Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DOLE FOOD CO INC | d257645d8k.htm |

| EX-99.1 - PRESS RELEASE - DOLE FOOD CO INC | d257645dex991.htm |

1

1

Dole Food Company, Inc.

Earnings Call and Webcast

Third Quarter 2011

November 17, 2011

Exhibit 99.2 |

2

2

Beth Potillo

Treasurer |

3

3

Forward-Looking Statements

The information presented here contains "forward-looking

statements," within the meaning of the Private Securities

Litigation Reform Act of 1995 that involve a number of risks and

uncertainties. Forward-looking statements, which are based on

management's current expectations, are generally identifiable by

the use of terms such as "may," "will," "expects,"

"believes," "intends," "anticipates" and similar

expressions. The potential risks and uncertainties that could cause actual

results to differ materially from those expressed or implied herein include

weather-related phenomena; market responses to industry

volume pressures; product and raw materials supplies and

pricing; energy supply and pricing; changes in interest and

currency exchange rates; economic crises and security risks in

developing countries; international conflict; and quotas, tariffs

and other governmental actions. Further information on the

factors that could affect Dole's financial results is included in its

SEC filings, including its Annual Report on Form 10-K.

|

4

Non-GAAP Financial Measures

EBIT before discontinued operations, Adjusted EBITDA, Adjusted EBITDA Excluding Significant Items, and

Comparable Income (loss) from continuing operations (total and per share) are measures commonly

used by financial analysts in evaluating the performance of companies. EBIT before discontinued

operations is calculated from net income by adding interest expense and income tax expense, and

subtracting income from discontinued operations, net of income taxes, and gain on disposal of discontinued

operations, net of income taxes. Adjusted EBITDA is calculated from EBIT before discontinued

operations by: (1) adding depreciation and amortization; (2) adding the net unrealized loss or

subtracting the net unrealized gain on foreign currency and bunker fuel hedges and the cross

currency swap which do not have a more than insignificant financing element present at contract inception; (3)

adding the net loss or subtracting the net gain on the long-term Japanese yen hedges; (4) adding

the foreign currency loss or subtracting the foreign currency gain on the vessel obligations;

(5) adding the net unrealized loss or subtracting the net unrealized gain on foreign

denominated instruments; and (6) subtracting the gain on asset sales. Due to the fact that the long-term Japanese

yen hedges had more than an insignificant financing element at inception, the liability is treated

similar to a debt instrument and the associated cash flows are classified as a financing

activity. As a result, both the realized and unrealized gains and losses related to these

hedges are subtracted from or added back to EBIT before discontinued operations when calculating Adjusted EBITDA.

Adjusted EBITDA Excluding Significant Items is calculated from Adjusted EBITDA by: (1) adding the

refinancing charges and loss on early retirement of 2014 notes: and (2) subtracting the gain on

container arbitration settlement. Comparable Income (loss) from continuing operations is

calculated from income (loss) from continuing operations by: (1) adding charges for restructuring and long-

term receivables, net of income taxes; (2) adding the net unrealized loss or subtracting the net

unrealized gain on foreign currency and bunker fuel hedges and the cross currency swap, net of

income taxes; (3) adding the net loss or subtracting the net gain on the long-term Japanese

yen hedges, net of income taxes; (4) adding the foreign currency loss or subtracting the foreign currency gain on

the vessel obligations, net of income taxes; (5) adding the net unrealized loss or subtracting the net

unrealized gain on foreign denominated instruments, net of income taxes; (6) adding the

refinancing charges and loss on early retirement of 2014 notes, net of income taxes; (7)

subtracting the gain on container arbitration settlement, net of income taxes; and (8) subtracting gain on asset

sales, net of income taxes. These items have been adjusted because management excludes these amounts

when evaluating the performance of Dole. Net debt is calculated as total debt less cash.

EBIT before discontinued operations, Adjusted EBITDA and Comparable Income (loss) from

continuing operations (total and per share) are not calculated or presented in accordance with

U.S. GAAP and are not a substitute for net income attributable to Dole Food Company, Inc., net

income, income from continuing operations, cash flows from operating activities or any other measure

prescribed by U.S. GAAP. Further, EBIT before discontinued operations, Adjusted EBITDA and Comparable

Income (loss) from continuing operations (total and per share) as used herein are not

necessarily comparable to similarly titled measures of other companies. However, Dole has

included these three measures herein because management believes that they are useful

performance measures for Dole and for securities analysts, investors and others in the evaluation of

Dole. |

5

5

David A. DeLorenzo

Chief Executive Officer |

6

Adjusted EBITDA

Excluding Significant Items

($ millions)

October 8, 2011

October 9, 2010

October 8, 2011

October 9, 2010

Adjusted EBITDA

19

$

101

$

278

$

299

$

Significant items included in Adjusted EBITDA:

Charges for restructuring and long-term

receivables

13

24

22

25

Gain on arbitration settlement, net

-

(27)

-

(27)

Refinancing charges and loss on early

retirement of 2014 notes

26

-

26

-

Adjusted EBITDA Excl. Significant Items

58

$

98

$

326

$

297

$

See Page 18 for reconciliation of Net Income to Adjusted EBITDA

Quarter

Ended

Three Quarters Ended

|

7

Adjusted EBITDA Excluding

Significant Items By Segment

($ millions)

October 8, 2011

October 9, 2010

October 8, 2011

October 9, 2010

Fresh fruit

35

$

58

$

250

$

195

$

Fresh vegetables

9

12

34

39

Packaged foods

32

30

82

94

Corporate/other

(18)

(2)

(40)

(31)

Adjusted EBITDA Excl. Significant Items

58

$

98

$

326

$

297

$

See Pages 19 & 20 for Adjusted EBITDA by segment |

8

Fresh Fruit: 3Q11

Review

Revenues increased 5%

Restructuring on track:

Q3 cost savings of $14 million

Additional restructuring initiatives to benefit 2012

–

Banana industry exports to Europe up 9% as a result of good

growing conditions

–

Additional restructuring initiatives in production and shipping

operations to benefit 2012

–

Reduced

2011

banana

volumes

(

19%

year-to-date)

–

Higher shipping costs primarily resulting from higher fuel prices

–

Volumes and prices up year-to-date

–

Higher fruit, packaging and shipping costs

–

Growth in China and Middle East markets

–

YTD volumes up ~10%, prices up ~4%

Latin America

Europe

North America

Asia |

Fresh Vegetables: 3Q11 Review

Packaged salads

-

Improved performance continues

-

Higher prices, better mix, increased retail volumes

-

Lower marketing costs

Fresh-packed vegetables

-

Weaker performance more than offsets packaged

salad improvements in the quarter

-

Lower iceberg lettuce pricing

Acquisition of SunnyRidge Farm

-

Premium blueberry and blackberry operations to

complement our existing fresh and frozen strawberry

program.

9

•

Packaged Salad

improvement continues

•

Completed acquisition of

SunnyRidge Farm |

Packaged Foods: 3Q11 Review

10

Dole

Fruit

Smoothie

Shakers

®

Frozen Fruit Single-serve Cups

Revenue increased 9%

Adjusted EBITDA increased $2 million to $32 million

U.S.

Dollar

Market

Shares

Product

2011*

2010*

Canned

pineapple

56.8% #1

57.3%

Canned

pineapple juice

57.7% #1

56.8%

Fruit Bowls

48.1% #1

46.7%

*Source: IRI Syndicated Data Total US for the third quarter ended

October 8, 2011 and October 9, 2010 Successful new product

introductions

Higher volume and pricing

offset increased product costs |

11

Summary

As anticipated, a challenging

market in Europe during the third

quarter

Year-to-date performance well

ahead of 2010

Implementing additional

restructuring initiatives focused

on further improving profitability

in Europe

Strategic investments in

SunnyRidge Farm and Healthy

Foods, LLC

Continued progress on asset

sale program |

12

12

Joseph S. Tesoriero

Chief Financial Officer |

13

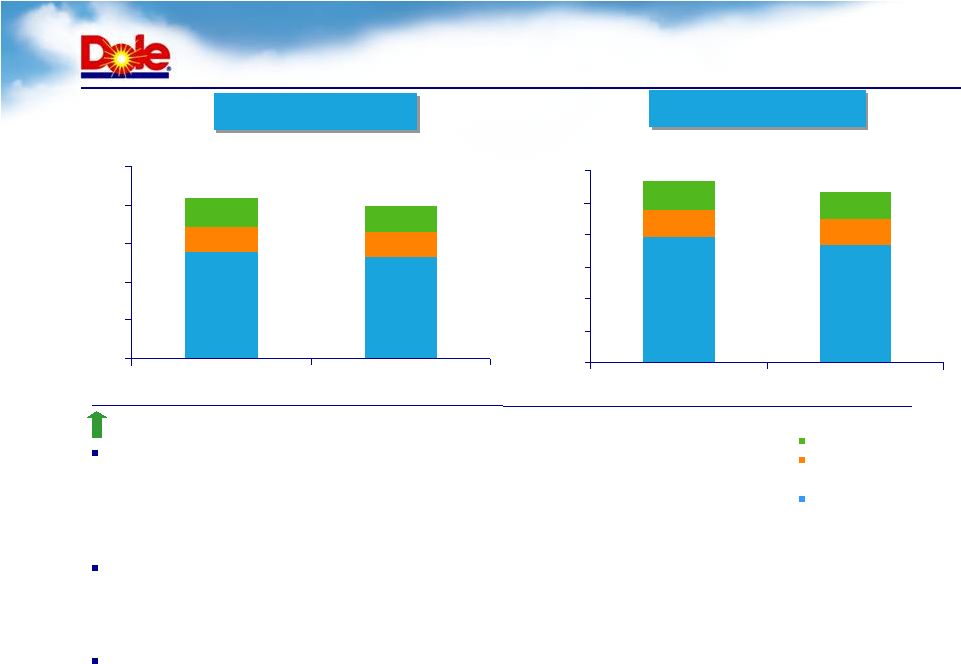

Segment Revenues

Packaged foods

Fresh

vegetables

Fresh fruit

($ millions)

3,932

3,674

852

825

903

836

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

2011

2010

$5,688

$5,336

First Three Quarters

First Three Quarters

First Three Quarters

3rd Quarter

3rd Quarter

3rd Quarter

1,393

1,327

327

326

366

335

$0

$500

$1,000

$1,500

$2,000

$2,500

2011

2010

$2,086

$1,989

Revenue in all segments increased

Fresh fruit up 5%

-

Higher

banana

volumes

in

North

America

and

Asia;

improved

banana

pricing

in North America, offset by planned lower volumes in Europe

-

Higher volumes and pricing of Chilean deciduous fruit

-

Higher pricing of pineapples and other fresh fruit in Asia

Vegetables

-

Packaged salads had higher prices and better mix, higher retail volumes

-

Fresh-packed vegetables had lower prices and volumes in iceberg lettuce,

partially offset by higher volumes and pricing in strawberries

Packaged foods up 9%

-

Higher sales across all major product lines

Note: Numbers may not foot due to rounding. |

14

Adjusted EBITDA Excluding

Significant Items By Segment

($ millions)

October 8, 2011

October 9, 2010

October 8, 2011

October 9, 2010

Fresh fruit

35

$

58

$

250

$

195

$

Fresh vegetables

9

12

34

39

Packaged foods

32

30

82

94

Corporate/other

(18)

(2)

(40)

(31)

Adjusted EBITDA Excl. Significant Items

58

$

98

$

326

$

297

$

See Pages 19 & 20 for Adjusted EBITDA by segment |

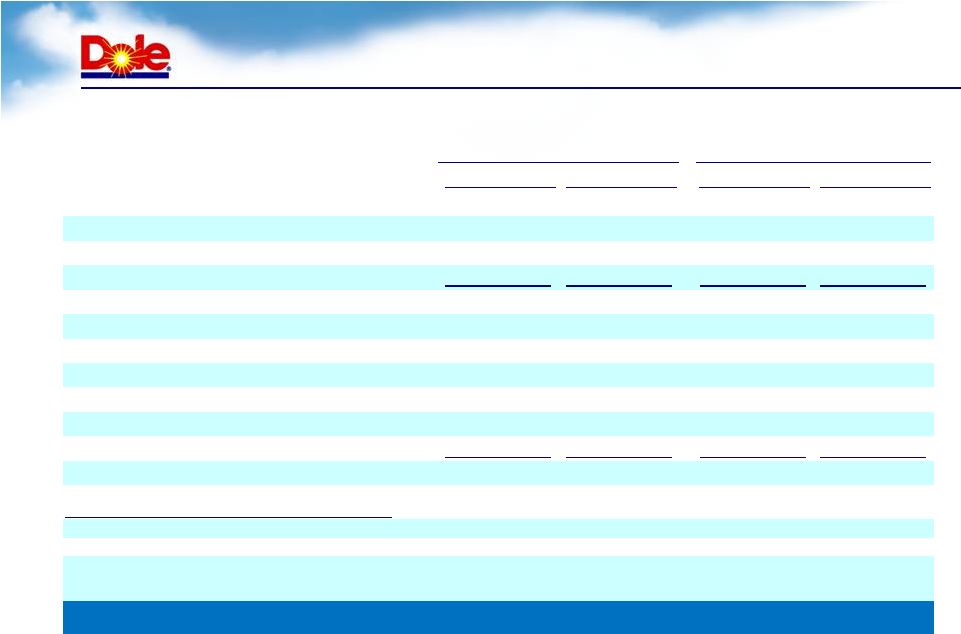

Comparable Income from Continuing Ops.

15

($ millions, except per share data)

See Page 4 for definition of non-GAAP measures

The

line

items

presented

here

have

been

adjusted

consistent

with

the

purpose

of

calculating

Comparable

Income

from

continuing operations, and thus are non-GAAP measures.

Q3 2011

Q3 2010

2011

2010

Revenues, net

2,086.0

$

1,988.6

$

5,687.9

$

5,336.0

$

Cost of products sold

(1,902.4)

(1,791.1)

(5,037.2)

(4,764.2)

Gross Margin

183.6

197.5

650.7

571.8

SMG&A expenses

(160.3)

(139.0)

(416.0)

(372.5)

Operating Income

23.3

58.5

234.7

199.3

Other, net

3.3

1.3

12.3

9.5

EBIT before disc. ops.

26.6

59.8

247.0

208.8

Interest expense

(41.4)

(49.2)

(111.7)

(127.4)

Earnings before taxes

(14.8)

10.6

135.3

81.4

Income taxes

(0.3)

(7.5)

(19.2)

(19.5)

Comparable Income from cont. ops.

$ (15.1)

$ 3.1

$ 116.1

$ 61.9

$ (0.17)

$ 0.04

$ 1.32

$ 0.71

Quarter Ended

Three Quarters Ended

Comp. Income from cont. ops. per share |

16

16

Q&A |

17

17

Appendix |

18

Reconciliation of Net Income to EBIT before Discontinued Operations,

Adjusted EBITDA and Adjusted EBITDA Excl. Significant Items

($ millions)

October 8, 2011

October 9, 2010

October 8, 2011

October 9, 2010

Net income (loss)

(47)

$

(49)

$

38

$

7

$

Discontinued operations, net

-

(5)

(1)

(5)

Interest expense

41

49

112

127

Income taxes

-

8

19

20

EBIT before discontinued operations

(6)

3

168

149

Depreciation and amortization

32

38

79

88

Net unrealized (gain) loss - derivatives

2

43

35

59

Net gain on long-term Japanese yen hedges

(3)

-

(7)

-

Foreign currency (gain) loss - vessel

obligations (2)

4

-

(1)

Net unrealized (gain) loss - foreign instruments

(1)

13

6

7

Gain on asset sales

(3)

-

(3)

(3)

Adjusted EBITDA

19

$

101

$

278

$

299

$

Significant items included in Adjusted EBITDA:

Charges for restructuring and long-term receivables

13

24

22

25

Gain on arbitration settlement, net

-

(27)

-

(27)

Write-off of debt issuance costs, refinancing fees

and loss on early retirement of 2014 notes

26

-

26

-

Adjusted EBITDA Excl.

Significant Items 58

$

98

$

326

$

297

$

Quarter Ended

Three Quarters

Ended |

19

Adjusted Q3 QTD EBITDA by Segment

($ millions)

Fresh

Fresh

Packaged

Corporate/

Fruit

Vegetables

Foods

Other

Total

Quarter Ended October 8, 2011

EBIT before disc. ops.

7

$

3

$

24

$

(40)

$

(6)

$

Net unrealized (gain) loss - derivatives

1

-

1

-

2

Net gain on long-term Japanese yen hedges

-

-

-

(3)

(3)

Foreign currency (gain) loss - vessel obligations

(2)

-

-

-

(2)

Net unrealized (gain) loss - foreign instruments

1

-

-

(2)

(1)

Gain on asset sales

(3)

-

-

-

(3)

Sub total

4

3

25

(45)

(13)

Depreciation and amortization

18

6

7

1

32

Adjusted EBITDA

22

$

9

$

32

$

(44)

$

19

$

Significant items

13

-

-

26

39

Adjusted EBITDA Excluding Significant Items

35

$

9

$

32

$

(18)

$

58

$

Fresh

Packaged

Corporate/

Fresh Fruit

Vegetables

Foods

Other

Total

Quarter Ended October 9, 2010

EBIT before disc. ops.

36

$

5

$

24

$

(62)

$

3

$

Net unrealized (gain) loss - derivatives

(2)

-

(1)

46

43

Foreign currency (gain) loss - vessel obligations

4

-

-

-

4

Net unrealized (gain) loss - foreign instruments

-

-

-

13

13

Sub total

38

5

23

(3)

63

Depreciation and amortization

23

7

7

1

38

Adjusted EBITDA

61

$

12

$

30

$

(2)

$

101

$

Significant items

(3)

-

-

(3)

Adjusted EBITDA Excluding Significant Items

58

$

12

$

30

$

(2)

$

98

$

|

20

Adjusted Q3 YTD EBITDA by Segment

($ millions)

Fresh

Fresh

Packaged

Corporate/

Fruit

Vegetables

Foods

Other

Total

Three Quarters Ended October 8, 2011

EBIT before disc. ops.

184

$

18

$

62

$

(96)

$

168

$

Net unrealized (gain) loss - derivatives

2

-

2

31

35

Net gain on long-term Japanese yen hedges

-

-

-

(7)

(7)

Foreign currency (gain) loss - vessel obligations

-

-

-

-

-

Net unrealized (gain) loss - foreign instruments

-

-

1

5

6

Gain on asset sales

(3)

-

-

-

(3)

Sub total

183

18

65

(67)

199

Depreciation and amortization

45

16

17

1

79

Adjusted EBITDA

228

$

34

$

82

$

(66)

$

278

$

Significant items

22

-

-

26

48

Adjusted EBITDA Excluding Significant Items

250

$

34

$

82

$

(40)

$

326

$

Fresh

Fresh

Packaged

Corporate/

Fruit

Vegetables

Foods

Other

Total

Three Quarters Ended October 9, 2010

EBIT before disc. ops.

147

$

23

$

78

$

(99)

$

149

$

Net unrealized (gain) loss - derivatives

-

-

(1)

60

59

Foreign currency (gain) loss - vessel obligations

(1)

-

-

-

(1)

Net unrealized (gain) loss - foreign instruments

1

-

-

6

7

Gain on asset sales

(3)

-

-

-

(3)

Sub total

144

23

77

(33)

211

Depreciation and amortization

53

16

17

2

88

Adjusted EBITDA

197

$

39

$

94

$

(31)

$

299

$

Significant items

(2)

-

-

-

(2)

Adjusted EBITDA Excluding Significant Items

195

$

39

$

94

$

(31)

$

297

$ |

21

Non-GAAP Financial Measures

($ thousands, except per share data)

Quarter Ended

Three Quarters Ended

October 8, 2011

October 9, 2010

October 8, 2011

October 9, 2010

Net Income (loss)

(47,004)

$

(48,829)

$

38,074

$

7,405

$

Income (loss) from discontinued operations, net of income taxes

43

(202)

(188)

(876)

Gain on disposal of discontinued operations, net of income taxes

-

(4,143)

(339)

(4,143)

Interest expense

41,402

49,187

111,709

127,375

Income taxes

123

7,522

18,781

19,764

EBIT

168,037

149,525

Depreciation & amortization

79,064

87,620

Net unrealized (gain)/loss on derivative instruments

2,487

43,527

35,104

59,164

Net (gain) loss on Japanese yen hedges

(2,298)

(6,582)

Foreign currency exchange (gain)/loss on vessel obligations

(2,590)

3,946

(51)

(1,147)

Gain on asset sales

(3,326)

-

(3,337)

(2,921)

Debt retirement costs in connection with initial public offering

Net unrealized FX (gain)/loss on foreign denominated borrowings

(1,645)

12,579

5,802

6,581

Sub Total

(7,372)

60,052

30,936

61,677

Adjusted EBITDA

18,858

$

101,185

$

278,037

$

298,822

$

Significant items included in Adjusted EBITDA:

Charges for restructuring and long-term receivables

13,171

23,518

21,873

24,888

Gain on arbitration settlement, net

-

(27,271)

-

(27,271)

Write-off of debt issuance costs, refinancing fees and loss on early

retirement of 2014 notes

26,192

-

26,192

-

Adjusted EBITDA excluding significant items

58,221

$

97,432

$

326,102

$

296,439

$

After tax adjustments

Net unrealized (gain)/loss on derivative instruments

2,609

$

43,575

$

34,855

$

59,183

$

Net (gain) loss on Japanese yen hedges

(2,298)

-

(6,582)

-

Foreign currency exchange (gain)/loss on vessel obligations

(2,590)

3,946

(51)

(1,147)

Gain on asset sales

(3,326)

-

(3,337)

(2,710)

Debt retirement costs in connection with initial public offering

-

-

-

-

Net unrealized FX (gain)/loss on foreign denominated borrowings

(1,851)

12,580

5,588

6,590

Charges for restructuring and long-term receivables

13,171

23,518

21,873

24,888

Gain on arbitration settlement, net

-

(27,271)

-

(27,271)

Refinancing charges and loss on early retirement of 2014 notes

26,192

-

26,192

-

Sub Total

31,907

$

56,348

$

78,538

$

59,533

$

Comparable income (loss) from continuing operations

($15,054)

$3,125

$116,085

$61,908

Comparable net income attributable to Dole Food Company, Inc.

($16,731)

$5,923

$112,706

$63,620

Earnings per share - Diluted:

Comparable income from continuing operations

($0.17)

$0.04

$1.32

$0.71

Comparable net income attributable to Dole Food Company, Inc.

($0.19)

$0.07

$1.28

$0.73

3,535

31,666

37,598

(5,436) |

22

Statements of Operations

Quarter Ended

Three Quarters Ended

October 8, 2011

October 9, 2010

October 8, 2011

October 9, 2010

Revenues, net

2,086,032

$

1,988,571

$

5,687,861

$

5,335,967

$

Cost of products sold

(1,910,314)

(1,789,085)

(5,047,176)

(4,763,474)

Gross margin

175,718

199,486

640,685

572,493

Selling, marketing and general and administrative expenses

(160,902)

(137,712)

(415,865)

(372,792)

Charges for restructuring and long-term receivables

(7,877)

(23,518)

(16,579)

(24,888)

Gain on arbitration settlement, net

-

27,271

-

27,271

Gain on asset sales

3,326

-

3,337

2,921

Operating income

10,265

65,527

211,578

205,005

Other income (expense), net

(18,956)

(61,994)

(53,970)

(62,883)

Interest income

1,318

1,606

3,802

4,724

Interest expense

(41,402)

(49,187)

(111,709)

(127,375)

Income (loss) from continuing operations before income taxes and equity

earnings

(48,775)

(44,048)

49,701

19,471

Income taxes

(123)

(7,522)

(18,781)

(19,764)

Earnings (losses from equity method investments

1,937

(1,604)

6,627

2,679

Income (loss) from continuing operations

(46,961)

(53,174)

37,547

2,386

Income (loss) from discontinued operations, net of income taxes

(43)

202

188

876

Gain on disposal of discontinued operations, net of income taxes

-

4,143

339

4,143

Net income (loss)

(47,004)

(48,829)

38,074

7,405

Less: Net income attributable to noncontrolling interests

(1,634)

(1,547)

(3,906)

(3,307)

Net income (loss) attributable to Dole Food Company, Inc.

(48,638)

$

(50,376)

$

34,168

$

4,098

$

($ thousands) |

Balance Sheets

23

October 8, 2011

January 1, 2011

(in thousands)

ASSETS

Cash and cash equivalents

190,586

$

170,147

$

Restricted cash and deposits

5,683

51,108

Receivables, net

700,420

751,265

Inventories

805,872

734,966

Prepaid expenses and other assets

67,816

67,909

Deferred income tax assets

43,835

36,810

Assets Held for Sale

120,845

86,050

Total current assets

1,935,057

1,898,255

Investments

97,170

87,914

Property, plant and equipment, net

894,078

943,030

Goodwill

407,247

407,247

Intangible assets, net

698,106

701,081

Other assets, net

217,048

219,463

Total Assets

4,248,706

4,256,990

LIABILITIES AND EQUITY

Accounts payable

486,561

521,330

Liabilities related to assets-held-for-sale

19,951

0

Accrued liabilities

533,771

642,481

Current portion of long-term debt, net

9,411

7,348

Notes payable

28,040

31,922

Total current liabilities

1,077,734

1,203,081

Long-term debt, net

1,575,559

1,564,325

Deferred income tax liabilities

248,838

244,324

Other long-term liabilities

515,640

428,476

Shareholders' equity

Common stock

89

89

Additional paid-in capital

784,121

776,918

Retained earnings

105,251

71,083

Accumulated other comprehensive income (loss )

(84,246)

(55,921)

Equity attributatble to shareholders of Dole Food

Company, Inc. 805,215

792,169

Equity attributatble to noncontrolling interests

25,720

24,615

Total equity

830,935

816,784

Total liabilities and equity

4,248,706

$

4,256,990

$

|