Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEACOR HOLDINGS INC /NEW/ | d263829d8k.htm |

Local

Service | Global Strength Charles Fabrikant

Executive Chairman of the Board

Investor Presentation

by November 30, 2011

Exhibit 99.1 |

2

Forward-Looking Statements

This presentation includes “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward- looking statements concerning

management’s expectations, strategic objectives, business prospects, anticipated economic performance and financial

condition and other similar matters involve known and unknown risks, uncertainties and other important

factors that could cause the actual results, performance or achievements of results to differ

materially from any future results, performance or achievements discussed or implied by such

forward-looking statements. Such risks, uncertainties and other important factors include, among

others: decreased demand and loss of revenues as a result of U.S. government implemented

moratoriums directing operators to cease certain drilling activities and any extension of such moratoriums (the

“Moratoriums”), weakening demand for the Company’s services as a result of unplanned

customer suspensions, cancellations, rate reductions or non- renewals of vessel charters and

aviation equipment or failures to finalize commitments to charter vessels and aviation equipment in response to

Moratoriums, increased government legislation and regulation of the Company’s businesses could

increase cost of operations, increased competition if the Jones Act is repealed, liability, legal

fees and costs in connection with providing spill and emergency response services, including the

Company’s involvement in response to the oil spill as a result of the sinking of the Deepwater

Horizon in April 2010, decreased demand for the Company’s services as a result of declines

in the global economy, declines in valuations in the global financial markets and illiquidity in the credit

sectors, including, interest rate fluctuations, availability of credit, inflation rates, change in laws,

trade barriers, commodity prices and currency exchange fluctuations, the cyclical nature of the

oil and gas industry, activity in foreign countries and changes in foreign political, military and

economic conditions, changes in foreign and domestic oil and gas exploration and production activity,

safety record requirements related to Offshore Marine Services, Marine Transportation Services

and Aviation Services, decreased demand for Marine Transportation Services and Harbor and

Offshore Towing Services due to construction of additional refined petroleum products, natural gas or

crude oil pipelines or due to decreased demand for refined petroleum products, crude oil or

chemical products or a change in existing methods of delivery, compliance with U.S. and foreign

government laws and regulations, including environmental laws and regulations, the dependence of

Offshore Marine Services, Marine Transportation Services and Aviation Services on several

customers, consolidation of the Company’s customer base, the ongoing need to replace aging vessels and

aircraft, industry fleet capacity, restrictions imposed by the Shipping Acts and Aviation Acts on the

amount of foreign ownership of the Company’s Common Stock, operational risks of Offshore

Marine Services, Marine Transportation Services, Harbor and Offshore Towing Services and Aviation

Services, effects of adverse weather conditions and seasonality, future phase-out of Marine

Transportation Services’ double-bottom tanker, dependence of spill response revenue on

the number and size of spills and upon continuing government regulation in this area and Environmental

Services’ ability to comply with such regulation and other governmental regulation, changes in

National Response Corporation’s Oil Spill Removal Organization classification, liability in

connection with providing spill response services, the level of grain export volume, the effect of fuel prices on

barge towing costs, variability in freight rates for inland river barges, the effect of international

economic and political factors in Inland River Services’ operations, adequacy of insurance

coverage, the attraction and retention of qualified personnel by the Company and various other matters and factors,

many of which are beyond the Company’s control. In addition, these statements constitute the

Company’s cautionary statements under the Private Securities Litigation Reform Act of 1995.

It is not possible to predict or identify all such factors. Consequently, the foregoing should not be considered

a complete discussion of all potential risks or uncertainties. The words “estimate,”

“project,” “intend,” “believe,” “plan” and similar expressions are

intended to identify forward-looking statements. Forward-looking statements speak only as of the

date of the document in which they are made. The Company disclaims any obligation or undertaking

to provide any updates or revisions to any forward-looking statement to reflect any change in the

Company’s expectations or any change in events, conditions or circumstances on which the

forward-looking statement is based. The forward-looking statements in this presentation

should be evaluated together with the many uncertainties that affect the Company’s businesses, particularly those

mentioned under “Forward-Looking Statements” on the Company’s Form 10-K and the

Company’s Form 10-Q and SEACOR’s periodic reporting on Form 8-K (if any), which

are incorporated by reference.

|

3

SEACOR Attitude

Maintain a conservative balance sheet and

transparent reporting.

Invest for appreciation and long-term, not just

accretion or today.

Leverage our expertise, geographic reach, and

asset base.

Partner with complementary expertise.

Practice patience, be prepared, and hope for

luck. |

4

SEACOR Focus

Energy

Food

Infrastructure

and

Transportation |

5

5,311 Employees Worldwide

as of December 31, 2010

Global Reach |

22%

22%

13%

7%

4%

4%

4%

3%

21%

40%

10%

13%

5%

2%

30%

60%

8%

3%

2%

27%

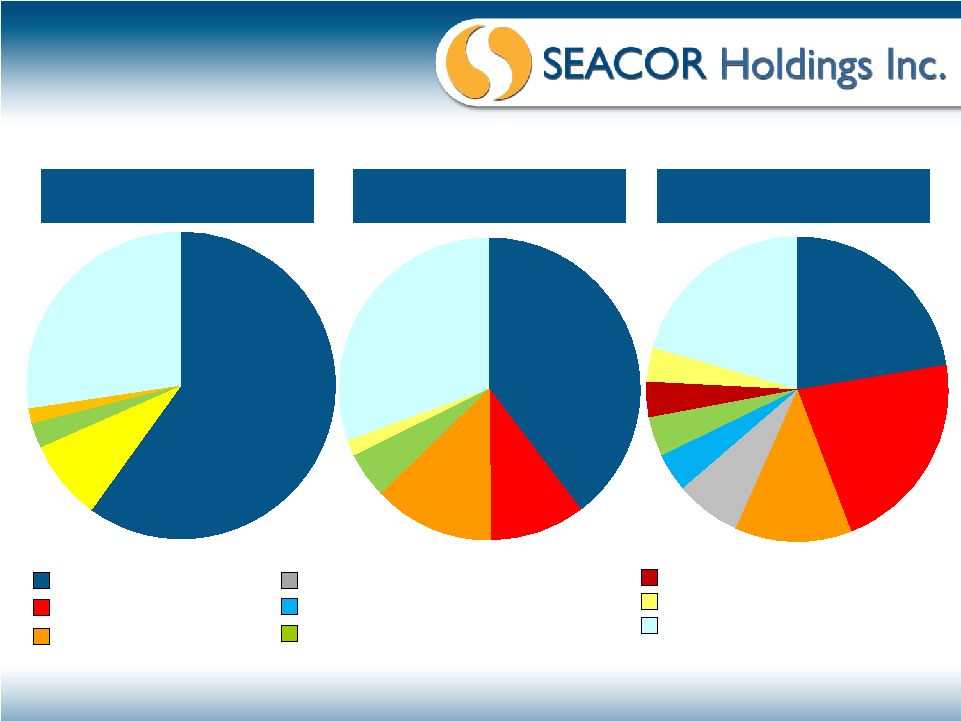

Growth with Diversification

As of December 31, 2000

Total Assets: $1.1 billion

As of June 30, 2005

Total Assets: $1.8 billion

As of September 30, 2011

Total Assets: $3.7 billion

Offshore Marine Services

Aviation Services

Inland River Services

Marine Transportation Services

Environmental Services

Commodity Trading and Logistics

Harbor and Offshore Towing Services

Other

Corporate (primarily liquid assets)

Note: Assets have been extracted from our Quarterly Reports on Form 10-Q and

our 2000 Annual Report on Form 10-K for all the business units with the

exception of Harbor and Offshore Towing Services. In our public filings, Harbor and Offshore Towing

Services is the main component of Other.

6 |

$0

$150

$300

$450

$600

$750

$900

1993

1995

1997

1999

2001

2003

2005

2007

2009

YTD

2011

Cash from Operating Activities

Proceeds from Asset Sales

Capital Expenditures

7

Funding Capital Expenditures

(USD in millions)

1

Note: Cash flow data has been extracted from our Quarterly Reports on Form 10-Q

and our Annual Reports on Form 10-K. Amounts presented reflect the

current presentation of cash from operating activities. 1

Nine months ended September 30, 2011.

Since 1993, we sold approximately $2.5 billion in older assets, earned cash from

operations of approximately $2.9 billion and invested approximately $3.5

billion in capital expenditures. |

8

Our Portfolio

Offshore Marine Services

Aviation Services

Inland River Services

Marine Transportation Services

Harbor and Offshore Towing Services

Environmental Services

Commodity Trading and Logistics |

Offshore Marine Services -

Assets

Crew/FSV

Specialty

9

Specialty

AHTS

Supply

Standby Safety |

Offshore Marine Services –

Fleet Details

10

Note: Fleet data has been extracted from our Quarterly Reports on Form 10-Q and

our Annual Reports on Form 10-K. 1

Average vessel age excludes the standby safety fleet.

Since Seabulk acquisition in

July 2005, we:

built, acquired, and

upgraded existing

offshore vessels, and

other offshore marine

equipment for

approximately $670

million.

disposed of 187 vessels

and other equipment for

net proceeds of

approximately $1 billion.

Fleet Count by Type

2003

2005

2007

2009

2011

Owned

AHTS

18

24

15

18

15

Crew (incl. Fast Support)

51

75

52

41

33

Mini-supply

26

22

15

6

5

Supply

12

32

13

11

10

Towing Supply

11

31

13

7

2

Standby Safety

19

21

23

24

26

Specialty

2

14

10

4

3

Total Owned

139

219

141

111

94

Average Vessel Age

1

10

16

13

11

10

Joint Ventured

54

33

11

12

17

Leased-in

36

43

42

27

22

Pooled or Managed

6

6

12

15

16

Total

235

301

206

165

149 |

SEACOR’s “Deepwater”

Support Fleet

11

12 AHTS Vessels (11 U.S.-flag)

8 U.S.-flag Fast Support Vessels

2 Specialty Vessels (1 U.S.-flag)

14 Supply Vessels (9 U.S.-flag)

7 Heavy Twin Helicopters

34 Medium Twin Helicopters

Note: Fleet includes company-owned, joint ventured, leased-in, and pooled

or managed equipment as of September 30, 2011. |

Offshore Marine Services -

Financials

12

Note: Income statement data has been extracted from our Quarterly Reports on Form

10-Q and our Annual Reports on Form 10-K. For details

on

the

definition

of

average

gross

property

&

equipment,

average

net

property

and

equipment,

operating

income

before

depreciation

and

amortization

(“OIBDA”),

return

on

average

gross

property

and

equipment,

and

return

on

average

net

property

and

equipment, see Appendix A.

1

Nine months ended September 30, 2011.

1

(USD in millions)

2006

2007

2008

2009

2010

YTD 2011

Revenue

682.6

$

692.4

$

708.7

$

562.3

$

515.9

$

267.0

$

Operating Expenses

339.0

374.5

390.1

309.6

309.6

199.7

Administrative and General

46.4

51.9

58.4

47.0

50.8

33.5

Depreciation and Amortization

81.5

60.5

55.6

54.9

51.8

36.5

Total Costs and Expenses

466.9

486.9

504.2

411.5

412.1

269.8

Gains on Asset Dispositions and Impairments, Net

67.0

82.5

69.2

22.5

29.5

13.2

Operating Income

282.7

$

288.0

$

273.8

$

173.2

$

133.2

$

10.4

$

Average Gross Property and Equipment

992.0

1,059.7

1,101.4

1,072.4

1,007.0

982.8

Average Net Property and Equipment

729.8

779.7

814.0

765.5

664.9

616.4

Reconciliation of Non-U.S. GAAP Financial Measures

Operating Income

282.7

288.0

273.8

173.2

133.2

10.4

Depreciation and Amortization

81.5

60.5

55.6

54.9

51.8

36.5

OIBDA

364.2

$

348.5

$

329.4

$

228.1

$

185.0

$

46.9

$

Return on Average Gross Property and Equipment

37%

33%

30%

21%

18%

6%

Return on Average Net Property and Equipment

50%

45%

40%

30%

28%

10% |

Aviation Services -

Assets

13

AW139 -

Medium

A109 –

Light twin

S76-C++ -

Medium

Bell 412 -

Medium

AS350B2 –

Light single

EC225 -

Heavy |

Aviation Services -

Operations

14 |

Aviation Services –

Operations

as of September 30, 2011

15

United States

Sweden

Aircraft in Region (# of aircraft)

Spain

Canada

India

Mexico

UK

Norway

Brazil

Training Center

Joint Ventures

Indonesia

1

130

4

12

4

1

18

2

3

2 |

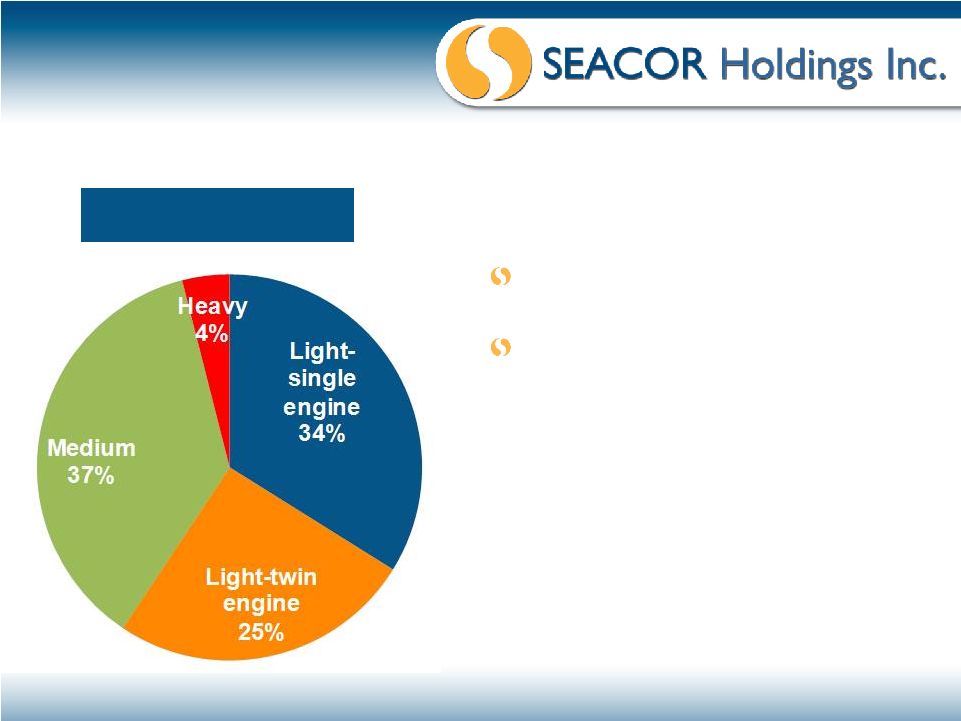

Aviation Services –

Fleet Details

16

As of September 30, 2011

177

Helicopters

Since Era acquisition in December

2004, we:

acquired new equipment for

approximately $870 million.

disposed

of

71

helicopters

2

and

other equipment for net proceeds

of approximately $150 million.

Note: Fleet data has been extracted from our Quarterly Reports on Form 10-Q and

our Annual Reports on Form 10-K . 1

Includes 147 company-owned, 7 joint ventured, 11 leased-in, and 12 managed.

2

Includes helicopters sold, scrapped, or destroyed.

1 |

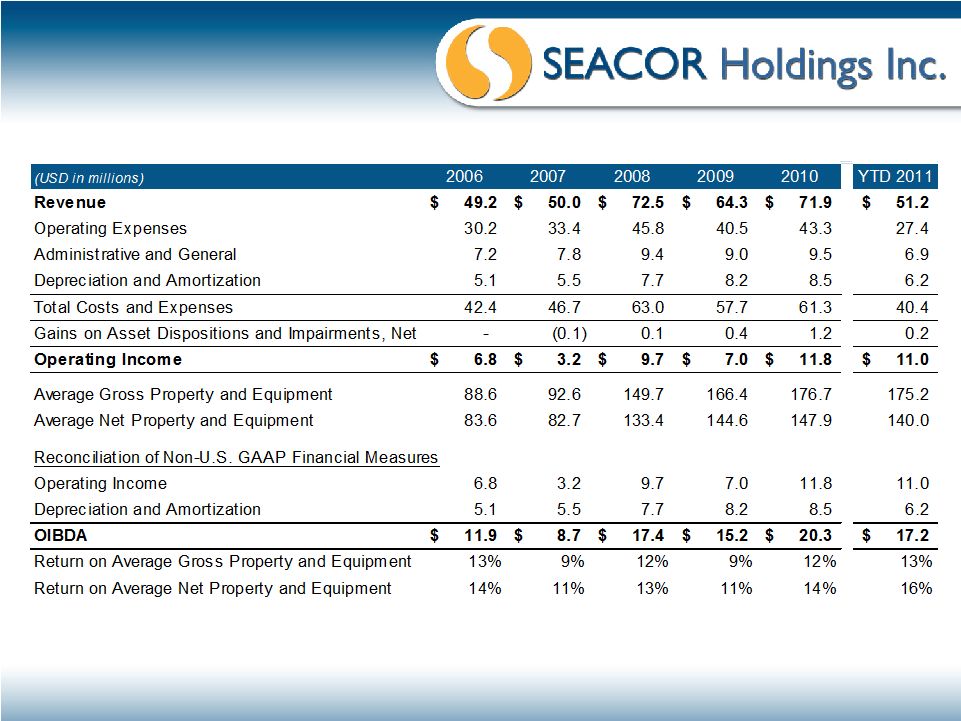

Aviation Services -

Financials

17

1

Note: Income statement data has been extracted from our Quarterly Reports on Form

10-Q and our Annual Reports on Form 10-K. For details

on

the

definition

of

average

gross

property

&

equipment,

average

net

property

and

equipment,

operating

income

before

depreciation

and

amortization

(“OIBDA”),

return

on

average

gross

property

and

equipment,

and

return

on

average

net

property

and

equipment, see Appendix A.

1

Nine months ended September 30, 2011.

(USD in millions)

2006

2007

2008

2009

2010

YTD 2011

Revenue

156.0

$

215.0

$

248.6

$

235.7

$

235.4

$

196.5

$

Operating Expenses

121.6

157.2

181.5

148.0

147.2

121.6

Administrative and General

14.9

18.9

20.1

21.4

25.8

20.1

Depreciation and Amortization

20.0

27.6

36.4

37.4

43.4

33.4

Total Costs and Expenses

156.5

203.7

238.0

206.7

216.4

175.1

Gains on Asset Dispositions and Impairments, Net

11.1

8.0

4.9

0.3

0.8

13.3

Operating Income

10.6

$

19.4

$

15.5

$

29.3

$

19.7

$

34.6

$

Average Gross Property and Equipment

250.0

351.8

476.5

607.5

716.4

805.1

Average Net Property and Equipment

222.2

307.2

402.6

498.2

568.5

621.6

Reconciliation of Non-U.S. GAAP Financial Measures

Operating Income

10.6

19.4

15.5

29.3

19.7

34.6

Depreciation and Amortization

20.0

27.6

36.4

37.4

43.4

33.4

OIBDA

30.6

$

47.0

$

51.9

$

66.7

$

63.1

$

68.0

$

Return on Average Gross Property and Equipment

12%

13%

11%

11%

9%

11%

Return on Average Net Property and Equipment

14%

15%

13%

13%

11%

15% |

Inland River Services -

Assets

Covered Hoppers

10,000 Bbl Tank Barges

30,000 Bbl Tank Barges

Grain Elevator

Open Hoppers

18

Unit

Tow

Liquid

Barges

Gateway Terminals

Towboats |

Inland River Services –

Areas of Operation

19

Argentina, Brazil, and Paraguay

Columbia

United States

•

St. Louis, Missouri – HQ

•

Sauget and McLeansboro, Illinois

•

Paducah, Kentucky

•

Memphis, Tennessee

•

Greenville, Mississippi

•

New Orleans, Louisiana

•

Fleet Locations in MO, AK, IL and

TN •

Buenos Aires - HQ

•

Corumbá, Brazil

•

Asunción, Paraguay

•

Rosario, Argentina

•

Ibicuy, Argentina

•

Barranquilla

•

Cartegena

|

Inland River Services –

Fleet Profile

20

Joint

Pooled or

Type

Owned

Ventured

Leased-In

Managed

Total

Dry Cargo Barges

689

172

2

626

1,489

Liquid Tank Barges

70

-

-

9

79

Deck Barges

20

-

-

-

20

Towboats

16

15

-

-

31

Dry Cargo Vessel

-

1

-

-

1

Total

795

188

2

635

1,620

As of September 30, 2011

Since launching new construction program in 2003, we:

built or acquired 631 barges, 11 towboats, and other property and

equipment for approximately $450 million.

1

disposed of 242 barges, six towboats, and other property and

equipment for net proceeds of approximately $144 million.

2

Note: Fleet data has been extracted from our Quarterly Reports on Form 10-Q and

our Annual Reports on Form 10-K . 1

Excludes14

barges

and

eight

towboats

related

to

the

acquisition

of

Waxler

Transportation

Company,

Inc,

and

Waxler

Towing

Company, Incorporated.

2

Excludes 73 barges associated with non-operating activities.

|

Inland River Services -

Financials

21

Note: Income statement data has been extracted from our Quarterly Reports on Form

10-Q and our Annual Reports on Form 10-K. For details

on

the

definition

of

average

gross

property

&

equipment,

average

net

property

and

equipment,

operating

income

before

depreciation

and amortization (“OIBDA”), return on average gross property and

equipment, and return on average net property and equipment, see Appendix

A. 1

Nine months ended September 30, 2011.

1 |

22

Marine Transportation Services -

Assets

Harbor and Offshore Towing Services -

Assets

Seabulk Trader

Seabulk Challenge

Seabulk Arctic

RORO Vessels

Tractor Tug

Conventional Tug

1

Roll-on/Roll-off vessels.

1 |

Harbor and Offshore Towing Services -

Port Locations |

24

Marine Transportation Services and Harbor

and Offshore Towing Services –

Fleet Profile

Since Seabulk acquisition in July

2005, we:

added approximately $40 million

and disposed of approximately

$275 million

of assets to the

marine transportation fleet.

added approximately $120

million and disposed of

approximately $15 million of

assets to the harbor and offshore

towing fleet.

Note: Fleet data has been extracted from our Quarterly Reports on Form 10-Q and

our Annual Reports on Form 10-K . 1

Primarily consists of the sale leaseback of the two U.S.-flag double-hull

tankers in 2010 and the sale of the two foreign flag double-hull tankers

in 2005. 1 |

Marine Transportation Services –

Financials

25

Note: Income statement data has been extracted from our Quarterly Reports on Form

10-Q and our Annual Reports on Form 10-K. For details

on

the

definition

of

average

gross

property

&

equipment,

average

net

property

and

equipment,

operating

income

before

depreciation

and

amortization

(“OIBDA”),

return

on

average

gross

property

and

equipment,

and

return

on

average

net

property

and

equipment,

see

Appendix A.

1

Nine months ended September 30, 2011.

1 |

Harbor and Offshore Towing Services –

Financials

26

1

Note: Income statement data has been extracted from our Quarterly Reports on Form

10-Q and our Annual Reports on Form 10-K. For details

on

the

definition

of

average

gross

property

&

equipment,

average

net

property

and

equipment,

operating

income

before

depreciation

and

amortization

(“OIBDA”),

return

on

average

gross

property

and

equipment,

and

return

on

average

net

property

and

equipment,

see

Appendix A.

1

Nine months ended September 30, 2011. |

27

Environmental Services -

Businesses |

Environmental Services -

Financials

(USD in millions)

2006

2007

2008

2009

2010

YTD 2011

Revenue

144.5

$

156.8

$

168.0

$

145.8

$

874.4

$

152.0

$

Operating Expenses

103.2

111.3

117.3

103.8

593.3

104.6

Administrative and General

20.6

23.3

27.5

25.5

31.6

25.6

Depreciation and Amortization

3.4

4.9

7.1

7.2

8.4

7.4

Total Costs and Expenses

127.1

139.5

151.9

136.4

633.2

137.6

Gains (Losses) on Asset Dispositions

(0.2)

0.2

0.1

(0.2)

0.5

-

Operating Income

17.2

$

17.5

$

16.2

$

9.2

$

241.7

$

14.4

$

Derivative Losses

-

-

-

-

-

-

Foreign Currency Gains (Losses)

(0.1)

(0.1)

(0.3)

-

(0.1)

-

Other, Net

-

-

-

-

-

-

Equity Earnings of 50% or Less

Owned Companies

0.1

0.2

0.6

0.2

0.7

-

Segment Profit

17.2

$

17.7

$

16.5

$

9.4

$

242.2

$

14.4

$

28

1

Note: Income statement data has been extracted from our Quarterly Reports on Form

10-Q and our Annual Reports on Form 10-K. 1

Nine months ended September 30, 2011. |

Ethanol plant

Tank barge

Commodity Trading and Logistics -

Energy

Tank railcar

Tank farms

29 |

Commodity Trading and Logistics -

Financials

30

1

Note: Income statement data has been extracted from our Quarterly Reports on Form

10-Q and our Annual Reports on Form 10-K. 1

Nine months ended September 30, 2011.

(USD in millions)

2007

2008

2009

2010

YTD

2011

Revenue

9.6

$

208.3

$

472.6

$

741.9

$

718.5

$

Operating Expenses

9.7

189.9

460.7

729.1

703.8

Administrative and General

0.9

9.0

12.6

11.4

6.8

Depreciation and Amortization

-

-

-

0.1

-

Total Costs and Expenses

10.6

198.9

473.4

740.6

710.7

Operating Income (Loss)

(1.0)

$

9.4

$

(0.8)

$

1.3

$

7.8

$

Derivative Gains (Losses)

0.7

(0.4)

4.0

(4.7)

(7.0)

Foreign Currency Gains (Losses)

-

0.1

0.5

(0.5)

0.1

Other, Net

-

-

-

0.8

-

Equity in Earnings (Losses) of

50% or Less Owned Companies

-

0.2

(0.1)

(0.6)

(3.3)

Segment Profit (Loss)

(0.3)

$

9.2

$

3.6

$

(3.7)

$

(2.3)

$

Segment Profit (Loss) -

Energy

(0.3)

0.4

6.1

4.4

(2.0)

Segment Profit (Loss) -

Sugar

-

0.2

(0.7)

0.9

1.0

Segment Profit (Loss) -

Rice

-

8.6

(1.8)

(9.0)

(1.3) |

31

Consolidated Company |

$0

$20

$40

$60

$80

$100

-$30

$20

$70

$120

$170

$220

$270

$320

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

32

Stockholder Value

Since 2006, $1 billion spent on Special

Cash Dividend and Share Repurchases,

highest

among

peer

group.

1

Average

price

per

share

–

Share

Repurchases

Cash

spent

per

period

–

Share

Repurchases

(USD in millions, except share data)

Note:

Share

repurchases,

average

price

per

share

and

the

Special

Cash

Dividend

have

been

extracted

from

our

Quarterly

Reports

on

Form 10-Q and our Annual Reports on Form 10-K with the exception of average

price per share presented from 1997 to 1999. Average price per share during

from 1997 to 1999 have been adjusted for the three-for-two stock split effective June 15, 2000.

1

Our

peer

group

includes

Tidewater,

Bourbon,

Gulfmark,

Hornbeck,

Farstad,

Bristow

and

Kirby.

Statements

are

based

on

review

of

public filings.

Cash

spent

per

period

–

Special

Cash

Dividend |

$0

$20

$40

$60

$80

$100

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

Book Value Per Share

2010 Special Cash Dividend

33

Solid Track Record

3

Note: Stockholders’

equity, common shares outstanding, and net income have been extracted from our

Quarterly Reports on Form 10- Q and our Annual Reports on Form

10-K with the exception of amounts referenced in footnote 1. 1

Growth

in

book

value

from

December

31,

1992

($7.84)

to

September

30,

2011.

Amounts

presented

from

1992

to

1999

have

been

adjusted for the three-for-two stock split effective June 15, 2000.

Amounts presented for 2010 and 2011 add back the 2010 Special Cash Dividend

of $15 per common share paid to shareholders of record on December 14, 2010.

2

Average from December 31, 1993 to September 30, 2011. For definitions of

After-Tax Returns on Equity see Appendix B. 3

As of September 30, 2011

Compounded Annual Growth in

Book Value Per Share

1

: 15%

Average After-Tax ROE

2

: 13% |

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

34

Minimal Leverage

Note: Total debt, cash and near cash assets, and total equity have been extracted

from our Quarterly Reports on Form 10-Q and our Annual Reports on Form

10-K. Amounts presented from 2004 to 2008 are restated for the adoption of new accounting rules related to the Company’s

convertible debt, which was repaid in 2009. For definitions of total debt to total

capital and net debt to total capital see Appendix B. 1

As of September 30, 2011.

1

Total

Debt

/

Total

Capital

From 1993 to 2004, our average Total Debt / Total Capital was 40%.

From 2005 to September 30, 2011, our average Total Debt / Total Capital was 33%.

Net

Debt

/

Total

Capital |

Conservative Balance Sheet

Note: Balance sheet data has been extracted from our September 30, 2011 Quarterly

Report on Form 10-Q. 1

Includes

cash

and

cash

equivalents,

restricted

cash,

marketable

securities,

construction

reserve

funds,

and

Title

XI

reserve

funds.

2

Includes current and long -term debt and capital lease obligations.

3

For definitions of total debt to total capital and net debt to total capital see

Appendix B. (USD in millions)

As of September 30, 2011

Cash and Near Cash Assets

1

707.3

$

Total Assets

3,662.3

Total Debt

698.4

Stockholders' Equity

1,831.6

Total Equity

1,842.6

Total Debt to Total Capital

3

27.5%

Total Net Debt to Total Capital

3

-0.4%

2

35 |

Stock Performance

36

(20)%

(15)%

(10)%

(5)%

-

%

5 %

10 %

15 %

20 %

Nov-10

Feb-11

May-11

Aug-11

Nov-11

5 Years

(100)%

100 %

300 %

500 %

700 %

900 %

1,100 %

1,300 %

Dec-92

Dec-94

Dec-96

Dec-98

Dec-00

Dec-02

Dec-04

Dec-06

Dec-08

Dec-10

1 Year

Since IPO

10 Years

CKH

S&P 500

Source: Yahoo!Finance |

37

Appendix A: Definitions

Average

gross

property

and

equipment

is

computed

by

averaging

the

beginning and ending quarterly values during the period. In our public filings, we

disclose net property and equipment by segment. We do not disclose total

gross property

and

equipment

by

business

unit,

however,

for

historical

cost

for

major

classes of equipment refer to Note 1 to our Consolidated Financial Statements

in our Annual Reports on Form 10-K.

Average

net

property

and

equipment

is

computed

by

averaging

the

beginning

and ending quarterly values during the period.

Operating

income

before

depreciation

and

amortization

(“OIBDA”)

is

a

non-

U.S. GAAP financial measure and calculated as operating income (loss) plus

depreciation and amortization.

Return

on

average

gross

property

and

equipment

is

calculated

as

operating

income before depreciation and amortization, a non-U.S. GAAP financial

measure, divided by average gross property and equipment. Returns for the

nine months ended September 30, 2011 were annualized.

Return

on

average

net

property

and

equipment

is

calculated

as

operating

income before depreciation and amortization, a non-U.S. GAAP financial

measure, divided by average net property and equipment. Returns for the nine

months ended September 30, 2011 were annualized.

|

38

Appendix B: Definitions

Book

value

per

share

is

calculated

as

SEACOR

Holdings

Inc.

stockholders’

equity divided by common shares outstanding at the end of the period.

After-Tax

Return

on

Equity

is

calculated

as

net

income

attributable

to

SEACOR

Holdings

Inc.

divided

by

SEACOR

Holdings

Inc.

stockholders’

equity

at the beginning of the year.

Total

Debt

to

Total

Capital

is

calculated

as

total

debt

divided

by

the

sum

of

total equity. Total equity is defined as SEACOR Holdings Inc.

stockholders’ equity plus noncontrolling interests in subsidiaries.

Net

Debt

to

Total

Capital

is

calculated

as

total

debt

less

cash

and

near

cash

assets divided by the sum of total equity. Total equity is defined as SEACOR

Holdings Inc. stockholders’

equity plus noncontrolling interests in subsidiaries.

|