Attached files

| file | filename |

|---|---|

| 8-K - ENDO PHARMACEUTICALS HOLDINGS INC--FORM 8-K - ENDO HEALTH SOLUTIONS INC. | d262080d8k.htm |

Exhibit 99.1 |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

2

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Statements including words such as

“believes,” “expects,”

“anticipates,”

“intends,”

“estimates,”

“plan,”

“will,”

“may,”

“look forward,”

“intend,”

“guidance,”

“future”

or similar

expressions are forward-looking statements. Because these statements reflect our

current views, expectations and beliefs concerning future events, these

forward-looking statements involve risks and uncertainties. Investors should note

that many factors, as more fully described under the caption “Risk

Factors”

in our Form 10-K, Form 10-Q and Form 8-K filings with the Securities and Exchange

Commission and as otherwise enumerated herein or therein, could affect our future

financial results and could cause our actual results to differ materially from those

expressed in forward-looking statements contained in our Annual Report on Form

10-K. The forward-looking statements in this presentation are qualified by

these risk factors. These are factors that, individually or in the aggregate, could cause our

actual results to differ materially from expected and historical results. We assume no

obligation to publicly update any forward-looking statements, whether as a result

of new information, future developments or otherwise. |

grow.

collaborate. innovate. thrive. ENDO PHARMACEUTICALS

3

I.

Our Diversified Business

II.

Pharmaceuticals

III.

American Medical Systems

IV.Innovation

V.

Financial Outlook |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

STRONG OPERATING PERFORMANCE

16% 3-YEAR CAGR FOR REVENUE*

* Revenue CAGR 2007-2010.

4

Sustaining our Growth |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

5

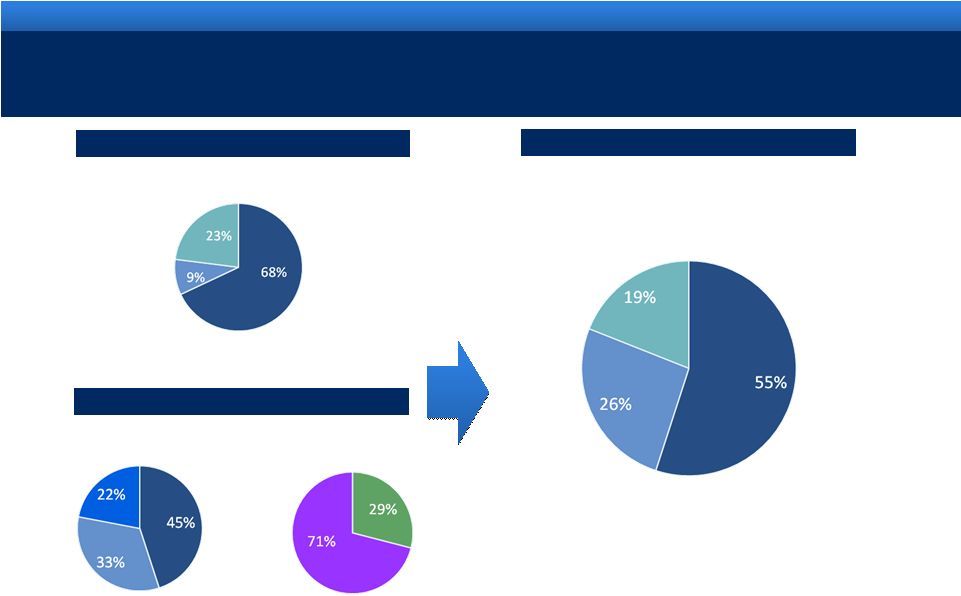

DIVERSIFIED HEALTHCARE SOLUTIONS COMPANY

Generic

Men’s

Health

TTM 9/30/11: $2.34B

(1)

TTM 9/30/11: $0.54B

(2)

TTM 9/30/11: $2.88B

(3)

Revenue mix

Endo

AMS

Pro Forma

1.

Represents TTM of pro forma 2010 acquisitions (Qualitest, HealthTronics and Penwest,

excluding AMS) 2.

Includes $0.3MM of revenue from the uterine health business, which was divested during the

first quarter 2010. 3.

Includes full year of AMS acquisition

Branded

Pharmaceuticals

Devices &

Services

Women’s

Health

BPH

Generic

Branded

Pharmaceuticals

Devices &

Services

Revenue mix

Revenue mix

International

US |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

6

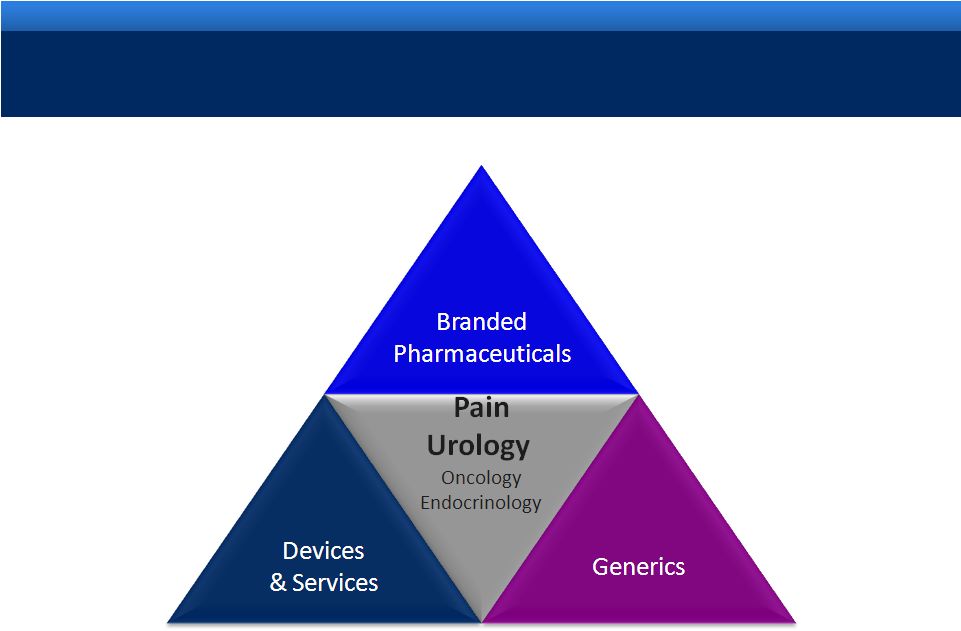

ENDO’S INTEGRATED BUSINESS MODEL |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

STRONG CORE BUSINESS SUPPORTING GROWTH

7 |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

40% of Sales from Controlled Substances

Manufacturing Flexibility

Distribution Capability

Product Line Optimization

GENERICS OVERVIEW

•

Strong Q3 2011 Topline

Growth

•

17% pro forma sales growth

versus same quarter last year.

•

Strong Growth Expectations

•

Expect net sales CAGR of more

than 15% for 2010 through 2012

•

Outperforming Deal Synergies

•

Cost of Goods improvement

through insourcing of product

manufacturing

•

API procurement

8 |

grow. collaborate.

innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

SO WHAT HAPPENS NEXT?

AMERICAN MEDICAL SYSTEMS

9 |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

10

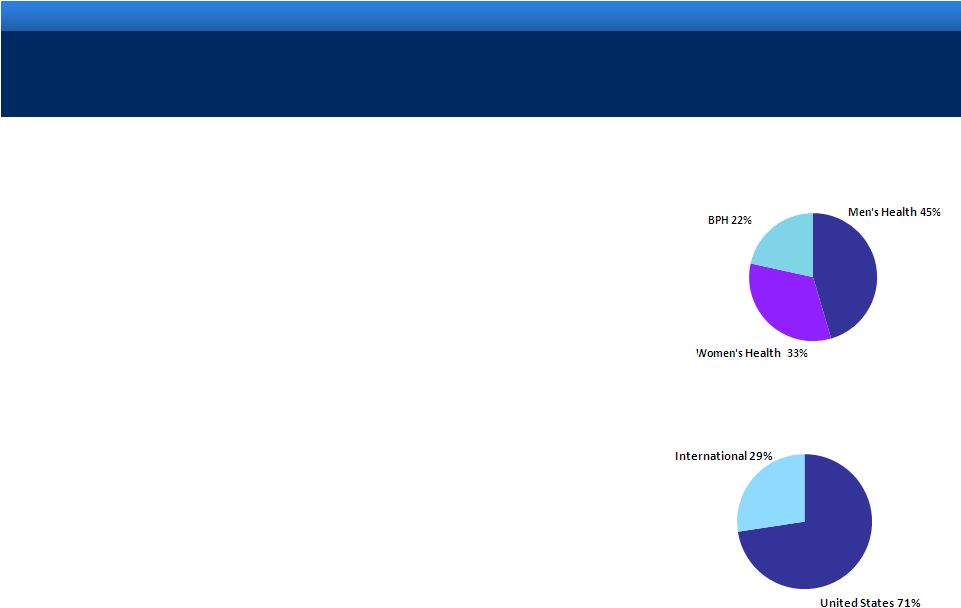

Leading Provider of Devices to Pelvic Health Space

•

Men’s Health: Solutions for male incontinence and erectile

dysfunction prostheses

•

Women’s Health: Solutions for female incontinence and pelvic

floor repair

•

Benign Prostatic Hyperplasia (BPH) Therapy: Laser treatments

Strong Product Portfolio Supported by Robust Future

Product Cadence

•

Solid market share in several categories that have historically

grown in the mid-to-high single digit range over the long-term

•

Near-term growth driven by new product launches and

increased utilization of recent products such as MoXy Fiber

Seasoned Management Team and High Quality Assets

•

Team has significant experience running a growing devices

business

•

Four global facilities –

two in the US (Minnetonka, MN and San

Jose, CA) and two in Europe (Breukelen, Netherlands and

Athlone, Ireland)

10

AMS COMPANY PROFILE

Revenue

by

Business

(1)

TTM as of 9/30/2011

Revenue

by

Geography

(1)

TTM as of 9/30/2011

(1) Includes $0.3MM of revenue from the

uterine health business, which was divested

during the first quarter of 2010 |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

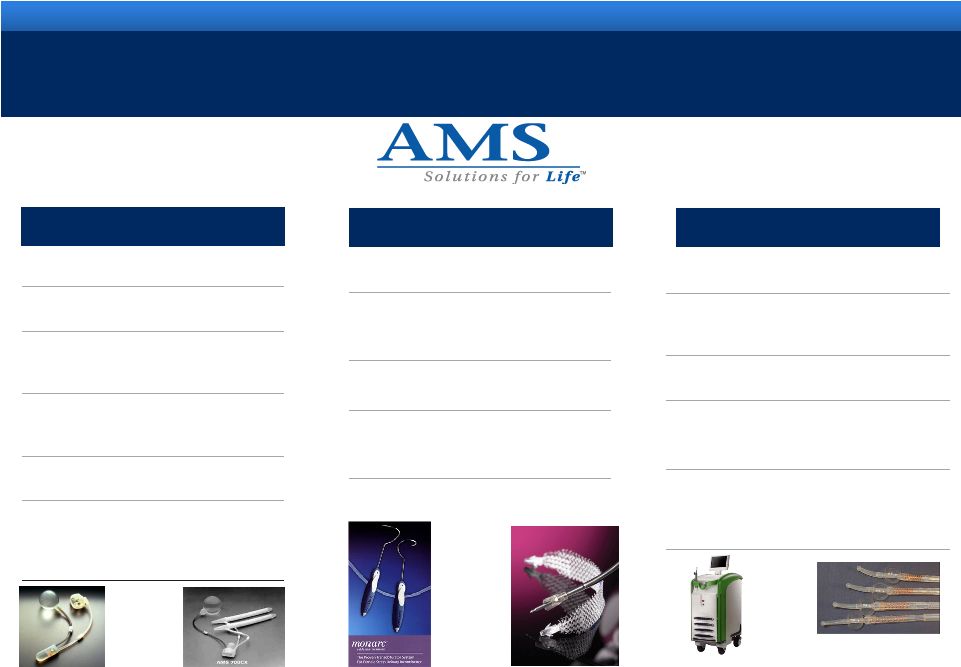

Men’s Health

11

AMS –

PRODUCT PORTFOLIO

BPH

Women’s Health

Product

Description

AMS 800®

Artificial Urinary

Sphincter

InVance®

Less invasive treatment

for moderate

incontinence

AdVance®

Less invasive treatment

for mild to moderate

incontinence

UroLume®

Endoprosthesis for non-

surgical candidates

AMS 700®

Semi-rigid malleable

prostheses/inflatable

prostheses for treatment

of Erectile Dysfunction

Product

Description

Monarc®

Self-fixating, subfascial

hammock for treatment of

stress incontinence

MiniArc®

Single-Incision Sling for

stress incontinence

Elevate®

Transvaginal pelvic floor

repair system (requires no

external incisions)

Product

Description

GreenLight™

Photo Vaporization / laser

therapy designed to

remove prostatic tissue

StoneLight®

Laser treatment of urinary

stones

SureFlex™

Fiber optic line designed

for holmium laser

lithotripsy

TherMatrx®

Less invasive tissue

ablation technique for

men not yet to the point

of urethral obstruction |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

12

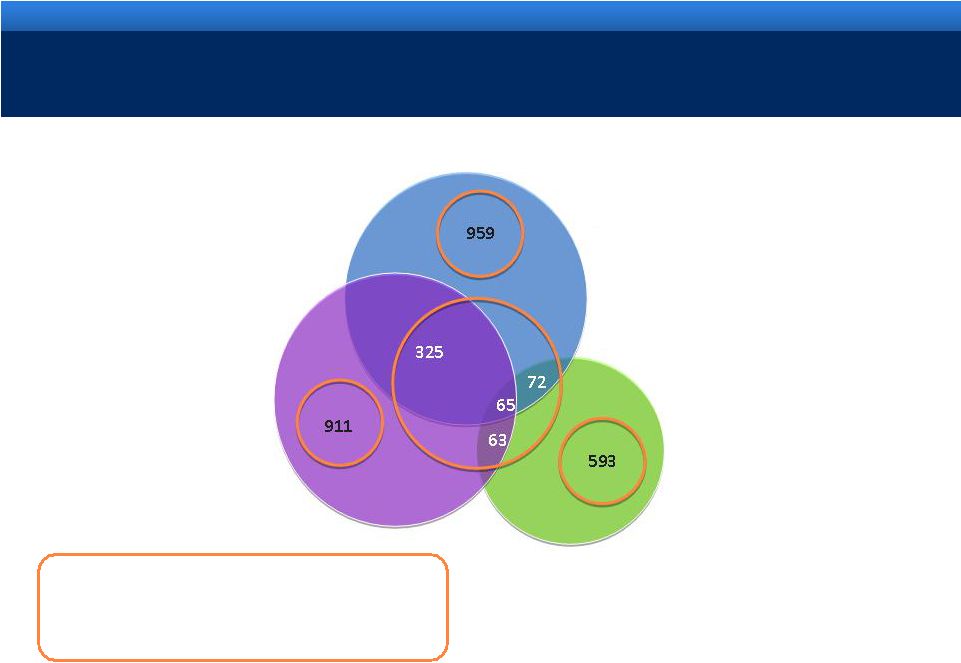

PRACTICE OVERLAP OPPORTUNITY

VALSTAR®/VANTAS®

(Urology practices

currently prescribing)

AMS

(Urology practices

with at least one MD using

AMS products in a top-200

AMS account)

HealthTronics

(Urology practices

currently in a partnership)

More than 2,400 practices

have a relationship with one business,

but could represent opportunity for the others |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

ENDO HEALTHCARE SOLUTIONS IN ACTION

PAIN & UROLOGY

Branded

Pharmaceuticals

Generics

Devices

and Services

13 |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

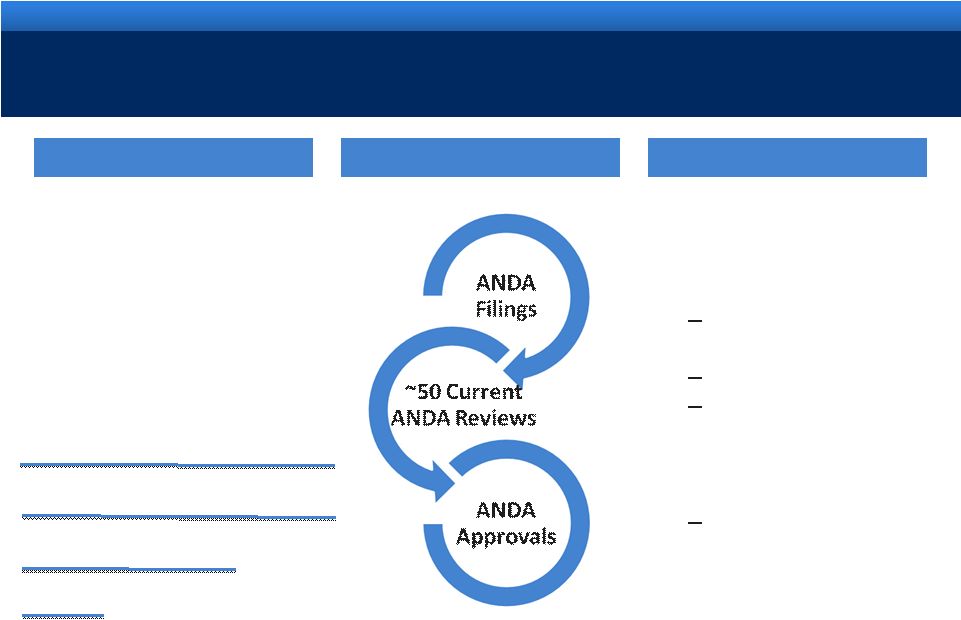

COMMITMENT TO INNOVATION

14

Branded Pharmaceuticals

Medical Devices

Generic Pharmaceuticals

Generic Development

Supplements strong

commercial base growth

•

Continually enhancing

existing products

•

Recent advances:

GreenLight™

XPS Laser

Console

MoXy™

Laser Fiber

AdVance™

XP (OUS)

•

Developing treatments in

new areas

Topas™

sling

•

Exploring new emerging

technologies

•

Key Therapeutic Areas

•

Pain

•

Oncology

•

Endocrinology

•

Semi-Virtual R&D Model

•

Global Partnerships

•

Discovery

•

Early Development

•

Development Pipeline

OPANA®

ER

(NDA)

Formulation designed to be crush-resistant

AVEED™

(NDA)

Long Acting Injectable Testosterone

Urocidin™

(Ph. III)

Bladder Cancer

Androgen Receptor Antagonist (Ph. I)

Castration Resistant Prostate Cancer |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

15

2011 ENDO GUIDANCE

Guidance

Revenue range

$2.72B -

$2.80B

Adjusted diluted EPS range

$4.55 -

$4.65

Reported (GAAP) diluted EPS range

$1.87 -

$1.97 |

|

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals

17

17

RECONCILIATION OF NON-GAAP MEASURES

17

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s

Current Report on Form 8-K filed today with the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per

Share Guidance for the Year Ending December 31, 2011 Lower End of Range

Upper End of Range

Projected GAAP diluted income per common share

$1.87

$1.97

Upfront and milestone-related payments to partners

$0.25

$0.25

Amortization of commercial intangible assets and inventory step-up

$2.10

$2.10

Acquisition and integration costs related to recent acquisitions.

$0.48

$0.48

Impairment of long-lived assets through September 30, 2011

$0.19

$0.19

Interest expense adjustment for ASC 470-20

$0.16

$0.16

Tax effect of pre-tax adjustments at the applicable tax rates and

certain other expected cash tax savings as a result of recent

acquisitions

($0.50)

($0.50)

Diluted adjusted income per common share guidance

$4.55

$4.65

The company's guidance is being issued based on certain assumptions including:

•Certain of the above amounts are based on estimates and there

can be no assurance that Endo will achieve these results

•Includes all completed business development transactions as of

December 1, 2011 |

|