Attached files

| file | filename |

|---|---|

| 8-K - 8-K - POPULAR, INC. | d263903d8k.htm |

Investor

Day Investor Day

December 2, 2011

December 2, 2011

San Juan, Puerto Rico

San Juan, Puerto Rico

Exhibit 99.1 |

Forward Looking

Statements Statements contained in this presentation that are not based on current or

historical fact are forward- looking in nature. Such forward-looking statements

are based on current plans, estimates and expectations and are made pursuant to the

Private Securities Litigation Reform Act of 1995. Forward-looking statements are

based on known and unknown risks, assumptions, uncertainties and other factors. The

Company's actual results, performance, or achievements may differ materially from any

future results, performance, or achievements expressed or implied by such forward-looking

statements.

The Company undertakes no obligation to publicly update or revise any forward-looking

statement. The financial information included in this presentation for the quarter

ended September 30, 2011 is based on unaudited data. Please refer to our Annual Report

on Form 10-K and other SEC reports for a discussion of those factors that could

impact our future results. 1 |

Meeting

Agenda •

Welcome

Remarks,

Corporate

Overview

&

P.R

Business

-

Richard

L.

Carrión,

Chairman

&

CEO

10:00 a.m. (9:00 a.m. EST)

•

U.S.

Business

Overview

-

Carlos

J.

Vázquez,

President,

U.S.

Operations, EVP

10:30 a.m. (9:30 a.m. EST)

•

Credit

Risk

Management

-

Lidio

V.

Soriano,

Risk

Management, EVP

10:50 a.m. (9:50 a.m. EST)

•

Puerto

Rico

Mortgage

Market

Overview

-

Gilberto

Monzón,

Consumer

Business, EVP

11:10 a.m. (10:10 a.m. EST)

•

Break

11:30 a.m. (10:30 a.m. EST)

•

Earnings Potential

-

Jorge A. Junquera, CFO, SEVP

11:45 a.m. (10:45 a.m. EST)

•

Strategy

Moving

Forward

-

Richard

L.

Carrión,

Chairman

&

CEO

12:05 p.m. (11:05 a.m. EST)

•

Q&A

12:20 a.m. (11:20 a.m. EST)

2 |

Corporate

Overview |

Senior Management

Team 4

Richard L. Carrión

•

Chairman of the Board since 1993 and CEO since 1994

•

President from 1991 to January 2009 and since May 2010

•

BS (Wharton School of the University of Pennsylvania), MS of information technology

(M.I.T.) Jorge A.

Junquera

Carlos J. Vázquez

Ignacio Alvarez

•

EVP and Chief Legal Officer since 2010

•

Partner of Pietrantoni Mendez & Alvarez LLP, a San Juan, Puerto Rico-based law firm,

from September 1992 to June 2010 •

BSFS

(Georgetown

University

School

of

Foreign

Service),

JD

(Harvard

Law

School)

Lidio V. Soriano

•

EVP of Corporate Risk Management Group since August 2011

•

Independent

Consultant,

CFO

of

W

Holding,

Inc.

from

October

2008

to

April

2010

•

BS (Cornell University), MBA (Tulane University)

•

CFO and Head of Finance Group since 1996 and SEVP since 1997

•

President of U.S. Operations from 1996 to 2001 and Head of Retail Banking from 1988 to 1995

•

Investment Officer and Treasurer from 1976 to 1987

•

BS (King’s College), graduate of the Securities Industry Institute at the Wharton School

of Business •

President of U.S. Operations since September 2010 and EVP since February 2010 and from March

1997 to April 2004 •

Head of Individual Credit Operations in Puerto Rico from April 2004 to September 2010 and

Individual Banking in the United States from January 2010 to September 2010 •

BS (Rensselaer Polytechnic Institute), MBA (Harvard Business School) |

Senior Management

Team 5

Juan Guerrero

•

EVP of Financial and Insurance Services Group since 2004

•

Director of Popular Securities since 1995, Popular Insurance since 2004 and Director of the

Popular Family of Funds since 2001 •

BS (Fairfield University), MBA (Indiana University)

Gilberto Monzón

•

EVP of Individual Credit Group since October 2010 and Head of Puerto Rico Mortgage Business

from July 1998 to October 2010 •

BS (Sacred Heart University), Graduate School of Mortgage Banking, U.S. Mortgage Bankers

Association •

Government

Relations

Committee

American

Bankers

Association

in

Washington,

D.C.

and

Residential

Board

of

Governors

MBA

of

America

Eduardo Negrón

•

EVP since 2008, Head of Administration Group since December

2010

•

Deputy Chief Legal Officer and Director of Government Affairs from 2005 to 2008

•

BA

(University

of

South

Florida),

CPA

since

1987,

JD

(University

of

Puerto

Rico)

Néstor Obie Rivera

•

EVP

of

Retail

Banking

and

Operations

since

April

2004

and

Head

of

Bank

Operations,

Real

Estate,

Information

Technology

and

Fraud

and

Security

since

2009

•

Head of Individual Banking from 1988 to 2004

•

BA

(University

of

Puerto

Rico),

MBA

(Inter

American

University),

graduate

studies

at

University

of

Wisconsin

•

1967 U.S. Air Force, Lackland AFB, 3276 Cryptographic Squadron

Eli Sepúlveda

•

EVP since February 2010 and Head of Puerto Rico Commercial Credit Group since January

2010 •

Head of Popular Auto from 2004 to 2008

•

BA (University of Puerto Rico), graduate studies at University of Wisconsin

Ricardo Toro

•

EVP of Commercial Banking Group since 2010

•

Head of Corporate Banking Division from 1989 to 2009

•

BA (University of Puerto Rico), MBA (University of Puerto Rico)

|

2005/2006

•

Aggressive diversification

consisting of Puerto Rico,

the U.S. and the Caribbean;

revenue diversification

through EVERTEC

•

Focused on growing U.S.

banking and mortgage

businesses (PFH & ELOAN )

2007/2008

•

Reorganized U.S. operation

to exit high-risk businesses

•

Shut down U.S. consumer

finance businesses (PFH &

ELOAN) & Texas region

•

Acquisition of P.R. Citibank

retail business

2009/2010

•

Focused on ensuring

capital and BHC liquidity

adequacy and participating

in the P.R. banking

consolidation

•

Raised common equity,

completed EVERTEC sale &

Westernbank transaction

2005

2006

2007

2008

2009

2010

Net Income (Loss)

$541M

$358M

($64M)

($1,244M)

($574M)

$137M

Tier 1 Common

7.98%

7.73%

7.08%

3.19%

6.39%

10.95%

NPL/Loans

1 .77%

2.24%

2.75%

4.67%

9.60%

7.58% ¹

FTEs

13,210

12,508

12,303

10,587

9,407

8,277

Where We Are Coming From

6

Strategy

Financials

2011/2012

•

Focused on:

Puerto Rico

Credit risk profile

improvement

Efficiency

Asset acquisition

United States

•

Repositioning as

community bank

•

Continued attention

to asset quality and

efficiency

¹

Excludes covered loans |

Puerto Rico

Business Overview |

P.R. Franchise

Value Built Over 118 Years Category

Market Position as of

Q2 2011

Market Share

as of Q2 2011

Top Competitor

Institution/Group

Share

Total Deposits (Net of Brokered)

1

42%

Credit Unions

12%

Total Loans

1

35%

FirstBank

16%

Commercial & Construction Loans

1

41%

FirstBank

22%

Credit Cards

1

40%

MBNA

28%

Mortgage Loan Production

1

33%

Scotiabank

13%

Personal Loans

2

33%

Credit Unions

52%

Auto Loans/Leases

3

16%

Reliable

24%

Assets Under Management

3

14%

UBS

48%

•

Indisputable, sustained market leadership

Source: Puerto Rico Office of the Commissioner

of Financial Institutions

8

Source: Puerto Rico Office of the Commissioner of Financial Institutions

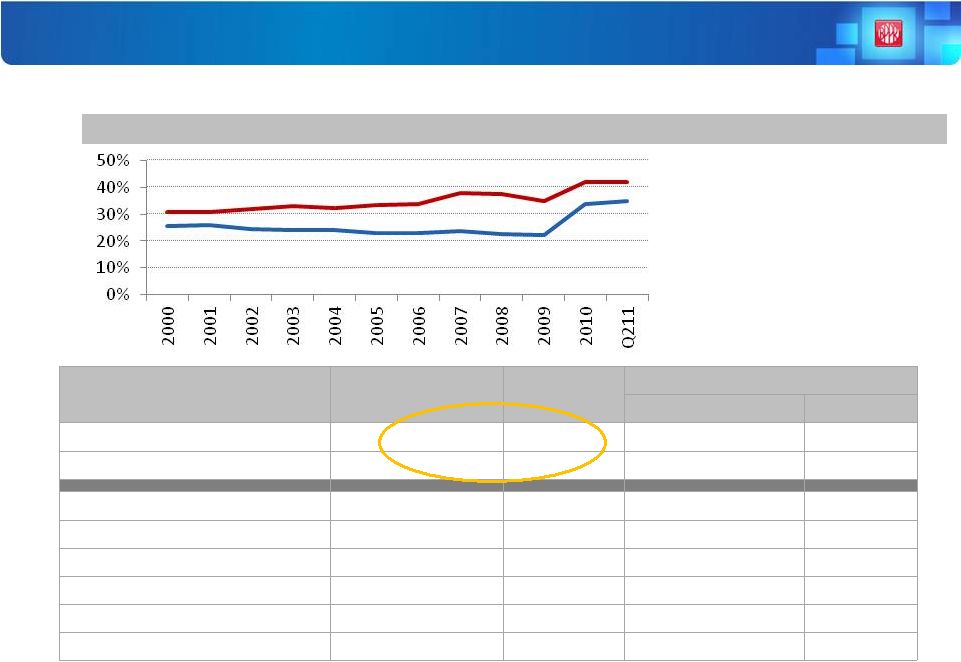

Market Share Trend (2000 –

2011)

Total Deposits (Net of Brokered)

Total Loans |

P.R. Franchise

Value Built Over 118 Years •

Extensive, loyal client base

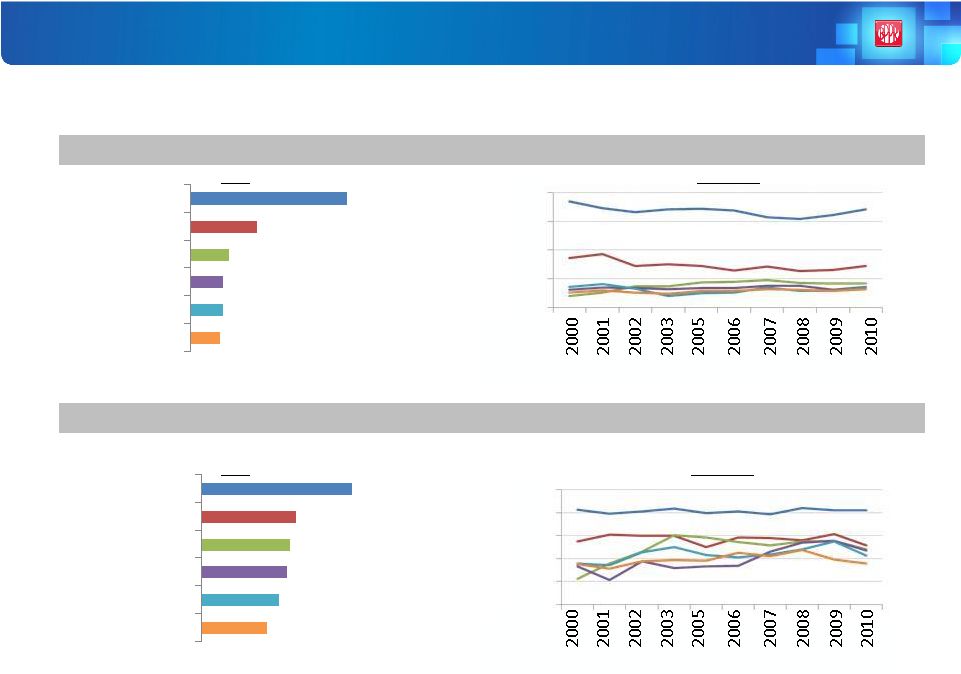

Client Penetration (%)

Loyalty Rate (%)

Percentage of interviewees who state they are clients of each institution. Source:

Inmark/Gaither International, Financial Behavior of Individuals Puerto Rico, 2010.

2010

2000-2010

2010

2000-2010

Percentage of an institution’s clients who consider it as their main institution.

Source: Inmark/Gaither International, Financial Behavior of Individuals Puerto Rico, 2010.

9

68

29

17

14

14

13

BPPR

Credit Unions

Doral

Scotiabank

Santander

FirstBank

82

51

48

47

42

36

BPPR

Credit Unions

Doral

Scotiabank

Santander

FirstBank

80

60

40

20

0

100

80

60

40

20

0 |

Puerto

Rico

Business

–

Financial

Overview

10

$ in millions (unaudited)

2008

2009

2010

Q1 11

Q2 11

Q3 11

Net Interest Income

$959

$867

$1,096

$295

$325

$321

Non Interest Income

532

667

448

122

114

118

Gross Revenues

1,491

1,534

1,544

417

439

439

Provision (BPPR)

(519)

(623)

(610)

(51)

(71)

(131)

Provision (covered WB)

(16)

(49)

(26)

Provision for loan losses

(519)

(623)

(610)

(67)

(120)

(157)

Personnel Expenses

(305)

(300)

(318)

(74)

(78)

(78)

Other Expenses

(426)

(454)

(542)

(126)

(139)

(143)

Expenses

(731)

(754)

(860)

(200)

(217)

(221)

Tax (Expense) Benefit

(14)

1

(27)

(146)

38

(7)

Net Income

$227

$158

$47

$4

$140

$54

NIM

3.94%

3.80%

4.43%

4.78%

5.19%

5.15%

•

Strong and stable top line despite challenging economic conditions

•

Healthy net interest margin

•

Impacted by high credit costs |

11

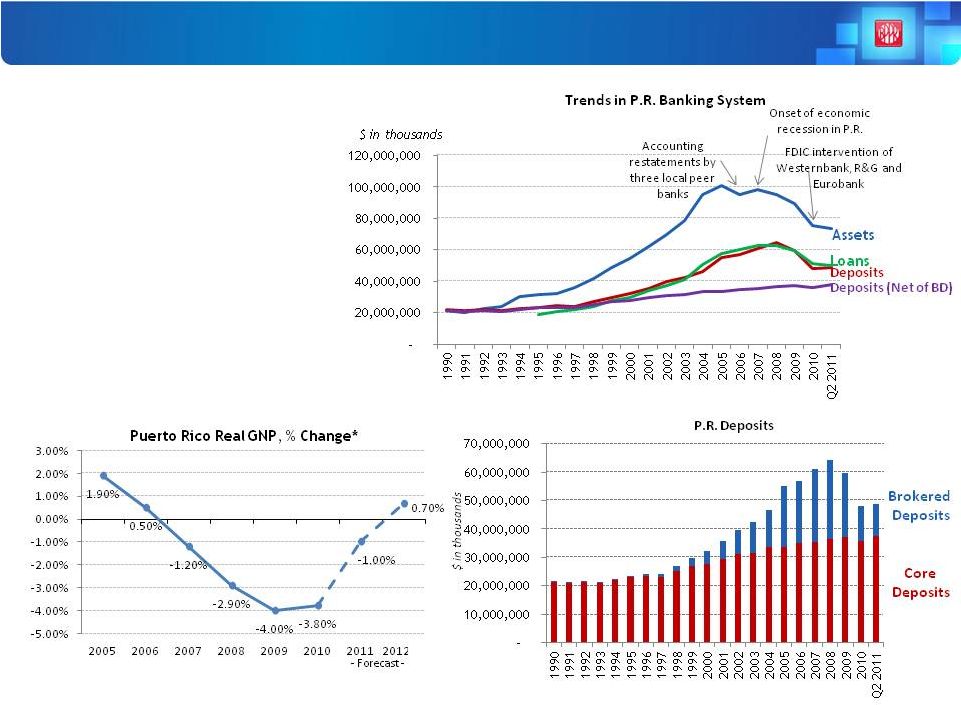

P.R. Banking Sector Has Been Contracting

•

Contraction in the market

as a result of economic

recession

•

High loan to deposit ratio

•

Reliance on brokered

deposits

•

Further consolidation

likely

*Source: Puerto Rico Planning Board / Fiscal Years |

Westernbank

Acquisition •

Vital strategic transaction that further solidified our leadership position amid a contracting

market •

Largest FDIC-assisted transaction in 2010 in terms of assets

•

Required important actions

Common equity raise of $1.15 billion

Sale of 51% of EVERTEC

•

Execution highlights

At the time of acquisition, Westernbank had 1,444 employees and BPPR had 6,150, compared to

current BPPR headcount of 6,910

•

Increases in customer-oriented areas, as well as critical groups such as Risk Management,

Loss Mitigation and Commercial Loans

Conversion completed in August 2010, only four months after the acquisition

Net increase of 12 branches

Added

over

100k

clients

who

did

not

have

a

relation

with

BPPR

at

the

time

of

the

acquisition

Retained 85% of clients and 91% of deposits one year after the transaction

Positive financial impact

12 |

Puerto

Rico

Business

–

Moving

Forward

13

Credit Risk

Management

Efficiency

Asset Growth

•

Continue to pursue sales of

loans held for sale

•

Emphasize resolution of large

cases

•

Further boost loss-mitigation

area

•

Redesign key processes

•

Implement retirement window

•

Consolidate branches

•

Continue to identify

opportunities to add low-risk

assets that can be managed

within existing infrastructure

Actions Taken

Moving Forward

•

Closed consumer-finance subsidiary

•

Strengthened collection areas

•

Emphasized loss-mitigation efforts

•

Sold $128 million (book value) in

construction and commercial loans

•

Controlled headcount and people-

related costs

•

Redesigned key processes

•

Acquired Citibank’s local retail

operations

•

Acquired R&G’s servicing rights

•

Acquired Westernbank

•

Acquired mortgage loans from

FirstBank

•

Acquired Citibank’s local AAdvantage

portfolio |

U.S.

Business Overview U.S. Business Overview |

Popular’s

U.S. Operations Have Changed Dramatically Since 2008 15

Operation was repositioned from a unit-based national lender to

a footprint-based relationship community bank

¹

Total Loans includes held-for-sale loans |

U.S. Business

-

Loans by Category 2008-2011 ($ in millions)

2008

2009

2010

9/30/11

2008 -

9/30/11

Other Loans Held for Sale

$2.7

$1.8

$1.7

$3.2

$0.5

Commercial Real Estate

2,673.4

2,583.6

2,237.2

2,225.7

-447.7

Construction & Land Dev.

873.7

653.1

368.9

223.7

-650.0

Multifamily Real Estate Loans

817.6

909.1

955.6

899.1

81.5

Commercial & Industrial Loans

2,325.4

1,811.1

1,221.1

576.7

-1,748.7

Leases

366.6

56.8

30.2

17.9

-348.7

Other Commercial Loans

208.4

187.7

187.3

399.5

191.1

1-4 Family Mortgage & Helocs

2,799.7

2,368.8

1,847.8

1,538.0

-1,261.7

Other Consumer Loans

176.2

105.1

72.1

64.9

-111.3

Total Consolidated Loans¹

10,243.7

8,677.1

6,921.9

5,948.7

-4,295.0

Popular’s U.S. Operations Have Changed Dramatically Since 2008

16

The

loan

portfolio

continues

to

evolve,

reflecting

the

strategy

shift

¹

Total Loans includes held-for-sale loans |

Popular

Community

Bank

(PCB)

/

BPNA

–

Overview

17

9/30/11

CA

IL

NY

CFL

SFL

Total

Total Deposits

$1,284.2

$792.9

$2,208.0

$235.7

$842.9

$5,363.7 ¹

No. of Branches

24

12

39

9

11

95

2008

2009

2010

9/30/11 YTD

Pre Provision Revenue

$492.5

$345.7

$364.6

$277.2

Pre Provision Revenue

% of Assets

3.96%

3.19%

4.06%

4.24%

Net interest income

$351.5

$315.5

$310.0

$222.9

Net Interest Margin

2.99%

2.90%

3.33%

3.62%

Provision

$472.3

$782.3

$402.2

$52.7

Personnel Expenses

$182.5

$117.4

$98.5

$73.4

Other Expenses

247.9

196.8

199.8

114.8

Total Expenses

$430.4

$314.2

$298.3

$188.2

Pre Provision Pre Tax

Revenues (less expenses)

$62.1

$31.5

$66.3

$89.0

Net (Loss) Income

($524.8)

($725.9)

($340.3)

$33.4

Regional Retail Breakdown

$ in millions

U.S. financial performance has reflected

this restructuring process while

maintaining stable revenues

Financial Performance

$ in millions

¹

Excludes deposits captured by E-LOAN

²

²

35,000 ATMs were added in September 2010 in leading national and

local merchant locations |

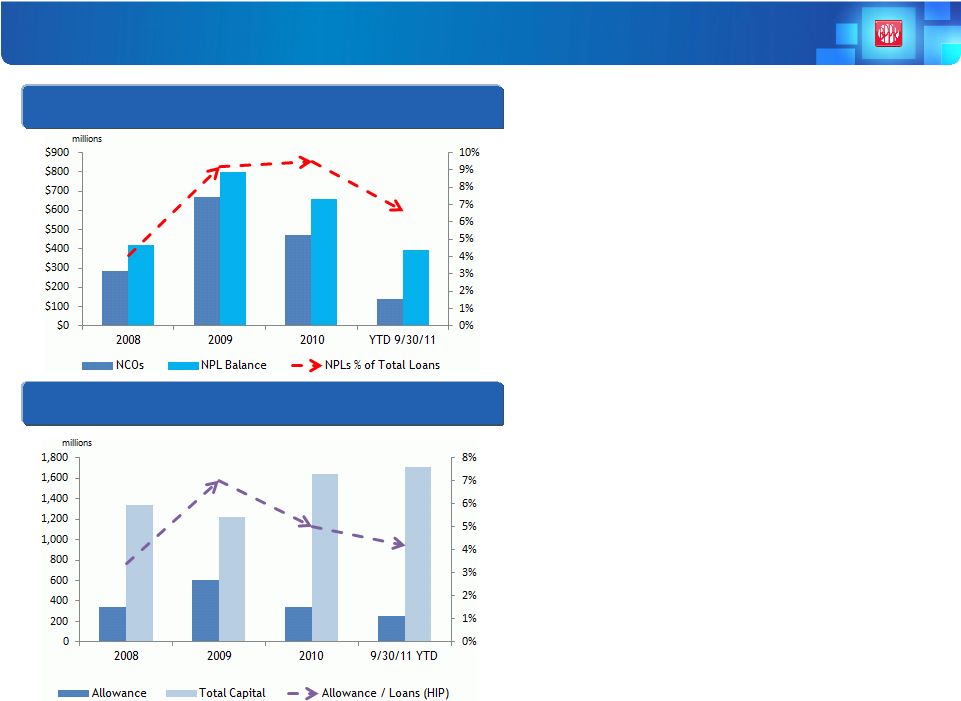

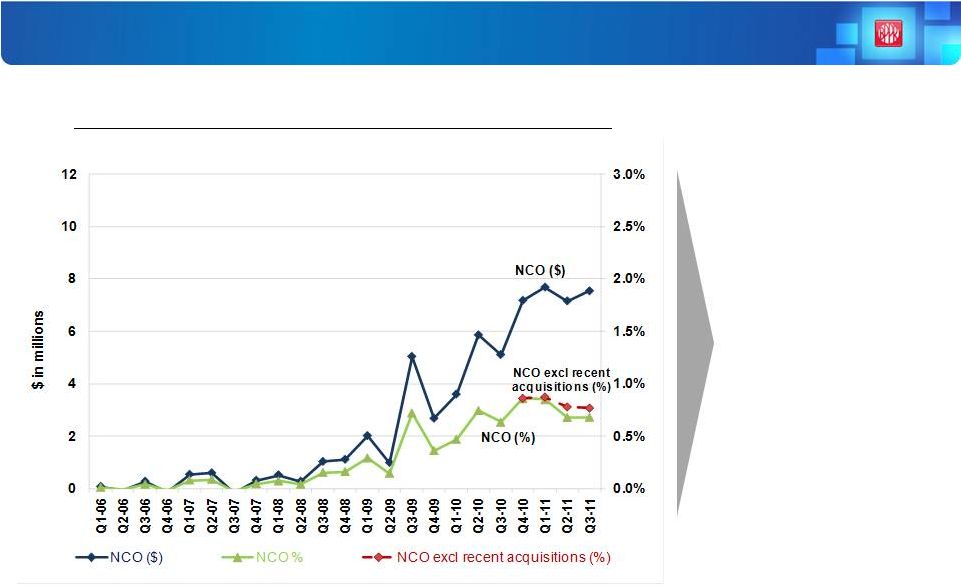

PCB/BPNA Credit

Trends Have Driven The Changes in Financial Performance 18

•

Net charge offs and non-performing loans

peaked in 2009; have since decreased and

should continue to improve

•

Non-performing loans as a percentage of total

portfolio have declined despite a shrinking loan

portfolio

•

Credit improvement is supported by strong

allowance for loan losses and capital. Allowance

to loans is tracking the reduction in losses

•

U.S.

mainland

operations

carry

a

fully

reserved

$1.3

billion¹

DTA.

Upon

our

return

to

profitability, some of that asset value may be

recaptured

Credit Metrics U.S.

Capital & Allowance

¹

Includes $697 million related to consolidated BPNA and $556 million

related to discontinued operations and U.S. holding Co.

|

U.S.

Business

–

Moving

Forward

•

Solidify trend of improving credit quality

Continue roll off or disposition of discontinued portfolios

Actively and aggressively manage existing classified portfolio

New asset growth in selected categories

•

Enhance community banking strategy and profitability

Improve client mix, maximize value of rebranding

Organic or transactional growth in targeted portfolios within footprint

Continue rationalization of our retail network with locations, product

characteristics, product offering and channel expansion

•

As financial conditions and regulatory environment allow, consider strategic

options as far as markets served, products, segments and use of capital

19 |

Risk

Management Risk Management |

21

•

Board committee oversees risk program

•

Risks

are

jointly

managed

by

business

units

and

centralized

risk

group

•

Centralized risk group is responsible for assessing and reporting risk positions

•

Management committees provide direct oversight

•

Simple community banking business model

•

Diversified product mix with concentration in Puerto Rico

•

Strong capital position

•

Closely monitor liquidity and interest-rate risk positions

•

Contained within our core markets and customer base

•

Exposures and appetite are monitored regularly

•

Exposures are stress tested to ensure adequacy

•

No proprietary trading; limited derivatives (client driven)

•

Investment

portfolio

–

mostly

U.S.

and

P.R.

government

exposure

•

Operational risk –

contained losses

•

Compliance

and

reputational

risk

–

continuous

monitoring

21

Risk Model Overview

Governance

Risk Appetite

Market and Other Risks

Credit Risk |

Credit Risk

Management •

Management’s top policy-making body

•

Reviews the adequacy of the allowance for loan losses, establishes credit

exposure reporting standards and monitors asset quality

•

Independent

of

the

lending

function

–

identifies,

measures

and

controls

credit

risk

•

Monitors credit underwriting standards and loan portfolio

•

Performs credit-process reviews of lending units

•

Segregated the underwriting, lending and workout functions from the core

commercial business.

•

Bolstered P.R.’s consumer loss mitigation function

•

Strengthened loan review and appraisal units to facilitate early identification of

risks and enhance controls

•

Adopted measures to strengthen credit-administration procedures, including a more

thorough review of a significant portion of our commercial loan portfolio in P.R. This

initiative follows a similar action taken in the U.S. in late 2010

22

Credit Risk

Management

Division

Credit Strategy

Committee

Recent

Actions |

Loan Portfolio

Detail •

Diversified across two regions:

P.R. –

76% U.S. –

24%

•

There are no significant borrower or industry concentrations

•

Top 20 non-covered relationships are only 4% of

total loans

•

Low average loan size; commercial $476K and

mortgage $129K

•

Early-stage delinquencies have declined $533million or 45%

since December 2009

•

Approximately 50% of the inflow of NPLs in the P.R.

commercial portfolio were current as of Q3 11 in their

payments, vs. 17% in Q2 and 14% in Q1

30 –

89 DPD / Total Loans

5.0%

4.9%

4.3%

4.2%

3.5%

3.9%

3.4%

3.2%

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

Commercial & Construction NPL Inflows

Excludes Covered Loans & LHFS

Excludes Covered Loans & LHFS

Total

NPLs:

$2,276

($ in millions)

23

Loan Portfolio -

Q3 2011

$ in millions

PR

US

Total

% of

Total

Loans Held to Maturity:

Construction

$

164 $ 194

$ 358

1%

C&I

2,801

1,051

3,852

15%

CRE-

Owner Occupied

2,285

895

3,180

13%

CRE-

Non-Owner

Occupied

1,327

2,230

3,557

14%

Consumer

3,518

743

4,261

17%

Mortgage

4,633

833

5,466

22%

Total Non-Covered

14,728

5,946

20,674

82%

Covered Loan-

WB

4,512

-

4,512

18%

Total

$ 19,240

$ 5,946

$ 25,186

100%

161

149

174

133

116

212

104

109

136

57

79

77

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

$-

$50

$100

$150

$200

$250

$300

$350

PR Inflows

US Inflows

$1,732

$1,625

$1,614

$1,572

$2,344

$2,330

$2,313

|

Credit

Summary Credit quality information excludes covered assets

$ in millions

Q3 11

Q2 11

Q3 11 vs.

Q2 11

Q1 11

YTD 2011

Loans Held to Maturity (HTM)

$20,674

$20,658

0.08%

$20,676

$20,674

Loans Held for Sale

369

509

-27.50%

570

369

Covered Loans

4,512

4,616

-2.25%

4,730

4,512

Total Loans

$25,555

$25,783

-0.88%

$25,976

$25,555

Non-performing assets (NPAs)

$2,167

$2,187

-0.91%

$2,235

$2,167

NPLs HTM to loans HTM

8.38%

7.86%

0.52%

7.81%

8.38%

Net charge-offs

$135

$133

1.50%

$139

$408

Net charge-offs to average loans

2.64%

2.59%

0.05%

2.74%

2.65%

Provision for loan losses

$151

$96

57.29%

$60

$306

Provision for loan losses to net

charge-offs

111.50%

71.76%

39.74%

42.86%

75.04%

Allowance for loan losses

$693

$690

0.43%

$727

$693

Allowance for loan losses to

loans (excl. LHFS)

3.35%

3.34%

0.01%

3.52%

3.35%

Allowance for loan losses to

NPLs HTM

39.99%

42.45%

-2.46%

45.07%

39.99%

•

NPAs

have

decreased

since

Q1

11

principally

driven

by

the

sale

of

non-performing

loans

•

NCOs

have remained relatively flat, although experiencing variability within the portfolios

•

Provision

for

loan

losses

has

increased

significantly

since

Q1

11

•

Allowance

&

allowance

to

loans

coverage

ratio

remained

relatively

flat

24 |

Methodology

ASC 450

General

Reserve-

ASC

450

(FAS

5)

+

Specific

Reserve-

ASC

310

(FAS

114)

=

Total

ALLL

Current

Status

•

Use of trend factor makes our provision highly sensitive to recent losses

•

We will continue to review and enhance our ALLL as our loan portfolio and market

conditions change

Allowance for Loan and Lease Losses (ALLL)

•

Base

loss

-

36-month

average

net

charge-offs

for

commercial

and

construction

portfolios

and 18-month average net charge-offs for consumer and mortgage portfolios

•

Trend

factor-

Replaces base-loss period with 6-month average net charge-offs when it is

higher than base loss (up to determined cap)

•

Environmental

factor

-

Captures

certain

credit

and

economic

trends

and

factors

not

considered in base loss

•

General

reserve

-

Based

on

historical

losses

adjusted

for

a

recent

trend

factor

+

environmental factor.

•

Specific

reserve

-

Attributed

to

loans

deemed

impaired

(mostly

commercial

loans

over

$1 million)

25 |

Non-covered

NPLs Total NPLs

$1,731,671

Total Non-Covered Reserves

$692,500

Coverage Ratio

40%

Lifetime Charge-offs (C/O)

$447,187

ALLL + C/O / NPL

66%

NPLs subject to specific impairment analysis (49%)

NPLs

$843,031

-

Mortgage -

$205,758 (2% Lifetime C/O)

-

Comm./Const.

-

$630,453

(25%

Lifetime

C/O)

ALLL

$26,747

Coverage Ratio

3%

Lifetime Charge-offs (C/O)

$243,273

ALLL + C/O / NPL

32%

NPLs not subject to specific analysis (51%)

NPLs

$888,640

Remaining Reserves*

$665,753

Coverage Ratio

75%

Lifetime Charge-offs (C/O)

$203,914

ALLL+ C/O / NPL

98%

ALLL and NPL coverage ratio remain adequate

•

49% of NPLs subject to specific analysis

Prompt charge-off of impaired portion of

collateral dependent commercial and

construction loans

Charge-off history of P.R. mortgage loans

•

Excluding loans subject to specific analysis and

charge-offs, NPL coverage ratio stands at 98%

NPL Coverage Ratio & Moving Forward

As

of

September

30,

2011

-

$

in

thousands

26

* Includes $32 million in specific reserve for certain performing loans.

As

of

September

30,

2011

-

$

in

thousands

As

of

September

30,

2011

-

$

in

thousands

•

Credit quality indicators in the U.S. continue reflecting signs of stability across all

portfolios •

P.R.’s economic situation continues to place pressure on our commercial and

mortgage portfolios. We are confident that our review led to early identification of

risks |

Puerto Rico

Mortgage Business Puerto Rico Mortgage Business |

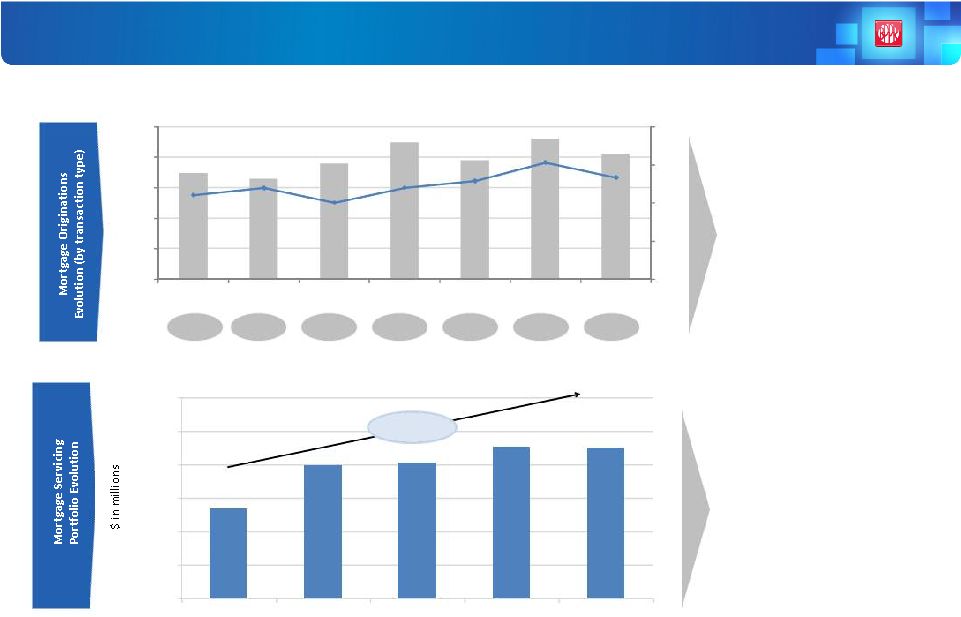

P.R. Mortgage

Business Continues to Increase Market Share 28

27%

27%

28%

30%

32%

33%

32%

Market

share of

originations

Popular has a strong,

seasoned team and most

extensive origination

network

•

Mortgage originations during

2011 have been higher than in

2010 in each of the first three

quarters

•

Popular’s market share has been

consistently improving (from 16%

in 2005 to 32% in Q3 11)

•

Popular’s largest competitor has

a market share of 13%

Popular is the largest

servicer and issuer on

the island

•

The mortgage servicing

portfolio has increased by

70% (from $13.5B to $22.5B)

during the last four years

•

As of Q3 11, the mortgage

servicing portfolio has the

following mix: 69% GNMA &

GSEs, 13% private labels and

18% BPPR owned

Source: Internal Reports, Office of the Commissioner of Financial Institutions of the

Commonwealth of Puerto Rico (OCFI) 277

327

55%

60%

50%

60%

65%

77%

67%

0

100

200

300

400

0%

20%

40%

60%

80%

100%

Q1-2010

Q2-2010

Q3-2010

Q4-2010

Q1-2011

Q2-2011

Q3-2011

New Money

Purchased

Mix

(%)

Total Originations

(in

millions $)

13,512

22,538

-

5,000

10,000

15,000

20,000

25,000

30,000

2007

2008

2009

2010

Q3 2011

+ 1.7X |

Book

Value (1)

(in millions)

%

Insured

(2)

Average Loan

Balance

(in thousands)

# of Loans

Uninsured

90+ DPD

(in millions)

Uninsured

90+ DPD

(%)

$4,189.4

7.4%

$116.4

36,000

$340.6

8.1%

443.9

43.1%

111.8

3,971

103.0

23.2%

4,633.3

10.8%

115.9

39,971

443.6

(3)

12.3%

1,217.4

90.0

13,522

214.8

17.6%

Total Owned

$5,850.7

$109.4

53,493

$658.4

11.2%

Recourse

(Fannie Mae &

Freddie Mac)

$3,601.9

n/a

$103.9

34,651

$262.6

7.3%

Mortgage Portfolio Overview

P.R. Mortgage Portfolios

As of Sept. 30, 2011

29

•

More than 90% of portfolio is composed of fixed-rate mortgages (no mortgage broker business,

no ARMs)

•

Average loan balance of total owned portfolio is $109K

•

More than 7% of regular portfolio and 43% of repurchased portfolio is insured

•

Total uninsured delinquency of mortgage owned portfolio (excluding covered loans) is $444

million (1)

Book value net of credit losses

(2)

Insured does not consider MGIC (<2% of owned portfolio)

(3)

Does not include $137 million in mortgage TDRs below 90 DPD that were classified as

non-accrual status upon restructuring and $291 million in mortgage loans insured by

U.S. Sponsored Agencies and GNMA repurchased options Repurchased portfolio

Covered portfolio

Regular portfolio

Sub-Total

Owned

(excl.

covered portfolio) |

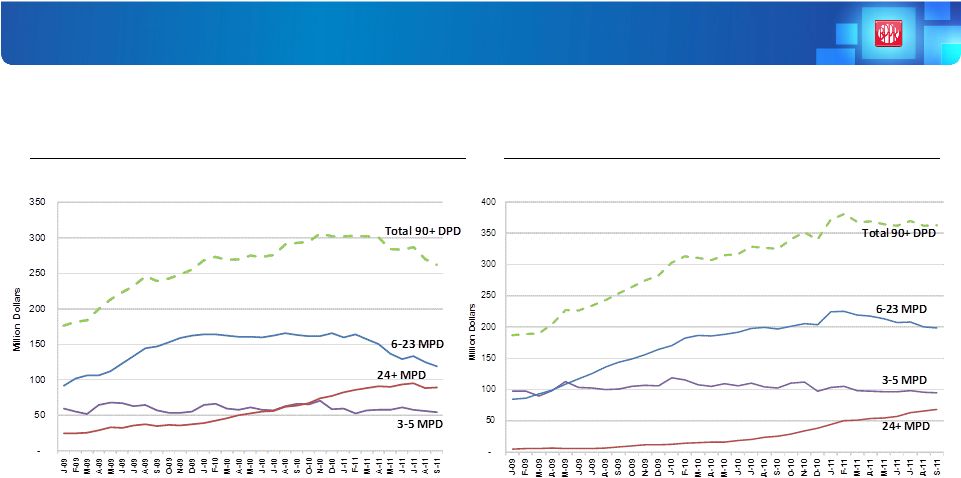

Total Delinquent

Balances are Decreasing in Both Regular & Recourse Portfolios. However, the 24+ MPD

Bucket Has Been Slower to Stabilize 30

Uninsured 90+ DPD $ Monthly Evolution

Regular portfolio

(1)

(1)

Excludes

regular

portfolio

serviced

by

others,

Popular

Finance,

Virgin

Islands

and

personal

loans

with

mortgage

guarantee

Uninsured 90+ DPD $ Monthly Evolution

Recourse portfolio + total repurchases

•

Stabilization

in

delinquency

is

mainly

driven

by

a

decrease

in

cases

entering

90+

DPD

and

an

increase

in

the

number of modifications

•

A new strategy launched during Q3 11 to control the increase in loans in the 24+ MPD bucket is

delivering positive results |

Penetration of

Loss Mitigation (LM) in 90+ DPD buckets has been increasing, but opportunity to impact

more cases is still high 31

There is opportunity to increase the % of delinquent

loans modified by proactively reaching clients and

incorporating them into the LM pipeline

Active in

LM Pipeline

Previous

Alternative

Denied or

Withdrawn

No LM

History

28.1%

39.5%

Total 90+

DPD $

100%

% of

Total

Mortgage

Owned

90+

DPD

Dollars

(as

of

September

30,

2011)

•

Active cases in LM have

increased rapidly during 2011,

from 19% of total 90+ DPD

balance in January to 28% in

September

•

Until modified, all loans are

subject to normal collections

efforts. However, there is a

significant opportunity to

continue increasing LM

penetration given that 40% of

the 90+ DPD balance has

never been in the LM pipeline

during the last two years

•

70% of modified loans are

still performing after one year

21.6%

10.9%

(1)

Excludes regular portfolio serviced by others, Popular Finance, Virgin Islands and personal

loans with mortgage guarantee

1 |

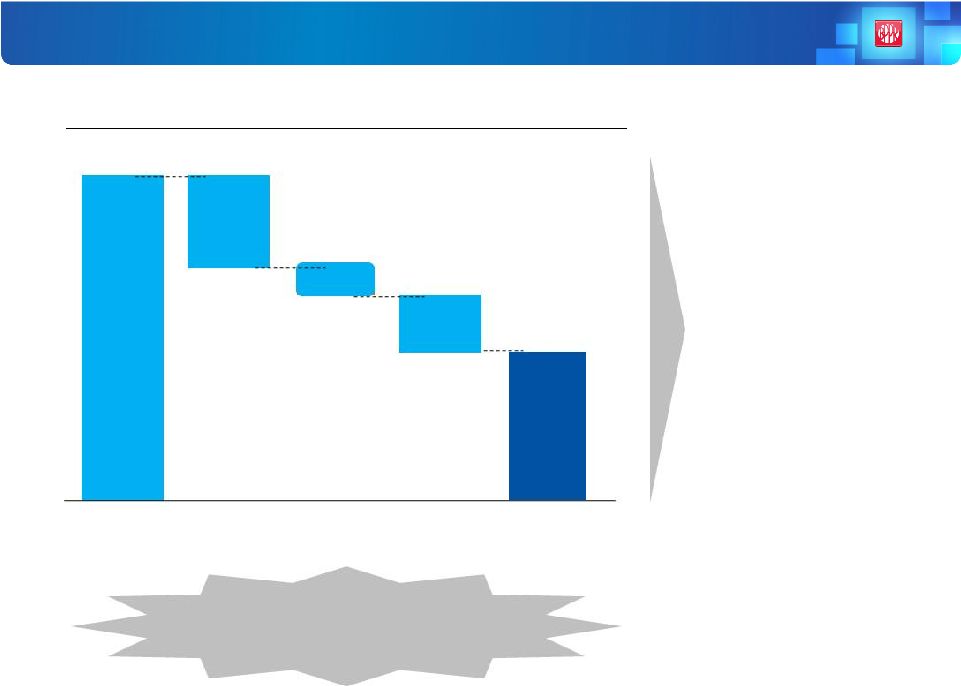

Credit Losses

Increased from 2008 to 2010 and Stabilized in 2011 32

Historical

Puerto

Rico

Segment

Mortgage

Credit

Losses

2006

-

2011

•

Mortgage net losses

have historically stayed

at very low levels

•

Despite increase in

NCOs from 2008 to

2010, losses remain low

(<1% of total portfolio)

•

Credit losses have

stabilized in 2011 |

P.R. Mortgage

Business – Moving Forward

33

•

Continue to maintain or grow market share under expected favorable conditions

in 2012

Continue capitalizing on broad package of government incentives,

which have

been extended until December 2012 with some minor modifications

Combine extensive distribution network with targeted campaigns

Create a team to capitalize on HARP Program opportunities

•

Continue

to

lower

regular

portfolio

delinquency

levels

by

maintaining

a

high

volume of loan modifications

Ensure that most delinquent cases are reviewed by the LM team to

reach

more clients in the most cost-effective way |

Earnings

Potential |

•

The company reported net income of $27.5 million in Q3 11

•

Tepid results show that in spite of strong and consistent top line revenues, high credit

costs are the main factor preventing Popular from reaching its profitability potential

•

Although

the

local

economy

is

leveling

off,

credit

costs

remain

elevated

due

to

a

lack

of

job

growth and high energy costs

•

Loan demand remains challenging both in P.R. and on the mainland, but we have made several

opportunistic portfolio purchases on the island

•

We continue to drive the cost of liabilities down by achieving lower costs of deposits and

accelerating payments to the FDIC Note

•

We are rolling out a plan to reduce expenses and increase efficiency in our distribution

system •

Recent deterioration in credit-quality metrics is causing volatility in the level of

reserve for loan losses

•

Credit costs are expected to remain elevated in Q4, but we continue to expect improvement in

2012

Current Situation: Driving forward against economic headwind

35 |

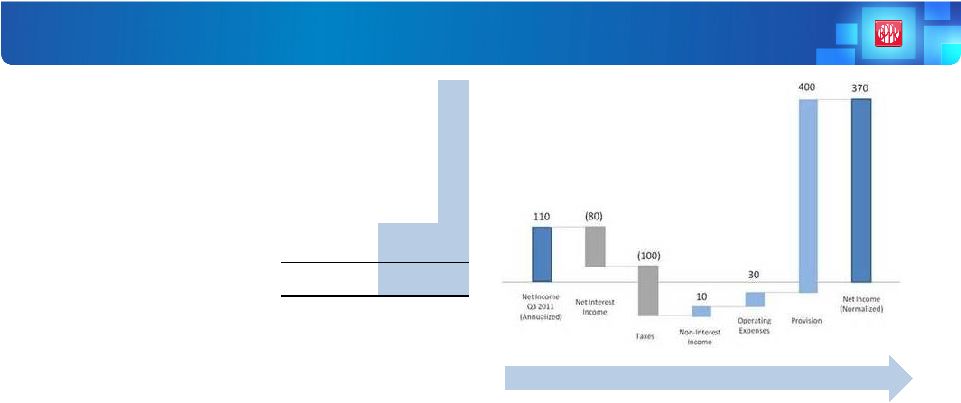

Assumptions:

•

Net Interest Income decreases due to a contraction of the margin, partially offset by slight

increases in loan volumes •

Non-Interest Income increases slightly from higher deposit and service fees in P.R. and

U.S., higher brokerage and insurance commissions and lower amortization of the

indemnity asset in P.R. •

Expenses are lower due to cost-control initiatives in P.R. , lower costs in managing NPLs

and lower FDIC expenses from improved asset quality

•

Provision for loan losses is reduced substantially due to more normalized levels of NPLs and

charge-offs, which require only 1-1¼

% provision on loans

•

Taxes increase due to higher pretax income in P.R.; approximately 10% of net income from U.S.

operations Potential Normalized Net Income –

Before Revenue Enhancing Opportunities

(in millions except per share data)

Annualized

Normalized

Q3 2011

Net Interest Income

1,480

$

1,400

$

Non-int Income

490

500

Top Line Revenue

1,970

1,900

Expenses

(1,130)

(1,100)

Pre-provision Net Revenue

840

800

Provision

(705)

(305)

Pretax Income

135

495

Tax

(25)

(125)

Net Income

110

$

370

$

Earning Assets

33,000

$

33,700

$

Equity

3,800

4,170

$

Margin

4.48%

4.15%

Efficiency

57.37%

57.89%

EPS

0.11

$

0.36

$

Variances leading to normalized earnings

36

Obtaining this level of normalized income and the time required to obtain it are subject to

various conditions, including continuing to reduce credit costs and economic scenarios in

the U.S. and P.R. We believe we should make significant progress during 2012 and be about

half way there at the end of 2012 |

As economic

conditions and the regulatory environment allow, we will take advantage of opportunities

as they arise •

Dominant franchise in P.R. is capable of ramping up profitability as the economy

improves •

Lower expenses from the unwinding of the credit-risk management platform currently in

place to administer very high levels of defaulting loan portfolios

•

Potential gain on sale from our 49% ownership interest in EVERTEC

•

Potential realization of $1.3B DTA on the mainland

•

Well positioned to benefit from further consolidation of the financial industry in P.R.

•

Higher levels of interest rates provide:

•

additional margin upside given that 74% of our balance sheet is funded with deposits

•

leverage opportunity with tax exempt Federal securities to improve the bottom line in P.R.

with minimum credit risk and modest interest-rate risk

•

Ample capital structure gives us the ability to take advantage of opportunities

Further Opportunities to Enhance Net Income

37 |

Strategy

Moving Forward |

Moving

Forward 39

Puerto Rico

Strategy

•

Improve credit-risk profile

•

Expand efficiency efforts

•

Add low-risk assets to existing

infrastructure

BPNA

Challenges

Other Considerations

•

Pace of economic recovery in P.R.

•

Challenging regulatory environment

•

Continue implementation of

community banking strategy

•

Keep focus on asset quality and

efficiency

•

TARP repayment

•

Possibility of acquisition in the U.S. in the future

•

Deferred tax asset |

Investor

Day Investor Day

December 2, 2011

December 2, 2011

San Juan, Puerto Rico

San Juan, Puerto Rico |