Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FOREST CITY ENTERPRISES INC | d254382d8k.htm |

Investor

Update November 2011

Exhibit 99.1 |

2

|

Information

Related to Forward-Looking Statements Statements made in this presentation that state

the Company’s or management's intentions, hopes, beliefs, expectations or

predictions of the future are forward-looking statements. It is important to note

that the Company's future events and actual results, financial or otherwise, could

differ materially from those projected in such forward-looking statements. Additional

information

concerning

factors

that

could

cause

future

events

or

actual

results

to

differ

materially from those in the forward-looking statements are included in the “Risk

Factors” section of the Company's SEC filings, including, but not limited

to, the Company's Annual Report

and quarterly reports. You are cautioned not to place undue reliance on such

forward-looking statements.

Use of non-GAAP measures

We frequently use the non-GAAP measures of earnings before depreciation, amortization and

deferred taxes (“EBDT”), comparable net operating income (“NOI”)

and measures based on the pro-rata consolidation method

(“pro-rata”) to explain operating performance and assist investors in

evaluating our business. For a more thorough discussion of our use of EBDT, NOI and

pro-rata measures, including how we reconcile these measures to their GAAP counterparts,

please refer to the Supplemental Packages furnished to the SEC on Form 8-K.

Copies of our quarterly and annual Supplemental Packages can be found on our website at

www.forestcity.net, or on the SEC’s website at www.sec.gov.

3 |

Our Strategic

Foundation 4

Develop

unique,

differentiated real estate

that fuels growth, creates

a “sense of place”

and

builds communities in

strong core markets

Be a value-added

owner and operator

of a diverse portfolio of

profitable real estate

assets

Build a

strong, sustaining

capital structure

and

balance sheet that

allow us to further

create value and

profitable growth |

Investment

Profile: “Core-PLUS” 5

Core

Products:

•

Diverse portfolio of 220+ income-producing assets

•

Apartment, office, retail, life science, mixed use, military housing

•

Consistent NOI growth, stable occupancy, low tenant concentration

Core

Markets:

•

Gateway cities with strong growth/demographics, barriers to entry

•

76% + of assets in New York, D.C., Boston, Chicago, Denver, California

•

Selective expansion in new growth markets, including Texas

PLUS:

•

Signature development capability to fuel future growth

•

Substantial entitlement at large, mixed-use projects in core markets

•

Expertise in public/private partnerships, urban infill, adaptive reuse

•

90-year+ track record, 50 years as a public company |

Balanced,

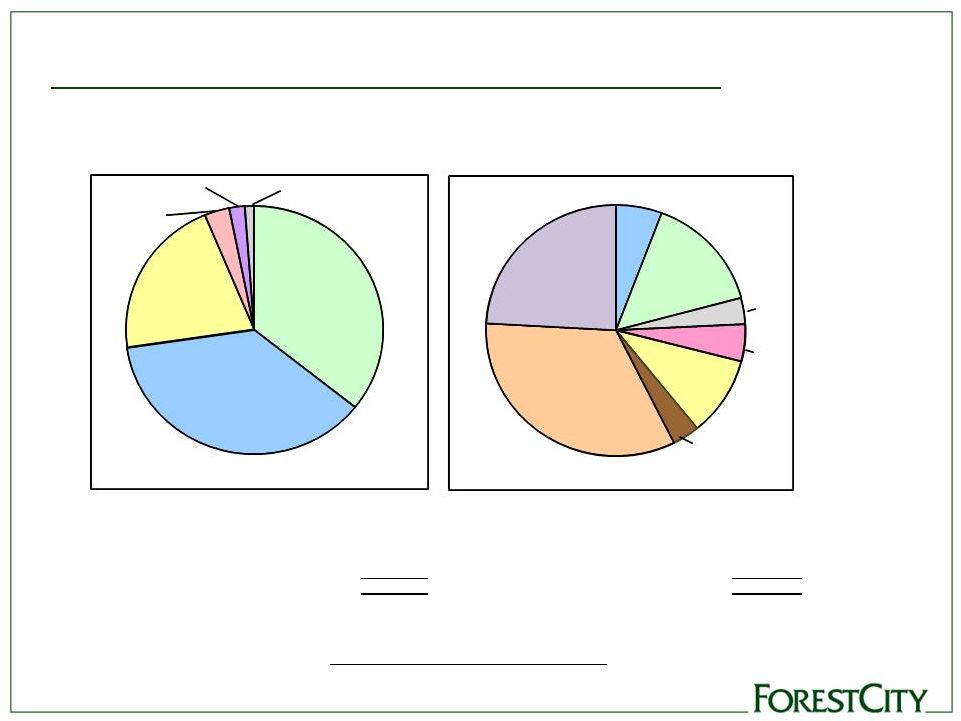

Diverse NOI Sources NOI by Product Type:

345,942

$

NOI by Market:

345,942

$

Casino Land Sale

42,622

Casino Land Sale

42,622

The Nets

(3,686)

The Nets

(3,686)

Corporate Activities

(25,035)

Corporate Activities

(25,035)

Other

(1)

(4,968)

Other

(1)

(4,968)

Grand Total NOI

354,875

$

Grand Total NOI

354,875

$

(1) Includes write-offs of abandoned development projects,

non-capitalizable development costs and unallocated

management

and

service

company

overhead,

net

of

historic

and

new

market

tax

credit

income.

(2) Includes subsidized senior housing.

Six Months Ended July 31, 2011

Six Months Ended July 31, 2011

Net Operating Income

(3)

by Product Type

Net Operating Income

(3)

by Core Market

Pro-Rata Consolidation

(dollars in thousands)

Office

$128,027

36.9%

Apartments

(2)

$72,656

21.0%

Military

Housing

$10,929

3.2%

Retail

$123,442

35.7%

Hotels

$6,769

2.0%

Land

$4,119

1.2%

Boston

$19,789

5.7%

California

$52,136

15.1%

Denver

$16,509

4.8%

Chicago

$11,914

3.4%

New York

$114,948

33.3%

Non-Core

Markets

$83,435

24.1%

Washington,

D.C.

$35,344

10.2%

Philadelphia

$11,867

3.4%

Pro-Rata Consolidation

(dollars in thousands)

for Supplemental Packages for the periods referenced above, which provide reconciliation of NOI to its

nearest GAAP equivalent. Refer

to

the

Investors

section

of

Forest

City’s

web

site

(http://ir.forestcity.net/phoenix.zhtml?c=88464&p=IROL-reportsother)

(3)

6 |

NOI by Market

and Product Type 7

(1)

Includes Senior Housing, Military Housing and Supported Living

(2)

Includes Hotels and Land Sales

2011 Q2 NOI

Split Between Products

% of TOTAL

Office

Retail

Apartments

1

Land/Other

2

New York

33%

67%

26%

7%

0%

California

15%

10%

69%

21%

0%

Washington DC

10%

34%

42%

24%

0%

Cleveland

8%

35%

9%

50%

6%

Boston

6%

77%

0%

23%

0%

Denver

5%

3%

35%

25%

37%

Pittsburgh

5%

17%

51%

5%

27%

Chicago

3%

20%

29%

51%

0%

Philadelphia

3%

21%

25%

54%

0%

Hawaii

3%

0%

0%

100%

0%

Florida

2%

0%

68%

32%

0%

Las Vegas

2%

0%

100%

0%

0%

Other

5%

7%

54%

58%

-19%

100%

37%

36%

24%

3% |

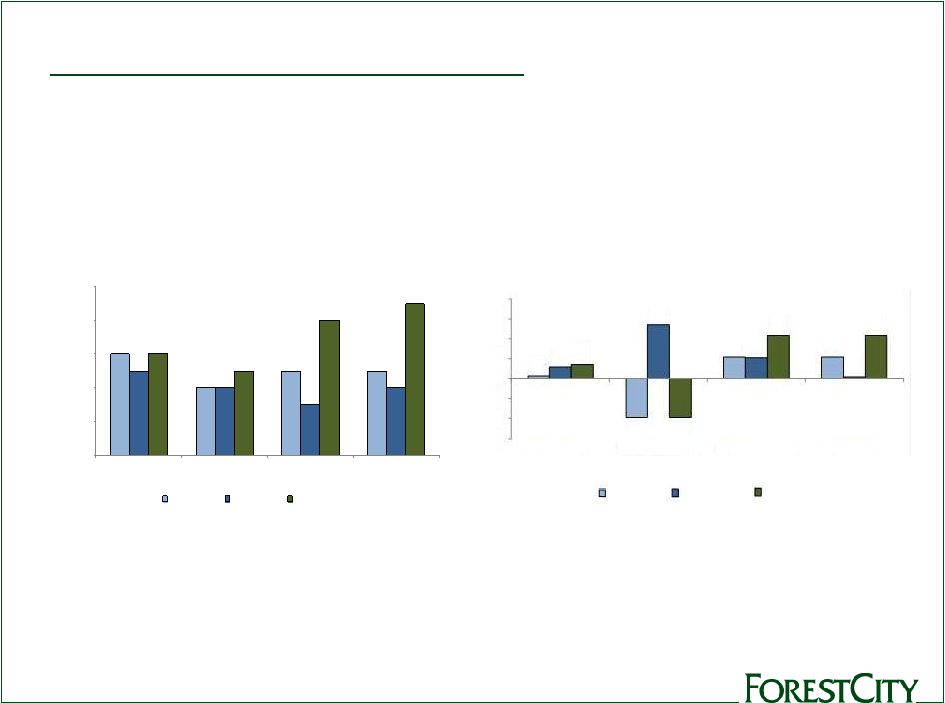

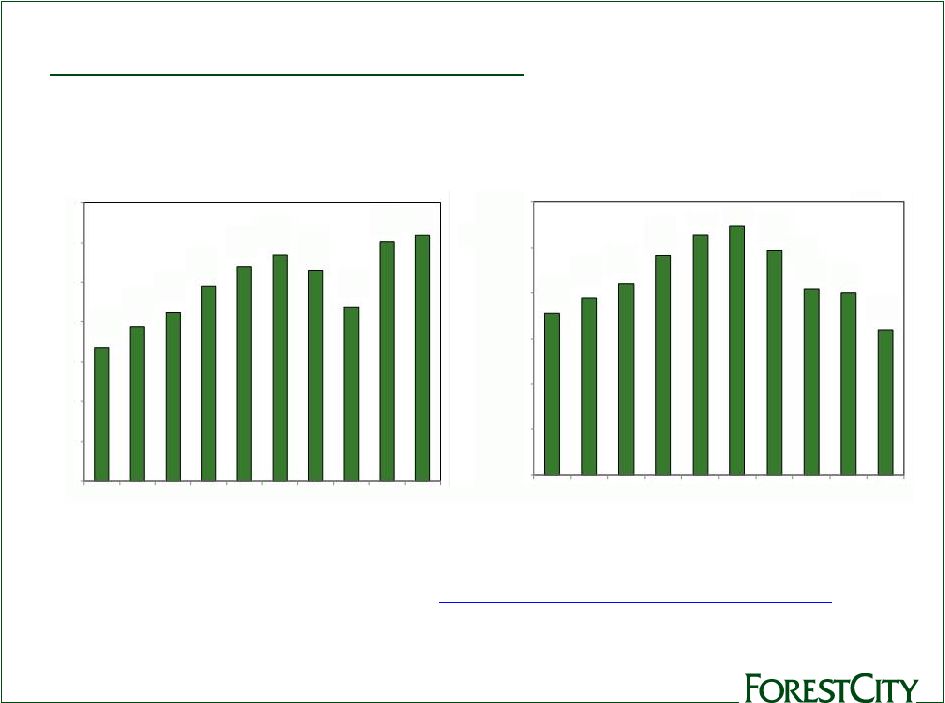

Average

Comparable

Occupancy

%

Consistent Operations

Comparable

NOI

Growth

–

Year-over-Year,

Pro

Rata

%

Source: Supplemental Packages for the six months ended July 31 2011, and the year ended

January 31,2011, 2010, and 2009. 8

Consistent Operations

2010 portfolio performance was in the top quartile industry-wide for all

major product types: office, retail and apartment.

(1) Prior periods have been recasted to exclude subsidized senior housing. The

Company believes this change will improve disclosure by allowing investors to see

results for the conventional apartment portfolio separated from those of the limited-dividend senior-housing properties.

92

90

91

91

91

90

89

90

92

91

94

95

86

88

90

92

94

96

YTD 1/31/09

YTD 1/31/10

YTD 1/31/11

YTD 7/31/11

Retail

Office

Residential (1)

8.0

4.0

2.0

-

(2.0)

(4.0)

(6.0)

6.0

Twelve months ended

1/31/09

Twelve months ended

1/31/10

Twelve months ended

1/31/11

Six months ended

7/31/11

0.3

1.2

4.3

(3.9)

(3.9)

5.4

1.4

2.2

0.2

4.3

2.1

2.2

Retail

Office

Residential (1)

8 |

Consistent

Operations EBDT per Share Since 2001

($ per share)

(1) (2)

(2)

Consistent Operations

Total EBDT Since 2001

($ in millions)

(1)

168.0

194.4

212.4

245.0

270.5

285.0

265.7

218.9

301.1

309.9

-

50

100

150

200

250

300

350

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

1.77

1.94

2.10

2.41

2.64

2.73

2.47

2.05

2.00

1.59

-

0.50

1.00

1.50

2.00

2.50

3.00

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Per–share data reflects new Class A common shares and the “if-converted”

effect of convertible debt and convertible preferred stock issued in 2009 and

2010.

(1)

Refer to the Investors section of Forest City’s web site

(http://ir.forestcity.net/phoenix.zhtml?c=88464&p=IROL-reportsother) for

Supplemental Packages for the periods referenced above, which provide reconciliation of EBDT

to its nearest GAAP equivalent. 9 |

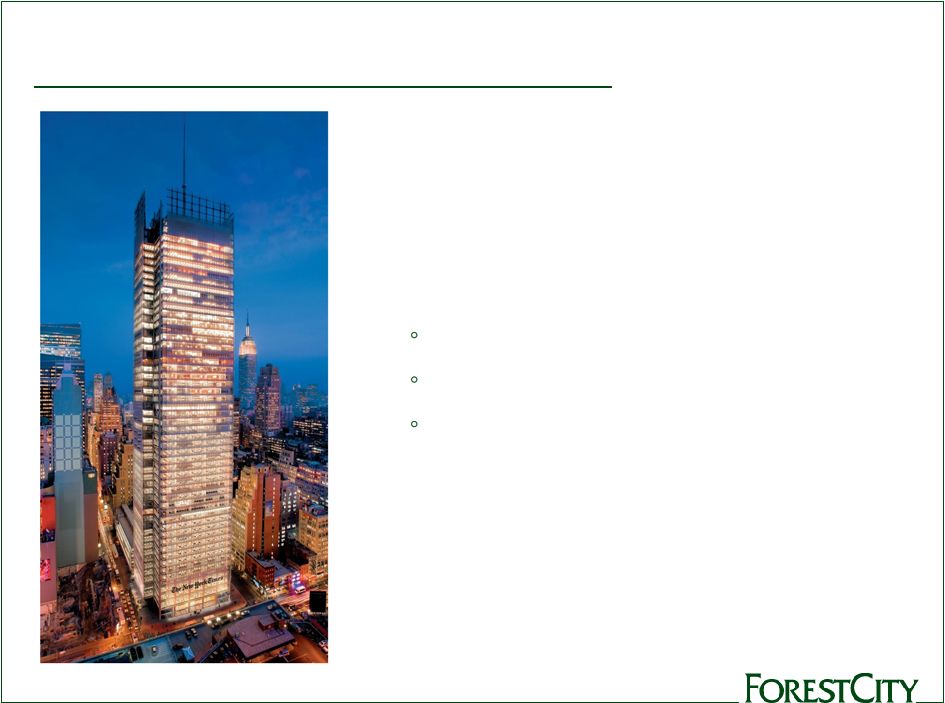

Portfolio

Highlights - Office

•

50 properties, 13.6M s.f. in conventional and

life science office

•

Concentrations in New York and Boston

•

Key properties:

New York Times, Manhattan (shown)

MetroTech Center, Brooklyn

University Park at MIT, Cambridge

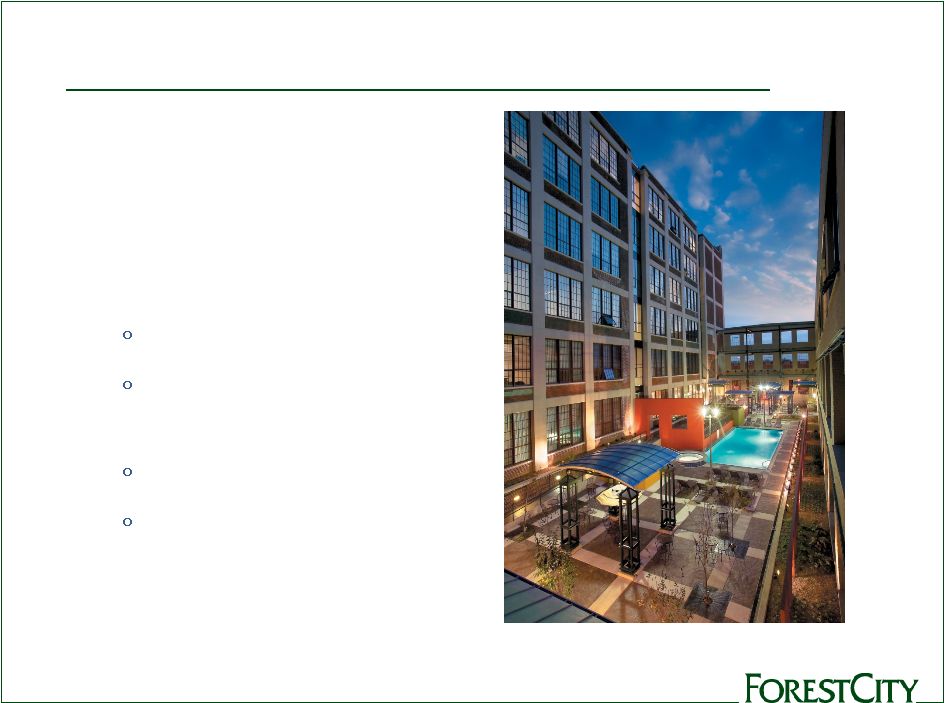

10 |

Portfolio

Highlights - Apartments

•

121 apartment communities,

34,000 total units; 14,100

military housing units

(1)

•

Key properties:

DKLB BKLN, Brooklyn

River Lofts at Tobacco

Row, Richmond (shown)

Metro 417, Los Angeles

Presidio Landmark,

San Francisco

11

(1) Includes Air Force -

Southern Group –

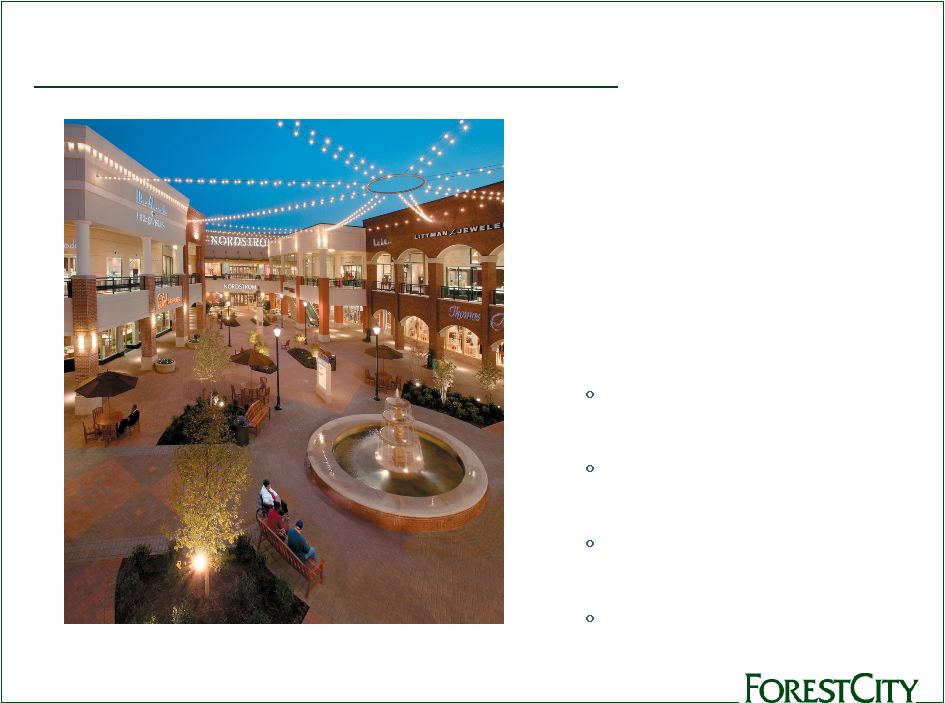

closed on September 30, 2011 |

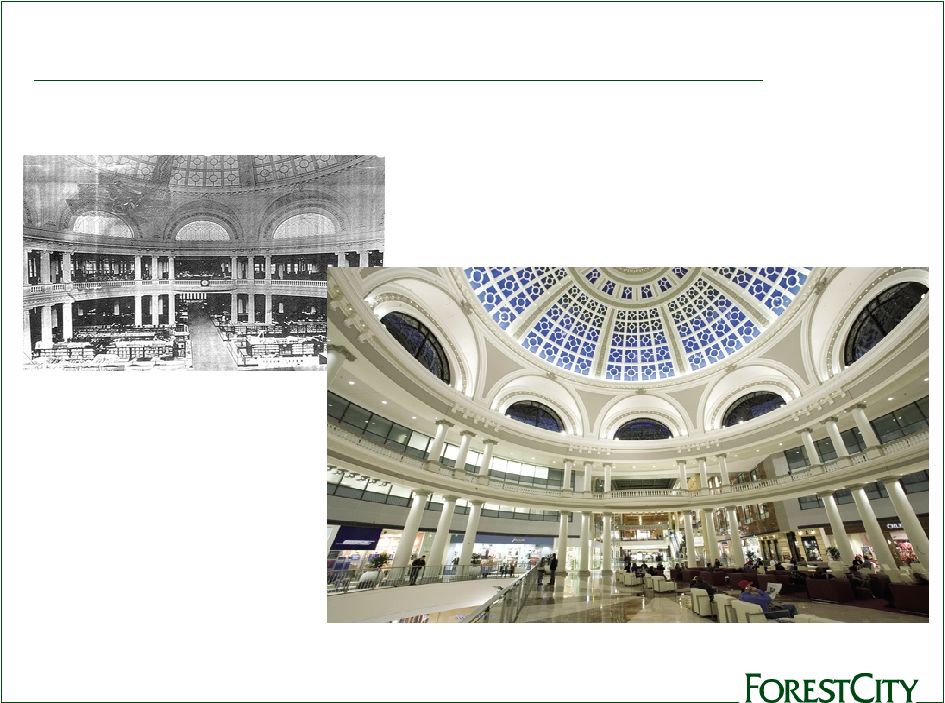

Portfolio

Highlights – Retail

•

46 centers, 26.5M total s.f.,

16.0M GLA

•

Enclosed regional malls,

open-air lifestyle centers,

big-box/power centers,

specialty centers

•

Key properties:

San Francisco Centre/

The Emporium

Short Pump Town Center,

Richmond (shown)

East River Plaza,

Manhattan

Victoria Gardens, Rancho

Cucamonga, CA

12 |

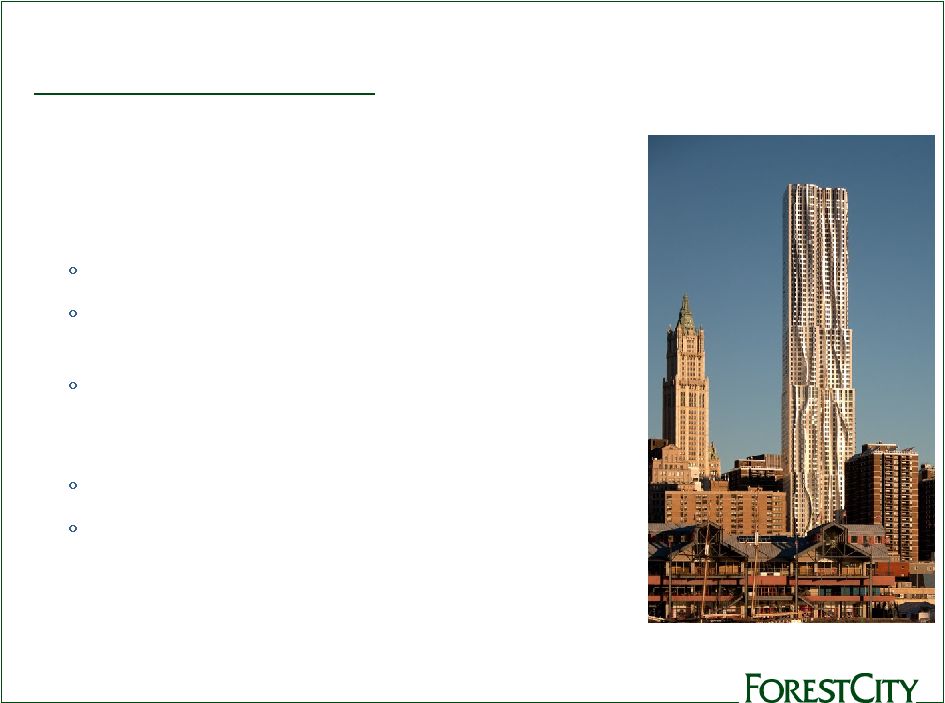

Recent

Opening •

8 Spruce Street,

* New York City (Lower Manhattan).

Frank Gehry-designed apartment tower. 76 stories,

903 market-rate units.

Tallest residential high-rise in the Western Hemisphere

“…

one of the most beautiful towers downtown.”

-

Paul Goldenberg, The New Yorker

“…

the

finest

skyscraper

to

rise

in

New

York

since

Eero

Saarinen’s CBS building went up 46 years ago.”

-

Nicholai Ourousoff, The New York Times

450+ executed leases after <200 days of active leasing

Lower floors include a K-8 public school and an

ambulatory care center for the New York Downtown

Hospital

13

* Over 680 units are open, remaining units on upper floors are under construction |

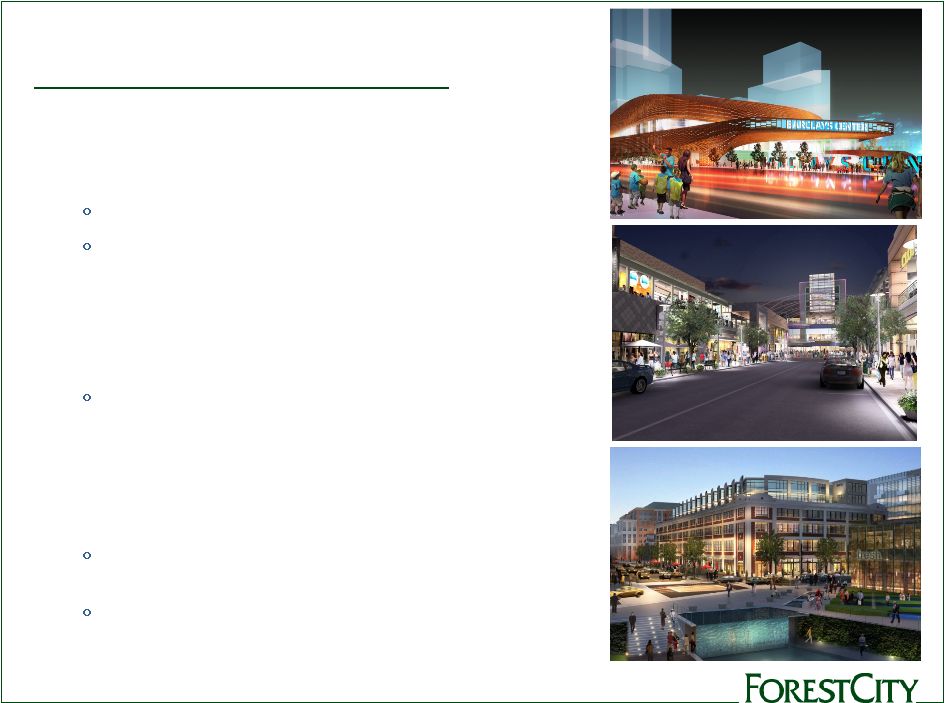

Under

Construction •

Barclays Center Arena,

Brooklyn

State-of-the-art sports and entertainment venue

Future home of the NBA Nets

First phase of the Atlantic Yards mixed-use project, which

will feature more that 6,400 housing units, approximately

250K s.f. of retail, and more than 8 acres of open space.

•

Westchester’s

Ridge

Hill,

Yonkers,

NY

1.3M s.f. mixed-use retail project

Currently opening in phases, culminating in Lord + Taylor

grand opening of a new 80K s.f store in February 2012.

•

Foundry

Lofts,

Washington,

D.C.

First

residential building at The Yards mixed-use project in Southeast D.C.

170 loft-style apartments in an adaptive reuse of a former

Navy Yard industrial building.

Leasing commenced in August, 2011

14 |

Value

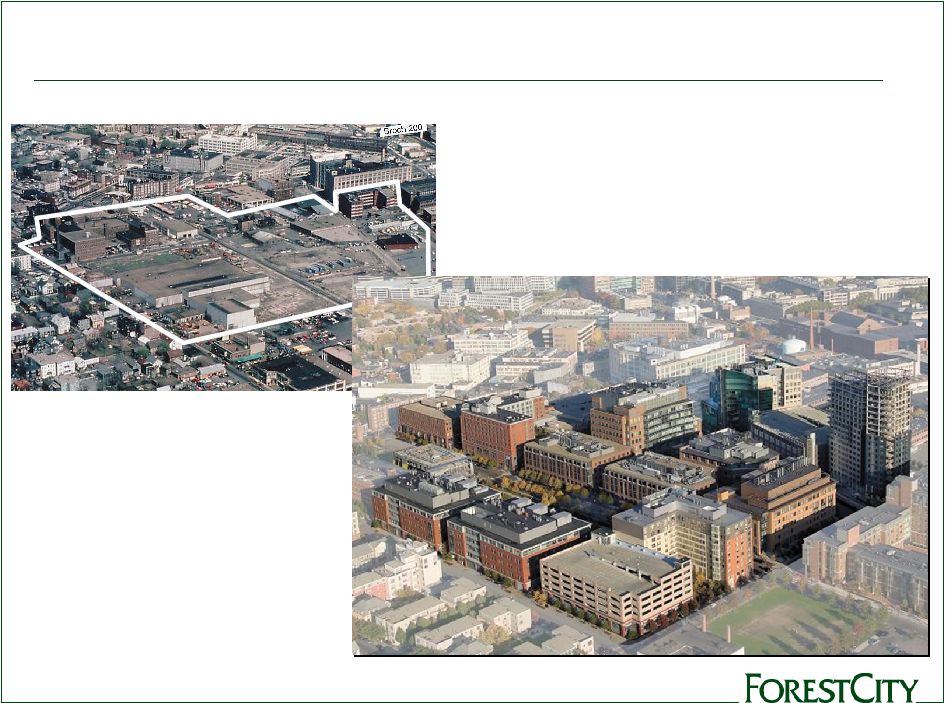

Creation: University Park, Cambridge 15 |

Value

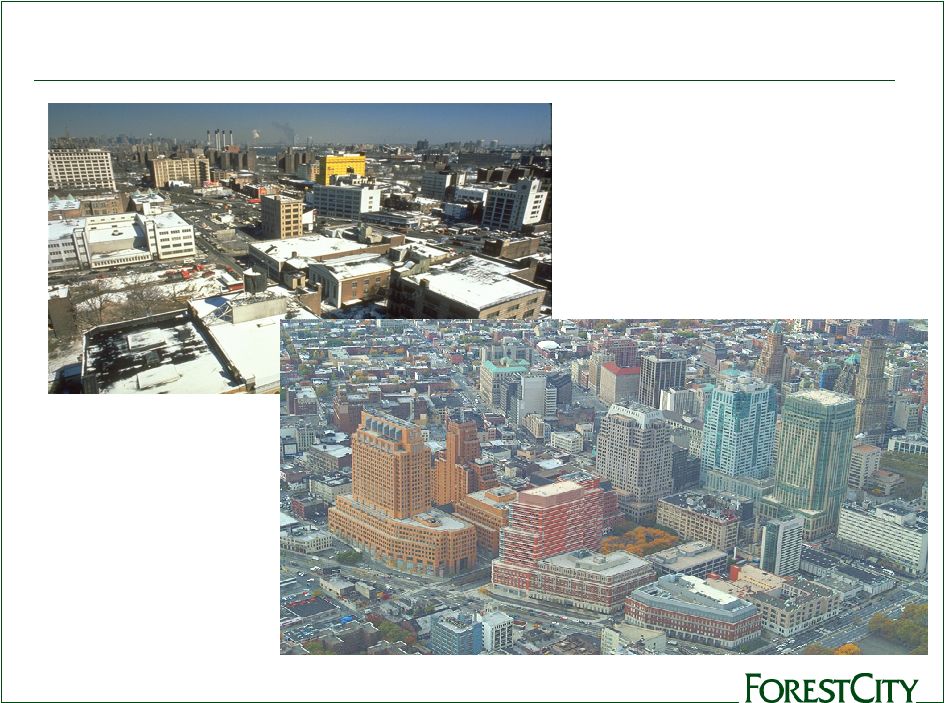

Creation: MetroTech Center, Brooklyn 16 |

Value

Creation: San Francisco Centre 17 |

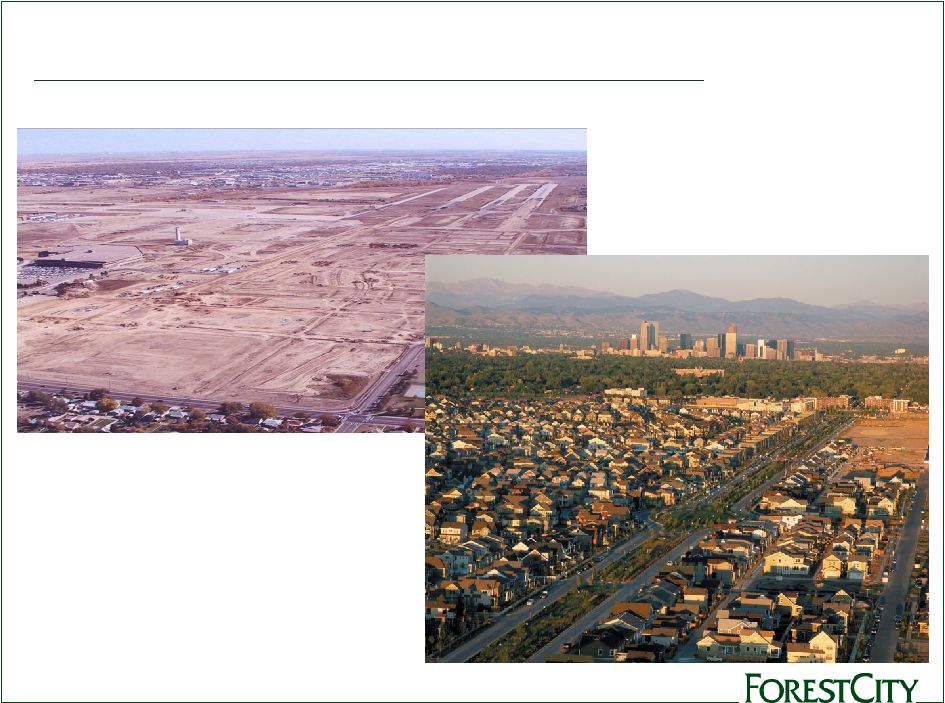

Value

Creation: Stapleton, Denver 18 |

Appendix

2012-2015 Strategic Plan

20

Asset Sales

21

Recourse Debt Maturities

22

Lease Expirations

23

Pipeline

25

Sustainability

32

19 |

2012-2015

Strategic Plan Key Themes:

•

Increase shareholder value by:

Greater

focus

on

the

core,

both

markets

and

products

Continuing

to

improve

the

balance

sheet

and

reduce risk

Driving

operational

excellence

through

all

aspects

of our company

20 |

Asset

Sales ($ in millions)

21

Cash

Net

Annualized

Cap

EBDT Year

EBDT/

Count

Proceeds

Sales Price

NOI

rate

Prior to Sale

Proceeds

Leverage

Total (10 Yr + YTD 2011: 2001-2011)

95

1,274.5

3,070.7

205.6

6.7%

97.0

7.6%

58%

Total (10 Yr: 2001-2010)

76

1,033.0

2,426.6

163.0

6.7%

73.6

7.1%

57%

Total (7 Yr: 2004-2010)

62

932.3

2,168.4

142.0

6.5%

63.4

6.8%

57%

Total (5 Yr: 2006-2010)

45

728.6

1,644.1

109.9

6.7%

50.3

6.9%

56% |

Addressing

Recourse Debt Maturities 22 |

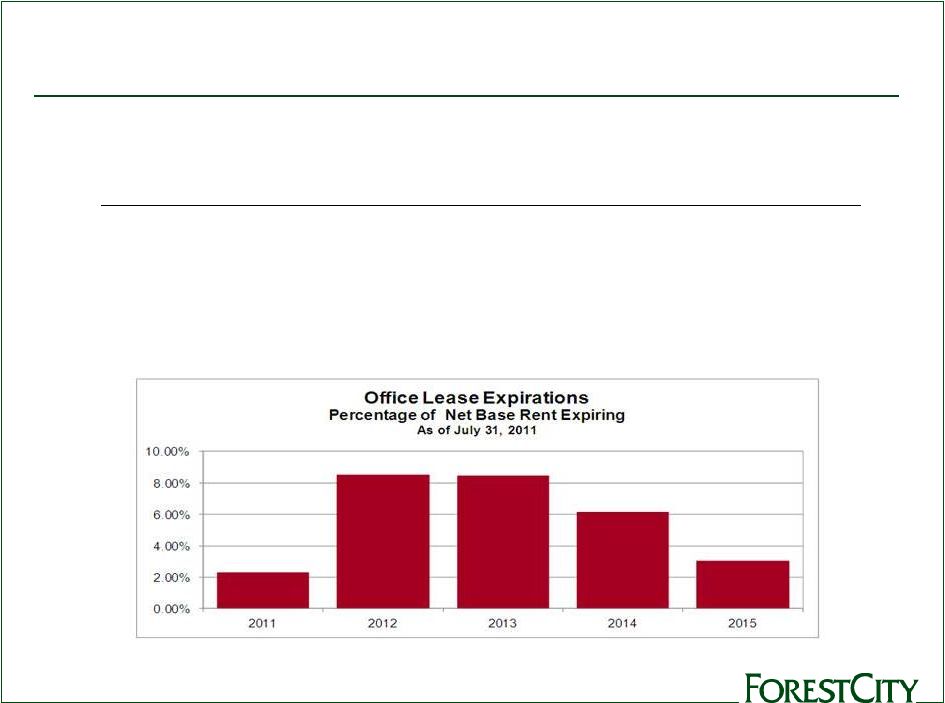

Office Lease

Expirations (as of July 31, 2011) 23

Expiration

Year

Number of

Expiring

Leases

Square Feet of

Expiring Leases

Percentage of

Total Leased

GLA

Net

Base Rent

Expiring

Percentage of

Total Base Rent

Average Base

Rent Per Square

Feet Expiring

2011

53

363,105

3.27 %

$

6,853,161

2.33 %

$

19.93

2012

92

989,473

8.91

25,054,936

8.50

31.42

2013

92

1,162,933

10.48

24,912,299

8.46

22.29

2014

63

968,391

8.72

18,067,606

6.13

30.44

2015

44

480,655

4.33

8,882,261

3.02

21.28 |

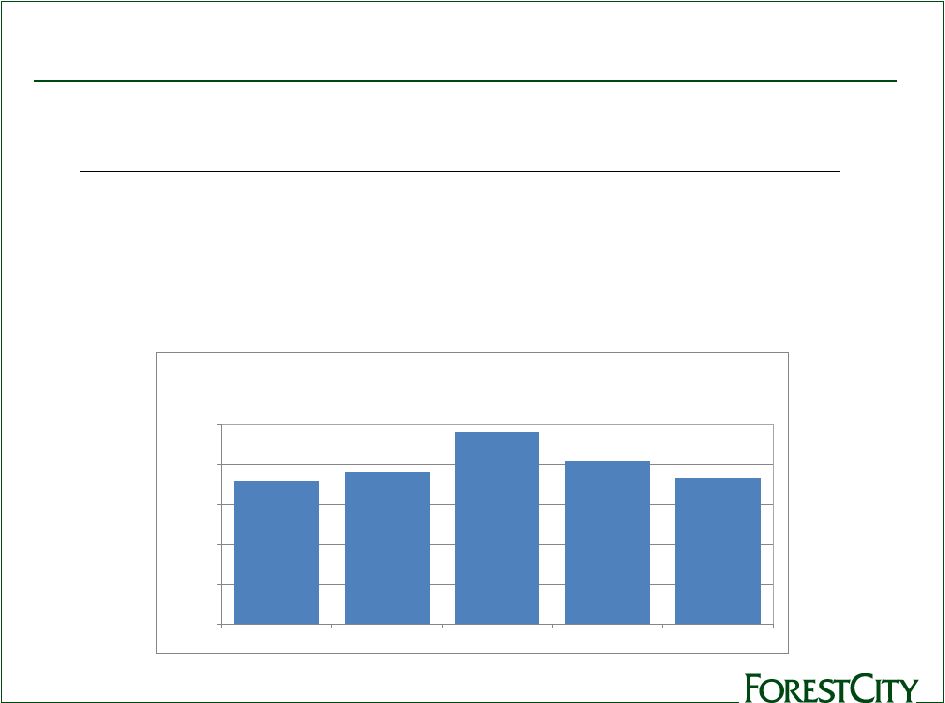

Retail Lease

Expirations (as of July 31, 2011) 24

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

2011

2012

2013

2014

2015

Retail Lease Expirations

Percentage of Net Base Rent Expiring

As of July 31, 2011

Expiration

Year

Number of

Expiring

Leases

Square Feet of

Expiring Leases

Percentage of

Total Leased

GLA

Net

Base Rent

Expiring

Percentage of

Total Base Rent

Average Base

Rent Per Square

Feet Expiring

2011

250

778,326

6.11 %

$

18,207,261

7.21 %

$

30.45

2012

271

950,123

7.46

19,349,688

7.66

27.94

2013

308

1,128,314

8.86

24,321,749

9.63

27.20

2014

258

1,107,037

8.69

20,677,933

8.19

27.39

2015

203

832,758

6.54

18,533,723

7.34

29.29 |

Pipeline:

Projects Opened or Acquired 25

Note:

See

pages

33

-

34

in

the

Supplemental

Package

for

the

quarter

ended

July

31,

2011

for

footnotes.

Openings and Acquisitions as of July 31, 2011

Cost at FCE

Date

Pro-Rata

Cost at Full

Total Cost

Pro-Rata Share

Sq. ft./

Gross

Dev (D)

Opened /

FCE Legal

FCE % (a)

Consolidation

at 100%

(Non-GAAP) (c)

No. of

Leasable

Property

Location

Acq (A)

Acquired

Ownership % (a)

(1)

(GAAP) (b)

(2)

(1) X (2)

Units

Area

2011 (2)

Retail Centers:

Westchester's Ridge Hill (d)

Yonkers, NY

D

Q2-11/12

70.0%

100.0%

$

0.0 0.0

$

0.0 176,000

176,000

Residential:

Manhattan, NY

D

Q1-11/12

35.7%

51.0%

$

0.0 0.0

$

0.0 682

(in millions)

$

$

8 Spruce Street (leasable units only) (d) (f) |

Pipeline:

Projects Under Construction 26

Note:

See

page

33

-

34

in

the

Supplemental

Package

for

the

quarter

ended

July

31,

2011

for

footnotes.

Projects Under Construction as of July 31, 2011 (4)

Projects Under Construction Subsequent to July 31, 2011 (2)

Cost at FCE

Pro-Rata

Cost at Full

Total Cost

Pro-Rata Share

Sq. ft./

Gross

Anticipated

FCE Legal

FCE % (a)

Consolidation

at 100%

(Non-GAAP) (c)

No. of

Leasable

Lease

Property

Location

Opening

Ownership % (a)

(1)

(GAAP) (b)

(2)

(1) X (2)

Units

Area

Commitment %

Retail Centers:

Westchester's Ridge Hill (e)

Yonkers, NY

Q2-11/12

70.0%

100.0%

842.4

$

842.4

$

842.4

$

1,336,000

1,336,000

(l)

52%

Residential:

8 Spruce Street (f) (j)

Manhattan, NY

Q1-11/12

35.7%

51.0%

0.0

875.7

$

446.6

$

903

51% (m)

Foundry Lofts

Washington, D.C.

Q3-11

100.0%

100.0%

61.4

61.4

61.4

170

61.4

$

937.1

$

508.0

$

1,073

Arena:

Barclays Center

Brooklyn, NY

Q3-12

33.8% (n)

33.8%

(n)

904.3

$

904.3

$

305.9

$

670,000

18,000 seats

(o)

56% (p)

Total Under Construction (k)

1,808.1

$

2,683.8

$

1,656.3

$

Fee Development:

Sq.ft.

Las Vegas City Hall

Las Vegas, NV

Q1-12

-

(q)

-

(q)

$

0.0

146.2

$

$

0.0 270,000

(in millions)

Retail Centers:

The Yards -

Boilermaker Shop

Washington, D.C.

Q3-12

100.0%

100.0%

19.4

$

19.4

$

19.4

$

41,000

41,000

73% (r)

Residential:

Novella Apartments

Denver, CO

Q3-12

90.0%

90.0%

10.1

$

10.1

$

9.1

$

85

Total Projects Under Construction Subsequent to July 31, 2011

29.5

$

29.5

$

28.5

$

$ |

Pipeline:

Equity Requirements 27

Equity

Requirements

for

Projects

Under

Construction

(a)

As of July 31, 2011

Less

Plus

Unconsolidated

Full

Less

Unconsolidated

Pro-Rata

Investments

Consolidation

Noncontrolling

Investments

Consolidation

100%

at 100%

(GAAP) (b)

Interest

at Pro-Rata

(Non-GAAP) (c)

Total Cost Under Construction

2,683.8

$

875.7

$

1,808.1

$

598.4

$

446.6

$

1,656.3

$

Total Loan Draws and Other Sources

at Completion (d)

1,668.2

539.0

1,129.2

376.5

263.1

1,015.8

Net Equity at Completion

1,015.6

336.7

678.9

221.9

183.5

640.5

Net Costs Incurred to Date

(e)

1,870.4

734.5

1,135.9

281.7

382.8

1,237.0

Loan Draws and Other Sources to Date

(e)

935.3

424.4

510.9

59.8

225.8

676.9

Net Equity to Date

(e)

935.1

310.1

625.0

221.9

157.0

560.1

% of Total Equity

92%

92%

87%

Remaining Costs

813.4

141.2

672.2

316.7

63.8

419.3

Remaining Loan Draws and Other Sources

732.9

114.6

618.3

316.7

37.3

338.9

Remaining Equity

80.5

$

26.6

$

53.9

$

-

$

26.5

$

80.4

$

% of Total Equity

8%

8%

13%

(dollars in millions)

(a)

This schedule includes only the four properties listed on the previous

page. This does not include costs associated with phased-in units, operating property renovations and military housing.

(b)

Amounts are presented on the full consolidation method of accounting, a

GAAP measure. Under full consolidation, costs are reported as consolidated at 100 percent if we are deemed to have control

or to be the primary beneficiary of our investments in the variable

interest entity ("VIE"). (c)

Cost at pro-rata share represents Forest City's share of cost,

based on the Company's pro-rata ownership of each property (a non-GAAP measure). Under the pro-rata consolidation method of

accounting the Company determines its pro-rata share by multiplying

its pro-rata ownership by the total cost of the applicable property.

(d)

"Other Sources" includes estimates of third party subsidies and

tax credit proceeds. The timing and the amounts may differ from our estimates.

(e)

Reflects activity through July 31, 2011

|

Projects

Opened or Acquired: prior two years 28

Note:

See

page

33

-

34

in

the

Supplemental

Package

for

the

quarter

ended

July

31,

2011

for

footnotes.

Cost at FCE

Date

Pro-Rata

Cost at Full

Total Cost

Pro-Rata Share

Sq. ft./

Gross

Dev (D)

Opened /

FCE Legal

FCE % (a)

Consolidation

at 100%

(Non-GAAP) (c)

No. of

Leasable

Lease

Property

Location

Acq (A)

Acquired

Ownership % (a)

(1)

(GAAP) (b)

(2)

(1) X (2)

Units

Area

Commitment %

Prior Two Years Openings

(7)

Retail Centers:

Village at Gulfstream Park (f)

Hallandale Beach, FL

D

Q1-10

50.0%

50.0%

0.0

198.9

$

99.5

$

511,000

511,000

70%

East River Plaza (f)

Manhattan, NY

D

Q4-09/Q2-10

35.0%

50.0%

0.0

390.6

195.3

527,000

527,000

90%

Promenade in Temecula Expansion

Temecula, CA

D

Q1-09

75.0%

100.0%

113.4

113.4

113.4

127,000

127,000

89%

113.4

$

702.9

$

408.2

$

1,165,000

1,165,000

Office:

Waterfront Station

-

East 4th & West 4th Buildings (g)

Washington, D.C.

D

Q1-10

45.0%

45.0%

245.9

$

245.9

$

110.7

$

631,000

99%

Residential: (h)

Presidio Landmark

San Francisco, CA

D

Q3-10

100.0%

100.0%

96.5

$

96.5

$

96.5

$

161

70% (r)

North Church Towers

Parma Heights, OH

A

Q3-09

100.0%

100.0%

5.1

5.1

5.1

399

86%

DKLB BKLN (f)

Brooklyn, NY

D

Q4-09/Q2-10

40.8%

51.0%

0.0

161.8

82.5

365

96%

101.6

$

263.4

$

184.1

$

925

Total Prior Two Years Openings (i)

460.9

$

1,212.2

$

703.0

$

Recap of Total Prior Two Years

Openings Total 2010

342.4

$

931.9

$

502.0

$

Total 2009

118.5

280.3

201.0

Total Prior Two Years Openings (i)

460.9

$

1,212.2

$

703.0

$

$ |

Projects Under

Development (full descriptions) 29

Projects Under Development

As of July 31, 2011

Below is a summary of our active large scale development projects,

which have yet to commence construction, often referred to as

our "shadow pipeline" which are crucial to our long-

term growth. While we cannot make any assurances on the timing or

delivery of these projects, our track record speaks to our ability to bring large, complex, projects to fruition when

there is demand and available construction financing. The

projects listed below represent pro-rata costs of $738.1 million ($918.2 million at full consolidation) of Projects Under

Development ("PUD") on our balance sheet and pro-rata

mortgage debt of $145.2 million ($184.7 million at full consolidation).

1)

Atlantic

Yards

-

Brooklyn,

NY

Atlantic Yards is adjacent to the state-of-the art arena, the

Barclays Center, which is designed by the award-winning firms Ellerbe Becket and SHoP Architects and is currently under

construction. In addition, Atlantic Yards will feature more than

6,400 units of housing, including over 2,200 affordable units,

approximately 250,000 square feet of retail space, and more than

8 acres of landscaped open space. 2)

LiveWork

Las

Vegas

-

Las

Vegas,

NV

LiveWork Las Vegas is a mixed-use project on a 13.5-acre parcel

in downtown Las Vegas. At full build-out, the project will have a new 260,000-square-foot City Hall for Las Vegas

and is also expected to include up to 1 million square feet of office

space and approximately 300,000 square feet of retail. The City

Hall is owned by the city of Las Vegas and is a fee-

development project.

3)

The

Yards

-

Washington,

D.C.

The Yards is a 42-acre mixed-use project, located in the

neighborhood of the Washington Nationals baseball park in Southeast D.C. The full development is expected to include up to

2,700 residential units, 1.8 million square feet of office space, and

300,000 square feet of retail and dining space. The Yards

features a 5.5-acre publicly funded public park that is a

gathering place and recreational focus for the community. The

first residential building, Foundry Lofts, which is under construction and expected to open in Q3-11.

4) The Science + Technology Park at Johns Hopkins -

Baltimore, MD

The 31-acre Science + Technology Park at Johns Hopkins is a new

center for collaborative research directly adjacent to the world-renowned Johns Hopkins medical and research

complex. Initial plans call for 1.1 million square feet in

five buildings, with future phases that could support additional

expansion. In 2008, the Company opened the first of those

buildings, 855 North Wolfe Street, a 279,000-square-foot office

building anchored by the Johns Hopkins School of Medicine’s Institute for Basic Biomedical Sciences.

5) Colorado Science + Technology Park at Fitzsimons -

Aurora, CO

The 184-acre Colorado Science + Technology Park at Fitzsimons is

becoming a hub for the biotechnology industry in the Rocky Mountain region. Anchored by the University of

Colorado at Denver Health Science Center, the University of Colorado

Hospital and The Denver Children’s Hospital, the park will offer cost-effective lease rates; build-to-suit office and

research sites; and flexible lab and office layouts in a

cutting-edge research park. The park is also adjacent to Forest City’s 4,700-acre Stapleton mixed-used development.

6) Waterfront Station -

Washington, D.C.

Located in Southwest Washington, D.C., Waterfront Station is adjacent

to the Waterfront/Southeastern University MetroRail station. Waterfront Station is expected to include 660,000

square feet of office space, an estimated 400 residential units and

40,000 square feet of stores and restaurants. 7) 300 Massachusetts

Avenue - Cambridge, MA

Located in the science and technology hub of Cambridge, MA, the 300

Massachusetts Avenue block represents an expansion of University Park @ MIT. In a 50/50 partnership with

MIT, Forest City is presently focused on a project that reflects

a development program of approximately 260,000 square feet of lab and

office space. Potential redevelopment of the entire block is

possible with the acquisition of adjacent parcels in future phases, and would result in an approximately 400,000

square foot project. |

Military

Housing 30

Military Housing as of July 31, 2011

Anticipated

FCE

Cost at Full

Total Cost

No.

Property

Location

Opening

Pro-Rata %

Consolidation

at 100%

of Units

Military Housing -

Openings (2)

Navy, Hawaii Increment III

Honolulu, HI

2007-Q1-11

*

$

0.0 464.8

$

2,520

Marines, Hawaii Increment II

Honolulu, HI

2007-Q2-11

*

0.0

292.7

1,175

Total Openings

$

0.0 757.5

$

3,695

Military Housing Under Construction (5)

Pacific Northwest Communities

Seattle, WA

2007-2011

*

$

0.0 280.5

$

2,985

Navy Midwest

Chicago, IL

2006-2012

*

0.0

200.3

1,401

Midwest Millington

Memphis, TN

2008-2012

*

0.0

33.1

318

Air Force Academy

Colorado Springs, CO

2007-2013

50.0%

0.0

69.5

427

Hawaii Phase IV

Kaneohe, HI

2007-2014

*

0.0

475.1

1,141

Total Under Construction

$

0.0 1,058.5

$

6,272

Total Military Housing

$

0.0 1,816.0

$

9,967

* The Company's share of residual cash flow ranges from 0-20%

during the life cycle of the project. Commitment executed

(in millions)

Below

is

a

summary

of

our

equity

method

investments

for

Military

Housing

Development

projects.

The

Company

provides

development,

construction

and

management

services

for

these

projects

and

receives

agreed

upon

fees

for

these

services.

The

following

phases

still

have

a

percentage

of

units

opened

and

under

construction:

Air

Force

–

Southern

Group

was

awarded

on

August

30,

2010.

This

project

is

expected

to

include

2,185

end

state

units

at

four

Air

Force

bases

in

Sumter,

SC,

Manchester,

TN,

Charleston,

SC

and

Biloxi,

MS.

There

are

330

financially

excluded

units

that

will

not

be

encumbered

by

debt

and

which

may

be

removed

from

the

end

state

at

the

sole

discretion

of

the

Air

Force.

The

financial

closing

of

the

project

was

executed

on

September

30,

2011,

with

property

management

and

construction

beginning

on

October

1,

2011.

Development

fees

related

to

our

military

housing

projects

are

earned

based

on

a

contractual

percentage

of

the

actual

development

costs

incurred.

We

also

recognize

additional

development

incentive

fees

upon

successful

completion

of

certain

criteria,

such

as

incentives

to

realize

development

cost

savings,

encourage

small

and

local

business

participation,

comply

with

specified

safety

standards

and

other

project

management

incentives

as

specified

in

the

development

agreements.

NOI

from

development

and

development

incentive

fees

is

$788,000

and

$1,925,000

for

the

three

and

six

months

ended

July

31,

2011

respectively,

and

$1,705,000

and

$3,318,000

for

the

three

and

six

months

ended

July

31,

2010,

respectively.

Construction

management

fees

are

earned

based

on

a

contractual

percentage

of

the

actual

construction

costs

incurred.

We

also

recognize

certain

construction

incentive

fees

based

upon

successful

completion

of

certain

criteria

as

set

forth

in

the

construction

contracts.

NOI

from

construction

and

incentive

fees

is

$738,000

and

$1,918,000

for

the

three

and

six

months

ended

July

31,

2011,

respectively,

and

$1,465,000

and

$3,060,000

recognized

during

the

three

and

six

months

ended

July

31,

2010,

respectively.

Property

management

and

asset

management

fees

are

earned

based

on

a

contractual

percentage

of

the

annual

net

rental

income

and

annual

operating

income,

respectively,

that

is

generated

by

the

military

housing

privatization

projects

as

defined

in

the

agreements.

We

also

recognize

certain

property

management

incentive

fees

based

upon

successful

completion

of

certain

criteria

as

set

forth

in

the

property

management

agreements.

Property

management,

management

incentive

and

asset

management

fees

generated

NOI

of

$2,418,000

and

$5,647,000

during

the

three

and

six

months

ended

July

31,

2011,

respectively,

and

$3,120,000

and

$6,242,000

during

the

three

and

six

months

ended

July

31,

2010,

respectively. |

Land

Holdings 31

Land Held for Development or Sale as of July 31, 2011

Gross

Saleable

Option

Location

Acres (1)

Acres (2)

Acres (3)

Stapleton -

Denver, CO

213

141

1,358

Mesa del Sol -

Albuquerque, NM

3,011

1,647

5,731

Central Station -

Chicago, IL

30

30

-

Texas

2,798

1,553

-

North Carolina

1,225

1,001

788

Ohio

967

652

470

Arizona

663

489

-

Other

884

698

-

Total

9,791

6,211

8,347

The Land Development Group acquires and sells raw land and sells

fully-entitled developed lots to residential, commercial, and industrial customers.

The Land Development Group also owns and develops raw land into

master-planned communities, mixed-use projects and other residential developments.

Below is a summary of our large Land Development Group projects.

(1) Represent all acres currently owned including those used for

roadways, open spaces and parks. (2) Saleable acres represent the total of all acres currently owned

that will be available for sales. The Land Development Group may choose to

further develop some of the acres into completed sublots prior to sale. (3) Option acres are those acres that the Land Development Group has a

formal option to acquire. Typically these options are in the form of

purchase agreements with contingencies for the satisfaction of due diligence reviews. |

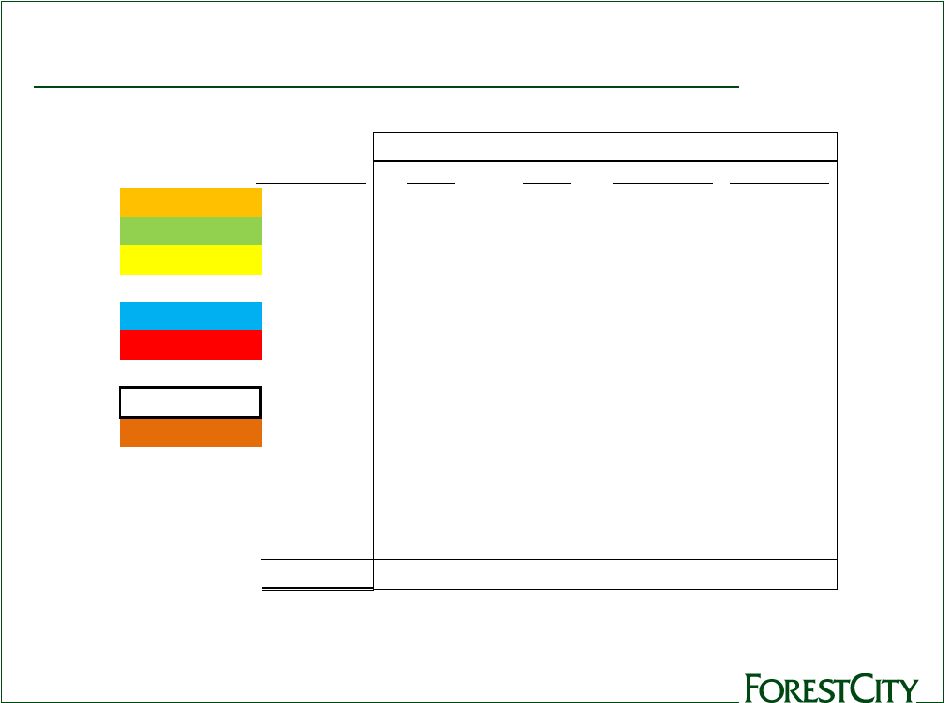

Sustainability

at Forest City 32

•

Leadership

30+ projects certified or seeking certification (LEED, Energy Star, others)

Approx. 17% of total portfolio is certified (based on cost at pro-rata)

A leader in breath of LEED certifications by project type:

•

New Construction

•

Existing Buildings

•

Core & Shell

•

Neighborhood Development

•

Homes

•

Value-add

Leveraging portfolio opportunities for energy generation/sale, reduced cost

Forest City included in Calvert Social Index since September, 2010

•

Commitment

A core value since 2003

Dedicated Energy & Sustainability Group provides enterprise-wide direction

Accountability and verification –

all projects prepare a sustainability “scorecard” |

End

33 |