Attached files

| file | filename |

|---|---|

| 8-K - SUCAMPO PHARMACEUTICALS, INC. 8-K - Sucampo Pharmaceuticals, Inc. | a50085637.htm |

Exhibit 99.1

Applying scientific and medical leadership in prostones to develop and commercialize therapeutics for an aging population Corporate Update As of November 29, 2011 1

Forward-Looking Statements Forward-looking statements contained in this presentation are based on Sucampo’s assumptions and events expectations concerning future events. They are subject to significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Sucampo’s forward-looking statements could be affected by numerous p g y foreseeable and unforeseeable events and developments such as regulatory delays, the failure of clinical trials, the inability to fund drug development initiatives, competitive products and other factors identified in the “Risk Factors” section of Sucampo’s Annual Report on Form 10-K and other periodic reports filed with the Securities and Exchange Commission. While Sucampo may elect to update these statements at some point in the future Sucampo specifically disclaims any obligation to do so, whether as a result of new information, future events or otherwise. In light of the significant uncertainties inherent in the forward-looking information in this presentation, you are cautioned not to place undue reliance on these forward-looking statements. 2

Sucampo Investment Highlights • Proven technology: Leadership in prostones -- key ion channel activators with validated activators, clinical utility • Commercial products focused on large patient populations: AMITIZA® approved in the U.S.; RESCULA® was approved in the U.S. and was approved in 45 countries; on market in Japan • Clinical expansion: AMITIZA label expansion strategies underway in the U.S., Europe and Asia; RESCULA label expansion strategies underway in the U.S. and Europe • Robust pipeline: Revenue stream fueling advances in proprietary prostone-based portfolio 3

Prostones • Class of compounds derived from endogenous functional fatty wound acids with wound-healing and restorative properties* • Selectively activate ion channels that modulate key pathways • Metabolize quickly into inactive form - useful for localized effect in specific organs • Broad and validated therapeutic applicability - can be targeted to induce specific pharmacological effects** *Blikslager AT et al. Comparison of the chloride channel activator lubiprostone and the oral laxative Polyethylene Glycol 3350 on Mucosal Barrier Repair in ischemic-injured porcine intestine. World J Gastroenterol 2008 Oct 21;14(39):6012-7. **Cuppoletti J et al. SPI-0211 activates T84 cell chloride transport and recombinant human ClC-2 chloride currents Am J Physiol Cell Physiol 287:C1173-C1183, 2004 4

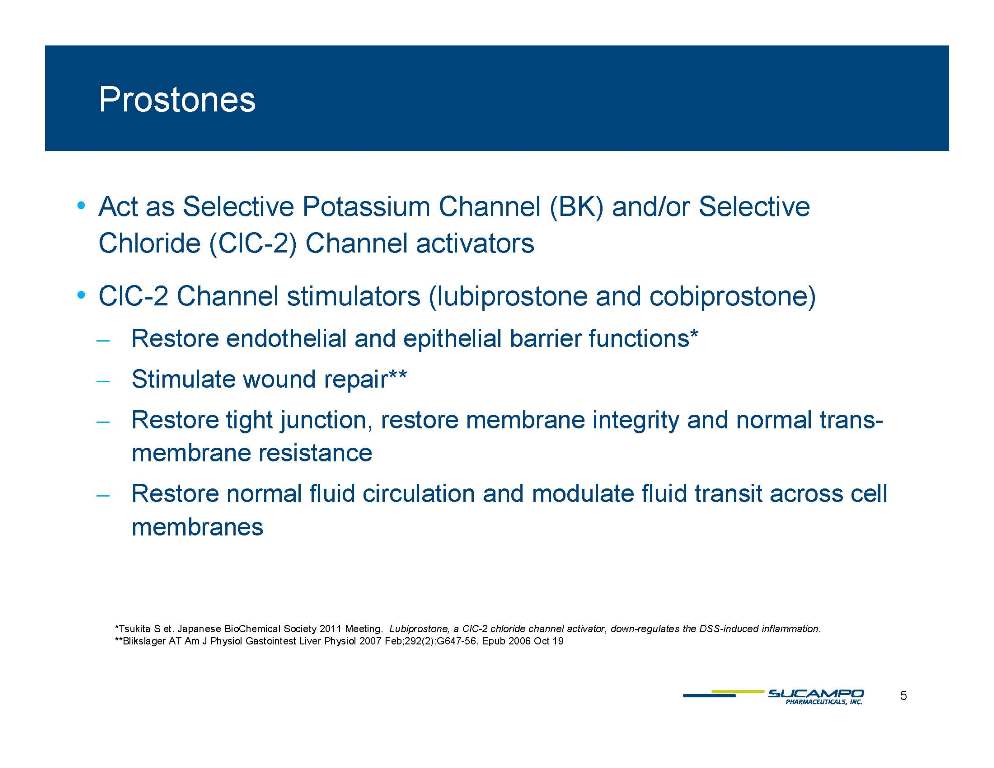

Prostones • Act as Selective Potassium Channel (BK) and/or Selective Chloride (ClC 2) Channel activators • ClC-2 Channel stimulators (lubiprostone and cobiprostone) - Restore endothelial and epithelial barrier functions - Stimulate wound repair** - Restore tight junction, restore membrane integrity and normal trans- membrane resistance - Restore normal fluid circulation and modulate fluid transit across cell membranes * Tsukita S et. Japanese BioChemical Society 2011 Meeting. Lubiprostone, a ClC-2 chloride channel activator, down-regulates the DSS-induced inflammation. **Blikslager AT Am J Physiol Gastointest Liver Physiol 2007 Feb;292(2):G647-56. Epub 2006 Oct 19 5

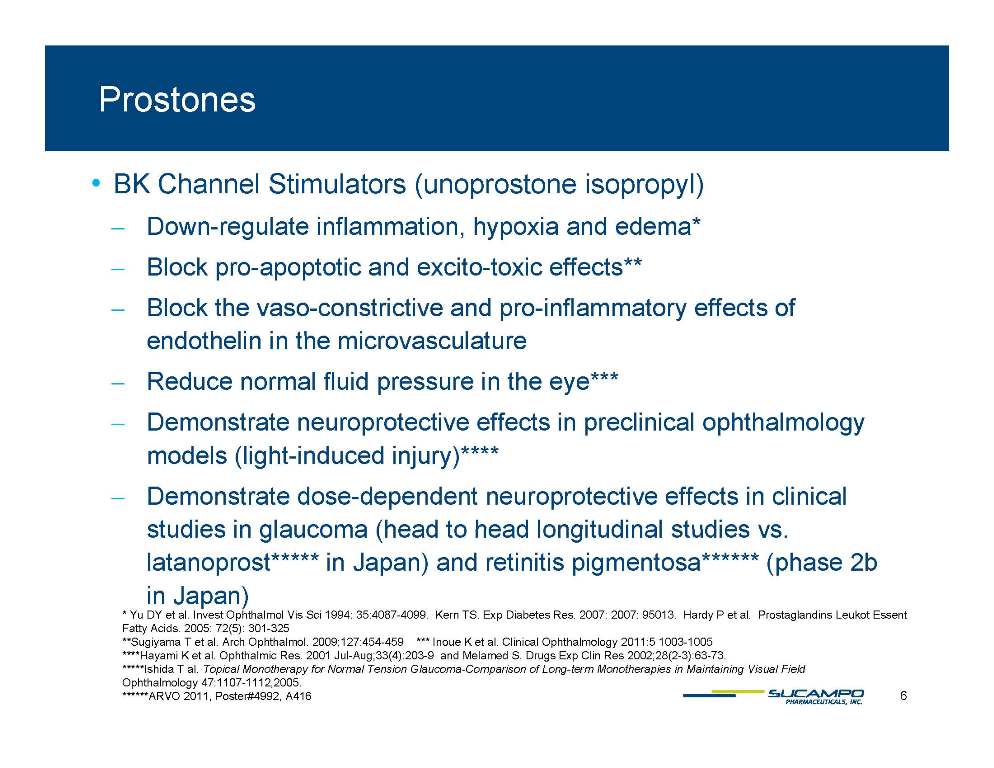

Prostones • BK Channel Stimulators (unoprostone isopropyl) - Down-regulate inflammation, hypoxia and edema* - Block pro-apoptotic and excito-toxic effects** - Block the vaso-constrictive and pro-inflammatory effects of endothelin in the microvasculature - Reduce normal fluid pressure in the eye*** - Demonstrate neuroprotective effects in preclinical ophthalmology models (light-induced injury)**** - Demonstrate dose-dependent neuroprotective effects in clinical studies glaucoma (head to head vs in longitudinal studies vs. latanoprost***** in Japan) and retinitis pigmentosa****** (phase 2b in Japan) * Yu DY et al. Invest Ophthalmol Vis Sci 1994: 35:4087-4099. Kern TS. Exp Diabetes Res. 2007: 2007: 95013. Hardy P et al. Prostaglandins Leukot Essent Acids 301 325 Fatty Acids. 2005: 72(5): 301-**Sugiyama T et al. Arch Ophthalmol. 2009;127:454-459 *** Inoue K et al. Clinical Ophthalmology 2011:5 1003-1005 ****Hayami K et al. Ophthalmic Res. 2001 Jul-Aug;33(4):203-9 and Melamed S. Drugs Exp Clin Res 2002;28(2-3):63-73. *****Ishida T al. Topical Monotherapy for Normal Tension Glaucoma-Comparison of Long-term Monotherapies in Maintaining Visual Field Ophthalmology 47:1107-1112,2005. ******ARVO 2011, Poster#4992, A416 6

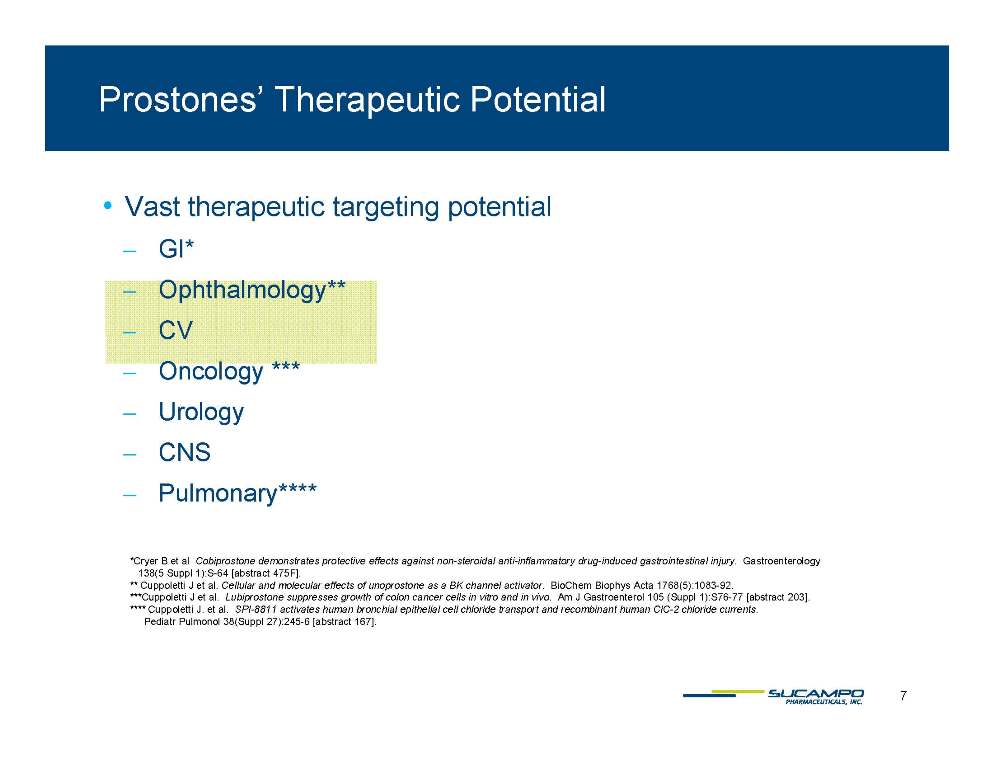

Prostones’ Therapeutic Potential • Vast therapeutic targeting potential - GI* - Ophthalmology** - CV - Oncology *** - Urology - CNS - Pulmonary**** *Cryer B et al Cobiprostone demonstrates protective effects against non-steroidal anti-inflammatory drug-induced gastrointestinal injury. Gastroenterology 138(5 Suppl 1):S-64 [abstract 475F]. ** Cuppoletti J et al. Cellular and molecular effects of unoprostone as a BK channel activator. BioChem Biophys Acta 1768(5):1083-92. ***Cuppoletti J et al. Lubiprostone suppresses growth of colon cancer cells in vitro and in vivo. Am J Gastroenterol 105 (Suppl 1):S76-77 [abstract 203]. **** Cuppoletti J. et al. SPI-8811 activates human bronchial epithelial cell chloride transport and recombinant human ClC-2 chloride currents. Pediatr Pulmonol 38(Suppl 27):245-6 [ abstract 167]. 7

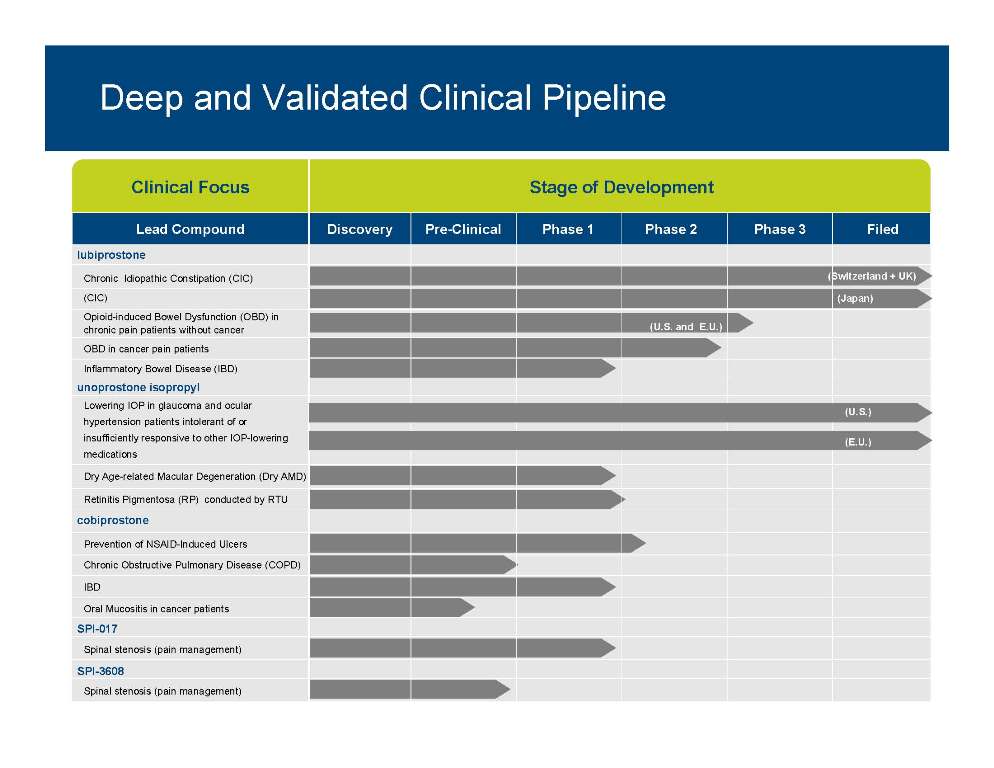

Deep and Validated Clinical Pipeline Clinical Focus Stage of Development Lead Compound Discovery Pre-Clinical Phase 1 Phase 2 Phase 3 Filed lubiprostone Chronic Idiopathic Constipation (CIC) (CIC) Opioid-induced Bowel Dysfunction (OBD) in chronic pain patients without cancer (U.S. and E.U.) (Japan) (Switzerland + UK) unoprostone isopropyl OBD in cancer pain patients Inflammatory Bowel Disease (IBD) Lowering IOP in glaucoma and ocular hypertension patients intolerant of or (U.S.) cobiprostone insufficiently responsive to other IOP-lowering medications Dry Age-related Macular Degeneration (Dry AMD) Retinitis Pigmentosa (RP) conducted by RTU (E.U.) SPI 017 Prevention of NSAID-Induced Ulcers Chronic Obstructive Pulmonary Disease (COPD) IBD Oral Mucositis in cancer patients 8 SPI-Spinal stenosis (pain management) SPI-3608 Spinal stenosis (pain management)

AMITIZA (lubiprostone) 9 24 mcg for CIC 8 mcg for IBS-C

AMITIZA (lubiprostone) A differentiated mechanism of action • Small secretion: Chloride intestine fluid ions enter intestinal lumen following CLC-2 activation • Small intestine fluid secretion: Sodium ions follow chloride ions into lumen to maintain isoelectric neutrality • Small intestine fluid secretion: Ion transport also draws water into lumen to maintain osmotic neutrality • Lubiprostone activates intestinal CLC-2 channels: Works through ‘facilitated diffusion’ and/or ‘passive transport’ • Increases tight junction integrity and function to maintain normal transepithelial resistance. Basavappa S., et al Journal of Cellular Physiology 2005;202(1):21-31 10

AMITIZA (lubiprostone) Indications: Approved by FDA for the treatment of IBS-C in women aged 18 years and older and for the treatment of CIC in adults Global status: Marketed by Takeda in US, Abbott holds marketing rights to CIC in Japan, ROW owned by Sucampo U.S. Sales (net): $220 million in 2010 Patent Life: May extend effective exclusivity to 2022 11

AMITIZA (lubiprostone) Key Events • Label expansion • Phase 3 OBD trial results • Swiss pricing • Japanese NDA decision • MAA approval in the U.K. • E.U. pricing • Japanese pricing • Decision in Takeda arbitration 12

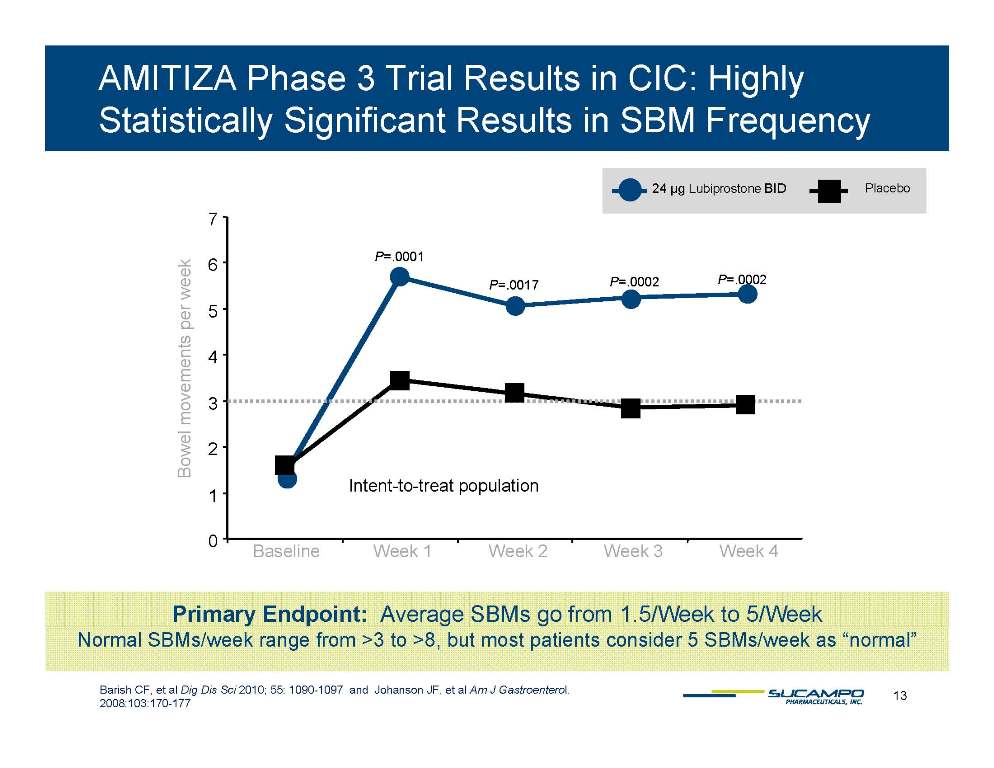

AMITIZA Phase 3 Trial Results in CIC: Highly Statistically Significant Results in SBM Frequency 24 µg Lubiprostone BID Placebo 7 P=.0001 P=.0017 P=.0002 P=.0002 5 6 s per week 3 4 l movements Intent-to-treat population 1 2 Bowel 0 Baseline Week 1 Week 2 Week 3 Week 4 Primary Endpoint: Average SBMs go from 1.5/Week to 5/Week Barish CF, et al Dig Dis Sci 2010; 55: 1090-1097 and Johanson JF, et al Am J Gastroenterol. 2008:103:170-177 Normal SBMs/week range from >3 to >8, but most patients consider 5 SBMs/week as “normal” 13

In a 48 Week trial of high-dose AMITIZA, taken with food, CIC patients 1.08 reports/1,000 patient days with a reported nausea event ̶ 58.2% of all nausea events were “Mild”, i.e., noticeable but no effect on daily activities, and “acceptable” 38.8% of all nausea events were Moderate, noticeable, some effect on daily activities, and “acceptable’ 3% of all nausea events, or 0.03 reports/100,000 patient days, were “Severe”, i.e., noticeable, had a significant effect on daily activities, and “unacceptable”. All of these “Severe” patients were on concomitant medicines, many with label warnings for nausea. Time of patients’ discontinuation for nausea: • 9 patients (3.6%) discontinued during weeks 0-12 • 4 patients (1.6%) discontinued during weeks 13-48 * Lembo, AJ, et al. Long-Term Safety and Effectiveness of Lubiprostone, a Chloride Channel (ClC-2) Activator, in Patients with Chronic Idiopathic Constipation. Dig Dis Sci (2011) 56:2639-2645 14

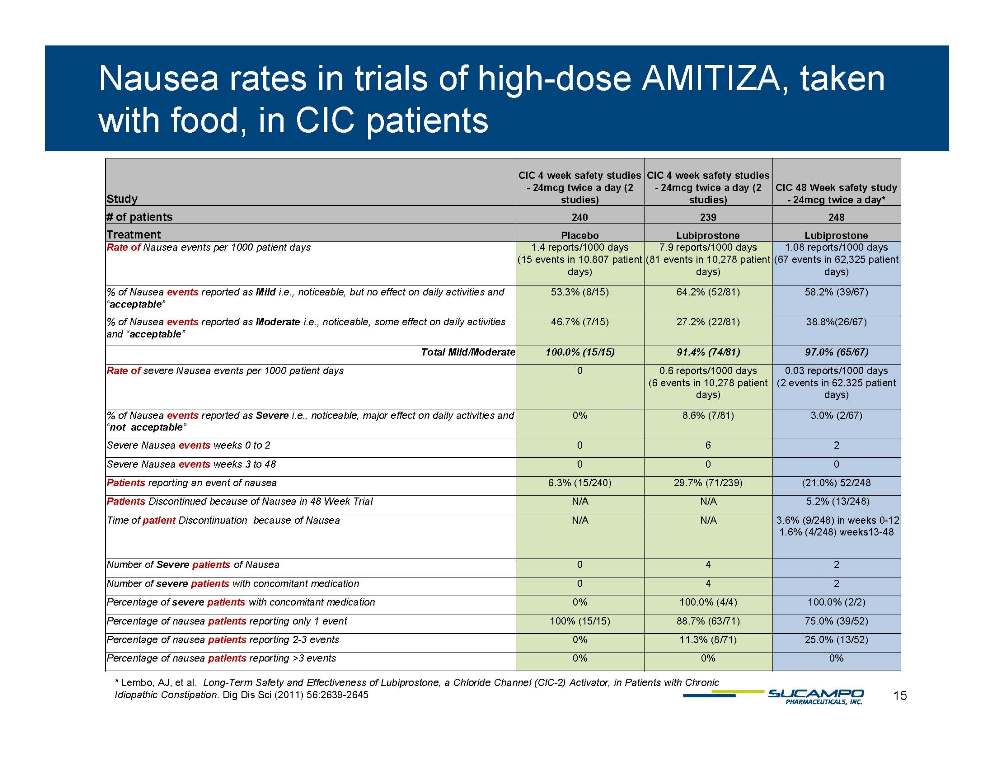

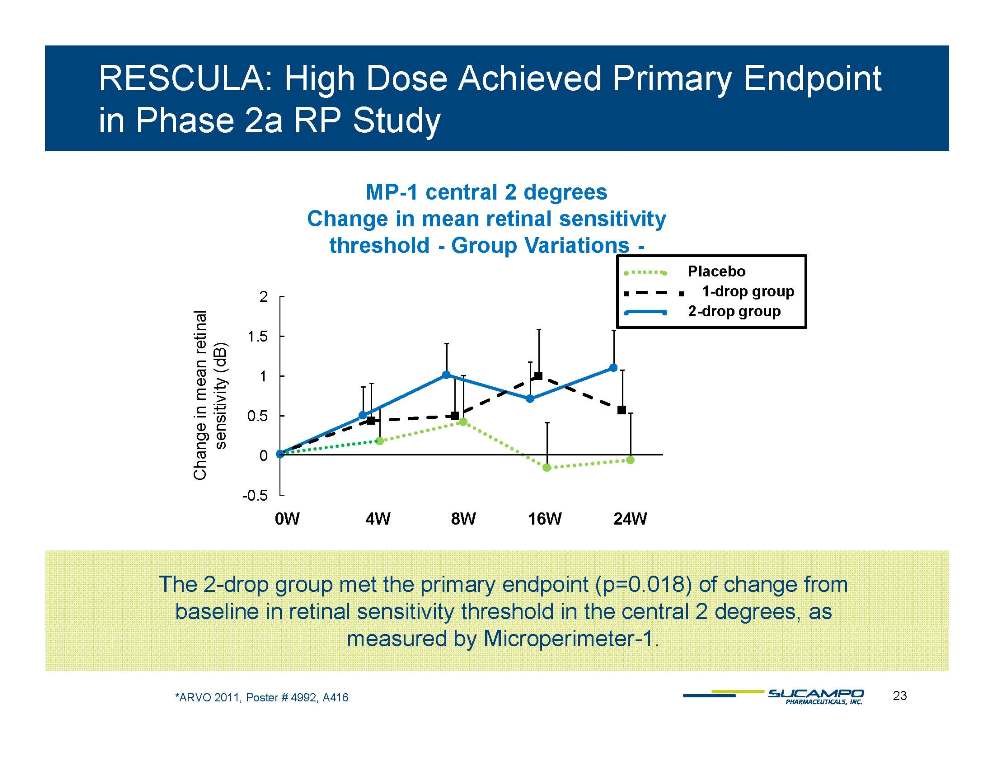

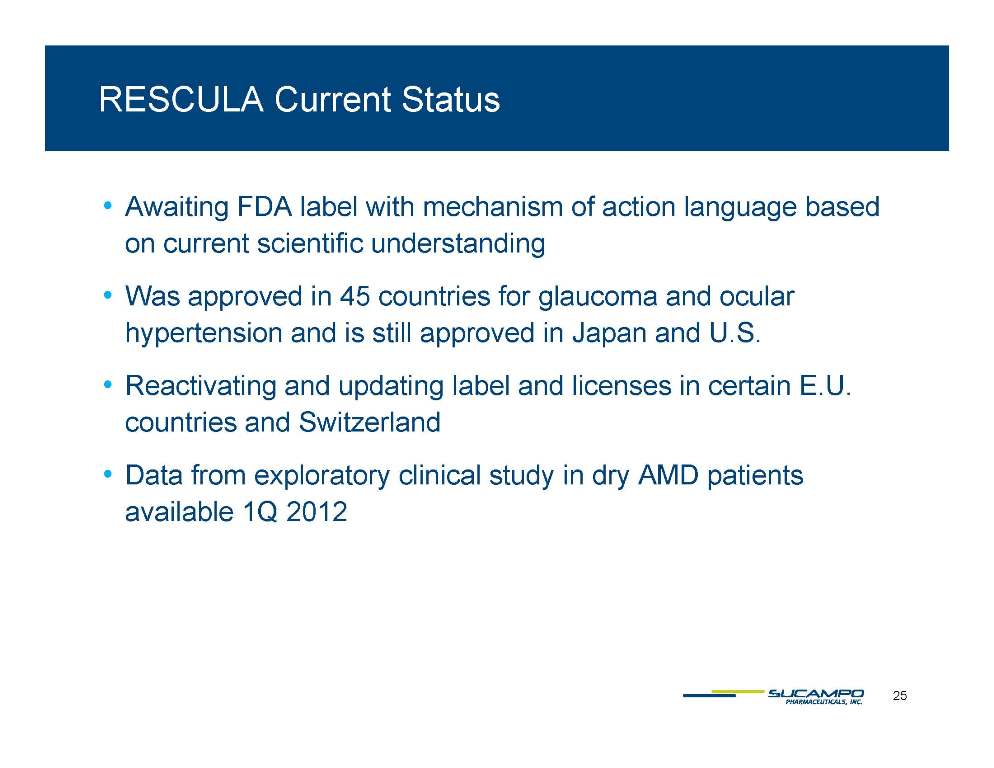

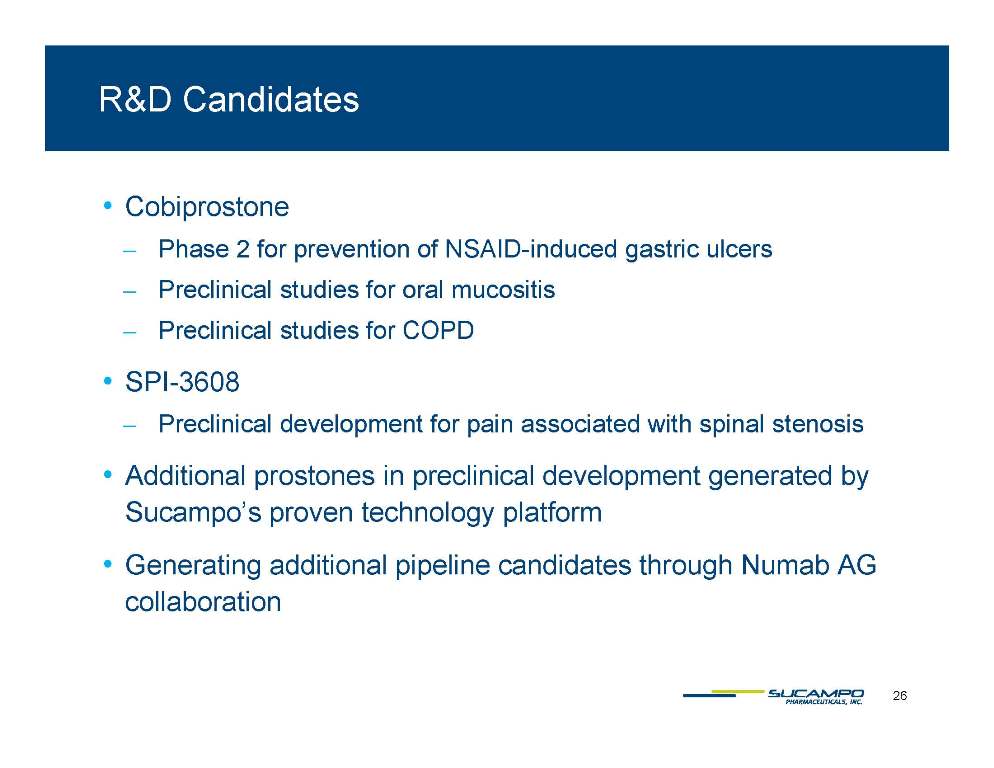

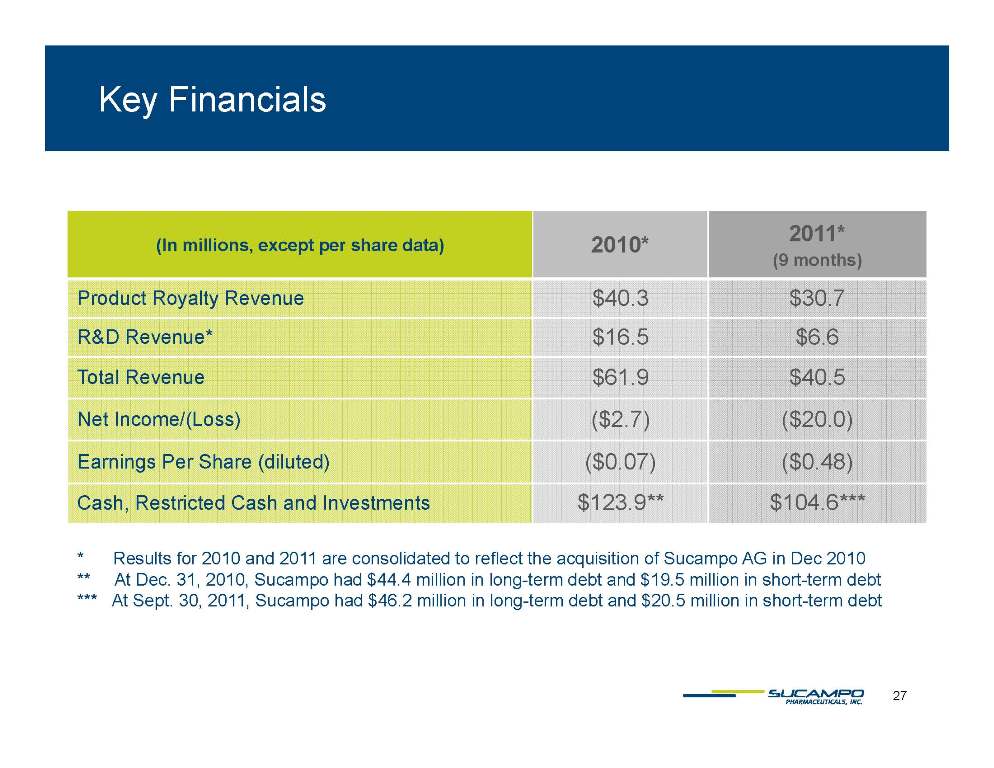

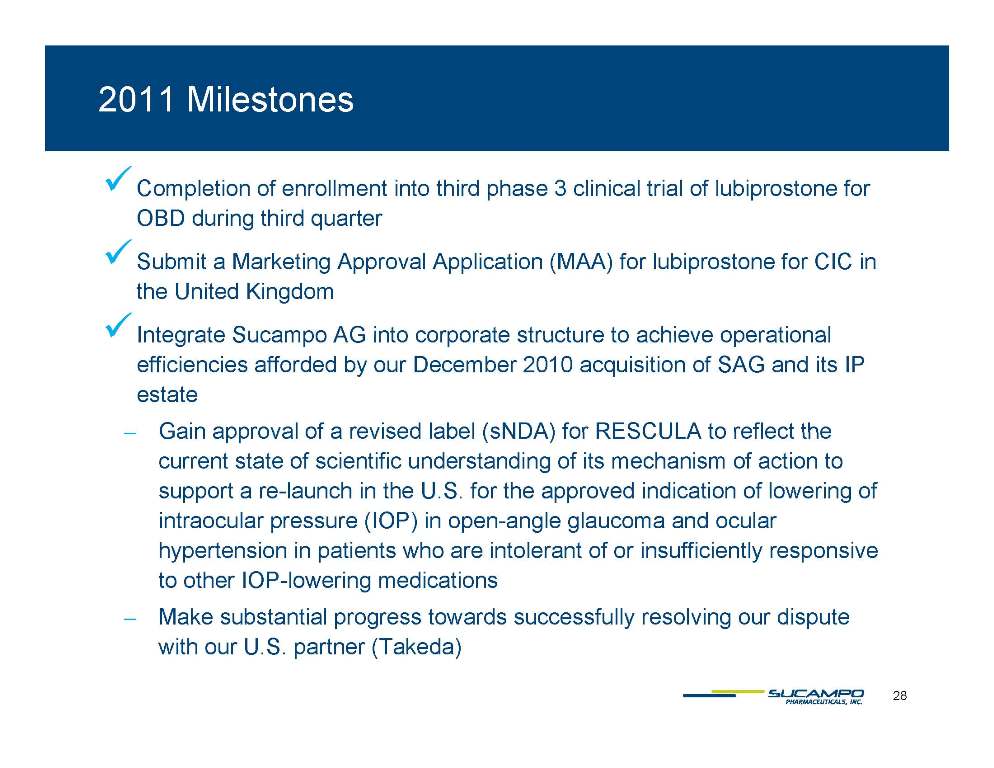

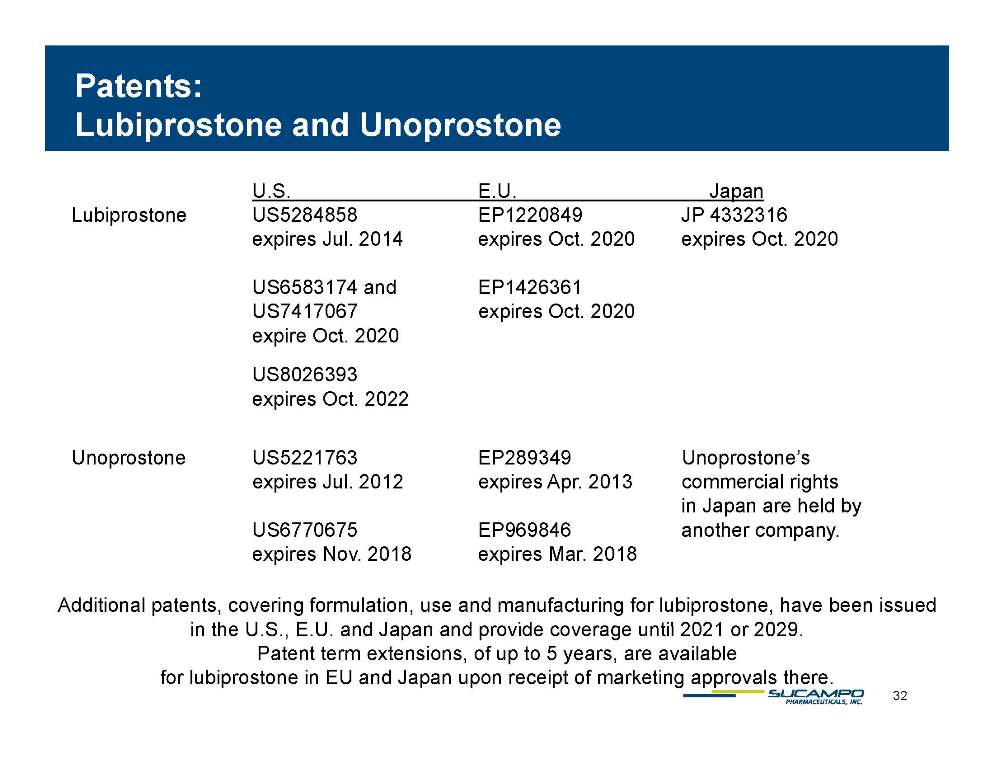

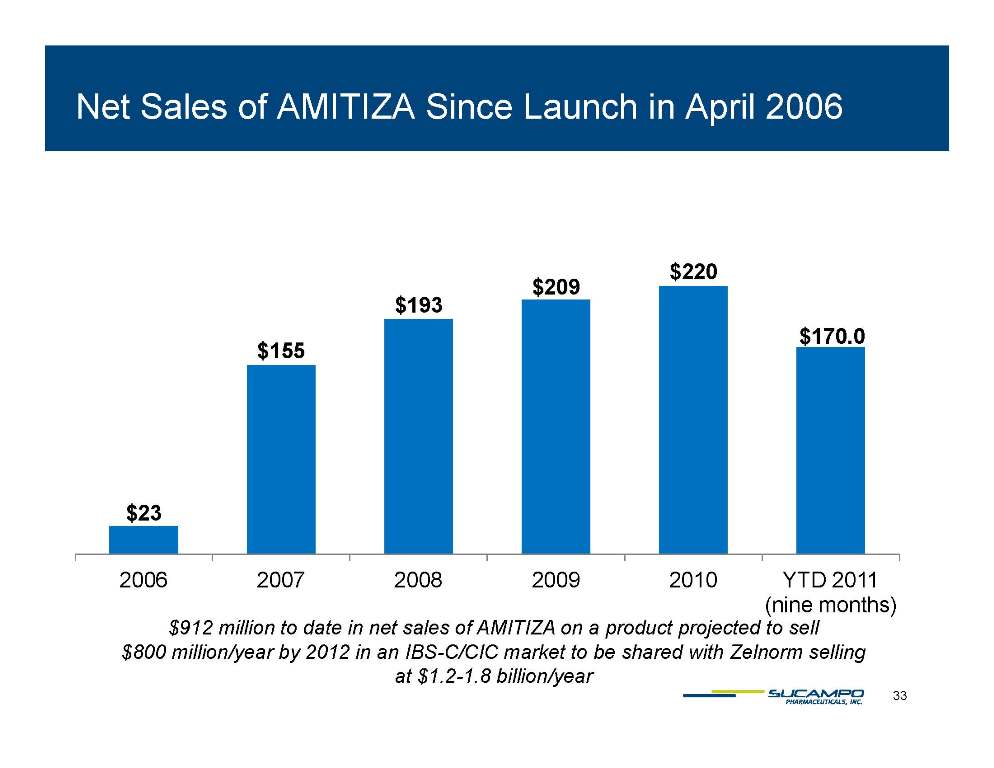

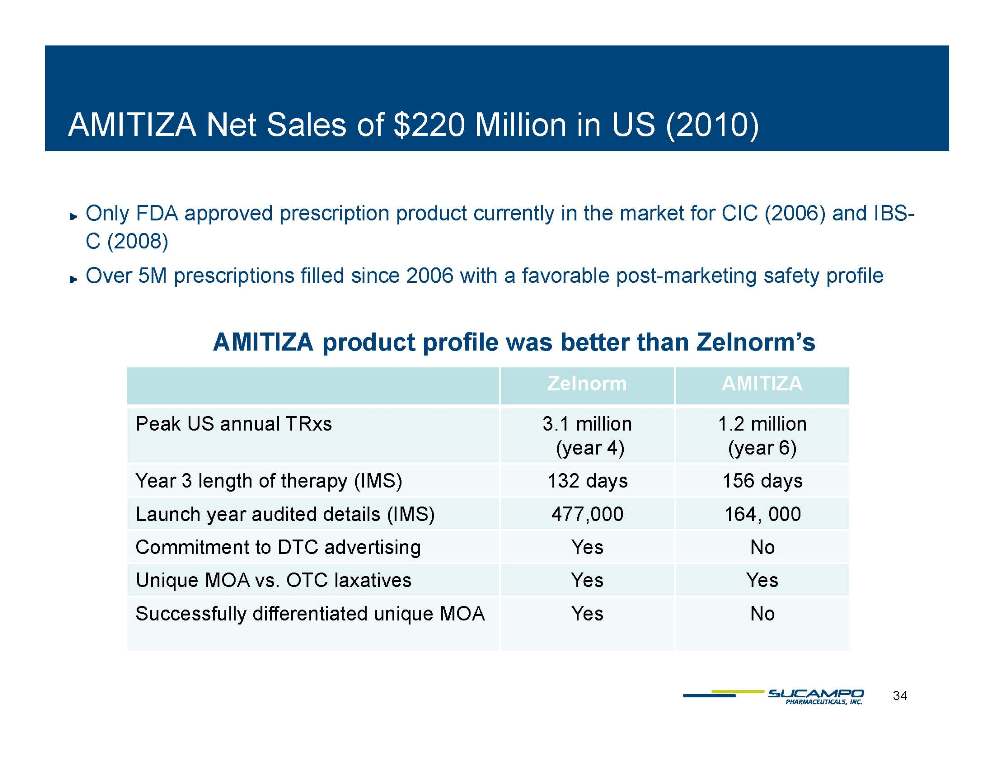

Nausea rates in trials of high-dose AMITIZA, taken with food, in CIC patients Study CIC 4 week safety studies - 24mcg twice a day (2 studies) CIC 4 week safety studies - 24mcg twice a day (2 studies) CIC 48 Week safety study - 24mcg twice a day* # of patients 240 239 248 Treatment Placebo Lubiprostone Lubiprostone p p Rate of Nausea events per 1000 patient days 1.4 reports/1000 days (15 events in 10,807 patient days) 7.9 reports/1000 days (81 events in 10,278 patient days) 1.08 reports/1000 days (67 events in 62,325 patient days) % of Nausea events reported as Mild i.e., noticeable, but no effect on daily activities and “acceptable” 53.3% (8/15) 64.2% (52/81) 58.2% (39/67) % of Nausea events reported as Moderate i.e., noticeable, some effect on daily activities and “acceptable” 46.7% (7/15) 27.2% (22/81) 38.8%(26/67) acceptable Total Mild/Moderate 100.0% (15/15) 91.4% (74/81) 97.0% (65/67) Rate of severe Nausea events per 1000 patient days 0 0.6 reports/1000 days (6 events in 10,278 patient days) 0.03 reports/1000 days (2 events in 62,325 patient days) % of Nausea events reported as Severe i.e., noticeable, major effect on daily activities and “not acceptable” 0% 8.6% (7/81) 3.0% (2/67) p Severe Nausea events weeks 0 to 2 0 6 2 Severe Nausea events weeks 3 to 48 0 0 0 Patients reporting an event of nausea 6.3% (15/240) 29.7% (71/239) (21.0%) 52/248 Patients Discontinued because of Nausea in 48 Week Trial N/A N/A 5.2% (13/248) Time of patient Discontinuation because of Nausea N/A N/A 3.6% (9/248) in weeks 0-12 1 6% k 13 48 1.6% (4/248) weeks13-Number of Severe patients of Nausea 0 4 2 Number of severe patients with concomitant medication 0 4 2 Percentage of severe patients with concomitant medication 0% 100.0% (4/4) 100.0% (2/2) Percentage of nausea patients reporting only 1 event 100% ( 15/15) 88.7% ( 63/71) 75.0% ( 39/52) 15 * Lembo, AJ, et al. Long-Term Safety and Effectiveness of Lubiprostone, a Chloride Channel (ClC-2) Activator, in Patients with Chronic Idiopathic Constipation. Dig Dis Sci (2011) 56:2639-2645 g g y ) ) ) Percentage of nausea patients reporting 2-3 events 0% 11.3% (8/71) 25.0% (13/52) Percentage of nausea patients reporting >3 events 0% 0% 0% Growth Strategy: AMTIZA in OBD Clinical program of three phase 3 trials of AMITIZA for the treatment opioidinduced induced bowel dysfunction (OBD) Reported positive results of AMITIZA phase 3 trial (OBD0631) at DDW 2010 Patients taking lubiprostone p=0 02) achieved a statistically significant (p 0.02) greater increase in the mean number of SBMs per week in 8 of the 12 weeks of the trial as compared to placebo patients The percentage of patients who achieved a SBM within 24 hours and 48 hours was significantly higher with lubiprostone as compared to placebo (p=0.0126 at 24 hours, and p=0.0360 at 48 hours) Statistical significance was achieved for the overall change from baseline in constipation-associated symptom secondary endpoints 16 *Cryer B., et al. A phase 3, randomized, double-blind, placebo-controlled clinical trial of lubiprostone for the treatment of opioid-induced bowel dysfunction in patients with chronic non-cancer pain. Gastroenterology 138(5 Suppl 1):S-129 [abstract 906] AMTIZA Expansion Strategy Well Underway Third phase 3 trial of AMITIZA for the treatment of OBD fully enrolled T i l d i Trial design ̶ Primary endpoint: change from baseline in SBM frequency at Week 8 without reduction in dose of study pain medication R d i d l b t ll d lti t ti l ̶ Randomized, placebo-controlled, multi-center trial ̶ Almost the same protocol as used in the successful phase 3 trial (OBD0631) reported at DDW 2010, except exclusion of patients on methadone One 24-lubiprostone or placebo ̶ mcg gel capsule of twice each day ̶ 12 week treatment period ̶ Permitted concomitant pain medications include fentanyl, morphine and oxycontin but exclude methadone ̶ Enrolled more than 420 patients in the U.S. and Europe Sucampo and Takeda will share trial costs equally 17 Top-line phase 3 results expected by year-end 2011 *Sucampo press releases, Jan.7, 2011 and Aug. 4, 2011 Terms of Sucampo’s AMITIZA Agreement with Takeda Takeda shall exert best efforts to promote, market, and sell and to maximize net sales revenue U S AMITIZA in the U.S. and Canada Sucampo’s tiered annual Sucampo s royalty rate: 18% to 26% of net sales Sucampo earned $20 million in upfront and $130 million in development milestone payments, as of Sept. 30, 2011 p py , p , We are disappointed by our partner’s performance Arbitration hearing for 2011 but set December it is not known if the arbitration will remain on schedule or how long thereafter the arbitration proceedings will conclude 18 AMITIZA Japanese Strategy Sucampo granted Abbott exclusive rights to commercialize AMITIZA Japan in for CIC and right of first refusal for additional indications in Japan If successfully developed, Sucampo will supply finished product to Abb Abbott Sucampo has received a total of $22.5 million in upfront and milestone payments from Abbott, as of Sept. 30, 2011 y Sucampo designed and managed the recently reported successful phase 3 efficacy trial and long-term safety trial in Japanese CIC patients NDA submitted September 2010 Next Steps: Japanese regulatory decision 19 RESCULA Compound: Unoprostone isopropyl Indication: FDA approved for the lowering of intraocular pressure (IOP) in open-angle glaucoma and ocular hypertension in patients who are intolerant of or insufficiently responsive to other IOPlowering medications Global status: Updating US label via sNDA; conducting trials to drive label expansion in dry AMD; reactivating and updating labels and licenses in EU Patent Life (Registered formulated drug product patent): Extends to 2018 20 RESCULA Upcoming Milestones: Data from exploratory dry AMD trial sNDA for glaucoma indication in US Reactivated licenses and revised labels in certain EU countries and Switzerland 21 RESCULA: Broad Therapeutic Potential A demonstrated, but not yet labeled, unique mechanism of action Rescula (unoprostone isopropyl) activates Maxi K (BK) channels in neurons and contractile cells* endothelin* Blocks effect of endothelin Lowers IOP by increased outflow of aqueous humor through trabecular meshwork and uveoscleral pathway** nerve*** Increases both retinal and choroidal components of ocular blood flow to optic nerve Exploring AMD potential suggested by increased choroidal blood flow and endothelin blockade M i t i i l fi ld i l ti t i hibit t i f ti l d Maintains visual field in glaucoma patients; inhibits apoptosis of retinal neurons and ischemia-induced degeneration of optic nerve fibers in non-clinical studies**** * Yu DY et al. Invest Ophthalmol Vis Sci. 1994;35:4087-4099. Kern TS. Exp Diabetes Res. 2007;2007:95013. Hardy P et al. Prostaglandins Leukot Essent Fatty Acids. 2005;72(5):301-325. ** al Res 2009;88:760 768 al Ophthalmol 2004;122:1782 1787 al Physiol Sci 22 Alm A et al. Exp Eye Res. 760-768. Toris CB et al. Arch Ophthalmol. 1782-1787. Llobet A et al. News Sci. 2003;18:205-209 *** Kojima S et al. Nippon Ganka Bakkai Zasshi. 1997:101;605-610. Makimoto Y et al. Jpn J Ophthalmol. 2002;46:31-35. Kimura I et al. Jpn J Ophthalmol. 2005;49:287-293 **** Sugiyama T et al. Arch Ophthalmol. 2009;127:454-459 RESCULA: High Dose Achieved Primary Endpoint in Phase 2a RP Study MP-1 central 2 degrees Change in mean retinal sensitivity th h ld G V iti threshold - Group Variations - 2 ____S.E. 1 5 2 tinal Placebo 1-drop group 2-drop group Mean_ S.E. 0.5 1 1.5 UF- 021 1_ 2_ _ UF- 021 1_ 1_ _ _____ 0.5 1 1.5 e in mean ret ensitivity (dB) -0.5 0 -0.5 0 Chang se 0W 4W 8W 16W 24W The 2-drop group met the primary endpoint (p=0.018) of change from baseline in retinal sensitivity threshold in the central 2 degrees, as 23 measured by Microperimeter-1. *ARVO 2011, Poster # 4992, A416 RESCULA: Exploring Potential with Phase 2a Study in Dry AMD Purpose: ̶ To study choroidal blood flow following administration of unoprostone isopropyl vs. placebo Design: ̶ A single-center, double-masked, randomized, placebo-controlled, cross-over designed study in 28 dry AMD patients ̶ Administer two doses (Day 1 and 8); 14 day follow-up period ̶ Choroidal blood flow measured by laser doppler flowmetery Study initiated in May 2011, expecting results in early 2012 24 RESCULA Current Status Awaiting FDA label with mechanism of action language based on current scientific understanding Was approved in 45 countries for glaucoma and ocular hypertension and is U S still approved in Japan and U.S. Reactivating and updating label and licenses in certain E.U. countries and Switzerland Data from exploratory clinical study in dry AMD patients available 1Q 2012 25 R&D Candidates Cobiprostone ̶ Phase 2 for prevention of NSAID-induced gastric ulcers ̶ Preclinical studies for oral mucositis ̶ Preclinical studies for COPD SPI-3608 ̶ Preclinical development for pain associated with spinal stenosis ec ca de e op e t o pa assoc ated t sp a ste os s Additional prostones in preclinical development generated by Sucampo’s proven technology platform Generating additional pipeline candidates through Numab AG collaboration 26 Key Financials (I illi t h d t ) 2010* 2011* In millions, except per share data) 2011 (9 months) Product Royalty Revenue $40.3 $30.7 Revenue* $16 5 $6 6 R&D Revenue 16.5 6.6 Total Revenue $61.9 $40.5 Net Income/(Loss) ($2.7) ($20.0) Earnings Per Share (diluted) ($0.07) ($0.48) Cash, Restricted Cash and Investments $123.9** $104.6*** * Results for 2010 and 2011 are consolidated to reflect the acquisition of Sucampo AG in Dec 2010 ** At Dec. 31, 2010, Sucampo had $44.4 million in long-term debt and $19.5 million in short-term debt *** At Sept. 30, 2011, Sucampo had $46.2 million in long-term debt and $20.5 million in short-term debt 27 2011 Milestones Completion of enrollment into third phase 3 clinical trial of lubiprostone for OBD during third quarter Submit a Marketing Approval Application (MAA) for lubiprostone for CIC in the United Kingdom Integrate AG into to Sucampo corporate structure achieve operational efficiencies afforded by our December 2010 acquisition of SAG and its IP estate ̶ Gain approval of a revised label (sNDA) for RESCULA to reflect the current state of scientific understanding of its mechanism of action to support a re-launch in the U.S. for the approved indication of lowering of intraocular pressure ( IOP) in open-angle glaucoma and ocular p ) p g g hypertension in patients who are intolerant of or insufficiently responsive to other IOP-lowering medications ̶ Make substantial progress towards successfully resolving our dispute 28 p g y g p with our U.S. partner (Takeda) Sucampo Investment Highlights Proven technology: Leadership in prostones -- key ion channel activators with validated activators, clinical utility Commercial products focused on large patient l ti AMITIZA i d i th U S d populations: is approved in the U.S.; and RESCULA is approved in the U.S. and was approved in 45 countries; on market in Japan Clinical expansion: AMITIZA label expansion strategies under way in the U.S., Europe and Asia; RESCULA label y , p ; expansion strategies underway in the U.S. and Europe Robust Revenue stream fueling 29 pipeline: advances in proprietary prostone-based portfolio scientific and medical Applying leadership in prostones to develop and commercialize therapeutics for an aging population Corporate Update 30 Appendix Corporate Update 31 Patents: Lubiprostone and Unoprostone p p U.S. E.U. Japan Lubiprostone US5284858 EP1220849 JP 4332316 Jul expires Oct 2020 expires Oct 2020 expires Jul. 2014 Oct. Oct. US6583174 and EP1426361 US7417067 expires Oct. 2020 Oct expire Oct. 2020 US8026393 expires Oct. 2022 Unoprostone US5221763 EP289349 Unoprostone’s expires Jul. 2012 expires Apr. 2013 commercial rights in Japan are held by US6770675 EP969846 another company company. expires Nov. 2018 expires Mar. 2018 Additional patents, covering formulation, use and manufacturing for lubiprostone, have been issued U S E U 2029 32 in the U.S., E.U. and Japan and provide coverage until 2021 or 2029. Patent term extensions, of up to 5 years, are available for lubiprostone in EU and Japan upon receipt of marketing approvals there. Net Sales of AMITIZA Since Launch in April 2006 $193 $209 $220 $170 0 $155 170.0 $23 2006 2007 2008 2009 2010 YTD 2011 (nine months) $912 million to date in net sales of AMITIZA on a 33 product projected to sell $800 million/year by 2012 in an IBS-C/CIC market to be shared with Zelnorm selling at $1.2-1.8 billion/year AMITIZA Net Sales of $220 Million in US 2010) ( ) Only FDA approved prescription product currently in the market for CIC (2006) and IBSC C (2008) Over 5M prescriptions filled since 2006 with a favorable post-marketing safety profile AMITIZA d t fil b tt th Z l ’ product profile was better than Zelnorm’s Zelnorm AMITIZA Peak US annual TRxs 3.1 million 1.2 million (year 4) (year 6) Year 3 length of therapy (IMS) 132 days 156 days Launch year audited details (IMS) 477,000 164, 000 Commitment to DTC advertising Yes No Unique MOA vs. OTC laxatives Yes Yes Successfully differentiated unique MOA Yes No 34