Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT - Ceetop Inc. | f10q0911ex31i_chinaceetop.htm |

| EX-32.1 - CERTIFICATION PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT - Ceetop Inc. | f10q0911ex32i_chinaceetop.htm |

| EX-31.2 - CERTIFICATION PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT - Ceetop Inc. | f10q0911ex31ii_chinaceetop.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Ceetop Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period ended September 30, 2011

Commission File Number 000-32629

China Ceetop.com, Inc.

(Exact name of registrant as specified in charter)

|

Oregon

|

98-0408707

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

A2803, Lianhe Guangchang, 5022 Binhe Dadao, Futian District, Shenzhen, China

|

518026

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

____________(86-755) 3336-6628________

Registrant’s telephone number, including area code

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated Filer ¨

|

|

|

Non-accelerated filer ¨

(Do not check if smaller reporting company)

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of November 14, 2011, the Company had outstanding 32,263,063 shares of its common stock, par value $0.001.

Special Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q, including "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 2 of Part I of this report include forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "proposed," "intended," or "continue" or the negative of these terms or other comparable terminology. You should read statements that contain these words carefully, because they discuss our expectations about our future operating results or our future financial condition or state other "forward-looking" information. There may be events in the future that we are not able to accurately predict or control. Before you invest in our securities, you should be aware that the occurrence of any of the events described in this Quarterly Report could substantially harm our business, results of operations and financial condition, and that upon the occurrence of any of these events, the trading price of our securities could decline and you could lose all or part of your investment. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, growth rates, levels of activity, performance or achievements. We are under no duty to update any of the forward-looking statements after the date of this Quarterly Report to conform these statements to actual results.

TABLE OF CONTENTS

|

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

|

|

|

Consolidated Balance Sheets (unaudited and audited)

|

F-2

|

|

Consolidated Statements of Income and Comprehensive Income (unaudited)

|

F-3

|

|

Consolidated Statements of Cash Flows (unaudited)

|

F-4

|

|

Consolidated Statements of Stockholders’ Equity (unaudited)

|

F-5

|

|

Notes to Consolidated Financial Statements (unaudited)

|

F-6 - F-1

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

1

|

|

Item 3. Quantitative and Qualitative Disclosures about Market Risk

|

5

|

|

Item 4. Controls and Procedures

|

5

|

|

PART II – OTHER INFORMATION

|

|

|

Item 1. Legal Proceedings

|

6

|

|

Item 1A. Risk Factors

|

6

|

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

|

6

|

|

Item 3. Defaults Upon Senior Securities

|

6

|

|

Item 4. Removed and Reserved

|

6

|

|

Item 5. Other Information

|

6

|

|

Item 6. Exhibits

|

6

|

|

Signatures

|

7

|

PART I – FINANCIAL INFORMATION

CHINA CEETOP.COM, INC.

CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

F-1

|

CHINA CEETOP.COM, INC.

|

||||||||||

|

CONSOLIDATED BALANCE SHEETS

|

||||||||||

|

Notes

|

September 30,

|

December 31,

|

||||||||

|

2011

|

2010

|

|||||||||

|

(Unaudited)

|

(Audited)

|

|||||||||

|

ASSETS

|

||||||||||

|

Current Assets

|

||||||||||

|

Cash and cash equivalents

|

|

$ | 1,612,390 | $ | 2,671,162 | |||||

|

Accounts receivable

|

2 | 271,146 | 97,045 | |||||||

|

Deposits and other receivables

|

91,743 | 169,703 | ||||||||

|

Inventories

|

2 | 245,415 | 164,649 | |||||||

|

Amount due from related parties

|

4 | - | 50,000 | |||||||

|

Prepayment

|

12,954 | 13,113 | ||||||||

|

Total Current Assets

|

2,233,648 | 3,165,672 | ||||||||

|

Property and equipment, net

|

2 | 70,915 | 106,783 | |||||||

|

Total Assets

|

$ | 2,304,563 | $ | 3,272,455 | ||||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||||

|

Current and Total Liabilities

|

||||||||||

|

Accounts payable

|

$ | 725,266 | $ | 989,564 | ||||||

|

Accrued expenses and other payable

|

283,436 | 305,399 | ||||||||

|

Total Current and Total Liabilities

|

$ | 1,008,702 | $ | 1,294,963 | ||||||

|

Stockholders' Equity

|

||||||||||

|

Common stock, USD0.001 par value, 200,000,000 shares authorized, 32,263,063 and 28,496,427 shares issued and outstanding at September 30, 2011 and December 31, 2010 respectively

|

5 | 32,263 | 28,496 | |||||||

|

Preferred stock, USD0.001 par value, 3,558,046 shares authorized, issued and outstanding

|

5 | 3,558 | 3,558 | |||||||

|

Additional paid-in capital

|

6 | 5,811,362 | 4,563,546 | |||||||

|

Common stock issued for prepaid service

|

7 | (780,183 | - | |||||||

|

Statutory reserve

|

8 | - | - | |||||||

|

Accumulated other comprehensive income

|

9 | 97,034 | 53,020 | |||||||

|

Accumulated deficit

|

(3,868,173 | (2,671,128 | ) | |||||||

|

Stockholders’ Equity

|

1,295,861 | 1,977,492 | ||||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 2,304,563 | $ | 3,272,455 | ||||||

The accompanying notes are an integral part of these consolidated financial statements

F-2

|

CHINA CEETOP.COM, INC.

|

||||||||||||||||

|

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

|

||||||||||||||||

|

(UNAUDITED)

|

||||||||||||||||

|

Three Months Ended September 30,

|

Nine Months Ended September 30,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Sales

|

$ | 3,214,882 | $ | 2,837,594 | $ | 10,402,375 | $ | 12,198,665 | ||||||||

|

Cost of sales

|

(3,057,157 | ) | (2,665,995 | ) | (9,831,223 | ) | (11,742,660 | ) | ||||||||

|

Gross profit

|

157,725 | 171,599 | 571,152 | 456,005 | ||||||||||||

|

Selling, general and administrative

expenses

|

(629,000 | ) | (668,646 | ) | (1,776,441 | ) | (1,662,225 | ) | ||||||||

|

(Loss) from operations

|

(471,275 | ) | (497,047 | ) | (1,205,289 | ) | (1,206,220 | ) | ||||||||

|

Other Income

|

||||||||||||||||

|

Interest income

|

1,906 | 2,580 | 6,169 | 5,113 | ||||||||||||

|

Other income

|

1,063 | 2,828 | 2,075 | 3,465 | ||||||||||||

|

Total other Income

|

2,969 | 5,408 | 8,244 | 8,578 | ||||||||||||

|

Net (loss)

|

$ | (468,306 | ) | $ | (491,639 | ) | $ | (1,197,045 | ) | $ | (1,197,642 | ) | ||||

|

Weighted average shares (include common shares and non-convertible preferred shares) outstanding

|

||||||||||||||||

|

Basic - note 2)

|

35,474,370 | 32,054,473 | 33,699,012 | 32,054,473 | ||||||||||||

|

Diluted - note 2)

|

35,474,370 | 32,054,473 | 33,699,012 | 32,054,473 | ||||||||||||

|

Net (loss) per share (include common shares and non-convertible preferred shares)

|

||||||||||||||||

|

Basic - note 2)

|

$ | (0.01 | ) | $ | (0.02 | ) | $ | (0.04 | ) | $ | (0.04 | ) | ||||

|

Diluted - note 2)

|

$ | (0.01 | ) | $ | (0.02 | ) | $ | (0.04 | ) | $ | (0.04 | ) | ||||

|

Net (loss)

|

$ | (468,306 | ) | $ | (491,639 | ) | $ | (1,197,045 | ) | $ | (1,197,642 | ) | ||||

|

Other comprehensive income

|

11,909 | 31,262 | 44,014 | 43,124 | ||||||||||||

|

Comprehensive (loss)

|

$ | (456,397 | ) | $ | (460,377 | ) | $ | (1,153,031 | ) | $ | (1,154,518 | ) | ||||

The accompanying notes are an integral part of these consolidated financial statements

F-3

|

CHINA CEETOP.COM, INC.

|

||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

||||||||

|

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2011 AND 2010

|

||||||||

|

(UNAUDITED)

|

||||||||

|

2011

|

2010

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||

|

Net loss

|

$ | (1,197,045 | ) | $ | (1,197,642 | ) | ||

|

Adjustments to reconcile net loss to net cash

|

||||||||

|

provided by/(used in) operating activities:

|

||||||||

|

Depreciation

|

38,450 | 35,655 | ||||||

|

Share-based payment expense

|

118,817 | - | ||||||

|

Provision for doubtful accounts

|

1,385 | 691 | ||||||

|

Reversal of provision previously recognized

|

(503 | ) | (638 | ) | ||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

(174,983 | ) | (22,019 | ) | ||||

|

Other receivable , deposits and prepayment

|

78,119 | (184,428 | ) | |||||

|

Inventories

|

(80,766 | ) | (128,703 | ) | ||||

|

Amount due from related parties

|

50,000 | - | ||||||

|

Accounts payable

|

(264,298 | ) | (213,876 | ) | ||||

|

Accrued expense and other payable

|

(31,963 | ) | 49,259 | |||||

|

Net cash used in operating activities

|

(1,462,787 | ) | (1,661,701 | ) | ||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||

|

Purchase of property and equipment

|

- | (2,649 | ) | |||||

|

Net cash used in investing activities

|

- | (2,649 | ) | |||||

|

CASH FLOW FROM FINANCING ACTIVITES

|

||||||||

|

Merge with China Ceetop

|

50,171 | - | ||||||

|

Capital injection from shareholders

|

312,412 | 2,934,000 | ||||||

|

Net cash provided by financing activities

|

362,583 | 2,934,000 | ||||||

|

Effect of exchange rate changes on cash and cash equivalents

|

41,432 | 27,101 | ||||||

|

Net (Decrease)/increase in cash and cash equivalents

|

(1,058,772 | ) | 1,296,751 | |||||

|

Cash and cash equivalents, beginning balance

|

2,671,162 | 1,484,992 | ||||||

|

Cash and cash equivalents, ending balance

|

$ | 1,612,390 | $ | 2,781,743 | ||||

The accompanying notes are an integral part of these consolidated financial statements

F-4

|

CHINA CEETOP.COM, INC.

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(UNAUDITED)

|

|

Common Stock

|

Preferred Stock

|

|||||||||||||||||||||||||||||||||||

|

Stock

outstanding

|

Amount

|

Stock

outstanding

|

Amount

|

Additional

Paid-in Capital

|

Common

Stock issued

for prepaid

service

|

Other

Comprehensive

Income/(loss)

|

(Accumulated Loss)

|

Total

Stockholders Equity

|

||||||||||||||||||||||||||||

|

Balance January 1, 2010

|

12,821,789 | $ | 12,822 | - | $ | - | $ | 1,618,778 | $ | - | $ | (24,591 | ) | $ | (1,074,541 | ) | $ | 532,468 | ||||||||||||||||||

|

Foreign currency translation

Adjustments - note 8)

|

- | - | - | - | - | - | 77,611 | - | 77,611 | |||||||||||||||||||||||||||

|

Issue of shares

|

19,232,684 | 19,232 | - | - | 10,768 | - | - | - | 30,000 | |||||||||||||||||||||||||||

|

Conversion of common stock to preferred stock

|

(3,558,046 | ) | (3,558 | ) | 3,558,046 | 3,558 | - | - | - | - | - | |||||||||||||||||||||||||

|

Waiver of amount due to a

shareholder

|

- | - | - | - | 2,934,000 | - | - | - | 2,934,000 | |||||||||||||||||||||||||||

|

(Loss) for the year ended

December 31, 2010

|

- | - | - | - | - | - | - | (1,596,587 | ) | (1,596,587 | ) | |||||||||||||||||||||||||

|

Balance December 31, 2010

|

28,496,427 | 28,496 | 3,558,046 | 3,558 | 4,563,546 | - | 53,020 | (2,671,128 | ) | 1,977,492 | ||||||||||||||||||||||||||

|

Foreign currency translation

adjustments - note 8)

|

- | - | - | - | - | - | 44,014 | - | 44,014 | |||||||||||||||||||||||||||

|

Merge with China Ceetop - note 1)

|

866,636 | 867 | - | - | 39,304 | - | - | - | 40,171 | |||||||||||||||||||||||||||

|

Capital injection from a shareholder - note 6)

|

- | - | - | - | 312,412 | - | - | - | 312,412 | |||||||||||||||||||||||||||

|

Issuance of common stock for

prepaid service - note 5, 7)

|

2,900,000 | 2,900 | - | - | 896,100 | (899,000 | ) | - | - | - | ||||||||||||||||||||||||||

|

Record of common stock for

Prepaid service - note 7)

|

- | - | - | - | - | 118,817 | - | - | 118,817 | |||||||||||||||||||||||||||

|

(Loss) for the nine months ended September 30, 2011

|

- | - | - | - | - | - | (1,197,045 | ) | (1,197,045 | ) | ||||||||||||||||||||||||||

|

Balance September 30, 2011

|

32,263,063 | $ | 32,263 | 3,558,046 | $ | 3,558 | $ | 5,811,362 | $ | (780,183 | ) | $ | 97,034 | $ | (3,868,173 | ) | $ | 1,295,861 | ||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements

F-5

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 1 – ORGANIZATION

China Ceetop.com, Inc. (the “Company” or “China Ceetop”) was incorporated in Oregon on February 18, 2003 under the name of GL Gold Inc. On June 6, 2003 the Company filed an amendment with the State of Oregon changing its name to Oregon Gold, Inc. On January 7, 2011 Oregon Gold Inc. changed its name to China Ceetop.com, Inc.

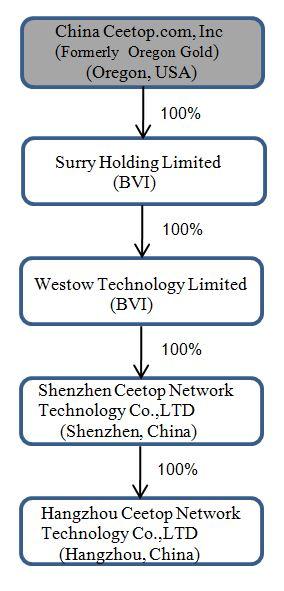

Surry Holdings Limited (“Surry”) was incorporated in the British Virgin Islands on September 18, 2009. Surry holds 100% of Westow Technology Limited (“Westow”), a company incorporated in the British Virgin Islands, which in turn holds 100% of Shenzhen Ceetop Network Technology Co., Limited ("SZ Ceetop"), a company incorporated in Shenzhen, Peoples’ Republic of China ("PRC") and ultimately holds 100% of Hangzhou Ceetop Network Technology Co., Limited ("HZ Ceetop"), a company incorporated in Hangzhou, PRC.

Pursuant to a series of transactions completed in September, 2009, Surry became the holding company of Westow, SZ Ceetop and HZ Ceetop ("Group Reorganization").

Since Surry, Westow, SZ Ceetop and HZ Ceetop were under common control of a controlling party both before and after the completion of the Group Reorganization, the Group Reorganization has been accounted for using merger accounting. The consolidated financial statements have been prepared on the basis as if Surry had always been the holding company of Westow, SZ Ceetop and HZ Ceetop and this group structure had been in existence throughout the nine months ended September 30, 2011 and year ended December 31, 2010 as defined by Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810, “Consolidation”.

On January 27, 2011, the Company became the holding company of Surry through a reverse acquisition. The Company acquired all of the issued and outstanding capital stock of Surry pursuant to the share exchange agreement dated December 30, 2010 by and among Surry, the Company and the shareholders of the Company (the “Share Exchange Agreement”). At the same time, the Company effected a reverse stock split such that the number of all existing issued shares were reduced from 19,900,100 to 866,636 on a 23 to 1 basis. Pursuant to the Share Exchange Agreement, the Company acquired 100% of the capital stock and ownership interests of Surry in exchange for 28,496,427 newly-issued shares of the Company’s common stock and 3,558,046 newly issued shares of the Company’s series A preferred stock.

Prior to the acquisition of the Surry, the Company was a non-operating public shell. Pursuant to securities and Exchange Commission (“SEC”) rules, the merger or acquisition of a private operating company into a non-operating public shell with nominal net assets is considered as a capital transaction, rather than a business combination. Accordingly, for accounting and financial reporting purposes, the transaction was treated as a reverse acquisition, wherein Surry is considered the acquirer. The assets and liabilities of Surry have been brought forward at their book value and no goodwill has been recognized. The historical financial statements prior to January 27, 2011 are those of Surry.

The Company operates in a single reportable segment, the principal activities of the Company are engaged in the provision of an online platform for distribution of 3C products (computers/communications/consumer electronics) in the PRC by way of a website named www.ceetop.com mainly through its wholly owned legal subsidiaries HZ Ceetop and SZ Ceetop.

These Consolidated Financial Statements present the Company and its subsidiaries on a historical basis.

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

These Unaudited Consolidated Financial Statements were prepared by the Company pursuant to the rules and regulations of the SEC. The information furnished herein reflects all adjustments (consisting of normal recurring accruals and adjustments) that are, in the opinion of management, necessary to present fairly the operating results for the respective periods. Certain information and footnote disclosures normally present in Annual Consolidated Financial Statements prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) were omitted pursuant to such rules and regulations. These Unaudited Consolidated Financial Statements should be read in conjunction with the Audited Consolidated Financial Statements and footnotes for the year ended December 31, 2010. The results for nine months ended September 30, 2011, are not necessary indicative of the results to be expected for the full year ending December 31, 2011.

F-6

CHINA CEETOP.COM, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company adopted the new accounting guidance (“Codification”) on July 1, 2009. For the nine months ended September 30, 2011, all reference for periods subsequent to July 1, 2009 are based on the codification. The Company's functional currency is the Chinese Yuan Renminbi (“RMB”); however the accompanying consolidated financial statements have been translated and presented in the United States Dollars (“USD”).

Principles of Consolidation

The Consolidated Financial Statements incorporate the financial statement items of the combining entities or businesses in which the common control combination occurs as if they had been combined from the date when the combining entities or businesses first came under the control of the controlling party.

The net assets of the combining entities or businesses are combined using the existing book values from the controlling parties’ perspective. No amount is recognized in respect of goodwill or excess of acquirer’s interest in the net fair value of acquiree’s identifiable assets, liabilities and contingent liabilities over cost at the time of common control combination, to the extent of the continuation of the controlling party’s interest.

The Consolidated Statements of Income and Comprehensive Income include the results of each of the combining entities or businesses from the earliest date presented or since the date when the combining entities or businesses first came under common control, where this is a shorter period.

A business combination involving entities or businesses under common control is a business combination in which all of the combining entities or businesses are ultimately controlled by the same party or parties both before and after the business combination, and that control is not transitory. Such business combinations are referred to as common control combinations, which is in line with U.S. GAAP.

Translation Adjustment

As of September 30, 2011 and December 31, 2010, the accounts of the Company were maintained, and its financial statements were expressed, in RMB. Such financial statements were translated into USD in accordance with the Foreign Currency Matters Topic of the Codification, with the RMB as the functional currency. According to the Codification, all assets and liabilities were translated at the current exchange rate, stockholders’ equity are translated at the historical rates and income statement items are translated at the average exchange rate for the period. The resulting translation adjustments are reported under other comprehensive income in accordance with the Comprehensive Income Topic of the Codification, as a component of shareholders’ equity. Transaction gains and losses are reflected in the income statement.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Comprehensive Income

The Company uses SFAS 130 “Reporting Comprehensive Income” (codified in FASB ASC Topic 220). Comprehensive income is comprised of net income and all changes to the statements of stockholders’ equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders. Comprehensive income for the nine months and three months ended September 30, 2011 and 2010 included net income and foreign currency translation adjustments.

F-7

CHINA CEETOP.COM, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Risks and Uncertainties

The Company’s operations are carried out in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC’s economy. The Company’s business may be influenced by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

The Company is subject to substantial risks from, among other things, intense competition associated with the industry in general, other risks associated with financing, liquidity requirements, rapidly changing customer requirements, limited operating history, foreign currency exchange rates and the volatility of public markets.

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought. There were no contingencies of this type as of September 30, 2011 and December 31, 2010.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material would be disclosed. There were no contingencies of this type as of September 30, 2011 and December 31, 2010.

Loss contingencies considered to be remote by management are generally not disclosed unless they involve guarantees, in which case the guarantee would be disclosed.

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand and cash in time deposits, certificates of deposit and all highly liquid debt instruments with original maturities of three months or less.

Accounts Receivable

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. Reserves are recorded based on the Company’s historical collation history. Allowances for doubtful accounts as of September 30, 2011 and December 31, 2010 were $1,385 and $503, respectively.

F-8

CHINA CEETOP.COM, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Inventories

Inventories are valued at the lower of cost (determined on a weighted average basis) or market. Management compares the cost of inventories with the market value and allowance is made for writing down their inventories to market value, if lower. There is no provision of inventories for the nine and three months ended September 30, 2011 and 2010. As of September 30, 2011 and December 31, 2010, inventories consist of the following:

|

09/30/2011

|

12/31/2010

|

|||||

|

$

|

245,415

|

164,649

|

Finished goods

Property, Plant & Equipment

Property, plant and equipment are stated at cost. Expenditures for maintenance and repairs are charged to earnings as incurred; additions, renewals and betterments are capitalized. When property, plant and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property, plant and equipment is provided using the straight-line method for substantially all assets with estimated lives of:

|

Office equipment

|

3 - 5 years

|

As of September 30, 2011 and December 31, 2010 Property, Plant & Equipment consist of the following:

|

09/30/2011

|

12/31/2010

|

|||||||

|

Office equipment

|

260,677 | 253,451 | ||||||

|

Accumulated depreciation

|

(189,762 | ) | (146,668 | ) | ||||

| $ | 70,915 | $ | 106,783 | |||||

Depreciation expense for the nine months ended September 30, 2011 and 2010 was $38,450 and $35,655, respectively.

Depreciation expense for the three months ended September 30, 2011 and 2010 was $12,970 and $12,245, respectively.

Long-Lived Assets

The Property, Plant and Equipment Topic of the Codification addresses financial accounting and reporting for the impairment or disposal of long-lived assets and supersedes previous accounting guidance, “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed Of,” and “Reporting the Results of Operations for a Disposal of a Segment of a Business.” The Company periodically evaluates the carrying value of long-lived assets to be held and used, which requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair market values are reduced for the cost of disposal. Based on its review, the Company believes that, as of September 30, 2011 and December 31, 2010, there were no impairments of its long-lived assets.

Fair Value of Financial Instruments

The Financial Instrument Topic of the Codification requires that the Company disclose estimated fair values of financial instruments. The carrying amounts reported in the balance sheets for current assets and current liabilities qualifying as financial instruments are a reasonable estimate of fair value.

F-9

CHINA CEETOP.COM, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Revenue Recognition

The Company’s revenue recognition policies are in compliance with SEC Staff Accounting bulletin (“SAB”) 104 (codified in FASB ASC Topic 605). Sales revenue is recognized at the completion of delivery to customers when a formal arrangement exists, the price is fixed or determinable, no other significant obligations of the Company exist and collectability is reasonably assured at the date of completion of delivery. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as unearned revenue.

Advertising

Advertising expenses consist primarily of costs of promotion for corporate image and product marketing and costs of direct advertising. The Company expenses all advertising costs as incurred. For the nine months ended September, 2011 and 2010, the Company incurred advertising expenses of $Nil and $44,179 respectively. For the three months ended September 30, 2011 and 2010, the Company incurred advertising expenses of $Nil and $1,165 respectively.

Shipping and Handling costs

Shipping and handling costs consist primarily of freight charges and packaging charges for delivery of goods to the customers and are included in selling, general and administrative expenses. The Company expenses all shipping and handling costs when they are incurred. For the nine months ended September 30, 2011 and 2010, the Company incurred freight charges of $90,168 and $103,846 respectively, and packaging charges of $2,772 and $19,227 respectively. For the three months ended September 30, 2011 and 2010, the Company incurred freight charges of $30,992 and $35,154 respectively and packaging charges of $2,772 and $4,765, respectively.

Income Taxes

The Company utilizes the accounting standards (“SFAS”) No. 109, “Accounting for Income Taxes,” codified in Financial Accounting Standard Board Accounting Standards Codification (“ASC”) Topic 740 which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, (“FIN 48”), codified in FASB ASC Topic 740. When tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits are classified as interest expense and penalties are classified in selling, general and administrative expenses in the statements of income. The adoption of FIN 48 did not have a material impact on the Company’s financial statements. At September 30, 2011 and December 31, 2010, the Company did not take any uncertain positions that would necessitate recording a tax related liability.

F-10

CHINA CEETOP.COM, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Statement of Cash Flows

In accordance with SFAS 95 “Statement of Cash Flows”, codified in FASB ASC Topic 230, cash flows from the Company’s operations are based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Basic and Diluted Earnings per Share

Earnings per share are calculated in accordance with FASB ASC Topic 260, “Earnings per Share”. Basic earnings per share is based upon the weighted average number of common shares and preferred shares outstanding. Preferred shares are included in the denominator of basic earnings per share because preferred shares participate with common shares in the earnings and dividends of the Company on a one-for-one basis. Diluted earnings per share is based on the assumption that all dilutive convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

Share-Based payment

Share-based payment is accounted for based on the FASB Statement No. 123R, “Share-Based Payment, an Amendment of FASB Statement No. 123” (“FAS No. 123R”) and Emerging Issue Task Force 96-18, “Accounting for Equity Instruments that are Issued to Other than Employees for Acquiring, or in Conjunction with Selling, Goods or Services” (“EITF 96-18”) and Emerging Issue Task Force 00-18 “Accounting Recognition for Certain Transactions involving Equity Instruments Granted to Other Than Employees” (“EITF 00-18”) (codified in FASB ASC Topic 505-50). The Company recognized in the statement of income and comprehensive income the fair value of shares, stock options and other equity-based compensation issued to non-employees when the service provided by non-employees is completed, or the date when the shares were issued (provided that the shares issued are fully vested and not subject to forfeiture) with the prepaid services presented as contra equity. This is in accordance with the consensus reached in EITF 00-18 that in the event that a note or receivable is acquired in exchange for the fully vested, non-forfeitable equity instruments, the note or receivable should be displayed as contra-equity by the granter. The Company as granter interprets that the term “receivable” also embraces prepaid service fees. For employees, the Company recognized in the statement of income and comprehensive income the grant date of the shares, stock options and other equity-based compensation over the requisite service period.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk are cash, accounts receivable and other receivables arising from its normal business activities. The Company places its cash in what it believes to be credit-worthy financial institutions. The Company has diversified customer base. Majority of sales are either cash receipt in advance or cash receipt upon delivery. During the nine months and three months ended September 30, 2011 and 2010, no customers accounted for more than 10% of net revenue. As of September 30, 2011 and December 31, 2010, no customers accounted for more than 10% of net accounts receivable. For those credit sales, the Company routinely assesses the financial strength of its customers and, based upon factors surrounding the credit risk, establishes an allowance, if required, for uncollectible accounts and, as a consequence, believes that its accounts receivable credit risk exposure beyond such allowance is limited.

F-11

CHINA CEETOP.COM, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Recent Accounting Pronouncements

In May 2011, the FASB issued ASU No. 2011-04, Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs, which amends the current fair value measurement and disclosure guidance of ASC Topic 820, Fair Value Measurement, to include increased transparency around valuation inputs and investment categorization. The guidance provided in ASU No. 2011-04 is effective prospectively for interim and annual periods beginning after December 15, 2011. The Company does not expect the adoption of these provisions to have a material impact on its consolidated statements of income and balance sheets.

In June 2011, the FASB issued ASU No. 2011-05, Comprehensive Income (Topic 220)—Presentation of Comprehensive Income (ASU 2011-05). ASU 2011-05 eliminates the option to present the components of other comprehensive income as part of the statement of changes in stockholders’ equity. Instead, ASU 2011-05 requires entities to report all non-owner changes in stockholders’ equity in either a single continuous statement of comprehensive income, or in two separate, but consecutive statements. ASU 2011-05 does not change the items that must be reported in other comprehensive income, or when an item must be reclassified to net income. ASU 2011-05 requires retrospective application and is effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. Other than the presentational changes that will be required by ASU 2011-05, the adoption of ASU 2011-05 is not expected to have any impact on its consolidated financial statements.

In September 2011, the FASB has issued ASU No. 2011-08, Intangibles—Goodwill and Other (Topic 350): Testing Goodwill for Impairment. ASU 2011-08 is intended to simplify how entities, both public and nonpublic, test goodwill for impairment. ASU 2011-08 permits an entity to first assess qualitative factors to determine whether it is “more likely than not” that the fair value of a reporting unit is less than its carrying amount as a basis for determining whether it is necessary to perform the two-step goodwill impairment test described in Topic 350, Intangibles-Goodwill and Other. The more-likely-than-not threshold is defined as having a likelihood of more than 50%. ASU 2011-08 is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. The Company has not yet determined the impact of the adoption of ASU 2011-08 on its consolidated financial statements.

F-12

CHINA CEETOP.COM, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 3 - INCOME TAXES

The Company operates in more than one jurisdiction with the main operations conducted in PRC and no activities in USA with complex regulatory environments subject to different interpretations by the taxpayer and the respective governmental taxing authorities. The Company evaluates its tax positions and establishes liabilities, if required.

Pursuant to the PRC Income Tax Laws, the Enterprise Income Tax (“EIT”) through December 31, 2007 is at a statutory rate of 33%, which is comprised of 30% national income tax and 3% local income tax. From January 1, 2008 onwards, the EIT is at a statutory rate of 25%.

Uncertain Tax Positions

Interest associated with unrecognized tax benefits are classified as income tax and penalties in selling, general and administrative expenses in the statements of operations. For the nine months and three months ended September 30, 2011 and 2010, the Company had no related interest and penalties expenses. Currently, the Company is not subject to examination by major tax jurisdictions, but the tax authority in PRC has the right to examine the Company’s tax position in all past years.

The deferred tax asset not recognized is as follows:

|

09/30/2011

|

12/31/2010

|

|||||||

|

Unused tax loss brought forward

|

2,671,128 | $ | 1,074,541 | |||||

|

Unused tax loss for the period/year

|

1,078,228 | 1,596,587 | ||||||

|

Unused tax loss carried forward

|

$ | 3,749,356 | $ | 2,671,128 | ||||

|

Unrecognized deferred tax asset brought forward

|

667,782 | 268,635 | ||||||

|

Unrecognized deferred tax asset for the period/year

(at PRC tax rate of 25%)

|

269,557 | 399,147 | ||||||

|

Unrecognized deferred tax asset carried forward

|

$ | 937,339 | $ | 667,782 | ||||

The Company has not recognized deferred tax asset in respect of PRC tax loss in these Consolidated Financial Statements as it is not more-likely-than-not that the future taxable profit against which loss can be utilized will be available to the entities operating in PRC. The unrecognized tax loss as of December 31, 2010 that will be expiring in 2013, 2014 and 2015 are respectively $426,068, $648,473 and $1,596,587. The unrecognized tax loss incurred for nine months ended September 30, 2011 of $1,078,228 (on top of the amount of unrecognized tax loss to December 31, 2010) will expire in 2016.

Note 4 - AMOUNT DUE FROM RELATED PARITES

As of December 31, 2010, the amount due from related parties was $50,000, it was unsecured interest free and was repayable on demand. There was no amount due from related parties at September 30, 2011.

Note 5 - COMMON STOCK AND PREFERRED STOCK

The Company is authorized to issue up to 200,000,000 shares of common stock of par value of $0.001 per share and 3,558,046 shares of Series A preferred stock of par value of $0.001 per share. As detailed in Note 1 above, on January 27, 2011, the Company effected a reverse stock split such that the number of all existing issue shares were reduced from 19,900,100 to 866,636 (equivalent to US$867) on a 23 to 1 basis. At the same time, pursuant to the Share Exchange Agreement, Surry became a wholly-owned subsidiary of the Company through issuance of 28,496,427 shares of common stock of par value of $0.001 per share and 3,558,046 shares of Series A preferred stock of par value of $0.001 per share.

For accounting purpose, this transaction was treated as reverse acquisition and the Company’s equity accounts at December 31, 2010 prior to the acquisition are restated based on the ratio of the exchange of 28,496,427 shares of common stock of the Company for 44,450 shares of common stock of Surry and exchange of 3,558,046 shares of preferred stock of the Company for 5,550 shares of preferred stock of Surry. As the par value of the capital stock of the Company and Surry are $0.001 and $1 respectively, the difference in capital of $17,946 arising from this reverse acquisition was reallocated to additional paid-in capital.

F-13

CHINA CEETOP.COM, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 5 - COMMON STOCK AND PREFERRED STOCK - CONTINUED

On July 12, 2011, the Company issued 2,900,000 shares of common stock to four independent parties as payments to such parties for market research and other advisory services for $899,000 (see Note 7).

As of September 30, 2011, the Company has a total of 32,263,063 shares of common stock and 3,558,046 shares of Series A Preferred Stock outstanding.

Each share of Series A Preferred Stock shall be equivalent to ten (10) shares of Common Stock and all shares of Series A Preferred Stock shall vote together with the shares of Common Stock as a single class.

Note 6 - ADDITIONAL PAID IN CAPITAL

Included in the balance of $5,811,362 as Additional Paid in Capital as of September 30, 2011, is an amount of $4,399,000 which arose from two waivers of amount due to shareholders of which a waiver of $1,465,000 took place in December, 2009 and the other waiver of $2,934,000 took place in February, 2010.

On July 21, 2011, the Company obtained a financial undertaking from a shareholder and that shareholder agreed in writing to inject funds in the amount of RMB10,000,000 (equivalent to $1,547,000) to HZ Ceetop as its working capital on or before December 31, 2011. That shareholder further agreed that such capital injection will be interest free and he waived his entitlement to and right for repayment to the capital injected. On August 8, 2011 there was a capital injection of RMB2,000,000 (equivalent to $312,412) received from that shareholder and was included in additional paid in capital of the Company.

Note 7 - SHARE BASED PAYMENTS

On July 12, 2011, the Company issued 2,900,000 shares of the Company’s common stock to Wuying Wang, Xiaoghua Jin, Lifang Yang and Qingxin Huang, four independent parties, in exchange for the market research and other advisory services pursuant to the terms of four consultancy agreements dated May 6, 2011, June 15, 2011, April 3, 2011 and May 5, 2011 respectively (“Consultancy Agreements”) (see Note 5). The shares were fully vested and not subject to forfeiture when issued. The fair value of the shares issued was $0.31 per share and the total fair value of the shares issued was $899,000. The fair value of the shares issued was based on the quoted market price of the Company’s shares as of July 12, 2011. The total fair value of the shares issued is recognized as a share-based payment expense over the period from date of the Consultancy Agreements to the date the consultancy services are completed. The consultancy services are to be performed for two to three years. For the three months and nine months ended September 30, 2011 the Company amortized $118,817 and $118,817 respectively as share-based payment expense. The unrecognized share-based payment expense of $780,183 as of September 30, 2011 will be amortized up to July 2014. There is no tax benefit related to the share-based payment expense recognized.

Note 8 – STATUTORY RESERVE

In accordance with the laws and regulations of the PRC, a wholly-owned Foreign Invested Enterprise’s income, after the payment of the PRC income taxes, shall be allocated to the statutory reserves. The allocation is 10 percent of the net income and the cumulative allocations are not to exceed 50 percent of the registered capital. However, the laws do not prohibit enterprises allocate net income to this reserve after the limit of 50 per cent of registered capital has been reached. These reserves are not transferable to the Company in the form of cash dividends, loans or advances. These reserves are therefore not available for distribution except in liquidation. As of September 30, 2011 and December 31, 2010, the Company has not been allocated to these non-distributable reserve funds due to loss sustained in both years.

F-14

CHINA CEETOP.COM, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

(UNAUDITED)

Note 9 – ACCUMULATED OTHER COMPREHENSIVE INCOME/(LOSS)

Balances and movements of accumulated other comprehensive income/(loss), included in stockholders’ equity, at September 30, 2011 and December 31, 2010, are as follows:

|

Foreign Currency Translation Adjustment

|

Accumulated Other Comprehensive Income/(Loss)

|

|||||||

|

Balance at December 31, 2009

|

$ | (24,591 | ) | $ | (24,591 | ) | ||

|

Change for 2010

|

77,611 | 77,611 | ||||||

|

Balance at December 31, 2010

|

53,020 | 53,020 | ||||||

|

Change for 2011 Q1

|

11,542 | 11,542 | ||||||

|

Balance at March 31, 2011

|

64,562 | 64,562 | ||||||

|

Change for 2011 Q2

|

20,563 | 20,563 | ||||||

|

Balance at June 30, 2011

|

85,125 | 85,125 | ||||||

|

Change for 2011 Q3

|

11,909 | 11,909 | ||||||

|

Balance at September 30, 2011

|

$ | 97,034 | $ | 97,034 | ||||

Note 10 - CURRENT VULNERABILITY DUE TO CERTAIN RISK FACTORS

The Company’s operations are carried out in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, by the general state of the PRC's economy. The Company’s business may be influenced by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Note 11 - LEASES

As at September 30, 2011, the Company had total future aggregate minimum lease payments under non-cancellable operating leases as follows:

|

09/30/2011

|

||||

|

Within 1 year

|

$ | 32,247 | ||

|

In the second year

|

49,759 | |||

|

In the third year

|

- | |||

| $ | 82,006 | |||

As at September 30, 2011, the Company has three offices situated in Hangzhou and Shenzhen, PRC, respectively. The operating leases for these three offices provide for monthly rental payments of $1,868, $708 and $1,503 that are expiring in January, 2012, September, 2012 and June, 2014 respectively. In respect of these three leases, the Company paid rental expenses of $40,026 and $37,932 for the nine months ended September 30, 2011 and 2010 respectively. For the three months ended September 30, 2011 and 2010, the Company paid rental expenses of $15,252 and $14,200 respectively.

Note 12 – SUBSEQUENT EVENTS

For the nine months ended September 31, 2011, the Company has evaluated subsequent events for potential recognition and disclosure. No significant events occurred subsequent to the balance sheet date but prior to the filing of this report that would have a material impact on our consolidated financial statements.

F-15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Description of Business

Overview

China Ceetop.com, Inc., an Oregon-registered corporation, is a leading Business-to-Consumer (“B2C”) e-commerce company. We own and operate the online platform: www.ceetop.com. We are committed to offering excellent online shopping experience, rapid delivery and outstanding customer service.

We mainly focus on selling Computers/Communications/Consumer (“3C”) products online and providing a trading information platform for both buyers and sellers as software as a service (“SaaS”). We carry a wide range of products in assorted categories, including mainstream digital products, home appliances, kitchen appliances, personal care, and lifestyle products, etc. under well-known international and Chinese brands.

Our website (www.Ceetop.com) adopts an initiative B2C mode: Compared with traditional operations, we connect directly with high-end channels in the 3C industry and thus lower the cost in many aspects. Meanwhile, we significantly reduce our delivery expense by close cooperation with leading third party logistic companies. All of these contribute to our pricing system.

We are headquartered in Shenzhen, China. We also maintain an operating office located in Hangzhou, China. We believe that our main competitive advantages include brand recognition, product selection, personalized service, low price, after-sale services, high quality search tools and delivery efficiency. We have expanded and become one of the top domestic and international online stores for 3C products.

Organization History

Organizational History of China Ceetop.com, Inc

China Ceetop.com, Inc. was incorporated in Oregon on February 18, 2003 under the name of GL Gold Inc. On June 6, 2003 the Company filed an amendment with the State of Oregon changing its name to Oregon Gold, Inc. On January 7, 2011 Oregon Gold Inc. changed its name to China Ceetop.com, Inc. On January 27, 2011, the Company became the holding company of Surry Holding Limited (“Surry”) through a reverse acquisition. The Company acquired all of the issued and outstanding capital stock of Surry pursuant to the share exchange agreement dated December 30, 2010 by and among Surry, the Company and the shareholders of the Company (the “Share Exchange Agreement”). At the same time, the Company effected a reverse stock split such that the number of all existing issued shares were reduced from 19,900,100 to 866,636 on a 23 to 1 basis. Pursuant to the Share Exchange Agreement, the Company acquired 100% of the capital stock and ownership interests of Surry in exchange for 28,496,427 newly-issued shares of the Company’s common stock and 3,558,046 newly issued shares of the Company’s series A preferred stock.

The original principal activities of the Company were engaged in the identification, acquisition, exploration and development of mining prospects believed to have gold mineralization. The Company ceased this business during the year.

Organizational History of Surry

Surry was incorporated in the British Virgin Islands on September 18, 2009. Surry owns 100% of the outstanding securities of Westow Technology Limited (“Westow”), a company incorporated in the British Virgin Islands. Surry’s subsidiaries are engaged in the operation of an online platform for sales of 3C products in the PRC by way of the website www.ceetop.com. Pursuant to a transaction completed on February 28, 2010, the Company holds 100% of Westow.

Organizational History of Westow

Westow was incorporated on September 7, 2009, and owns 100% of the outstanding securities of Shenzhen Ceetop Network Technology Co., Limited, a company incorporated in Shenzhen, PRC.

1

Organizational History of Shenzhen Ceetop Network Technology Co., Limited and Hangzhou Ceetop Network Technology Co.

HZ Ceetop Network Technology Co., Ltd. (“HZ Ceetop”) was incorporated in October 31, 2006 and Shenzhen Ceetop Network Technology Co., Limited (“SZ Ceetop”) was incorporated as a wholly foreign-owned enterprise in August, 2009 under the laws of the PRC. SZ Ceetop owns a 100% of the outstanding securities of HZ Ceetop.

Corporate Organization

The address for each entity is set forth below:

|

Name

|

Address

|

|

China Ceetop.com, Inc

|

A2803, Lianhe Guangchang, 5022 Binhe Dadao, Futian District, Shenzhen, China

|

|

Surry Holdings Limited

|

P.O. Box 957, Offshore Incorporations Centre, Road Town, Tortola, British Virgin Islands

|

|

Westow Technology Limited

|

P.O. Box 957, Offshore Incorporations Centre, Road Town, Tortola, British Virgin Islands

|

|

Shenzhen Ceetop Network Technology Co. Ltd (headquarters)

|

2803, Lianhe Guangchang A, 5022 Binhe Dadao, Futian District, Shenzhen, China,518033

Telephone: 0755-33366628

|

|

Hangzhou Ceetop Network Technology Co. Ltd

|

501 A Yuanhua Wangzuo Center, 65 Xintang Road, Hangzhou, China, 310020

Telephone: +86-0571-86632800

|

Comparison of Three Months Ended September 30, 2011 and 2010

The following table sets forth the results of our operations for the three months ended September 30, 2011 and 2010 indicated in U.S. dollars and as a percentage of net sales:

|

Three months ended September 30,

|

||||||||||||||||

|

2011

|

2010

|

|||||||||||||||

|

US Dollars

|

Percentage

|

US Dollars

|

Percentage

|

|||||||||||||

|

Sales, net

|

$

|

3,214,882

|

100.00

|

%

|

$

|

2,837,594

|

100.0

|

%

|

||||||||

|

Cost of sales

|

(3,057,157

|

)

|

95.1

|

%

|

(2,665,995

|

)

|

94

|

%

|

||||||||

|

Gross profit

|

157,725

|

4.9

|

%

|

171,599

|

6

|

%

|

||||||||||

|

Selling, general and administrative expenses

|

(629,000

|

)

|

19.5

|

%

|

(668,464

|

)

|

23.6

|

%

|

||||||||

|

Loss from operations

|

(471,275

|

)

|

14.6

|

%

|

(497,047

|

)

|

17.5

|

%

|

||||||||

|

Net (loss)

|

$

|

(468,306

|

)

|

14.5

|

%

|

$

|

(491,639

|

)

|

17.3

|

%

|

||||||

Net Sales

For the three months ended September 30, 2011, our net sales increased to $3,214,882 from $2,837,594 for the three months ended September 30, 2010, representing a 13.3% increase. This increase in net sales was due to the increase in sales of high value products, such as notebooks, digital cameras, and mobile phones during the three months ended September 30, 2011. The Company received financial backing from a major shareholder of $1,547,000 in July 2011 of which $312,412 was injected to the Company for working capital requirements on August 8, 2011.

Cost of Sales

For the three months ended September 30, 2011, our cost of sales increased to $3,057,157 from $2,665,995 compared with the three months ended September 30, 2010, representing a 14.7% increase. This increase in cost of sales was mainly due to the increase in sales.

2

Gross Profit

For the three months ended September 30, 2011, our gross profit decreased to $157,725 from $171,599 for the three months ended September 30, 2010, representing a 8.1% decrease. Our gross profit ratio decreased to 4.9% for the three months ended September 30, 2011 from 6% for the three months ended September 30, 2010. This decrease in gross profit ratio was mainly due to the increase in purchase costs of the products while the selling prices remained unchanged for the three months ended September 30, 2011.

Selling, General and Administrative Expenses

Our selling, general and administrative expenses decreased to $629,000 for the three months ended September 30, 2011 from $668,464 for the three months ended September 30, 2010, representing a 5.9% decrease. This decrease was mainly due to the strengthened cost controls implemented by management.

Net loss

Our net loss decreased to $468,306 for the three months ended September 30, 2011 from $491,639 for the three months ended September 30, 2010, representing a 4.7% decrease. This decrease was mainly due to the increase in net sales and decrease in selling, general and administrative expenses.

Comparison of Nine Months Ended September 30, 2011 and 2010

The following table sets forth the results of our operations for the nine months ended September 30, 2011 and 2010 indicated in U.S. dollars and as a percentage of net sales:

|

Nine months ended September 30,

|

||||||||||||||||

|

2011

|

2010

|

|||||||||||||||

|

US Dollars

|

Percentage

|

US Dollars

|

Percentage

|

|||||||||||||

|

Sales, net

|

$

|

10,402,375

|

100.00

|

%

|

$

|

12,198,665

|

100.0

|

%

|

||||||||

|

Cost of sales

|

(9,831,223

|

)

|

94.5

|

%

|

(11,742,660

|

)

|

96.3

|

%

|

||||||||

|

Gross profit

|

571,152

|

5.5

|

%

|

456,005

|

3.7

|

%

|

||||||||||

|

Selling, general and administrative expenses

|

(1,776,441

|

)

|

17.1

|

%

|

(1,662,225

|

)

|

13.6

|

%

|

||||||||

|

Loss from operations

|

(1,205,289

|

)

|

11.6

|

%

|

(1,206,220

|

)

|

9.9

|

%

|

||||||||

|

Net (loss)

|

$

|

(1,197,045

|

)

|

11.5

|

%

|

$

|

(1,197,642

|

)

|

9.8

|

%

|

||||||

Net Sales

For the nine months ended September 30, 2011 and 2010, the Company's sales decreased $1,796,290 or 14.7%. During the nine months ended September 30, 2011 we realized lower sales in relation to the same period in 2010, due to a large discount campaign performed in January 2010. During that campaign, the Company offered large discounts as a market strategy to build up the Company name in the competitive e-commerce market. After the campaign, our net sales returned to a normal level.

Cost of Sales

For the nine months ended September 30, 2011, our cost of sales decreased to $9,831,223 from $11,742,660 compared with the nine months ended September 30, 2010, representing a 16.3% decrease. This decrease in cost of sales was mainly due to the decrease in sales.

3

Gross Profit

For the nine months ended September 30, 2011, our gross profit increased to $571,152 from $456,005 for the nine months ended September 30, 2010, representing a 25.3% increase. Our gross profit ratio increased to 5.5% for the nine months ended September 30, 2011 from 3.7% for the nine months ended September 30, 2011. This increase in gross profit ratio was mainly due to strengthened cost control by management for the nine months ended September 30, 2011, and the campaign held in January 2010 that provided large discounts to customers, resulting in a deteriorating effect to the gross profit ratio for the nine months ended September 30, 2010.

Selling, General and Administrative Expenses

Our selling, general and administrative expenses grew to $1,776,441 for the nine months ended September 30, 2011 from $1,662,225 for the nine months ended September 30, 2010, representing a 6.9% increase. This increase was mainly due to the increase in staff salaries.

Net Loss

Our net loss decreased to $1,197,045 for the nine months ended September 30, 2011 from $1,197,642 for the nine months ended September 30, 2010, representing a 0.05% decrease. This decrease was mainly due to the decrease in cost of sales.

Liquidity and Capital Resources

As of September 30, 2011 and September 30, 2010, we had cash and cash equivalents of $1,612,390 and $2,781,743, respectively, primarily consisting of cash on hand and demand deposits. To date, we have financed our operations primarily through cash flows from operations and capital contributions by our shareholders.

The following is a summary of cash provided by or used in each of the indicated types of activities during the nine months ended September 30, 2011 and 2010:

|

|

Nine months ended

September 31,

|

|

||||||

|

2011

|

2010

|

|||||||

|

Net cash (used in) operating activities

|

$

|

(1,462,787

|

)

|

$

|

(1,661,701

|

)

|

||

|

Net cash (used in) investing activities

|

-

|

(2,649

|

)

|

|||||

|

Net cash provided by financing activities

|

362,583

|

2,934,000

|

||||||

|

Effect of exchange rate change on cash and cash equivalents

|

41,432

|

27,101

|

||||||

|

Net (decrease)/increase in cash and cash equivalents

|

(1,058,772

|

)

|

1,296,751

|

|||||

|

Cash and cash equivalents at beginning of period

|

2,671,162

|

1,484,992

|

||||||

|

Cash and cash equivalents at end period

|

$

|

1,612,390

|

$

|

2,781,743

|

||||

Operating activities

Net cash used in operating activities was $1,462,787 for the nine months ended September 30, 2011, as compared to net cash used in operating activities of $1,661,701 for the nine months ended September 30, 2010. The net cash used in operating activities for the nine months ended September 30, 2011 consisted of the net loss of $1,197,045, adjustments for non-cash activities of $158,149, decrease in changes in accounts receivable of $174,983, increase in changes in other receivable, deposits and prepayment of $78,119, decrease in changes in inventories of $80,766, the increase from amount due from related parties of $50,000, the decrease in changes in accounts payable of $264,298 and the decrease in changes in accrued expense and other payable of $31,963.

Investing activities

No cash was used in investing activities for the nine months ended September 30, 2011, as compared to $2,694 net cash used in investing activities for the nine months ended September 30, 2010. The change in net cash used in investing activities for the nine months ended September 30, 2011, as compared to the same period in last year, was due to no purchase of property, plant and equipment for the nine months ended September 30, 2011.

Financing activities

Net cash provided by financing activities for the nine months ended September 30, 2011 was $362,583, as compared to $2,934,000 net cash provided by financing activities for the nine months ended September 30, 2010. Net cash provided by financing activities for the nine months ended September 30, 2011 was attributable to cash received from the Company’s merger with Surry of $50,171, and capital injection from a shareholder of $312,412, while net cash provided by financing activities for the nine months ended September 30, 2010 was attributable to capital injection from four former shareholders of SZ Ceetop prior to the reverse acquisition took place on January 27, 2011.

4

Notwithstanding the foregoing, we incurred a loss of $1,197,045 for the nine months ended September 30, 2011 and had sustained accumulated losses of $3,868,173 as of September 30, 2011, as a result of continued financial support from shareholders. We have net equity of $1,295,861 as at September 30, 2011.

We have been implementing the following measures in order to improve our financial position in the next one to two quarters (there is no guarantee that any or all of the foregoing will occur):

|

(i)

|

we have been implementing various strategies to enhance our sales and reduce our costs; and

|

|

(ii)

|

we have been negotiating with a commercial bank in PRC for short-term bank loan facility.

|

In addition, on July 21, 2011, we obtained a financial undertaking from a major shareholder, Mr. Guoxing Wang agreed in writing to inject funds in the amount of RMB 10,000,000 (equivalent to $1,547,000) to HZ Ceetop as its working capital on or before December 31, 2011. Mr. Wang further agreed that such capital injection will be interest free and he waived his entitlement to and right for repayment to the capital injected. On August 8, 2011, RMB2,000,000 (equivalent to $312,412) was injected into HZ Ceetop.

Off-Balance Sheet Arrangements

We have never entered into any off-balance sheet arrangements and have never established any special purpose entities. We have not guaranteed any debt or commitments of other entities or entered into any options on non-financial assets.

ITEM 3. Quantitative and Qualitative Disclosures about Market Risk

As a smaller reporting company, we are not required to provide the information required by this Item.

ITEM 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in the Company’s reports filed or submitted under the Securities Exchange Act of 1934 (the “Exchange Act”) is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in the Company’s reports filed under the Exchange Act is accumulated and communicated to management, including the Company’s Chief Executive Officer and Chief Financial Officer (the “Certifying Officers”), as appropriate to allow timely decisions regarding required disclosure.

As required by Rules 13a-15 and 15d-15 under the Exchange Act, the Certifying Officers carried out an evaluation of the effectiveness of the design and operation of the Company’s disclosure controls and procedures as of March 31, 2011. Their evaluation was carried out with the participation of the Company’s management. Based upon their evaluation, the Certifying Officers concluded that the Company’s disclosure controls and procedures were not effective.

Changes in Internal Control Over Financial Reporting

There has been no change in the Company’s internal control over financial reporting that occurred in the quarter ended September 30, 2011, that has materially affected, or is reasonably likely to affect, the Company’s internal control over financial reporting.

5

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

Neither the Company nor its property is a party to any pending legal proceeding.

Item 1A. Risk Factors

Smaller reporting companies are not required to provide disclosure pursuant to this Item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None

Item 4. Removed and Reserved

None

Item 5. Other Information

None

Item 6. Exhibits

None

|

Exhibit Number

|

Name of Exhibit

|

|

31.1

|

Certification of Chief Executive Officer, pursuant to Rule 13a-14(a) of the Exchange Act, as enacted by Section 302 of the Sarbanes-Oxley Act of 2002.(1)

|

|

31.2

|

Certification of Chief Financial Officer, pursuant to Rule 13a-14(a) of the Exchange Act, as enacted by Section 302 of the Sarbanes-Oxley Act of 2002.(1)

|

|

32.1

|

Certification of Chief Executive Officer and Chief Financial Officer, pursuant to 18 United States Code Section 1350, as enacted by Section 906 of the Sarbanes-Oxley Act of 2002. (1)

|

|

101**

|

The following materials from the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2011 formatted in XBRL (Extensible Business Reporting Language): (i) the Condensed Consolidated Balance Sheets, (ii) the Condensed Consolidated Statements of Income, (iii) the Condensed Consolidated Statements of Stockholders’ Equity, (iv) the Condensed Consolidated Statements of Cash Flows and (v) the Notes to Condensed Consolidated Financial Statements, tagged as blocks of text. (2)

|

(1) Filed herewith

(2) Users of this data are advised that pursuant to Rule 406T of Regulation S-T, this XBRL information is being furnished and not filed herewith for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and Sections 11 or 12 of the Securities Act of 1933, as amended, and is not to be incorporated by reference into any filing, or part of any registration statement or prospectus, of China Ceetop.com, Inc., whether made before or after the date hereof, regardless of any general incorporation language in such filing.

6

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report on Form 10-Q to be signed on its behalf by the undersigned, thereunto duly authorized.

|

CHINA CEETOP.COM, INC.

|

|||

|

(Registrant)

|

|||