As filed with the Securities and Exchange Commission on November 28, 2011

Registration No. 333-167167

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 6

TO

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ETFS COLLATERALIZED COMMODITIES TRUST

Sponsored by ETF Securities USA LLC

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Delaware |

6799 |

30-0635848 |

48 Wall Street

11th Floor

New York, NY 10005

(212) 918-4954

(Address, including zip code, and telephone number, including area code,

of Registrant’s principal executive offices)

Wilmington Trust Company

Rodney Square North

1100 North Market Street

Wilmington, DE 19890

(302) 651-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

Kathleen H. Moriarty, Esq. |

Peter J. Shea, Esq. |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. S

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

Large accelerated filer £ |

Accelerated filer £ |

|

Non-accelerated filer S |

Smaller reporting company £ |

|

(Do not check if a smaller reporting company) |

|

Calculation of Registration Fee ETFS Oil

$

1,250,000

$

90.00 ETFS Natural Gas

$

1,250,000

$

90.00 ETFS Copper

$

1,250,000

$

90.00 ETFS Wheat

$

1,250,000

$

90.00 ETFS Composite Agriculture

$

1,250,000

$

90.00 ETFS Composite Industrial Metals

$

1,250,000

$

90.00 ETFS Composite Energy

$

1,250,000

$

90.00 ETFS All Commodities

$

1,250,000

$

90.00 ETFS Short Oil

$

1,250,000

$

90.00 ETFS Short Natural Gas

$

1,250,000

$

90.00 ETFS Short Copper

$

1,250,000

$

90.00 ETFS Short Wheat

$

1,250,000

$

90.00 ETFS Short Gold

$

1,250,000

$

90.00 ETFS Leveraged Oil

$

1,250,000

$

90.00 ETFS Leveraged Natural Gas

$

1,250,000

$

90.00 ETFS Leveraged Copper

$

1,250,000

$

90.00 ETFS Leveraged Wheat

$

1,250,000

$

90.00 ETFS Leveraged Gold

$

1,250,000

$

90.00

(1)

The proposed maximum aggregate offering price has been calculated assuming that shares are sold at a price of $25.00 per share. (2) The amount of the registration fee of the shares is calculated in reliance upon Rule 457(o) under the Securities Act of 1933 and using the proposed maximum aggregate offering price as described above. (3) $1,620.00 was previously paid in the initial filing of the registration statement on Form S-1, filed on May 27, 2010. The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of

the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

Title of each class of

securities to be registered

Proposed maximum

aggregate offering price(1)

Amount of

registration fee(2)(3)

The information in this Prospectus is not complete and may be changed. The trust may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. Subject to completion, dated , 2011 PROSPECTUS ETFS COLLATERALIZED COMMODITIES TRUST

Proposed Maximum Long Collateralized Exchange Traded Commodity Funds: ETFS Oil

$[ ] ETFS Natural Gas

$[ ] ETFS Copper

$[ ] ETFS Wheat

$[ ] ETFS Composite Agriculture

$[ ] ETFS Composite Industrial Metals

$[ ] ETFS Composite Energy

$[ ] ETFS All Commodities

$[ ] The ETFS Collateralized Commodities Trust (the “trust”) is a Delaware statutory trust currently organized by ETF Securities USA LLC, the trust’s sponsor, into separate, segregated Fund series. Each of the 8 initial Funds listed above will issue common shares of fractional undivided beneficial interests

in and ownership of that Fund. Shares in each Fund will be separately offered on a continuous basis and listed on [Exchange]. CME Group Index Services LLC and UBS Securities LLC, which are unaffiliated with the Funds or the sponsor, calculate, maintain and publish each Fund’s Commodity Index. Each Fund will hold collateralized prepaid, cash-settled commodities contracts referred to as Commodity Contracts. The Commodity Contracts are over-the-counter contracts negotiated by the sponsor with unaffiliated financial institution counterparties who have committed to providing each Fund with

exposure to the daily returns, subject to daily adjustment, of each Fund’s specified Commodity Index. There will be no cash, securities, futures or options on futures positions held or managed by any Fund. Each Fund will continuously offer and redeem its shares in Creation Unit blocks of [50,000] shares only. Only Authorized Participants may purchase and redeem Creation Units for cash. It is anticipated that on or after the effective date of this offering, the initial Authorized Participant will, though it is

under no obligation to do so, make initial purchases of [ ] or more Creation Units of each Fund at an initial price per share of $[ ]. Thereafter, shares of the Funds will be offered to Authorized Participants in Creation Units at each Fund’s respective Value per Share. See “Creation and

Redemption of Shares” and “Plan of Distribution” for further information regarding the creation and redemption of Creation Units. All other investors may only buy or sell a Fund’s shares on the [Exchange] at current market prices and may incur fees or brokerage commissions on their transactions. Investing in the shares involves significant risks. See “Risk Factors” beginning on page 19. Neither the SEC nor any state securities commission has approved these securities or determined that this Prospectus is accurate or complete. Any representation to the contrary is a criminal offense. None of the trust or the Funds is a mutual fund or any other type of investment company within the meaning of the Investment Company Act of 1940, and none is subject to regulation thereunder. The Commodity Futures Trading Commission has not passed upon the merits of participating in these pools nor has the Commission passed upon the adequacy or accuracy of this disclosure document. This Prospectus is in two parts: a disclosure document and a statement of additional information. These parts are bound together, and both contain important information. [ ], 2011

Aggregate Offering

Price Per Fund

COMMODITY FUTURES TRADING COMMISSION YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS

WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO

WITHDRAW YOUR PARTICIPATION IN THE POOL. FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL

TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED TO THESE POOLS AT PAGES 57 THROUGH 59 AND A STATEMENT OF

THE PERCENTAGE RETURNS NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 14. THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN ANY OF THESE COMMODITY POOLS. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN ANY OF THESE

COMMODITY POOLS, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 19 THROUGH 38. THIS POOL HAS NOT COMMENCED TRADING AND DOES NOT HAVE ANY PERFORMANCE HISTORY. THE SPONSOR HAS NOT PREVIOUSLY OPERATED ANY OTHER COMMODITY POOLS OR TRADED ANY OTHER ACCOUNTS. REGULATORY NOTICES You should rely only on the information contained in this Prospectus or to which we have referred you. We do not authorize anyone to provide you with information that is different. This Prospectus does not constitute an offer or solicitation to sell or a solicitation of an offer to buy, nor shall there be any offer, solicitation, or sale of the shares in any jurisdiction in which such offer, solicitation, or sale is not authorized or to any person to whom it is unlawful to make any such

offer, solicitation, or sale.

RISK DISCLOSURE STATEMENT

ETFS COLLATERALIZED COMMODITIES TRUST PART I DISCLOSURE DOCUMENT TABLE OF CONTENTS

Page

1

1

1

2

2

4 Purchases and Sales in the Secondary Market on the [Exchange]

5

6

7

8

9

9

9

10

10

10

10

11

11

11

11

11

11

12

13

13

13

13

14

15

19

19

24

31 Risks Related to Regulatory Requirements and Potential Legislative Changes

33

40

40

40

41

42

43

47 MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

50

50

50

50 i

Page

50

50

51

53

54

54

55

56

56

58

58

58

59

59

59

60

60

61

62

64

64

64

64

64

66

66

67

67

67

67

68

68

68

69

69

69

71

71

71

71 DESCRIPTION OF THE SHARES & CERTAIN MATERIAL TERMS OF THE TRUST AGREEMENT

72

72

72

73

74

74 Duties of the Sponsor; Limitation of Sponsor Liability; Indemnification of Sponsor

75

76

76 ii

Page Possible Repayment of Distributions Received by Shareholders; Indemnification by Shareholders

76

77

77

77

77

77

78

79

79

80 THE SECURITIES DEPOSITORY; BOOK-ENTRY-ONLY SYSTEM; GLOBAL SECURITY

80

81

81

81

82

82

84 Recent Legislative Developments Affecting Shares Held By or Through Foreign Entities

84

85

85

86

87

87

87

88

F-1

F-1

F-2

F-11

F-14

A-1 iii

The following is only a summary of portions of this Prospectus. You should carefully read the entire Prospectus before investing in any Fund’s shares. The definition of certain capitalized terms may be found in the “Glossary of Certain Terms” in Appendix A appearing before the back cover of this

Prospectus. The ETFS Collateralized Commodities Trust was formed as a Delaware statutory trust with 18 separate series of “Collateralized Exchange Traded Commodity Funds” on May 27, 2010. This Prospectus relates to the following funds: ETFS Oil, ETFS Natural Gas, ETFS Copper, ETFS Wheat, ETFS

Composite Agriculture, ETFS Composite Industrial Metals, ETFS Composite Energy and ETFS All Commodities (each, a “Fund” and together, the “Funds”). Each Fund issues shares of fractional undivided beneficial interests in and ownership of such Fund only. The term of the trust and each Fund is

perpetual unless terminated earlier by the sponsor. Each Fund offers investors the opportunity to obtain long exposure to an index referencing a specified commodity or commodities (a “Commodity Index”). Each Fund seeks to track changes, whether positive or negative, to the return of its Commodity Index on a daily basis only, rather than over

longer periods of time. Each Fund’s performance will also be subject to a daily adjustment calculation to account for a daily accrual to a Fund of a 3-month U.S. Treasury bill rate of return, less certain ordinary expenses of the Fund (the “Daily Capital Adjustment”). See “Investment Objectives, Pricing

and Commodity Contracts.” The shares of each Fund are designed for investors who want a cost-effective and convenient way to obtain exposure to individual commodities and specified commodity sectors on U.S. and non-U.S. markets. ETF Securities USA LLC serves as the sponsor of the trust. The principal offices of each Fund are located at c/o ETF Securities (US) LLC, 48 Wall Street, New York, New York 10005, and the telephone number of each of them is (212) 918-4954. The principal office and location of books and

records of the sponsor is located at Ordnance House, 31 Pier Road, St. Helier, Jersey JE48 PW, Channel Islands and its telephone number is 011-44-1534-825-500. The Funds are designed to track the daily performance of, and the value of the total assets of a Fund (the “Value”) and the Fund’s per share Value (the “Value per Share”) are calculated by reference to, their respective Commodity Indices calculated and published by CME Group Index Services

LLC and UBS Securities LLC (the “index providers”) subject to a Daily Capital Adjustment. Each Fund seeks to provide daily investment results, before extraordinary fees and expenses, which correspond to 100% of the daily performance, whether positive or negative, of its Commodity Index shown below, subject to a Daily Capital Adjustment.

Long Fund Name

Commodity Index ETFS Oil

Dow Jones-UBS Brent Crude Sub-IndexSM ETFS Natural Gas

Dow Jones-UBS Natural Gas Sub-IndexSM ETFS Copper

Dow Jones-UBS Copper Sub-IndexSM ETFS Wheat

Dow Jones-UBS Wheat Sub-IndexSM ETFS Composite Agriculture

Dow Jones-UBS Agriculture Sub-IndexSM ETFS Composite Industrial Metals

Dow Jones-UBS Industrial Metals Sub-IndexSM ETFS Composite Energy

Dow Jones-UBS Energy Sub-IndexSM ETFS All Commodities

Dow Jones-UBS Commodity IndexSM Each Commodity Index is calculated by reference to the daily settlement prices of one or more constituent futures contracts (its “Designated Contract” or “Index Component”). A Commodity Index’s front month or “lead” Designated Contract is replaced (or “rolled”) as it expires with the next

Designated Contract. The Commodity Indices are said to provide an “excess return” because, in addition to the daily underlying commodity price movement, they also provide a positive or 1

negative yield (“roll yield”) that results from the replacement of expiring lead Designated Contracts with the next Designated Contracts at a price that is either lower or higher than that of the expiring Designated Contract. Each Fund’s performance reflects the performance of its specified Commodity

Index through prepaid, cash-settled commodities contracts whose value is derived by reference to the daily value of the Commodity Index, subject to the Daily Capital Adjustment (“Commodity Contracts”). There will be no cash, securities, futures or options on futures positions held or managed by any

Fund. The number of shares of a Fund will be kept equal in number to the Commodity Contracts held by that Fund. The Commodity Contracts will be in the form of prepaid, cash-settled commodities contracts with one or more counterparties, which, as described more fully under “Risk Factors”, are

treated as “swaps” within the meaning of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). Each time shares in a Fund are created or redeemed, an equal number of Commodity Contracts between the Fund and its counterparties will be created or terminated. A

creation or termination of Commodity Contracts will be allocated by the Fund to one or more counterparties in such manner as agreed under the terms of the applicable facility agreement committing a counterparty to enter into a stated aggregate amount of Commodity Contracts and setting forth the

terms for their provision (“Facility Agreement”). All Commodity Contracts are paid for in full by Authorized Participants creating new Fund shares, on behalf of the Fund, upon such Commodity Contracts’ creation. A Fund will track the daily performance of the referenced Commodity Index according to the terms of its Commodity Contracts with the counterparties. Commodity Contracts are collateralized to the extent that the counterparty will post assets to a collateral account (“collateral”) on each business

day equal to the obligations owed by the counterparty to the Fund under such Commodity Contracts as of the end of the previous day on which relevant commodity futures exchanges are open and no market disruption events have occurred with respect to the relevant Designated Contract (“Pricing

Day”). The return to the Fund on its Commodity Contracts will be equal to the total return of the daily performance of each Commodity Index plus the Daily Capital Adjustment. The components of the Daily Capital Adjustment reflect an interest return on the value of the Commodity Contract less

expenses as described herein. The “Daily Contract Price” of each Commodity Contract will be calculated daily by the calculation agent to reflect: (1) the daily performance (100%) of each Fund’s Commodity Index, and (2) the daily accrual of each Commodity Contract’s Daily Capital Adjustment, which can be negative or positive. Consequently, the Daily Contract Price of each Commodity Contract represents a “total” return equal to the sum of the Fund’s long Commodity Index daily performance and the accrual of the Daily Capital Adjustment. The value amount of the Commodity Contracts will be determined each day so

that the Fund will track the daily performance rather than the long-term performance of each Commodity Index. The Fund’s counterparties will not pay cash to the Fund if Daily Contract Prices increase from one day to the next, and the Fund will not pay cash to its counterparties if Daily Contract Prices decrease from one day to the next. Instead, the value of the Fund’s Commodity Contracts will be adjusted

as described below. The Funds will not pay distributions to shareholders and shareholders will realize losses or gains solely based upon the market trading prices at which they acquire and dispose of Fund shares. Fund Valuation and Commodity Contract Pricing The value for each share in a block of [50,000] shares that will be used for creation and redemption purposes (a “Creation Unit”) will equal the Value per Share of the Fund. As administrator of the trust, JPMorgan Chase Bank, N.A. (the “administrator”) will publish each Fund’s Value and Value

per Share on each day (other than a Saturday or Sunday) that the [Exchange] is open for regular trading (“business day”) on the sponsor’s website at 2

www.etfsecurities.com. The Value of each Fund will equal the aggregate of the Daily Contract Prices of all Commodity Contracts held by the Fund, less the portion of any extraordinary, non-recurring expenses attributable to such Fund that are not assumed by the sponsor under the Amended and

Restated Trust Agreement dated as of [ ], 2011 between the sponsor and the trustee, as amended or supplemented from time to time (the “Trust Agreement”). A Fund’s Value per Share is the Fund’s Value on a given day divided by the number of the Fund’s shares outstanding on that day. The

above calculations will be performed after the Commodity Indices have been published for that day and prior to [Exchange] trading commencing on the following day. The Daily Contract Price of a Commodity Contract will be determined at the end of each Pricing Day by the calculation agent. The Daily Contract Price will reflect the daily return of the Fund’s specified Commodity Index multiplied by the Fund’s stated return multiplier (its “Delta Factor,” which is

100%) and adjusted by the Daily Capital Adjustment. The daily return of a Commodity Index is the difference between the current Designated Contract settlement price or prices on the commodity futures exchange upon which Designated Contracts are traded (the “Component Exchange”) and the

previous day’s settlement price for such Designated Contract. The Daily Capital Adjustment is an accrual to the Fund of a daily rate of return equal to a 3-month U.S. Treasury bill rate, less the following ordinary expenses of the Fund: (1) the spread rate agreed to by the Fund and its counterparties as

compensation of the counterparties for providing the Fund with exposure to the Commodity Index (the “Commodity Contract Spread”), (2) the fixed fee rate that accrues daily to the sponsor in consideration for the provision of all management and administrative services for the Fund (the “sponsor’s

fee”), and (3) the fixed rate amount that finances payment of the Fund’s index licensing fees to the index providers and the tax reporting costs of the Fund (the “Service Allowance”). The 3-month Treasury bill rate represents the part of the Daily Capital Adjustment that is added to the excess return

(spot futures price plus or minus roll yield) in order to provide investors with total return exposure to the Commodity Index. Commodity Contracts are collateralized to the extent that the counterparty will post collateral on each Pricing Day equal to the obligations owed by the counterparty to the Fund

as at the previous Pricing Day. The Daily Capital Adjustment may be negative if such expenses exceed the 3-month U.S. Treasury bill rate. See “Investment Objectives, Pricing and Commodity Contracts—Fund Valuation and Commodity Contract Pricing,” “Creation and Redemption of Shares—Determination

of Redemption Proceeds,” and “Trust and Fund Expenses.” Effect of Commodity Market Disruptions on Commodity Contract Pricing and the Funds A “Market Disruption Event” is the occurrence or continuance of, with respect to a Designated Contract of a Fund’s Commodity Index, (1) the failure to determine, announce or publish its relevant settlement price, (2) its termination or suspension, or the material limitation or disruption in its

trading, or (3) its settlement price reflecting the Component Exchange’s maximum permitted price change from the previous day’s settlement price. Any day on which a Market Disruption Event occurs or is continuing will not be a Pricing Day for the Fund referencing the Commodity Index affected by

such disruption. Thus, no Daily Contract Price will be calculated for a Commodity Contract referencing such Commodity Index upon the occurrence of a Market Disruption Event regardless of whether or not the index providers publish the Commodity Index on that day. The occurrence and continuation of a Market Disruption Event on any day on which a Component Exchange is open for trading during its regular session (including days on which it closes prior to its scheduled time) (a “Trading Day”) is a “Market Disruption Day”. For the first [five] consecutive

Market Disruption Days, no Daily Contract Price will be determined and all rights to create or redeem Creation Units will be suspended. After this period, the calculation agent will use its reasonable efforts to calculate substitute settlement values of the affected Commodity Index using the same

methodology and processes for each individual commodity as are used for the calculation of the Commodity Index in the index providers’ publication setting forth the methodology for calculation of a Commodity Index (the “Handbook”) and use those settlement values to resume the calculation of Daily

Contract Prices. When the calculation agent so determines substitute Daily Contract Prices, those days will be considered Pricing Days and creation and redemption activities will resume. 3

The calculation agent will determine substitute Daily Contract Prices for only [60] consecutive Pricing Days, if the Market Disruption Event persists that long and the sponsor and the counterparties have not earlier agreed upon a replacement index for the affected Commodity Index. Once this period

expires, substitute Daily Contract Price calculations will cease as will any further creation and redemption activities and the sponsor may terminate the affected Fund and effect a mandatory redemption of such Fund’s shares (a “Compulsory Redemption”). Effect of Index Providers’ Failure to Publish a Commodity Index on Commodity Contract Pricing and the Funds If the index providers fail to publish a Fund’s Commodity Index on a Trading Day for the regular trading of such Commodity Index’s Designated Contracts on the relevant Component Exchange and such Trading Day is also not a Market Disruption Day, then the calculation agent will use its

reasonable efforts to calculate the Commodity Index using the same methodology and processes as are set forth in the index providers’ Handbook. The calculation agent will then use the substitute Commodity Index data to calculate the Fund’s substitute Daily Contract Prices. If the failure to publish a

Commodity Index persists for longer than [65] consecutive Pricing Days and the sponsor and the counterparties have not earlier agreed upon a replacement index for the affected Commodity Index, the substitute Daily Contract Price calculations will cease as will any further creation and redemption

activities and the sponsor may terminate the affected Fund and effect a Compulsory Redemption of such Fund’s shares. Intra-Day Decline of Fund Value to Zero Will Terminate the Fund A Fund will be terminated and its shares will be Compulsorily Redeemed if its intra-day indicative Value declines to zero. This situation would generally arise if Commodity Contract prices decrease by 100% or more from the prior Pricing Day’s Daily Contract Price, although a commodity losing its

entire value would be a remote event. Value Calculation Times Value and Value per Share are expected to be calculated by the administrator at 7:00 p.m. (Eastern Time) on each “business day” the [Exchange] is open for regular trading and are determined by the closing of the respective Component Exchanges utilized by each Fund’s specified Commodity Index. Publication of Pricing Information The Value and Value per Share of each Fund will be posted on each business day by the sponsor on its website at www.etfsecurities.com. Provision of Collateral by Counterparties Each counterparty has entered into a tri-party Custodial Undertaking Agreement with each of the Funds and the collateral agent appointed by the sponsor to establish collateral accounts and manage the functions relating to the collateral posted by counterparties (the “collateral agent”). Under each

Custodial Undertaking Agreement the counterparty will be required to post collateral in respect of each Fund into a separate account maintained by the collateral agent equal to the value of that counterparty’s liability to the Fund under the Commodity Contracts as of the close of the preceding Pricing

Day. JPMorgan Chase Bank, N.A. serves as the collateral agent of each Fund and its rights and duties with respect to servicing the collateral it holds and maintains in relation to such Funds are set forth in the Custodial Undertaking Agreement. Collateral will include only:

•

Cash in U.S. Dollars; provided that Cash may be invested in AAA-rated U.S. Treasury Securities or AAA-rated money market funds;

4

• U.S. Treasury Securities (other than (i) interest-only securities and principal only securities and (ii) inflation linked securities) issued by the U.S. Treasury Department; • Fully modified pass-through certificates (“GNMA Certificates”) in book-entry form which are guaranteed by the Government National Mortgage Association; • AAA-rated securities backed by student loans under Sallie Mae marketing Association (“SLMA”); • Supranational bonds issued by the International Bank for Reconstruction and Development, the European Investment Bank, the Council of Europe, the Asian Development Bank or the Inter-American Development Bank, or the Agency for International Development, provided that such securities

are rated AAA by Standard & Poors or Aaa by Moody’s Investors Service; • Corporate debt securities that are rated at least BBB- by Standard & Poors or Baa3 by Moody’s Investors Service at the issue level, in the following G7 markets: Canada, UK, U.S., Italy, France, Germany and Japan; • Convertible bonds that are rated at least BBB- by Standard & Poors or Baa3 by Moody’s Investors Service at the issue level, and which have an underlying equity that is a constituent of one of the following major G7 stock indices: Canada (S&P/TSX 60), UK (FTSE 100), U.S. (S&P 500), Italy (FTSE

MIB), France (CAC 40), Germany (DAX 30) and Japan (NIKKEI 225); • Common equities that are constituents of one of the above G7 stock indices; • Preferred equities of issuers of common shares identified above; • American Depositary Receipts listed on the NYSE Composite or the AMEX Composite; and • Specified U.S. exchange-traded funds. The calculation agent will report to the collateral agent after the close of business for each Pricing Day the amount of increase or decrease in the Daily Contract Price of each Fund’s Commodity Contracts on such Pricing Day. The collateral agent, in turn, will call for additional collateral from the

counterparty or release collateral to the counterparty as necessary to ensure that the value of the collateral for the Commodity Contracts always equals the aggregate Daily Contract Prices for the previous Pricing Day. In the case of creation of a Fund’s Creation Units, the counterparties will post collateral with the Fund’s collateral agent upon the settlement of the creation equal in value to the increased counterparties’ obligations to the Fund that correspond to the new Commodity Contracts created when the

order for new Creation Units was accepted. In the case of a redemption, the Fund’s collateral agent will release collateral to the Fund’s counterparties upon the settlement of the redemption equal in value to the decreased counterparties’ obligations to the Fund that corresponds to the Commodity

Contracts terminated when the order to redeem existing Creation Units was accepted. Purchases and Sales in the Secondary Market on the [Exchange] The shares of each Fund are listed on the [Exchange] under the following symbols and CUSIP numbers:

Long Fund Name

Ticker Symbol

CUSIP Number ETFS Oil

OILB

26923D100 ETFS Natural Gas

NATT

26923D209 ETFS Copper

COPA

26923D308 ETFS Wheat

WHAT

26923D407 ETFS Composite Agriculture

AGRI

26923D506 ETFS Composite Industrial Metals

INDM

26923D605 ETFS Composite Energy

ENGB

26923D704 ETFS All Commodities

ALLC

26923D803 5

Secondary market purchases and sales of shares will be subject to ordinary brokerage commissions and charges. The shares of each Fund trade on the [Exchange], like any other listed security traded on the [Exchange]. Investors will realize a loss or gain on their investment in a Fund’s shares based

solely on the trading price of the shares on the secondary market. Creation and Redemption of Shares Shares in each Fund may be created or redeemed only by certain broker-dealers or other securities market participants who are participants in DTC who have entered into Authorized Participant Agreements with the trust and the sponsor and Direct Agreements with each counterparty of a Fund

(“Authorized Participants”). Such shares may be created and redeemed from time to time, but only in one or more Creation Units of a Fund. A Creation Unit is a basket of [50,000] shares. The Funds will not issue or redeem fractional Creation Units. The creation/redemption process is important for each Fund in providing Authorized Participants an arbitrage mechanism through which they keep share trading prices in line with the Fund’s Value per Share. As a Fund trades intraday on the [Exchange], its market price will fluctuate due to simple supply and demand. The following scenarios describe the conditions surrounding a creation/redemption:

•

If the market price of a share of a Fund becomes more expensive than the Value per Share, an Authorized Participant can purchase through a cash payment the shares as a Creation Unit from the Fund, and then sell the new shares on the market. This process of increasing the supply of shares is

expected to bring the trading price of a share back to its Value per Share. • If the Value per Share exceeds the trading price of a share of a Fund, an Authorized Participant can purchase shares in an amount equal to a Creation Unit and redeem them for the cash value of the underlying Commodity Contracts. This process of increasing the demand for shares on the

[Exchange] is expected to raise the trading price of a share to meet its Value per Share. These processes are referred to as the arbitrage mechanism. The arbitrage mechanism helps to minimize the difference between the trading price of a share of a Fund and the Value per Share. Over time, these buying and selling pressures should balance out, and the Fund’s market trading price is

expected to stay in line with the Value per Share. The arbitrage mechanism provided by the creation and redemption process is designed and required in order to maintain the relationship between the market trading price of shares and the Value per Share. This arbitrage mechanism is one of the critical ways in which funds featuring a creation and

redemption process differ from closed-end funds. In closed-end funds, no one can create or redeem shares past the initial offering date, commonly resulting in premiums or discounts to such fund’s underlying asset value. The amount payable for the creation or redemption of a Creation Unit will equal the Value per Share of each share in the Creation Unit as of the end of the business day during which the order for such creation or redemption is submitted. If the date on which such creation or redemption is

submitted is not a Pricing Day, the Value per Share will be determined based on the next Pricing Day. Creation and redemption orders will be settled on the third business day after the order is accepted. Settlement will be effected on a delivery free of payment basis with shares being transferred directly between Authorized Participants and the Fund, and cash being transferred directly between the

Authorized Participant and counterparty. The sponsor will reject orders for share creations if a Fund is unable to obtain an equal number of Commodity Contracts. Creation orders are subject to an aggregate limit and a daily limit on the creation of new Commodity Contracts. The aggregate limit is based on all Collateralized Exchange Traded Commodity Funds of the trust. Commodity Contracts cannot be created to the extent that the total 6

outstanding Daily Contract Price of all Commodity Contracts of all Collateralized Exchange Traded Commodity Funds would exceed the aggregate limit of [$__________] unless the counterparties otherwise agree. The daily limit is per Collateralized Exchange Traded Commodity Fund and may differ

among Collateralized Exchange Traded Commodity Funds. Commodity Contracts relating to a Fund may not be created to the extent that the sum of the Daily Contract Price of all Commodity Contracts created on the same business day for that Fund would exceed an expected daily limit amount of

[$__________] unless the counterparties otherwise agree. Whenever a Fund is unable to create new Commodity Contracts either because of the aggregate limit or the daily limit, creation orders submitted after such limits are reached will be rejected. Redemptions are subject to a daily limit for each Fund. Such limit will be equal to the daily creation limit for the Fund, unless the counterparties otherwise agree. Whenever a Fund is unable to terminate existing Commodity Contracts because of the daily limit, redemption orders submitted after such

limit is reached will be rejected. Authorized Participants pay a transaction fee of $500 to the Fund in connection with each order for the creation or redemption of shares. Once a creation order has been accepted, a Fund’s counterparties will be required to create new Commodity Contracts having an aggreate Daily Contract Price equal to the aggregate Value per Share of the shares comprising the created Creation Units. Similarly, once a redemption order has been

accepted, a Fund’s counterparties will be required to terminate Commodity Contracts having an aggregate Daily Contract Price equal to the aggregate Value per Share of the shares comprising the redeemed Creation Units. Intra-Day Indicative Value per Share The [Exchange] will publish the intra-day indicative Value per Share of each Fund based on the prior day’s final Value per Share, adjusted every 15 seconds throughout the day to reflect the continuous changes in Daily Contract Prices. The intra-day indicative Value per Share of each Fund will not

include any extraordinary expenses of the Fund incurred but not assumed by the sponsor that day, if any. Other Investors Retail investors may purchase and sell shares through traditional brokerage accounts. Purchases or sales of shares may be subject to customary brokerage commissions. Investors are encouraged to review the terms of their brokerage accounts for applicable charges. The Index Providers and the Commodity Indices The Commodity Indices are constructed, calculated and published by the index providers, who are unaffiliated with the trust and the sponsor in their capacity as index providers. The methodology used to calculate these indices is set out in the The Dow Jones-UBS Commodity IndexSM Handbook,

which is available at www.djindexes.com. For more information about the construction and maintenance of the Commodity Indices, see “The Commodity Indices.” Each Commodity Index tracks one or more Index Components and is designed to reflect two components:

•

changes in the current market or spot price of the commodity determined from futures contract settlement prices on the Component Exchange. A rise in the market price of a commodity will be positive for the Funds, and a drop in price will be negative for the Funds; and • the effect of “backwardation” or “contango” in the futures market when replacing or “rolling” expiring front month Designated Contracts with the next Designated Contracts. If the market is in backwardation, the Commodity Index will tend to increase since the expiring front month Designated

Contract will be valued higher than the replacement Designated Contract. If the market is in contango, the Commodity Index will tend to decrease because the expiring front month Designated Contract will be valued lower than the replacement Designated Contract. Generally, the effect of

backwardation will tend to be positive for the Funds; conversely, the effect of contango will tend to be negative for the Funds. 7

A Fund may in the future use different commodity indices to calculate the Daily Contract Prices of its Commodity Contracts. Any change in commodity indices shall be instituted on such terms as agreed upon in writing by the sponsor and subject to 30 days’ prior notice to shareholders of such

change. The sponsor will communicate such change to shareholder through a press release, announcement on its website (www.etfsecurities.com), and/or communication through [Exchange]. The sponsor does not intend to change the investment objective of any Fund to track a commodity index that reflects a Designated Contract not reflected by the Fund’s original Commodity Index. In the event that a substitute index is necessary for a Fund, the sponsor will notify shareholders as

described above. ETF Securities USA LLC, a Delaware limited liability company, serves as sponsor of each Fund. The sponsor, formed on June 17, 2009, is wholly-owned by ETF Securities Limited. Under the Delaware Limited Liability Company Act and the governing documents of the sponsor, ETF Securities

Limited, the sole member of the sponsor, is not responsible for the debts, obligations, and liabilities of the sponsor solely by reason of being the sole member of the sponsor. The sponsor serves as the commodity pool operator of the trust and each Fund. The sponsor has no experience in operating commodity pools. The sponsor is registered as a commodity pool operator with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National

Futures Association (“NFA”). As a registered commodity pool operator, with respect to both the trust and each Fund, the sponsor must comply with various regulatory requirements under the Commodity Exchange Act (“CEA”) and the rules and regulations of the CFTC and the NFA, including investor

protection requirements, antifraud prohibitions, disclosure requirements, and reporting and recordkeeping requirements. The sponsor is also subject to periodic inspections and audits by the CFTC and the NFA. The principal office of the sponsor is located at Ordnance House, 31 Pier Road, St. Helier,

Jersey JE48 PW, Channel Islands, and its telephone number is 011-44-1534-825-500. The sponsor’s books and records will be kept at its principal office and, upon 72 hours advance notice from the CFTC or the NFA, made available for inspection at the principal offices of the Funds at c/o ETF Securities

(US) LLC, 48 Wall Street, New York, New York 10005. Under the Trust Agreement of the trust between the sponsor and Wilmington Trust Company, as trustee, the sponsor has exclusive management and control of all aspects of the business of each Fund. Specifically, the sponsor:

•

Selects the Funds’ service providers; • Selects counterparties; • Negotiates various fees and agreements; and • Performs such other services as the sponsor believes that the trust may require from time to time. In consideration for the sponsor’s services, each Fund accrues daily to the sponsor the sponsor’s fee, monthly in arrears, in an amount equal to the per annum rate, as set forth in the “Sponsor’s Agreement” between each Fund and the sponsor, for each Fund based on its daily Value. The sponsor’s

fee is deducted as a part of the Daily Capital Adjustment and paid to the sponsor by the counterparties:

Long Fund Name

Sponsor’s Fee

ETFS Oil [ ]%

ETFS Natural Gas [ ]%

ETFS Copper [ ]%

ETFS Wheat [ ]%

ETFS Composite Agriculture [ ]%

ETFS Composite Industrial Metals [ ]%

ETFS Composite Energy [ ]%

ETFS All Commodities [ ]% 8

The sponsor receives the sponsor’s fee and bears all the organizational and routine ordinary expenses of each Fund except for (1) the Service Allowance, which finances each Fund’s costs of tax reporting and index licensing fees payable to the index providers, and (2) the Commodity Contract Spread

payable by each Fund to its counterparties. The Funds bear all their extraordinary, non-recurring expenses that are not assumed by the sponsor under the Trust Agreement. Wilmington Trust Company, a Delaware trust company, acts as the trustee of the trust for the purpose of creating a Delaware statutory trust in accordance with the Delaware Statutory Trust Act (the “DSTA”). The trustee has only nominal duties and liabilities to the trust and the Funds. The trustee

will have no duty or liability to supervise or monitor the performance of the sponsor, nor will the trustee have any liability for the acts or omissions of the sponsor. Each Authorized Participant must be (1) a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) a participant in the Depository Trust Company (“DTC”),

(3) a party to an Authorized Participant Agreement with the administrator and the sponsor setting forth the procedures for the creation and redemption of Creation Units in a Fund (an “Authorized Participant Agreement”), and (4) a party to a Direct Agreement with each of the counterparties of the

relevant Fund setting forth certain standard undertakings, representations and procedures regarding the payment of monies in the event of settlement failures for creations and redemptions (a “Direct Agreement”). Only Authorized Participants may place orders to create or redeem one or more Creation

Units. A list of the current Authorized Participants can be obtained from the sponsor. The sponsor will provide the form of the Authorized Participant Agreement and Direct Agreement. The initial counterparties for each of the Funds are UBS AG, Merrill Lynch Commodities, Inc. and Morgan Stanley Capital Group, Inc., each of whom has entered into a Facility Agreement with the trust on behalf of each Fund. Additional or replacement counterparties may enter into a Facility

Agreement from time to time. The counterparties may also be Authorized Participants or shareholders of a Fund. Commodity Contracts will be allocated so that UBS AG receives 45.00% of the aggregate value of Daily Contract Prices for a Fund, and Merrill Lynch Commodities, Inc., Morgan Stanley Capital Group, Inc. and any other future counterparties will be allocated the remaining 55.00%. The allocation

to any counterparty other than UBS AG will be in the sole discretion of the sponsor but in no event greater than 35% of the aggregate value of Daily Contract Prices for a Fund. Under their Facility Agreements, each of the initial counterparties will issue Commodity Contracts pursuant to a form of the standardized contract developed by the International Swaps and Derivatives Association, known as an “ISDA Agreement.” Each counterparty will enter into the ISDA

Agreements with each of the Funds in order to provide for standardized terms across all counterparties. The ISDA Agreements are comprised of the form of ISDA Master Agreement (Multicurrency—Cross-Border) as published by ISDA in 2002 (“ISDA Master Agreement”) and all related documentation

including the ISDA master confirmation entered into by the trust on behalf of a Fund with a counterparty (“ISDA Master Confirmation”), credit support annex and any schedules thereto. These Commodity Contracts provide a Fund with exposure to and track the specified Commodity Index in

accordance with the terms of the ISDA Agreements. Under the prepaid, cash-settled purchase/sale structure, the counterparties receive a specified amount in exchange for a Commodity Contract and the counterparty for such Commodity Contract pays upon termination a return based on a specified

formula for that contract based principally on the performance of the referenced Commodity Index. 9

The value of each of the Index Components is reflected in the daily level of each Commodity Index. The change in daily Commodity Index levels is the principal component of the formula determining the Daily Contract Price. The aggregate value of the Daily Contract Prices for a Fund, in turn, is

the principal component of the Fund’s daily Value and Value per Share. Counterparties may track a Fund’s referenced Commodity Index by holding the Designated Contracts of such Commodity Index, although the counterparties are not required to do so. The Fund is entitled to the return under the

Commodity Contracts regardless of the extent to or manner in which each a counterparty might choose to hedge its obligation. Each counterparty will sign a Custodial Undertaking Agreement with each Fund and the collateral agent to establish each Fund’s collateral account in the name and for the benefit of each Fund counterparty for the posting of collateral and to set forth the terms of the day-to-day management of the

collateral. No counterparty of a Fund is responsible for the Commodity Contract obligations of any other counterparty of that Fund. Additional counterparties will be appointed by the sponsor on a similar basis. More information about UBS AG, including its current financial statements, may be found at www.ubs.com/1/e/investors.html. More information about Merrill Lynch Commodities, Inc., including its parent company’s current financial statements, may be found at

http://ir.ml.com/phoenix.zhtml?c=93516&p=irol-irhome. More information about Morgan Stanley Capital Group, Inc., including its parent company’s current financial statements, may be found at www.morganstanley.com/about/ir/index.html. JPMorgan Chase Bank, N.A., a national association formed under the laws of the U.S., serves as the collateral agent of each Fund pursuant to the terms of the Custodial Undertaking Agreements. UBS Securities LLC, a Delaware limited liability company, has been selected by the sponsor to serve as the calculation agent responsible for determining each Commodity Contract’s Daily Contract Price for each Fund, including substitute Daily Contract Prices on Market Disruption Days that are

also considered to be Pricing Days and Pricing Days on which the index providers fail to calculate a Commodity Index. JPMorgan Chase Bank, N.A., a national association formed under the laws of the U.S., serves as the agency service provider for each Fund (the “agency service provider”) pursuant to appointment by the sponsor and the terms of the agreement to provide certain services to the Funds (the “Agency

Services Agreement”). The agency service provider, among other things, provides transfer agent services with respect to the creation and redemption of shares and acts as “index receipt agent” (as such term is defined in the rules of the National Securities Clearing Corporation) with respect to the

settlement of orders from Authorized Participants. JPMorgan Chase Bank, N.A., a national association formed under the laws of the U.S., serves as the custodian for each Fund pursuant to appointment by the sponsor and the terms of the custody agreement (“Custody Agreement”). The custodian will hold a Fund’s securities and cash, if any,

delivered to the custodian upon the Fund’s foreclosure on its collateral account and will provide related settlement services in the event of a Fund’s Compulsory Redemption. The custodian will maintain separate and distinct books and records segregating the assets of each Fund not represented by

Commodity Contracts or collateral, if any. 10

JPMorgan Chase Bank, N.A., a national association formed under the laws of the U.S., serves as the administrator pursuant to appointment by the sponsor and the terms of a servicing agreement (the “Fund Servicing Agreement”). The administrator, among other things, provides accounting and other

administrative services for each Fund. In addition, the administrator will receive from Authorized Participants creation and redemption orders and deliver acceptances and rejections of such orders to Authorized Participants as well as coordinate the transmission of such orders and instructions among the

sponsor, the counterparties, and the Authorized Participants. ALPS Distributors, Inc., a Colorado corporation (“ALPS”), serves as the marketing agent pursuant to the Distribution Services Agreement and assists the sponsor with certain functions and duties relating to marketing of the Funds, including reviewing and approving marketing materials. ALPS retains

all marketing materials separately for each Fund at its principal office at 1290 Broadway, Suite 1100, Denver, Colorado 80203; telephone number (303) 623-2577. The Fund’s proceeds from sales of Creation Units are delivered by Authorized Participants directly to each of the Fund’s counterparties with which such Authorized Participants have entered into a Direct Agreement after such counterparties have issued corresponding Commodity Contracts to the

Fund. The counterparties will deposit collateral equal to the value of such new Commodity Contracts with the collateral agent. The offering of each Fund’s shares is continuous with no termination date. The shares of each Fund are evidenced by global certificates that the Fund issues to DTC. The shares of each Fund are available only in book-entry form. Shareholders may hold shares of any Fund through DTC, if they are participants in DTC, or indirectly through entities that are participants in

DTC. All proceeds of the offering of the shares of each Fund will be used to enter into Commodity Contracts with one or more counterparties. The initial Creation Units of the Funds are expected to be purchased by the initial Authorized Participant on or after the effective date of this offering. The only

assets attributable to the Funds will be its Commodity Contracts. The ability of a Fund to meet its share redemption obligations will be dependent on its receipt of payments under the Fund’s Commodity Contracts from counterparties or (to the extent sufficient to pay the redemption proceeds) the

realization of collateral provided by the counterparties under the Custodial Undertaking Agreement. Additional Expenses of the Funds and the Shareholders Except for the Commodity Contract Spread, sponsor’s fee, and Service Allowance of a Fund, no Fund will bear any further expenses (except extraordinary, non-recurring expenses such as the payment of certain indemnification liabilities to the trustee and the sponsor as determined under the Trust

Agreement). See “Trust and Fund Expenses” and “Description of the Shares & Certain Material Terms of the Trust Agreement—The Sponsor.” As described below, the sponsor will pay all additional expenses of the Funds and the trust.

Organization and Offering Expenses

Expenses incurred in connection with organizing the trust and each Fund and

the registration and initial offering of its shares will be paid by the sponsor. Expenses incurred

in connection with the continuous offering of shares of 11

each Fund after the

commencement of its trading operations will also be paid by the sponsor.

Routine Operational, Administrative,

and Other Ordinary Expenses

The sponsor will pay all of the routine operational, administrative, and other ordinary expenses of each Fund, including, but not limited to, computer services, the fees and expenses of the trustee, the agency service provider, the custodian, the administrator and

the marketing agent, legal and accounting fees and expenses, filing fees, and printing, mailing and duplication costs. The fees and expenses of the collateral agent are paid by the counterparties.

Non-Recurring Fees and Expenses

All extraordinary, non-recurring expenses (referred to as extraordinary fees and expenses in the Trust Agreement), if any, will be borne by the affected Funds. Extraordinary fees and expenses affecting the trust as a whole will be prorated to each Fund according

to its respective Value. Extraordinary, non-recurring expenses include, without limitation, legal claims and liabilities, litigation costs or indemnification or other unanticipated expenses. Such non-recurring and unusual fees and expenses, by their nature, are

unpredictable in terms of timing and amount.

Brokerage Commissions

Retail investors may purchase and sell shares through traditional brokerage accounts. Investors may be charged a customary commission by their brokers in connection with purchases of shares that will vary from investor to investor. Investors are encouraged to

review the terms of their brokerage accounts for applicable charges. As discussed, each Fund also imposes on an Authorized Participant transaction fees to offset, or partially offset, transfer and other transaction costs associated with the issuance and redemption of Creation Units. A fixed transaction fee of $500 is applicable to each creation and redemption

transaction, regardless of the number of Creation Units transacted. The following table summarizes the breakeven analysis by estimating, based on an initial, 365-day investment of $100.00 in each Fund, the amount of (i) all fees and expenses which are anticipated to be incurred by a new investor, (ii) interest income earned by a new investor, and (iii) the income

required for an investor to break-even on such investment during the 365-day investment period:

Fund

Initial

Fees and

Less

Income Required

In $s

As % ETFS Oil

$

100.00

$

[__]

$

[__]

$

[__]

[__]

% ETFS Natural Gas.

$

100.00

$

[__]

$

[__]

$

[__]

[__]

% ETFS Copper.

$

100.00

$

[__]

$

[__]

$

[__]

[__]

% ETFS Wheat.

$

100.00

$

[__]

$

[__]

$

[__]

[__]

% ETFS Composite Agriculture

$

100.00

$

[__]

$

[__]

$

[__]

[__]

% ETFS Composite Industrial Metals

$

100.00

$

[__]

$

[__]

$

[__]

[__]

% ETFS Composite Energy

$

100.00

$

[__]

$

[__]

$

[__]

[__]

% ETFS All Commodities

$

100.00

$

[__]

$

[__]

$

[__]

[__]

% A more complete analysis may be found in the Breakeven Table and the notes thereto on pages 14 and 15. Each Fund is subject to the approximate fees and expenses in the aggregate amounts per 12

Share

Price

Expenses

Interest

Income

to Break Even

annum set forth in the above table and elsewhere in this Prospectus. These estimates were arrived at using an initial share price of $100.00 for each Fund. Fees and expenses are calculated using a constant, daily Value per Share equal to the initial share price. The fees and expenses represent the sum of

the applicable Commodity Contract Spread, the sponsor’s fee and the Service Allowance. For the purposes of this example, no extraordinary expenses are incurred by the trust or any Fund during the 365-day calculation period. Each Fund will be successful only if its annual returns from its Commodity Contracts exceed these fees and expenses per annum. Each Fund is expected to earn interest income equal to [0.06]% per annum, based upon the yield of 3-month U.S. Treasury bills as of [•], 2011, which is paid to each Fund

as a part of such Fund’s Daily Capital Adjustment. Therefore, based upon the difference between the current yield of 3-month U.S. Treasury bills and the annual fees and expenses, in order for an investor to break-even during the first 365 days of its investment in a Fund, such Fund will be required to

earn a return on its Commodity Contracts equal to or greater than the approximate amount per annum set forth in the above table. The actual 3-month U.S. Treasury bill rate used to calculate the Daily Capital Adjustment could be higher or lower than the current yield of 3-month U.S. Treasury bill. The Funds currently do not expect to make distributions with respect to capital gains or income. Depending on a Fund’s performance for the taxable year and a shareholder’s own tax situation for such year, a shareholder’s income tax liability for the taxable year for his, her or its allocable share of

such Fund’s net ordinary income or loss and capital gain or loss may exceed any distributions a shareholder receives with respect to such year. See “—U.S. Federal Income Tax Considerations”. The fiscal year of each Fund ends on December 31. The Funds have only recently been organized and have limited financial histories. U.S. Federal Income Tax Considerations Each Fund is expected to be treated as a separate tax-transparent partnership for U.S. federal income tax purposes. Under that treatment, each shareholder that is (1) an individual who is treated as a citizen or resident of the U.S. for U.S. federal income tax purposes, (2) a corporation or partnership

created or organized in or under the laws of the U.S. or any political subdivision thereof, (3) an estate, the income of which is includible in gross income for U.S. federal income tax purposes regardless of its source, or (4) a trust, if a court within the U.S. is able to exercise primary supervision over the

administration of the trust and one or more U.S. persons have the authority to control all the substantial decisions of the trust (each, a “U.S. Shareholder”) will be required to take into account for U.S. federal income tax purposes its allocable share of the relevant Fund’s income, gains, losses, deductions

and credits, without regard to whether it receives cash distributions from the Fund. Because the Funds generally are not expected to make cash distributions, a U.S. Shareholder may incur U.S. federal income tax liability during its holding period without receiving cash distributions sufficient to fund such

liability. Any gain allocated to a U.S. Shareholder in connection with the maturity or other taxable disposition of underlying Commodity Contracts that the Fund has held for more than one year generally should be treated as long-term capital gain subject to reduced rates of U.S. federal income tax in the

hands of non-corporate U.S. Shareholders. Any gain recognized by a U.S. Shareholder upon its sale or other taxable disposition of shares that it has held for more than one year also generally should be treated as long-term capital gain. A U.S. Shareholder generally will be allocated its share of the

Fund’s matching ordinary income and expense from the deposits under the Commodity Contracts and the sponsor’s fee and the Service Allowance, respectively. The 13

deductibility of such expense may be subject to limitations in the hands of U.S. Shareholders. U.S. Shareholders should refer to the section “Material U.S. Federal Income Tax Considerations” for more information. The “Breakeven Table” below indicates the approximate percentage and dollar returns required for the value of an initial $100.00 investment in a Share of each Fund to equal the amount originally invested 365 days after issuance. The “Breakeven Table,” as presented, is an approximation only. The capitalization of each Fund does not directly affect the level of its charges as a percentage of its net asset value, other than brokerage commissions. BREAKEVEN TABLE

ETFS Oil

ETFS

ETFS

ETFS

ETFS

ETFS

ETFS

ETFS Expense(1)

$

$

$

$

$

$

$

$

Sponsor’s Fee(2)

$

0.

$

0.

$

0.

$

0.

$

0.

$

0.

$

0.

$

0. Service Allowance

$

$

$

$

$

$

$

$ Commodity Contract Spread

$

$

$

$

$

$

$

$ Organization and

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00 Brokerage Commissions

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00 Routine Operational,

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00

$

0.00 Interest Income(8)

$

([__]

)

$

([__]

)

$

([__]

)

$

([__]

)

$

([__]

)

$

([__]

)

$

([__]

)

$

([__]

) Annual Breakeven(12) In Dollars

$

0

$

0

$

0

$

0

$

0

$

0

$

0

$

0 In % of Value per Share

0

%

0

%

0

%

0

%

0

%

0

%

0

%

0

%

(1) The breakeven analysis assumes that the shares have a constant daily Fund Value and is based on $100.00 as the Value per Share. See “Trust and Fund Expenses” on page 58 for an explanation of the expenses included in the “Breakeven Table.”

(2) From the Sponsor’s Fee, the sponsor will be responsible for paying the fees and expenses of the Administrator, ALPS Distributors and all other ordinary expenses of the Funds. (3) The sponsor is responsible for paying the organization and offering expenses and the continuous offering costs of each Fund. (4) The Funds will not incur any brokerage commissions or trading fees. (5) You may pay customary brokerage commissions in connection with purchases of the shares. Because such brokerage commission rates will vary from investor to investor, such brokerage commissions have not been included in the Breakeven Table. Investors are encouraged to review the terms of their

brokerage accounts for applicable charges. (6) The sponsor is responsible for paying all routine operational, administrative and other ordinary expenses of each Fund. (7) In connection with orders to create and redeem Baskets, Authorized Participants will pay a transaction fee in the amount of $500 per order. Because these transaction fees are de minimis in amount, are charged on a transaction-by-transaction basis (and not on a Basket-by-Basket basis), and are borne

by the Authorized Participants, they have not been included in the Breakeven Table. (8) Interest income currently is estimated to be earned at a rate of [ ]%, based upon the yield on 3-month U.S. Treasury bills as of ___, 2011. Actual interest income could be higher or lower than the current yield of 3-month U.S. Treasury bills. 14

Natural Gas

Copper

Wheat

Composite

Agri.

Comp. Ind.

Metals

Comp.

Energy

All

Commodities

Offering Expense

Reimbursement(3)

and Fees(4,5)

Administrative and

Other Ordinary

Expenses(6,7)

(9) ETFS Oil is subject to (i) a sponsor’s fee of [ ]% per annum, (ii) a Service Allowance of [ ]% per annum and (iii) a Commodity Contract Spread of [ ]% per annum. ETFS Oil is subject to fees and expenses in the aggregate amount of approximately [ ]% per annum. ETFS Oil will be successful only if its annual returns from the underlying futures contracts, including annual income from 3-month U.S. Treasury bills, exceeds approximately [

]% per annum. ETFS Oil is expected to earn [ ]% per annum, based upon the yield of 3-month U.S. Treasury bills as of [ ], 2011. Therefore, based upon the difference between the current yield of 3-month U.S. Treasury bills and the annual fees and expenses, ETFS Oil would be required to earn approximately [ ]% per annum, in order for an investor to break-even on an investment during the first twelve months of an investment. Actual interest income could be higher or lower than the current yield of 3-month U.S. Treasury bills. (10) ETFS Natural Gas is subject to (i) a Sponsor’s Fee of [ ]% per annum, (ii) a Service Allowance of [ ]% per annum and (iii) a Commodity Contract Spread of [ ]% per annum. ETFS Natural Gas is subject to fees and expenses in the aggregate amount of approximately [ ]% per annum. ETFS Natural Gas will be successful only if its annual returns from the underlying futures contracts, including annual income from 3-month U.S. Treasury bills, exceeds approximately [

]% per annum. ETFS Natural Gas is expected to earn [ ]% per annum, based upon the yield of 3-month U.S. Treasury bills as of [ ], 2011. Therefore, based upon the difference between the current yield of 3-month U.S. Treasury bills and the annual fees and expenses, ETFS Natural Gas would be required to earn approximately [ ]% per annum, in order for an investor to break-even on an investment during the first twelve months of an investment. Actual interest income could be higher or lower than the current yield of 3-month U.S. Treasury bills. (11) ETFS Copper, ETFS Wheat, ETFS Composite Agriculture, ETFS Composite Industrial Metals, ETFS Composite Energy and ETFS All Commodities are each subject to (i) a sponsor’s fee of [ ]% per annum, (ii) a Service Allowance of [ ]% per annum and (iii) a Commodity Contract Spread of [ ]% per annum. ETFS Copper, ETFS Wheat, ETFS Composite Agriculture, ETFS Composite Industrial Metals, ETFS Composite Energy and ETFS All Commodities are each subject to fees and expenses in the aggregate amount of approximately [

]% per annum. Each of ETFS Copper, ETFS Wheat, ETFS Composite Agriculture, ETFS Composite Industrial Metals, ETFS Composite Energy and ETFS All Commodities will be successful only if its annual returns from the underlying futures contracts, including annual income from 3-month

U.S. Treasury bills, exceeds approximately [ ]% per annum. Each of ETFS Copper, ETFS Wheat, ETFS Composite Agriculture, ETFS Composite Industrial Metals, ETFS Composite Energy and ETFS All Commodities is expected to earn [ ]% per annum, based upon the yield of 3-month U.S. Treasury bills as of [ ], 2011. Therefore, based upon the difference between the current yield of 3-month U.S. Treasury bills and the annual fees and expenses, each of ETFS Copper, ETFS Wheat, ETFS Composite Agriculture, ETFS

Composite Industrial Metals, ETFS Composite Energy and ETFS All Commodities would be required to earn approximately [ ]% per annum, in order for an investor to break-even on an investment during the first twelve months of an investment. Actual interest income could be higher or lower than the current yield of 3-month U.S. Treasury bills. (12) Actual annual breakeven amount may vary depending on the performance of the Fund. Each Fund in which you invest will furnish you an annual report within 90 calendar days after the end of such Fund’s fiscal year as required by the rules and regulations of the SEC as well as with those reports required by the CFTC and the NFA, including, but not limited to, an annual audited

financial statement examined and certified by independent registered public accountants and any other reports required by any other governmental authority that has jurisdiction over the activities of the Funds. Monthly account statements conforming to CFTC and NFA requirements are posted on the sponsor’s website at www.etfsecurities.com. 15

The annual, quarterly and current reports and other filings made with the SEC by the Funds will be posted on the sponsor’s website at www.etfsecurities.com. Shareholders of record will also be provided with appropriate information to permit them to file U.S. federal and state income tax returns (on

a timely basis) with respect to shares held. Additional reports may be posted on the sponsor’s website at the discretion of the sponsor or as required by regulatory authorities. See “Description of the Shares and Certain Material Terms of the Trust Agreement—Reports to Shareholders” and “Where You

Can Find More Information.” 16

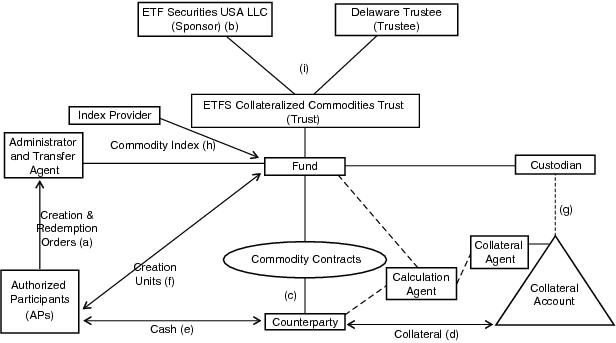

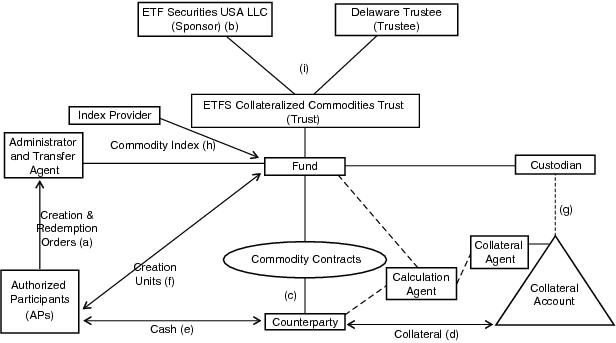

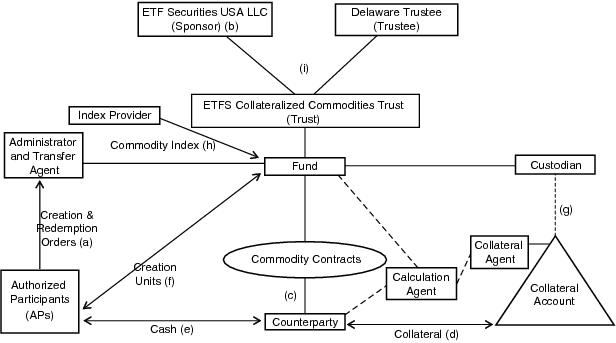

Organizational Chart Notes to Organizational Chart. (a) The Authorized Participant places creation or redemption orders with the administrator pursuant to the Authorized Participant Agreement. (b) The administrator and the sponsor approve or reject the Authorized Participant’s order. Among other reasons, an order may be rejected because the counterparties are limited in the amount of Commodity Contracts they may create or terminate. If approved, the sponsor instructs the Fund’s

counterparty to create new Commodity Contracts equal in value to a creation order or cash out existing Commodity Contracts equal in value to a redemption order. (c) Upon receipt of the sponsor’s instruction, the Fund’s counterparty creates new Commodity Contracts for creation orders and cashes out existing Commodity Contracts for redemption orders. The counterparty may also cash out Commodity Contracts upon the sponsor’s instruction to pay non-recurring

or extraordinary expenses of the Fund if the sponsor does not otherwise assume such expenses. The calculation agent will daily determine the Daily Contract Price of the Fund’s Commodity Contracts and report such Daily Contract Price to the administrator, the sponsor, the counterparty and the

collateral agent. The Fund is expected to own and hold only Commodity Contracts, which are created or terminated upon acceptance of creation or redemption orders for Fund shares. The Fund is not expected to hold cash or other investments during its ordinary operation. (d) Upon the creation of new Commodity Contracts, the counterparty posts collateral to the collateral account equal in value to the Commodity Contracts so created. Upon the liquidation of existing Commodity Contracts, the counterparty receives collateral from the collateral account equal in value to

the Commodity Contracts so liquidated. As the Daily Contract Price of a Commodity Contract fluctuates, as determined by the calculation agent, the collateral agent will require the counterparty to post additional collateral as the value increases and release collateral to the counterparty as the value

decreases. Collateral will also be posted at mark-to-market value if existing collateral value falls. (e) On settlement of creation and redemption orders, the Authorized Participant, respectively, pays the cash value of a creation order to the counterparty on behalf of the Fund and receives the cash 17

Notes to Organizational Chart (cont.). value of redemption order from the counterparty on behalf of the Fund. The cash settlement process is coordinated with the share delivery settlement process by the Fund’s transfer agent. (f) Also at settlement of creation and redemption orders, the Fund issues Creation Units of the Fund’s shares to the Authorized Participant for creation orders or receives the surrender of Creation Units from the Authorized Participant. Such issuances and surrenders are handled for the Fund by its

transfer agent and is coordinated with the cash settlement process. (g) If the counterparty defaults on its Commodity Contract obligations to the Fund, all collateral in the Fund’s collateral account attributable to the defaulting counterparty is liquidated by the collateral agent and the cash proceeds from the sale of the collateral is delivered to the Fund’s custodian for the

benefit of the Fund and its shareholders. Until such a default occurs, the Fund has no rights or interests with respect to the collateral, which is held solely for the benefit of the counterparty. (h) The index providers are unaffiliated with the sponsor and have licensed the use of the Fund’s referenced Commodity Index to the sponsor. The sponsor pays the index provider’s licensing fee from the Service Allowance that is accrued daily by the counterparty under the Fund’s Commodity Contracts

and paid monthly to the sponsor by the counterparty. The remainder of the Service Allowance reimburses the sponsor for the costs of preparing annual tax reports that are delivered to the Fund’s shareholders. (i) The sponsor and the trustee created the trust and the Funds under the Trust Agreement. The Fund pays the sponsor’s fee under the Sponsor Agreement between the sponsor and the Fund. The sponsor’s fee is accrued daily under the Fund’s Commodity Contracts and paid monthly to the sponsor by

the counterparty on behalf of the Fund. 18

Before you invest in the shares, you should be aware that there are various risks. You should consider carefully the risks described below together with all of the other information included in this Prospectus. THE SHARES ARE SPECULATIVE AND INVOLVE

A HIGH DEGREE OF RISK. In particular, the shares represent interests in complex, commodity-based products involving a significant degree of risk and may not be suitable or appropriate for you. The shares are intended for sophisticated, professional and institutional investors. You may lose your entire investment in the shares. Commodity Price and Commodity Index Risk Factors Commodity prices are volatile and may cause a loss in the value of the shares. The value of the shares will be affected by movements in commodity prices generally and by the way in which those prices and other factors affect the prices of the Index Component futures contracts (and hence of the Commodity Index). Commodity prices generally may fluctuate widely and may be affected by numerous factors, including:

•