Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOME BANCSHARES INC | d257639d8k.htm |

| EX-2.1 - PURCHASE AND ASSUMPTION AGREEMENT - HOME BANCSHARES INC | d257639dex21.htm |

| EX-99.1 - PRESS RELEASE - HOME BANCSHARES INC | d257639dex991.htm |

Exhibit 99.2 |

Transaction

Overview •

Purchased and assumed select assets and liabilities of Vision

Bank from Park National Corporation

–

All non-performing loans and OREO are excluded

from the

transaction

•

Acquired approximately $378.6 million in performing loans &

assumed approximately $535.0 million in deposits

•

Acquired branches will operate as Centennial Bank, a wholly-

owned subsidiary of Home BancShares, Inc. |

Strategic

Opportunity •

Additive to current Panhandle footprint & expands into

Alabama

–

Complements 2010 Panhandle transactions

•

Coastal Community / Bayside Savings / Wakulla Bank/ Gulf State Bank

–

Both Florida & Alabama communities are popular long-time

vacation destinations for many Arkansans

–

Strong military presence along this Gulf Coast footprint,

similar to central Arkansas

•

Financially compelling transaction –

immediately accretive to:

–

Net income

–

Earnings per share

•

Leverages a portion of our excess capital |

Pro-Forma

Capital Ratios Ratio

Post

Acquisition

Benchmark

TCE

9.3%

7.0%

Leverage

10.2%

5.0%

Tier 1

12.8%

6.0%

Total RBC

14.1%

10.0%

Note: Post-acquisition values are approximate assuming 1/1/2012 closing date

|

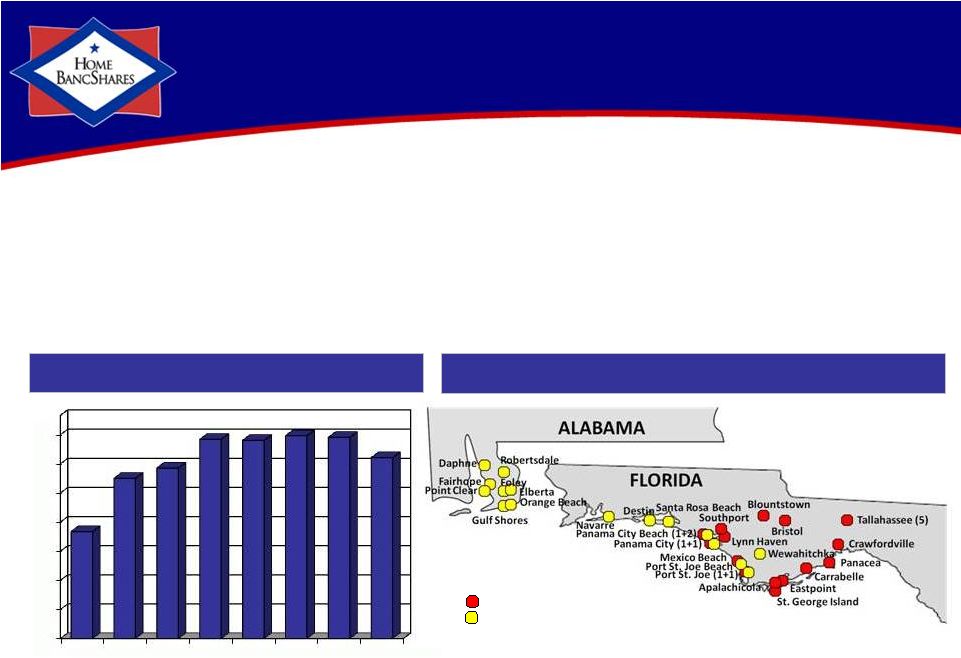

Overview of

Vision Bank •

17 full service locations spanning from Mobile, Alabama to

Port St. Joe, Florida

•

Core funded franchise with top 5 aggregate market share

across its counties of operation

(1)

Core Deposits ($mm)

Source: Core deposits defined as total deposits less time deposits greater than

$100K Note: MRQ as of 9/30/11 ; Shown as Vision Bank of FL & Vision Bank of AL

(’04YE-’06YE); Shown as Vision Bank of FL (’07YE-MRQ) (1)Vision

Bank counties of operation include: Baldwin, AL; Bay, Gulf, Okaloosa, Santa Rosa & Walton, FL

Acquired Vision Bank Branches

Existing Branches

Pro Forma Gulf Coast Branch Network

$60

$120

$180

$240

$300

$360

$420

$480

'04YE

'05YE

'06YE

'07YE

'08YE

'09YE

'10YE

MRQ

$280

$390

$411

$470

$468

$478

$475

$433 |

Rank

Institution

Branches

Deposits ($mm)

Deposits per

Branch ($mm)

Market Share

1

Regions Financial Corporation

51

2,779

$

54

$

16.3%

2

Wells Fargo & Company

27

1,717

64

10.1%

3

Suntrust Banks, Inc.

25

1,315

53

7.7%

Home BancShares, Inc. - Pro Forma

38

1,301

68

7.7%

4

Hancock Holding Company

34

955

34

5.6%

5

Synovus Financial Corp.

19

903

48

5.3%

6

Bank of America Corporation

17

827

49

4.9%

7

Capital City Bank Group, Inc.

20

816

41

4.8%

8

Home BancShares, Inc.

21

720

34

4.2%

9

Park National Corporation

17

581

34

3.4%

10

BB&T Corporation

13

542

42

3.2%

Home BancShares Counties of Operation in Gulf Coast Region

Gulf Coast Deposit Market Share

•

Ranked

4th

with

aggregate

market

share

of

7.7%

in

counties

of

operation

(1)(2)

–

Ranked in top three in Baldwin County in Alabama

–

Ranked in top three in Bay, Calhoun, Gulf, Franklin, Liberty & Wakulla Counties in

Florida •

Top 5 deposit market share among community banks in combined counties of operation

(1) Deposit market share as of 6/30/11

(2) For HOMB Pro-Forma counties of operation in Gulf Coast Region: Baldwin, AL; Bay,

Calhoun, Franklin, Gulf, Leon, Liberty, Okaloosa, Santa Rosa, Wakulla and Walton FL.

Deposit Market Share

(1)(2) |

Gulf Coast

Deposit Market Share Selected Markets

Branch

Count

HOMB Pro-forma

Deposits (6/30/11)

Total Deposits

in Market

Deposit Market

Share Rank

Deposit Market

Share %

Franklin County, FL

4

$171

$191

1

89.6%

Gulf County, FL

5

128

181

1

70.7

Wakulla County, FL

3

143

227

1

62.9

Calhoun County, FL

1

22

109

3

20.4

Liberty County, FL

1

13

82

2

16.4

Baldwin County, AL

8

363

3,233

3

11.3

Bay County, FL

8

283

2,560

2

11.1

Leon County, FL

5

156

4,914

10

3.2

Santa Rosa County, FL

1

12

1,237

12

1.0

Walton County, FL

1

4

752

13

0.6

(Dollars in Millions)

Source: FDIC as of 6/30/11

Home BancShares Inc. Pro-Forma |

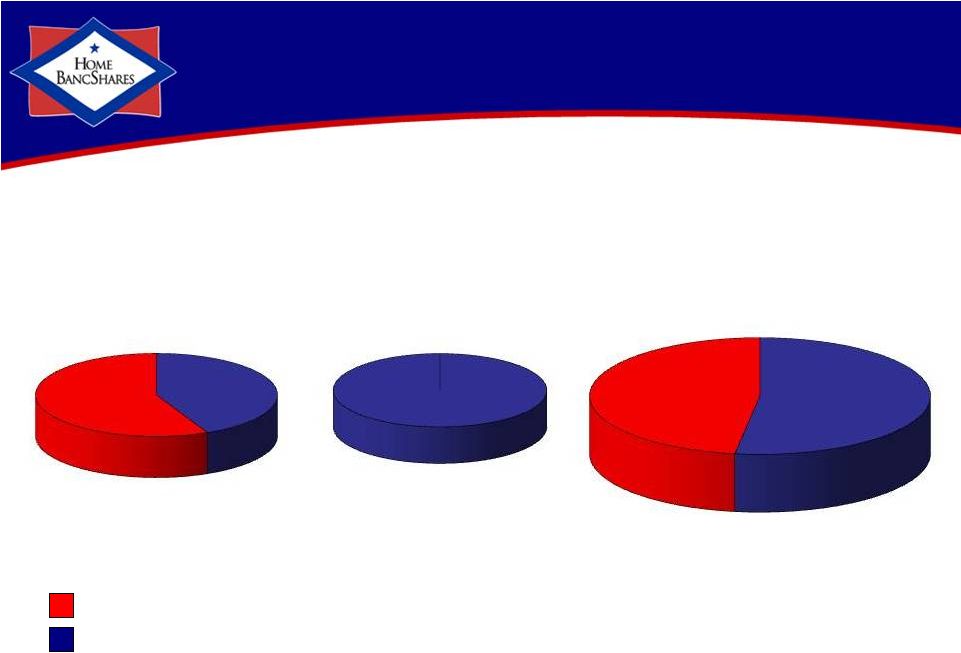

Deposit

Composition HOMB

Vision Bank

HOMB –

Pro Forma

(Dollars in Millions)

26%

49%

18%

7%

20%

14%

17%

51%

7%

Transaction Accounts

Money Market & Savings

Jumbo Time Deposits

Retail Time Deposits

7%

59%

25%

HOMB

09/30/11

Acquired

Deposits

HOMB

Pro Forma

Transaction Accounts

$

$

$

Money Market & Savings

1,423

312

1,735

Retail Time Deposits

522

73

595

Jumbo Time Deposits

739

110

849

$

2,885

$

535

$

3,420 241

201

40 |

Loan

Composition Loan Type

HOMB

(9/30/11)

Acquired

Performing

Loans

(10/31/11)

HOMB

Pro-forma

Total

% of

Pro-forma

Total Loans

Commercial RE

(Non-farm/non-residential & agri.)

$ 964

$ 123

$ 1,087

40%

Construction/Land Development

484

57

541

20%

Residential Real Estate

581

161

742

27%

Commercial & Industrial

(1)

238

33

271

10%

Consumer

41

4

45

2%

Other

30

1

31

1%

Total

$ 2,338

$ 379

$ 2,717

100%

(1)

Includes Agricultural

(Dollars in Millions) |

Total

Assets $4.2 Billion

Holding Company

(As of Acquisition Date) |

Asset

Composition HOMB

(1)

Vision Bank

HOMB –

Pro Forma

(1)

(Dollars in Millions)

Florida/Alabama Assets

Arkansas Assets

$3,295

52.4%

43.1%

56.9%

$1,570

$1,725

$1,190

Note: Acquisition values are approximate

(1) Excludes $862M of common corporate assets at the holding company.

(9/30/11)

$535

100%

$535

$2,760

47.6%

$1,570 |

Historical

Acquisitions Year

Acquired Bank

Location

Assets

($mm)

2003

Community Bank

Cabot, AR

$326

2005

Twin City Bank

North Little Rock, AR

$633

2005

Marine Bank

Marathon, FL

$258

2005

Bank of Mountain View

Mountain View, AR

$203

2008

Centennial Bank

Little Rock, AR

$234

2010

Old Southern Bank

Orlando, FL

$335

2010

Key West Bank

Key West, FL

$97

2010

Coastal Community Bank

Panama City, FL

$362

2010

Bayside Savings Bank

Port Saint Joe, FL

$63

2010

Wakulla Bank

Crawfordville, FL

$353

2010

Gulf State Community Bank

Carrabelle, FL

$112

2011

Vision Bank

Panama City, FL

$535 |

Gulf Coast

Presence Existing Branch Locations (19 Locations)

Eastpoint

Apalachicola

Carrabelle

Port St. Joe (1+1)

Lynn Haven

Panama City (1+1)

St. George Island

Panama City Beach (1+2)

Mexico Beach

Southport

Blountstown

Bristol

Tallahassee (5)

Panacea

Crawfordville

Daphne

Fairhope

Point Clear

Robertsdale

Elberta

Foley

Orange Beach

Gulf Shores

Vision Bank Acquisition (17 Locations )

Port St. Joe Beach

Navarre

Destin

Santa Rosa Beach

Wewahitchka

ALABAMA

FLORIDA |

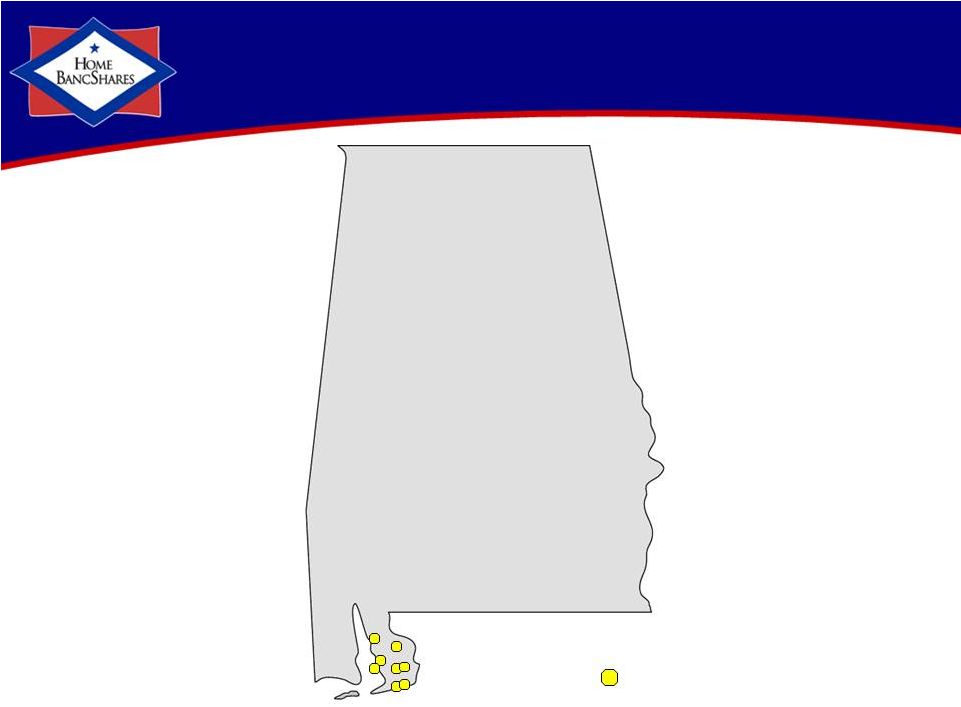

Alabama

Footprint ALABAMA

8 Branches

Vision Bank Acquisition

Foley

Daphne

Fairhope

Point Clear

Robertsdale

Elberta

Orange Beach

Gulf Shores |

FLORIDA

Port Charlotte

Punta Gorda

Marco Island

Key Largo

Islamorada

Marathon (2)

Big Pine

Key West (3)

Summerland

46 Branches

Orlando (2)

Winter Park

Longwood (2)

Clermont

Eastpoint

Apalachicola

Carrabelle

Port St. Joe

Lynn Haven

Panama City (1+1)

St. George Island

Panama City Beach (1+2)

Mexico Beach

Southport

Blountstown

Bristol

Tallahassee (5)

Panacea

Crawfordville

Navarre

Port St. Joe Beach

Wewahitchka

Destin

Santa Rosa Beach

Florida Footprint

Existing Branch Locations

Vision Bank Acquisition |

Potential

Future Opportunities Potential Opportunities Asset Size Distribution

Total Institutions: 48

Total Assets: $13.2bn

Florida

Tallahassee

Jacksonville

Orlando

Miami

Tampa

Potential Opportunity

City

Source: SNL Financial Includes

regulated depositories headquartered in Florida with assets less than $2.0 billion and Texas Ratio greater than 100% as of 9/30/2011 plus other

selected potential opportunities identified by HOMB. 0

5

10

15

20

25

< $100mm

$100mm -

$250mm

$250mm -

$750mm

$750mm -

$2B

10

21

13

4 |

Conclusion

•

Significantly enhances Florida franchise & expands to Alabama

–

Acquisition provides scale in Florida Panhandle

–

Logical extension into Alabama from existing HOMB franchise

•

Financially attractive transaction

–

Highly accretive to earnings

–

Payback period for dilution to book value and tangible book value of

approximately 4½

years

–

Premium for total deposits is 5.32%

–

Non performing loans and other real estate owned excluded

from the transaction

•

Acquisition is consistent with HOMB’s operating strategy

–

Stable core deposit base in Arkansas enhanced by higher-growth Florida markets

•

Seamless integration expected

–

HOMB has formed a dedicated team to lead the integration process

for this

Acquisition in Florida

–

Positive addition of great Vision bankers to our outstanding team of bankers along

the Gulf Coast |

Contact

Information Corporate Headquarters

Home BancShares, Inc.

719 Harkrider St., Suite 100

P.O. Box 966

Conway, AR 72033

Financial Information

Randy Mayor

Chief Financial Officer

(501) 328-4657

rmayor@homebancshares.com

Website

www.homebancshares.com |

|