Attached files

| file | filename |

|---|---|

| EX-32 - STELLAR RESOURCES 10K, CERTIFICATION 906, CEO/CFO - STELLAR RESOURCES LTD | stellarexh32.htm |

| EX-31.2 - STELLAR RESOURCES 10K, CERTIFICATION 302, CFO - STELLAR RESOURCES LTD | stellarexh31_2.htm |

| EX-31.1 - STELLAR RESOURCES 10K, CERTIFICATION 302, CEO - STELLAR RESOURCES LTD | stellarexh31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2011

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________________ to ____________________

Commission File number 0-51400

STELLAR RESOURCES LTD.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-0373867

|

|

State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization

|

Identification No.)

|

375 N. Stephanie Street, Suite 1411, Las Vegas, Nevada, 89014-1411

(Address of principal executive offices)

Registrant’s telephone number, including area code (702) 475-5857

Securities registered pursuant to section 12(b) of the Act: N/A

Securities registered pursuant to section 12(b) of the Act: N/A

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filed, an accelerated filed, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | o | Accelerated filer | o |

| Non- accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b(2) of the Exchange Act).o Yes x No

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. o Yes o No

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: The total number of shares of Common Stock, par value $0.001 per share, outstanding as of November 12, 2010 is 69,344,051.

TABLE OF CONTENTS

PART I

Item 1. Business

General

Stellar Resources Ltd. is listed on the OTC Bulletin Board under the Symbol "SRRL" and have since our formation on April 9, 1999 been in the pre-exploration and exploration stage and are not operators of any mines or wells nor are we engaged in any mineral/oil production or sales activities. We have a minimum amount of cash and have not yet developed any producing resource properties. We have no history of any earnings. There is no assurance that we will be a profitable company. Historically the Company concentrated on mineral property exploration. During 2010 the Company’s focus changed to oil and gas property, exploration and development. We presently operate with minimum overhead costs and need to raise additional funds in the next 12 months, either in the forms of loans or issuance of equity, in order to continue our operations. We are primarily an oil and gas technology and exploration and development company. We are committed to developing and acquiring oil and gas technologies that have high impact on the profitability of oil and gas projects. Our strategy is to apply these high profit impact technologies our own oil and gas exploration and production projects.

The Company has focused its oil and gas operations principally on approximately 20,000 acres of oil and gas leases in Carbon County, Montana and approximately 6,400 acres of oil and gas leases in Park County, Wyoming. Stellar plans to operate a majority of its projects through the drilling and production phases. The Company intends to leverage the risks associated with drilling by obtaining industry partners to share in the costs of drilling. However, in some cases Stellar will retain a controlling interest in the prospects it drills.

On July 14 2011 the Company acquired from its’ President, Mr. Ray Jefferd, all right, title and interest to the ZeroGap intellectual property, free of any encumbrances or royalties.

ZeroGap stands for Zero Emission Refining Onsite with Gas Assisted Production. The ZeroGap technology is still in the research and development stage but shows significant promise based on existing proven technologies of hydrocracking and hydrotreating for upgrading and refining crude oil.

A key benefit of the ZeroGap technology is its promise of upgrading oil in-situ. The second key benefit is the potential to significantly increase the recovery of oil-in-place, particularly low API crude oil. ZeroGap is also an environmentally friendly technology with a small footprint and potential for near zero toxic emissions. The technology involves the use of a gasifier to produce injection gases that will be used to upgrade underground crude oil and enhance its extraction/recovery.

The purchase price for the acquisition is $3,000,000 which the Company has satisfied by the issuance of 30,000,000 of its restricted common shares to Mr. Jefferd. The shares have been recorded at the exchange amount of $37,291 being the legal fees incurred by Mr. Jefferd in developing the Intellectual Property.

Stellar has acquired this technology as part of its ongoing strategic plan to be in the business of oil and gas exploration and production, technological development, and the accumulation of oil and gas reserves. The Company obtained an independent expert fairness opinion on July 11, 2011 prepared by Dr. Michael Tenhover prior to finalizing the acquisition of ZeroGap outlining the inherent value and validity of the technology. Dr. Tenhover, has over 30 years of experience in the oil and gas industry and is the former chief scientist for advanced materials at BP. Dr. Tenhover has 36 issued US patents, 3 invited review chapters for scientific books, 89 publications in peer reviewed scientific publications and has given numerous invited scientific lectures at conferences and major universities around the world.

Website Access to Our Reports

We make available free of charge our annual report on Form 10K, quarterly reports on Form 10-Q, current reports on Form 8K, and all amendments to those reports as reasonably practicable after such reports are filed electronically with the Securities and Exchange Commission. Information of our website is not part of this report. Our website can be viewed at www.stellarltd.com

Strategic Business Plan

One of our key plans is to enhance shareholder value to the implementation of plans for controlled growth and development. Our long term goal and focus is to grow our oil and gas production through a strategic combination of selected feasible property acquisition and an exploration and development program primarily focused on developing the Company’s leasehold properties. Further, Stellar is committed to developing and acquiring oil and gas technologies that have high impact on the profitability of oil and gas projects. The Company’s strategy is to apply these high profit impact technologies to its own oil and gas exploration and production projects.

Item 1A. Risk Factors

The information set forth in this Item 1A should be read in conjunction with the rest of the information included in this report, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 the historical financial statements and related notes this report contains. While we attempt to identify, manage and mitigate risks and uncertainties associated with our business to the extent practical under the circumstances, some level of risk and uncertainty will always be present. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial also may negatively impact our business, financial condition or operating results.

Our acquisition strategy exposes us to various risks, including those relating to difficulties in identifying suitable acquisition opportunities and integrating businesses, assets and/or personnel, as well as difficulties in obtaining financing for our targeted acquisitions and the potential for increased leverage or debt service requirements.

A key component of our business strategy is that, we have pursued and intend to continue to pursue acquisitions of complementary assets and businesses.

Our acquisition strategy in general and our recent acquisitions in particular, involve numerous inherent risks, including:

|

|

●

|

unanticipated costs and assumption of liabilities and exposure to unforeseen liabilities of acquired businesses, including environmental liabilities;

|

|

|

●

|

difficulties in integrating the operations and assets of the acquired business and the acquired personnel;

|

|

|

●

|

limitations on our ability to properly assess and maintain an effective internal control environment over an acquired business in order to comply with applicable periodic reporting requirements;

|

|

|

●

|

potential losses of key employees and customers of the acquired businesses;

|

|

|

●

|

risks of entering markets in which we have limited prior experience; and

|

|

|

●

|

increases in our expenses and working capital requirements. The process of integrating an acquired business may involve unforeseen costs and delays or other operational, technical and financial difficulties that may require a disproportionate amount of management attention and financial and other resources. Possible future acquisitions may be for purchase prices significantly higher than those we paid for previous acquisitions. Our failure to achieve consolidation savings, to incorporate the acquired businesses and assets into our existing operations successfully or to minimize any unforeseen operational difficulties could have a material adverse effect on our financial condition and results of operations.

|

In addition, we may not have sufficient capital resources to complete additional acquisitions. We may incur substantial additional indebtedness to finance future acquisitions and also may issue equity securities or convertible securities in connection with such acquisitions. Debt service requirements could represent a significant burden on our results of operations and financial condition and the issuance of additional equity or convertible securities could be dilutive to our existing shareholders. Furthermore, we may not be able to obtain additional financing on satisfactory terms.

Even if we have access to the necessary capital, we may be unable to continue to identify additional suitable acquisition opportunities, negotiate acceptable terms or successfully acquire identified targets.

Item 2. Oil and Gas Properties / Technologies

Oil and Gas Properties

Elk Hills, Montana

On March 3, 2010, as completed on June 10, 2010, the Company announced it was entering into an agreement to acquire 100% of Elk Hills Heavy Oil, LLC (“EHHO”) and Four Bear Heavy Oil, LLC (“FBHO”) from Mr. Ray Jefferd and Mr. Glen Landry. The assets of EHHO consist of more than 20,000 continuous acres of oil and gas leases in Carbon County, Montana, and the assets of FBHO consist of more than 6,400 acres of oil and leases in Park County, Wyoming. The Company will have an area of mutual interest with the Sellers to acquire additional leases within one mile of the borders of the existing oil and gas leases, excluding the properties in Big Horn County Montana.

On June 14, 2010 Stellar acquired 100% of EHHO and 100% of FBHO from Mr. Ray Jefferd and Mr. Glen Landry. The Company acquired these oil and gas leases as part of its strategic plan to enter into the business of oil and gas production, development, exploration, and the accumulation of oil and gas reserves.

On July 8, 2010 Stellar announced the completion of a non-brokered private placement with Elk Hills Petroleum Canada Ltd. (“EHPC”) for 5,000,000 common shares at $.175 per share for gross proceeds of $875,000.

Concurrent with the private placement Stellar experienced a 50% dilution of its equity interest in EHHO as EHHO issued 90,000 Ownership Units to EHPC.

Further, Stellar and EHPC have each made $375,000 capital contributions (total $750,000) into EHHO enabling EHHO to undertake an exploration drilling program on the EHHO oil and gas leases in Carbon County, Montana. Additionally EHPC has agreed in principal to lend EHHO $1,750,000 repayable from future revenue generated from hydrocarbons produced from the EHHO leases. The loan obligation has since been terminated by mutual agreement in order to enter into an agreement with Deloro Resources Ltd. (TSX-V:DLL “Deloro”).

On May 10, 2011, Stellar announced it has entered into an agreement with Deloro and EHPC whereby Deloro can acquire up to a 1/3 interest in the ~ 20,000 acre Elk Hills Heavy Oil Project in Carbon County, Montana.

Under the terms of the agreement, Deloro can earn up to a 1/3 interest (60,000 ownership units) in EHHO from Stellar and EHPC by issuing 3,000,000 shares to Stellar and 3,000,000 shares to EHPC, and making a capital contribution of Cdn$600,000 to EHHO on or before September 11, 2011 ($450,000 for approved exploration expenditures and the balance of funds to meet current and future operating liabilities of EHHO). Deloro will become the Operator of the project. The Deloro shares issued to Stellar and EHPC shall be subject to a four month and one day hold. The TSX-V has approved this transaction. Upon Deloro meeting all the terms and conditions of the acquisition Stellar shall retain a 1/3 interest in EHHO.

To date Deloro has issued the required shares to Stellar and EHPC and also made a Cdn$150,000 capital contribution to EHHO. Accordingly, pursuant to the agreement Deloro has earned 30,000 ownership units (a 16.66% interest) in EHHO. As Deloro failed to complete its full capital contribution of Cdn$600,000 by September 11, 2011, Deloro can no longer earn any further interest in EHHO.

During the fall of 2010 three exploration wells were drilled on the property. Stellar received a report on the EHHO lands summarizing the exploration activities on the two of the three test wells drilled in 2010.

The Morris Block

From the introduction of the Morris Block Evaluation Report prepared by Glen Landry of Longshot Oil and Ted Doughty of Prisem Geoscience Consulting.

Introduction

The 15-13 Bauwens was drilled as an exploration well to evaluate the Tensleep sands in the hanging wall of the Bluewater fault. This location was determined to be the highest structural position along approximately 8.5 miles of the Bluewater fault.

The Tensleep sandstone was encountered approximately 54 feet high to the prognosis at a depth of 1,350 feet KB. After encountering the oil shows at this point, it was determined that the core point was too high in perhaps the Crow Mountain sand and that we should drill ahead to the prognosticated top. The decision was reversed but 16 feet of the top of the Tensleep has already been cut.

A total of 93 feet of 4 inch core was cut and recovered. The top 3-4 feet were oil saturated. Logs confirm the water line. Approximately 20 feet of oil column is present.

The volume of oil can be calculated from the Anderson photo interpretation or from surface measurements of the Gray bull sands by Ted Doughty.

Conclusion

The 15-13 Bauwens was drilled to evaluate the idea that oil would accumulate on the downdip or hanging wall of the Bluewater fault. It was hoped that the commercial oil leg would extend downdip as much as one mile or more from the drill site.

The oil leg is very commercial.

|

Morris Block

|

High

|

Most Likely

|

Low

|

|

Oil in Place

|

15,000,000

|

10,000,000

|

5,000,000

|

|

Recovery Factor

|

60%

|

50%

|

40%

|

|

Oil in Tanks

|

9,000,000

|

5,000,000

|

2,000,000

|

|

Total Net Profit

|

372,960,000

|

207,200,000

|

82,880,000

|

It is hard to believe that the vertical column in the 15-13 Bauwens is not larger. Several theories may explain the size of the reservoir in the Morris Block as follows:

Limiting reservoir parameters

|

|

1.

|

There may be leakage across the fault. The Loma Oil #1 just two miles to the northeast was drilled across the fault and an accumulation of 20 feet is present. This suggests that some leakage is present along the fault. The oil column in the Morris Block stops at 1350 or +3270.

|

|

|

2.

|

All oil fields around the flank of the Pryor Mountains have a tilted water table. While the bottom of the column in the Morris Block is at +3279 we will likely find the column to be much lower further down the flank of the trap.

|

|

|

3.

|

The various blocks may carry separate water lines from the sealing along their flanks. We have an apparent waterline at +2963 in the Barber #1 located in the northwest of section one of the Jim and Mary Block, located two miles north. Numerous waterlines are depicted in the fault blocks on the original cross section. The oil leg is expected to be thicker and wider as we explore to the north. Development drilling should follow the handing wall with adequate setback so as to not cut the fault.

|

Summary

The core in the 15-13 revealed limited permeability in the upper portion of the core samples. Porosity improves in the lower wet section. The offsetting updip development wells will be oil wet in this section, with 64 feet of pay likely.

Permeability may or may not be adequate for commercial production with steam. We think commercial viability is likely. Based upon our evaluation, the Morris Block should produce in excess of 5 mmbo.

Two options are available:

|

|

1.

|

Drill additional updip wells to further block reserves and provided additional baseline data for the reservoir engineer.

|

|

|

2.

|

Retain the reservoir engineer, KADE Technologies, to model the reserves and producibility of the field from the 15-13 Bauwens alone.

|

Glen Landry, Longshot Oil, LLC

Ted Doughty, Prisem Geoscience Consulting

The Paugh Block

The 2-25 Paugh was drilled to explore the reserve potential of the Tensleep Sandstone. Cuttings and core suggest a very large reserve potential subject to the results of the core analysis. Only 40 feet of core survived the trip to Calgary but the analysis was revealing. Oil saturations were in the 30% - 45% range, below the saturation to be commercial. Updip drilling should increase the oil saturation significantly. The northeast of section 36 should be adequately updip to attain commercial oil saturations.

Permeability is a problem. Originally the risk in the project was adequate permeability. There was some concern that the core lab could not get the crude flushed from the plugs to adequately determine the permeability. As can be seen by the charts on the following page the permeability is primarily 1 – 5 millidarcies. This analysis is likely close to the truth but note that the permeability does not track with the porosity, but instead is “flatline”. One can question whether we got the bitumen out of the pore space before the calculation was made.

Summary

In summary, a significant amount of oil was observed in the Paugh 2-25. A shift of a few points in saturation and permeability would make the prospect a world class deposit. More drilling is recommended.

In future the porosity core data from this well will be overlain atop the electric logs as was done in the Bauwens. The log calculations for porosity and oil saturation will be qualified with the core. Logging on new wells will be calibrated from the core to approximately the true porosity and oil saturation with the need for new cores.

In the spring of 2011 Loring Tarcore of Calgary, AB completed its testing of the cores from the Bauwens and Paugh wells. Notwithstanding earlier positive analysis by Prisem the Company concluded that the low gravity of the oil and porosity and permeability were not sufficient to justify continued investment in the project by the Company.

On October 25, 2011 the Company sold its remaining 75,000 units of capital in EHHO for $1,000,000. Payment of the purchase price is by a non-interest bearing promissory note due on or before April 30, 2012. The purchaser holds 4,000,000 shares of the Company which are to be used as collateral for the payment.

Four Bear Property, Wyoming

Four Bear Heavy Oil LLC, a wholly owned subsidiary of Stellar, owns more than 5,800 acres of oil and gas leases in Park County, Wyoming, USA. There are three potential drilling areas on the property.

1. Willow Draw Field

The Willow Draw field is adjoining one of the Four Bear leases. Within 500 meters of the Four Bear Leases more than 150,000 barrels of oil has been produced from three wells. On March 23, 2011, Legacy Energy as subsidiary of Nimin Energy Corp, the operators of the Willow Draw field received permits to drill three additional new wells all with 1000 meters of the Four Bear Leases. Geological work indicates that the Willow Draw field continues onto the Four Bear leased property. Four Bear has potentially at least one and as many as ten offsetting wells that can be drilled on the Four Bear Leases that adjoin the Legacy Energy leases.

The following is except from an announcement by Nimin Energy:

“Nimin Energy Corp. owns and operates at an average 97 percent working interest in four mature heavy oil fields located in Park County Wyoming which it acquired in December of 2009. The fields which were discovered between 1966 and 1971, have produced over nine million barrels of oil since discovery.

The fields are part of the Basin Margin Anticline play on the Western side of the Big Horn Basin and produce from the Tensleep Sandstone of Pennsylvanian age and the Phosphoria limestone of Permian age. Oil gravities range from 14 to 18 degrees API from an approximate reservoir depth of 3,500 to 4,500 feet.

The Company believes the fields to have significant infill drilling potential and plan to drill multiple development wells in the fields. Offset fields in the basin have already been infill drilled and have shown a significant increase in oil recovery and production rates due to the drilling. The company anticipates several years of drilling activity as it develops this core set of assets. While drilling these development wells the company will be studying the feasibility of implementing its CMD technology (see technology section) on the fields for future enhanced oil recovery.”

2. Section 2

Section 2 is 558 Acres (225 hectares) in Township 47 North, Range 103 West, Section 2, Park County, Wyoming.

Four wells with cumulative production of 361,000 barrels of oil from three producing zones are located within one mile of the Project. The nearest well to the proposed drilling location is 0.6 miles (1 kilometer) distant. Total production within five miles (8 kilometers) is more than 5 million barrels from more than 50 wells.

3. Undrilled Structures nearby

Four Bear also owns leases covering more than 1,500 acres that is approximately two kilometers to the east this is a potential structure, undrilled, similar in size to the Willow Draw field and the original Four Bear Field.

Oil and Gas Technologies

ZeroGap

On July 14 2011 the Company acquired from its’ President, Mr. Ray Jefferd, all right, title and interest to the ZeroGap intellectual property, free of any encumbrances or royalties. The purchase price for the acquisition is $3,000,000 which the company has satisfied by the issuance of 30,000,000 of its restricted common shares to Mr. Jefferd.

ZeroGap stands for Zero Emission Refining Onsite with Gas Assisted Production. The ZeroGap technology is still in the research and development stage but shows significant promise based on existing proven technologies of hydrocracking and hydrotreating for upgrading and refining crude oil.

A key benefit of the ZeroGap technology is its promise of upgrading oil in-situ. The second key benefit is the potential to significantly increase the recovery of oil-in-place, particularly low API crude oil.

ZeroGap is also an environmentally friendly technology with a small footprint and potential for near zero toxic emissions. The technology involves the use of a gasifier to produce injection gases that will be used to upgrade underground crude oil and enhance its extraction/recovery.

Stellar obtained an independent expert fairness opinion on July 11, 2011 prior to finalizing the acquisition of ZeroGap. The following are excerpts from the Fairness Opinion written by Dr. Michael Tenhover.

ZeroGap is a “Platform Technology” – the various embodiments constitute a wide range of uses, applications and methods.”

In principal, ZeroGap can address all the oil production opportunities mentioned in Enhanced Crude Oil Extraction. These relate to heavy and extra heavy crude oils. As discussed, these are multiple billions of bbls of oil opportunities.

In addition, two other markets may be of interest for this technology. These may be of near term interest since in these cases, the wells have already been drilled and production is in place. ZeroGap may be able to recover and enhance their existing production.

|

|

1.

|

Stranded oil – After production, a large amount of the oil remains in the formation. In North America as much as 60% of the oil will be left after conventional production. ZeroGap may be used here in mobilizing and in-situ upgrading this oil.

|

|

|

2.

|

Transition zone oil – A lot of oil is left behind at the oil-water interface. Due to the higher mobility of water, recovery is difficult. ZeroGap may be useful here to apply the appropriate gas chemistry to increase the mobility of the oil phase and decrease the mobility of the water phase”.

|

The bottom-line here is that there is a very large resource available and lots of opportunities for new technology to aid in the production/extraction of the World’s heavy/extra heavy crude oil.

Subsequent Events

Subsequent to the year end the Company:

|

|

i)

|

Issued 187,300 common shares at $0.10 per share for aggregate proceeds of $18,730 (Cdn$18,000).

|

|

|

ii)

|

Accepted as subscription for 1,181,100 common shares at $.02 per share for aggregate proceeds of $23,622 (Cdn$24,000).

|

|

|

iii)

|

On September 2, 2011 the Company transferred 1,000,000 shares of its investment in Deloro in full settlement of the Cdn$28,000 note payable.

|

|

|

iv)

|

On September 23, 2011 entered into a binding agreement, subject to due diligence, to acquire 100% of American Microbial Labs which holds technology suitable for cleaning produced water generated from the recovery of oil and gas wells as well as oil spills located both on land and in water. (See below)

|

|

|

v)

|

On October 25, 2011 the Company sold its remaining 75,000 units of capital in EHHO for $1,000,000. Payment of the purchase price is by a non-interest bearing promissory note due on or before April 30, 2012. The purchaser holds 4,000,000 shares of the Company which are to be used as collateral for the payment.

|

American Microbial Labs

On September 26, 2011 Stellar entered into a binding agreement, subject to due diligence, to acquire 100% of American Microbial Labs LLC (“American Microbial).

American Microbial has 33 species of specialized microbes. These microbes have an affinity for hydrocarbons such as crude oil, diesel fuel and kerosene. They are particularly effective at consuming hydrocarbons in both waters and soils. American Microbial Labs has the proven technology to grow, harvest, stabilize and package the microbes in commercial quantities.

The Company, upon closing, intends to increase the production of the microbes by adding new production equipment in Alabama. The company intends to build a services business based on using the microbes for cleaning produced water and for oil spill clean-up.

Produced Water

Stellar sees a large and growing market for produced water clean-up in the oil and gas business. Many oil wells produce more water than oil, often a lot more water than oil. Regulatory bodies worldwide are tightening rules on the disposal of produced water. New regulations are planned throughout the world and when they come into effect the current practice of simply pumping untreated produced water into disposal wells will be severely curtailed. Meeting new standards for treating and disposing of produced water will demand new solutions. Without cost effective methods and technologies for treating produced water many existing mature oil fields will simply become uneconomical to operate.

Testing

The Company will be conducting tests using the microbes on Alberta oil sands produced water as part of its due diligence process. The Company sees the Alberta Oil Sands as a large potential market to utilize the microbes to treat the tailings ponds from heavy oil recovery and upgrading facilities. Further, the microbes have proven effective in cleaning up oil spills on land. Clean-up can be achieved in-situ without the requirement of excavating the soil, allowing for better and lower cost clean-up for large and small oil spills.

Item 3. Legal Proceedings

We are not aware of any pending litigation nor do we have any reason to believe that any such litigation exists. Further, our officers and directors know of no legal proceedings against us, or our property contemplated by any governmental authority.

Item 4. Submission of Matters to a Vote of Security holders

There were no matters submitted to a vote of shareholders by the Company during this Fiscal Year.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common equity is registered on the Over the Counter Bulletin Board ("OTCQB" Symbol "SRRL"). We have no common equity which is subject to outstanding options, or warrants or securities convertible into common equity.

The following table sets forth the periods indicated the range of high and low closing bid quotations per share as reported by the over-the-counter market for the past two (2) years. These quotations represent inter-dealer prices, without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

|

Year 2011

|

High

|

Low

|

||||||

|

First Quarter

|

$ | 0.46 | $ | 0.10 | ||||

|

Second Quarter

|

$ | 0.38 | $ | 0.06 | ||||

|

Third Quarter

|

$ | 0.11 | $ | 0.03 | ||||

|

Fourth Quarter

|

$ | 0.12 | $ | 0.04 | ||||

|

Year 2010

|

High

|

Low

|

||||||

|

First Quarter

|

$ | 0.08 | $ | 0.07 | ||||

|

Second Quarter

|

$ | 0.07 | $ | 0.06 | ||||

|

Third Quarter

|

$ | 0.30 | $ | 0.065 | ||||

|

Fourth Quarter

|

$ | 0.30 | $ | 0.08 | ||||

As of July 31, 2011, the closing price of our common stock as reported on the OTCBB was $0.12 and there were 69,344,051 shares of our common equity outstanding, held by 34 shareholders of record. Of our common stock outstanding 4,370,000 are held in brokerage accounts, and therefore we are unable to give an accurate statement as to the number of shareholders.

Rule 144 Shares

Under Rule 144, as currently in effect, a person who has beneficially owned shares of a company's common stock for at least six months, begins when the securities were bought and fully paid for, is entitled to sell within any three month period a number of shares that does not exceed the greater of 1% of the outstanding shares of the same class being sold, or if the class is listed on a stock or quoted on Nasdaq, the greater of 1% or the average reported weekly trading volume during the four weeks preceding filing of Form 144 (Notice of Proposed Sale) with the SEC.

Under Rule 144 (k), a person who is not one of the Company’s affiliates at any time during the three months preceding a sale, and who has beneficially owned the shares proposed to be sold for at least two (2) years, is entitled to sell their shares without complying with the manner of sale, public information, volume limitation or notice provisions of Rule 144.

As of the date of this filing, persons who are affiliates hold 6,764,528 of the 52642,247 common shares that may be sold pursuant to Rule 144.

Dividends

We have not paid any dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future. If any earnings are realized, we intend to finance the growth of our business. We cannot assure you that we will ever pay cash dividends. Whether we pay any cash dividends in the future will depend on the financial condition, results of operations and other factors that the Board of Directors (“Board”) will consider at that time.

Recent Sale of Unregistered Security

On July 7, 2010 the Company entered into a private placement with Elk Hills Petroleum Canada and sold 5,000,000 of its common shares at US$.175 per share for net proceeds of $875,000.

On December 1, 2010, the Company issued 45,833 common shares at $0.30 for aggregate proceeds of $13,750.

On February 11, 2011, the Company issued 101,215 common shares at $0.20 for aggregate proceeds of $20,243. The Company paid a cash finder’s fee of $1,026 pursuant to this financing.

On February 25, 2011, the Company issued 136,353 common shares at $0.15 for aggregate proceeds of $20,453.

On July 14, 2011, the Company issued 30,000,000 common shares to the President in consideration for the acquisition of the Zerogap Intellectual Property.

On August 15, 2011 the Company issued 187,300 common shares at $0.10 per share for aggregate proceeds of $18,730.

On October 25, 2011, the Company entered into a subscription agreement for 1,181,100 common shares at $.02 per share for aggregate proceeds of $23,622.

Item 6. Selected Financial Data.

The following information derives from our audited financial statements. This information should be reviewed in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 of this report and the historical financial statements and related notes this report contains.

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2011 AND 2010

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

CONSOLIDATED BALANCE SHEETS

CONSOLIDATED STATEMENTS OF OPERATIONS

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

CONSOLIDATED STATEMENTS OF CASH FLOWS

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors of Stellar Resources Ltd.

We have audited the accompanying consolidated balance sheets of Stellar Resources Ltd (an exploration stage company) as of July 31, 2011 and 2010 and the related consolidated statements of operations, stockholders’ equity and cash flows for the years ended July 31, 2011 and 2010 and the period from April 9, 1999 (inception) through July 31, 2011. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, these consolidated financial statements present fairly, in all material respects, the consolidated financial position of Stellar Resources Ltd as of July 31, 2011 and 2010 and the results of its operations and its cash flows for the years ended July 31, 2011 and 2010 and the period from April 9, 1999 (inception) through July 31, 2011 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, to date the Company has reported losses since inception from operations and requires additional funds to meet its obligations and fund the costs of its operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in this regard are described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

“DMCL”

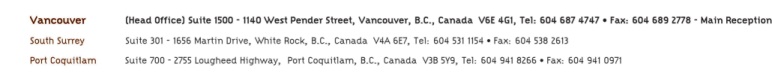

DALE MATHESON CARR-HILTON LABONTE LLP

CHARTERED ACCOUNTANTS

Vancouver, Canada

November 15, 2011

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED BALANCE SHEETS

|

JULY 31,

|

JULY 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current

|

||||||||

|

Cash

|

$ | 1,221 | $ | 58,300 | ||||

|

Investment (Note 4)

|

330,000 | - | ||||||

|

Prepaid expenses

|

- | 8,845 | ||||||

| 331,221 | 67,145 | |||||||

|

Investment in EHHO (Note 6)

|

200,000 | 541,858 | ||||||

|

Oil and gas properties, unproven (Note 7)

|

134,720 | 128,000 | ||||||

|

Intangible asset (Note 9)

|

40,091 | - | ||||||

| $ | 706,032 | $ | 737,003 | |||||

|

LIABILITIES

|

||||||||

|

Current

|

||||||||

|

Accounts payable

|

$ | 64,292 | $ | 3,592 | ||||

|

Advances payable (Note 10)

|

108,346 | 108,346 | ||||||

|

Due to related parties (Note 11)

|

46,559 | 35,121 | ||||||

|

Notes payable (Note 12)

|

54,338 | 23,702 | ||||||

| 273,535 | 170,761 | |||||||

|

FUTURE INCOME TAX LIABILITY (Notes 6 & 14)

|

30,000 | 30,000 | ||||||

| 303,535 | 200,761 | |||||||

|

STOCKHOLDERS’ EQUITY

|

||||||||

|

Capital stock (Note 13)

|

||||||||

|

Authorized:

|

||||||||

|

200,000,000 common shares with a par value of $0.001 per share

|

||||||||

|

Issued and outstanding:

|

||||||||

|

69,344,051 common shares (2010: 39,060,650 common shares)

|

69,343 | 39,060 | ||||||

|

Additional paid-in capital

|

2,119,543 | 2,059,142 | ||||||

|

Deficit accumulated during the exploration stage

|

(1,778,022 | ) | (1,555,674 | ) | ||||

|

Accumulated other comprehensive loss

|

(8,367 | ) | (6,286 | ) | ||||

| 402,497 | 536,242 | |||||||

| $ | 706,032 | $ | 737,003 | |||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF OPERATIONS

|

CUMULATIVE RESULTS OF OPERATIONS FROM APRIL 9, 1999 (INCEPTION)

|

||||||||||||

|

TO

|

||||||||||||

|

YEARS ENDED JULY 31,

|

JULY 31,

|

|||||||||||

|

2011

|

2010

|

2011

|

||||||||||

|

Expenses

|

||||||||||||

|

General and administrative

|

$ | 77,278 | $ | 58,942 | $ | 238,932 | ||||||

|

Interest and finance fees (Note 11)

|

5,366 | 1,776 | 23,004 | |||||||||

|

Investor relations

|

- | - | 17,989 | |||||||||

|

Management fees (Note 11)

|

51,140 | 21,270 | 822,410 | |||||||||

|

Professional fees

|

91,706 | 56,606 | 288,198 | |||||||||

|

Property examination and expenditure costs

|

- | 1,105 | 165,489 | |||||||||

|

Loss before other items

|

(225,490 | ) | $ | (139,699 | ) | (1,556,022 | ) | |||||

|

Other Items

|

||||||||||||

|

Gain on partial disposal of EHHO (Note 6)

|

304,689 | - | 304,689 | |||||||||

|

Management fees

|

15,000 | - | 15,000 | |||||||||

|

Dilution loss from EHHO (Note 6)

|

- | (196,000 | ) | (196,000 | ) | |||||||

|

Impairment loss on EHHO (Note 6)

|

(314,908 | ) | - | (314,908 | ) | |||||||

|

Loss from equity interest in EHHO (Note 6)

|

(1,639 | ) | (29,142 | ) | (30,781 | ) | ||||||

|

Net Loss

|

$ | (222,348 | ) | $ | (364,841 | ) | $ | (1,778,022 | ) | |||

|

Basic and Diluted Loss Per Common Share

|

$ | (0.01 | ) | $ | (0.01 | ) | ||||||

|

Weighted Average Number of Common Shares Outstanding – Basic and Diluted

|

40,595,223 | 31,951,198 | ||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2011

|

Deficit

|

||||||||||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||||||||||

|

Additional

|

Share

|

Deferred

|

During The

|

|||||||||||||||||||||||||

|

Common stock

|

Paid-In

|

Subscriptions

|

Stock

|

Exploration

|

||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Received

|

Compensation

|

Stage

|

Total

|

||||||||||||||||||||||

|

Issuance of common stock for cash at $0.001 per share – April 12, 1999

|

18,000,000 | $ | 18,000 | $ | (15,000 | ) | $ | - | $ | - | $ | - | $ | 3,000 | ||||||||||||||

|

Net loss, April 9, 1999

|

||||||||||||||||||||||||||||

|

(inception) to July 31, 1999

|

- | - | - | - | - | (2,090 | ) | (2,090 | ) | |||||||||||||||||||

|

Balance, July 31, 1999

|

18,000,000 | 18,000 | (15,000 | ) | - | - | (2,090 | ) | 910 | |||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (680 | ) | (680 | ) | |||||||||||||||||||

|

Balance, July 31, 2000

|

18,000,000 | 18,000 | (15,000 | ) | - | - | (2,770 | ) | 230 | |||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (180 | ) | (180 | ) | |||||||||||||||||||

|

Balance, July 31, 2001

|

18,000,000 | 18,000 | (15,000 | ) | - | - | (2,950 | ) | 50 | |||||||||||||||||||

|

Subscriptions received

|

- | - | - | 35,981 | - | - | 35,981 | |||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (43,953 | ) | (43,953 | ) | |||||||||||||||||||

|

Balance, July 31, 2002

|

18,000,000 | $ | 18,000 | $ | (15,000 | ) | $ | 35,981 | $ | - | $ | (46,903 | ) | $ | (7,922 | ) | ||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2011

|

Deficit

|

||||||||||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||||||||||

|

Additional

|

Share

|

Deferred

|

During The

|

|||||||||||||||||||||||||

|

Common stock

|

Paid-In

|

Subscriptions

|

Stock

|

Exploration

|

||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Received

|

Compensation

|

Stage

|

Total

|

||||||||||||||||||||||

|

Balance, July 31, 2002

|

18,000,000 | $ | 18,000 | $ | (15,000 | ) | $ | 35,981 | $ | - | $ | (46,903 | ) | $ | (7,922 | ) | ||||||||||||

|

Issuance of common stock for cash at $0.10 per share – October 2, 2002

|

2,192,856 | 2,193 | 34,354 | (35,981 | ) | - | - | 566 | ||||||||||||||||||||

|

Issuance of common stock for cash at $0.25 per share – October 2, 2002

|

722,976 | 723 | 29,401 | - | - | - | 30,124 | |||||||||||||||||||||

|

Issuance of common stock for cash at $0.25 per share – October 15, 2002

|

96,000 | 96 | 3,904 | - | - | - | 4,000 | |||||||||||||||||||||

|

Issuance of common stock for cash at $0.25 per share – January 9, 2003

|

120,000 | 120 | 4,880 | - | - | - | 5,000 | |||||||||||||||||||||

|

Issuance of common stock for cash at $0.25 per share – March 21, 2003

|

277,488 | 277 | 11,285 | - | - | - | 11,562 | |||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (54,823 | ) | (54,823 | ) | |||||||||||||||||||

|

Balance, July 31, 2003

|

21,409,320 | 21,409 | 68,824 | - | - | (101,726 | ) | (11,493 | ) | |||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (76,798 | ) | (76,798 | ) | |||||||||||||||||||

|

Balance, July 31, 2004

|

21,409,320 | 21,409 | 68,824 | - | - | (178,524 | ) | (88,291 | ) | |||||||||||||||||||

|

Net Loss

|

- | - | - | - | - | (35,127 | ) | (35,127 | ) | |||||||||||||||||||

|

Balance, July 31, 2005

|

21,409,320 | $ | 21,409 | $ | 68,824 | $ | - | $ | - | $ | (213,651 | ) | $ | (123,418 | ) | |||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2011

|

Deficit

|

||||||||||||||||||||||||||||||||

|

Accumulated

|

Accumulated

|

|||||||||||||||||||||||||||||||

|

Additional

|

Share

|

Deferred

|

During The

|

Other

|

||||||||||||||||||||||||||||

|

Common stock

|

Paid-In

|

Subscriptions

|

Stock

|

Exploration

|

Comprehensive

|

|||||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Received

|

Compensation

|

Stage

|

Loss

|

Total

|

|||||||||||||||||||||||||

|

Balance, July 31, 2005

|

21,409,320 | $ | 21,409 | $ | 68,824 | $ | - | $ | - | $ | (213,651 | ) | $ | - | $ | (123,418 | ) | |||||||||||||||

|

Net loss

|

- | - | - | - | - | (62,279 | ) | - | (62,279 | ) | ||||||||||||||||||||||

|

Balance July 31, 2006

|

21,409,320 | 21,409 | 68,824 | - | - | (275,930 | ) | - | (185,697 | ) | ||||||||||||||||||||||

|

Issuance of common stock in settlement of notes payable and accrued interest at $0.0833 per share – October 3, 2006

|

1,230,876 | 1,231 | 101,342 | - | - | - | - | 102,573 | ||||||||||||||||||||||||

|

Issuance of common stock on grant of stock award at $0.125 per share – October 4, 2006

|

6,000,000 | 6,000 | 744,000 | - | (750,000 | ) | - | - | - | |||||||||||||||||||||||

|

Amortization of deferred compensation

|

- | - | - | - | 465,550 | - | - | 465,550 | ||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | (5,034 | ) | (5,034 | ) | ||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (531,309 | ) | - | (531,309 | ) | ||||||||||||||||||||||

|

Balance July 31, 2007

|

28,640,196 | $ | 28,640 | $ | 914,166 | $ | - | $ | (284,450 | ) | $ | (807,239 | ) | $ | (5,034 | ) | $ | (153,917 | ) | |||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2011

|

Deficit

|

||||||||||||||||||||||||||||||||

|

Accumulated

|

Accumulated

|

|||||||||||||||||||||||||||||||

|

Additional

|

Share

|

Deferred

|

During The

|

Other

|

||||||||||||||||||||||||||||

|

Common stock

|

Paid-In

|

Subscriptions

|

Stock

|

Exploration

|

Comprehensive

|

|||||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Received

|

Compensation

|

Stage

|

Loss

|

Total

|

|||||||||||||||||||||||||

|

Balance July 31, 2007

|

28,640,196 | $ | 28,640 | $ | 914,166 | $ | - | $ | (284,450 | ) | $ | (807,239 | ) | $ | (5,034 | ) | $ | (153,917 | ) | |||||||||||||

|

Amortization of deferred compensation

|

- | - | - | - | 244,750 | - | - | 244,750 | ||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | (1,161 | ) | (1,161 | ) | ||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (294,738 | ) | - | (294,738 | ) | ||||||||||||||||||||||

|

Balance July 31, 2008

|

28,640,196 | 28,640 | 914,166 | - | (39,700 | ) | (1,101,977 | ) | (6,195 | ) | (205,066 | ) | ||||||||||||||||||||

|

Issuance of common stock for cash at $0.01 per share – December 19, 2008

|

801,294 | 801 | 7,302 | - | - | - | - | 8,103 | ||||||||||||||||||||||||

|

Issuance of common stock for cash at $0.02 per share –

March 16, 2009

|

1,619,160 | 1,619 | 30,674 | - | - | - | - | 32,293 | ||||||||||||||||||||||||

|

Amortization of deferred compensation

|

- | - | - | - | 39,700 | - | - | 39,700 | ||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | 938 | 938 | ||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (88,856 | ) | - | (88,856 | ) | ||||||||||||||||||||||

|

Balance July 31, 2009

|

31,060,650 | $ | 31,060 | $ | 952,142 | $ | - | $ | - | $ | (1,190,833 | ) | $ | (5,257 | ) | $ | (212,888 | ) | ||||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2011

|

Deficit

|

||||||||||||||||||||||||||||||||

|

Accumulated

|

Accumulated

|

|||||||||||||||||||||||||||||||

|

Additional

|

Share

|

Deferred

|

During The

|

Other

|

||||||||||||||||||||||||||||

|

Common stock

|

Paid-In

|

Subscriptions

|

Stock

|

Exploration

|

Comprehensive

|

|||||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Received

|

Compensation

|

Stage

|

Loss

|

Total

|

|||||||||||||||||||||||||

|

Balance July 31, 2009

|

31,060,650 | $ | 31,060 | $ | 952,142 | $ | - | $ | - | $ | (1,190,833 | ) | $ | (5,257 | ) | $ | (212,888 | ) | ||||||||||||||

|

Issuance of common stock on acquisition of EHHO and FBHO at $0.08 per share – May 20, 2010

|

3,000,000 | 3,000 | 237,000 | - | - | - | - | 240,000 | ||||||||||||||||||||||||

|

Issuance of common stock for cash at $0.175 per share – July 2, 2010

|

5,000,000 | 5,000 | 870,000 | - | - | - | - | 875,000 | ||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | (1,029 | ) | (1,029 | ) | ||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (364,841 | ) | - | (364,841 | ) | ||||||||||||||||||||||

|

Balance July 31, 2010

|

39,060,650 | $ | 39,060 | $ | 2,059,142 | $ | - | $ | - | $ | (1,555,674 | ) | $ | (6,286 | ) | $ | 536,242 | |||||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2011

|

Deficit

|

||||||||||||||||||||||||||||||||

|

Accumulated

|

Accumulated

|

|||||||||||||||||||||||||||||||

|

Additional

|

Share

|

Deferred

|

During The

|

Other

|

||||||||||||||||||||||||||||

|

Common stock

|

Paid-In

|

Subscriptions

|

Stock

|

Exploration

|

Comprehensive

|

|||||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Received

|

Compensation

|

Stage

|

Loss

|

Total

|

|||||||||||||||||||||||||

|

Balance July 31, 2010

|

39,060,650 | $ | 39,060 | $ | 2,059,142 | $ | - | $ | - | $ | (1,555,674 | ) | $ | (6,286 | ) | $ | 536,242 | |||||||||||||||

|

Issuance of common stock for cash at $0.30 per share – November 19,2010

|

45,833 | 46 | 13,704 | - | - | - | - | 13,750 | ||||||||||||||||||||||||

|

Issuance of common stock for cash at $0.20 per share – February 25, 2011

|

101,215 | 101 | 20,142 | - | - | - | - | 20,243 | ||||||||||||||||||||||||

|

Finders fees paid

|

- | - | (1,026 | ) | - | - | - | - | (1,026 | ) | ||||||||||||||||||||||

|

Issuance of common stock for cash at $0.15 per share – February 25, 2011

|

136,353 | 136 | 20,290 | - | - | - | - | 20,426 | ||||||||||||||||||||||||

|

Issuance of common stock for intellectual property –

July 14, 2011

|

30,000,000 | 30,000 | 2,970,000 | - | - | - | - | 3,000,000 | ||||||||||||||||||||||||

|

Reversal of additional paid-in capital upon related party transaction (Note 9)

|

(2,962,709 | ) | (2,962,709 | ) | ||||||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | (2,081 | ) | (2,081 | ) | ||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (222,348 | ) | - | (222,348 | ) | ||||||||||||||||||||||

|

Balance July 31, 2011

|

69,344,051 | $ | 69,343 | $ | 2,119,543 | $ | - | $ | - | $ | (1,778,022 | ) | $ | (8,367 | ) | $ | 402,497 | |||||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

CUMULATIVE RESULTS OF OPERATIONS FROM APRIL 9, 1999 (INCEPTION)

|

||||||||||||

|

TO

|

||||||||||||

|

YEARS ENDED JULY 31,

|

JULY 31,

|

|||||||||||

|

2011

|

2010

|

2011

|

||||||||||

|

Cash Flows from Operating Activities

|

||||||||||||

|

Net loss

|

$ | (222,348 | ) | $ | (364,841 | ) | $ | (1,778,022 | ) | |||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||||||

|

Realized foreign exchange losses on settlement of notes payable

|

- | (5 | ) | 12,518 | ||||||||

|

Unrealized foreign exchange

|

3,945 | - | 3,975 | |||||||||

|

Stock-based compensation

|

- | - | 750,000 | |||||||||

|

Accrued interest

|

4,515 | 321 | 22,686 | |||||||||

|

Share of loss of equity investment

|

1,639 | 29,142 | 30,781 | |||||||||

|

Gain on partial disposal of EHHO

|

(304,689 | ) | - | (304,689 | ) | |||||||

|

Impairment loss on EHHO

|

314,908 | - | 314,908 | |||||||||

|

Dilution loss

|

- | 196,000 | 196,000 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Prepaid expenses

|

8,845 | (8,845 | ) | - | ||||||||

|

Accounts payable and accrued liabilities

|

60,700 | (722 | ) | 64,292 | ||||||||

|

Net cash used in operating activities

|

(132,485 | ) | (148,950 | ) | (687,581 | ) | ||||||

|

Cash Flows from Financing Activities

|

||||||||||||

|

Proceeds from issuance of common stock, net

|

53,393 | 875,000 | 1,059,022 | |||||||||

|

Proceeds from (repayment of) notes payable

|

25,000 | (4,365 | ) | 114,300 | ||||||||

|

Advances payable

|

- | (74,010 | ) | 108,346 | ||||||||

|

Advances from related parties

|

6,533 | 34,432 | 41,654 | |||||||||

|

Net cash provided by financing activities

|

84,926 | 831,057 | 1,323,322 | |||||||||

|

Cash Flows from Investing Activities

|

||||||||||||

|

Acquisition of oil and gas properties

|

(6,720 | ) | (250,000 | ) | (256,720 | ) | ||||||

|

Acquisition of Intellectual property

|

(2,800 | ) | - | (2,800 | ) | |||||||

|

Investment in EHHO

|

- | (375,000 | ) | (375,000 | ) | |||||||

| (9,520 | ) | (625,000 | ) | (634,520 | ) | |||||||

|

Net Increase (Decrease) in Cash

|

(57,079 | ) | 57,107 | 1,221 | ||||||||

|

Cash, Beginning

|

58,300 | 1,193 | - | |||||||||

|

Cash, Ending

|

$ | 1,221 | $ | 58,300 | $ | 1,221 | ||||||

Continued…

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

|

CUMULATIVE RESULTS OF OPERATIONS FROM APRIL 9, 1999 (INCEPTION)

|

||||||||||||

|

TO

|

||||||||||||

|

YEARS ENDED JULY 31,

|

JULY 31,

|

|||||||||||

|

2011

|

2010

|

2011

|

||||||||||

|

Supplemental Disclosures of Cash Flow Information and Non-Cash Investing and Financing Activities

|

||||||||||||

|

Cash paid for:

|

||||||||||||

|

Interest

|

$ | - | $ | 110 | $ | 110 | ||||||

|

Income taxes

|

$ | - | $ | - | $ | - | ||||||

|

Common shares issued on settlement of notes payable and accrued interest

|

$ | - | $ | - | $ | 102,573 | ||||||

|

Common shares issued on acquisition of intellectual property

|

$ | 37,291 | $ | - | $ | 37,291 | ||||||

|

Common stock of Deloro received as part proceeds on partial disposal of EHHO (Note 6)

|

$ | 330,000 | $ | - | $ | 330,000 | ||||||

|

Common shares issued on acquisition of EHHO and FBHO

|

$ | - | $ | 240,000 | $ | 240,000 | ||||||

|

Future income tax liability on property acquisition

|

$ | - | $ | 30,000 | $ | 30,000 | ||||||

The accompanying notes are an integral part of these financial statements

24

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2011 AND 2010

|

1.

|

NATURE OF CONTINUED OPERATIONS AND BASIS OF PRESENTATION

|

The Company was incorporated in the State of Nevada on April 9, 1999 and is in the exploration stage of its resource property activities.

On June 10, 2010, the Company completed the acquisition of 100% of Elk Hills Heavy Oil, LLC (“EHHO”) and Four Bear Heavy Oil, LLC. (“FBHO”). EHHO’s assets consist of oil and gas leases in Carbon County, Montana, and FBHO’s asset consists of oil and leases in Park County, Wyoming. On July 7 2010, the Company’s interest in EHHO was diluted to 50% as a result of EHHO issuing 90,000 units of capital to Elk Hills Petroleum Canada Inc. (“EHPC”). As a result of the above transactions the Company’s focus changed from the exploration of mineral properties to oil and gas exploration. On May 4, 2011, the Company entered into a letter agreement with Deloro Resources Ltd. (“Deloro”), EHPC and EHHO whereby Deloro may acquire up to a 1/3rd interest (being 60,000 ownership units) in EHHO. As at July 31 Deloro has acquired a 1/6 interest in EHHO pursuant to this agreement, and the Company now holds a 41.67% interest in EHHO. (Note 6)

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. This contemplates that assets will be realized and liabilities and commitments satisfied in the normal course of business. To date, the Company has not generated any revenues from operations and had working capital of $57,587 and an accumulated deficit of $1,778,022 at July 31, 2011. The Company’s continuance of operations is contingent on raising additional working capital, and on the future development of its potential resource property interests. Accordingly, these factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company is currently negotiating with several parties to provide equity financing sufficient to finance corporate operations and provide working capital for the next twelve months. Although there is no assurance that management’s plans will be realized, management believes that the Company will be able to continue operations in the future. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event the Company cannot continue operating as a going concern.

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

The consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States and are presented in United States dollars.

|

|

a)

|

Exploration Stage Company

|

The Company is an exploration stage company. The Company is devoting substantially all of its present efforts to establish a new business. All losses accumulated since inception have been considered as part of the Company’s exploration stage activities.

|

|

b)

|

Basis of Consolidation

|

The consolidated financial statements include the results of the Company and the results of its wholly-owned subsidiary, FBHO, a company incorporated in Washington State on February 28, 2010.

The Company previously consolidated its interest in EHHO; however, during the year ended July 31, 2010 the Company’s interest in EHHO was reduced to the level of significant influence, and thus effective July 7, 2010, the investment in EHHO is recorded using the equity method of accounting (Notes 5 and 6).

All intercompany balances and transactions have been eliminated in the consolidation.

25

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2011 AND 2010

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

|

|

|

c)

|

Investments

|

Long term investments in which the Company has voting interests of 20% to 50%, or where the Company has the ability to exercise significant influence, are accounted for using the equity method. Under this method, the Company’s share of the investees’ earnings and losses are included in operations and its investments therein are adjusted by a like amount. Dividends are credited to the investment accounts.

Investments over which the Company does not exercise significant influence have been designated as available for sale investments and are measured at fair value, with unrealized gains and losses recorded in other comprehensive income until the asset is realized, at which time they will be recorded in net earnings (losses). The market value of publicly traded investments is based on quoted market prices.

|

|

d)

|

Cash and Cash Equivalents

|

For purposes of the balance sheet and statement of cash flows, the Company considers all highly liquid instruments purchased with maturity of three months or less to be cash and equivalents. At July 31, 2011 and 2010, the Company had no cash equivalents.

|

|

e)

|

Oil and Gas Properties

|

The Company follows the full cost method of accounting for oil and gas operations whereby all costs of exploring for and developing oil and gas reserves are initially capitalized on a country-by-country (cost centre) basis. Such costs include land acquisition costs, geological and geophysical expenses, carrying charges on non-producing properties, costs of drilling and overhead charges directly related to acquisition and exploration activities.

Costs capitalized, together with the costs of production equipment, are depleted and amortized on the unit-of-production method based on the estimated gross proved reserves. Petroleum products and reserves are converted to a common unit of measure, using 6 MCF of natural gas to one barrel of oil.

Costs of acquiring and evaluating unproved properties are initially excluded from depletion calculations. These unevaluated properties are assessed periodically to ascertain whether impairment has occurred. When proved reserves are assigned or the property is considered to be impaired, the cost of the property or the amount of the impairment is added to costs subject to depletion calculations.

If capitalized costs, less related accumulated amortization and deferred income taxes, exceed the “full cost ceiling” the excess is expensed in the period such excess occurs. The “full cost ceiling” is determined based on the present value of estimated future net revenues attributed to proved reserves, using current prices less estimated future expenditures plus the lower of cost and fair value of unproved properties within the cost centre.

Proceeds from a sale of petroleum and natural gas properties are applied against capitalized costs, with no gain or loss recognized, unless such a sale would alter the relationship between capitalized costs and proved reserves of oil and gas attributable to a cost centre.

|

|

f)

|

Asset Retirement Obligations

|

The Company records the fair value of an asset retirement obligation as a liability in the period in which it incurs an obligation associated with the retirement of long lived tangible assets as a result of the acquisition, construction, development and/or normal use of an asset. The estimated fair value of the asset retirement obligation is based on the current cost escalated at an inflation rate and discounted at a credit adjusted risk free rate. The liability is capitalized as part of the cost of the related asset and amortized over its useful life. The liability accretes until the Company settles the obligation.

26

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2011 AND 2010

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

|

|

|

g)

|

Impairment of Long-lived Assets

|

The carrying value of intangible assets and other long-lived assets are reviewed on a regular basis for the existence of facts or circumstances that may suggest impairment. The Company recognizes impairment when the sum of the expected undiscounted future cash flows is less than the carrying amount of the asset. Impairment losses, if any, are measured as the excess of the carrying amount of the asset over its estimated fair value. Impairment on the properties with unproved reserves is evaluated by considering criteria such as future drilling plans for the properties, the results of geographic and geologic data related to the unproved properties and the remaining term of the property leases.

|

|

h)

|

Intangible Asset

|

Intangible assets consist of a patent pending are stated at cost and amortized over 10 year straight– line.

|

|

i)

|

Earnings (Loss) Per Share

|

Basic earnings (loss) per share is computed by dividing net earnings (loss) available to common shareholders by the weighted average number of outstanding common shares. Diluted earnings (loss) per share gives effect to all potential dilutive common shares outstanding. Dilutive loss per share excludes all potential common shares if their effect is anti-dilutive. Because the Company does not have any potentially dilutive securities, diluted earnings (loss) per share is equal to basic earnings (loss) per share.

|

|

j)

|

Use of Estimates and Assumptions

|

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Accordingly, actual results could differ from those estimates. Significant areas requiring management’s estimates and assumptions are determining the fair value of transactions involving common stock, valuation of deferred tax balances, carrying value of unproven oil and gas interests and equity accounted investments.

|

|

k)

|

Foreign Currency Translation

|

Foreign denominated monetary assets and liabilities are translated to their United States dollar equivalents using foreign exchange rates which prevailed at the balance sheet date. Revenue and expenses are translated at average rates of exchange during the period. Related translation adjustments are reported as a separate component of stockholders' deficit, whereas gains or losses resulting from foreign currency transactions are included in results of operations.

|

|

l)

|

Stock Based Compensation

|

The Company accounts for stock based compensation arrangements using a fair value method and records such expense on a straight-line basis over the vesting period. The Company has not granted any stock options since inception.

27

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2011 AND 2010

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

|

|

|

m)

|

Long-lived Assets

|

Acquired intangible assets are initially recorded at cost, and provision for impairment is made whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. We measure recoverability of these assets by comparing the carrying amounts to the future undiscounted cash flows the assets are expected to generate. If intangible assets are considered to be impaired, the impairment to be recognized equals the amount by which the carrying value of the asset exceeds its fair market value.

|

|

n)

|

Income Taxes

|

Deferred income taxes are provided for tax effects of temporary differences between the tax basis of asset and liabilities and their reported amounts in the financial statements. The Company uses the liability method to account for income taxes, which requires deferred taxes to be recorded at the statutory rate expected to being in effect when the taxes are paid. Valuation allowances are provided for a deferred tax asset when it is more likely than not that such asset will not be realized.

Management evaluates tax positions taken or expected to be taken in a tax return. The evaluation of a tax position includes a determination of whether a tax position should be recognized in the financial statements, and such a position should only be recognized if the Company determines that it is more likely than not that the tax position will be sustained upon examination by the tax authorities, based upon the technical merits of the position. For those tax positions that should be recognized, the measurement of a tax position is determined as being the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement.

|

|

o)

|

New Accounting Standards

|

Recent Accounting Standards Not Yet Adopted

The Company has reviewed issued accounting pronouncements and plans to adopt those that are applicable to it. The Company does not expect the adoption of any other pronouncements to have an impact on its results of operations or financial position.

28

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2011 AND 2010

|

3.

|

FINANCIAL INSTRUMENTS

|

Fair value is defined as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity. In addition, the fair value of liabilities should include consideration of non-performance risk including the entity’s own credit risk.