Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GULFMARK OFFSHORE INC | d256936d8k.htm |

GulfMark Offshore, Inc

GulfMark Offshore, Inc

Bank of America Merrill Lynch 2011 Global Energy

Bank of America Merrill Lynch 2011 Global Energy

Conference

Conference

Exhibit 99.1 |

Forward Looking Statements

Forward Looking Statements

2

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains certain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, which

involve known and unknown risk, uncertainties and other factors. Among the

factors that could cause actual results to differ materially are: the price of

oil and gas and its effect on industry conditions; industry volatility;

fluctuations in the size of the offshore marine vessel fleet in areas where

the Company operates; changes in competitive factors; delay or cost overruns

on construction projects and other material factors that are described from time

to time in the Company's filings with the SEC, including the Company's Form

10-K for the year ended December

31, 2010. Consequently, the forward-looking statements contained herein should

not be regarded as representations that the projected outcomes can or will

be achieved. NYSE:

GLF

www.GulfMark.com |

The GulfMark Fleet

The GulfMark Fleet

3 |

4

Global Vessel Diversification

Global Vessel Diversification

West Africa

AHTS

2

US Gulf

PSV

10

FSV/Crew

3

Mexico

AHTS

2

Crew

1

Trinidad

PSV

FSV/Crew

Brazil

PSV

7

AHTS

SpV

1

North Sea

PSV

20

AHTS

1

SpV

1

Worldwide

PSV

46

AHTS

17

FSV/Crew

8

SpV

2

Total

SE Asia

PSV

3

AHTS

11

Revenue Breakout by Region

–

Trailing Twelve Months

Ended September 30, 2011

North Sea

45%

Southeast

Asia

17%

19%

19%

Gulf of Mexico

Rest of Americas

Americas

6

4

1

73 |

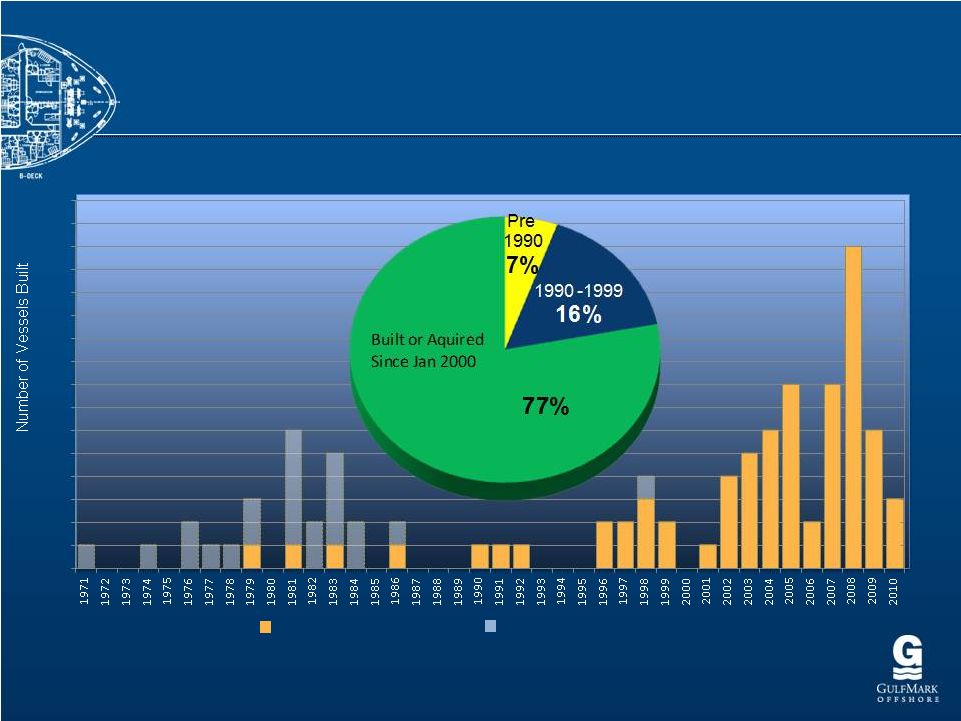

Young & Versatile Fleet

Young & Versatile Fleet

5

Number of Vessels We Built Per Year

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

Vessels in Current Fleet

Vessels not in Current Fleet |

Worldwide Vessel Fleet by Category

Worldwide Vessel Fleet by Category

6

Source:

Pareto

Securities

Equity

Research

–

March

2011

Vessel categorization

AHTS

Size (bhp)

Category

Spec

<10,000

AHTS Small

Low-end

10,000-14,999

AHTS Medium

High-end

15,000-19,999

AHTS Large

High-end

>19,999

AHTS X-Large

High-end

Size (dwt)

Category

Spec

<3,000

PSV Small

Low-end

3,000-4,499

PSV Medium

High-end

>4,499

PSV Large

High-end

PSV

0

200

400

600

800

1000

1200

1400

0

200

400

600

800

1000

1200

1400

AHTS XL

PSV Large

PSV Medium

AHTS Large

AHTS Medium

AHTS Small

PSV Small

GulfMark

Vessel Focus |

Benefits of Geographic Diversification

Benefits of Geographic Diversification

7 |

Gulf of Mexico:

Gulf of Mexico:

Deepwater Utilization on Recovery

Deepwater Utilization on Recovery

8

Decreased Exposure to U.S. Gulf of Mexico by Approximately 50%

—

Lower Utilization, but also Lower Revenue Exposure in the U.S. Gulf of

Mexico Option Value of Positioning Vessels on Short-Term Contracts in

Trinidad —

Ability to Quickly Capitalize on a Recovery in the U.S. Gulf of Mexico

Supply Constraint of Deepwater Vessels

—

Due to the Disproportionate Movement of Higher Specification Vessels Out of the

Gulf of Mexico as Compared to Lower Specification Vessels

Vessel Differentiation Based on Safety, Quality, and Training

—

Due to the Deepwater Horizon Event, we Anticipate a Preference for Our Highly

Trained Mariners and the Modern Safety Equipment on Our Vessels

Aggressively Dry-Docking and Modifying Existing Fleet in Anticipation of

U.S. Gulf of Mexico Recovery |

9

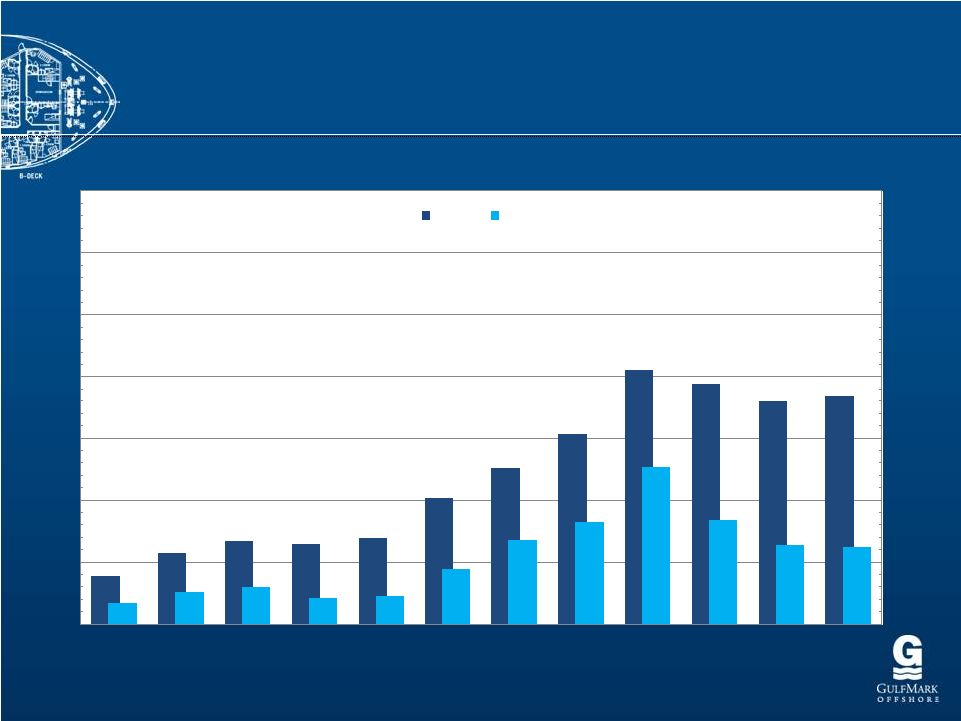

Total Revenue in Backlog

Total Revenue in Backlog

(in thousands of dollars)

(in thousands of dollars)

$0

$2,500

$5,000

$7,500

$10,000

$12,500

$15,000

$17,500

$20,000

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

Q4

2005

Q1

2006

Q2

2006

Q3

2006

Q4

2006

Q1

2007

Q2

2007

Q3

2007

Q4

2007

Q1

2008

Q2

2008

Q3

2008

Q4

2008

Q1

2009

Q2

2009

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

$900,000

$1,000,000

$22,500

$25,000 |

Strong Customer Base

Strong Customer Base

10

Note: Percentages Based on Vessel Count as of September 28, 2011

Smaller

Independents &

31

National Oil

Companies

43%

Others

Super Majors &

%

Majors & Large

Independents

26

% |

Building For Our Future

Building For Our Future

11

Significant number of new generation rigs on order

Increasing Activity both in the North Sea and New Frontiers

Industry call for higher specification vessels to meet increasing regulatory

demands: waters, longer distances, rougher seas

•

Deeper Waters and Harsher Environments

•

Increased cargo carrying capacity and flexibility

•

Enhanced Green Footprint and offering greater safety support greater

|

12

Remontowa Shipyard, Poland

Delivery Q2/2013 Q3/2013

Two

MMC

887

CD

1000m²

Deck

Area

DP

II

MAIN

PARTICULARS

Large Cargo Capacities

LOA

88.93 m

Beam

18.80 m

Depth

7.40 m

DWT

5100 T

Max Draft

6.05 m

Speed

14.30 kts

FiFi System

Tank Cleaning System

Oil Recovery

SPS Code

Green Passport*

41 Berths

Gym

Recreational Lounges

Total Power

6800 kW

Propulsion

Diesel electric

2 x 2000 kW Azimuth

Thrusters

1 x 910 kW Bow Tunnel

1 x 800 kW Retractable Azimuth

New Build Program Announced

New Build Program Announced |

13

One MMC 879 CD 846m²

Deck Area DPII

Total Power

6800 kW

Propulsion

Diesel electric

2 x 2000 kW Azimuth

Thrusters

2 x 910 kW Bow Tunnel

MAIN PARTICULARS

Large Cargo Capacities

LOA

79.45 m

Beam

16.80 m

Depth

7.40 m

DWT

4000 T

Max Dr

6.00 m

Speed

14.00 kts

FiFi System

Tank Cleaning System

Oil Recovery

SPS Code

Green Passport

29 Berths

Gym

Recreational Lounges

Remontowa Shipyard, Poland

Delivery Q3/2013

New Build Program Cont’d

New Build Program Cont’d |

14

Two UT 755 XL 715m²

Deck Area DPII

Total Power

5580 kW

Propulsion

Conventional

2 x 2790 kW CPP

Thrusters

2 x 590 kW Stern Tunnel

2 x 660 kW Bow Tunnel

MAIN PARTICULARS

Large Cargo Capacities

LOA

74.95 m

Beam

16.00 m

Depth

7.00 m

DWT

3000 T

Max Dr

5.80 m

Speed

14.50 kts

FiFi System

Tank Cleaning System

Oil Recovery

SPS Code

Green Passport*

25 Berths

Gym

Recreational Lounges

Rosetti Shipyard, Italy

Delivery Q4/2013

Q1/2014

New Build Program Cont’d

New Build Program Cont’d |

15

Total Power

8400 kW

Propulsion

Diesel electric

2 x 2600 kW CRP

Thrusters

2 x 1100 kW Bow Tunnel

1 x 883 kW Retractable Azimuth

MAIN PARTICULARS

Large Cargo Capacities

LOA

92.60 m

Beam

19.20 m

Depth

8.40 m

DWT

4700 T

Max Dr

6.85 m

Speed

17.00 kts

Ice Classed

Winterized

Rescue

Oil Recovery

Tank Cleaning System

SPS Code

Green Passport

40 Berths

Gym

Recreational Lounges

Siemek A/S Shipyard, Flekkefjord, Norway

Delivery Q2/2013

New Build Program Cont’d

New Build Program Cont’d

Deck Area

One

ST-216 Arctic

1050m²

DPII |

Map of North Sea

Map of North Sea

16

(vessel outlines indicate planned location for new build vessels)

|

End of Presentation

End of Presentation

17 |

Appendix: Financial Information

Appendix: Financial Information

18 |

Long Term Revenue & EBITDA

Long Term Revenue & EBITDA

(in millions of dollars)

(in millions of dollars)

19

* Note: Adjusted for Special Items, See Supporting Information at the end of this

Presentation $0

$100

$200

$300

$400

$500

$600

$700

$0

$100

$200

$300

$400

$500

$600

$700

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011 TTM

Revenue

EBITDA* |

2011 by Quarter –

2011 by Quarter –

Actual and Consensus

Actual and Consensus

(in thousands of dollars)

(in thousands of dollars)

20

* Consensus:

As

compiled

by

Thomson

One

–

First

Call

as

of

November

3,

2011

Q1

Q2

Q3

Q4

2011

(Actual)

(Actual)

(Actual)

(Consensus*)

(Consensus*)

Revenues

81,289

$

96,911

$

103,778

$

103,700

$

385,678

$

Direct operating expenses

44,318

55%

46,908

48%

48,103

46%

48,000

46%

187,328

49%

Drydock expense

6,524

8%

3,683

4%

5,726

6%

1,000

1%

16,933

4%

General and administrative expenses (Regional)

6,178

8%

5,379

6%

5,961

6%

5,900

6%

23,418

6%

General and administrative expenses (Corporate)

5,245

6%

5,530

6%

5,897

6%

5,600

5%

22,273

6%

Depreciation expense

14,675

18%

14,982

15%

14,896

14%

15,000

14%

59,553

15%

Gain on sale of assets / Other special items

10

0%

-

0%

-

0%

-

0%

10

0%

Operating Income

4,339

5%

20,428

21%

23,194

22%

28,200

27%

76,162

20%

Pre-Gain Operating Income

4,349

5%

20,428

21%

23,194

22%

28,200

27%

76,172

20%

EBITDA (Pre Gain)

19,025

23%

35,411

37%

38,090

37%

43,200

42%

135,726

35%

Interest expense

(5,727)

(5,630)

(5,757)

(5,600)

(22,714)

Interest income

67

119

195

100

480

Foreign currency gain (loss) and other

(58)

73

(2,803)

-

(2,788)

Income before income taxes

(1,379)

14,990

14,829

22,700

51,141

Income tax benefit (provision)

212

15%

(1,699)

11%

(664)

4%

(1,500)

7%

(3,651)

7%

Net Income

(1,167)

$

13,291

$

14,165

$

21,200

$

47,490

$

Diluted EPS (Actual)

(0.05)

0.51

0.54

-

1.01

Consensus EPS

-

-

-

0.80

0.80

(in thousands) |

21

2011 Q3 vs. Q2

2011 Q3 vs. Q2

(in thousands of dollars, excluding special items)

(in thousands of dollars, excluding special items)

Jun 30,

Sequential

Sep 30,

2011

Change

2011

Revenues

96,911

$

6,867

$

6.6%

103,778

$

Direct operating expenses

46,908

48.4%

1,195

2.1%

48,103

46.4%

Drydock expense

3,683

3.8%

2,044

(1.7%)

5,726

5.5%

General and administrative expenses (Regional)

5,379

5.6%

582

(0.2%)

5,961

5.7%

General and administrative expenses (Corporate)

5,530

5.7%

367

0.0%

5,897

5.7%

Depreciation expense

14,982

15.5%

(87)

1.1%

14,896

14.4%

(Gain) loss on sale of assets / Other special items

-

0.0%

-

0.0%

-

0.0%

Operating Income

20,428

21.1%

2,766

1.3%

23,194

22.3%

Incremental Margin

Pre-Gain Operating Income

20,428

21.1%

2,766

1.3%

23,194

22.3%

Incremental Margin

EBITDA (Pre Gain)

35,411

36.5%

2,679

0.2%

38,090

36.7%

Incremental Margin

Interest expense

(5,630)

(127)

(5,757)

Interest income

119

76

195

Foreign currency gain (loss) and other

73

(2,877)

(2,803)

Income (loss) before income taxes

14,990

(161)

14,829

Income tax benefit (provision)

(1,699)

11.3%

(1,035)

(6.9%)

(664)

4.5%

Net Income (Loss)

13,291

$

874

14,165

$

Diluted Earnings (Loss) Per Share

:

0.51

$

0.54

$

Diluted Earnings (Loss) Per Share (Before Gains): 0.51

$

0.54

$

Weighted average common shares

25,829

25,869

Weighted average diluted common shares

25,949

25,989

(in thousands) |

22

Quarter Ended September 30, 2011

Quarter Ended September 30, 2011

(in thousands of dollars, excluding special items)

(in thousands of dollars, excluding special items)

Revenues

$

49,176

$

16,660

$ 37,942

103,778

Direct operating expenses

20,999

42.7%

3,410

20.5%

23,694

62.4%

48,103

46.4%

Drydock expense

2,999

6.1%

2,023

12.1%

704

1.9%

5,726

5.5%

General and administrative expenses (Regional)

3,195

6.5%

762

4.6%

2,005

5.3%

5,961

5.7%

General and administrative expenses (Corporate)

-

0.0%

-

0.0%

-

0.0%

5,897

5.7%

Depreciation expense

4,924

10.0%

2,428

14.6%

7,078

18.7%

14,896

14.4%

(Gain) loss on sale of assets

-

0.0%

-

0.0%

-

0.0%

-

0.0%

Operating Income

$ 17,059

34.7%

$ 8,038

48.2%

$ 4,461

11.8%

$ 23,194

22.3%

Pre-Gain Operating Income

$ 17,059

34.7%

$ 8,038

48.2%

$ 4,461

11.8%

$ 23,194

22.3%

EBITDA (Pre Gain)

$ 21,984

44.7%

$ 10,466

62.8%

$ 11,539

30.4%

$ 38,090

36.7%

Interest expense

(5,757)

Interest income

195

Foreign currency gain (loss) and other

(2,803)

Income before income taxes

$ 14,829

Income tax benefit (provision)

(664)

4.5%

Net Income

$ 14,165

Diluted Earnings Per Share

$

0.54

Diluted Earnings Per Share (Before Gains)

Weighted average diluted common shares

25,989

Consolidating

Income

Statement

for

the

Three

Months

Ended

Sep

30,

2011

North Sea

Southeast

Asia

Americas

Total

$

0.54 |

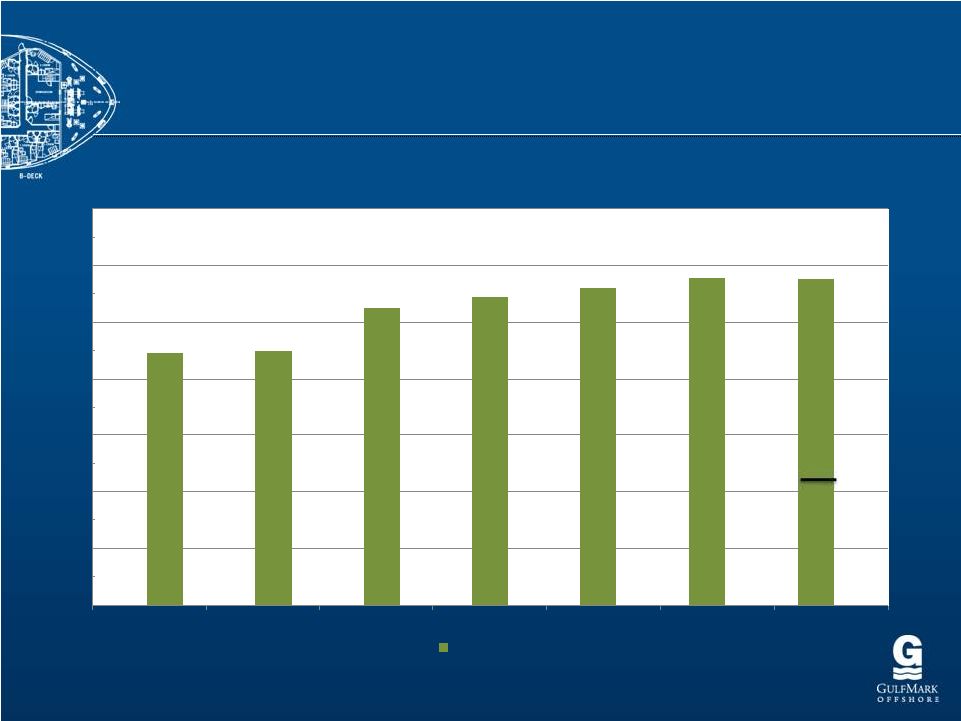

Dry Powder Continues to Grow

Dry Powder Continues to Grow

(in thousands of dollars)

(in thousands of dollars)

23

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Liquidity

175 revolver

113 cash |

24

Vessel Dispositions Demonstrate

Vessel Dispositions Demonstrate

Long-Term Value

Long-Term Value

Vessel

Name

Year

of

Sale

Year

Built

Age at

Disposal

Sales

Price

Original

Cost

Sales Price as

a Percentage

of Original

Cost

Highland Pioneer

2011

1983

28

2,850,000

4,699,301

61%

North Traveller

2010

1998

12

18,692,000

17,775,436

105%

Seapower

2010

1974

36

380,000

1,355,389

28%

Sea Searcher

2009

1976

33

2,000,000

1,298,096

154%

Highland Sprite

2009

1986

23

5,075,000

6,935,050

73%

Sefton Supporter

2009

1971

38

1,029,000

909,535

113%

North Fortune

2008

1983

25

19,000,000

9,955,746

191%

Sea Eagle

2008

1976

32

2,000,000

985,754

203%

Sem Valiant

2008

1981

27

2,600,000

2,798,898

93%

North Crusader

2008

1984

24

19,000,000

12,380,504

153%

Sea Diligent

2008

1981

27

3,950,000

2,805,178

141%

Sea Endeavor

2007

1981

26

2,500,000

2,573,100

97%

Sea Explorer

2007

1981

26

5,125,000

2,821,841

182%

Sem Courageous

2007

1981

26

2,500,000

2,132,069

117%

North Prince

2007

1978

29

5,650,000

7,212,539

78%

Sentinel

2006

1979

27

7,400,000

4,733,578

156%

Highland Patriot

2006

1982

24

10,800,000

7,289,049

148%

Average Age

27

Total Average

125% |

25

Investment Highlights

Investment Highlights

Industry Leaders in HSE Performance & People Development

Strong Demand for Modern Offshore Marine Equipment

Global Presence and Operations Expertise

Financial Stability & Flexibility to Pursue Opportunities

Growth through Acquisition and New Construction

Young, Versatile, High-Specification Fleet |

Current Debt Structure

Current Debt Structure

26

$160 million Sr. Notes, 7.75%

—

Matures July 2014

—

Call Premium of 1.292%, or $2.1 million

$200 million Term-Loan, LIBOR+2.5%, $141.7 million Outstanding

—

Goes to Current Classification on December 31 (Matures 2012)

—

$100 million Portion Fixed at 4.15%, Effective Rate of 5.9%

$175 million Revolver, LIBOR+0.8%, $0 Outstanding

—

$25 million Available in the U.S.

—

Effective Rate of 1.2%

—

—

Matures June 2013

Begins

to

Reduce

by

$15.2

million

Per

Year

Beginning

in

December

2011 |

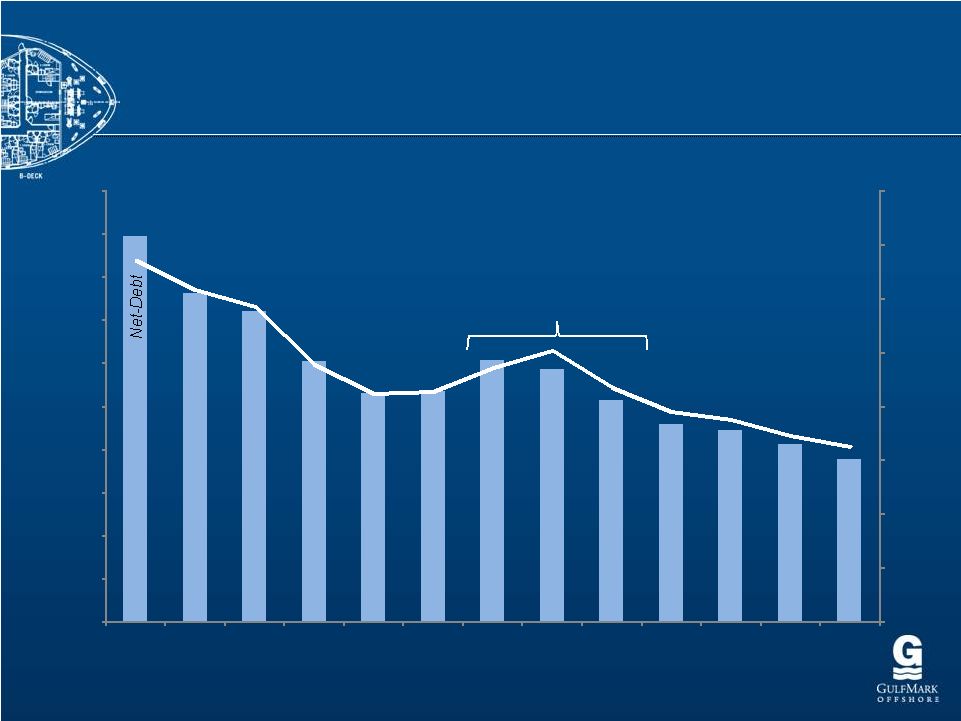

27

Consistent Reduction in

Consistent Reduction in

Net Debt Position

Net Debt Position

0%

5%

10%

15%

20%

25%

30%

35%

40%

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

$450,000

$500,000

Q3 2008

Q4 2008

Q1 2009

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Net-Debt to

Total Book

Capitalization

Finalization of Previous New-Build

Program |

Reconciliation of Adjusted EBITDA

Reconciliation of Adjusted EBITDA

28

EBITDA is defined as net income (loss) before interest expense, net,

income tax provision, and depreciation and amortization, which includes impairment. Adjusted

EBITDA is calculated by adjusting EBITDA for certain items that we

believe are non-cash or unusual, consisting of: (i) loss from unconsolidated ventures; (ii) minority

interest;

and

(iii)

other

(income)

expense,

net.

EBITDA

and

Adjusted

EBITDA

are

not

measurements

of

financial

performance

under

GAAP

and

should

not

be

considered

as an alternative to cash flow data, a measure of liquidity or an

alternative to income from operations or net income as indicators of our operating performance or any other

measures

of

performance

derived

in

accordance

with

GAAP.

EBITDA

and

Adjusted

EBITDA

are

presented

because

we

believe

they

are

used

by

security

analysts,

investors and other interested parties in the evaluation of companies

in our industry. However, since EBITDA and Adjusted EBITDA are not measurements determined in

accordance with GAAP and are thus susceptible to varying calculations,

EBITDA and Adjusted EBITDA as presented may not be comparable to other similarly titled

measures of other companies.

2002

2003

2004

2005

2006

2007

2008

2009

2010

TTM

Q3 2011

Net (loss) income

$24.0

$0.5

($4.6)

$38.4

$89.7

$99.0

$183.8

$50.6

($34.7)

$41.5

Interest expense, net

10.9

12.8

17.0

18.4

14.4

4.8

12.8

19.9

20.7

22.3

Income tax (benefit)

3.0

0.2

(6.5)

3.4

3.0

30.2

11.7

(2.1)

(12.7)

(1.2)

Depreciation & Amortization

21.4

28.0

26.1

28.9

28.5

30.6

44.3

53.0

57.0

59.1

EBITDA

59.3

$

41.5

$

32.0

$

89.1

$

135.6

$

164.6

$

252.6

$

121.5

$

30.2

$

121.7

$

Adjustments:

Impairment

-

-

-

-

-

-

-

46.2

97.7

-

Debt refinancing costs

-

-

6.5

-

-

-

-

-

-

-

Accounting Change

-

-

7.3

-

-

-

-

-

-

-

Other

(2.5)

1.3

(1.5)

(0.5)

0.1

0.3

(1.6)

1.2

(0.1)

2.8

Adjusted EBITDA

$56.8

$42.8

$44.3

$88.6

$135.7

$164.9

$251.0

$168.8

$127.8

$124.5 |