Attached files

Exhibit 10.19

OFFICE SPACE LEASE

DUNDEAL CANADA (GP) INC.

Landlord

and

LEGEND ENERGY CANADA LTD.

Tenant

Suite 230

Atrium II, 840 – 6th Avenue SW, Calgary, Alberta

Rentable Area: approximately 3,242 square feet

Date: October 17, 2011

INDEX

| PART 1 – BASIC INFORMATION | ||

| 1.1 |

Landlord | |

| 1.2 |

Tenant | |

| 1.3 |

Indemnifier | |

| 1.4 |

Building | |

| 1.5 |

Premises | |

| 1.6 |

Use | |

| 1.7 |

Term | |

| 1.8 |

Commencement Date | |

| 1.9 |

Basic Rent | |

| 1.10 |

Additional Rent | |

| 1.11 |

Prepaid Rent | |

| 1.12 |

Deposit | |

| 1.13 |

Rent Commencement Date | |

| 1.14 |

Basic Information | |

| PART 2 – BASIC TERMS AND PRINCIPLES | ||

| 2.1 |

Lease | |

| 2.2 |

Grant | |

| 2.3 |

Basic Covenants | |

| PART 3 – USE OF PREMISES | ||

| 3.1 |

Use | |

| 3.2 |

Abandonment | |

| 3.3 |

Operating Standards | |

| 3.4 |

Compliance with Laws | |

| 3.5 |

No Waste or Nuisance | |

| 3.6 |

Common Areas | |

| 3.7 |

Easements | |

| PART 4 – TERM – POSSESSION | ||

| 4.1 |

Term | |

| 4.2 |

Tenant Fixturing | |

| 4.3 |

Early Occupation | |

| 4.4 |

Delayed Possession | |

| 4.5 |

Surrender | |

| 4.6 |

Overholding | |

| 4.7 |

Effect of Termination | |

| 4.8 |

Acceptance of Premises | |

| PART 5 – RENT | ||

| 5.1 |

Payment | |

| 5.2 |

Basic Rent | |

| 5.3 |

Deposit | |

| 5.4 |

Additional Rent | |

| 5.5 |

Utilities | |

| 5.6 |

Additional Services | |

| 5.7 |

General Provisions | |

- i -

| PART 6 – TAXES | ||

| 6.1 |

Taxes Payable by Landlord | |

| 6.2 |

Business and Other Taxes Payable by Tenant | |

| 6.3 |

Allocation of Realty Taxes to Premises | |

| 6.4 |

Allocation of Realty Taxes to Common Areas | |

| 6.5 |

Contesting Taxes | |

| 6.6 |

Alternate Methods of Taxation | |

| 6.7 |

Other Taxes | |

| PART 7 – MAINTENANCE, REPAIRS AND ALTERATIONS | ||

| 7.1 |

Responsibility of Tenant | |

| 7.2 |

Responsibility of Landlord | |

| 7.3 |

Inspection, Entry and Notice | |

| 7.4 |

Alterations or Improvements | |

| 7.5 |

Removal and Restoration | |

| 7.6 |

External Changes | |

| 7.7 |

Trade Fixtures | |

| 7.8 |

Tenant’s Signs | |

| 7.9 |

Directory Board | |

| 7.10 |

Identification Signage to Premises | |

| 7.11 |

Landlord’s Signs | |

| PART 8 – STANDARD SERVICES AND ALTERATIONS | ||

| 8.1 |

Operation of Building | |

| 8.2 |

Services to Premises | |

| 8.3 |

Building Services | |

| 8.4 |

Utilities | |

| 8.5 |

Limitation | |

| 8.6 |

Landlord’s Alterations | |

| 8.7 |

Interruption or Delay of Services | |

| 8.8 |

Public Policy | |

| 8.9 |

Security Information | |

| PART 9 – DISPOSITIONS BY TENANT | ||

| 9.1 |

Transfers | |

| 9.2 |

Additional Requirements | |

| 9.3 |

No Release | |

| 9.4 |

Costs | |

| 9.5 |

No Advertising | |

| PART 10 – INSURANCE AND INDEMNIFICATION | ||

| 10.1 |

Tenant’s Insurance | |

| 10.2 |

Policy Requirements | |

| 10.3 |

Proof of Insurance | |

| 10.4 |

Failure to Maintain | |

| 10.5 |

Damage to Leasehold Improvements | |

| 10.6 |

Increase in Insurance Premiums/Cancellation | |

| 10.7 |

Landlord’s Insurance | |

| 10.8 |

Non-Liability for Loss, Injury or Damage | |

| 10.9 |

Indemnification of Landlord | |

| 10.10 |

Extension of Rights and Remedies | |

- ii -

| PART 11 – DAMAGE | ||

| 11.1 |

Damage to Premises | |

| 11.2 |

Damage to the Building | |

| 11.3 |

Architect’s Certificate | |

| 11.4 |

Limitation on Landlord’s Liability | |

| PART 12 – LANDLORD’S REMEDIES | ||

| 12.1 |

Landlord May Perform Tenant’s Covenants | |

| 12.2 |

Re-Entry | |

| 12.3 |

Right to Distrain | |

| 12.4 |

Landlord May Follow Chattels | |

| 12.5 |

Rights Cumulative | |

| 12.6 |

Acceptance of Rent Non-Waiver | |

| PART 13 – ADDITIONAL PROVISIONS | ||

| 13.1 |

Landlord Default | |

| 13.2 |

Relocation | |

| 13.3 |

Demolition | |

| 13.4 |

Effect of Termination | |

| PART 14 – TRANSFERS BY LANDLORD | ||

| 14.1 |

Sales, Conveyance and Assignment | |

| 14.2 |

Effect of Sale, Conveyance or Assignment | |

| 14.3 |

Subordination | |

| 14.4 |

Attornment | |

| 14.5 |

Nondisturbance | |

| 14.6 |

Effect of Attornment | |

| 14.7 |

Execution of Instrument | |

| PART 15 – MISCELLANEOUS | ||

| 15.1 |

Certification | |

| 15.2 |

Rights of Mortgagees | |

| 15.3 |

Joint and Several Liability | |

| 15.4 |

Landlord and Tenant Relationship | |

| 15.5 |

No Waiver | |

| 15.6 |

Expropriation | |

| 15.7 |

Additional Costs | |

| 15.8 |

Notice | |

| 15.9 |

Non Merger | |

| 15.10 |

Lease Entire Agreement | |

| 15.11 |

Registration | |

| 15.12 |

Name of Building | |

| 15.13 |

Governing Law | |

| 15.14 |

Survival of Tenant’s Covenants | |

| 15.15 |

Quiet Enjoyment | |

| 15.16 |

Severability | |

| 15.17 |

Amendments | |

| 15.18 |

Assigns | |

| 15.19 |

Status of Manager | |

| 15.20 |

Acceptance by Tenant | |

- iii -

| Schedule 1 - |

Legal Description | |

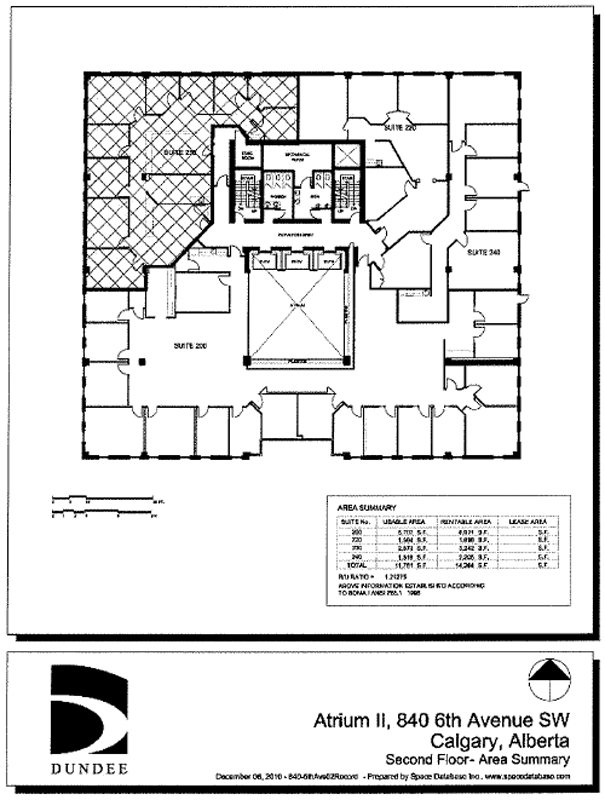

| Schedule 2 - |

Floor Plan | |

| Schedule 3 - |

Definitions | |

| Schedule 4 - |

Operating Standards | |

| Schedule 5 - |

Construction Schedule | |

| Schedule 6 - |

Operating Costs | |

| Schedule 7 - |

Indemnity | |

| Schedule 8 - |

Determination of Rentable Area | |

| Schedule 9 - |

Special Provisions |

- iv -

OFFICE SPACE LEASE

THIS LEASE is made as of the 17th day of October, 2011 between Landlord and Tenant listed below.

PART I - BASIC INFORMATION

| 1.1 | Landlord: | Name: | Dundeal Canada (GP) Inc. | |||

| Address: | c/o Dundee Realty Management Corp. | |||||

| 734 – 7th Avenue SW, Suite 400, Calgary, Alberta T2P 3P8 | ||||||

| Phone No.: | 403-212-7114 | |||||

| Fax No.: | 403-212-7179 | |||||

| 1.2 | Tenant: | Name: | Legend Energy Canada Ltd. | |||

| Address: | 840 – 6th Avenue SW, Suite 230, Calgary, Alberta T2P 3E5 | |||||

| Phone No.: | 403-617-2071 | |||||

| 1.3 | Indemnifier: | Intentionally deleted. | ||||

| 1.4 | Building: Atrium II, 840 – 6th Avenue SW, Calgary, Alberta, and situate upon the lands described in Schedule 1 to this Lease. | |||||

| 1.5 | Premises: The area outlined on Schedule 2 to this Lease, located on the 2nd floor of the Building, designated as Suite 230 and having a Rentable Area of approximately 3,242 square feet. | |||||

| 1.6 | Use: The Premises may not be used for any purpose other than as a first class business office. | |||||

| 1.7 | Term: Five (5) years commencing on the Commencement Date and expiring October 31, 2016, subject to Tenant’s option to extend provided for herein. | |||||

| 1.8 | Commencement Date: November 1, 2011 | |||||

| 1.9 | Basic Rent: | |||||

| Period |

Annual Rate (per sq. ft. of Rentable Area) |

Annual Amount (plus Rental Taxes) |

Monthly Amount (plus Rental Taxes) |

|||||||||

| November 1, 2011 to and including October 31, 2016 |

$ | 16.00 | $ | 51,872.00 | $ | 4,322.67 | ||||||

| 1.10 | Additional Rent: The following additional payments are payable as rent as of and from the Rent Commencement Date: |

| .1 | Tenant’s Share of Realty Taxes and Operating Costs |

| .2 | Utilities for the Premises |

| .3 | Additional Services |

| 1.11 | Prepaid Rent: Landlord acknowledges receipt of the sum of $9,157.03 to be applied to the rent accruing for the first one month of the Term. |

| 1.12 | Deposit: Landlord acknowledges that Tenant has deposited $9,157.03 with Landlord to be applied as provided in this Lease. |

| 1.13 | Rent Commencement Date: November 1, 2011 |

| 1.14 | Basic Information: Each reference in this Lease to any portion of the Basic Information shall incorporate the specific information described above. Certain words and phrases recurring throughout this Lease have defined meanings as set out in Schedule 3 to this Lease, unless the subject matter or context requires otherwise. |

PART 2 - BASIC TERMS AND PRINCIPLES

| 2.1 | Lease: This is a lease as well as a business contract. It is intended that this Lease be an absolutely net and carefree lease for Landlord and that rent be received by Landlord free of any cost or obligation concerning the Premises or the Building unless specified in this Lease. Each provision of this Lease applicable to each party although not expressed as a covenant, shall be construed to be a covenant of such party for all purposes. |

| 2.2 | Grant: In consideration of the rents to be paid and the covenants contained in this Lease, Landlord leases the Premises to Tenant and Tenant leases and accepts the Premises from Landlord, to have and to hold the Premises during the Term, at the rent, subject to the conditions and limitations and in accordance with the covenants contained in this Lease. |

| 2.3 | Basic Covenants: Landlord covenants to observe and perform all of the terms and conditions to be observed and performed by Landlord under this Lease. Tenant covenants to pay the Rent when due under this Lease, and to observe and perform all of the terms and conditions to be observed and performed by Tenant under this Lease. |

PART 3 - USE OF PREMISES

| 3.1 | Use: Tenant covenants to use the Premises only as specified in section 1.6 in accordance with the Operating Standards and the standards of comparable office buildings in the municipality. Tenant shall take possession of the Premises no later than the Commencement Date, unless Landlord otherwise consents in writing. |

| 3.2 | Abandonment: Tenant will not vacate or abandon the Premises at any time during the Term without Landlord’s prior written consent, which consent may be unreasonably or arbitrarily withheld. If Tenant, without Landlord’s prior written consent, vacates, or abandons the Premises, or fails to conduct its business therein, or uses or permits or suffers the use of the Premises for any purpose not specifically herein authorized, Tenant will be in breach of Tenant’s obligations under this Lease, and then without constituting a waiver of Tenant’s obligations or limiting Landlord’s remedies hereunder, all Rent reserved in this Lease will immediately become due and payable to Landlord unless payment thereof is guaranteed to the satisfaction of Landlord. |

| 3.3 | Operating Standards: Tenant shall comply with the Operating Standards. Landlord may from time to time make other rules and regulations to amend and supplement the Operating Standards and which relate to the operation, use, reputation, safety, care or cleanliness of the Building and the Premises, the operation and maintenance of buildings and equipment, the use of Common Areas, and any other matters affecting the operation and use of the Building and conduct of business in the Premises and which may differentiate between different types of businesses. |

- 2 -

| 3.4 | Compliance with Laws: Tenant is responsible at all times to comply with and to keep the Premises, the Leasehold Improvements and Trade Fixtures in compliance and accordance with the requirements of all applicable laws, directions, rules, regulations or codes of Landlord and every Authority having jurisdiction and of any insurer by which Landlord or Tenant is insured and affecting the construction, operation, condition, maintenance, use or occupation of the Premises or the making of any repair or alteration including, without limitation, compliance with each Environmental Law and any agreements with adjoining owners and or third parties affecting the Premises and the Building. Tenant shall not allow or cause any act or omission to occur in or about the Premises which may result in an illegal or prohibited use or causes any breach of or non-compliance with such laws, directions, rules, regulations and codes. If, due to Tenant’s acts, omissions or use of the Premises, repairs, alterations or improvements to the Premises or the Building are necessary to comply with any of the foregoing or with the requirements of insurance carriers, Tenant will pay the entire cost thereof. |

| 3.5 | No Waste or Nuisance: Tenant shall not commit or permit any waste or damage to the Premises or the Building, or commit or permit anything which may disturb the quiet enjoyment of any occupant of the Building or which may interfere with the operation of the Building. Tenant will not cause or permit any nuisance or hazard in or about the Premises and Tenant will not permit the storage of any Contaminant or any Discharge in or about the Premises or the Building and will keep the Premises free of Contaminants, debris, trash, rodents, vermin and anything of a dangerous, noxious or offensive nature or which could create a fire hazard (through undue load on electrical circuits or otherwise) or undue vibration, heat or any noxious or strong noises or odours or anything which may disturb the enjoyment of the Building and the Common Areas by customers and other tenants of the Building. Without limiting the generality of the foregoing: (a) Tenant shall not use or permit the use of any equipment or device such as, without limitation, loudspeakers, stereos, public address systems, sound amplifiers, radios, televisions, VCR’s or DVD’s which is in any manner audible or visible outside of the Premises; and (b) no noxious or strong odours shall be allowed to permeate outside the Premises; and (c) no boot trays or other items may be placed outside the Premises; in each case without the prior written consent of Landlord which may be arbitrarily withheld or withdrawn on 24 hours notice to Tenant. |

| 3.6 | Common Areas: Landlord agrees that Tenant, in common with all others entitled thereto including the general public in concourse areas, may use and have access through the Common Areas for their intended purposes during Normal Business Hours only; provided however, that in an emergency or in the case of Landlord making repairs, Landlord may temporarily close or restrict the use of any part of the Common Areas, although Landlord shall, in such instances, endeavour not to prevent access to the Premises. |

| 3.7 | Easements: Tenant acknowledges that Landlord and any persons authorized by Landlord may install, maintain and repair pipes, wires and other conduits or facilities through the Common Areas and the Premises. Any such installing, maintaining and repairing shall be done as quickly as possible and in a manner that will minimize inconvenience to Tenant to the extent reasonably possible in the circumstances. |

PART 4 - TERM - POSSESSION

| 4.1 | Term: This Lease shall be for the Term set out in section 1.7 unless earlier terminated as provided in this Lease, and nothing hereafter contained in this Part 4 shall postpone the Commencement Date, or extend the Term. |

| 4.2 | Tenant Fixturing: Subject to Schedule 9, section 2, Fixturing Period (Early Occupancy), should Landlord permit Tenant to take possession of the Premises for purposes of fixturing or installing its Leasehold Improvements prior to the Commencement Date, then all of the terms and conditions of this Lease, except for payment of Basic Rent, shall be in full force and effect as of the date Tenant takes such possession, and Tenant shall reimburse Landlord for the cost of any Additional Services provided during the fixturing period, including the cost of cleaning and rubbish removal, and any Utilities consumed in the Premises. |

- 3 -

| 4.3 | Early Occupation: Subject to Schedule 9, section 2, Fixturing Period (Early Occupancy), if Tenant begins to conduct business in all or any portion of the Premises before the Commencement Date, Tenant will pay to Landlord on the Commencement Date a rental in respect thereof for the period from the date Tenant begins to conduct business in all or any part of the Premises to the Commencement Date, which rental will be that proportion of Rent for the first year which the number of days in such period bears to 365 and all other provisions of this Lease will be applicable during such period, except where clearly inappropriate. |

| 4.4 | Delayed Possession: Subject to Schedule 9, section 2, Fixturing Period (Early Occupancy), if Landlord is delayed for any reason in delivering possession of all or any portion of the Premises to Tenant on or before the Commencement Date, then Tenant will take possession of the Premises on the date when Landlord delivers possession of all of the Premises, which date will be conclusively established by notice from Landlord to Tenant at least five (5) days before such date. This Lease will not be void or voidable nor will the Term be extended nor will Landlord be liable to Tenant for any loss or damage resulting from any delay in delivering possession of the Premises to Tenant, but no Rent will be payable by Tenant (unless such delay is principally caused by or attributable to Tenant, its employees, servants, agents or contractors), for the period prior to the date on which Landlord can so deliver possession of all of the Premises, unless Tenant elects to take possession of a portion of the Premises whereupon Rent will be payable in respect of such portion from the date such possession is so taken. |

| 4.5 | Surrender: Tenant shall surrender possession of the Premises upon termination of this Lease by expiration of the Term or operation of the terms hereof, in good and substantial repair and condition as required by this Lease. |

| 4.6 | Overholding: If Tenant remains in possession of the Premises following termination of this Lease by expiration of the Term or operation of the terms hereof, with or without objection by Landlord, and without any written agreement otherwise providing, Tenant shall be deemed to be a monthly tenant upon the same terms and conditions as are contained in this Lease except as to the Term, and except as to Basic Rent which shall be equal to the greater of: (a) twice the Basic Rent payable in the last year of the Term or any renewal term, or (b) the then prevailing rate charged by Landlord in the Building. This provision shall not authorize Tenant to so overhold where Landlord has objected. |

| 4.7 | Effect of Termination: The expiry or termination of this Lease whether by elapse of time or by the exercise of any right of either Landlord or Tenant pursuant to this Lease shall be without prejudice to the right of Landlord to recover arrears of rent and the right of each party to recover damages for an antecedent default by the other. |

| 4.8 | Acceptance of Premises: Taking possession of all or any portion of the Premises by Tenant will be conclusive evidence as against Tenant that the Premises or such portion thereof are in satisfactory condition on the date of taking possession, subject only to latent defects and to those deficiencies (if any) listed in writing in a notice delivered by Tenant to Landlord not more than ten days after the date of taking possession. |

PART 5 - RENT

| 5.1 | Payment: From and after the Rent Commencement Date, Tenant shall pay to Landlord the Basic Rent and the Additional Rent. Tenant covenants to pay rent without any deduction, abatement or set off except as specified in this section. All rent in arrears shall bear interest at the Interest Rate from the date on which the same became due until the date of payment. Except as provided in sections 11.1 or 11.2 or by reason of a decision by Landlord to terminate this Lease pursuant to Part 11, damage to or destruction of all or any portion of the Premises or the Building shall not terminate this Lease nor entitle Tenant to surrender the Premises, nor in any way affect Tenant’s obligation to pay rent. Tenant agrees to deliver to Landlord at the time and for the period requested from time to time by Landlord monthly post-dated cheques in amounts conforming with the monthly Basic Rent payments, plus any Additional Rent payments estimated by Landlord in advance. Alternatively, if and to the extent Landlord so requires, rent will be paid to Landlord, |

- 4 -

| at Tenant’s expense, by an automated debiting system, under which payments are deducted from Tenant’s bank account and credited to Landlord’s bank account on the due date, without prejudice to any other right or remedy of Landlord; otherwise rent will be paid to Landlord at the address of Landlord set forth in section 1.1, or to such other person or at such other address as Landlord may from time to time designate in writing. Tenant’s obligations to pay rent will survive the expiration or earlier termination of this Lease. |

| 5.2 | Basic Rent: Tenant shall pay Basic Rent in the amount set out in section 1.9, without demand and without any set-off, deduction or abatement (except as provided herein), in advance in equal consecutive monthly instalments on the first of each month commencing on the Rent Commencement Date. Rent is subject to adjustment upon measurement of the actual Rentable Area of the Premises by Landlord. |

| 5.3 | Deposit: Tenant shall pay to Landlord a security deposit in the amount specified in section 1.12 to be held by Landlord as security for Tenant’s performance of its covenants under this Lease. No interest shall accrue or be payable to Tenant in respect of the deposit. If Tenant shall be in default of any such covenant, Landlord may appropriate and apply such portion of the security deposit as Landlord considers necessary to compensate it for rent outstanding or loss or damage suffered by Landlord arising out of or in connection with such default. When requested by Landlord following any such appropriation Tenant shall pay to Landlord an amount sufficient to restore the original amount of the security deposit. Tenant shall not assign or encumber its interest in the security deposit, and Landlord shall not be bound by any attempted assignment or encumbrance of the security deposit, except in the case of any permitted Transfer of the Lease, in which case Tenant’s interest in the security deposit shall be deemed to have been assigned to such permitted transferee as of the date of such Transfer. So much of the deposit as remains unappropriated by Landlord shall be returned to Tenant within 60 days of the later of (i) the expiry of the Term so long as Tenant has surrendered the Premises in accordance with all requirements of this Lease, or (ii) the date Tenant vacates the Premises in accordance with the Lease, otherwise the deposit shall be forfeited to Landlord as liquidated damages, without prejudice to any other right or remedy available to Landlord. |

| 5.4 | Additional Rent: From and after the Rent Commencement Date, or such earlier date specified in this Lease, Tenant shall pay to Landlord, or to others if any sums are required by the terms of this Lease to be paid to anyone other than Landlord, further annual rent for the Premises equal to the aggregate of the following amounts: |

| .1 | Each Realty Tax levied or imposed upon or in respect of the Premises and each Realty Tax allocated to the Premises under Part 6 of this Lease, |

| .2 | Tenant’s Share of Operating Cost, |

| .3 | All amounts payable by Tenant pursuant to the Construction Schedule, |

| .4 | All charges for heat, water, gas, electricity or any other Utilities used or consumed in the Premises which are not supplied to Tenant by or through Landlord, |

| .5 | All charges for Additional Services, and |

| .6 | Tenant’s Additional Share of Costs. |

On or before the Commencement Date and the commencement of any Fiscal Period during the Term, Landlord shall estimate the Realty Taxes and Operating Costs and Tenant’s Share thereof. Tenant shall pay to Landlord in equal monthly instalments in advance on the first day of each month a sum on account of Tenant’s Share of Realty Taxes and Operating Costs based on Landlord’s estimates.

Landlord may from time to time re-estimate the amount of estimated Realty Taxes and Operating Costs for the then current Fiscal Period and re-estimate Tenant’s Share thereof for the remainder of the Fiscal Period and Tenant shall change its monthly instalments to conform with the revised estimates.

- 5 -

Within 12 months after the end of each Fiscal Period, Landlord shall determine the actual Tenant’s Share of Realty Taxes and Operating Costs and the difference between such actual determination and the amount already billed to Tenant in instalments. If the aggregate of Tenant’s instalments for the Fiscal Period in question was less than the actual determination, then Tenant shall pay the difference to Landlord within 10 days after demand, or if the aggregate of such instalments was more than the actual determination, Landlord shall credit the difference to Tenant’s rental account.

| 5.5 | Utilities: Except where Tenant is purchasing Utilities directly from a supplier with Landlord’s consent, Tenant shall pay to Landlord the cost incurred by Landlord in providing Utilities to the Premises as reasonably determined by Landlord, commencing on the earlier of the date of possession and the Rent Commencement Date, and billed monthly, in advance. The amount of such cost shall be based on Landlord’s reasonable estimates for the quantities and types of Utilities supplied multiplied by the average unit costs to Landlord for each of such types of Utilities. Tenant shall also pay to Landlord the cost of cleaning, maintaining and servicing all electric light fixtures in the Premises, including the cost of replacing light bulbs, tubes, starters and ballasts. If Landlord shall from time to time reasonably determine that the use of electricity or any other Utility or service in the Premises is disproportionate to the use of other tenants in the Building, Landlord may adjust Tenant’s share of the cost thereof from a date reasonably determined by Landlord to take equitable account of the disproportionate use and may separately charge Tenant for such excess cost, plus 15% of such excess cost to cover Landlord’s costs of administration. At Landlord’s request, Tenant shall install and maintain at Tenant’s expense metering devices for checking the use of any such Utility or service in the Premises. In all cases Tenant shall reimburse Landlord in the same manner in which Landlord is charged including any energy demand or consumption charges. |

| 5.6 | Additional Services: |

| .1 | Tenant may from time to time be provided with or request Additional Services from Landlord and Tenant shall pay to Landlord, Landlord’s charge for such Additional Services plus 15% of such charge to cover Landlord’s cost of administration, payable forthwith upon delivery of Landlord’s invoice therefor. |

| .2 | Tenant shall not install in the Premises equipment or Utilities (including telephone, telecommunication or other information technology equipment) which may or does overload any Utilities or which generates sufficient heat to affect the temperature otherwise maintained in the Premises by the HVAC Facilities as normally operated. Landlord may install supplementary HVAC units, facilities or services in the Premises, or modify the HVAC Facilities, as may in Landlord’s reasonable opinion be required to maintain proper temperature levels, and Tenant shall pay Landlord, within ten days of receipt of any invoice, for the cost thereof, including, without limitation, installation, operation and maintenance expenses, plus 15% of such cost to cover Landlord’s costs of administration. |

| 5.7 | General Provisions: |

| .1 | No Delay in Payment of Rent: Nothing contained in this Lease shall suspend or delay the payment of any money by Tenant at the time it becomes due and payable. Tenant agrees that Landlord may, at its option, apply any sums received against any amounts due and payable under this Lease in such manner as Landlord sees fit. No payment by Tenant, or receipt by Landlord, of a lesser amount than the Rent due hereunder will be deemed to be other than on account of the earliest stipulated Rent, nor will any endorsement or statement on any cheque or any letter accompanying any cheque, or payment as Rent, be deemed an accord and satisfaction, and Landlord may accept such cheque or payment without prejudice to Landlord’s right to recover the balance of such Rent or pursue any other remedy available to Landlord. |

| .2 | Interest on Arrears: If any amount of Rent is in arrears it shall bear interest at the Interest Rate. |

- 6 -

| .3 | Partial Periods: If the Rent Commencement Date is any day other than the first day of a calendar month, or if the Term ends on a day other than the last day of a calendar month, then Basic Rent and Additional Rent, as the case may be, will be adjusted for the months affected, pro rata, based on a 365 day year. |

| .4 | Estimated Amounts: Where Landlord estimates or re-estimates the costs of Realty Taxes, Operating Costs and the amount of Utilities supplied, it shall do so acting reasonably and shall provide Tenant with statements of such estimates. |

| .5 | Statements: Invoices for the actual determination of Tenant’s Share of Operating Costs and Realty Taxes shall be accompanied by a statement of such Operating Costs and Realty Taxes verified to be correct by Landlord. Tenant may not claim a re-adjustment in respect of Tenant’s Share of Operating Costs or Realty Taxes for a Fiscal Year based upon any error of computation or allocation except by notice delivered to Landlord within six months after the date of delivery of Landlord’s statement. |

| .6 | General: All amounts payable by Tenant to Landlord pursuant to this Lease shall be deemed to be Rent. All Rent shall be paid in lawful money of Canada. |

| .7 | Allocations: Where any amount, cost or expense is to be determined, allocated, apportioned or attributed under any provision of this Lease, Landlord shall do so and shall act reasonably in determining and applying criteria which are relevant to doing so and Landlord may retain engineering, accounting, legal and other professional consultants to assist and advise in doing so. If a charge for Additional Services is payable by Tenant under this Lease, then to the extent any cost or expense is included in such charge, such cost or expense shall be excluded from Operating Cost. |

PART 6 - TAXES

| 6.1 | Taxes Payable by Landlord: Landlord shall pay all Realty Taxes in the first instance, unless levied or imposed directly against Tenant or the Premises. |

| 6.2 | Business and Other Taxes Payable by Tenant: Tenant shall pay before delinquency all Business Taxes, and any other taxes, charges, rates, duties and assessments levied, rated, imposed, charged or assessed against or in respect of any use, occupancy or conduct of business at the Premises or in respect of the Leasehold Improvements, Trade Fixtures, Tenant Property, or the business or income of Tenant on or from the Premises or rent payable under this Lease. Tenant shall pay to Landlord any increase or incremental amount of Realty Taxes or other taxes which Landlord, acting reasonably, has determined to be attributable to an act by Tenant (for example declaring itself a separate school supporter) or attributable to the Leasehold Improvements, Trade Fixtures and Tenant Property. |

| 6.3 | Allocation of Realty Taxes to Premises: There may be more than one Realty Tax for the Lands and the Building, each such Realty Tax being separately assessed, charged or imposed upon or in respect of the Lands and the Building. Subject to section 6.4 and the last paragraph of this section 6.3, each Realty Tax for the Building shall be allocated to the Premises under either section 6.3.1 or 6.3.2, as Landlord, from time to time, determines, such that: |

| .1 | if there is a separate assessment or charge (or in lieu thereof, any information available to Landlord from which a separate assessment or charge may be determined by Landlord) for the Premises such Realty Tax for the Lands and the Building may be allocated to the Premises on the basis of such separate assessment or charge; or |

| .2 | Tenant’s Share of such Realty Tax for the Lands and the Building may be allocated to the Premises. For the purpose of this section 6.3.2. if any rentable premises in the Building are vacant, any lower tax rate or other reduction in such Realty Tax due to such vacancy |

- 7 -

| shall be deemed not to exist and such Realty Tax for the Lands and the Building shall be adjusted to be the amount that would be applicable if the Building was fully occupied and the benefit of any lower tax rate or other reduction in such Realty Tax due to vacancies shall accrue solely to Landlord. |

| 6.4 | Allocation of Realty Taxes to Common Areas: Landlord may allocate to the Common Areas a portion of any Realty Tax for the Building and such allocated portion may include, without limitation, any amount of such Realty Tax related to assessments for portions of the Common Areas identified in the assessments of rentable premises. |

| 6.5 | Contesting Taxes: |

| .1 | Tenant may, at its expense, appeal or contest the taxes, assessments and other amounts payable as described in section 6.2 but such appeal or contest shall be limited to the assessment of the Premises alone and not to any other part of the Building or the Lands and provided Tenant first gives Landlord written notice of its intention to do so, and consults with Landlord, and provides such security as Landlord requires and obtains Landlord’s prior written approval. |

| .2 | Landlord reserves the exclusive right to appeal or contest any taxes payable by Landlord, including Realty Taxes. |

| 6.6 | Alternate Methods of Taxation: If, during the Term, the method of taxation shall be altered so that the whole or any part of the Realty Taxes now levied on real estate and improvements are levied wholly or partially as a capital levy or on the rents received or reserved or otherwise, or if any new or other tax, assessment, levy, imposition or charge in lieu thereof, shall be imposed upon Landlord, related in any way to the Building, the Lands or the income therefrom, then all such taxes, assessments, levies, impositions and charges shall be included when determining Realty Taxes. If, during the Term, the method of taxation shall be altered, so that the whole or any part of the business taxes formerly payable in respect of any use or occupancy of the Premises is merged into a comprehensive realty tax, Landlord shall have the right to allocate and collect such component of the comprehensive realty tax (as would have been formerly business taxes) in the manner or on the same basis as would have been employed by the Authority previously levying same. |

| 6.7 | Other Taxes: Tenant shall pay upon demand, any Rental Taxes or other similar taxes imposed by an Authority upon Landlord or Tenant. |

PART 7 - MAINTENANCE, REPAIRS AND ALTERATIONS

| 7.1 | Responsibility of Tenant: Without notice or demand from Landlord and except to the extent that Landlord is specifically responsible therefor under this Lease, Tenant will maintain the Premises, the Leasehold Improvements and the Trade Fixtures and all improvements therein (whether or not such improvements were installed or furnished by Tenant) in good order and condition all as a careful owner would do, including without limitation: |

| .1 | making repairs, replacements and alterations as needed, including those necessary to comply with the requirements of any Authority. |

| .2 | removing all debris and refuse in accordance with the Operating Standards. |

| .3 | maintaining and keeping in a good state of repair, the Leasehold Improvements, the Trade Fixtures and any signage, or other fixtures, attachments or installations in any part of the Building permitted by this Lease to be installed by or on behalf of Tenant, whether or not located in the Premises. |

- 8 -

| .4 | keeping the Premises in a clean and tidy condition, and not permitting wastepaper, garbage, ashes, waste or objectionable material to accumulate thereon or in or about the Building, other than in areas and in a manner designated by Landlord. |

| .5 | repairing all damage in the Premises resulting from any misuse, excessive use or installation, alteration, or removal of Leasehold Improvements, Trade Fixtures, fixtures, furnishings or equipment. |

Tenant will promptly notify Landlord of any damage to or defect in any part of the Premises, or in any equipment or utility system serving the Premises, of which Tenant becomes aware notwithstanding that Landlord may have no obligation with regard thereto.

| 7.2 | Responsibility of Landlord: Subject to Part 11, Landlord shall maintain and keep in a good state of repair: |

| .1 | the Building structure, roof, and permanent building walls (except for interior faces facing into the Premises), |

| .2 | the HVAC Facilities, |

| .3 | systems and equipment installed by Landlord for the supply and distribution of Utilities, |

| .4 | the Common Areas including the elevators, |

| .5 | Landlord’s Improvements in the Premises, and |

| .6 | damage from causes against which Landlord has agreed to insure, as primary insurer. |

The following provisions limit Landlord’s obligations in this section 7.2:

| .7 | if all or part of such systems, facilities and equipment are destroyed, damaged or impaired, Landlord will have a reasonable time in which to complete the necessary repair or replacement, and during that time will be required only to maintain such services as are reasonably possible in the circumstances, |

| .8 | Landlord may temporarily discontinue such services or any of them at such times as may be necessary due to Unavoidable Delay, |

| .9 | Landlord will use reasonable diligence in carrying out its obligations under this section 7.2, but will not be liable under any circumstances for any consequential damage to any person (including, without limitation, Tenant) or to any property for any failure to do so, |

| .10 | no reduction or discontinuance of Landlord services will be construed as an eviction of Tenant or release Tenant from any obligation of Tenant under this Lease, and |

| .11 | nothing contained herein will derogate from the provisions of Part 11 or from Landlord’s ability to include in Operating Costs, the cost of complying with this Part 7. |

| 7.3 | Inspection, Entry and Notice: |

| .1 | Tenant will permit Landlord and its authorized agents, employees, consultants and contractors to enter upon the Premises at any time or times to examine, measure and inspect the Premises, to show the Premises to prospective tenants, mortgagees or purchasers, to provide janitorial and maintenance services and to make all repairs, alterations, changes, adjustments, improvements or additions to the Premises or the |

- 9 -

| Building including the Building systems that Landlord considers necessary or desirable, whether for the direct benefit of the Premises or where necessary to serve another part of the Building. For these purposes, Landlord may take all material into and upon the Premises that is required therefor and may have access to the overhead conduits and access panels and shafts and Landlord may check, calibrate, adjust and balance controls and other parts of the Building systems and facilities including the HVAC Facilities. The Rent required to be paid pursuant to this Lease will not abate or be reduced while any such repairs, alterations, changes, adjustments, improvements or additions are being made due to loss or interruption of Tenant’s business. Tenant will not obstruct pipes, conduits, ducts or shafts or other parts of the Building systems so as to prevent access to them by Landlord. Tenant will provide free and unhampered access for the above purposes and will not be entitled to compensation for any damages, inconvenience, nuisance or discomfort caused thereby, but Landlord in exercising its rights under this section will make reasonable efforts to minimize interference with Tenant’s use and enjoyment of the Premises. No entry made or work undertaken by or on behalf of Landlord upon the Premises pursuant to this section is a re-entry or a breach of Landlord’s covenant for quiet enjoyment. Despite the foregoing, Landlord will endeavour to give Tenant at least 24 hours prior notice before doing any repair or maintenance work during Normal Business Hours, except in the case of emergencies. |

| .2 | Landlord may give notice to Tenant requiring it to perform in accordance with section 7.1 hereof, and Tenant shall rectify any failure to perform within the time period set out in section 12.1 hereof. Should Tenant fail to commence such remedy within the allotted time, or having so commenced, fail to diligently continue such remedy to conclusion, Landlord may carry out such remedy without further notice to Tenant, and charge Tenant for such remedy as if it were an Additional Service requested by Tenant. |

| .3 | If Tenant is not present to open and permit any entry into the Premises when for any reason an entry shall be necessary or in the case of a real or apprehended emergency, Landlord or its agents may, using reasonable force, enter the same without rendering Landlord or such agents liable therefor, and without affecting the obligations and covenants of Tenant under this Lease. Landlord may also upon reasonable prior notice to Tenant, show the Premises to prospective purchasers, tenants and existing or prospective mortgagees. |

| .4 | Nothing in this Lease shall make Landlord liable for any actions, notices or inspections as described in this section 7.3, nor is Landlord required to inspect the Premises, give notice to Tenant or carry out remedies on Tenant’s behalf, nor is Landlord under any obligation for the care, maintenance or repair of the Premises, except as specifically provided in this Lease. |

| 7.4 | Alterations or Improvements: |

| .1 | Following approval by Landlord, Tenant shall install its initial Leasehold Improvements and Trade Fixtures in accordance with the provisions of the Construction Schedule annexed hereto and the Building’s Design Criteria Manual provided to Tenant. |

| .2 | Following installation of such initial Leasehold Improvements, and Trade Fixtures, Tenant shall not make any alterations, repairs, changes, replacements, additions, installations or improvements (the “Alterations”) to any part of the Premises, Leasehold Improvements or Trade Fixtures without Landlord’s prior written approval, which approval shall not be unreasonably withheld, unless the Alterations may affect a structural part of the Building or may affect the mechanical, electrical, HVAC or other basic systems of the Building or the capacities thereof, in which case Landlord’s approval may be arbitrarily withheld. Tenant shall submit to Landlord details of any proposed Alterations, including complete working drawings and specifications prepared by qualified designers and conforming to good engineering practice. |

- 10 -

| .3 | The installation of all Leasehold Improvements and Alterations shall: |

| .1 | at Landlord’s option, be performed by Landlord as an Additional Service, |

| .2 | be performed expeditiously and at the sole risk and expense of Tenant, and in accordance with the Design Criteria Manual, |

| .3 | be performed by competent workers whose labour union affiliations, if any, are compatible with others employed by Landlord and its contractors, and who will not interfere with work being performed by Landlord, |

| .4 | be performed in a good and workmanlike manner and only in strict accordance with the drawings and specifications which Landlord has approved, |

| .5 | be performed in compliance with the applicable requirements of all Authorities, evidence of which shall be provided to Landlord, and be subject to the supervision and direction of Landlord, |

| .6 | equal or exceed the then current standard for the Building, and |

| .7 | subject to section 7.4.7, be carried out only by persons selected by Tenant and approved in writing by Landlord, who will, if required by Landlord, deliver to Landlord before commencement of the work performance and payment bonds as well as proof of workers’ compensation and public liability and property damage insurance coverage, with Landlord as an additional named insured, in amounts, with companies, and in form reasonably satisfactory to Landlord, which will remain in effect during the entire period in which the work will be carried out. |

Prior to taking possession of the Premises and commencing any work Tenant shall provide Landlord with an insurance certificate from its insurer and its contractors’ insurer confirming comprehensive general liability and building risk insurance in effect in an amount not less than $5,000,000 per occurrence and naming Landlord as an additional insured and containing cross liability and severability of interest provisions.

| .4 | Any Leasehold Improvements made by Tenant without the prior written consent of Landlord or which are not in strict accordance with the drawings and specifications approved by Landlord shall, if requested by Landlord, be promptly removed by Tenant at Tenant’s expense, and the Premises shall be restored to their previous condition. |

| .5 | Tenant shall reimburse Landlord for the cost of technical evaluation of Tenant’s plans and specifications and shall revise such plans and specifications as Landlord deems necessary. Tenant shall be solely responsible for the adequacy and sufficiency of Tenant’s plans and specifications and Landlord shall have no liability of any kind arising from Landlord’s review or approval of such plans and specifications nor shall Landlord’s review and approval constitute an acknowledgement or indication of any kind as to the adequacy or sufficiency of Tenant’s plans and specifications. |

| .6 | In carrying out any alterations or improvements in the Premises, Tenant, at its expense, shall pay to Landlord with respect to such work the cost to Landlord of all Utilities supplied to the Premises with respect to such work and the cost of any Additional Services including the cost of any necessary cutting or patching or repairing of any damage to the Building or the Premises, any cost to Landlord of removing refuse, cleaning, hoisting of materials and any other costs of Landlord which can be reasonably allocated as a direct expense relating to the conduct of such work. |

- 11 -

| .7 | If a request is made by Tenant with respect to approval of Alterations or initial work including work which may affect the structure or matters which affect the mechanical, electrical, HVAC or other basic systems of the Building or the capacities thereof, which request is approved by Landlord, Landlord may require that such work be designed by consultants designated by it and paid by Tenant and that it be performed by Landlord or its contractors. If Landlord or its contractors perform such work, it shall be at Tenant’s expense in an amount equal to Landlord’s total cost of such work or the contract price therefor plus, in either case, 15% payable following completion upon demand. Notwithstanding the foregoing, if Tenant requests Landlord to alter or install any Leasehold Improvements or Trade Fixtures such work will be considered as an Additional Service. Tenant will, if required by Landlord, deliver to Landlord prior to commencement of any Alterations an unconditional irrevocable letter of credit or other security satisfactory to Landlord in amount equal to Landlord’s reasonable estimate of the cost of performing such Alterations, including 15% of the total of such costs representing Landlord’s overhead. If Landlord does not elect to perform any Alterations or initial work on Tenant’s behalf Landlord will nevertheless be paid a fee equal to 5% of the total cost of such work for co-ordination and supervision services. Notwithstanding anything to the contrary contained herein, if Landlord or its contractors perform any Alterations or initial work including work which may affect the structure or matters which affect the mechanical, electrical, HVAC or other basic systems of the Building or the capacities thereof, it shall be at Tenant’s sole expense, plus a construction management fee in accordance with Schedule 9, section 1 hereof. |

| .8 | No Leasehold Improvements by or on behalf of Tenant shall be permitted which may adversely affect the condition or operation of the Building or any of its systems or the Premises or diminish the value thereof or restrict or reduce Landlord’s coverage for municipal zoning purposes. |

| .9 | During construction and installation of Leasehold Improvements, Tenant shall keep the Building clean of any related debris and in any event, after construction is completed Tenant shall do an adequate “first clean” to the Premises. |

| .10 | Any Alterations and initial work will be subject to supervision by Landlord or its employees, agents, manager or contractors during construction. Tenant acknowledges that such supervision will be for the benefit of Landlord only and that Landlord will not be responsible in any way whatsoever for the quality, design, construction or installation of any such Alterations. |

| .11 | Any increase in Realty Taxes on or fire or casualty insurance premiums for the Building attributable to the Alterations will be borne by Tenant and Tenant will pay Landlord for the cost of such increase upon receipt of Landlord’s invoice. |

| .12 | Tenant shall promptly pay all its contractors and suppliers and shall do all things necessary to prevent a lien attaching to the Lands or Building and should any such lien be made, filed or attach Tenant shall discharge or vacate such lien immediately. If Tenant shall fail to discharge or vacate any lien, then in addition to any other right or remedy of Landlord, Landlord may discharge or vacate the lien by paying into Court the amount required to be paid to obtain a discharge, and the amount so paid by Landlord together with all costs and expenses including solicitor’s fees (on a solicitor and his client basis) incurred in connection therewith shall be due and payable by Tenant to Landlord on demand together with interest at the Interest Rate, calculated from the date of payment by Landlord until all of such amounts have been paid by Tenant to Landlord. |

- 12 -

| 7.5 | Removal and Restoration: |

| .1 | The Leasehold Improvements shall immediately upon installation become the property of Landlord without compensation to Tenant. |

| .2 | Unless Landlord by notice in writing requests otherwise, or unless Landlord elects to do so on Tenant’s behalf as an Additional Service, Tenant shall at its expense, prior to the end of the Term or earlier termination of this Lease, remove all (or part, as designated by Landlord) of the Leasehold Improvements and restore the Premises to the base building standard with the basic systems of the Building, including the reconstruction necessary to reinstate the Premises original structure in the event structural changes were undertaken by Tenant. |

| .3 | Tenant shall repair and make good any damage to the Premises or to the Building caused either in the installation or removal of Leasehold Improvements and Trade Fixtures. |

So long as Tenant hereunder is Legend Energy Canada Ltd., is itself in possession of the Premises and is not then and has not been in default, Tenant shall not be required to remove its leasehold improvements or restore the Premises to the condition they were in previous to Tenant’s occupancy, provided that, at the expiration of the Term, the Premises shall be left in an “as is” condition and Landlord’s approval shall be required for Tenant to remove any leasehold improvements from the Premises. If Tenant does remove any leasehold improvements from the Premises, Tenant shall be responsible to repair any damage, which may have been caused to the Premises or the Building by the installation or removal thereof, reasonable wear and tear excepted.

Notwithstanding any provision to the contrary contained in the foregoing paragraph, it is understood and agreed that Tenant shall be obligated to restore any non-typical leasehold improvements including but not limited to any vaults installed in the Premises, any internal staircases, computer rooms, raised flooring, non-standard ceiling treatment, rooftop equipment, mezzanine area, etc.

| 7.6 | External Changes: Tenant agrees that it shall not erect, affix or attach to any roof, exterior walls or surfaces of the Building any antennae, sign or fixture of any kind, nor shall it make any opening in or alteration to the roof, walls, or structure of the Premises, or install in the Premises or Building free standing air-conditioning units, without the prior written consent of Landlord which may be arbitrarily withheld. |

| 7.7 | Trade Fixtures: Tenant may, at the end of the Term, if not in default, remove its Trade Fixtures, and Tenant shall, in the case of every installation or removal of Trade Fixtures, make good any damage caused to the Premises or the Building by such installation or removal. Any Trade Fixtures removed during the Term will be contemporaneously replaced with Trade Fixtures of equal or better quality. Any Trade Fixtures and equipment belonging to Tenant, if not removed at the termination or expiry of this Lease, shall, if Landlord so elects, be deemed abandoned and become the property of Landlord without compensation to Tenant. If Landlord shall not so elect, Landlord may remove such Trade Fixtures from the Premises and store them at Tenant’s risk and expense and Tenant shall save Landlord harmless from all damage to the Premises caused by such removal, whether by Tenant or by Landlord. |

| 7.8 | Tenant’s Signs: Tenant shall not at any time cause or permit any sign, picture, advertisement, notice, lettering, flag, decoration or direction (collectively called “Signs”) to be painted, displayed, inscribed, placed, affixed or maintained within the Premises and visible outside the Premises or in or on any windows or the exterior of the Premises (including glass demising walls facing onto Common Areas), nor anywhere else on or in the Building, without the prior and continuous consent of Landlord which consent may, with respect to proposed signage on the main floor of the Building, or which can be seen from outside the Premises, be arbitrarily withheld, but otherwise shall not be unreasonably withheld, provided that the copy and style of any Signs shall be consistent with the character of the Building and in accordance with Landlord’s Sign criteria. No hand-written Signs will be permitted. Landlord may at any time prescribe a uniform pattern of identification Signs for tenants to be placed on the outside of the Premises and other premises. Any breach by Tenant of this provision may be immediately rectified by Landlord at Tenant’s |

- 13 -

| expense and in this connection, Landlord shall be entitled to enter the Premises and remove any Signs contravening this provision and charge Tenant the costs thereof, and same shall not constitute a re-entry under this Lease and Landlord shall not be liable for any damages caused thereby, whether or not arising from its own negligence. |

| 7.9 | Directory Board: Landlord may erect and maintain a directory board in the main lobby of the Building which shall indicate the name of Tenant and the location of the Premises within the Building. Tenant shall pay Landlord’s cost of changes thereto, and any other signage with respect to the Premises. Should sufficient space exist on the directory board, Landlord may provide to Tenant, at Tenant’s expense, additional entries as requested. The directory board shall be exclusively controlled by Landlord and shall be for identification only and not for advertising. Landlord’s acceptance of any name for listing on the directory board will not be deemed, nor will it substitute for, Landlord’s consent, as required by this Lease, to any Transfer. |

| 7.10 | Identification Signage to Premises: Within thirty (30) days following the Commencement Date, Landlord shall erect, at Landlord’s cost, the Landlord’s standard identification signage indicating the Tenant’s name on the exterior of the Premises in a location to be determined by Landlord and on the floor’s lobby directory board. Tenant shall pay Landlord’s costs of changes thereafter, and any other signage with respect to the Premises. Should sufficient space exist on the floor’s lobby directory board, Landlord may provide to Tenant, at Tenant’s expense, additional entries as requested. Said signage shall be exclusively controlled by Landlord and shall be for identification only and not for advertising. Landlord’s acceptance of any name for listing on the floor’s directory board will not be deemed, nor will it substitute for, Landlord’s consent, as required by this Lease, to any Transfer. |

| 7.11 | Landlord’s Signs: In addition to Landlord’s right to install general information and direction signs in and about the Building as would be customary for comparable office building in the municipality, Landlord shall have the right at any time to place upon the Building a notice of reasonable dimensions, reasonably placed so as not to interfere with Tenant’s business, stating that the Building is for sale, or that areas of the Building are for lease, as the case may be, and at any time during the last nine (9) months of the Term, that the Premises are for lease and Tenant shall not remove or interfere with such notices or signs. |

PART 8 - STANDARD SERVICES AND ALTERATIONS

| 8.1 | Operation of Building: Landlord shall operate the Building during the Term to an appropriate standard having regard to the size, age, type and location of the Building. The Building shall at all times be under the exclusive control and management of Landlord and, subject to participation by Tenant by payment of Operating Costs, Landlord will provide the services set out in section 8.2, 8.3 and 8.4. |

| 8.2 | Services to Premises: Landlord will provide in the Premises: |

| .1 | HVAC as required for the use and occupancy of the Premises during Normal Business Hours, |

| .2 | janitor services, including window washing, as reasonably required to keep the Premises clean provided that Tenant will leave the Premises in a reasonably tidy condition at the end of each business day, |

| .3 | electric power for normal lighting and small business office equipment (but not equipment using amounts of power disproportionate to that used by other tenants in the Building), |

| .4 | replacement of Building standard fluorescent tubes, light bulbs and ballasts as required from time to time as a result of normal usage, and |

| .5 | maintenance, repair, and replacement as set out in section 8.4. |

- 14 -

| 8.3 | Building Services: Landlord will provide in the Building: |

| .1 | janitorial service, domestic running water and necessary supplies in washrooms sufficient for the normal use thereof by occupants in the Building, |

| .2 | access to and egress from the Premises, including elevator or escalator service if included in the Building. Landlord may reduce the number of elevators in service after Normal Business Hours. Landlord retains the right to regulate the use of elevators for the purpose of carrying freight, and |

| .3 | HVAC, lighting, electric power, domestic running water, and janitor service in those areas of the Building from time to time designated by Landlord for use during Normal Business Hours by Tenant in common with all tenants and other persons in the Building but under the exclusive control of Landlord. |

| 8.4 | Utilities: |

| .1 | Electrical Power: Landlord will supply to the Premises sufficient electrical power to operate the standard lighting fixtures supplied by Landlord plus circuits sufficient to deliver power to the Premises as set out in the Construction Schedule. If Tenant requires electrical power at a different voltage or at a greater capacity than Landlord’s system delivers, then any additional systems required, if available, shall be installed, operated and maintained at Tenant’s cost. |

| .2 | Water and Sewage Connections: Landlord shall provide to the floor(s) on which the Premises is located, water for drinking fountains, cold or tempered water for washroom facilities and the necessary sewer connections. Any connections made to Leasehold Improvements or special facilities by Tenant shall be made at Tenant’s cost and in accordance with section 7.4. |

| .3 | Information Technology: Landlord may provide or arrange with third parties to provide to the Building, access to advanced information technology systems and equipment including fibre optic and other sophisticated telecommunication facilities. Landlord shall from time to time in its discretion determine the terms and conditions applicable to Landlord providing Tenant with access and connections to such systems and equipment including the amounts of fees and charges payable by Tenant to Landlord and applicable from time to time for access and connection privileges. |

| .4 | Utility Regulations: The obligation of Landlord to furnish Utilities as set out in this section 8.4 shall be subject to the rules and regulations of the supplier of such utility or other Authority regulating the business or providing any of these Utilities. |

| 8.5 | Limitation: Tenant acknowledges and agrees that the degree of heating and cooling and other services provided after Normal Business Hours will be reduced by Landlord in a manner comparable to other similar office buildings in the municipality. Landlord may enter the Premises at any time in order to inspect, control or regulate the operation of any HVAC Facilities. |

| .1 | The systems furnished and operated by Landlord for providing HVAC to the Premises are designed for a reasonable density of persons and for general office purposes based on window shading being fully closed where windows are exposed to direct sunlight. Arrangement of partitions, equipment or special purpose areas, or the installation of equipment with high levels of heat production by Tenant may require alteration of the portion of the HVAC Facilities located within the Premises. Any alterations that can be accommodated by Landlord’s equipment shall be made at Tenant’s expense and in accordance with section 7.4 hereof. Balancing of the system within the Premises shall be |

- 15 -

| at Tenant’s expense. Tenant acknowledges that the HVAC Facilities serving the Premises or the Building may require initial balancing or that alterations made from time to time whether inside the Premises or in other areas of the Building, may temporarily cause imbalance of the HVAC Facilities and Tenant shall allow a reasonable amount of time for such readjustment and rebalancing. |

| .2 | Should Landlord fail to provide sufficient heat or HVAC at any time it shall not be liable for direct, indirect, or consequential damages, or for personal discomfort or illness. |

| 8.6 | Landlord’s Alterations: Notwithstanding anything contained in this Lease, Landlord shall have the right, at any time, to add buildings, additions and parking structures on the Lands or to make additions to, or subtractions from, or to change, rearrange or relocate any part of the Common Areas, the Lands or the Building including the Premises. Landlord shall also have the right to enclose any open area, and to grant, modify or terminate easements and other agreements pertaining to the use and maintenance of all or any part of the Building, Common Areas or the Lands, and to close all or any part of the Lands, Common Areas or the Building to such extent as Landlord considers reasonably necessary to prevent accrual of any rights therein to any persons at any time. Landlord is entitled to make changes to the parking areas and facilities and to make any changes or additions to the systems, pipes, conduits, Utilities or other building services within or serving the Premises or any other premises in the Building. In doing any of the foregoing, Landlord shall have the right to enter upon the Premises and same shall not constitute a re-entry hereunder. Landlord shall not be liable for any damage caused to Tenant’s property. No claim for compensation shall be made by Tenant by reason of inconvenience, nuisance, discomfort or consequential loss arising from such changes or Landlord’s entry. Landlord shall make such changes as expeditiously as reasonably possible. The Building and all Common Areas shall at all times be subject to the exclusive control and management of Landlord or as Landlord may direct from time to time. Tenant shall cooperate with Landlord in any of its programmes to improve or make more efficient the operation of the Lands and Building. |

| 8.7 | Interruption or Delay of Services: Landlord may slow down, interrupt, delay, or shut down any of the services or Utilities outlined in this Part 8 on account of repairs, maintenance or alterations to any equipment or other parts of the Building and where practical, Landlord shall schedule such interruptions, delays, slow downs, or stoppage so as to minimize any inconvenience to Tenant. Landlord shall not be responsible for any direct, indirect or consequential damages, losses, or injuries caused. |

| 8.8 | Public Policy: Landlord shall be deemed to have observed and performed the terms and conditions to be performed by Landlord under this Lease, including those relating to the provision of Utilities, if in so doing it acts in accordance with a directive, policy or request of an Authority acting in the fields of energy, conservation, waste management and disposal, security, the environment or other area of public interest. |

| 8.9 | Security and Information: Landlord may provide a security guard or receptionist in the main lobby of the Building to provide general information to visitors and to control traffic in and out of the Building. Landlord may from time to time elect to substitute such services with automated systems and other devices that may from time to time seem appropriate for a comparable office building in the municipality. It is acknowledged by Tenant that such services are intended for the general benefit of the Building and are not intended to specifically protect or otherwise serve Tenant, its employees or the Premises. |

PART 9 - DISPOSITIONS BY TENANT

| 9.1 | Transfers: Tenant covenants that no Transfer affecting Tenant, this Lease, the Premises or the business of Tenant at the Premises shall be permitted or effective until Landlord’s prior written consent to the Transfer is delivered to Tenant. Tenant shall deliver to Landlord its written request for consent to such Transfer together with copies of the proposed Transfer documents and shall provide Landlord with full particulars of the proposed Transfer and the business and financial responsibility and standing of the proposed Transferee. If Tenant requests Landlord’s consent to any Transfer, Landlord may: |

| .1 | refuse its consent (which refusal may be without any reasons being given or for reasons which are arbitrary or unreasonable, and such refusal shall not be subject to any review or any contestation by anyone or any Authority); or |

- 16 -

| .2 | refuse its consent if the proposed Transfer is to: (i) an existing tenant or occupant of the Building or of any other building owned or managed the Landlord or any of its affiliates within the same market area as determined by the Landlord; or (ii) a consulate, embassy, trade commission or other representative of a foreign government; or (in) a government, quasi-government or public agency, service or office; or |

| .3 | elect to cancel and terminate this Lease if the request is to assign the Lease or to sublet all of the Premises, or if the request is to sublet a portion of the Premises only, to cancel and terminate this Lease with respect to such portion. If Landlord elects to cancel this Lease and so advises Tenant in writing, Tenant shall then notify Landlord in writing within 15 days thereafter of Tenant’s intention either to refrain from such assigning or subletting or to accept the cancellation of the Lease (in whole, or in part). Failure of Tenant to deliver notice to Landlord within such 15 day period advising of Tenant’s intention to refrain from such assigning or subletting, shall be deemed to be an acceptance by Tenant of Landlord’s cancellation of this Lease (in whole, or in part, as the case may be). Any cancellation of this Lease pursuant to this section 9.1 shall be effective on the later of the date originally proposed by Tenant as being the effective date of transfer or the last day of the month which is not less than 60 days following the date of Landlord’s notice of cancellation of this Lease; or |

| .4 | grant its consent with such conditions, if any, as Landlord elects to impose in its sole discretion, which conditions shall be effective upon completion of such Transfer and may include but are not limited to: |

| .1 | an increase in Basic Rent to an amount which is equal to the then fair market basic rent for the Premises for the balance of the Term, as determined by Landlord; |

| .2 | the relinquishment of any rights of the Tenant with respect to the name of the Building, with respect to signage, with respect to renewal of this Lease or extension of the Term, or in respect to additional premises in the Building, or of exclusivity of use; |

| .3 | waiver by Tenant of any further rights to rent free periods or other inducements of any kind provided under this Lease; |

| .4 | the requirement that any party to the Transfer enter into a new lease with Landlord on Landlord’s then standard lease form for the Building and that Tenant enter into such new lease as a guarantor or indemnifier; |

| .5 | the deletion of any of the amendments to Landlord’s standard form of lease contained in this Lease; and |

| .6 | the requirement that any party to the Transfer other than Tenant covenant directly with Landlord in writing to perform and observe such of the covenants, obligations and agreements of Tenant under this Lease as Landlord requires. |

| 9.2 | Additional Requirements: If Landlord agrees to grant its consent to any Transfer under section 9.1: |

| .1 | Tenant shall not permit or cause such Transfer to be completed except: |

| .1 | upon terms consistent with the terms of Tenant’s request and information under section 9.1 (except to the extent modified by any conditions imposed by Landlord under section 9.1); |

- 17 -

| .2 | upon conditions imposed by Landlord, if any, under section 9.1; and |

| .3 | upon terms not otherwise inconsistent with the terms of this Lease; |

| .2 | Tenant shall cause to be executed and delivered by any party to the Transfer (including Tenant) such documentation as may be required by Landlord in connection with such Transfer; |

| .3 | if Tenant shall receive or be entitled to receive from any Transferee either directly or indirectly, any consideration for the Transfer or the use of the whole or any portion of the Premises, either in the form of money or monies worth, goods, or services, Tenant shall forthwith pay an amount equivalent in value to such consideration to Landlord and such amount shall be deemed to be Additional Rent due; |

| .4 | in the event of any subletting or other Transfer by Tenant by reason of which Tenant receives a rent or other payment of any kind related to any sublease or other right to use the Premises or conduct the business of Tenant therein, in the form of money or monies worth, goods or services from the subtenant or any other person, which is more than the rent payable hereunder to Landlord, Tenant shall pay such excess to Landlord in addition to all Rent, Additional Rent and other charges payable under this Lease, and such excess amounts shall be deemed to be further Additional Rent due; |

| .5 | if such Transfer shall not be completed within 60 days after Landlord’s consent is given, such consent shall expire and become null and void and Tenant shall not then allow or cause such Transfer to be completed without again complying with all the requirements of this section 9; |

and such consent shall not be effective unless and until Tenant shall have complied fully with this section 9.2.

| 9.3 | No Release: No Transfer or other disposition by Tenant of this Lease or of any interest under this Lease shall release Tenant from the performance of any of its covenants under this Lease and Tenant shall continue to be bound by this Lease. Tenant’s liability under the Lease will continue notwithstanding the bankruptcy, insolvency, dissolution or liquidation of any Transferee of this Lease or the termination of this Lease for default or the termination, disclaimer, surrender or repudiation of this Lease pursuant to any statute or rule of law. Furthermore, if this Lease is terminated for default or is terminated, disclaimed, surrendered or repudiated pursuant to any statute or rule of law, then, in addition to and without limiting Tenant’s liability under this Lease, Tenant, upon notice from Landlord given within 90 days after any such termination, disclaimer, surrender or repudiation, shall enter into a new lease with Landlord for a term commencing on the effective date of such termination, disclaimer, surrender or repudiation and expiring on the date this Lease would have expired but for such termination, disclaimer, surrender or repudiation and otherwise upon the same terms and conditions as are contained in this Lease with respect to the period after such termination, disclaimer, surrender or repudiation. |

| 9.4 | Costs: Prior to Landlord delivering any requested consent, Tenant shall pay Landlord’s costs incurred in processing each request by Tenant for consent to Transfer including all internal and external legal costs incurred. |

| 9.5 | No Advertising: Tenant will not print, publish, post, display or broadcast any notice or advertisement or otherwise advertise that all or part of the Premises is available for lease or sublease or is otherwise available for the purpose of effecting a Transfer, and it will not permit any broker or other person to do any |

- 18 -

| of the foregoing, unless the complete text and format of any such notice of advertisement is first approved in writing by Landlord. Without restricting or limiting Landlord’s right to refuse any text or format on the other grounds, no text or format proposed by Tenant may contain a reference to the rental rate for the Premises and in no event shall Tenant display any sign that is visible from outside the Premises. |

PART 10 - INSURANCE AND INDEMNIFICATION

| 10.1 | Tenant’s Insurance: Tenant shall, at its sole cost and expense, take out and maintain in full force and effect at all times throughout the Term the following insurance: |

| .1 | “All Risks” insurance upon property of every description and kind owned by Tenant, or for which Tenant is legally liable, or which is installed by or on behalf of Tenant, within the Premises or on the Lands or Building, including, without limitation, stock in trade, furniture, equipment, partitions, Trade Fixtures and Leasehold Improvements, in an amount not less than the full replacement cost thereof from time to time. If there shall be a dispute as to the amount of full replacement cost the decision of Landlord or the Mortgagee shall be conclusive; |

| .2 | Commercial general liability and property damage insurance, including personal liability, contractual liability, tenants’ legal liability, non-owned automobile liability and owners’ and contractors’ protective insurance coverage with respect to the Premises and the Common Areas, which coverage shall include the business operations conducted by Tenant and any other person on the Premises. Such policies shall be written on a comprehensive basis with coverage for any one occurrence or claim of not less than $5,000,000.00 or such higher limits as Landlord or the Mortgagee may require from time to time; |

| .3 | Business interruption insurance including loss of profits; |

| .4 | Any form of insurance as Tenant, Landlord or the Mortgagee may reasonably require from time to time in amounts and for insurance risks against which a prudent tenant would protect itself. |

| 10.2 | Policy Requirements: Each policy of insurance taken out by Tenant in accordance with this Lease shall be taken out with insurers, and shall be in such form and on such terms as are satisfactory to Landlord, and each such policy shall name Landlord, any Mortgagee and the Manager and any others designated by Landlord as additional named insureds, as their respective interests may appear, and each of such policies shall contain, in form satisfactory to Landlord: |

| .1 | the standard mortgage clause as required by the Mortgagee; |

| .2 | a waiver by the insurer of any rights of subrogation or indemnity or any other claim over, to which such insurer might otherwise be entitled against Landlord, the Manager and their respective officers, directors, agents, employees or those for whom it is in law responsible; |

| .3 | an undertaking by the insurer to notify Landlord and the Mortgagee in writing not less than 30 days prior to any proposed material change, cancellation or other termination thereof; |

| .4 | a provision that Tenant’s insurance is primary and shall not call into contribution any other insurance available to Landlord; |

| .5 | a severability of interests clause and a cross-liability clause, where applicable. |

- 19 -