Attached files

| file | filename |

|---|---|

| 8-K - ESSEX PROPERTY TRUST INC 8-K 11-16-2011 - ESSEX PROPERTY TRUST, INC. | form8k.htm |

Exhibit 99.1

Reveal (formerly Millenium at Warner Center) - Los Angeles, CA

2011 NAREIT REIT World

November 15-17, 2011

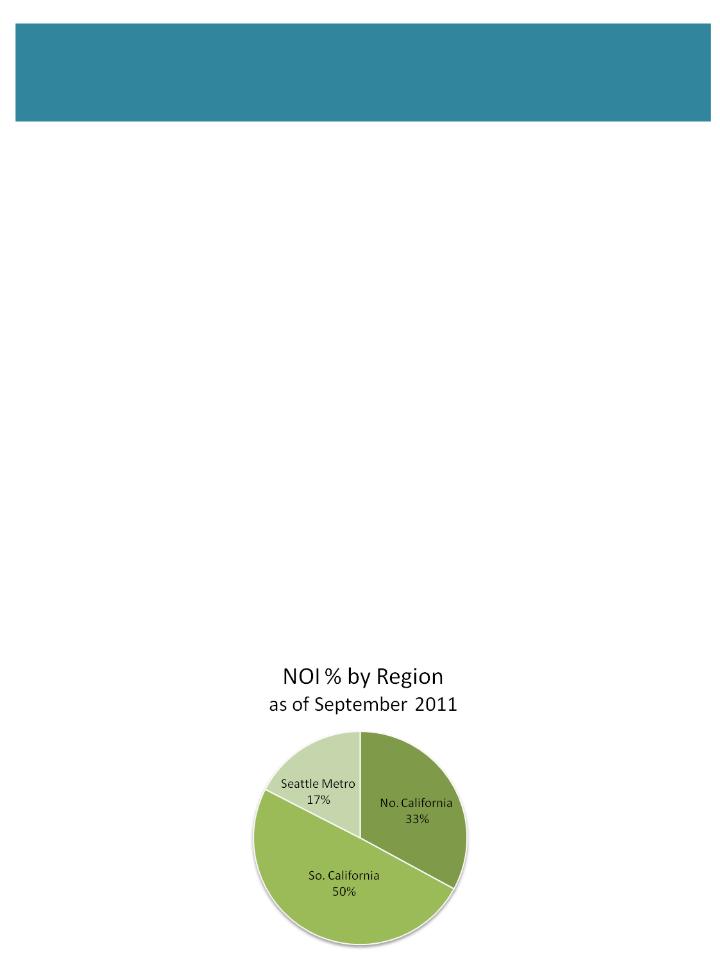

At IPO, Essex owned 16 multifamily properties (4,410 units); currently, Essex has ownership

in 155 apartment communities (32,076 units)

in 155 apartment communities (32,076 units)

§ Multifamily REIT dedicated to supply-constrained markets

- Formed in 1971

- Initial Public Offering in June 1994

• IPO stock price was $19.50 a share

• Today the stock trades around $134 per share

§ Highest total return of any REIT since IPO - 1,834% (Source: SNL Financial)

§ Cumulative Dividend paid in excess of $50 per share since IPO

§ Consistent operating philosophy through numerous market cycles

- Research-based strategy

- Rigorous underwriting leveraging real-time platform operating data

- Total return driven

§ Experienced management team - top executives have worked together for an average

tenure of 18+ years

2

About Essex Property Trust

20-34 Year Olds - Lost Fewer Jobs in 2008 -2009, recovering faster

Echo Boomers will Drive Demand with Higher Propensity to Rent

* Through September 2011

Sources: Marcus & Millichap Research Services, BLS

Multifamily Fundamental Drivers

* Source: Green Street Advisors

Major Decline in For-Sale Housing Supply

New Home Sales and Recessions

4

Easy Financing Converted

Renters to Homeowners

Residential Supply Distortion

§ West Coast recovered later, implying rent growth has greater

upside potential

§ Better than average job growth prospects, especially in

technology related industries

§ Most desirable locations due to quality of life

§ New supply remains muted, <1% annual addition to residential

stock in Essex markets

§ Demographic tailwinds of retirees and 'echo boomers‘

expected to increase renter demand

Essex expects market rents for its portfolio to increase 28% over the next 5

years.

years.

Economic Assumptions

§ Moderate U.S. GDP Growth 2.8% annual average

§ Moderate U.S. Job Growth 1.7% annual average

§ 3.5% CPI Growth

Why Essex is Maintaining the West Coast Focus?

5

Drivers of strong continued demand in Essex markets

§ California and Washington combined are the 6th largest economy in the world

§ 52% of Venture Capital spending is in our markets - key driver of growth industries & jobs

§ Incoming Echo Boomers (64 million) & quality of life factors favor the West Coast

§ Higher percentage of educated workers

The West Coast is Well-Positioned

6

California Population Trends on the Rebound

California Job Growth now outpacing US Trend

Drivers of Renter Demand - Population & Jobs

|

Source: US Census

|

|

Source: BLS

|

7

September 2009**

Most state economies are doing poorly (red = declining)

West Coast economies are recovering

The West Coast Recovery is Underway

8

Snapshots of FRB of Philadelphia Coincident Index*

* The FRB of Philadelphia publishes its monthly coincident index as an indicator of the economic health of each state

**Represents 3 month change in index

September 2011**

September Y-Y Job Growth: Selected Metros by % Growth

(000’s)

9

|

Source: BLS

|

§ Tech/ Energy based markets are leading the way

§ Positive growth spreading across the country

Strong MSA Job Growth in Essex Portfolio

Job Growth: 1.6 million jobs created in U.S. and 130,000 in Essex markets

10

Education Data for Essex Counties & State/U.S. Data

§ Essex’s tech markets have a significantly higher percentage of college

educated workers.

§ These markets should continue to lead job growth

§ Concentrated in the highest skilled California counties

|

Source: U.S. Census

|

Essex Attracts Higher Wage Renters

Job Growth by Level of Education

§ BLS Household survey indicates the number of employed up 1.24 million Year-

over-Year for September 2011 of which 978,000 were in the group Age

over-Year for September 2011 of which 978,000 were in the group Age

25+ with a College degree.

11

§ High Single-Family Prices Restrict Homeownership

§ Despite the fall in home prices since 2008, prices remain high in

supply-constrained markets

|

Source: National Association of Realtors, Dataquick, Essex

|

Homeownership is not Affordable

12

Conclusions:

§ Single family supply is low everywhere currently

§ When single family supply recovers, we expect a sharp rebound in the

non-constrained markets

§ The supply constrained coastal rental markets will have less

competition from for-sale as compared to 2003 - 2007

|

Source: U.S. Census

|

Essex Supply Risk Low

Class ‘B’ Vacancy Rates are Low in Supply- Constrained Markets

Vacancy Rate Spread by Class (selected metros)

13

* All vacancies as of 2Q 2011

Sources: Marcus & Millichap Research Services, Reis

Superior Class ‘B’ Occupancy in Essex Markets

§ To Grow FFO/share consistent with NAV Growth

§ Focus on delivering growth from operations platform

§ Target acquisitions generating (at least an) unlevered return of 9%

§ Target development generating at least 10% unlevered returns and

for unfunded commitments to represent 5-7% of total capital

§ Target redevelopment generating unlevered returns of 8-10%

§ Actively upgrade the portfolio through investment and property

sales (up to 20% of portfolio identified as being potentially for sale

over the next several years.)

Essex Intermediate Goals

14

Total Return Since IPO

*Total Return as of June 7, 1994 to November 8, 2011

Performance Record

15

Top 10 REITs by Total Return*

|

1

|

Essex Property Trust, Inc.

|

1,834

|

|

2

|

Public Storage

|

1,616

|

|

3

|

Taubman Centers, Inc.

|

1,549

|

|

4

|

AvalonBay Communities, Inc.

|

1,489

|

|

5

|

Realty Income Corporation

|

1,439

|

|

6

|

Simon Property Group, Inc.

|

1,206

|

|

7

|

Tanger Factory Outlet Centers

|

1,175

|

|

8

|

First REIT of New Jersey

|

1,132

|

|

9

|

Vornado Realty Trust

|

1,041

|

|

10

|

EastGroup Properties, Inc.

|

1,033

|

Seattle Market Review

Average Rent

as a % of

Median Household Income

(in 000’s)

Job Growth

vs.

Total Residential Supply

(% change)

Actual Job Growth by Sector:

Sept. ‘11 vs. Sept. ‘10

Source: Essex, U.S. Census, BLS

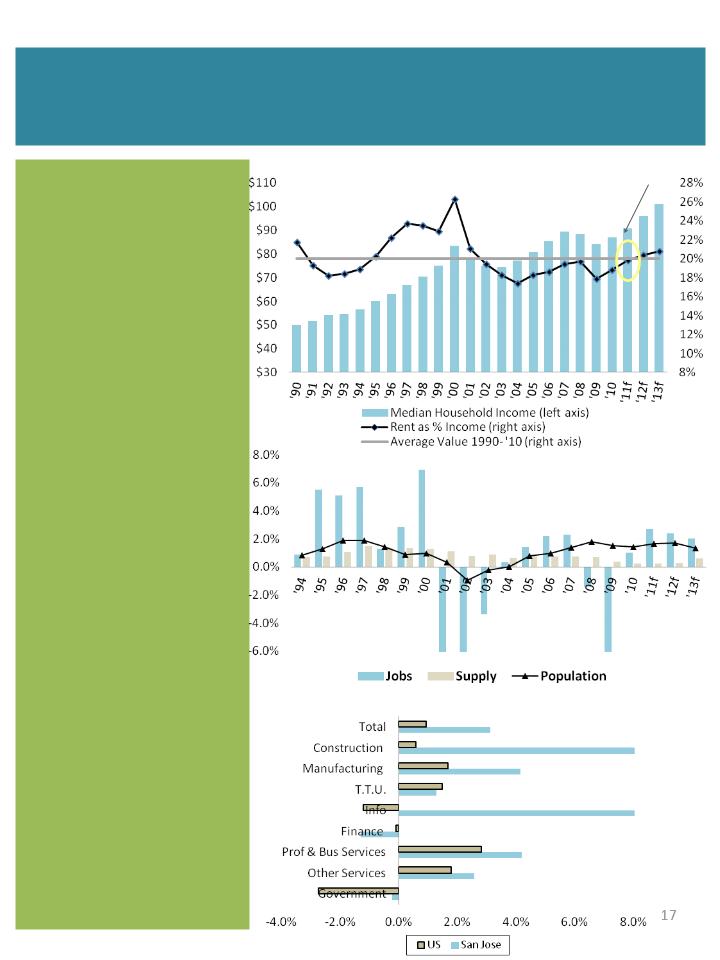

Northern California Market Review

(San Jose MSA Example)

Average Rent

as a % of

Median Household Income

(in 000’s)

Job Growth

vs.

Total Residential Supply

(% change)

Actual Job Growth by Sector:

Sept. ‘11 vs. Sept. ‘10

Gap = 3% of

current rents

current rents

Source: Essex, U.S. Census, BLS

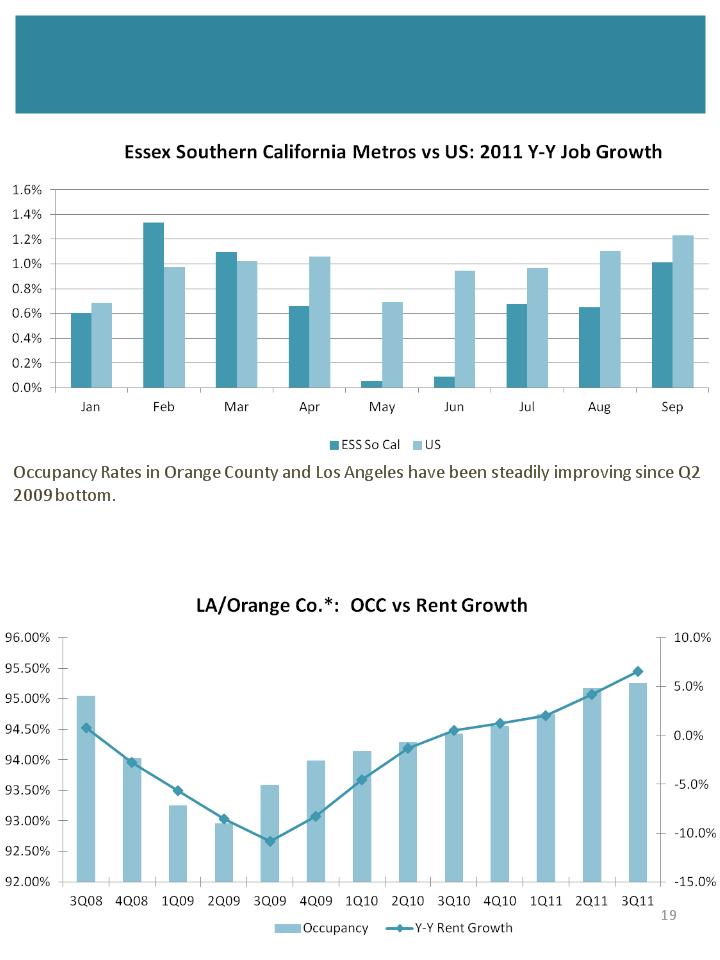

Southern California Market Review

(Los Angeles MSA Example)

Average Rent

as a % of

Median Household Income

(in 000’s)

Job Growth

vs.

Total Residential Supply

(% change)

Actual Job Growth by Sector:

Sept. ‘11 vs. Sept. ‘10

Gap = 9.6% of

current rents

current rents

Source: Essex, U.S. Census, BLS

Southern California Market Review

Occupancy breaks through 95% for both markets for the first time since q4 2007.

Essex believes with occupancy rates above 95% pricing power shifts to the landlord

|

Source: BLS

|

|

Source: Axiometrics

|

|

*LA/Orange Numerical Average

|

Multiple Investment Platforms

§ Development

- Upgrading the portfolio

- Over the past 25-years, we have delivered over 8,500 units through our

development program

§ Acquisitions

- Accelerating portfolio growth

- Improving cash flows and total per share returns

- Targeting markets with high rent growth potential

- Since 2010, Essex has acquired $1.5 billion of high quality and well-located

properties

§ Redevelopment

- Repositioning the portfolio and augmenting internal growth

- Capitalizing on the strategy of owning Class B quality assets in “A” locations

§ Co-Investments & Preferred Equity Investments

- Diversifying capital sources

- Enhancing risk adjusted returns

- Moderating portfolio volatility

20

INVESTMENT ACTIVITY

Since January 2010, Essex has acquired or committed to develop $1.5 billion in new investments

|

1

|

Corbella (169 units)

|

$23.8

|

$1,045

|

|

2

|

Elevation (157 units)

|

$22.4

|

$1,141

|

|

3

|

Courtyard off Main (109 units)

|

$30.1

|

$1,601

|

|

4

|

Joule (295 units)

|

$85.4

|

$1,548

|

|

5

|

The Bernard (63 units)

|

$15.0

|

$1,335

|

|

6

|

Redmond Hill (882 units)

|

$151.3

|

$1,136

|

|

7

|

Queen Anne (275 units)

|

$79.1

|

-

|

|

8

|

Fourth & U (171 units)

|

$62.3

|

$1,676

|

|

9

|

Family Tree (121 units)

|

$31.6

|

$1,580

|

|

10

|

The Commons (264 units)

|

$45.2

|

$1,320

|

|

11

|

101 San Fernando (323 units)

|

$65.4

|

$1,690

|

|

12

|

Bella Villagio (231 units)

|

$58.4

|

$1,746

|

|

13

|

Via (284 units)

|

$112.0

|

$2,215

|

|

14

|

Cadence Phase I (280 units)

|

$98.6

|

-

|

|

15

|

West Dublin (309 units)

|

$94.5

|

-

|

Seattle Area

Northern

California

California

Southern

California

California

21

1

2

3

4

5

6

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

Acquisitions

Development

Preferred Equity Investments/ Co-investments

Cost

(in millions)

Avg.

Rent

7

Cost

(in millions)

Avg.

Rent

Cost

(in millions)

Avg.

Rent

|

16

|

Arbors at Parc Rose (373 units)

|

$92.0

|

$1,723

|

|

17

|

Muse (152 units)

|

$41.6

|

$1,764

|

|

18

|

Allegro (96 units)

|

$30.6

|

$2,262

|

|

19

|

416 on Broadway (115 units)

|

$43.0

|

$2,114

|

|

20

|

Santee Court (165 units)

|

$31.2

|

$1,345

|

|

21

|

Santee Village (73 units)

|

$19.0

|

$2,004

|

|

22

|

Anavia (250 units)

|

$84.8

|

$2,112

|

|

23

|

Skyline (349 units)

|

$134.3

|

$3,046

|

|

24

|

Bellerive (63 units)

|

$27.2

|

$2,738

|

|

25

|

Reveal (438 units)

|

$132.9

|

$1,991

|

|

26

|

Fountain at La Brea (187 units)

|

$74.7

|

-

|

Anavia - Anaheim, CA

101 San Fernando - San Jose, CA

Essex Skyline - Santa Ana, CA

22

416 on Broadway - Glendale, CA

Santee Court - Los Angeles, CA

Elevation - Redmond, WA

Bella Villagio - San Jose, CA

Corbella at Juanita Bay - Kirkland, WA

DEVELOPMENT TRACK RECORD

Over the past 25-years, we have delivered over 8,500 units through our development program

|

|

|

|

|

|

Estimated

Units |

|

Estimated retail

sq. feet |

|

Incurred to

Date |

|

Estimated

Total Cost |

|

Construction

Complete |

|

Project Name

|

|

Location

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Via

|

|

Sunnyvale, CA

|

|

284

|

|

40,000

|

|

$101.2

|

|

$112.0

|

|

Oct-11

|

|

|

Queen Anne (JV)

|

|

Seattle, WA

|

|

275

|

|

17,000

|

|

$28.5 |

|

$79.1

|

|

Apr-13

|

|

|

West Dublin (JV)

|

|

Dublin, CA

|

|

309

|

|

-

|

|

$17.9

|

|

$94.5

|

|

Jun-13

|

|

|

Cadence - Phase I (JV)

|

|

San Jose, CA

|

|

280

|

|

-

|

|

$65.2 |

|

$98.6

|

|

Jul-13

|

|

|

Fountain at La Brea (JV)

|

|

West Hollywood, CA

|

|

187

|

|

18,200

|

|

$21.0

|

|

$74.7

|

|

Jan-14

|

|

|

Total Active Development Pipeline

|

|

1,335 |

|

75,200

|

|

$233.8 |

|

$458.9

|

|

|

||

ACTIVE DEVELOPMENT PIPELINE

(Dollars in Millions)

Via - Sunnyvale, CA

23

§ Capitalize on the strategy of owning Class B quality assets in “A” locations - supply

constraint in Essex markets results in older housing stock which leads to greater

renovation potential

§ Selective repositioning: rent justified improvements to maximize NOI and value

Highridge - Rancho Palos Verde, CA

255 units

$16.6 million renovation cost

$65,000 cost per unit

9.25% return

Redevelopment

Before

After

Before

After

The Pointe at Cupertino - Cupertino, CA

116 units

$8.0 million renovation cost

$69,000 cost per unit

9.5% return

REDEVELOPMENT

24

Fund & Joint Ventures

25

The co-investment program facilitates external growth via private capital,

provides a diversified source of equity and enhances risk adjusted returns.

This platform represents 18.2% of the units in Essex’s total portfolio.

Current Co-Investment Programs Consists of:

§ Fund II

- 14 well-positioned assets with dispositions beginning in 2012/2013

§ Programmatic Joint Ventures

- Wesco I - a 50/50 joint venture to acquire apartments. The joint

venture has invested $375 million to date.

- Canada Pension Plan Investment Board (“CPPIB”) - 55% Essex/45%

CPPIB joint venture to develop Cadence and West Dublin.

§ Single Asset Joint Venture

- Essex Skyline at MacArthur Place - a 50/50 joint venture to invest in a

349-unit high-rise condominium

§ Development Joint Ventures with Regional Developers:

- Queen Anne- a 50/50 joint venture to develop and operate a 275-unit

community.

community.

- Fountain at La Brea - a 50/50 joint venture to develop and operate a 187-

unit community.

unit community.

Essex is 30% leveraged on total market capitalization with a strong interest

coverage ratio of over 2.5x, staggered maturities and a BBB S&P corporate

rating.

coverage ratio of over 2.5x, staggered maturities and a BBB S&P corporate

rating.

Conservatively Proportioned and Flexible Balance Sheet

|

Cost of Debt

|

5.5%

|

4.9%

|

5.0%

|

5.3%

|

5.2%

|

4.9%

|

Debt Maturities

Consolidated Debt ($MM): $2,260 at 9/30/11, excludes lines of credit

2011 Guidance (updated November 2, 2011)

FFO Per Share Guidance

$5.66- $5.74

Same Property Revenue Growth (Midpoint)

3.9%

Same Property NOI Growth (Midpoint)

5.4%

Market Expectations

2011

2011

2011

Market

Market

Market

Job Growth

Rent Growth

Occupancy

Southern California

0.9%

4.8%

95.2%

Northern California

1.6%

9.7%

96.5%

Seattle Metro

2.0%

9.0%

95.5%

Weighted Average

1.2%

7.5%

95.8%

US Economic Assumptions

GDP Growth of 1.75%

Job Growth of 1.1%

Targeted Acquisitions

$450 million - $550 million

Targeted Development Investment

$263 million related to finishing Via, starting Queen Anne and the Cadence

Campus Phase I, West Dublin, and starting Fountain at La Brea

27

28

2011 Guidance Road Map

NOTES

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

29

Via - Sunnyvale, CA

416 on Broadway - Glendale, CA

Joule - Seattle, WA

For additional information, please contact the Company’s

Investor Relations department at (650) 849-1600.

Investor Relations department at (650) 849-1600.

Fourth & U - Berkeley, CA

Axis 2300 - Irvine, CA

Arbors at Park Rose - Oxnard, CA