Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DYNEGY HOLDINGS, LLC | a11-30978_28k.htm |

| EX-99.1 - EX-99.1 - DYNEGY HOLDINGS, LLC | a11-30978_2ex99d1.htm |

| EX-99.3 - EX-99.3 - DYNEGY HOLDINGS, LLC | a11-30978_2ex99d3.htm |

Exhibit 99.2

THIS IS NOT A SOLICITATION OF ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THIS DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT.

|

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK |

|

|

|

|

|

|

|

|

x |

|

|

|

: |

|

|

In re: |

: |

Chapter 11 |

|

|

: |

|

|

DYNEGY HOLDINGS, LLC, et al.,(1) |

: |

Case No. 11-38111 (CGM) |

|

|

: |

|

|

|

: |

Jointly Administered |

|

Debtors. |

: |

|

|

|

x |

|

DISCLOSURE STATEMENT RELATED TO THE CHAPTER 11 PLAN

OF REORGANIZATION FOR DYNEGY HOLDINGS, LLC

PROPOSED BY DYNEGY HOLDINGS, LLC AND DYNEGY INC.

Dated: December 1, 2011

|

SIDLEY AUSTIN LLP |

|

WHITE & CASE LLP |

|

James F. Conlan |

|

Thomas E Lauria |

|

Jeffrey E. Bjork |

|

Gerard H. Uzzi |

|

Paul S. Caruso |

|

1155 Avenue of Americas |

|

Matthew A. Clemente |

|

New York, New York 10036-2787 |

|

787 Seventh Avenue |

|

Telephone: (212) 819-8200 |

|

New York, New York 10019 |

|

Facsimile: (212) 354-8113 |

|

Telephone: (212) 839-5300 |

|

|

|

Facsimile: (212) 839-5599 |

|

COUNSEL FOR DYNEGY INC. |

|

|

|

|

|

PROPOSED COUNSEL FOR THE DEBTORS AND DEBTORS IN POSSESSION |

|

|

(1) The Debtors, together with the last four digits of each Debtor’s federal tax identification number, are Dynegy Holdings, LLC (8415); Dynegy Northeast Generation, Inc. (6760); Hudson Power, L.L.C. (NONE); Dynegy Danskammer, L.L.C. (9301); and Dynegy Roseton, L.L.C. (9299). The location of the Debtors’ corporate headquarters and the service address for Dynegy Holdings, LLC, Dynegy Northeast Generation, Inc. and Hudson Power, L.L.C. is 1000 Louisiana Street, Suite 5800, Houston, Texas 77002. The location of the service address for Dynegy Roseton, L.L.C. is 992 River Road, Newburgh, New York 12550. The location of the service address for Dynegy Danskammer, L.L.C. is 994 River Road, Newburgh, New York 12550.

TABLE OF CONTENTS

|

|

|

Page |

|

|

|

|

|

I. INTRODUCTION |

1 | |

|

|

| |

|

II. NOTICE TO HOLDERS OF CLAIMS |

2 | |

|

|

| |

|

III. ADDITIONAL INFORMATION AND INCORPORATION BY REFERENCE |

4 | |

|

|

| |

|

IV. SUMMARY EXPLANATION OF CHAPTER 11 |

5 | |

|

|

| |

|

A. |

Overview of Chapter 11 |

5 |

|

|

|

|

|

B. |

Plan of Reorganization |

6 |

|

|

|

|

|

C. |

Confirmation of a Plan of Reorganization |

7 |

|

|

|

|

|

V. OVERVIEW OF THE PLAN |

7 | |

|

|

| |

|

A. |

Summary of the Terms of the Plan |

8 |

|

|

|

|

|

B. |

Summary of Treatment Under the Plan |

12 |

|

|

|

|

|

VI. GENERAL INFORMATION |

15 | |

|

|

| |

|

A. |

Overview of the Company |

15 |

|

|

|

|

|

B. |

Overview of the Company’s Business |

16 |

|

|

|

|

|

C. |

Overview of the Debtors’ Businesses |

17 |

|

|

|

|

|

|

1. Dynegy Holdings, LLC |

17 |

|

|

|

|

|

|

2. Dynegy Northeast Generation, Inc. |

18 |

|

|

|

|

|

|

3. Hudson Power, L.L.C. |

18 |

|

|

|

|

|

|

4. Dynegy Danskammer, L.L.C. |

18 |

|

|

|

|

|

|

5. Dynegy Roseton, L.L.C. |

18 |

|

|

|

|

|

D. |

Operations of Dynegy Danskammer and Dynegy Roseton |

19 |

|

|

|

|

|

E. |

Events Leading to the Need for Restructuring |

20 |

|

|

|

|

|

F. |

Prepetition Restructurings |

21 |

|

|

|

|

|

G. |

Restructuring Support Agreement |

22 |

|

H. |

Prepetition Indebtedness and Lease Obligations |

23 |

|

|

|

|

|

|

1. New Credit Facilities |

23 |

|

|

|

|

|

|

2. DH Note |

25 |

|

|

|

|

|

|

3. Cash Collateralized Letter of Credit Facility |

25 |

|

|

|

|

|

|

4. Credit Agreement |

26 |

|

|

|

|

|

|

5. Unsecured Debt |

26 |

|

|

|

|

|

|

6. Bilateral Contingent Letter of Credit Facility |

27 |

|

|

|

|

|

|

7. Lease Obligations |

27 |

|

|

|

|

|

I. |

The Debtors’ Employees |

28 |

|

|

|

|

|

J. |

Dynegy’s Board of Directors |

29 |

|

|

|

|

|

K. |

Dynegy’s Officers |

31 |

|

|

|

|

|

L. |

Material Prepetition Litigation |

32 |

|

|

|

|

|

M. |

Information on the Plan Proponents |

33 |

|

|

|

|

|

VII. SELECTED FINANCIAL INFORMATION |

33 | |

|

|

| |

|

VIII. FINANCIAL PROJECTIONS AND ASSUMPTIONS |

34 | |

|

|

| |

|

IX. THE REORGANIZATION CASES |

35 | |

|

|

| |

|

A. |

Commencement of the Chapter 11 Cases |

35 |

|

|

|

|

|

B. |

First Day Pleadings |

36 |

|

|

|

|

|

|

1. Joint Administration |

36 |

|

|

|

|

|

|

2. Case Management |

36 |

|

|

|

|

|

|

3. Extension of Deadline for Filing Schedules and Statements |

36 |

|

|

|

|

|

|

4. Retention of a Claims and Noticing Agent and Administrative Agent |

36 |

|

|

|

|

|

|

5. Limitation of Service |

36 |

|

|

|

|

|

|

6. Business Operations |

37 |

|

|

|

|

|

C. |

Representation of DH |

42 |

|

D. |

Formation and Representation of the Creditors’ Committee |

43 |

|

|

|

|

|

E. |

Interim Compensation and Reimbursement of Professional Persons and Committee Members |

43 |

|

|

|

|

|

F. |

Adversary Proceeding Filed by the Lease Indenture Trustee |

44 |

|

|

|

|

|

G. |

Request for Appointment of an Examiner |

44 |

|

|

|

|

|

H. |

Motion to Dismiss |

44 |

|

|

|

|

|

X. THE CHAPTER 11 PLAN |

45 | |

|

|

| |

|

A. |

Classification and Treatment of Claims and Equity Interests |

45 |

|

|

|

|

|

|

1. Unclassified Claims |

45 |

|

|

|

|

|

|

2. Classified Claims and Equity Interests |

45 |

|

|

|

|

|

B. |

Identification of Classes of Claims and Equity Interests as Impaired or Unimpaired |

46 |

|

|

|

|

|

|

1. Unimpaired Classes of Claims and Equity Interests |

46 |

|

|

|

|

|

|

2. Impaired Class of Claims |

46 |

|

|

|

|

|

|

3. Impairment Controversies |

46 |

|

|

|

|

|

C. |

Provisions for Treatment of Classified Claims and Equity Interests Under the Plan |

46 |

|

|

|

|

|

|

1. Class 1 — Priority Claims |

46 |

|

|

|

|

|

|

2. Class 2 — Secured Claims |

46 |

|

|

|

|

|

|

3. Class 3 — General Unsecured Claims |

47 |

|

|

|

|

|

|

4. Class 4 — Convenience Claims |

47 |

|

|

|

|

|

|

5. Class 5 — Equity Interests |

47 |

|

|

|

|

|

D. |

Provision for Treatment of Intercompany Claims |

47 |

|

|

|

|

|

E. |

Provisions for Treatment of Unclassified Claims Under the Plan |

47 |

|

|

|

|

|

|

1. Unclassified Claims |

47 |

|

|

|

|

|

F. |

Acceptance or Rejection of the Plan |

49 |

|

|

1. Class of Claims Entitled to Vote to Accept or Reject the Plan |

49 |

|

|

|

|

|

|

2. Classes of Claims and Equity Interests Deemed to Accept the Plan |

49 |

|

|

|

|

|

|

3. Class Acceptance Requirement |

49 |

|

|

|

|

|

G. |

Plan Settlement and Compromise |

50 |

|

|

|

|

|

H. |

Means for Implementation of the Plan |

51 |

|

|

|

|

|

|

1. Operations Between the Confirmation Date and the Effective Date |

51 |

|

|

|

|

|

|

2. Certain Intercompany Transactions on or About the Effective Date |

51 |

|

|

|

|

|

|

3. Corporate Action |

53 |

|

|

|

|

|

|

4. Allowance of Senior Notes Claims and Subordinated Notes Claims |

53 |

|

|

|

|

|

|

5. Adjustment to Amount of Plan Cash Payment and Principal Amount of Plan Secured Notes |

54 |

|

|

|

|

|

|

6. Plan Secured Notes Alternative Payment |

54 |

|

|

|

|

|

|

7. Establishment of Claims Purchasing Fund |

55 |

|

|

|

|

|

|

8. Termination of Certain Debt Obligations |

55 |

|

|

|

|

|

|

9. Causes of Action |

55 |

|

|

|

|

|

|

10. Appointment of the Disbursing Agent |

56 |

|

|

|

|

|

|

11. Sources of Cash for Plan Distributions |

56 |

|

|

|

|

|

|

12. Investment of Funds Held by the Disbursing Agent; Tax Reporting by the Disbursing Agent |

56 |

|

|

|

|

|

|

13. Releases by DH, its non-Debtor Affiliates, the Estate and the Plan Proponents |

56 |

|

|

|

|

|

|

14. Releases by Creditors |

57 |

|

|

|

|

|

I. |

Description of Certain Securities to Be Issued Pursuant to the Plan |

57 |

|

|

|

|

|

|

1. Plan Secured Notes |

57 |

|

|

|

|

|

|

2. Plan Preferred Stock |

63 |

|

|

|

|

|

J. |

The Plan Trust |

66 |

|

|

1. Creation of the Plan Trust and the Appointment of the Plan Trust Administrator |

66 |

|

|

|

|

|

|

2. Property of the Plan Trust |

66 |

|

|

|

|

|

|

3. Powers and Duties of the Plan Trust Administrator |

66 |

|

|

|

|

|

K. |

Plan Distribution Provisions |

67 |

|

|

|

|

|

|

1. Plan Distributions |

67 |

|

|

|

|

|

|

2. Timing of Plan Distributions |

67 |

|

|

|

|

|

|

3. Address for Delivery of Plan Distributions/Unclaimed Plan Distributions |

67 |

|

|

|

|

|

|

4. De Minimis Plan Distributions |

68 |

|

|

|

|

|

|

5. Time Bar to Cash Payments |

68 |

|

|

|

|

|

|

6. Manner of Payment Under the Plan |

68 |

|

|

|

|

|

|

7. Fractional Plan Distributions |

68 |

|

|

|

|

|

|

8. Special Distribution Provisions Concerning the Prepetition Notes Claims |

69 |

|

|

|

|

|

|

9. Reserve for Contested Claims |

70 |

|

|

|

|

|

|

10. Surrender and Cancellation of Instruments |

70 |

|

|

|

|

|

L. |

Procedures for Resolving and Treating Contested Claims |

70 |

|

|

|

|

|

|

1. Claim Objection Deadline |

70 |

|

|

|

|

|

|

2. Prosecution of Contested Claims |

70 |

|

|

|

|

|

|

3. Settlement of Claims and Causes of Action |

71 |

|

|

|

|

|

|

4. Entitlement to Plan Distributions Upon Allowance |

71 |

|

|

|

|

|

|

5. Estimation of Claims |

71 |

|

|

|

|

|

M. |

Conditions Precedent to Confirmation of the Plan and the Occurrence of the Effective Date |

71 |

|

|

|

|

|

|

1. Conditions Precedent to Confirmation |

71 |

|

|

|

|

|

|

2. Conditions Precedent to the Occurrence of the Effective Date |

72 |

|

|

3. Waiver of Conditions |

73 |

|

|

|

|

|

|

4. Effect of Non-Occurrence of the Effective Date |

74 |

|

|

|

|

|

N. |

The Disbursing Agent |

74 |

|

|

|

|

|

|

1. Powers and Duties of the Disbursing Agent |

74 |

|

|

|

|

|

|

2. Plan Distributions |

74 |

|

|

|

|

|

|

3. Exculpation of the Disbursing Agent |

74 |

|

|

|

|

|

O. |

Treatment of Executory Contracts and Unexpired Leases |

75 |

|

|

|

|

|

|

1. Assumption and Rejection of Executory Contracts and Unexpired Leases |

75 |

|

|

|

|

|

|

2. Cure |

76 |

|

|

|

|

|

|

3. Claims Arising from Rejection, Expiration or Termination |

77 |

|

|

|

|

|

P. |

Retention of Jurisdiction |

77 |

|

|

|

|

|

Q. |

Miscellaneous Provisions |

79 |

|

|

|

|

|

|

1. Substantial Consummation |

79 |

|

|

|

|

|

|

2. Payment of Statutory Fees |

79 |

|

|

|

|

|

|

3. Satisfaction of Claims |

79 |

|

|

|

|

|

|

4. Special Provisions Regarding Insured Claims |

79 |

|

|

|

|

|

|

5. Third Party Agreements; Subordination |

79 |

|

|

|

|

|

|

6. Exculpation |

80 |

|

|

|

|

|

|

7. Discharge of DH |

80 |

|

|

|

|

|

|

8. Notices |

81 |

|

|

|

|

|

|

9. Headings |

82 |

|

|

|

|

|

|

10. Governing Law |

82 |

|

|

|

|

|

|

11. Expedited Determination |

82 |

|

|

|

|

|

|

12. Exemption from Transfer Taxes |

82 |

|

|

|

|

|

|

13. Exemption from Registration |

83 |

|

|

14. Notice of Entry of Confirmation Order and Relevant Dates |

83 |

|

|

|

|

|

|

15. Interest and Attorneys’ Fees |

83 |

|

|

|

|

|

|

16. Modification of the Plan |

83 |

|

|

|

|

|

|

17. Revocation of the Plan |

83 |

|

|

|

|

|

|

18. Corrective Action |

84 |

|

|

|

|

|

|

19. Setoff Rights |

84 |

|

|

|

|

|

|

20. Compliance with Tax Requirements |

84 |

|

|

|

|

|

|

21. Rates |

85 |

|

|

|

|

|

|

22. Injunctions |

85 |

|

|

|

|

|

|

23. Binding Effect |

86 |

|

|

|

|

|

|

24. Successors and Assigns |

86 |

|

|

|

|

|

|

25. Severability |

86 |

|

|

|

|

|

|

26. No Admissions |

86 |

|

|

|

|

|

XI. RISK FACTORS |

87 | |

|

|

| |

|

A. |

General Considerations |

87 |

|

|

|

|

|

B. |

Certain Bankruptcy Considerations |

87 |

|

|

|

|

|

C. |

Claims Estimation Considerations |

88 |

|

|

|

|

|

D. |

Risks Related to the Plan Securities |

89 |

|

|

|

|

|

E. |

Disclosure Statement Disclaimer |

96 |

|

|

|

|

|

F. |

Forward Looking Statements |

98 |

|

|

|

|

|

XII. CONFIRMATION AND CONSUMMATION PROCEDURES |

100 | |

|

|

| |

|

A. |

Overview |

100 |

|

|

|

|

|

B. |

Confirmation of the Plan |

101 |

|

|

|

|

|

|

1. Elements of Section 1129 of the Bankruptcy Code |

101 |

|

|

|

|

|

|

2. Acceptance |

103 |

|

|

3. Best Interests of Creditors Test |

103 |

|

|

|

|

|

|

4. Feasibility |

104 |

|

|

|

|

|

C. |

Effect of Confirmation |

104 |

|

|

|

|

|

XIII. SECURITIES LAW MATTERS |

105 | |

|

|

| |

|

A. |

Issuance of Plan Securities |

105 |

|

|

|

|

|

B. |

Subsequent Transfers of Plan Securities |

105 |

|

|

|

|

|

C. |

Delivery of Disclosure Statement |

106 |

|

|

|

|

|

XIV. CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES |

107 | |

|

|

| |

|

A. |

General |

107 |

|

|

|

|

|

B. |

Tax Consequences to Holders of Class 3 — General Unsecured Claims |

108 |

|

|

|

|

|

|

1. U.S. Holders |

108 |

|

|

|

|

|

|

2. Non-U.S. Holders |

109 |

|

|

|

|

|

C. |

Tax Consequences to Holders of Claims other than Class 3 — General Unsecured Claims |

110 |

|

|

|

|

|

D. |

Tax Consequences to Dynegy, DH and DNE Upon Consummation of the Plan |

110 |

|

|

|

|

|

|

1. In General |

110 |

|

|

|

|

|

|

2. Cancellation of Indebtedness |

111 |

|

|

|

|

|

|

3. Section 382 Limitation on Net Operating Losses |

112 |

|

|

|

|

|

|

4. Accrued Interest |

114 |

|

|

|

|

|

|

5. Federal Alternative Minimum Tax |

114 |

|

|

|

|

|

|

6. Wortheless Stock Deduction Upon Contribution of DNE to Plan Trust |

115 |

|

|

|

|

|

E. |

Taxation of Plan Securities |

115 |

|

|

|

|

|

|

1. Issue Price of Plan Secured Notes and Plan Preferred Stock |

115 |

|

|

|

|

|

|

2. Taxation of Plan Secured Notes |

115 |

|

|

3. Taxation of Plan Preferred Stock |

119 |

|

|

|

|

|

F. |

Information Reporting and Backup Withholding |

123 |

|

|

|

|

|

XV. ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN |

124 | |

|

|

| |

|

A. |

Liquidation Under Chapter 7 of the Bankruptcy Code |

124 |

|

|

|

|

|

B. |

Alternative Plans of Reorganization |

125 |

|

|

|

|

|

XVI. CONCLUSION |

126 | |

SCHEDULES AND EXHIBITS

|

List of Defined Terms |

Schedule 1 |

|

|

|

|

*Chapter 11 Plan of Reorganization |

Exhibit “A” |

|

|

|

|

**Disclosure Statement Order |

Exhibit “B” |

|

|

|

|

**Selected Financial Information |

Exhibit “C” |

|

|

|

|

**Projections |

Exhibit “D” |

|

|

|

|

**Liquidation Analysis |

Exhibit “E” |

* Included as Exhibit 99.1 to the Current Report on Form 8-K filed December 2, 2011.

** Exhibits not included in the Current Report on Form 8-K filed December 2, 2011, such Exhibits will be filed with the Bankruptcy Court at a later date not yet determined.

I.

INTRODUCTION

THIS DISCLOSURE STATEMENT RELATES TO A PLAN FOR DYNEGY HOLDINGS, LLC ONLY, AND NOT THE OTHER DEBTORS (DYNEGY NORTHEAST GENERATION, INC., HUDSON POWER, L.L.C., DYNEGY DANSKAMMER, L.L.C., AND DYNEGY ROSETON, L.L.C.) IN THESE CHAPTER 11 CASES.

All capitalized terms used in this Disclosure Statement but not defined in this Disclosure Statement shall have the meaning ascribed to them in the Plan (see Exhibit “A” to the Plan, Glossary of Defined Terms). For ease of reference, all terms defined in this Disclosure Statement are listed on Schedule 1 hereto with reference to the page number where the term is defined. Unless otherwise stated, all references herein to “Schedules” and “Exhibits” are references to schedules and exhibits to this Disclosure Statement, respectively.

BY ORDER DATED (THE “DISCLOSURE STATEMENT ORDER”), THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF NEW YORK (THE “BANKRUPTCY COURT”) APPROVED THE DISCLOSURE STATEMENT RELATING TO THE CHAPTER 11 PLAN OF REORGANIZATION FOR DYNEGY HOLDINGS, LLC (“DH”) PROPOSED BY DH AND DYNEGY INC. (“DYNEGY” AND TOGETHER WITH DH, THE “PLAN PROPONENTS”). THIS DISCLOSURE STATEMENT INCLUDES AND DESCRIBES THE CHAPTER 11 PLAN OF REORGANIZATION FOR DYNEGY HOLDINGS, LLC PROPOSED BY DYNEGY HOLDINGS, LLC AND DYNEGY INC., DATED DECEMBER 1, 2011 (THE “PLAN”), A COPY OF WHICH IS ATTACHED HERETO AS EXHIBIT “A.” PURSUANT TO THE PLAN, CLASS 1 — PRIORITY CLAIMS, CLASS 2 — SECURED CLAIMS, CLASS 4 — CONVENIENCE CLAIMS AND CLASS 5 — EQUITY INTERESTS ARE UNIMPAIRED AND ARE THEREFORE DEEMED TO HAVE ACCEPTED THE PLAN. ACCORDINGLY, THE PLAN PROPONENTS ARE ONLY SOLICITING ACCEPTANCES OF THE PLAN FROM THE HOLDERS OF CLASS 3 — GENERAL UNSECURED CLAIMS.

THE PLAN IS THE PRODUCT OF EXTENSIVE NEGOTIATIONS BETWEEN AND AMONG, AND IS SUPPORTED BY, THE PLAN PROPONENTS AND AN AD HOC GROUP OF HOLDERS OF APPROXIMATELY $1.4 BILLION OF SENIOR NOTES (THE “CONSENTING NOTEHOLDERS”). THE PLAN PROPONENTS AND THE CONSENTING NOTEHOLDERS BELIEVE THAT THE PLAN IS IN THE BEST INTEREST OF AND PROVIDES THE HIGHEST AND MOST EXPEDITIOUS RECOVERIES AVAILABLE TO ALL HOLDERS OF CLAIMS, INCLUDING HOLDERS OF CLASS 3 — GENERAL UNSECURED CLAIMS. ALL HOLDERS OF CLASS 3 — GENERAL UNSECURED CLAIMS ARE URGED TO VOTE IN FAVOR OF THE PLAN.

VOTING INSTRUCTIONS ARE CONTAINED IN THE DISCLOSURE STATEMENT ORDER, A TRUE AND CORRECT COPY OF WHICH IS ATTACHED HERETO AS

EXHIBIT “B.” IN ADDITION, THE SOLICITATION PACKAGE ACCOMPANYING EACH OF THE BALLOTS CONTAINS APPLICABLE VOTING INSTRUCTIONS. TO BE COUNTED, YOUR BALLOT MUST BE DULY COMPLETED, EXECUTED AND ACTUALLY RECEIVED BY 5:00 P.M. (PREVAILING EASTERN TIME), ON , 2012 (THE “VOTING DEADLINE”).

II.

NOTICE TO HOLDERS OF CLAIMS

The purpose of this Disclosure Statement is to enable each holder of a Claim that is impaired under the Plan to make an informed decision in exercising its right to vote on the Plan. More information on voting on the Plan is contained in this Disclosure Statement in the article entitled “Confirmation and Consummation Procedures.”

THIS DISCLOSURE STATEMENT CONTAINS IMPORTANT INFORMATION THAT MAY BEAR UPON YOUR DECISION TO ACCEPT OR REJECT THE PLAN. PLEASE READ THIS DOCUMENT WITH CARE.

PLAN SUMMARIES AND STATEMENTS MADE IN THIS DISCLOSURE STATEMENT ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCE TO THE PLAN AND THE EXHIBITS ANNEXED TO THE PLAN AND TO THE EXHIBITS AND SCHEDULES ANNEXED TO THIS DISCLOSURE STATEMENT. THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE ONLY AS OF THE DATE HEREOF, AND THERE CAN BE NO ASSURANCE THAT THE STATEMENTS CONTAINED HEREIN WILL BE CORRECT AT ANY TIME AFTER THE DATE HEREOF. IN THE EVENT OF ANY CONFLICT BETWEEN THE DESCRIPTIONS SET FORTH IN THIS DISCLOSURE STATEMENT AND THE TERMS OF THE PLAN, THE TERMS OF THE PLAN SHALL GOVERN.

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND RULE 3016(b) OF THE FEDERAL RULES OF BANKRUPTCY PROCEDURE (THE “BANKRUPTCY RULES”) AND NOT NECESSARILY IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAW OR OTHER NON-BANKRUPTCY LAW. THIS DISCLOSURE STATEMENT HAS NEITHER BEEN APPROVED NOR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”), NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THE STATEMENTS CONTAINED HEREIN. PERSONS OR ENTITIES TRADING IN OR OTHERWISE PURCHASING, SELLING OR TRANSFERRING SECURITIES OR CLAIMS OF PLAN PROPONENTS OR ANY OF THEIR SUBSIDIARIES OR AFFILIATES SHOULD EVALUATE THIS DISCLOSURE STATEMENT AND THE PLAN IN LIGHT OF THE PURPOSE FOR WHICH THEY WERE PREPARED.

AS TO CONTESTED MATTERS, ADVERSARY PROCEEDINGS AND OTHER ACTIONS OR THREATENED ACTIONS, THIS DISCLOSURE STATEMENT SHALL NOT CONSTITUTE OR BE CONSTRUED AS AN ADMISSION OF ANY FACT OR

LIABILITY, STIPULATION, OR WAIVER, BUT RATHER AS A STATEMENT MADE IN SETTLEMENT NEGOTIATIONS SUBJECT TO RULE 408 OF THE FEDERAL RULES OF EVIDENCE AND OTHER SIMILAR RULES. ACCORDINGLY, THIS DISCLOSURE STATEMENT SHALL NOT BE ADMISSIBLE IN ANY NON-BANKRUPTCY PROCEEDING NOR SHALL IT BE CONSTRUED TO BE CONCLUSIVE ADVICE ON THE TAX, SECURITIES, OR OTHER LEGAL EFFECTS OF THE PLAN AS TO HOLDERS OF CLAIMS AGAINST, OR EQUITY INTERESTS IN, DH OR ANY OF ITS SUBSIDIARIES OR AFFILIATES.

On , 2012 after notice and a hearing, the Bankruptcy Court entered the Disclosure Statement Order pursuant to section 1125 of the Bankruptcy Code, finding that this Disclosure Statement contains information of a kind, and in sufficient detail, adequate to enable a hypothetical, reasonable investor typical of the solicited holders of Claims against DH to make an informed judgment with respect to the acceptance or rejection of the Plan. APPROVAL OF THIS DISCLOSURE STATEMENT BY THE BANKRUPTCY COURT DOES NOT CONSTITUTE A DETERMINATION BY THE BANKRUPTCY COURT OF THE FAIRNESS OR MERITS OF THE PLAN OR OF THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT.

Each holder of a Claim entitled to vote to accept or reject the Plan should read each of this Disclosure Statement and the Plan in its entirety before voting. No solicitation of votes to accept or reject the Plan may be made except pursuant to this Disclosure Statement and section 1125 of the Bankruptcy Code. Except for the Plan Proponents and certain of the professionals they have retained, no person has been authorized to use or promulgate any information concerning DH, its businesses, or the Plan other than the information contained in this Disclosure Statement, and if other information is given or made, such information may not be relied upon as having been authorized by the Plan Proponents. YOU SHOULD NOT RELY ON ANY INFORMATION RELATING TO DH, ITS BUSINESSES OR THE PLAN OTHER THAN THAT CONTAINED IN THIS DISCLOSURE STATEMENT AND THE SCHEDULES AND EXHIBITS ANNEXED HERETO.

After carefully reviewing this Disclosure Statement, including the attached Schedules and Exhibits, please indicate your acceptance or rejection of the Plan by voting in favor of or against the Plan on the enclosed ballot, and return the completed ballot to the address set forth on the ballot in the enclosed postage prepaid return envelope so that it will be actually received by Epiq Bankruptcy Solutions, LLC (“Epiq” or the “Solicitation Agent” or the “Claims Agent,” as applicable), no later than the Voting Deadline. All votes to accept or reject the Plan must be cast by using the appropriate ballot. Votes which are cast in any other manner will not be counted. All ballots must be actually received by the Solicitation Agent no later than the Voting Deadline: , 2012 at 5:00 p.m., Prevailing Eastern Time. For detailed voting instructions and the name, address and phone number of the person you may contact if you have questions regarding the voting procedures, see the Disclosure Statement Order attached hereto as Exhibit “B.”

DO NOT RETURN ANY OTHER DOCUMENTS WITH YOUR BALLOT.

You will be bound by the Plan if it is accepted by the requisite holders of Claims and confirmed by the Bankruptcy Court, even if you do not vote to accept the Plan or if you are the holder of an unimpaired Claim or Equity Interest that is not entitled to vote on the Plan. The Consenting Noteholders, which hold in the aggregate approximately $1.4 billion of the $3.37 billion of Senior Notes included in Class 3 — General Unsecured Claims, have agreed to vote to accept the Plan. See “General Information — Restructuring Support Agreement.” Class 3 — General Unsecured Claims will have accepted the Plan if the holders of at least two-thirds in amount and more than one-half in number of the Claims entitled to vote and actually voting in such class have accepted the Plan. See “Confirmation and Consummation Procedures.” Further information concerning the minimum thresholds required to constitute acceptance of the Plan for the purposes of confirmation is contained in Article XII herein entitled “Confirmation and Consummation Procedures.”

Pursuant to section 1128 of the Bankruptcy Code, the Bankruptcy Court has scheduled a hearing to consider confirmation of the Plan (the “Confirmation Hearing”) on , 2012, at .m., Prevailing Eastern Time, before the Honorable Cecelia G. Morris, United States Bankruptcy Judge. The Bankruptcy Court has directed that objections, if any, to confirmation of the Plan be filed and served on or before , 2012, in the manner described in the Disclosure Statement Order attached hereto as Exhibit “B.”

THE PLAN PROPONENTS AND THE CONSENTING NOTEHOLDERS URGE ALL HOLDERS OF CLASS 3 — GENERAL UNSECURED CLAIMS TO ACCEPT THE PLAN.

III.

ADDITIONAL INFORMATION AND INCORPORATION BY REFERENCE

Dynegy and DH have filed annual and quarterly reports and other information with the SEC. Holders of Claims entitled to vote on the Plan may read and copy any reports, statements and other information that Dynegy and DH file at the SEC’s public reference room located at 100 F Street, NE, Washington, D.C. 20549 and request copies of the documents, upon payment of a duplicating fee, by writing the Public Reference Section of the SEC. Please call 1-800-SEC-0330 for further information on the public reference rooms. Dynegy’s and DH’s filings will also be available to the public from commercial document retrieval services and at the web site maintained by the SEC at http://www.sec.gov. The reports that Dynegy and DH file are also available free of charge on Dynegy’s website at http://www.dynegy.com. Information on Dynegy’s website does not constitute part of this Disclosure Statement, is not incorporated by reference in this Disclosure Statement and should not be relied upon in connection with making any decision with respect to voting for the Plan.

The Plan Proponents “incorporate by reference” information into this Disclosure Statement. This means the Plan Proponents disclose important information to the holders of Claims entitled to vote on the Plan by referring such holders to another document filed separately

with the SEC. The information in the documents incorporated by reference is considered to be part of this Disclosure Statement, and information in documents that Dynegy and DH file later with the SEC will automatically update and supersede this information. The Plan Proponents incorporate by reference the documents listed below filed by Dynegy and DH under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These documents contain important information about them and their financial condition.

· Annual Report on Form 10-K of Dynegy and DH for the fiscal year ended December 31, 2010;

· Quarterly Reports on Form 10-Q of Dynegy and DH for the periods ended March 31, 2011 and June 30, 2011;

· Quarterly Report on Form 10-Q of Dynegy for the period ended September 30, 2011;

· Current Reports on Form 8-K or 8-K/A of Dynegy and DH filed on January 25, 2011, January 26, 2011, February 8, 2011, February 11, 2011, February 14, 2011, February 23, 2011, March 1, 2011, April 11, 2011, June 10, 2011, June 21, 2011, June 28, 2011, July 11, 2011, August 1, 2011, August 26, 2011, September 12, 2011, September 26, 2011, October 14, 2011, November 2, 2011 and November 8, 2011 (to the extent such reports are filed);

· Current Reports on Form 8-K or 8-K/A of Dynegy filed on March 10, 2011, March 22, 2011, May 5, 2011, November 14, 2011, November 17, 2011 and November 22, 2011 (to the extent such reports are filed);

· Current Report on Form 8-K of DH filed on September 8, 2011; and

· Definitive Proxy Statement on Schedule 14A of Dynegy filed April 29, 2011.

Holders of Claims entitled to vote on the Plan can also obtain from the Plan Proponents, as applicable, without charge, copies of any document incorporated by reference in this Disclosure Statement, excluding exhibits (unless the exhibit is specifically incorporated by reference into the information that this Disclosure Statement incorporates, in which case the Plan Proponents may charge a nominal fee to cover its expenses) by requesting such materials in writing or by telephone from Dynegy at:

Dynegy Inc.

Attention: Investor Relations

1000 Louisiana Street, Suite 5800

Houston, Texas 77002

(713) 507-6400

IV.

SUMMARY EXPLANATION OF CHAPTER 11

A. Overview of Chapter 11

Chapter 11 is the principal reorganization chapter of the Bankruptcy Code pursuant to which a debtor may reorganize its business for the benefit of its creditors, equity interest holders,

and other parties in interest. DH and certain of its direct and indirect subsidiaries (the “Debtors”)(1) commenced the Chapter 11 Cases with the filing of petitions for voluntary protection under chapter 11 of the Bankruptcy Code on November 7, 2011. By order of the Bankruptcy Court, the Chapter 11 Cases have been consolidated for procedural purposes only and are being jointly administered under Case No. 11-38111 (CGM).

The commencement of a chapter 11 case creates an estate comprising all of the legal and equitable interests of a debtor as of the date the petition is filed. Sections 1101, 1107, and 1108 of the Bankruptcy Code provide that a debtor may continue to operate its business and remain in possession of its property as a “debtor in possession” unless the bankruptcy court orders the appointment of a trustee. In the Chapter 11 Cases, DH and each of the other Debtors remain in possession of their property and continue to operate their businesses as debtors in possession.

The filing of a chapter 11 petition triggers the automatic stay provisions of the Bankruptcy Code. Section 362 of the Bankruptcy Code provides, among other things, for an automatic stay of all actions against a debtor on account of prepetition claims against it and various other forms of interference with a debtor’s property or business. Exempted from the automatic stay are, among other things, actions by governmental authorities seeking to exercise police or regulatory powers. Except as otherwise ordered by the bankruptcy court administering a chapter 11 case, the automatic stay remains in full force and effect until the effective date of a confirmed plan of reorganization.

The formulation and ultimate consummation of a plan of reorganization is the principal purpose of a chapter 11 case. The plan sets forth the means for satisfying claims against and interests in a debtor’s estate. Unless a trustee is appointed, only a debtor may file a plan during the first 120 days of a chapter 11 case (the “Exclusive Filing Period”), and the debtor will have 180 days to solicit acceptance of such plan (the “Exclusive Solicitation Period”). However, section 1121(d) of the Bankruptcy Code permits the bankruptcy court to extend or reduce the Exclusive Filing Period and Exclusive Solicitation Period upon a showing of “cause.” The Exclusive Filing Period and Exclusive Solicitation Period may not be extended beyond 18 months and 20 months, respectively, from the Petition Date. The Plan was filed within the Exclusive Filing Period. To the extent that DH believes it may be unable to secure acceptance of the Plan within the Exclusive Solicitation Period, DH may seek to extend that period. So long as the Exclusive Solicitation Period continues, and so long as no trustee is appointed in the Chapter 11 Case of DH, only DH (or Persons authorized by DH) shall be entitled to file and solicit a plan of reorganization.

B. Plan of Reorganization

Although referred to simply as a plan of reorganization, a plan may provide for anything from a comprehensive restructuring of a debtor’s business and its related obligations to a simple liquidation of a debtor’s assets. In either event, upon confirmation of a plan, the plan becomes binding on the debtor and all of its creditors and equity holders, and the prior obligations owed by the debtor to such parties are compromised and exchanged for the obligations specified in the

(1) The Debtors are Dynegy Holdings, LLC; Dynegy Northeast Generation, Inc.; Hudson Power, L.L.C. Dynegy Danskammer, L.L.C.; and Dynegy Roseton, L.L.C.

plan. For a description of key components of the Plan, refer to the article of this Disclosure Statement entitled “Overview of the Plan.”

After a plan of reorganization has been filed, the holders of impaired claims against and equity interests in a debtor are permitted to vote to accept or reject the plan. Before soliciting acceptances of the proposed plan, section 1125 of the Bankruptcy Code requires the debtor to prepare and file a disclosure statement containing adequate information of a kind, and in sufficient detail, to enable a hypothetical reasonable investor to make an informed judgment about the plan. This Disclosure Statement is presented to holders of Claims against DH to satisfy the requirements of section 1125 of the Bankruptcy Code in connection with the Plan Proponents’ solicitation of votes on the Plan.

C. Confirmation of a Plan of Reorganization

If all classes of claims and equity interests accept a plan of reorganization, the bankruptcy court may confirm the plan if the bankruptcy court independently determines that the requirements of section 1129(a) of the Bankruptcy Code have been satisfied. These requirements are discussed in this Disclosure Statement in the article entitled “Confirmation and Consummation Procedures.” The Plan Proponents believe that the Plan satisfies all the applicable requirements of section 1129(a) of the Bankruptcy Code.

Chapter 11 of the Bankruptcy Code does not require that each holder of a claim or interest in a particular class vote in favor of a plan for the bankruptcy court to determine that the class has accepted the plan. Further information concerning minimum thresholds required to constitute acceptance of the Plan for the purposes of confirmation is contained in this Disclosure Statement in the article entitled “Confirmation and Consummation Procedures.”

Classes of claims or equity interests that are not “impaired” under a plan of reorganization are conclusively presumed to have accepted the plan and thus are not entitled to vote. Thus, acceptances of a plan will generally be solicited only from those persons who hold claims or equity interests in an impaired class. Under the Plan, Class 1 — Priority Claims, Class 2 — Secured Claims, Class 4 — Convenience Claims, and Class 5 — Equity Interests are unimpaired classes and Class 3 — General Unsecured Claims is the only impaired class. Accordingly, only holders of Class 3 — General Unsecured Claims are entitled to vote on the Plan.

V.

OVERVIEW OF THE PLAN

The following is an overview of the Plan. It is qualified in its entirety by reference to the full text of the Plan, which is attached to this Disclosure Statement as Exhibit “A.” In addition, for a more detailed description of the terms and provisions of the Plan, refer to the article of this Disclosure Statement entitled “The Chapter 11 Plan.”

As noted above, this is a plan of reorganization for DH only, and not the other Debtors in these Chapter 11 Cases. The Plan provides for the treatment of Claims against and Equity Interests in DH. It further provides for the settlement of all Claims and Causes of Action arising from or related to the Prepetition Restructurings, including the Prepetition Lawsuits. As part of

this settlement, Dynegy will provide substantial consideration under the Plan, consisting of Cash, the Plan Secured Notes, and the Plan Preferred Stock, all as described more fully below. Such consideration shall provide significant recoveries to holders of Claims against DH, including certain of those Persons who are plaintiffs in the Prepetition Lawsuits. As such, if the Plan is confirmed and the Effective Date occurs, for and in consideration of the undertakings and other agreements of Dynegy under and in connection with the Plan, all Claims and Causes of Action arising from or related to the Prepetition Restructurings, including the Prepetition Lawsuits, will be released and permanently and forever stayed, restrained and enjoined.

The Plan Proponents believe that the settlement and compromise proposed in the Plan and the resulting treatment provided under the Plan to holders of Claims against DH offer the best alternative to DH and its stakeholders.

Accordingly, the Plan Proponents urge holders of Class 3 — General Unsecured Claims to vote to accept the Plan. The Consenting Noteholders, which hold in the aggregate approximately $1.4 billion of the $3.37 billion of Senior Notes included in Class 3 — General Unsecured Claims, have agreed to vote to accept the Plan. See “General Information — Restructuring Support Agreement.” Class 3 — General Unsecured Claims will have accepted the Plan if the holders of at least two-thirds in amount and more than one-half in number of the Claims entitled to vote and actually voting in such class have accepted the Plan. See “Confirmation and Consummation Procedures.”

A. Summary of the Terms of the Plan

The Plan is built around the following key elements, which are qualified in their entirety by reference to the full text of the Plan.

· The Plan Settlement:(2)

· Dynegy shall issue to DH for the benefit of holders of Allowed General Unsecured Claims against DH, in accordance with and pursuant to the Plan, (i) the Plan Cash Payment, (ii) the Plan Preferred Stock, and (iii) either (A) the Plan Secured Notes or (B), in lieu of the Plan Secured Notes, the Plan Secured Notes Alternative Payment; and DH shall thereafter cause such property to be distributed to the holders of Allowed General Unsecured Claims in accordance with and pursuant to the Plan.

(2) As discussed herein and in the Plan, to implement the settlement and compromise in the most efficient manner, Dynegy will form a wholly-owned direct subsidiary, New DH, as a Delaware corporation, which will then form a wholly-owned direct subsidiary, Legacy DH, as a Delaware limited liability company. Dynegy will contribute to New DH its 100% equity interest in DH, and DH will then merge with Legacy DH, with Legacy DH as the surviving entity. Substantially all of the assets of Legacy DH will then be transferred to New DH. The equity interests in Legacy DH will then be transferred to the Plan Trust, which will be administered by the Plan Trust Administrator.

· Dynegy and DH shall cause Dynegy Gas Investments, LLC (“DGIN”) to cancel the DH Note and deem such DH Note fully satisfied and extinguished;

· Legacy DH (as successor to DH) and Dynegy shall cancel the Undertaking Agreement and Dynegy’s obligations under such Undertaking Agreement shall be deemed to be fully satisfied and extinguished;

· Legacy DH (as successor to DH) shall transfer to New DH (a newly formed, wholly-owned subsidiary of Dynegy) 100% of the equity interests in DGIN;

· DH, its non-Debtor Affiliates, its Estate, and the Plan Proponents shall release, and be deemed to have released, all Claims and Causes of Action of the types described in Section 8.13 of the Plan against all persons and entities referenced in such Section 8.13 of the Plan; and

· Holders of Claims or Causes of Action arising from or related to the Prepetition Restructurings, including the Prepetition Lawsuits, shall be enjoined from taking any action in respect of or on account of such Claims or Causes of Action against DH and all successors thereto, Dynegy or its non-Debtor Affiliates, or any of their current or former respective members, equity holders, directors, managers, officers, employees, agents, and professionals, successors and assigns or their respective assets and property.

· Treatment afforded Class 3 — General Unsecured Claims under the Plan:

· Class 3 — General Unsecured Claims shall consist of all General Unsecured Claims against DH, which specifically includes all Senior Notes Claims, Subordinated Notes Claims, and Lease Guaranty Claims.

· Except to the extent that a holder of an Allowed General Unsecured Claim against DH and the Plan Proponents agree on less favorable treatment for such holder, each holder of an Allowed General Unsecured Claim against DH shall receive, on the Effective Date, a Pro Rata Share of (i) the Plan Cash Payment, (ii) the Plan Preferred Stock, and (iii) at the sole option of Dynegy, in its capacity as a Plan Proponent, either (a) the Plan Secured Notes or (b) the Plan Secured Notes Alternative Payment.

· The Plan Cash Payment is a Cash payment to be provided by Dynegy in the amount of $400 million, subject to adjustment as set forth in Section 8.5 of the Plan and described below, plus an amount equal to the interest that would have accrued on $1 billion aggregate principal amount of Plan Secured Notes had such Plan Secured Notes been issued on the Petition Date.

· The Plan Secured Notes will be 11% Senior Secured Notes due 2018 issued by Dynegy in the aggregate principal amount of $1 billion, subject to adjustment as set forth in Sections 8.5 and 12.3 of the Plan, which Plan Secured Notes shall, subject to certain exceptions and permitted liens, be secured by (i) a first-priority security interest on the Plan Secured Notes Debt Service Account and all of the presently-owned and after-acquired assets of the direct and indirect wholly-owned subsidiaries of Dynegy (excluding (a) Dynegy Gas Investments Holdings, LLC and Dynegy Coal Investments Holdings, LLC and their respective subsidiaries, (b) DH (except for the equity interests in DGIN covered in clause (ii) below) and (c) Dynegy Northeast Generation, Inc. (“DNE”) and its direct and indirect subsidiaries); and (ii) a first-priority pledge of the equity interests in each of the direct and indirect subsidiaries of Dynegy, including Dynegy Gas HoldCo, LLC, Dynegy Coal HoldCo, LLC, Dynegy Gas Investments Holdings, LLC and Dynegy Coal Investments Holdings, LLC (but excluding (a) each of the Ring-Fenced Entities (as defined in the “Description of the New Secured Notes” attached to the Plan as Exhibit “C” (the “Notes Description”) that are direct and indirect subsidiaries of Dynegy Gas Investments Holdings, LLC and Dynegy Coal Investments Holdings, LLC and (b) DNE and its direct and indirect subsidiaries.

· Pursuant to Sections 12.2 and 12.3 of the Plan, the effectiveness of the Plan is conditioned on the satisfaction or waiver of certain conditions precedent to the Effective Date, including, among other things, that the Lease Guaranty Claims are Allowed or estimated in an aggregate amount that does not exceed $300 million. If the Lease Guaranty Claims are Allowed or estimated as set forth in the Plan in an aggregate amount that is less than $300 million, the aggregate principal amount of Plan Secured Notes to be issued pursuant to the Plan shall be reduced by an amount to be determined for every dollar such Lease Guaranty Claims are less than $300 million. If the Lease Guaranty Claims are Allowed or estimated as set forth in the Plan in an aggregate amount that exceeds $300 million and the condition precedent to the occurrence of the Effective Date described in this paragraph is waived in accordance with the terms of the Plan, the aggregate principal amount of Plan Secured Notes to be issued pursuant to the Plan shall be increased by an amount to be determined for every dollar such Lease Guaranty Claims exceed $300 million. The adjustment amounts left to be determined shall be (i) an amount that is the same for an increase or decrease in the aggregate principal amount of Plan Secured Notes, (ii) agreed to among the Plan Proponents and Requisite Consenting Noteholders, and (iii) identified in a Plan Document to be filed with the Bankruptcy Court not less than ten (10) days prior to the Plan Objection Deadline.

· Pursuant to Section 8.5 of the Plan, the aggregate amount of the Plan Cash Payment to be issued is subject to increase, with a corresponding dollar-for-dollar reduction in the aggregate principal amount of the Plan Secured Notes to be issued on the Effective Date, by the amount of Cash held by DH and certain of its Affiliates in excess of the sum of (i) $200 million (including, for this purpose, any funds in the Plan Secured Notes Debt Service Account, but excluding, for this purpose, the Plan Cash Payment) and (ii) any Cash reserved in an amount agreed to by the Plan Proponents and the Requisite Consenting Noteholders to pay (on the Effective Date, or thereafter as contemplated by the Plan) Allowed Administrative Claims and other Allowed Claims pursuant to and in accordance with the Plan and to fund the Plan Trust.

· The Plan Secured Notes Alternative Payment may be issued by Dynegy, at its sole option, in lieu of issuing the Plan Secured Notes, and shall be a Cash payment in an amount equal to the aggregate principal amount of the Plan Secured Notes that would have been issued, after applicable adjustments pursuant to Section 12.3 of the Plan.

· The Plan Preferred Stock will be Redeemable Convertible Preferred Shares, par value $0.01 per share, issued by Dynegy and will accrue dividends, commencing on November 7, 2011, at an annual rate of 4% through December 31, 2013, 8% from January 1, 2014 through December 31, 2014, and 12% thereafter, compounding as set forth in the “Designation of the Preferred Stock” attached to the Plan as Exhibit “D” (the “Stock Designation”). Dividends will not be paid in cash, but will accrue. The Plan Preferred Stock will not be convertible at the option of the holder; but, based upon the capital structure of Dynegy anticipated to be in effect as of the Effective Date, the Plan Preferred Stock shall be convertible into 97% of Dynegy’s fully-diluted common stock on the terms set forth in the Stock Designation. The Plan Preferred Stock may be redeemed by Dynegy, subject to certain limitations, as set forth in the Stock Designation, at an aggregate price (assuming redemption of all Plan Preferred Stock outstanding as of the Effective Date) equal to: $1.95 billion if redeemed prior to May 8, 2013; $2.0 billion if redeemed between May 8, 2013 and December 31, 2013; and $2.1 billion if redeemed between January 1, 2014 and the mandatory conversion date (December 31, 2015), in each case, plus accrued and unpaid dividends. The Plan Preferred Stock will have no voting or governance rights except that, following the occurrence of a Trigger Event, the Plan Preferred Stock will vote, on an “as converted” basis together with the holders of the Common Stock (as defined below), and subject to the receipt of any required regulatory approvals, on all matters submitted to stockholders. In addition, after the Effective Date, the approval of holders of Plan Preferred Stock will be required for certain actions by Dynegy, as described in more detail in the Stock Designation.

· The Subordination Alternative Election:

· The subordination provisions of the Subordinated Notes Indenture shall be enforceable against holders of Allowed Subordinated Notes Claims. As such, Allowed Subordinated Notes Claims shall be subordinated to Allowed Senior Notes Claims with respect to the right to receive Plan Distributions and all Plan Distributions on account of Allowed Subordinated Notes Claims shall be automatically distributed to holders of Allowed Senior Notes Claims without any further action or demand and shall be shared pro rata only among holders of Allowed Senior Notes Claims. However, a holder of an Allowed Subordinated Notes Claim may elect, in the alternative, to reduce the amount of its Allowed Subordinated Notes Claim to 25% of the Allowed face amount of such Claim, and receive its Pro Rata Share of the Plan Distributions under Class 3 — General Unsecured Claims, without subordination, based on the reduced amount of its Allowed Subordinated Notes Claim.

B. Summary of Treatment Under the Plan

The following chart summarizes the treatment of each class of Claims against and Equity Interests in DH under the Plan:

CLAIMS AND EQUITY INTERESTS NOT CLASSIFIED UNDER THE PLAN

|

Type of Claims(3) |

|

Treatment of Type of Claims |

|

Administrative Claims

Estimated Allowed Claims: $[TBD] |

|

On the Plan Distribution Date, each holder of an Allowed Administrative Claim shall receive (i) the amount of such holder’s Allowed Administrative Claim in one Cash payment or (ii) such other treatment as may be agreed upon in writing by the Plan Proponents and such holder; provided, that such treatment shall not provide a recovery to such holder having a present value as of the Effective Date in excess of such holder’s Allowed Administrative Claim; and provided, further, that an Administrative Claim representing a liability incurred in the ordinary course of business of DH may be paid at the Plan Proponents’ election in the ordinary course of business. |

|

Priority Tax Claims

|

|

At the election of the Plan Proponents, each holder of an Allowed Priority Tax Claim shall receive in |

(3) Administrative Claims and Priority Tax Claims are treated in accordance with sections 1129(a)(9)(A) and 1129(a)(9)(C) of the Bankruptcy Code, respectively. Such Claims are not designated as classes of Claims for the purposes of the Plan or for the purposes of sections 1123, 1124, 1125, 1126 or 1129 of the Bankruptcy Code.

|

Estimated Allowed Claims: $[TBD] |

|

full satisfaction of such Allowed Priority Tax Claim: (a) payments in Cash, in regular installments over a period ending not later than five (5) years after the Petition Date, of a total value, as of the Effective Date, equal to the Allowed amount of such Claim; (b) a lesser amount in one Cash payment as may be agreed upon in writing by the Plan Proponents and such holder; or (c) such other treatment as may be agreed upon in writing by the Plan Proponents and such holder; provided, that such agreed upon treatment may not provide such holder with a recovery having a present value as of the Effective Date that is greater than the amount of such holder’s Allowed Priority Tax Claim or that is less favorable than the treatment provided to the most favored nonpriority unsecured Claims under the Plan. |

CLAIMS AND EQUITY INTERESTS CLASSIFIED UNDER THE PLAN

|

Class of Claims |

|

Treatment of Class of Claims |

|

Class 1 — Priority Claims Estimated Allowed Claims: $[TBD] Unimpaired |

|

Each holder of an Allowed Priority Claim against DH shall be left unimpaired under the Plan, and, pursuant to section 1124 of the Bankruptcy Code, all of the legal, equitable and contractual rights to which such Claim entitles such holder in respect of such Claim shall be left unaltered, and except to the extent that a holder of an Allowed Priority Claim and the Plan Proponents agree on less favorable treatment for such holder, such Allowed Priority Claim against DH (including any amounts to which such holder is entitled pursuant to section 1124(2) of the Bankruptcy Code) shall be paid in full in accordance with such rights on the Plan Distribution Date. |

|

Class 2 — Secured Claims Estimated Allowed Claims: $[TBD] Unimpaired |

|

Each holder of an Allowed Secured Claim against DH shall be left unimpaired under the Plan, and, pursuant to section 1124 of the Bankruptcy Code, all of the legal, equitable and contractual rights to which such Claim entitles such holder in respect of such Claim shall be left unaltered, and except to the extent that a holder of an Allowed Secured Claim and the Plan Proponents agree on less favorable treatment for such holder, such Allowed Secured Claim against DH (including any amounts to which such holder is entitled pursuant to section 1124(2) of the Bankruptcy Code) shall be paid in full in accordance with such rights on the Plan Distribution Date or, if after the Plan Distribution Date, as and when such payment is due. |

|

|

|

|

|

Class 3 — General Unsecured Claims

Estimated Allowed Senior and Subordinated Notes Claims:

· 2012 Notes — $90 million

· 2015 Notes — $811 million

· 2016 Notes — $1,092 million

· 2018 Notes - $ 181 million

· 2019 Notes — $1,137 million

· 2026 Notes — $176 million

· Subordinated Notes — $216 million

Estimated Allowed Other Claims: $[TBD]

Impaired |

|

Except to the extent that a holder of an Allowed General Unsecured Claim and the Plan Proponents agree on less favorable treatment for such holder, each holder of an Allowed General Unsecured Claim against DH shall receive, on the Effective Date, its Pro Rata Share of (i) the Plan Cash Payment, (ii) the Plan Preferred Stock, and (iii) at the sole option of Dynegy, in its capacity as a Plan Proponent, either (a) the Plan Secured Notes or (b) the Plan Secured Notes Alternative Payment.

In accordance with Section 16.5 of the Plan, pursuant to Article XV of the Subordinated Notes Indenture, Allowed Subordinated Notes Claims shall be subordinated to Allowed Senior Notes Claims with respect to the right to receive Plan Distributions, and all Plan Distributions on account of Allowed Subordinated Notes Claims shall be automatically turned over and distributed to holders of Allowed Senior Notes Claims without any further action or demand and shall be shared pro rata only among holders of Allowed Senior Notes Claims; provided, however, that holders of Allowed Subordinated Notes Claims may, in full and final satisfaction and settlement of all of such holder’s Allowed Subordinated Notes Claims, elect to (a) reduce the amount of such Allowed Subordinated Notes Claims to an amount that is equal to $0.25 for every $1.00 of such Allowed Subordinated Notes Claims, and (b) pursuant to such election, receive a Pro Rata Share of the Plan Distributions based on |

|

|

|

the reduced amount of such Allowed Subordinated Notes Claims, without subordination. |

|

|

|

|

|

Class 4 — Convenience Claims Estimated Allowed Claims: $[TBD] Unimpaired |

|

Each holder of an Allowed Convenience Claim against DH shall be left unimpaired under the Plan, and, pursuant to section 1124 of the Bankruptcy Code, all of the legal, equitable and contractual rights to which such Claim entitles such holder in respect of such Claim shall be left unaltered, and such Allowed Convenience Claim against DH (including any amounts to which such holder is entitled pursuant to section 1124(2) of the Bankruptcy Code) shall be paid in full in accordance with such rights on the Plan Distribution Date or, if after the Plan Distribution Date, as and when such payment is due. |

|

|

|

|

|

Class 5 — Equity Interests Unimpaired |

|

Each holder of an Allowed Equity Interest in DH shall be left unimpaired under the Plan, and, pursuant to section 1124 of the Bankruptcy Code, all of the legal, equitable and contractual rights to which such Allowed Equity Interest entitles such holder in respect of such Allowed Equity Interest shall be left unaltered. |

VI.

GENERAL INFORMATION

The discussion below briefly describes DH, as well as the other Debtors, and certain of their non-Debtor subsidiaries and affiliates (together with Dynegy, collectively, the “Company”) and their businesses as they exist as of the date of this Disclosure Statement. Please note that while all of the Debtors filed voluntary petitions for relief under chapter 11 of the Bankruptcy Code and their cases are being jointly administered under Case No. 11-38111 (CGM), the Plan only addresses the Claims against and Equity Interests in DH.

A. Overview of the Company

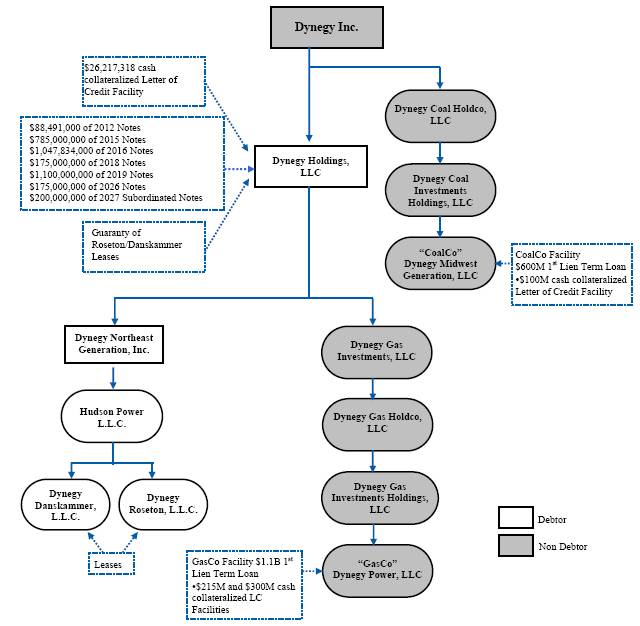

Dynegy and DH are holding companies and conduct substantially all of their business operations through their subsidiaries. Their primary business is the production and sale of electric energy, capacity and ancillary services from their fleet of sixteen operating power plants in six states totaling approximately 11,600 megawatts of generating capacity. The organizational chart below illustrates the structure of the Company as of the date of this Disclosure Statement. Please note that this organizational chart does not show all legal entities in the corporate structure.

B. Overview of the Company’s Business

The operating subsidiaries of Dynegy and DH sell electric energy, capacity and ancillary services on a wholesale basis from their power generation facilities. The capacity of a power generation facility is its electricity production capability, measured in megawatts (“MW”). The capacity is used to produce electric energy, which is measured in megawatt hours. Wholesale electricity customers will, for reliability reasons and to meet regulatory requirements, contract for rights to capacity from generating units. Ancillary services are the products of a power generation facility that support the transmission grid operation, follow real-time changes in load, and provide emergency reserves for major changes to the balance of generation and load.

The operating subsidiaries of Dynegy and DH sell these products individually or in combination to customers under short-, medium- and long-term contractual agreements or tariffs. These customers include regional transmission organizations and independent system operators, integrated utilities, municipalities, electric cooperatives, transmission and distribution utilities, industrial customers, power marketers, financial participants such as banks and hedge funds, other power generators, and commercial end-users. All products are sold on a wholesale basis for various lengths of time from hourly to multi-year transactions. Some customers, such as municipalities or integrated utilities, purchase products for resale in order to serve their retail, commercial and industrial customers. Other customers, such as some power marketers, may buy products and related services to serve their own wholesale or retail customers or as a hedge against power sales they have made.

C. Overview of the Debtors’ Businesses

DH is a holding company that conducts its business operations through its direct and indirect subsidiaries, including the other Debtors. The primary business of DH and its operating subsidiaries is the production and sale of electric energy, capacity and ancillary services from a fleet of 10 operating power plants in six states totaling approximately 9,903 MW of generating capacity. The other Debtors’ direct operations consist of only two of these plants — at Dynegy Danskammer and Dynegy Roseton — which have a combined generating capacity of 1,693 MW.

DH and the other Debtors rely on certain non-Debtor subsidiaries of DH for essential functions. For example, Dynegy Administrative Services Company, a Delaware corporation, generally manages the segregated cash management systems for DH and its subsidiaries. Dynegy Power Marketing, LLC, a Texas limited liability company (“DPM”), performs various functions, including marketing power and capacity, coordinating the power output of the various generation facilities, and providing fuel management services. The Debtors also have service agreements with other non-Debtor affiliates, under which the Debtors provide compensation to such affiliates for their services.

As noted above, while all of the Debtors filed voluntary petitions for relief under chapter 11 of the Bankruptcy Code and their cases are being jointly administered under Case No. 11-38111(CGM) solely for procedural purposes, the Plan only addresses the claims against and equity interests in DH. The following is a description of each of DH and the other Debtors.

1. Dynegy Holdings, LLC

DH began operations as Natural Gas Clearinghouse (“Clearinghouse”) in 1985. From the inception of its operations until 1990, Clearinghouse’s activities related primarily to natural gas marketing. Starting in 1990, Clearinghouse began expanding its core business operations through acquisitions and strategic alliances resulting in the formation of a midstream energy asset business, and it established energy marketing operations in both Canada and the United Kingdom. In 1994, Clearinghouse initiated electric power marketing operations in order to take advantage of opportunities created by the deregulation of the domestic electric power industry, and in March 1995, Clearinghouse merged with Trident NGL Holding, Inc., a fully integrated natural gas liquids company, with the surviving entity named NGC Corporation (“NGC”). Approximately one year later, NGC completed a strategic combination with Chevron U.S.A. Inc.

and certain of its affiliates (collectively, “Chevron”) whereby substantially all of Chevron’s midstream assets merged with NGC. In 1998, NGC changed its name to Dynegy Inc. to reflect its evolution from a natural gas marketing company to an energy services company capable of meeting the growing demands and diverse challenges of the dynamic energy market of the 21st century. In early 2000, Dynegy Inc. acquired Illinova Corporation, and as part of this acquisition, Dynegy Inc. changed its name to Dynegy Holdings Inc. and became a wholly-owned subsidiary of a new holding company, now referred to as Dynegy Inc. On September 1, 2011, DH changed its corporate form from a Delaware corporation to a Delaware limited liability company pursuant to the General Corporation Law of the State of Delaware (the “DGCL”).

As further described above, DH is a holding company that conducts its business operations through its direct and indirect subsidiaries, including the other Debtors. The primary business of DH and its operating subsidiaries is the production and sale of electric energy, capacity and ancillary services from a fleet of 10 operating power plants in six states totaling approximately 9,903 MW of generating capacity.

2. Dynegy Northeast Generation, Inc.

DNE is a Delaware corporation and wholly-owned subsidiary of DH that holds 100% of the equity interests in Hudson Power, L.L.C. and provides administrative support and employs personnel for the operation of the Danskammer and Roseton power generation facilities.

3. Hudson Power, L.L.C.

Hudson Power, L.L.C. (“Hudson Power”) is a Delaware limited liability company that has no operations and holds 100% of the equity interests in Dynegy Danskammer and Dynegy Roseton.

4. Dynegy Danskammer, L.L.C.

Dynegy Danskammer, L.L.C. (“Dynegy Danskammer”), a Delaware limited liability company, owns the 185-acre site in Newburgh, New York on which the Danskammer power generation facility is located, adjacent to the Roseton site. There are six (6) units at Dynegy Danskammer’s power generation facility — four of which are owned by Dynegy Danskammer, and two of which are leased by Dynegy Danskammer from Danskammer OL LLC (the “Danskammer Owner Lessor”), an indirect subsidiary of Public Service Enterprise Group, Inc. (“PSEG”), an unaffiliated entity. A further description of Dynegy Danskammer’s operations is set forth below.

5. Dynegy Roseton, L.L.C.

Dynegy Roseton, L.L.C. (“Dynegy Roseton”), a Delaware limited liability company, owns the 195-acre site in Newburgh, New York, on which the Roseton power generation facility is located, adjacent to the Danskammer site. Dynegy Roseton operates the two (2) units at the power generation facility. It leases these units from Roseton OL LLC (the “Roseton Owner Lessor” and together with the Danskammer Owner Lessor, the “Owner Lessors”), an indirect subsidiary of PSEG. A further description of Dynegy Roseton’s operations is set forth below.

D. Operations of Dynegy Danskammer and Dynegy Roseton

Dynegy Danskammer owns units 1, 2, 5, and 6 at the Danskammer power generation facility. Units 1 and 2 are “peakers” (power plants that generally run only during periods of peak demand for electricity) with a net capacity of 129.7 MW. They use natural gas and fuel oil as their primary fuels. Units 5 and 6 are emergency diesel generators with net capacities of 2.5 MW each and currently are not in operation and are not connected to the power grid. Dynegy Danskammer leases units 3 and 4 (collectively, the “Danskammer Facility”) from the Danskammer Owner Lessor; these units are “baseload” power plants (power plants that generally run at all times, providing the amount of electricity generally needed to meet customer demand) with a net capacity of 373.4 MW. They use coal and natural gas as their primary fuels.

Dynegy Roseton leases both units at the Roseton power generation facility (collectively, the “Roseton Facility” and together with the Danskammer Facility, the “Leased Facilities”) from the Roseton Owner Lessor; these units are “peakers” with a net capacity of 1,200 MW. They use natural gas and fuel oil as their primary fuels.

The Leased Facilities are connected to the Northeast Power Coordinating Council, one of the 10 regional reliability councils that form the North American Electric Reliability Council. They compete primarily in the New York wholesale market, operated and maintained by the New York Independent System Operator (the “NYISO”), although the power generated at the Danskammer and Roseton facilities may be sold into the Pennsylvania/New Jersey/Maryland Power Pool, as well as to New England, Quebec, and Ontario.

The operations of Dynegy Danskammer and Dynegy Roseton are subject to extensive federal, state, and local statutes, rules and regulations, including the Federal Power Act (the “FPA”), the Comprehensive Environmental Response, Compensation and Liability Act, the Superfund Amendments and Reauthorization Act, the Resource Conservation and Recovery Act, and the Occupational Safety and Health Act. Their regulators include the Federal Energy Regulatory Commission (“FERC”), the New York Public Service Commission (the “NYPSC”), and the Environmental Protection Agency (the “EPA”).

Dynegy Danskammer and Dynegy Roseton have no employees; the workers at the facility are employed by DNE.(4) Their major liabilities consist of semiannual rent payments to the Owner Lessors under the Lease Documents (defined below). In addition to the land on which the Roseton and Danskammer power plants are located and the power plant units or leasehold interests therein, as applicable, their assets consist of various capital spare parts, emissions credits, emissions control and monitoring equipment, fuel inventory, fuel supply equipment, communications equipment and licenses, vehicles, a locomotive, administrative buildings, and similar items. Substantially all of Dynegy Danskammer’s and Dynegy Roseton’s revenues are derived from sales to the NYISO through DPM, a non-Debtor affiliate. Due to NYISO regulations, DPM, rather than one of the Debtors, is a party to energy supply contracts with the NYISO. Because none of the Debtors are currently authorized NYISO market

(4) One employee, the Managing Director of Plant operations at the Danksammer and Roseton facilities is employed by Dynegy Operating Company, a non-Debtor Affiliate.

participants/customers,(5) DPM, an energy marketer that is a registered NYISO customer and market participant and is authorized to sell energy, capacity and certain ancillary services at market-based rates, provides energy management services to Dynegy Roseton and Dynegy Danskammer. Among other things, DPM sells the energy generated by the Leased Facilities into the NYISO markets.

The Debtors’ obligations under the Danskammer Lease Documents and the Roseton Lease Documents (together, the “Lease Documents”) are significantly burdensome, do not provide economic value to the Debtors’ estates, and will impair the Debtors’ ability to reorganize absent rejection. Accordingly, the Debtors have determined that the rejection of the Lease Documents is an appropriate exercise of their business judgment. On the Petition Date, the Debtors filed a Motion Pursuant to Section 365 of the Bankruptcy Code and Bankruptcy Rule 6006 for Entry of an Order Authorizing the Debtors to Reject the Lease Documents (the “Motion to Reject”) [Docket No. 5]. Further information concerning the Motion to Reject is contained in this Disclosure Statement in the article entitled “The Reorganization Cases.”

E. Events Leading to the Need for Restructuring

A combination of dwindling liquidity due to declining revenues (resulting from lower prices over the past two years) and unprofitable leases at the Roseton Facility and Danskammer Facility have adversely impacted the Company’s financial performance. Overall, sustained low power prices over the past two years have had a significant adverse impact on the Debtors’ business and continue to negatively impact their projected future liquidity. Specifically, DH’s annual consolidated revenue peaked in the year ending December 31, 2008 at $3.324 billion, and has since declined to $2.468 billion in the year ending December 31, 2009 and $2.323 billion in the year ending December 31, 2010. As further illustration of the steep decline in revenue, for the nine month period ending September 30, 2010, DH reported consolidated revenues of $1.872 billion, and for the nine month period ending September 30, 2011, DH reported consolidated revenues of $1.347 billion.