non-default rate specified in the Existing Credit Agreement for accrued and unpaid interest as of the Petition Date and of interest accruing after the Petition Date at the Eurodollar rate set forth in the Existing Credit Agreement, and (iv) the payment of the reasonable fees and expenses incurred by the administrative agent under the Existing Credit Agreement and by the Initial Backstop Lenders (as defined in the Support Agreement) and the continuation of the payment on a current basis of the administration fees that are provided for thereunder. So long as there are any borrowings outstanding, or the Commitment is in effect, the Primed Parties shall not be permitted to take any action in the Bankruptcy Court or otherwise related to the enforcement of such adequate protection liens or the Primed Liens. The adequate protection liens and superpriority claims of the Primed Parties shall be settled, released and discharged on the effective date of the Plan of Reorganization in consideration for the treatment the Primed Parties receive on account of their prepetition claims under the Existing Credit Agreement under the Plan of Reorganization.

|

|

Security After

Conversion Date:

|

As set forth for the Revolving Credit Facility under the heading “Security” in Exhibit A.

|

|

Mandatory

Prepayments Prior to

Conversion Date:

|

Mandatory prepayments of the Revolving Loans shall be required from (a) 100% of the Net Sale Proceeds (as defined in the Existing Credit Agreement) from asset sales by the Loan Parties (subject to certain ordinary course and reinvestment exceptions to be mutually agreed upon) and (b) 100% of the Net Cash Proceeds (as defined in the Existing Credit Agreement) from insurance recovery and condemnation events of the

|

B-5

|

Loan Parties (subject to certain reinvestment rights to be mutually agreed upon).

On a bi-weekly basis, unrestricted cash and cash equivalents (to be defined in the definitive documents) of the Loan Parties in excess of $10,000,000 shall be applied to prepay the outstanding Revolving Loans.

Mandatory repayments of Revolving Loans made pursuant to the immediately preceding paragraph above shall not reduce the commitments under the DIP Facility. In addition, if at any time the outstandings pursuant to the DIP Facility (including Letter of Credit outstandings) exceed the aggregate Commitments with respect thereto, prepayments of Revolving Loans (and/or the cash collateralization of Letters of Credit) shall be required in an amount equal to such excess.

|

|

|

Mandatory

Prepayments After Conversion Date:

|

As set forth for the Revolving Credit Facility under the heading “Mandatory Prepayments” in Exhibit A.

|

|

Reductions in

Commitments:

|

Voluntary reductions of the unutilized portion of the DIP Facility commitments will be permitted at any time, without premium or penalty, subject to reimbursement for all losses, expenses and liabilities of DIP Lenders with respect to LIBOR-based Revolving Loans (other than lost profits) to the extent set forth in the Existing Credit Agreement. Such reductions will be pro rata with respect to such prepaid commitments.

|

|

Representations

and Warranties:

|

Representations and warranties of the type as in the Existing Credit Agreement, with such additions and modifications as may be agreed upon, including without limitation, to take into account, prior to the Conversion Date, the commencement of the Bankruptcy Cases.

|

B-6

|

Conditions

Precedent:

|

Conditions precedent of the type as set forth in the Existing Credit Agreement, with such additions and modifications to provide for the transactions contemplated by this Term Sheet and the Support Agreement (the date upon which all initial conditions precedent have been satisfied or waived, the “Closing Date”), including without limitation:

(a) Each Loan Party shall have executed and delivered definitive financing documentation with respect to the DIP Facility consistent with this Term Sheet and otherwise satisfactory to the parties thereto (the “DIP Documentation”).

(b) The interim order approving the DIP Facility and providing for the use of the prepetition lenders’ cash collateral shall provide that until entry of the Final Order extensions of credit under the DIP Facility shall not exceed $20,000,000 and shall otherwise be in form and substance satisfactory to the DIP Lenders (the “Interim Order”), shall have been entered by the Bankruptcy Court no later than three business days after the Petition Date, shall be in full force and effect and shall not be subject to any stay.

(c) The Administrative Agent shall have received a thirteen-week cash flow forecast for the period beginning with the week which includes the Petition Date through the thirteenth week thereafter (as thereafter updated on a bi-weekly basis, the “Budget”), in substance satisfactory to the DIP Lenders and in form consistent with the cash flow forecasts previously delivered by the Borrower pursuant to the Existing Credit Agreement.

(d) The DIP Lenders, the Joint Bookrunners and the Agent shall have received all fees required to be paid, and all expenses required to be paid for which invoices have been presented, on or before the Closing Date.

(e) All motions and orders submitted to the Bankruptcy Court on or about the Petition Date shall be in form and substance reasonably satisfactory to the DIP Lenders.

(f) The DIP Lenders shall be reasonably satisfied with any material changes to the existing cash management arrangements of the Loan Parties.

(g) The Administrative Agent shall have received such legal opinions (including opinions from counsel to the Loan Parties), documents and other instruments as are customary for transactions of this type or as they may reasonably request.

|

B-7

|

(h) (i) the Pulitzer Support Agreement (as defined in the Support Agreement) shall have become effective in accordance with its terms and shall be in full force and effect, and (ii) reorganization cases are commenced with respect to Pulitzer Inc. and its subsidiaries on the Petition Date and the interim order with respect to the use of cash collateral of Pulitzer Inc. and its subsidiaries shall have been entered in accordance with the terms of the Support Agreement.

|

|

|

Conditions

Precedent

to Each Borrowing

under the DIP

Facility:

|

Prior to the Conversion Date, the making of each extension of credit under the DIP Facility shall be conditioned upon the satisfaction of conditions substantially similar to those in the Existing Credit Agreement, and the Interim Order or the final order approving the DIP Facility, substantially in the form of the Interim Order and otherwise in form and substance satisfactory to the DIP Lenders (the “Final Order”), as applicable, having been entered by the Bankruptcy Court being in full force and effect and not being subject to any stay.

From and after the Conversion Date, the making of each extension of credit under the DIP Facility, shall be conditioned upon the satisfaction of conditions set forth under the heading “Conditions Precedent to Each Borrowing under Revolving Facility” in Exhibit A.

|

|

Exit Conditions:

|

The “Conversion Date” shall be the date on which, in addition to the conditions precedent set forth in “Conditions Precedent and Implementation” set forth in Exhibit A, the following conditions (the “Exit Conditions”) are also satisfied: (a) the Confirmation Order (as defined in the Support Agreement) shall be in form and substance reasonably satisfactory to the Administrative Agent and shall have been entered, shall not be subject to any stay and the conditions precedent to the Effective Date shall have been satisfied (or waived) to the reasonable satisfaction of the Agent, and the Effective Date shall have occurred; (b) the sum of (1) unrestricted cash and cash equivalents of the Borrower and its subsidiaries (excluding Pulitzer Inc. and its subsidiaries) and (2) unused availability under Revolving Credit Facility immediately after giving effect to the Conversion Date shall not be less than $26 million, as such amount is reflected in a certificate of the Borrower delivered to the Administrative Agent on or prior to the Conversion Date, based on the Borrower’s good faith assumptions; (c) on the Conversion Date, all Revolving Loans and other obligations of the Borrower under the DIP Facility shall have been converted to loans under the Revolving Credit Facility and all letters of credit under the Existing Credit Agreement shall have been converted to Letters of Credit under the Revolving Credit Facility; (d) pro forma compliance with all financial covenants set forth in Exhibit A after giving effect to the occurrence of the Effective Date and (e) no default or event of default under the DIP Facility exists or would exist under the Revolving Credit Facility after giving effect to the

|

B-8

|

occurrence of the Effective Date.

|

|

|

Intercreditor

Matters:

|

On and after the Conversion Date, the relative rights and priorities in the collateral securing the Revolving Credit Facility and in the collateral provided to secure the Second Lien Term Loan Facility (as defined in the Support Agreement) among the DIP Lenders and the lenders under Second Lien Term Loan Facility shall be set forth in an intercreditor agreement substantially in the form attached to the Support Agreement.

|

|

Affirmative and

Negative Covenants:

|

Prior to the Conversion Date, affirmative and negative covenants of the type as in the Existing Credit Agreement, with such additions and modifications to provide for the transactions contemplated by this Term Sheet, including delivery of monthly financial statements, bi-weekly updated thirteen-week cash flow projections, bi-weekly variance reports of actual performance to the Budget, delivery of Bankruptcy Court filings and limitations on amendments to the Interim Order or the Final Order.

From and after the Conversion Date, as set forth under the heading “Affirmative and Negative Covenants” in Exhibit A.

To the extent not contributed or otherwise transferred prior to the Petition Date, the Borrower shall be authorized to contribute or otherwise transfer cash to Pulitzer for purposes of making the “Lee Closing Date Payment” in accordance with the requirements of the Pulitzer Support Agreement (as such term is defined in the Support Agreement).

|

|

Financial Covenants:

|