Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - ContinuityX Solutions, Inc. | v240977_8-ka.htm |

| EX-10.2 - EXHIBIT 10.2 - ContinuityX Solutions, Inc. | v240977_ex10-2.htm |

| EX-10.6 - EXHIBIT 10.6 - ContinuityX Solutions, Inc. | v240977_ex10-6.htm |

| EX-10.1 - EXHIBIT 10.1 - ContinuityX Solutions, Inc. | v240977_ex10-1.htm |

| EX-10.5 - EXHIBIT 10.5 - ContinuityX Solutions, Inc. | v240977_ex10-5.htm |

| EX-10.7 - EXHIBIT 10.7 - ContinuityX Solutions, Inc. | v240977_ex10-7.htm |

| EX-10.3 - EXHIBIT 10.3 - ContinuityX Solutions, Inc. | v240977_ex10-3.htm |

| EX-14 - EXHIBIT 14 - ContinuityX Solutions, Inc. | v240977_ex14.htm |

| EX-10.8 - EXHIBIT 10.8 - ContinuityX Solutions, Inc. | v240977_ex10-8.htm |

| EX-10.4 - EXHIBIT 10.4 - ContinuityX Solutions, Inc. | v240977_ex10-4.htm |

Exhibit 2

ACQUISITION AGREEMENT

This Agreement dated as of the 8th day of November, 2011 by and among EDUtoons, Inc., a Delaware corporation with an address at 610 State Route 116, Metamora, IL 61548 (“EDUtoons”), ContinuityX, Inc. a Delaware corporation (“Continuity”), with offices at 610 State Route 116, Metamora, IL 61548, and the stockholders of Continuity who are set forth on Exhibit “A” which is annexed to, and made a part of, this Agreement.

WITNESSETH

WHEREAS, EDUtoonss desires to acquire one hundred (100%) percent of the outstanding and issued common stock of Continuity (the “Continuity Common Stock”) in exchange for seven million three hundred thousand (7,300,000) shares of the issued and outstanding common stock of EDUtoons, par value $0.001 per share (the “EDUtoons Common Stock”);

WHEREAS, Continuity’s stockholders desire to acquire seven million three hundred thousand (7,300,000) shares of the issued and outstanding common stock of EDUtoons, par value $0.001 per share from EDUtoons in exchange for one hundred (100%) of the issued and outstanding shares of the common stock of Continuity;

WHEREAS, the Board of Directors of both Continuity and EDUtoons believe that this Agreement is: (i) in the best interests of each corporation and the stockholders of both Continuity and EDUtoons and (ii) will advance the long-term business interests of EDUtoons and Continuity.

NOW, THEREFORE, in consideration of the foregoing recitals, which shall be considered an integral part of this Agreement, in consideration of the representations, warranties, and covenants contained in this Agreement, and for other good and valuable consideration, the receipt, sufficiency and adequacy of which is hereby acknowledged;

IT IS AGREED:

1. Recitals. The parties hereto adopt as part of this Agreement each of the recitals which is set forth in the WHEREAS clauses, and agree that such recitals shall be binding upon the Parties hereto by way of contract and not merely by way of recital or inducement. Such WHEREAS clauses are hereby confirmed and ratified as being true and accurate by each Party to this Agreement.

2. Acquisition. “Acquisition” shall refer to the following: (i) The acquisition by Continuity’s stockholders of an aggregate of seven million three hundred thousand (7,300,000) shares of the EDUtoons Common Stock in exchange for one hundred (100%) percent of the issued and outstanding common shares of the Continuity Common Stock, and (ii) Continuity becoming a wholly-owned subsidiary of EDUtoons.

3. Other Definitions.

A. The “Closing Date” of the Acquisition shall mean November 8, 2011.

1

B. “DGCL” shall refer to the Delaware General Corporation Law.

4. Closing Transactions.

A. The Stockholders of Continuity have approved this Agreement.

B. The Board of Directors of Continuity has approved this Agreement.

C. The Board of Directors of EDUtoons has approved this Agreement.

D. At the Closing, EDUtoons shall deliver to Continuity’s shareholders seven million three hundred thousand (7,300,000) shares of the EDUtoons Common Stock on a basis of approximately seventy-three (73) shares of EDUtoons for each share of Continuity.

E. At the Closing, Continuity’s stockholders shall deliver to EDUtoons one hundred (100%) percent of their shares of the Continuity Common Stock together with duly executed stock powers in blank.

F. Subject to, and consistent with, the provisions of this Agreement, and in accordance with the relevant provisions of the DGCL, upon one hundred (100%) percent of the Continuity Common Stock being delivered to EDUtoons, Continuity shall become a wholly-owned subsidiary of EDUtoons after the completion of the transactions set forth in this Article “4” of this Agreement.

5. Post-Closing Transactions.

EDUtoons shall file a Form 8-K with the Securities and Exchange Commission (“SEC”) within four (4) business days after the Closing Date disclosing the Closing and the terms and conditions of the Acquisition in compliance with the applicable SEC rules and regulations.

2

6. Representations, Warranties and Covenants of Continuity and David Godwin and Anthony Roth. Continuity and David Godwin and Anthony Roth each severally but not jointly (both are independent of the other and without knowledge of, or responsibility for, the other) represent, warrant and covenant to EDUtoons as follows:

A. Corporate Status.

i. Continuity is a corporation duly organized, validly existing and in good standing pursuant to the laws of the State of Delaware, with all requisite power and authority to carry on its business as presently conducted in all jurisdictions where presently conducted, to enter into this Agreement and to consummate the transactions set forth in this Agreement; and

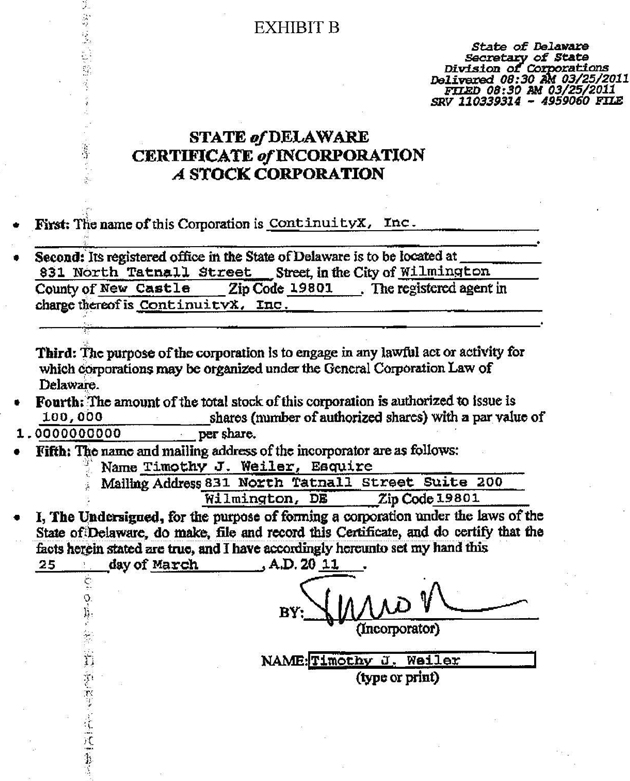

ii. Copies of (a) the Certificate of Incorporation of Continuity, and all amendments to the Certificate of Incorporation and (b) the Bylaws of Continuity, as amended, certified by the Secretary of Continuity are annexed to, and made a part of, this Agreement as Exhibits “B” and “C”, respectively, and are complete and correct as of the date of this Agreement.

B. Capitalization. Continuity does not have any (i) subscriptions, options, warrants, rights or other agreements outstanding to acquire from Continuity shares of stock of Continuity or any other equity security or security convertible into an equity security of Continuity, (ii) outstanding shares of preferred stock or (iii) agreements or commitments to increase, decrease or otherwise alter the authorized capital stock of Continuity. David Godwin and Anthony Roth each represent and warrant the following with respect to only the shares which are set forth next to each of their names on Exhibit “A”, he, she or it:

i. is the record, beneficial and equitable owner of such shares; and

ii. holds his, hers or its shares free and clear of all liens, claims or encumbrances and that he, she or it has the full right and authority to exchange or transfer said shares pursuant to the terms of this Agreement..

C. Authority of Continuity. Continuity has full corporate power and authority to execute, deliver and perform this Agreement and has taken all corporate action required by law and its organizational documents to authorize the execution and delivery of this Agreement and the consummation of the transactions set forth in this Agreement and no other corporate action on its part is necessary to authorize and approve this Agreement or to consummate the transactions contemplated by this Agreement. This Agreement and the consummation by Continuity of the transactions set forth in this Agreement have been duly and validly authorized, executed and delivered by the Board of Directors of Continuity, and (assuming the valid authorization, execution and delivery of this Agreement by EDUtoons) this Agreement is valid and binding upon Continuity and enforceable against Continuity in accordance with its terms (except as the enforceability of this Agreement may be limited by bankruptcy, insolvency, bank moratorium or similar laws affecting creditors' rights generally and laws restricting the availability of equitable remedies, and may be subject to general principles of equity whether or not such enforceability is considered in a proceeding at law or in equity). An executed certified resolution of the Board of Directors of Continuity approving Continuity’s entry into this Agreement and the consummation of the transactions set forth in this Agreement are annexed to, and made a part of, this Agreement as Exhibit “D”.

3

D. Compliance with the Law and Other Instruments. Continuity is and has been in material compliance in all material respects with any and all legal requirements applicable to Continuity, including, but not limited to, all applicable federal and state “blue-sky” securities laws. Continuity (i) has not received or entered into any citations, complaints, consent orders, compliance schedules, or other similar enforcement orders or received any written notice from any governmental authority or any other written notice which would indicate that Continuity is not currently in compliance with all applicable legal requirements, and (ii) is not in default under any legal requirement applicable to Continuity, and no condition exists (whether or not covered by insurance) that with or without notice or lapse of time or both would constitute a default under, or breach or violation of, any legal requirement applicable to Continuity. Without limiting the generality of the foregoing, Continuity has not received notice of any claim, action, suit, investigation or proceeding which might result in a finding that Continuity is not or has not been in compliance with legal requirements relating to (i) the development, testing, manufacture, packaging, distribution, and marketing of its products, (ii) employment, safety and health, and/or (iii) environmental protection, building, zoning and land use.

E. Absence of Conflicts. The execution and delivery of this Agreement, the transfer of their shares of Continuity Common Stock and the consummation by Continuity of the transactions set forth in this Agreement: (i) do not and shall not conflict with or result in a breach of any provision of Continuity’s Certificate of Incorporation or Bylaws, (ii) do not and shall not result in any breach of, or constitute a default or cause an acceleration under any arrangement, agreement or other instrument to which Continuity is a party to or by which any of its assets are bound, (iii) do not and shall not cause Continuity to violate or contravene any provision of law or any governmental rule or regulation, and (iv) will not and shall not result in the imposition of any lien, or encumbrance upon, any property of Continuity. Continuity has performed in all material respects all of its obligations which are, as of the date of this Agreement, required to be performed, pursuant to the terms of any such agreement, contract or commitment.

F. Financial Statements. Attached hereto as Exhibit “E” are the following audited financial statements of Continuity (collectively the “Continuity Financial Statements”): (i) consolidated balance sheets as of June 30, 2011, (ii) statements of income for the period from inception on March 25, 2011 through June 30, 2011, (iii) changes in stockholders’ equity and (iv) cash flow from inception to June 30, 2011.

G. Environmental Compliance.

i. Continuity has complied and is in compliance, in all material respects, with all applicable Environmental, Health and Safety Requirements.

ii. Without limiting the generality of subparagraph “i” of this Paragraph “G” of this Article “6” of this Agreement, Continuity has obtained, has complied and is in compliance, in all material respects, with all material permits, licenses and other authorizations which are required pursuant to Environmental, Health and Safety Requirements for the occupation of its facilities and the operation of its business.

4

iii. Continuity has not received any written or oral notice, report or other information with respect to any actual or alleged material violation of Environmental, Health and Safety Requirements, or any material liabilities or potential material liabilities (whether accrued, absolute, contingent, unliquidated or otherwise), including any material investigatory, remedial or corrective obligations, relating to its business or its facilities arising under Environmental, Health and Safety Requirements.

H. OSHA Compliance. Continuity is in compliance with all applicable federal, state and local laws, rules, regulations, codes, plans, injunctions, judgments, orders, decrees, rulings and charges pursuant to OSHA and other governmental requirements relating to occupational health and safety including, but not limited to, OSHA.

I. Non-Tax Liabilities. Continuity does not have any liabilities of any nature, accrued or contingent, including, but not limited to, liabilities to customers or suppliers, other than the following:

i. Liabilities for which full provision has been made on the Continuity Financial Statements; and

ii. Other liabilities arising since inception and prior to the date of this Agreement in the ordinary course of business (which shall not include liabilities to customers on account of defective products or services) as set forth in Section “6I” of the Continuity Disclosure Statement which is annexed hereto as Exhibit “F” which are not inconsistent with the representations and warranties of Continuity or any other provision of this Agreement.

J. Representations and Obligations With Respect to Taxes.

i. As used in this Paragraph “J” of this Article “6” of this Agreement, “Affiliated Group” means any affiliated group within the meaning of Section 1504(a) of the Internal Revenue Code of 1986, as amended (the “Code”) or any similar group defined under a similar provision of state, local, or foreign law; “Tax” means any Federal, state, local or foreign income, gross receipts, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental (including taxes under Section 59A of the Code), customs duties, capital stock, franchise, profits, withholding, social security (or similar), unemployment, disability, real property, personal property, sales, use, transfer, registration, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty, or addition thereto, whether disputed or not, and “Taxes” means any or all of the foregoing collectively; and “Tax Return” means any return, declaration, report, claim for refund or information return or statement relating to Taxes, including any schedule or attachment thereto and including any amendment thereof.

ii. Continuity has filed all tax returns which it was required to file, all such tax returns were true, correct, and complete in all material respects, all taxes owed by Continuity (whether or not shown on any tax return and whether or not any tax return was required) have been paid, Continuity is not currently the beneficiary of any extension of time within which to file any tax return, no claim has ever been made by a taxing authority in a jurisdiction where the Continuity does not file tax returns which it is or may be subject to taxation by that jurisdiction, and there are no liens on any of the assets of Continuity that arose in connection with any failure (or alleged failure) to pay any tax, except for liens for taxes not yet due.

5

iii. Continuity has withheld and paid all Taxes required to have been withheld and paid in connection with amounts paid or owing to any employee, independent contractor, creditor, stockholder, or other third party.

iv. No director or officer (or employee responsible for tax matters) of Continuity has received any notification (whether written or oral) that any taxing authority will assess any additional taxes for any period for which tax returns have been filed. There is no dispute or claim concerning any tax liability of Continuity claimed or raised by any taxing authority. Section “6J” of Exhibit “F” lists all Federal, state, local, and foreign income tax returns filed with respect to Continuity and indicates which of those tax returns has been audited and indicates those tax returns which currently are the subject of audit or with respect to which any written or unwritten notice of any audit or examination has been received by Continuity. No issue relating to taxes has been raised by a taxing authority during any pending audit or examination, and no issue relating to taxes was raised by a taxing authority in any completed audit or examination, which reasonably can be expected to recur in a later taxable period. Section “6J” of Exhibit “F” includes true, correct, and complete copies of all Federal income tax returns, examination reports, and statements of deficiencies assessed against or agreed to by Continuity.

v. Continuity has not waived any statute of limitations with respect to taxes or agreed to any extension of time with respect to a tax assessment or deficiency.

vi. Continuity has not made any payments, is not obligated to make any payments and is not a party to any agreement which under certain circumstances could obligate it to make any payments that will not be deductible under section 280G of the Code. Continuity has not been a United States real property holding corporation within the meaning of Section 897(c)(2) of the Code during the applicable period specified in Section 897(c)(1)(A)(ii) of the Code. Continuity has disclosed on its Federal income tax returns all positions taken therein which could give rise to a substantial understatement of Federal income tax within the meaning of Section 6662 of the Code. Continuity is not a party to any tax allocation or sharing agreement. Continuity (a) has not been a member of an Affiliated Group filing a consolidated Federal income tax return and (b) has no liability for the taxes of any person under treasury regulation section 1.1502-6 (or any similar provision of state, local or foreign law), as a transferee or successor, by contract or otherwise.

vii. Continuity shall not be required to include in a taxable period ending after the Closing Date taxable income attributable to income which accrued in a prior taxable period but was not recognized in any prior taxable period as a result of the installment method of accounting, the completed contract method of accounting, the long-term contract method of accounting, the cash method of accounting, or Section 481 of the Code or any comparable provision of state, local, or foreign tax law.

viii. Except as otherwise set forth in Section “6J” of Exhibit “F” attached hereto, Continuity is not a party to any joint venture, partnership, or other arrangement or contract which could be treated as a partnership for Federal income tax purposes.

6

ix. Continuity has not entered into any sale leaseback or leveraged lease transaction which fails to satisfy the requirements of Revenue Procedure 75-21 (or similar provisions of foreign law) or any safe harbor lease transaction.

x. All elections with respect to taxes affecting Continuity are disclosed or attached to a tax return of Continuity.

xi. All private letter rulings issued by the Internal Revenue Service to Continuity (and any corresponding ruling or determination of any state, local, or foreign taxing authority) have been disclosed in Section “6J” of Exhibit “F”, and there are no pending requests for any such rulings (or corresponding determinations).

K. Contracts. Except as set forth in Section “6K” of Exhibit “F”, Continuity is not a party to any material contracts.

L. Absence of Changes. Since inception, there has not been any material adverse change in the business, financial condition, operations, results of operations, or future prospects of Continuity taken as a whole. Without limiting the generality of the foregoing except as set forth in Section 6C of Exhibit “F”, since inception:

i. Continuity has not sold, leased, transferred, or assigned any material assets, tangible or intangible, outside of the ordinary course of business;

ii. Continuity has not entered into any material agreement, contract, lease, or license outside of the ordinary course of business;

iii. no party (including Continuity) has accelerated, terminated, made material modifications to, or canceled any material agreement, contract, lease, or license to which Continuity is a party;

iv. Continuity has not made any material expenditures of its capital outside of the ordinary course of business;

v. Continuity has not made any material capital investment in, or any material loan to, any other person or entity outside of the ordinary course of business;

vi. Continuity has not granted any license or sublicense of any material rights under or with respect to any intellectual property;

vii. Continuity has not declared, set aside, or paid any dividend or made any distribution with respect to its capital stock (whether in cash or in kind);

viii. Continuity has not experienced any material damage, destruction, or loss (whether or not covered by insurance) to its property;

7

ix. Continuity has not made any loan to, or entered into any other transaction with, any of its directors, officers, and employees outside of the ordinary course of business;

x. Continuity has not granted any increase in the base compensation of any of its directors, officers, and employees outside of the ordinary course of business;

xi. Continuity has not made any other material change in employment terms for any of its directors, officers, and employees outside of the ordinary course of business;

xii. Continuity has not experienced any event, circumstance, or change (other than general economic conditions) which had or can reasonably be expected to have a material adverse effect upon the business, operations, prospects, properties, financial condition, or working capital of Continuity;

xiii. Continuity has not made any change in any existing election, or made any new election, with respect to any tax law in any jurisdiction which election could have an effect upon the tax treatment of Continuity or its business operations;

xiv. Continuity has not settled any claim or litigation, or filed any motions, orders, briefs, or settlement agreements in any proceeding before any governmental authority or any arbitrator;

xv. Continuity has not maintained its books of account other than in the usual, regular, and ordinary manner and on a basis consistent with prior periods or made any change in any of its accounting methods or practices;

xvi. Continuity has not suffered any extraordinary losses or waived any rights of any value;

xvii. Continuity has not (a) liquidated inventory or accepted product returns other than in the ordinary course, (b) accelerated receivables, (c) delayed payables, or (d) changed in any material respect its practices in connection with the payment of payables and/or the collection of receivables; and

xviii. Continuity has not committed to do any of the actions set forth in Subparagraphs “i” through “xxiii” of this Paragraph “L” of this Article “6” of this Agreement.

M. No Approvals. No approval of any third party including, but not limited to, any governmental authority is required in connection with the consummation of the transactions set forth in this Agreement.

N. Broker. Continuity has not had any dealing with respect to the transactions set forth in this Agreement with any business broker, firm or salesman, or any person or corporation, investment banker or financial advisor who is or shall be entitled to any broker's or finder's fee or any other commission or similar fee with respect to the transactions set forth in this Agreement. Continuity represents that it has not dealt with any such person, firm or corporation and agrees to indemnify and hold harmless Continuity from and against any and all claims for brokerage commissions by any person, firm or corporation on the basis of any act or statement alleged to have been made by Continuity or its affiliates or agents.

8

O. Securities Laws. Neither Continuity nor any director or executive officer of Continuity, is or has been the subject of any action involving a claim of violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty. There has not been, and there is not, pending or contemplated, any investigation by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (FINRA), or other regulatory authority with respect to Continuity or any current or former director or executive officer of Continuity.

P. Intellectual Property.

i. Continuity has not interfered with, infringed upon, misappropriated, or violated any material intellectual property rights of third parties in any material respect, and none of the directors and officers of Continuity has ever received any charge, complaint, claim, demand, or notice alleging any such interference, infringement, misappropriation, or violation (including any claim that Continuity must license or refrain from using any intellectual property rights of any third party). No third party has interfered with, infringed upon, misappropriated, or violated any intellectual property rights of Continuity in any respect.

ii. Section “6P” of Exhibit “F” identifies each patent or registration which has been issued to Continuity with respect to any of its intellectual property, identifies each pending patent application or application for registration which Continuity has made with respect to any of its intellectual property, and identifies each license, agreement, or other permission which Continuity has granted to any third party with respect to any of its intellectual property (together with any exceptions). Section “6P” of Exhibit “F” sets forth correct and complete copies of all such patents, registrations, applications, licenses, agreements, and permissions (as amended to date). Section “6P” of Exhibit “F” also identifies each trade name or unregistered trademark and each copyright used by Continuity in connection with any of its businesses.

With respect to each item of intellectual property required to be identified in Section “6P” of Exhibit “F” pursuant to the prior paragraph of this Subparagraph “ii” of this Paragraph “P” of this Article “6” of this Agreement:

a. Continuity possesses all right, title, and interest in and to the item, free and clear of any security interest, license, or other restriction;

b. the item is not subject to any outstanding injunction, judgment, order, decree, ruling, or charge;

c. no action, suit, proceeding, hearing, investigation, charge, complaint, claim, or demand is pending or is threatened which challenges the legality, validity, enforceability, use, or ownership of the item; and

d. Continuity has never agreed to indemnify any person or entity for or against any interference, infringement, misappropriation, or other conflict with respect to the item.

9

iii. Section “6P” of Exhibit “F” identifies each material item of intellectual property which any third party owns and which Continuity uses pursuant to license, sublicense, agreement, or permission. Section “6P” of Exhibit “F” sets forth correct and complete copies of all such licenses, sublicenses, agreements, and permissions (with all amendments, if any).

With respect to each item of intellectual property required to be identified in Section “6P” of Exhibit “F” pursuant to the prior paragraph of this Subparagraph “iii” of this Paragraph “P” of this Article “6” of this Agreement:

a. the license, sublicense, agreement, or permission covering the item is legal, valid, binding, enforceable, and in full force and effect in all material respects;

b. no other party to the license, sublicense, agreement, or permission is in material breach or default thereof , and no event has occurred which with notice or lapse of time would constitute a material breach or default by such other party or permit termination, modification or acceleration thereof by Continuity;

c. Continuity is not in material breach or default of any such license, sublicense, agreement, or permission, and no event has occurred which with notice or lapse of time would constitute a material breach or default by Continuity or permit termination, modification, or acceleration thereof by another party thereto;

d. no other party to the license, sublicense, agreement, or permission has repudiated any material provision thereof;

e. Continuity has not repudiated any material provision of any license, sublicense, agreement, or permission; and

f. Continuity has not granted any sublicense or similar right with respect to the license, sublicense, agreement, or permission.

iv. Continuity is not aware that any of its employees is obligated under any contract (including licenses, covenants or commitments of any nature) or other agreement, or subject to any judgment, decree or order of any court or administrative agency, which would interfere with his or her duties to Continuity or that would conflict with Continuity’s business as conducted.

Q. Insurance. Section “6Q” of Exhibit “F” sets forth the following information with respect to each material insurance policy (including policies providing property, casualty, liability, and workers’ compensation coverage and bond and surety arrangements) with respect to which Continuity is a party, a named insured, or otherwise the beneficiary of coverage:

i. the name, address, and telephone number of the agent;

10

iii. the policy number and the period of coverage;

iv. the scope (including an indication of whether the coverage is on a claims made, occurrence, or other basis) and the amount (including a description of how deductibles and ceilings are calculated and operate) of coverage; and

v. a description of any retroactive premium adjustments or other material loss-sharing arrangements.

With respect to each such insurance policy: (i) the policy is legal, valid, binding, enforceable, and in full force and effect in all material respects; (ii) neither any of Continuity nor any other party to the policy is in material breach or default (including with respect to the payment of premiums or the giving of notices), and no event has occurred which, with notice or the lapse of time, would constitute such a material breach or default, or permit termination, modification, or acceleration, under the policy (including but not limited to retroactive premium adjustments); and (iii) no party to the policy has repudiated any material provision thereof. Section “6Q” of Exhibit “F” describes any material self-insurance arrangements affecting Continuity, and identifies each material insurance claim made by Continuity in the three (3) years prior to the date of this Agreement.

R. Employee Benefits. There is no employee benefit plan which Continuity maintains or to which Continuity contributes or has any obligation to contribute.

S. Guaranties. Continuity is not a guarantor or is not otherwise responsible for any liability or obligation (including indebtedness) of any other person or entity.

T. Certain Business Relationships. Except as set forth in Section “6T” of Exhibit “F”, none of the officers, directors or stockholders of Continuity has been involved in any material business arrangement or relationship with Continuity, and none of the officers, directors or stockholders of Continuity owns any material asset, tangible or intangible, which is used in the business of Continuity.

U. Registration Rights. Except as is set forth in Section “6U” of Exhibit “F”, Continuity has not granted or agreed to grant to any person or entity any rights (including piggyback registration rights) to have any securities of Continuity registered with the United States Securities and Exchange Commission or any other governmental authority.

V. Change of Control Payments. Neither the execution, delivery and performance by Continuity of this Agreement nor the consummation of any of the transactions contemplated by this Agreement shall require any payment by Continuity, in cash or kind, under any agreement, plan, policy, commitment or other arrangement of Continuity. There are no agreements, plans, policies, commitments or other arrangements with respect to any compensation, benefits or consideration which will be materially increased, or the vesting of benefits of which will be materially accelerated, as a result of the execution and delivery of this Agreement and any of the Exhibits to this Agreement or the occurrence of any of the transactions completed by this Agreement. There are no payments or other benefits, the value of which will be calculated on the basis of any of the transactions contemplated by this Agreement. Continuity has not made, is not obligated to make, and is not a party to any agreement that under certain circumstances could obligate it to make any “excess parachute payment” as defined in Code Section 280G.

11

W. Investments. Continuity owns no debt or equity securities of any entities except as set forth in Section “6W” of Exhibit “F” attached hereto.

X. Accounts Receivable. Except as otherwise set forth in Section “6X” of Exhibit “F”, the accounts receivable reflected on the June 30, 2011 balance sheet included in the Continuity Financial Statements and all of Continuity’s accounts receivable arising since June 30, 2011 arose from bona fide transactions in the ordinary course of business, and the goods and services involved have been sold, delivered, and performed to the account obligors, and no further filings (with governmental authorities, insurers or others) are required to be made, no further goods are required to be provided and no further services are required to be rendered in order to complete the sales and fully render the services and to entitle Continuity to collect the accounts receivable in full. Except as otherwise set forth in Section “6X” of Exhibit “F” attached hereto, no such account has been assigned or pledged to any other person or entity, and, except only to the extent fully reserved against as set forth in the June 30, 2011 balance sheet included in the Continuity Financial Statements, no defense or set-off to any such account has been asserted by the account obligor.

Y. Inventory. Continuity does not have any inventory.

Z. Properties and Assets. Continuity has and will have as of the Closing Date legal and beneficial ownership of any and all properties and assets (real, personal or mixed, tangible or intangible) set forth in Section “6Z” of Exhibit “F”, or the legal right to use such properties and assets through lease agreements, licenses or the like, free and clear of any and all liens. Except as otherwise set forth in Section “6Z” of Exhibit “F”, Continuity’s properties and assets are suitable for the purposes for which intended and in operating condition and repair consistent with normal industry standards, except for ordinary wear and tear, and except for such properties and assets as shall have been taken out of service on a temporary basis for repairs or replacement consistent with Continuity’s prior practices and normal industry standards. Except as otherwise set forth in Section “6Z” of Exhibit “F”, since inception there has not been any significant interruption of Continuity’s business due to inadequate maintenance or obsolescence of the properties and assets.

AA. Real Property. Except as set forth on Section “6AA” of Exhibit “F” Continuity has no interest in any real property.

BB. Commitments.

i. Except as otherwise set forth in Section “6BB” of Exhibit “F”, Continuity is not a party to or bound by any of the following, whether written or oral:

a. any contract which cannot by its terms be terminated by Continuity upon 30 days’ or less notice without penalty or whose term continues beyond one year after the date of this Agreement;

12

b. any contract or commitment for capital expenditures by Continuity not in the ordinary course of business;

c. any lease or license with respect to any properties, real or personal, whether as landlord, tenant, licensor, or licensee;

d. any contract, indenture, or other instrument relating to the borrowing of money or the guarantee of any obligation or the deferred payment of the purchase price of any Properties;

e. any partnership agreement, joint venture agreement or limited liability company agreement;

f. any contract with any affiliate of Continuity relating to the provision of goods or services by or to Continuity;

g. any contract for the sale of any assets not in Continuity’s ordinary course of business;

h. any contract which purports to limit Continuity’s freedom to compete freely in any line of business or in any geographic area;

i. preferential purchase right, right of first refusal, or similar contract; or

j. other contract with respect to the business of Continuity.

ii. Except as disclosed in Section “6BB” of Exhibit “F”, all of the contracts listed or required to be listed in Section “6BB” of Exhibit “F” are valid, binding, and in full force and effect, Continuity has not been notified or advised by any party thereto of such party’s intention or desire to terminate or modify any such contract in any respect, and Continuity is not in breach of any of the terms or covenants of any contract listed or required to be listed in Section “6BB” of Exhibit “F”.

iii. Except as otherwise set forth in Section “6BB” of Exhibit “F”, Continuity is not a party to or bound by any contract or contracts the terms of which were arrived at by or otherwise reflect less-than-arm’s-length negotiations or bargaining.

CC. Permits. Continuity has any and all permits, rights, approvals, licenses, authorizations, legal status, orders, or contracts under any legal requirement or otherwise granted by any governmental authority (“Permits”) necessary for Continuity to own, operate, use, and/or maintain its properties and to conduct its business and operations as presently conducted and as it presently expects such business and operations to be conducted in the future. All such Permits are in effect, no proceeding is pending to modify, suspend or revoke, withdraw, terminate, or otherwise limit any such Permits. No administrative or governmental actions have been taken in connection with the expiration or renewal of such Permits which could reasonably be expected to adversely affect the ability of Continuity to own, operate, use, or maintain any of its properties or to conduct its business and operations as presently conducted and as expected to be conducted in the future. There are no (i) violations which have occurred that remain uncured, unwaived, or otherwise unresolved, or are occurring in respect of any such Permits, other than inconsequential violations, and (ii) circumstances which exist that would prevent or delay the obtaining of any requisite consent, approval, waiver, or other authorization of the transactions contemplated by this Agreement with respect to such Permits that by their terms or under applicable law may be obtained only after Closing.

13

(i) the name of each bank, trust company, or other financial institution and stock or other broker with which Continuity has an account, credit line or safe deposit box or vault, (ii) the names of all persons authorized to draw thereon or to have access to any safe deposit box or vault, (iii) the purpose of each such account, safe deposit box, or vault, and (iv) the names of all persons authorized by proxies, powers of attorney, or other like instrument to act on behalf of Continuity in matters concerning any of its business or affairs.

DD. Banks. Section “6DD” of Exhibit “F” sets forth Except as otherwise set forth in Section “6DD” of Exhibit “F” attached hereto, no such proxies, powers of attorney, or other like instruments are irrevocable.

EE. Absence of Certain Business Practices. There is no instance where Continuity or any affiliate or agent of Continuity, or any other person acting on behalf of or associated with Continuity, acting alone or together, has received, directly or indirectly, any rebates, payments, commissions, promotional allowances or any other economic benefits, regardless of their nature or type, from any customer, supplier, employee, or agent of any customer or supplier.

FF. Transactions with Affiliates. Except as set forth in Section “6FF” of Exhibit “F” attached hereto and except for normal advances to employees consistent with past practices, payment of compensation for employment to employees consistent with past practices, and participation in employee benefit plans by employees, Continuity has not purchased, acquired, or leased any property or services from, or sold, transferred, or leased any property or services to, or loaned or advanced any money to, or borrowed any money from, or entered into or been subject to any management, consulting, or similar agreement with, or engaged in any other significant transaction with any officer, director, or stockholder of Continuity or any of their respective affiliates. Except as set forth in Section “6FF” of Exhibit “F”, no officer, director, or stockholder of Continuity and none of their respective affiliates is indebted to Continuity for money borrowed or other loans or advances, and Continuity is not indebted to any such affiliate.

GG. Litigation. There are no legal, administrative, arbitration or other proceedings or governmental investigations materially affecting Continuity or its properties, assets or businesses, or with respect to any matter arising out of the conduct of Continuity’s business pending or threatened, by or against, any officer or director of Continuity in connection with its affairs, whether or not covered by insurance. (i) neither Continuity nor its officers or directors are subject to any order, writ, injunction or decree of any court, department, agency or instrumentality affecting Continuity, and (ii) Continuity is not presently engaged in any legal action. Section “6GG” of Exhibit “F” also includes a listing of all claims, actions, suits, investigations, or proceedings involving Continuity which were pending, settled, or adjudicated since inception.

14

HH. Business Conducted in No Other Name. All business of Continuity has been conducted in its name and for its benefit and there are no parties related, either directly or indirectly, which are competing for the business of Continuity.

II. No Approvals. No approval of any governmental authority is required of them in connection with the consummation of the transactions set forth in this Agreement.

JJ. Broker. They have not had any dealing with respect to this transaction with any business broker, firm or salesman, or any person or corporation, investment banker or financial advisor who is or shall be entitled to any broker's or finder's fee or any other commission or similar fee with respect to the transactions set forth in this Agreement. David Godwin and Anthony Roth represent that they have not dealt with any such person, firm or corporation and agrees to indemnify and hold harmless EDUtoons from and against any and all claims for brokerage commissions by any person, firm or corporation on the basis of any act or statement alleged to have been made by him or it or his or its affiliates or agents.

KK. Complete Disclosure. No representation or warranty of Continuity which is set forth in this Agreement, or in a writing furnished or to be furnished pursuant to this Agreement, contains or shall contain any untrue statement of a material fact, or omits or shall omit to state any fact which is required to make the statements which are contained in this Agreement or in a writing furnished or to be furnished pursuant to this Agreement, in light of the circumstances under which they were made, not materially misleading. There is no fact relating to the business, affairs, operations, conditions (financial or otherwise) or prospects of Continuity which would materially adversely affect same which has not been disclosed to EDUtoons in this Agreement.

LL. Notification If any event occurs or any event known to either Continuity, David Godwin or Anthony Roth relating to or affecting either shall occur as a result of which (i) any provision of this Article “6” of this Agreement at that time shall include an untrue statement of a fact, or (ii) this Article “6” of this Agreement shall omit to state any fact necessary to make the statements herein, in light of the circumstances under which they were made, not misleading, Continuity, David Godwin or Anthony Roth, as the case may be, shall immediately notify EDUtoons pursuant to Paragraph “C” of Article “12” of this Agreement.

MM. No Defense. It shall not be a defense to a suit for damages for any misrepresentation or breach of covenant or warranty that EDUtoons knew or had reason to know that any covenant, representation or warranty of Continuity in this Agreement or furnished or to be furnished to EDUtoons contained untrue statements.

7. Continuity’s Non-Director Stockholders’ Representations, Warranties and Covenants. Continuity’s Non-Director Stockholders (those Stockholders other than David Godwin or Anthony Roth) (“Continuity’s Non-Director Stockholders”) each severally but not jointly (each Non-Director Stockholder is independent of the others and without knowledge of, or responsibility for, the other Non-Director Stockholders) represent, warrant and covenant to Continuity and EDUtoons as follows:

A. Ownership. They each represent and warrant the following with respect to only the shares which are set forth next to each of their names on Exhibit A, he, she or it:

15

i. is the record, beneficial and equitable owner of such shares; and

ii. holds his, hers or its shares free and clear of all liens, claims or encumbrances and that he, she or it has the full right and authority to exchange or transfer said shares pursuant to the terms of this Agreement.

B. Absence of Conflicts. Their execution and delivery of this Agreement, the transfer of their shares of Continuity Common Stock and the consummation by them of the transactions set forth in this Agreement do not and shall not cause them to violate or contravene any provision of law or any governmental rule or regulation.

C. No Approvals. No approval of any governmental authority is required of them in connection with the consummation of the transactions set forth in this Agreement.

D. Broker. They have not had any dealing with respect to this transaction with any business broker, firm or salesman, or any person or corporation, investment banker or financial advisor who is or shall be entitled to any broker's or finder's fee or any other commission or similar fee with respect to the transactions set forth in this Agreement. The Warranting Continuity Stockholders represent that they have not dealt with any such person, firm or corporation and agrees to indemnify and hold harmless Continuity and EDUtoons from and against any and all claims for brokerage commissions by any person, firm or corporation on the basis of any act or statement alleged to have been made by him or it or his or its affiliates or agents.

E. Complete Disclosure. No representation or warranty of them which is contained in this Agreement, or in a writing furnished or to be furnished pursuant to this Agreement, contains or shall contain any untrue statement of a material fact, omits or shall omit to state any fact which is required to make the statements which are contained herein or therein, in light of the circumstances under which they were made, not materially misleading.

F. Notification. If any event occurs or any event known to Continuity’s Non-Director Stockholders relating to or affecting Continuity’s Non-Director stockholders shall occur as a result of which (i) any provision of this Article “7” of this Agreement at that time shall include an untrue statement of a fact, or (ii) this Article “7” of this Agreement shall omit to state any fact necessary to make the statements herein, in light of the circumstances under which they were made, not misleading, Continuity’s Non-Director Stockholders shall immediately notify Continuity and EDUtoons pursuant to Paragraph “C” of Article “12” of this Agreement.

G. No Defense. It shall not be a defense to a suit for damages by another party to this Agreement against them for any misrepresentation or breach of covenant or warranty that the other party which is suing them knew or had reason to know that any covenant, representation or warranty of him in this Agreement contained untrue statements.

8. EDUtoons’s Representations, Warranties and Covenants. EDUtoons represents, warrants and covenants to Continuity as follows:

16

A. Corporate Status.

i. EDUtoons is a corporation duly organized, validly existing and in good standing pursuant to the laws of the State of Delaware, with all requisite power and authority to carry on its business as presently conducted in all jurisdictions where presently conducted, to enter into this Agreement and to consummate the transactions set forth in this Agreement; and

ii. Copies of (a) the Certificate of Incorporation of EDUtoons, and all amendments to the Certificate of Incorporation certified by the Secretary of EDUtoons and (b) the Bylaws of EDUtoons, as amended, certified by the Secretary of EDUtoons are annexed to, and made a part of, this Agreement as Exhibits “G” and “H”, respectively, and are complete and correct as of the date of this Agreement.

B. Capitalization. EDUtoons does not have any (i) subscriptions, options, warrants, rights or other agreements outstanding to acquire from EDUtoons shares of stock of EDUtoons or any other equity security or security convertible into an equity security of EDUtoons, (ii) outstanding shares of preferred stock or (iii) agreements or commitments to increase, decrease or otherwise alter the authorized capital stock of EDUtoons.

C. Authority of EDUtoons. EDUtoons has full corporate power and authority to execute, deliver and perform this Agreement and has taken all corporate action required by law and its organizational documents to authorize the execution and delivery of this Agreement and the consummation of the transactions set forth in this Agreement and no other corporate action on its part is necessary to authorize and approve this Agreement or to consummate the transactions contemplated by this Agreement. This Agreement and the consummation by EDUtoons of the transactions set forth in this Agreement have been duly and validly authorized, executed and delivered by the Board of Directors of EDUtoons, and (assuming the valid authorization, execution and delivery of this Agreement by Continuity) this Agreement is valid and binding upon EDUtoons and enforceable against EDUtoons in accordance with its terms (except as the enforceability of this Agreement may be limited by bankruptcy, insolvency, bank moratorium or similar laws affecting creditors' rights generally and laws restricting the availability of equitable remedies, and may be subject to general principles of equity whether or not such enforceability is considered in a proceeding at law or in equity). An executed certified resolution of the Board of Directors of EDUtoons approving EDUtoons’s entry into this Agreement and the consummation of the transactions set forth in this Agreement are annexed to, and made a part of, this Agreement as Exhibit “I”.

D. Compliance with the Law and Other Instruments. Except as otherwise set forth in Section “8D” of the EDUtoons Disclosure Statement which is annexed hereto as Exhibit “J”, EDUtoons is and has been in material compliance in all material respects with any and all legal requirements applicable to EDUtoons, including, but not limited to, all applicable federal and state “blue sky” securities laws. Except as otherwise set forth in Section “8D” of Exhibit “J”, EDUtoons (i) has not received or entered into any citations, complaints, consent orders, compliance schedules, or other similar enforcement orders or received any written notice from any governmental authority or any other written notice which would indicate that EDUtoons is not currently in compliance with all applicable legal requirements, and (ii) is not in default under any legal requirement applicable to EDUtoons, and no condition exists (whether or not covered by insurance) that with or without notice or lapse of time or both would constitute a default under, or breach or violation of, any legal requirement applicable to EDUtoons. Without limiting the generality of the foregoing, EDUtoons has not received notice of any claim, action, suit, investigation or proceeding which might result in a finding that EDUtoons is not or has not been in compliance with legal requirements relating to (i) the development, testing, manufacture, packaging, distribution, and marketing of its products, (ii) employment, safety and health, and/or (iii) environmental protection, building, zoning and land use.

17

E. Absence of Conflicts. The execution and delivery of this Agreement, and the consummation by EDUtoons of the transactions set forth in this Agreement: (i) do not and shall not conflict with or result in a breach of any provision of EDUtoons’s Certificate of Incorporation or Bylaws, (ii) do not and shall not result in any breach of, or constitute a default or cause an acceleration under any arrangement, agreement or other instrument to which EDUtoons is a party to or by which any of its assets are bound, (iii) do not and shall not cause EDUtoons to violate or contravene any provision of law or any governmental rule or regulation, and (iv) will not and shall not result in the imposition of any lien, or encumbrance upon, any property of EDUtoons. EDUtoons has performed in all material respects all of its obligations which are, as of the date of this Agreement, required to be performed, pursuant to the terms of any such agreement, contract or commitment.

F. Financial Statements. The following audited financial statements for EDUtoons (collectively the “EDUtoons Financial Statements”) are available (i) statements of income for the period between inception and ended June 30, 2011 , (ii) changes in stockholders’ equity, and (iii) cash flow as of and for the period between inception and ended June 30, 2011. The EDUtoons Financial Statements (including the notes thereto) have been prepared in accordance with GAAP applied on a consistent basis throughout the periods covered thereby and present fairly the financial condition of EDUtoons as of such dates and the results of operations of EDUtoons for such periods.

G. Environmental Compliance.

i. EDUtoons has complied and is in compliance, in all material respects, with all applicable Environmental, Health and Safety Requirements.

ii. Without limiting the generality of subparagraph “i” of this Paragraph “G” of this Article “6” of this Agreement, EDUtoons has obtained, has complied and is in compliance, in all material respects, with all material permits, licenses and other authorizations which are required pursuant to Environmental, Health and Safety Requirements for the occupation of its facilities and the operation of its business.

iii. EDUtoons has not received any written or oral notice, report or other information with respect to any actual or alleged material violation of Environmental, Health and Safety Requirements, or any material liabilities or potential material liabilities (whether accrued, absolute, contingent, unliquidated or otherwise), including any material investigatory, remedial or corrective obligations, relating to its business or its facilities arising under Environmental, Health and Safety Requirements.

18

H. OSHA Compliance. EDUtoons is in compliance with all applicable federal, state and local laws, rules, regulations, codes, plans, injunctions, judgments, orders, decrees, rulings and charges pursuant to OSHA and other governmental requirements relating to occupational health and safety including, but not limited to, OSHA.

I. Non-Tax Liabilities. EDUtoons does not have any liabilities of any nature, accrued or contingent, including, but not limited to, liabilities to customers or suppliers, other than the following:

i. Liabilities for which full provision has been made on the EDUtoons Financial Statements; and

ii. Other liabilities arising since inception and prior to the date of this Agreement in the ordinary course of business (which shall not include liabilities to customers on account of defective products or services) as set forth in Section “8I” of Exhibit “J” which are not inconsistent with the representations and warranties of EDUtoons or any other provision of this Agreement.

J. Representations and Obligations Regarding Taxes.

i. As used in this Paragraph “J” of this Article “6” of this Agreement, “Affiliated Group” means any affiliated group within the meaning of Section 1504(a) of the Code or any similar group defined under a similar provision of state, local, or foreign law; “Tax” means any Federal, state, local or foreign income, gross receipts, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental (including taxes under Section 59A of the Code), customs duties, capital stock, franchise, profits, withholding, social security (or similar), unemployment, disability, real property, personal property, sales, use, transfer, registration, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty, or addition thereto, whether disputed or not, and “Taxes” means any or all of the foregoing collectively; and “Tax Return” means any return, declaration, report, claim for refund or information return or statement relating to Taxes, including any schedule or attachment thereto and including any amendment thereof.

ii. Except as set forth in Section “8J” of Exhibit “J”, EDUtoons has filed all tax returns which it was required to file and all such tax returns were true, correct, and complete in all material respects, all taxes owed by EDUtoons (whether or not shown on any tax return and whether or not any tax return was required) have been paid, EDUtoons is not currently the beneficiary of any extension of time within which to file any tax return, no claim has ever been made by a taxing authority in a jurisdiction where EDUtoons does not file tax returns which it is or may be subject to taxation by that jurisdiction, and there are no liens on any of the assets of EDUtoons that arose in connection with any failure (or alleged failure) to pay any tax, except for liens for taxes not yet due.

iii. EDUtoons has withheld and paid all Taxes required to have been withheld and paid in connection with amounts paid or owing to any employee, independent contractor, creditor, stockholder, or other third party.

19

iv. No director or officer (or employee responsible for tax matters) of EDUtoons has received any notification (whether written or oral) that any taxing authority will assess any additional taxes for any period for which tax returns have been filed. There is no dispute or claim concerning any tax liability of EDUtoons claimed or raised by any taxing authority. Except as otherwise set forth in Section “8J” of Exhibit “J” attached hereto, no issue relating to taxes has been raised by a taxing authority during any pending audit or examination, and no issue relating to taxes was raised by a taxing authority in any completed audit or examination, which reasonably can be expected to recur in a later taxable period.

v. EDUtoons has not waived any statute of limitations with respect to taxes or agreed to any extension of time with respect to a tax assessment or deficiency.

vi. EDUtoons has not made any payments, is not obligated to make any payments and is not a party to any agreement which under certain circumstances could obligate it to make any payments that will not be deductible under section 280G of the Code. EDUtoons has not been a United States real property holding corporation within the meaning of Section 897(c)(2) of the Code during the applicable period specified in Section 897(c)(1)(A)(ii) of the Code. EDUtoons has disclosed on its Federal income tax returns all positions taken therein which could give rise to a substantial understatement of Federal income tax within the meaning of Section 6662 of the Code. EDUtoons is not a party to any tax allocation or sharing agreement. EDUtoons (a) has not been a member of an Affiliated Group filing a consolidated Federal income tax return and (b) has no liability for the taxes of any person under treasury regulation section 1.1502-6 (or any similar provision of state, local or foreign law), as a transferee or successor, by contract or otherwise.

vii. EDUtoons shall not be required to include in a taxable period ending after the Closing Date taxable income attributable to income which accrued in a prior taxable period but was not recognized in any prior taxable period as a result of the installment method of accounting, the completed contract method of accounting, the long-term contract method of accounting, the cash method of accounting, or Section 481 of the Code or any comparable provision of state, local, or foreign tax law.

viii. Except as otherwise set forth in Section “8J” of Exhibit “J” attached hereto, EDUtoons is not a party to any joint venture, partnership, or other arrangement or contract which could be treated as a partnership for Federal income tax purposes.

ix. Except as otherwise set forth in Section “8J” of Exhibit “J” attached hereto, EDUtoons has not entered into any sale leaseback or leveraged lease transaction which fails to satisfy the requirements of Revenue Procedure 75-21 (or similar provisions of foreign law) or any safe harbor lease transaction.

x. All elections with respect to taxes affecting EDUtoons are disclosed or attached to a tax return of EDUtoons.

xi. All private letter rulings issued by the Internal Revenue Service to EDUtoons (and any corresponding ruling or determination of any state, local, or foreign taxing authority) have been disclosed in Section “8J” of Exhibit “J”, and there are no pending requests for any such rulings (or corresponding determinations).

20

K. Contracts. Except as set forth in Section “8K” of Exhibit “J”, EDUtoons is not a party to any material contracts.

L. Absence of Changes. Since its inception, there has not been any material adverse change in the business, financial condition, operations, results of operations, or future prospects of EDUtoons taken as a whole. Without limiting the generality of the foregoing, except as set forth in Section “8L” of Exhibit “J” since its inception:

i. EDUtoons has not sold, leased, transferred, or assigned any material assets, tangible or intangible, outside of the ordinary course of business;

ii. EDUtoons has not entered into any material agreement, contract, lease, or license outside of the ordinary course of business;

iii. no party (including EDUtoons) has accelerated, terminated, made material modifications to, or canceled any material agreement, contract, lease, or license to which EDUtoons is a party;

iv. EDUtoons has not imposed any security interest upon any of its assets, tangible or intangible;

v. EDUtoons has not made any material expenditures of its capital outside of the ordinary course of business;

vi. EDUtoons has not made any material capital investment in, or any material loan to, any other person or entity outside of the ordinary course of business;

vii. EDUtoons has not created, incurred, assumed, or guaranteed more than $10,000 in aggregate indebtedness for borrowed money and capitalized lease obligations;

viii. EDUtoons has not granted any license or sublicense of any material rights under or with respect to any intellectual property;

ix. there has been no change made or authorized in the Certificate of Incorporation or Bylaws of EDUtoons;

x. EDUtoons has not issued, sold, or otherwise disposed of any of its capital stock, or granted any options, warrants, or other rights to purchase or obtain (including upon conversion, exchange or exercise) any of its capital stock;

xi. EDUtoons has not declared, set aside, or paid any dividend or made any distribution with respect to its capital stock (whether in cash or in kind);

xii. EDUtoons has not experienced any material damage, destruction, or loss (whether or not covered by insurance) to its property;

21

xiii. EDUtoons has not made any loan to, or entered into any other transaction with, any of its directors, officers, and employees outside of the ordinary course of business;

xiv. EDUtoons has not entered into any employment contract or collective bargaining agreement, written or oral, or modified the terms of any existing such contract or agreement;

xv. EDUtoons has not granted any increase in the base compensation of any of its directors, officers, and employees outside of the ordinary course of business;

xvi. EDUtoons has not adopted, amended, modified, or terminated any bonus, profit-sharing, incentive, severance, or other plan, contract, or commitment for the benefit of any of its directors, officers, and employees (or taken any such action with respect to any other employee benefit plan);

xvii. EDUtoons has not made any other material change in employment terms for any of its directors, officers, and employees outside of the ordinary course of business;

xviii. EDUtoons has not experienced any event, circumstance, or change (other than general economic conditions) which had or can reasonably be expected to have a material adverse effect upon the business, operations, prospects, properties, financial condition, or working capital of EDUtoons;

xix. EDUtoons has not made any change in any existing election, or made any new election, with respect to any tax law in any jurisdiction which election could have an effect upon the tax treatment of EDUtoons or its business operations;

xx. EDUtoons has not settled any claim or litigation, or filed any motions, orders, briefs, or settlement agreements in any proceeding before any governmental authority or any arbitrator;

xxi. EDUtoons has not maintained its books of account other than in the usual, regular, and ordinary manner and on a basis consistent with prior periods or made any change in any of its accounting methods or practices;

xxii. EDUtoons has not suffered any extraordinary losses or waived any rights of any value;

xxiii. EDUtoons has not (a) liquidated inventory or accepted product returns other than in the ordinary course, (b) accelerated receivables, (c) delayed payables, or (d) changed in any material respect its practices in connection with the payment of payables and/or the collection of receivables; and

xxiv. EDUtoons has not committed to do any of the actions set forth in Subparagraphs “i” through “xxiii” of this Paragraph “L” of this “6” of this Agreement.

22

M. No Approvals. No approval of any third party including, but not limited to, any governmental authority is required in connection with the consummation of the transactions set forth in this Agreement.

N. Broker. EDUtoons has not had any dealing with respect to the transactions set forth in this Agreement with any business broker, firm or salesman, or any person or corporation, investment banker or financial advisor who is or shall be entitled to any broker's or finder's fee or any other commission or similar fee with respect to the transactions set forth in this Agreement. EDUtoons represents that it has not dealt with any such person, firm or corporation and agrees to indemnify and hold harmless Continuity from and against any and all claims for brokerage commissions by any person, firm or corporation on the basis of any act or statement alleged to have been made by EDUtoons or its affiliates or agents.

O. Securities Laws. Neither EDUtoons nor any director or executive officer of EDUtoons, is or has been the subject of any action involving a claim of violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty. There has not been, and there is not, pending or contemplated, any investigation by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (FINRA), or other regulatory authority with respect to EDUtoons or any current or former director or executive officer of EDUtoons.

P. Intellectual Property.

i. EDUtoons has not interfered with, infringed upon, misappropriated, or violated any material intellectual property rights of third parties in any material respect, and none of the directors and officers of EDUtoons has ever received any charge, complaint, claim, demand, or notice alleging any such interference, infringement, misappropriation, or violation (including any claim that EDUtoons must license or refrain from using any intellectual property rights of any third party). No third party has interfered with, infringed upon, misappropriated, or violated any material intellectual property rights of EDUtoons in any respect.

ii. Section “8P” of Exhibit “J” identifies each patent or registration which has been issued to EDUtoons with respect to any of its intellectual property, identifies each pending patent application or application for registration which EDUtoons has made with respect to any of its intellectual property, and identifies each license, agreement, or other permission which EDUtoons has granted to any third party with respect to any of its intellectual property (together with any exceptions).

iii. Section “8P” of Exhibit “J” identifies each material item of intellectual property which any third party owns and which EDUtoons uses pursuant to license, sublicense, agreement, or permission. Section “8P” of Exhibit “J” sets forth correct and complete copies of all such licenses, sublicenses, agreements, and permissions (with all amendments, if any).

iv. EDUtoons is not aware that any of its employees is obligated under any contract (including licenses, covenants or commitments of any nature) or other agreement, or subject to any judgment, decree or order of any court or administrative agency, which would interfere with his or her duties to EDUtoons or that would conflict with EDUtoons’s business as proposed to be conducted.

23

Q. Insurance. EDUtoons does not maintain any insurance currently.

R. Employee Benefits. There is no employee benefit plan which EDUtoons maintains or to which EDUtoons contributes or has any obligation to contribute.

S. Guaranties. EDUtoons is not a guarantor or is not otherwise responsible for any liability or obligation (including indebtedness) of any other person or entity.

T. Certain Business Relationships. Except as set forth in Section “8T” of Exhibit “J”, none of the officers, directors or stockholders of EDUtoons has been involved in any material business arrangement or relationship with EDUtoons, and none of the officers, directors or stockholders of EDUtoons owns any material asset, tangible or intangible, which is used in the business of EDUtoons.

U. Registration Rights. Except as is set forth in Section “8U” of Exhibit “J”, EDUtoons has not granted or agreed to grant to any person or entity any rights (including piggyback registration rights) to have any securities of EDUtoons registered with the United States Securities and Exchange Commission or any other governmental authority.

V. Change of Control Payments. Neither the execution, delivery and performance by EDUtoons of this Agreement nor the consummation of any of the transactions contemplated by this Agreement shall require any payment by EDUtoons, in cash or kind, under any agreement, plan, policy, commitment or other arrangement of EDUtoons. There are no agreements, plans, policies, commitments or other arrangements with respect to any compensation, benefits or consideration which will be materially increased, or the vesting of benefits of which will be materially accelerated, as a result of the execution and delivery of this Agreement and any of the Exhibits to this Agreement or the occurrence of any of the transactions completed by this Agreement. There are no payments or other benefits, the value of which will be calculated on the basis of any of the transactions contemplated by this Agreement. EDUtoons has not made, is not obligated to make, and is not a party to any agreement that under certain circumstances could obligate it to make any “excess parachute payment” as defined in Code Section 280G.

W. Investments. EDUtoons owns the debt or equity securities of the entities set forth in Section “8W” of Exhibit “J” attached hereto.

X. Accounts Receivable. EDUtoons does not have any accounts receivable.

Y. Inventory. EDUtoons does not have any inventory of any type of products.

Z. Property and Assets. EDUtoons does not have and will not have as of the Closing Date legal and beneficial ownership of any properties or assets.

24

AA. Real Property. Except as set forth on Section “8AA” of Exhibit “J” EDUtoons has no interest in any real property.

BB. Commitments. Except as otherwise set forth in Section “8BB” of Exhibit “J”, EDUtoons is not a party to or bound by any contract or commitment, whether written or oral.

CC. Permits. Except as otherwise set forth in Section “8CC” of Exhibit “J”, EDUtoons has any and all permits, rights, approvals, licenses, authorizations, legal status, orders, or contracts under any legal requirement or otherwise granted by any governmental authority (“Permits”) necessary for EDUtoons to own, operate, use, and/or maintain its properties and to conduct its business and operations as presently conducted and as it presently expects such business and operations to be conducted in the future. Except as otherwise set forth in Section “8CC” of Exhibit “J”, all such Permits are in effect, no proceeding is pending to modify, suspend or revoke, withdraw, terminate, or otherwise limit any such Permits, no such proceeding is threatened. No administrative or governmental actions have been taken, and no such actions which are threatened in connection with the expiration or renewal of such Permits which could reasonably be expected to adversely affect the ability of EDUtoons to own, operate, use, or maintain any of its properties or to conduct its business and operations as presently conducted and as expected to be conducted in the future. Except as otherwise set forth in Section “8CC” of Exhibit “J”, there are no (i) violations which have occurred that remain uncured, unwaived, or otherwise unresolved, or are occurring in respect of any such Permits, other than inconsequential violations, and (ii) circumstances which exist that would prevent or delay the obtaining of any requisite consent, approval, waiver, or other authorization of the transactions contemplated by this Agreement with respect to such Permits that by their terms or under applicable law may be obtained only after Closing.

DD. Banks. In Section “8DD” of Exhibit “J” sets forth (i) the name of each bank, trust company, or other financial institution and stock or other broker with which EDUtoons has an account, credit line or safe deposit box or vault, (ii) the names of all persons authorized to draw thereon or to have access to any safe deposit box or vault, (iii) the purpose of each such account, safe deposit box, or vault, and (iv) the names of all persons authorized by proxies, powers of attorney, or other like instrument to act on behalf of EDUtoons in matters concerning any of its business or affairs. Except as otherwise set forth in Section “8DD” of Exhibit “J” attached hereto, no such proxies, powers of attorney, or other like instruments are irrevocable.

EE. Absence of Certain Business Practices. There is no instance where EDUtoons or any affiliate or agent of EDUtoons, or any other person acting on behalf of or associated with EDUtoons, acting alone or together, has received, directly or indirectly, any rebates, payments, commissions, promotional allowances or any other economic benefits, regardless of their nature or type, from any customer, supplier, employee, or agent of any customer or supplier.

FF. Transactions with Affiliates. Except as set forth in Section “8FF” of Exhibit “J” attached hereto, EDUtoons has not purchased, acquired, or leased any property or services from, or sold, transferred, or leased any property or services to, or loaned or advanced any money to, or borrowed any money from, or entered into or been subject to any management, consulting, or similar agreement with, or engaged in any other significant transaction with any officer, director, or stockholder of EDUtoons or any of their respective affiliates. Except as set forth in Section “8FF” of Exhibit “J”, no officer, director, or stockholder of EDUtoons and none of their respective affiliates is indebted to EDUtoons for money borrowed or other loans or advances, and EDUtoons is not indebted to any such affiliate.

25

GG. Litigation. Except as set forth in Section “8GG” of Exhibit “J”, there are no legal, administrative, arbitration or other proceedings or governmental investigations materially affecting EDUtoons or its properties, assets or businesses, or with respect to any matter arising out of the conduct of EDUtoons’s business pending or threatened, by or against, any officer or director of EDUtoons in connection with its affairs, whether or not covered by insurance. Except as set forth in Section “8GG” of Exhibit “J”, (i) neither EDUtoons nor its officers or directors are subject to any order, writ, injunction or decree of any court, department, agency or instrumentality affecting EDUtoons, and (ii) EDUtoons is not presently engaged in any legal action. Section “8GG” of Exhibit “J” also includes a listing of all claims, actions, suits, investigations, or proceedings involving EDUtoons which were pending, settled, or adjudicated.

HH. Business Conducted in No Other Name. All business of EDUtoons has been conducted in its name and for its benefit and there are no parties related, either directly or indirectly, which are competing for the business of EDUtoons.