Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

o

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| For the fiscal year ended ______________ | |

|

OR

|

|

| x |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| For the transition period from January 1, 2011 to August 31, 2011 | |

| Commission file number 333-162103 |

China Bilingual Technology & Education Group Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of incorporation or organization)

|

68-0678185

(I.R.S. Employer Identification No.)

|

|

|

No. 2 Longbao Street

Xiaodian Zone, Taiyuan City

Shanxi Province, P.R. China

(Address of principal executive offices)

|

030031

(Zip Code)

|

Registrant’s telephone number, including area code 86-351-7963988

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YesoNox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YesoNox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesxNoo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).YesxNoo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YesoNox

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $23,868,025.

As of November 28, 2011, there were 30,014,528 shares of Common Stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: NONE

1

CHINA BILINGUAL TECHNOLOGY & EDUCATION GROUP INC.

Table of Contents

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business.

|

3 |

|

Item 1A.

|

Risk Factors.

|

12 |

|

Item 1B.

|

Unresolved Staff Comments.

|

20 |

|

Item 2.

|

Properties.

|

20 |

|

Item 3.

|

Legal Proceedings.

|

21 |

|

Item 4.

|

Removed and Reserved.

|

21 |

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

21 |

|

Item 6.

|

Selected Financial Data.

|

22 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

23 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

28 |

|

Item 8.

|

Financial Statements and Supplementary Data.

|

F-1 |

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

|

29 |

|

Item 9B.

|

Other Information.

|

29 |

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

30 |

|

Item 11.

|

Executive Compensation.

|

34 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

36 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

37 |

|

Item 14.

|

Principal Accountant Fees and Services.

|

37 |

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules.

|

38 |

2

PART I

Forward-Looking Statements

Forward-looking statements in this report, including without limitation, statements related to China Bilingual Technology & Education Group Inc.’s (“China Bilingual”) plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties including without limitation the following: (i) China Bilingual’s plans, strategies, objectives, expectations and intentions are subject to change at any time at the discretion of China Bilingual.; (ii) China Bilingual’s plans and results of operations will be affected by China Bilingual’s ability to manage growth; and (iii) other risks and uncertainties indicated from time to time in China Bilingual’s filings with the Securities and Exchange Commission (“SEC”).

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of such terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of such statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We are under no duty to update any of the forward-looking statements after the date of this report.

Factors that might affect our forward-looking statements include, among other things:

|

●

|

overall economic and business conditions;

|

|

|

●

|

the demand for our services;

|

|

|

●

|

competitive factors in the industries in which we compete;

|

|

|

●

|

changes in tax requirements (including tax rate changes, new tax laws and revised tax law interpretations);

|

|

|

●

|

the outcome of litigation and governmental proceedings;

|

|

|

●

|

interest rate fluctuations and other changes in borrowing costs;

|

|

|

●

|

other capital market conditions, including availability of funding sources;

|

|

|

●

|

potential impairment of our indefinite-lived intangible assets and/or our long-lived assets; and

|

|

|

●

|

changes in government regulations related to the education industry.

|

ITEM 1. BUSINESS.

China Bilingual Technology & Education Group Inc. (the “Company”, “we”, “us” or “our”) is an education company that owns and operates high-quality K-12 private boarding schools in the People’s Republic of China (the “PRC”). The Company established school operations in 1998 and currently operates three schools encompassing kindergarten, elementary, middle and high school levels with approximately 13,220 students and 1,876 faculty and staff. The Company’s schools are located in Shanxi and Sichuan Provinces and provide students with an innovative and high-quality education with a focus on fluency and cultural skills in both Chinese and English, as well as a strong core curriculum. The schools regularly rank among the top schools in their respective regions for college entrance exam scores and national college entrance rates. The Company’s schools have earned excellent teaching reputations and are recognized for the success of their students and strong faculty. As the PRC experiences rapid industrialization and economic growth, the government is focused on education as a means to increase worker productivity and raise the standard of living. Parents in the PRC’s new middle and upper classes are sending their children to receive private school education to give them an advantage in the PRC’s increasingly competitive workforce. The Company’s sector in education is not subject to corporate income tax, and the Company anticipates its growth will come from both organic growth through increased enrollment and expansion of its business model and teaching methods into new schools, which may be acquired by the Company.

The Company was incorporated in the State of Nevada on March 31, 2009 under the name Designer Export, Inc. On June 30, 2010, the Company changed its name to China Bilingual Technology & Education Group Inc.

On June 30, 2010, the Company entered into a Share Exchange Agreement (“Agreement”) with Kahibah Limited (“KL”), a British Virgin Islands (“BVI”) corporation and its shareholders. According to this Agreement, the Company acquired all the issued and outstanding shares of KL. The Company issued 26,100,076 shares of its common stock, after giving effect to the cancellation of 7,748,343 shares on June 30, 2010, to KL’s shareholders in exchange for 100% of the shares of KL. After the closing of the transaction, the Company had a total of 30,000,005 shares of common stock issued and outstanding, with KL’s shareholders owning 87% of the total issued and outstanding shares of the Company’s common stock, and the balance held by those who held shares of the Company’s common stock prior to the closing of the exchange. This transaction resulted in KL’s shareholders obtaining a majority voting interest in the Company. All shares are shown effective of a 2.582781 forward stock split as of July 14, 2010.

3

The acquisition of KL and the operations of its subsidiaries were accounted for as a reverse merger, whereby KL is the continuing entity for financial reporting purposes and is deemed, for accounting purposes, to be the acquirer of the Company. In accordance with the applicable accounting guidance for accounting for the business combination as a reverse merger, KL is deemed to have undergone a recapitalization, whereby KL is deemed to have issued common stock to the Company’s common equity holders. Accordingly, although the Company, as KL’s parent company, was deemed to have legally acquired KL, in accordance with the applicable accounting guidance for accounting for the transaction as a reverse merger and re-capitalization, KL is the surviving entity for accounting purposes and its assets and liabilities are recorded at their historical carrying amounts with no goodwill or other intangible assets recorded as a result of the accounting merger with the Company.

As part of the acquisition, the Company changed its name to China Bilingual Technology & Education Group Inc. Share and per share amounts stated have been retroactively adjusted to reflect the acquisition. The accompanying financial statements present the historical financial condition, results of operations and cash flows of KL and its operating subsidiaries prior to the recapitalization.

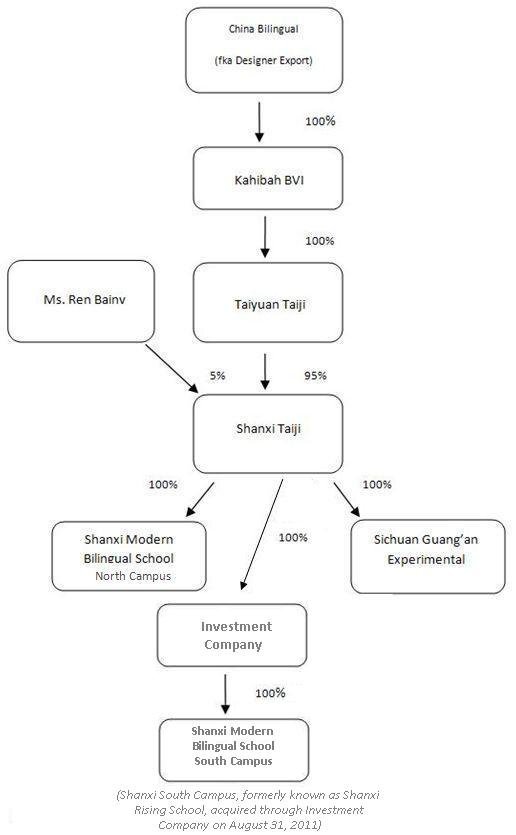

The historical consolidated financial statements of the Company are those of KL, and of the consolidated entities. The consolidated financial statements of the Company presented for the eight months ended August 31, 2011 and 2010 and the years ended December 31, 2010 and 2009 included the financial statements of China Bilingual, KL, KL’s subsidiary Taiyuan Taiji Industry Development Co., Ltd. (“Taiyuan Taiji”), a wholly-foreign owned enterprise (“WFOE”) under the laws of the PRC, which owns 95% of the registered capital of Shanxi Taiji Industry Development Co., Ltd. (“Shanxi Taiji”), an equity joint venture company organized under the laws of the PRC. Shanxi Taiji owns all of the registered capital of Shanxi Modern Bilingual School (“Shanxi North Campus”) and Sichuan Guang’an Experimental High School (“Sichuan Guang’an School”), both private non-enterprise entities incorporated under the laws of the PRC, collectively the “Subsidiaries.”

Since the ownership of KL and its Subsidiaries was substantially the same, the merger with each was accounted for as a transfer of equity interests between entities under common control, whereby the acquirer recognized the assets and liabilities of each Subsidiary transferred at their carrying amounts. The reorganization was treated similar to the pooling of interest method with carry over basis. Accordingly, the financial statements for KL and its Subsidiaries have been combined for all periods presented, similar to a pooling of interest. The reorganization of entities under common control was retrospectively applied to the financial statements of all prior periods when the financial statements are issued for a period that includes the date the transaction occurred. Intercompany transactions and balances are eliminated in consolidations.

On August 31, 2011, the Company’s entered into an Equity Transfer Agreement and purchased all of the outstanding equity of Shanxi Rising Education Investment Company Limited (the “Investment Company”) from the equity holders (the “Sellers”) for a total purchase consideration of RMB 690,000,000 (approximately $108,226,806). The net present value of the total fair value consideration transferred equals RMB 616,023,000 (approximately $96,623,480), of which RMB 336,563,000 (approximately $52,790,055) has been paid. Under the terms of the Equity Transfer Agreement the balance of the purchase price is to be paid over three years in three scheduled payments as follows: (See Note 19 – Business Combination for additional details on the Equity Transfer Agreement.)

|

|

1)

|

RMB 153,437,000 (or RMB 135,016,000, approximately $21,177,319, net of discount) to be paid by August 31, 2012,

|

|

|

|

|

|

2)

|

RMB 100,000,000 (or RMB 76,947,000, approximately $12,069,171, net of discount) by August 31, 2013, and

|

|

|

|

|

|

3)

|

RMB 100,000,000 (or RMB 67,497,000, approximately $10,586,935, net of discount) by August 31, 2014.

|

The net present value of the payments is discounted at the Company’s current financing interest rate of 14%.

The Investment Company, a limited liability company established under the laws of the PRC, is an education company that owns and operates a K-12 private boarding school in Jinzhong City, Shanxi Province of the PRC, encompassing kindergarten, primary and secondary education. The Investment Company was established in 2001 and it has share capital of RMB 70,000,000. It is the parent company of Shanxi Rising School (the "Rising School"), founded 2002, which currently serves over 5,400 students from its location in Shanxi Province, the PRC. The Rising School is now known by the Company as the “Shanxi South Campus.”

The acquisition of the Investment Company has been accounted for as a business combination under Accounting Standards Codification Topic 805, Business Combinations (“ASC 805”). The total purchase consideration of RMB 690,000,000 has been allocated to the net tangible and intangible assets acquired and liabilities assumed based on their estimated fair values as of August 31, 2011. As of the balance sheet date, August 31, 2011, the exchange rate to the US Dollar was RMB 6.3755.

Prior to closing the Equity Transfer Agreement, the Company became involved in the operations of the Shanxi South Campus in the spring of 2011. With the consent of the Investment Company, the Company assisted in the operations, accounting and promotion of the school to attract more and better students for the 2011-2012 school year. Some of these responsibilities included collecting prepaid tuition, room & board and other school fees (“School Fees”) in advance of the school year, which combined with better operations, higher tuition rates and an increase in enrollment led to an increase in deferred revenue at August 31, 2011. The Company’s involvement at the Shanxi South Campus was under the direction of Investment Company management until it assumed control of the Investment Company on August 31, 2011, in accordance with the Equity Transfer Agreement.

4

For the purpose of preparing the consolidated financial statement, the total purchase price is allocated to the Company’s net tangible assets acquired and liabilities assumed as of August 31, 2011. The adjustments record the purchase price allocation entries as of August 31, 2011, including allocation of fair values of the associated tangible assets, intangible assets and acquired liabilities, to eliminate the Company's historical equity balances and to record the estimated use of cash to fund the cash portion of the acquisition. The adjustments also include certain decreases in intercompany balances eliminated in consolidation. Accordingly, the fair value of assets acquired and liabilities assumed may be materially impacted by the results of the Company’s on-going operations after the date of the Equity Transfer Agreement.

The Company undertakes to meet the market demands for primary and secondary educational needs through the operations of private boarding schools within the PRC. The following chart shows the Company structure:

5

Overview

The Company continues to carry on the business of Shanxi Taiji, our PRC operating entity, as our sole line of business.

Shanxi Taiji owns all of the registered capital of Shanxi Modern Bilingual School, a private non-enterprise entity incorporated under the laws of the PRC and Sichuan Guang’an Experimental School, a private non-enterprise entity incorporated under the laws of the PRC. Since its inception, Shanxi Taiji has striven to meet the market demands for kindergarten, primary and secondary educational needs through the establishment of Shanxi Modern Bilingual School and Sichuan Guang’an Experimental School.

After the Transaction, Shanxi Taiji also owns all the registered capital of the Investment Company, a PRC company, which in turn holds 100% of the Shanxi Rising School, a private non-enterprise entity incorporated under the PRC laws, providing kindergarten, primary and secondary school education in Jinzhong City, Shanxi Province of the PRC.

Shanxi Modern Bilingual School - North Campus

Shanxi North Campus was established in 1998 by Shanxi Taiji, approved by the Taiyuan Bureau of Education. The school offers kindergarten, elementary, middle and high school in one full-time boarding school. It has a good school learning environment with a campus covering 38 acres and 1.4 million square feet of buildings in Taiyuan City, Shanxi. The school has three academic buildings, an administration building, four student apartment buildings, two cafeterias, six teacher residential buildings, a multi-functional arts gymnasium and a high-standard polyurethane plastic 400-meters circular track field, many standard basketball courts and a large children’s playground.

The school is equipped with:

· audio-visual language teaching facilities;

· multimedia amphitheater;

· modern computer classrooms, which allow us to teach remotely;

· physics, chemistry, and biology laboratories;

· library; and

· reading, art and music rooms

Since its inception, the number of students enrolled in our school has increased steadily over the years from nine students at inception in 1998 to 4,912 enrolled students for the 2011 – 2012 school year. The enrollment at the Shanxi North Campus is down approximately 1,800 students from its enrollment height last school year because approximately 2,000 junior-middle school students (Grade levels 6th and 7th) were transferred to the Shanxi South Campus to accommodate more space for growth in our lower level grades in the Shanxi North Campus.

The number of the Shanxi North Campus’ existing staff is 785, all of which are full-time, including 40 individuals in the management and administration, 364 teachers and 381 staff members in support. Currently the school has 4,912 students in 132 classes. (Almost 350 teachers were transferred from the Shanxi North Campus this school year to the Shanxi South Campus to support the transition after the school acquisition, as well as the transition of the junior-middle school to the new campus.)

The school has received numerous accolades for excellence in teaching. The Taiyuan Bureau of Education awarded our school its “Special Award” for high school education and teaching quality and "Comprehensive Excellence Award", junior secondary education teaching quality "Prize" and the "Excellence Award." Other honors the school has earned over the past few years include the "Taiyuan Excellence High School," and "High School Graduation Exam Prize." The school has also been awarded the "Outstanding Private Middle School in Shanxi Province", "Green School in Shanxi Province," "National Children's Computer Examination Training Points" and "Model School in Information Technology in Shanxi Province," and "National Creative Writing Experimental School."

Shanxi Modern Bilingual School - South Campus (formerly known as Shanxi Rising School, acquired August 31, 2011)

Shanxi South Campus was established in 2002. The school offers kindergarten, elementary, middle and high school in one full-time boarding school. The school has a good learning environment with a campus covering 82 acres and 2.2 million square feet of buildings in Jinzhong City, Shanxi (approximately 15 kilometers south of the Company’s Shanxi North Campus). The teaching, administration and residential buildings are all equipped according to the highest national standard.

The school is equipped with:

· lecture classrooms;

· multimedia classrooms;

· special classrooms for art and music;

· metaphase and nature laboratory;

· computer room;

· arts center;

· network center;

· library and reading room; and

· instrument and equipment store house.

6

The number of the school’s existing staff is 794, all of which are full-time, including 32 individuals in the management and administration, 388 teachers and 374 staff members in support. Currently the school has 5,428 students in 138 classes.

The school size is suitable, which is not only good for the teaching and students’ physical and psychological health, but also easy to management. With the idea of small class size management, the students’ number is no more than 40 in each class in elementary and middle school.

The school has attained encouraging success in the teaching area. In the Entrance Examination to Senior Middle School in 2011, the school was ranked second in more than 200 middle schools in Taiyuan City; the university entrance exam result was also gratifying with more than half of the examiners have reached the university entrance line. Moreover, the school’s students have won numerous awards in “The 21st School Art Education Month in Taiyuan” in the dance, art and calligraphy competitions.

Sichuan Guang’an School

Sichuan Guang’an School was established in 2002 by Shanxi Taiji, approved by the Guang’an Bureau of Education. The school was originally established by the local government as a high school, but the Company assumed operational control prior to the school opening so that the region would have an established private boarding school operator. The school now offers kindergarten, elementary, middle and high school in one full-time boarding school. It has a good school learning environment with a tree-lined campus covering 23 acres and 750,000 square feet of buildings in Guang’an, Sichuan. We have two academic buildings, an administrative building, four student apartments, four teacher apartment buildings, two cafeterias, an audio-visual technology building (also for the library), a large-scale indoor sports center, a high-standard polyurethane plastic 400-meters circular track field, and many standard basketball courts and a large children’s playground. All school equipment meets provincial-level high school’s standards.

The school is equipped with:

· modern art rooms;

· science labs,

· multimedia network classroom

· a language lab;

· a high specification amphitheater;

· music, dance and , piano rooms;

· 400 meters circular track and field; and

· basketball courts, volleyball courts and badminton courts.

The number of the school’s existing staff is 240, all of which are full-time, including 15 individuals in the management and administration, 115 teachers and 110 staff members in support. Currently the school has 2,880 students in 63 classes.

The number of existing staff is 240, including 160 full-time teachers. 80% of which are high school or intermediate teaching experts. We have approximately 3,600 students. Our school’s characteristics are: expert administration, an excellent teaching team, small class sizes; bilingual education; and a modern learning environment. Since our school was established our students have shown excellent academic performance. In 2003 college entrance examination 90.5% of our students achieved the enrollment mark, ranking the first in Guangan’s high school. Huaying Matriculation champion came from our school and the highest mark of Chinese, mathematics, English, integrated science all came from our school. In 2004, College of Liberal Arts Huaying champion still came from our school; in 2005, 8 of the top ten Huaying college entrance students were from our school. In 2010, the rate of college entrance of the school ranked number one in Huaying City.

The students of Sichuan Guang’an School have won numerous awards at the national, provincial, municipal and other types of competitions. The school has won awards for college entrance exam scores and education quality from the local and provincial government including College Entrance Examination Growth Award", awarded by the National Education, "Key Lessons Experimental School", and named" Huaying Private Education Advanced High School, first prize in the quality of education, Huaying enterprises advanced units within education curriculum reform; the first prize of annual college entrance examination; Huaying special contribution; first prize of the quality of high school education; in 2009, received the 2007-2008 school degree Huaying advanced unit in private education, Huaying second faculty Games men's high school basketball group first. The school is the only local school employing qualified foreign teachers, and it is the Huaying’s first large-scale private education school.

7

Competition

The PRC education industry is highly competitive. Competition among educational institutions is primarily driven by location, courses, research capability and reputation. In all of the geographical areas in which we operate or expect to operate, there are other educational institutions, training centers and other education providers, which provide services comparable to those that we offer or expect to offer. Competition between PRC educational institutions has intensified in recent years due to the increase in private educational institutions and extra-curricular training centers that allow students to choose the educational institutions and courses they would like to attend.

In general, educational institutions compete within the communities they serve based on the teaching quality and specialty of the teachers, enrollment rate, reputation, the physical condition of their facilities and teaching equipment. We strive to distinguish the educational institutions we operate based on the quality provided and our ability to attract and retain teachers with varied specialties. We strive to maintain and improve the level of enrollment and to provide quality facilities and teaching services.

Our schools emphasize the bilingual education model. We integrate English teaching across our entire curriculum and integrate it into the students’ daily lives. We maintain a staff of foreign teachers to teach not only language skills but also cultural skills. Our teachers and staff are well-paid with an average age of 35. Over 80% of our teachers are national, provincial, municipal and district subject leaders, the backbone of teaching in the PRC - considered teaching experts.

We face competition from domestic and international education service providers that are seeking to acquire and operate educational institutions in the PRC. We expect competition for attractive opportunities to intensify because of the continued privatization of the education industry in the PRC and the difficulty in setting up new educational institutions in the PRC, which requires approval from the local Bureau of Education or the Ministry of Education of the PRC. Other competitors, such as high-end standalone, private educational institutions and training centers that cater to high-income consumers and foreign expatriates, have emerged primarily as a result of the increasing affluence of the Chinese population. These standalone private educational institutions and training centers are managed by both foreign and domestic high school, college and university operators.

Government Approvals and Regulations

General Regulatory Environment

The PRC’s education industry is regulated by various government agencies, mainly including the Ministry of Education (the “MOE”). The MOE has branch offices across the PRC to oversee the education industry at the provincial, municipal and county levels, which together with the MOE we refer to as the Education Authorities. These Education Authorities, together with other relevant government agencies, such as the Ministry of Civil Affairs (“MCA”) and Ministry of Labor and Social Security have promulgated rules and regulations relating to the establishment, licensing and operation of educational institutions, the licensing, administration and management of educational staff and the taxation of educational services and incomes.

Operation of Private Schools

Level of Approval

Pursuant to the Law of the People’s Republic of China on Promotion of Private Education promulgated by the Standing Committee of the Ninth National People’s Congress of the PRC which became effective on September 1, 2003, and the Implementation Rules to the Law of the People’s Republic of China on Promotion of Private Education issued by the State Council which became effective on April 1, 2004, each private school must obtain a private funded school education permit from the relevant education authority in order to conduct business as an education service provider. Private schools providing certifications, pre-school education, education for self-study aid and other academic education shall be subject to approval by the Education Authorities. The Education Authorities under the local people’s governments at or above the county level shall be responsible for the work relating to private schools of academic education in their own administrative region. The administrative departments for labor and social security and the relevant departments under the local people’s governments at or above the county level shall respectively be responsible for the work relating to private schools of non-academic education which means occupational qualification training and occupational skill training within the scope of their duties. For degree education, (i) establishment of colleges is preliminarily examined by education authorities at the provincial level, and then is examined and approved by the government of the provincial level; (ii) establishment of universities for bachelor or higher degrees is preliminarily examined by education authorities of the provincial level, and then is examined and approved by MOE; (iii) establishment of senior high schools, vocational middle schools and technical secondary schools is preliminarily examined by Education Authorities of the county level, and then is examined and approved by educational authorities of the municipal level and shall be delivered to the government of the municipal level and educational authorities of the provincial level for reference; (iv) establishment of junior middle schools and primary schools is examined and approved by Education Authorities of the county level and shall be delivered to Education Authorities of the municipal level for reference. A duly approved private school will be granted a permit for operating a private school, and shall be registered with the MCA or its local counterparts as a privately run non-enterprise institution. Each of our schools has obtained the permit for operating a private school and has been registered with the relevant local counterpart of the MCA.

8

Expansion of Business

Pursuant to the Implementation Rules to the Law of the People’s Republic of China on Promotion of Private Education issued by the State Council in 2004, private schools and government-run schools shall share equal legal status, and the State safeguards the autonomy of the private schools. The State protects the lawful rights and interests of the sponsors, principals, teachers and staff members of private schools. Prospectors and advertisements of private schools shall be approved by relevant examination and approval authorities. Upon the approval of its prospectors and advertisements, the private school enjoys its independent right of recruiting students and enjoys the equal recruiting right as government-run schools of the same kind. The private schools may make plans on the scope, standard and method of recruiting students independently. Private schools shall abide by the relevant regulations with respect to recruiting college-level or above students. In addition, operation of a private school is highly regulated. For example, the types and amounts of fees charged by a private school providing certifications shall be approved by the governmental pricing authority and be publicly disclosed. Thus, for a private school to expand its business, it has some discretionary power, but it must abide by a procedure under which, any increase in recruitment of students or increase in fees must be approved in advance by the relevant authorities.

Levels and Grades of schools

Subject to the Education Law of the People’s Republic of China issued by the eighth National People’s Congress in 1995, schools of the basic education system are divided into four levels including infant school education, primary education, secondary education and higher education. Accordingly, based on the four levels, there are the following kinds of schools: nursery school, primary school, junior middle school, senior high school, and university. Nursery school, primary school and junior middle school represent compulsory education. With respect to universities, there are several kinds of college degrees: bachelor degree, master degree and doctorate degree. And for different levels of private schools, there are different approval authorities. The State Council and all local people’s government at different levels shall supervise and manage the educational work according to the principle of management by different levels and division of labor with individual responsibility. Secondary and lower education shall be managed by the local people’s government under the leadership of the State Council. Higher education shall be managed by the State Council and the people’s government of the province, autonomous region or municipality directly under the central government. Besides the basic education system, the state adopts a vocational education system and an adult education system. The people’s government at different levels, relevant administrative departments, enterprises and institutions shall adopt measures to develop and ensure for citizens vocational school education or vocational training in various forms. Meanwhile, no organization or individual may establish or operate a school or any other institution of education for profit-making purposes. However, private schools may be operated for “reasonable returns,” as described in more detail below.

School Privatization

Although no definitive regulation has been promulgated with respect to the privatization of government-run schools, the PRC government has announced a series of regulations and policies to encourage private schools and Sino-foreign-run schools. The Standing Committee of the Ninth National People’s Congress issued Law of the People’s Republic of China on Promotion of Private Schools to encourage social funds to invest in the education industry in 2002. To implement the above law, the State Council issued the Implementation Rules to the Law of the People’s Republic of China on Promotion of Private Schools in 2004. In order to encourage foreign funds to invest in the PRC education industry and strengthen international exchange and cooperation in the field of education, the State Council also issued Regulations of the People’s Republic of China on Chinese-Foreign Schools in 2003. National Development and Reform Commission and Ministry of Commerce jointly modified Catalogue of Foreign Investment Industries in 2007, in which there are encouraged education industry, restricted education industry and prohibited education industry. The encouraged education industry is a higher-degree educational institution (only limited to joint venture or cooperative), the restricted education industry is a common senior high school education mechanism (only limited to joint venture or cooperative) and the prohibited education industry is a compulsory education and military, police, political and other kinds of education that are of a special nature in the PRC.

Special tax rules applicable to preferential tax treatment and non-preferential tax treatment for privately-run schools

Private schools are divided into three categories: private schools established with donated funds; private schools that require reasonable returns and private schools that do not require reasonable returns.

The Law of the People’s Republic of China on Promotion of Private Schools prescribes principally that private schools enjoy the preferential tax treatment polices regulated by the State. And the Implementation Rules to the Law of the People’s Republic of China on Promotion of Private Schools prescribes further, that the private schools established by donation and the private schools whose investors do not ask for reasonable rewards of investment may enjoy the same preferential tax and other preferential treatments as the government-run schools. And for private schools whose investors ask for reasonable rewards of investment, its preferential tax treatment policies are jointly formulated by the finance department, tax department and other related administrative departments of the State Council. To date, however, no regulations have been promulgated by the relevant authorities in this regard.

9

Notwithstanding whether a school is state or privately-owned, the preferential local tax treatments include: business tax, urban maintenance and construction tax, extra charges for education, enterprise income tax, house property tax, deed tax, land-use tax of cities and towns, stamp tax, etc.

1. With respect to the business tax and enterprise income tax: (i) the proceeds from educational services provided by a degree educational school will be exempted from business tax; (ii) the proceeds from students working during school term will be exempted from business tax; (iii) the proceeds from technology development, technology transfer or relevant technological consultant or services provided by school will be exempted from business tax; (iv) the proceeds from caring services provided by a kindergarten or nursing school will be exempted from business tax; (v) the proceeds from further-study classes or training classes held by a government-run preliminary school, secondary school or higher school (not including subordinate enterprises) will be exempted from business tax; (vi) the proceeds from the operation of an enterprise owned wholly by a government-run vocational school will be exempted from business tax, and for the proceeds from the operation of an enterprise owned by a privately-run vocational school, the business tax is not exempted; (vii) donation to education careers from a taxpayer contributed through non-profit social entities or state organs will be exempted from income tax; (viii) the proceeds from an educational institution in accordance with regulations of non-profit income under Enterprise Income Tax Law will be exempted from income tax; and (ix) individual income tax derived from interest of savings deposit of education will be exempted.

2. With respect to the house property tax, land-use tax of cities and towns, stamp tax: (i) house or land of all kinds of schools, kindergartens or nursing schools invested by state or enterprises will be exempted from house property tax or land-use tax; and (ii) the writing papers signed by property owners to denote the property to schools will be exempted from stamp tax.

3. With respect to farm land occupation tax: the farm land approved for schools or nursing schools will be exempted from farm land occupation tax.

Restrictions on Foreign Ownership

The PRC has been gradually relaxing the restrictions on domestic private investment in private schools since 1978. From 1978-1992, the development of private schools was in an early stage; from 1992-1997, the development of private schools was in a fast-development stage; and since 1997, the development of private schools have been in a regulatory development stage. The private school system has become an important and necessary part of the PRC education system. In 2003, the State Council promulgated the Regulations of the People’s Republic of China on Operating Chinese-Foreign Schools, and MOE issued the Implementing Rules for the Regulations on Operating Chinese-foreign Schools, or the Implementing Rules, which encourage substantive cooperation between overseas educational organizations with relevant qualifications and experience in providing high-quality education and PRC educational organizations to jointly operate various types of schools in the PRC, with such cooperation in the areas of higher education and occupational education being encouraged. Chinese-foreign cooperative schools are not permitted, however, to engage in compulsory education and military, police, political and other kinds of education that are of a special nature in the PRC.

The establishment of a Chinese-foreign joint venture educational institution in the PRC requires approvals from different levels of government, which are difficult to obtain. An application for establishing a Chinese-foreign cooperatively-run school offering higher education for academic qualifications at or above the regular university education shall be subject to examination and approval of the MOE; an application for establishing a Chinese- foreign cooperatively-run school offering specialized higher education or higher education for non-academic qualifications shall be subject to examination and approval of the people’s government of the province, autonomous region or municipality directly under the Central Government where the proposed school is to be located. An application for establishing a Chinese-foreign cooperatively-run school offering secondary education for academic qualifications, programs of tutoring self-taught students for examinations, programs offering supplementary teaching of school courses and pre-school education shall be subject to examination and approval of the education administrative department of the people’s government of the province, autonomous region or municipality directly under the Central Government where the proposed school is to be located. An application for establishing a Chinese-foreign cooperatively-run school offering vocational technical training shall be subject to examination and approval of the labor administrative department of the people’s government of the province, autonomous region or municipality directly under the Central Government where the proposed school is to be located.

All of the equity interests in Taiyuan Taiji are owned by KL directly. Taiyuan Taiji owns 95% of the equity interests in Shanxi Taiji directly. All of the registered capital of Shanxi North Campus and Sichuan Guang’an School are owned by Shanxi Taiji. All of the registered capital of the Shanxi South Campus are owned by the Investment Company, which is 100% owned by Shanxi Taiji.

Licensing Requirements

Each educational institution in the PRC is required to obtain a private funded school education permit (a “Education Permit”), from the relevant local Education Authority. To obtain an Education Permit, a private school must submit an application to its relevant Education Authority to demonstrate that it (i) has obtained a permit for setting up the educational institution from the relevant Educational Authority; (ii) is in compliance with certain basic operational standards for a legal person pursuant to the PRC Company Law; (iii) is in proper corporate form with proper name, organizational structure and premises; (iv) has adequate funds and meets certain minimum facility and personnel requirements promulgated by MOE; (v) has proper bylaws; and (vi) is capable of bearing civil liabilities independently. In addition, private schools are permitted to conduct only those business activities within the approved business scope established by the relevant Education Authority.

10

We have regulatory approvals from the education commissions in the Shanxi and Sichuan Provinces (which have the authority to issue and regulate education permits) which constitute the requisite private funded school education permits for the establishment of private schools in price bureau of the provinces, approvals for charging fees from local pricing regulatory authorities and all of the necessary permits, registrations, licenses and/or approvals required by the local government authority to operate.

Organizations and Activities of Private Schools

According to the Law of the People’s Republic of China on Promotion of Private schools, a private school shall set up an executive council, a board of directors or other forms of decision-making bodies of the school.

The executive council or the board of directors of the school shall be composed of the sponsors or their representatives, the principal, and the representatives of the teachers and staff members. More than one-third of the council members or directors shall, at least, have five years’ education or teaching experience each. The executive council or the board of directors of the school shall be composed of not less than five persons, with one of them serving as chairman of the council or board. The list of the names of the chairman and members of the council or the chairman of the board and directors shall be submitted to the examination and approval authority for the record.

The executive council or the board of directors of a school shall exercise the following functions and powers: (i) to appoint and dismiss the principal; (ii) to amend the articles of association of the school and formulate rules and regulations of the school; (iii) to make development plans and approve annual work plans; (iv) to raise funds for running the school, and examine and verify the budgets and final accounts; (v) to decide on the size and the wage standards of the teachers and staff members; (vi) to decide on the division, merging and termination of the school; and (vii) to decide on other important matters.

The chairman of the executive council or the board of directors or the principal of a private school shall serve as the legal representative of the school. A private school shall, in reference to the qualifications for the principal of a government-run school of the same grade and category, appoint its principal, and the age limit may appropriately be extended both ways, and the appointment shall be reported to the examination and approval authority for verification and approval.

The principal of a private school shall be in charge of education, teaching and administration of the school, and exercise the following functions and powers: (i) to carry out the decisions made by the executive council, board of directors or any other form of decision-making body; (ii) to put into execution the development plans, draw up the annual work plans and financial budgets, and formulate the rules and regulations of the school; (iii) to appoint and dismiss staff members of the school, and give rewards and impose punishments; (iv) to make arrangements for education, teaching and scientific research and ensure the quality of education and teaching; (v) to be responsible for the daily work of school administration; and (vi) other powers delegated by the executive council, the board of directors or any other form of decision-making body of the school.

A private school may, on the basis of relevant classifications, the length of schooling and academic performance and in accordance with the relevant regulations of the State, issue academic credentials, certificates for completing a course or qualification certificates of training to the students it enrolls. Students who receive training in vocational skills may be awarded vocational qualification certificates of the State when they are considered qualified by the vocational skills appraisal authority approved by the State. A private school shall, in accordance with law, ensure that the teachers and staff members participate in democratic management and supervision through the representative assembly of the teachers and staff members with the teachers as the main body, or through other forms. Teachers and staff members of a private school shall, in accordance with the Trade Union Law, have the right to form trade union organizations to protect their lawful rights and interests.

We believe that Shanxi North Campus, Shanxi South Campus and Sichuan Guang’an School currently operate in compliance with the relevant regulations.

Ownership of Foreign Entities by PRC Residents

The PRC State Administration of Foreign Exchange, or SAFE, issued a public notice, or the SAFE Notice, in October 2005 regarding the use of special purpose vehicles, or SPVs, by PRC residents seeking offshore financing to fund investments in the PRC. The SAFE Notice requires PRC residents to register with and receive approvals from SAFE in connection with offshore investment activities. The SAFE Notice provides that each PRC resident who is an ultimate controller of the offshore company must complete the prescribed registration procedure with the relevant local branch of SAFE prior to establishing or assuming control of an offshore company for the purpose of transferring to that offshore company assets of or equity interest in a PRC enterprise.

11

The notice applies retroactively. As a result, PRC residents who have established or acquired control of these SPVs that have made onshore investments in the PRC were required to complete the relevant overseas investment foreign exchange registration procedures by March 31, 2006. These PRC residents must also amend the registration with the relevant SAFE branch in the following circumstances: (i) the PRC residents have completed the injection of equity investment or assets of a domestic company into the SPV; (ii) the overseas funding of the SPV has been completed; or (iii) there is a material change in the capital of the SPV. If we are deemed an SPV under the SAFE Notice, we would be required to comply with the approval and registration requirements under the SAFE Notice. As of date of this report, our PRC shareholders have not registered their ownership interests in us with SAFE because our PRC shareholders believe that the SAFE Notice is not applicable to them. In the event SAFE holds a different view from that of our shareholders, failure of our PRC shareholders to comply with these registration requirements may subject them to fines or legal sanctions or limit the ability of Shanxi Taiji to obtain or update its foreign exchange registration certificate with SAFE, which may in turn subject us to fines or legal sanctions, restrict our cross-border investment activities or limit Shanxi Taiji ability to distribute dividends to us.

Regulations on Foreign Currency Exchange

Under the Foreign Currency Administration Rules promulgated by the State Council in 1996 and last revised on August 5, 2008 and various other regulations issued by SAFE, and other relevant PRC government authorities, Renminbi is convertible into other currencies for the purpose of current account items, such as trade related receipts and payments, interest and dividends. The conversion of Renminbi into other currencies and remittance of the converted foreign currency outside the PRC for the purpose of capital account items, such as direct equity investments, loans and repatriation of investment, requires the prior approval from SAFE or its local office. Payments for transactions that take place within the PRC must be made in Renminbi. PRC companies may repatriate foreign currency payments received from abroad subject to SAFE’s requirements. Foreign-invested enterprises may retain foreign currency in accounts with designated foreign exchange banks. Domestic enterprises may convert all of their foreign currency current account proceeds into Renminbi. Capital investments by the Company into Taiyuan Taiji will be considered capital account items, which are subject to rigorous regulations and controls in the PRC. Payments for international equipment will be considered current account items, which only need to satisfy certain documentary and procedural requirements of the foreign exchange regulations.

Regulations on Dividend Distribution

The principal regulations governing dividend distributions by wholly foreign owned enterprises and Sino-foreign equity joint ventures include:

|

•

|

The Wholly Foreign Owned Enterprise Law (1986), as amended;

|

||

|

•

|

The Wholly Foreign Owned Enterprise Law Implementing Rules (1990), as amended;

|

||

|

•

|

The Sino-foreign Equity Joint Venture Enterprise Law (1979), as amended; and

|

||

|

•

|

The Sino-foreign Equity Joint Venture Enterprise Law Implementing Rules (1983), as amended.

|

Under these regulations, wholly foreign owned enterprises and Sino-foreign equity joint ventures in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, before paying dividends to their shareholders, these foreign-invested enterprises are required to set aside at least 10% of their profits each year, if any, to fund certain reserve funds until the amount of the cumulative total reserve funds reaches 50% of the relevant company’s registered capital. Accordingly, our wholly-owned subsidiary, Taiyuan Taiji is allowed to distribute dividends to us only after having set aside the required amount of its profits into the reserve funds as required under applicable PRC laws and regulations.

Employees

We have approximately 1,876 employees, all of which are full-time consisting of approximately 57 in corporate management and staff positions, 87 individuals in school management and administration, 867 teachers and 865 support staff members. None of our employees are represented by a labor union. We intend to hire additional employees on an as-needed basis during the next 12 months.

ITEM 1A. RISK FACTORS

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

Risks Relating to Our Business and Industry

If we are unable to continue to attract course participants to enroll in our courses, our revenues may decline and we may not be able to maintain profitability.

The success of our business depends primarily on the number of enrollments in our schools and the amount of tuition that we can charge. Therefore, our ability to continue to attract course students to enroll in our courses and maintain revenue growth is critical to the continued success and growth of our business. This in turn will depend on several factors, including our ability to develop new courses and enhance existing courses to respond to changes in market trends and demands of students, to effectively market our schools to a broader base of prospective course participants, to train and retain qualified lecturers and tutors, to develop additional high-quality educational content and to respond to competitive pressures. If we are unable to increase our enrollments in some of our relatively new courses and generate sufficient tuition to exceed the incremental costs associated with developing and delivering such new courses, we may be unable to maintain substantial revenue growth.

12

Failure to attract and retain qualified personnel and experienced senior management could disrupt our operations and adversely affect our business and competitiveness.

Our continuing success is dependent, to a large extent, on our ability to attract and retain qualified personnel and experienced senior management. If one or more of our senior management team members are unable or unwilling to continue to work for us, we may not be able to replace them within a reasonable period of time or at all, and our business may be severely disrupted, our financial condition and results of operations may be materially and adversely affected and we may incur additional expenses in recruiting and training additional personnel. If any of our senior management joins a competitor or forms a competing business, our business may be severely disrupted.

We have been operating under our current ownership structure for a limited time which may make it difficult for you to evaluate our business and prospects.

We acquired all of the issued and outstanding capital of Kahibah Limited in June 2010. Shanxi North Campus and Sichuan Guang'an School commenced operations in 1998 and 2002, respectively. We acquired the Shanxi South Campus on August 31, 2011 and the school commenced operations in 2002. Accordingly, we have a limited history for our operation upon which you can evaluate the viability and sustainability of our business and its acceptance by students. Our present and future competitors may have longer operating histories, larger, student enrollments, larger teams of professional staff and greater financial, technical, marketing and other resources.

We are dependent on the Shanxi North Campus, Shanxi South Campus and Sichuan Guang’an School for all of our revenues. Any adverse development relating to any of these schools could materially and adversely affect our future results of operations.

Shanxi North Campus, Shanxi South Campus and Sichuan Guang’an School account for all of our revenue. Unless we are successful in acquiring control of and operating other educational institutions, all of our revenue will continue to be derived from these three schools. As a result, any development that has a material adverse effect on one or more of these schools may have a material adverse effect upon our business and financial performance, including developments such as the following:

|

·

|

any reduction in student enrollment at any of these educational institutions;

|

|

·

|

any increase in competition from other schools; and

|

|

·

|

the failure to attract and retain high quality teaching staff in our schools.

|

Our operating results may vary significantly from quarter to quarter as a result of seasonal and other variations to which our business is subject. This may result in volatility or adversely affect our stock price.

We experience seasonality in results of operations primarily as a result of changes in the level of student enrollments during the course of the school year and the duration of the school year. Because many parents prepay for their children’s programs at the time of enrollment the enrollment dates correspond to the trends of revenue. We typically generate the largest portion of revenue in the third quarter, and we experience lower revenues from tuition fees in the fourth quarter. As our schools revenue grows at varying rates, these seasonal fluctuations may become more evident. As a result, we believe that quarter-to-quarter comparisons of our results of operations may not be a fair indicator and should not be relied upon as a measure of future performance.

We may lose market share and our profitability may be materially and adversely affected, if we fail to compete effectively with our present and future competitors or to adjust effectively to changing market conditions and trends.

We face competition from providers of online vocational/career education, training, and expect to face increasing competition from existing competitors and new market entrants in the traditional education. The provision of professional education and test preparation courses over the Internet is a relatively recent concept. Although traditional classroom instruction is generally viewed as a more accepted method, online education is increasingly apparent as an acceptable means of receiving training and instruction. We therefore compete with providers of online education institutions and training centers in the various subject areas for which we offer courses. In addition, due to low barriers to entry for Internet-based businesses, we expect to face increasing competition from both existing domestic competitors and new entrants on the online education side. We may face increased competition from international competitors that cooperate with local businesses to provide services based on the foreign partners’ technology and experience developed in their home markets.

13

If we fail to develop and introduce new courses, services and products that meet our target customers’ expectations, or adopt new technologies important to our business, our competitive position and ability to generate revenues may be materially and adversely affected.

Our core business is centered on acquiring control of schools that provide kindergarten, primary school, secondary school and high school educations in urban communities. As the growing trend toward urbanization is expected to result in more people seeking job and career advancement opportunities in urban areas, the development of new courses, services and products is subject to risks and uncertainties. Unexpected technical, operational, logistical, regulatory or other problems could delay or prevent the introduction of one or more of new courses, service or products. Moreover, we cannot assure you that any of these courses, products and services will match the quality or popularity of those developed by our competitors, achieve widespread market acceptance or generate the desired level of income. The technology used in internet and value-added telecommunications services and products in general, and in online education services in particular, has evolved a lot in recent years. The online course providers seek to satisfy the demand of self-taught learners for high-level education and part-time workers seeking time flexibility. Providers of traditional education may lose part of the target course participants, if they fail to anticipate and adapt to such technological changes.

Risks Relating to Regulation of Our Business and to Our Structure

The education sector, in which all of our business is conducted, is subject to extensive regulation in the PRC, and our ability to conduct business is highly dependent on our compliance with these regulatory frameworks.

The PRC government regulates all aspects of the education sector, including licensing of parties to perform various services, pricing of tuition and other fees, curriculum content, standards for the operations of schools and learning centers associated with foreign participation. The laws and regulations applicable to the education sector are in some aspects vague and uncertain, and often lack detailed implementing regulations. These laws and regulations are subject to change, and new laws and regulations may be adopted, some of which may have retroactive application or have a negative effect on our business. For example, in 2003, the PRC government adopted a new regulatory framework for Chinese-foreign cooperation in education. This new framework may encourage institutions with more experience, better reputations, greater technological know-how and larger financial resources than we have to compete against us and limit our growth. In addition, because the PRC government and the public view the conduct of educational institutions as a vital social service, there is considerable ongoing scrutiny of the education sector and its participants.

We must comply with PRC’s extensive regulations on private and foreign participation in the education sector, which has caused us to adopt complex structural arrangements with our PRC subsidiary and PRC affiliated entity. If the relevant PRC authorities decide our structural arrangements do not comply with these restrictions, we would be precluded from conducting some or all of our current business.

Although our corporate structure and business are designed to comply with the limitations on foreign investment and participation in the education sector, we cannot assure you that we will not be found to be in violation of any current or future PRC laws and regulations. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations. If we or our PRC subsidiary or PRC affiliated entity are found to be or to have been in violation of PRC laws or regulations limiting foreign ownership or participation in the education sector, the relevant regulatory authorities have broad discretion in dealing with such violation, including but not limited to:

|

•

|

levying fines and confiscating illegal income;

|

||

|

•

|

requiring us to discontinue all or a portion of our business; and/or

|

||

|

•

|

revoking business licenses.

|

Any of these or similar actions could cause significant disruption to our business operations or render us unable to conduct all or a substantial portion of our business operations.

The preferential tax treatment status of the educational institutions we operate places limitations on our ability to freely operate our business, including limitations on pricing and our ability to withdraw profits from the educational institutions we operate for distribution to shareholders or for use in other parts of our business. The educational institutions we operate may incur additional costs if they seek to convert to non-preferential tax treatment status and we cannot assure you that the educational institutions we operate will be able to retain their preferential tax treatment status.

The educational institutions we operate are classified as educational institutions with preferential tax treatment, entitling them to certain tax benefits including exemption from income, turnover and property taxes. However, as a result of their preferential tax treatment status, the educational institutions we operate are prohibited from setting prices for educational services and accommodations above certain price thresholds set by the PRC government and are required to reinvest distributable profits into operations rather than being allowed to distribute profits as investment returns to the educational institutions’ owners. As a result, the educational institutions we operate are limited in the prices they may charge for educational services and accommodations and may not distribute their profits to Shanxi Taiji. These restrictions limit the financial returns the educational institutions we operate may achieve and prevent Shanxi Taiji from receiving profits from the educational institutions for investment in other high schools, acquisitions of other high schools and universities or use in other parts of its business. The only fees we anticipate that Shanxi Taiji will be able to receive from the educational institutions we operate are service fees to be paid by the educational institutions for technical services, investment and management consulting services provided by Shanxi Taiji to the educational institutions we operate. As a result, for as long as the educational institutions we operate retain their preferential tax treatment status, Shanxi Taiji will be unable to use the profits from the operations of the educational institutions it owns for reinvestment in or expansion of its business (other than reinvestment of the funds in the educational institutions from which the profits were derived) or for distribution to its shareholders. Accordingly, we anticipate that at some point in the future Shanxi Taiji will convert the educational institutions we operate to non-preferential tax treatment entities to enable it to distribute their profits to Shanxi Taiji for use in other parts of its business. We are not able to predict the time of such conversion at this time. Factors to be considered in determining whether to undertake this conversion include, our ability to acquire control of additional educational institutions, the pace at which we are able to acquire control of additional educational institutions, our competitive position in the education industry in the PRC and any negative impact the increase in tax expense will have on the network of educational institutions’ operating margins. Potential problems related to the conversion decision include, but are not limited to, Shanxi Taiji’s ability to obtain the necessary regulatory approvals for such a conversion. The conversion of the educational institutions we operate from entities that receive preferential tax treatment to entities that do not receive preferential tax treatment may result in an increase in the price of educational services provided by the network educational institutions in order to mitigate the effect of increased taxes and maintain the same profit margin. Any increase in prices for our services may result in the loss of price sensitive students. If the educational institutions we operate are converted into entities that do not receive preferential tax treatment entities, they will only be able to pay to Shanxi Taiji profits that have been generated from and after the date of conversion. An educational institution that does not receive preferential tax treatment is permitted to set its own pricing schemes and may distribute profits to its investors, but is required to pay corporate income taxes in the PRC. As a result, if Shanxi Taiji converts the educational institutions we operate to entities that do not receive preferential tax treatment, the educational institutions we operate will be less competitive against the state-sponsored high schools, colleges and universities which receive preferential tax treatment, as they will be required to pay income taxes on the their profits from and after the date of conversion. At the time of conversion, those educational institutions will become subject to corporate income tax in the PRC and we will be required to make payments to the local governments. A change in laws or a failure by one of the educational institutions we operate to satisfy the requirements of maintaining preferential tax treatment status may cause one or more of the educational institutions we operate to lose preferential tax treatment status. As a result, we cannot assure you that the educational institutions we operate or expect to operate will continue to qualify as preferential tax treatment entities and enjoy this preferential tax treatment in the future. We also cannot assure you that the laws will remain the same and that Shanxi Taiji will be able to convert the educational institutions we operate to non-preferential tax treatment entities at times that are desirable for our business. A loss of preferential tax treatment status by any of the educational institutions we operate before the desired time, or an inability to convert any of the educational institutions we operate to non-preferential tax treatment status at the desired time, may have a material adverse effect on our business, competitive position, cash flows, financial condition, results of operations and prospects.

14

The PRC’s economic, political and social conditions, as well as governmental policies, could affect the financial markets in the PRC and our liquidity and access to capital and our ability to operate our business.

The PRC economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth over the past, growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on us.

The PRC economy has been transitioning from a planned economy to a more market-oriented economy. Although the PRC government has implemented measures since the late 1970s emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in the PRC are still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over the PRC economic growth through the allocation of resources, controlling payment of foreign currency- denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Since late 2003, the PRC government implemented a number of measures, such as raising bank reserves against deposit rates to place additional limitations on the ability of commercial banks to make loans and raise interest rates, in order to slow down specific segments of the PRC economy which it believed to be overheating. These actions, as well as future actions and policies of the PRC government, could materially affect our liquidity and access to capital and our ability to operate our business.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have little precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past 32 years has significantly enhanced the protections afforded to various forms of foreign investment in the PRC. Our PRC subsidiary, Taiyuan Taiji, is a wholly foreign-owned enterprise which is an enterprise incorporated in the PRC and wholly-owned by foreign investors. Taiyuan Taiji is subject to laws and regulations applicable to foreign investment in the PRC in general and laws and regulations applicable to wholly foreign-owned enterprises in particular. However, these laws, regulations and legal requirements change frequently, and their interpretation and enforcement involve uncertainties. For example, we may have to resort to administrative and court proceedings to enforce the legal protection that we enjoy either by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems.

Recent regulations relating to offshore investment activities by PRC residents may increase the administrative burden we face and create regulatory uncertainties that could restrict our overseas and cross-border investment activity, and a failure by our shareholders who are PRC residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our PRC resident shareholders to liability under PRC law.